Exhibit 99.1

Annual Meeting of Shareholders

May 5, 2009

Forward-Looking Statements

and Non-GAAP Financial Information

The forward-looking statements, as defined in the applicable federal securities laws, being made today are subject to

risks and uncertainties. TSFG’s actual results may differ materially from those set forth in such forward-looking

statements. These statements include, but are not limited to, factors that may affect TSFG’s return goals, loan growth,

loan sales, customer funding growth, expense control, income tax rate, expected financial results for acquisitions,

noninterest income, adequacy of capital and future capital levels, factors that will affect credit quality and the net

interest margin, effectiveness of hedging strategies, risks and effects of changes in interest rates, effects of general

economic and financial market conditions, and market performance. Reference is made to TSFG’s reports filed with the

Securities and Exchange Commission for a discussion of factors that may cause such differences to occur. TSFG

undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances

after today’s presentation.

This presentation contains certain non-GAAP measures, such as results excluding the impact of certain nonoperating

items and separation of the loan portfolio into core and non-core loans (based on TSFG’s ability to build/expand

banking relationships). TSFG management uses these non-GAAP, or operating measures, in its analysis of TSFG’s

performance. TSFG believes presentations of financial measures excluding the impact of certain items provide useful

supplemental information and better reflect its core operating activities. Management uses operating measures, in

particular, to analyze on a consistent basis and over a longer period of time, the performance of which it considers to be

its core operations. Operating measures adjust GAAP information to exclude the effects of nonoperating items, such as

gains or losses on certain asset sales, early extinguishment of debt, employment contract buyouts, impairment charges,

and other nonoperating expenses.

The limitations associated with utilizing operating measures are the risk that persons might disagree as to the

appropriateness of items comprising these measures and different companies might calculate these measures

differently. Management compensates for these limitations by providing detailed reconciliations between GAAP and

operating measures. These disclosures should not be considered an alternative to GAAP results. A reconciliation of GAAP

results and non-GAAP measures is provided in the Quarterly Financial Data Supplement on our web site,

www.thesouthgroup.com, in the Investor Relations section under Quarterly Earnings.

Change is needed

History of 4th Quartile Financial Performance

Financial performance reputation of the Company

is less than stellar

Pre-Cycle ROA vs. Southeast Peers

SOURCE: GAAP ROA per SNL Financial; Southeast peers include BBT, CNB, FCNCA, FHN, RF, SNV, STI, TRMK, UCBI, and WTNY

Entered credit cycle with below-peer financial performance

1.16%

0.73%

5-Yr Avg. ROA

(2003-2007)

1.24%

1.13%

Southeast Peer

Median

0.74%

0.59%

TSFG

10-Yr Avg. ROA

(1998-2007)

3-Yr Avg. ROA

(2005-2007)

Pre-Cycle Return on Average Assets

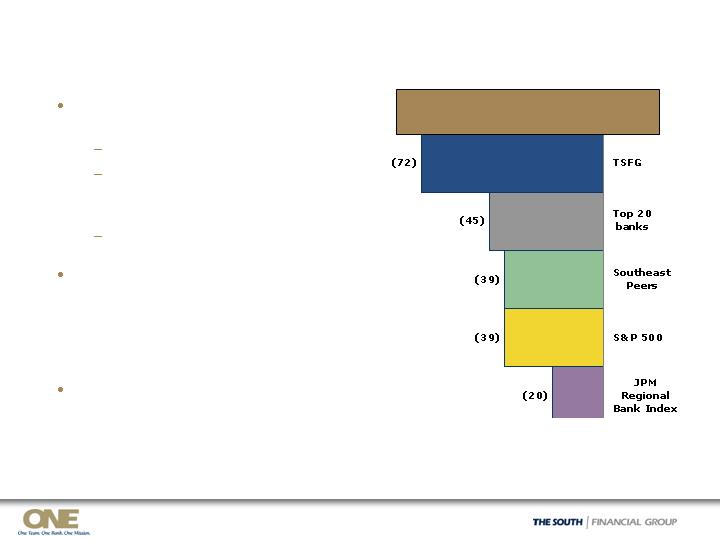

2008 Financial Performance

For non-operating items, see reconciliations of GAAP to non-GAAP measures provided on page 17 of the Quarterly Financial Data Supplement

available on TSFG’s web site, www.thesouthgroup.com, in the Investor Relations section.

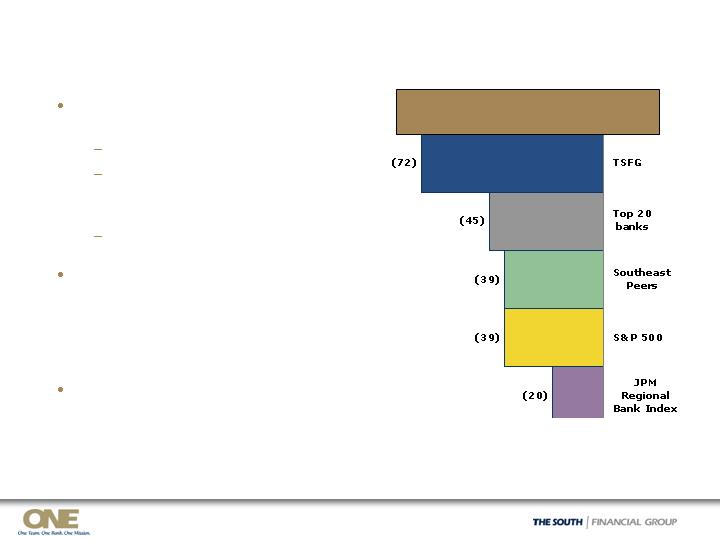

SOURCE: SNL Financial; Southeast peers include BBT, CNB, FCNCA, FHN, RF, SNV, STI, TRMK, TSFG, UCBI, and WTNY; JPMorgan Regional

