EXHIBIT 99.1

Report of Independent Auditor

Board of Directors

IsoRay Medical, Inc.

Richland, Washington

We have audited the accompanying balance sheet of IsoRay Medical, Inc. (“the Company”) (a Development Stage Enterprise) as of March 31, 2005, and the related statements of operations, changes in shareholders’ equity (deficit) and cash flows for the nine months ended March 31, 2005, and the period from inception (December 17, 2001) to March 31, 2005. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and the significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion the financial statements referred to above present fairly, in all material respects, the financial position of IsoRay Medical, Inc. (a Development Stage Enterprise) as of March 31, 2005, and the results of its operations and its cash flows for the nine months ended March 31, 2005 and the period from inception (December 17, 2001) to March 31, 2005, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3, certain conditions indicate that the Company may be unable to continue as a going concern. The accompanying financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

/s/ DeCoria, Maichel & Teague, P.S.

Spokane, Washington

May 16, 2005

IsoRay Medical, Inc. (A Development Stage Enterprise) | | | |

Balance Sheet | | | |

March 31, 2005 | | | |

| | | | |

| | | | |

ASSETS | | | |

| | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 154,947 | |

| Accounts receivable | | | 21,238 | |

| Inventory (Note 5) | | | 24,867 | |

| Prepaid expenses (Note 6) | | | 623,537 | |

| | | | | |

| Total current assets | | | 824,589 | |

| | | | | |

| Fixed assets, net of accumulated depreciation (Note 7) | | | 412,519 | |

| Other assets, net of accumulated amortization (Note 8) | | | 437,713 | |

| | | | | |

| Total assets | | $ | 1,674,821 | |

| | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY (DEFICIT) | | | | |

| | | | | |

| Current liabilities: | | | | |

| Bank line of credit (Note 9) | | $ | 200,000 | |

| Accounts payable | | | 484,783 | |

| Accrued liabilities | | | 114,553 | |

| Notes payable, due within one year (Note 10) | | | 42,390 | |

| Capital lease obligations, due within one year (Note 11) | | | 8,750 | |

| | | | | |

| Total current liabilities | | | 850,476 | |

| | | | | |

| Notes payable, due after one year (Note 10) | | | 615,664 | |

| Capital lease obligations, due after one year (Note 11) | | | 16,687 | |

| Convertible debentures payable, due after one year (Note 12) | | | 495,000 | |

| | | | | |

| Total liabilities | | | 1,977,827 | |

| | | | | |

| Commitments and contingencies (Notes 16 and 17) | | | | |

| | | | | |

| Shareholders' equity (deficit) (Notes 1 and 13): | | | | |

| Preferred stock, $.001 par value, 10,000,000 shares authorized: | | | | |

| Series A: No shares issued and outstanding | | | - | |

| Series B: 1,483,723 shares issued and outstanding | | | 1,484 | |

| Common stock, $.001 par value, 100,000,000 shares authorized, | | | | |

| 7,209,119 shares issued and outstanding | | | 7,209 | |

| Additional paid-in capital | | | 3,401,136 | |

| Deficit accumulated during the development stage | | | (3,712,835 | ) |

| | | | | |

| Total shareholders' equity (deficit) | | | (303,006 | ) |

| | | | | |

| Total liabilities and shareholders' equity (deficit) | | $ | 1,674,821 | |

The accompanying notes are an integral part of the financial statements.

IsoRay Medical, Inc. (A Development Stage Enterprise) | | | | | |

Statements of Operations | | | | | |

Nine Months Ended March 31, 2005 and Period from | | | | | |

Inception (December 17, 2001) to March 31, 2005 | | | | | |

| | | | | | |

| | | | | | |

| | | | | Inception | |

| | | Nine Months | | (December 17, 2001) | |

| | | Ended | | to March 31, 2005 | |

| | | March 31, 2005 | | (Note 2) | |

| | | | | | |

| Product sales | | $ | 74,735 | | $ | 74,735 | |

| Cost of product sales | | | 958,923 | | | 958,923 | |

| | | | | | | | |

| Gross profit (loss) | | | (884,188 | ) | | (884,188 | ) |

| | | | | | | | |

| Operating expenses: | | | | | | | |

| | | | | | | | |

| Research and development | | | 58,061 | | | 257,327 | |

| Sales and marketing expenses | | | 420,762 | | | 420,762 | |

| General and administrative expenses | | | 806,042 | | | 1,933,759 | |

| | | | | | | | |

| Total operating expenses | | | 1,284,865 | | | 2,611,848 | |

| | | | | | | | |

| Operating loss | | | (2,169,053 | ) | | (3,496,036 | ) |

| | | | | | | | |

| Non-operating income (expense): | | | | | | | |

| | | | | | | | |

| Interest income | | | 529 | | | 2,799 | |

| Financing expense (Note 8) | | | (58,285 | ) | | (98,708 | ) |

| Loss on disposal of fixed assets | | | (120,890 | ) | | (120,890 | ) |

| | | | | | | | |

| Non-operating income (expense), net | | | (178,646 | ) | | (216,799 | ) |

| | | | | | | | |

| Net loss | | $ | (2,347,699 | ) | $ | (3,712,835 | ) |

IsoRay Medical, Inc. (A Development Stage Enterprise) | | | | | | | | | |

Statement of Changes in Shareholders' Equity (Deficit) | | | | | | | | |

Nine Months Ended March 31, 2005 and Period from | | | | | | | |

Inception (December 17, 2001) to March 31, 2005 | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Deficit | | | |

| | | | | | | | | | | | | Accumulated | | | |

| | | | | | | | | | | Additional | | During the | | | |

| | | Series B Preferred Stock | | Common Stock | | Paid-in | | Development | | | |

| | | Shares | | Amount | | Shares | | Amount | | Capital | | Stage | | Total | |

| | | | | | | | | | | | | | | | |

| Balances at inception (December 17, 2001) | | | - | | $ | - | | | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common shares for cash and compensation | | | | | | | | | 10,000 | | | 10 | | | 9,990 | | | | | | 10,000 | |

Net loss for the period from incorporation (June 15, 2004) to June 30, 2004 (Notes 1 and 2) | | | | | | | | | | | | | | | | | | (18,557 | ) | | (18,557 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Balances at June 30, 2004 | | | - | | | - | | | 10,000 | | | 10 | | | 9,990 | | | (18,557 | ) | | (8,557 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Merger and recapitalization transaction (Note 1) | | | 1,483,723 | | | 1,484 | | | 6,167,426 | | | 6,167 | | | 1,624,944 | | | (1,346,579 | ) | | 286,016 | |

Issuance of common shares for cash pursuant to private placement, net of offering costs (Note 4) | | | | | | | | | 765,500 | | | 766 | | | 1,355,812 | | | | | | 1,356,578 | |

Issuance of common shares pursuant to exercise of warrants granted in connection with private placement (Note 13) | | | | | | | | | 24,750 | | | 25 | | | 12,350 | | | | | | 12,375 | |

Issuance of common shares as inducement for guarantee of debt (Note 13) | | | | | | | | | 211,140 | | | 211 | | | 348,170 | | | | | | 348,381 | |

Issuance of common shares as partial payment for laser welding stations (Note 13) | | | | | | | | | 30,303 | | | 30 | | | 49,970 | | | | | | 50,000 | |

Payments to common shareholders in lieu of issuing fractional shares (Note 13) | | | | | | | | | | | | | | | (100 | ) | | | | | (100 | ) |

| Net loss for nine months ended March 31, 2005 | | | | | | | | | | | | | | | | | | (2,347,699 | ) | | (2,347,699 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Balances at March 31, 2005 | | | 1,483,723 | | $ | 1,484 | | | 7,209,119 | | $ | 7,209 | | $ | 3,401,136 | | $ | (3,712,835 | ) | $ | (303,006 | ) |

The accompanying notes are an integral part of the financial statements.

