Investor Presentation

Fourth Quarter 2008

Forward-Looking Statements

and Non-GAAP Financial Information

The forward-looking statements, as defined in the applicable federal securities laws, being made today are subject to risks

and uncertainties. TSFG’s actual results may differ materially from those set forth in such forward-looking statements.

These statements include, but are not limited to, factors that may affect TSFG’s return goals, loan growth, loan sales,

customer funding growth, expense control, income tax rate, expected financial results for acquisitions, noninterest income,

adequacy of capital and future capital levels, factors that will affect credit quality and the net interest margin, effectiveness

of hedging strategies, risks and effects of changes in interest rates, effects of future economic conditions, and market

performance. Reference is made to TSFG’s reports filed with the Securities and Exchange Commission for a discussion of

factors that may cause such differences to occur. TSFG undertakes no obligation to release revisions to these forward-

looking statements or reflect events or circumstances after today’s presentation.

This presentation contains certain non-GAAP measures that exclude the impact of certain nonoperating items. TSFG

management uses these non-GAAP, or operating measures, in its analysis of TSFG’s performance. TSFG believes

presentations of financial measures excluding the impact of certain items provide useful supplemental information and

better reflect its core operating activities. Management uses operating measures, in particular, to analyze on a consistent

basis and over a longer period of time, the performance of which it considers to be its core operations.

Operating measures adjust GAAP information to exclude the effects of nonoperating items, such as gains or losses on

certain asset sales, early extinguishment of debt, employment contract buyouts, impairment charges, and other

nonoperating expenses. The limitations associated with utilizing operating measures are the risk that persons might

disagree as to the appropriateness of items comprising these measures and different companies might calculate these

measures differently. Management compensates for these limitations by providing detailed reconciliations between GAAP

and operating measures. These disclosures should not be considered an alternative to GAAP results. A reconciliation of

GAAP results and non-GAAP measures is provided in the Quarterly Financial Data Supplement on our web site,

www.thesouthgroup.com, in the Investor Relations section under Quarterly Earnings.

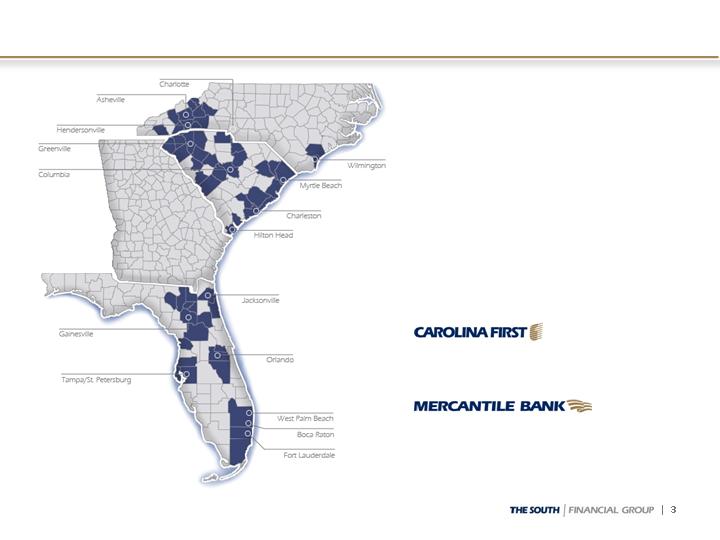

Total assets $13.7

Loans held for investment $10.3

Customer funding* $8.0

Tangible shareholders’ equity $1.0

Shareholders' equity $1.5

Tangible equity** to tangible

assets 7.94%

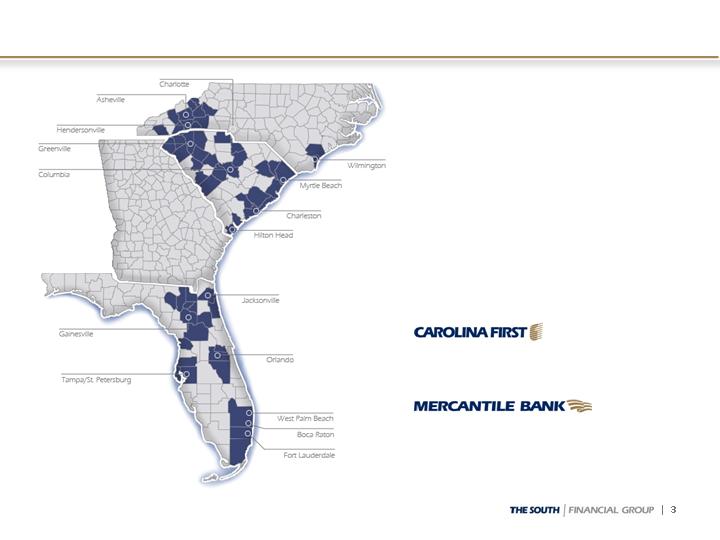

Branch offices:

NC 27

SC 82

FL 71

TSFG AT A GLANCE

$ in billions, as of 9/30/08

Company Overview

* Customer funding includes total deposits less brokered deposits plus customer sweeps.

