Exhibit 99

Targeting Profitable Growth

Ohio Casualty Corporation Investor Presentation

September 17, 2004

Forward Looking Statements

Certain of the statements contained in these materials, including all financial forecasts and projections, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified herein by words or phrases such as "expect," "project," "forecast," "plan," "goal," and similar expressions of future or conditional verbs such as "will," "should," and "would." Future premium levels, loss experience, operating expenses and profits are all influenced by a number of factors, including those identified below, all of which are inherently difficult to forecast. Consequently, actual results may differ materially from those included in the forward-looking statements. Among the factors that could cause actual results to differ materially from the forward-looking statements are the following:

General Industry Factors

Pricing environment for the Corporation’s insurance products and general competition Changes in governmental regulation

Acts of war and terrorist activities

Fluctuations in interest rates and performance of the financial markets

General economic and market conditions

Corporation-Specific Factors

Ability of the Corporation to successfully execute its Corporate Strategic Plan

Ability of the Corporation to maintain appropriate lines of credit

Ability of the Corporation to achieve and maintain planned price increases for its insurance products Ability of the Corporation to achieve and maintain planned expense savings

Ability of the Corporation to retain key employees and agents having the experience and skills necessary to execute the Corporation’s Strategic Plan Ability of the Corporation to attain planned benefits from technology initiatives Ability of the Corporation to maintain sufficient financial strength ratings Adequacy of the Corporation’s property and casualty reserves Catastrophe losses and other adverse claims experience Availability and pricing of reinsurance Litigation and administrative proceedings

Other factors that could cause actual results to differ include those matters set forth in the Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003. The Corporation disclaims any obligation or intention to publicly update or revise any of the forward-looking statements contained in these materials, whether as a result of new information, future events or otherwise.

Targeting Profitable Growth

2

Objectives of This Meeting

Update of the 2004-2006 Strategic Plan Discuss execution of the Strategic Plan

Provide an agent’s perspective on the Ease of Doing Business (EODB) initiatives Q & A with Executive Management Team

Targeting Profitable Growth

3

Agenda

Overview Dan Carmichael

President & CEO

Financials Mike Winner

Executive VP & CFO

Operations Beth Riczko

President, Insurance Operations

Technology John Kellington

Senior VP & CTO

Agent’s Perspective Brian Bartosh

Top O’Michigan Insurance Agency

Summary Dan Carmichael

Targeting Profitable Growth

4

Corporate Overview

Dan Carmichael President & CEO

Summary of Key Objectives

Deliver superior ease of use

Leverage technology focused on reducing costs for agents Drive improved position in agencies

Achieve improved profitability, above-market real growth and more sophisticated pricing of risks Focus organization on process improvements

Lower operating costs while improving service

Grow within independent agent and broker distribution channel Earn higher financial ratings and greater shareholder value

Targeting Profitable Growth

6

We Are Successfully Executing Our Strategic Plan

Launching

Accelerate Profitable Growth

Accelerate Agent Appointments Open New Markets

In-Process

Build Competitive Capability

Roll Out P.A.R.I.S.SM Enhance Agency Interface Re-engineer Processes Improve Claims Legal Expense

Done!

Restore Profitability

Increased Prices

Improved Underwriting and Pricing Exited New Jersey Personal Auto

Targeting Profitable Growth

7

Key Initiatives Recently Accomplished

Re-engineered major processes with significant savings Converted all commercial lines policies to P.A.R.I.S.SM upon renewal

Expanded personal lines agency interface and electronic communication Established commercial lines Service Center Reduced claims legal and claims staff expense — achieved long-term goal for claims expense ratio Reduced current costs and rate of increase in future employee benefits expense

Targeting Profitable Growth

8

Key Initiatives in Progress

Install commercial lines policy issuance by agents Achieve additional expense savings from further workflow re-engineering Use predictive modeling to enhance pricing analysis Continue agency value analysis, segmentation and improved agent communication Strengthen marketing capabilities Continue upgrading skills of underwriting and claims professionals