| | | | | |

Statements of Cash Flows | | | | | |

Nine Months Ended March 31, 2005 and Period from | | | | | |

Inception (December 17, 2001) to March 31, 2005 | | | | | |

| | | | | | |

| | | | | | |

| | | | | Inception | |

| | | Nine Months | | (December 17, 2001) | |

| | | Ended | | to March 31, 2005 | |

| | | March 31, 2005 | | (Note 2) | |

| | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | |

| Net loss | | $ | (2,347,699 | ) | $ | (3,712,835 | ) |

| Adjustments to reconcile net loss to net cash used by operating | | | | | | | |

| activities: | | | | | | | |

| Depreciation and amortization | | | 98,824 | | | 195,326 | |

| Loss on disposal of fixed assets | | | 120,890 | | | 120,890 | |

| Compensation recorded in connection with issuance of common stock | | | - | | | 9,900 | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | | | (21,238 | ) | | (21,238 | ) |

| Inventory | | | 19,451 | | | (24,867 | ) |

| Prepaid expenses | | | (436,282 | ) | | (623,537 | ) |

| Accounts payable | | | 450,751 | | | 484,783 | |

| Accrued liabilities | | | 114,553 | | | 114,553 | |

| | | | | | | | |

| Net cash used by operating activities | | | (2,000,750 | ) | | (3,457,025 | ) |

| | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | |

| Purchases of fixed assets | | | (112,127 | ) | | (422,315 | ) |

| Additions to other assets | | | (100,072 | ) | | (134,193 | ) |

| | | | | | | | |

| Net cash used by investing activities | | | (212,199 | ) | | (556,508 | ) |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | |

| Cash received in connection with merger and recapitalization (Note 1) | | | 31,011 | | | - | |

| Borrowings on bank line of credit | | | 200,000 | | | 200,000 | |

| Borrowings under notes payable | | | 280,000 | | | 845,707 | |

| Proceeds from sales of convertible debentures payable | | | 495,000 | | | 495,000 | |

| Principal payments on notes payable | | | (6,946 | ) | | (187,653 | ) |

| Principal payments on capital lease obligations | | | (122 | ) | | (122 | ) |

| Issuance of common shares and LLC membership shares for cash pursuant to | | | | | | | |

| private placements, net of offering costs | | | 1,368,953 | | | 2,815,648 | |

| Payments to common and Series B Preferred shareholders in lieu of | | | | | | | |

| issuing fractional shares | | | (100 | ) | | (100 | ) |

| | | | | | | | |

| Net cash provided by financing activities | | | 2,367,796 | | | 4,168,480 | |

| | | | | | | | |

| Net increase in cash and cash equivalents | | | 154,847 | | | 154,947 | |

| | | | | | | | |

| Cash and cash equivalents, beginning of period | | | 100 | | | - | |

| | | | | | | | |

CASH AND CASH EQUIVALENTS, END OF PERIOD | | $ | 154,947 | | $ | 154,947 | |

| | | | | | | | |

| Supplemental disclosures of cash flow information: | | | | | | | |

| Cash paid for interest | | $ | 33,312 | | $ | 73,578 | |

| Non-cash investing and financing activities: | | | | | | | |

| Net non-cash assets and liabilities received in connection with | | | | | | | |

| merger and recapitalization (Note 1) | | $ | 255,005 | | $ | - | |

| Fixed assets acquired by capital lease obligations | | $ | 25,559 | | $ | 25,559 | |

| Issuance of common shares as compensation for guarantee of debt | | $ | 348,381 | | $ | 348,381 | |

| Issuance of common shares as partial payment for laser welding stations | | $ | 50,000 | | $ | 236,000 | |

The accompanying notes are an integral part of the financial statements.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements

March 31, 2005

1. Organization

IsoRay Medical, Inc. (“the Company”), a Delaware corporation, was incorporated effective June 15, 2004 to develop, manufacture and sell medical devices for the treatment of cancer. The Company is headquartered in Richland, Washington.

Management of the Company initiated a merger transaction effective October 1, 2004, in which IsoRay, Inc. and its subsidiary, IsoRay Products LLC, two companies that shared common ownership and management with the Company, merged with and into the Company. The merger between the companies was considered to be a capital transaction in substance, rather than a business combination. That is, the transaction was considered to be the issuance of stock by the Company for the net assets of IsoRay, Inc. and IsoRay Products LLC, accompanied by a recapitalization. Accordingly, no goodwill or other intangible assets were recorded as part of the transaction. For financial accounting purposes, the Company is considered to be the surviving entity. In connection with the recapitalization, the consolidated accumulated deficit of IsoRay, Inc., through the date of the merger, was recorded on the Company’s books. The transaction was structured to qualify as a tax-free reorganization, pursuant to the provisions of Section 351 of the Internal Revenue Code of 1986, as amended.

In connection with the transaction, the Company issued 6,167,426 shares of its common stock to the common shareholders of IsoRay, Inc. and the Class B and C members of IsoRay Products LLC, and 1,483,723 Series B Preferred shares to the Class A members of IsoRay Products LLC, in exchange for their IsoRay, Inc. common shares and their IsoRay Products LLC membership interests and all rights, title and interests, in and to the consolidated net assets of IsoRay, Inc. and IsoRay Products LLC, which were as follows on the date of the exchange:

| Cash | | $ | 31,011 | |

| Inventory | | | 44,318 | |

| Prepaid expenses | | | 187,255 | |

| Fixed assets, net of accumulated depreciation | | | 416,493 | |

| Other assets, net of accumulated amortization | | | 17,314 | |

| | | | | |

| Total assets | | | 696,391 | |

| Less accounts payable | | | (25,375 | ) |

| Less notes payable | | | (385,000 | ) |

| | | | | |

| Consolidated net assets at date of merger and recapitalization | | $ | 286,016 | |

The net book value of the assets and liabilities of IsoRay, Inc. and IsoRay Products LLC approximated their fair value at the date of exchange.

The shares of IsoRay Medical, Inc. common stock and Series B Preferred stock issued pursuant to the transaction bear a restrictive legend and are not freely transferable.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

2. Summary of Significant Accounting Policies

Basis of Presentation

The Company’s planned principal operations have commenced, but revenue from the sale of its product has not been significant. Its activities have consisted primarily of soliciting capital and debt financing, and conducting research and development. Accordingly, the Company’s financial statements are presented as those of a development stage enterprise, as prescribed by Statement of Financial Accounting Standards (SFAS) No. 7, Accounting and Reporting by Development Stage Enterprises (see Note 3). For purposes of presenting the “since inception” amounts required by SFAS No. 7, the Company has included the amounts of IsoRay, Inc. and IsoRay Products LLC from the dates of their inception, December 17, 2001 and September 15, 2003, respectively, through the date of the merger and recapitalization with the Company (see Note 1).

Cash Equivalents

The Company considers all highly liquid investments with maturities of three months or less when purchased to be cash equivalents.

Financial instruments which potentially subject the Company to concentration of credit risk consist principally of temporary cash investments which are classified as cash equivalents. The accounts are guaranteed by the Federal Deposit Insurance Corporation (FDIC) up to $100,000. At March 31, 2005, uninsured cash balances totaled $54,947.

Accounts Receivable

Accounts receivable are stated at the amount that management of the Company expects to collect from outstanding balances. Management provides for probable uncollectible amounts through an allowance for doubtful accounts. Additions to the allowance for doubtful accounts are based on management’s judgment, considering historical write-offs, collections and current credit conditions. Balances which remain outstanding after management has used reasonable collection efforts are written off through a charge to the allowance for doubtful accounts and a credit to the applicable accounts receivable. Payments received subsequent to the time that an account is written off are considered bad debt recoveries. At March 31, 2005, management considers all accounts to be collectible, and therefore has not recorded an allowance for doubtful accounts.

Inventory

Inventory is reported at the lower of cost, which is determined using the weighted average method, or net realizable value.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

2. Summary of Significant Accounting Policies, Continued

Fixed Assets

Fixed assets are carried at the lower of cost or net realizable value. Production equipment with a value of $2,500 or greater, and other fixed assets with a value of $1,000 or greater are capitalized. Major betterments that extend the useful lives of assets are also capitalized. Normal maintenance and repairs are charged to expense as incurred. When assets are sold or otherwise disposed of, the cost and accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized in operations. Depreciation is computed using the straight-line method over the estimated useful lives of the respective assets, which range from 3 to 7 years.

The Company has adopted the provisions of SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. The provisions of SFAS No. 144 require that an impairment loss be recognized when the estimated future cash flows (undiscounted and without interest) expected to result from the use of an asset are less than the carrying amount of the asset. Measurement of an impairment loss is based on the estimated fair value of the asset if the asset is expected to be held and used.

Management of the Company periodically reviews the net carrying value of all of its equipment on an asset-by-asset basis. These reviews consider the net realizable value of each asset to determine whether a permanent impairment in value has occurred and the need for any asset write-down.

