QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Possis Medical Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held December 8, 2004

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Possis Medical, Inc., a Minnesota corporation, will be held on Wednesday, December 8, 2004, at 4:00 p.m., Central Time, at the Minneapolis Marriott City Center, 30 South Seventh Street, Minneapolis, Minnesota 55402, for the following purposes:

- 1.

- To elect seven directors.

- 2.

- To ratify the appointment of Deloitte & Touche LLP as our independent auditors.

- 3.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

All shareholders of record as of the close of business on Friday, October 22, 2004, will be entitled to vote at the meeting.

Your attention is respectfully directed to the enclosed proxy statement and card. Your vote is important. Whether or not you expect to attend the Annual Meeting in person, please (1) date, sign and promptly mail the enclosed proxy card in the return envelope provided; (2) call the toll-free number listed on the proxy card; or (3) vote via the Internet as indicated on the proxy card.

Dated: November 5, 2004

Possis Medical Inc. • 9055 Evergreen Boulevard NWM • Minneapolis, MN 55433-8003 USA

Phone: (763) 780-4555 Toll Free 1-800-810-7677 Fax: (763) 780-2227

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD DECEMBER 8, 2004

SOLICITATION AND REVOCATION OF PROXIES, VOTING RIGHTS

This proxy statement is furnished to the shareholders of Possis Medical, Inc. ("Possis") in connection with the solicitation of proxies for the Annual Meeting of Shareholders to be held on December 8, 2004, and any adjournments thereof. The enclosed proxy is solicited by our Board of Directors.

On October 22, 2004, 17,807,910 shares of common stock, our only voting securities, were outstanding. Each share of common stock is entitled to one vote. Shareholders are not entitled to cumulate their votes in the election of directors. Only holders of common stock of record at the close of business on October 22, 2004, will be entitled to notice of and to vote at this Annual Meeting of Shareholders.

You may vote your shares in three ways: (i) through the Internet; (ii) by a toll-free telephone call; or (iii) by completing the enclosed proxy card and mailing it to Possis. The procedures for Internet and telephone voting are described on the proxy card. The Internet and telephone voting procedures are designed to verify shareholders' identities, allow shareholders to give voting instructions and confirm that their instructions have been recorded properly. Shareholders who vote through the Internet should be aware that they may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers, and that these costs must be borne by the shareholder. Shareholders who vote by Internet or telephone need not return a proxy card by mail.

You have the right to revoke your proxy at any time before the convening of the Annual Meeting. Revocation must be in writing, regardless of how you voted your shares, signed in exactly the same manner as described in the proxy, and dated. Revocations will be honored if received at our principal executive offices, addressed to the attention of the Corporate Secretary, before the convening of the Annual Meeting on December 8, 2004. In addition, on the day of the meeting, prior to the convening thereof, revocations may be delivered to Possis representatives who will be seated at the door of the meeting hall.

Proxies that are properly completed and not revoked will be voted as indicated in such proxy. Proxies that lack any such specification will be voted in favor of the proposals set forth in the Notice of Meeting and in favor of all of the director nominees. If you abstain from voting as to any matter, then the shares held by you will be deemed present at the meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such matter, but will not be deemed to have been voted in favor of such matter. Abstentions as to any proposal, therefore, will have the same effect as a vote against such proposal. If a broker returns a "non-vote" proxy, indicating a lack of voting instruction by the beneficial holder of the shares and a lack of discretionary authority on the part of the broker to vote on a particular matter, then the shares covered by such non-vote will not be deemed to be represented at the meeting for purposes of calculating the vote for approval of such matter, but will be deemed to be present for purposes of determining the presence of a quorum.

Possis will bear the cost of the solicitation of proxies, including the charges and expenses of brokerage firms and others for forwarding solicitation material to, and obtaining proxies from, beneficial owners of our common shares. In addition to the use of the mails, proxies may be solicited in

1

person or by telephone, letter or facsimile. Proxies may be solicited by our officers or other employees, who will receive no special compensation for their services. This proxy statement and the enclosed form of proxy are first being sent to shareholders on approximately November 5, 2004.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership as of October 11, 2004, of each director and "named executive officer" (as defined under the heading "Executive Compensation") and all directors and executive officers as a group. We are not aware of any person who beneficially owns more than five percent of our common shares.

Name of Beneficial Owner or

Identity of Group

| | Amount

Beneficially

Owned(1)

| | Total %

of Class

|

|---|

| Robert G. Dutcher, Chairman, President & Chief Executive Officer | | 529,384 | (2) | 2.9 |

Mary K. Brainerd, Director |

|

19,283 |

(3) |

* |

Seymour J. Mansfield, Director |

|

241,828 |

(4) |

1.3 |

William C. Mattison, Jr., Director |

|

362,837 |

(5) |

2.0 |

Whitney A. McFarlin, Director |

|

62,908 |

(6) |

* |

Donald C. Wegmiller, Director |

|

34,849 |

(7) |

* |

Rodney A. Young, Director |

|

22,396 |

(8) |

* |

Eapen Chacko, Vice President, Finance and Chief Financial Officer |

|

103,090 |

(9) |

* |

Irving R. Colacci, Vice President, General Counsel and Secretary |

|

213,639 |

(10) |

1.2 |

James D. Gustafson, Vice President, Technology, Product Development and Quality Systems |

|

205,988 |

(11) |

1.1 |

Shawn F. McCarrey, Vice President, Worldwide Sales |

|

119,946 |

(12) |

* |

Directors and Executive Officers as a Group (12 persons) |

|

2,171,288 |

(13) |

12.0 |

- (1)

- Includes options that are currently exercisable or will become exercisable within sixty days of October 11, 2004.

- (2)

- Includes 470,939 shares issuable upon exercise of currently exercisable options.

- (3)

- Includes 18,280 shares issuable upon exercise of currently exercisable options.

- (4)

- Includes 118,753 shares issuable upon exercise of currently exercisable options.

- (5)

- Includes 221,000 shares held indirectly in trust and by an IRA and 30,334 shares issuable upon exercise of currently exercisable options.

- (6)

- Includes 60,905 shares issuable upon exercise of currently exercisable options.

- (7)

- Includes 4,304 shares issuable upon exercise of currently exercisable options.

- (8)

- Includes 20,833 shares issuable upon exercise of currently exercisable options and 160 shares owned indirectly by minor child.

- (9)

- Includes 95,375 shares issuable upon exercise of currently exercisable options.

- (10)

- Includes 205,875 shares issuable upon exercise of currently exercisable options.

- (11)

- Includes 193,925 shares issuable upon exercise of currently exercisable options.

- (12)

- Includes 98,498 shares issuable upon exercise of currently exercisable options and 275 shares owned by a minor child.

- (13)

- Includes 1,532,796 shares issuable upon exercise of currently exercisable options.

- *

- Denotes ownership of less than 1% of shares outstanding

2

ELECTION OF DIRECTORS

(Proposal Number One)

At the Annual Meeting, seven directors will be elected to serve until the next Annual Meeting of Shareholders and until their respective successors are elected and qualified.

The affirmative vote of a majority of the shares of our common stock presented in person or by proxy and entitled to vote at the annual meeting is necessary to elect each nominee. Unless instructed not to vote for the election of directors or not to vote for any specific nominee, Proxies will be voted FOR the election as directors of the seven nominees named below. If any nominee becomes unavailable for any reason or if a vacancy should occur before the election, which events are not anticipated, the named proxies may vote for such other person as they, in their discretion, may determine.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ALL NOMINEES FOR DIRECTOR.