Bank Index includes top 40 banks by market cap excluding JPM, WFC, and BAC

Stock Price Change

% Decline in 2008

2008 loss available to common

shareholders:

$569 million reported (GAAP)

Non-cash goodwill impairment

of $426 million for FL banking

segment

$134 million operating loss

Increased allowance for credit

losses to 2.45% at Y/E 2008 (from

1.26% at Y/E 2007) and 2008 net

charge-offs of $223 million (vs.

$53 million a year ago)

Strengthened capital base and

maintained overall liquidity

position

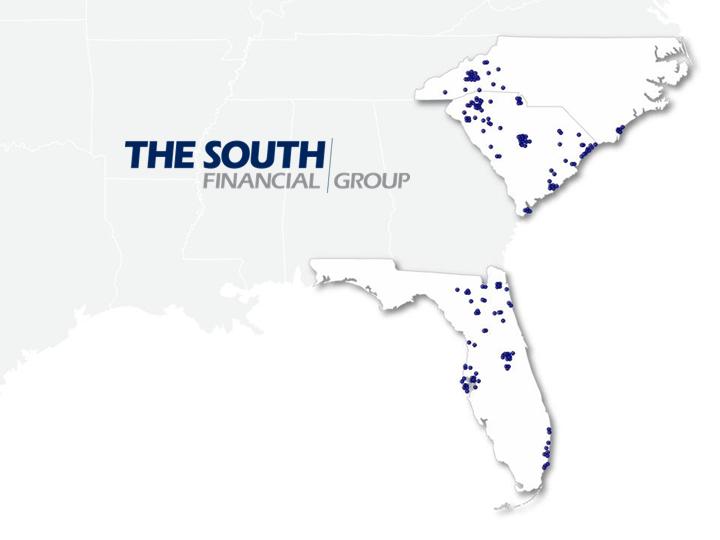

Challenging Environment

All financial institutions affected, but TSFG has had

higher than peer losses

Mix (portfolio and geography)

Underwriting

Must be prepared – the Credit Contraction/Credit Crunch

will deepen and prolong the recession

Regulatory environment will become more intense

Have the beginnings of a clear separation of winners and

losers

Winners will be rewarded

Fewer Competitors

Re-intermediation (for a time)

Margin Improvements

Core Business continues to be viable

In the business of building financial wealth and

security

The “hope and dream” of every individual

TSFG can be positioned well

Solidify strong brand and community support in SC and

then re-create in Florida and NC

Community focused; flexible; “do business” bias

Improved controls; adequate now to control/grow the

business

Simple core operating systems

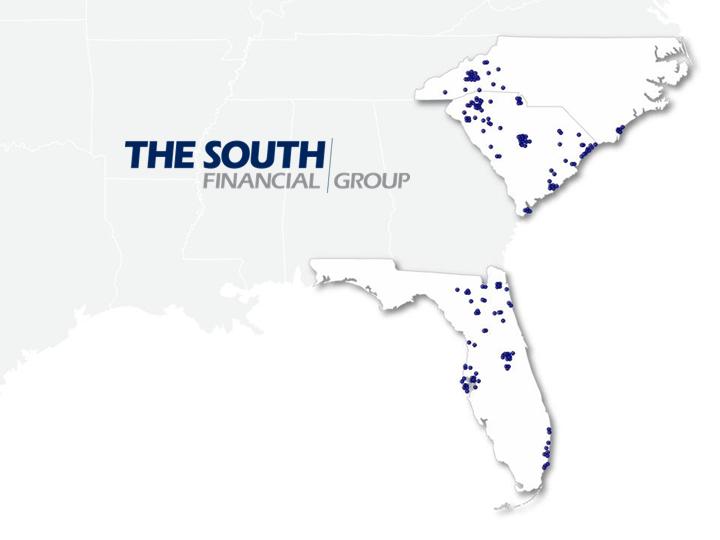

Strategically, enough size (and in the right location) to

become one of the consolidators of smaller

Southeastern banks looking for an exit strategy

Focused on the “right” footprint; management team

capable of integrating problem institutions

Action Plan to realize the opportunities

Build/choose leadership that can make the vision come

true

Preserve and generate capital and liquidity

Continue focus on credit management and execution

Reduce costs and execute on Revenue and Efficiency

Project (Project NOW)