Although management has made its best estimate of the factors that affect net realizable value based on current conditions, it is reasonably possible that changes could occur which could adversely affect management's estimate of net cash flows expected to be generated from its assets, and necessitate asset impairment write-downs.

Other Assets

Other assets, which include deferred financing costs, deferred charges, patents and licenses, are stated at cost, less accumulated amortization. Amortization of deferred financing costs is computed using the interest method over the term of the associated debt. Amortization of patents and licenses is computed using the straight-line method over the estimated economic useful lives of the assets. The Company periodically reviews the carrying values of patents and licenses and any impairments are recognized when the expected future operating cash flows to be derived from such assets are less than their carrying value.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

2. Summary of Significant Accounting Policies, Continued

Financial Instruments

The Company follows SFAS No. 107, Disclosures about Fair Value of Financial Instruments. SFAS No. 107 extends fair value disclosure practices by requiring all entities to disclose the fair value of financial instruments, both assets and liabilities, recognized and not recognized in the balance sheet, for which it is practicable to estimate the fair value. The fair value of a financial instrument is the amount at which the instrument could be exchanged in a current transaction between willing parties, other than a forced liquidation sale.

The carrying amounts of financial instruments, including cash and cash equivalents; accounts receivable; accounts payable; notes payable; capital lease obligations; and convertible debentures payable, approximated their fair values at March 31, 2005.

Revenue Recognition

Product sales are recorded when title passes to the customer, which is generally at the time of shipment. Prepayments, if any, received from customers prior to the time that products are shipped are recorded as deferred revenue. When the related products are shipped, the amount recorded as deferred revenue is recognized as revenue. The Company's sales agreements do not provide for product returns or allowances.

Stock-Based Compensation

SFAS No. 123, Accounting for Stock-Based Compensation, as amended by SFAS No. 148, requires companies to recognize stock-based expense based on the estimated fair value of employee stock options. Alternatively, SFAS No. 123 allows companies to retain the current approach set forth in Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees (APB 25), provided that expanded footnote disclosure is presented. The Company has not adopted the fair value method of accounting for stock-based compensation under SFAS No. 123, but provides the pro forma disclosure required when appropriate (see Note 13).

Research and Development Costs

Research and development costs, including research materials, administrative expenses and contractor fees, are charged to operations as incurred, in accordance with SFAS No. 2, Accounting for Research and Development Costs. The cost of equipment used in research and development activities which has alternative uses is capitalized as part of fixed assets and not treated as an expense in the period acquired. Depreciation of capitalized equipment used to perform research and development is classified as research and development expense in the year computed.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

2. Summary of Significant Accounting Policies, Continued

Income Taxes

Income taxes are accounted for under the liability method. Under this method, the Company provides deferred income taxes for temporary differences that will result in taxable or deductible amounts in future years based on the reporting of certain costs in different periods for financial statement and income tax purposes. This method also requires the recognition of future tax benefits such as net operating loss carryforwards, to the extent that realization of such benefits is more likely than not. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in operations in the period that includes the enactment.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management of the Company to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Accordingly, actual results could differ from those estimates and affect the amounts reported in the financial statements.

3. Risks and Uncertainties

As a development stage enterprise, the Company has a limited operating history and its prospects are subject to the expenses, risks and uncertainties frequently encountered by companies in similar stages of development. These potential risks include failure to acquire adequate financing to fund further development of its products; failure to obtain and operate a production facility; failure to successfully create a market for its products; and other risks and uncertainties. The Company’s financial statements have been prepared on a going concern basis, which contemplates the realization of assets and settlement of liabilities and commitments in the normal course of business. Management’s plans to raise additional financing include the sale of additional equity or borrowings. Management expects to obtain the necessary financing, however, no assurance can be given that such financing will be completed on terms acceptable to the Company. If the Company is unable to obtain additional financing, the development of the Company’s products could be delayed or suspended. The financial statements do not include any adjustments relating to the recoverability of assets and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

4. Private Placement Offerings

October 15, 2004 Private Placement

In October 2004, the Company commenced an offering (“the October 15, 2004 Offering”) of up to $2,000,000 of securities to accredited investors in a private placement, which management believes was exempt from registration under the Securities Act of 1933 ("the Act") pursuant to Section 4(2) of the Act and Rule 506 of Regulation D. The October 15, 2004 Offering consisted of up to 100 Investment Units, each unit consisting of 10,000 shares of the Company’s common stock and a callable warrant to purchase 3,000 shares of common stock at an exercise price of $.50 per share, for $20,000 per Investment Unit. Simultaneous with the October 15, 2004 Offering, the officers and directors of the Company had the right to independently sell similar Investment Units pursuant to a separate private placement memorandum on substantially the same terms and conditions as the October 15, 2004 Offering.

Through December 31, 2004, the expiration date of the October 15, 2004 Offering, the Company sold 76.55 Investment Units, representing 765,500 common shares and callable warrants for the purchase of 229,650 common shares, for cash totaling $1,531,000. In connection with the sales of the Investment Units, the Company paid commissions and expense allowances totaling $119,980 to broker-dealers, and legal expenses totaling $54,442 to attorneys, which amounts have been recorded as reductions of additional paid-in capital. Additionally, the broker-dealers were granted warrants for the purchase of 4.23 Investment Units at $20,000 per Investment Unit (see Note 13).

January 31, 2005 Private Placement

In January 2005, the Company commenced an offering (“the January 31, 2005 Offering”) of up to $2,000,000 of 8% convertible debentures (see Note 12) to accredited investors in a private placement, which management believes was exempt from registration under the Securities Act of 1933 ("the Act") pursuant to Section 4(2) of the Act and Rule 506 of Regulation D.

Through March 31, 2005, the Company sold debentures totaling $495,000. In connection with the sales of these debentures, the Company paid commissions totaling $23,200, which amount has been recorded as deferred financing costs, and is included in other assets on the balance sheet.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

5. Inventory

Inventory consists of the following at March 31, 2005:

| Raw materials | | $ | 8,281 | |

| Work in process | | | 11,141 | |

| Finished seeds | | | 5,445 | |

| | | | | |

| | | $ | 24,867 | |

Work in process inventory is reported net of a valuation allowance of approximately $26,000 because the costs expected to be incurred in completing this inventory are in excess of the estimated selling price of the finished seeds.

6. Prepaid Expenses

Inventory consists of the following at March 31, 2005:

| Prepaid contract work | | $ | 420,638 | |

| Prepaid legal fees for patents and trademarks | | | 145,400 | |

| Prepaid insurance | | | 38,643 | |

| Other prepaid expenses | | | 18,856 | |

| | | | | |

| | | $ | 623,537 | |

7. Fixed Assets

| Production equipment | | $ | 295,640 | |

| Office equipment | | | 59,608 | |

| Furniture and fixtures | | | 6,483 | |

| Leasehold improvements | | | 138,692 | |

| | | | | |

| | | | 500,423 | |

| Less accumulated depreciation and amortization | | | (87,904 | ) |

| | | | | |

| | | $ | 412,519 | |

Depreciation expense for the nine months ended March 31, 2005 totaled $70,770. Accumulated depreciation and amortization includes $79,695 of accumulated depreciation recorded on the books of IsoRay, Inc. and IsoRay Products LLC prior to the merger and recapitalization transaction (see Note 1). Management believes the gross amounts for cost and accumulated depreciation carried over from these companies provide more meaningful information to the users of the financial statements. Office equipment includes $25,559 of assets under capital lease at March 31, 2005. Accumulated amortization of this equipment totaled $53 at March 31, 2005.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

8. Other Assets

Other assets, net of accumulated amortization, consist of the following at March 31, 2005:

| Deferred financing costs, net of accumulated | | | |

| amortization of $25,129 | | $ | 372,666 | |

| Deferred charges | | | 48,558 | |

| Patents | | | 6,612 | |

| Licenses | | | 9,877 | |

| | | | | |

| | | $ | 437,713 | |

Deferred financing costs include the fair value of shares issued to certain shareholders for their guarantee of certain company debt (see Note 13). Amortization of deferred financing costs, totaling $25,129 for the nine months ended March 31, 2005, is included in financing expense on the statement of operations. Amortization of patents and licenses was $2,925 for the nine months ended March 31, 2005.