** Includes $249 million of mandatorily convertible preferred stock issued in May 2008

*** Mercantile Bank is a division of Carolina First Bank.

***

Super-Community Bank Model

Community banking is the core strength of TSFG

Focused on customer relationships with local decision-making

Accessible and responsive

Involved in our communities

Target middle-market and small businesses and retail customers

Built through multi-product relationships

Located in attractive Southeastern markets with long-term growth

potential

Led by local Market Presidents in 13 markets

Average of 23 years banking experience

Local market and customer knowledge

Local authority to make customer decisions

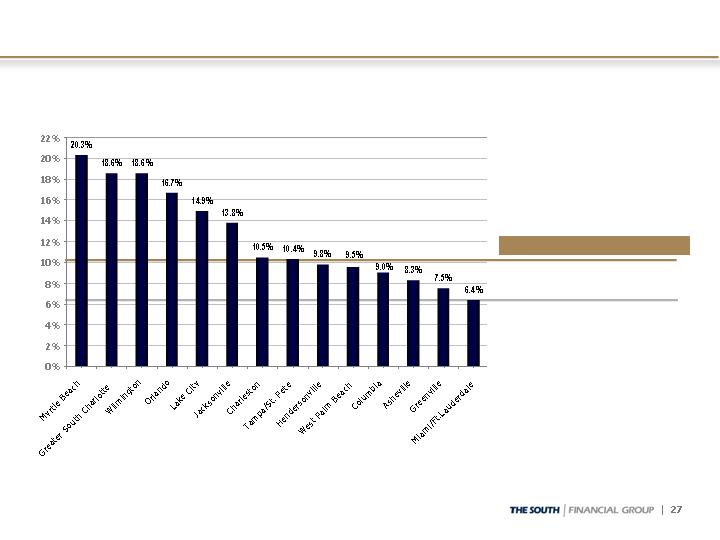

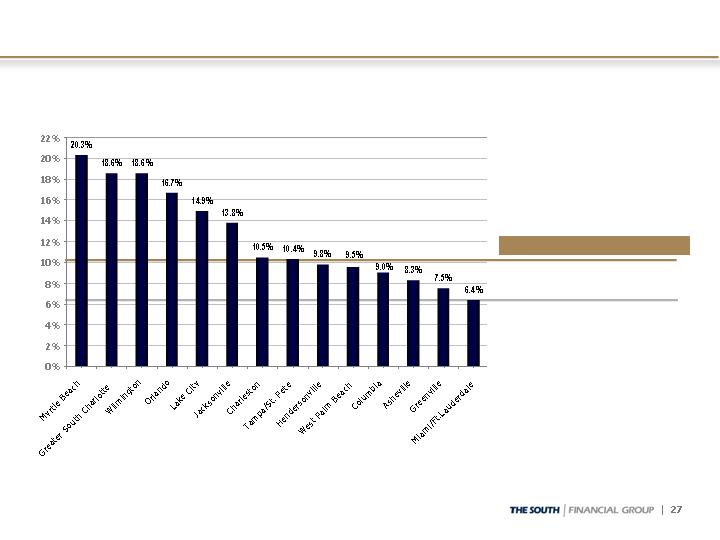

PROJECTED HOUSEHOLD GROWTH (2008-2013)

Growth estimates deposit weighted by county as of 6/30/08

SOURCE: SNL Financial

Footprint: Long-term Growth Potential

6.3

Trustmark

6.4

Regions

6.5

Operating Peer Median

6.5

U.S. Median

7.0

Whitney

6.7

BOK Financial

10.5

Colonial BancGroup

10.5

SunTrust Banks

11.3

Zions Bancorporation

11.8

Cullen/Frost

8.3

BB&T

10.2

The South Financial Group

%

14.2

United Community Banks

5.5

8.8

Household Growth

(%)

