Washington, D.C. 20549

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the periods covered by the annual report:

Indicate by check mark whether the registrant by filing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g 3-2(b) under the Securities Exchange Act of 1934 (the “Exchange Act”). If “Yes” is marked, indicate the file number assigned to the registrant in connection with such rule.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant has been required to file such reports); and (2) has been subject to such filing requirements in the past 90 days.

This Form 40-F contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. Such statements are generally identifiable by the terminology used, such as "plan", "anticipate", "intend", "expect", "estimate", "budget" or other similar wording. Forward looking statements include but are not limited to: references to business strategy and goals; references to future capital and other expenditures; drilling plans; construction activities; refinery turnarounds; the submission of development plans; seismic activity; refining margins; oil and gas production levels and the sources of growth thereof; results of exploration activities and dates by which certain areas may be developed or may come on-stream; retail throughputs; pre-production and operating costs; reserves and resources estimates; reserves life-of-field estimates; natural gas export capacity; and environmental matters. By their very nature, these forward-looking statements require Petro-Canada to make assumptions that may not materialize or that may not be accurate. These forward-looking statements are subject to known and unknown risks and uncertainties, and other factors which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements. Such factors include, but are not limited to: imprecision of reserves estimates of recoverable quantities of oil, natural gas and liquids from resource plays and other sources not currently classified as reserves; general economic, market and business conditions; industry capacity; competitive action by other companies; fluctuations in oil and gas prices; refining and marketing margins; the ability to produce and transport crude oil and natural gas to markets; the effects of weather and climate conditions; the results of exploration and development drilling and related activities; fluctuation in interest rates and foreign currency exchange rates; the ability of suppliers to meet commitments; actions by governmental authorities including increases in taxes; decisions or approvals of administrative tribunals; changes in environmental and other regulations; risks attendant with oil and gas operations, both domestic and international; international political events; expected rates of return; and other factors, many of which are beyond the control of Petro-Canada. These factors are discussed in greater detail elsewhere in this Form 40-F.

Readers are cautioned that the foregoing list of important factors affecting forward-looking statements is not exhaustive. Furthermore, the forward-looking statements contained herein are made as of the date of this Form 40-F, and Petro-Canada does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this Form 40-F are expressly qualified by this cautionary statement.

| 2 | Proved reserves replacement ratio is calculated by dividing the year-over-year net change in proved reserves, before deducting production, by the annual production over the same time period. The reserves replacement ratio is a general indicator of the Company’s reserves growth. It is only one of a number of metrics which can be used to analyse a company’s upstream business. |

Project Execution

Petro-Canada manages a number of different-sized projects to support continuing operations and future growth. Many projects are influenced by external factors beyond the Company’s control. These factors include items such as material costs, labour productivity, timely availability of skilled labour and currency fluctuations.

While Petro-Canada cannot control all project inputs, the Company is committed to continuing to improve its project management capability. Petro-Canada’s goal is to consistently and predictably deliver projects on time and on budget, and achieve defined expectations. Enhanced project management capability is expected to improve all elements of project execution, including safety and environmental performance, quality, cycle time and cost. By leveraging experience gained from major project developments, the Company has established project management “best practices.”

Non-Operated Interests

Other companies may manage the construction or operation of assets in which Petro-Canada has a significant interest. Business assets in which Petro-Canada has a major interest, but does not operate, include Hibernia (20% interest), Syncrude (12% interest), White Rose (27.5% interest) and Buzzard (29.9% interest). Major projects are managed through different forms of joint venture executive committees, resulting in Petro-Canada having some ability to influence these projects. As well, Petro-Canada has joint venture or other operating agreements which specify our expectations from third-party operators. Nevertheless, third-party operation and management of the Company’s assets could adversely affect Petro-Canada’s financial performance.

Environmental Regulations

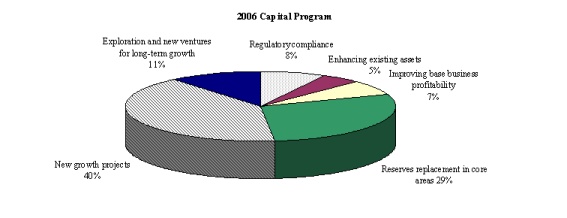

Environmental risks in the oil and gas industry are significant. This situation has arisen because related laws and regulations are becoming more stringent in Canada and in other countries where Petro-Canada operates. Due to increased regulations, Petro-Canada is investing additional capital to satisfy new product specifications and/or address environmental issues. In 2006, the Company anticipates that it will invest $265 million of its capital expenditure program toward regulatory compliance, most of which will be incurred to modify refineries to produce low-sulphur distillates. Other environmental regulations may result in future increased operating costs as a result of creating a future liability when dismantling or remediating assets.

Petro-Canada conducts Life-Cycle Value Assessments (LCVA) to integrate and balance environmental, social and economic decisions related to major projects. A key component of the LCVA process is the assessment and planning for all life-cycle stages involved in constructing, manufacturing, distributing and eventually abandoning an asset or a product. This process encourages more comprehensive exploration of alternatives. The LCVA is a useful technique; however, its predictive capability is limited by assumptions that involve the reliance on the current regulatory regime or one that can be reasonably expected.

Emission Of Greenhouse Gases

The Kyoto Protocol, ratified by the Government of Canada in December 2002 and effective as of February 16, 2005, requires signatory nations to reduce their emissions of carbon dioxide and other greenhouse gases. As a result, Petro-Canada may be required to reduce emissions of greenhouse gases from operations or to purchase emission-trading credits. While the details of implementation of the Kyoto Protocol in Canada have not been finalized, the impact on Petro-Canada could be higher capital expenditures and operating expenses. The Government of Canada may also impose higher vehicle fuel efficiency standards. The impact of this action could be to decrease the demand for gasoline and diesel fuels sold by Petro-Canada and depress the Company’s margins for refined products.

Petro-Canada is committed to reducing emissions. Additional detail will be available in the Company’s Report to the Community, which is expected to be released in the second quarter of 2006. The Report will be posted on www.petro-canada.ca. Through industry organizations, Petro-Canada continues to work with a number of regulatory groups and government associations to find a cost-effective approach which will minimize the negative financial impact of the Kyoto Protocol on the Company, while still reducing emissions. The level of influence these discussions and co-operative efforts have on the Government of Canada’s implementation plan may be quite limited.

Government Regulations

Petro-Canada’s operations are regulated by, and could be intervened upon by, a variety of governments around the world. Governments’ actions could impact the contracting of exploration and production interests, impose specific drilling obligations, and possibly expropriate or cancel contract rights. Governments may also regulate prices of commodities or refined products, or intervene through taxes, royalties and exploration rights.

Petro-Canada tries to mitigate the impact of government regulations by selecting operating environments with stable governments. To date, Petro-Canada has had a co-operative relationship with its regulators and the governments in the countries in which it operates. Most of the contact with regulators occurs through the Company’s management, regulatory affairs personnel in each business unit and a centralized corporate government relations department. Petro-Canada aims to have regular, constructive communication with regulators and governments so issues can be resolved in a mutually acceptable fashion. The Company also has a strong record of regulatory compliance within the jurisdictions where it operates. Petro-Canada operates in many different jurisdictions and derives revenue from several categories of products. This diversification makes financial performance less sensitive to the action of any single government. Nevertheless, Petro-Canada has limited ability to influence regulations which may have a material adverse effect on the Company.

Counterparties

In the normal course of business, Petro-Canada is exposed to credit risk resulting from the uncertainty of business partners’ or counterparties’ ability to fulfill their obligations. The Company has established internal credit policies and procedures that include financial assessments, exposure limits and processes to monitor and minimize the exposures against these limits. Where appropriate, Petro-Canada also uses netting and collateral arrangements to minimize risk.

OPERATIONAL RISKS

Exploring for, developing, producing, refining, transporting and marketing oil, natural gas and refined products involve significant operational hazards. These risks include well blowouts, fires, explosions, gaseous leaks, migration of harmful substances and oil spills. Any of these operational incidents could cause personal injury, environmental contamination, or damage and destruction of the Company’s assets. These incidents could also interrupt production.

Petro-Canada manages operational risks primarily through a Total Loss Management (TLM) system. TLM is an internally developed management system based on external “best practices” with standards for preventing operational incidents. Regular TLM audits test compliance with these standards.

The Company also purchases insurance to transfer the financial impact of some operational risks to high credit quality third-party insurers. Petro-Canada regularly evaluates its exposures related to operational risks and adjusts the nature of its coverage, including deductibles and limits. Although Petro-Canada maintains insurance in line with customary industry practices, the Company cannot and does not fully insure against all risks. Losses resulting from operational incidents could have a material adverse impact on the Company.

