UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | April 30 | |

|

Date of reporting period: | April 30, 2013 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

April 30, 2013

Columbia Intermediate Bond Fund

Not FDIC insured • No bank guarantee • May lose value

Columbia Intermediate Bond Fund

Dear Shareholders,

Dear Shareholders,

U.S. equities had a strong first quarter

Similar to 2012, equities once again were the best performing asset class in the first quarter of 2013. The S&P 500 Index reached an all-time closing high on the last trading day of the quarter and pushed through its October 2007 peak. Although global equities have performed well year-to-date, there is significant performance divergence among regions. In local currency terms, Japanese equities were the best performing developed market globally, and U.S. stocks outperformed most other global equity markets. European equities rose in the first quarter but trailed U.S. stocks and had a turbulent March, as investors were reminded of instability in the eurozone with news of a banking crisis in Cyprus.

Although all 10 sectors of the S&P 500 Index delivered positive returns, this was a rally led by defensive stocks such as those in health care, consumer staples and utilities. Materials and technology stocks were the weakest sectors.

High yield leads fixed income; most sectors flat to down

The fixed-income markets lagged equities with modest, single-digit returns coming from municipals and high-yield sectors in the United States. Most government and investment-grade credit sectors were roughly flat to down for the first quarter of 2013. Emerging market bonds were the biggest disappointment with single-digit losses.

Columbia Management to begin delivering summary prospectuses

Each Columbia fund is required to update its prospectus on an annual basis. Beginning with June 2013 prospectus updates, shareholders of Columbia retail mutual funds will start to receive a summary prospectus, rather than the full length (statutory) mutual fund prospectus they have received in the past.

Each fund's summary prospectus will include the following key information:

> Investment objective

> Fee and expense table

> Portfolio turnover rate information

> Principal investment strategies, principal risks and performance information

> Management information

> Purchase and sale information

> Tax information

> Financial intermediary compensation information

Each fund's statutory prospectus will contain additional information about the fund and its risks. Both the statutory and summary prospectus will be updated each year, and will be available at columbiamanagement.com. Shareholders may request a printed version of a statutory prospectus at no cost by calling 800.345.6611 or sending an email to serviceinquiries@columbiamanagement.com.

Stay on track with Columbia Management

Backed by more than 100 years of experience, Columbia Management is one of the nation's largest asset managers. At the heart of our success — and, most importantly, that of our investors — are highly talented industry professionals, brought together by a unique way of working. We are dedicated to helping you take advantage of today's opportunities and anticipate tomorrow's. We stay abreast of the latest investment trends and ideas, using our collective insight to evaluate events and transform them into solutions you can use.

Visit columbiamanagement.com for:

> The Columbia Management Perspectives blog, featuring timely posts by our investment teams

> Detailed up-to-date fund performance and portfolio information

> Economic analysis and market commentary

> Quarterly fund commentaries

> Columbia Management Investor, our award-winning quarterly newsletter for shareholders

Thank you for your continued support of the Columbia Funds. We look forward to serving your investment needs for many years to come.

Best Regards,

J. Kevin Connaughton

President, Columbia Funds

The S&P 500 Index, an unmanaged index, measures the performance of 500 large-capitalization U.S. stocks and is frequently used as a general measure of market performance. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about a fund, visit columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2013 Columbia Management Investment Advisers, LLC. All rights reserved.

Columbia Intermediate Bond Fund

Performance Overview | | | 2 | | |

Manager Discussion of Fund Performance | | | 4 | | |

Understanding Your Fund's Expenses | | | 6 | | |

Portfolio of Investments | | | 7 | | |

Statement of Assets and Liabilities | | | 34 | | |

Statement of Operations | | | 36 | | |

Statement of Changes in Net Assets | | | 37 | | |

Financial Highlights | | | 40 | | |

Notes to Financial Statements | | | 51 | | |

Report of Independent Registered

Public Accounting Firm | | | 62 | | |

Federal Income Tax Information | | | 63 | | |

Trustees and Officers | | | 64 | | |

Important Information About This Report | | | 69 | | |

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiamanagement.com or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

Columbia Intermediate Bond Fund

Performance Summary

> Columbia Intermediate Bond Fund (the Fund) Class A shares returned 5.52% excluding sales charges for the 12-month period that ended April 30, 2013.

> The Fund outperformed its benchmark, the Barclays U.S. Aggregate Bond Index, which returned 3.68% for the same 12-month period.

> Selected overweights in sectors outside the Treasury market helped the Fund outperform its benchmark.

Average Annual Total Returns (%) (for period ended April 30, 2013)

| | Inception | | 1 Year | | 5 Years | | 10 Years | |

Class A | | 07/31/00 | | | | | | | |

Excluding sales charges | | | | | | | 5.52 | | | | 6.52 | | | | 5.39 | | |

Including sales charges | | | | | | | 2.05 | | | | 5.83 | | | | 4.88 | | |

Class B | | 02/01/02 | | | | | | | |

Excluding sales charges | | | | | | | 4.74 | | | | 5.73 | | | | 4.61 | | |

Including sales charges | | | | | | | 1.74 | | | | 5.73 | | | | 4.61 | | |

Class C | | 02/01/02 | | | | | | | |

Excluding sales charges | | | | | | | 4.90 | | | | 5.89 | | | | 4.76 | | |

Including sales charges | | | | | | | 3.90 | | | | 5.89 | | | | 4.76 | | |

Class I* | | 09/27/10 | | | 6.00 | | | | 6.88 | | | | 5.70 | | |

Class K* | | 02/28/13 | | | 5.67 | | | | 6.59 | | | | 5.44 | | |

Class R* | | 01/23/06 | | | 5.26 | | | | 6.26 | | | | 5.13 | | |

Class R4* | | 11/08/12 | | | 5.77 | | | | 6.79 | | | | 5.65 | | |

Class R5* | | 11/08/12 | | | 5.82 | | | | 6.80 | | | | 5.66 | | |

Class W* | | 09/27/10 | | | 5.59 | | | | 6.58 | | | | 5.44 | | |

Class Y* | | 11/08/12 | | | 5.84 | | | | 6.80 | | | | 5.66 | | |

Class Z | | 12/05/78 | | | 5.79 | | | | 6.79 | | | | 5.65 | | |

Barclays U.S. Aggregate Bond Index | | | | | | | 3.68 | | | | 5.72 | | | | 5.04 | | |

Returns for Class A are shown with and without the maximum initial sales charge of 3.25%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 3.00% in the first year, declining to 1.00% in the fourth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. The Fund's other classes are not subject to sales charges and have limited eligibility. Please see the Fund's prospectuses for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiamanagement.com or calling 800.345.6611.

*The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiamanagement.com/mutual-funds/appended-performance for more information.

The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage passthroughs), asset-backed securities, and commercial mortgage-backed securities.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Annual Report 2013

2

Columbia Intermediate Bond Fund

Performance Overview (continued)

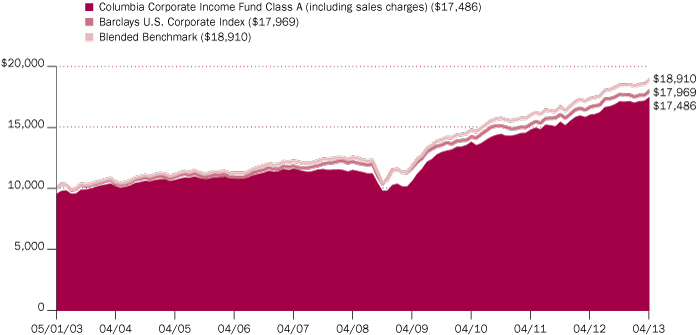

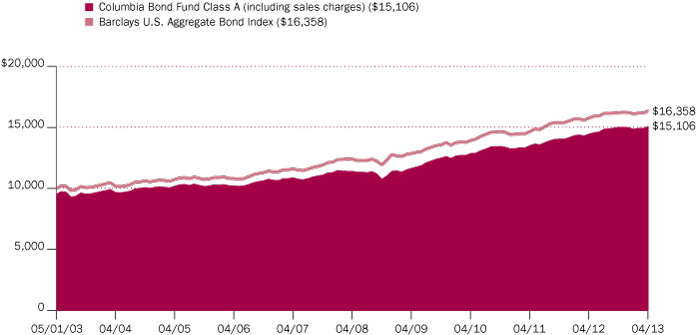

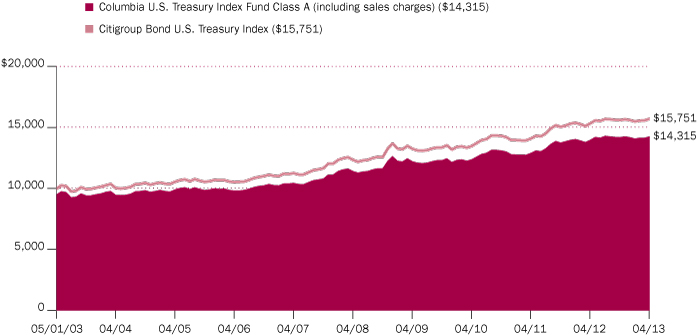

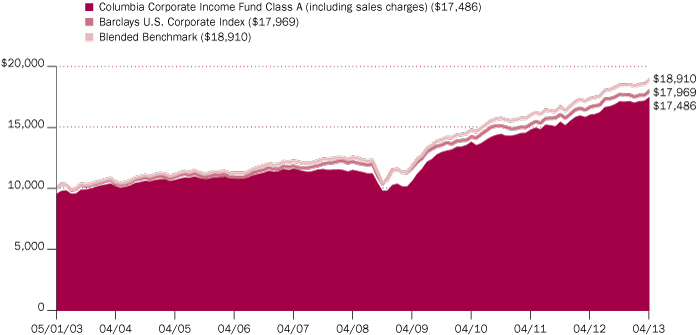

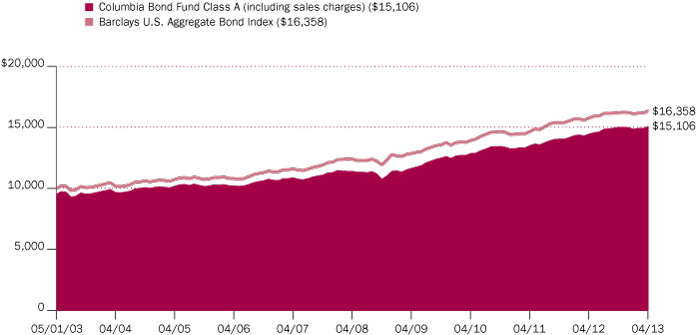

Performance of a Hypothetical $10,000 Investment (May 1, 2003 – April 30, 2013)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Intermediate Bond Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Annual Report 2013

3

Columbia Intermediate Bond Fund

Manager Discussion of Fund Performance

For the 12-month period that ended April 30, 2013, the Fund's Class A shares returned 5.52% excluding sales charges. The Fund's return was higher than the 3.68% return of its benchmark, the Barclays U.S. Aggregate Bond Index, for the same 12-month period. Selected overweights in sectors outside the Treasury market helped the Fund outperform its benchmark.