9. Bank Line of Credit

The Company has a $395,000 revolving line of credit with Columbia River Bank that expires September 29, 2005. Amounts outstanding under the line bear interest at the bank’s reference rate (Wall Street Journal Prime Rate, which was 4.75% at March 31, 2005) plus 2.0%. The line of credit is collateralized by all accounts receivable and inventory, and is personally guaranteed by certain shareholders up to $375,000 (see Note 13). The Company owed $200,000 on the line of credit at March 31, 2005.

10. Notes Payable

Notes payable consist of the following at March 31, 2005:

| Note payable to Tri-City Industrial Development Council (TRIDEC), | | | |

| non-interest bearing, due in annual installments of $10,000, | | | |

| maturing August 2006 | | $ | 20,000 | |

| Note payable to Benton-Franklin Economic Development District | | | | |

| (BFEDD), due in monthly installments of $2,855, including interest | | | | |

| and servicing fee at a combined 8.0%, maturing October 2009 | | | 226,762 | |

| Note payable to Columbia River Bank, due in monthly installments | | | | |

| of $1,551, including interest at 7%, maturing January 2008 | | | 46,292 | |

| Convertible notes payable to investors, interest at 10.0% | | | | |

| payable quarterly, principal due at maturity in 2006 and 2007 | | | 365,000 | |

| | | | | |

| | | | 658,054 | |

| Less amounts due within one year | | | (42,390 | ) |

| | | $ | 615,664 | |

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

10. Notes Payable, Continued

Principal maturities on notes payable are due as follows:

Year ending March 31, | | | |

| 2006 | | $ | 42,390 | |

| 2007 | | | 364,909 | |

| 2008 | | | 78,089 | |

| 2009 | | | 21,105 | |

| 2010 | | | 151,561 | |

| | | | | |

| | | $ | 658,054 | |

The note payable to TRIDEC bears no interest, but has not been discounted because the note was exchanged solely for cash.

The note payable to BFEDD, which is collateralized by substantially all of the Company’s assets, and guaranteed by certain shareholders, was executed pursuant to a Development Loan Agreement. The note contains certain restrictive covenants relating to: working capital; levels of long-term debt to equity; incurrence of additional indebtedness; payment of compensation to officers and directors; and payment of dividends. At March 31, 2005, the Company was not in compliance with certain of the covenants. The Company has obtained a waiver from BFEDD relating to these covenants, which applies at March 31, 2005 and through March 31, 2006.

The note payable to Columbia River Bank is collateralized by certain production equipment.

The merger agreement between IsoRay Medical, Inc., IsoRay, Inc. and IsoRay Products LLC (see Note 1) provided the former note holders of IsoRay Products LLC with the option of exchanging their notes for IsoRay Medical, Inc. Series A Preferred shares, or receiving IsoRay Medical, Inc. notes payable with substantially the same terms and conditions as their IsoRay Products LLC notes. None of the IsoRay Products LLC note holders elected to receive IsoRay Medical, Inc. Series A Preferred shares. Accordingly, all the note holders (i.e., investors) were issued convertible notes as described above. Note holders can convert principal and accrued interest on their outstanding balances into Series B Preferred shares by exercising the warrants that were issued to them in connection with the merger and recapitalization (see Notes 1 and 13).

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

11. Capital Lease Obligations

The Company leases certain equipment under long-term agreements that represent capital leases. Future minimum lease payments under capital lease obligations are as follows:

Year ending March 31, | | | |

| 2006 | | $ | 9,856 | |

| 2007 | | | 9,787 | |

| 2008 | | | 9,018 | |

| | | | | |

| Total future minimum lease payments | | | 28,661 | |

| Less amount representing interest | | | (3,224 | ) |

| | | | | |

| Present value of net minimum lease payments | | | 25,437 | |

| Less amount due within one year | | | (8,750 | ) |

| | | | | |

| Amount due after one year | | $ | 16,687 | |

12. Convertible Debentures Payable

Through March 31, 2005, the Company had sold $495,000 of convertible debentures pursuant to the January 31, 2005 Offering (see Note 4). The debentures, which bear interest at 8% and mature two years from the date of issuance (February and March 2007), can be converted into shares of the Company’s common stock at a rate of $3.50 per share plus, at the discretion of the Company, either a cash payment for accrued interest, or that number of common shares equal to the amount of unpaid accrued interest at $3.50 per share.

After the debentures have been outstanding for six months, the Company may, at its option, prepay them, in whole or in part, by paying the principal and interest accrued through the date of the prepayment. If such prepayment occurs within one year of the date of issuance of the debenture, the Company must also pay the debenture holder 5% of the principal redeemed. If only a portion of the debenture is prepaid, a new debenture with substantially the same terms and conditions will be issued to the debenture holder for the remaining principal balance.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

13. Shareholders’ Equity (Deficit)

The authorized capital structure of the Company consists of 100,000,000 shares of $.001 par value common stock and 10,000,000 shares of $.001 par value preferred stock.

In addition to the shares of common stock and Series B Preferred stock issued pursuant to the merger and recapitalization transaction (see Note 1), and the common shares issued pursuant to the October 15, 2004 Offering (see Note 4), the Company had the following transactions that affected shareholders’ equity (deficit) during the nine months ended March 31, 2005.

Issuance of Common Stock for Cash

The Company issued 24,750 shares of its common stock for cash of $12,375, pursuant to the exercise of warrants granted in connection with the October 15, 2004 Offering.

Issuance of Common Stock for Guarantee of Debt

The Company issued 211,140 shares of its common stock to certain shareholders as an inducement for their guarantee of the Columbia River Bank line of credit (see Note 9) and the note payable to Benton-Franklin Economic Development District (see Note 10). The transactions were recorded at the fair value of the shares, estimated to be $348,381, since management considered this amount to be more readily determinable than the value of the guarantees. The guarantees were recorded as deferred financing costs (see Note 8).

Issuance of Common Stock in Partial Payment of Equipment Purchase

The Company issued 30,303 shares of its common stock and paid $40,000 cash in full satisfaction of the $90,000 purchase price of three laser welding stations. The transaction was recorded at the purchase price of the laser welding stations, since management considered this amount to be more readily determinable than the value of the shares.

Cash Payments for Fractional Shares

The Company paid a combined total of $100 to the former common shareholders of IsoRay, Inc. and the former Class A, B and C members of IsoRay Products LLC for fractional shares that resulted from the merger and recapitalization that was effective October 1, 2004 (see Note 1).

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

13. Shareholders’ Equity (Deficit), Continued

Warrants to Purchase IsoRay Medical, Inc. Common Stock

Pursuant to the October 15, 2004 Offering (see Note 4), the Company granted warrants for the purchase of 229,650 shares of its common stock at $.50 per share. Through March 31, 2005, warrants for the purchase of 24,750 common shares had been exercised for cash of $12,375. Warrants for the purchase of common stock outstanding at March 31, 2005 totaled 204,900, which expire through January 2007. The outstanding warrants are callable, in whole or in part, by the Company any time six months after the warrant grant date, at the exercise price then in effect, by giving at least 30 days notice. If any warrants are called by the Company, the warrant holder can exercise the warrants called, at the exercise price then in effect, any time during the 30 day notice period.

Warrants to Purchase IsoRay Medical, Inc. Series B Preferred Stock

Pursuant to a private placement of debt units during 2003 and 2004, IsoRay Products LLC issued $365,000 of notes payable to investors (see Note 10) and granted warrants for the purchase of 227,750 of its Class A member shares. In connection with the merger and recapitalization transaction (see Note 1), the Company exchanged the IsoRay Products LLC warrants for warrants to purchase 384,440 IsoRay Medical, Inc. Series B Preferred shares. None of these warrants had been exercised at March 31, 2005. The warrants are summarized as follows:

| Number of | | Exercise | | Expiration |

Shares | | Price | | Date |

| | | | | |

| 91,785 | | $.59 | | July 1, 2005 |

| 91,785 | | $.59 | | February 28, 2007 |

| 90,096 | | $.89 | | July 1, 2005 |

| 90,096 | | $.89 | | February 28, 2007 |

| 10,339 | | $1.18 | | July 1, 2005 |

| 10,339 | | $1.18 | | February 28, 2007 |

| | | | | |

| 384,440 | | $.59 to $1.18 | | |

Warrants to Purchase IsoRay Medical, Inc. Investment Units

In connection with the October 15, 2004 Offering (see Note 4), the Company granted the selling broker-dealers warrants to purchase 4.23 Investment Units at $20,000 per Investment Unit. These Investment Units, which currently do not have an expiration date, represent 42,300 IsoRay Medical, Inc. common shares and 12,690 warrants to purchase common shares at $.50 per share. None of these warrants had been exercised at March 31, 2005.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

