UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Christopher O. Petersen, Esq. c/o Columbia Management Investment Advisers, LLC 225 Franklin Street Boston, MA 02110 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 345-6611 | |

|

Date of fiscal year end: | August 31 | |

|

Date of reporting period: | August 31, 2013 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

August 31, 2013

Columbia Emerging Markets Fund

Not FDIC insured • No bank guarantee • May lose value

Dear Shareholders,

Dear Shareholders,

A return to volatility

Volatility returned to the financial markets in the second quarter of 2013, as uncertainty about the global economy, monetary policy and the impact of the sequester's spending cuts weighed on investors. Households advanced their spending but also allocated less to savings. Labor markets continued to crank out jobs at a steady pace, slowly reducing unemployment. Housing activity remained strong and retail sales were higher despite no real increase in income. The single weak spot was in the manufacturing sector, where activity slowed. While the consumer has weathered the domestic drag well, business has been closer to the global slowdown and effects of sequestration. Businesses remain very cautious, keeping inventories and staffs lean, and are planning for but not yet confident enough to make capital expenditures.

Against this backdrop, equities outperformed fixed income during the second quarter of 2013. Small-cap stocks outperformed large- and mid-cap stocks, and growth outperformed value except for in the large-cap sector. Outside the United States, foreign stock markets generally lost ground, with the most significant losses sustained by emerging markets.

Columbia Management to begin delivering summary prospectuses

Each Columbia fund is required to update its prospectus on an annual basis. Beginning with June 2013 prospectus updates, shareholders of Columbia retail mutual funds will start to receive a summary prospectus, rather than the full length (statutory) mutual fund prospectus they have received in the past.

Each fund's summary prospectus will include the following key information:

> Investment objective

> Fee and expense table

> Portfolio turnover rate information

> Principal investment strategies, principal risks and performance information

> Management information

> Purchase and sale information

> Tax information

> Financial intermediary compensation information

Each fund's statutory prospectus will contain additional information about the fund and its risks. Both the statutory and summary prospectus will be updated each year, and will be available at columbiamanagement.com. Shareholders may request a printed version of a statutory prospectus at no cost by calling 800.345.6611 or sending an email to serviceinquiries@columbiamanagement.com.

Stay on track with Columbia Management

Backed by more than 100 years of experience, Columbia Management is one of the nation's largest asset managers. At the heart of our success — and, most importantly, that of our investors — are highly talented industry professionals, brought together by a unique way of working. We are dedicated to helping you take advantage of today's opportunities and anticipate tomorrow's. We stay abreast of the latest investment trends and ideas, using our collective insight to evaluate events and transform them into solutions you can use.

Visit columbiamanagement.com for:

> The Columbia Management Perspectives blog, featuring timely posts by our investment teams

> Detailed up-to-date fund performance and portfolio information

> Economic analysis and market commentary

> Quarterly fund commentaries

> Columbia Management Investor, our award-winning quarterly newsletter for shareholders

Thank you for your continued support of the Columbia Funds. We look forward to serving your investment needs for many years to come.

Best Regards,

J. Kevin Connaughton

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about a fund, visit columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2013 Columbia Management Investment Advisers, LLC. All rights reserved.

Columbia Emerging Markets Fund

Performance Overview | | | 2 | | |

Manager Discussion of Fund Performance | | | 4 | | |

Understanding Your Fund's Expenses | | | 7 | | |

Portfolio of Investments | | | 8 | | |

Statement of Assets and Liabilities | | | 15 | | |

Statement of Operations | | | 17 | | |

Statement of Changes in Net Assets | | | 18 | | |

Financial Highlights | | | 21 | | |

Notes to Financial Statements | | | 32 | | |

Report of Independent Registered

Public Accounting Firm | | | 40 | | |

Federal Income Tax Information | | | 41 | | |

Trustees and Officers | | | 42 | | |

Board Consideration and Approval of Advisory Agreement | | | 45 | | |

Important Information About This Report | | | 49 | | |

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiamanagement.com or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

Columbia Emerging Markets Fund

Performance Summary

> Columbia Emerging Markets Fund (the Fund) Class A shares returned 0.98% excluding sales charges for the 12-month period that ended August 31, 2013.

> The Fund outperformed the MSCI Emerging Markets Index (Net), which returned 0.54% during the same period. The MSCI EAFE Index (Net), which tracks performance in more developed foreign markets, rose 18.66% for the same 12-month period.

> The Fund's significant overweight in information technology and good stock selection in utilities helped the Fund's results vs. the MSCI Emerging Markets Index (Net), as did selections in Russia, Mexico and the Philippines.

Average Annual Total Returns (%) (for period ended August 31, 2013)

| | Inception | | 1 Year | | 5 Years | | 10 Years | |

Class A* | | 09/28/07 | | | | | | | |

Excluding sales charges | | | | | 0.98 | | | | 1.49 | | | | 11.04 | | |

Including sales charges | | | | | -4.79 | | | | 0.30 | | | | 10.38 | | |

Class B* | | 02/28/13 | | | | | | | |

Excluding sales charges | | | | | 0.30 | | | | 0.74 | | | | 10.19 | | |

Including sales charges | | | | | -4.70 | | | | 0.42 | | | | 10.19 | | |

Class C* | | 09/28/07 | | | | | | | |

Excluding sales charges | | | | | 0.26 | | | | 0.70 | | | | 10.20 | | |

Including sales charges | | | | | -0.74 | | | | 0.70 | | | | 10.20 | | |

Class I* | | 09/27/10 | | | 1.47 | | | | 1.84 | | | | 11.34 | | |

Class K* | | 02/28/13 | | | 1.23 | | | | 1.66 | | | | 11.19 | | |

Class R* | | 09/27/10 | | | 0.67 | | | | 1.25 | | | | 10.74 | | |

Class R4* | | 03/19/13 | | | 1.27 | | | | 1.75 | | | | 11.29 | | |

Class R5* | | 11/08/12 | | | 1.37 | | | | 1.77 | | | | 11.30 | | |

Class W* | | 09/27/10 | | | 1.09 | | | | 1.50 | | | | 11.02 | | |

Class Y* | | 11/08/12 | | | 1.40 | | | | 1.77 | | | | 11.30 | | |

Class Z | | 01/02/98 | | | 1.29 | | | | 1.75 | | | | 11.29 | | |

MSCI Emerging Markets Index (Net) | | | | | 0.54 | | | | 1.88 | | | | 12.17 | | |

MSCI EAFE Index (Net) | | | | | 18.66 | | | | 1.62 | | | | 7.57 | | |

Returns for Class A are shown with and without the maximum initial sales charge of 5.75%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. The Fund's other classes are not subject to sales charges and have limited eligibility. Please see the Fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiamanagement.com or calling 800.345.6611.

* The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiamanagement.com/mutual-funds/appended-performance for more information.

The MSCI Emerging Markets Index (Net) is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

The MSCI EAFE (Europe, Australasia, Far East) Index (Net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The index is compiled from a composite of securities markets of Europe, Australasia and the Far East and is widely recognized by investors in foreign markets as the measurement index for portfolios of non-North American securities.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Annual Report 2013

2

Columbia Emerging Markets Fund

Performance Overview (continued)