U.S. Economy: Growth in the Slow Lane

Europe's general economic woes, a financial crisis in Cyprus and U.S. struggles to avoid a fiscal cliff of tax increases and various spending cuts (commonly referred to as the sequester) weighed on the global economy throughout the 12-month period ended April 30, 2013. Late in the period, the sequester clouded consumer confidence in the United States, even though it has had little material impact on the economy to date. However, a decrease in the U.S. unemployment rate early in 2013, steady manufacturing activity and a rebound in the housing market are encouraging signs that growth has broadened in recent months. Pent-up demand, low mortgage rates and an improving labor market have lifted home sales. Even so, there has been no real improvement in the overall pace of economic growth since the current cycle of recovery began in 2009. Household income growth is practically nonexistent, and household spending has come under pressure after the expiration of the payroll tax cut. Against this backdrop, U.S. investors bid prices higher on stocks and other volatile assets as central banks continued to pour liquidity into key markets.

Risk Taking Rewarded for Fixed-Income Investors

Within fixed-income, investors were rewarded for venturing away from the safety of the Treasury market. In this environment, the Fund benefited from its investments in high quality commercial mortgage-backed securities (CMBS), corporate bonds and high-yield bonds, all of which outperformed lower-yielding, lower risk securities. High-yield bonds are not represented in the benchmark index, which gave the Fund a relative advantage in an environment that favored riskier assets. The Fund was correspondingly underweight in underperforming sectors, such as Treasury securities and agency mortgage-backed securities, which also benefited relative returns.

During the period, we noted an improvement in appraisals in commercial real estate and responded by taking a more aggressive stance with the Fund's positions in CMBS. Specifically, we moved down the capital structure to invest in junior bonds whose risk profiles we believed were improving in line with the underlying markets. This move aided overall returns.

Not all decisions had a positive impact on results. Late last summer, we trimmed the Fund's high-yield investments (from approximately 7.0% to 4.5% of net assets), and this move detracted from returns when the high-yield group continued to rally. The Fund's overall duration, a measure of interest rate sensitivity, was slightly shorter than the benchmark, which detracted somewhat from relative results. The Fund's shorter duration meant it did not benefit as much as the index when yields declined. (Bond prices and yields move in opposite directions.)

Looking Ahead

We intend to continue to seek high quality investments and adjust risk exposure in accordance with prevailing valuations and economic trends. We are mindful

Portfolio Management

Carl Pappo, CFA

Brian Lavin, CFA

Michael Zazzarino

Portfolio Breakdown (%)

(at April 30, 2013) | |

Asset-Backed Securities —

Agency | | | 1.1 | | |

Asset-Backed Securities —

Non-Agency | | | 4.3 | | |

Commercial Mortgage-Backed

Securities — Non-Agency | | | 11.4 | | |

Common Stocks | | | 0.0 | (a) | |

Financials | | | 0.0 | (a) | |

Industrials | | | 0.0 | (a) | |

Corporate Bonds & Notes | | | 48.2 | | |

Consumer Discretionary | | | 4.9 | | |

Consumer Staples | | | 1.8 | | |

Energy | | | 3.8 | | |

Financials | | | 16.0 | | |

Health Care | | | 2.7 | | |

Industrials | | | 3.0 | | |

Materials | | | 1.5 | | |

Telecommunication | | | 7.0 | | |

Utilities | | | 7.5 | | |

Foreign Government

Obligations | | | 0.3 | | |

Money Market Funds | | | 0.1 | | |

Municipal Bonds | | | 1.4 | | |

Preferred Debt | | | 3.1 | | |

Residential Mortgage-Backed

Securities — Agency | | | 14.6 | | |

Residential Mortgage-Backed

Securities — Non-Agency | | | 3.9 | | |

Senior Loans | | | 0.6 | | |

Consumer Discretionary | | | 0.1 | | |

Consumer Staples | | | 0.2 | | |

Energy | | | 0.0 | (a) | |

Financials | | | 0.1 | | |

Health Care | | | 0.1 | | |

Industrials | | | 0.0 | (a) | |

Materials | | | 0.0 | (a) | |

Telecommunication | | | 0.1 | | |

Treasury Bills | | | 3.0 | | |

U.S. Treasury Obligations | | | 8.0 | | |

Warrants | | | 0.0 | (a) | |

Total | | | 100.0 | | |

Percentages indicated are based upon total investments. The Fund's portfolio composition is subject to change.

(a) Rounds to zero.

Annual Report 2013

4

Columbia Intermediate Bond Fund

Manager Discussion of Fund Performance (continued)

that consensus forecasts now call for annual economic growth in the 2% range, and our portfolio positioning is currently consistent with that outlook. In particular, as the riskier sectors of the market have rallied, their yield advantage over Treasury securities has compressed. Should we see further erosion of the yield advantage, we would seek to adopt a more conservative framework.

Quality Breakdown (%)

(at April 30, 2013) | |

AAA rating | | | 35.7 | | |

AA rating | | | 6.3 | | |

A rating | | | 13.0 | | |

BBB rating | | | 31.9 | | |

Non-investment grade | | | 9.5 | | |

Non rated | | | 3.6 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total fixed income securities (excluding Money Market Funds).

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from AAA (highest) to D (lowest), and are subject to change. The ratings shown are determined by using the middle rating of Moody's, S&P, and Fitch after dropping the highest and lowest available ratings. When a rating from only two agencies is available, the lower rating is used. When a rating from only one agency is available, that rating is used. When a bond is not rated by any of these agencies, it is designated as Not rated. Credit ratings are subjective opinions and not statements of fact.

Annual Report 2013

5

Columbia Intermediate Bond Fund

Understanding Your Fund's Expenses

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

November 1, 2012 – April 30, 2013

| | Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,010.50 | | | | 1,020.53 | | | | 4.29 | | | | 4.31 | | | | 0.86 | | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,006.70 | | | | 1,016.81 | | | | 8.01 | | | | 8.05 | | | | 1.61 | | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,007.50 | | | | 1,017.50 | | | | 7.32 | | | | 7.35 | | | | 1.47 | | |

Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,012.40 | | | | 1,022.36 | | | | 2.44 | | | | 2.46 | | | | 0.49 | | |

Class K | | | 1,000.00 | | | | 1,000.00 | | | | 1,011.90 | * | | | 1,020.88 | | | | 1.31 | * | | | 3.96 | | | | 0.79 | * | |

Class R | | | 1,000.00 | | | | 1,000.00 | | | | 1,009.20 | | | | 1,019.24 | | | | 5.58 | | | | 5.61 | | | | 1.12 | | |

Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 1,009.90 | ** | | | 1,021.82 | | | | 2.84 | ** | | | 3.01 | | | | 0.60 | ** | |

Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 1,010.30 | ** | | | 1,022.12 | | | | 2.56 | ** | | | 2.71 | | | | 0.54 | ** | |

Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,010.40 | | | | 1,020.58 | | | | 4.24 | | | | 4.26 | | | | 0.85 | | |

Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,010.50 | ** | | | 1,022.56 | | | | 2.13 | ** | | | 2.26 | | | | 0.45 | ** | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,011.70 | | | | 1,021.72 | | | | 3.09 | | | | 3.11 | | | | 0.62 | | |

*For the period February 28, 2013 through April 30, 2013. Class K shares commenced operations on February 28, 2013.

**For the period November 8, 2012 through April 30, 2013. Class R4, Class R5 and Class Y shares commenced operations on November 8, 2012.

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investment vehicles (including mutual funds and exchange-traded funds).

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Annual Report 2013

6

Columbia Intermediate Bond Fund

Portfolio of Investments

April 30, 2013

(Percentages represent value of investments compared to net assets)

Corporate Bonds & Notes 50.4%

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Aerospace & Defense 0.4% | |

ADS Tactical, Inc.

Senior Secured(a)

04/01/18 | | | 11.000 | % | | | 1,076,000 | | | | 1,073,310 | | |

B/E Aerospace, Inc.

Senior Unsecured

04/01/22 | | | 5.250 | % | | | 563,000 | | | | 598,187 | | |

Bombardier, Inc.

Senior Notes(a)

01/15/23 | | | 6.125 | % | | | 614,000 | | | | 663,120 | | |

Huntington Ingalls Industries, Inc.

03/15/18 | | | 6.875 | % | | | 1,111,000 | | | | 1,229,044 | | |

Kratos Defense & Security Solutions, Inc.

Senior Secured

06/01/17 | | | 10.000 | % | | | 1,281,000 | | | | 1,412,302 | | |

L-3 Communications Corp.

02/15/21 | | | 4.950 | % | | | 10,050,000 | | | | 11,337,686 | | |

Lockheed Martin Corp.

Senior Unsecured

09/15/21 | | | 3.350 | % | | | 3,775,000 | | | | 4,008,488 | | |

Oshkosh Corp.

03/01/20 | | | 8.500 | % | | | 736,000 | | | | 824,320 | | |

TransDigm, Inc.