INFORMATION CONCERNING NOMINEES

The following information concerning the principal occupations of the nominees has been furnished by the nominees. Each of the nominees has held his or her principal occupation for more than the past five years, unless otherwise indicated.

Director Nominees

| | Principal Occupation

| | Age

| | Director

Since

| | Committee

Positions

|

|---|

| Robert G. Dutcher | | Chairman, President and Chief Executive Officer of the Company. Director: Daktronics, Inc. | | 59 | | 1993 | | Executive and Strategic Planning |

Mary K. Brainerd |

|

President and Chief Executive Officer of Health Partners in Minneapolis, Minnesota, a family of non-profit Minnesota health care organizations, since 2002; Executive Vice President and Chief Operating Officer of Health Partners from 2000 to 2002; Executive Vice President of Care Delivery, Health Partners from 1994 to 2000. Director: Regions Hospital, Minnesota Life, Capital City Partnership, Guthrie Theater and Minnesota Business Partnership. |

|

51 |

|

2001 |

|

Compensation; Governance and Nominating |

Seymour J. Mansfield |

|

Officer and Shareholder of Mansfield, Tanick & Cohen, P.A., Attorneys, in Minneapolis, Minnesota. |

|

59 |

|

1987 |

|

Executive and Strategic Planning; Compensation; Governance and Nominating |

| | | | | | | | | |

3

William C. Mattison, Jr. |

|

Retired. Formerly a Principal of Gerard, Klauer, Mattison & Co., Inc. in New York, New York, an institutional equity research and banking firm; served as President or Vice Chairman of Gerard, Klauer, Mattison from 1989 to 1998. |

|

57 |

|

1999 |

|

Executive and Strategic Planning; Audit; Governance and Nominating |

Whitney A. McFarlin |

|

Retired. Past Chairman, President and Chief Executive Officer of Angeion Corporation, a medical device company in Minneapolis, Minnesota, from 1993 to 1998; Chairman, President and Chief Executive Officer of Clarus Medical Systems, Inc. from 1990 to 1993; and Chairman, President and Chief Executive Officer of Everest and Jennings, Inc. from 1985 to 1990. Past Executive Vice President, Medtronic, Inc. |

|

64 |

|

1998 |

|

Audit; Governance and Nominating |

Donald C. Wegmiller |

|

Chairman of Clark Consulting Healthcare Group in Minneapolis, Minnesota, a compensation and benefits consulting firm. Director: ADESA Inc; JLJ Medical Devices International LLC; Third Millenium Healthcare Systems, Inc; Vivius; Provaction Medical, Inc.; Omni-cell, Inc. |

|

66 |

|

1987 |

|

Executive and Strategic Planning; Compensation; Governance and Nominating |

Rodney A. Young |

|

President and Chief Executive Officer of Medical Graphics Corporation since November 2004; Executive Vice President of Medical Graphics Corporation prior to November 2004. Formerly Chairman, Chief Executive Officer and President of LecTec Corporation. Director: Health Fitness Corporation (1996-2003). |

|

49 |

|

1999 |

|

Audit; Governance and Nominating |

CORPORATE GOVERNANCE

Meetings of the Board of Directors

During fiscal year 2004, the Board of Directors held three meetings. Actions were also taken by written consent. All director nominees attended at least 75% of all meetings of the Board and the committees of which they are members.

4

Committees

During fiscal year 2004, the Board of Directors restructured its standing committees. We still have four committees to address Board business. Duties and responsibilities, however, have been reassigned.

Executive and Strategic Planning Committee. The Executive and Strategic Planning Committee is responsible for exercising the authority of the Board during the intervals between meetings of the Board, for formulating and recommending general policies for Board consideration and for the functions formerly carried out by the Strategic Planning Committee, including working with management in the development of its annual Strategic Plan and advising the Board on strategic issues. This Committee met once during fiscal year 2004.

Governance and Nominating Committee. The newly created Governance and Nominating Committee is responsible for the director nomination and election process, succession planning, and corporate governance issues. Its membership consists of all members of the Board who meet the independent requirements of the Nasdaq listing standards. The Committee operates under a charter, which is available on the Company's website at www.possis.com under the Investors tab. A copy of this Committee's charter is also attached to this proxy statement. The Nominating and Governance Committee met once during fiscal year 2004.

The Governance and Nominating Committee determines the required selection criteria and qualifications of director nominees based on qualification criteria that it develops. The Committee will consider these criteria for nominees identified by the Committee, by shareholders, or through some other source.

The Governance and Nominating Committee will consider qualified candidates for possible nomination that are submitted by the Company's shareholders. To propose a nominee, shareholders should send a letter no later that July 8, 2005 with the proposed nominee's name, biographical information and contact information to the Company, addressed to the Chairman of the Nominating and Governance Committee.

In addition, the Board has also appointed Seymour J. Mansfield as Lead Director. His duties and responsibilities as Lead Director are described in the Charter for the Nominating and Governance Committee.

Audit Committee. The Audit Committee met four times during fiscal year 2004 and assists the Board in fulfilling its responsibility for the safeguarding of assets and oversight of the quality and integrity of our accounting, auditing and reporting practices, overseeing and enforcing governance policies and practices and such other duties as directed by the Board. All members of the Audit Committee are independent, as defined in Rule 4350(d)(2) of the NASD. The Board of Directors has determined that Whitney A. McFarlin is an audit committee financial expert within the meaning of SEC regulations.

Compensation Committee. The Compensation Committee met three times during fiscal 2004 and is responsible for defining and administering our executive compensation program.

Newly adopted charters for all four of the Board's standing committees are attached hereto as an addendum.

Director Fees

Beginning with calendar year 2002, when director compensation was last adjusted, directors who are not employees have received an annual retainer of $6,000, meeting fees of $1,500 per Board meeting attended in person, $500 for each telephonic Board meeting attended, $3,000 for the Chair of each Board committee, $6,000 for each member of the Executive Committee, $500 for each committee

5

meeting attended as committee Chair and $250 for each committee meeting attended as a committee member. In addition, the director serving in the recently created position of Lead Director will receive an additional retainer in an amount to be approved by the Board of Directors. Our 1999 Stock Compensation Plan provides for the annual grant of options to purchase 4,000 common shares to outside directors. The exercise price of these options must be at least 100% of the fair market value at date of grant. The date of grant is the first business day of each calendar year. The options vest 50% after six months and the remainder one year after the date of grant, and expire ten years after the date of grant. During fiscal 2004, 24,000 options were granted to outside directors under this Plan at an exercise price of $19.09. Directors also receive restricted stock equal in value on the date of grant to $6,000. New directors will receive a stock option grant of 8,000 shares of Possis common stock upon initial election to the Board. The Board also has a stock option program to promote retention of directors for a period long enough to allow for a full understanding of the Company, to encourage solid judgments that lead to sustained business success and to aid in the recruitment of new qualified directors. Upon election to a sixth term, directors will receive a 20,000 share stock option grant and additional grants of 4,000 shares annually for ten years. Vesting of these grants is contingent on appreciation of the value of the Company's stock to specified price levels. One director qualified for this grant in 2004 and received 24,000 shares at an option price of $19.09. In addition, all shares continue to be eligible for vesting for five years following retirement from service as a director and vest, in any event, five years following the date of the grant.

Pursuant to our 1999 Stock Compensation Plan, each outside director may elect to receive director fees in the form of discounted stock options. Each director must make an election each year with regard to fees that would otherwise be payable for that calendar year. The exercise price of the options is 50% of the fair market value on the date of grant, which is the first business day of the year following the year for which the fees are earned. Each option becomes exercisable in full six months following the date of grant, is exercisable for 10 years following the date of grant, and is subject to the general restrictions on exercise and transferability applicable to stock options issued to employees. The number of shares subject to each option is calculated by dividing the fees owed to the particular director by the discounted exercise price.

