UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04413 | |

| Exact name of registrant as specified in charter: | Delaware Group® Equity Funds IV | |

| Address of principal executive offices: | 610 Market Street | |

| Philadelphia, PA 19106 | ||

| Name and address of agent for service: | David F. Connor, Esq. | |

| 610 Market Street | ||

| Philadelphia, PA 19106 | ||

| Registrant’s telephone number, including area code: | (800) 523-1918 | |

| Date of fiscal year end: | March 31 | |

| Date of reporting period: | March 31, 2021 |

Item 1. Reports to Stockholders

|  |

Annual report

Alternative / specialty mutual fund

Delaware Healthcare Fund

March 31, 2021

Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Fund’s shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by signing up at delawarefunds.com/edelivery. If you own these shares through a financial intermediary, you may contact your financial intermediary. You may elect to receive paper copies of all future shareholder reports free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at 800 523-1918. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Delaware Funds® by Macquarie or your financial intermediary. |

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

Visit delawarefunds.com/edelivery.

Experience Delaware Funds® by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices in the United States, Europe, Asia, and Australia. As active managers, we prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 80 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Healthcare Fund at delawarefunds.com/literature.

Manage your account online

| ● | Check your account balance and transactions |

| ● | View statements and tax forms |

| ● | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

The Fund is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Fund is governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of March 31, 2021, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2021 Macquarie Management Holdings, Inc.

| Portfolio management review | |

| Delaware Healthcare Fund | March 31, 2021 (Unaudited) |

Performance preview (for the year ended March 31, 2021)

| Delaware Healthcare Fund (Institutional Class shares) | 1-year return | +28.91% | ||

| Delaware Healthcare Fund (Class A shares) | 1-year return | +28.55% | ||

| Russell 3000® Healthcare Index (benchmark) | 1-year return | +39.92% |

For complete, annualized performance for Delaware Healthcare Fund, please see the table on page 4. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee. The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions. Please see page 6 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks maximum long-term capital growth through capital appreciation.

Market review

The healthcare sector continued to experience significant challenges during the fiscal year ended March 31, 2021, even as concern about the economic impact of the COVID-19 pandemic subsided. The period began with a rebound for the broader healthcare sector. Pharmaceutical, diagnostic, and biotechnology companies that addressed the pandemic through testing, vaccine development, and drug therapies saw positive returns. Elsewhere in the healthcare universe, managed care and healthcare services companies rebounded as fear eased that lockdowns would disrupt clinical trials, routine medical care, and procedures. In November, the election of US President Joe Biden reignited concerns about increased regulatory pressure and drug-pricing reform once the new administration took office. Additionally, the Food and Drug Administration has delayed several drug approvals. On a positive note, several biotechnology companies performed well while the pace of COVID-19 vaccinations ramped up in the United States.

We continue putting a premium on disciplined, intensive research when analyzing investment opportunities for the Fund. We favor companies that exhibit such traits as:

| ● | proven competitiveness |

| ● | seasoned management teams |

| ● | stock valuations that are discounted meaningfully from our estimates of intrinsic value. |

These characteristics are part of our daily considerations as we follow our conservative, stock-by-stock approach to portfolio management.

1

Portfolio management review

Delaware Healthcare Fund

Within the Fund

For the fiscal year ended March 31, 2021, Delaware Healthcare Fund underperformed its benchmark, the Russell 3000 Healthcare Index. The Fund’s Institutional Class shares returned 28.91%. The Fund’s Class shares advanced 28.55% at net asset value and 21.15% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the benchmark returned 39.92%. For complete, annualized performance of Delaware Healthcare Fund, please see the table on page 4.

Among sectors, the Fund’s holdings in the blue-chip medical products sector detracted the most from relative performance. Unfavorable stock selection outweighed favorable asset allocation. The Fund’s large overweight position in Roche Holding AG also detracted from relative performance as shares of the company performed in line with the broader healthcare sector. The Fund’s overweight position in Sanofi also underperformed during the period due to skepticism over the company’s pipeline and the value of its research and development (R&D) program. We believe that there are structural growth opportunities for Sanofi in certain areas such as its vaccine business. We also think that cost-efficiency improvements the company has made have been undervalued. Chugai Pharmaceutical Co. Ltd. detracted from relative performance due to lack of near-term catalysts. Chugai Pharmaceutical is among the strongest franchises in Japan and is also partnered with Roche, allowing Chugai to benefit from both companies’ pipelines. We believe the company continues to have an attractive platform of hemophilia and oncology drugs. In contrast, the Fund’s underweight positions in Merck & Co. Inc., Johnson & Johnson, and Pfizer Inc. contributed to relative performance as all three of these companies underperformed during the period.

The Fund’s holdings in the small- and mid-cap medical products sector also detracted from relative performance due to unfavorable asset allocation and stock selection. The Fund’s overweight position in Viatris Inc. was the main detractor from performance in the sector. The company provided earnings guidance for the year that was below investors’ expectations. Despite these short-term setbacks, Viatris remains among the best franchises in the industry for generic pharmaceuticals and we believe the company is well-positioned for growth as demand for generics increases. The Fund’s underweight to Align Technology Inc. and Danaher Corp. was negative in terms of asset allocation. Shares of Intra-Cellular Therapies Inc. were a bright spot in the sector. Shares of the company outperformed after it announced positive data in a Phase 3 study for treating patients with bipolar and related disorders. Shares of Halozyme Therapeutics Inc. also performed well after the company reported strong quarterly results and raised revenue guidance for the following year due to stronger-than-expected sales of Darzalex, which is used to treat multiple myeloma.

In the biotechnology sector, unfavorable stock selection overwhelmed positive asset allocation. The Fund’s overweight position in uniQure NV was the largest detractor from relative performance in the sector. Shares of the company underperformed in June after the market reacted unfavorably to the announcement that CSL Behring would acquire exclusive commercialization rights to uniQure’s gene-therapy program. Despite this near-term underperformance, uniQure remains the market leader in gene therapy, and recent clinical trials indicate promise for success in its gene-therapy platform. The Fund’s overweight position in MorphoSys AG also detracted from performance. Shares of the company declined after it reported quarterly earnings that were below investors’ expectations. MorphoSys remains one of the few

2

antibody technology platforms that has not been acquired by a large pharmaceutical company and has demonstrated continued progress on its own proprietary cancer pipeline. Shares of Regeneron Pharmaceuticals Inc. underperformed after the stock reached all-time highs earlier in the period as investor excitement waned slightly. We continue to believe that the company is undervalued and trades at a significant discount to its intrinsic value. In contrast, shares of Mirati Therapeutics Inc. outperformed after investors became excited about prospects for one of its pipeline drugs. Shares of Immunomedics Inc. rose in September when Gilead announced a planned acquisition of the firm. Finally, shares of MacroGenics Inc. outperformed as investors became excited about several drugs in the company’s pipeline.

Among non-healthcare companies, a large overweight position in Micron Technology Inc. in the US contributed the most to the Fund’s performance. Shares rose due to rising prices of dynamic random access memory (DRAM).