Synovus

Company Name

First Horizon

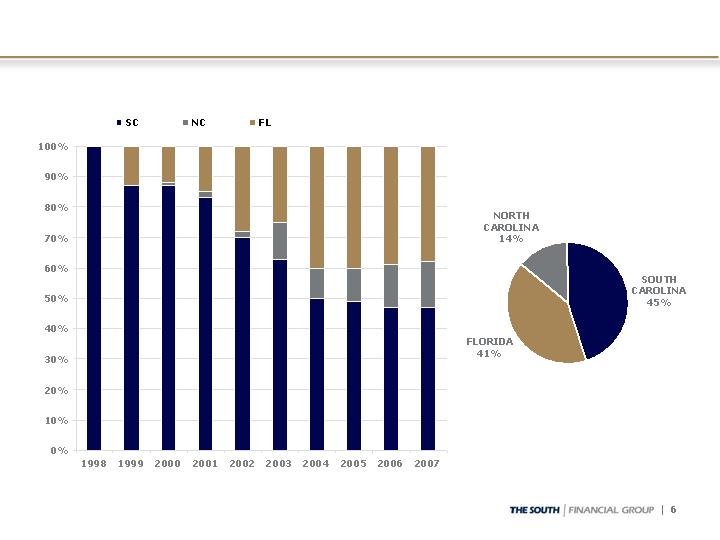

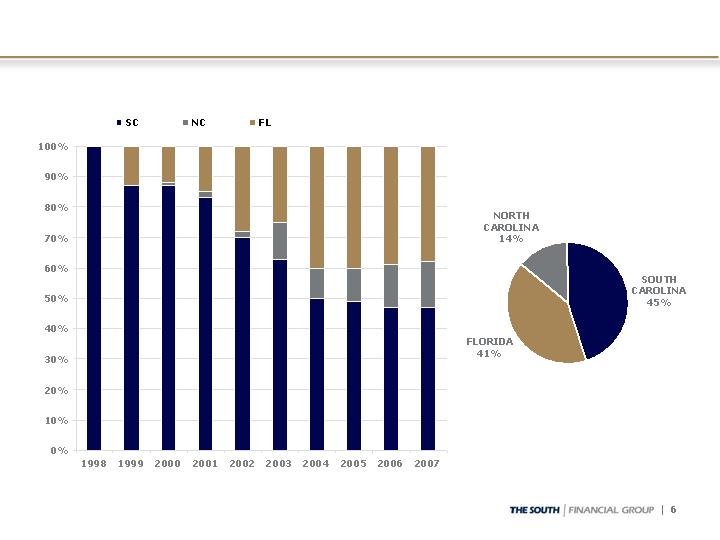

DEPOSITS BY STATE*

*Percent of total deposits by state as of December 31; reflects customer deposits after 12/31/04

As of September 30, 2008

Footprint: Geographic Diversification

Proactive and Realistic Approach to Cycle

$250 million Capital Raise in May 2008

Attracted sophisticated large investors

Reduced quarterly common cash dividend to $0.01 per share;

preserves $52 million annually in retained capital

Strengthened overall Liquidity Position

$4.7 billion unused capacity at 9/30/08

In May 2008, suspended indirect automobile lending in Florida

Parent company has over $125 million in cash to cover expected

cash flow needs, debt service and existing dividends through 2011

with no support from banking subsidiary

New Risk Management team

Lynn Harton (former Chief Credit Officer of Regions/Union

Planters) hired in 2/07; now Interim President & CEO

Significant number of senior leadership level hires from same

team

Large bank experience in turnaround situations

Proactive and Realistic Approach (continued)

Resulted in Early Identification of real estate credit issues

New management processes reflected in risk grades identified

growing level of problems

Disclosed rising levels of nonaccruals in 1Q08, ahead of

Southeastern Peers

Increased loan loss reserve in 1Q08 to one of the highest levels in

the Southeast; continued in 2Q08 and 3Q08

Began loan sales (2Q08) earlier than peers

Recognized by analysts as having a realistic and aggressive

posture in managing credit risk

Continue Transition of CEO

Search well underway by Board

Lynn Harton named Interim President & CEO November 14, 2008

$347 million of TARP Capital

Received preliminary approval November 14, 2008

Control operating noninterest expenses, excluding

environmental costs

Early stages of efficiency project with focus on both

expense management and revenue opportunities

Expense Control

Increase through growth in deposits and wealth

management revenues

Noninterest Income

Continue to manage tangible equity ratio

Maintain strong regulatory capital ratios

Capital Management

Aggressively identify and resolve stressed portfolios

Improve longer-term performance relative to peers

Credit Quality

Focus on liquidity in near-term with longer-term

view of improving NIM

Lower funding costs longer-term by improving

volume, mix, and cost of deposits

Funding

Focus on relationship-based lending to small and

family-owned businesses in market

Deemphasize noncore portfolios: indirect, lot loans,

residential construction, shared national credits

Loan Growth

OBJECTIVES

EXECUTION POINTS

Strategic Objectives

Diversified Loan Portfolio

Loan Mix

As of September 30, 2008

($ in millions)

Total Loans Held for

Investment $10,300

C&I

Commercial

Development

Mortgage*

Diversified portfolio

By product and customer

By geography

In-footprint focus

Customers we know; markets

we understand

No broker mortgage/HE loans

Minimal subprime exposure

Suspended Florida indirect

Disciplined approval and portfolio

management processes

Local credit officers

Executive credit committee

approval for largest

relationships

Special assets department for

high risk loans

Centralized consumer

approval and collections

Specialized credit support for our

largest businesses

CRE; Corporate Banking/SNC

Owner-

Occupied

Indirect -

Sales Finance

Income

Property

Residential

Construction

Home Equity

* Mortgage includes Consumer Lot Loans and Other (Direct Retail and Unsecured Lines).