On January 2, 2004, all eligible outside directors received discounted stock options in lieu of cash payments of fees for calendar year 2003. A total of 11,074 options at an exercise price of $9.55 were granted to six directors.

SHAREHOLDER COMMUNICATION POLICY

Shareholders may communicate with the Company's Board of Directors by sending a letter addressed to the Board of Directors or specified individual directors to: Possis Medical, Inc., 9055 Evergreen Blvd. NW, Minneapolis, MN 55433, c/o Irving R. Colacci, Vice President, General Counsel and Secretary. All communications will be compiled by the General Counsel of the Company and submitted to the Board or the individual directors on a periodic basis.

The Company encourages, but does not require, directors to attend the annual meeting of shareholders. All directors attended the Company's 2003 annual meeting of shareholders. All current directors, with the exception of Robert Dutcher, are determined to be "independent" for purposes of federal regulations and listing requirements of the NASD.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth compensation paid for services rendered to the Company during each of the three fiscal years ended July 31, 2004, 2003 and 2002, to our President and Chief Executive

6

Officer and our four other highest paid executive officers who received salary and bonus in excess of $100,000 during fiscal year 2004 ("named executive officers"):

| |

| |

| |

| | Long-Term Compensation Awards

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

| |

| |

| | Securities

Underlying

Options/(2)

SARs (#)

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus(1)

($)

| | Restricted

Stock Award ($)

| | All Other

Compensation(3) ($)

|

|---|

Robert G. Dutcher,

Chairman, President and Chief Executive Officer | | 2004

2003

2002 | | 258,392

225,998

214,881 | | 176,300

177,500

175,300 | | —

—

— | | 56,300

49,800

57,400 | | 23,937

20,046

13,291 |

Eapen Chacko,

Vice President, Finance and Chief Financial Officer |

|

2004

2003

2002 |

|

148,516

138,602

131,441 |

|

91,300

83,200

70,200 |

|

—

—

— |

|

22,800

19,500

21,700 |

|

23,856

6,742

5,904 |

Irving R. Colacci

Vice President, Legal Affairs and Human Resources, General Counsel and Secretary |

|

2004

2003

2002 |

|

141,262

132,300

125,716 |

|

86,800

78,300

68,000 |

|

—

—

— |

|

21,100

19,900

22,000 |

|

24,513

12,380

12,704 |

James D. Gustafson,

Vice President, Technology, Product Development and Quality Systems |

|

2004

2003

2002 |

|

148,055

138,602

131,516 |

|

94,900

83,200

70,200 |

|

—

—

— |

|

22,800

19,500

21,700 |

|

23,242

10,748

16,958 |

Shawn F. McCarrey,

Vice President, Worldwide Sales |

|

2004

2003

2002 |

|

142,538

126,000

120,000 |

(4)

(5)

(6) |

42,000

25,300

20,000 |

|

—

—

23,900 |

(7) |

21,200

19,900

43,523 |

|

12,772

13,511

13,145 |

- (1)

- Cash bonuses shown are awarded following the end of the fiscal year, based on fiscal year performance.

- (2)

- Stock options shown for 2004 were granted on September 17, 2004 based on fiscal year 2004 performance and vest in four equal annual installments.

- (3)

- Includes Company matching contributions to its 401(k) Plan, executive benefits including financial planning and car allowance and excess life insurance premium payments. The allocated amounts in this column are as follows: Dutcher: 2004: 401(k)—$6,828, executive benefits—$21,593, excess life insurance—$516; 2003: 401(k)—$4,410, executive benefits—$14,822, excess life insurance—$814; 2002: 401(k)—$5,586, executive benefits—$6,848, excess life insurance—$857. Chacko: 2004: 401(k)—$6,210, executive benefits—$17,170, excess life insurance—$476; 2003: 401(k)—$3,628, executive benefits—$2,727, excess life insurance—$387; 2002: 401(k)—$3,947, executive benefits—$1,731, excess life insurance—$226. Colacci: 2004: 401(k)—$5,625, executive benefits—$18,647, excess life insurance—$241; 2003: 401(k)—$3,969, executive benefits—$8,148, excess life insurance—$263; 2002: 401(k)—$4,057, executive benefits—$8,510, excess life insurance—$137. Gustafson: 2004: 401(k)—$6,196, executive benefits—$16,871, excess life insurance—$175; 2003: 410(k)—$3,975, executive benefits—$6,520, excess life insurance—$253; 2002: 401(k)—$10,290, executive benefits—$6,520, excess life insurance—$148. McCarrey: 2004: 401(k)—$6,349, executive benefits—$6,000, excess life insurance—$423; 2003: 410(k)—$7,367, executive benefits—$6,000, excess life insurance—$144; 2002: 401(k)—$7,061, executive benefits—$6,000, excess life insurance—$84.

- (4)

- Reflects base salary only. Total compensation includes $102,179 in commissions.

- (5)

- Reflects base salary only. Total compensation includes $103,081 in commissions.

7

- (6)

- Reflects base salary only. Total compensation includes $106,555 in commissions.

- (7)

- Mr. McCarrey was granted 5,000 shares of restricted stock: 2,500 shares vested on April 16, 2002 and 2,500 shares vested on April 16, 2003. The dollar value shown represents the fair market value of the stock on the April 16, 2001 date of grant. As of July 31, 2004, the fair market value of this stock was $143,000, based on the $28.60 closing price of our common stock on that date.

Option Grants in Last Fiscal Year

The following table provides information concerning stock option grants to the named executive officers during fiscal year 2004.

| | Number of

Securities

Underlying

Options/SARs

Granted

(#)

| |

| |

| |

| |

| |

|

|---|

| | Percent of Total

Options/SARs Granted

to Employees in

Fiscal Year

($)

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1)

$

|

|---|

Name

| | Exercise

Price

($/Sh)

| |

|

|---|

| | Expiration Date

| | 5%

| | 10%

|

|---|

| Robert G. Dutcher | | 49,800 | | 10.6 | | 18.69 | | August 28, 2013 | | 585,351 | | 1,483,395 |

| Eapen Chacko | | 19,500 | | 4.2 | | 18.69 | | August 28, 2013 | | 229,204 | | 580,847 |

| Irving R. Colacci | | 19,900 | | 4.2 | | 18.69 | | August 28, 2013 | | 233,905 | | 592,762 |

| James D. Gustafson | | 19,500 | | 4.2 | | 18.69 | | August 28, 2013 | | 229,204 | | 580,847 |

| Shawn F. McCarrey | | 19,900 | | 4.2 | | 18.69 | | August 28, 2013 | | 233,905 | | 592,762 |

All options granted to employees during fiscal year 2004 vest in four equal annual installments beginning one year following the date of grant.

- (1)

- The 5% and 10% assumed annual rates of compounded stock price appreciation are mandated by rules of the Securities and Exchange Commission (SEC) and do not represent the Company's estimate or projection of the Company's future common stock prices. These amounts represent certain assumed rates of appreciation only. Actual gains, if any, on stock option exercises are dependent on the future performance of the common stock and overall stock market conditions. The amounts reflected in this table may not necessarily be achieved.

8

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides information concerning stock option exercises and the value of unexercised options at July 31, 2004, for the named executive officers.