Outlook

For global healthcare investors, there are risks that short-term legislative and judicial action could overshadow the positive long-term fundamentals of the sector and of specific companies. We continue to see tremendous long-term opportunities in the global healthcare asset class. The baby-boom generation in the US is aging, implying expanding demand for healthcare products and services for decades to come. At the same time, middle classes in countries with emerging economies (notably India and China) are growing rapidly, creating big appetites for Western-style medicine. We remain positive on the sector and its growth opportunities.

We believe that healthcare remains one of the few growth sectors in the economy. We continue to see what we view as many attractive opportunities in the sector, particularly in biotechnology, where we see potential for continued innovation in cancer treatments and gene therapy technology. We remain overweight in the biotechnology sector, particularly in small to mid-cap companies, where we see potential for technological breakthroughs.

We continue putting a premium on disciplined, intensive research when analyzing investment opportunities for the Fund. We favor companies that exhibit such traits as:

| ● | proven competitiveness |

| ● | seasoned management teams |

| ● | stock valuations that are discounted meaningfully from our estimates of intrinsic value. |

These characteristics are part of our daily considerations as we follow our conservative, stock-by-stock approach to portfolio management.

Delaware Healthcare Fund used derivatives, foreign currency exchange contracts, during the fiscal year. However, these had a minimal effect on performance.

3

| Performance summary | |

| Delaware Healthcare Fund | March 31, 2021 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through March 31, 2021 | ||||||||

| 1 year | 5 year | 10 year | Lifetime | ||||||

| Class A (Est. September 28, 2007) | |||||||||

| Excluding sales charge | +28.55% | +14.15% | +14.83% | +15.83% | |||||

| Including sales charge | +21.15% | +12.80% | +14.15% | +15.32% | |||||

| Class C (Est. January 28, 2010) | |||||||||

| Excluding sales charge | +27.62% | +13.30% | +13.98% | +14.64% | |||||

| Including sales charge | +26.62% | +13.30% | +13.98% | +14.64% | |||||

| Class R (Est. January 28, 2010) | |||||||||

| Excluding sales charge | +28.30% | +13.87% | +14.55% | +15.21% | |||||

| Including sales charge | +28.30% | +13.87% | +14.55% | +15.21% | |||||

| Institutional Class (Est. September 28, 2007) | |||||||||

| Excluding sales charge | +28.91% | +14.43% | +15.12% | +16.07% | |||||

| Including sales charge | +28.91% | +14.43% | +15.12% | +16.07% | |||||

| Russell 3000 Healthcare Index | +39.92% | +15.02% | +16.13% | +12.16% | * | ||||

| * | The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date. |

| 1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 5. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

4

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

Healthcare companies are subject to extensive government regulation and their profitability can be affected by restrictions on government reimbursement for medical expenses, rising costs of medical products and services, pricing pressure, and malpractice or other litigation.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

“Non-diversified” funds may allocate more of their net assets to investments in single securities than “diversified” funds. Resulting adverse effects may subject these funds to greater risks and volatility.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| Institutional | ||||||||

| Fund expense ratios | Class A | Class C | Class R | Class | ||||

| Total annual operating expenses | ||||||||

| (without fee waivers) | 1.27% | 2.02% | 1.52% | 1.02% | ||||

| Net expenses (including fee | ||||||||

| waivers, if any) | 1.27% | 2.02% | 1.52% | 1.02% | ||||

| Type of waiver | n/a | n/a | n/a | n/a |

5

Performance summary

Delaware Healthcare Fund

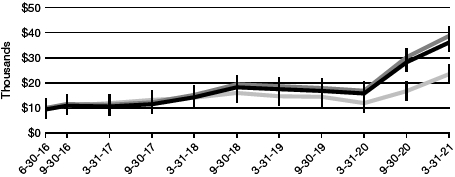

Performance of a $10,000 Investment1

Average annual total returns from March 31, 2011 through March 31, 2021

| For period beginning March 31, 2011 through March 31, 2021 | Starting value | Ending value | |||||||

| Russell 3000 Healthcare Index | $10,000 | $44,615 | ||||||

| Delaware Healthcare Fund — Institutional Class shares | $10,000 | $40,883 | ||||||

| Delaware Healthcare Fund — Class A shares | $9,425 | $37,572 | ||||||

| 1 | The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on March 31, 2011, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 5. Please note additional details on pages 4 through 7. |

The graph also assumes $10,000 invested in the Russell 3000 Healthcare Index as of March 31, 2011. The Russell 3000 Healthcare Index measures the performance of all healthcare holdings included in the Russell 3000 Index, which represents the 3,000 largest US companies based on total market capitalization.

Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

6

| Nasdaq symbols | CUSIPs | |||

| Class A | DLHAX | 24610E101 | ||

| Class C | DLHCX | 24610E200 | ||

| Class R | DLRHX | 24610E309 | ||

| Institutional Class | DLHIX | 24610E408 |

7

Disclosure of Fund expenses

For the six-month period from October 1, 2020 to March 31, 2021 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from October 1, 2020 to March 31, 2021.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table assume reinvestment of all dividends and distributions.

8

Delaware Healthcare Fund

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | |||||||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | ||||||||||||||||

| 10/1/20 | 3/31/21 | Expense Ratio | 10/1/20 to 3/31/21* | ||||||||||||||||

| Actual Fund return† | |||||||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,070.10 | 1.21% | $ | 6.24 | ||||||||||||

| Class C | 1,000.00 | 1,066.60 | 1.96% | 10.10 | |||||||||||||||

| Class R | 1,000.00 | 1,069.10 | 1.46% | 7.53 | |||||||||||||||

| Institutional Class | 1,000.00 | 1,071.60 | 0.96% | 4.96 | |||||||||||||||

| Hypothetical 5% return (5% return before expenses) | |||||||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,018.90 | 1.21% | $ | 6.09 | ||||||||||||

| Class C | 1,000.00 | 1,015.16 | 1.96% | 9.85 | |||||||||||||||

| Class R | 1,000.00 | 1,017.65 | 1.46% | 7.34 | |||||||||||||||

| Institutional Class | 1,000.00 | 1,020.14 | 0.96% | 4.84 | |||||||||||||||

| * | “Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

In addition to the Fund’s expenses reflected above, the Fund also indirectly bears its portion of the fees and expenses of the investment companies (Underlying Funds) in which it invests. The table above does not reflect the expenses of the Underlying Funds.