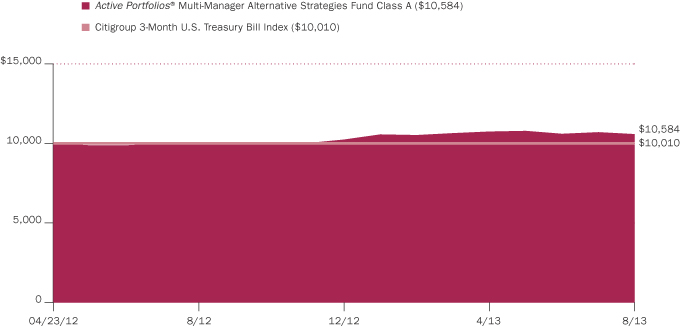

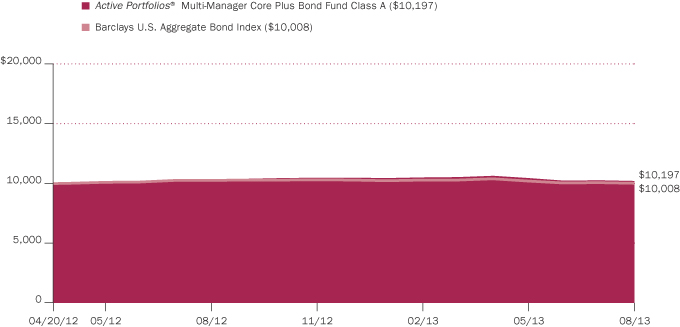

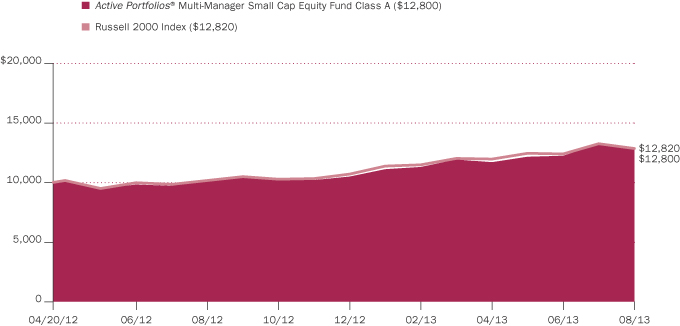

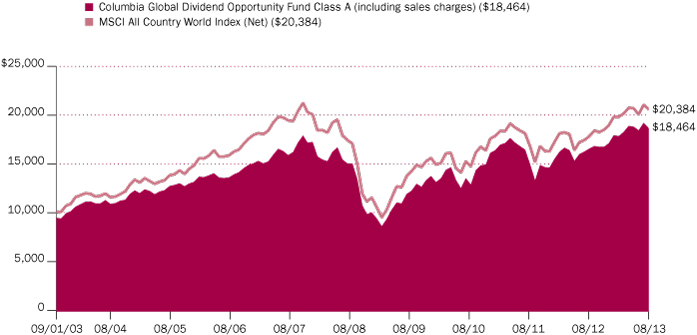

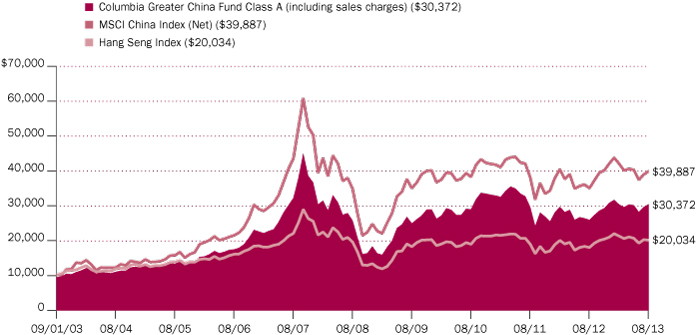

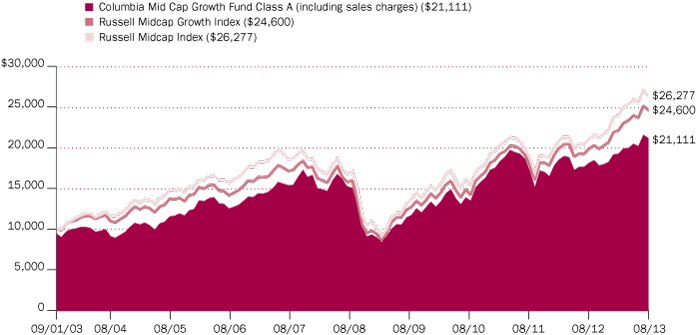

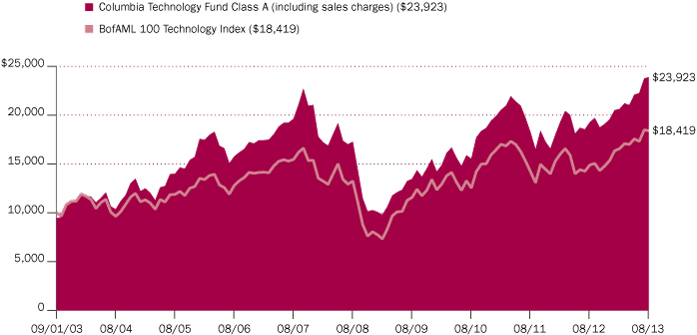

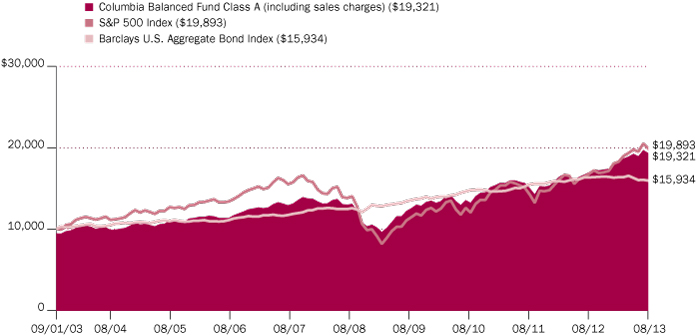

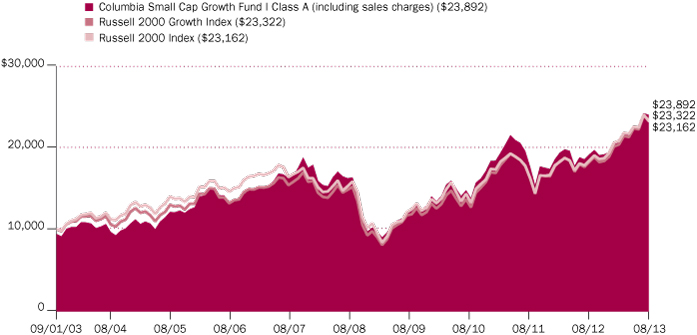

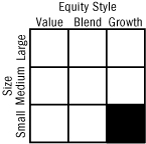

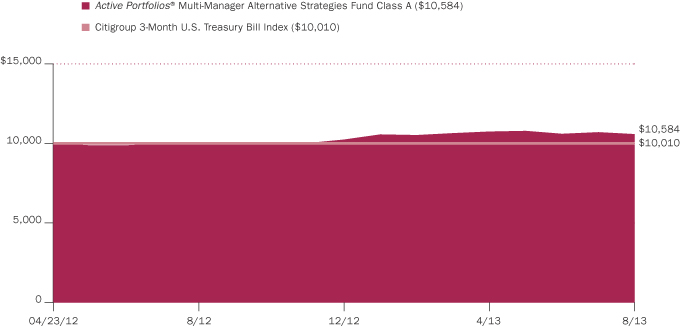

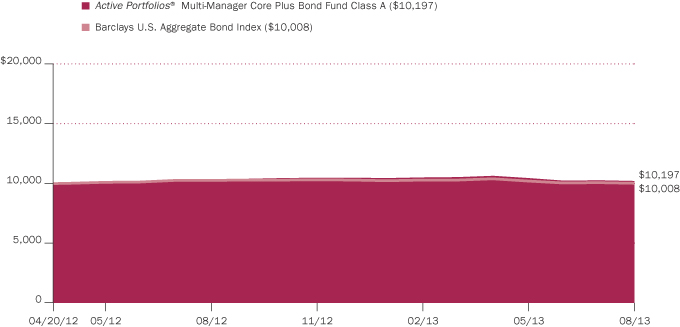

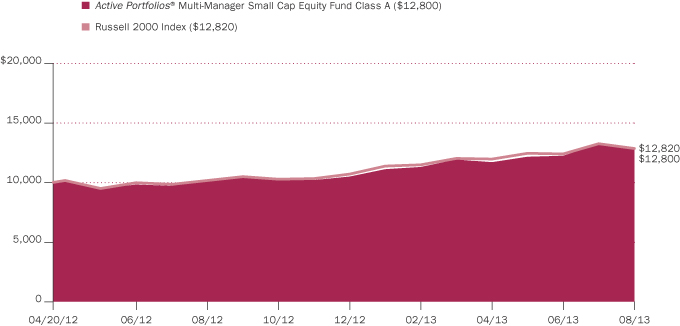

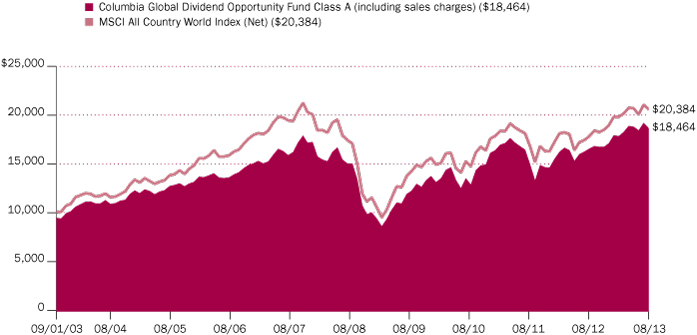

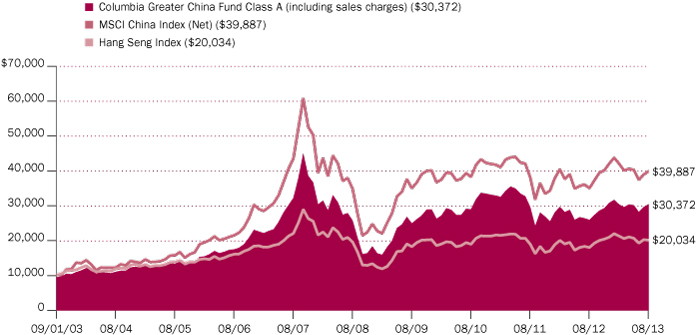

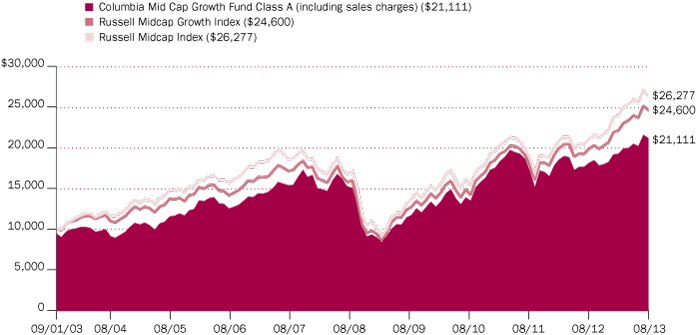

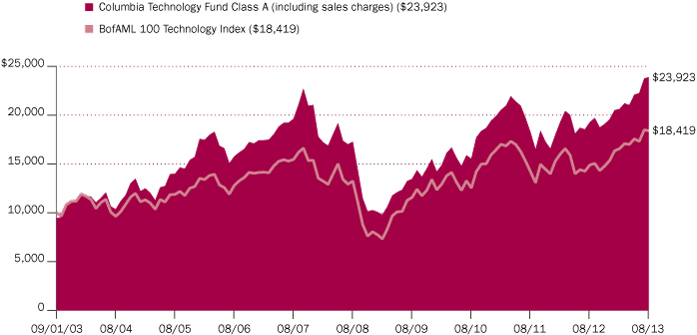

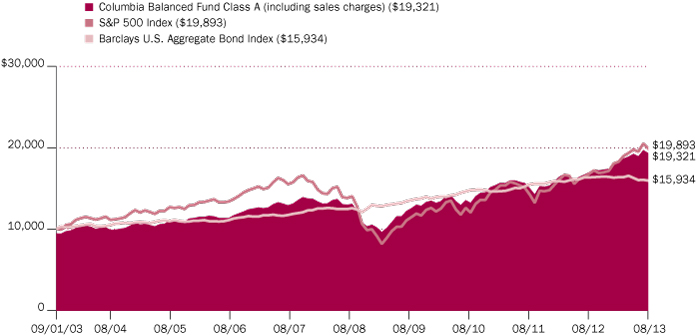

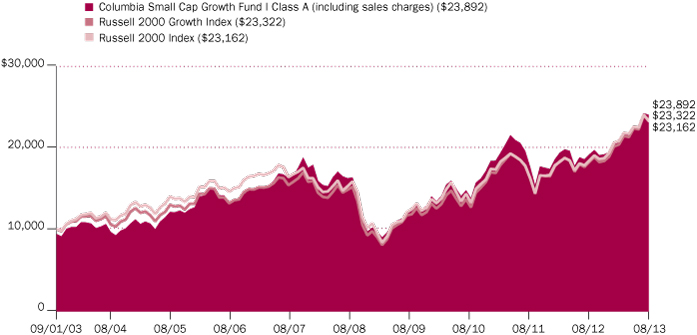

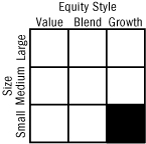

Performance of a Hypothetical $10,000 Investment (September 1, 2003 – August 31, 2013)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Emerging Markets Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Annual Report 2013

3

Columbia Emerging Markets Fund

Manager Discussion of Fund Performance

For the 12-month period that ended August 31, 2013, the Fund's Class A shares returned 0.98% excluding sales charges. The MSCI Emerging Markets Index (Net), returned 0.54% for the same period. In comparison, the MSCI EAFE Index (Net), which is designed to track the performance of more developed foreign equity markets, returned 18.66% for the same 12-month period. Stock selection in Russia, Mexico and the Philippines helped support the Fund's performance relative to the MSCI Emerging Markets Index (Net), as did an overweight in information technology stocks and positioning among utilities. However, selections in health care did relatively poorly, as did an overweight in India and exposure to Taiwan that was below that of the MSCI Emerging Markets Index (Net).

Europe, China Weigh on Global Growth

Europe's lingering problems and decelerating growth in China weighed on the global economy during the 12-month period, but growth began to firm as eurozone recessions showed signs of ending and job growth and a revitalized housing market bolstered the U.S. economy. Within emerging markets, the Chinese economy continued to slow in the first half of 2013. However, we expect a steadier second half as China's large trading partners, the United States and Europe, have allowed exports to stabilize. A more severe economic slowdown has been avoided as the Chinese government took measures to boost economic recovery, including expediting numerous small infrastructure stimulus projects, kicking off tax reform by reducing the tax burden for corporations and implementing measures to bolster export trade.

Growth in India and Thailand has also been subpar in 2013. Weak demand from Europe, the United States and China has been a drag on Thailand's export business and the domestic economy has weakened. Our mid-term growth outlook for Thailand, however, is favorable and we believe its equities are attractively priced. Elsewhere in the world, growth in Brazil continued to disappoint and Mexico has come in below expectations. However, our mid-term growth outlook for Mexico is more positive, given its leverage to the U.S. economy, continued gains in cost competitiveness in the manufacturing sector vs. China and a string of important economic reforms on the agenda.

Although emerging market equities generated solid returns early in the 12-month period, they pulled back after remarks by U.S. Federal Reserve (Fed) chairman Ben Bernanke that the Fed may start tapering its bond-buying program later this year and end the program by mid 2014. (Following the close of the reporting period, the Fed announced that it will continue its bond-buying program.) Several major emerging market currencies weakened significantly. Markets such as India and Indonesia, with large current account deficits, performed particularly poorly, but even healthier economies, such as the Philippines, suffered as emerging economies fell into disfavor.

Investments in Technology, Utilities Helped Drive Results

The Fund's overweight relative to the MSCI Emerging Markets Index (Net) in information technology aided results. Seen as a growth area that would benefit from improving economies in the United States and Europe, technology was the best-performing sector in emerging markets. Technology holdings that did particularly well included internet companies NAVER of South Korea, Tencent Holdings in China and QIWI, a Russian processor of electronic payments.

Portfolio Management

Dara White, CFA

Jasmine Weili Huang, CFA, CPA (U.S. and China), CFM

Robert Cameron

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on a fund's portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

©2013 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Top Ten Holdings (%)

(at August 31, 2013) | |

Samsung Electronics Co., Ltd.

(South Korea) | | | 4.9 | | |

Grupo Financiero Banorte

SAB de CV, Class O (Mexico) | | | 1.8 | | |

Hyundai Motor Co.

(South Korea) | | | 1.6 | | |

Sands China Ltd. (Hong Kong) | | | 1.6 | | |

Metropolitan Bank & Trust

(Philippines) | | | 1.6 | | |

Banco Bradesco SA, ADR

(Brazil) | | | 1.4 | | |

Kasikornbank PCL, Foreign