Credit Quality Results – 3Q08

Residential construction and housing-related loans primary stress

NCOs $75.4 million, or 2.87% of average loans annualized

$28.1 million related to loan sales and loans transferred to held for sale

$17.6 million from the recognition of previously-established specific reserves on

impaired loans as charge-offs (including $5.5 million related to loans sold or held

for sale)

Provision of $84.6 million, a $20.8 million increase from 2Q08

Exceeds NCOs by $9.2 million

Built reserve to 1.97% (from 1.85% at 6/30/08)

Coverage of NPLs held for investment relatively unchanged at 0.84 times

NPAs increased to 2.83% of loans and foreclosed property

Ratio is 2.62%, excluding NPLs held for sale of $22.6 million

NPLs held for investment increased to $240.1 million, up from $220.2 million at

6/30/08

3Q08 loan sales ($ in millions):

Compared to 2Q08 loan sales of $40 million with NCOs of $16.1 million

$39.4

23.3

$16.1

Sales

Price

$71.7

45.8

$25.9

Legal

Balance

$22.6

22.6

$ --

Nonaccrual

Loans HFS

$28.1

$4.2

Total

20.6

1.9

Pending sale

$7.5

$2.3

Loans sold

3Q08

NCOs

Pre-Q3

NCOs

Loan and Credit Quality Stress is Housing-Related

0.84%

$47.0

2.09%

$219

$10,476

Total, 6/30/08

1.16%

$147.4

$75.4

2.30%

$238

100%

$10,300

Total Loans HFI

4.64%

11.9

6.9

5.92%

36

6%

610

Mortgage**

1.69%

9.1

3.4

0.10%

1

6%

680

Indirect – sales

finance

0.71%

3.6

2.6

0.68%

5

8%

784

Home equity

2.16%

0.94%

9.03%

1.87%

1.05%

0.58%

0.97%

NAL %

of O/S

Balance

1.1

78.1

12.5

4.9

1.7

$24.5

YTD Net

Charge-

offs

$25.0

0.0

44.6

2.5

1.9

0.8

$12.7

QTD Net

Charge-

offs

1.14%

1.84%

1.76%

0.27%

1.15%

0.79%

0.44%

30-day

past due

%

22

20%

2,084

Completed

income property

11

6%

601

Commercial

development

$10,276

100

1,410

1,207

$ 2,824

Outstanding

Balance

1%

14%

12%

27%

% of O/S

Balance

1

Other**

7

Owner-occupied

CRE

$28

C&I

127

Residential

construction

$222

Nonaccrual

Loans HFI*

Total, 3/31/08

As of September 30, 2008, $ in millions

HFI = Held for Investment; 30-day past due % of outstanding balance excludes nonaccrual loans.

* Nonaccrual loans exclude nonaccrual loans held for sale of $22.6 million.

** Mortgage includes Consumer Lot Loans. Other includes Direct Retail and Unsecured Lines.

See page 9 of the Quarterly Financial Data Supplement for Commercial Real Estate loans by product type and by

geography. Commercial Development includes Commercial A&D and Commercial Construction. Residential

Construction includes Residential A&D, Residential Construction, Residential Condo, and Undeveloped Land.

Residential Construction

2.40%

$20.9

13.18%

$96

47%

$729

Total FL, 6/30/08

1.33%

$22.3

8.47%

$131

$1,550

Overall Total, 6/30/08

0.45%

$3.5

$2.5

2.14%

$10

34%

$485

Total SC, 9/30/08

0.29%

$0.8

2.93%

$15

32%

$499

Total SC, 6/30/08

0.52%

$0.6

6.43%

$21

21%

$322

Total NC, 6/30/08

1.87%

$70.2

$39.4

15.47%

$96

44%

$619

Total FL, 9/30/08

2.41%

$9.8

12.80%

$103

50%

$806

Total FL, 3/31/08

1.76%

$78.1

$44.6

9.03%

$127

100%

$1,410

Overall Total,

9/30/08

1.58%

$11.2

8.23%

$134

$1,628

Overall Total, 3/31/08

3.63%

$4.4

$2.7

6.93%

$21

22%

$306

Total NC, 9/30/08

27.18%

12.36%

19.70%

10.63%

NAL %

of O/S

Balance

21.7

3.5

27.7

$17.3

YTD Net

Charge-

offs

11.2

1.1

16.2

$10.9

QTD Net

Charge-

offs

0.00%

3.12%

1.12%

2.43%

30-day

past due

%

39

14%

196

FL residential A&D

11

6%

90

FL residential

construction

65

$268

Outstanding

Balance

5%

19%

% of

Resid.

Constr.

17

FL residential

condo

$29

FL undeveloped

land

Residential Construction:

Nonaccrual

Loans

HFI*

As of September 30, 2008, $ in millions

30-day past due % of outstanding balance excludes nonaccrual loans.

* Nonaccrual loans exclude nonaccrual loans held for sale of $20 million.

Performing Differently

By Geography

Commercial Nonaccruals – Net Balance

$195

127

11

22

7

$28

9/30/08

Nonaccrual

Loan

Balance

$165

108

10

20

6

$21

Net Balance

Less

Specific

Reserve

67%

$30

$53

$248

Total Commercial

67%

76%

76%

67%

56%

Net Balance

as % of

Unpaid

Principal

2

4

26

Completed income

property

1

2

13

Commercial

development

163

8

$38

Unpaid

Principal (1)

36

1

$10

Cumulative

Net Charge-

offs (2)

19

Residential

construction

1

Owner-occupied

CRE

$7

C&I

9/30/08

Specific

Reserve (3)

$ in millions

-

=

-

=

(1) Outstanding balance at default

(2) Typically charge-down at nonaccrual to approximately 80% of most recent appraised value

(3) Additional specific reserves are established as necessary based on estimated holding period and current market and economic conditions;

recognized as charge-offs when realized. However, these amounts do not include the qualitative components within the overall allowance for

credit loans.

Home Equity Lines/Loans

SC, $343

43.6%

FL, $276

35.3%

NC, $131

16.7%

As of September 30, 2008, $ in millions

Originated by TSFG sales force in-

market; no broker loans

Strong FICO scores

Conservative LTV position and usage

amounts

Not pushed as a growth product

Home Equity Portfolio = HE Line and HE Loan portfolios

Geography based on customer address

Other, $34

4.4%

Summary Statistics

NA

NA

55%

WAvg Util %

70%

55%

45%

730

730

$784

Total

67%

71%

Orig WAvg

LTV %

20%

67%

2nd Lien %

80%

33%

1st Lien %

693

740

Jul 08 FICO

699

737

Orig FICO

$190

$594

Balance $

Loans

Lines

2008, $87

11.1%

2007, $152

19.3%

2006, $129

16.5%

2004 or before

$296

37.7%

2005, $120

15.4%

By Vintage

Total Home Equity Portfolio, $784

By Geography

Mortgage Banking Portfolio

Remains a small portion of

entire portfolio

$610 million

6% of total loans HFI

NAL increase of $7.7 million

from Q2 to Q3

Increases from higher risk

portions of the portfolio (Lot

Loans and Construction Perm)

Balances continue to decline

in both Lot Loans and

Construction Perm products

As of September 30, 2008, $ in millions

Construction Perm:

$113.8

$113.3

$95.7

$78.8

Balance

0.38%

2.91%

5.86%

1.70%

30-89 DPD

0.00%

0.00%

0.00%

0.00%

90+ DPD

2.62%

4.11%

9.85%

15.98%

NAL %

$3.0

$4.7

$9.4

$12.6

NAL $

Lot Loans:

$311.4

$291.4

$266.2

$249.1

Balance

2.92%

5.34%

2.09%

3.84%

30-89 DPD

0.78%

1.03%

2.00%

2.34%

90+ DPD

1.92%

2.89%

4.07%

6.12%

NAL %

$6.0

$8.4

$10.8

$15.2

NAL $

SIVA* Alt-A:

$3.9

1.56%

1.87%

6.22%

$251.8

1Q08

$2.7

1.06%

1.17%

7.52%

$254.9

4Q07

$8.1

$8.3

NAL $

3.04%

2.94%

NAL %

0.69%

2.21%

90+ DPD

0.90%

1.89%

30-89 DPD

$267.9

$282.3

Balance

2Q08

3Q08

Mortgage Portfolio = Mortgage, Consumer Lot Loans, and Construction Perm products (excludes HE Loan)

* SIVA = Stated Income Verified Assets

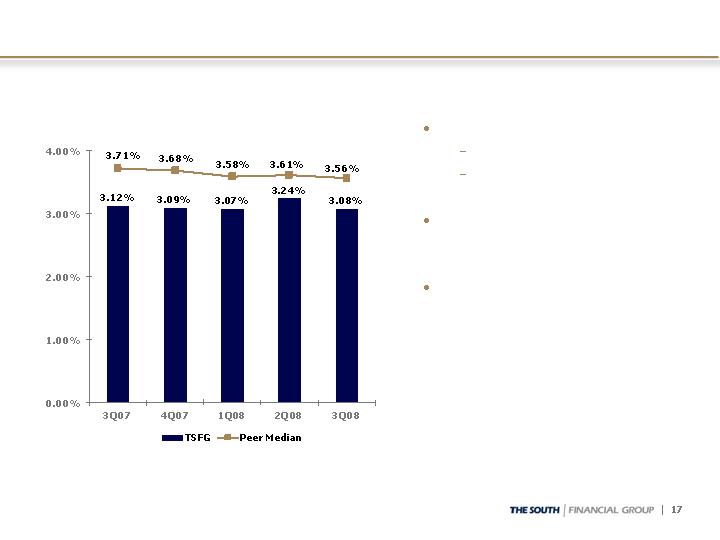

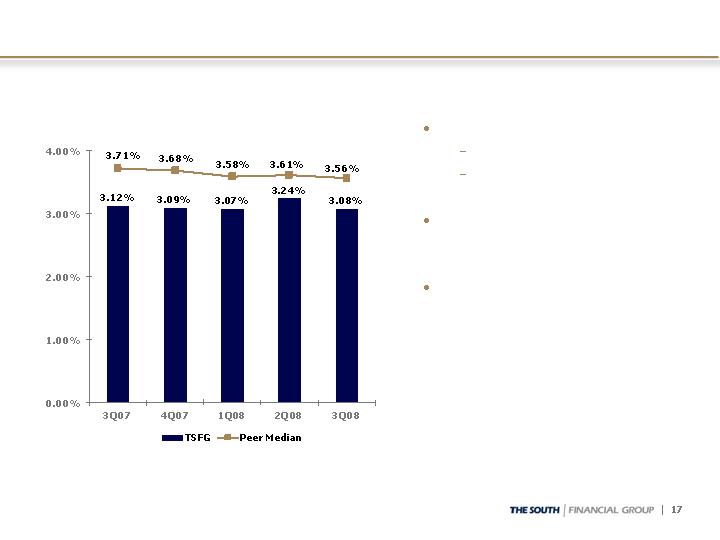

Net Interest Margin

Net Interest Margin (FTE)

Decrease 3Q08 vs. 2Q08

Funding mix: –10 bp

Increase in nonaccrual

interest reversals: -3 bp

Better positioned with less

volatility; interest rate risk

reduced

Near-term margin pressures

persist; levels and/or pricing

of customer funding, levels

of NPAs and NCOs, maturing

interest rate swaps, short-

term movements in LIBOR,

and recent cuts in the

Federal Funds target rate

-5

+3

-10

-3

-5

Peer

-16

+17

-2

-3

0

TSFG

Basis Point Change:

Customer Funding

25.3%

372

1,468

1,840

Time deposits < $100,000

(16.5)%

(357)

2,163

1,806

Money market

(0.8)%

(61)

7,496

7,435

Customer deposits

2.8%

15

537

552

Customer sweep accounts

Customer deposits:

(0.6)%

3.0%

(0.7)%

(3.2)%

(7.6)%

LQ %

Change

(36)

1,127

1,091

Interest-bearing

(1)

151

150

Savings accounts

45

1,480

1,525

Time deposits $100,000 or

more

$(46)

$8,033

$7,987

Total customer funding

$(84)

$ Change

$1,107

6/30/08

Balance

$1,023

9/30/08

Balance

Noninterest-bearing

$ in millions

Customer funding reflects total deposits excluding brokered deposits plus customer

sweeps.

Wholesale Borrowings

29%

2%

19%

2%

--

2%

3%

1%

Actual

% of Total Assets

By Maturity

$4,713

40%

$3,984

$1,771

$959

$767

$487

Total wholesale

borrowings

--

25%

2,574

998

954

622

--

Brokered CDs

--

20%

19

--

5

14

--

Commercial paper

633

20%

298

298

--

--

--

FHLB advances

275

200

--

$ --

> 1 year

20%

20%

20%

20%

Policy

limit

275

226

480

$112

Total

--

453

3,627

$ --

Unused

capacity

--

26

--

Repurchase

agreements

--

375

$ 112

Over-

night

--

105

$ --

2 days

to 3

mos.

--

Other*

--

Fed Reserve and

T,T&L

$ --

Fed funds

purchased

4 to 12

mos.

As of September 30, 2008, $ in millions

* No parent company ($207 million) or bank ($68 million) exposure to capital markets

rollover risk for trust preferred securities and related obligations until 2033 for parent

company and 2012 for bank-level

Capital Position

10.49%

13.84%

12.11%

12.30%

15.68%

14.18%

10.57%

9/30/08

Pro

Forma

with

TARP*

7.77%

10.69%

8.91%

8.16%

10.88%

9.33%

6.72%

Pre-

Capital

Raise

3/31/08

Actual

9/30 Pro Forma in Excess

of Well Capitalized Min.

$1,127

$683

$1,086

$1,500

$1,012

$1,458

$929

Pre-tax $

assuming 35%

tax rate **

5%

10%

6%

5%

10%

6%

TSFG

target

>6%

Well

Capitalized

Minimum

8.54%

11.59%

9.86%

9.70%

12.68%

11.18%

7.94%

9/30/08

Actual

$444

Total risk-based

$732

Leverage

CAROLINA FIRST

BANK

$706

Tier 1 risk-based

$658

Total risk-based

$975

Leverage

$947

Tier 1 risk-based

$604

Tangible equity to

tangible assets

THE SOUTH

FINANCIAL

GROUP

After-tax

$

$ in millions

* Assumes $347 million of capital with 75% initially contributed to Carolina First Bank

** For illustrative purposes only

FDIC insurance

Loan collection and monitoring

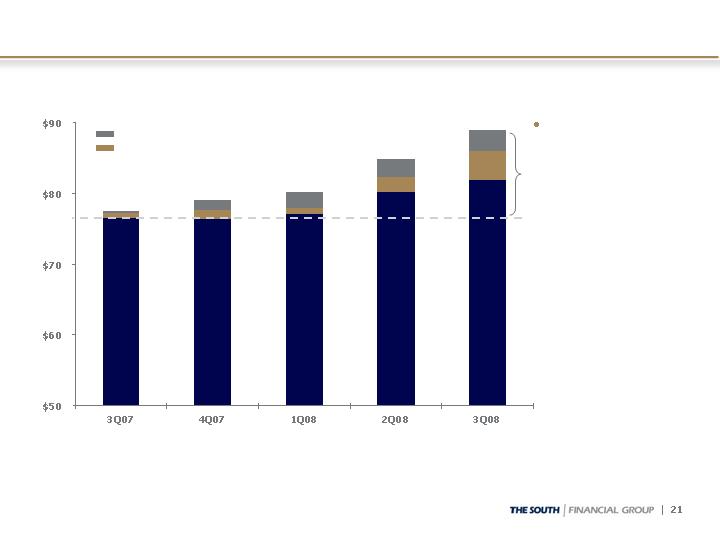

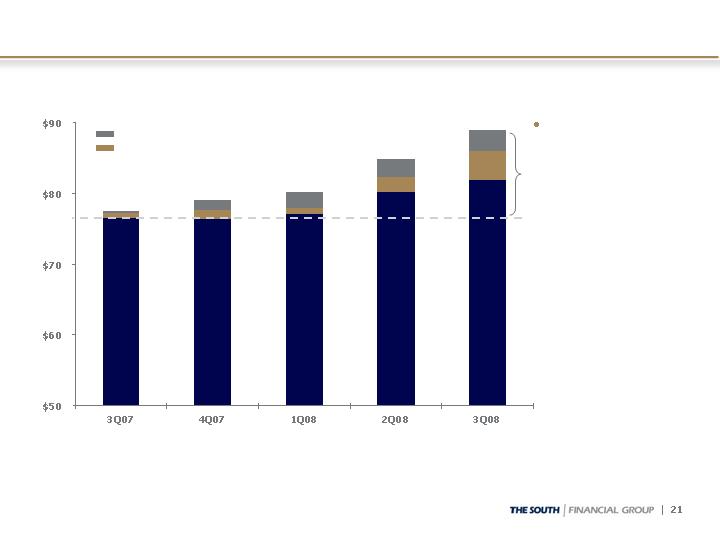

Noninterest Expenses

Operating Noninterest Expenses

TSFG operating noninterest expenses exclude nonoperating items, such as goodwill impairment, loss on early extinguishment of debt, Visa-related

litigation, and employment contract buyouts/severance. GAAP noninterest expenses totaled $78.7 for 3Q07, $80.5 for 4Q07, $268.2 for 1Q08, $87.6 for

2Q08, and $93.4 for 3Q08. For non-operating items, see reconciliations of GAAP to non-GAAP measures provided on page 15 of the Quarterly Financial

Data Supplement for 3Q08 included in the Appendix and on TSFG’s web site, www.thesouthgroup.com, in the Investor Relations section.

$77.4

$79.1

$80.1

$84.7

$88.9

More than

half of the

$11.5 million

year-over-

year increase

is from loan

collection

and FDIC

insurance

expense

$ in millions

2.56%

2.46%

2.33%

2.25%

2.19%

TSFG

As % of Average Assets (annualized):

Efficiency Improvement Project

Three fundamental objectives:

Increase revenue

Improve our customers’ experience

Manage expenses

Emphasis on improving the customer experience by improving

workflows, policies, and procedures

Specific examples include back office branch operations,

lending process redesign, centralized procurement function

Outstanding commitment across the organization

Management support at the highest level

Started with 40 business leaders throughout company

Engage employees in on-going idea generation

Timing

Initial launch 4Q08 based on Phase I Analysis

1Q09 complete opportunity sizing

12-18 months to realize benefits

Operating Noninterest Income

For Qtr Ending September 30, 2008, $ in millions

Noninterest Income

See page 3 of the Quarterly Financial Data Supplement for additional information on categories of noninterest income. Total nonterest income for

3Q08 totaled $27.9 and included a $(0.7) net loss on securities, which is excluded from operating noninterest income shown above.

Together, customer fee and wealth management income comprise over 70% of total

Customer fee income

Deposit related

Treasury Services

Wealth management income

Private bankers as portal to leverage and expand customer base

Licensed branch employees

n/m

n/m

(3%)

(0.8)

Loss on OREO

(4)%

(6)%

23%

6.5

Other

% Change 3Q08 vs.

3Q08

(3)%

(6)%

100%

$ 28.6

Total

5%

(53)%

3%

0.9

Mortgage banking

(3)%

2%

25%

7.2

Wealth management

9%

(2)%

7%

2.0

-- Debit card income

9%

3%

8%

2.2

-- Treasury services

2%

3%

52%

$14.8

Customer fee income

3Q07

2Q08

% of Total

$

Positioned to Emerge Stronger

Operate as Super-Community Bank

Leverage strategic footprint and its long-term growth

potential

Deep and experienced management team

Risk management talent and processes

Maintain strong balance sheet throughout credit environment

Capital strength

Liquidity management

Higher loan loss reserves

Relationship lending with focus on deposit balances

Appendix – List of Operating Peers

Associated (ASBC)

BOK Financial (BOKF)

Colonial (CNB)

Commerce (CBSH)

Cullen/Frost (CFR)

Fulton (FULT)

Synovus (SNV)

Trustmark (TRMK)

United Community (UCBI)

Valley National (VLY)

U.S. Median 6.5%

TSFG Weighted Average* 10.2%

*Deposit weighted by county based on

TSFG deposits in each market

SOURCE: SNL Financial

PROJECTED HOUSEHOLD GROWTH (2008-2013)

NOTE: The regions highlighted are complete MSAs except for Greater South Charlotte, which is York County, SC (Rock Hill), Hendersonville, NC, which is

Henderson County, and West Palm Beach, which is Palm Beach County.

TSFG’s Footprint: Household Growth

Loan and Credit Quality Composition, 6/30/08

0.84%

$71.9

$47.0

2.09%

$219

100%

$10,476

Total Loans HFI

3.21%

5.0

3.8

4.51%

28

6%

629

Mortgage*

1.46%

5.7

3.3

0.07%

1

7%

729

Indirect – sales

finance

0.74%

0.9

0.8

0.60%

5

7%

781

Home equity

2.16%

0.20%

8.47%

0.57%

0.84%

0.43%

0.98%

NAL %

of O/S

Balance

1.0

33.6

10.0

2.9

0.9

$11.8

YTD Net

Charge-

offs

$25.0

1.0

22.3

8.7

2.6

0.4

$4.4

QTD Net

Charge-

offs

1.14%

1.95%

1.33%

0.86%

0.21%

0.43%

0.50%

30-day

past due

%

17

19%

2,037

Completed

income property

3

6%

575

Commercial

development

$10,276

100

1,550

1,184

$ 2,891

Outstanding

Balance

1%

15%

11%

28%

% of O/S

Balance

0

Other*

5

Owner-occupied

CRE

$28

C&I

131

Residential

construction

$222

Nonaccrual

Loans

Total, 3/31/08

As of June 30, 2008, $ in millions

HFI = Held for Investment; 30-day past due % of outstanding balance excludes nonaccrual loans

* Mortgage includes Consumer Lot Loans. Other includes Direct Retail and Unsecured Lines.

Commercial Development includes Commercial A&D and Commercial Construction. Residential Construction

includes Residential A&D, Residential Construction, Residential Condo, and Undeveloped Land.

Residential Construction by Geography, 6/30/08

0.29%

$1.0

$0.8

2.93%

$15

32%

$499

Total SC

0.14%

$0.2

2.67%

$14

31%

$506

Total SC, 3/31/08

1.77%

$1.2

5.48%

$17

19%

$316

Total NC, 3/31/08

2.40%

$30.8

$20.9

13.18%

$96

47%

$729

Total FL

2.41%

$9.8

12.80%

$103

50%

$806

Total FL, 3/31/08

1.33%

$33.6

$22.3

8.47%

$131

100%

$1,550

Overall Total

1.58%

$11.2

8.23%

$134

$1,628

Overall Total, 3/31/08

0.52%

$1.7

$0.6

6.43%

$21

21%

$322

Total NC

33.19%

5.79%

16.90%

6.88%

NAL %

of O/S

Balance

10.6

2.3

11.5

$6.3

YTD Net

Charge-

offs

7.7

2.3

6.5

$4.4

QTD Net

Charge-

offs

4.91%

8.47%

0.40%

1.33%

30-day

past due

%

44

17%

259

FL residential A&D

6

7%

103

FL residential

construction

80

$287

Outstanding

Balance

5%

18%

% of

Resid.

Constr.

27

FL residential

condo

$20

FL undeveloped

land

Residential Construction:

Nonaccrual

Loans

As of June 30, 2008, $ in millions

30-day past due % of outstanding balance excludes nonaccrual loans.

Current as of 12/1/08