UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

Possis Medical Inc. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held December 13, 2006

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Possis Medical, Inc., a Minnesota corporation, will be held on Wednesday, December 13, 2006, at 4:00 p.m., Central Time, at the office of Dorsey & Whitney LLP, 50 South Sixth Street, 15th Floor, Minneapolis, Minnesota 55402, for the following purposes:

1. To elect seven directors.

2. To ratify the appointment of Deloitte & Touche LLP as our independent auditors.

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

All shareholders of record as of the close of business on Friday, October 20, 2006, will be entitled to vote at the meeting.

Your attention is respectfully directed to the enclosed proxy statement and card. Your vote is important. Whether or not you expect to attend the Annual Meeting in person, please (1) date, sign and promptly mail the enclosed proxy card in the return envelope provided; (2) call the toll-free number listed on the proxy card; or (3) vote via the Internet as indicated on the proxy card.

| By Order of the Board of Directors |

| |

| |

| IRVING R. COLACCI |

| Vice President, General Counsel and Secretary |

| |

Dated: November 3, 2006 | |

Possis Medical Inc. • 9055 Evergreen Boulevard NW • Minneapolis, MN 55433-8003 USA

Phone: (763) 780-4555 Toll Free 1-800-810-7677 Fax: (763) 780-2227

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD DECEMBER 13, 2006

SOLICITATION AND REVOCATION OF PROXIES, VOTING RIGHTS

This proxy statement is furnished to the shareholders of Possis Medical, Inc. (“Possis”) in connection with the solicitation of proxies for the Annual Meeting of Shareholders to be held on December 13, 2006, and any adjournments thereof. The enclosed proxy is solicited by our Board of Directors.

On October 20, 2006, 17,219,616 shares of common stock, our only voting securities, were outstanding. Each share of common stock is entitled to one vote. Shareholders are not entitled to cumulate their votes in the election of directors. Only holders of common stock of record at the close of business on October 20, 2006, will be entitled to notice of and to vote at this Annual Meeting of Shareholders.

You may vote your shares in three ways: (i) through the Internet; (ii) by a toll-free telephone call; or (iii) by completing the enclosed proxy card and mailing it to Possis. The procedures for Internet and telephone voting are described on the proxy card. The Internet and telephone voting procedures are designed to verify shareholders’ identities, allow shareholders to give voting instructions and confirm that their instructions have been recorded properly. Shareholders who vote through the Internet should be aware that they may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers, and that these costs must be borne by the shareholder. Shareholders who vote by Internet or telephone need not return a proxy card by mail.

You have the right to revoke your proxy at any time before the convening of the Annual Meeting. Revocation must be in writing, regardless of how you voted your shares, signed in exactly the same manner as described in the proxy, and dated. Revocations will be honored if received at our principal executive offices, addressed to the attention of the Corporate Secretary, before the convening of the Annual Meeting on December 13, 2006. In addition, on the day of the meeting, prior to the convening thereof, revocations may be delivered to Possis representatives who will be seated at the door of the meeting hall.

Proxies that are properly completed and not revoked will be voted as indicated in such proxy. Proxies that are signed but do not indicate how we should vote will be voted in favor of the proposals set forth in the Notice of Meeting and in favor of all of the director nominees. If you abstain from voting as to any matter, then the shares held by you will be deemed present at the meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such matter, but will not be deemed to have been voted in favor of the matter. Abstentions as to any proposal, therefore, will have the same effect as a vote against the proposal. If a broker returns a “nonvote” proxy, indicating a lack of voting instruction by the beneficial holder of the shares and a lack of discretionary authority on the part of the broker to vote on a particular matter, then the shares covered by such non-vote will not be deemed to be represented at the meeting for purposes of calculating the vote for approval of the matter, but will be deemed to be present for purposes of determining the presence of a quorum.

1

Possis will bear the cost of the solicitation of proxies, including the charges and expenses of brokerage firms and others for forwarding solicitation material to, and obtaining proxies from, beneficial owners of our common shares. In addition to the use of the mails, proxies may be solicited in person or by telephone, letter or facsimile. Proxies may be solicited by our officers or other employees, who will receive no special compensation for their services. This proxy statement and the enclosed form of proxy are first being sent to shareholders on approximately November 3, 2006.

2

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership as of October 3, 2006, by each person known to us to beneficially own 5% or more of our common stock, by each of our directors, and by each of our “named executive officers” (as defined under the heading “Executive Compensation”) and all directors and executive officers as a group.

| | Amount | | | |

Name of Beneficial | | Beneficially | | Total % | |

Owner or Identity of Group | | Owned (1) | | of Class | |

Royce and Associates, LLC 1414 Avenue of the Americas New York, NY 10019 | | 1,967,384 | (2) | 11.4 | |

| | | | | |

Black River Asset Management, LLC 12700 Whitewater Drive Minnetonka, MN 55343 | | 864,306 | (3) | 5.0 | |

| | | | | |

Robert G. Dutcher | | 607,871 | | 3.5 | |

| | | | | |

Mary K. Brainerd | | 34,982 | | * | |

| | | | | |

Seymour J. Mansfield | | 237,947 | | 1.4 | |

| | | | | |

William C. Mattison, Jr. | | 180,379 | | 1.0 | |

| | | | | |

Whitney A. McFarlin | | 79,296 | | * | |

| | | | | |

Donald C. Wegmiller | | 53,710 | | * | |

| | | | | |

Rodney A. Young | | 35,556 | | * | |

| | | | | |

Irving R. Colacci | | 230,797 | | 1.3 | |

| | | | | |

Jules L. Fisher | | 13,600 | | * | |

| | | | | |

James D. Gustafson | | 235,693 | | 1.4 | |

| | | | | |

Shawn F. McCarrey | | 165,185 | | * | |

| | | | | |

Directors and Executive Officers as a Group (12 persons) | | 2,126,299 | | 12.3 | |

(1) Includes shares owned indirectly by trusts, spouses, minor children and options that are currently exercisable or will become exercisable within sixty days of October 3, 2006, as follows: Mr. Dutcher, 541,414 shares; Ms. Brainerd, 32,921 shares; Mr. Mansfield, 122,804 shares; Mr. Mattison, 134,318 shares; Mr. McFarlin, 76,235 shares; Mr. Wegmiller, 22,607 shares; Mr. Young, 32,935 shares; Mr. Colacci, 226,950 shares; Mr. Gustafson, 225,200 shares; Mr. McCarrey, 134,823 shares; Mr. Scott, 215,125 shares; Mr. Fisher, 10,000 shares; and for all directors and executive officers as a group, 1,687,332 shares.