Registered Shares (Thailand) | | | 1.4 | | |

Credicorp Ltd. (Peru) | | | 1.4 | | |

China Overseas Land &

Investment Ltd. (China) | | | 1.3 | | |

SK Telecom Co., Ltd.

(South Korea) | | | 1.3 | | |

Percentages indicated are based upon total investments (excluding Money Market Funds).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Annual Report 2013

4

Columbia Emerging Markets Fund

Manager Discussion of Fund Performance (continued)

Stock-picking in Russia also helped results, led by supermarket chain Magnit. Security selection in Mexico aided returns relative to the MSCI Emerging Markets Index (Net). Mexico did well both because its manufacturing sector became more price-competitive with China and because of its close ties to the improving U.S. economy. Standouts in Mexico included Alfa, an industrial conglomerate, and banking firm Grupo Financiero Santander Mexico. The Fund's large overweight relative to the MSCI Emerging Markets Index (Net) in the Philippines also helped, with the Fund's stock selections significantly outperforming those in the MSCI Emerging Markets Index (Net). A strong contribution came from Universal Robina, a consumer staples producer, which we sold after its share price appreciated significantly. In the utilities sector, natural gas utilities ENN Energy and Towngas China benefited from China's decision to begin favoring natural gas over coal because of environmental concerns.

Health Care Investments Lagged

Although health care stocks did generally well, our selections underperformed the MSCI Emerging Markets Index (Net). One notable disappointment was Wockhardt Limited, an Indian generic drug manufacturer that ran into difficulties with the U.S. Food and Drug Administration. We sold the position. Health care stocks in Brazil also did poorly, as health care spending failed to meet expectations, leading to poor results by companies such as Fleury, an operator of diagnostic and treatment centers, and Qualicorp, a health care insurer. When emerging market trends turned negative in the final months of the period, the Fund's overweight in India hurt performance, as investors worried about that nation's large current account deficit, rising inflation and higher interest rates. Conversely, an underweight in Taiwan hurt results, as that market was seen as a relatively safer place in emerging markets.

Looking Ahead

After underperforming other markets for a prolonged period, emerging market equities were trading at significant discounts to more developed nations at the end of the period. However, the long-term trends favoring developing markets currently remain intact. Emerging markets continue to gain a larger share of global gross domestic product, and their growing middle class populations have the potential to create many good opportunities.

With these trends in mind, we reduced exposure to India and Indonesia, which we think carry larger structural economic risk, and have maintained weights below the MSCI Emerging Markets Index (Net) in other countries with what we believe are large structural risks, including South Africa, Brazil, Malaysia and some Central European markets. We have increased Fund positions in Korea and China, exporting economies positioned to benefit from improving demand from the United States and Europe, and we have maintained healthy exposure to Thailand and the Philippines, which we believe have been unfairly punished in the recent market downturn. By sector, we have reduced positions in consumer staples on valuation concerns after stellar performance over the last few years, and kept the portfolio underexposed (as of period-end) to materials and energy sectors, as heavy industrial infrastructure investments in emerging markets have slowed. We continue to find many quality companies with what we believe to be solid long-term growth prospects whose stocks are trading at attractive prices and that should have the potential to do well over time.

Country Breakdown (%)

(at August 31, 2013) | |

Brazil | | | 8.1 | | |

Canada | | | 0.4 | | |

Chile | | | 1.1 | | |

China | | | 17.4 | | |

Hong Kong | | | 2.7 | | |

India | | | 6.0 | | |

Indonesia | | | 3.9 | | |

Malaysia | | | 1.7 | | |

Mexico | | | 6.1 | | |

Panama | | | 1.1 | | |

Peru | | | 1.9 | | |

Philippines | | | 5.0 | | |

Poland | | | 0.6 | | |

Russian Federation | | | 6.5 | | |

Singapore | | | 0.3 | | |

South Africa | | | 2.2 | | |

South Korea | | | 16.6 | | |

Taiwan | | | 7.3 | | |

Thailand | | | 4.8 | | |

Turkey | | | 2.4 | | |

United Kingdom | | | 0.6 | | |

United States(a) | | | 3.3 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total investments. The Fund's portfolio composition is subject to change.

(a) Includes investments in Money Market Funds.

Investment Risks

Funds which concentrate their investments in a geographic region may expose an investor to greater volatility: for example, currency fluctuations, differences in security regulation, accounting standards, foreign taxation regulations and political risks. These risks may be enhanced in emerging markets. Investments in equity securities are subject to sudden and unpredictable drops in value and periods of lackluster performance. See the Fund's prospectus for information on these and other risks.

