SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

J. D. EDWARDS & COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

2003 PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders of J.D. Edwards & Company will be held at:

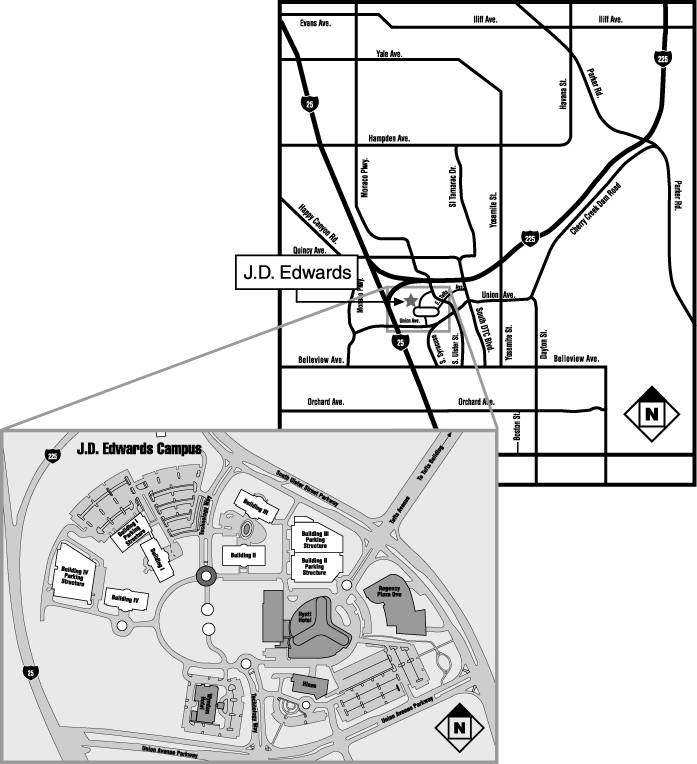

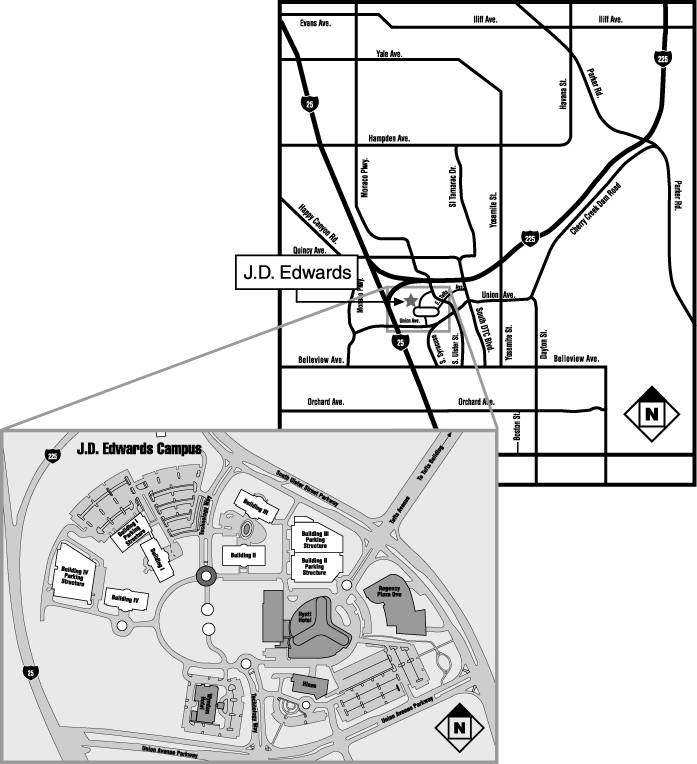

J.D. EDWARDS DENVER HEADQUARTERS

One Technology Way

Denver, Colorado

on March 26, 2003, at 10:00 a.m.

YOUR VOTE IS IMPORTANT!

Your vote is important to us. Whether you plan to attend the meeting or not, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares by telephone, via the Internet, or by signing, dating and returning the enclosed Proxy card will save the Company the expenses and extra work of additional solicitation. An addressed envelope, for which no postage is required if mailed in the United States, is enclosed if you wish to vote by mail. If you attend the meeting and prefer to vote in person, you may do so.

Voting by theInternet ortelephone is fast and convenient, and your vote is immediately confirmed and tabulated. Most importantly, by using the Internet or telephone, you can help J.D. Edwards reduce postage and Proxy tabulation costs.

PLEASE DO NOT RETURN THE ENCLOSED PAPER BALLOT IF YOU ARE VOTING OVER THE INTERNET OR BY TELEPHONE.

PROXIES SUBMITTED BY TELEPHONE OR THE INTERNET MUST BE RECEIVED BY 12:00 MIDNIGHT, CENTRAL TIME, ON MARCH 23, 2003.

PROXY VOTING OPTIONS

|

VOTE BY INTERNET

| | VOTE BY TELEPHONE (within U.S. and Canada)

|

|

WWW.COMPUTERSHARE.COM/US/PROXY | | Via touch tone phone |

24 hours a day / 7 days a week | | toll-free 24 hours a day / 7 days a week |

|

INSTRUCTIONS: | | INSTRUCTIONS: |

|

Read the accompanying Proxy Statement. | | Read the accompanying Proxy Statement. |

|

Point your browser to: | | Call: |

WWW.COMPUTERSHARE.COM/US/PROXY | | 1-866-290-9741 to vote all sharesexcept those held through 401k Plan |

|

Enter the information requested on your computer screen and follow the simple instructions to vote. You can also register to receive future Proxy materials electronically, instead of in print. This means that we will notify you, via email, when Proxy materials are distributed in the future, and provide you with a hyperlink from which you can view the materials via the Internet. | | 1-866-290-9742 to vote shares held through 401k Plan You will be asked to enter your Holder Account and Proxy Access numbers located on your Proxy card. Follow the recorded instructions to vote. Call is toll-free in U.S. and Canada. |

J.D. EDWARDS DENVER HEADQUARTERS

February 21, 2003

Dear Stockholder:

I cordially invite you to attend the Annual Meeting of Stockholders of J.D. Edwards & Company, which will be held at our Denver Headquarters, One Technology Way, Denver, Colorado, on Wednesday, March 26, 2003, beginning at 10:00 a.m. Maps of the Denver Technological Center and J.D. Edwards’ Denver campus can be found on the inside front cover of this document.

The attached Notice of Annual Meeting and Proxy Statement contain details of the business to be conducted at this year’s Annual Meeting.

It is important that your shares be represented and voted at the meeting, whether or not you decide to attend. I encourage you to promptly vote and submit your Proxy as instructed by telephone, via the Internet, or by signing, dating, and returning the enclosed Proxy card in the enclosed postage-paid envelope. If you decide to attend the Annual Meeting, you will be able to vote in person even if you have previously submitted your Proxy.

We will provide live audio coverage of the Annual Meeting from the J.D. Edwards Investor Relations website atwww.jdedwards.com. Additionally, we will make an audio replay of the Annual Meeting available on the Investor Relations website until April 9, 2003.

On behalf of our Board of Directors, I would like to thank you for your continued support of J.D. Edwards. I look forward to seeing you on March 26th.

Sincerely,

Robert M. Dutkowsky

Chairman, President, and Chief Executive Officer

NOTICE OF 2003 ANNUAL MEETING OF STOCKHOLDERS

Wednesday, March 26, 2003

10:00 A.M.

February 21, 2003

Dear J.D. Edwards Stockholder:

J.D. Edwards & Company will hold its 2003 Annual Meeting of Stockholders on Wednesday, March 26, 2003 at its Denver Headquarters at One Technology Way, Denver, Colorado 80237. The meeting will begin at 10:00 a.m., local time.

Only stockholders of record who owned shares of J.D. Edwards common stock at the close of business on January 27, 2003 may vote at this meeting or any adjournments that may take place. The purposes of the meeting are to:

| | 1. | | Elect two Class III directors for a term of three years; |

| | 2. | | Approve the adoption of the 2003 J.D. Edwards & Company Equity Incentive Plan; |

| | 3. | | Approve the adoption of the J.D. Edwards & Company Performance Based Bonus Plan; |

| | 4. | | Ratify the appointment of PricewaterhouseCoopers LLP as J.D. Edwards’ independent accountants for the 2003 fiscal year; and |

| | 5. | | Transact other business as may properly come before the meeting. |

Your Board of Directors recommends that you vote in favor of the four proposals discussed in this Proxy Statement.

At the meeting, we will also report on J.D. Edwards’ fiscal 2002 business results and other matters of interest to stockholders.

We look forward to seeing you at the meeting.

By Order of the Board of Directors

Richard G. Snow, Jr.