Targeting Profitable Growth

9

Financial Update

Mike Winner Executive VP & CFO

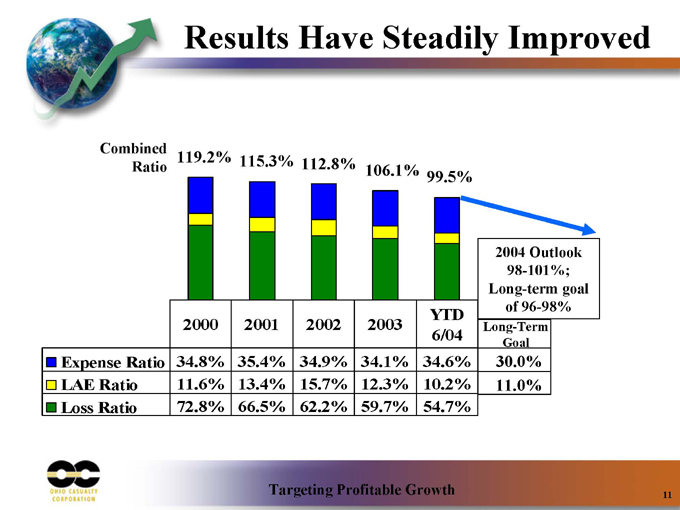

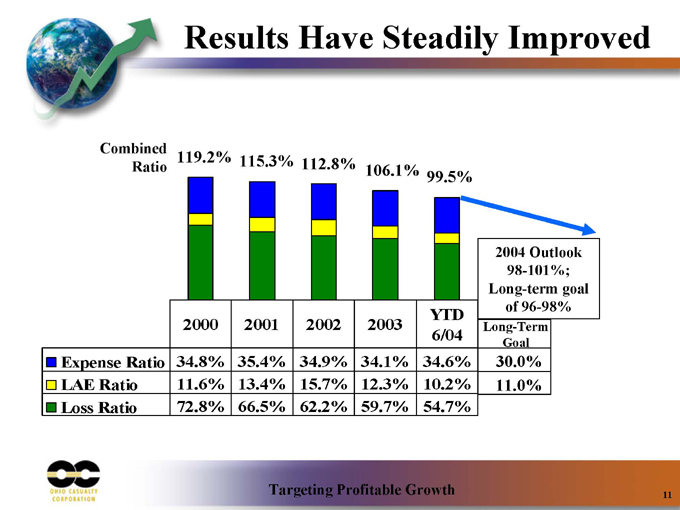

Results Have Steadily Improved

Combined Ratio

119.2% 115.3% 112.8%

106.1% 99.5%

2004 Outlook 98-101%; Long-term goal of 96-98%

2000 2001 2002 2003 YTD 6/04

Expense Ratio 34.8% 35.4% 34.9% 34.1% 34.6%

LAE Ratio 11.6% 13.4% 15.7% 12.3% 10.2%

Loss Ratio 72.8% 66.5% 62.2% 59.7% 54.7%

Long-Term Goal

30.0%

11.0%

Targeting Profitable Growth

11

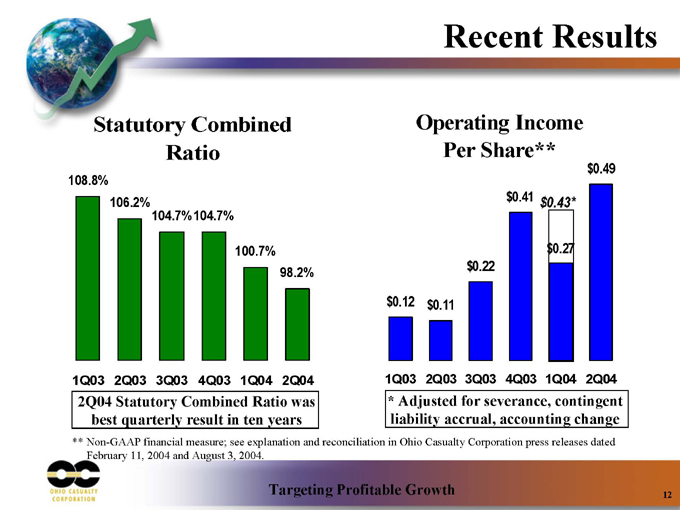

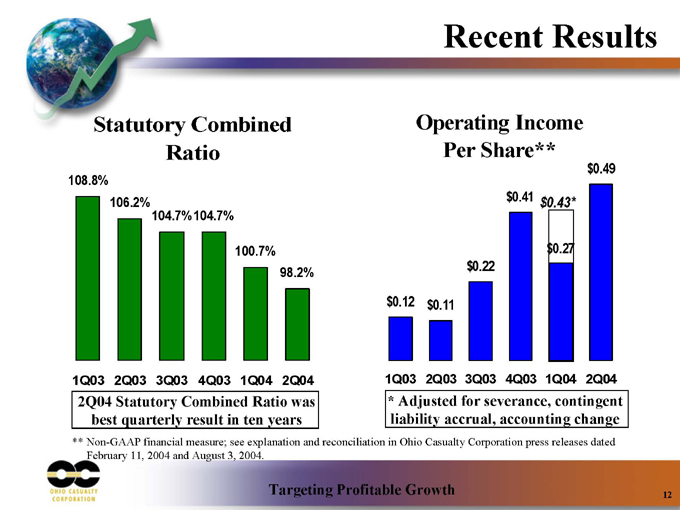

Recent Results

Statutory Combined Ratio

108.8%

106.2%

104.7%

104.7%

100.7%

98.2%

1Q03 2Q03 3Q03 4Q03 1Q04 2Q04

2Q04 Statutory Combined Ratio was best quarterly result in ten years

Operating Income Per Share** $0.12 $0.11 $0.22 $0.41 $0.43* $0.27 $0.49

1Q03 2Q03 3Q03 4Q03 1Q04 2Q04

* Adjusted for severance, contingent liability accrual, accounting change

** Non-GAAP financial measure; see explanation and reconciliation in Ohio Casualty Corporation press releases dated February 11, 2004 and August 3, 2004.

Targeting Profitable Growth

12

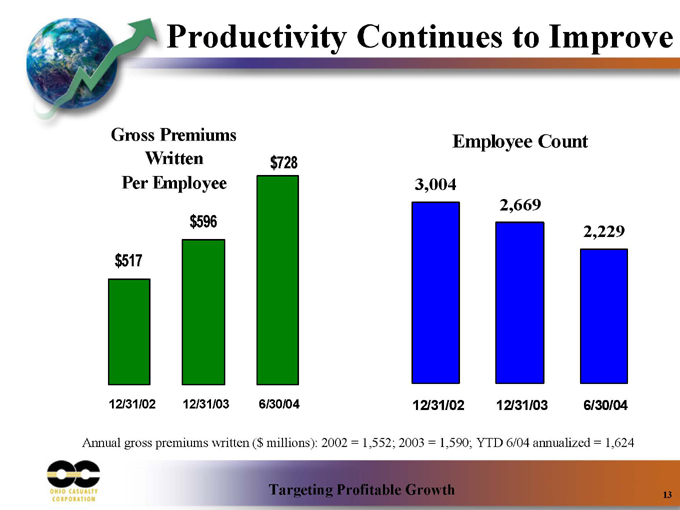

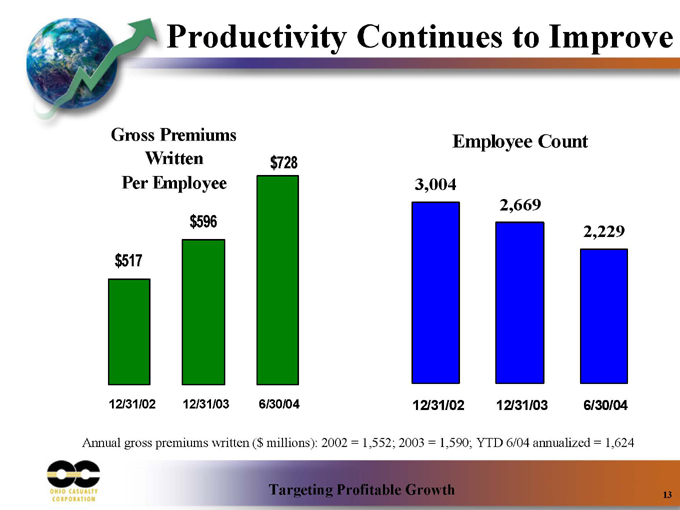

Productivity Continues to Improve

Gross Premiums Written Per Employee

$517

$596

$728

12/31/02 12/31/03 6/30/04

Employee Count

3,004

2,669

2,229

12/31/02 12/31/03 6/30/04

Annual gross premiums written ($ millions): 2002 = 1,552; 2003 = 1,590; YTD 6/04 annualized = 1,624

Targeting Profitable Growth

13

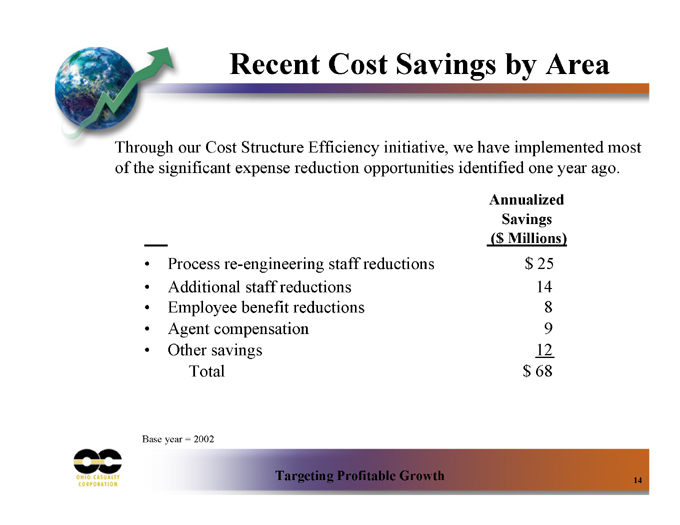

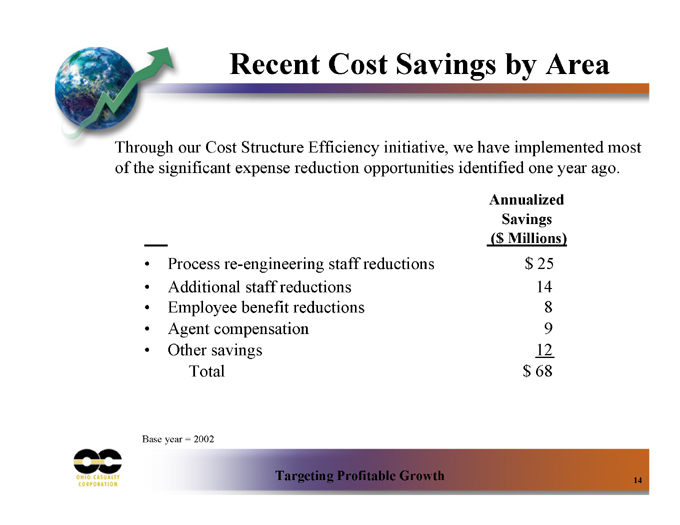

Recent Cost Savings by Area

Through our Cost Structure Efficiency initiative, we have implemented most of the significant expense reduction opportunities identified one year ago.