9

| Security type / sector allocations and top 10 equity holdings | |

| Delaware Healthcare Fund | As of March 31, 2021 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| Security type / sector | Percentage of net assets | ||||

| Common Stock ◆ | 101.28% | ||||

| Biotechnology | 32.97% | ||||

| Blue Chip Medical Products | 39.67% | ||||

| Healthcare Services | 8.40% | ||||

| Other | 12.67% | ||||

| Small- / Mid-Cap Medical Products | 7.57% | ||||

| Rights | 0.00% | ||||

| Total Value of Securities | 101.28% | ||||

| Liabilities Net of Receivables and Other Assets | (1.28% | ) | |||

| Total Net Assets | 100.00% | ||||

| ◆ | Narrow industries are utilized for compliance purposes for diversification whereas broad sectors are used for financial reporting. |

To monitor compliance with the Fund’s concentration guidelines as described in the Fund’s prospectus and Statement of Additional Information, the Biotechnology and Blue Chip Medical Products sector (as disclosed herein for financial reporting purposes) are subdivided into a variety of “industries” (in accordance with the requirements of the Investment Company Act of 1940 (1940 Act), as amended). The Biotechnology sector consisted of biotechnology and pharmaceuticals. As of September 30, 2020, such amounts, as a percentage of total net assets, were 27.33% and 5.64% respectively. The Blue Chip Medical Products sector consisted of biotechnology, healthcare-products, and pharmaceuticals. As of September 30, 2020 such amounts, as a percentage of total net assets, were 7.56%, 2.72%, and 29.39% respectively. The percentage in any such single industry will comply with the Fund’s concentration policy even if the percentages in the Biotechnology and Blue Chip Medical Products sectors for financial reporting purposes may exceed 25%.

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 equity holdings | Percentage of net assets | |