Annual Report 2013

5

Columbia Emerging Markets Fund

Manager Discussion of Fund Performance (continued)

Summary of Investments in Securities

by Industry (%) (at August 31, 2013) | |

Airlines | | | 1.1 | | |

Auto Components | | | 0.5 | | |

Automobiles | | | 3.6 | | |

Beverages | | | 2.4 | | |

Capital Markets | | | 0.2 | | |

Chemicals | | | 2.2 | | |

Commercial Banks | | | 17.3 | | |

Computers & Peripherals | | | 0.7 | | |

Construction & Engineering | | | 0.6 | | |

Construction Materials | | | 1.9 | | |

Diversified Financial Services | | | 3.0 | | |

Diversified Telecommunication

Services | | | 0.5 | | |

Electric Utilities | | | 0.7 | | |

Electrical Equipment | | | 0.9 | | |

Electronic Equipment,

Instruments & Components | | | 3.2 | | |

Energy Equipment & Services | | | 0.6 | | |

Food & Staples Retailing | | | 2.1 | | |

Food Products | | | 2.1 | | |

Gas Utilities | | | 1.4 | | |

Health Care Providers & Services | | | 1.4 | | |

Hotels, Restaurants & Leisure | | | 2.5 | | |

Household Durables | | | 1.4 | | |

Independent Power Producers &

Energy Traders | | | 1.4 | | |

Industrial Conglomerates | | | 1.1 | | |

Insurance | | | 0.6 | | |

Internet Software & Services | | | 3.8 | | |

IT Services | | | 2.3 | | |

Leisure Equipment & Products | | | 0.4 | | |

Life Sciences Tools & Services | | | 0.5 | | |

Machinery | | | 1.1 | | |

Media | | | 0.4 | | |

Metals & Mining | | | 1.5 | | |

Multiline Retail | | | 1.3 | | |

Oil, Gas & Consumable Fuels | | | 7.2 | | |

Personal Products | | | 0.4 | | |

Pharmaceuticals | | | 0.7 | | |

Real Estate Management &

Development | | | 1.7 | | |

Semiconductors &

Semiconductor Equipment | | | 11.1 | | |

Software | | | 1.0 | | |

Specialty Retail | | | 1.1 | | |

Textiles, Apparel & Luxury Goods | | | 0.9 | | |

Tobacco | | | 0.3 | | |

Trading Companies & Distributors | | | 1.2 | | |

Transportation Infrastructure | | | 1.1 | | |

Water Utilities | | | 0.5 | | |

Wireless Telecommunication

Services | | | 4.9 | | |

Money Market Funds | | | 1.4 | | |

Total | | | 98.2 | | |

Percentages indicated are based upon net assets. The Fund's portfolio composition is subject to change.

Annual Report 2013

6

Columbia Emerging Markets Fund

Understanding Your Fund's Expenses

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

March 1, 2013 – August 31, 2013

| | Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 877.00 | | | | 1,016.29 | | | | 8.23 | | | | 8.85 | | | | 1.75 | | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 874.10 | | | | 1,012.58 | | | | 11.63 | | | | 12.56 | | | | 2.49 | | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 873.40 | | | | 1,012.53 | | | | 11.74 | | | | 12.61 | | | | 2.50 | | |

Class I | | | 1,000.00 | | | | 1,000.00 | | | | 879.70 | | | | 1,018.90 | | | | 5.80 | | | | 6.23 | | | | 1.23 | | |

Class K | | | 1,000.00 | | | | 1,000.00 | | | | 878.40 | | | | 1,017.50 | | | | 7.07 | | | | 7.64 | | | | 1.51 | | |

Class R | | | 1,000.00 | | | | 1,000.00 | | | | 875.70 | | | | 1,015.04 | | | | 9.40 | | | | 10.10 | | | | 2.00 | | |

Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 886.80 | * | | | 1,017.40 | | | | 6.45 | * | | | 7.74 | | | | 1.53 | * | |

Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 878.90 | | | | 1,018.60 | | | | 6.08 | | | | 6.53 | | | | 1.29 | | |

Class W | | | 1,000.00 | | | | 1,000.00 | | | | 877.90 | | | | 1,016.24 | | | | 8.29 | | | | 8.90 | | | | 1.76 | | |

Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 879.20 | | | | 1,018.50 | | | | 6.17 | | | | 6.63 | | | | 1.31 | | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 878.50 | | | | 1,017.45 | | | | 7.16 | | | | 7.69 | | | | 1.52 | | |

*For the period March 19, 2013 through August 31, 2013. Class R4 shares commenced operations on March 19, 2013.

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investment vehicles (including mutual funds and exchange-traded funds).

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Annual Report 2013

7

Columbia Emerging Markets Fund

Portfolio of Investments

August 31, 2013

(Percentages represent value of investments compared to net assets)

Common Stocks 93.7%

Issuer | | Shares | | Value ($) | |

Brazil 7.2% | |

Arezzo Industria e Comercio SA | | | 426,300 | | | | 5,955,103 | | |

Banco Bradesco SA, ADR | | | 1,421,360 | | | | 16,516,203 | | |

Cielo SA | | | 229,660 | | | | 5,563,548 | | |

Companhia de Bebidas das

Americas, ADR | | | 406,637 | | | | 14,142,835 | | |

Cosan Ltd., Class A | | | 353,796 | | | | 4,733,791 | | |

Hypermarcas SA | | | 676,900 | | | | 4,590,307 | | |

Linx SA | | | 357,100 | | | | 5,754,729 | | |

Mills Estruturas e Servicos de

Engenharia SA | | | 809,000 | | | | 10,019,468 | | |

Qualicorp SA(a) | | | 613,000 | | | | 4,737,618 | | |

Raia Drogasil SA | | | 230,800 | | | | 1,623,179 | | |

Ultrapar Participacoes SA | | | 454,600 | | | | 9,924,816 | | |

Vale SA | | | 207,200 | | | | 2,960,434 | | |

Total | | | | | 86,522,031 | | |

Canada 0.3% | |

Pacific Rubiales Energy Corp. | | | 222,578 | | | | 4,211,506 | | |

Chile 1.1% | |

Inversiones La Construccion SA | | | 202,505 | | | | 2,539,994 | | |

SACI Falabella | | | 1,043,559 | | | | 10,326,172 | | |

Total | | | | | 12,866,166 | | |

China 17.1% | |

Anhui Conch Cement Co., Ltd., Class H | | | 2,877,000 | | | | 9,251,545 | | |

Anton Oilfield Services Group Ltd. | | | 6,842,000 | | | | 4,346,451 | | |

Baidu, Inc., ADR(a) | | | 29,208 | | | | 3,958,560 | | |

China Communications Construction

Co., Ltd., Class H | | | 9,694,000 | | | | 7,392,285 | | |

China Merchants Holdings

International Co., Ltd. | | | 1,494,000 | | | | 5,025,750 | | |

China Overseas Land & Investment Ltd. | | | 5,280,000 | | | | 15,668,662 | | |

China Petroleum & Chemical Corp.,

Class H | | | 16,592,000 | | | | 11,947,571 | | |

China Resources Power Holdings

Co., Ltd. | | | 2,506,000 | | | | 5,738,676 | | |

China Vanke Co., Ltd., Class B | | | 2,612,914 | | | | 5,233,523 | | |

CIMC Enric Holdings Ltd. | | | 3,872,000 | | | | 4,031,985 | | |

CNOOC Ltd. | | | 6,442,000 | | | | 12,737,714 | | |

ENN Energy Holdings Ltd. | | | 2,520,000 | | | | 12,486,982 | | |

GCL-Poly Energy Holdings Ltd.(a) | | | 27,375,000 | | | | 7,194,244 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Guangdong Investment Ltd. | | | 7,660,000 | | | | 6,333,373 | | |

Haier Electronics Group Co., Ltd. | | | 2,179,000 | | | | 3,805,395 | | |

Haitong Securities Co., Ltd., Class H | | | 1,853,200 | | | | 2,671,353 | | |

Huaneng Power International, Inc.,

Class H | | | 11,106,000 | | | | 11,041,499 | | |

Industrial & Commercial Bank of

China Ltd., Class H | | | 23,067,000 | | | | 15,083,646 | | |

Lenovo Group Ltd. | | | 9,212,000 | | | | 8,883,558 | | |

PetroChina Co., Ltd., Class H | | | 7,502,000 | | | | 8,165,279 | | |

SINA Corp.(a) | | | 55,571 | | | | 4,302,307 | | |

Tencent Holdings Ltd. | | | 223,300 | | | | 10,428,622 | | |

Termbray Petro-King Oilfield

Services Ltd.(a) | | | 4,987,000 | | | | 2,641,914 | | |

Want Want China Holdings Ltd. | | | 6,300,000 | | | | 9,314,494 | | |

WuXi PharmaTech (Cayman), Inc. ADR(a) | | | 240,012 | | | | 5,760,288 | | |

Youku Tudou, Inc., ADR(a) | | | 227,886 | | | | 5,284,676 | | |

Zhuzhou CSR Times Electric Co., Ltd.,

Class H | | | 2,344,000 | | | | 7,360,717 | | |

Total | | | | | 206,091,069 | | |

Hong Kong 2.7% | |

Sa Sa International Holdings Ltd. | | | 8,342,000 | | | | 8,916,367 | | |

Sands China Ltd. | | | 3,329,200 | | | | 19,079,664 | | |

Towngas China Co., Ltd. | | | 4,539,000 | | | | 4,269,540 | | |

Total | | | | | 32,265,571 | | |

India 5.9% | |

Apollo Hospitals Enterprise Ltd. | | | 528,957 | | | | 6,921,595 | | |

Eicher Motors Ltd. | | | 62,055 | | | | 2,995,960 | | |

Havells India Ltd | | | 354,200 | | | | 3,226,313 | | |

HCL Technologies Ltd. | | | 516,805 | | | | 8,120,983 | | |

HDFC Bank Ltd., ADR | | | 339,341 | | | | 9,834,102 | | |

Hexaware Technologies Ltd. | | | 2,043,226 | | | | 3,970,524 | | |

ICICI Bank Ltd., ADR | | | 374,818 | | | | 9,752,764 | | |

Just Dial Ltd.(a) | | | 322,124 | | | | 3,307,293 | | |

Lupin Ltd. | | | 649,869 | | | | 7,838,736 | | |

Motherson Sumi Systems Ltd. | | | 1,987,496 | | | | 5,841,177 | | |

Tata Motors Ltd. | | | 1,376,932 | | | | 6,178,490 | | |

TTK Prestige Ltd. | | | 64,864 | | | | 3,275,022 | | |

Total | | | | | 71,262,959 | | |

Indonesia 3.9% | |

PT Ace Hardware Indonesia Tbk | | | 65,895,500 | | | | 4,276,110 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