(2) Based on a Schedule 13G filed by Royce and Associates, LLC, dated January 31, 2006. Represents shares over which Royce and Associates has sole dispositive power.

(3) Based on a Schedule 13G filed by Black River Asset Management, LLC, dated April 28, 2006. Represents shares over which Black River Asset Management, LLC, has shared voting and disposition power as the advisor to Black River Long/Short Fund, LTD and Black River Long/Short Opportunity Fund, LLC.

* Denotes ownership of less than 1% of shares outstanding

3

ELECTION OF DIRECTORS

(Proposal Number One)

At the Annual Meeting, seven directors will be elected to serve until the next Annual Meeting of Shareholders and until their respective successors are elected and qualified.

Directors are elected by a plurity of the votes cast, which means that the seven nominees receiving the highest number of votes will be elected. Unless instructed not to vote for the election of directors or not to vote for any specific nominee, Proxies will be voted FOR the election as directors of the seven nominees named below. If any nominee becomes unavailable for any reason or if a vacancy should occur before the election, which events are not anticipated, the named proxies may vote for such other person as they, in their discretion, may determine.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ALL NOMINEES FOR DIRECTOR.

INFORMATION CONCERNING NOMINEES

The following information concerning the principal occupations of the nominees has been furnished by the nominees. Each of the nominees has held his or her principal occupation for more than the past five years, unless otherwise indicated.

| | | | | | Director | | |

Director Nominees | | Principal Occupation | | Age | | Since | | Committee Positions |

Robert G. Dutcher | | Chairman of the Board since 2001; President and Chief Executive Officer of the Company since 1993; Director: Daktronics, Inc. | | 61 | | 1993 | | Executive/Strategic Planning |

| | | | | | | | |

Mary K. Brainerd | | President and Chief Executive Officer of HealthPartners, Inc., a family of non-profit Minnesota health care organizations, since 2002; Executive Vice President and Chief Operating Officer of HealthPartners from 2000 to 2002. | | 53 | | 2001 | | Compensation; Nominating/Governance |

| | | | | | | | |

Seymour J. Mansfield | | Officer and Shareholder of Mansfield, Tanick & Cohen, P.A., Attorneys. | | 61 | | 1987 | | Lead Director; Executive/ Strategic Planning; Compensation; Nominating/Governance |

| | | | | | | | |

William C. Mattison | | Retired since 2003. Formerly a Principal of Gerard, Klauer, Mattison & Co., Inc., an institutional equity research and banking firm. | | 59 | | 1999 | | Executive/Strategic Planning; Audit; Nominating/Governance |

4

Whitney A. McFarlin | | Retired since 1998. Chairman, President, and Chief Executive Officer of Angeion Corporation, a medical device company from 1993 to 1998. | | 66 | | 1998 | | Audit; Nominating/Governance |

| | | | | | | | |

Donald C. Wegmiller | | Senior Consultant and Advisor, Clark Consulting, since February 2006; Chairman of Clark Consulting Healthcare Group, a compensation and benefits consulting firm from 2002-2006; President and CEO, Clark Consulting (formerly Clark/Barders and Healthcare Compensation Strategies) from 1993 to 2002. Director: ADESA, Inc.; Omnicell, Inc. | | 68 | | 1987 | | Executive/Strategic Planning; Compensation; Nominating/Governance |

| | | | | | | | |

Rodney A. Young | | President and Chief Executive Officer of Angeion Corporation, a medical device company, since November 2004; Executive Vice President of Medical Graphics Corporation from 2003 to 2004. Chairman, Chief Executive Officer and President of LecTec Corporation from 1996 to 2003. Director: Angeion Corporation; Health Fitness Corporation. | | 51 | | 1999 | | Audit; Nominating/Governance |

CORPORATE GOVERNANCE

Meetings of the Board of Directors

During fiscal year 2006, the Board of Directors held eight meetings, three of which were telephone meetings. Actions were also taken by written consent. All director nominees, with the exception of Mary K. Brainerd, attended at least 75% of all meetings of the Board and the committees of which they are members.

Committees

During fiscal year 2006, the Board of Directors maintained the committee structure established in 2004. The Board has four committees to address Board business. Duties and responsibilities are as follows:

Executive and Strategic Planning Committee. The Executive and Strategic Planning Committee is responsible for exercising the authority of the Board during the intervals between meetings of the Board, for formulating and recommending general policies for Board consideration, for working with management in the development of its annual Strategic Plan, and for advising the Board on strategic issues. It operates under a charter available on the Company website at www.possis.com under the Investors/Corporate Overview/Corporate Governance tab. This Committee did not meet during fiscal year 2006.

Nominating and Governance Committee. The Nominating and Governance Committee is responsible for the director nomination and election process, succession planning, and corporate governance issues. It determines

5

the required selection criteria and qualifications of director nominees based on qualification criteria that it develops. The Committee will apply these criteria for nominees identified by the Committee, by shareholders, or through some other source. The Committee’s membership consists of all members of the Board who meet the independent requirements of the Nasdaq listing standards. The Committee operates under a charter, which is available on the Company’s website at www.possis.com under the Investors/Corporate Overview/Corporate Governance tab. In addition, Seymour J. Mansfield serves as Lead Director. His duties and responsibilities as Lead Director are described in the Charter for the Nominating and Governance Committee. The Nominating and Governance Committee met once during fiscal year 2006.