Name

| | Shares Acquired

upon Exercise

(#)

| | Value Realized(1)

($)

| | Number of Securities Underlying

Unexercised Options at Fiscal Year-End

Exercisable/Unexercisable

(#)

| | Value of Unexercised In-the-

Money Options at Fiscal Year-End

Exercisable/Unexercisable (2)

($)

|

|---|

| Robert G. Dutcher | | 20,000 | | 352,901 | | 439,539/97,350 | | 8,801,893/1,304,981 |

| Eapen Chacko | | — | | — | | 62,200/38,650 | | 1,822,218/526,398 |

| Irving R. Colacci | | 10,000 | | 195,500 | | 192,025/39,775 | | 3,864,079/545,312 |

| James D. Gustafson | | 6,500 | | 127,075 | | 180,250/3,150 | | 3,430,599/537,636 |

| Shawn F. McCarrey | | — | | — | | 74,773/38,650 | | 1,856,482/528,990 |

- (1)

- The dollar values shown are calculated by determining the difference between the fair market value of the common stock underlying the options on the date of exercise and the exercise price of the options.

- (2)

- The dollar values shown are calculated by determining the difference between the fair market value of the common stock underlying the options at fiscal year-end and the exercise price of the options. The closing price of the stock on July 30, 2004 was $28.60.

Supplemental Executive Retirement Plan

The Company maintains a Supplemental Executive Retirement Plan, or SERP, in order to supplement the retirement benefits payable to Mr. Dutcher pursuant to the Company's other compensation plans. The SERP provides for target payments for a period of ten years beginning at retirement based on a percentage of annual cash compensation. Assuming Mr. Dutcher remains employed by the Company until age 65, the SERP provides for an annual target benefit equal to fifty percent of his annual base salary at retirement, subject to calculation based on actual base salary and investment return. In the event that Mr. Dutcher retires after he reaches age 60, but before he reaches age 65, he will be entitled to receive the accrued balance of his SERP account as of the date of retirement. Following a change in control, as defined in the SERP, Mr. Dutcher may terminate his employment and receive benefits as if he had worked until age 65. Assuming Mr. Dutcher were to retire from the Company at age 65, he would receive an estimated target annual benefit of approximately $160,000 per year for ten years subject to variability dependent on actual base salary prior to retirement and investment return.

9

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information on equity compensation plans under which equity securities of the Company are authorized for issuance, as of July 31, 2004:

Plan category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the second column)

|

|---|

| Equity compensation plans approved by Security holders(1) | | 2,652,263 | | $ | 11.08 | | 559,995 |

| Equity compensation plans not approved by Security holders | | — | | | — | | — |

| | |

| |

| |

|

| Total | | 2,652,263 | | $ | 11.08 | | 559,995 |

| | |

| |

| |

|

- (1)

- Includes the Company's 1992 and 1999 Stock Compensation Plans.

Change in Control Plan

On September 15, 1999, our Board of Directors approved a Change in Control Termination Pay Plan that provides, at the discretion of the Board, salary and benefit continuation payments to executive officers and selected key management and technical personnel in the event they are terminated within twenty-four months of a change in control. At this time, the Board of Directors has committed to a three-year salary and benefit continuation for the Chief Executive Officer and two-year salary and benefit continuations for other executive officers. In addition, other key management and technical personnel are entitled to salary and benefit continuation benefits ranging in duration from six to twenty-four months. The Board of Directors has approved additional payments upon a change in control notwithstanding employment status following a change in control. These payments will be awarded if we achieve "substantial growth" as determined by the Board based on the value of the Possis at the time of the change in control and the Board's assessment of performance and growth. The amount of the pool available for such payments is limited, in aggregate, to between one and four percent of the value of Possis at the time of the change in control.

Report of the Possis Medical Inc. Compensation Committee

The Compensation Committee of the Board of Directors consists of three independent, outside directors. The Committee provides assistance to the Board of Directors in fulfilling the Board's responsibility to shareholders relating to compensation philosophy and practices for corporate executive officers. The Committee meets as necessary to review executive compensation policies, the design of compensation programs and individual salaries and awards for executive officers. In carrying out its responsibilities, the Committee believes its policies and procedures should remain flexible in order that it can best react to changing conditions and environments, and to assure the directors and shareholders that our executive compensation and stock plan practices are of the highest quality.

Compensation Philosophy. Our compensation program is intended to attract and retain high quality executive leadership and to motivate these executives to perform consistent with the interests of shareholders. Executive officer compensation is directly linked to both individual and Company performance necessary to increase value to shareholders. The program is designed to provide a competitive base salary while retaining flexibility through the structuring of short- and long-term incentives that recognize progress toward achievement of both individual and corporate goals.

10

The development of appropriate criteria to guide compensation decisions going forward continues to be driven by two factors: the fact that the Company has entered a new stage in its development and is establishing a foundation for long-term growth and profitability; and the need to continue to enhance the alignment of management's interests with those of the shareholders. As we increase our market penetration through the sale and placement of AngioJet® System products and enhance performance through the realization of operational efficiencies, our performance will be evaluated on our ability to increase profitability while maintaining strong new product development efforts. Corporate and individual performance measures will continue to reflect an emphasis on financial goals, sales growth, profitability targets, and product development, research and regulatory approvals necessary to support sustained growth.

Compensation decisions for fiscal year 2004 were based on an extensive review and evaluation of executive and incentive compensation programs conducted three years ago and the adoption at that time of a compensation program designed as a three-year program. The Committee retained an outside compensation consultant to analyze industry-wide compensation practices and to recommend base and variable compensation for the Company's officers, as well as to evaluate the Company's overall incentive compensation program for key employees. Based on the recommendations of its outside consultant and its own consideration of the challenges faced by the Company in retaining and attracting talent, the Committee instituted a three-year compensation program designed to guide compensation decisions as the Company transitions from an emerging medical device company with sales consistent with its emerging status, to an established company expecting continuing growth in revenues.

Compensation of executive management and key managerial and technical personnel is based on three types of compensation: base salaries; short-term incentives; and long-term equity-based compensation.

Base Salaries. The Committee typically reviews base salaries on an annual basis and makes adjustments as it deems appropriate. Generally, annual base salary adjustments will be modest except when the Company achieves certain specified milestones or comparative survey date compels a more significant adjustment. Base salaries are typically paid in cash consistent with normal payroll practices. Adjustments are typically made effective the first day of the fiscal year.

Short-term Incentives. The Company continues to provide executives and other key employees with an opportunity to earn short-term incentive awards. The short-term incentive awards are typically in the form of cash bonuses awarded based on individual and corporate performance against specified objectives and vary in amount depending on the employee's pay grade and job responsibilities.

Long-term Equity-based Compensation. The major component of the Company's long-term equity-based compensation program consists of stock options awarded annually at the discretion of the Board under the Company's Stock Compensation Plan. Stock options are intended by the Committee to maximize individual performance and strengthen the alignment of management interests with that of the shareholders. It is the current intent of the Committee that the maximum number of stock options granted to employees each year going forward, exclusive of options to new employees and extraordinary grants compelled by special circumstances, shall not exceed two percent of the Company's shares issued and outstanding. In addition, it is the Company's current intention to repurchase at least as many shares in the open market under its current stock repurchase program as are awarded in stock options. Stock options have historically been granted annually to officers and other key employees based on progress toward achievement of short- and long-term strategic objectives, technical and regulatory milestones, and corporate financial performance goals. Until 1999, exercisability was conditioned on passage of time, with no specific performance requirements. Stock options awarded for fiscal year 1999 and 2000 to officers included special vesting provisions tied to appreciation in stock value. In 2002, the Committee returned to its normal practice of conditioning the vesting of stock options on the passage of time.