Vice President, General Counsel and Secretary

IMPORTANT

Your vote is important to us. Whether you plan to attend the meeting or not, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares by telephone, via the Internet, or by signing, dating and returning the enclosed Proxy card will save the Company the expenses and extra work of additional solicitation. An addressed envelope, for which no postage is required if mailed in the United States, is enclosed if you wish to vote by mail. If you attend the meeting and prefer to vote in person, you may do so.

PROXIES SUBMITTED BY TELEPHONE OR THE INTERNET MUST BE RECEIVED BY 12:00 MIDNIGHT, CENTRAL TIME, ON MARCH 23, 2003.

TABLE OF CONTENTS

J.D. EDWARDS & COMPANY

ONE TECHNOLOGY WAY

DENVER, COLORADO 80237

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MARCH 26, 2003

This Proxy Statement, which was first mailed to stockholders on February 21, 2003, is furnished in connection with the solicitation of Proxies by the Board of Directors of J.D. Edwards & Company (“J.D. Edwards” or the “Company”), to be voted at the Annual Meeting of Stockholders of the Company, which will be held at 10:00 a.m. on March 26, 2003, at the Company’s Denver Headquarters, One Technology Way, Denver, Colorado, for the purposes set forth in the accompanying Notice of 2003 Annual Meeting of Stockholders. Stockholders who execute Proxies retain the right to revoke them at any time before the shares are voted by Proxy at the Annual Meeting. A stockholder may revoke a Proxy by delivering a signed statement to the Secretary of the Company at or prior to the Annual Meeting, by executing another Proxy dated as of a later date, or by voting at the Annual Meeting. The Company will pay the cost of solicitation of Proxies.

Stockholders of record at the close of business on January 27, 2003 (the “Record Date”) will be entitled to vote at the meeting on the basis of one vote for each share held. On January 27, 2003, there were 119,795,065 shares of common stock outstanding. The shares on your Proxy card or cards represent all shares of J.D. Edwards common stock that you owned on the Record Date. If you are an employee of J.D. Edwards, this also includes those shares held in custody for your account by Fidelity Investments, as trustee for the J.D. Edwards & Company Retirement Savings Plan.

PROPOSALS

1. ELECTION OF DIRECTORS

The Board of Directors is formally comprised of nine members, divided into three classes, with members of each class holding office for staggered three-year terms. There are currently three Class I directors whose terms expire in 2004, three Class II directors whose terms expire in 2005, and two Class III directors whose terms expire at this Annual Meeting. Presently, there is one vacancy in Class III of the Board of Directors. Each director serves in office until his or her respective successor is duly elected and qualified or until his or her death or resignation, whichever is earlier. Any additional directors added to the Board will be distributed among the three classes so that, as nearly as possible, each class will consist of an equal number of directors.

Two Class III directors are to be elected at this meeting for a three-year period ending in 2006. The Board of Directors has nominatedMichael J. Maples andTrygve E. Myhren for reelection. If either of the nominees is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for a nominee designated by the current Board to fill the vacancy. We are not aware that any nominee will be unable or will decline to serve as a director. The Board is currently examining potential candidates to fill the vacancy in Class III of the Board; however, no nomination has been made as of the date of this Proxy Statement. Your Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

YOUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE TWO NOMINEES.

MANAGEMENT INFORMATION

NOMINEES FOR CLASS III DIRECTORS

Michael J. Maples, 60, has been a director of J.D. Edwards since January 1997. Mr. Maples has been retired since July 1995 and is currently operating a ranch. From April 1988 to July 1995, Mr. Maples held various management positions at Microsoft Corporation, most recently as Executive Vice President of the Worldwide Products Group. Prior to that, he served as a Director of Software Strategy for IBM. Mr. Maples holds a B.S. in electrical engineering from Oklahoma University and an M.B.A. from Oklahoma City University. He is a member of the Board of Directors of Lexmark International, Inc. and NetIQ Corporation.

Trygve E. Myhren, 66, has been a director of J.D. Edwards since January 1997. He is currently President of Myhren Media, Inc., a private investment firm concentrating in media, telecommunications and software, and other enabling technology. He is also a special limited partner of Megunticook Partners, LLC, which manages early stage venture funds. From November 1990 to March 1996, he served as President of The Providence Journal Company, a company that owned and managed newspapers, broadcast television stations, cable television systems, programming networks, and interactive and multimedia ventures. During this same time, he was also Chief Executive Officer of King Holdings, an owner and manager of broadcast and cable television properties. From 1981 to 1988, Mr. Myhren served as Chairman and Chief Executive Officer of American Television and Communications Corporation, a publicly traded subsidiary of Time, Inc. During 1986 and 1987, Mr. Myhren also served as Chairman of the National Cable Television Association. Mr. Myhren has a B.A. in political science and philosophy from Dartmouth College and an M.B.A. from the Amos Tuck School of Business Administration at Dartmouth College. He is a member of the Board of Directors of Advanced Marketing Services, Inc. and Dreyfus Founders Funds.

INCUMBENT CLASS I DIRECTORS

Gerald Harrison, 70, has served on the Board of Directors of J.D. Edwards since January 1997. He has been engaged in private research and writing since 1984. From 1982 to 1984, he was President and Chief Executive Officer of Stearns-Roger World Corporation, an engineering and construction firm, and for 14 years prior to that, he served in various other positions. Mr. Harrison holds an L.L.B. from the University of Colorado School of Law.

Delwin D. Hock, 68, has served on the Board of Directors of J.D. Edwards since March 1997. He has been self-employed as a business consultant and private investor since July 1997. He retired from his positions as Chief Executive Officer of Public Service Company of Colorado, a utility services company, in January 1996 and as Chairman of the Board of Directors in July 1997. From September 1962 to January 1996, Mr. Hock held various management positions with the Public Service Company, including Chief Financial Officer, President and Chief Operating Officer, President and Chief Executive Officer, and Chairman. Mr. Hock received his B.S. in accounting from the University of Colorado. He is a member of the Board of Directors of Allied Motion Technologies, Inc. and American Century Investors.

Robert M. Dutkowsky, 48, has been President and Chief Executive Officer and a member of the Board of Directors of the Company since January 2002. He has served as Chairman of the Board since March 2002. Mr. Dutkowsky joined J.D. Edwards from Teradyne, Inc., where he served as President of its Assembly Test Division from October through December 2001. From April 2000 through October 2001, Mr. Dutkowsky was Chairman, President, and Chief Executive Officer of GenRad, Inc., which was acquired by Teradyne in October 2001. Prior to joining GenRad in 2000, Mr. Dutkowsky was with EMC, where he served as Executive Vice President responsible for global sales, marketing, alliances, and customer service from October 1997 until its acquisition of Data

2

General in 1999. He served as President of Data General in 1999 after its acquisition by EMC. Previously, Mr. Dutkowsky held management positions at IBM during his 20-year employment with that company. Mr. Dutkowsky holds a B.S. degree in Industrial and Labor Relations from Cornell University. He is a member of the Board of Directors of Network Associates, Inc.

INCUMBENT CLASS II DIRECTORS

Richard E. Allen, 45, has served on the Board of Directors of J.D. Edwards since September 1991. Mr. Allen has been Executive Vice President, Finance and Administration, since May 2000. He has served as Chief Financial Officer and Assistant Secretary of J.D. Edwards since January 1990. Prior to his promotion to Executive Vice President, Mr. Allen served as Senior Vice President, Finance and Administration, from November 1997 through April 2000, as Vice President, Finance and Administration, from January 1990 through October 1997, and as Treasurer from January 1990 to April 2000. Mr. Allen acted as Controller of J.D. Edwards from August 1985 to September 1994 and as Secretary from March 1986 to January 1990. Mr. Allen holds a B.S. in Business Administration from Colorado State University, and is a member of the Board of Directors of World Technology Services, Inc.

Robert C. Newman, 59, is one of the co-founders of the Company. He has been a member of the Board of Directors of J.D. Edwards since August 1978. He is currently on staff as a professor at the University of Denver and manages private investments through his firm, Greenwood Gulch Ventures LLC. From August 1978 until June 1997, he served in a number of management roles with J.D. Edwards, including Vice President of Complementary Technologies and Managing Director of J.D. Edwards & Company, Ltd. (U.K.). Dr. Newman holds a B.S. in industrial engineering from the University of California, Berkeley, an M.B.A. from the University of California, Los Angeles, and a Ph.D. in management from Golden Gate University.