8

Columbia Emerging Markets Fund

Portfolio of Investments (continued)

August 31, 2013

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

PT AKR Corporindo Tbk | | | 13,469,000 | | | | 4,887,395 | | |

PT Bank Negara Indonesia Persero Tbk | | | 17,838,000 | | | | 6,267,431 | | |

PT Bank Tabungan Pensiunan

Nasional Tbk(a) | | | 9,394,500 | | | | 3,352,868 | | |

PT Gudang Garam Tbk | | | 1,142,000 | | | | 3,955,644 | | |

PT Jasa Marga Persero Tbk | | | 9,370,000 | | | | 4,663,328 | | |

PT Nippon Indosari Corpindo Tbk | | | 8,421,000 | | | | 5,079,038 | | |

PT Sumber Alfaria Trijaya Tbk | | | 76,500,000 | | | | 3,993,132 | | |

PT Telekomunikasi Tbk | | | 30,480,000 | | | | 6,122,500 | | |

PT Tower Bersama Infrastructure Tbk(a) | | | 8,300,000 | | | | 3,941,443 | | |

Total | | | | | 46,538,889 | | |

Malaysia 1.6% | |

CIMB Group Holdings Bhd | | | 5,082,300 | | | | 11,241,484 | | |

Tenaga Nasional Bhd | | | 3,146,200 | | | | 8,356,066 | | |

Total | | | | | 19,597,550 | | |

Mexico 6.0% | |

Alfa SAB de CV, Class A | | | 5,225,600 | | | | 12,965,245 | | |

Cemex SAB de CV, ADR(a) | | | 1,247,299 | | | | 14,019,641 | | |

Fomento Economico Mexicano

SAB de CV, ADR | | | 91,934 | | | | 8,676,731 | | |

Grupo Financiero Banorte SAB de CV,

Class O | | | 3,411,600 | | | | 21,006,836 | | |

Grupo Financiero Santander Mexico

SAB de CV, ADR, Class B | | | 924,837 | | | | 12,614,777 | | |

Grupo Mexico SAB de CV, Class B | | | 823,490 | | | | 2,354,413 | | |

Total | | | | | 71,637,643 | | |

Panama 1.1% | |

Copa Holdings SA, Class A | | | 98,720 | | | | 12,910,602 | | |

Peru 1.8% | |

Credicorp Ltd. | | | 133,057 | | | | 16,131,831 | | |

Southern Copper Corp. | | | 208,559 | | | | 5,735,372 | | |

Total | | | | | 21,867,203 | | |

Philippines 4.9% | |

BDO Unibank, Inc. | | | 177,439 | | | | 293,395 | | |

Bloomberry Resorts Corp.(a) | | | 15,108,500 | | | | 3,646,790 | | |

GT Capital Holdings, Inc. | | | 668,560 | | | | 11,579,594 | | |

LT Group, Inc. | | | 14,182,700 | | | | 6,158,010 | | |

Metropolitan Bank & Trust | | | 10,339,973 | | | | 18,822,792 | | |

Philippine Long Distance Telephone Co. | | | 135,060 | | | | 8,644,838 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Security Bank Corp. | | | 2,711,030 | | | | 7,134,340 | | |

Semirara Mining Corp. | | | 513,250 | | | | 2,780,256 | | |

Total | | | | | 59,060,015 | | |

Poland 0.6% | |

Eurocash SA | | | 473,006 | | | | 7,595,492 | | |

Russian Federation 6.3% | |

Gazprom OAO, ADR | | | 857,395 | | | | 6,739,125 | | |

Lukoil OAO, ADR | | | 215,005 | | | | 12,428,364 | | |

Magnit OJSC, GDR(b) | | | 152,002 | | | | 8,436,111 | | |

Mail.ru Group Ltd., GDR(b) | | | 316,603 | | | | 10,337,088 | | |

MD Medical Group Investments

PLC, GDR(b) | | | 58,697 | | | | 587,557 | | |

Mobile Telesystems OJSC, ADR | | | 566,032 | | | | 11,977,237 | | |

NovaTek OAO | | | 787,647 | | | | 8,537,222 | | |

QIWI PLC, ADR | | | 140,379 | | | | 4,183,294 | | |

Sberbank of Russia | | | 4,901,665 | | | | 13,136,462 | | |

Total | | | | | 76,362,460 | | |

Singapore 0.3% | |

Hutchison Port Holdings Trust | | | 5,305,000 | | | | 3,916,936 | | |

South Africa 2.2% | |

AVI Ltd. | | | 1,500,791 | | | | 8,028,353 | | |

Clicks Group Ltd. | | | 753,278 | | | | 4,017,141 | | |

Discovery Ltd. | | | 539,646 | | | | 4,441,982 | | |

FirstRand Ltd. | | | 1,686,500 | | | | 4,932,457 | | |

Life Healthcare Group Holdings Ltd. | | | 1,342,107 | | | | 4,620,978 | | |

Total | | | | | 26,040,911 | | |

South Korea 15.4% | |

Cheil Industries, Inc. | | | 70,834 | | | | 5,606,524 | | |

Duksan Hi-Metal Co., Ltd.(a) | | | 347,739 | | | | 7,519,748 | | |

Gamevil, Inc.(a) | | | 67,679 | | | | 3,383,255 | | |

Hotel Shilla Co., Ltd. | | | 128,764 | | | | 7,772,131 | | |

Hyundai Motor Co. | | | 85,801 | | | | 19,133,140 | | |

InkTec Co., Ltd.(a) | | | 97,864 | | | | 2,196,850 | | |

Kia Motors Corp. | | | 175,594 | | | | 10,564,197 | | |

LG Chem Ltd. | | | 32,199 | | | | 8,283,330 | | |

NAVER Corp. | | | 19,085 | | | | 7,676,537 | | |

NHN Entertainment Corp.(a)(c) | | | — | | | | 25 | | |

Samsung Electronics Co., Ltd. | | | 46,395 | | | | 56,880,755 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

9

Columbia Emerging Markets Fund

Portfolio of Investments (continued)

August 31, 2013

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Samsung SDI Co., Ltd. | | | 90,424 | | | | 13,680,418 | | |

Seoul Semiconductor Co., Ltd. | | | 134,158 | | | | 4,495,622 | | |

SK Hynix, Inc.(a) | | | 520,230 | | | | 13,147,852 | | |

SK Telecom Co., Ltd. | | | 78,026 | | | | 15,538,406 | | |

Suprema, Inc.(a) | | | 302,478 | | | | 6,026,431 | | |

WeMade Entertainment Co., Ltd.(a) | | | 75,829 | | | | 3,462,365 | | |

Total | | | | | 185,367,586 | | |

Taiwan 7.1% | |

Airtac International Group | | | 552,210 | | | | 3,627,719 | | |

CTBC Financial Holding Co., Ltd. | | | 19,612,662 | | | | 12,303,238 | | |

Delta Electronics, Inc. | | | 819,000 | | | | 3,687,154 | | |

Far EasTone Telecommunications

Co., Ltd. | | | 4,472,000 | | | | 11,285,686 | | |

Giant Manufacturing Co., Ltd. | | | 648,800 | | | | 4,348,170 | | |

Giga Solar Materials Corp. | | | 505,000 | | | | 4,050,694 | | |

Hermes Microvision, Inc. | | | 153,000 | | | | 4,108,557 | | |

MediaTek, Inc. | | | 868,000 | | | | 10,594,498 | | |

Standard Foods Corp. | | | 841,000 | | | | 2,464,367 | | |

Taiwan Semiconductor

Manufacturing Co., Ltd. | | | 4,223,048 | | | | 14,000,995 | | |

Tong Hsing Electronic Industries Ltd. | | | 1,290,000 | | | | 6,650,623 | | |

TPK Holding Co., Ltd. | | | 842,000 | | | | 8,883,156 | | |

Total | | | | | 86,004,857 | | |

Thailand 4.7% | |

Advanced Information Service PCL,

Foreign Registered Shares | | | 988,800 | | | | 7,339,115 | | |

Bangkok Bank PCL, Foreign Registered

Shares | | | 2,227,900 | | | | 12,476,594 | | |

BEC World PCL, Foreign Registered

Shares | | | 3,045,900 | | | | 5,133,339 | | |

Kasikornbank PCL, Foreign Registered

Shares | | | 3,330,000 | | | | 16,364,321 | | |

PTT Global Chemical PCL, Foreign

Registered Shares | | | 5,004,300 | | | | 10,671,779 | | |

Robinson Department Store PCL,

Foreign Registered Shares | | | 3,600,900 | | | | 5,114,850 | | |

Total | | | | | 57,099,998 | | |

Turkey 2.4% | |

Anadolu Hayat Emeklilik AS | | | 1,456,673 | | | | 2,601,813 | | |

Arcelik AS | | | 2,046,812 | | | | 10,195,938 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Tofas Turk Otomobil Fabrikasi AS | | | 1,404,014 | | | | 7,202,265 | | |