| Micron Technology | 9.02% | |

| Sanofi ADR | 5.87% | |

| Amgen | 5.36% | |

| Roche Holding | 5.08% | |

| UnitedHealth Group | 3.89% | |

| Regeneron Pharmaceuticals | 3.71% | |

| Arena Pharmaceuticals | 3.18% | |

| Eli Lilly and Co. | 2.77% | |

| Anthem | 2.74% | |

| Illumina | 2.68% |

10

| Schedule of investments | |

| Delaware Healthcare Fund | March 31, 2021 |

| Number of shares | Value (US $) | |||||

| Common Stock – 101.28% ◆ | ||||||

| Biotechnology – 32.97% | ||||||

| ACADIA Pharmaceuticals † | 160,000 | $ | 4,128,000 | |||

| Alder Biopharmaceuticals =, † | 75,000 | 66,000 | ||||

| Alexion Pharmaceuticals † | 20,000 | 3,058,200 | ||||

| Alkermes † | 423,142 | 7,904,293 | ||||

| Allogene Therapeutics † | 146,779 | 5,181,299 | ||||

| Alnylam Pharmaceuticals † | 41,000 | 5,788,790 | ||||

| Amarin ADR † | 190,000 | 1,179,900 | ||||

| AnaptysBio † | 93,732 | 2,019,925 | ||||

| Arcus Biosciences † | 461,200 | 12,950,496 | ||||

| Arena Pharmaceuticals † | 525,000 | 36,429,750 | ||||

| Athenex † | 70,000 | 301,000 | ||||

| BioMarin Pharmaceutical † | 124,000 | 9,363,240 | ||||

| Cellectis ADR † | 226,875 | 4,585,144 | ||||

| Clovis Oncology † | 250,200 | 1,756,404 | ||||

| Coherus Biosciences † | 430,000 | 6,282,300 | ||||

| Dynavax Technologies † | 760,000 | 7,470,800 | ||||

| Epizyme † | 203,200 | 1,769,872 | ||||

| Exact Sciences † | 96,353 | 12,697,398 | ||||

| Five Prime Therapeutics † | 100,000 | 3,767,000 | ||||

| Forma Therapeutics Holdings † | 92,786 | 2,599,864 | ||||

| Fortress Biotech † | 100,000 | 353,000 | ||||

| Galmed Pharmaceuticals † | 306,010 | 1,049,614 | ||||

| Incyte † | 80,000 | 6,501,600 | ||||

| Intellia Therapeutics † | 20,000 | 1,605,100 | ||||

| Intercept Pharmaceuticals † | 27,000 | 623,160 | ||||

| Karyopharm Therapeutics † | 380,000 | 3,997,600 | ||||

| Landos Biopharma † | 147,182 | 1,417,363 | ||||

| MacroGenics † | 420,000 | 13,377,000 | ||||

| Madrigal Pharmaceuticals † | 28,500 | 3,333,645 | ||||

| MEI Pharma † | 600,000 | 2,058,000 | ||||

| Mersana Therapeutics † | 150,000 | 2,427,000 | ||||

| Mirati Therapeutics † | 60,000 | 10,278,000 | ||||

| MorphoSys † | 300,000 | 26,132,447 | ||||

| Mustang Bio † | 120,000 | 398,400 | ||||

| Myriad Genetics † | 135,000 | 4,110,750 | ||||

| Nektar Therapeutics † | 256,385 | 5,127,700 | ||||

| Neurocrine Biosciences † | 110,000 | 10,697,500 | ||||

| NextCure † | 150,000 | 1,501,500 | ||||

| ProQR Therapeutics † | 620,000 | 4,098,200 | ||||

| Provention Bio † | 70,000 | 734,650 | ||||

| Puma Biotechnology † | 61,255 | 595,399 | ||||

| Regeneron Pharmaceuticals † | 90,000 | 42,582,600 | ||||

11

Schedule of investments

Delaware Healthcare Fund

| Number of shares | Value (US $) | |||||

| Common Stock ◆ (continued) | ||||||

| Biotechnology (continued) | ||||||

| REGENXBIO † | 149,000 | $ | 5,082,390 | |||

| Rigel Pharmaceuticals † | 1,600,000 | 5,472,000 | ||||

| Rocket Pharmaceuticals † | 58,000 | 2,573,460 | ||||

| Sangamo Therapeutics † | 400,000 | 5,012,000 | ||||

| Sarepta Therapeutics † | 13,000 | 968,890 | ||||

| Seagen † | 80,000 | 11,108,800 | ||||

| Sio Gene Therapies † | 64,171 | 167,486 | ||||

| Surface Oncology † | 350,000 | 2,730,000 | ||||

| Syndax Pharmaceuticals † | 180,000 | 4,024,800 | ||||

| Translate Bio † | 456,300 | 7,524,387 | ||||

| Ultragenyx Pharmaceutical † | 70,000 | 7,970,200 | ||||

| uniQure † | 706,166 | 23,790,732 | ||||

| United Therapeutics † | 86,800 | 14,519,036 | ||||

| Vascular Biogenics † | 200,000 | 400,000 | ||||

| Vertex Pharmaceuticals † | 25,000 | 5,372,250 | ||||

| Viking Therapeutics † | 330,100 | 2,087,882 | ||||

| Voyager Therapeutics † | 5,700 | 26,847 | ||||

| WaVe Life Sciences † | 81,955 | 459,768 | ||||

| Xencor † | 129,191 | 5,562,964 | ||||

| XOMA † | 3,466 | 141,447 | ||||

| Yumanity Therapeutics † | 37,500 | 678,750 | ||||

| Yumanity Therapeutics =, † | 750,000 | 0 | ||||

| 377,973,992 | ||||||

| Blue Chip Medical Products – 39.67% | ||||||

| AbbVie | 226,559 | 24,518,215 | ||||

| Amgen | 246,964 | 61,447,113 | ||||

| AstraZeneca | 110,000 | 10,989,786 | ||||

| Biogen † | 45,000 | 12,588,750 | ||||

| Boston Scientific † | 380,000 | 14,687,000 | ||||

| Bristol-Myers Squibb | 180,000 | 11,363,400 | ||||

| Chugai Pharmaceutical | 700,000 | 28,379,318 | ||||

| Eli Lilly and Co. | 170,000 | 31,759,400 | ||||

| Gilead Sciences | 195,000 | 12,602,850 | ||||

| GlaxoSmithKline | 300,000 | 5,326,910 | ||||

| GlaxoSmithKline ADR | 309,300 | 11,038,917 | ||||

| Johnson & Johnson | 100,000 | 16,435,000 | ||||

| Merck & Co. | 295,000 | 22,741,550 | ||||

| Pfizer | 604,600 | 21,904,658 | ||||

| Roche Holding | 180,000 | 58,171,719 | ||||

| Sanofi | 200,000 | 19,759,995 | ||||

| Sanofi ADR | 1,360,000 | 67,265,600 | ||||

| Stryker | 15,000 | 3,653,700 | ||||

12

| Number of shares | Value (US $) | |||||

| Common Stock ◆ (continued) | ||||||

| Blue Chip Medical Products (continued) | ||||||

| UCB | 76,000 | $ | 7,229,836 | |||

| Zimmer Biomet Holdings | 80,000 | 12,806,400 | ||||

| 454,670,117 | ||||||

| Healthcare Services – 8.40% | ||||||

| Anthem | 87,500 | 31,408,125 | ||||

| Change Healthcare † | 25,532 | 564,257 | ||||

| CVS Health | 180,000 | 13,541,400 | ||||

| Quest Diagnostics | 48,000 | 6,160,320 | ||||

| UnitedHealth Group | 120,000 | 44,648,400 | ||||

| 96,322,502 | ||||||

| Other – 12.67% | ||||||

| Bumble Class A † | 1,366 | 85,211 | ||||

| Cia de Minas Buenaventura ADR † | 66,353 | 665,520 | ||||

| Compugen † | 690,000 | 5,927,100 | ||||

| DigitalOcean Holdings † | 1,000 | 42,130 | ||||

| Fannie Mae † | 1,300,000 | 2,691,000 | ||||

| Federal Home Loan Mortgage † | 1,050,000 | 2,152,500 | ||||

| Micron Technology † | 1,172,000 | 103,382,120 | ||||

| SK Telecom ADR | 885,805 | 24,120,470 | ||||

| Sohu.com ADR † | 390,722 | 6,142,150 | ||||

| 145,208,201 | ||||||

| Small- / Mid-Cap Medical Products – 7.57% | ||||||

| Aerie Pharmaceuticals † | 5,100 | 91,137 | ||||

| Halozyme Therapeutics † | 230,000 | 9,588,700 | ||||

| Illumina † | 80,000 | 30,724,800 | ||||

| InnoCare Pharma 144A #, † | 17,000 | 39,711 | ||||

| Inspire Medical Systems † | 30,000 | 6,209,700 | ||||

| Intra-Cellular Therapies † | 450,000 | 15,268,500 | ||||

| Perrigo | 210,000 | 8,498,700 | ||||

| Viatris † | 1,170,018 | 16,345,152 | ||||

| 86,766,400 | ||||||

| Total Common Stock (cost $848,651,715) | 1,160,941,212 | |||||

13

Schedule of investments

Delaware Healthcare Fund

| Number of shares | Value (US $) | |||||

| Rights – 0.00% | ||||||

| Ambit Bioscience =, † | 76,500 | $ | 0 | |||

| Total Rights (cost $0) | 0 | |||||

| Total Value of Securities–101.28% | ||||||

| (cost $848,651,715) | $ | 1,160,941,212 | ||||

| ◆ | Narrow industries are utilized for compliance purposes for diversification whereas broad sectors are used for financial reporting. |

| † | Non-income producing security. |

| = | The value of this security was determined using significant unobservable inputs and is reported as a Level 3 security in the disclosure table located in Note 3 in “Notes to financial statements.” |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At March 31, 2021, the aggregate value of Rule 144A securities was $39,711, which represents 0.00% of the Fund’s net assets. See Note 10 in “Notes to financial statements.” |

Summary of abbreviations:

ADR – American Depositary Receipt

See accompanying notes, which are an integral part of the financial statements.

14

| Statement of assets and liabilities | |

| Delaware Healthcare Fund | March 31, 2021 |

| Assets: | ||||

| Investments, at value* | $ | 1,160,941,212 | ||

| Receivable for fund shares sold | 2,398,353 | |||

| Foreign tax reclaims receivable | 1,220,612 | |||

| Dividends receivable | 598,011 | |||

| Total Assets | 1,165,158,188 | |||

| Liabilities: | ||||

| Due to custodian | 14,997,726 | |||

| Payable for fund shares redeemed | 2,582,951 | |||

| Investment management fees payable to affiliates | 806,607 | |||

| Other accrued expenses | 330,749 | |||

| Distribution fees payable to affiliates | 172,208 | |||

| Dividend disbursing and transfer agent fees and expenses payable to affiliates | 8,247 | |||

| Trustees’ fees and expenses payable to affiliates | 6,596 | |||

| Audit and tax fees payable | 5,500 | |||

| Accounting and administration expenses payable to affiliates | 3,649 | |||

| Reports and statements to shareholders expenses payable to affiliates | 1,648 | |||

| Legal fees payable to affiliates | 1,458 | |||

| Total Liabilities | 18,917,339 | |||

| Total Net Assets | $ | 1,146,240,849 | ||

| Net Assets Consist of: | ||||

| Paid-in capital | $ | 837,784,842 | ||

| Total distributable earnings (loss) | 308,456,007 | |||

| Total Net Assets | $ | 1,146,240,849 | ||

15

Statement of assets and liabilities

Delaware Healthcare Fund

| Net Asset Value | ||||

| Class A: | ||||

| Net assets | $ | 344,530,877 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 12,432,190 | |||

| Net asset value per share | $ | 27.71 | ||

| Sales charge | 5.75 | % | ||

| Offering price per share, equal to net asset value per share / (1 - sales charge) | $ | 29.40 | ||

| Class C: | ||||

| Net assets | $ | 112,012,564 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 4,332,249 | |||

| Net asset value per share | $ | 25.86 | ||

| Class R: | ||||

| Net assets | $ | 4,866,827 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 178,565 | |||

| Net asset value per share | $ | 27.26 | ||

| Institutional Class: | ||||

| Net assets | $ | 684,830,581 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 24,523,535 | |||

| Net asset value per share | $ | 27.93 | ||

| ____________________ | ||||

| * Investments, at cost | $ | 848,651,715 |

See accompanying notes, which are an integral part of the financial statements.