Kathleen J. Cunningham, 56, has served on the Board of Directors of J.D. Edwards since November 2002. Ms. Cunningham has been retired since August 2001. Ms. Cunningham has held various senior executive positions with several high technology companies, both publicly traded and privately held. She served as Chief Financial Officer, Treasurer and Assistant Corporate Secretary of Requisite Technology, Inc. from May 1999 to August 2001. From April 1992 to April 1999, Ms. Cunningham acted as Chief Operating Officer, Chief Financial Officer, Treasurer and Assistant Corporate Secretary of NxTrend Technology, Inc. Ms. Cunningham was Vice President Finance and Administration, Chief Financial Officer, Treasurer, and Assistant Corporate Secretary of Spatial Technology, Inc. from 1987 to 1991. Ms. Cunningham served as Vice President Finance, Chief Financial Officer and Treasurer of U.S. West Information Systems, Inc. from 1985 through 1987, and as Director and Assistant Treasurer, Financial Planning and Cash Management for U.S. West, Inc. from 1983 to 1985. Prior to her tenure with U.S. West, Ms. Cunningham acted as Vice President, Financial Planning and Vice President, Financial Institutions, for Intrawest Financial Corporation from 1981 to 1983, and from 1974 to 1981 she served as Senior Vice President, Chief Financial Officer, Treasurer and Assistant Corporate Secretary of GEFCO. Ms. Cunningham received a B.A. in economics and political science from the University of Wisconsin at Madison and an M.B.A. in Finance from the University of Denver.

BOARD AND COMMITTEE MEETINGS

The Board of Directors met, either in person or by telephone, 28 times during fiscal 2002, including 11 full Board meetings and 17 committee meetings. Overall attendance at the Board and committee meetings was 94%. Attendance was at least 82% for each director.

3

The Board of Directors has Audit, Compensation, Finance, and Governance and Nominations Committees.

The Audit Committee reviews and reports to the Board on the quality and performance of both the internal and external accountants and auditors, the reliability of financial information, and the adequacy of financial controls and policies. The committee also initiates and approves changes in any of these areas when necessary. The Audit Committee Report for fiscal 2002 appears on page 18 of this Proxy Statement, and a copy of the Amended and Restated Audit Committee Charter is included asAppendix A to this Proxy Statement.

The Compensation Committee reviews and reports to the Board on compensation and personnel policies and plans, including management development and succession plans, employee compensation and benefits, and administration of stock plans. The Compensation Committee Report appears on page 14 of this Proxy Statement.

The Finance Committee reviews and reports to the Board on J.D. Edwards’ capital structure, capital expenditures, financing arrangements, risk management, and long range financial planning.

The Governance and Nominations Committee acts on behalf of the Board in between Board meetings on matters regarding corporate governance and nominations for membership to the Board. The Committee then reports any actions taken at the next regular Board meeting. The purpose of the Committee is to ensure that the Board of Directors is properly constituted to meet its fiduciary obligations to shareholders and the Company and that the Company has and follows appropriate governance standards.

The following table sets forth the current members of each committee and the number of meetings held in fiscal 2002:

Name

| | Audit

| | Compensation

| | Finance

| | Governance and Nominations

|

Richard E. Allen | | | | | | X | | |

|

Kathleen J. Cunningham | | X | | | | X | | |

|

Robert M. Dutkowsky | | | | | | | | X |

|

Gerald Harrison | | X | | | | | | X |

|

Delwin D. Hock | | X | | | | | | X |

|

Michael J. Maples | | | | X | | | | |

|

Trygve E. Myhren | | | | X | | X | | |

|

Robert C. Newman | | | | | | X | | X |

|

Number of Meetings in Fiscal 2002 | | 7 | | 7 | | 1 | | 2 |

J.D. Edwards compensates each of its directors who is not an employee of J.D. Edwards or its subsidiaries as follows:

| | • | | $15,000 per year as an annual retainer |

| | • | | $1,500 for each Board meeting attended |

| | • | | $500 for each Board conference call attended |

| | • | | $1,500 for each committee meeting attended (directors do not receive a fee for a committee meeting attended that is held in conjunction with a Board meeting) |

Additionally, non-employee directors may elect to receive stock options, instead of the cash amounts described above, to purchase shares of J.D. Edwards common stock having a fair market

4

value equal to the cash compensation they otherwise would have received. Only one non-employee director in fiscal 2002 elected to receive stock options in lieu of cash compensation. Non-employee directors are also reimbursed for expenses incurred in attending meetings. J.D. Edwards does not separately compensate directors who are employees of J.D. Edwards or its subsidiaries.

J.D. Edwards also grants each non-employee director non-qualified stock options to purchase 35,000 shares of J.D. Edwards common stock at the Annual Meeting at which the director is first elected to the Board and non-qualified stock options to purchase 10,000 shares of J.D. Edwards common stock each successive year he or she remains a director. Under the 1997 J.D. Edwards Equity Incentive Plan (the “1997 Plan”), these shares vest 25% on the first anniversary date of the grant and 1/48th each month thereafter. Vesting continues whether or not a non-employee director remains on the Board, and the options remain exercisable for their full term of 8 years. The exercise price for all options granted to non-employee directors is equal to the closing price of the common stock on the date of grant. Non-employee directors are also eligible to receive discretionary grants under the 1997 Plan. No discretionary grants were made to directors during fiscal 2002. See Proposal No. 2, “Approval of the 2003 J.D. Edwards & Company Equity Incentive Plan,” for a description of the terms of options to be granted under the proposed 2003 J.D. Edwards & Company Equity Incentive Plan, if approved by stockholders.

5

BENEFICIAL OWNERS’ AND MANAGEMENT’S OWNERSHIP OF J.D. EDWARDS STOCK

The following table shows, as of January 27, 2003, how many shares of J.D. Edwards common stock were owned by (1) each person or entity known to beneficially own more than 5% of the outstanding shares; (2) each of the officers named in the Summary Compensation Table; (3) each director; and (4) all directors and executive officers as a group. Each stockholder listed can be reached at J.D. Edwards’ principal offices, unless otherwise noted.

Name

| | Shares Actually Held

| | Options Exercisable Within 60 Days (1)(2)

| | | No. of Shares Beneficially Owned Through Retirement Savings Plan

| | Total Shares Beneficially Owned(1)

| | Percent Beneficially Owned

| |

Richard E. Allen(3) | | 341,748 | | 592,001 | | | 43,823 | | 977,572 | | * | |

|

John H. Bonde | | 3,847 | | 270,000 | (4) | | — | | 273,847 | | * | |

|

Kathleen J. Cunningham | | — | | — | | | — | | — | | * | |

|

Harry Debes | | 2,740 | | 36,667 | | | — | | 39,407 | | * | |

|

Robert M. Dutkowsky | | — | | 615,625 | (5) | | — | | 615,625 | | * | |

|

Gerald Harrison | | 11,540 | | 61,834 | | | — | | 73,374 | | * | |

|

Delwin D. Hock | | 15,240 | | 61,834 | | | — | | 77,074 | | * | |

|

Michael R. Madden | | 5,477 | | 222,459 | | | 486 | | 228,422 | | * | |

|

Michael J. Maples | | 25,870 | | 51,941 | | | — | | 77,811 | | * | |

|

C. Edward McVaney(6) | | 5,249,621 | | — | | | 67,920 | | 5,317,541 | | 4.44 | % |

|

Trygve E. Myhren | | 20,040 | | 51,834 | | | — | | 71,874 | | * | |

|

Robert C. Newman(7) | | 7,446,854 | | — | | | 61,233 | | 7,508,087 | | 6.27 | % |

|

Kylee A. Fernalld(8) | | 7,197,670 | | — | | | — | | 7,197,670 | | 6.01 | % |

|

Kevin E. McVaney(9) | | 6,898,621 | | — | | | — | | 6,898,621 | | 5.76 | % |

|

All directors and executive officers as a group (17 Persons including those Named above) | | 13,390,154 | | 2,252,642 | | | 206,101 | | 15,848,897 | | 13.23 | % |

| * | | Less than 1% of the Company’s common stock |

| (1) | | The number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934 and the information is not necessarily indicative of beneficial ownership for any other purpose. Under this rule, beneficial ownership includes any shares as to which the individual or entity has voting power or investment power and any shares which the individual has the right to acquire within 60 days after January 27, 2003 through the exercise of any stock option or other right. Unless otherwise indicated in the footnotes, each person or entity has sole voting and investment power or shares voting and investment power with his or her spouse with respect to the shares shown as beneficially owned. |

| (2) | | The amounts shown in this column represent shares of J.D. Edwards common stock that each person has the right to acquire as a result of the exercise of stock options within 60 days after January 27, 2003. |

| (3) | | Includes 299,011 shares held by the Allen Family Trust, 21,660 shares held by the Allen Family charitable Lead Trust, 3,200 shares held by the Allen Family Foundation, and 14,000 shares held of record by Mr. Allen’s children. |

| (4) | | Includes options to purchase 250,000 shares of common stock and 20,000 shares underlying restricted stock purchase rights granted to Mr. Bonde. |