The Nominating and Governance Committee will consider qualified candidates for possible nomination that are submitted by the Company’s shareholders. To propose a nominee, shareholders should send a letter no later than July 7, 2007, with the proposed nominee’s name, biographical information and contact information to the Company, addressed to the Chairman of the Nominating and Governance Committee. We generally require that each Director be an individual of highest character and integrity, have substantial experience which is of particular relevance to Possis, have sufficient time available to devote to our affairs, and represent the best interests of all our stakeholders, including our stockholders. The Nominating and Governance Committee has discretion as to the determination of which individuals will best fit these criteria.

Audit Committee. The Audit Committee met four times during fiscal year 2006 and assists the Board in fulfilling its responsibility for the safeguarding of assets and oversight of the quality and integrity of our accounting, auditing and reporting practices, and such other duties as directed by the Board. The Audit Committee has sole authority to appoint, determine funding for, retain and oversee our independent registered public accounting firm and to pre-approve all audit services and permissible non-audit services. It is our policy to present to the entire committee proposals for all audit services and permissible non-audit services prior to engagement. All members of the Audit Committee are independent, as defined in Rule 4350(d)(2) of the NASD. The Board of Directors has determined that Whitney A. McFarlin is an audit committee financial expert within the meaning of SEC regulations. The Committee operates under a charter, which is available on the Company’s website at www.possis.com under the Investors/Corporate Overview/Corporate Governance tab.

Compensation Committee. The Compensation Committee met two times during fiscal 2006 and is responsible for defining and administering our executive compensation program. The responsibilities of the Compensation Committee are discussed in this proxy statement under the caption Executive Compensation - Report of the Possis Medical, Inc. Compensation Committee. The Committee operates under a charter, which is available on the Company’s website at www.possis.com under the Investors/Corporate Overview/Corporate Governance tab.

Director Fees

Effective April 2006, directors who are not employees receive an annual retainer of $7,500, meeting fees of $2,000 per Board meeting attended in person, $1,000 for each telephonic Board meeting attended, $3,000 as the Chair of a Board committee, a $6,000 retainer as a member of the Executive/Strategic Planning Committee, a retainer of $1,500 for serving as a Committee member, $500 for each committee meeting attended as committee Chair and $250 for each committee meeting attended as a committee member. In addition, the director serving in the position of Lead Director receives an additional annual retainer in the amount of $15,000. Our 1999 Stock Compensation Plan provides for the annual grant to outside directors on the first business day of each calendar year of options to purchase 4,000 common shares. The exercise price of these options must be at least 100% of the fair market value on date of grant. Fifty percent of the options vest after six months and the remainder vest after one year. Beginning with options to be granted in January 2007, all options to directors will expire in five years instead of the ten year expiration period provided in all grants to date. During fiscal 2006, 24,000 options were granted to outside directors under this Plan at an

6

exercise price of $10.02. Directors also receive, on the first business day of each calendar year, restricted stock equal in value on the date of grant to their annual retainer. New directors will receive a stock option grant of 8,000 shares of Possis common stock upon initial election to the Board, which vest in four equal annual installments beginning one year after the date of the grant. The Board also has a stock option program to promote retention of directors for a period long enough to allow for a full understanding of the Company, to encourage solid judgments that lead to sustained business success and to aid in the recruitment of new qualified directors. Following election to a sixth term, directors receive a 20,000 share stock option grant and additional grants of 4,000 shares annually for ten years. Vesting of these grants is contingent on appreciation of the value of the Company’s stock to specified price levels. No directors qualified for the first time for this grant in 2006 and three directors received 4,000 shares each at an option price of $10.02 as part of the annual tenure option grant program. In addition, all shares continue to be eligible for vesting for five years following retirement from service as a director and vest, in any event, five years following the date of the grant.

Pursuant to our 1999 Stock Compensation Plan, each outside director may elect to receive director fees in the form of discounted stock options. Each director must make an election each year with regard to fees that would otherwise be payable for that calendar year. The exercise price of the options is 50 percent of the fair market value on the date of grant, which is the first business day of the year following the year for which the fees are earned. Each option becomes exercisable in full six months following the date of grant. The number of shares subject to each option is calculated by dividing the fees owed to the particular director by the discounted exercise price. Going forward, these grants will remain exercisable for five years. On January 3, 2006, all eligible outside directors received discounted stock options in lieu of cash payments of fees for calendar year 2005. A total of 27,494 options at an exercise price of $5.01 were granted to six directors.

SHAREHOLDER COMMUNICATION POLICY

Shareholders may communicate with the Company’s Board of Directors by sending a letter addressed to the Board of Directors or specified individual directors to: Possis Medical, Inc., 9055 Evergreen Blvd. NW, Minneapolis, MN 55433, c/o Irving R. Colacci, Vice President, General Counsel and Secretary. All communications will be compiled by the General Counsel of the Company and submitted to the Board or the individual directors on a periodic basis.

The Company encourages, but does not require, directors to attend the annual meeting of shareholders. All directors attended the Company’s 2005 annual meeting of shareholders. All current directors, with the exception of Robert Dutcher, are determined to be “independent” for purposes of federal regulations and listing requirements of the NASD.

CODE OF ETHICS

We have adopted a formal Code of Ethics that is applicable to all of our officers, directors and employees, including our senior financial officers. It is the responsibility of any employee, officer or director to report any violations of our code of ethics to the Company’s General Counsel or the Chair of its Audit Committee. Our Code of Ethics is available on our website at www.possis.com under the Investors/Corporate Overview/Corporate Governance tab.