11

Fiscal Year 2004 Compensation. The Company's performance in fiscal year 2004 supported awards of variable compensation and equity grants. For purposes of its performance assessment, the Committee placed a 50% weighting on financial goals and a 50% weighting on non-financial product development and technical goals. The Committee assessed overall fiscal year 2004 corporate performance at 89% of plan, based on achievement of earnings goals, continuing improvement in gross margins and continued profitability, offset by delays in some important product development projects. Cash bonus awards totaling $960,000 were granted to 45 officers, managers and other key employees. For fiscal year 2004, based on the assessment that the Company performed at 89% of its goals and objectives, the Chief Executive Officer received approximately 39% of his total compensation in the form of a cash bonus, the sales vice president received 50% of his total compensation in the form of commissions and a cash bonus, and the remaining vice presidents received from 35% to 44% of their total compensation in the form of a cash bonus.

Pursuant to our 1999 Incentive Compensation Plan, the Committee granted stock options in September 2004 to 45 officers, managers and other key employees, an increase of four recipients over 2003 awards. A total of 337,000 stock options were awarded at an option exercise price of $17.25, the fair market value of Possis Stock on the day of grant, representing approximately 1.86% of the Company's total shares outstanding. Of the total options granted, approximately 49% were granted to officers. The stock option grants were made based on year-end financial and technical performance.

During fiscal year 2004, the Committee conducted a detailed review of its executive compensation program, with the assistance of an outside consultant and updated surveys, and determined that mid-year adjustments were appropriate. Effective February 1, 2004, the base salaries and target cash bonus opportunities for the Company's executive staff were adjusted to bring total compensation more in line with the compensation of similarly situated executives in the medical devices industry. In addition, the ratio of fixed versus variable compensation was adjusted such that operational executive compensation was weighted more heavily toward variable compensation. Base salary was weighted more heavily for the Chief Executive Officer, the Chief Financial Officer and General Counsel. Additional year-end adjustments were made based on the philosophy guiding the mid-year adjustments. The mid-year adjustments in base salary for all officers, excluding the CEO, ranged from 3.9% to 4.8%. Year-end adjustments in base salary, effective August 1, 2004 ranged from 1.5% to 15%. Effective August 1, 2004, total compensation for all officers, excluding the CEO, was increased within a range of 3.1% to 5.7%. The mid-year adjustments in target variable compensation for all officers, excluding the CEO, ranged from 2.2% to 9.2%. The percentage of target variable compensation for operational officers was increased as a component of total compensation, and the percentage of target variable compensation for the CEO, CFO and General Counsel was decreased. Year-end adjustments in variable compensation, effective August 1, 2004 ranged from 0% to 7%.

Compensation Program for fiscal year 2005. The Committee intends to conduct a comprehensive review of all executive and incentive compensation programs during fiscal year 2005, utilizing outside expertise as appropriate and examining industry compensation practices to ensure that the Company remains competitive in its industry and continues to attract and retain high quality executive leadership. Compensation decisions will continue to be based on the Committee's general compensation philosophies, as described herein, the need to be flexible enough to effectively respond to changing conditions and the importance of continuing to enhance the alignment of management's interests with those of the shareholders.

Supplemental Retirement Program. Based on a determination that the Company's least competitive benefit in relation to industry comparables is executive retirement benefits, and that a cost-effective defined contribution, performance-driven program for the executives is reasonable, the Board approved, in principle, a supplemental retirement program for the Company's executive officers. A supplemental retrirement program for the CEO has been previously established. This program conditions entitlement to retirement benefits on a "cliff" standard of eligibility, allows for increased benefits if the Company

12

performs in excess of Plan, begins with a benefit of 8% of base salary, recognizes that the Company has, in the past, relied on stock options to make up for the lack of traditional retirement programs and that use of stock options in the future may be less desirable to the Company due to the changing accounting environment.

Chief Executive Officer Compensation. Robert G. Dutcher, as President and Chief Executive Officer of the Company, participates in the general compensation program of the Company, as described above, along with all other key employees. Mr. Dutcher's base salary is set at a level determined by the Committee to be competitive with other similarly situated companies based on salary surveys and other comparative data, and reflects the scope of his responsibilities and individual performance as an officer. Effective February 1, 2004, Mr. Dutcher's base salary was increased by 19% and his target cash bonus award was reduced by 7%. Effective August 1, 2004, Mr. Dutcher's base salary was increased by 13 percent and his target cash bonus was reduced by 11%. He received a cash bonus of $176,300 and a grant of 56,300 stock options in September 2004 to reward fiscal year 2004 performance. All of the options granted to Mr. Dutcher vest in four equal annual installments beginning one year following the date of grant. All cash and equity awards reflect the Committee's judgment as to Mr. Dutcher's individual performance, the overall performance of the Company as measured against corporate objectives and the Committee's commitment to aligning the interests of the Chief Executive Officer with those of shareholders. Performance is measured based on financial factors (such as revenues, margins and earnings) and on technical factors (such as achievement of product development goals). The terms and conditions of the option awards are identical to those contained in grants to other officers.

The Committee has adopted a plan for Chief Executive Officer compensation as part of its compensation philosophy and plan for all executives, as described above. Chief Executive Officer compensation will continue to be based on corporate and individual performance measured against established guidelines and objectives. Current guidelines and objectives are contained in the Company's strategic plan, as approved by the Board.

The Board of Directors approved a Supplemental Executive Retirement Plan for Mr. Dutcher effective 2004. The Plan provides a target benefit equal to fifty percent of base compensation at retirement with smaller benefits paid in the event Mr. Dutcher retires prior to age 65. Since Mr. Dutcher is a highly valued employee of Possis Medical, the Plan has been structured as both a retirement supplement and retention vehicle incorporating both noncompete and nondisclosure provisions. The Company intends to accrue a Plan liability over the target benefit period on a basis consistent with the Company's general unfunded payment obligation.

Compensation Committee of the Board of Directors

Donald C. Wegmiller, Chairman

Seymour J. Mansfield

Mary K. Brainerd

13

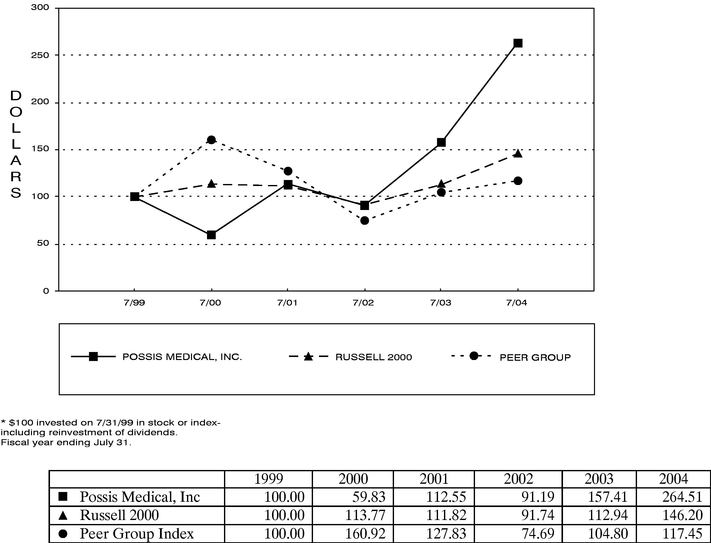

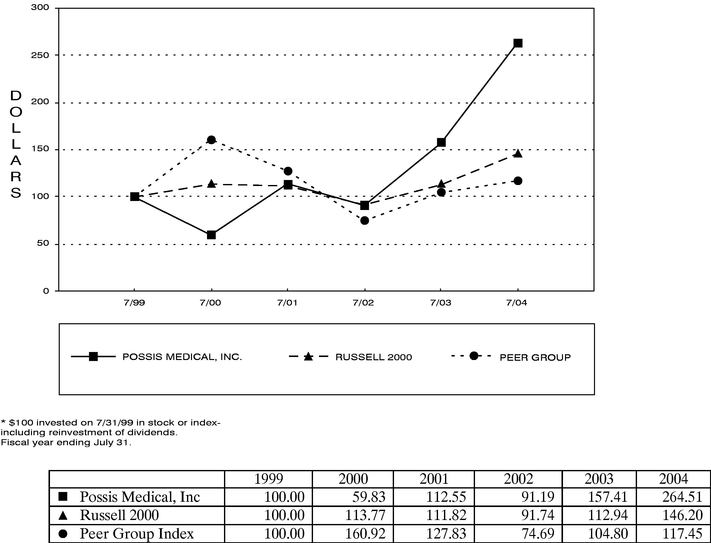

PERFORMANCE GRAPH

Set forth below is a graph showing the five-year cumulative returns through July 31, 2004 of Possis Medical, Inc. common stock as compared with the Russell 2000 Index and a peer group index comprised of nine companies in the medical device industry with similar cardiovascular markets to Possis Medical, Inc. (the "Peer Group"(1)). The graph assumes an investment of $100.00 in the Company's common stock in each of the indexes on July 31, 1999, and the reinvestment of all dividends.

Possis Medical, Inc. is included in the Russell 2000 Index and is similar in size and stage of commercialization as the other companies in the Peer Group. The Russell 2000 Index does not have an index specifically for medical devices.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG POSSIS MEDICAL, INC., THE RUSSELL 2000 INDEX AND A PEER GROUP

- (1)

- Arthrocare Corp.; Cardiac Science, Inc.; Datascope Corp.; Endocardial Solutions, Inc.; Kensey Nash Corp.; Merit Medical Systems, Inc.; Novoste Corp.; Micro Therapeutics, Inc.; Spectranetics Corp.

14

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that our executive officers and directors and persons who beneficially own more than 10% of a registered class of our equity securities file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of such forms received by us with respect to fiscal 2004 and written representations from certain reporting persons, we believe that all filing requirements applicable to our executive officers and directors have been complied with, with the exception of options and restricted stock granted to the Company's Board of Directors on January 2, 2004 and a gift of stock made by one of the officers of the Company, which were reported beyond the two-day period required by the SEC. We are aware of no person who owns more than 10% of our common shares.

AUDIT COMMITTEE REPORT AND PAYMENT OF FEES TO ACCOUNTANTS

Payment of Fees to Accountants

The following table presents fees billed for professional services rendered for the audit of the Company's annual financial statements for fiscal years 2003 and 2004 and fees billed for other services provided by the Company's independent auditors in each of the last two fiscal years.

| | Fiscal Year 2003

| | Fiscal Year 2004

|

|---|

| Audit Fees(1) | | $ | 119,064 | | $ | 119,774 |

| Audit-Related Fees(2) | | $ | 11,000 | | $ | 12,950 |

| Tax Fees(3) | | $ | 39,165 | | $ | 25,545 |

| All Other Fees(4) | | $ | 40,400 | | $ | 118,850 |

- (1)

- Audit Fees consisted of fees billed by Deloitte & Touche LLP for services rendered in auditing the Company's financial statements for fiscal years 2003 and 2004 and reviewing the financial statements included in the Company's quarterly reports on Form 10-Q for fiscal years 2003 and 2004.

- (2)

- Audit-Related Fees consisted of fiscal year 2002 and 2003 audits of the Company's 401(k) Plan.

- (3)

- Tax Fees consisted of preparation of fiscal year 2002 and 2003 corporate income tax returns and consultation on international tax issues.

- (4)

- All Other Fees include fees for executive retirement planning, executive tax return preparation and seminars addressing corporate governance and accounting regulation issues.

Prior to engagement of the Company's auditors to render audit or non-audit services, the engagement is approved by the Audit Committee.

The Audit Committee has determined that the provision of non-audit services was compatible with maintaining the independence of Deloitte & Touche LLP.

Report of the Audit Committee of the Board of Directors

The Audit Committee is responsible for overseeing management's financial reporting practices and internal controls.

The Audit Committee operates under a written charter adopted by the Board of Directors, a copy of which is attached to this Proxy Statement as an addendum. All of the members of the Audit Committee are independent for purposes of current Nasdaq listing requirements.

15

The Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended July 31, 2004 with the Company's management. The Audit Committee has discussed with Deloitte & Touche LLP, the Company's independent public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Audit Committee has also received the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee has discussed the independence of Deloitte & Touche LLP with that firm.

Based on the Audit Committee's review and discussions described above, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended July 31, 2004 for filing with the SEC.

Audit Committee of the Board of Directors

Whitney A. McFarlin, Chair

William C. Mattison, Jr.

Rodney A. Young

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

(Proposal Number Two)

While the Company is not required to do so, the Company is submitting the selection of Deloitte & Touche LLP to serve as the Company's independent auditors for the fiscal year ending July 31, 2005 for ratification in order to ascertain the views of the Company's shareholders on this appointment. If the selection is not ratified, the Audit Committee will reconsider its selection.

Deloitte & Touche LLP, has been the Company's independent auditor since July 31, 1960. Representatives of Deloitte & Touche LLP will be in attendance at the Annual Meeting of Shareholders and will have the opportunity to make a statement if they desire to do so. In addition, they will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS RATIFY THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY'S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING JULY 31, 2005. The enclosed proxy will be voted FOR the appointment unless a contrary specification is made.

SHAREHOLDER PROPOSALS

In order to be eligible for inclusion in our proxy solicitation materials for our next annual meeting of shareholders, any shareholder proposal to be considered at such meeting must be received at our principal executive offices, 9055 Evergreen Boulevard N.W., Minneapolis, Minnesota 55433-8003, no later than July 8, 2005. Pursuant to the our bylaws, in order for business to be properly brought before the next annual meeting by a shareholder, the shareholder must give written notice of such shareholder's intent to bring a matter before the annual meeting no later than July 8, 2005. Such notice should be sent to the Corporate Secretary at our principal executive offices, and must set forth certain information with respect to the shareholder who intends to bring such matter before the meeting and the business desired to be conducted, as set forth in greater detail in our bylaws. Any such proposal will be subject to the requirements of the proxy rules adopted under the Securities Exchange Act of 1934. Shareholder proposals that are submitted after July 8, 2005 may not be presented in any matter at the 2005 Annual Meeting of Shareholders.

16

OTHER MATTERS

The Board of Directors is aware of no other matter that will be presented for action at the annual meeting. If, however, other matters do properly come before the meeting, it is the intention of the persons named in the proxy to vote in accordance with their best judgment on such matters.

ANNUAL REPORT

A copy of our Annual Report on Form 10-K may be obtained without charge by any beneficial owner of our common shares on the record date upon written request addressed to Investor Relations, Possis Medical, Inc., 9055 Evergreen Boulevard N.W., Minneapolis, Minnesota 55433-8003.

| | | By Order of the Board of Directors

IRVING R. COLACCI,Vice President, General Counsel and Secretary |

Dated: November 5, 2004

Possis Medical Inc. • 9055 Evergreen Boulevard NW • Minneapolis, MN 55433-8003 USA

Phone: (763) 780-4555 Toll Free 1-800-810-7677 Fax: (763) 780-2227

17

COMMITTEE CHARTERS ADDENDUM

- 1.

- Executive and Strategic Planning Committee Charter

- 2.

- Nominating and Governance Committee Charter

- 3.

- Audit Committee Charter

- 4.

- Compensation Committee Charter

18

1. EXECUTIVE AND STRATEGIC PLANNING COMMITTEE CHARTER

Role and Purpose

The Executive and Strategic Planning Committee of the Board of Directors is organized pursuant to Section VI of the By-laws of the Company, which specifies that the Committee shall:

- •

- During the intervals between meetings of the Board of Directors, and subject to such limitations as may be required by law or by resolution of the Board of Directors, have and may exercise all of the authority of the Board of Directors in the management of the Corporation; and

- •

- From time to time, formulate and recommend to the Board of Directors for approval general policies regarding the management of the business and affairs of the Corporation;

In addition to the responsibilities imposed by the By-laws of the Company, the Board further specifies that the Committee shall:

- •

- Oversee and review the development of strategic business plans for the Company as developed by management;

- •

- Participate in the identification of strategies and plans for the growth and success of the business; and

- •

- Assess the strengths and weaknesses of the organization as they relate to the ability of achieving plans and objectives.

Membership

Consistent with the By-laws of the Company, the membership of the Committee shall consist of at least two Directors. No member of the Executive Committee shall continue to be a member after ceasing to be a Director. The Board of Directors shall have the power at any time to increase or decrease the number of members of the Executive Committee, to fill any vacancies, to change any member, and to change the functions or terminate the Committee's existence

Duties and Responsibilities

The Executive Committee's primary responsibilities include:

- •

- During the intervals between meetings of the Board of Directors, exercise all of the authority of the Board of Directors in the management of the Corporation;

- •

- From time to time, formulate and recommend to the Board of Directors for approval general policies regarding the management of the business and affairs of the Corporation;

- •

- Actively review and approve, as appropriate, strategic plans developed by management;

- •

- Actively review and consider budgets developed by management to support proposed strategic plans; and

- •

- Formulate recommendations to the full Board of Directors as to adoption of strategic plans and other initiatives proposed by management.

Meetings

The Committee shall meet at such times as it deems appropriate to carry out its responsibilities. Meetings may be held in person or by teleconference at the discretion of the Committee. A majority of the Committee shall constitute a quorum for the purposes of conducting business and actions may be taken by formal resolution or by an Action in Writing. The corporate secretary, or such other person as appointed by the Committee, shall record minutes of all meetings.

19

A majority of the Committee shall be necessary to constitute a quorum for the transaction of any business, and the act of a majority of the members present at a meeting at which a quorum is present shall be the act of the Executive Committee.

Resources and Authority

The Committee may request any officer or employee of the Company or the Company's outside counsel or any independent consultant to attend a meeting of the Committee or to meet with any member of, or consultants to, the Committee. The Committee has the authority to use other resources either within or outside the Company to address special circumstances when appropriate.

The Committee may delegate its authority to subcommittees established by the Committee from time to time. Such subcommittees will consist of one or more members of the Committee and will report to the Committee.

Adoption of Charter

The Board of Directors of Possis Medical, Inc., adopted this Charter on: August 13, 2004.

20

2. NOMINATING & GOVERNANCE COMMITTEE CHARTER

Role and Purpose

The Nominating & Governance Committee of the Board of Directors is to:

- •

- Identify and recommend individuals qualified to become members of the Board of Directors;

- •

- Be responsible for the director nomination and election process and for responding to shareholder proposals for director nominations;

- •

- Oversee succession planning for the corporation's Chief Executive Officer;

- •

- Lead in shaping the corporate governance of the corporation and, oversee corporate response to issues affecting the Board and the Company; and

- •

- Develop and recommend to the Board, on an ongoing basis as appropriate, corporate governance policies applicable to the corporation and actively monitor the corporation's compliance with applicable governance policies, principles, rules and regulations.

Membership

The Committee will consist of all members of the Board who meet the independence requirements of the National Association of Securities Dealers (NASD). Members of the Committee are subject to removal at any time by a majority of the Board. The Board may fill any resulting vacancy. The Board's Lead Director, as appointed from time to time by the Board, shall serve as Chair of the Committee.

Lead Director

The Board of Directors has appointed a Lead Director to Chair the Nominating and Governance Committee and to be responsible for the independent activities of the Board. The duties and responsibilities of the Lead Director, both as Chair of the Nominating and Governance Committee and as Lead Director of the entire Board of Directors, shall be as follows:

- •

- Serve as Chair of the Nominating and Governance Committee;

- •

- Coordinate the activities of the independent directors;

- •

- Ensure that the independent directors can perform their duties responsibly while not interfering with the flow of Company operations;

- •

- Participate, as appropriate, in the preparation of agendas for Board and Committee meetings;

- •

- Advise the Board as to the quality, quantity and timeliness of the flow of information from Company management necessary for the independent directors to effectively and responsibly perform their duties; and specifically request the inclusion of certain material as appropriate;

- •

- Recommend to the Board, as appropriate, the retention of consultants who report directly to the Board;

- •

- Assure compliance with and implementation of Company governance policies and guidelines;

- •

- Coordinate and develop the agenda for and facilitate executive sessions of the Board's independent directors;

- •

- Act as principal liaison between the independent directors and the Chair of the Board on sensitive issues; and

- •

- Make recommendations to the Board concerning membership of the various Board Committees and selection of Committee chairs.

21

Duties and Responsibilities of the Committee

The Committee will:

- •

- Develop qualification criteria for Board members (considering goals for Board composition and individual qualifications) and evaluate potential candidates in accordance with established criteria;

- •

- Review and respond to director nominations or recommendations submitted in writing by the corporation's stockholders;

- •

- Recommend to the Board a slate of candidates for presentation to the stockholders at each annual meeting of stockholders and one or more nominees for each vacancy on the Board that occurs between annual meetings of stockholders;

- •

- Recommend to the Board qualified members of the Board for membership on committees of the Board;

- •

- Review and develop executive succession plans, and ensure that appropriate plans are in place to identify a qualified successor to the corporation's Chief Executive Officer;

- •

- Provide regular reports of its activities to the Board;

- •

- Review and reassess periodically the adequacy of this Charter and recommend any proposed changes to the Board for approval;

- •

- Periodically consider the adequacy of the certificate of incorporation and by-laws of the corporation and recommend to the Board of Directors, as conditions dictate, that it propose amendments to the certificate of incorporation and by-laws for consideration by the shareholders;

- •

- Develop and recommend to the Board of Directors, on an ongoing basis, a set of corporate governance principles and keep abreast of developments with regard to corporate governance to enable the Committee to make recommendations to the Board of Directors in light of such developments as may be appropriate; and

- •

- Consider policies relating to meetings of the Board of Directors. This may include meeting schedules and locations, time spent by the Board on Company matters, agendas and procedures for delivery of written material and other forms of communications in advance of and during meetings.

Meetings

The Committee will meet twice annually, or more frequently as circumstances dictate. A majority of the members of the Committee will constitute a quorum for the transaction of business.

Resources and Authority

The Committee will have the resources and authority appropriate to discharge its responsibilities, including the authority to use internal personnel and to engage external search firms to identify director candidates, and will have sole authority to retain and terminate any such search firm and to approve the fees and other retention terms related to the appointment of such firm.

The Committee will have the authority to obtain advice and assistance from internal or external legal, accounting or other advisors.

The Committee may delegate its authority to subcommittees established by the Committee from time to time, which subcommittees will consist of one or more members of the Committee and will report to the Committee.

Adoption of Charter

The Board of Directors of Possis Medical, Inc., adopted this Charter on: August 13, 2004.

22

3. AUDIT COMMITTEE CHARTER

Role and Purpose

The Audit Committee of the Board of Directors is to assist the Board in fulfilling its responsibility for oversight of the:

- •

- Integrity of the Company's financial statements;

- •

- Compliance with legal and regulatory requirements,

- •

- Independent auditor's qualifications and independence;

- •

- Performance of internal audit functions; and

- •

- Independent auditors.