6

| (5) | | Includes options to purchase 515,625 shares of common stock and 100,000 shares underlying restricted stock purchase rights granted to Mr. Dutkowsky. |

| (6) | | Includes 1,891,401 shares held by the C. Edward McVaney Revocable Trust and 3,358,220 shares held of record by Mr. McVaney’s wife in the Carole Louise McVaney Trust. |

| (7) | | Includes 4,651,619 shares held by Newkop Investments L.L.P., a company affiliated with Mr. Newman, 191,804 shares held of record by Mr. Newman’s wife in each of the Judith Newman Grantor Retained Annuity Trusts 3 and 4, and 191,804 shares held of record by Mr. Newman in each of the Robert Newman Grantor Retained Annuity Trusts 3 and 4. |

| (8) | | As reflected on Ms. Fernalld’s most recent Form 13(g) filing. |

| (9) | | As reflected on Mr. McVaney’s most recent Form 13(g) filing. |

7

COMPENSATION OF EXECUTIVE OFFICERS

SUMMARY COMPENSATION TABLE

The following table sets forth certain information concerning total compensation received by the Chief Executive Officers and each of the other four most highly compensated executive officers who served in those capacities during fiscal 2002, or the Named Executive Officers, for services rendered to J.D. Edwards during the last three fiscal years. Robert M. Dutkowsky was appointed by the Board of Directors to the positions of President and Chief Executive Officer as of January 2, 2002, replacing C. Edward McVaney. Information pertaining to the Named Executive Officers’ Employment Agreements with the Company is provided on pages 11 through 13 of this Proxy Statement under the heading “Agreements with Certain Executive Officers.”

| | | Year

| | Annual Compensation

| | | Other Annual Compensation

| | | Long-Term Compensation Awards

| | All Other Compensation

| |

Name and Principal Position

| | | Base Salary

| | Bonus

| | | | Restricted Stock Awards

| | | Securities Underlying Options

| |

|

Richard E. Allen, Executive Vice President and Chief Financial Officer | | 2002 2001 2000 | | $ | 346,000 331,000 297,815 | | $ | 710,630 24,450 57,289 | (1) | | | — — — | | | | — — — | | | — 84,800 250,000 | | | — — — | |

|

John H. Bonde, Former Executive Vice President and Chief Operating Officer(2) | | 2002 2001 — | | $ | 500,000 371,212 — | | $ | 202,000 — — | | | $ | — 5,122 — | | | $ | 237,400 — — | (3) | | — 250,000 — | | | — — — | |

|

Harry Debes, Senior Vice President, Americas Sales and Consulting Services(4) | | 2002 2001 — | | $ | 350,000 72,917 — | | $ | 145,500 131,250 — | | | | — — — | | | | — — — | | | — 80,000 — | | $ | — 118,086 — | (5) |

|

Robert M. Dutkowsky, President and Chief Executive Officer and Chairman (6) | | 2002 — — | | $ | 539,205 — — | | $ | 487,500 — — | | | $ | 181,119 — — | (7) | | $ | 1,589,000 — — | (8) | | 1,600,000 — — | | | — — — | |

|

Michael R. Madden, Senior Vice President, Software Engineering and Chief Technology Officer | | 2002 2001 2000 | | $ | 290,000 278,750 211,083 | | $ | 149,200 108,750 106,644 | (9) | | | — — — | | | | — — — | | | — 38,500 243,000 | | | — — — | |

|

C. Edward McVaney, Former President and Chief Executive Officer and Chairman | | 2002 2001 2000 | | $ | 24,620 120,000 120,000 | | $ | — 4,800 — | | | | — — — | | | | — — — | | | — — — | | $ | 125,000 — — | (10) |

| (1) | | Includes Stay Bonus paid to Mr. Allen under the terms of his Employment Agreement in consideration for his remaining in the employment of the Company for the Initial Employment Term of 2 years. See description of Mr. Allen’s Employment Agreement under “Agreements with Certain Executive Officers”, beginning on page 11 of this Proxy Statement. |

| (2) | | Mr. Bonde assumed the positions of Executive Vice President and Chief Operating Officer of the Company during fiscal 2001. Mr. Bonde received no compensation from the Company prior to that time. Mr. Bonde resigned from the Company as of December 31, 2002. |

| (3) | | As of October 31, 2002, Mr. Bonde held restricted stock purchase rights with respect to 20,000 shares of Company common stock, valued at $237,000. Mr. Bonde may purchase the restricted stock for $.01 per share. The Company waived all restrictions related to the sale of the stock by Mr. Bonde pursuant to the terms of his Separation Agreement, effective as of December 31, 2002. See “Agreements with Certain Executive Officers”, beginning on page 11 of this Proxy Statement, for a discussion of the terms of Mr. Bonde’s Separation Agreement. |

8

| (4) | | Mr. Debes assumed the position of Senior Vice President, Americas Sales and Consulting Services during fiscal 2001. Mr. Debes provided services to the Company on a consulting basis from May 20, 2001 through August 15, 2001. Mr. Debes was neither an employee nor a consultant to the Company and received no compensation from the Company prior to May 2001. |

| (5) | | Compensation paid to Mr. Debes from May 20, 2001 through August 15, 2001 for services provided to the Company on a consulting basis. |

| (6) | | Mr. Dutkowsky assumed the positions of President and Chief Executive Officer of the Company during fiscal 2002. Mr. Dutkowsky received no compensation from the Company prior to that time. |

| (7) | | Includes $80,411 reimbursed to Mr. Dutkowsky for payment of taxes, and $90,708 reimbursed to Mr. Dutkowsky for payment of commuting and related expenses, and $10,000 reimbursed to Mr. Dutkowsky for payment of legal fees. |

| (8) | | As of October 31, 2002, Mr. Dutkowsky held restricted stock purchase rights with respect to 100,000 shares of Company common stock, valued at $1,185,000. My. Dutkowsky may purchase the restricted stock for $.01 per share. The restrictions lapsed as to 50,000 shares on January 2, 2003, and will lapse as to 50,000 shares on January 2, 2004. |

| (9) | | Includes Retention Bonus paid to Mr. Madden under the terms of his Employment Agreement in consideration for his remaining in the employment of the Company for the initial term of 3 years. |

| (10) | | Amount paid to Mr. McVaney pursuant to an arrangement in connection with his resignation as President and Chief Executive Officer in January 2002. |

9

OPTION GRANTS IN THE LAST FISCAL YEAR

The following table sets forth, as to the Named Executive Officers, information concerning stock options granted during fiscal 2002.

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(4)

|

Name

| | No. of Securities Underlying Options Granted(1)

| | Percent of Total Options Granted to Employees in Fiscal Year(2)

| | | Exercise Price per Share

| | Expiration Date(3)

| |

| | | | | | 5%

| | 10%

|

Richard E. Allen | | — | | — | | | | — | | — | | | — | | | — |

John H. Bonde | | — | | — | | | | — | | — | | | — | | | — |

Harry Debes | | — | | — | | | | — | | — | | | — | | | — |

Robert M. Dutkowsky(5) | | 500,000 | | 16.10 | % | | $ | 15.90 | | 1/2/10 | | $ | 3,795,771 | | $ | 9,091,531 |

| | | 1,100,000 | | 35.43 | % | | | 15.90 | | 1/2/10 | | | 8,350,696 | | | 20,001,368 |

Michael R. Madden | | — | | — | | | | — | | — | | | — | | | — |

C. Edward McVaney | | — | | — | | | | — | | — | | | — | | | — |

| (1) | | The options in this table are nonqualified stock options granted under the J.D. Edwards 1997 Equity Incentive Plan and have exercise prices equal to the closing price of J.D. Edwards common stock on the date of grant. Except as otherwise noted, all options have 8-year terms and vest 25% on the first anniversary date of the grant and 1/48th each month thereafter. |

| (2) | | J.D. Edwards granted options to purchase 3,104,752 shares of common stock to employees in fiscal 2002. |

| (3) | | The options in this table may terminate before their expiration as a result of the termination of the optionee’s status as an employee or upon the optionee’s disability or death. |

| (4) | | Under rules promulgated by the SEC, the amounts in these two columns represent the hypothetical gain or option spread that would exist for the options in this table based on an assumed stock price appreciation from the date of grant until the end of the options’ eight-year term at assumed annual rates of 5% and 10%. The 5% and 10% assumed annual rates of appreciation are specified in SEC rules and do not represent J.D. Edwards’ estimate or projection of future stock price growth. There can be no assurance that the actual stock price appreciation over the 8-year option term will be at the assumed 5% and 10% annual rates of compounded stock appreciation or at any other defined rate. |

| (5) | | See discussion of Mr. Dutkowsky’s Employment Agreement under “Agreements with Certain Executive Officers”, beginning on page 11 of this Proxy Statement, for a description of the terms of Mr. Dutkowsky’s stock option grants. |