13. Shareholders’ Equity (Deficit), Continued

Options to Purchase IsoRay Medical, Inc. Common Stock

In July 2003, the IsoRay, Inc. Board of Directors resolved to create the IsoRay, Inc. 2003 Option Plan (“the 2003 Plan”). The purpose of the 2003 Plan was to retain and reward the best available personnel for positions of substantial responsibility and to provide additional incentive to employees, directors and consultants of the company to promote the success of the company’s business. The maximum number of options to purchase IsoRay, Inc. common stock that could be granted pursuant to the 2003 Plan was 400,000. Through September 30, 2004, options for the purchase of 354,812 shares of IsoRay, Inc.’s common stock had been granted. The options, which were fully vested and exercisable at $1.00 per share, were set to expire in July 2013. Because the option exercise price was equal to the estimated fair value of IsoRay Inc.’s common stock at the date of grant, no compensation was recognized associated with these options. Through the effective date of the merger and recapitalization transaction (see Note 1), 71,580 of these options had been exercised for cash of $71,580, and 114,050 had been exercised in cashless transactions, in which $57,025 of compensation was recorded by IsoRay, Inc. The remaining outstanding options, representing 169,182 shares of IsoRay, Inc. common stock, were canceled by IsoRay, Inc. Replacement options to purchase 326,589 IsoRay Medical, Inc. common shares were granted pursuant to the IsoRay Medical, Inc. 2004 Stock Option Plan (“the 2004 Plan”) and the IsoRay Medical, Inc. 2004 Employee Stock Option Plan (“the 2004 Employee Plan”). The replacement options are included in the totals shown below for options granted and outstanding pursuant to the 2004 Plan and the 2004 Employee Plan.

In June 2004, the IsoRay Medical, Inc. Board of Directors resolved to create the 2004 Plan and the 2004 Employee Plan. The stated purpose of the plans is to provide an incentive based form of compensation to directors, officers, key employees and service providers of the Company and encourage such persons to invest in shares of the Company’s common stock, thereby acquiring a proprietary interest in the success of the Company.

The maximum number of options to purchase IsoRay Medical, Inc. common stock that can be granted pursuant to the 2004 Plan is 1,500,000. At March 31, 2005, options for the purchase of 1,401,384 shares of the Company’s common stock had been granted and were outstanding. These options, which vest at various times, are exercisable at $1.00 per share, and expire through August 2014. Because the option exercise prices were equal to the estimated fair value of the Company’s common stock at the date of grant, no compensation was recognized associated with these options.

The maximum number of options to purchase IsoRay Medical, Inc. common stock that can be granted pursuant to the 2004 Employee Plan is 1,500,000. At March 31, 2005, options for the purchase of 1,255,205 shares of the Company’s common stock had been granted and were outstanding. The options, which vest at various times, are exercisable at $1.00 to $2.00 per share, and expire through December 2014. Because the option exercise prices were equal to the estimated fair value of the Company’s common stock at the date of grant, no compensation was recognized associated with these options.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

13. Shareholders’ Equity (Deficit), Continued

Stock-Based Compensation

As described in Note 2, the Company currently accounts for stock-based compensation in accordance with SFAS No. 123. As permitted by SFAS No. 123, management currently accounts for share-based payments to employees using APB 25's intrinsic value method, and provides expanded footnote disclosure when necessary.

In December 2004, the Financial Accounting Standards Board issued SFAS No. 123 (revised 2004), Share-Based Payment ("SFAS No. 123(R)"), which is a revision of SFAS No. 123. SFAS No. 123(R) also supersedes APB 25, and amends SFAS No. 95, Statement of Cash Flows. Generally, the approach in SFAS No. 123(R) is similar to the approach prescribed by SFAS No. 123. SFAS No. 123(R) requires that all share-based payments to employees, including grants of employee stock options, be recognized in the income statement based on their fair values. Pro forma disclosure will no longer be permitted. SFAS No. 123(R) is effective at the beginning of the first interim or annual period beginning after December 15, 2005. Management expects to adopt SFAS No. 123(R) on January 1, 2006.

During the nine months ended March 31, 2005, the Company granted stock options to employees and directors for the purchase of 2,230,000 shares of its common stock. These options are exercisable at prices ranging from $1.00 to $2.00 per share and expire through August 2014.

The pro forma net loss presented below was determined as if the Company had accounted for these options under the fair value method of SFAS No. 123. The fair value of these options was estimated at the date of grant using the minimum value method set forth in SFAS No. 123(R).

| Net loss as reported for the nine months ended March 31, 2005 | | $ | 2,347,699 | |

| SFAS No. 123 stock option expense | | | 771,365 | |

| Pro forma net loss for the nine months ended March 31, 2005 | | $ | 3,119,064 | |

The following assumptions were used in calculating the fair value of the options:

| Risk-free interest rate | 3.50% |

| Expected dividend yield | 0.00% |

If the Company had fully accounted for its employee stock options in accordance with the provisions of SFAS No. 123, compensation expense would have been $771,365 greater than the amount recorded for the nine months ended March 31, 2005.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

14. Income Taxes

The Company recorded no income tax provision or benefit for the nine months ended March 31, 2005.

At March 31, 2005, the Company had a net deferred tax asset of approximately $800,000, arising principally from net operating loss carryforwards. The deferred tax asset was calculated based on the currently enacted 34% statutory income tax rate. Since management of the Company cannot determine if it is more likely than not that the Company will realize the benefit of its net deferred tax asset, a valuation allowance equal to the full amount of the net deferred tax asset at March 31, 2005 has been established.

At March 31, 2005, the Company had tax basis net operating loss carryforwards of approximately $2,350,000 available to offset future regular taxable income. These net operating loss carryforwards expire through 2025.

15. Related Party Transactions

In addition to transactions described in Note 13, the Company had the following transactions with related parties:

During the nine months ended March 31, 2005, the Company paid or accrued $3,825 for accounting services performed by a company owned by a member of the Board of Directors.

In September 2003, IsoRay Products LLC issued 100,000 of its Class B member shares to Roger Girard, the IsoRay, Inc. President, who was also a Director of IsoRay, Inc., for $100 cash. The Class B member shares were similar in all respects to IsoRay Products LLC Class A member shares, except they were not entitled to a 15% annual, cumulative dividend. Based on an estimate of the fair value of the Class B shares, as determined by reference to cash sales of Class A member shares, IsoRay Products LLC recorded $50,000 of compensation expense in connection with the issuance of these shares. The 100,000 Class B member shares were exchanged for 168,798 IsoRay Medical, Inc. common shares in connection with the merger and recapitalization transaction (see Note 1).

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

15. Related Party Transactions, Continued

During 2003, IsoRay Products LLC granted warrants for the purchase of 100,000 of its Class A member shares to a financial services company for its services in connection with a private placement. These warrants were exercisable at $1.00 per share and were to expire on October 30, 2006. The financial services company was a shareholder of IsoRay Products LLC. Because the exercise price was equal to the estimated fair value at the date of grant, no compensation was recognized associated with these warrants. In connection with the merger and recapitalization transaction (see Note 1), IsoRay Medical, Inc. granted warrants for the purchase of 168,799 of its Series B Preferred shares, exercisable at $.59 per share, in exchange for the warrants granted by IsoRay Products LLC. These warrants, one-half of which are exercisable through July 1, 2005 and one-half of which are exercisable through February 28, 2007, are included in the warrant totals disclosed in Note 13.

16. Commitments and Contingencies

Royalty Agreement for Invention and Patent Application

A shareholder of the Company previously assigned his rights, title and interest in an invention to IsoRay Products LLC in exchange for a royalty equal to 1% of the Gross Profit, as defined, from the sale of “seeds” incorporating the technology. The patent and associated royalty obligation were transferred to the Company effective October 1, 2004 in connection with the merger and recapitalization transaction (see Note 1).

The Company must also pay a royalty of 2% of Gross Sales, as defined, for any sub-assignments of the aforesaid patented process to any third parties. The royalty agreement will remain in force until the expiration of the patents on the assigned technology, unless earlier terminated in accordance with the terms of the underlying agreement. To date, there have been no product sales incorporating the technology and there is no royalty due pursuant to the terms of the agreement.