16

| Statement of operations | |

| Delaware Healthcare Fund | Year ended March 31, 2021 |

| Investment Income: | |||||

| Dividends | $ | 16,856,724 | |||

| Foreign tax withheld | (933,465 | ) | |||

| 15,923,259 | |||||

| Expenses: | |||||

| Management fees | 9,634,541 | ||||

| Distribution expenses – Class A | 848,823 | ||||

| Distribution expenses – Class C | 1,200,288 | ||||

| Distribution expenses – Class R | 25,287 | ||||

| Dividend disbursing and transfer agent fees and expenses | 1,198,602 | ||||

| Accounting and administration expenses | 231,517 | ||||

| Custodian fees | 167,123 | ||||

| Reports and statements to shareholders expenses | 134,576 | ||||

| Registration fees | 73,021 | ||||

| Trustees’ fees and expenses | 66,865 | ||||

| Legal fees | 61,329 | ||||

| Audit and tax fees | 51,859 | ||||

| Other | 37,570 | ||||

| 13,731,401 | |||||

| Less expenses paid indirectly | (1,022 | ) | |||

| Total operating expenses | 13,730,379 | ||||

| Net Investment Income | 2,192,880 | ||||

| Net Realized and Unrealized Gain (Loss): | |||||

| Net realized gain (loss) on: | |||||

| Investments | 41,601,944 | ||||

| Foreign currencies | (94,843 | ) | |||

| Foreign currency exchange contracts | 15,213 | ||||

| Net realized gain | 41,522,314 | ||||

| Net change in unrealized appreciation (depreciation) of: | |||||

| Investments | 227,038,211 | ||||

| Foreign currencies | 17,247 | ||||

| Net change in unrealized appreciation (depreciation) | 227,055,458 | ||||

| Net Realized and Unrealized Gain | 268,577,772 | ||||

| Net Increase in Net Assets Resulting from Operations | $ | 270,770,652 | |||

See accompanying notes, which are an integral part of the financial statements.

17

Statements of changes in net assets

Delaware Healthcare Fund

| Year ended | |||||||||

| 3/31/21 | 3/31/20 | ||||||||

| Increase (Decrease) in Net Assets from Operations: | |||||||||

| Net investment income | $ | 2,192,880 | $ | 1,826,275 | |||||

| Net realized gain | 41,522,314 | 79,685,586 | |||||||

| Net change in unrealized appreciation (depreciation) | 227,055,458 | (79,428,868 | ) | ||||||

| Net increase in net assets resulting from operations | 270,770,652 | 2,082,993 | |||||||

| Dividends and Distributions to Shareholders from: | |||||||||

| Distributable earnings: | |||||||||

| Class A | (18,672,006 | ) | (23,247,550 | ) | |||||

| Class C | (6,749,762 | ) | (8,927,434 | ) | |||||

| Class R | (251,007 | ) | (442,120 | ) | |||||

| Institutional Class | (41,992,451 | ) | (43,754,405 | ) | |||||

| (67,665,226 | ) | (76,371,509 | ) | ||||||

| Capital Share Transactions: | |||||||||

| Proceeds from shares sold: | |||||||||

| ��Class A | 69,442,617 | 51,114,758 | |||||||

| Class C | 21,953,241 | 17,068,454 | |||||||

| Class R | 1,265,503 | 2,037,618 | |||||||

| Institutional Class | 287,315,606 | 248,681,594 | |||||||

| Net asset value of shares issued upon reinvestment of | |||||||||

| dividends and distributions: | |||||||||

| Class A | 18,050,063 | 22,461,260 | |||||||

| Class C | 6,636,552 | 8,722,235 | |||||||

| Class R | 249,130 | 439,981 | |||||||

| Institutional Class | 38,712,295 | 39,559,439 | |||||||

| 443,625,007 | 390,085,339 | ||||||||

18

| Year ended | |||||||||

| 3/31/21 | 3/31/20 | ||||||||

| Capital Share Transactions (continued): | |||||||||

| Cost of shares redeemed: | |||||||||

| Class A | $ | (75,426,756 | ) | $ | (97,367,467 | ) | |||

| Class C | (37,378,394 | ) | (32,342,093 | ) | |||||

| Class R | (2,942,339 | ) | (3,818,176 | ) | |||||

| Institutional Class | (280,391,146 | ) | (315,447,503 | ) | |||||

| (396,138,635 | ) | (448,975,239 | ) | ||||||

| Increase (decrease) in net assets derived from capital share | |||||||||

| transactions | 47,486,372 | (58,889,900 | ) | ||||||

| Net Increase (Decrease) in Net Assets | 250,591,798 | (133,178,416 | ) | ||||||

| Net Assets: | |||||||||

| Beginning of year | 895,649,051 | 1,028,827,467 | |||||||

| End of year | $ | 1,146,240,849 | $ | 895,649,051 | |||||

See accompanying notes, which are an integral part of the financial statements.

19

Financial highlights

Delaware Healthcare Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income (loss)1 |

| Net realized and unrealized gain |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets3 |

| Ratio of net investment income (loss) to average net assets |

| Portfolio turnover |

| 1 | The average shares outstanding have been applied for per share information. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. |

| 3 | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

20

| Year ended | ||||||||||||||||||||

| 3/31/21 | 3/31/20 | 3/31/19 | 3/31/18 | 3/31/17 | ||||||||||||||||

| $ | 22.75 | $ | 24.63 | $ | 22.63 | $ | 19.19 | $ | 18.46 | |||||||||||

| 0.03 | 0.03 | (0.03 | ) | 0.04 | 0.16 | |||||||||||||||

| 6.49 | 0.11 | 2.44 | 4.08 | 1.97 | ||||||||||||||||

| 6.52 | 0.14 | 2.41 | 4.12 | 2.13 | ||||||||||||||||

| (0.06 | ) | — | (0.15 | ) | (0.68 | ) | (0.18 | ) | ||||||||||||

| (1.50 | ) | (2.02 | ) | (0.26 | ) | — | (1.22 | ) | ||||||||||||

| (1.56 | ) | (2.02 | ) | (0.41 | ) | (0.68 | ) | (1.40 | ) | |||||||||||

| $ | 27.71 | $ | 22.75 | $ | 24.63 | $ | 22.63 | $ | 19.19 | |||||||||||

| 28.55% | (0.27% | ) | 10.74% | 21.56% | 12.30% | |||||||||||||||

| $ | 344,531 | $ | 272,911 | $ | 319,993 | $ | 212,838 | $ | 154,687 | |||||||||||

| 1.23% | 1.27% | 1.28% | 1.31% | 1.38% | ||||||||||||||||

| 0.11% | 0.13% | (0.10% | ) | 0.18% | 0.84% | |||||||||||||||

| 22% | 24% | 33% | 28% | 29% | ||||||||||||||||

21

Financial highlights

Delaware Healthcare Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income (loss)1 |

| Net realized and unrealized gain |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets3 |

| Ratio of net investment income (loss) to average net assets |

| Portfolio turnover |

| 1 | The average shares outstanding have been applied for per share information. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. |