12/15/18 | | | 7.750 | % | | | 128,000 | | | | 141,760 | | |

TransDigm, Inc.(a)

10/15/20 | | | 5.500 | % | | | 347,000 | | | | 370,423 | | |

Total | | | | | | | 21,658,640 | | |

Automotive 1.8% | |

Allison Transmission, Inc.(a)

05/15/19 | | | 7.125 | % | | | 802,000 | | | | 872,175 | | |

American Axle & Manufacturing, Inc.

03/15/21 | | | 6.250 | % | | | 487,000 | | | | 513,176 | | |

Chrysler Group LLC/Co-Issuer, Inc.

Secured

06/15/19 | | | 8.000 | % | | | 983,000 | | | | 1,100,960 | | |

Dana Holding Corp.

Senior Unsecured

02/15/21 | | | 6.750 | % | | | 356,000 | | | | 390,710 | | |

Ford Motor Co.

Senior Unsecured

02/01/29 | | | 6.375 | % | | | 10,635,000 | | | | 12,467,368 | | |

07/16/31 | | | 7.450 | % | | | 8,525,000 | | | | 11,343,169 | | |

11/01/46 | | | 7.400 | % | | | 6,485,000 | | | | 8,606,380 | | |

Ford Motor Credit Co. LLC

Senior Unsecured

04/15/16 | | | 4.207 | % | | | 5,694,000 | | | | 6,081,254 | | |

06/15/16 | | | 3.984 | % | | | 52,751,000 | | | | 56,097,893 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Jaguar Land Rover Automotive PLC(a)

02/01/23 | | | 5.625 | % | | | 650,000 | | | | 679,250 | | |

Lear Corp.

03/15/18 | | | 7.875 | % | | | 560,000 | | | | 606,200 | | |

Schaeffler Finance BV(a)

Senior Secured

02/15/19 | | | 8.500 | % | | | 482,000 | | | | 550,685 | | |

05/15/21 | | | 4.750 | % | | | 412,000 | | | | 417,150 | | |

Visteon Corp.

04/15/19 | | | 6.750 | % | | | 936,000 | | | | 1,009,710 | | |

Total | | | | | | | 100,736,080 | | |

Banking 11.1% | |

Ally Financial, Inc.

02/15/17 | | | 5.500 | % | | | 314,000 | | | | 342,236 | | |

03/15/20 | | | 8.000 | % | | | 3,265,000 | | | | 4,105,737 | | |

Bank of Montreal

Senior Unsecured

11/06/22 | | | 2.550 | % | | | 32,775,000 | | | | 32,678,439 | | |

Bank of New York Mellon Corp. (The)

Senior Unsecured

05/15/19 | | | 5.450 | % | | | 3,325,000 | | | | 4,031,147 | | |

Barclays Bank PLC(a)(b)

09/29/49 | | | 7.434 | % | | | 27,022,000 | | | | 29,453,980 | | |

Barclays Bank PLC(b)

12/15/49 | | | 6.278 | % | | | 13,820,000 | | | | 13,612,700 | | |

Chinatrust Commercial Bank

Subordinated Notes(a)(b)

03/29/49 | | | 5.625 | % | | | 3,570,000 | | | | 3,672,637 | | |

Citigroup, Inc.

Subordinated Notes

08/25/36 | | | 6.125 | % | | | 5,485,000 | | | | 6,318,396 | | |

Citigroup, Inc.(b)

05/29/49 | | | 5.350 | % | | | 50,410,000 | | | | 50,410,000 | | |

Citigroup, Inc.(b)(c)

05/29/49 | | | 5.350 | % | | | 10,075,000 | | | | 10,075,000 | | |

City National Bank

Subordinated Notes

07/15/22 | | | 5.375 | % | | | 12,545,000 | | | | 14,091,994 | | |

Discover Bank

Subordinated Notes

11/18/19 | | | 8.700 | % | | | 3,045,000 | | | | 4,090,842 | | |

HBOS PLC

Subordinated Notes(a)

05/21/18 | | | 6.750 | % | | | 26,389,000 | | | | 29,449,649 | | |

JPMorgan Chase & Co.

Senior Unsecured

09/23/22 | | | 3.250 | % | | | 5,755,000 | | | | 5,893,195 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

7

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

JPMorgan Chase & Co.(b)

04/29/49 | | | 7.900 | % | | | 45,291,000 | | | | 52,748,525 | | |

12/29/49 | | | 5.150 | % | | | 2,015,000 | | | | 2,047,744 | | |

JPMorgan Chase Capital XXI(b)

02/02/37 | | | 1.223 | % | | | 23,320,000 | | | | 18,976,650 | | |

JPMorgan Chase Capital XXIII(b)

05/15/47 | | | 1.290 | % | | | 21,955,000 | | | | 17,257,728 | | |

Lloyds Banking Group PLC(a)(b)

11/29/49 | | | 6.267 | % | | | 13,770,000 | | | | 11,084,850 | | |

12/31/49 | | | 6.657 | % | | | 10,925,000 | | | | 10,406,062 | | |

M&T Bank Corp.(a)

12/31/49 | | | 6.875 | % | | | 25,445,000 | | | | 26,446,413 | | |

Mellon Capital IV(b)

06/29/49 | | | 4.000 | % | | | 1,035,000 | | | | 1,006,538 | | |

Merrill Lynch & Co., Inc.

Subordinated Notes

05/02/17 | | | 5.700 | % | | | 8,245,000 | | | | 9,190,182 | | |

PNC Financial Services Group, Inc. (The)(b)

05/29/49 | | | 8.250 | % | | | 47,390,000 | | | | 47,485,159 | | |

Royal Bank of Scotland Group PLC

Senior Unsecured

09/18/15 | | | 2.550 | % | | | 14,060,000 | | | | 14,482,630 | | |

State Street Capital Trust IV(b)

06/01/67 | | | 1.280 | % | | | 13,675,000 | | | | 11,538,281 | | |

State Street Corp.

03/15/18 | | | 4.956 | % | | | 39,754,000 | | | | 45,192,268 | | |

Synovus Financial Corp.

Senior Unsecured

02/15/19 | | | 7.875 | % | | | 1,041,000 | | | | 1,199,753 | | |

U.S. Bancorp

Subordinated Notes

07/15/22 | | | 2.950 | % | | | 17,600,000 | | | | 17,789,640 | | |

Wachovia Capital Trust III(b)

03/29/49 | | | 5.570 | % | | | 22,395,000 | | | | 22,506,975 | | |

Washington Mutual Bank

Subordinated Notes(d)(e)(f)

01/15/15 | | | 5.125 | % | | | 27,379,000 | | | | 41,069 | | |

Wells Fargo & Co.

Subordinated Notes

02/13/23 | | | 3.450 | % | | | 44,485,000 | | | | 45,392,138 | | |

Wells Fargo & Co.(b)

03/29/49 | | | 7.980 | % | | | 30,575,000 | | | | 35,428,781 | | |

Wells Fargo Capital X

12/15/36 | | | 5.950 | % | | | 14,155,000 | | | | 14,471,039 | | |

Total | | | | | | | 612,918,377 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Brokerage —% | |

E*TRADE Financial Corp.

Senior Unsecured

11/15/19 | | | 6.375 | % | | | 682,000 | | | | 733,150 | | |

Nuveen Investments, Inc.(a)

Senior Unsecured

10/15/17 | | | 9.125 | % | | | 182,000 | | | | 194,285 | | |

10/15/20 | | | 9.500 | % | | | 579,000 | | | | 623,873 | | |

Total | | | | | | | 1,551,308 | | |

Building Materials 0.1% | |

American Builders & Contractors Supply Co., Inc.

Senior Unsecured(a)

04/15/21 | | | 5.625 | % | | | 302,000 | | | | 314,080 | | |

Gibraltar Industries, Inc.(a)

02/01/21 | | | 6.250 | % | | | 209,000 | | | | 224,153 | | |

HD Supply, Inc.

01/15/21 | | | 10.500 | % | | | 568,000 | | | | 595,690 | | |

Secured

04/15/20 | | | 11.000 | % | | | 385,000 | | | | 473,550 | | |

HD Supply, Inc.(a)

Senior Unsecured

07/15/20 | | | 7.500 | % | | | 730,000 | | | | 790,225 | | |

Norcraft Companies LP/Finance Corp.

Secured

12/15/15 | | | 10.500 | % | | | 793,000 | | | | 834,632 | | |

Nortek, Inc.

12/01/18 | | | 10.000 | % | | | 127,000 | | | | 142,716 | | |

04/15/21 | | | 8.500 | % | | | 592,000 | | | | 661,560 | | |

Total | | | | | | | 4,036,606 | | |

Chemicals 0.8% | |

Ashland, Inc.(a)

08/15/22 | | | 4.750 | % | | | 440,000 | | | | 459,800 | | |

08/15/22 | | | 4.750 | % | | | 296,000 | | | | 309,320 | | |

Senior Unsecured

04/15/18 | | | 3.875 | % | | | 607,000 | | | | 625,210 | | |

Celanese U.S. Holdings LLC

06/15/21 | | | 5.875 | % | | | 757,000 | | | | 847,840 | | |

11/15/22 | | | 4.625 | % | | | 80,000 | | | | 82,400 | | |

Dow Chemical Co. (The)

Senior Unsecured

11/15/22 | | | 3.000 | % | | | 5,265,000 | | | | 5,267,132 | | |

Dupont Performance Coatings, Inc.(a)

05/01/21 | | | 7.375 | % | | | 845,000 | | | | 899,925 | | |

Huntsman International LLC

11/15/20 | | | 4.875 | % | | | 300,000 | | | | 314,250 | | |

JM Huber Corp.

Senior Notes(a)

11/01/19 | | | 9.875 | % | | | 827,000 | | | | 952,084 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

8

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Koppers, Inc.

12/01/19 | | | 7.875 | % | | | 235,000 | | | | 259,675 | | |

Lubrizol Corp.

02/01/19 | | | 8.875 | % | | | 4,611,000 | | | | 6,396,393 | | |

LyondellBasell Industries NV

Senior Unsecured

04/15/19 | | | 5.000 | % | | | 11,065,000 | | | | 12,609,541 | | |

11/15/21 | | | 6.000 | % | | | 8,020,000 | | | | 9,730,714 | | |

MacDermid, Inc.(a)

04/15/17 | | | 9.500 | % | | | 770,000 | | | | 795,025 | | |

Momentive Performance Materials, Inc.

Senior Secured

10/15/20 | | | 8.875 | % | | | 673,000 | | | | 733,570 | | |

10/15/20 | | | 10.000 | % | | | 85,000 | | | | 89,888 | | |

PQ Corp.

Secured(a)

05/01/18 | | | 8.750 | % | | | 1,828,000 | | | | 1,962,815 | | |

Total | | | | | | | 42,335,582 | | |

Construction Machinery 0.3% | |

CNH Capital LLC

11/01/16 | | | 6.250 | % | | | 446,000 | | | | 493,945 | | |

Case New Holland, Inc.

12/01/17 | | | 7.875 | % | | | 1,206,000 | | | | 1,435,140 | | |

Caterpillar, Inc.

Senior Unsecured

06/26/22 | | | 2.600 | % | | | 8,065,000 | | | | 8,275,045 | | |

Columbus McKinnon Corp.

02/01/19 | | | 7.875 | % | | | 752,000 | | | | 810,280 | | |

H&E Equipment Services, Inc.

09/01/22 | | | 7.000 | % | | | 102,000 | | | | 112,965 | | |

Neff Rental LLC/Finance Corp.

Secured(a)

05/15/16 | | | 9.625 | % | | | 888,000 | | | | 952,380 | | |

United Rentals North America, Inc.

12/15/19 | | | 9.250 | % | | | 695,000 | | | | 797,513 | | |

04/15/22 | | | 7.625 | % | | | 711,000 | | | | 815,872 | | |

Secured

07/15/18 | | | 5.750 | % | | | 605,000 | | | | 659,450 | | |

Total | | | | | | | 14,352,590 | | |

Consumer Cyclical Services 0.1% | |

Corrections Corp. of America(a)

05/01/23 | | | 4.625 | % | | | 357,000 | | | | 372,173 | | |

Goodman Networks, Inc.

Senior Secured(a)

07/01/18 | | | 13.125 | % | | | 849,000 | | | | 943,451 | | |

Monitronics International, Inc.

04/01/20 | | | 9.125 | % | | | 385,000 | | | | 418,688 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Vivint, Inc.(a)

Senior Secured

12/01/19 | | | 6.375 | % | | | 1,809,000 | | | | 1,822,567 | | |

Senior Unsecured

12/01/20 | | | 8.750 | % | | | 678,000 | | | | 715,290 | | |

Total | | | | | | | 4,272,169 | | |

Consumer Products 0.1% | |

Alphabet Holding Co., Inc.

Senior Unsecured PIK(a)

11/01/17 | | | 7.750 | % | | | 359,000 | | | | 376,052 | | |

Serta Simmons Holdings LLC

Senior Unsecured(a)

10/01/20 | | | 8.125 | % | | | 1,018,000 | | | | 1,084,170 | | |

Spectrum Brands Escrow Corp.(a)

11/15/20 | | | 6.375 | % | | | 594,000 | | | | 648,945 | | |

11/15/22 | | | 6.625 | % | | | 305,000 | | | | 336,263 | | |

Spectrum Brands, Inc.

03/15/20 | | | 6.750 | % | | | 835,000 | | | | 910,150 | | |

Tempur-Pedic International, Inc.(a)

12/15/20 | | | 6.875 | % | | | 109,000 | | | | 118,946 | | |

Total | | | | | | | 3,474,526 | | |

Diversified Manufacturing 0.7% | |

Amsted Industries, Inc.

Senior Notes(a)

03/15/18 | | | 8.125 | % | | | 426,000 | | | | 462,210 | | |

Apex Tool Group LLC(a)

02/01/21 | | | 7.000 | % | | | 205,000 | | | | 220,375 | | |

General Electric Co.

Senior Unsecured

10/09/22 | | | 2.700 | % | | | 18,860,000 | | | | 19,423,499 | | |

10/09/42 | | | 4.125 | % | | | 18,257,000 | | | | 19,329,197 | | |

Silver II Borrower/US Holdings LLC(a)

12/15/20 | | | 7.750 | % | | | 624,000 | | | | 669,240 | | |

Total | | | | | | | 40,104,521 | | |

Electric 4.1% | |

Alabama Power Co.

Senior Unsecured

03/15/41 | | | 5.500 | % | | | 19,980,000 | | | | 25,175,280 | | |

01/15/42 | | | 4.100 | % | | | 4,453,000 | | | | 4,643,575 | | |

Arizona Public Service Co.

Senior Unsecured

08/01/16 | | | 6.250 | % | | | 5,471,000 | | | | 6,384,055 | | |

CMS Energy Corp.

Senior Unsecured

09/30/15 | | | 4.250 | % | | | 3,690,000 | | | | 3,966,750 | | |

02/15/18 | | | 5.050 | % | | | 7,836,000 | | | | 9,001,605 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

9

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Calpine Corp.

Senior Secured(a)

02/15/21 | | | 7.500 | % | | | 659,000 | | | | 743,022 | | |

Commonwealth Edison Co.

1st Mortgage

08/15/16 | | | 5.950 | % | | | 5,344,000 | | | | 6,196,614 | | |

03/15/36 | | | 5.900 | % | | | 8,325,000 | | | | 10,795,752 | | |

Senior Unsecured

07/15/18 | | | 6.950 | % | | | 4,500,000 | | | | 5,537,691 | | |

Consolidated Edison Co. of New York, Inc.

Senior Unsecured

04/01/38 | | | 6.750 | % | | | 7,228,000 | | | | 10,414,587 | | |

Duke Energy Carolinas LLC

1st Refunding Mortgage

09/30/42 | | | 4.000 | % | | | 18,876,000 | | | | 19,264,015 | | |

FPL Energy American Wind LLC

Senior Secured(a)

06/20/23 | | | 6.639 | % | | | 1,571,799 | | | | 1,517,434 | | |

FPL Energy National Wind LLC

Senior Secured(a)

03/10/24 | | | 5.608 | % | | | 676,413 | | | | 661,062 | | |

FirstEnergy Corp.

Senior Unsecured

03/15/18 | | | 2.750 | % | | | 18,020,000 | | | | 18,367,588 | | |

03/15/23 | | | 4.250 | % | | | 9,325,000 | | | | 9,632,147 | | |

GenOn Energy, Inc.

Senior Unsecured

10/15/18 | | | 9.500 | % | | | 627,000 | | | | 744,562 | | |

Georgia Power Co.

Senior Unsecured

09/01/40 | | | 4.750 | % | | | 10,707,000 | | | | 11,877,821 | | |

Nevada Power Co.

05/15/18 | | | 6.500 | % | | | 2,173,000 | | | | 2,690,924 | | |

08/01/18 | | | 6.500 | % | | | 1,818,000 | | | | 2,260,975 | | |

09/15/40 | | | 5.375 | % | | | 2,525,000 | | | | 3,122,553 | | |

05/15/41 | | | 5.450 | % | | | 20,945,000 | | | | 26,233,814 | | |

Niagara Mohawk Power Corp.

Senior Unsecured(a)

08/15/19 | | | 4.881 | % | | | 6,213,000 | | | | 7,217,773 | | |

Ohio Edison Co.

Senior Unsecured

05/01/15 | | | 5.450 | % | | | 1,130,000 | | | | 1,232,321 | | |

Oncor Electric Delivery Co. LLC

Senior Secured

09/30/40 | | | 5.250 | % | | | 10,541,000 | | | | 12,328,553 | | |

Pacific Gas & Electric Co.

Senior Unsecured

01/15/40 | | | 5.400 | % | | | 6,060,000 | | | | 7,384,849 | | |

Southern California Edison Co.

1st Refunding Mortgage

09/01/40 | | | 4.500 | % | | | 6,075,000 | | | | 6,858,511 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Tampa Electric Co.

Senior Unsecured

05/15/18 | | | 6.100 | % | | | 3,709,000 | | | | 4,574,076 | | |

Tenaska Alabama II Partners LP

Senior Secured(a)

03/30/23 | | | 6.125 | % | | | 2,289,230 | | | | 2,516,690 | | |

Toledo Edison Co. (The)

Senior Secured

05/15/37 | | | 6.150 | % | | | 3,543,000 | | | | 4,486,575 | | |

TransAlta Corp.

Senior Unsecured

01/15/15 | | | 4.750 | % | | | 885,000 | | | | 933,402 | | |

Total | | | | | | | 226,764,576 | | |

Entertainment 0.1% | |

AMC Entertainment, Inc.

06/01/19 | | | 8.750 | % | | | 884,000 | | | | 973,505 | | |

12/01/20 | | | 9.750 | % | | | 46,000 | | | | 53,475 | | |

Cedar Fair LP/Canada's Wonderland Co./Magnum

Management Corp.(a)

03/15/21 | | | 5.250 | % | | | 443,000 | | | | 452,968 | | |

Cinemark USA, Inc.(a)

12/15/22 | | | 5.125 | % | | | 302,000 | | | | 312,570 | | |

Six Flags, Inc.(a)(d)(e)(g)

06/01/14 | | | 0.000 | % | | | 458,000 | | | | — | | |

United Artists Theatre Circuit, Inc.

1995-A Pass-Through Certificates(d)(e)

07/01/15 | | | 9.300 | % | | | 2,183,793 | | | | 2,183,793 | | |

Total | | | | | | | 3,976,311 | | |

Environmental —% | |

Clean Harbors, Inc.

08/01/20 | | | 5.250 | % | | | 831,000 | | | | 878,783 | | |

Clean Harbors, Inc.(a)

06/01/21 | | | 5.125 | % | | | 578,000 | | | | 604,010 | | |

Total | | | | | | | 1,482,793 | | |

Food and Beverage 1.5% | |

ARAMARK Corp.(a)

03/15/20 | | | 5.750 | % | | | 471,000 | | | | 493,373 | | |

Campbell Soup Co.

Senior Unsecured

08/02/22 | | | 2.500 | % | | | 7,978,000 | | | | 7,704,841 | | |

08/02/42 | | | 3.800 | % | | | 10,842,000 | | | | 10,025,608 | | |

Coca-Cola Co. (The)

Senior Unsecured

09/01/21 | | | 3.300 | % | | | 18,641,000 | | | | 20,423,676 | | |

ConAgra Foods, Inc.

Senior Unsecured

01/25/18 | | | 1.900 | % | | | 13,053,000 | | | | 13,291,517 | | |

10/01/28 | | | 7.000 | % | | | 12,110,000 | | | | 16,018,115 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

10

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Constellation Brands Inc.(c)

Senior Unsecured

05/01/21 | | | 3.750 | % | | | 217,000 | | | | 217,000 | | |

05/01/23 | | | 4.250 | % | | | 361,000 | | | | 361,000 | | |

HJ Heinz Co.

Secured(a)

10/15/20 | | | 4.250 | % | | | 1,477,000 | | | | 1,495,463 | | |

Heineken NV

Senior Unsecured(a)

10/01/42 | | | 4.000 | % | | | 2,620,000 | | | | 2,583,328 | | |

Mondelez International, Inc.

Senior Unsecured

02/09/40 | | | 6.500 | % | | | 4,725,000 | | | | 6,356,937 | | |

Pinnacle Foods Finance LLC/Corp.(a)

05/01/21 | | | 4.875 | % | | | 383,000 | | | | 394,011 | | |

Shearer's Foods, Inc. LLC

Senior Secured(a)

11/01/19 | | | 9.000 | % | | | 477,000 | | | | 530,663 | | |

Total | | | | | | | 79,895,532 | | |

Gaming 0.1% | |

Caesars Entertainment Operating Co., Inc.

Senior Secured

02/15/20 | | | 8.500 | % | | | 487,000 | | | | 469,955 | | |

MGM Resorts International

03/01/18 | | | 11.375 | % | | | 849,000 | | | | 1,097,332 | | |

12/15/21 | | | 6.625 | % | | | 311,000 | | | | 337,824 | | |

MGM Resorts International(a)

10/01/20 | | | 6.750 | % | | | 109,000 | | | | 119,628 | | |

ROC Finance LLC/Corp.

Secured(a)

09/01/18 | | | 12.125 | % | | | 1,149,000 | | | | 1,350,075 | | |

Seminole Indian Tribe of Florida(a)

Secured

10/01/17 | | | 7.750 | % | | | 61,000 | | | | 65,880 | | |

Senior Secured

10/01/20 | | | 6.535 | % | | | 728,000 | | | | 815,360 | | |

Senior Unsecured

10/01/20 | | | 7.804 | % | | | 695,000 | | | | 761,998 | | |

Seneca Gaming Corp.(a)

12/01/18 | | | 8.250 | % | | | 473,000 | | | | 510,840 | | |

Studio City Finance Ltd.(a)

12/01/20 | | | 8.500 | % | | | 1,433,000 | | | | 1,604,960 | | |

Tunica-Biloxi Gaming Authority

Senior Unsecured(a)

11/15/15 | | | 9.000 | % | | | 577,000 | | | | 526,512 | | |

Total | | | | | | | 7,660,364 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Gas Distributors 0.1% | |

Sempra Energy

Senior Unsecured

06/01/16 | | | 6.500 | % | | | 5,060,000 | | | | 5,883,272 | | |

Gas Pipelines 3.6% | |

Access Midstream Partners LP/Finance Corp.

05/15/23 | | | 4.875 | % | | | 1,132,000 | | | | 1,168,790 | | |

Colorado Interstate Gas Co. LLC

Senior Unsecured

11/15/15 | | | 6.800 | % | | | 12,753,000 | | | | 14,612,183 | | |

El Paso LLC

Senior Secured

09/15/20 | | | 6.500 | % | | | 1,329,000 | | | | 1,500,109 | | |

01/15/32 | | | 7.750 | % | | | 416,000 | | | | 474,104 | | |

El Paso Pipeline Partners Operating Co. LLC

10/01/21 | | | 5.000 | % | | | 15,509,000 | | | | 17,891,369 | | |

Enterprise Products Operating LLC

03/15/23 | | | 3.350 | % | | | 10,615,000 | | | | 11,081,455 | | |

02/01/41 | | | 5.950 | % | | | 13,978,000 | | | | 17,038,273 | | |

02/15/42 | | | 5.700 | % | | | 4,809,000 | | | | 5,733,035 | | |

Hiland Partners LP/Finance Corp.(a)

10/01/20 | | | 7.250 | % | | | 1,549,000 | | | | 1,723,262 | | |

Kinder Morgan Energy Partners LP

Senior Unsecured

02/15/15 | | | 5.625 | % | | | 2,745,000 | | | | 2,975,382 | | |

01/15/38 | | | 6.950 | % | | | 5,315,000 | | | | 7,002,225 | | |

09/01/39 | | | 6.500 | % | | | 6,924,000 | | | | 8,779,867 | | |

MarkWest Energy Partners LP/Finance Corp.

06/15/22 | | | 6.250 | % | | | 603,000 | | | | 670,838 | | |

02/15/23 | | | 5.500 | % | | | 938,000 | | | | 1,029,455 | | |

07/15/23 | | | 4.500 | % | | | 137,000 | | | | 142,823 | | |

NiSource Finance Corp.

02/15/23 | | | 3.850 | % | | | 5,220,000 | | | | 5,499,040 | | |

12/15/40 | | | 6.250 | % | | | 10,065,000 | | | | 12,280,830 | | |

Regency Energy Partners LP/Finance Corp.

12/01/18 | | | 6.875 | % | | | 303,000 | | | | 331,028 | | |

07/15/21 | | | 6.500 | % | | | 1,176,000 | | | | 1,317,120 | | |

04/15/23 | | | 5.500 | % | | | 783,000 | | | | 857,385 | | |

Regency Energy Partners LP/Finance Corp.(a)

11/01/23 | | | 4.500 | % | | | 370,000 | | | | 382,950 | | |

Sabine Pass Liquefaction LLC(a)

Senior Secured

02/01/21 | | | 5.625 | % | | | 760,000 | | | | 786,600 | | |

04/15/23 | | | 5.625 | % | | | 618,000 | | | | 634,995 | | |

Southern Natural Gas Co. LLC/Issuing Corp.

Senior Unsecured

06/15/21 | | | 4.400 | % | | | 11,545,000 | | | | 12,862,735 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

11

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Southern Natural Gas Co. LLC

Senior Unsecured

03/01/32 | | | 8.000 | % | | | 7,110,000 | | | | 10,419,456 | | |

TransCanada PipeLines Ltd.(b)

05/15/67 | | | 6.350 | % | | | 30,598,000 | | | | 32,666,425 | | |

Transcontinental Gas Pipe Line Co. LLC

Senior Unsecured

04/15/16 | | | 6.400 | % | | | 5,897,000 | | | | 6,753,869 | | |

08/01/42 | | | 4.450 | % | | | 14,145,000 | | | | 14,610,413 | | |

Williams Partners LP

Senior Unsecured

04/15/40 | | | 6.300 | % | | | 7,360,000 | | | | 8,965,518 | | |

Total | | | | | | | 200,191,534 | | |

Health Care 1.5% | |

Amsurg Corp.(a)

11/30/20 | | | 5.625 | % | | | 317,000 | | | | 334,435 | | |

Biomet, Inc.(a)

08/01/20 | | | 6.500 | % | | | 575,000 | | | | 626,750 | | |

CHS/Community Health Systems, Inc.

11/15/19 | | | 8.000 | % | | | 945,000 | | | | 1,071,394 | | |

Senior Secured

08/15/18 | | | 5.125 | % | | | 474,000 | | | | 507,180 | | |

ConvaTec Healthcare E SA

Senior Unsecured(a)

12/15/18 | | | 10.500 | % | | | 1,090,000 | | | | 1,226,250 | | |

DaVita HealthCare Partners, Inc.

08/15/22 | | | 5.750 | % | | | 568,000 | | | | 604,920 | | |

Emdeon, Inc.

12/31/19 | | | 11.000 | % | | | 787,000 | | | | 918,822 | | |

Express Scripts Holding Co.

02/15/17 | | | 2.650 | % | | | 19,156,000 | | | | 20,137,994 | | |

02/15/22 | | | 3.900 | % | | | 12,275,000 | | | | 13,394,492 | | |

Fresenius Medical Care U.S. Finance II, Inc.(a)

07/31/19 | | | 5.625 | % | | | 335,000 | | | | 374,363 | | |

01/31/22 | | | 5.875 | % | | | 846,000 | | | | 968,670 | | |

Fresenius Medical Care U.S. Finance, Inc.(a)

09/15/18 | | | 6.500 | % | | | 848,000 | | | | 981,560 | | |

HCA Holdings, Inc.

Senior Unsecured

02/15/21 | | | 6.250 | % | | | 328,000 | | | | 359,160 | | |

HCA, Inc.

02/15/22 | | | 7.500 | % | | | 1,655,000 | | | | 1,977,725 | | |

05/01/23 | | | 5.875 | % | | | 194,000 | | | | 210,975 | | |

Senior Secured

02/15/20 | | | 6.500 | % | | | 889,000 | | | | 1,026,795 | | |

02/15/20 | | | 7.875 | % | | | 395,000 | | | | 437,956 | | |

Hanger, Inc.

11/15/18 | | | 7.125 | % | | | 479,000 | | | | 522,110 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Hologic, Inc.

08/01/20 | | | 6.250 | % | | | 239,000 | | | | 258,120 | | |

IASIS Healthcare LLC/Capital Corp.

05/15/19 | | | 8.375 | % | | | 916,000 | | | | 968,670 | | |

IMS Health, Inc.

Senior Unsecured(a)

11/01/20 | | | 6.000 | % | | | 427,000 | | | | 456,890 | | |

Kinetic Concepts, Inc./KCI U.S.A., Inc.

Secured

11/01/18 | | | 10.500 | % | | | 426,000 | | | | 477,120 | | |

McKesson Corp.

Senior Unsecured

12/15/22 | | | 2.700 | % | | | 24,205,000 | | | | 24,374,919 | | |

Multiplan, Inc.(a)

09/01/18 | | | 9.875 | % | | | 1,331,000 | | | | 1,497,375 | | |

Physio-Control International, Inc.

Senior Secured(a)

01/15/19 | | | 9.875 | % | | | 635,000 | | | | 725,487 | | |

Physiotherapy Associates Holdings, Inc.

Senior Unsecured(a)

05/01/19 | | | 11.875 | % | | | 439,000 | | | | 384,125 | | |

Radnet Management, Inc.

04/01/18 | | | 10.375 | % | | | 364,000 | | | | 389,480 | | |

Rural/Metro Corp.

Senior Unsecured(a)

07/15/19 | | | 10.125 | % | | | 503,000 | | | | 520,605 | | |

STHI Holding Corp.

Secured(a)

03/15/18 | | | 8.000 | % | | | 768,000 | | | | 840,960 | | |

Tenet Healthcare Corp.(a)

Senior Secured

06/01/20 | | | 4.750 | % | | | 397,000 | | | | 412,880 | | |

04/01/21 | | | 4.500 | % | | | 509,000 | | | | 519,180 | | |

Truven Health Analytics, Inc.

Senior Unsecured(a)

06/01/20 | | | 10.625 | % | | | 590,000 | | | | 674,075 | | |

Universal Hospital Services, Inc.

Secured

08/15/20 | | | 7.625 | % | | | 415,000 | | | | 449,238 | | |

Vanguard Health Holding Co. II LLC/Inc.

02/01/18 | | | 8.000 | % | | | 1,391,000 | | | | 1,505,757 | | |

02/01/19 | | | 7.750 | % | | | 258,000 | | | | 280,253 | | |

Total | | | | | | | 80,416,685 | | |

Healthcare Insurance 0.2% | |

Aetna, Inc.

Senior Unsecured

11/15/22 | | | 2.750 | % | | | 12,060,000 | | | | 12,014,775 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

12

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Home Construction 0.1% | |

Ashton Woods U.S.A. LLC/Finance Co.(a)

02/15/21 | | | 6.875 | % | | | 339,000 | | | | 346,204 | | |

Beazer Homes USA, Inc.

05/15/19 | | | 9.125 | % | | | 311,000 | | | | 340,545 | | |

Beazer Homes USA, Inc.(a)

02/01/23 | | | 7.250 | % | | | 275,000 | | | | 287,375 | | |

KB Home

03/15/20 | | | 8.000 | % | | | 419,000 | | | | 493,373 | | |

Meritage Homes Corp.

04/01/22 | | | 7.000 | % | | | 461,000 | | | | 519,778 | | |

Meritage Homes Corp.(a)

03/01/18 | | | 4.500 | % | | | 377,000 | | | | 378,885 | | |

Shea Homes LP/Funding Corp.

Senior Secured

05/15/19 | | | 8.625 | % | | | 753,000 | | | | 855,596 | | |

Taylor Morrison Communities, Inc./Monarch, Inc.(a)

04/15/20 | | | 7.750 | % | | | 701,000 | | | | 786,872 | | |

04/15/21 | | | 5.250 | % | | | 178,000 | | | | 182,005 | | |

Total | | | | | | | 4,190,633 | | |

Independent Energy 2.8% | |

Anadarko Petroleum Corp.

Senior Unsecured

09/15/17 | | | 6.375 | % | | | 5,310,000 | | | | 6,364,564 | | |

03/15/40 | | | 6.200 | % | | | 4,650,000 | | | | 5,873,215 | | |

Antero Resources Finance Corp.

12/01/17 | | | 9.375 | % | | | 53,000 | | | | 57,638 | | |

08/01/19 | | | 7.250 | % | | | 219,000 | | | | 237,615 | | |

Aurora USA Oil & Gas, Inc.

Senior Unsecured(a)

04/01/20 | | | 7.500 | % | | | 702,000 | | | | 730,080 | | |

Carrizo Oil & Gas, Inc.

10/15/18 | | | 8.625 | % | | | 1,428,000 | | | | 1,581,510 | | |

Chesapeake Energy Corp.

08/15/20 | | | 6.625 | % | | | 1,568,000 | | | | 1,775,760 | | |

02/15/21 | | | 6.125 | % | | | 1,185,000 | | | | 1,303,500 | | |

03/15/23 | | | 5.750 | % | | | 667,000 | | | | 723,695 | | |

Comstock Resources, Inc.

06/15/20 | | | 9.500 | % | | | 773,000 | | | | 869,625 | | |

Concho Resources, Inc.

01/15/21 | | | 7.000 | % | | | 2,742,000 | | | | 3,084,750 | | |

Continental Resources, Inc.

04/01/21 | | | 7.125 | % | | | 1,068,000 | | | | 1,233,540 | | |

09/15/22 | | | 5.000 | % | | | 2,358,000 | | | | 2,564,325 | | |

Continental Resources, Inc.(a)

04/15/23 | | | 4.500 | % | | | 18,878,000 | | | | 20,128,667 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Devon Energy Corp.

Senior Unsecured

01/15/19 | | | 6.300 | % | | | 4,360,000 | | | | 5,266,304 | | |

05/15/42 | | | 4.750 | % | | | 5,730,000 | | | | 5,910,140 | | |

EP Energy Holdings LLC/Bond Co., Inc.

Senior Unsecured PIK(a)

12/15/17 | | | 8.125 | % | | | 452,000 | | | | 481,380 | | |

EP Energy LLC/Finance, Inc.

Senior Unsecured

05/01/20 | | | 9.375 | % | | | 1,373,000 | | | | 1,599,545 | | |

EnCana Corp.

Senior Unsecured

11/15/21 | | | 3.900 | % | | | 4,515,000 | | | | 4,862,958 | | |

Halcon Resources Corp.(a)

05/15/21 | | | 8.875 | % | | | 927,000 | | | | 994,207 | | |

Hess Corp.

Senior Unsecured

02/15/19 | | | 8.125 | % | | | 2,925,000 | | | | 3,814,366 | | |

10/01/29 | | | 7.875 | % | | | 4,885,000 | | | | 6,569,236 | | |

08/15/31 | | | 7.300 | % | | | 2,143,000 | | | | 2,773,953 | | |

Kodiak Oil & Gas Corp.

12/01/19 | | | 8.125 | % | | | 1,964,000 | | | | 2,234,050 | | |

Kodiak Oil & Gas Corp.(a)

01/15/21 | | | 5.500 | % | | | 390,000 | | | | 411,450 | | |

Laredo Petroleum, Inc.

02/15/19 | | | 9.500 | % | | | 728,000 | | | | 829,920 | | |

05/01/22 | | | 7.375 | % | | | 814,000 | | | | 895,400 | | |

MEG Energy Corp.(a)

01/30/23 | | | 6.375 | % | | | 492,000 | | | | 519,060 | | |

Nexen, Inc.

Senior Unsecured

05/15/37 | | | 6.400 | % | | | 10,780,000 | | | | 14,108,045 | | |

07/30/39 | | | 7.500 | % | | | 13,901,000 | | | | 20,619,465 | | |

Oasis Petroleum, Inc.

11/01/21 | | | 6.500 | % | | | 2,241,000 | | | | 2,465,100 | | |

01/15/23 | | | 6.875 | % | | | 753,000 | | | | 835,830 | | |

Plains Exploration & Production Co.

02/15/23 | | | 6.875 | % | | | 731,000 | | | | 832,426 | | |

QEP Resources, Inc.

Senior Unsecured

05/01/23 | | | 5.250 | % | | | 1,214,000 | | | | 1,289,875 | | |

Range Resources Corp.

05/15/19 | | | 8.000 | % | | | 482,000 | | | | 527,790 | | |

08/01/20 | | | 6.750 | % | | | 415,000 | | | | 460,650 | | |

Ras Laffan Liquefied Natural Gas Co., Ltd. II

Senior Secured(a)

09/30/20 | | | 5.298 | % | | | 4,899,179 | | | | 5,425,840 | | |

SM Energy Co.

Senior Unsecured

11/15/21 | | | 6.500 | % | | | 447,000 | | | | 491,700 | | |

01/01/23 | | | 6.500 | % | | | 254,000 | | | | 280,670 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

13

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Whiting Petroleum Corp.

10/01/18 | | | 6.500 | % | | | 53,000 | | | | 57,108 | | |

Woodside Finance Ltd.(a)

05/10/21 | | | 4.600 | % | | | 21,105,000 | | | | 23,880,898 | | |

Total | | | | | | | 154,965,850 | | |

Integrated Energy 0.7% | |

Shell International Finance BV

08/21/22 | | | 2.375 | % | | | 28,405,000 | | | | 28,593,865 | | |

03/25/40 | | | 5.500 | % | | | 9,256,000 | | | | 12,037,215 | | |

Total | | | | | | | 40,631,080 | | |

Life Insurance 1.9% | |

ING U.S., Inc.(a)

07/15/22 | | | 5.500 | % | | | 3,680,000 | | | | 4,154,009 | | |

MetLife Capital Trust X(a)

04/08/38 | | | 9.250 | % | | | 27,070,000 | | | | 37,898,000 | | |

MetLife, Inc.

08/01/39 | | | 10.750 | % | | | 9,161,000 | | | | 14,565,990 | | |

Prudential Financial, Inc.

Senior Unsecured

12/01/17 | | | 6.000 | % | | | 431,000 | | | | 515,477 | | |

Prudential Financial, Inc.(b)

06/15/38 | | | 8.875 | % | | | 30,232,000 | | | | 37,638,840 | | |

09/15/42 | | | 5.875 | % | | | 9,820,000 | | | | 10,611,689 | | |

03/15/44 | | | 5.200 | % | | | 1,270,000 | | | | 1,292,225 | | |

Total | | | | | | | 106,676,230 | | |

Lodging —% | |

Choice Hotels International, Inc.

07/01/22 | | | 5.750 | % | | | 484,000 | | | | 542,080 | | |

Media Cable 1.2% | |

CCO Holdings LLC/Capital Corp.

01/31/22 | | | 6.625 | % | | | 1,804,000 | | | | 1,984,400 | | |

CCO Holdings LLC/Capital Corp.(a)

03/15/21 | | | 5.250 | % | | | 505,000 | | | | 515,100 | | |

CSC Holdings LLC

Senior Unsecured

02/15/18 | | | 7.875 | % | | | 507,000 | | | | 595,725 | | |

02/15/19 | | | 8.625 | % | | | 87,000 | | | | 105,923 | | |

CSC Holdings, Inc.

Senior Unsecured

11/15/21 | | | 6.750 | % | | | 442,000 | | | | 503,880 | | |

Cablevision Systems Corp.

Senior Unsecured

04/15/20 | | | 8.000 | % | | | 475,000 | | | | 546,250 | | |

09/15/22 | | | 5.875 | % | | | 409,000 | | | | 414,113 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Cequel Communications Holdings I LLC/Capital Corp.

Senior Unsecured(a)

09/15/20 | | | 6.375 | % | | | 727,000 | | | | 774,255 | | |

Cogeco Cable, Inc.(a)

05/01/20 | | | 4.875 | % | | | 167,000 | | | | 170,131 | | |

DIRECTV Holdings LLC/Financing Co., Inc.

02/15/16 | | | 3.125 | % | | | 5,473,000 | | | | 5,766,960 | | |

03/01/16 | | | 3.500 | % | | | 16,707,000 | | | | 17,792,253 | | |

03/15/17 | | | 2.400 | % | | | 13,940,000 | | | | 14,426,520 | | |

03/01/21 | | | 5.000 | % | | | 4,642,000 | | | | 5,286,978 | | |

DISH DBS Corp.

06/01/21 | | | 6.750 | % | | | 1,578,000 | | | | 1,704,240 | | |

07/15/22 | | | 5.875 | % | | | 837,000 | | | | 853,740 | | |

DISH DBS Corp.(a)

03/15/23 | | | 5.000 | % | | | 351,000 | | | | 340,470 | | |

Lynx II Corp.

Senior Unsecured(a)

04/15/23 | | | 6.375 | % | | | 366,000 | | | | 396,195 | | |

NBCUniversal Enterprise, Inc.(a)

04/15/19 | | | 1.974 | % | | | 11,890,000 | | | | 12,044,683 | | |

Quebecor Media, Inc.

Senior Unsecured(a)

01/15/23 | | | 5.750 | % | | | 731,000 | | | | 762,068 | | |

Unitymedia Hessen GmbH & Co. KG NRW

Senior Secured(a)

01/15/23 | | | 5.500 | % | | | 356,000 | | | | 367,125 | | |

Videotron Ltd.

07/15/22 | | | 5.000 | % | | | 411,000 | | | | 423,330 | | |

WaveDivision Escrow LLC/Corp.

Senior Unsecured(a)

09/01/20 | | | 8.125 | % | | | 24,000 | | | | 25,560 | | |

WideOpenWest Finance LLC/Capital Corp.(a)

07/15/19 | | | 10.250 | % | | | 335,000 | | | | 376,875 | | |

Total | | | | | | | 66,176,774 | | |

Media Non-Cable 1.3% | |

AMC Networks, Inc.

07/15/21 | | | 7.750 | % | | | 1,348,000 | | | | 1,543,460 | | |

12/15/22 | | | 4.750 | % | | | 372,000 | | | | 382,230 | | |

Clear Channel Worldwide Holdings, Inc.

03/15/20 | | | 7.625 | % | | | 1,161,000 | | | | 1,250,977 | | |

Clear Channel Worldwide Holdings, Inc.(a)

11/15/22 | | | 6.500 | % | | | 780,000 | | | | 836,550 | | |

DigitalGlobe, Inc.(a)

02/01/21 | | | 5.250 | % | | | 327,000 | | | | 330,270 | | |

Hughes Satellite Systems Corp.

06/15/21 | | | 7.625 | % | | | 875,000 | | | | 1,004,063 | | |

Senior Secured

06/15/19 | | | 6.500 | % | | | 436,000 | | | | 485,050 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

14

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Intelsat Jackson Holdings SA

10/15/20 | | | 7.250 | % | | | 2,168,000 | | | | 2,406,480 | | |

Intelsat Luxembourg SA(a)

06/01/21 | | | 7.750 | % | | | 276,000 | | | | 291,180 | | |

06/01/23 | | | 8.125 | % | | | 785,000 | | | | 834,063 | | |

MDC Partners, Inc.(a)

04/01/20 | | | 6.750 | % | | | 661,000 | | | | 687,440 | | |

NBCUniversal Media LLC

04/01/16 | | | 2.875 | % | | | 5,922,000 | | | | 6,264,665 | | |

National CineMedia LLC

Senior Secured

04/15/22 | | | 6.000 | % | | | 574,000 | | | | 625,660 | | |

News America, Inc.

12/15/35 | | | 6.400 | % | | | 3,710,000 | | | | 4,714,790 | | |

02/15/41 | | | 6.150 | % | | | 6,636,000 | | | | 8,334,789 | | |

Nielsen Finance LLC/Co.

10/15/18 | | | 7.750 | % | | | 10,345,000 | | | | 11,521,744 | | |

Nielsen Finance LLC/Co.(a)

10/01/20 | | | 4.500 | % | | | 13,788,000 | | | | 14,080,995 | | |

Reed Elsevier Capital, Inc.(a)

10/15/22 | | | 3.125 | % | | | 15,745,000 | | | | 15,579,293 | | |

Starz LLC/Finance Corp.

09/15/19 | | | 5.000 | % | | | 229,000 | | | | 239,019 | | |

Univision Communications, Inc.(a)

05/15/21 | | | 8.500 | % | | | 890,000 | | | | 992,350 | | |

Senior Secured

11/01/20 | | | 7.875 | % | | | 784,000 | | | | 882,000 | | |

09/15/22 | | | 6.750 | % | | | 551,000 | | | | 611,610 | | |

Total | | | | | | | 73,898,678 | | |

Metals 0.6% | |

Alpha Natural Resources, Inc.

04/15/18 | | | 9.750 | % | | | 889,000 | | | | 964,565 | | |

06/01/19 | | | 6.000 | % | | | 170,000 | | | | 158,525 | | |

ArcelorMittal USA LLC

04/15/14 | | | 6.500 | % | | | 8,622,000 | | | | 8,968,190 | | |

ArcelorMittal

Senior Unsecured

02/25/15 | | | 4.250 | % | | | 4,160,000 | | | | 4,305,904 | | |

08/05/15 | | | 4.250 | % | | | 3,635,000 | | | | 3,797,917 | | |

10/15/39 | | | 7.500 | % | | | 1,154,000 | | | | 1,214,090 | | |

03/01/41 | | | 7.250 | % | | | 4,352,000 | | | | 4,450,447 | | |

Arch Coal, Inc.

06/15/21 | | | 7.250 | % | | | 157,000 | | | | 143,655 | | |

Arch Coal, Inc.(a)

06/15/19 | | | 9.875 | % | | | 815,000 | | | | 847,600 | | |

Calcipar SA

Senior Secured(a)

05/01/18 | | | 6.875 | % | | | 690,000 | | | | 737,437 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

FMG Resources August 2006 Proprietary Ltd.(a)

11/01/19 | | | 8.250 | % | | | 983,000 | | | | 1,071,470 | | |

Inmet Mining Corp.(a)

06/01/20 | | | 8.750 | % | | | 1,194,000 | | | | 1,289,520 | | |

06/01/21 | | | 7.500 | % | | | 446,000 | | | | 466,070 | | |

JMC Steel Group, Inc.

Senior Notes(a)

03/15/18 | | | 8.250 | % | | | 528,000 | | | | 552,420 | | |

Peabody Energy Corp.

11/15/21 | | | 6.250 | % | | | 937,000 | | | | 999,076 | | |

Rio Tinto Finance USA PLC

08/21/22 | | | 2.875 | % | | | 3,875,000 | | | | 3,862,356 | | |

Total | | | | | | | 33,829,242 | | |

Non-Captive Consumer 0.8% | |

Discover Financial Services

Senior Unsecured

04/27/22 | | | 5.200 | % | | | 3,367,000 | | | | 3,859,414 | | |

11/21/22 | | | 3.850 | % | | | 9,800,000 | | | | 10,258,787 | | |

HSBC Finance Capital Trust IX(b)

11/30/35 | | | 5.911 | % | | | 8,013,000 | | | | 8,133,195 | | |

HSBC Finance Corp.

Subordinated Notes

01/15/21 | | | 6.676 | % | | | 16,605,000 | | | | 20,092,930 | | |

Springleaf Finance Corp.

Senior Unsecured

12/15/17 | | | 6.900 | % | | | 950,000 | | | | 985,625 | | |

Total | | | | | | | 43,329,951 | | |

Non-Captive Diversified 0.8% | |

Air Lease Corp.

03/01/20 | | | 4.750 | % | | | 997,000 | | | | 1,031,895 | | |

CIT Group, Inc.

Senior Unsecured

08/15/17 | | | 4.250 | % | | | 259,000 | | | | 274,540 | | |

CIT Group, Inc.(a)

Senior Secured

04/01/18 | | | 6.625 | % | | | 477,000 | | | | 555,705 | | |

Senior Unsecured

02/15/19 | | | 5.500 | % | | | 2,851,000 | | | | 3,221,630 | | |

General Electric Capital Corp.

Senior Unsecured

09/07/22 | | | 3.150 | % | | | 32,610,000 | | | | 33,151,815 | | |

International Lease Finance Corp.

Senior Unsecured

04/15/18 | | | 3.875 | % | | | 92,000 | | | | 93,380 | | |

05/15/19 | | | 6.250 | % | | | 409,000 | | | | 458,591 | | |

12/15/20 | | | 8.250 | % | | | 2,805,000 | | | | 3,506,250 | | |

04/15/21 | | | 4.625 | % | | | 155,000 | | | | 157,713 | | |

Total | | | | | | | 42,451,519 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

15

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Oil Field Services 0.3% | |

Athlon Holdings LP/Finance Corp.(a)

04/15/21 | | | 7.375 | % | | | 384,000 | | | | 404,160 | | |

Atwood Oceanics, Inc.

Senior Unsecured

02/01/20 | | | 6.500 | % | | | 1,722,000 | | | | 1,876,980 | | |

Green Field Energy Services, Inc.(a)

Senior Secured

11/15/16 | | | 13.250 | % | | | 1,276,000 | | | | 1,314,280 | | |

11/15/16 | | | 13.250 | % | | | 31,000 | | | | 31,930 | | |

Offshore Group Investments Ltd.

Senior Secured(a)

04/01/23 | | | 7.125 | % | | | 607,000 | | | | 631,280 | | |

Oil States International, Inc.(a)

01/15/23 | | | 5.125 | % | | | 433,000 | | | | 444,908 | | |

Weatherford International Ltd.

03/15/38 | | | 7.000 | % | | | 8,740,000 | | | | 10,328,617 | | |

Total | | | | | | | 15,032,155 | | |

Other Financial Institutions —% | |

FTI Consulting, Inc.(a)

11/15/22 | | | 6.000 | % | | | 405,000 | | | | 432,338 | | |

Other Industry 0.8% | |

Igloo Holdings Corp. PIK

Senior Unsecured(a)

12/15/17 | | | 8.250 | % | | | 359,000 | | | | 373,360 | | |

Interline Brands, Inc.

11/15/18 | | | 7.500 | % | | | 710,000 | | | | 766,800 | | |

Memorial Sloan-Kettering Cancer Center

Senior Unsecured

07/01/52 | | | 4.125 | % | | | 16,955,000 | | | | 17,095,811 | | |

President and Fellows of Harvard College

Senior Notes

10/15/40 | | | 4.875 | % | | | 8,205,000 | | | | 9,978,241 | | |

President and Fellows of Harvard College(a)

01/15/39 | | | 6.500 | % | | | 9,860,000 | | | | 14,515,054 | | |

Unifrax I LLC/Holding Co.(a)

02/15/19 | | | 7.500 | % | | | 437,000 | | | | 454,480 | | |

Total | | | | | | | 43,183,746 | | |

Packaging 0.1% | |

Ardagh Packaging Finance PLC/MP Holdings U.S.A., Inc.

Senior Unsecured(a)

11/15/20 | | | 7.000 | % | | | 869,000 | | | | 912,450 | | |

Reynolds Group Issuer, Inc. LLC

Senior Secured

10/15/20 | | | 5.750 | % | | | 1,288,000 | | | | 1,349,180 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Reynolds Group Issuer, Inc./LLC

04/15/19 | | | 9.000 | % | | | 310,000 | | | | 334,800 | | |

08/15/19 | | | 9.875 | % | | | 1,137,000 | | | | 1,276,283 | | |

02/15/21 | | | 8.250 | % | | | 149,000 | | | | 158,126 | | |

Senior Secured

08/15/19 | | | 7.875 | % | | | 576,000 | | | | 645,120 | | |

Sealed Air Corp.(a)

12/01/20 | | | 6.500 | % | | | 212,000 | | | | 236,910 | | |

09/15/21 | | | 8.375 | % | | | 299,000 | | | | 349,830 | | |

Total | | | | | | | 5,262,699 | | |

Paper —% | |

Graphic Packaging International, Inc.

04/15/21 | | | 4.750 | % | | | 610,000 | | | | 631,350 | | |

Pharmaceuticals 1.2% | |

Jaguar Holding Co. II/Merger Sub, Inc.

Senior Unsecured(a)

12/01/19 | | | 9.500 | % | | | 312,000 | | | | 361,140 | | |

Johnson & Johnson

Senior Unsecured

05/15/41 | | | 4.850 | % | | | 13,478,000 | | | | 16,567,468 | | |

Merck & Co., Inc.

Senior Unsecured

09/15/22 | | | 2.400 | % | | | 22,160,000 | | | | 22,350,443 | | |

09/15/42 | | | 3.600 | % | | | 18,365,000 | | | | 18,030,720 | | |

Roche Holdings, Inc.(a)

03/01/19 | | | 6.000 | % | | | 5,407,000 | | | | 6,716,094 | | |

Valeant Pharmaceuticals International(a)

10/15/20 | | | 6.375 | % | | | 1,136,000 | | | | 1,258,120 | | |

Total | | | | | | | 65,283,985 | | |

Property & Casualty 0.9% | |

Alliant Holdings, Inc.

Senior Unsecured(a)

12/15/20 | | | 7.875 | % | | | 535,000 | | | | 563,088 | | |

HUB International Ltd.(a)

10/15/18 | | | 8.125 | % | | | 1,162,000 | | | | 1,250,602 | | |

Liberty Mutual Group, Inc.(a)

05/01/22 | | | 4.950 | % | | | 6,775,000 | | | | 7,541,246 | | |

05/01/42 | | | 6.500 | % | | | 11,755,000 | | | | 13,828,511 | | |

Senior Unsecured

03/15/35 | | | 6.500 | % | | | 3,375,000 | | | | 3,894,456 | | |

Transatlantic Holdings, Inc.

Senior Unsecured

11/30/39 | | | 8.000 | % | | | 14,905,000 | | | | 21,491,475 | | |

Total | | | | | | | 48,569,378 | | |

Railroads 0.7% | |

BNSF Funding Trust I(b)

12/15/55 | | | 6.613 | % | | | 19,236,000 | | | | 22,025,220 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

16

Columbia Intermediate Bond Fund

Portfolio of Investments (continued)

April 30, 2013

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

CSX Corp.

Senior Unsecured

05/30/42 | | | 4.750 | % | | | 10,560,000 | | | | 11,369,878 | | |

Union Pacific Corp.

Senior Unsecured

08/15/18 | | | 5.700 | % | | | 5,897,000 | | | | 7,154,382 | | |

Total | | | | | | | 40,549,480 | | |

Refining 0.2% | |

Marathon Petroleum Corp.

Senior Unsecured

03/01/41 | | | 6.500 | % | | | 6,540,000 | | | | 8,458,816 | | |

REITs 1.2% | |

Boston Properties LP

Senior Unsecured

05/15/21 | | | 4.125 | % | | | 21,402,000 | | | | 23,713,395 | | |

CBRE Services, Inc.

03/15/23 | | | 5.000 | % | | | 266,000 | | | | 272,318 | | |

Duke Realty LP

Senior Unsecured

02/15/15 | | | 7.375 | % | | | 4,125,000 | | | | 4,552,754 | | |

08/15/19 | | | 8.250 | % | | | 7,140,200 | | | | 9,339,681 | | |

06/15/22 | | | 4.375 | % | | | 7,440,000 | | | | 8,023,802 | | |

Simon Property Group LP

Senior Unsecured

02/01/23 | | | 2.750 | % | | | 19,560,000 | | | | 19,698,133 | | |

Total | | | | | | | 65,600,083 | | |

Restaurants 0.6% | |

McDonald's Corp.

Senior Unsecured(c)

05/01/43 | | | 3.625 | % | | | 32,055,000 | | | | 31,383,127 | | |

Retailers 1.1% | |

99 Cent Only Stores

12/15/19 | | | 11.000 | % | | | 497,000 | | | | 574,656 | | |

Amazon.com, Inc.

Senior Unsecured

11/29/22 | | | 2.500 | % | | | 17,725,000 | | | | 17,405,471 | | |

Burlington Coat Factory Warehouse Corp.

02/15/19 | | | 10.000 | % | | | 668,000 | | | | 747,325 | | |

Burlington Holdings LLC/Finance, Inc.

Senior Unsecured PIK(a)

02/15/18 | | | 9.000 | % | | | 596,000 | | | | 618,350 | | |

Claire's Stores, Inc.

Senior Secured(a)

03/15/20 | | | 6.125 | % | | | 171,000 | | | | 180,619 | | |

Jo-Ann Stores, Inc.

Senior Unsecured(a)

03/15/19 | | | 8.125 | % | | | 592,000 | | | | 631,960 | | |

Corporate Bonds & Notes (continued)

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

L Brands, Inc.

04/01/21 | | | 6.625 | % | | | 659,000 | | | | 757,026 | | |

Macy's Retail Holdings, Inc.

02/15/23 | | | 2.875 | % | | | 6,200,000 | | | | 6,147,548 | | |

07/15/27 | | | 6.790 | % | | | 21,850,000 | | | | 27,121,968 | | |

03/15/37 | | | 6.375 | % | | | 3,925,000 | | | | 4,745,415 | | |

Rite Aid Corp.

03/15/20 | | | 9.250 | % | | | 412,000 | | | | 476,890 | | |

Senior Secured

08/15/20 | | | 8.000 | % | | | 215,000 | | | | 245,638 | | |

Senior Unsecured

02/15/27 | | | 7.700 | % | | | 489,000 | | | | 511,005 | | |

Sally Holdings LLC/Capital, Inc.

06/01/22 | | | 5.750 | % | | | 396,000 | | | | 426,690 | | |

Total | | | | | | | 60,590,561 | | |

Supermarkets 0.4% | |

Kroger Co. (The)

12/15/18 | | | 6.800 | % | | | 9,502,000 | | | | 11,783,326 | | |

Safeway, Inc.

Senior Unsecured

02/01/31 | | | 7.250 | % | | | 6,605,000 | | | | 7,868,140 | | |

Total | | | | | | | 19,651,466 | | |

Technology 1.2% | |

Alliance Data Systems Corp.(a)

12/01/17 | | | 5.250 | % | | | 546,000 | | | | 569,205 | | |