Patent and Know-How Royalty License Agreement

IsoRay Products LLC was the holder of an exclusive license to use certain “know-how.” This license was transferred to IsoRay Medical, Inc. in connection with the merger and recapitalization transaction (see Note 1). The terms of the original license agreement required the payment of a royalty based on the Net Factory Sales Price, as defined in the agreement, of licensed product sales. Because the licensor’s patent application was ultimately abandoned, only a 1% “know-how” royalty based on Net Factory Sales Price, as defined, remains applicable. To date, there have been no product sales incorporating the licensed technology and there is no royalty due pursuant to the terms of the agreement. A minimum annual royalty of $4,000 will apply once product sales incorporating the licensed technology commence.

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

16. Commitments and Contingencies, Continued

Battelle Memorial Institute Production Agreement

In April 2004, IsoRay Products LLC entered into an agreement with Battelle Memorial Institute, Pacific Northwest Division (Battelle), the operator of the Pacific Northwest National Laboratory, for certain production-related services and facilities. This agreement was assumed by IsoRay Medical, Inc. following the merger and recapitalization (see Note 1). In accordance with the terms of the agreement, the Company is required to make advance payments, which are then applied against billings by Battelle as services are provided. During the nine months ended March 31, 2005, the Company incurred $574,225 of costs for production-related services and facilities provided by Battelle. At March 31, 2005, prepaid expenses include $131,552 related to this agreement. The agreement, which expires December 31, 2006, may be terminated at any time by either party, upon giving a 60-day written notice to the other party.

Facility Lease Agreements

The Company leases office and laboratory space under a noncancelable operating lease agreement. The lease agreement, which currently requires monthly lease payments of $2,605, expires December 31, 2005. Annual rent expense under this agreement was $14,639 for the nine months ended March 31, 2005. Future minimum lease payments under this lease for the period from April 1, 2005 through December 31, 2005 are $23,446.

In February 2005, the Company entered into a lease agreement for a portion of a building in which it intends to establish production facilities. The lease term commences upon regulatory licensing approval, which has not yet been obtained, and terminates one year from the commencement date of the lease. The annual rental is 25,800 shares of the Company’s common stock. Inasmuch as the lease term has not yet commenced, there was no rent recognized during the nine months ended March 31, 2005. In connection with this lease, the Company has entered into a tenant improvement construction agreement (see Note 17).

Equipment Lease Agreements

The Company leases certain production and office equipment under noncancelable operating lease agreements. The lease agreements, which currently require combined monthly lease payments of $402, expire through December 2009. Annual rent expense under these agreements was $611 for the nine months ended March 31, 2005. Future minimum lease payments under these lease agreements are as follows:

Year ending March 31,

| 2006 | | $ | 4,824 | |

| 2007 | | | 4,824 | |

| 2008 | | | 4,824 | |

| 2009 | | | 528 | |

| 2010 | | | 528 | |

IsoRay Medical, Inc. (A Development Stage Enterprise)

Notes to Financial Statements, Continued

March 31, 2005

17. Subsequent Events

The following events and transactions have occurred subsequent to March 31, 2005:

Sale of Convertible Debentures Payable

During the period from April 1, 2005 through May 16, 2005, the Company sold $600,000 of convertible debentures pursuant to the January 31, 2005 Offering (see Notes 4 and 12).

Tenant Improvement Construction Agreement

In connection with its production facility lease (see Note 16), the Company entered into a tenant improvement construction agreement in April 2005. Per the terms of the agreement, the cost of the tenant improvement construction to be borne by the Company shall not exceed $365,760. Through April 30, 2005, the Company owed approximately $63,000 for work performed under the tenant improvement construction agreement.

Equipment Lease

Through May 16, 2005, the Company entered into four additional equipment leases, each of which qualifies as a capital lease. The terms of the leases require combined monthly payments of $18,604 and expire through March 2009. Equipment to be capitalized under these leases totals $511,154.

Letter of Intent

On March 18, 2005, the Company entered into a non-binding letter of intent to merge with a subsidiary of Century Park Pictures Corporation (Century). Century is a public company subject to the periodic reporting requirements of the Securities Exchange Act of 1934. Historically, Century’s operations consisted of developing, producing and marketing various entertainment properties. At present, Century has no operations and has been seeking a suitable business combination transaction through either an acquisition or a merger.

Under the terms of the letter of intent, the Company would be the surviving entity in the merger with the Century subsidiary. The Company’s shareholders, convertible note holders, convertible debenture holders, and option and warrant holders would receive shares or derivative securities, as applicable, exchanged for similar shares or derivative securities of Century. On a fully diluted basis, shareholders of the Company would own 82% of Century following the merger, and the shareholders of Century would own 18%.

Management believes the transaction has been structured to qualify as a non-taxable reorganization under Section 368(a)(1)(A) of the Internal Revenue Code of 1986, as amended. Management of the Company has been negotiating a Merger Agreement with the management of Century. The Merger Agreement will be subject to adoption by votes of the shareholders of the respective parties to the agreement.

Report of Independent Auditors

Board of Directors

IsoRay, Inc.

Richland, Washington

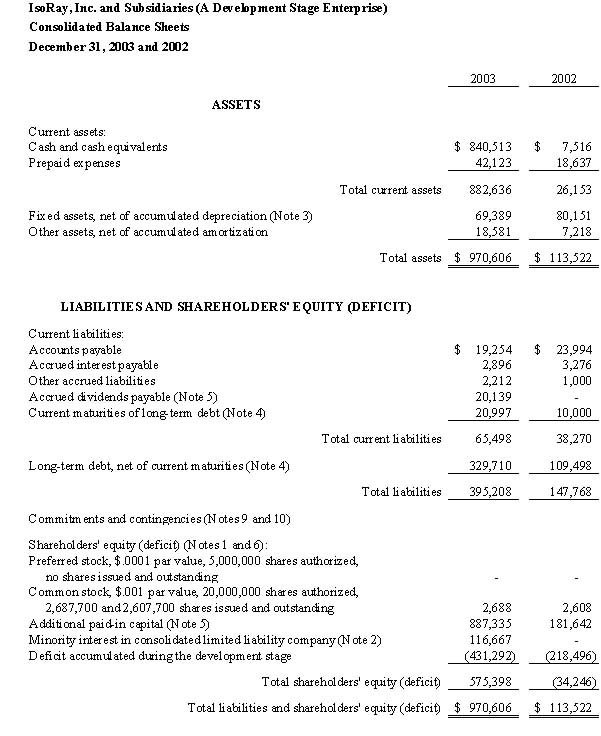

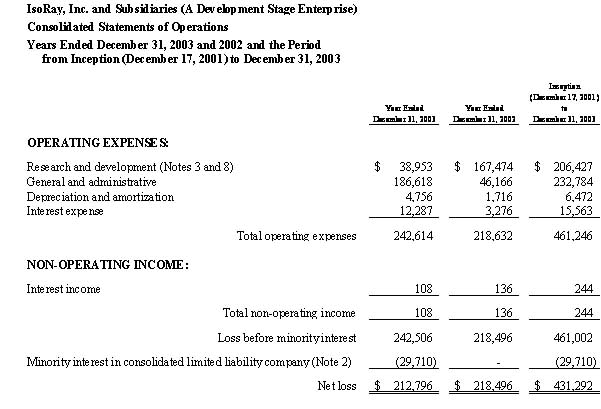

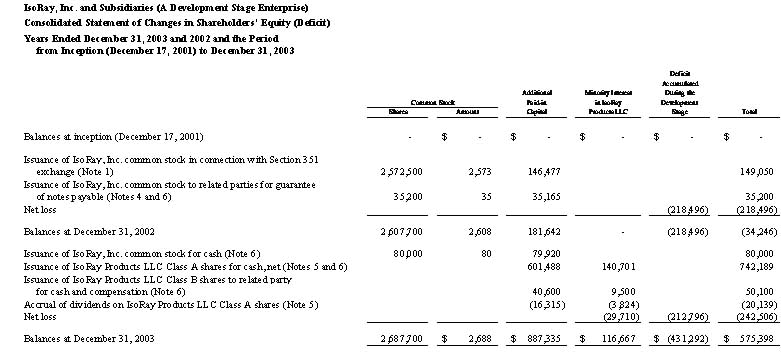

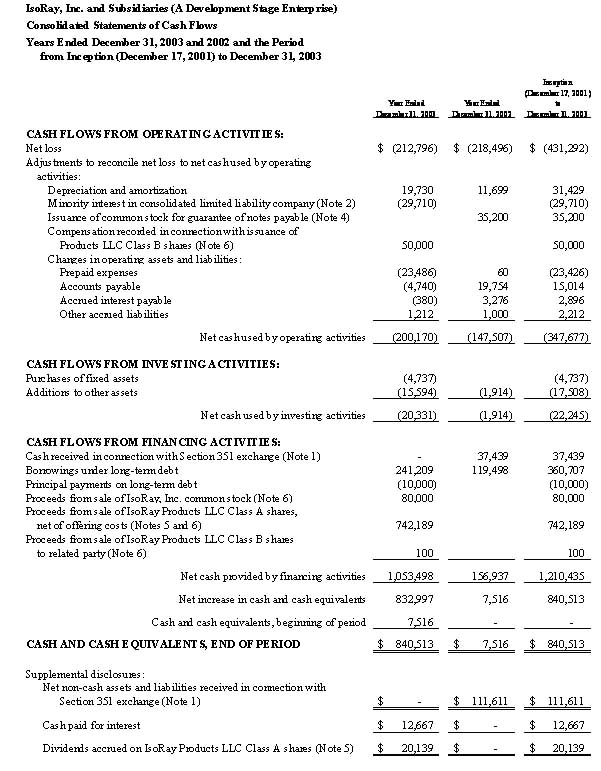

We have audited the accompanying consolidated balance sheets of IsoRay, Inc. and Subsidiaries (“the Company”) (a Development Stage Enterprise) as of December 31, 2003 and 2002, and the related consolidated statements of operations, changes in shareholders’ equity (deficit) and cash flows for the years then ended and the period from inception (December 17, 2001) to December 31, 2003. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and the significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion the financial statements referred to above present fairly, in all material respects, the consolidated financial position of IsoRay, Inc. and Subsidiaries (a Development Stage Enterprise) as of December 31, 2003 and 2002, and the consolidated results of their operations and their cash flows for the years then ended and the period from inception (December 17, 2001) to December 31, 2003, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 10, certain conditions indicate that the Company may be unable to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

/s/ DeCoria, Maichel & Teague, P.S.

Spokane, Washington

March 15, 2004, except Note 11,

as to which the date is June 25, 2004

IsoRay, Inc. and Subsidiaries (A Development Stage Enterprise)

Notes to Consolidated Financial Statements

December 31, 2003 and 2002

1. Organization

The consolidated financial statements include the accounts of IsoRay, Inc., IsoRay Management LLC and IsoRay Products LLC.

IsoRay, Inc. (“the Company”), a Washington corporation, was formed on December 17, 2001 to develop, manufacture and sell radiation and medical devices. The Company is headquartered in Richland, Washington.

Effective May 1, 2002, the Company elected to participate in a transaction that qualified as a tax-free reorganization, pursuant to the provisions of Section 351 of the Internal Revenue Code of 1986, as amended. In connection with the transaction, the Company issued 2,572,500 shares of its common stock to the Members of Yarosi LLC (“Yarosi”) in exchange for their Membership interests and all rights, title and interests, in and to the net assets of Yarosi, which were as follows on the date of the exchange:

| Cash | | $ | 37,439 | |

| Prepaid expenses | | | 18,697 | |

| Furniture and equipment, net of accumulated depreciation | | | 90,301 | |

| Other assets, net of accumulated amortization | | | 6,853 | |

| | | | | |

| Total assets | | | 153,290 | |

| Less accounts payable | | | (4,240 | ) |

| | | | | |

| Net assets at date of exchange | | $ | 149,050 | |

The net book value of the assets and liabilities of Yarosi approximated their fair value at the date of exchange.

The shares of IsoRay, Inc. common stock issued pursuant to the transaction bear a restrictive legend and are not freely transferable.

IsoRay Management LLC (“Management LLC”) is a Washington limited liability company that was formed on September 15, 2003 to be the sole manager of IsoRay Products LLC (see Note 8). Management LLC is headquartered in Richland, Washington, and is 100% owned by IsoRay, Inc.

IsoRay Products LLC (“Products LLC”) is a Washington limited liability company that was formed on September 15, 2003 to develop, manufacture and sell radiation and medical devices. Products LLC is headquartered in Richland, Washington. At December 31, 2003, Management LLC owned 81.1% of Products LLC (see Notes 2 and 5).

IsoRay, Inc. and Subsidiaries (A Development Stage Enterprise)

Notes to Consolidated Financial Statements, Continued

December 31, 2003 and 2002

2. Summary of Significant Accounting Policies

Basis of Presentation

To date, the Company has not begun its planned principal operations, and its activities have consisted primarily of soliciting capital and debt financing, and conducting research and development. Accordingly, the Company’s consolidated financial statements are presented as those of a development stage enterprise, as prescribed by Statement of Financial Accounting Standards (SFAS) No. 7, “Accounting and Reporting by Development Stage Enterprises” (see Note 10).

Principles of Consolidation

The consolidated financial statements include the accounts of IsoRay, Inc., IsoRay Management LLC and IsoRay Products LLC. Significant intercompany balances and transactions have been eliminated in consolidation.

Minority Interest in Consolidated Limited Liability Company

The minority interest in consolidated limited liability company is represented by the Class A shares of IsoRay Products LLC that were sold to accredited and non-accredited outside investors pursuant to the private placement of investment units during 2003 (see Note 5). At December 31, 2003, IsoRay, Inc., through its 100% ownership of IsoRay Management LLC, constructively owned 81.1% of IsoRay Products, LLC, and the Products LLC Class A shareholders owned 18.9%.

Management has classified the minority interest in Products LLC as a component of shareholders’ equity (deficit) in the balance sheet at December 31, 2003, as it believes that classification most closely reflects the economic substance and relationship of the entities.

Cash Equivalents

The Company considers all highly liquid investments with maturities of three months or less when purchased to be cash equivalents.

Financial instruments which potentially subject the Company to concentration of credit risk consist principally of temporary cash investments which are classified as cash equivalents. The accounts are guaranteed by the Federal Deposit Insurance Corporation (FDIC) up to $100,000. At December 31, 2003, uninsured cash balances totaled $740,513. There were no uninsured cash balances at December 31, 2002.

IsoRay, Inc. and Subsidiaries (A Development Stage Enterprise)

Notes to Consolidated Financial Statements, Continued

December 31, 2003 and 2002

2. Summary of Significant Accounting Policies, continued

Fixed Assets

Purchased fixed assets are carried at cost. Donated fixed assets are carried at their estimated fair value at the date of contribution. Major additions and betterments are capitalized. Expenditures for repairs and maintenance that represent betterments or substantially prolong the useful lives of assets are also capitalized. Only assets with a value of $400 or greater are capitalized. Normal maintenance and repairs are charged to expense as incurred. When assets are sold or otherwise disposed of, the cost and accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized in the consolidated statement of operations. Depreciation is computed using the straight-line method over the estimated useful lives of the respective assets, which range from 3 to 7 years.

Other Assets

Other assets, which include patents, licenses, and prepaid financing costs, are stated at cost, less accumulated amortization. Amortization is computed using the straight-line method over the estimated economic useful lives of the assets. The Company periodically reviews the carrying values of other assets and any impairments are recognized when the expected future operating cash flows to be derived from such assets are less than their carrying value.

Financial Instruments

The Company follows SFAS No. 107, “Disclosures about Fair Value of Financial Instruments.” SFAS No. 107 extends fair value disclosure practices by requiring all entities to disclose the fair value of financial instruments, both assets and liabilities, recognized and not recognized in the balance sheets, for which it is practicable to estimate the fair value. The fair value of a financial instrument is the amount at which the instrument could be exchanged in a current transaction between willing parties, other than a forced liquidation sale.

The carrying amounts of financial instruments, including cash and cash equivalents, accounts payable and long-term debt, approximated their fair values as of December 31, 2003 and 2002.

IsoRay, Inc. and Subsidiaries (A Development Stage Enterprise)

Notes to Consolidated Financial Statements, Continued

December 31, 2003 and 2002

2. Summary of Significant Accounting Policies, continued

Stock-Based Compensation

SFAS No. 123, "Accounting for Stock-Based Compensation," as amended by SFAS No. 148, requires companies to recognize stock-based expense based on the estimated fair value of employee stock options. Alternatively, SFAS No. 123 allows companies to retain the current approach set forth in APB Opinion 25, "Accounting for Stock Issued to Employees,” provided that expanded footnote disclosure is presented. The Company has not adopted the fair value method of accounting for stock-based compensation under SFAS No. 123, but provides the expanded disclosure required when appropriate.