| 3 | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

22

| Year ended | ||||||||||||||||||||

| 3/31/21 | 3/31/20 | 3/31/19 | 3/31/18 | 3/31/17 | ||||||||||||||||

| $ | 21.42 | $ | 23.47 | $ | 21.61 | $ | 18.36 | $ | 17.72 | |||||||||||

| (0.17 | ) | (0.15 | ) | (0.20 | ) | (0.12 | ) | 0.02 | ||||||||||||

| 6.11 | 0.12 | 2.33 | 3.90 | 1.88 | ||||||||||||||||

| 5.94 | (0.03 | ) | 2.13 | 3.78 | 1.90 | |||||||||||||||

| — | — | (0.01 | ) | (0.53 | ) | (0.04 | ) | |||||||||||||

| (1.50 | ) | (2.02 | ) | (0.26 | ) | — | (1.22 | ) | ||||||||||||

| (1.50 | ) | (2.02 | ) | (0.27 | ) | (0.53 | ) | (1.26 | ) | |||||||||||

| $ | 25.86 | $ | 21.42 | $ | 23.47 | $ | 21.61 | $ | 18.36 | |||||||||||

| 27.62% | (1.02% | ) | 9.91% | 20.67% | 11.45% | |||||||||||||||

| $ | 112,012 | $ | 99,376 | $ | 115,843 | $ | 76,033 | $ | 57,814 | |||||||||||

| 1.98% | 2.02% | 2.03% | 2.06% | 2.13% | ||||||||||||||||

| (0.64% | ) | (0.62% | ) | (0.85% | ) | (0.57% | ) | 0.09% | ||||||||||||

| 22% | 24% | 33% | 28% | 29% | ||||||||||||||||

23

Financial highlights

Delaware Healthcare Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income (loss)1 |

| Net realized and unrealized gain |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets3 |

| Ratio of net investment income (loss) to average net assets |

| Portfolio turnover |

| 1 | The average shares outstanding have been applied for per share information. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. |

| 3 | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

24

| Year ended | ||||||||||||||||||||

| 3/31/21 | 3/31/20 | 3/31/19 | 3/31/18 | 3/31/17 | ||||||||||||||||

| $ | 22.40 | $ | 24.34 | $ | 22.37 | $ | 18.98 | $ | 18.27 | |||||||||||

| (0.04 | ) | (0.03 | ) | (0.08 | ) | (0.02 | ) | 0.11 | ||||||||||||

| 6.40 | 0.11 | 2.40 | 4.04 | 1.95 | ||||||||||||||||

| 6.36 | 0.08 | 2.32 | 4.02 | 2.06 | ||||||||||||||||

| — | — | (0.09 | ) | (0.63 | ) | (0.13 | ) | |||||||||||||

| (1.50 | ) | (2.02 | ) | (0.26 | ) | — | (1.22 | ) | ||||||||||||

| (1.50 | ) | (2.02 | ) | (0.35 | ) | (0.63 | ) | (1.35 | ) | |||||||||||

| $ | 27.26 | $ | 22.40 | $ | 24.34 | $ | 22.37 | $ | 18.98 | |||||||||||

| 28.30% | (0.52% | ) | 10.44% | 21.26% | 12.03% | |||||||||||||||

| $ | 4,867 | $ | 5,269 | $ | 7,080 | $ | 5,683 | $ | 5,169 | |||||||||||

| 1.48% | 1.52% | 1.53% | 1.56% | 1.63% | ||||||||||||||||

| (0.14% | ) | (0.12% | ) | (0.35% | ) | (0.07% | ) | 0.59% | ||||||||||||

| 22% | 24% | 33% | 28% | 29% | ||||||||||||||||

25

Financial highlights

Delaware Healthcare Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets3 |

| Ratio of net investment income to average net assets |

| Portfolio turnover |

| 1 | The average shares outstanding have been applied for per share information. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. |

| 3 | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

26

| Year ended | ||||||||||||||||||||

| 3/31/21 | 3/31/20 | 3/31/19 | 3/31/18 | 3/31/17 | ||||||||||||||||

| $ | 22.91 | $ | 24.75 | $ | 22.74 | $ | 19.28 | $ | 18.53 | |||||||||||

| 0.10 | 0.09 | 0.04 | 0.09 | 0.21 | ||||||||||||||||

| 6.55 | 0.12 | 2.43 | 4.10 | 1.98 | ||||||||||||||||

| 6.65 | 0.21 | 2.47 | 4.19 | 2.19 | ||||||||||||||||

| (0.13 | ) | (0.03 | ) | (0.20 | ) | (0.73 | ) | (0.22 | ) | |||||||||||

| (1.50 | ) | (2.02 | ) | (0.26 | ) | — | (1.22 | ) | ||||||||||||

| (1.63 | ) | (2.05 | ) | (0.46 | ) | (0.73 | ) | (1.44 | ) | |||||||||||

| $ | 27.93 | $ | 22.91 | $ | 24.75 | $ | 22.74 | $ | 19.28 | |||||||||||

| 28.91% | (0.01% | ) | 10.98% | 21.84% | 12.53% | |||||||||||||||

| $ | 684,831 | $ | 518,093 | $ | 585,911 | $ | 282,585 | $ | 137,621 | |||||||||||

| 0.98% | 1.02% | 1.03% | 1.06% | 1.13% | ||||||||||||||||

| 0.36% | 0.38% | 0.14% | 0.43% | 1.09% | ||||||||||||||||

| 22% | 24% | 33% | 28% | 29% | ||||||||||||||||

27

| Notes to financial statements | |

| Delaware Healthcare Fund | March 31, 2021 |

Delaware Group® Equity Funds IV (Trust) is organized as a Delaware statutory trust and offers 20 series. These financial statements and the related notes pertain to Delaware Healthcare Fund (Fund). The Trust is an open-end investment company. The Fund is considered non-diversified under the Investment Company Act of 1940, as amended, (1940 Act), and offers Class A, Class C, Class R, and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of 5.75%. There is no front-end sales charge when you purchase $1,000,000 or more of Class A shares. However, if Delaware Distributors, L.P. (DDLP) paid your financial intermediary a commission on your purchase of $1,000,000 or more of Class A shares, for shares purchased prior to July 1, 2020, you will have to pay a limited contingent deferred sales charge (“Limited CDSC”) of 1.00% if you redeem these shares within the first year after your purchase and 0.50% if you redeem shares within the second year or for shares purchased on or after July 1, 2020, you will have to pay a Limited CDSC of 1.00% if you redeem these shares within the first 18 months after your purchase; unless a specific waiver of the Limited CDSC applies. Class C shares are sold with a CDSC of 1.00%, which will be incurred if redeemed during the first 12 months. Class R and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors.

1. Significant Accounting Policies

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services — Investment Companies. The following accounting policies are in accordance with US generally accepted accounting principles (US GAAP) and are consistently followed by the Fund.

Security Valuation — Equity securities, except those traded on the Nasdaq Stock Market LLC (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange on the valuation date. Equity securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If, on a particular day, an equity security does not trade, the mean between the bid and ask prices will be used, which approximates fair value. Equity securities listed on a foreign exchange are normally valued at the last quoted sales price on the valuation date. Open-end investment companies are valued at their published net asset value (NAV). Foreign currency exchange contracts are valued at the mean between the bid and ask prices, which approximates fair value. Interpolated values are derived when the settlement date of the contract is an interim date for which quotations are not available. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Trust’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. The Fund may use fair value pricing more frequently for securities traded primarily in non-US markets because, among other things, most foreign markets close well before the Fund values its securities, generally as of 4:00pm Eastern time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, government actions or pronouncements, aftermarket trading, or news events may have occurred in the interim. Whenever such a significant event occurs, the Fund may

28

value foreign securities using fair value prices based on third-party vendor modeling tools (international fair value pricing). Restricted securities are valued at fair value using methods approved by the Board.

Federal and Foreign Income Taxes — No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken or expected to be taken on the Fund’s federal income tax returns through the year ended March 31, 2021 and for all open tax years (years ended March 31, 2018–March 31, 2020), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. In regard to foreign taxes only, the Fund has open tax years in certain foreign countries in which it invests that may date back to the inception of the Fund. If applicable, the Fund recognizes interest accrued on unrecognized tax benefits in interest expense and penalties in “Other” on the “Statement of operations.” During the year ended March 31, 2021, the Fund did not incur any interest or tax penalties.

Class Accounting — Investment income, common expenses, and realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Foreign Currency Transactions — Transactions denominated in foreign currencies are recorded at the prevailing exchange rates on the valuation date in accordance with the Fund’s prospectus. The value of all assets and liabilities denominated in foreign currencies is translated daily into US dollars at the exchange rate of such currencies against the US dollar. Transaction gains or losses resulting from changes in exchange rates during the reporting period or upon settlement of the foreign currency transaction are reported in operations for the current period. The Fund generally does not bifurcate that portion of realized gains and losses on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices. These gains and losses are included on the “Statement of operations” under “Net realized gain (loss) on investments.” The Fund reports certain foreign currency related transactions as components of realized gains (losses) for financial reporting purposes, whereas such components are treated as ordinary income (loss) for federal income tax purposes.

Use of Estimates — The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other — Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Funds® by Macquarie (Delaware Funds) are generally allocated among such funds on the basis of average net assets. Management fees and certain other

29

Notes to financial statements

Delaware Healthcare Fund

1. Significant Accounting Policies (continued)

expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Foreign dividends are also recorded on the ex-dividend date or as soon after the ex-dividend date that the Fund is aware of such dividends, net of all tax withholdings, a portion of which may be reclaimable. Withholding taxes and reclaims on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The Fund declares and pays dividends from net investment income and distributions from net realized gain on investments, if any, annually. The Fund may distribute more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on the ex-dividend date.

The Fund receives earnings credits from its custodian when positive cash balances are maintained, which may be used to offset custody fees. There were no such earnings credits for the year ended March 31, 2021.

The Fund receives earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. If the amount earned is greater than $1, the expenses paid under this arrangement are included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses” with the corresponding expenses offset included under “Less expenses paid indirectly.” For the year ended March 31, 2021, the Fund earned $1,022 under this arrangement.

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Macquarie Investment Management Business Trust and the investment manager, an annual fee which is calculated daily and paid monthly at the rates of 0.85% on the first $500 million of the average daily net assets of the Fund, 0.80% on the next $500 million, 0.75% on the next $1.5 billion, and 0.70% on average daily net assets in excess of $2.5 billion.

DMC may permit its affiliates, Macquarie Investment Management Global Limited (MIMGL) and Macquarie Funds Management Hong Kong Limited (together, the “Affiliated Sub-Advisors”), to execute Fund equity security trades on its behalf. DMC may also seek quantitative support from MIMGL. Although the Affiliated Sub-Advisors serve as sub-advisors, DMC has ultimate responsibility for all investment advisory services. For these services, DMC, not the Fund, may pay each Affiliated Sub-Advisor a portion of its investment management fee.

Delaware Investments Fund Services Company (DIFSC), an affiliate of DMC, provides fund accounting and financial administrative oversight services to the Fund. For these services, DIFSC’s fees are calculated daily and paid monthly based on the aggregate daily net assets of all funds within the Delaware Funds at the following annual rates: 0.00475% of the first $35 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $45 billion (Total Fee). Each fund in the Delaware Funds pays a minimum of $4,000, which, in aggregate, is subtracted from the Total

30

Fee. Each fund then pays its portion of the remainder of the Total Fee on a relative NAV basis. This amount is included on the “Statement of operations” under “Accounting and administration expenses.” For the year ended March 31, 2021, the Fund was charged $44,283 for these services.

DIFSC is also the transfer agent and dividend disbursing agent of the Fund. For these services, DIFSC’s fees are calculated daily and paid monthly based on the aggregate daily net assets of the retail funds within the Delaware Funds at the following annual rates: 0.014% of the first $20 billion; 0.011% of the next $5 billion; 0.007% of the next $5 billion; 0.005% of the next $20 billion; and 0.0025% of average daily net assets in excess of $50 billion. The fees payable to DIFSC under the shareholder services agreement described above are allocated among all retail funds in the Delaware Funds on a relative NAV basis. This amount is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” For the year ended March 31, 2021, the Fund was charged $107,448 for these services. Pursuant to a sub-transfer agency agreement between DIFSC and BNY Mellon Investment Servicing (US) Inc. (BNYMIS), BNYMIS provides certain sub-transfer agency services to the Fund. Sub-transfer agency fees are paid by the Fund and are also included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” The fees are calculated daily and paid as invoices are received on a monthly or quarterly basis.

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual distribution and service (12b-1) fee of 0.25%, 1.00%, and 0.50% of the average daily net assets of the Class A, Class C, and Class R shares, respectively. The fees are calculated daily and paid monthly. Institutional class shares do not pay 12b-1 fee.

As provided in the investment management agreement, the Fund bears a portion of the cost of certain resources shared with DMC, including the cost of internal personnel of DMC and/or its affiliates that provide legal, tax, and regulatory reporting services to the Fund. For the year ended March 31, 2021, the Fund was charged $36,665 for internal legal, tax, and regulatory reporting services provided by DMC and/or its affiliates’ employees. This amount is included on the “Statement of operations” under “Legal fees.”

For the year ended March 31, 2021, DDLP earned $189,782 for commissions on sales of the Fund’s Class A shares. For the year ended March 31, 2021, DDLP received gross CDSC commissions of $22 and $15,281 on redemptions of the Fund’s Class A and Class C shares, respectively, and these commissions were entirely used to offset upfront commissions previously paid by DDLP to broker/dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DIFSC, and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

Cross trades for the year ended March 31, 2021, were executed by the Fund pursuant to procedures adopted by the Board designed to ensure compliance with Rule 17a-7 under the 1940 Act. Cross trading is the buying or selling of portfolio securities between funds of investment companies, or between a fund of an investment company and another entity, that are or could be considered affiliates by virtue of having a common investment advisor (or affiliated investment advisors), common directors/trustees

31

Notes to financial statements

Delaware Healthcare Fund

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates (continued)

and/or common officers. At its regularly scheduled meetings, the Board reviews a report related to the Fund’s compliance with the procedures adopted by the Board. Pursuant to these procedures, for the year ended March 31, 2021, the Fund engaged in securities purchases of $21,002,000. The Fund did not engage in Rule 17a-7 securities sales for the year ended March 31, 2021.

In addition to the management fees and other expenses of the Fund, the Fund indirectly bears the investment management fees and other expenses of the investment companies (Underlying Funds) in which it invests. The amount of these fees and expenses incurred indirectly by the Fund will vary based upon the expense and fee levels of the Underlying Funds and the number of shares that are owned of the Underlying Funds at different times.

3. Investments

For the year ended March 31, 2021, the Fund made purchases and sales of investment securities other than short-term investments as follows:

| Purchases | $ | 263,386,684 | |

| Sales | 259,483,625 |

The tax cost of investments includes adjustments to net unrealized appreciation (depreciation) which may not necessarily be the final tax cost basis adjustments, but approximates the tax basis unrealized gains and losses that may be realized and distributed to shareholders. At March 31, 2021, the cost and unrealized appreciation (depreciation) of investments for federal income tax purposes for the Fund were as follows:

| Cost of investments | $ | 856,881,953 | ||

| Aggregate unrealized appreciation of investments | $ | 395,485,932 | ||

| Aggregate unrealized depreciation of investments | (91,426,673 | ) | ||

| Net unrealized appreciation of investments | $ | 304,059,259 |

US GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three-level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available under the

32

circumstances. The Fund’s investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-level hierarchy of inputs is summarized as follows:

| Level 1 – | Inputs are quoted prices in active markets for identical investments. (Examples: equity securities, open-end investment companies, futures contracts, and exchange-traded options contracts) |

| Level 2 – | Other observable inputs, including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks, and default rates) or other market-corroborated inputs. (Examples: debt securities, government securities, swap contracts, foreign currency exchange contracts, foreign securities utilizing international fair value pricing, broker-quoted securities, and fair valued securities) |

| Level 3 – | Significant unobservable inputs, including the Fund’s own assumptions used to determine the fair value of investments. (Examples: broker-quoted securities and fair valued securities) |

Level 3 investments are valued using significant unobservable inputs. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Valuations may also be based upon current market prices of securities that are comparable in coupon, rating, maturity, and industry. The derived value of a Level 3 investment may not represent the value which is received upon disposition and this could impact the results of operations.

The following table summarizes the valuation of the Fund’s investments by fair value hierarchy levels as of March 31, 2021:

| Level 1 | Level 3 | Total | |||||||

| Securities | |||||||||

| Assets: | |||||||||

| Common Stock | $ | 1,160,875,212 | $ | 66,000 | $ | 1,160,941,212 | |||

| Rights | — | — | — | ||||||

| Total Value of Securities | $ | 1,160,875,212 | $ | 66,000 | $ | 1,160,941,212 | |||

The securities that have been valued at zero on the “Schedule of investments” are considered to be Level 3 investment in this table.

During the year ended March 31, 2021, there were no transfers into or out of Level 3 investments. The Fund’s policy is to recognize transfers into or out of Level 3 investments based on fair value at the beginning of the reporting period.

A reconciliation of Level 3 investments is presented when the Fund has a significant amount of Level 3 investments at the beginning, interim, or end of the year in relation to the Fund’s net assets.

33

Notes to financial statements

Delaware Healthcare Fund

3. Investments (continued)

Management has determined not to provide a reconciliation of Level 3 investments as the Level 3 investments were not considered significant to the Fund’s net assets at the beginning, interim, or end of the year. Management has determined not to provide additional disclosure on Level 3 inputs since the Level 3 investments were not considered significant to the Fund’s net assets at the end of the year.

4. Dividend and Distribution Information

Income and long-term capital gain distributions are determined in accordance with federal income tax regulations, which may differ from US GAAP. Additionally, distributions from net gains on foreign currency transactions and net short-term gains on sales of investment securities are treated as ordinary income for federal income tax purposes. The tax character of dividends and distributions paid during the years ended March 31, 2021 and 2020 were as follows:

| Year ended | ||||||

| 3/31/21 | 3/31/20 | |||||

| Ordinary income | $ | 31,320,443 | $ | 8,985,354 | ||

| Long-term capital gains | 36,344,783 | 67,386,155 | ||||

| Total | $ | 67,665,226 | $ | 76,371,509 | ||

5. Components of Net Assets on a Tax Basis

As of March 31, 2021, the components of net assets on a tax basis were as follows:

| Shares of beneficial interest | $ | 837,784,842 | |

| Undistributed long-term capital gains | 6,960,669 | ||

| Qualified late year loss deferrals | (2,563,921 | ) | |

| Net unrealized appreciation on investments and foreign currencies | 304,059,259 | ||

| Net assets | $ | 1,146,240,849 |

The differences between book basis and tax basis components of net assets are primarily attributable to tax deferral of losses on wash sales and tax treatment of securities no longer considered passive foreign investment companies.

Qualified late year ordinary and capital losses (including currency and specified gain/loss items) represent losses realized from January 1, 2021 through March 31, 2021 and November 1, 2020 through March 31, 2021, respectively, that, in accordance with federal income tax regulations, the Funds have elected to defer and treat as having arisen in the following fiscal year.

For financial reporting purposes, capital accounts are adjusted to reflect the tax character of permanent book/tax differences. Results of operations and net assets were not affected by these reclassifications. For the year ended March 31, 2021, the Fund had no reclassifications.

34

6. Capital Shares

Transactions in capital shares were as follows:

| Year ended | ||||||

| 3/31/21 | 3/31/20 | |||||

| Shares sold: | ||||||

| Class A | 2,507,628 | 2,088,179 | ||||

| Class C | 861,818 | 732,473 | ||||

| Class R | 46,355 | 83,857 | ||||

| Institutional Class | 10,544,285 | 10,187,681 | ||||

| Shares issued upon reinvestment of dividends and distributions: | ||||||

| Class A | 643,955 | 888,851 | ||||

| Class C | 253,207 | 365,712 | ||||

| Class R | 9,033 | 17,663 | ||||

| Institutional Class | 1,371,804 | 1,555,621 | ||||

| 16,238,085 | 15,920,037 | |||||

| Shares redeemed: | ||||||

| Class A | (2,717,239 | ) | (3,972,133 | ) | ||

| Class C | (1,423,056 | ) | (1,394,743 | ) | ||

| Class R | (112,004 | ) | (157,203 | ) | ||

| Institutional Class | (10,008,677 | ) | (12,797,263 | ) | ||

| (14,260,976 | ) | (18,321,342 | ) | |||

| Net increase (decrease) | 1,977,109 | (2,401,305 | ) | |||

Certain shareholders may exchange shares of one class for shares of another class in the same Fund. These exchange transactions are included as subscriptions and redemptions in the table above and on the “Statements of changes in net assets.” For the years ended March 31, 2021 and 2020, the Fund had the following exchange transactions.

| Exchange Redemptions | Exchange Subscriptions | |||||||||

| Institutional | ||||||||||

| Class A | Class C | Class A | Class | |||||||

| Shares | Shares | Shares | Shares | Value | ||||||

| Year ended | ||||||||||

| 3/31/21 | 30,727 | 36,941 | 25,288 | 39,764 | $1,878,288 | |||||

| Year ended | ||||||||||