Turk Traktor ve Ziraat Makineleri AS | | | 82,725 | | | | 2,171,361 | | |

Turkiye Halk Bankasi AS | | | 972,243 | | | | 6,147,547 | | |

Total | | | | | 28,318,924 | | |

United Kingdom 0.6% | |

Lonmin PLC(a) | | | 890,287 | | | | 4,696,424 | | |

Randgold Resources Ltd. | | | 29,451 | | | | 2,320,806 | | |

Total | | | | | 7,017,230 | | |

United States 0.5% | |

Cognizant Technology Solutions Corp.,

Class A(a) | | | 83,240 | | | | 6,101,492 | | |

Total Common Stocks

(Cost: $1,114,618,291) | | | | | 1,128,657,090 | | |

Preferred Stocks 1.7%

Brazil 0.8% | |

Alpargatas SA | | | 925,300 | | | | 4,754,575 | | |

Petroleo Brasileiro SA | | | 667,900 | | | | 4,686,035 | | |

Total | | | | | 9,440,610 | | |

South Korea 0.9% | |

Samsung Electronics Co., Ltd. | | | 13,410 | | | | 11,060,455 | | |

Total Preferred Stocks

(Cost: $18,507,691) | | | | | 20,501,065 | | |

Exchange-Traded Funds 1.4%

Vanguard Emerging Markets ETF | | | 321,244 | | | | 12,117,324 | | |

iShares MSCI Taiwan Index Fund | | | 338,483 | | | | 4,562,751 | | |

Total Exchange-Traded Funds

(Cost: $16,874,407) | | | | | 16,680,075 | | |

Money Market Funds 1.4%

Columbia Short-Term Cash Fund,

0.097%(d)(e) | | | 16,536,242 | | | | 16,536,242 | | |

Total Money Market Funds

(Cost: $16,536,242) | | | | | 16,536,242 | | |

Total Investments

(Cost: $1,166,536,631) | | | 1,182,374,472 | | |

Other Assets & Liabilities, Net | | | 21,538,597 | | |

Net Assets | | | 1,203,913,069 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

10

Columbia Emerging Markets Fund

Portfolio of Investments (continued)

August 31, 2013

Notes to Portfolio of Investments

(a) Non-income producing.

(b) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At August 31, 2013, the value of these securities amounted to $19,360,756 or 1.61% of net assets.

(c) Represents fractional shares.

(d) The rate shown is the seven-day current annualized yield at August 31, 2013.

(e) As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of its outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended August 31, 2013, are as follows:

Issuer | | Beginning

Cost ($) | | Purchase

Cost ($) | | Proceeds

From Sales ($) | | Ending

Cost ($) | | Dividends —

Affiliated

Issuers ($) | | Value ($) | |

Columbia Short-Term Cash Fund | | | 6,468,836 | | | | 484,564,455 | | | | (474,497,049 | ) | | | 16,536,242 | | | | 31,426 | | | | 16,536,242 | | |

Abbreviation Legend

ADR American Depositary Receipt

GDR Global Depositary Receipt

Fair Value Measurements

Generally accepted accounting principles (GAAP) require disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category.

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

> Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

> Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

> Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Foreign equity securities actively traded in markets where there is a significant delay in the local close relative to the New York Stock Exchange (NYSE) are classified as Level 2. The values of these securities may include an adjustment to reflect the impact of significant market movements following the close of local trading, as described in Note 2 to the financial statements — Security Valuation.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

11

Columbia Emerging Markets Fund

Portfolio of Investments (continued)

August 31, 2013

Fair Value Measurements (continued)

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund's Board of Trustees (the Board), the Investment Manager's Valuation Committee (the Committee) is responsible for carrying out the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager's organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third-party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

12

Columbia Emerging Markets Fund

Portfolio of Investments (continued)

August 31, 2013

Fair Value Measurements (continued)

The following table is a summary of the inputs used to value the Fund's investments at August 31, 2013:

Description | | Level 1

Quoted Prices in Active

Markets for Identical

Assets ($) | |

Level 2

Other Significant

Observable Inputs ($) | |

Level 3

Significant

Unobservable Inputs ($) | |

Total ($) | |

Equity Securities | |

Common Stocks | |

Consumer Discretionary | | | 16,281,276 | | | | 124,483,046 | | | | — | | | | 140,764,322 | | |

Consumer Staples | | | 29,033,051 | | | | 59,041,781 | | | | — | | | | 88,074,832 | | |

Energy | | | 31,298,476 | | | | 57,895,531 | | | | — | | | | 89,194,007 | | |

Financials | | | 88,396,507 | | | | 169,753,503 | | | | — | | | | 258,150,010 | | |

Health Care | | | 10,497,906 | | | | 19,968,866 | | | | — | | | | 30,466,772 | | |

Industrials | | | 35,895,315 | | | | 49,299,750 | | | | — | | | | 85,195,065 | | |

Information Technology | | | 35,148,607 | | | | 220,490,995 | | | | — | | | | 255,639,602 | | |

Materials | | | 25,069,861 | | | | 43,027,258 | | | | — | | | | 68,097,119 | | |

Telecommunication Services | | | 11,977,237 | | | | 52,871,988 | | | | — | | | | 64,849,225 | | |

Utilities | | | — | | | | 48,226,136 | | | | — | | | | 48,226,136 | | |

Preferred Stocks | |

Consumer Discretionary | | | 4,754,575 | | | | — | | | | — | | | | 4,754,575 | | |

Energy | | | 4,686,035 | | | | — | | | | — | | | | 4,686,035 | | |

Information Technology | | | — | | | | 11,060,455 | | | | — | | | | 11,060,455 | | |

Exchange-Traded Funds | | | 16,680,075 | | | | — | | | | — | | | | 16,680,075 | | |

Total Equity Securities | | | 309,718,921 | | | | 856,119,309 | | | | — | | | | 1,165,838,230 | | |

Mutual Funds | |

Money Market Funds | | | 16,536,242 | | | | — | | | | — | | | | 16,536,242 | | |

Total Mutual Funds | | | 16,536,242 | | | | — | | | | — | | | | 16,536,242 | | |

Total | | | 326,255,163 | | | | 856,119,309 | | | | — | | | | 1,182,374,472 | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund's assets assigned to the Level 2 input category are generally valued using the market approach, in which a security's value is determined through reference to prices and information from market transactions for similar or identical assets. These assets include certain foreign securities for which a third party statistical pricing service may be employed for purposes of fair market valuation. The models utilized by the third party statistical pricing service take into account a security's correlation to available market data including, but not limited to, intraday index, ADR, and ETF movements.

There were no transfers of financial assets between Levels 1 and 2 during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

13

Columbia Emerging Markets Fund

Portfolio of Investments (continued)

August 31, 2013

Fair Value Measurements (continued)

The following table is a reconciliation of Level 3 assets for which significant observable and/or unobservable inputs were used to determine fair value.

| | | Common Stocks ($) | |

Balance as of August 31, 2012 | | | 2,906,255 | | |

Accrued discounts/premiums | | | — | | |

Realized gain (loss) | | | — | | |

Change in unrealized appreciation (depreciation) | | | — | | |

Sales | | | — | | |

Purchases | | | — | | |

Transfers into Level 3 | | | — | | |

Transfers out of Level 3 | | | (2,906,255 | ) | |

Balance as of August 31, 2013 | | | — | | |

Financial assets were transferred from Level 3 to Level 2 as observable market inputs were utilized and management's determination that there was sufficient, reliable and observable market data to value these assets as of period end.

Transfers in and/or out of Level 3 are determined based on the fair value at the beginning of the period for security positions held throughout the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

14

Columbia Emerging Markets Fund

Statement of Assets and Liabilities

August 31, 2013

Assets | |

Investments, at value | |

Unaffiliated issuers (identified cost $1,150,000,389) | | $ | 1,165,838,230 | | |

Affiliated issuers (identified cost $16,536,242) | | | 16,536,242 | | |

Total investments (identified cost $1,166,536,631) | | | 1,182,374,472 | | |

Foreign currency (identified cost $6,948,094) | | | 6,940,673 | | |

Receivable for: | |

Investments sold | | | 20,077,308 | | |

Capital shares sold | | | 2,426,640 | | |

Dividends | | | 1,823,174 | | |

Reclaims | | | 42,199 | | |

Prepaid expenses | | | 15,149 | | |

Trustees' deferred compensation plan | | | 27,623 | | |

Total assets | | | 1,213,727,238 | | |

Liabilities | |

Payable for: | |

Investments purchased | | | 7,456,331 | | |

Capital shares purchased | | | 1,901,867 | | |

Investment management fees | | | 33,650 | | |

Distribution and/or service fees | | | 3,234 | | |

Transfer agent fees | | | 167,168 | | |

Administration fees | | | 2,537 | | |

Plan administration fees | | | 112 | | |

Compensation of board members | | | 24,048 | | |

Chief compliance officer expenses | | | 58 | | |

Other expenses | | | 189,184 | | |

Trustees' deferred compensation plan | | | 27,623 | | |

Other liabilities | | | 8,357 | | |

Total liabilities | | | 9,814,169 | | |

Net assets applicable to outstanding capital stock | | $ | 1,203,913,069 | | |

Represented by | |

Paid-in capital | | $ | 1,202,079,940 | | |

Undistributed net investment income | | | 4,297,316 | | |

Accumulated net realized loss | | | (18,273,957 | ) | |

Unrealized appreciation (depreciation) on: | |

Investments | | | 15,837,841 | | |

Foreign currency translations | | | (28,071 | ) | |

Total — representing net assets applicable to outstanding capital stock | | $ | 1,203,913,069 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

15

Columbia Emerging Markets Fund

Statement of Assets and Liabilities (continued)

August 31, 2013

Class A | |

Net assets | | $ | 300,600,973 | | |

Shares outstanding | | | 32,915,770 | | |

Net asset value per share | | $ | 9.13 | | |

Maximum offering price per share(a) | | $ | 9.69 | | |

Class B | |

Net assets | | $ | 8,712,980 | | |

Shares outstanding | | | 980,144 | | |

Net asset value per share | | $ | 8.89 | | |

Class C | |

Net assets | | $ | 23,756,062 | | |

Shares outstanding | | | 2,668,451 | | |

Net asset value per share | | $ | 8.90 | | |

Class I | |

Net assets | | $ | 184,936,690 | | |

Shares outstanding | | | 20,078,645 | | |

Net asset value per share | | $ | 9.21 | | |

Class K | |

Net assets | | $ | 506,456 | | |

Shares outstanding | | | 55,239 | | |

Net asset value per share | | $ | 9.17 | | |

Class R | |

Net assets | | $ | 5,862,749 | | |

Shares outstanding | | | 644,625 | | |

Net asset value per share | | $ | 9.09 | | |

Class R4 | |

Net assets | | $ | 37,377 | | |

Shares outstanding | | | 4,043 | | |

Net asset value per share | | $ | 9.24 | | |

Class R5 | |

Net assets | | $ | 1,381,156 | | |

Shares outstanding | | | 149,740 | | |

Net asset value per share | | $ | 9.22 | | |

Class W | |

Net assets | | $ | 31,425,780 | | |

Shares outstanding | | | 3,443,211 | | |

Net asset value per share | | $ | 9.13 | | |

Class Y | |

Net assets | | $ | 464,895 | | |

Shares outstanding | | | 50,296 | | |

Net asset value per share | | $ | 9.24 | | |

Class Z | |

Net assets | | $ | 646,227,951 | | |

Shares outstanding | | | 70,385,677 | | |

Net asset value per share | | $ | 9.18 | | |

(a) The maximum offering price per share is calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge of 5.75%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

16

Columbia Emerging Markets Fund

Statement of Operations

Year Ended August 31, 2013

Net investment income | |

Income: | |

Dividends — unaffiliated issuers | | $ | 22,376,270 | | |

Dividends — affiliated issuers | | | 31,426 | | |

Income from securities lending — net | | | 42,054 | | |

Foreign taxes withheld | | | (2,406,216 | ) | |

Total income | | | 20,043,534 | | |

Expenses: | |

Investment management fees | | | 8,951,551 | | |

Distribution and/or service fees | |

Class A | | | 405,085 | | |

Class B(a) | | | 53,722 | | |

Class C | | | 137,266 | | |

Class R | | | 16,252 | | |

Class W | | | 80,442 | | |

Transfer agent fees | |

Class A | | | 446,288 | | |

Class B(a) | | | 14,703 | | |

Class C | | | 38,158 | | |

Class K(a) | | | 129 | | |

Class R | | | 9,000 | | |

Class R4(b) | | | 29 | | |

Class R5(c) | | | 424 | | |

Class W | | | 94,071 | | |

Class Z | | | 1,018,326 | | |

Administration fees | | | 631,189 | | |

Plan administration fees | |

Class K(a) | | | 647 | | |

Compensation of board members | | | 30,723 | | |

Custodian fees | | | 450,809 | | |

Printing and postage fees | | | 245,022 | | |

Registration fees | | | 115,672 | | |

Professional fees | | | 85,152 | | |

Chief compliance officer expenses | | | 450 | | |

Other | | | 94,108 | | |

Total expenses | | | 12,919,218 | | |

Fees waived or expenses reimbursed by Investment Manager and its affiliates | | | (531,115 | ) | |

Expense reductions | | | (3,600 | ) | |

Total net expenses | | | 12,384,503 | | |

Net investment income | | | 7,659,031 | | |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | |

Investments | | | (4,567,528 | ) | |

Foreign currency translations | | | (2,231,491 | ) | |

Net realized loss | | | (6,799,019 | ) | |

Net change in unrealized appreciation (depreciation) on: | |

Investments | | | (94,693,687 | ) | |

Foreign currency translations | | | (19,088 | ) | |

Foreign capital gains tax | | | 2,002,125 | | |

Net change in unrealized appreciation (depreciation) | | | (92,710,650 | ) | |

Net realized and unrealized loss | | | (99,509,669 | ) | |

Net decrease in net assets from operations | | $ | (91,850,638 | ) | |

(a) Class B shares and Class K shares are for the period from February 28, 2013 (commencement of operations) to August 31, 2013.

(b) Class R4 shares are for the period from March 19, 2013 (commencement of operations) to August 31, 2013.

(c) Class R5 shares are for the period from November 8, 2012 (commencement of operations) to August 31, 2013.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

17

Columbia Emerging Markets Fund

Statement of Changes in Net Assets

| | | Year Ended

August 31,

2013(a) | | Year Ended

August 31,

2012(b) | | Year Ended

March 31,

2012 | |

Operations | |

Net investment income | | $ | 7,659,031 | | | $ | 3,367,642 | | | $ | 3,450,760 | | |

Net realized gain (loss) | | | (6,799,019 | ) | | | (10,607,643 | ) | | | 19,330,314 | | |

Net change in unrealized appreciation (depreciation) | | | (92,710,650 | ) | | | (16,444,132 | ) | | | (65,783,832 | ) | |

Net decrease in net assets resulting from operations | | | (91,850,638 | ) | | | (23,684,133 | ) | | | (43,002,758 | ) | |

Distributions to shareholders | |

Net investment income | |

Class A | | | (52,693 | ) | | | — | | | | — | | |

Class C | | | (4,710 | ) | | | — | | | | — | | |

Class I | | | (1,395,035 | ) | | | — | | | | — | | |

Class R | | | (1,660 | ) | | | — | | | | — | | |

Class R5 | | | (15 | ) | | | — | | | | — | | |

Class W | | | (147,818 | ) | | | — | | | | — | | |

Class Y | | | (16 | ) | | | — | | | | — | | |

Class Z | | | (1,091,744 | ) | | | — | | | | — | | |

Net realized gains | |

Class A | | | — | | | | (512,127 | ) | | | (592,509 | ) | |

Class C | | | — | | | | (127,996 | ) | | | (98,528 | ) | |

Class I | | | — | | | | (10,754,774 | ) | | | (4,482,137 | ) | |

Class R | | | — | | | | (22,097 | ) | | | (121 | ) | |

Class W | | | — | | | | (1,438,404 | ) | | | (2,457,505 | ) | |

Class Z | | | — | | | | (8,210,326 | ) | | | (15,459,948 | ) | |

Total distributions to shareholders | | | (2,693,691 | ) | | | (21,065,724 | ) | | | (23,090,748 | ) | |

Increase (decrease) in net assets from capital stock activity | | | 838,326,071 | | | | 37,390,292 | | | | 37,201,115 | | |

Total increase (decrease) in net assets | | | 743,781,742 | | | | (7,359,565 | ) | | | (28,892,391 | ) | |

Net assets at beginning of year | | | 460,131,327 | | | | 467,490,892 | | | | 496,383,283 | | |

Net assets at end of year | | $ | 1,203,913,069 | | | $ | 460,131,327 | | | $ | 467,490,892 | | |

Undistributed (excess of distributions over) net investment income | | $ | 4,297,316 | | | $ | 2,472,104 | | | $ | (897,513 | ) | |

(a) Class R5 shares and Class Y shares are for the period from November 8, 2012 (commencement of operations) to August 31, 2013.