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

The following table sets forth, as to the Named Executive Officers, certain stock option information concerning the number of shares subject to both exercisable and unexercisable stock options and the value of the options as of October 31, 2002.

| | | Shares Acquired On Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at Fiscal Year End

| | Value of Unexercised In-the-Money Options At Fiscal Year End ($)(1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Richard E. Allen | | 0 | | 0 | | 578,687 | | 63,934 | | $ | 1,688,386 | | $ | 0 |

John H. Bonde | | 0 | | 0 | | 62,500 | | 187,500 | | | 0 | | | 0 |

Harry Debes | | 0 | | 0 | | 28,333 | | 51,667 | | | 24,366 | | | 44,433 |

Robert M. Dutkowsky | | 0 | | 0 | | 429,688 | | 1,170,312 | | | 0 | | | 0 |

Michael R. Madden | | 0 | | 0 | | 204,427 | | 90,073 | | | 49,300 | | | 32,300 |

C. Edward McVaney | | — | | — | | — | | — | | | — | | | — |

| (1) | | Based on the fair market value of J.D. Edwards common stock at fiscal year end ($11.86) less the exercise price payable for the shares. |

10

AGREEMENTS WITH CERTAIN EXECUTIVE OFFICERS

J.D. Edwards entered into an Employment Agreement with Richard E. Allen (“Mr. Allen”), dated August 1, 2000 but effective as of May 1, 2000, for an initial term (the “Initial Employment Term”) of two years, which automatically renewed for an additional term of one year on May 1, 2002. Under the terms of his renewed agreement, Mr. Allen serves as Executive Vice President, Finance and Administration and Chief Financial Officer. Mr. Allen receives an annual base salary of $346,000 as well as annual bonus compensation of up to seventy-five percent (75%) of his base salary based upon achievement of certain objectives determined and approved by the Compensation Committee of the Board. Mr. Allen was awarded stock options to purchase 225,000 shares of J.D. Edwards common stock, at an exercise price of $13.0625 per share, the closing price of the common stock as of the date of the grant, when he initially entered into his Employment Agreement with the Company. Those options vested one hundred percent (100%) on May 1, 2002. Upon completion of the Initial Employment Term during fiscal 2002, Mr. Allen received a Stay Bonus equal to 100% of his on target earnings for the first year of the Initial Employment Term. Mr. Allen is entitled to severance payments in the event of his termination of employment for reasons other than for Cause, as defined in his Agreement. His Agreement will automatically renew for successive one-year periods unless either J.D. Edwards or Mr. Allen provides the other with written notice of intent not to renew no later than 30 days prior to the end of any period. Salary and bonus compensation, as well as subsequent option grants, if any, for renewal periods will be established by a written addendum to Mr. Allen’s Employment Agreement to be approved by the Compensation Committee of the Board.

J.D. Edwards entered into an Employment Agreement with Harry Debes (“Mr. Debes”), dated May 4, 2001 but effective as of August 16, 2001. Under the terms of his Agreement, Mr. Debes serves as Senior Vice President, Americas Sales and Consulting Services. Mr. Debes receives an annual base salary of $350,000, along with certain bonus compensation of up to seventy-five percent (75%) of his base salary based upon achievement of certain objectives determined and approved by the Compensation Committee of the Board. Mr. Debes was awarded stock options to purchase 80,000 shares of J.D. Edwards common stock on May 14, 2001, at an exercise price of $11.00 per share, the closing price of the common stock as of the date of the grant. In addition, Mr. Debes is entitled to receive a grant of options to purchase 50,000 shares of common stock, to be granted at fair market value, on the first day on which the price of J.D. Edwards common stock is at or above $24.00, as well as a grant of options to purchase 50,000 shares of common stock, to be granted at fair market value, on the first day on which the stock price is at or above $36.00. In the event Mr. Debes’ employment with the Company terminates, all unvested options will be immediately forfeited, and Mr. Debes will have a period of three months following termination of employment to exercise any vested, but unexercised, options. Mr. Debes is eligible to participate in all employee benefits provided by the Company. In the event Mr. Debes’ employment is terminated by the Company for Performance or Disability, as defined in his Agreement, Mr. Debes will be entitled to receive severance pay in the amount of his then current twelve months base salary, conditioned upon Mr. Debes signing a Separation Agreement with the Company in the form appended to his Employment Agreement. Should Mr. Debes voluntarily resign or be terminated for cause, as defined in his Employment Agreement, he will not be entitled to any severance pay. Mr. Debes’ Agreement will automatically renew for successive one-year periods unless either J.D. Edwards or Mr. Debes provides the other with written notice of intent not to renew no later than 30 days prior to the end of any period.

J.D. Edwards entered into an Employment Agreement with Robert M. Dutkowsky (“Mr. Dutkowsky”), dated and effective as of January 2, 2002, for a term of not less than two years. Under the terms of his Agreement, Mr. Dutkowsky serves as the President and Chief Executive Officer of the Company. Mr. Dutkowsky was appointed to the Board of Directors as of January 2, 2002, and

11

was appointed Chairman of the Board at the Annual Meeting on March 26, 2002. Mr. Dutkowsky receives an annual base salary of $650,000, as well as bonus compensation of up to one hundred percent (100%) of his annual base salary, contingent upon Mr. Dutkowsky’s continued employment with the Company and achievement of certain objectives determined and approved by the Compensation Committee of the Board. Mr. Dutkowsky received guaranteed bonus payments of $162,500 on each of March 31, June 30, September 30, and December 31, 2002. In the event of Mr. Dutkowsky’s death or disability, as defined in the Employment Agreement, or in the event he is terminated without cause, also as defined in his Agreement, Mr. Dutkowsky will receive certain guaranteed bonus payments. Mr. Dutkowsky was awarded stock options to purchase 1,100,000 shares of J.D. Edwards common stock on January 2, 2002, which vest as follows: (a) 275,000 on January 2, 2002; and (b) 17,187.5 on the last day of each month, beginning in February, 2002. Mr. Dutkowsky was also awarded additional stock options to purchase 500,000 shares of J.D. Edwards common stock on January 2, 2002, which vest in full on the fifth anniversary of the effective date of the Agreement, or will vest earlier as follows: (a) 250,000 on the date on which the average fair market value of J.D. Edwards common stock, as defined in the Agreement, over any sixty consecutive trading days has reached (or exceeded) two times the original per share exercise price of the stock options; and (b) 250,000 on the date on which the average fair market value over any sixty consecutive trading days has reached (or exceeded) three times the original per share exercise price of the stock options. The exercise price of all of the above stock options is $15.90 per share, the closing price of the common stock as of the date of the grant. In addition, Mr. Dutkowsky was granted a right to purchase 100,000 shares of restricted common stock of the Company at a price of $.01 per share. The restrictions on Mr. Dutkowsky’s restricted stock lapsed as to 50,000 shares on January 2, 2003, and the restrictions on the remaining 50,000 shares will lapse on January 2, 2004. Vesting is contingent upon his continued employment with the Company. If Mr. Dutkowsky voluntarily resigns from employment with the Company or is terminated for Cause as defined in his Agreement at any time during the initial employment term, his unvested stock options will be cancelled as of the date of his resignation or termination and Mr. Dutkowsky will have the right to exercise only those options which are vested as of the date of his resignation or termination. If Mr. Dutkowsky’s employment is terminated by the Company without Cause or because of Mr. Dutkowsky’s death or disability, all of his vested stock options and restricted stock, as well as any stock options or restricted stock that are due to vest within one year after such termination of employment, will become vested on the date of termination. In addition, if any of the share price goals of the stock options are attained within sixty days after such termination of employment, then the applicable stock options will vest on the date the goals are attained. Finally, if Mr. Dutkowsky’s employment is terminated without Cause in connection with a Change in Control, as defined in his Agreement, all of Mr. Dutkowsky’s unvested stock options will fully vest and the restrictions on his restricted stock will lapse on the date of termination of his employment. Mr. Dutkowsky will have a period of six months following his termination of employment within which to exercise his vested stock options. Mr. Dutkowsky may participate in all employee benefits provided by the Company. Mr. Dutkowsky will be entitled to received severance pay in an amount equal to two years of his then current base salary and two years of his Target Bonus, as defined in his Agreement, in the event his employment is terminated without Cause, contingent upon his entering into a Separation Agreement in the form appended to his Employment Agreement.

