Filed by J.D. Edwards & Company

Pursuant to Rule 425 Under the Securities Act of 1933

Subject Company: J.D. Edwards & Company

(File No. 333-106269)

The following is a series of slides presented by Les Wyatt, Senior Vice President and Chief Marketing Officer of J.D. Edwards & Company, which relate to the proposed acquisition of J.D. Edwards by PeopleSoft, Inc.

On June 19, 2003, PeopleSoft commenced an exchange offer and filed a Schedule TO and a registration statement on Form S-4 with the SEC, and J.D. Edwards filed a Solicitation/Recommendation Statement on Schedule 14D-9, with respect to the proposed acquisition of J.D. Edwards. PeopleSoft and J.D. Edwards have mailed a Prospectus, the Schedule 14D-9 and related tender offer materials to Stockholders of J.D. Edwards. Stockholders should read these documents and any amendments carefully because they contain important information about the transaction. These filings can be obtained without charge from the SEC at www.sec.gov.

1

J.D. Edwards Merges with PeopleSoft

– Expanding Customer Value & Choices

Les Wyatt

Sr. Vice President and Chief Marketing Officer

2

J.D. Edwards Merging with

PeopleSoft – June 2, 2003

Press Release – June 2, 2003

“PeopleSoft Announces Plan to Acquire J.D. Edwards”

| n | | Will Form the 2nd Largest Enterprise Application Co. |

| | n | | 11,000 combined customers in 150 countries |

| | n | | 13,000 combined employees |

| | n | | $2.8B in combined revenues |

Together, PeopleSoft and J.D. Edwards will

set a new standard in serving the needs of

enterprise application software customers.

3

A Leadership Combination

Or “1 + 1 = 3”

PeopleSoft Strengths

| | J.D. Edwards Strengths

|

| | | |

| n Large Enterprise | | n Mid-Market Leader |

| n Vertical Markets | | n Vertical Markets |

n Fin. Services | | n Industrial |

n Communications | | n Consumer |

n Healthcare | | n Wholesale Dist. |

n Education | | n Life Sciences |

n Government | | n Construction |

| | | n Real Estate |

| | | n Asset Intensive |

4

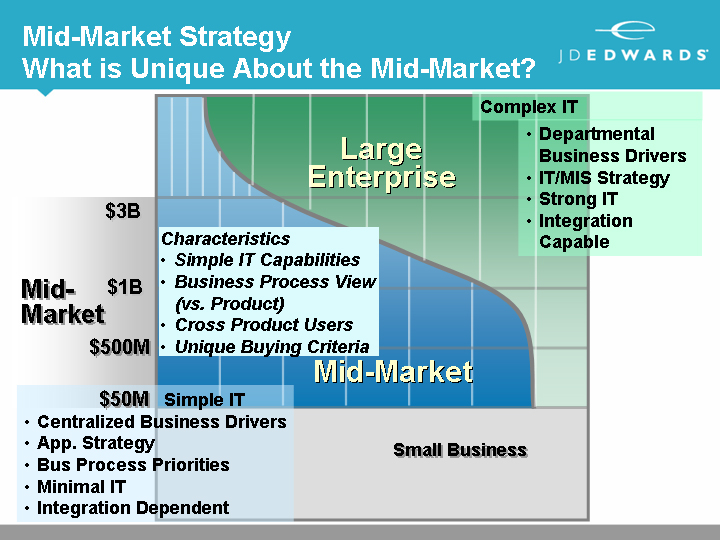

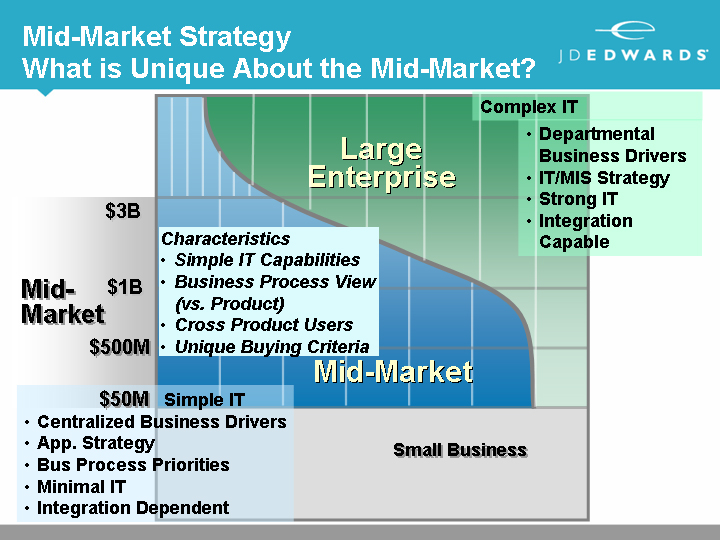

Mid-Market Strategy

What is Unique About the Mid-Market?

| | | | | | | Complex IT |

| | | |

| | | | | | | · Departmental Business Drivers |

| | | | | | | · IT/MIS Strategy |

| | | | | | | · Strong IT |

| | | | | | | · Integration Capable |

| | | | | | | | | |

| | | | | Characteristics |

| | | | | · Simple IT Capabilities |

| | | Mid- | | · Business Process View |

| | | Market | | (vs. Product) |

| | | | | · Cross Product Users |

| | | | | · Unique Buying Criteria |

| | | |

| Simple IT | | | | | | |

| · Centralized Business Drivers | | | | |

| · App. Strategy | | | | | | |

| · Bus Process Priorities | | | | |

| · Minimal IT | | | | | | |

| · Integration Dependent | | | | | | |

| | | | | | | | | |

5

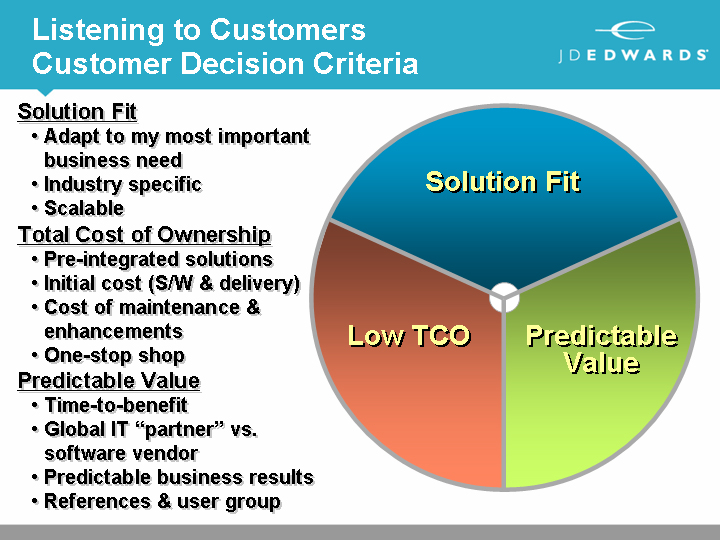

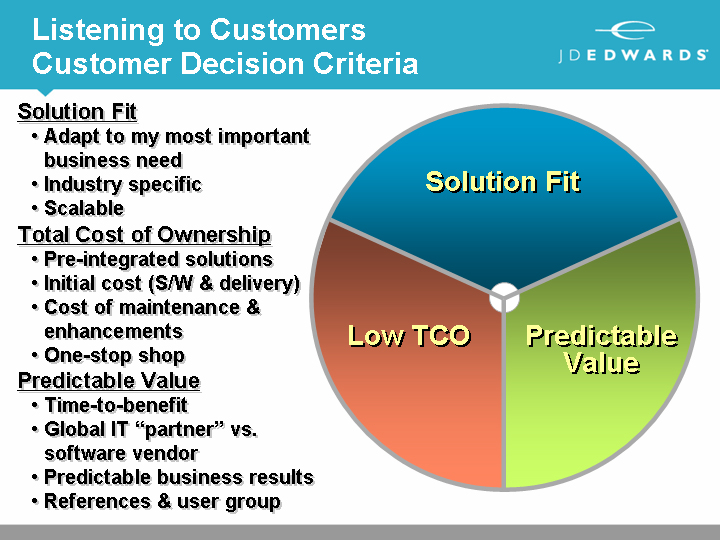

Listening to Customers

Customer Decision Criteria

Solution Fit · Adapt to my most important business need · Industry specific · Scalable | | |

| | |

Total Cost of Ownership · Pre-integrated solutions · Initial cost (S/W & delivery) · Cost of maintenance & enhancements · One-stop shop | | | | |

| | |

Predictable Value · Time-to-benefit · Global IT “partner” vs. software vendor · Predictable business results · References & user group | | | | |

6

J.D. Edwards Value Proposition

Make Customers Stronger | | |

Our customers are our

first priority in everything we do, and this enables you to solve your most important business challengesthrough innovation and a results-oriented relationship. | | |

| | | |

7

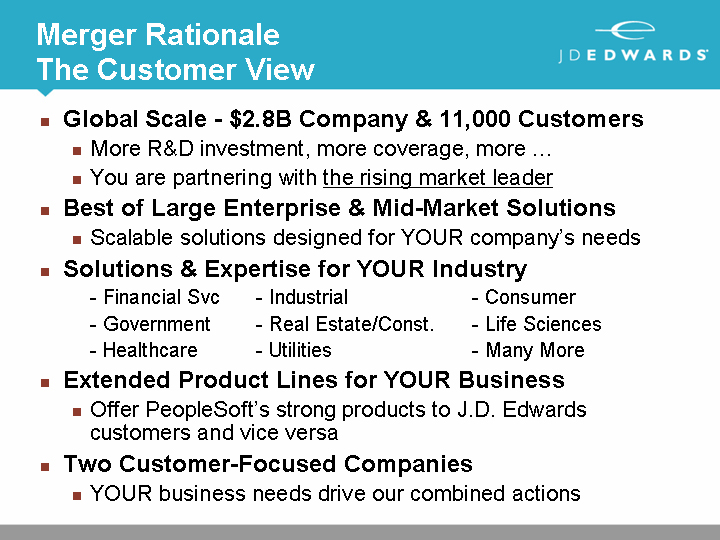

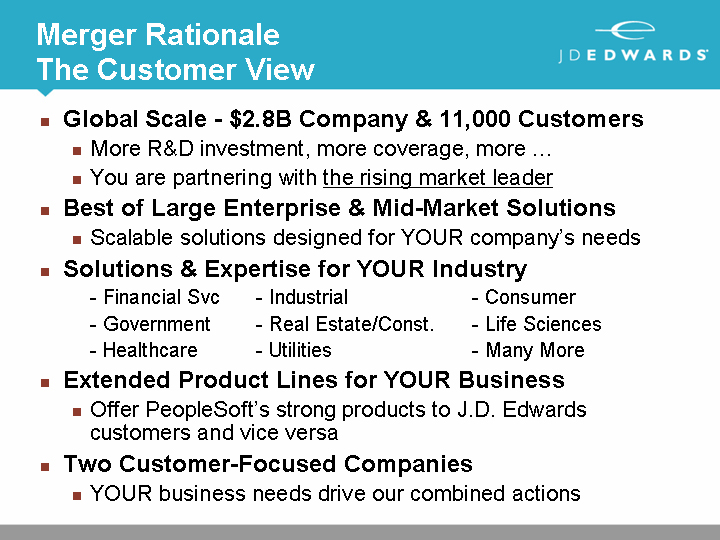

Merger Rationale

The Customer View

| n | | Global Scale – $2.8B Company & 11,000 Customers |

| | n | | More R&D investment, more coverage, more . . . |

| | n | | You are partnering withthe rising market leader |

| n | | Best of Large Enterprise & Mid-Market Solutions |

| | n | | Scalable solutions designed for YOUR company’s needs |

| n | | Solutions & Expertise for YOUR Industry |

| – Financial Svc | | – Industrial | | – Consumer |

| – Government | | – Real Estate/Const. | | – Life Sciences |

| – Healthcare | | – Utilities | | – Many More |

| n | | Extended Product Lines for YOUR Business |

| | n | | Offer PeopleSoft’s strong products to J.D. Edwards |

| n | | Two Customer-Focused Companies |

| | n | | YOUR Business needs drive our combined actions |

8

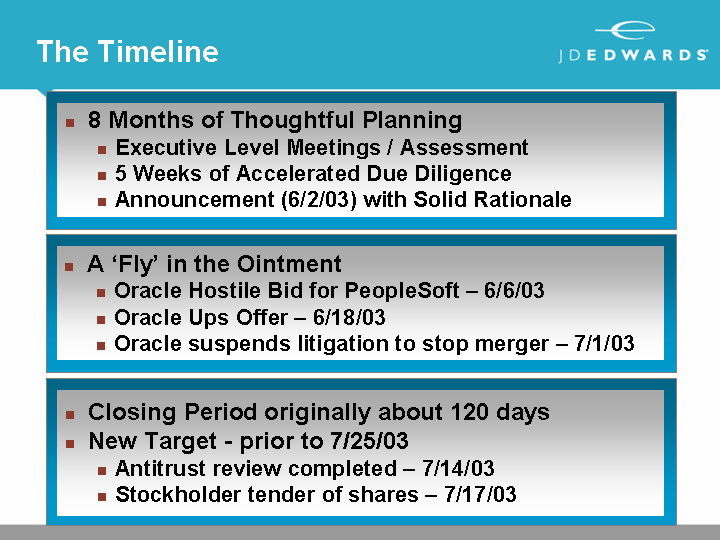

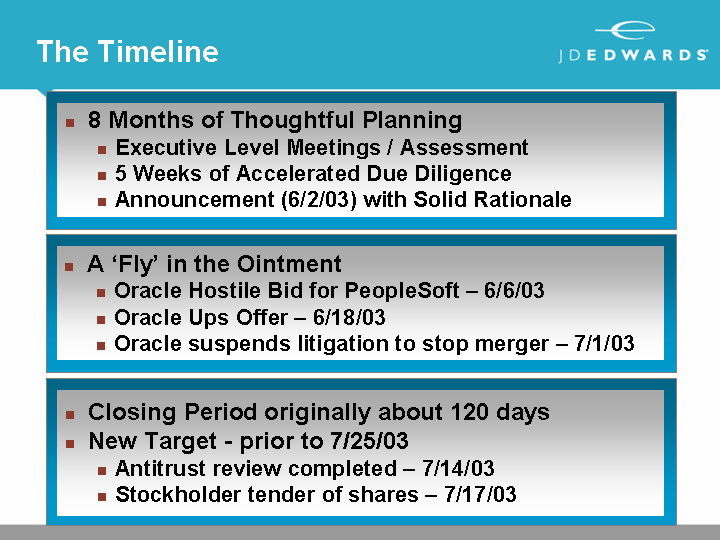

The Timeline

| n | | 8 Months of Thoughtful Planning |

| | n | | Executive Level Meetings / Assessment |

| | n | | 5 Weeks of Accelerated Due Diligence |

| | n | | Announcement (6/2/03) with Solid Rationale |

| n | | A ‘Fly’ in the Ointment |

| | n | | Oracle Hostile Bid for PeopleSoft – 6/6/03 |

| | n | | Oracle Ups Offer – 6/18/03 |

| | n | | Oracle suspends litigation to stop merger – 7/1/03 |

| n | | Closing Period originally about 120 days |

| n | | New Target – prior to 7/25/03 |

| | n | | Antitrust review completed – 7/14/03 |

| | n | | Stockholder tender of shares – 7/17/03 |

9

1 + 1 = 3

PeopleSoft & J D EDWARDS

| Together, PeopleSoft and J.D. Edwards will |

| set a new standard in serving the needs of |

| enterprise application software customers. |

10