7

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth compensation paid for services rendered to the Company during each of the three fiscal years ended July 31, 2006, 2005 and 2004, to our President and Chief Executive Officer and our four other highest paid executive officers who received salary and bonus in excess of $100,000 during fiscal year 2006 (“named executive officers”):

SUMMARY COMPENSATION TABLE

| | | | Annual Compensation | | Long-Term Compensation | |

| | | | | | | | | | Awards | | | |

| | | | | | | | | | | | Securities | | | |

| | | | | | | | | | Restricted | | Underlying | | | |

| | | | | | | | Other Annual | | Stock | | Options(4)/ | | All Other | |

| | | | Salary | | Bonus(1) | | Compensation(2) | | Award(3) | | SARs | | Compensation(5) | |

Name and Principal Position | | Year | | ($) | | ($) | | ($) | | ($) | | (#) | | ($) | |

Robert G. Dutcher | | 2006 | | 341,543 | | 168,500 | | 19,814 | | 70,300 | | 29,600 | | 7,466 | |

Chairman, President and | | 2005 | | 330,085 | | 104,800 | | 21,280 | | 66,910 | | 55,300 | | 7,978 | |

Chief Executive Officer | | 2004 | | 258,392 | | 176,300 | | 25,593 | | — | | 56,300 | | 7,344 | |

| | | | | | | | | | | | | | | |

Irving R. Colacci | | 2006 | | 173,200 | | 83,100 | | 16,439 | | 32,465 | | 13,600 | | 5,604 | |

Vice President, Legal Affairs and Human | | 2005 | | 166,539 | | 56,760 | | 19,473 | | 36,591 | | 23,100 | | 6,934 | |

Resources, General Counsel and | | 2004 | | 141,262 | | 86,800 | | 18,647 | | — | | 21,100 | | 5,866 | |

Secretary, Chief Governance Officer | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Jules L. Fisher(6) | | 2006 | | 180,000 | | 90,600 | | 4,580 | | 32,465 | | 13,600 | | 3,807 | |

Vice President, Finance and | | 2005 | | 28,000 | | 0 | | 0 | | 0 | | 0 | | 0 | |

Chief Financial Officer | | 2004 | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | |

| | | | | | | | | | | | | | | |

James D. Gustafson, | | 2006 | | 172,000 | | 92,100 | | 13,776 | | 32,465 | | 13,600 | | 5,827 | |

Senior Vice President, Research, | | 2005 | | 161,808 | | 66,600 | | 15,067 | | 42,927 | | 23,100 | | 6,670 | |

Development, Engineering, Clinical | | 2004 | | 148,055 | | 94,900 | | 16,871 | | — | | 22,800 | | 6,371 | |

Evaluation & Chief Quality Officer | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Shawn F. McCarrey, | | 2006 | | 192,649 | | 139,700 | | 3,850 | | 45,300 | | 13,600 | | 6,631 | |

Executive Vice President, | | 2005 | | 154,400 | | 119,703 | | 3,861 | | 21,042 | | 23,100 | | 187 | |

Worldwide Sales and Marketing | | 2004 | | 142,538 | | 144,719 | | 6,000 | | — | | 21,200 | | 6,772 | |

(1) Cash bonuses shown are awarded following the end of the fiscal year, based on fiscal year performance.

(2) Includes value of use of company car, health club dues and value of financial and tax planning services provided by the company.

(3) Value of Restricted Stock shown for 2005 calculated based on $12.57 value as of August 29, 2005, date of grant. Value of Restricted Stock shown for 2006 calculated based on $8.66 value as of August 15, 2006, date of grant.

(4) Stock options shown for 2006 were granted on August 15, 2006, based on fiscal year 2006 performance and vest in four equal annual installments.

(5) Includes Company matching contributions to its 401(k) Plan and excess life insurance premium payments. The allocated amounts in this column are as follows: Dutcher: 2006: 401(k) - - $6,674, excess life insurance premiums - $792; 2005: 401(k) - $7,303, excess life insurance premiums - $675; 2004: 401(k) - $6,828, excess life insurance premiums - - $516; Colacci: 2006: 401(k) - $5,328, excess life insurance premiums - $276; 2005: 401(k) - $6,648, excess life insurance premiums - $286; 2004: 401(k) - $5,625, excess life insurance premiums - $241; Gustafson: 2006: 401(k) - $5,551, excess life insurance premiums - $276; 2005: 401(k) - $6,435, excess life insurance premiums - $235; 2004: 401(k) - $6,196, excess life insurance premiums - $175; McCarrey: 2006: 401(k) - $6,396, excess life insurance premiums - $235; 2005: 401(k) - $0, excess life insurance premiums - $187; 2004: 401(k) - $6,349, excess life insurance premiums - $423; Fisher: 2006: 401(k) - $3,531, excess life insurance premiums - $276.

(6) Mr. Fisher commenced his employment with Possis in May 2005.

8

Option Grants in Last Fiscal Year

The following table provides information concerning stock option grants to the named executive officers during fiscal year 2006.

| | Number of | | Percent of Total | | | | | | Potential Realizable Value | |

| | Securities | | Options/SARs | | | | | | at Assumed Annual Rates | |

| | Underlying | | Granted to | | | | | | of Stock Price Appreciation | |

| | Options/SARs | | Employees in | | Exercise | | | | for Option Term (2) | |

| | Granted(1) | | Fiscal Year | | Price | | | | $ | |

Name | | (#) | | ($) | | ($/Sh) | | Expiration Date | | 5% | | 10% | |

Robert G. Dutcher | | 55,300 | | 9.9 | % | 12.57 | | August 29, 2010 | | 437,158 | | 1,107,844 | |

Irving R. Colacci | | 23,100 | | 4.2 | % | 12.57 | | August 29, 2010 | | 182,610 | | 462,770 | |

James D. Gustafson | | 23,100 | | 4.2 | % | 12.57 | | August 29, 2010 | | 182,610 | | 462,770 | |

Shawn F. McCarrey | | 23,100 | | 4.2 | % | 12.57 | | August 29, 2010 | | 182,610 | | 462,770 | |

Jules Fisher | | 0 | | 0 | | N/A | | N/A | | 0 | | 0 | |

(1) All options granted to employees during fiscal year 2006 vest in four equal annual installments beginning one year following the date of grant.