J.D. Edwards entered into an Employment Agreement with Michael R. Madden (“Mr. Madden”), effective as of August 1, 2000 (the “Effective Date”), for a period of not less than three years. Under the terms of his Employment Agreement, Mr. Madden serves as Senior Vice President, Software Engineering and Chief Technology Officer. Mr. Madden receives an annual base salary of $290,000, as well as certain bonus compensation of up to 40% of his base salary contingent upon his achievement of certain objectives as determined by the Compensation Committee of the Board. In addition, under the terms of the Employment Agreement, the Company agreed to pay a total Retention Bonus of $275,000 to Mr. Madden, payable incrementally over the term of his Agreement as follows: 25% upon execution of the Agreement by Mr. Madden and 25% on each of the first, second, and third

12

anniversaries of the Effective Date. Mr. Madden was awarded stock options to purchase 150,000 shares of J.D. Edwards common stock when he initially entered into his Employment Agreement with the Company, at an exercise price of $13.063 per share, the closing price of the common stock as of the date of the grant. Those options vested 25% on the Effective Date, and have continued to vest at a rate of 1/36 per month thereafter. Mr. Madden is eligible to participate in all employee benefits provided by the Company to its employees. Mr. Madden is entitled to receive severance payments in the amount of one year’s then current base salary in the event of termination of his employment for Performance or Disability, as defined in his Agreement. If Mr. Madden’s employment is terminated other than for Cause, Performance, or Disability, each as defined in his Agreement, he will be entitled to receive severance pay equal to one year’s base salary and bonus compensation. Mr. Madden’s Agreement will automatically renew for successive one-year periods unless either J.D. Edwards or Mr. Madden provides the other with written notice of intent not to renew no later than 30 days prior to the end of any period.

J.D. Edwards entered into a Separation Agreement with John H. Bonde (“Mr. Bonde”), the Company’s former Executive Vice President and Chief Operating Officer, effective as of December 31, 2002 (the “Effective Date”). Under the terms of the Separation Agreement, Mr. Bonde will receive a lump-sum payment of $500,000. Mr. Bonde will receive medical, dental and vision coverage, at no expense, for a certain period following the Effective Date. Should Mr. Bonde be re-employed by J.D. Edwards at any time within 52 weeks following the Effective Date (the “Severance Period”), he will be required to repay, on a pro-rated basis, any amounts received under the Separation Agreement corresponding to the period during which he is re-employed. Mr. Bonde has agreed not to compete with the Company for a period of one year from the Effective Date. Under the terms of the Separation Agreement, restricted stock purchase rights for 20,000 shares of J.D. Edwards common stock became vested as of the Effective Date, and the Company waived all restrictions related to the sale of these shares after purchase by Mr. Bonde. Also under the terms of the Separation Agreement, options to purchase 250,000 shares of J.D. Edwards common stock became fully vested, and Mr. Bonde will have a period of 2 years from the Effective Date to exercise the options, at an exercise price of $11.938 per share.

J.D. Edwards maintains a Management Change in Control Plan in which the executive officers participate. The Company’s Management Change in Control Plan provides for severance payments to be made to participants under circumstances which, following a change in control of J.D. Edwards, as defined in the Plan, are deemed to be an involuntary termination of such participant’s employment with J.D. Edwards. The severance payments are determined based upon a formula that takes into account each participant’s annual compensation at the time of involuntary termination and the average bonus received by a participant over the preceding three years.

13

REPORT OF THE J.D. EDWARDS & COMPANY BOARD OF DIRECTORS COMPENSATION COMMITTEE

The Compensation Committee of the Board has responsibility to review and report to the Board on compensation and personnel policies, programs and plans, including management development and succession plans, employee compensation and benefits, and administration of stock plans. The purpose of this report is to summarize the principles, specific program objectives, and other factors considered by the Committee in reaching its determinations regarding executive compensation.

Executive Compensation Policies

The objectives of J.D. Edwards’ executive compensation program are to:

| | Ÿ | | Attract, retain, and motivate highly qualified executive talent |

| | Ÿ | | Reward executives based on J.D. Edwards’ performance |

| | Ÿ | | Align the compensation and interests of executive officers with the long-term interests of J.D. Edwards stockholders |

The Company’s executive compensation program consists of base salary, cash bonuses, long-term incentives in the form of stock options and restricted stock purchase rights, and the benefit programs generally available to all full-time employees.

The Compensation Committee reviews the base salaries of executive officers annually. In its recommendation of base salary adjustments, the Committee considers individual performance and experience, relative scope of responsibility, and company performance, as well as the base salaries paid to other executives in the competitive marketplace.

J.D. Edwards offers a Company Bonus Plan (the “Bonus Plan”), an annual profit sharing plan designed to reward employees with bonus compensation of up to a certain predetermined percentage of their base compensation when profits exceed predefined thresholds. Under this Bonus Plan, participants are eligible to receive bonus awards equal to a certain percentage of their base compensation. The funding of the pool for this Bonus Plan is contingent upon the Company’s achievement of certain predefined quarterly and annual profit margin thresholds. Funding is 50% formula driven and 50% discretionary. The Bonus Plan pool was funded and bonuses were paid at 50% for fiscal 2002 based upon achievement of profit margin thresholds.

The Compensation Committee has approved a Performance Based Bonus Plan effective November 1, 2002, subject to approval of the stockholders of the Company at the Annual Meeting. Under this Performance Plan, incentive compensation paid would be performance based for purposes of exemption from the limitations of Section 162(m) of the Internal Revenue Code, as amended (the “Code”). See Proposal No. 3. “Approval of J.D. Edwards & Company Performance Based Bonus Plan,” beginning on page 29 of this Proxy Statement, for a discussion of the terms of the Performance Based Bonus Plan.

Ownership of J.D. Edwards common stock is a key and fundamental element of executive compensation. Executive officers, as well as other employees, are eligible to receive stock option and restricted stock purchase rights grants under the J.D. Edwards 1997 Equity Incentive Plan. This plan permits the Board or the Compensation Committee to grant stock options to officers and employees on terms the Board or the Committee may determine. Options granted generally have a term of 8 years and vest 25% at the end of the first year and 1/48th each month thereafter until fully vested four years from the date of grant. Options to purchase a total of 3,104,752 shares were granted to employees in fiscal 2002.

14

The Compensation Committee has approved a new 2003 Equity Incentive Plan, subject to approval of the stockholders of the Company at the Annual Meeting. If the stockholders approve the 2003 Equity Incentive Plan, it will replace the Company’s 1997 Equity Incentive Plan, which will be terminated except with respect to outstanding awards previously granted thereunder. See Proposal No. 2 “Approval of the 2003 J.D. Edwards & Company Equity Incentive Plan”, beginning on page 21 of this Proxy Statement, for a discussion of the terms of the 2003 Equity Incentive Plan.

The J.D. Edwards 1997 Employee Stock Purchase Plans for U.S. and Non-U.S. Employees permit employees to acquire J.D. Edwards common stock through payroll deductions and promote broad-based equity participation throughout the company. The Committee believes that the stock plans align the interests of employees with the long-term interests of stockholders.

J.D. Edwards maintains the J.D. Edwards & Company Retirement Savings Plan to provide retirement benefits to its employees. The 401(k) portion of the Retirement Savings Plan provides benefits through tax deferred salary deductions for its U.S. employees who meet certain eligibility requirements. J.D. Edwards generally matches 50% of an employee’s eligible contributions up to a maximum match of 3% of eligible compensation. This match is discretionary. The profit sharing contribution portion of the Retirement Savings Plan is designed to be invested primarily in J.D. Edwards common stock for the benefit of the U.S. employees. Company contributions are determined by the Board, in its discretion, and, if made, may be in the form of cash or J.D. Edwards common stock.

Chief Executive Officer Compensation for Fiscal 2002

Robert M. Dutkowsky has served as President and Chief Executive Officer of J.D. Edwards since January 2, 2002. Mr. Dutkowsky earned a base salary of $539,205 in fiscal 2002, which took into consideration factors including his performance and experience, scope of responsibility, and comparable salaries paid in the competitive marketplace. Mr. Dutkowsky received $487,500 in cash incentives in fiscal 2002, which were conditioned upon his continued employment with the Company. The Company also reimbursed Mr. Dutkowsky for certain expenses. See “Summary Compensation Table,” beginning on page 8 of this Proxy Statement for further details of the compensation paid to Mr. Dutkowsky during fiscal 2002. Mr. Dutkowsky received grants of stock options and restricted stock purchase rights as part of his Employment Agreement with the Company. The terms of the stock option and restricted stock purchase rights grants are detailed in the discussion of Mr. Dutkowsky’s Employment Agreement, under the heading “Agreements with Certain Executive Officers” beginning on page 11 of this Proxy Statement. Mr. Dutkowsky did not participate in the Company’s annual grant of stock options which occurred in December 2002. Also, during fiscal 2002, C. Edward McVaney served as President and Chief Executive Officer from November 1, 2001 until January 2, 2002. Mr. McVaney earned a base salary of $24,620 for the portion of fiscal 2002 during which he served. Mr. McVaney did not participate in J.D. Edwards’ bonus incentive compensation plan. Mr. McVaney received no option grants during fiscal 2002. Mr. McVaney resigned from his positions as President and Chief Executive Officer of the Company as of January 2, 2002 and received separation pay of $125,000.