Set clear performance targets

Build consensus around vision/strategy

Visit each market to have face to face communication of

new vision, possibilities, and strategies

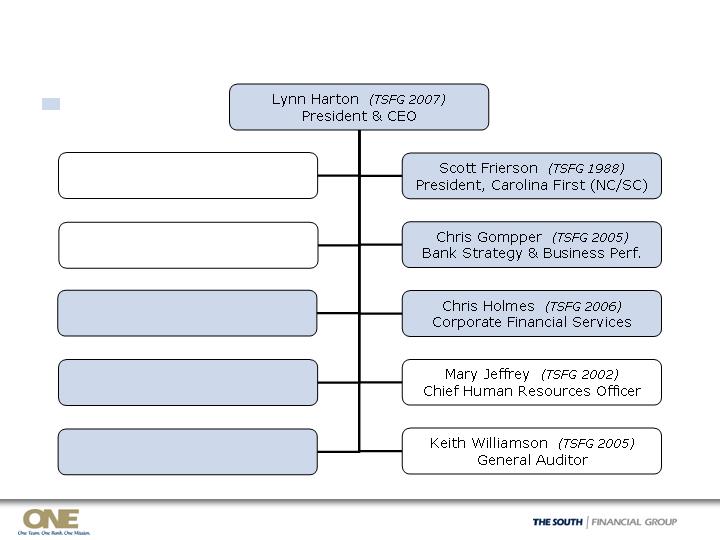

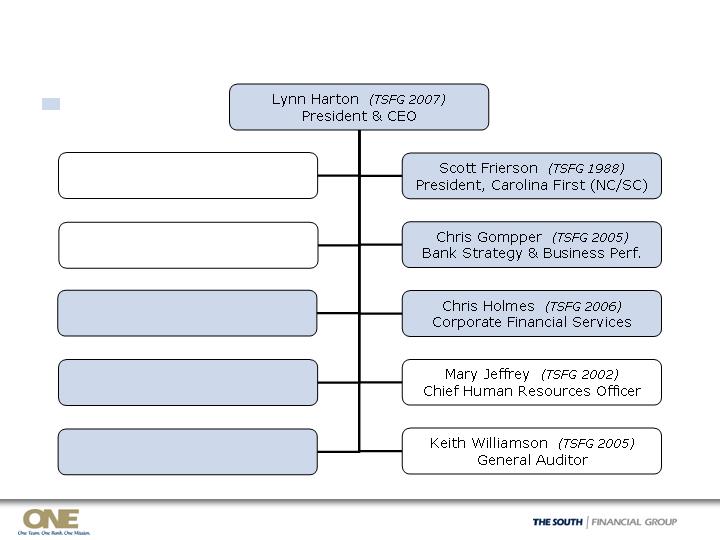

Organizational Changes

Our Executive Management Team

James Gordon (TSFG 2007)

Chief Financial Officer

Tanya Butts (TSFG 2006)

Operations & Technology

William Crawford (TSFG 2002)

Chief Legal & Risk Officer

Ernie Diaz (TSFG 2007)

President, Mercantile (FL)

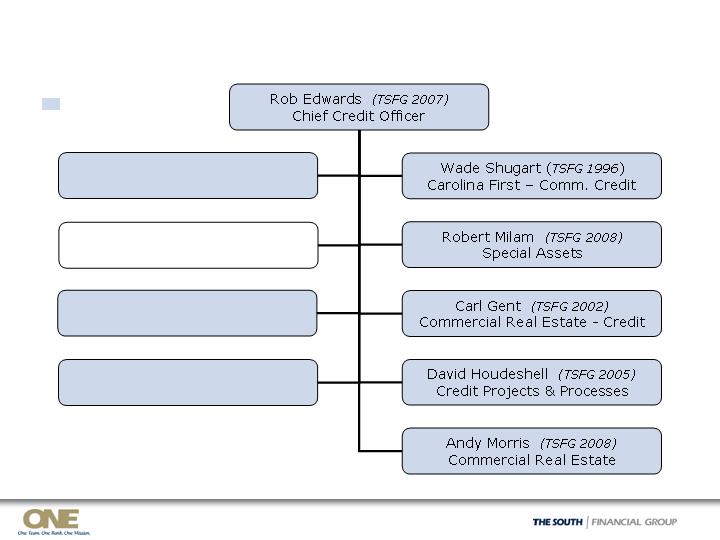

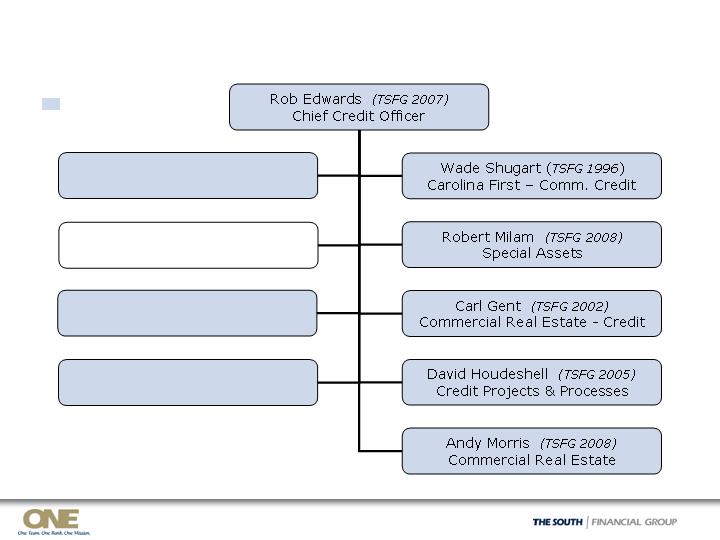

Rob Edwards (TSFG 2007)

Chief Credit Officer

New TSFG role in

last 12 months

Eliminated line of business “silos”

All relationship management teams report to and are

integrated by Bank Presidents

Incentive plans changed to foster cooperation “all win

or lose together”

Line of Business support (strategies, product

development, performance management, etc.) created

and consolidated under one leader

One Team. One Bank. One Mission.

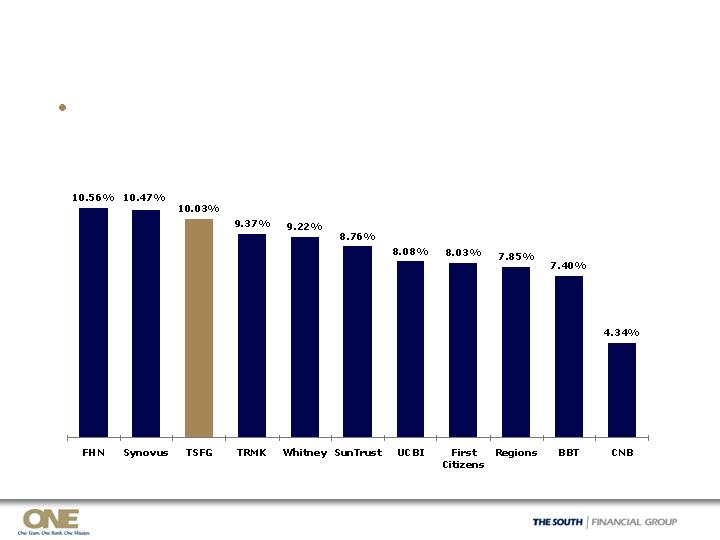

Capital and Liquidity

Capital Base – Proactive Steps Taken

$347 million preferred from U.S. Treasury’s

Capital Purchase Program

12/08:

Actively managing balance sheet growth

Exited indirect lending in FL and non-

relationship dealers in NC/FL

Grow core loans

Reduced non-core ($230 million in 1Q09)

Ongoing:

$250 million of mandatorily convertible

preferred stock

To date, $60 million converted to

common

Reduced quarterly cash dividend to $0.01

5/08:

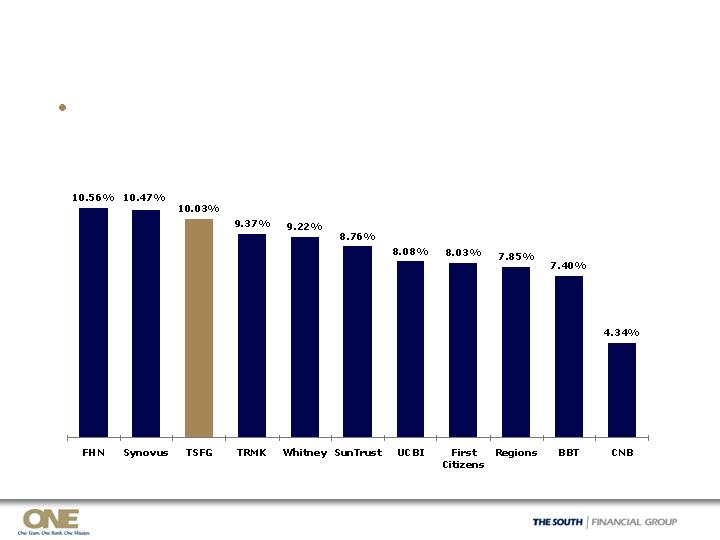

Total Capital Position vs. Southeast Peers

Higher is better

Tangible Equity as % Tangible Assets

As of 3/31/09

SOURCE: SNL Financial; First Citizens as of 12/31/08 since 3/31/09 information is not available

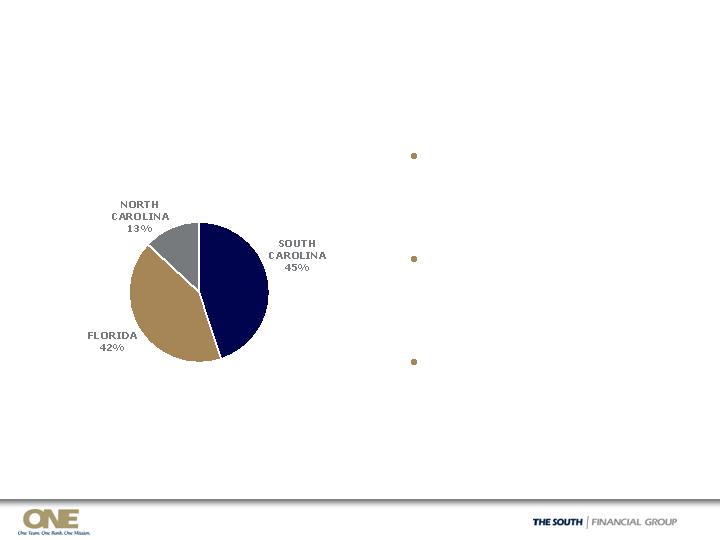

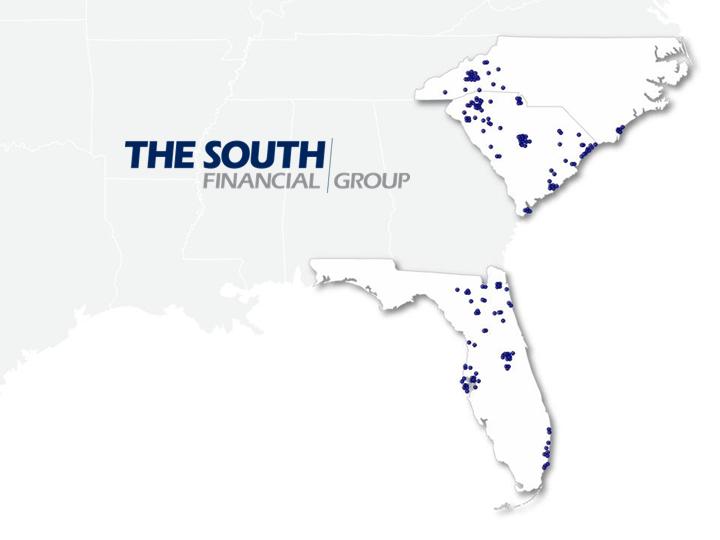

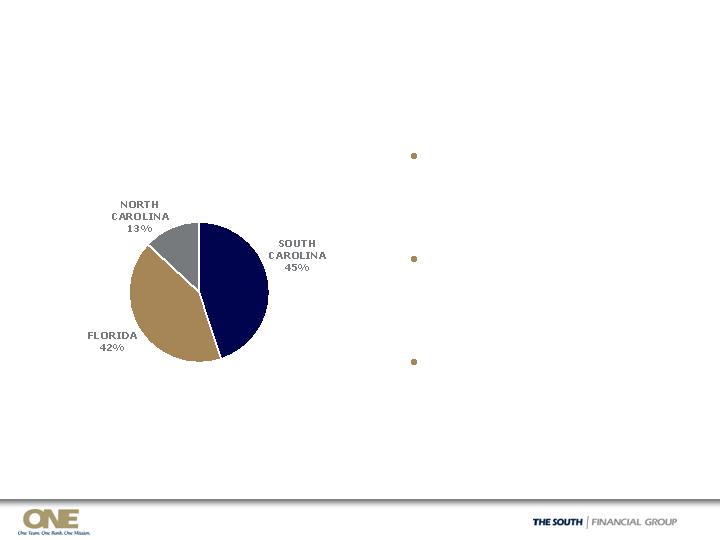

*Customer deposits are total deposits less brokered deposits. Core deposits are total deposits less certificates of deposit.

Customer Deposits

By State*

As of March 31, 2009

Geographic Diversification and Liquidity

Liquidity Position:

Unused secured

borrowing capacity of

$3.9 billion at 3/31/09

2.8% linked-quarter

growth in core

deposits in 1Q09

Strong parent

company liquidity

Credit Execution

“All about Credit”

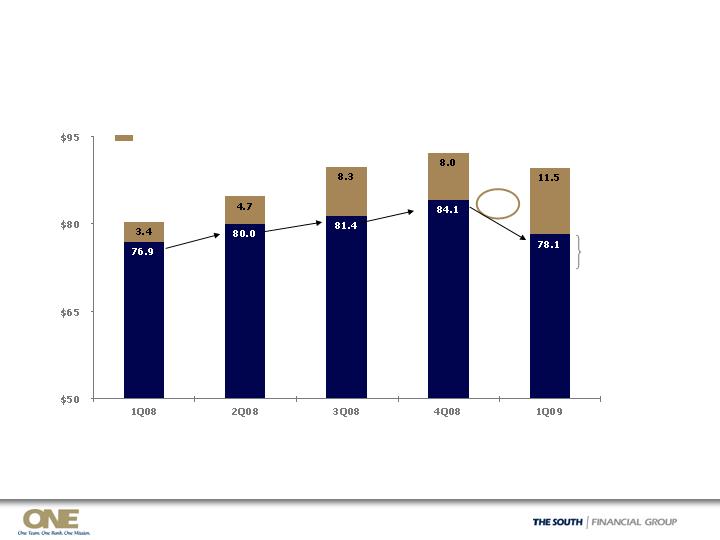

Gross Nonaccrual Loan Inflows

$ in millions

Net Charge-Offs

$ in millions

* Nonperforming assets as a % of loans and foreclosed property

Nonperforming Asset Ratio*

Allowance for Credit Losses

as % of Loans HFI

Credit Actions

Early Identification of real estate credit issues

Disclosed rising levels of nonaccruals in 1Q08, ahead of SE Peers

Built loan loss reserves to one of highest levels for SE peers

Began proactive loan sales in 2Q08

Recognized cumulative NCOs during cycle (1Q08 to 1Q09) of

$332 million

No significant investment security credit issues

Risk Management

New Chief Credit Officer, Lynn Harton, in Jan 2007 (now CEO,

bringing credit/risk background)

Strengthened overall leadership in credit with large bank

turnaround experience

Over 50% change in key credit risk managers

Named Robert Edwards as Chief Credit Officer and William

Crawford as Chief Risk Officer in Dec 2008

Our Credit Team

Jay Richards (TSFG 2008)

Mercantile – Comm. Credit

Chuck Valerio (TSFG 1999)

Retail Credit

Mark Mullins (TSFG 2007)

Risk Reporting & Analytics

Holly Russell (TSFG 2008)

Mortgage Credit

New TSFG role

since mid-2007

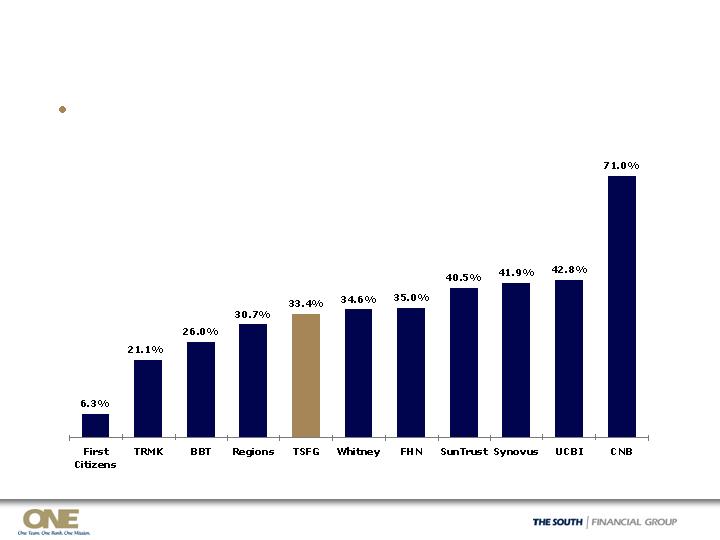

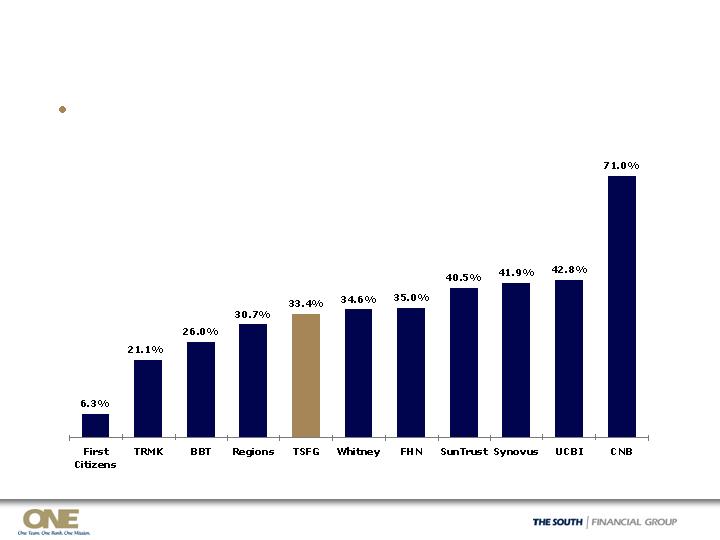

“Texas Ratio” vs. Southeast Peers

Lower is better

NPAs plus 90+ Days Past Due as % of GAAP

Tangible Equity plus Loan Loss Reserve

As of 3/31/09

SOURCE: SNL Financial; First Citizens as of 12/31/08 since 3/31/09 information is not available

Cost Reductions

Proactive & Realistic Approach to Cycle

Headwinds

Immediate Expense Reductions

FDIC insurance; special

assessment

Loan and foreclosed asset

expense

Non-operating charges related

to Corporate Campus under

construction

Actions taken:

Total Employees down 3%

linked-quarter

No Executive Management

Bonuses for 2008 performance

No Employee merit increases

during 2009

401k match cut 50%

New travel and other expense

policies

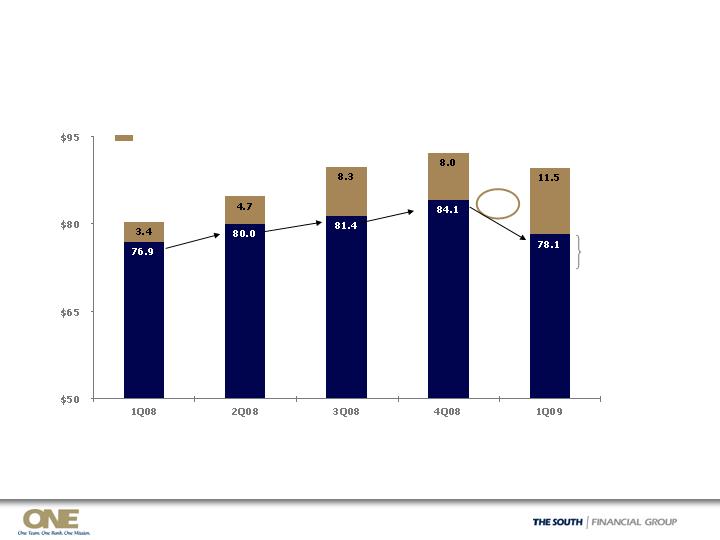

Credit-related costs* and FDIC insurance

Noninterest Expense Control

* Credit–related costs include loan and foreclosed asset expense, loss on nonperforming loans held for sale, and gain/loss on sale of OREO.

For non-operating items, see reconciliations of GAAP to non-GAAP measures provided on page 15 of the Quarterly Financial Data Supplement

available on TSFG’s web site, www.thesouthgroup.com, in the Investor Relations section.

$80.3

$84.7

$89.7

$92.1

$ in millions

+$3.1

+$2.7

Operating Noninterest Expenses

- $6.0

$89.6

+$1.4

Includes

$1.3 for

Project

NOW

costs

2,430

2,505

2,535

2,572

2,485

# Employees (FTEs):

Project NOW

Anticipated annual pre-tax operating benefits of $18 to $20 million

(revenue improvements of $12 to $13 million and expense savings of

$5 to $7 million)

Approximately $10 to $11 million on track for realization in

second half of 2009

1Q09 noninterest expenses included associated costs of $1.3 million

#6 Consolidate Retail Products

#7 Collect Commercial Loan Fees & Pricing

#8 Streamline Commercial Processes

#5 Rationalize Information Technology Applications

#4 Centralize Procurement Function

#3 Optimize Sales & Service Center Operations

#2 Enhance Retail Deposit Fees

#1 Simplify Branch Processes

8 Initial Workstreams (Phase 1)

Set Clear Performance Measures

Performance Measures

Achieve Pre-Tax, Pre-Provision Operating Income Budget

Reduce 2009 operating noninterest expenses

(excl. OREO/LHS write-downs)

Deliver Project NOW targets for 2009

Improve efficiency and expense

management

Maintain NPA% relative to SE peer median

Maintain NCO% relative to SE peer median

Improve credit quality

Increase core deposits/total customer funding

Lower core loan to customer funding ratio

Achieve deposit growth and

funding mix targets

Achieve core loan growth per budget

Reduce non-core loan portfolio per budget

Achieve loan portfolio mix and

growth targets

Improve overall core loan yields/fees from 1/09

Reduce overall customer funding costs from 1/09

Increase pricing spreads on loans

and deposits

Performance Target

Corporate Goals

Achieve annual growth in core noninterest income

(excl. BOLI/Derivatives)

Grow noninterest income and

deepen relationship cross-sell

Vision, Strategy, Communication, Branding

Vision/Strategy – Our Mission

To be the relationship bank of choice

in the markets we serve,

distinguished by knowledgeable and

trusted professionals working

together to make a difference for

our customers, shareholders, team

members and communities

Vision/Strategy – Our Segments

Commercial Banking

Local C&I and select real estate and corporate

relationships (those with a meaningful opportunity for

deposits and noninterest income services)

Private Banking

Emerging and high net worth persons associated with

the businesses we bank (owners and executives), and

professional service firms

Retail Banking

Local consumer and small businesses that value

service delivery over price and product features

Vision/Strategy – Our Value Proposition

We know our customers, and we care about their

success

We operate with integrity and deliver “plain talk” and

personal attention

We are big enough to serve our customers, while

providing personalized service

Decisions are made by local people that our clients know

and trust

We offer a competitive product mix at a fair price

We are accessible, highly responsive and exceed

expectations

Communication and Market Visits

Clear communication – must be a priority in times of

opportunity and rebuilding

Improved Internal Communications

ONE Messages to all team members

Vision/Strategy Workshops

TSFG Board tour of Florida markets

Market visits

Customer Road Shows in 7 Markets since February

Observations from Market/Branch On-Site Visits

Marketing/Branding Campaign

Our mission – to be the best relationship bank in each

of our markets – as the foundation

Carolina First and Mercantile Bank start from different

positions

Tailor marketing/branding accordingly

High potential for growth

Established history

Expensive media markets

“Affordable” media

Limited branch network

Strong branch network

Low market share

Strong market share

Low awareness

High awareness

Weak to no brand investment

Strong branding investment

Mercantile Bank

Carolina First

Carolina First

In keeping with our mission

and the methods we use to

deliver

Builds on existing brand

strength and past branding

investments

Campaign features “icons”

Positions us as partner/

trusted advisor

“We take your

banking personally.”

Mercantile Bank

Lack strong brand identity;

need more assertive

message

Simple, straightforward call

to action

Campaign features

“numbers” and “people”

Put faces and names on

local market leaders,

making them

recognizable, real, and

accessible

“Let’s do business.”

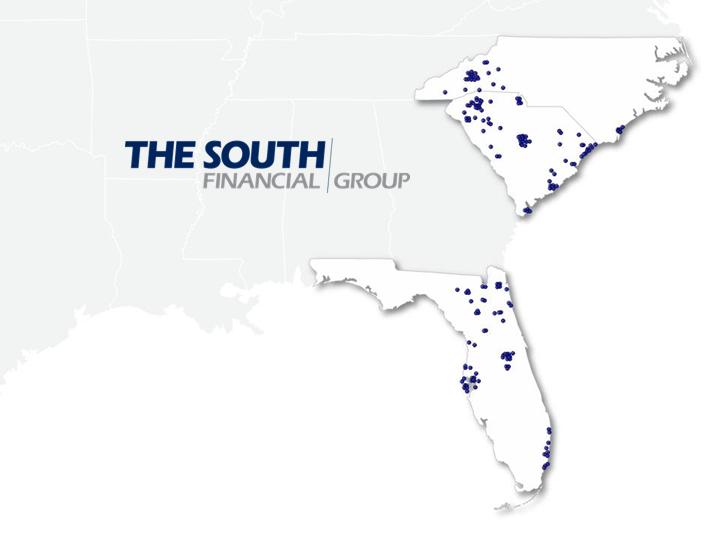

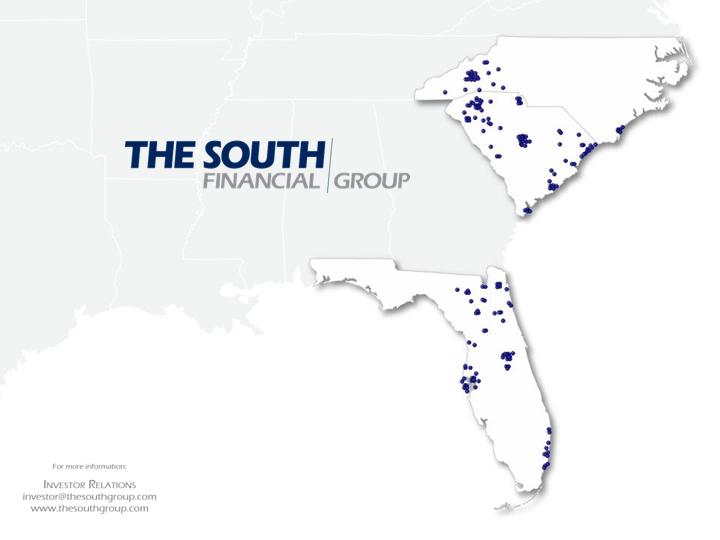

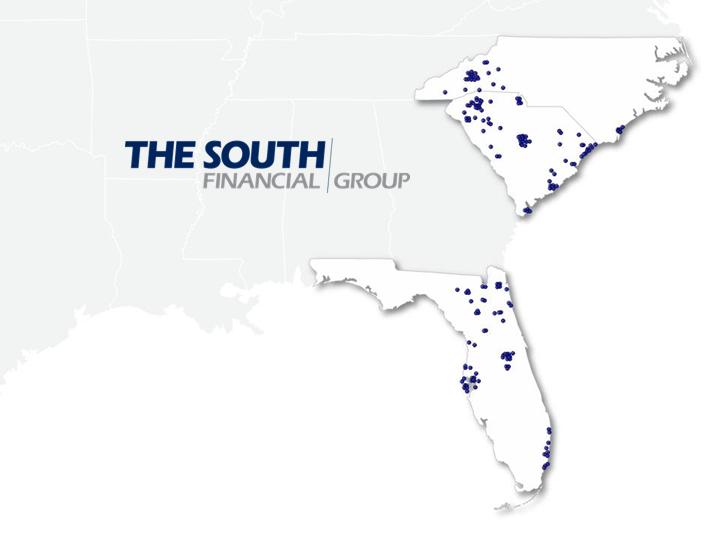

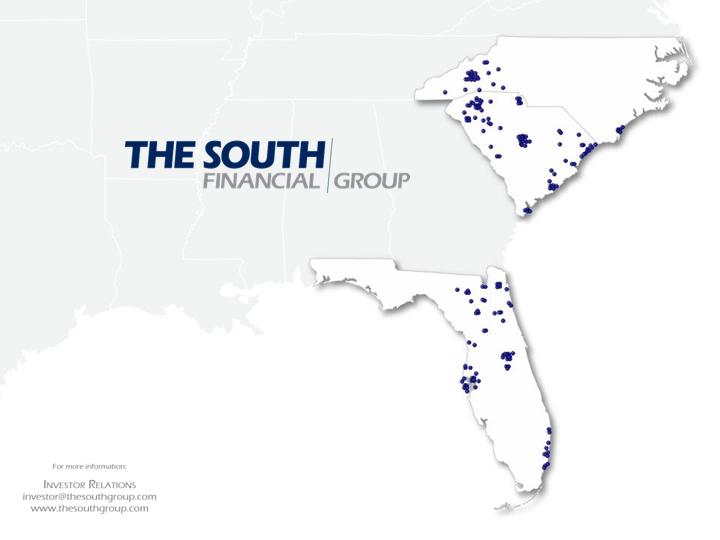

PROJECTED HOUSEHOLD GROWTH (2008-2013)

Growth estimates deposit weighted by county as of 6/30/08

SOURCE: SNL Financial

Footprint: Long-term Growth Potential

Company Name

Household Growth

(%)

United Community Banks

14.2

%

Cullen/Frost

11.8

Zions Bancorporation

11.1

SunTrust Banks

10.5

Colonial BancGroup

10.5

The South Financial Group

10.2

Synovus

8.8

BB&T

8.3

Whitney

7.0

BOK Financial

6.7

U.S. Median

6.5

Operating Peer Median

6.5

Regions

6.4

Trustmark

6.3

First Horizon

5.5

Questions