(2) The 5% and 10% assumed annual rates of compounded stock price appreciation are mandated by rules of the Securities and Exchange Commission (SEC) and do not represent the Company’s estimate or projection of the Company’s future common stock prices. These amounts represent certain assumed rates of appreciation only. Actual gains, if any, on stock option exercises are dependent on the future performance of the common stock and overall stock market conditions. The amounts reflected in this table may not necessarily be achieved.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides information concerning stock option exercises and the value of unexercised options at July 31, 2006, for the named executive officers.

| | | | | | Number of | | | |

| | | | | | Securities | | Value of | |

| | | | | | Underlying | | Unexercised | |

| | | | | | Unexercised | | In-the-Money | |

| | | | | | Options at | | Options at | |

| | | | | | Fiscal Year-End | | Fiscal Year-End | |

| | Shares Acquired | | Value | | Exercisable/ | | Exercisable/ | |

Name | | upon Exercise

(#) | | Realized

($) | | Unexercisable

(#) | | Unexercisable(1)

($) | |

Robert G. Dutcher | | — | | — | | 486,714/136,775 | | 800,185/0 | |

Irving R. Colacci | | — | | — | | 189,675/70,125 | | 343,736/0 | |

James D. Gustafson | | — | | — | | 193,425/55,375 | | 314,938/0 | |

Shawn F. McCarrey | | — | | — | | 113,773/53,950 | | 167,758/0 | |

Jules L. Fisher | | — | | — | | 5,000/15,000 | | 0/0 | |

(1) The dollar values represent the difference between $8.36 (the fair market value of the common stock underlying the options at fiscal year end) and the exercise price of the options.

Supplemental Executive Retirement Plans

The Company maintains a Supplemental Executive Retirement Plan, or SERP, in order to supplement the retirement benefits payable to the Company’s Chief Executive Officer, Robert G. Dutcher. The SERP provides for target payments for a period of ten years beginning at retirement based on a percentage of annual cash compensation. Assuming Mr. Dutcher remains employed by the Company until age 65, the SERP

9

provides for an annual target benefit equal to fifty percent of his annual base salary at retirement, subject to calculation based on actual base salary and investment return. In the event that Mr. Dutcher retires after he reaches age 60, but before he reaches age 65, he will be entitled to receive the accrued balance of his SERP account as of the date of retirement. Following a change in control, as defined in the SERP, Mr. Dutcher may terminate his employment and receive benefits as if he had worked until age 65. Assuming Mr. Dutcher were to retire from the Company at age 65, he would receive an estimated target annual benefit of approximately $160,000 per year for ten years subject to variability dependent on actual base salary prior to retirement and investment return.

The company also maintains a Supplemental Nonqualified 401(k) Profit Sharing Plan for Executive Officers excluding the CEO. This plan provides for annual contributions of between six percent and fourteen percent of base salary to participants for fiscal years 2006 and 2007, based on corporate performance, with payouts extending for ten years following retirement. Contributions for fiscal year 2006 were made at six percent of base salary.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information on equity compensation plans under which equity securities of the Company are authorized for issuance, as of July 31, 2006:

| | | | | | Number of securities | |

| | | | | | remaining available for | |

| | | | | | future issuance under | |

| | | | | | equity compensation | |

| | Number of securities to | | Weighted- average | | plans (excluding | |

| | be issued upon exercise | | exercise price of | | securities reflected in | |

Plan category | | of outstanding options. | | outstanding options. | | the second column) | |

Equity compensation plans approved by Security holders (1) | | 3,208,179 | | $ | 11.55 | | 349,046 | |

Equity compensation plans not approved by Security holders | | None | | N/A | | None | |

Total | | 3,208,179 | | $ | 11.55 | | 349,046 | |

(1) Includes the Company s 1992 and 1999 Stock Compensation Plans.

Change in Control Plan

On September 15, 1999, our Board of Directors approved a Change in Control Termination Pay Plan that provides, at the discretion of the Board, salary and benefit continuation payments to executive officers and selected key management and technical personnel in the event they are terminated within twenty-four months of a change in control. At this time, the Board of Directors has committed to a three-year salary and benefit continuation for the Chief Executive Officer and two-year salary and benefit continuations for other executive officers. In addition, other key management and technical personnel are entitled to salary and benefit continuation benefits ranging in duration from six to twenty-four months. The Board of Directors has approved additional payments upon a change in control notwithstanding employment status following a change in control. The amount of the pool available for such payments is limited, in aggregate, to between two and four percent of the value of Possis at the time of the change in control. The percentage applied is based on the extent to which the change in control agreement price exceeds the value of the corporation prior to public announcement of the acquisition.

Report of the Possis Medical Inc. Compensation Committee

The Compensation Committee of the Board of Directors consists of three independent, outside directors.

10

The Committee provides assistance to the Board of Directors in fulfilling the Board’s responsibility to shareholders relating to compensation philosophy and practices for corporate executive officers. The Committee meets as necessary to review executive compensation policies, the design of compensation programs and individual salaries and awards for executive officers. In carrying out its responsibilities, the Committee believes its policies and procedures should remain flexible to ensure that it can best react to changing conditions and environments and that our executive compensation and stock plan practices are of the highest quality.

Compensation Philosophy. Our compensation program is intended to attract and retain high quality executive leadership and to motivate these executives to perform consistent with the interests of shareholders. Executive officer compensation is directly linked to both individual and Company performance necessary to increase value to shareholders. The program is designed to provide a competitive base salary while retaining flexibility through the structuring of short- and long-term incentives that recognize progress toward achievement of both individual and corporate goals.

Compensation decisions for fiscal year 2006 were based on a three year program adopted at the beginning of fiscal year 2005 based on an extensive review and evaluation of executive and incentive compensation programs conducted by an independent outside compensation consultant, the Committee’s independent review, and recommendations and additional information provided by management. One year ago, the Committee and its consultant analyzed industry-wide compensation practices in order to develop a base and variable compensation structure for the Company’s officers that was competitive with industry practices and consistent with the needs and structure of the Company. For fiscal year 2006, the Committee implemented the second year of the planned three year program, performing additional research into appropriate compensation levels and adjusting base salary and variable compensation.

Compensation of executive management and key managerial and technical personnel continues to be based on three types of compensation: base salaries; short-term incentives; and long-term equity-based compensation.

Base Salaries. The Committee reviews base salaries on an annual basis and makes adjustments as it deems appropriate. Generally, annual base salary adjustments will be modest, except when the Company achieves certain specified milestones or comparative survey data, specifically from the medical device industry, compels a more significant adjustment. Base salaries are typically paid in cash consistent with normal payroll practices. Adjustments are typically made effective the first day of the fiscal year. In addition, promotions and/or assumption of additional responsibilities will support a greater than normal increase in base salary.