Annualized Savings ($ Millions)

Process re-engineering staff reductions $ 25

Additional staff reductions 14

Employee benefit reductions 8

Agent compensation 9

Other savings 12

Total $ 68

Base year = 2002

Targeting Profitable Growth

14

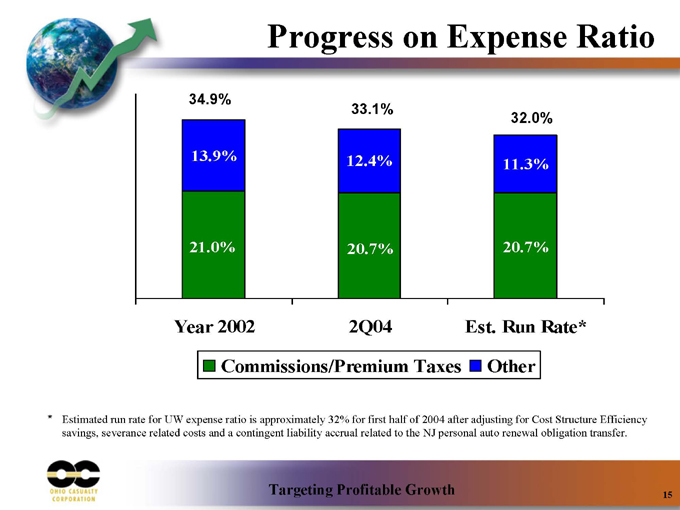

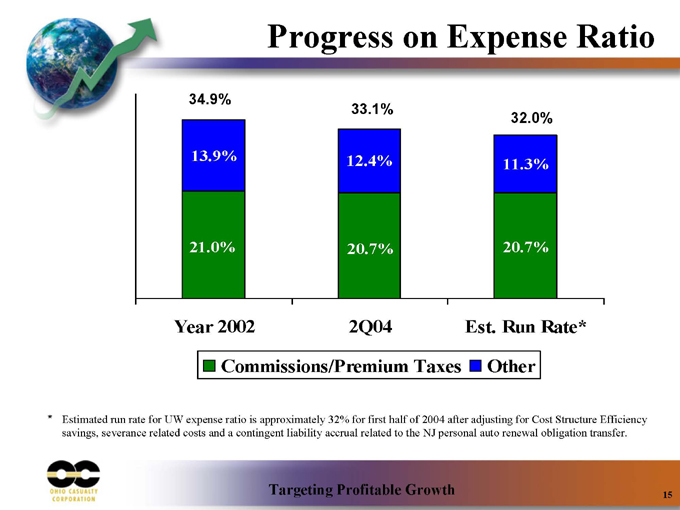

Progress on Expense Ratio

34.9%

13.9%

21.0%

33.1%

12.4%

20.7%

32.0%

11.3%

20.7%

Year 2002 2Q04 Est. Run Rate*

Commissions/Premium Taxes Other

* Estimated run rate for UW expense ratio is approximately 32% for first half of 2004 after adjusting for Cost Structure Efficiency savings, severance related costs and a contingent liability accrual related to the NJ personal auto renewal obligation transfer.

Targeting Profitable Growth

15

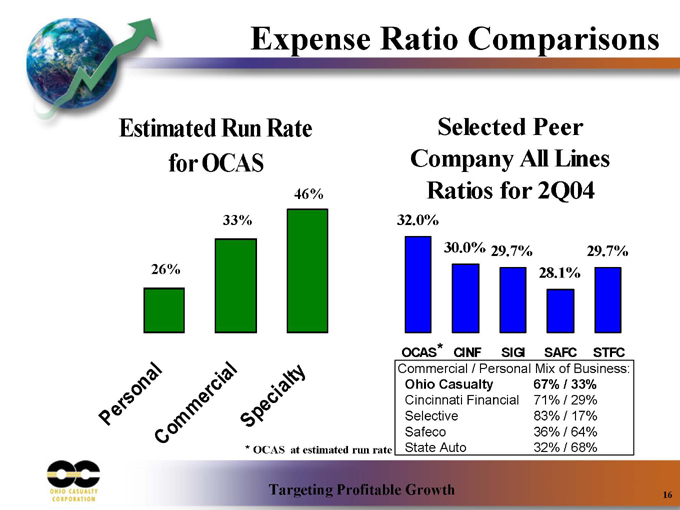

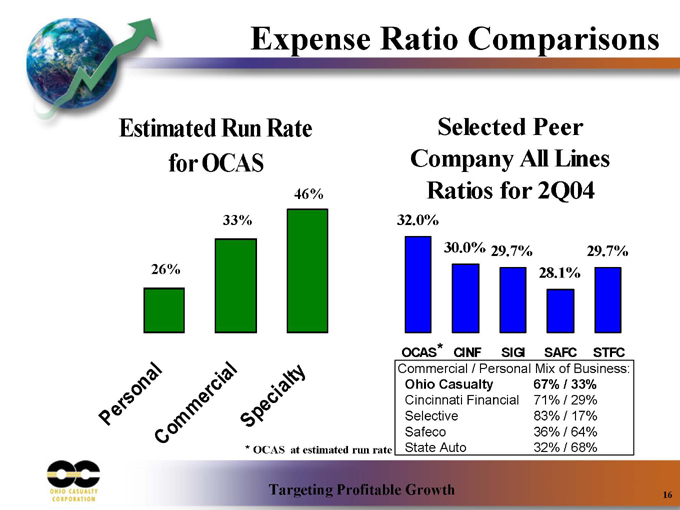

Expense Ratio Comparisons

Estimated Run Rate for OCAS

26%

33%

46%

Personal Commercial

Specialty

Selected Peer Company All Lines Ratios for 2Q04

32.0%

30.0%

29.7%

28.1%

29.7%

OCAS* CINF SIGI SAFC STFC

Commercial / Personal Mix of Business:

Ohio Casualty 67% / 33%

Cincinnati Financial 71% / 29%

Selective 83% / 17%

Safeco 36% / 64%

State Auto 32% / 68%

* OCAS at estimated run rate

Targeting Profitable Growth

16

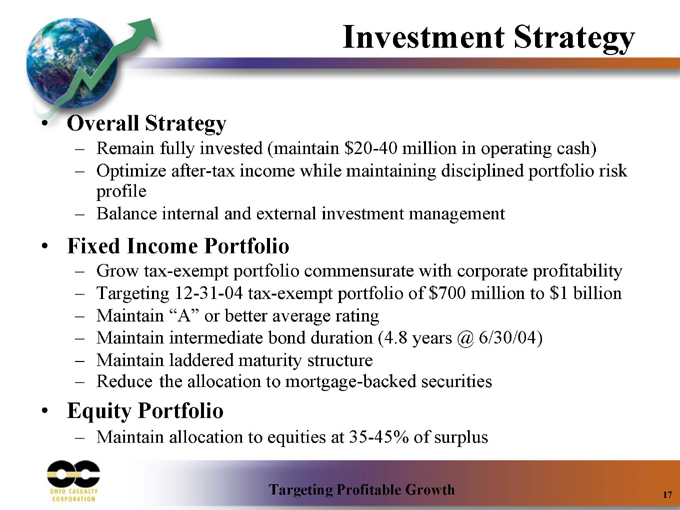

Investment Strategy

Overall Strategy

Remain fully invested (maintain $20-40 million in operating cash) Optimize after-tax income while maintaining disciplined portfolio risk profile Balance internal and external investment management

Fixed Income Portfolio

Grow tax-exempt portfolio commensurate with corporate profitability Targeting 12-31-04 tax-exempt portfolio of $700 million to $1 billion Maintain “A” or better average rating Maintain intermediate bond duration (4.8 years @ 6/30/04) Maintain laddered maturity structure Reduce the allocation to mortgage-backed securities