Respectfully submitted by the members of the Compensation Committee of the Board of Directors.

Trygve Myhren, Chairman

Michael J. Maples

15

EQUITY COMPENSATION PLAN INFORMATION

As of October 31, 2002

| | | (a) | | (b) | | (c) | |

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants, and rights

| | Weighted-average exercise price of outstanding options, warrants, and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column(a))

| |

Equity compensation plans approved by security holders | | — | | | — | | — | |

Equity compensation plans not approved by security holders(1)(2) | | 19,489,067 | | $ | 18.24 | | 24,100,000 | (3) |

Total | | 19,489,067 | | $ | 18.24 | | 24,100,000 | (3) |

| (1) | | See Notes to Consolidated Financial Statements, contained in the Company’s Annual Report on Form 10-K for the Fiscal Year Ended October 31, 2002, for a description of the terms of the Company’s equity compensation plans. |

| (2) | | Includes options to purchase 251,011 shares of J.D. Edwards common stock assumed by the Company in connection with the acquisition of YouCentric, Inc. in November 2002. The weighted-average exercise price of the YouCentric options is $.10. |

| (3) | | Includes 14,100,000 shares authorized for issuance under the 1992 Incentive Stock Option Plan and the 1992 Nonqualified Stock Option Plan (collectively, the “1992 Plans”), and 10,000,000 shares authorized for issuance under the 1997 Equity Incentive Plan (the “1997 Plan”). Although 14,100,000 shares are authorized for issuance under the 1992 Plans, upon approval of the 1997 Plan, the Board of Directors resolved that no further issuances would be made under the 1992 Plans and no issuances have been made under the 1992 Plans since that resolution was made in 1997. The Board of Directors has further resolved that, contingent upon approval of Company stockholders of the 2003 J.D. Edwards & Company Equity Incentive Plan (the “Proposed Plan”), no further issuances will be made under the 1997 Plan. See Proposal 2., “Approval of the 2003 J.D. Edwards & Company Equity Incentive Plan,” beginning on page 21 of this Proxy Statement, for a description of the terms of the Proposed Plan. |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

J.D. Edwards’ Compensation Committee was formed to review and report to the Board on compensation and personnel policies, programs and plans, including management development and succession plans, employee compensation and benefits, and administration of stock plans. The Committee is currently composed of Mr. Myhren and Mr. Maples. No interlocking relationship exists between any member of the Board or Compensation Committee and the board of directors or compensation committee of any other company, nor has any interlocking relationship existed in the past.

16

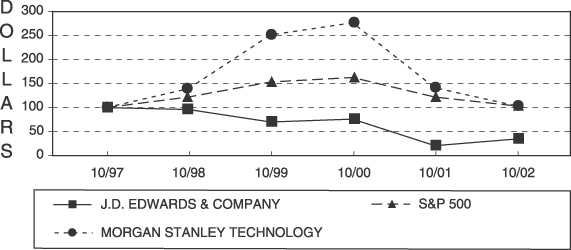

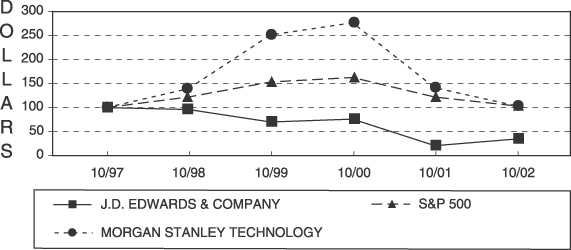

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative total return to stockholders on J.D. Edwards common stock with the cumulative total return of the S&P 500 Index and the Morgan Stanley Technology Index. The graph assumes that $100 was invested on October 31, 1997 in J.D. Edwards common stock, the S&P 500 Index, and the Morgan Stanley Technology Index, including reinvestment of dividends. No dividends have been declared or paid on J.D. Edwards common stock. Note that historic stock price performance is not necessarily indicative of future stock price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG J.D. EDWARDS & COMPANY, THE S & P 500 INDEX

AND THE MORGAN STANLEY TECHNOLOGY INDEX

| | * | | $100 invested on 10/31/97 in stock or index-including reinvestment of dividends. Fiscal year ending October 31. |

17

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Since December of 1998, Jones Lang LaSalle has represented the Company in certain real estate transactions, including as tenant representative in locating field offices and providing project management services for tenant build out of certain field offices. Ryan S. Cunningham, the step son of Kathy Cunningham, who joined the Board of Directors in November 2002, is an employee of Jones Day, a division of Jones Lang LaSalle, in the Denver office. The broker services provided by the Jones Lang LaSalle division for which Ms. Cunningham’s step son is employed are not paid for directly by the Company, but are reimbursed out of a sharing of commissions with the landlord’s broker. Ms. Cunningham has not participated in any Board discussions with respect to the Jones Lang LaSalle relationship in the past, nor will she participate in any future discussions. Any future transactions between the Company and any director or executive officer will be subject to approval by a majority of the disinterested members of the Board.

SECTION 16(A) BENEFICIAL OWNERSHIP COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires J.D. Edwards’ directors, executive officers, and holders of more than 10% of J.D. Edwards common stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of J.D. Edwards. Except as described below, based solely upon a review of reports submitted and representations made to J.D. Edwards, we believe that, during fiscal 2002, our executive officers, directors and 10% stockholders complied with all applicable Section 16(a) filing requirements except that Mr. Mathews filed one late report on Form 4 detailing option exercises and sales which occurred in March 2002, Mr. McVaney filed one late report on Form 5 detailing sales which took place in February and March 2002, and Jan Zapapas, a former director of the Company, filed an Initial Statement of Beneficial Ownership on Form 3 late in July 2002.

REPORT OF THE J.D. EDWARDS & COMPANY BOARD OF DIRECTORS AUDIT COMMITTEE

The J.D. Edwards & Company Audit Committee has (1) reviewed and discussed the Company’s audited consolidated financial statements with management, (2) discussed with PricewaterhouseCoopers LLP, its independent accountants (“PricewaterhouseCoopers”), the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended, (3) received the written disclosures and the letter from PricewaterhouseCoopers as required by Independence Standards Board Standard No. 1 and discussed with PricewaterhouseCoopers their independence, and (4) considered whether the provision of non-audit services by PricewaterhouseCoopers is compatible with maintaining their independence. Based upon these discussions and reviews, the Audit Committee recommended to the Board that the audited financial statements be included in J.D. Edwards’ Annual Report on Form 10-K for the fiscal year ended October 31, 2002 and filed with the Securities and Exchange Commission.

The Audit Committee is currently composed of the following three directors, all of whom are independent directors as defined in Rule 4200(a)(15) of the National Association of Securities Dealers listing standards:

Delwin D. Hock, Chairman

Gerald Harrison

Kathleen J. Cunningham

Ms. Cunningham was appointed to the Board of Directors in November 2002 and was not a member of the Audit Committee during fiscal 2002.

18

The Board has adopted an amended and restated written charter for the Audit Committee. The Amended and Restated Charter is included as Appendix A to the Proxy Statement for the 2003 Annual Meeting of Stockholders.

Respectfully submitted by the members of the Audit Committee of the Board of Directors for the fiscal year ended October 31, 2002.

Delwin D. Hock

Gerald Harrison

19

FEES PAID TO PRICEWATERHOUSECOOPERS LLP

Audit Fees

The aggregate fees billed by PricewaterhouseCoopers LLP (“PwC”) for professional services related to the audit of our annual financial statements for fiscal 2002 included in our Annual Report on Form 10-K, and for the review of the financial statements for fiscal 2002 included in our Quarterly Reports on Form 10-Q were $1,010,000.

Financial Information Systems Design and Implementation Fees

No fees were paid to PwC for professional services related to information technology services design and implementation for fiscal 2002.

All Other Fees

The aggregate fees billed by PwC for all other professional services provided to us for fiscal 2002, excluding those described above under “Audit Fees” were $862,000. The other services consisted of tax compliance and planning, international statutory audits and employee benefit plan audits, merger and acquisition services, and other consultation services. In the course of its meetings, the Audit Committee has determined that these other services are compatible with maintaining PwC’s independence.

These fees are comprised primarily of the following (in thousands):

Tax compliance and planning | | $ | 368 |

International statutory audits and employee benefit plan audits | | | 299 |

Review services for other SEC filings | | | 55 |

Other consultation services | | | 140 |

| | |

|

|

Total all other fees | | $ | 862 |

| | |

|

|

20

2. APPROVAL OF THE 2003 J.D. EDWARDS & COMPANY EQUITY INCENTIVE PLAN

We are asking our stockholders to approve our 2003 Equity Incentive Plan so that we can use it to assist us in achieving the Company’s goals of maintaining consistent profitable growth and increasing stockholder value, while also receiving a federal income tax deduction for certain compensation paid under the Equity Incentive Plan. Our Board of Directors has approved the 2003 Equity Incentive Plan, subject to approval from our stockholders at the Annual Meeting. If the stockholders approve the 2003 Equity Incentive Plan, it will replace our 1997 Equity Incentive Plan which will be terminated, except with respect to outstanding awards previously granted thereunder, and no further options will be granted under the 1997 Equity Incentive Plan. Our named executive officers and directors have an interest in this proposal.

A total of 10,000,000 shares of our common stock have initially been reserved for issuance under the Equity Incentive Plan. Additional shares of our common stock will be added to the Equity Incentive Plan on the first day of each fiscal year beginning on the first day of our 2004 fiscal year and ending on the first day of our 2012 fiscal year equal to the lesser of (a) 9,000,000, (b) 5% of the outstanding shares of common stock on the last day of the preceding fiscal year, or (c) an amount determined by our Board of Directors. As of February 21, 2003, no awards have been granted under the 2003 Equity Incentive Plan.

We believe strongly that your approval of the 2003 Equity Incentive Plan is essential to our continued success and to the continued value of your investment. Our employees are our most valuable asset. Stock options and other awards such as those provided under the Equity Incentive Plan are vital to our ability to attract and retain outstanding and highly skilled individuals in the competitive labor markets in which we must compete. Such awards also are crucial to our ability to motivate employees to achieve our goals of maintaining consistent profitable growth and increasing stockholder value.

Summary of the Equity Incentive Plan

The following paragraphs provide a summary of the principal features of the 2003 Equity Incentive Plan (the “Plan”) and its operation. The following summary is qualified in its entirety by reference to the Plan. To view a copy of the Plan in its entirety, please visit the Investors Relations website atwww.jdedwards.com.

Background and Purpose of the Plan

The Plan permits the grant of the following types of incentive awards: (1) stock options, (2) stock appreciation rights, (3) restricted stock, (4) performance units, and (5) performance shares (each, an “Award”). The Plan is intended to increase the variety of incentives that we offer to eligible employees, non-employee directors and consultants who provide significant services to us. This encourages stock ownership by key performers and aligns their interests with our stockholders’ interests in our success. The Plan is also intended to further our growth and profitability.

Administration of the Plan

The Compensation Committee of our Board of Directors (the “Committee”) administers the Plan. The members of the Committee must qualify as “non-employee directors” under Rule 16b-3 of the Securities Exchange Act of 1934, and also as “outside directors” under Section 162(m) of the Internal Revenue Code (so that we can receive a federal tax deduction for certain compensation paid under the Plan). The current members of the Committee qualify under each of these standards.

Subject to the terms of the Plan, the Committee has the sole discretion to select the employees and consultants who receive Awards, determine the terms and conditions of Awards (for example, the

21

exercise price and vesting schedule), and interpret the provisions of the Plan and outstanding Awards. The Committee may delegate any part of its authority and powers under the Plan to one or more directors and/or our officers, but only the Committee itself can make Awards to participants who are our executive officers.

If an Award expires or is cancelled without having been fully exercised or vested, the unvested or cancelled shares of common stock subject to the award generally will be returned to the available pool of shares reserved for issuance under the Plan. Also, if we experience a stock dividend, reorganization or other change in our capital structure, the Committee has discretion to adjust the number of shares available for issuance under the Plan, the outstanding Awards, and the per-person limits on Awards, as appropriate to reflect the stock dividend or other change.

Eligibility to Receive Awards

The Committee selects the employees and consultants who will be granted Awards under the Plan. The actual number of individuals who will receive an Award under the Plan cannot be determined in advance because the Committee has the discretion to select the participants. Our non-employee directors generally are not eligible to receive discretionary Awards under the Plan. Instead, our non-employee directors are automatically granted Awards of a predetermined number of nonqualified stock options, and certain cash payments, for each year that they serve on our Board, except that non-employee directors may choose to forgo their retainer, meeting and committee fees, if any, in exchange for awards of options and/or restricted stock.

Stock Options

A stock option is the right to acquire shares of our common stock at a fixed exercise price for a fixed period of time. Under the Plan, the Committee may grant nonqualified stock options and/or incentive stock options. The Committee will determine the number of shares covered by each option, but during a given fiscal year, no participant may be granted options covering more than 2,000,000 shares, except an additional 1,000,000 shares may be granted to an employee in connection with his or her initial employment as inducement to join J.D. Edwards.

The exercise price of the shares subject to each option is set by the Committee but cannot be less than 100% of the fair market value (on the date of grant) of the shares covered by incentive stock options or nonqualified options intended to qualify as “performance based” under Section 162(m) of the Code, unless nonqualified options are otherwise so qualified. No more than 20% of the shares reserved for issuance under the Plan may be issued pursuant to nonqualified stock options with an exercise price less than 100% of the fair market value of the shares covered by such an option on the date of grant.

In addition, the exercise price of an incentive stock option must be at least 110% of fair market value if (on the grant date) the participant owns stock possessing more than 10% of the total combined voting power of all of our classes of stock or that of any of our subsidiaries. The aggregate fair market value of the shares (determined on the grant date) covered by incentive stock options which first become exercisable by any participant during any calendar year also may not exceed $100,000.

An option granted under the Plan cannot generally be exercised until it becomes vested. The Committee establishes the vesting schedule of each option at the time of grant. Options become exercisable at the times and on the terms established by the Committee. Options granted under the Plan expire at the times established by the Committee, but not later than 8 years after the grant date (except in certain cases of death, in which case a participant’s option would remain exercisable for up to three years after the date of death).

22

The exercise price of each option granted under the Plan must be paid in full at the time of exercise. The Committee also may permit payment through the tender of shares that are already owned by the participant, or by any other means which the Committee determines to be consistent with the purpose of the Plan. The participant must pay any taxes that we are is required to withhold at the time of exercise.

Stock Appreciation Rights

Awards of stock appreciation rights may be granted in connection with all or any part of an option, either concurrently with the grant of an option or at any time thereafter during the term of the option, or may be granted independently of options. No participant may be granted stock appreciation rights covering more than 2,000,000 shares in any fiscal year.

The Committee determines the terms of stock appreciation rights, except that the exercise price of a stock appreciation right may not be less than 100% of the fair market value of the shares on the date of grant.

A stock appreciation right in connection with an option will entitle the participant to exercise the stock appreciation right by surrendering to us a portion of the unexercised related option. The participant will receive in exchange from us an amount equal to the excess of the fair market value of the shares on the date of exercise of the stock appreciation right covered by the surrendered portion of the related option over the exercise price of the shares covered by the surrendered portion of the related option. When a stock appreciation right granted in connection with an option is exercised, the related option, to the extent surrendered, will cease to be exercisable. A stock appreciation right granted in connection with an option will be exercisable until, and will expire no later than, the date on which the related option ceases to be exercisable or expires.

Stock appreciation rights may also be granted independently of options. Such a stock appreciation right will entitle the participant, upon exercise, to receive from us an amount equal to the excess of the fair market value of the shares on the date of exercise over the fair market value of the shares covered by the exercised portion of the stock appreciation right on the date of grant. A stock appreciation right granted without a related option will be exercisable, in whole or in part, at such time as the Committee will specify in the stock appreciation right agreement.

Our obligation arising upon the exercise of a stock appreciation right may be paid in shares or in cash, or any combination thereof, as the Committee may determine.

Restricted Stock

Awards of restricted stock are shares that vest in accordance with the terms and conditions established by the Committee. The Committee will determine the number of shares of restricted stock granted to any employee or consultant, but during any fiscal year of the Company, no participant may be granted more than 300,000 shares of restricted stock. Also, the total number of shares subject to Awards of restricted stock under the Plan may not exceed 20% of the shares reserved for issuance under the Plan.

In determining whether an Award of restricted stock should be made, and/or the vesting schedule for any such Award, the Committee may impose whatever conditions to vesting as it determines to be appropriate. For example, the Committee may determine to grant an Award of restricted stock only if the participant satisfies performance goals established by the Committee.

23

Performance Units and Performance Shares

Performance units and performance shares are Awards that will result in a payment to a participant only if performance goals established by the Committee are achieved or the Awards otherwise vest. The applicable performance goals will be determined by the Committee, and may be applied on a Company-wide or an individual business unit basis, as deemed appropriate in light of the participant’s specific responsibilities (see “Performance Goals” below for more information).

During any fiscal year, no participant may receive performance units with an initial value of more than $2,000,000 and no participant may receive more than 300,000 performance shares.

Non-Employee Director Stock Options

Under the Plan, our non-employee directors will receive annual, automatic, non-discretionary grants of nonqualified stock options.