Short-term Incentives. The Company continues to provide executives and other key employees with an opportunity to earn short-term incentive awards. Short-term incentive awards are typically in the form of cash bonuses awarded based on individual and corporate performance against specified objectives and vary in amount depending on the employee’s pay grade and job responsibilities.

Long-term Equity-based Compensation. The major component of the Company’s long-term equity-based compensation program has consisted of stock options awarded annually at the discretion of the Board under the Company’s Stock Compensation Plan. Stock options are intended by the Committee to maximize individual performance and strengthen the alignment of management interests with that of the shareholders. For fiscal year 2006, the Committee granted a portion of long-term equity-based compensation in the form of Restricted Stock, consistent with general industry trends and in light of the impact of new accounting rules that apply to stock options. It remains the intent of the Committee that the maximum number of stock options and restricted stock granted to employees each year going forward, exclusive of options to new employees and extraordinary grants compelled by special circumstances, shall not exceed two percent of the

11

Company’s shares issued and outstanding. In addition, the Company intends to continue to repurchase at least as many shares in the open market under its current stock repurchase program as are awarded in stock options and restricted stock in order to reduce or eliminate dilution of shareholders’ interests. Stock options have historically been granted annually to officers and other key employees based on progress toward achievement of short- and long-term strategic objectives, technical and regulatory milestones, and corporate financial performance goals. The Committee’s normal practice is to condition the vesting of stock options on the passage of time.

Fiscal Year 2006 Compensation. The Company’s fiscal year 2006 performance was evaluated in light of financial goals determined at the beginning of the fiscal year, non-financial goals addressing product development, clinical and regulatory milestones, and performance in connection with unplanned for and unanticipated events and circumstances that arose during the year. The Committee assessed overall fiscal year 2006 corporate performance at 64 percent of plan, due in large part to the Company’s shortfall as to revenues and earnings. The Company performed well in the area of significant product development and clinical milestones and in responding to unplanned events and circumstances that arose during the course of the year. Cash bonus awards totaling $991,400 were granted to 47 officers, managers and other key employees.

Pursuant to our 1999 Incentive Compensation Plan, the Committee granted stock options and restricted stock grants in August 2006 to 47 officers, managers and other key employees. A total of 228,200 stock options were awarded at an option exercise price of $8.66, the fair market value of Possis Stock on the day of grant, representing approximately 1.3 percent of the Company’s total shares outstanding. Of the total options granted, approximately 41 percent were granted to officers. In addition, the Committee granted 63,390 shares of restricted stock to the same group of officers, managers and other key employees, of which 43 percent were granted to officers.

Base salaries and target cash bonus opportunities for the Company’s executive officers are adjusted effective the first day of each fiscal year consistent with the Company’s compensation philosophy and program. Annual adjustments effective August 1, 2005, ranged from six percent to seventeen percent to reflect promotions, assumptions of additional responsibilities and one-time corrections to set salaries at industry-competitive levels. Base salary increases effective August 1, 2006, ranged from five percent to six percent and reflect a normal annual adjustment.

Supplemental Retirement Program. Two years ago, the Compensation Committee, based on extensive surveys of industry compensation practices, determined that the Company’s least competitive benefit in relation to industry comparables was executive retirement benefits, and that a cost-effective defined contribution, performance-driven program for the executives was reasonable. The Board, consequently, approved a supplemental retirement program for the Company’s executive officers, excluding its CEO. A supplemental retirement program for the CEO had been previously established. This program conditions entitlement to retirement benefits on a “cliff” standard of eligibility, allows for increased benefits if the Company performs in excess of Plan, recognizes that the Company has, in the past, relied on stock options to make up for the lack of traditional retirement programs and recognizes that use of stock options in the future may be less desirable to the Company due to the changing accounting environment. For fiscal year 2006, benefits equal to 6 percent of the base salary were awarded to five officers, totaling $51,300 under this nonqualified profit sharing plan.

Chief Executive Officer Compensation. Robert G. Dutcher, as President and Chief Executive Officer of the Company, participates in the general compensation program of the Company, as described above, along with all other key employees. Mr. Dutcher’s base salary is set at a level determined by the Committee to be competitive with other similarly situated companies based on salary surveys and other comparative data, and reflects the scope of his responsibilities and individual performance as an officer. Effective August 1, 2006,

12

Mr. Dutcher’s base salary and target cash bonus were increased by 5 percent compared to a 7.3 percent increase effective August 1, 2005. He received a cash bonus of $161,200, a grant of 28,300 stock options, and 7,770 shares of restricted stock to reward fiscal year 2006 performance. All of the options granted to Mr. Dutcher vest in four equal annual installments beginning one year following the date of grant. The restricted stock vests in four equal annual installments beginning one year following the date of grant, with accelerated vesting in the event that the stock appreciates 30 percent and maintains that value for twenty trading days. All cash and equity awards reflect the Committee’s judgment as to Mr. Dutcher’s individual performance, the overall performance of the Company as measured against corporate objectives and the Committee’s commitment to aligning the interests of the Chief Executive Officer with those of shareholders. The terms and conditions of the option awards are identical to those contained in grants to other officers.

The Committee has adopted a plan for Chief Executive Officer compensation as part of its compensation philosophy and plan for all executives, as described above. Chief Executive Officer compensation will continue to be based on corporate and individual performance measured against established guidelines and objectives. Current guidelines and objectives are contained in the Company’s strategic plan, as approved by the Board.

The Board of Directors approved a Supplemental Executive Retirement Plan for Mr. Dutcher effective for the 2005 fiscal year. The Plan provides a target benefit equal to fifty percent of base compensation at retirement with smaller benefits paid in the event Mr. Dutcher retires prior to age 65. Since Mr. Dutcher is a highly valued employee of Possis Medical, the Plan has been structured as both a retirement supplement and retention vehicle incorporating both noncompete and nondisclosure provisions. The Company intends to accrue a Plan liability over the target benefit period on a basis consistent with the Company’s general unfunded payment obligation.