FOREIGN RISKS

Petro-Canada has significant operations in a number of countries that have varying political, economic and social systems. As a result, the Company’s operations and related assets are subject to potential risks of actions by governmental authorities, internal unrest, war, political disruption, economic and legal sanctions (such as restrictions against countries that the U.S. government may deem to sponsor terrorism), and changes in global trade policies. The Company’s operations may be restricted, disrupted or prohibited in any country in which these risks occur. Petro-Canada has production in OPEC-member countries, which is constrained by OPEC quotas.

The Company continually evaluates exposure in any one country in the context of total operations. Investment may be limited to avoid excessive exposure in any one country or region. The Company also purchases political risk insurance to partially mitigate some political risks.

MARKET RISKS

More detailed quantification of the impact of some of the following risks can be found in the earnings sensitivities table on page four of the Business Environment section in the MD&A.

Commodity Prices

In Petro-Canada’s upstream businesses, significant market risk exposure exists due to changing commodity prices of crude oil and natural gas. Commodity prices are volatile and influenced by factors such as supply and demand fundamentals, geopolitical events, OPEC decisions and weather. In 2005, the monthly average Brent crude oil price ranged between $44.23 US/bbl and $64.12 US/bbl, and the AECO-C hub index ranged between $6.16 per gigajoule (GJ) and $12.08/GJ. These commodity prices also impact the refined products margins realized by the Downstream business, another significant market risk. In 2005, the benchmark monthly average New York Harbour 3-2-1 refinery crack spread per bbl ranged from $4.86 US/bbl to $21.74 US/bbl. Petro-Canada’s ability to maintain product margins in an environment of higher feedstock costs is contingent upon the Company’s ability to flow higher costs through to customers.

Petro-Canada generally does not hedge large volumes of production. Management believes commodity prices are volatile and difficult to predict. The business is managed so that the Company can substantially withstand the impact of a lower price environment, while maintaining the opportunity to capture significant upside when the price environment is higher. However, commodity prices and margins may be hedged occasionally to capture opportunities that represent extraordinary value and to ensure the economic value of an acquisition. For example, as part of the Company’s acquisition of an interest in the Buzzard field in the U.K. sector of the North Sea, the Company entered into a series of derivative contracts related to the future sale of Brent crude oil (see Derivative Instruments below). Certain Downstream physical transactions are routinely hedged for operational needs and to facilitate sales to customers.

Foreign Exchange

As energy commodity prices are primarily priced in U.S. dollars, a large portion of Petro-Canada’s revenue stream is affected by the Canada/U.S. exchange rate. As a result, the Company’s earnings are negatively affected by a strengthening Canadian dollar. The Company is also exposed to fluctuations in other foreign currencies, such as the euro and the British pound. Generally, Petro-Canada does not hedge foreign exchange exposures, although the Company partially mitigates the U.S. dollar exposure by denominating the majority of its debt obligations in U.S. dollars. Foreign exchange exposure related to asset acquisitions or divestitures, or project capital expenditures, may be hedged on a case-by-case basis.

Interest Rates

Petro-Canada targets a blend of fixed and floating rate debt. Generally, this strategy enables the Company to take advantage of lower interest rates on floating debt, while matching overall debt maturities with the life of cash-generating assets. The Company is exposed to fluctuations in the rate of interest it pays on floating rate debt. This interest rate exposure is within the Company’s risk tolerance.

Derivative Instruments

Petro-Canada’s Market Risk and Derivative Policy prohibits the use of derivative instruments for speculative purposes. Petro-Canada instead uses derivatives primarily to hedge physical transactions for operational needs and to facilitate sales to customers. The gains and losses associated with these financial instruments essentially offset gains and losses on the physical transactions. Except as specifically authorized by the Board of Directors, the term of hedging instruments cannot exceed 18 months. Monitoring and reporting of the derivatives portfolio includes periodic testing of the fair value of all outstanding derivatives. Fair values are determined by obtaining independent third-party quotes for the value of each derivative instrument. The objectives and strategies of all hedge transactions are documented and the effectiveness of the derivative instrument in offsetting a change in the value of the hedged exposure is assessed on a regular basis.

Effective January 1, 2004, the Company elected to discontinue hedge accounting for certain hedging programs. All derivatives that do not qualify as a hedge, or are not designated as a hedge, are accounted for using the mark-to-market accounting method. These derivatives are recorded in the balance sheet as either an asset or liability, with the fair value recognized in earnings in each reporting period. As a result, the realized and unrealized values of these transactions are recognized in Investment and Other Income.

During 2004, as part of the Company’s acquisition of an interest in the Buzzard field, the Company entered into a series of derivative contracts related to the future sale of Brent crude oil. The purpose of these transactions was to ensure value-added returns to Petro-Canada on this investment, even in the event of a material decrease in oil prices. These contracts effectively lock in an average forward price of approximately $26 US/bbl on a volume of 35,840,000 barrels. This volume represents approximately 50% of the Company’s share of estimated plateau production in the 2007-2010 time frame. As at December 31, 2005, this hedge had a mark-to-market unrealized loss of $767 million after-tax, of which $562 million was recognized in the income statement in 2005.

In 2005, other derivative instruments in place for refining supply and product purchases resulted in an increase in net earnings from continuing operations of about $4 million after-tax. This result compared with a decrease in net earnings from continuing operations of about $1 million in 2004.

Upstream

Petro-Canada’s upstream operations consist of four business segments: North American Natural Gas, with current production in Western Canada and the U.S. Rockies; East Coast Oil, with three major developments offshore Newfoundland and Labrador; Oil Sands operations in northeastern Alberta; and International, where the Company is active in three core areas: Northwest Europe; North Africa/Near East; and Northern Latin America. The Company’s diverse asset base provides a balanced portfolio and a platform for long-term growth.

North American Natural Gas

Business Summary and Strategy

North American Natural Gas explores for and produces natural gas, crude oil and NGL in Western Canada and the U.S. Rockies. This business also markets natural gas in North America, has established resources in the Mackenzie Delta/Corridor and has landholdings in Alaska.

The North American Natural Gas strategy is to be a significant and sustainable market participant by accessing new and diverse natural gas supply sources in North America. Key features of the strategy include:

| § | transitioning further into unconventional gas plays; |

| § | optimizing core properties in Western Canada and developing coal bed methane and tight gas in the U.S. Rockies; |

| § | stepping out of traditional operating areas, with an increased focus on exploration; |

| § | developing LNG import capacity at Gros-Cacouna, Quebec; and |

| § | building the northern resource base for long-term growth. |

Western Canada and U.S. Rockies

North American Natural Gas reserve extensions, new discoveries, revisions and improved recovery added 95 billion cubic feet equivalent of natural gas, crude oil and NGL to proved reserves before royalties. Annual production before royalties totalled 244 Bcf of natural gas and 5.4 million barrels (MMbbls) of conventional crude oil and NGL. Exploration and development drilling activity in North American Natural Gas resulted in 706 gross (488 net) wells, including 680 gross (468 net) natural gas wells and two gross (two net) oil wells, for an overall success rate of 96%.

The North American realized natural gas price averaged $8.47/Mcf in 2005, up 26% from $6.72/Mcf in 2004.

Western Canada natural gas production averaged 704 million cubic feet per day of natural gas equivalent (MMcfe/d), down 8% from 764 MMcfe/d in 2004. Exploration and development drilling activity in Western Canada resulted in 373 gross successful wells, for an overall success rate of 94% in 2005. Western Canada operating and overhead costs were $1.10/Mcfe in 2005, up from $0.92/Mcfe in the previous year. The operating and overhead cost increase in Western Canada reflects insurance premium surcharges and general industry-wide cost pressures for materials, fuel and labour. The Company’s cost increases reflect industry-wide operating cost trends which have been rising approximately 15% per year.

During 2004, the North American Natural Gas business grew to include unconventional gas operations and skills. In mid-2004, its footprint was extended into the U.S. Rockies with the acquisition of Prima Energy Corporation (U.S. Rockies) for $644 million, net of acquired cash. This acquisition added production from coal bed methane in the Powder River Basin and from tight gas in the Denver-Julesburg Basin, as well as significant expertise in unconventional production. The value from the U.S. Rockies acquisition will come from developing the large inventory of probable reserves.

U.S. Rockies production averaged 52 MMcfe/d in 2005, compared to 23 MMcfe/d in 2004, which reflected the mid-year 2004 acquisition.

Exploration and development drilling activity in the U.S. Rockies resulted in more than 300 development wells in 2005, up from 148 wells in 2004. In addition, Petro-Canada obtained 407 permits for new coal bed methane wells in 2005, with 292 applications submitted for consideration. Most of the new wells are in the de-watering phase. U.S. Rockies operating and overhead costs were $1.84/Mcfe in 2005, up from $2.00/Mcfe in 2004.