Membership

The membership of the Committee shall consist of at least three directors who are generally knowledgeable in financial and auditing matters and who meet the independence and experience requirements of the Securities and Exchange Commission and the National Association of Securities Dealers, Inc. In addition, The Chair of the Committee shall be a "financial expert," as that term is interpreted by the NASD. The Committee is expected to maintain free and open communication (including private executive sessions at least annually) with the independent accountants, the internal auditors, and management of the Corporation. In discharging this oversight role, the committee is empowered to investigate any matter brought to its attention, with full power to retain outside counsel or other experts for this purpose. This Charter shall be reviewed and updated annually.

Duties and Responsibilities

The Audit Committee's primary responsibilities include:

- •

- Selection and retention of the independent accountant who audits the financial statements of the Corporation, including fees and the terms of engagement. In so doing, the committee will discuss and consider the auditor's written affirmation that the auditor is, in fact, independent, will discuss the nature and rigor of the audit process, and will require, receive and review all reports of the auditor. The independent auditor shall report directly to the audit committee;

- •

- Provision of guidance and oversight to the internal audit function of the Corporation including review of the organization, plans and results of such activity;

- •

- Review of financial statements (including quarterly reports) with management and the independent auditor, including quality of earnings, discussions of significant items subject to estimate, consideration of the suitability of accounting principles, review of highly judgmental areas, audit adjustments whether or not recorded and such other inquiries as may be appropriate;

- •

- Discussion with management and the auditors of the quality and adequacy of the Company's internal controls;

- •

- Discussion with management of the status of pending litigation, taxation matters and other areas of oversight to the legal and compliance area as may be appropriate.

- •

- Review and approve all related-party transactions;

- •

- Resolve disputes between management and the independent auditors regarding financial reporting;

23

- •

- Pre-approve any audit services and non-audit services provided by the independent auditor;

- •

- Establish and maintain procedures for the (a) receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, and (b) for the confidential, anonymous submission by employees of concerns regarding accounting or auditing matters;

- •

- Reporting on audit committee activities to the full Board;

- •

- Issuance annually of a summary report for inclusion in the proxy statement for the Company's annual meeting;

- •

- Retain independent counsel and other advisors as the audit committee determines necessary to carry out its duties;

- •

- Determine appropriate funding for payment of compensation to both independent auditors and any advisors the audit committee chooses to hire; and

- •

- Monitor the Company's Anonymous Telephone Complaint System and ensure that the System functions to facilitate the transfer of relevant and material complaint information to the Board, as appropriate.

Meetings

The Audit Committee shall meet, at a minimum, on a quarterly basis and shall have such additional meetings as it deems necessary to carry out its responsibilities. Meetings may be held in person or by teleconference at the discretion of the Committee. A majority of the Committee shall constitute a quorum for the purposes of conducting business and actions may be taken by formal resolution or by an Action in Writing. The Corporate Secretary, or such other person as appointed by the Committee, shall record minutes of all meetings.

Resources and Authority

The Committee will have the resources and authority appropriate to discharge its responsibilities, including sole authority to:

- •

- Retain and terminate the independent auditor, which will be accountable to and report to the Committee;

- •

- Approve any non-audit relationship with the independent auditor, other than any relationship to provide services prohibited by Section 10A(g) of the Securities Exchange Act of 1934, as amended; and

- •

- Approve all audit engagement fees and terms.

In addition, the Committee will have authority to:

- •

- Conduct or authorize investigations into any matters within its scope of responsibilities;

- •

- Engage outside auditors for special audits, reviews and other procedures;

- •

- Retain special counsel and other experts and consultants to advise the Committee; and

- •

- Approve the fees and other retention terms for such parties.

The Committee may request any officer or employee of the Company or the Company's outside counsel or independent auditor to attend a meeting of the Committee or to meet with any member of, or consultants to, the Committee. The Committee has the authority to use other resources either within or outside the Company to address special circumstances when appropriate.

The Committee may delegate its authority to subcommittees established by the Committee from time to time. Such subcommittees will consist of one or more members of the Committee and will report to the Committee.

Adoption of Charter

The Board of Directors of Possis Medical, Inc., adopted this Charter on: August 13, 2004.

24

4. COMPENSATION COMMITTEE CHARTER

Role and Purpose

The Compensation Committee of the Board of Directors shall provide assistance to the Board of Directors in fulfilling their responsibility to shareholders relating to compensation philosophy and practices for corporate executive officers and administration of employee benefit programs. Members of the Committee shall have a solid understanding of the role of compensation in attracting, motivating and retaining senior executives in particular and all employees in general.

Membership

The Committee will consist of three or more members of the Board appointed from time to time by the Board. The Committee will consist solely of non-employee directors who meet the independence requirements of the National Association of Securities Dealers, Inc. Additionally, no director may serve on the Committee unless he or she (a) is a "non-employee director" for purposes of Rule 16b-3 under the Securities Exchange Act of 1934 and (b) satisfies the requirements of an "outside director" for purposes of Section 162(m) of the Internal Revenue Code. Committee members are subject to removal at any time by a majority of the Board. The Board may fill any vacancy.

Duties and Responsibilities

The Compensation Committee's primary responsibilities include:

- •

- Establish, implement and oversee executive compensation strategy consistent with the Company's plans and objectives and linked to progressive variable compensation practices;

- •

- Meet as necessary with management, legal advisors, human resources professionals and other outside professional compensation advisors to review current trends and practices in executive compensation and disclosure requirements under various securities rules and regulations;

- •

- Review and approve corporate goals and objectives relevant to Chief Executive Officer compensation; evaluate the Chief Executive Officer's performance in light of those goals and objectives; and set the Chief Executive Officer's compensation level based on this evaluation;

- •

- Make recommendation to the Board with respect to incentive compensation plans and equity-based plans; administer such plans and determine that these plans are consistent with each plan's intended purpose;

- •

- Review and approve all compensation arrangements between the Company and executive officers and take all necessary salary actions in the form of written resolutions. Such arrangements may include, but not be limited to, cash compensation, bonuses, stock options, restricted stock award, insurance, retirement programs, other benefits and other perquisites;

- •

- Report its actions and recommendations to the Board on a timely and continuous basis and prepare minutes of all its meetings that include information on Committee actions, discussions and decisions;

- •

- Conduct performance evaluations of the Compensation Committee as it deems appropriate.

- •

- Review and update, as appropriate, this Charter;

- •

- Review and recommend to the Board any appropriate changes to Board compensation;

- •

- Prepare a report addressing the Company's compensation policies for the fiscal year, as required by the Securities and Exchange Commission and for inclusion in the proxy statement for the Company's annual meeting.

25

Meetings

The Compensation Committee will meet as scheduled by the Committee Chairman as circumstances and the needs of the Company dictate.

A majority of the members of the Committee shall constitute a quorum for any meeting. Any action of a majority of the members of the Committee present at any meeting at which a quorum is present, or any action of the Committee if all of the Committee members execute a written action in which the action is filed with the Corporate Secretary, shall be an action of the Committee.

Resources and Authority

The Committee may delegate its authority to subcommittees established by the Committee from time to time, which subcommittees will consist of one or more members of the Committee and will report to the Committee, except that the Committee will not delegate its authority with respect to compensation matters involving any persons subject to Section 16 of the Securities and Exchange Act of 1934 or in a manner that would result in noncompliance with Section 162(n) of the Internal Revenue Code.

The Committee has the authority to retain consultants of its selection to advise it with respect to the Company's salary and incentive compensation and benefits programs.

Adoption of Charter