Compensation Committee of the Board of Directors

Donald C. Wegmiller, Chairman

Seymour J. Mansfield

Mary K. Brainerd

13

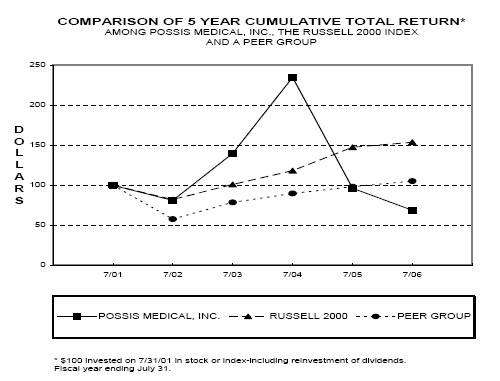

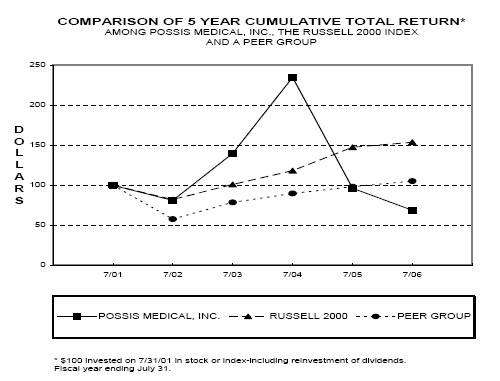

PERFORMANCE GRAPH

Set forth below is a graph showing the five-year cumulative returns through July 31, 2006, of Possis Medical, Inc. common stock as compared with the Russell 2000 Index and a peer group index comprised of seven companies in the medical device industry with similar cardiovascular markets to Possis Medical, Inc. (the “Peer Group”(1)). The graph assumes an investment of $100.00 in the Company’s common stock in each of the indexes on July 31, 2001, and the reinvestment of all dividends.

Possis Medical, Inc. is comparable to companies included in the Russell 2000 Index and is similar in size and stage of commercialization as the other companies in the Peer Group. The Russell 2000 Index does not have an index specifically for medical devices.

| | Cumulative Total Return | |

| | 7/01 | | 7/02 | | 7/03 | | 7/04 | | 7/05 | | 7/06 | |

POSSIS MEDICAL, INC. | | 100.00 | | 81.02 | | 139.85 | | 235.00 | | 96.14 | | 68.69 | |

RUSSELL 2000 | | 100.00 | | 82.04 | | 101.00 | | 118.23 | | 147.53 | | 153.79 | |

PEER GROUP | | 100.00 | | 57.56 | | 78.48 | | 89.73 | | 98.26 | | 105.11 | |

(1) Arthrocare Corp.; Cardiac Science, Inc.; Datascope Corp.; Kensey Nash Corp.; Merit Medical Systems, Inc.; Novoste Corp.; Spectranetics Corp.

14

SECTION 16(a) BENEFICIAL OWNER

SHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that our executive officers and directors and persons who beneficially own more than 10% of a registered class of our equity securities file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of such forms received by us with respect to fiscal 2006 and written representations from certain reporting persons, we believe that all filing requirements applicable to our executive officers and directors have been complied with.

AUDIT COMMITTEE REPORT AND PAYMENT OF FEES TO ACCOUNTANTS

Payment of Fees to Accountants

The following table presents fees billed for professional services rendered for the audit of the Company’s annual financial statements for fiscal years 2005 and 2006 and fees billed for other services provided by the Company’s independent auditors in each of the last two fiscal years.

| | Fiscal Year 2005 | | Fiscal Year 2006 | |

Audit Fees (1) | | $ | 242,331 | | $ | 273,703 | |

Audit-Related Fees (2) | | 13,400 | | 89,395 | |

Tax Fees (3) | | 114,845 | | 95,392 | |

All Other Fees (4) | | 66,970 | | 19,770 | |

| | | | | | | |

(1) Audit Fees consisted of fees billed by Deloitte & Touche LLP for services rendered in auditing the Company’s financial statements for fiscal years 2005 and 2006, and reviewing the financial statements included in the Company’s quarterly reports on Form 10-Q for fiscal years 2005 and 2006, and services related to Sarbanes-Oxley 404 certification.

(2) Audit-Related Fees consisted of fees for fiscal year 2004 and 2005 audits of the Company’s 401(k) Plan and fees related to special projects in connection with business initiatives during fiscal year 2006.

(3) Tax Fees consisted of preparation of fiscal year 2004 and 2005 corporate income tax returns, and consultation on international tax issues.

(4) All Other Fees include fees for executive retirement planning, executive tax return preparation, and special project fees in fiscal 2005 and for special project fees in fiscal year 2006.

Prior to engagement of the Company’s auditors to render audit or non-audit services, the engagement is approved by the Audit Committee.

The Audit Committee has determined that the provision of non-audit services was compatible with maintaining the independence of Deloitte & Touche LLP.

15

Report of the Audit Committee of the Board of Directors

The Audit Committee is responsible for overseeing management’s financial reporting practices and internal controls.

The Audit Committee operates under a written charter adopted by the Board of Directors. All of the members of the Audit Committee are independent for purposes of current Nasdaq listing requirements.

The Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended July 31, 2006 with the Company’s management. The Audit Committee has discussed with Deloitte & Touche LLP, the Company’s independent public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Audit Committee has also received the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee has discussed the independence of Deloitte & Touche LLP with that firm.

Based on the Audit Committee’s review and discussions described above, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2006 for filing with the SEC.

Audit Committee of the Board of Directors

Whitney A. McFarlin, Chair

William C. Mattison, Jr.

Rodney A. Young

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

(Proposal Number Two)

While the Company is not required to do so, the Company is submitting the selection of Deloitte & Touche LLP to serve as the Company’s independent auditors for the fiscal year ending July 31, 2007, for ratification in order to ascertain the views of the Company’s shareholders on this appointment. If the selection is not ratified, the Audit Committee will reconsider its selection.