In Western Canada, Petro-Canada operates 11 natural gas field processing plants with total licensed capacity of approximately 1.1 Bcf/d, of which the Company’s share is approximately 691 MMcf/d. The following table shows Petro-Canada’s working interest ownership and the capacity of operated processing plants.

PETRO-CANADA OWNERSHIP AND CAPACITY

| Petro-Canada Operated Plants | Working Interest Ownership (%) | Gross Licensed Capacity (MMcf/d) | Net Licensed Capacity (MMcf/d) |

| |

| Brazeau Sweet | 47 | 78 | 37 |

| Brazeau Sour | 30 | 107 | 32 |

Total Brazeau | | 185 | 69 |

| | | |

| Hanlan Sweet | 41 | 44 | 18 |

| Hanlan Sour | 46 | 380 | 175 |

Total Hanlan | | 424 | 193 |

| | | | |

| Wilson Creek Sweet | 52 | 12 | 7 |

| Wilson Creek Sour | 52 | 22 | 11 |

Total Wilson Creek | | 34 | 18 |

| | | | |

| Boundary Lake Sweet | 100 | 20 | 20 |

| Boundary Lake Sour | 50 | 66 | 33 |

| Parkland 1 | 44 | 18 | 8 |

| Parkland 2 | 35 | 12 | 4 |

| Wildcat Hills | 66 | 124 | 82 |

| Bearberry | 100 | 94 | 94 |

| Ferrier | 99 | 119 | 118 |

| Gilby East | 100 | 52 | 52 |

Total 2005 | | 1,148 | 691 |

Petro-Canada also has varying working interests in other natural gas processing plants and field gathering facilities operated by other oil and gas companies. The Company’s aggregate share from such interests is 173 MMcf/d of licensed capacity.

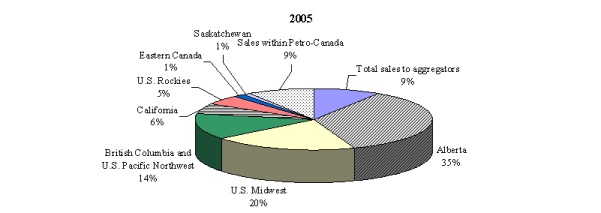

In 2005, North American Natural Gas marketed 813 MMcf/d of natural gas of which 738 MMcf/d were direct sales. Approximately 9% (75 MMcf/d) of total sales were internal to Petro-Canada, at market prices, and were used for refinery and lubricant facilities process fuel along with some plant feedstock, and steam generation at the MacKay River oil sands operation. In Western Canada, the Company markets natural gas produced by other companies in addition to Petro-Canada’s own production. In Western Canada, the Company sold 772 MMcf/d in 2005, down 9% from 844 MMcf/d in 2004 reflecting lower production. U.S. Rockies sales for 2005 were 41 MMcfe/d, compared with 19 MMcfe/d in 2004. Higher 2005 sales reflect the mid-year 2004 acquisition of the U.S. Rockies. To achieve better control over sales volumes, prices and transportation-related costs, Petro-Canada focuses on direct sales to end-users, distribution companies, wholesale marketers and natural gas spot markets. Marketing efforts include management of the gas portfolio, gas supply contracts, pipeline commitments and customer relationships.

The following table shows the market distribution of Petro-Canada’s North American Natural Gas sales.

NORTH AMERICAN NATURAL GAS SALES BY MARKET

| | 2005 | 2004 |

| | (MMcf/d) | (% of Total) | (MMcf/d) | (% of Total) |

Sales to aggregators | | | | |

| Canwest Gas Supply Inc. | 14 | 2 | 16 | 2 |

| ProGas Limited | 38 | 5 | 35 | 4 |

| Cargill Incorporated | 20 | 2 | 17 | 2 |

| Others | 3 | - | 6 | 1 |

Total sales to aggregators | 75 | 9 | 74 | 9 |

Direct sales | | | | |

| Alberta | 286 | 35 | 368 | 44 |

| U.S. Midwest | 160 | 20 | 159 | 18 |

| British Columbia and U.S. Pacific Northwest | 112 | 14 | 106 | 12 |

| California | 45 | 6 | 45 | 5 |

| U.S. Rockies | 41 | 5 | 19 | 2 |

| Eastern Canada | 12 | 1 | 12 | 1 |

| Saskatchewan | 7 | 1 | 8 | 1 |

Total before internal sales | 663 | 82 | 717 | 83 |

| Sales within Petro-Canada | 75 | 9 | 72 | 8 |

Total direct sales | 738 | 91 | 789 | 91 |

Total sales | 813 | 100 | 863 | 100 |

The Company has future commitments to sell and transport natural gas associated with normal operations. Under future fixed-price commitments entered into during the 1990s, approximately 10 MMcf/d (1.7% of estimated 2006 natural gas production in Western Canada) has been sold at an average plant gate netback price of $3.26/Mcf. In 2007, the volume of natural gas sold under these fixed-price contracts is expected to remain at 10 MMcf/d at an average plant gate netback price of $3.54/Mcf.

Royalty Regime

The royalty regimes are a significant factor in the profitability of crude oil and natural gas production. Royalties on conventional crude oil and natural gas owned by provincial governments are determined by regulation and may be amended from time to time. Royalty payments to provincial governments are generally calculated as a percentage of production and vary depending upon factors such as well production volumes, selling prices, method of recovery, location of production and date of discovery. Royalties payable on production of privately owned crude oil and natural gas are negotiated with the mineral rights owner. In 2005, Petro-Canada’s average royalty rate for North American Natural Gas was approximately 23% for conventional crude oil, NGL and natural gas.

Mackenzie Delta/Corridor, Northwest Territories

With interests in eight blocks covering approximately one million gross undeveloped acres (600,000 net acres), Petro-Canada is a significant leaseholder in the Mackenzie Delta/Corridor. During 2005, Petro-Canada acquired two exploration licences, covering 410,000 acres with work commitment bids totalling approximately $35 million. Petro-Canada’s holdings are comprised of six exploration licences and two Inuvialuit land concessions. Petro-Canada is the operator of five of the licences. The net work commitments on the licences total approximately $57.5 million and are guaranteed by performance bonds for the Company’s net share of approximately $14.4 million. Work program terms in the Inuvialuit land concessions include seismic acquisition and drilling. In 2002, a natural gas discovery at the Tuk M-18 well tested at restricted rates of up to 30 MMcf/d. Having secured what is believed to be the area’s most prospective acreage for future exploration, Petro-Canada will pace activities pending the anticipated approval and construction timeline for the Mackenzie pipeline.

Petro-Canada also holds a 100% position in 73,000 acres covering two Significant Discovery Areas (SDAs) in the Colville Hills area of the Mackenzie Corridor. The M-47 well on the Tweed Lake SDA was re-entered and tested in 2004, with restricted rates up to 10 MMcf/d.

Alaska

Petro-Canada’s initial foray into Alaska was in the Foothills area north of the Brooks Mountain Range. A field geological study has confirmed that the geology and prospectivity of this area is similar to the Alberta Foothills, where Petro-Canada has developed considerable expertise and has had significant success finding natural gas. During 2005, Petro-Canada and Anadarko Petroleum Corporation increased their joint land position to 2.5 million acres in the gas prospective North Slope region of the Brooks Range in Alaska. In January 2006, BG (Alaska) E&P Inc. joined the Foothills joint venture and each company now holds an one-third interest in the acreage. While it is unlikely the region will be serviced by a pipeline for some time, this acreage is close to a proposed pipeline route to southern markets. Also in 2004, Petro-Canada acquired a large land position (322,610 gross and net acres) in the National Petroleum Reserve-Alaska, an area with significant potential for large oil prospects.

LNG

Petro-Canada is seeking to participate in the global LNG business consistent with its strategy to add long-life producing assets to its portfolio. In July 2004, an MOU was signed with TransCanada PipeLines to develop and share (50/50) ownership of an LNG facility at Gros-Cacouna, Quebec, with a preliminary cost estimate of $660 million. The proposed facility will receive, store and re-gasify imported LNG. Petro-Canada will have throughput and marketing rights to 100% of the send-out capacity of approximately 500 MMcf of natural gas per day.

Petro-Canada continued to advance the proposed LNG import and re-gasification terminal at Gros-Cacouna, Quebec, with a joint filing of an Environmental Impact Assessment with the provincial and federal governments in the second quarter of 2005. The Company, along with its partner, TransCanada PipeLines, is aiming to secure regulatory approval by late 2006. A joint provincial and federal government hearing is scheduled for spring 2006 and pre-construction engineering is proceeding in anticipation of regulatory approvals to allow for timely construction startup. The project continues to forecast startup in late 2009.

Link to Petro-Canada’s Corporate and Strategic Priorities

The North American Natural Gas business is aligned with Petro-Canada’s strategic priorities as outlined by its progress in 2005 and goals for 2006.

| | 2005 PROGRESS | 2006 GOALS |

DELIVERING PROFITABLE GROWTH WITH A FOCUS ON OPERATED, LONG-LIFE ASSETS | § drilled 100 gross wells in Western Canada and 290 wells in the Western Canada Medicine Hat region1; § drilled 310 wells, added 37,000 net acres of land and obtained 407 permits for new coal bed methane wells in the U.S. Rockies; § filed regulatory application for the LNG facility at Gros-Cacouna; and § increased joint land position with partner in Alaska to 2.5 million acres and acquired 410,000 acres in the Mackenzie Corridor. | § create a stronger exploration focus; § expand growth of unconventional gas plays to about 25% of production; § optimize core asset concentric opportunities; and § advance exploration prospects in the Mackenzie Delta/Corridor and Alaska. |

DRIVING FOR FIRST QUARTILE2 OPERATION OF OUR ASSETS | § achieved better than 98% reliability3 at Western Canada facilities; and § conducted major turnarounds at Wildcat Hills, Wilson Creek and Gilby gas plants, with no lost-time incidents. | § achieve reliability rate approaching 99%; § conduct major turnaround of the Hanlan gas plant; and § continue to leverage costs through strategic alliances and preferred suppliers. |

CONTINUING TO WORK AT BEING A RESPONSIBLE COMPANY | § saw 44% increase in total recordable injury frequency compared to 2004. While contractor injury frequency improved, an upswing in employee injuries had a negative effect; § continued to reduce injury severity; § improved employee and contractor safety culture through initial phase of behaviour-based safety programs; § proactively remediated and reclaimed old sites; and § saw slight increase in regulatory exceedances compared to 2004. | § reduce total recordable injury frequency and regulatory exceedances; § continue safety culture improvements by rolling out the next phase of behaviour-based safety for employees and contractors; § drive for continuous improvement in contractor safety performance; § develop and implement stakeholder relations strategy; and § proactively remediate and reclaim old sites on a risked basis. |

1 Only includes wells where Petro-Canada has a working interest.

2 References to first quartile operations in this AIF do not refer to industry-wide benchmarks or externally known measures. The Company has a variety of internal metrics which define and track first quartile operational performance.

3 Throughout this AIF, we refer to reliability rates within the five business units. These reliability rates are calculated using internal methods that vary among the business units and take various factors into account. There are no existing external or industry-wide standards used in calculating reliability rates and, therefore, our resulting calculations are not necessarily comparable to other companies in the oil and gas industry.

East Coast Oil

Business Summary and Strategy

Petro-Canada is positioned in every major oil development off Canada’s East Coast. The Company is the operator and holds the largest interest in Terra Nova (34%), as well as a 20% interest in nearby Hibernia and a 27.5% interest in White Rose.

The East Coast Oil strategy is to improve reliability and sustain profitable production well into the next decade. Key features of the strategy include:

| § | delivering top quartile safety and operating performance; |

| § | sustaining profitable production through reservoir extensions and add-ons; and |

| § | pursuing high potential development projects. |

Realized crude prices remained strong while production decreased due to turnaround work to improve Terra Nova reliability in 2005. East Coast Oil realized crude prices averaged $63.15/bbl in 2005, up from $48.39/bbl in 2004. Petro-Canada’s share of East Coast Oil production averaged 75,300 b/d in 2005, down from 78,200 b/d in 2004, mainly due to the 40-day planned turnaround at Terra Nova. East Coast Oil operating and overhead costs averaged $4.52/bbl in 2005, compared with $2.89/bbl in 2004. Operating costs for East Coast Oil have remained relatively flat, excluding insurance premium surcharges and startup costs for White Rose.

Hibernia

The Hibernia oilfield lies approximately 315 kilometres southeast of St. John’s, Newfoundland and Labrador. The production system used is a fixed Gravity Base Structure (GBS), which sits on the sea floor. It has a production capacity of 230,000 b/d, storage capacity of 1.3 MMbbls, and it commenced production in November 1997.

The Hibernia oilfield, encompassing the Hibernia and Ben Nevis Avalon reservoirs, is estimated to have a remaining production life of 20 to 25 years. Assessment continues of the development potential of the Ben Nevis Avalon and southern extension of the Hibernia reservoir.

At December 31, 2005, there were 27 producing oil wells, 16 water injection wells and six gas injection wells in operation. Field production is transported by shuttle tanker either from the platform to a transshipment terminal on the Avalon Peninsula or, if tanker schedules permit, directly to market. Crude oil delivered to the transshipment facility is transferred to storage tanks and loaded onto tankers for transport to markets in Eastern Canada and the U.S. Petro-Canada has a 14% ownership interest in the transshipment facility.

Petro-Canada’s share of Hibernia’s production averaged 39,800 b/d in 2005, down slightly from 40,800 b/d in 2004. The Hibernia platform continued to operate at first quartile levels during 2005, with slightly lower production reflecting normal reservoir decline rates.

Terra Nova

The Terra Nova oilfield, which lies approximately 350 kilometres southeast of St. John’s, Newfoundland and Labrador, was discovered by Petro-Canada in 1984. Located about 35 kilometres southeast of Hibernia, it is the second oilfield to be developed offshore Newfoundland and Labrador. The production system used is a Floating Production Storage and Offloading (FPSO) vessel, which is a ship moored on location. Terra Nova was the first harsh environment development in North America to use an FPSO vessel. It has a production capacity of 180,000 b/d and a storage capacity of 960,000 bbls. Production from the Terra Nova oilfield began in January 2002. The field is estimated to have a remaining production life of approximately 14 to 16 years.

At year-end 2005, 14 producing oil wells, six water injection wells and three gas injection wells were in operation. Terra Nova uses the same system of shuttle tankers and a transshipment terminal that is currently used for Hibernia, and also transports its crude oil to markets in Eastern Canada and the U.S.

At Terra Nova, the Company’s share of production averaged 33,700 b/d in 2005, down from 37,400 b/d in 2004. During the fourth quarter of 2005, Petro-Canada successfully completed a 40-day turnaround at Terra Nova. The turnaround included regulatory inspections on equipment and modifications to improve the reliability of the gas compression and injection systems. Following the turnaround, Terra Nova was operating at a 90% facility reliability rate.

Petro-Canada continues to drive for first quartile reliability at Terra Nova, with a second phase of improvements planned to occur during an extended turnaround commencing in mid-2006. The FPSO vessel will be relocated to a dry dock to complete work required for regulatory certification and compliance; completion of reliability improvements to the gas compression system; and expansion of the accommodations to enable a larger crew to perform ongoing maintenance. Upon completion of the Terra Nova turnaround, reliability is expected to be sustained at first quartile levels.

White Rose

White Rose, the third development offshore Newfoundland and Labrador, is located about 350 kilometres southeast of St. John’s, and approximately 50 kilometres northeast of Hibernia and Terra Nova. It also uses an FPSO vessel similar to that of Terra Nova. The vessel has a design production capacity of 100,000 b/d and a storage capacity of 940,000 barrels. Production is offloaded to chartered tankers which go directly to markets in Eastern Canada and the U.S. The FPSO sailed to the field in August and, in November 2005, White Rose achieved first oil on budget and ahead of schedule. At year end, production rates averaged between 17,000 b/d to 19,000 b/d net to Petro-Canada.

Development plans for White Rose include the drilling of 19 to 21 wells, with a life-of-field estimate of 230 MMbbls (gross) of oil over a 10- to 12-year time frame. Ten wells, including three producing wells, six water injection wells and one gas injection well were drilled prior to production startup.

Offshore Oil Royalty Regime

The royalty regime for the Hibernia project has three tiers: gross royalty, net royalty and supplementary royalty. Gross royalty increased to 5% of gross field revenue on July 1, 2003. The gross royalty rate will remain at 5% until net royalty payout is reached. The gross royalty is indexed to crude oil prices under certain conditions. Upon achieving payout, including a specified return allowance, the net royalty payable becomes the greater of 30% of net revenue, or 5% of gross revenue. After a further level of payout is reached, which includes an additional return allowance, a supplementary royalty of 12.5% of net revenue also becomes payable.

The Terra Nova royalty regime has three tiers. The royalty consists of a sliding-scale basic royalty payable throughout the project’s life, with two additional tiers of net royalties which are payable upon the achievement of specified levels of profitability. The basic royalty is payable as a percentage of gross field revenue, with an initial rate of 1%, which rises to 10% depending on cumulative production levels and the occurrence of simple payout. After tier one payout has been reached, including a specified return allowance, net royalty will become the greater of the basic royalty, or 30% of net revenue. An additional net royalty equal to 12.5% of net revenue will be payable once a further level of payout, including an additional return allowance, is attained. As expected, royalty payments at Terra Nova increased in the fourth quarter of 2005 from 5% of gross revenues to a range of 27% to 29% of gross revenues.

In July 2003, the Government of Newfoundland and Labrador published regulations for the royalty regime that will apply to the development of petroleum resources in offshore areas other than Hibernia and Terra Nova. The generic offshore royalty regime consists of a sliding-scale basic royalty payable throughout a project’s life, and a two-tier net royalty payable upon the achievement of specified levels of profitability. The basic royalty is calculated as a percentage of gross field revenue commencing at 1% and rising to 7.5%, depending on cumulative production levels and the achievement of simple payout. Upon reaching tier one payout, including a return allowance, the net royalty is calculated as the greater of the basic royalty, or 20% of net revenue. An additional 10% net royalty rate is payable once a higher level of return on investment is attained. The generic royalty will apply to the White Rose development.

Other Offshore Exploration and Development

Petro-Canada’s plans to extend plateau production and expand existing developments progressed with the approval of the Far East development by the Canada-Newfoundland and Labrador Offshore Petroleum Board. The first production well in the Far East reservoir is being drilled and is expected to be on-stream in the first quarter of 2006.

In addition to existing East Coast Oil developments, Petro-Canada holds interests in a number of discoveries, including a 23.9% interest in the Hebron/Ben Nevis oilfield discoveries. Early in 2005, Chevron (as operator), Petro-Canada and the other joint venture participants signed a unitization and joint operating agreement to advance the joint evaluation of the Hebron/Ben Nevis and West Ben Nevis oilfields offshore Newfoundland and Labrador. Hebron is estimated to have total resources of approximately 580 MMbbls (gross).

Link to Petro-Canada’s Corporate and Strategic Priorities

The East Coast Oil business is aligned with Petro-Canada’s strategic priorities as outlined by its progress in 2005 and goals for 2006.

| | 2005 PROGRESS | 2006 GOALS |

DELIVERING PROFITABLE GROWTH WITH A FOCUS ON OPERATED, LONG-LIFE ASSETS | § achieved first oil production from the White Rose development; § signed joint operating agreement for Hebron; and § received regulatory approval for Far East development at Terra Nova. | § secure Hebron project provincial benefits agreement and begin front-end engineering and design; § achieve first production from the Far East development at Terra Nova; § advance in-field Hibernia growth prospects; and § delineate West White Rose prospect. |

DRIVING FOR FIRST QUARTILE OPERATION OF OUR ASSETS | § improved Terra Nova reliability to 90%; and § maintained relatively flat operating and overhead costs excluding insurance premium surcharges and startup costs for White Rose. | § conduct a 70- to 90-day turnaround scheduled at Terra Nova for regulatory compliance and first quartile reliability initiatives; and § achieve White Rose plateau production. |

CONTINUING TO WORK AT BEING A RESPONSIBLE COMPANY | § saw 6% increase in total recordable injury frequency compared to 2004; § worked with regulators to address the outcomes of the 2004 oily water discharge; § conducted Terra Nova turnaround ahead of schedule and with improved safety record; and § improved the produced water system resulting in zero regulatory exceedances for 2005. | § reduce total recordable injury frequency; § apply lessons learned from oily water discharge to prevent future incidents; § maintain zero regulatory exceedances; and § ensure major TLM focus during the significant Terra Nova turnaround and startup. |

Oil Sands

Business Summary and Strategy

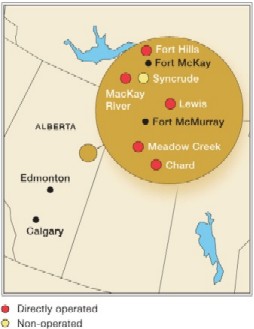

Petro-Canada’s major Oil Sands interests include a 12% ownership in the Syncrude joint venture (an oil sands mining operation and upgrading facility), 100% ownership of the MacKay River in situ bitumen development (a steam-assisted gravity drainage (SAGD) operation), a 55% ownership in and operatorship of the Fort Hills oil sands mining and upgrading project, and extensive oil sands acreage considered prospective for in situ development of bitumen resources.

The Oil Sands strategy for profitable growth includes:

§ phased and integrated development of reserves to incorporate knowledge gained;

§ disciplined capital investment to ensure long-life projects are value creating; and

§ a staged approach to development of capital-intensive Oil Sands projects to allow rigorous cost management and the opportunity to benefit from evolving technology.

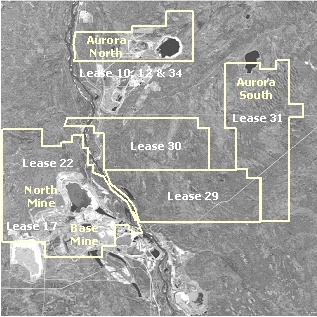

Oil Sands Mining - Syncrude

Petro-Canada has a 12% interest in Syncrude, the world’s largest oil sands mining operation located approximately 40 kilometres north of Fort McMurray, Alberta. Syncrude is a joint venture formed to mine shallow deposits of oil sands from the McMurray formation in the Athabasca Oil Sands, and to extract and upgrade bitumen to produce synthetic crude oil. Syncrude is readily accessible by public roads.

Syncrude holds eight oil sands leases (numbered 10, 12, 17, 22, 29, 30, 31 and 34) issued by the Province of Alberta, covering a total of approximately 255,000 acres. The operating licence associated with these leases expires in 2035. The licence permits Syncrude to mine oil sands and produce synthetic crude oil from approved development areas on the oil sands leases. The leases are automatically renewable as long as oil sands operations are ongoing or the leases are part of an approved development plan. All eight leases are included in a development plan approved by the Alberta Energy and Utilities Board. There were no known commercial operations on these leases prior to the startup of Syncrude operations in 1978.

Design engineering on the Syncrude project commenced in 1972. Alberta government approvals were received in 1973. Site preparation and construction continued from 1973 to 1978. Commercial operations commenced in 1978. A $1.2 billion capacity addition project was undertaken from 1984 to 1988. The first two stages of the Syncrude 21 expansion projects were completed in 1997 and 2001, respectively. The $470 million Stage I project comprised expansions of the north mine and an upgrader de-bottleneck. The $1 billion Stage II project consisted of the opening of the Aurora mine and a further upgrader de-bottleneck. Progress continues on the construction of the Stage III project, which includes a second Aurora mine and an upgrading expansion. In September 2005, the project announced a 2% increase to its total cost estimate from $8.1 billion to $8.3 billion, which was further increased to $8.4 billion in January 2006. Syncrude’s Stage III expansion is on schedule and expected to be on-stream in mid-2006 and will increase Petro-Canada’s share of production capacity to approximately 42,000 b/d. Production is expected to reach this level following a ramp up period of two to three years.

Syncrude has an estimated remaining proved and probable reserves life in excess of 50 years. Proved reserves of 30 degree synthetic crude oil from Syncrude are based on high geological certainty and the application of proven or piloted technology. Drill-hole spacing is less than 500 metres and appropriate co-owner and regulatory approvals are in place. For probable reserves, drill hole spacing is less than 1,000 metres and reserves are included in the 50-year long-range lease development plan. In 2005, approximately 153 million tons of oil sands produced 94 MMbbls of bitumen that was upgraded into 78 MMbbls of synthetic crude oil.

Three mines are currently in operation at Syncrude. The Base mine operations are carried out using drag lines, bucket wheel reclaimers and belt conveyors. These operations will be discontinued in 2006. The North mine and Aurora mine operations are carried out using truck, shovel and hydro-transport systems. An extraction process recovers about 90% of the crude bitumen contained in the mined sands. Refining processes upgrade the bitumen into high-quality, light (30 degree) sweet synthetic crude oil, with a process yield of approximately 85%. Syncrude’s synthetic crude oil production is processed at refineries in Edmonton, Alberta, Eastern Canada and the U.S.

Two electricity generating plants located on-site and owned by the Syncrude joint venture partners provide power for Syncrude. One plant produces a maximum of 270 megawatts (MW); the other produces 80 MW.

Syncrude’s production and operating costs were affected by turnarounds in 2005. Petro-Canada’s share of Syncrude’s production averaged 25,700 b/d in 2005, compared with 28,600 b/d in 2004. Coker and vacuum distillation unit turnarounds at Syncrude and a hydrogen plant shutdown reduced production by 2,900 b/d in 2005. Average unit operating and overhead costs increased to $31.90/bbl in 2005, up from $21.13/bbl in 2004. Higher operating costs were mainly due to lower production, higher maintenance costs, rising natural gas costs, an insurance premium surcharge and Syncrude incentive-based compensation. Syncrude realized price for synthetic crude oil averaged $70.41/bbl in 2005, up from $52.40/bbl in 2004.

Oil Sands In Situ - Bitumen

In September 2002, Petro-Canada successfully completed construction of its 100% owned, in situ bitumen production facility at MacKay River. Following the introduction of steam to the reservoir, Petro-Canada commenced bitumen production in November 2002. The extraction process at MacKay River utilizes SAGD, a technology that Petro-Canada participated in developing through its involvement in the Underground Test Facility (UTF). SAGD combines horizontal drilling with thermal steam injection. Steam is injected into the reservoir through the top well of a horizontal well pair to mobilize the bitumen, which flows to the lower producing well. This technology can economically recover more than 60% of the bitumen in place. The initial development at MacKay River includes two well pads of 12 and 13 horizontal well pairs, respectively. Well pairs are about 700 to 750 metres in length and produce 800 b/d to 1,200 b/d of bitumen. On average, wells are expected to have a six- to eight-year life. More than 90% of the water used to generate steam at MacKay River is recycled, a key feature of the environmental efficiency of the facility. The bitumen production from the project is currently being transported to the Athabasca Pipeline Terminal via a lateral insulated pipeline operated by Enbridge Pipelines (Athabasca) Inc. To enable onward shipment through major North American pipelines, the bitumen is diluted with synthetic crude oil provided under a long-term supply arrangement with Suncor Energy Marketing Inc. The MacKay River reserves are expected to sustain plateau production of 27,000 b/d to 30,000 b/d, after accounting for well maturity, turnarounds and unplanned events, for approximately 25 to 30 years.

MacKay River’s reliability improved and unit operating costs decreased in 2005. Production averaged 21,300 b/d in 2005, up from an average of 16,600 b/d in 2004. MacKay River reliability averaged 98% in 2005, up from 79% in 2004. Unit operating and overhead costs decreased by 22% in 2005, averaging $17.06/bbl, compared with $21.87/bbl in 2004. Lower unit operating costs were due to higher production which lowered per unit fixed costs, partially offset by higher natural gas costs. MacKay River realized price for bitumen averaged $18.53/bbl in 2005, compared with $18.37/bbl in 2004.

Early in 2005, Petro-Canada acquired the Dover UTF and oil sands leases adjacent to the MacKay River development. The leases provide additional SAGD development potential. Later in the year, Petro-Canada filed an application for a potential MacKay River in situ expansion project with first production by the end of the decade and peak production of an additional 40,000 b/d to follow. Petro-Canada also continued to evaluate its Lewis leases in 2005.

Fort Hills Acquisition

In early 2005, Petro-Canada strengthened its position in oil sands mining by securing the majority interest and operatorship of the Fort Hills project from UTS. Later in the year, a mining partner, Teck Cominco, joined the consortium. Petro-Canada is project operator with a 55% interest; UTS has a 30% interest; and Teck Cominco holds a 15% interest. Petro-Canada plans to market 100% of the production from Fort Hills. The Fort Hills oil sands mining and upgrading project has leases estimated to contain at least 2.8 billion bbls of bitumen resource (1.5 billion bbls net to Petro-Canada), which will be recovered over a 30- to 40-year period. The project has received regulatory approval to produce up to 190,000 b/d of bitumen from the mine.

In 2006, the Company will work on the Fort Hills mine, extraction and upgrading Design Basis Memorandum (DBM), which establishes key design parameters and a more detailed project schedule. Early in 2006, Petro-Canada announced plans to locate the Fort Hills upgrader northeast of Edmonton in Sturgeon County, in an area zoned for heavy industrial development. The upgrader is expected to use delayed coking technology to convert Fort Hills bitumen into light synthetic crude oil. Once the DBM is completed near the end of the year, a regulatory application will be filed in either late 2006 or early 2007.

Royalty Regime

During 2001, Syncrude completed the transition from a project-specific contractual royalty to the 1997 Province of Alberta Oil Sands Royalty Regulation. Effective in January 2002, the royalty payable by Syncrude to the Province of Alberta was set at the greater of 1% of gross revenue, or 25% of net revenue. The net revenue is determined by subtracting allowable operating and capital costs from gross revenue. In 2005, the royalty paid averaged $0.71/bbl. It is expected that Syncrude will reach royalty payout in early 2006, at which time the royalty rate will shift to 25% of net operating revenues from 1% of gross revenue. The total royalty payable in 2006 is expected to equate to a rate of between 3% and 10% of gross revenue, depending on crude oil prices.

The MacKay River operation is subject to the 1997 Alberta Oil Sands Royalty Regulation. Prior to royalty payout, which includes a specified return allowance, the royalty is calculated as 1% of gross revenue. After royalty payout, the royalty is based on the greater of 1% of gross revenue, or 25% of net revenue. The net revenue is determined by subtracting allowable operating and capital costs from gross revenue. In 2005, the royalty paid was $0.16/bbl.

Integrated Oil Sands Development

At the Edmonton refinery, Petro-Canada is investing to convert the facility to oil sands feedstock exclusively and to produce low-sulphur products. By mid-2008, an anticipated capital investment of $1.6 billion is expected to expand coker capacity, add new crude and vacuum units, increase sulphur plants and expand utilities. Costs based on the completion of preliminary engineering have increased from the original conceptual estimate of $1.2 billion. The increase reflects a more current assessment of refinery integration requirements and industry-wide cost pressures. Project economics remain strong as projected light/heavy crude differentials are expected to offset the increase in capital.

It is anticipated that the refinery conversion program will enable Petro-Canada to directly upgrade 26,000 b/d of bitumen and process 48,000 b/d of sour synthetic crude oil, replacing the conventional light crude feedstock refined today. The refinery conversion program supports the Company’s long-term strategy and builds on a $1.4 billion investment in gasoline and diesel desulphurization.

Link to Petro-Canada’s Corporate and Strategic Priorities

The Oil Sands business is aligned with Petro-Canada’s strategic priorities as outlined by its progress in 2005 and goals for 2006.

| | 2005 PROGRESS | 2006 GOALS |

DELIVERING PROFITABLE GROWTH WITH A FOCUS ON OPERATED, LONG-LIFE ASSETS | § secured a position in oil sands mining with Petro-Canada becoming operator and owning a 55% interest in Fort Hills; § acquired the Dover UTF and oil sands leases adjacent to MacKay River; § progressed construction of the Syncrude Stage III expansion; and § undertook an extensive drilling program at Lewis. | § advance Fort Hills and MacKay River expansion development plans; § start up Syncrude Stage III expansion; and § increase MacKay River production to between 27,000 b/d and 30,000 b/d by year end. |

DRIVING FOR FIRST QUARTILE OPERATION OF OUR ASSETS | § decreased MacKay River unit operating costs by 22%; § achieved average reliability at MacKay River of 98%, up from 79% in 2004; and § saw Syncrude non-fuel unit operating costs increase by 47%. | § decrease MacKay River non-fuel unit operating costs by 15%; § decrease Syncrude non-fuel unit operating costs by 25%; and § sustain MacKay River reliability at 2005 levels or better. |

CONTINUING TO WORK AT BEING A RESPONSIBLE COMPANY | § saw no change to total recordable injury frequency compared to 2004; § on behalf of Downstream, completed recycled waterline for reusing wastewater at the Edmonton refinery; and § established the McLelland Lake Wetland Complex Sustainability Committee to assist in the management of the patterned fen. | § maintain focus on total recordable injury frequency; and § ensure regulators, First Nations and other key stakeholders affected by major projects are properly consulted and engaged. |

International

Business Summary and Strategy

International production and exploration interests are currently focused in three regions. In Northwest Europe, production comes from the U.K. and the Netherlands sectors of the North Sea. The North Africa/Near East region provides crude oil production from interests in Libya, with exploration activity extending to Syria, Algeria, Tunisia and Morocco. In Northern Latin America, operations are focused in Trinidad and Tobago, and Venezuela.

In 2005, Petro-Canada reached an agreement to sell the Company’s mature producing assets in Syria. The sale closed on January 31, 2006. These assets and associated results are reported as discontinued operations and excluded from continuing operations.

The International strategy is to access a sizable resource base using a three-fold approach to:

| § | optimize and leverage existing assets; |

| § | seek out new, long-life opportunities; and |

| § | build a balanced exploration program. |

Strong realized commodity prices were partially offset by lower production in 2005. International production from continuing operations averaged 106,300 boe/d in 2005, compared with 117,400 boe/d in 2004. The decrease was primarily due to lower production in Northwest Europe. International crude oil and liquids realized prices from continuing operations averaged $65.90/bbl and natural gas realized prices averaged $6.97/Mcf in 2005, compared with $49.19/bbl and $5.27/Mcf, respectively, in 2004. Operating and overhead costs from continuing operations averaged $7.60/boe in 2005, up from $7.13/boe in 2004, due to lower production and higher overhead costs to support growth projects.

Northwest Europe

Production in Northwest Europe comes from the U.K. and the Netherlands sectors of the North Sea, with exploration programs extending into Denmark and Norway. Extensive industry development has taken place in the North Sea since the early 1970s. While the basin is now a mature play, moderate-size fields continue to be developed and exploited.

Petro-Canada’s Northwest Europe production averaged 44,600 boe/d in 2005, compared with 54,600 boe/d in 2004. Added production volumes from the new Pict field were more than offset by production declines in the Netherlands sector of the North Sea, an unscheduled Triton platform shutdown at the end of the year and a maintenance turnaround at the Scott platform mid-year. Northwest Europe crude oil and liquids realized prices averaged $66.13/bbl and natural gas averaged $7.35/Mcf in 2005, compared with $50.37/bbl and $5.65/Mcf, respectively, in 2004.

In the Outer Moray Firth, Petro-Canada holds a 20.6% working interest in the Scott oilfield and production platform, and a 9.4% working interest in the Telford oilfield, a subsea tie-back to the Scott platform. High-quality crude oil from Scott and Telford is transported to shore via the Forties Pipeline System. Associated gas is transported via the Scottish Area Gas Evacuation pipeline system.

In the central North Sea, the Company’s interests are centred on the Triton development area, which is comprised of the joint development of the Guillemot West and Northwest fields, the Bittern field and the Clapham field, which came on-stream at the end of 2003. The Pict field, which achieved first oil in June 2005, also produces through the Triton FPSO. The Pict field is estimated to have resources of about 13 MMbbls of oil and produced an average of 15,000 boe/d during the last half of 2005. The crude oil gathered at Triton is shipped via tanker, while gas is exported through the SEGAL system to the U.K. Petro-Canada is a 33.1% owner of the Triton FPSO.

In June 2004, the third U.K. area of focus was added in Outer Moray Firth through the acquisition of a 29.9% interest in the Buzzard oilfield. The purchase also included nearby blocks that have exploration potential. The Buzzard field is currently under development with more than 88% of the construction complete as of December 31, 2005. Progress on the field continues on schedule and on budget with first oil expected in late 2006. Peak production of 60,000 boe/d net to Petro-Canada is expected in late 2007. The field is being developed with three bridge-linked platforms supporting the wellhead facilities, the production facilities, living quarters and the utilities.

In the Netherlands sector, the major source of gas production is from Blocks L8b and L5c (Petro-Canada working interests are 25% and 30%, respectively). The produced gas is transported to shore by pipeline and sold to NV Nederlandse Gasunie under long-term delivery/offtake contracts. Petro-Canada’s oil production from the Netherlands sector is primarily from the Petro-Canada operated Hanze field (Petro-Canada working interest - 45%). Oil from the Hanze platform is exported by dedicated tanker, with the cargoes marketed on a spot basis into Northwest Europe. Petro-Canada also holds a 12% interest in the onshore Bergen gas storage facility operated by BP p.l.c. A small non-operated asset, L5b-C is expected to be on-stream in late 2006, with peak production in excess of 3,000 boe/d net to Petro-Canada.

The De Ruyter field, located in the southern North Sea approximately 60 kilometres northwest of the Hague, is expected to be on-stream in late 2006 with peak production of 10,000 boe/d net to Petro-Canada. Crude oil will be exported to shore via shuttle tanker. Gas export will be via tie-in to an existing pipeline.

Other Developments

Petro-Canada continues to focus on building a balanced exploration program. In 2005, the Company made two discoveries in the U.K. sector of the North Sea and progressed work on the Hejre discovery. Petro-Canada has a 100% working interest in the Saxon discovery in the Triton area, which is estimated to have resources of about 14 MMbbls of oil and could be on-stream sometime in 2007. A second discovery has been made in Block 13/27a, which is located northwest of the Buzzard field. Petro-Canada is determining if additional appraisal is warranted to establish commercial viability. In Denmark, work progressed on the previously discovered Hejre field, in which Petro-Canada has a 25% working interest. A successful appraisal well is being evaluated.

In the third quarter of 2005, Petro-Canada was awarded eight blocks in the U.K. Continental Shelf 23rd round of licensing. These blocks are located in the Moray Firth. Petro-Canada is the operator and currently has a 90% working interest in these blocks and a total work program of four commitment wells, plus seismic acquisition and reprocessing.

During the fourth quarter of 2005, Petro-Canada was awarded five production licences by the Norwegian Ministry of Petroleum and Energy. The licences are located in the North Sea where Petro-Canada has established knowledge and expertise. The Company is operator of two licences and non-operator for the remaining three licences. The work program on four of the licences covers reprocessing 3D seismic and a two-year drill-or-drop commitment. The work program for the remaining licence involves seismic exploration and a one-well commitment to be drilled within four years. As part of this exploration program, Petro-Canada will be opening an office in Norway.

North Africa/Near East

The core region of North Africa/Near East provides crude oil production from interests principally in Libya.

Petro-Canada’s 2005 production from continuing operations in Libya and Algeria averaged 49,800 boe/d, relatively unchanged from 50,900 boe/d in 2004. North Africa/Near East crude oil and liquids realized prices from continuing operations averaged $65.75/bbl, compared with $48.26/bbl in 2004.

In Libya, Petro-Canada is one of the country’s largest producers through its 49% interest in Veba Oil Operations (VOO), a joint venture with the National Oil Corporation of Libya (NOC). Production is high-quality, low-sulphur (sweet) crude oil.

Petro-Canada’s production through the VOO joint venture comes from three concessions that combine the operations of more than 20 fields, and one exploration and production-sharing agreement (EPSA) covering the En Naga North and En Naga West oilfields. Petro-Canada also has equity interests in the Ras Lanuf export terminal and various pipelines through which the majority of the production is exported. Petro-Canada’s production is currently sold on contract to the NOC. As Libya is a member of OPEC, Libyan production may be constrained by OPEC quotas.

In late 2005, Petro-Canada reached an agreement to sell the Company’s producing assets in Syria. Syria remains an important part of the North Africa/Near East region, with an active exploration program in Block II. In 2005, the Company procured 3D and 2D seismic surveys in Block II and plans to drill two exploration wells in 2006.

In Algeria, Petro-Canada is the operator and has a 100% working interest in the Zotti Block. The award received final government approval late in 2004 and Petro-Canada continues to process 2D seismic data acquired earlier in 2005, with a well planned for 2006.

Petro-Canada relinquished its Tinrhert Block production sharing contract (PSC) with SONATRACH, the Algerian national oil company, effective December 31, 2004. This included a 70% interest in the Tamadanet oilfield, which was producing about 600 b/d at the end of the year.

In Tunisia, Petro-Canada is operator and has a 72.5% interest in the Melitta Block, located mainly offshore in the Mediterranean Sea. In early 2006, Petro-Canada was awarded two offshore, non-operated prospecting permits.

In mid-2005, Petro-Canada signed a one-year reconnaissance licence with the Moroccan Office National Bureau for Hydrocarbons and Mines. The Company will carry out field work and studies in the Bas Draa Block (covering 59,000 square kilometres) during the reconnaissance licence period.

Northern Latin America

In Northern Latin America, Petro-Canada’s operations are focused in Trinidad and Tobago where the Company holds a 17% working interest in the North Coast Marine Area 1 (NCMA-1) offshore gas development project operated by BG Group plc (British Gas). Natural gas production is delivered by pipeline to the LNG facility operated by Atlantic LNG at Point Fortin for liquefaction and subsequent sale into U.S. markets.

In 2005, Petro-Canada’s share of Trinidad and Tobago production averaged 72 MMcf/d, unchanged from 2004. Northern Latin America realized price for natural gas averaged $6.62/Mcf, compared with $4.81/Mcf in 2004.

Petro-Canada signed PSCs with the Trinidad and Tobago Ministry of Energy and Energy Industries for offshore exploration Blocks 1a, 1b and 22 in 2005. These blocks cover 4,258 kilometres, with Block 1a containing four discoveries. Awarding of these three blocks considerably strengthens Petro-Canada’s prospects for future growth in the area. Late in 2005, work on the Trinidad and Tobago offshore exploration Block 22 was advanced with the start of a 3D seismic survey; a second seismic survey on Blocks 1a and 1b started in early 2006. The Company expects to invest more than $100 million in the first phase of exploration, which includes the 3D seismic survey and the drilling of six exploration wells.

In Western Venezuela, Petro-Canada holds a 50% working interest in the La Ceiba Block that straddles the eastern shores of Lake Maracaibo. In 2003, Petroleos de Venezuela, S.A., the national oil company of Venezuela, approved an agreement for an extended production test to evaluate the commercial viability of the La Ceiba oil discovery. A declaration of commercial viability and a field development plan were filed for the La Ceiba development in late 2005. If developed, peak production from La Ceiba is expected to be about 13,000 b/d net to Petro-Canada. This project will provide the Company with a meaningful foothold in the country, which is perceived to have significant future opportunities.

Business Development Opportunities

The Company continues to advance discussions on importing gas from Russia to North America through a joint LNG project with Gazprom. The project proposed in the St. Petersburg region is expected to export 3.5 million to 5 million tonnes per annum (or 500 MMcf/d to 700 MMcf/d) with the gas supplied from the Russian gas grid. In October 2004, an MOU was signed with Gazprom to develop a feasibility study by mid-2005. The work was completed and Petro-Canada and Gazprom are currently discussing whether to move to a commercial proposal for the project.

Link to Petro-Canada’s Corporate and Strategic Priorities

The International business is aligned with Petro-Canada’s strategic priorities as outlined by its progress in 2005 and goals for 2006.

| | 2005 PROGRESS | 2006 GOALS |

DELIVERING PROFITABLE GROWTH WITH A FOCUS ON OPERATED, LONG-LIFE ASSETS | § advanced Buzzard development on schedule and on budget; § achieved first oil at Pict in June 2005; § progressed exploration with two discoveries in the U.K. sector of the North Sea and the Hejre appraisal; and § was awarded eight blocks in the 23rd U.K. licensing round and five Norwegian production licences. | § achieve first production by year end at Buzzard in the U.K. sector of the North Sea and at De Ruyter and L5b-C in the Netherlands sector of the North Sea; § conduct 11-well drilling program with balanced risk profile; § complete seismic program in Trinidad and Tobago and refine exploration well locations; and § advance field development plans for LaCeiba in Venezuela and Saxon in the U.K. sector of the North Sea. |

DRIVING FOR FIRST QUARTILE OPERATION OF OUR ASSETS | § completed Hanze turnaround in nine days versus planned 14 days; § participated in peer benchmarking studies for North Sea producing facilities; and § secured lease on new London office building on very favourable terms. | § conduct North Sea Triton de-bottlenecking study; § ensure De Ruyter operations readiness; § increase technical and environment, health and safety co-operation in Libya; § improve reliability and uptime on the Scott platform; and § roll out International management system. |

CONTINUING TO WORK AT BEING A RESPONSIBLE COMPANY | § reduced total recordable injury frequency by 22% compared to 2004; § initiated program of Zero Harm inspections by management; § rolled out Zero Harm supervisory training for leaders; § worked with community to minimize impact of onshore well in Tunisia; § developed oil spill strategy and coastline mapping for offshore well in Tunisia; and § initiated plan to protect forest reserve during seismic operations in Syria. | § maintain focus on total recordable injury frequency; § consult with communities in Trinidad and Tobago in preparation for exploration drilling program; § reduce oil in produced water at Triton; and § introduce Employee Assistance Program for International employees. |

Discontinued Operations

In late 2005, Petro-Canada reached an agreement to sell the Company’s producing assets in Syria for EUR 484 million (Canadian equivalent of $676 million as at December 20, 2005), before adjustments. The sale closed on January 31, 2006 and a gain on disposal of approximately $140 million will be recorded in the first quarter of 2006. The sale of these mature assets aligns with Petro-Canada’s strategy to increase the proportion of long-life and operated assets within the portfolio. Syria remains an important part of the North Africa/Near East producing region. Petro-Canada has maintained an active exploration program in Block II and has continued pursuit of new opportunities. Additional information concerning Petro-Canada’s discontinued operations can be found in Note 3 to the Consolidated Financial Statements.

Upstream Production and Prices

The following table shows Petro-Canada’s average daily production of conventional crude oil, NGL, bitumen, synthetic crude oil (from mining operations) and natural gas, before and after deduction of royalties for the years indicated.

AVERAGE DAILY PRODUCTION OF CRUDE OIL, NGL,

BITUMEN, SYNTHETIC CRUDE OIL AND NATURAL GAS

| | Years Ended December 31, |

| | 2005 | 2004 | 2003 |

| | Before Royalties | After Royalties | Before Royalties | After Royalties | Before Royalties | After Royalties |

Crude oil and equivalents (thousands of barrels/day - Mbbl/d) | | | | | | |

| East Coast Oil | 75.3 | 69.6 | 78.2 | 75.1 | 86.1 | 84.0 |

Oil Sands1 | 47.0 | 46.5 | 45.2 | 44.8 | 36.1 | 35.7 |

| North American Natural Gas | 14.7 | 11.2 | 15.3 | 11.4 | 16.9 | 12.6 |

| Northwest Europe | 33.7 | 33.2 | 40.4 | 40.4 | 37.7 | 37.7 |

| North Africa/Near East | 49.8 | 44.0 | 50.9 | 43.7 | 53.4 | 43.3 |

| Total crude oil and NGL | 220.5 | 204.5 | 230.0 | 215.4 | 230.2 | 213.3 |

Natural gas production (MMcf/d) | | | | | | |

| North American Natural Gas | 668 | 512 | 695 | 530 | 693 | 521 |

| Northwest Europe | 66 | 66 | 85 | 85 | 80 | 80 |

| North Africa/Near East | - | - | - | - | - | - |

| Northern Latin America | 72 | 56 | 72 | 51 | 63 | 63 |

Total natural gas | 806 | 634 | 852 | 666 | 836 | 664 |

Total production from continuing operations2 (thousands of barrels of oil equivalent/day - Mboe/d) | 355 | 310 | 372 | 326 | 370 | 324 |

Discontinued operations | | | | | | |

Crude oil and NGL (Mbbl/d) | 65.9 | 20.3 | 75.7 | 23.7 | 89.7 | 34.6 |

Natural gas production (MMcf/d) | 25 | 4 | 21 | 3 | 32 | 6 |

Total production from discontinued operations2 (Mboe/d) | 70 | 21 | 79 | 24 | 95 | 36 |

Total production2 (Mboe/d) | 425 | 331 | 451 | 350 | 465 | 360 |

Proved oil and NGL reserves3, 4 (millions of barrels - MMbbls) | 866 | 733 | 801 | 674 | 796 | 650 |

Proved natural gas reserves (trillions of cubic feet - Tcf)4 | 2.2 | 1.7 | 2.5 | 2.0 | 2.5 | 2.0 |

1 Includes production of synthetic crude oil from Syncrude mining operation.

| 2 | Natural gas is converted to oil equivalent using six Mcf of gas to one boe. |

| 3 | Includes reserves of synthetic crude oil from Syncrude mining operation. |

| 4 | Syria proved reserves before royalties of 49 MMboe are included as at December 31, 2005. |

The following table shows Petro-Canada’s average daily production of conventional crude oil, NGL, bitumen, synthetic crude oil and natural gas, before deduction of royalties by quarter for the years indicated.

AVERAGE DAILY PRODUCTION OF CRUDE OIL, NGL,

BITUMEN, SYNTHETIC CRUDE OIL AND NATURAL GAS

BEFORE ROYALTIES BY QUARTER

| | | 2005 Three Months Ended | | 2004 Three Months Ended | |

| | | Mar. 31 | | June 30 | | Sept. 30 | | Dec. 31 | | Mar. 31 | | June 30 | | Sept. 30 | | Dec. 31 | |

Crude oil and equivalents (Mbbl/d) | | | | | | | | | | | | | | | | | | | | | | | | | |

| East Coast Oil | | | 77.9 | | | 77.8 | | | 64.7 | | | 81.1 | | | 87.5 | | | 85.4 | | | 71.5 | | | 68.4 | |

Oil Sands1 | | | 38.3 | | | 48.9 | | | 52.1 | | | 48.3 | | | 47.4 | | | 40.7 | | | 45.4 | | | 47.1 | |

| North American Natural Gas | | | 16.2 | | | 14.5 | | | 14.0 | | | 14.0 | | | 15.1 | | | 13.7 | | | 15.7 | | | 16.9 | |

| Northwest Europe | | | 34.3 | | | 26.3 | | | 38.7 | | | 35.6 | | | 46.8 | | | 43.7 | | | 36.6 | | | 34.8 | |

| North Africa/Near East | | | 48.1 | | | 49.7 | | | 50.4 | | | 50.9 | | | 51.7 | | | 50.5 | | | 51.0 | | | 50.7 | |