Research and Development Costs

Research and development costs, including research materials, administrative expenses and contractor fees, are charged to operations in the year incurred in accordance with SFAS No. 2, “Accounting for Research and Development Costs.” The cost of equipment used in research and development activities which has alternative uses is capitalized as part of fixed assets and not treated as an expense in the year acquired. Depreciation of capitalized equipment used to perform research and development is classified as research and development expense in the year recorded (see Note 3).

Income Taxes

The Company follows SFAS No. 109, “Accounting for Income Taxes,” which requires an asset and liability approach in determining income taxes. The Company provides deferred income taxes for temporary differences that will result in taxable or deductible amounts in future years based on the reporting of certain costs in different periods for financial statement and income tax purposes. This method also requires the recognition of future tax benefits such as net operating loss carryforwards, to the extent that realization of such benefits is more likely than not. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in operations in the period that includes the enactment.

IsoRay, Inc. and Subsidiaries (A Development Stage Enterprise)

Notes to Consolidated Financial Statements, Continued

December 31, 2003 and 2002

2. Summary of Significant Accounting Policies, continued

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management of the Company to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Accordingly, actual results could differ from those estimates and affect the amounts reported in the consolidated financial statements.

Reclassification of 2002 Amounts

Certain 2002 amounts in the consolidated financial statements have been reclassified to conform with the 2003 presentation. These reclassifications have no effect on net loss or deficit accumulated during the development stage, as previously reported.

3. Fixed Assets

Fixed assets consist of the following at December 31, 2003 and 2002:

| | | | | | |

| | | 2003 | | 2002 | |

| | | | | | |

| Production equipment | | $ | 104,818 | | $ | 104,818 | |

| Office equipment | | | 2,604 | | | - | |

| Furniture and fixtures | | | 1,254 | | | 1,254 | |

| Leasehold improvements | | | 2,061 | | | - | |

| | | | | | | | |

| | | | 110,737 | | | 106,072 | |

| Less accumulated depreciation | | | (41,348 | ) | | (25,921 | ) |

| | | | | | | | |

| | | $ | 69,389 | | $ | 80,151 | |

Depreciation expense for the years ended December 31, 2003 and 2002 totaled $15,499 and $10,150, respectively, of which $14,974 and $9,983, respectively, was charged to research and development expense. Accumulated depreciation includes $15,771 of accumulated depreciation recorded on Yarosi’s books prior to the Section 351 exchange (see Note 1), as management believes the gross amounts for cost and accumulated depreciation provide more meaningful information to the users of the financial statements.

IsoRay, Inc. and Subsidiaries (A Development Stage Enterprise)

Notes to Consolidated Financial Statements, Continued

December 31, 2003 and 2002

4. Long-term Debt

Long-term debt consists of the following at December 31, 2003:

| | | | |

| Note payable to Tri-City Industrial Development Council | | | |

| (TRIDEC), non-interest bearing, due in annual | | | | |

| installments of $10,000, maturing 2006 | | $ | 30,000 | |

| Note payable to Benton-Franklin Economic Development | | | | |

| District (BFEDD), interest and servicing fee at a | | | | |

| combined 8.0%, due in monthly installments commencing | | | | |

| January 2004, maturing 2008 | | | 160,707 | |

| Notes payable to debt unit purchasers, interest at 10.0% payable | | | | |

| quarterly, principal due at maturity in 2006 | | | 160,000 | |

| | | | | |

| | | | 350,707 | |

| Less amounts due within one year | | | (20,997 | ) |

| | | | | |

| | | $ | 329,710 | |

Principal maturities on long-term debt are due as follows:

| | | |

| | Year Ending December 31, | | | | |

| | 2004 | | $ | 20,997 | |

| | 2005 | | | 21,986 | |

| | 2006 | | | 182,981 | |

| | 2007 | | | 14,059 | |

| | 2008 | | | 110,684 | |

| | | | | | |

| | | | $ | 350,707 | |

| | | | | | |

The note payable to TRIDEC bears no interest, but has not been discounted because the note was exchanged solely for cash.

The note payable to BFEDD, which is collateralized by the Company’s fixed assets and patents, and guaranteed by certain shareholders, is pursuant to a Development Loan Agreement. The note contains certain restrictive covenants relating to working capital, long-term debt to equity, incurrence of additional indebtedness and payment of compensation to officers and directors. At December 31, 2003, the Company was in violation of certain of these covenants. Although the Company did not obtain a waiver for these covenant violations, the principal balance at December 31, 2003 has been classified in accordance with the note terms, inasmuch as the note was paid in full in January 2004.

The notes payable to debt unit purchasers were issued during 2003 in connection with the IsoRay Products LLC private placement (see Note 5).

IsoRay, Inc. and Subsidiaries (A Development Stage Enterprise)

Notes to Consolidated Financial Statements, Continued

December 31, 2003 and 2002

5. Products LLC Private Placement

In October 2003, Products LLC commenced an offering of up to $2,400,000 of securities to accredited and non-accredited outside investors in a private placement, which was exempt from registration under the Securities Act of 1933 ("the Act") pursuant to Section 4(2) of the Act and Rule 506 of Regulation D. The securities offered for sale consisted of Class A shares and “debt units.”

Class A Shares

Through December 31, 2003, Products LLC had sold 716,036 Class A shares for cash totaling $801,551, and incurred offering-related costs totaling $59,362. The proceeds from the sale of the Class A shares have been allocated to additional paid-in capital and minority interest in the balance sheet. Additional shares were sold subsequent to December 31, 2003 (see Note 11).

The Class A shareholders are entitled to a 15% annual, cumulative dividend payable quarterly. Although management, in its sole discretion, may elect to not pay the dividend in any quarter, the terms of the offering require the Company to accrue any unpaid dividends on its books as unsecured debt, with the same status as unsecured trade payables. Accordingly, the Company has recorded $20,139 of accrued dividends payable in the balance sheet at December 31, 2003.

The holders of Products LLC Class A shares are entitled to one vote for each share held of record on all matters submitted to a vote of the Products LLC members. In the event of liquidation, dissolution, or winding-up of Products LLC, the holders of the Products LLC Class A shares are entitled to receive a pro rata share of the net assets of Products LLC after payment of all liabilities, including any cumulative unpaid dividends, as discussed in the preceding paragraph. The shares of IsoRay, Inc. common stock issued pursuant to the transaction bear a restrictive legend and are not freely transferable.

Debt Units

Each debt unit consists of a $5,000 secured note payable and two warrants. The notes payable are secured by the Company's patents, patents pending and current patent applications, bear interest at 10%, payable quarterly, and mature three years from their issue date. Each warrant entitles the holder to purchase 875 Products LLC Class A shares. One of the warrants is exercisable through July 1, 2005, and the second warrant is exercisable through February 28, 2007. The warrant exercise prices range from $1.00 to $1.50 per share, depending on the Products LLC Class A share price at the time of the debt unit sale.

IsoRay, Inc. and Subsidiaries (A Development Stage Enterprise)

Notes to Consolidated Financial Statements, Continued

December 31, 2003 and 2002

5. Products LLC Private Placement, continued

Debt Units, continued

Through December 31, 2003, the Company issued notes payable totaling $160,000 pursuant to this offering. Warrants granted in connection with the issuance of these notes payable are summarized as follows:

| | | Number of | | | Exercise | | | Expiration | |

| | | Shares | | | Price | | | Date | |

| | | | | | | | | | |

| | | 4,375 | | | $1.00 | | | July 1, 2005 | |

| | | 4,375 | | | $1.00 | | | February 28, 2007 | |

| | | 23,625 | | | $1.50 | | | July 1, 2005 | |

| | | 23,625 | | | $1.50 | | | February 28, 2007 | |

| | | | | | | | | | |

| | | 56,000 | | | | | | | |

6. Shareholders’ Equity (Deficit)

In addition to the shares of IsoRay, Inc. common stock issued pursuant to the exchange transaction described in Note 1, the Company had the following transactions that affected shareholders’ equity (deficit) during the years ended December 31, 2003 and 2002.

Issuance of IsoRay, Inc. Common Stock for Guarantee of Notes Payable