(b) For the period from April 1, 2012 to August 31, 2012. During the period, the Fund's fiscal year end was changed from March 31 to August 31.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

18

Columbia Emerging Markets Fund

Statement of Changes in Net Assets (continued)

| | | Year Ended August 31,

2013(a)(b)(c) | | Year Ended August 31,

2012(d) | | Year Ended March 31,

2012 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

Capital stock activity | |

Class A shares | |

Subscriptions(e) | | | 2,636,881 | | | | 26,583,598 | | | | 162,311 | | | | 1,508,117 | | | | 555,663 | | | | 5,446,196 | | |

Fund merger | | | 32,834,274 | | | | 343,952,533 | | | | — | | | | — | | | | — | | | | — | | |

Distributions reinvested | | | 4,600 | | | | 47,103 | | | | 53,170 | | | | 458,327 | | | | 44,090 | | | | 458,094 | | |

Redemptions | | | (3,791,329 | ) | | | (37,797,872 | ) | | | (209,407 | ) | | | (1,946,160 | ) | | | (453,183 | ) | | | (4,533,244 | ) | |

Net increase | | | 31,684,426 | | | | 332,785,362 | | | | 6,074 | | | | 20,284 | | | | 146,570 | | | | 1,371,046 | | |

Class B shares | |

Subscriptions | | | 23,449 | | | | 233,508 | | | | — | | | | — | | | | — | | | | — | | |

Fund merger | | | 1,298,485 | | | | 13,280,157 | | | | — | | | | — | | | | — | | | | — | | |

Redemptions(e) | | | (341,790 | ) | | | (3,267,161 | ) | | | — | | | | — | | | | — | | | | — | | |

Net increase | | | 980,144 | | | | 10,246,504 | | | | — | | | | — | | | | — | | | | — | | |

Class C shares | |

Subscriptions | | | 474,898 | | | | 4,689,298 | | | | 66,130 | | | | 597,104 | | | | 196,797 | | | | 1,842,538 | | |

Fund merger | | | 2,350,220 | | | | 24,070,065 | | | | — | | | | — | | | | — | | | | — | | |

Distributions reinvested | | | 434 | | | | 4,355 | | | | 13,992 | | | | 118,375 | | | | 7,347 | | | | 75,603 | | |

Redemptions | | | (474,174 | ) | | | (4,602,908 | ) | | | (55,595 | ) | | | (489,620 | ) | | | (95,911 | ) | | | (934,131 | ) | |

Net increase | | | 2,351,378 | | | | 24,160,810 | | | | 24,527 | | | | 225,859 | | | | 108,233 | | | | 984,010 | | |

Class I shares | |

Subscriptions | | | 535,621 | | | | 5,294,155 | | | | 4,799,454 | | | | 47,189,400 | | | | 17,888,097 | | | | 179,326,082 | | |

Fund merger | | | 1,255 | | | | 13,231 | | | | — | | | | — | | | | — | | | | — | | |

Distributions reinvested | | | 135,571 | | | | 1,395,022 | | | | 1,241,880 | | | | 10,754,682 | | | | 430,963 | | | | 4,482,016 | | |

Redemptions | | | (6,842,882 | ) | | | (67,045,926 | ) | | | (1,156,924 | ) | | | (10,483,515 | ) | | | (6,063,738 | ) | | | (63,290,156 | ) | |

Net increase (decrease) | | | (6,170,435 | ) | | | (60,343,518 | ) | | | 4,884,410 | | | | 47,460,567 | | | | 12,255,322 | | | | 120,517,942 | | |

Class K shares | |

Subscriptions | | | 267 | | | | 2,768 | | | | — | | | | — | | | | — | | | | — | | |

Fund merger | | | 56,204 | | | | 589,942 | | | | — | | | | — | | | | — | | | | — | | |

Redemptions | | | (1,232 | ) | | | (12,270 | ) | | | — | | | | — | | | | — | | | | — | | |

Net increase | | | 55,239 | | | | 580,440 | | | | — | | | | — | | | | — | | | | — | | |

Class R shares | |

Subscriptions | | | 180,415 | | | | 1,796,815 | | | | 4,178 | | | | 38,451 | | | | 54,120 | | | | 491,245 | | |

Fund merger | | | 604,088 | | | | 6,305,185 | | | | — | | | | — | | | | — | | | | — | | |

Distributions reinvested | | | 162 | | | | 1,653 | | | | 2,559 | | | | 22,006 | | | | — | | | | — | | |

Redemptions | | | (194,289 | ) | | | (1,947,977 | ) | | | (3,907 | ) | | | (35,413 | ) | | | (2,915 | ) | | | (28,812 | ) | |

Net increase | | | 590,376 | | | | 6,155,676 | | | | 2,830 | | | | 25,044 | | | | 51,205 | | | | 462,433 | | |

Class R4 shares | |

Subscriptions | | | 4,043 | | | | 41,531 | | | | — | | | | — | | | | — | | | | — | | |

Net increase | | | 4,043 | | | | 41,531 | | | | — | | | | — | | | | — | | | | — | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

19

Columbia Emerging Markets Fund

Statement of Changes in Net Assets (continued)

| | | Year Ended August 31,

2013(a)(b)(c) | | Year Ended August 31,

2012(d) | | Year Ended March 31,

2012 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

Capital stock activity (continued) | |

Class R5 shares | |

Subscriptions | | | 157,427 | | | | 1,641,613 | | | | — | | | | — | | | | — | | | | — | | |

Fund merger | | | 7,415 | | | | 78,238 | | | | — | | | | — | | | | — | | | | — | | |

Redemptions | | | (15,102 | ) | | | (150,186 | ) | | | — | | | | — | | | | — | | | | — | | |

Net increase | | | 149,740 | | | | 1,569,665 | | | | — | | | | — | | | | — | | | | — | | |

Class W shares | |

Subscriptions | | | 1,198,209 | | | | 11,876,193 | | | | 592,737 | | | | 5,381,728 | | | | 2,191,717 | | | | 22,357,223 | | |

Fund merger | | | 2,037 | | | | 21,335 | | | | — | | | | — | | | | — | | | | — | | |

Distributions reinvested | | | 14,449 | | | | 147,809 | | | | 166,858 | | | | 1,438,313 | | | | 236,514 | | | | 2,457,384 | | |

Redemptions | | | (1,239,286 | ) | | | (12,558,608 | ) | | | (377,133 | ) | | | (3,465,882 | ) | | | (3,750,857 | ) | | | (36,168,400 | ) | |

Net increase (decrease) | | | (24,591 | ) | | | (513,271 | ) | | | 382,462 | | | | 3,354,159 | | | | (1,322,626 | ) | | | (11,353,793 | ) | |

Class Y shares | |

Subscriptions | | | 77,955 | | | | 746,157 | | | | — | | | | — | | | | — | | | | — | | |

Redemptions | | | (27,659 | ) | | | (268,119 | ) | | | — | | | | — | | | | — | | | | — | | |

Net increase | | | 50,296 | | | | 478,038 | | | | — | | | | — | | | | — | | | | — | | |

Class Z shares | |

Subscriptions | | | 60,811,078 | | | | 617,216,504 | | | | 941,857 | | | | 8,507,338 | | | | 3,480,320 | | | | 34,454,928 | | |

Fund merger | | | 294,617 | | | | 3,095,702 | | | | — | | | | — | | | | — | | | | — | | |

Distributions reinvested | | | 64,663 | | | | 664,735 | | | | 635,329 | | | | 5,495,596 | | | | 889,517 | | | | 9,250,974 | | |

Redemptions | | | (9,939,321 | ) | | | (97,812,107 | ) | | | (3,000,548 | ) | | | (27,698,555 | ) | | | (12,230,897 | ) | | | (118,486,425 | ) | |

Net increase (decrease) | | | 51,231,037 | | | | 523,164,834 | | | | (1,423,362 | ) | | | (13,695,621 | ) | | | (7,861,060 | ) | | | (74,780,523 | ) | |

Total net increase | | | 80,901,653 | | | | 838,326,071 | | | | 3,876,941 | | | | 37,390,292 | | | | 3,377,644 | | | | 37,201,115 | | |

(a) Class B and Class K shares are for the period from February 28, 2013 (commencement of operations) to August 31, 2013.

(b) Class R4 shares are for the period from March 19, 2013 (commencement of operations) to August 31, 2013.

(c) Class R5 and Class Y shares are for the period from November 8, 2012 (commencement of operations) to August 31, 2013.

(d) For the period from April 1, 2012 to August 31, 2012. During the period, the Fund's fiscal year end was changed from March 31 to August 31.

(e) Includes conversions of Class B shares to Class A shares, if any.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2013

20

Columbia Emerging Markets Fund

The following tables are intended to help you understand the Fund's financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any, and is not annualized for periods of less than one year.

| | | Year Ended August 31, | | Year Ended March 31, | |

Class A | | 2013 | | 2012(a) | | 2012 | | 2011 | | 2010 | | 2009 | |

Per share data | |

Net asset value, beginning of period | | $ | 9.08 | | | $ | 10.01 | | | $ | 11.48 | | | $ | 11.27 | | | $ | 6.42 | | | $ | 14.96 | | |

Income from investment operations: | |

Net investment income (loss) | | | 0.14 | | | | 0.05 | | | | 0.05 | | | | 0.01 | | | | (0.01 | ) | | | 0.07 | | |

Net realized and unrealized gain (loss) | | | (0.05 | ) | | | (0.55 | ) | | | (0.95 | ) | | | 1.75 | | | | 5.00 | | | | (6.36 | ) | |

Total from investment operations | | | 0.09 | | | | (0.50 | ) | | | (0.90 | ) | | | 1.76 | | | | 4.99 | | | | (6.29 | ) | |

Less distributions to shareholders: | |

Net investment income | | | (0.04 | ) | | | — | | | | — | | | | (0.09 | ) | | | (0.14 | ) | | | — | | |

Net realized gains | | | — | | | | (0.43 | ) | | | (0.57 | ) | | | (1.46 | ) | | | — | | | | (2.26 | ) | |

Total distributions to shareholders | | | (0.04 | ) | | | (0.43 | ) | | | (0.57 | ) | | | (1.55 | ) | | | (0.14 | ) | | | (2.26 | ) | |

Redemption fees: | |

Redemption fees added to paid-in capital | | | — | | | | — | | | | — | | | | — | | | | 0.00 | (b) | | | 0.01 | | |

Net asset value, end of period | | $ | 9.13 | | | $ | 9.08 | | | $ | 10.01 | | | $ | 11.48 | | | $ | 11.27 | | | $ | 6.42 | | |

Total return | | | 0.98 | % | | | (4.80 | %) | | | (8.06 | %) | | | 16.74 | % | | | 78.17 | % | | | (49.44 | %) | |

Ratios to average net assets(c)(d) | |

Total gross expenses | | | 1.76 | % | | | 2.08 | %(e) | | | 2.08 | %(f) | | | 1.96 | %(f) | | | 1.77 | %(f) | | | 2.14 | %(g) | |