Equity Portfolio

Maintain allocation to equities at 35-45% of surplus

Targeting Profitable Growth

17

Operations Review

Beth Riczko President, Insurance Operations

Competitive Advantages

Versus National Companies

Stronger agency relationships Superior local knowledge of markets

Versus Regional Companies

Greater scale to support technology advantage More data to increase pricing sophistication

Targeting Profitable Growth

19

Relationships & Market Knowledge

Structured to build strong agency relationships

Service Center maintains agency name recognition in customer communication Personal lines underwriters are dedicated to specific agents Segregation of commercial lines underwriters for new business versus retained business renewals

Focus on core geography provides opportunities for local market knowledge

Concentration of premium volume in top 5 personal lines states is approximately 65% Concentration of premium volume in top 10 commercial lines states is approximately 60%

Targeting Profitable Growth

20

Scale For Technology Advantages

State-of-the-art technology

P.A.R.I.S.SM software platform supports all commercial lines products for all states Personal lines and specialty lines under development

Agency Interface applications with SEMCI options

Agents can lower their cost of doing business and improve their access to OCAS data Widespread adoption of existing interface solutions with 80% of all personal lines new business input by agents

Claims department utilizing “best of breed” tools & methods

SEMCI stands for Single Entry, Multiple Company Interface

Targeting Profitable Growth

21

Data for Pricing Sophistication

Workers Compensation Loss Experience by Territorial Relativity

0.80 0.75 0.70 0.65 0.60 0.55

0.50 0.45

0.40 0.35 0.30 0.25 0.20 0.15

200%

180%

160%

140%

120% 100% 80%

60%

40%

20%

0%

>= 0.7, < 0.8 >= 0.8, < 0.9 >= 0.9, < 1 >= 1, < 1.1 >= 1.1, < 1.2 >= 1.2, < 1.3 >= 1.3, < 1.4 >= 1.4

Territory Relativity

Targeting Profitable Growth

22

Technology Update

John Kellington Senior VP & CTO

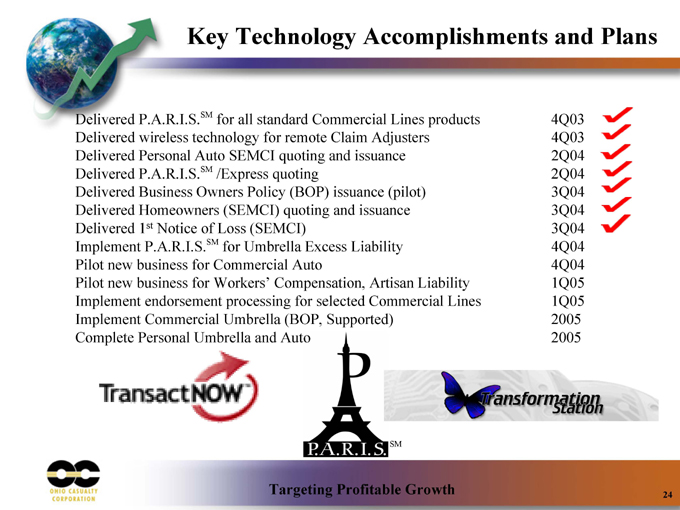

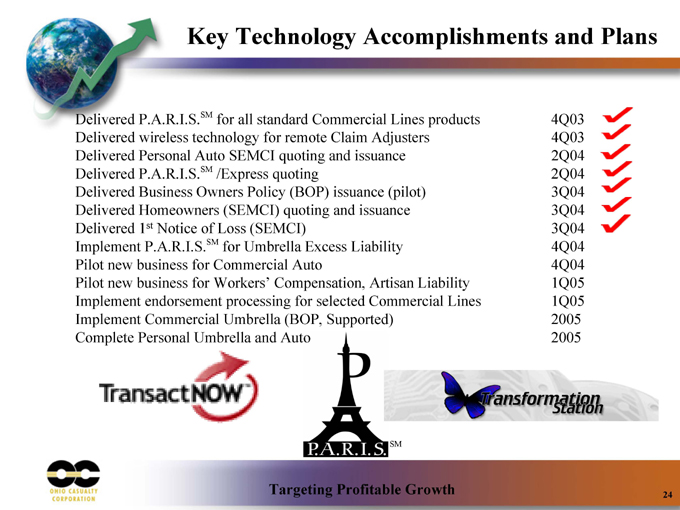

Key Technology Accomplishments and Plans

Delivered P.A.R.I.S.SM for all standard Commercial Lines products 4Q03

Delivered wireless technology for remote Claim Adjusters 4Q03

Delivered Personal Auto SEMCI quoting and issuance 2Q04

Delivered P.A.R.I.S.SM /Express quoting 2Q04

Delivered Business Owners Policy (BOP) issuance (pilot) 3Q04

Delivered Homeowners (SEMCI) quoting and issuance 3Q04

Delivered 1st Notice of Loss (SEMCI) 3Q04

Implement P.A.R.I.S.SM for Umbrella Excess Liability 4Q04

Pilot new business for Commercial Auto 4Q04

Pilot new business for Workers’ Compensation, Artisan Liability 1Q05

Implement endorsement processing for selected Commercial Lines 1Q05

Implement Commercial Umbrella (BOP, Supported) 2005

Complete Personal Umbrella and Auto 2005

Targeting Profitable Growth

24

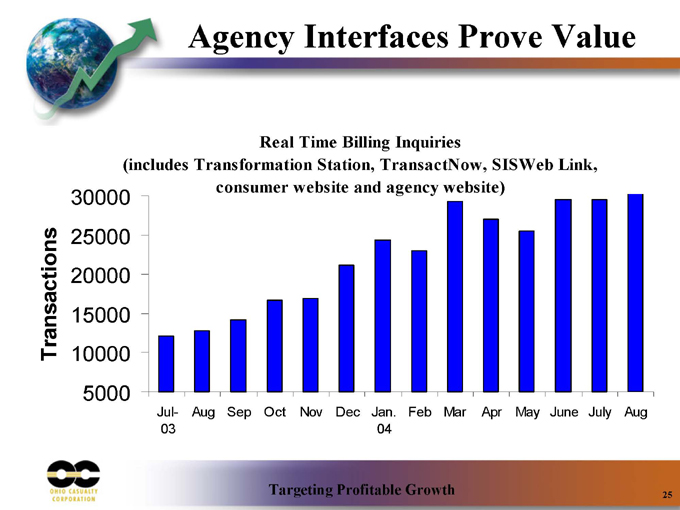

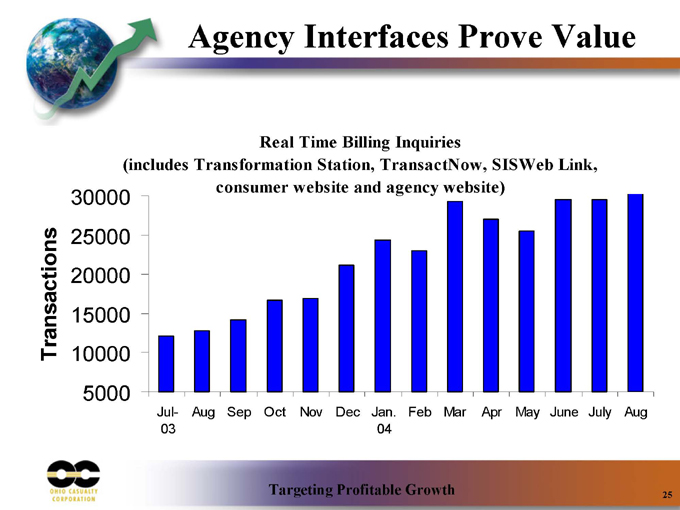

Agency Interfaces Prove Value

Real Time Billing Inquiries

(includes Transformation Station, TransactNow, SISWeb Link, consumer website and agency website)

Transactions

30000

25000

20000

15000

10000

5000

Jul- Aug Sep Oct Nov Dec Jan. Feb Mar Apr May June July Aug

03 04

Targeting Profitable Growth

25

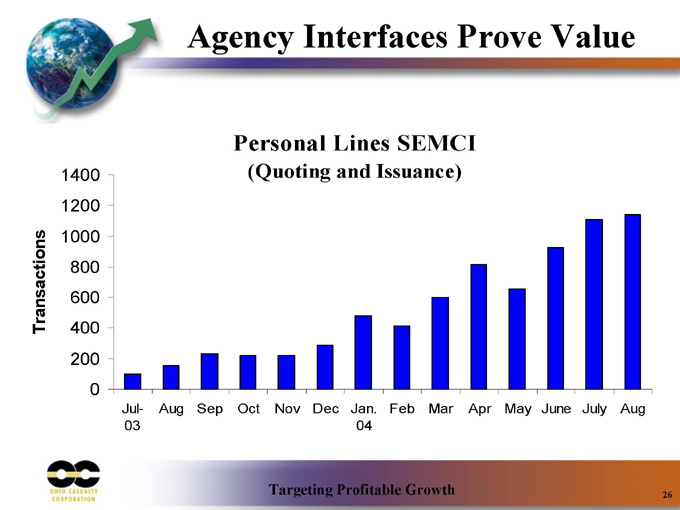

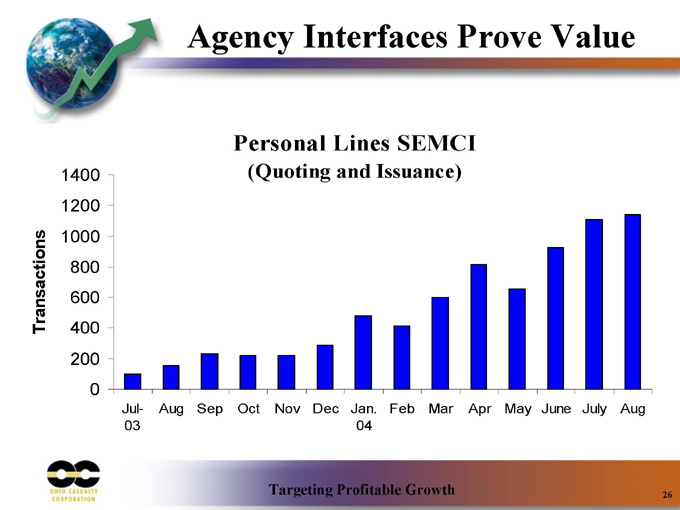

Agency Interfaces Prove Value

Personal Lines SEMCI

(Quoting and Issuance)

Transactions

1400 1200 1000 800 600 400 200 0

Jul- Aug Sep Oct Nov Dec Jan. Feb Mar Apr May June July Aug

03 04

Targeting Profitable Growth

26

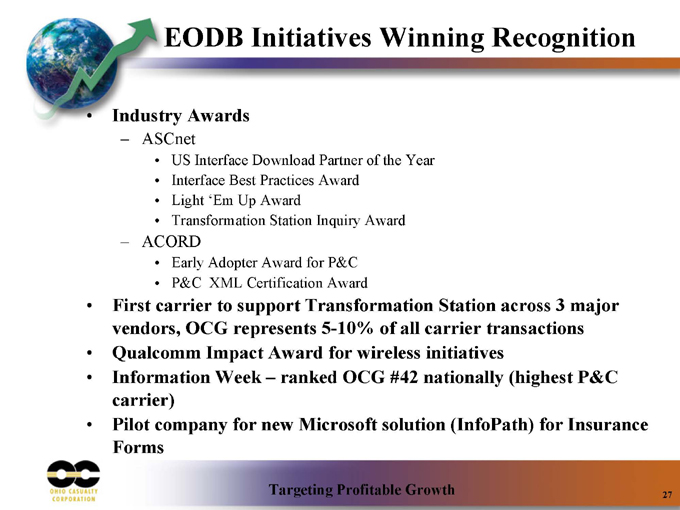

EODB Initiatives Winning Recognition

Industry Awards

ASCnet

US Interface Download Partner of the Year Interface Best Practices Award Light ‘Em Up Award Transformation Station Inquiry Award

ACORD

Early Adopter Award for P&C P&C XML Certification Award

First carrier to support Transformation Station across 3 major vendors, OCG represents 5-10% of all carrier transactions Qualcomm Impact Award for wireless initiatives Information Week – ranked OCG #42 nationally (highest P&C carrier) Pilot company for new Microsoft solution (InfoPath) for Insurance Forms

Targeting Profitable Growth

27

SEMCI - Single Entry, Multiple Company Interface

Agents enter data in their own systems, SEMCI translates and transmits data to carrier’s system

No more re-entering data into carrier systems Agents don’t need to learn each carrier’s system

Don’t have to remember ID and password for each carrier

Agent surveys indicate SEMCI preference

75% of surveyed agents indicated different proprietary company interfaces or duplicate entry as their biggest interface challenges

Agency workflow studies highlight SEMCI advantage

BOP quote with 3 carriers requires 64 minutes to complete on carrier Internet Websites versus 8 minutes with SEMCI

Targeting Profitable Growth

28

Why A Carrier’s Technology Is Important

Brian Bartosh Top O’Michigan Insurance Agency

Top O’ Michigan Insurance

Multi-Line Insurance Agency in Michigan Began in 1974 First automation in 1982 29 Employees Main Office Financial Services Office 7 Branch Sales Offices

Targeting Profitable Growth

30

We have our own priorities

Majority of service to our clients begins at the agency We’d like a consistent approach to carrier interaction Inefficient work-flows cost us real money Training has always been an issue Quick response from carrier allows us to provide quick response to our clients

Targeting Profitable Growth

31

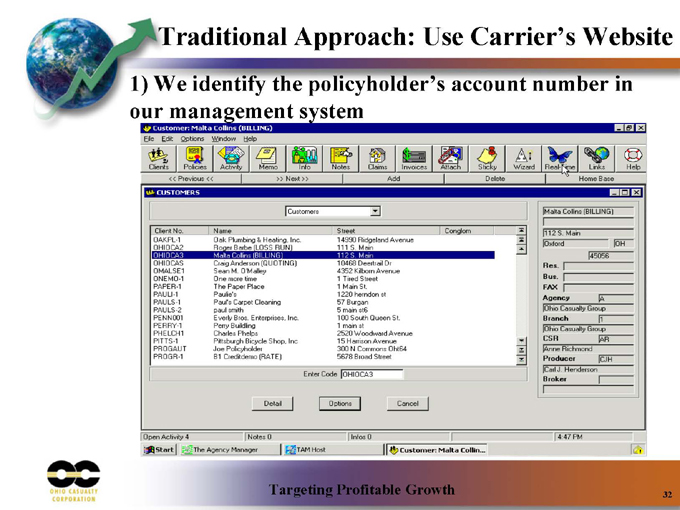

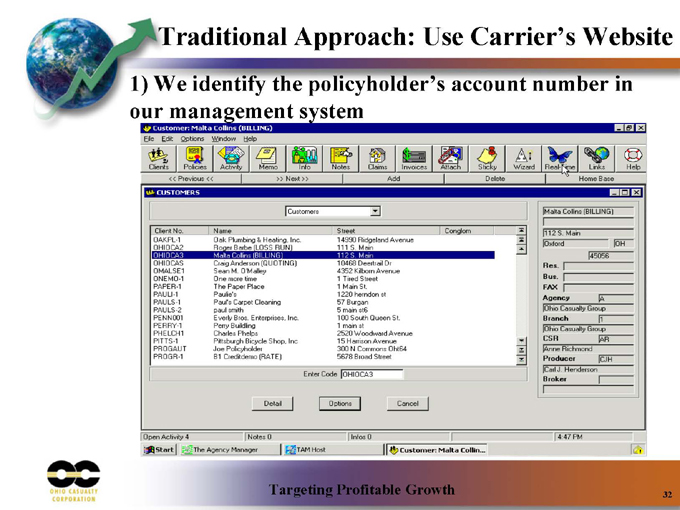

Traditional Approach: Use Carrier’s Website

1) We identify the policyholder’s account number in our management system

Targeting Profitable Growth

32

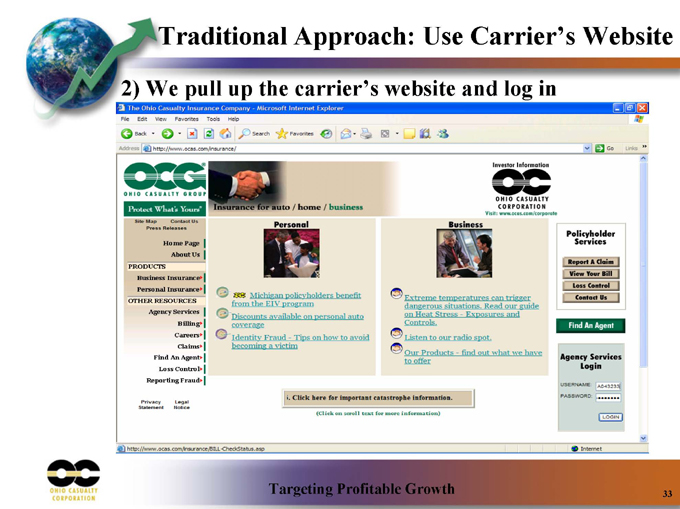

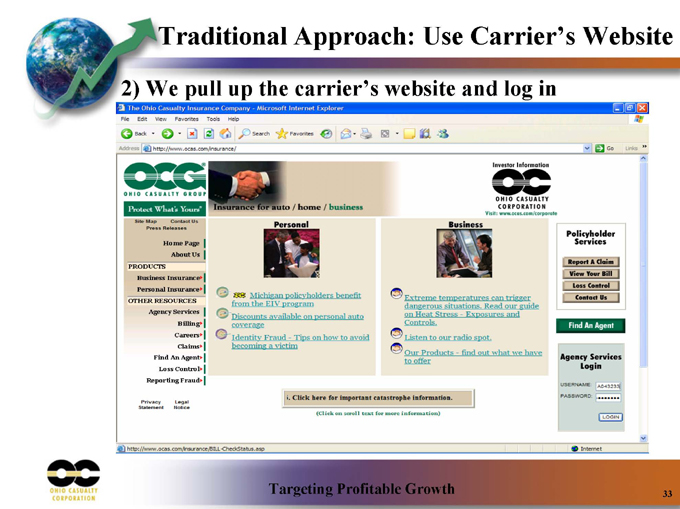

Traditional Approach: Use Carrier’s Website

2) We pull up the carrier’s website and log in

Targeting Profitable Growth

33

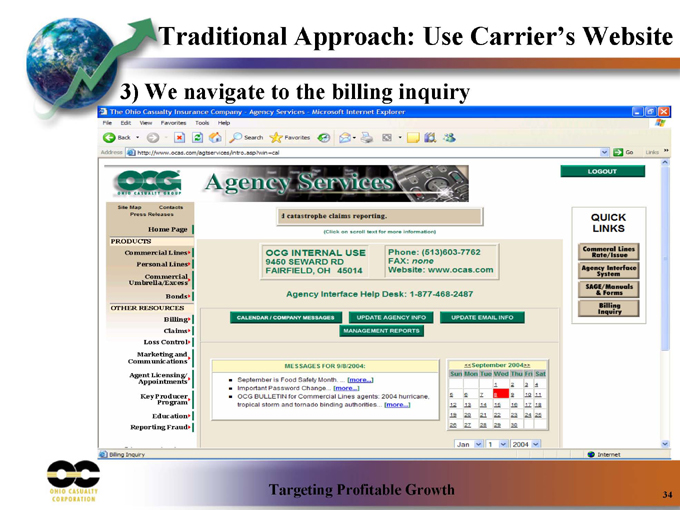

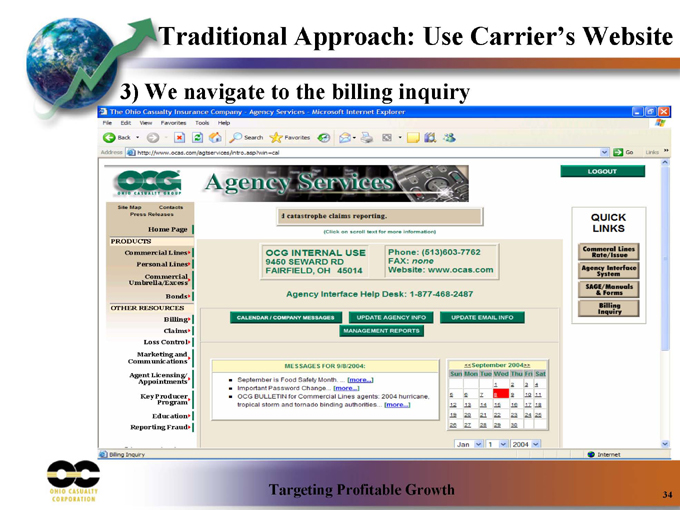

Traditional Approach: Use Carrier’s Website

3) We navigate to the billing inquiry

Targeting Profitable Growth

34

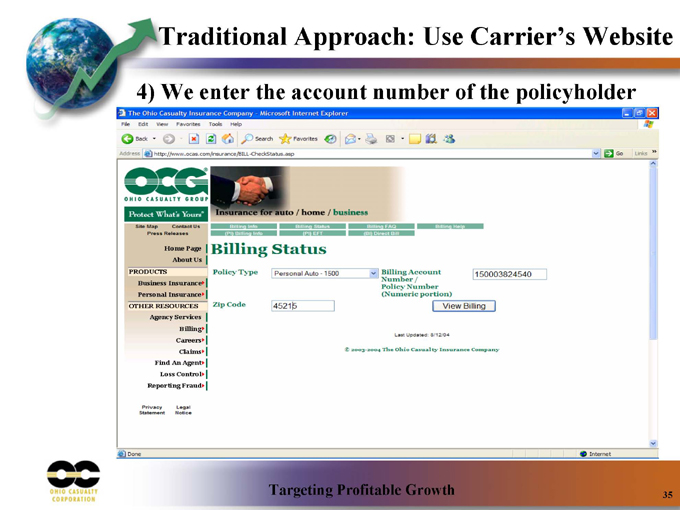

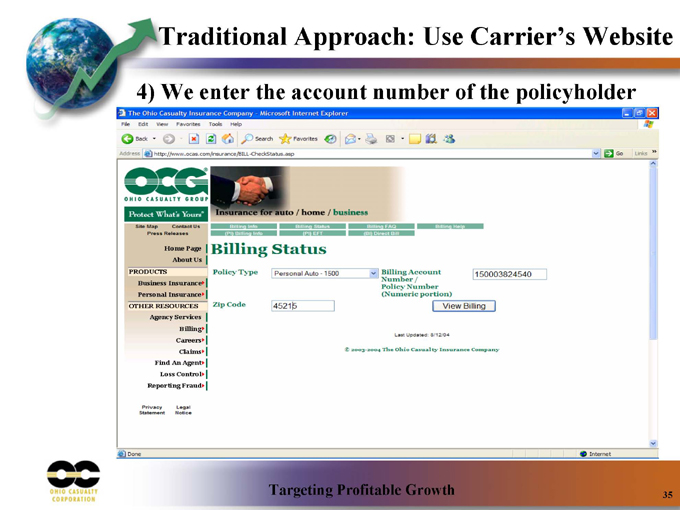

Traditional Approach: Use Carrier’s Website

4) We enter the account number of the policyholder

Targeting Profitable Growth

35

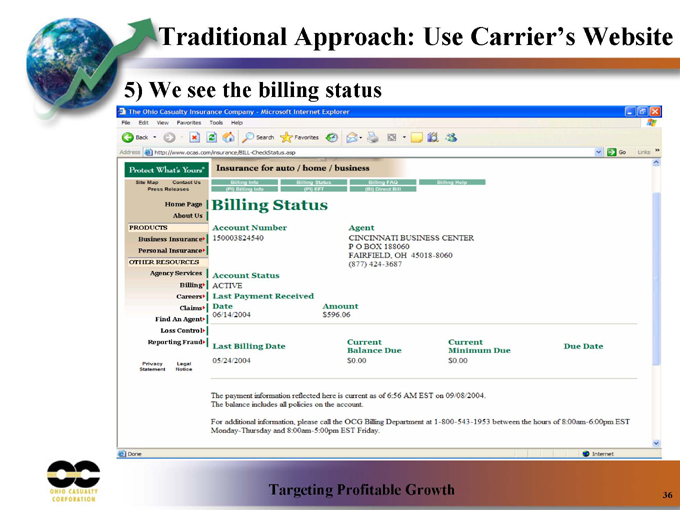

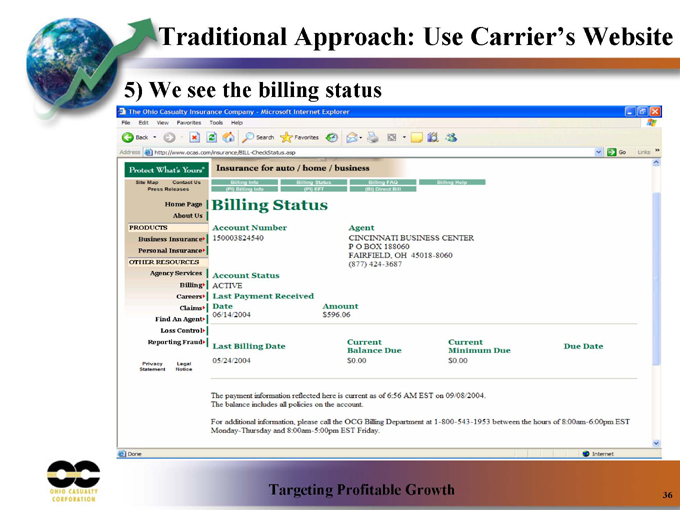

Traditional Approach: Use Carrier’s Website

5) We see the billing status

Targeting Profitable Growth

36

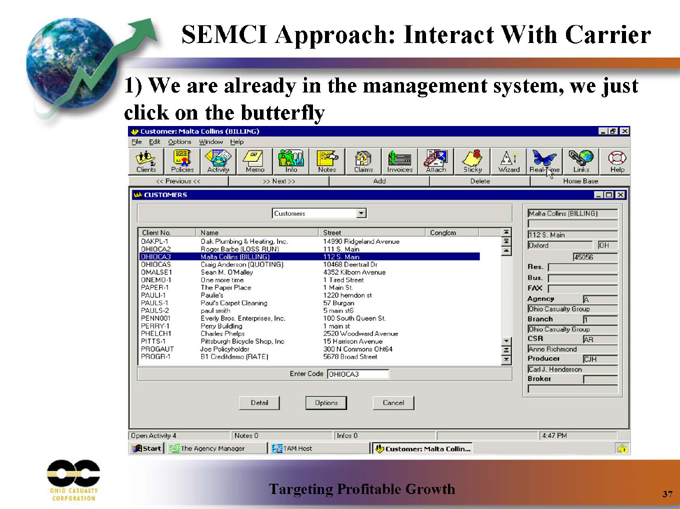

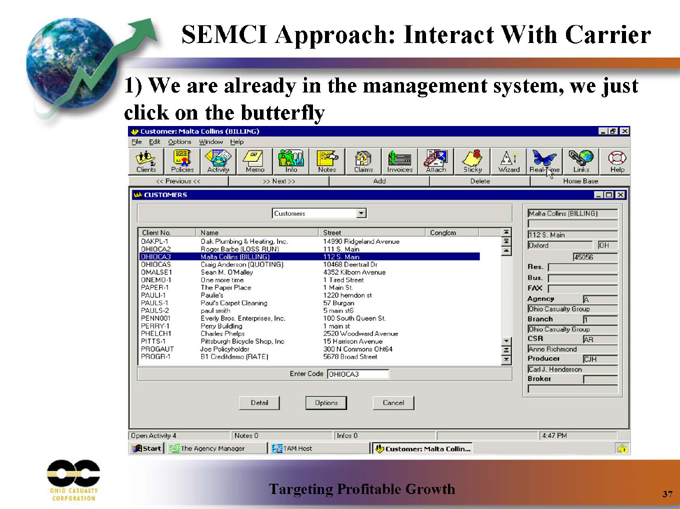

SEMCI Approach: Interact With Carrier

1) We are already in the management system, we just click on the butterfly

Targeting Profitable Growth

37

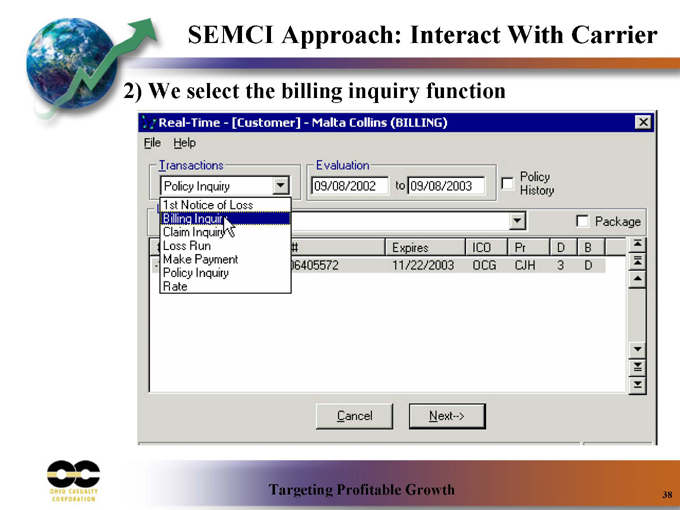

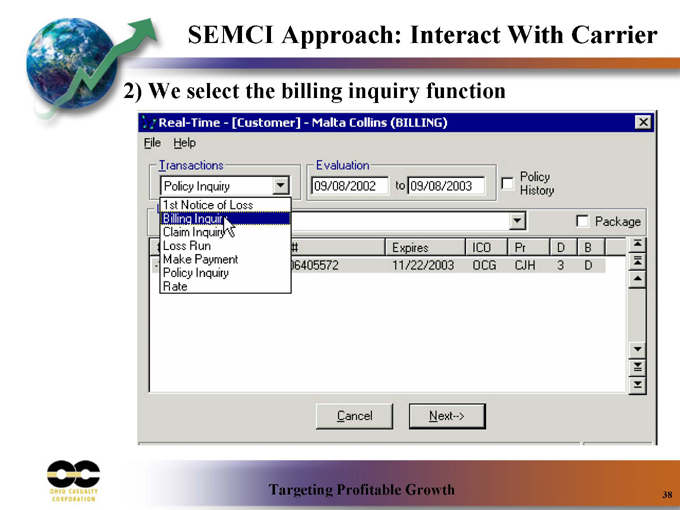

SEMCI Approach: Interact With Carrier

2) We select the billing inquiry function

Targeting Profitable Growth

38

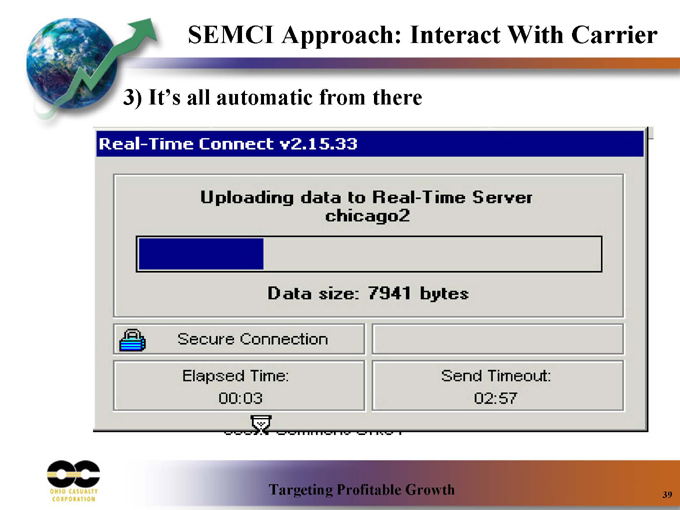

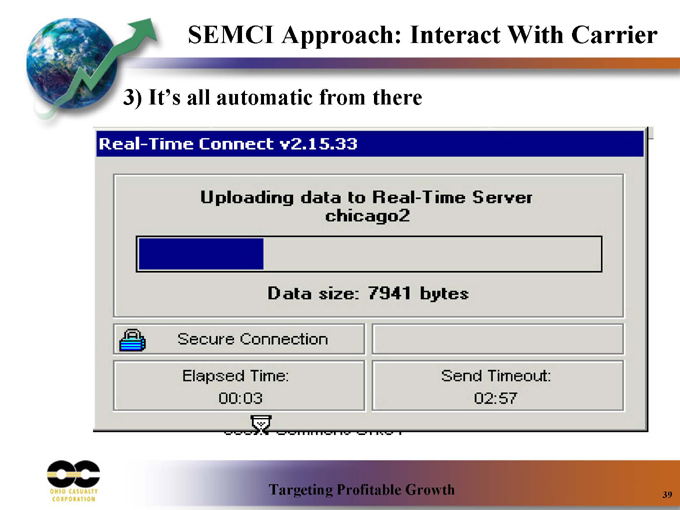

SEMCI Approach: Interact With Carrier

3) It’s all automatic from there

Targeting Profitable Growth

39

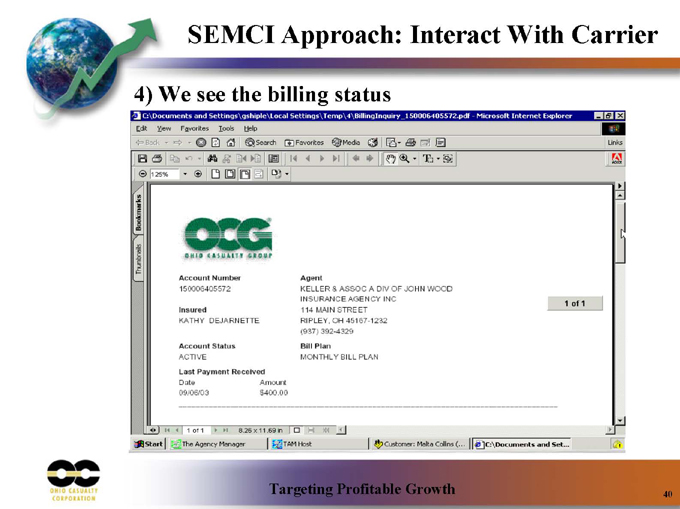

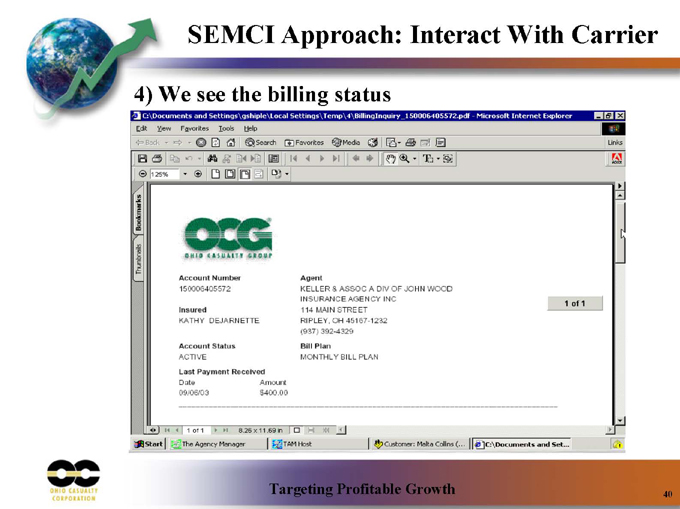

SEMCI Approach: Interact With Carrier

4) We see the billing status

Targeting Profitable Growth

40

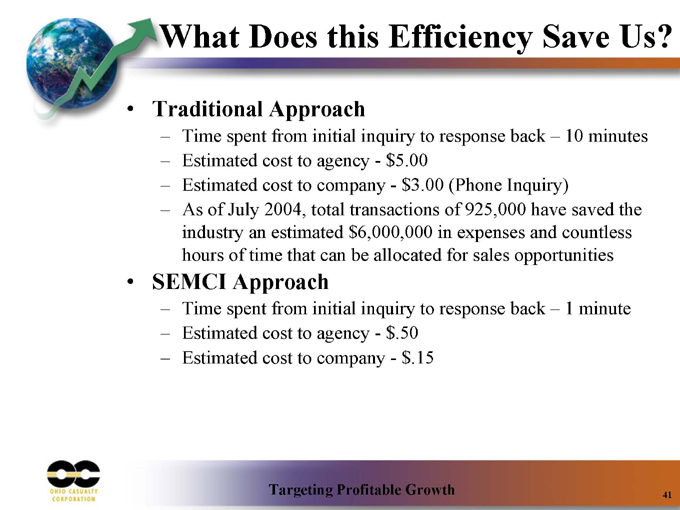

What Does this Efficiency Save Us?

Traditional Approach

Time spent from initial inquiry to response back – 10 minutes Estimated cost to agency—$5.00 Estimated cost to company—$3.00 (Phone Inquiry) As of July 2004, total transactions of 925,000 have saved the industry an estimated $6,000,000 in expenses and countless hours of time that can be allocated for sales opportunities

SEMCI Approach

Time spent from initial inquiry to response back – 1 minute Estimated cost to agency—$.50 Estimated cost to company—$.15

Targeting Profitable Growth

41

We Ask these Questions of Our Carriers:

Do you believe SEMCI is a positive industry direction?

What is your commitment to the SEMCI solutions available today?

What are your timelines for implementing the most common SEMCI transactions?

Targeting Profitable Growth

42

The industry’s perspective of Ohio Casualty

Leader in support of agency workflows using SEMCI Not just an innovator, but an implementer!

Technology compliments business operations

Targeting Profitable Growth

43

Summary

Dan Carmichael

Turnaround Is Complete

Actions in 2001-2003 have restored profitability Process is in place to continue reducing expenses Award-winning P.A.R.I.S.SM technology offers unique advantages EODB gains will accelerate top-line growth

Targeting Profitable Growth

45

Why Invest in Ohio Casualty

This year’s cost reduction and EODB initiatives will pay off in 2005 Structural changes, targeted marketing and sophisticated pricing will accelerate profitable growth Technology improvements, service center, and other Ease Of Doing Business efforts will tighten our link to top quality agents, gaining more of their business Emphasis on improving financial strength, increasing book value Refinancing notes will enhance EPS in 2005

Targeting Profitable Growth

46