Deloitte & Touche LLP, has been the Company’s independent auditor since July 31, 1960. Representatives of Deloitte & Touche LLP will be in attendance at the Annual Meeting of Shareholders and will have the opportunity to make a statement if they desire to do so. In addition, they will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS RATIFY THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING JULY 31, 2007. The enclosed proxy will be voted FOR the appointment unless a contrary specification is made.

16

SHAREHOLDER PROPOSALS

In order to be eligible for inclusion in our proxy solicitation materials for our next annual meeting of shareholders, any shareholder proposal to be considered at such meeting must be received at our principal executive offices, 9055 Evergreen Boulevard N.W., Minneapolis, Minnesota 55433-8003, no later than July 7, 2007. Pursuant to the our bylaws, in order for business to be properly brought before the next annual meeting by a shareholder, the shareholder must give written notice of such shareholder’s intent to bring a matter before the annual meeting no later than July 7, 2007. Such notice should be sent to the Corporate Secretary at our principal executive offices, and must set forth certain information with respect to the shareholder who intends to bring such matter before the meeting and the business desired to be conducted, as set forth in greater detail in our bylaws. Any such proposal will be subject to the requirements of the proxy rules adopted under the Securities Exchange Act of 1934. Shareholder proposals that are submitted after July 7, 2007 may not be presented in any matter at the 2007 Annual Meeting of Shareholders.

OTHER MATTERS

The Board of Directors is aware of no other matter that will be presented for action at the annual meeting. If, however, other matters do properly come before the meeting, it is the intention of the persons named in the proxy to vote in accordance with their best judgment on such matters.

ANNUAL REPORT

A copy of our Annual Report on Form 10-K may be obtained without charge by any beneficial owner of our common shares on the record date upon written request addressed to Investor Relations, Possis Medical, Inc., 9055 Evergreen Boulevard N.W., Minneapolis, Minnesota 55433-8003.

| By Order of the Board of Directors |

| IRVING R. COLACCI, |

| Vice President, General Counsel and Secretary |

Dated: November 3, 2006

Possis Medical Inc. • 9055 Evergreen Boulevard NW • Minneapolis, MN 55433-8003 USA

Phone: (763) 780-4555 | Toll Free 1-800-810-7677 | Fax: (763) 780-2227 |

17

POSSIS MEDICAL, INC.

PROXY FOR ANNUAL SHAREHOLDERS MEETING

December 13, 2006

4:00 p.m.

Dorsey & Whitney LLP

50 South Sixth Street, 15th floor

Minneapolis, Minnesota 55402

POSSIS MEDICAL, INC. | |

9055 Evergreen Boulevard, N.W., | |

Minneapolis, Minnesota 55433-8003 | proxy |

This Proxy is solicited by the Board of Directors of the Corporation.

The undersigned hereby appoints Irving R. Colacci and Jules L. Fisher as Proxies, with the power to appoint their substitute, and the undersigned hereby authorizes them to represent and vote, as designated below, all Common Shares of Possis Medical, Inc., a Minnesota corporation, that the undersigned would be entitled to vote if personally present at the Annual Meeting of Shareholders of Possis Medical, Inc. to be held at the offices of Dorsey & Whitney LLP, 50 South Sixth Street, 15th floor, Minneapolis, Minnesota 55402, on the 13th day of December 2006, at 4:00 p.m., or any adjournments thereof.

See reverse for voting instructions.

There are three ways to vote your Proxy

Your telephone or Internet vote authorizes the Named Proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

VOTE BY PHONE — TOLL FREE — 1-800-560-1965 — QUICK  EASY EASY  IMMEDIATE IMMEDIATE |

· Use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week until 12:00 p.m. Noon (CT) on December 12, 2006.

· Please have your proxy card and the last four digits of your Social Security Number or Taxpayer Identification Number available. Follow the simple instructions the voice provides you.

VOTE BY INTERNET — http://www.eproxy.com/poss/ — QUICK  EASY EASY  IMMEDIATE IMMEDIATE |

· Use the Internet to vote your proxy 24 hours a day, 7 days a week until 12:00 p.m. Noon (CT) on December 12, 2006.

· Please have your proxy card and the last four digits of your Social Security Number or Taxpayer Identification Number available. Follow the simple instructions to obtain your records and create an electronic ballot.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we’ve provided or return it to Possis Medical, Inc., c/o Shareowner Services,SM P.O. Box 64873, St. Paul, MN 55164-0873.

If you vote by Phone or Internet, please do not mail your Proxy Card

Please detach here Please detach here

|

| | | | | | | | |

| | | | | | | | |

| The Board of Directors Recommends a Vote FOR Items 1, 2, and 3. | |

| | | | | | | | |

| 1. | Election of directors: | 01 Robert G. Dutcher | 05 Whitney A. McFarlin | o | Vote FOR | o | Vote WITHHELD | |

| | 02 Mary K. Brainerd | 06 Donald C. Wegmiller | | all nominees | | from all nominees | |

| | 03 Seymour J. Mansfield | 07 Rodney A. Young | | (except as marked) | | | |

| | 04 William C. Mattison, Jr. | | | | | | |

| | | | | | | | |

| (Instructions: To withhold authority to vote for any indicated nominee,

write the number(s) of the nominee(s) in the box provided to the right.) | | | |

| | | | | | |

| 2. | PROPOSAL TO RATIFY SELECTION OF Deloitte & Touche LLP

as our independent auditors. | | o For | o Against | o Abstain | |

| | | | | | | |

| 3. | In his discretion, the Proxy is hereby authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof. | | | | | |

| | | | | | | |

| THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED FOR EACH PROPOSAL. | |

| | | | | | | |

| Address Change? Mark Box | o | | Date | | |

| Indicate changes below: | | | | | |

| | | | | | |

| | | | | |

| | | | | |

| | | | | | | |

| | | | PLEASE REMEMBER TO DATE THIS PROXY. | |

| | | | | |

| | | | Please sign above exactly as name appears hereon. Executors, administrators, trustees, guardians, etc, should so indicate when signing. If a corporation, please sign in full corporate name by the president or other authorized officer. If a partnership, please sign in partnership name by an authorized person. Please return promptly in the enclosed addressed envelope. | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | |