www.skyonemedical.com

China Sky One Medical Inc.

(OTCBB:CSKI)

Confidential Investment Presentation

1

Safe Harbor Statement

This presentation contains "forward-looking statements" within the meaning of the “safe-

harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such

statements involve known and unknown risks, uncertainties and other factors that could

cause the actual results of the Company to differ materially from the results expressed or

implied by such statements, including changes from anticipated levels of sales, future

international, national or regional economic and competitive conditions, changes in

relationships with customers, access to capital, difficulties in developing and marketing new

products and services, marketing existing products and services, customer acceptance of

existing and new products and services and other factors. Accordingly, although the

Company believes that the expectations reflected in such forward-looking statements are

reasonable, there can be no assurance that such expectations will prove to be correct. The

Company has no obligation to update the forward-looking information contained in this

presentation.

2

Offering Summary

Use of Proceeds

Capitalization Table

Company Overview

Investment Highlights

Market Overview

Company History

Product Overview

Research & Development

Distribution Platform

Government Support

Production Capacity

Financial Highlights

Acquisition Targets

Management Profile

Overview

3

Offering Summary

Issuer: China Sky One Medical, Inc

Symbol: CSKI/OTCBB

Market Capitalization: $124.6 Million*

Shares Outstanding: 12.1 Million

Offering: Private Investment in Public Equities

Securities Offered: Common Stock

Amount : $30.0 Million

Use of Proceeds: Acquisitions & Working Capital

*Based on November 8, 2007 share price of $10.30

4

Use of Proceeds

Acquisitions

Target 1: $ 8.0 Million

Target 2: $10.0 Million

Working Capital: $ 4.0 Million

New Product Marketing: $ 8.0 Million

Total $30.0 Million

5

Capitalization Table

(Amounts in Millions)

June 30, 2007

Cash

$5.15

Debt

$0.00

Shareholder Equity

$20.98

Total Shares Outstanding

12.10

Warrants

1.64

(1)

Options

0.16

(2)

Fully Diluted

13.90

Shares held by insiders

52%

Restricted Shares

(3)

28%

Free Float

20%

(1)

Warrants with a weighted average exercise price of $2.55 @ expiration of 10/08 - 7/09

(2)

Options with a weighted average exercise price of $3.45 @ expiration of 12/08 - 1/10

(3)

Restricted stock issued May 31, 2006

6

Company Overview

China Sky One Medical

Harbin, Heilongjiang, China

45,000 Square Meters

US Auditor:

Murrell, Hall, McIntosh & Co, PLLP

US Attorney:

Hodgson Russ, LLP

Placement Agent:

Global Hunter Securities, LLC

IR Firm:

Integrated Corporate Relations, Inc

China Sky One Medical manufactures, markets and distributes

proprietary over-the-counter Traditional Chinese Medicines (“TCM”) and

biological diagnostic kits, and markets and distributes 3rd party

manufactured products.

7

Investment Highlights

Highly favorable market conditions

Pharmaceutical sales growth outpacing GDP growth

Highly robust organic top line growth

2006: 157%

2007E: 137%

Extensive distribution network

1,400 Sales Reps, 50 Distributors, >20 Countries

Diverse portfolio of SFDA approved products

70+ OTC products: TCM, Western medicines & diagnostic kits

Robust R&D pipeline

18 biological diagnostic kits to launch in near term

Well known brands

“TDR” and “Kangxi” ubiquitous

Strong government support

$3.3 Million in grants issued in 2007

Experienced management team

8

Market Overview

Rapidly Growing Industry

China’s total healthcare expenditures exceeded $100 Billion in

2005

Pharmaceutical spending outpacing GDP growth

00-04 CAGR: GDP:11.2%, Pharmaceutical spending:15.4%

World’s fifth largest pharmaceutical market by 2010

World’s second largest healthcare market by 2020

Government Imperatives

The government supports innovative projects within the

biomedical industry, including:

Biomedical engineering projects, such as oncology and

cardiology diagnostic products

Modernizing TCM production

Developing indigenous biotechnology capabilities

Changing Demographics

Rising levels of disposable income

Continued emphasis on self-care

Aging

9

Industry Overview

Traditional Chinese Medicine

The TCM Market is a large and well established component of

China’s healthcare industry and culture

TCM Market reached $16.8 Billion in 2006

Mainstream form of medicine in China; roots reaching back

thousands of years

Plant-based medicine is a component of TCM based on

materials from roots, stems and leaves

Effective with fewer side-effects

Commonly indicated for chronic and recurring diseases

Government support for modernizing TCM production

10

Favorable Industry Dynamics

Highly Fragmented Industry

Over 1,200 TCM manufacturers

Numerous privately-held companies with limited access to

growth capital

Combined sales of top three manufacturers account for only

5.5% of total market

Rigorous Regulatory Policies Force Smaller Players to

Consider M&A Alternatives

Obligation to meet Good Manufacturing Practice (“GMP”)

standards requirements drains cash

Significant Consolidation Opportunities for Companies

with:

Fully integrated infrastructure

Leveragable sales and distribution platform

Brand name recognition

Access to growth capital

11

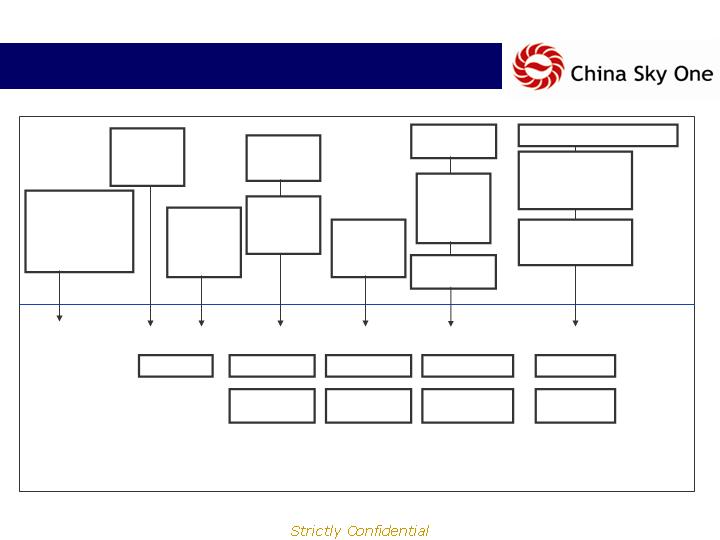

History

1996 2000 2001 2003 2005 2006 2007

Tian Di Ren

Medicine Sales

formed: TCM and

Western medicine

sales and

distribution

TDR adds

R&D and

proprietary

pipeline

Kangxi

subsidiary

formed

with 4

products

First Bio

subsidiary

formed

TDR adds

biological

R&D

initiatives

ACPG

formed for

reverse

merger

CSKI debuts

on OTCBB

Two

biological

product

lines

launched

Kangxi and

First merge

Breaks ground for

new R&D center

(30,000 sq m)

8 clinical trials in process

6 Products

18 Products

30 Products

38 Products

74 Products

300

Pharmacies

800

Pharmacies

1,600

Pharmacies

3,000

Pharmacies

Received more

than $2.5 Million

in grants from

government

12

Product Portfolio:

Proprietary + 3rd Party Products

Diversified product portfolio consists of external use TCM,

traditional Western medicine and rapid diagnostic kits.

Company Manufactured Products:

External use TCM:

28 TCM products of variable topical formulations, including sprays,

ointments, creams, powders and patches

Rapid diagnostic kits:

3 products include early pregnancy tests, micro-albumin urine tests to

assess kidney functions and cardiac enzyme kits for acute myocardial

infarctions (heart attacks)

3rd Party Products:

43 products treating variety of ailments from Camphor creams for

dermatitis to sulfasalazine suppositories for different types of colitis,

including ulcerative colitis

13

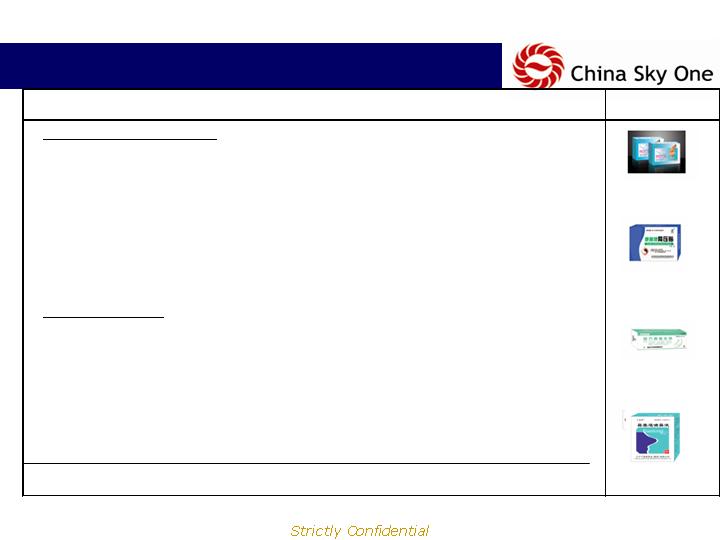

Product Portfolio: Key Products

Product

Application

% Sales

2007E

Manufactured by Company

Sumei Slim Patch

TCM patch with Saponin as the

main active ingredient to promote

weight loss

19.0%

Anti-Hypertension Patch

TCM combines with modern trans-

dermal theraputic system (TTS) to

provide an effective theraputic

treatment for reducing blood

pressure

12.5%

3rd Party Products

Compound Camphor Cream

Treats dermatitis, eczema,

neurodermitis, allergic dermatitis

and popular urticaria

5.7%

Sulfasalazine

Effective for ulcerative colitis and

nonspecific chronic colitis

4.7%

Qianliming Nasal Drops

Effective for Coryza (head cold),

Ethyl ester hydroxybenzene, etc.

3.4%

45.3%

14

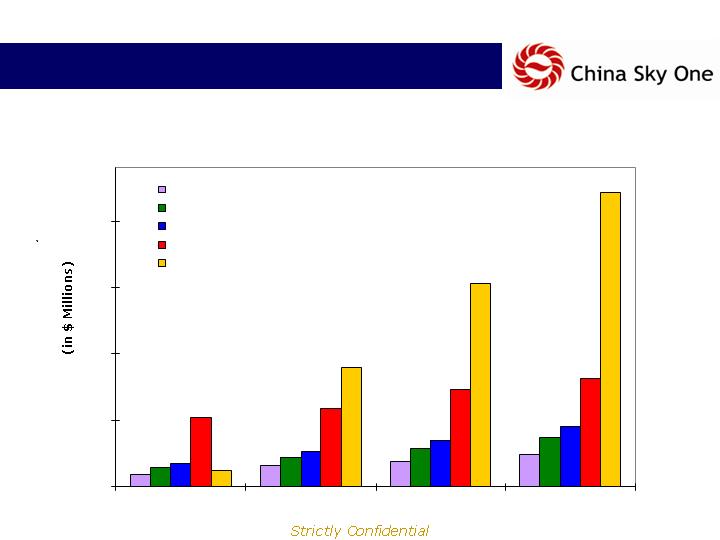

Product Portfolio: Key Products

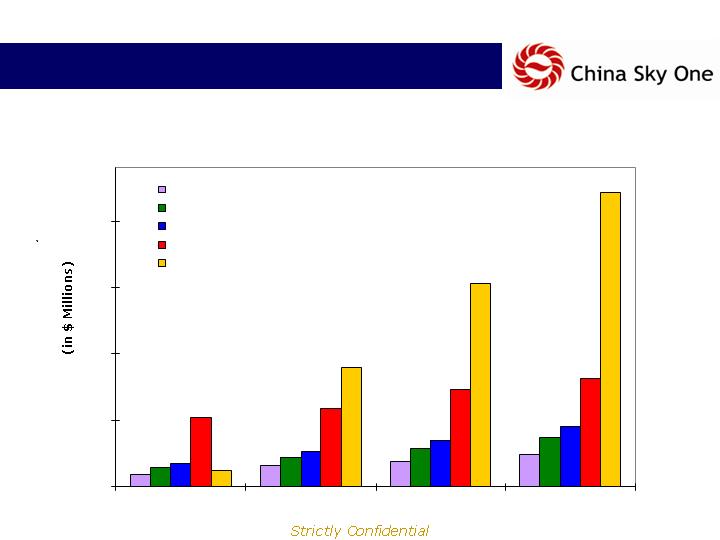

Sales by Product

0

5

10

15

20

2006

2007

2008

2009

Qianliming Nasal Drops: 25.6% CAGR

Sulfasalazine Suppositories: 27.6% CAGR

Compound Camphor Cream: 26.2% CAGR

Anti-Hypertension Patch: 11.7% CAGR

Sumei Slim Patch: 106.6% CAGR

15

Product Portfolio: Rapid Diagnostic Kits

Diagnostic Products

Micro-Albumin Testing kit

Assess kidney functions in diabetic patients

AMI Testing Kit

Assess myocardial infarction (heart attack)

Early Pregnancy Test

Diagnostic Product Pipeline

18 Rapid Diagnostic Kits in Development:

Oncology kits (6)

Infectious disease kits (3)

Others (9)

16

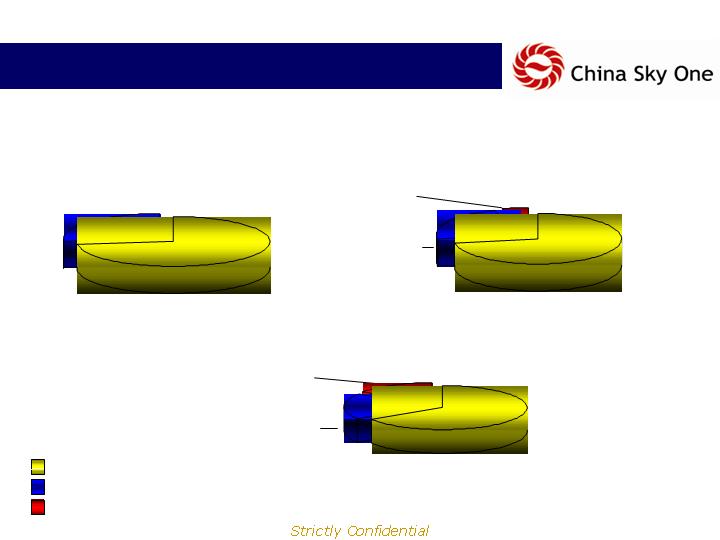

Product Sales

Sales By Product Type

2006

$19.8MM

$13.6MM

(68.9%)

2007E

$47.1MM

$32.8MM

(69.5%)

$12.2MM

(25.9%)

$2.1MM

(4.6%)

$60.2MM

(69.0%)

$16.3MM

(18.7%)

$10.8MM

(12.4%)

2008E*

$87.3MM

Manufactured by Company

3rd Party Products

Diagnostics Kits/Biologicals

$6.2MM

(31.1%)

*2008E includes Acquisitions

17

Research & Development

R&D Highlights:

Recognized leader in monoclonal antibody preparation, human

antibody and gene recombination drug studies

Well established relationships with renowned universities

including:

Harbin Medical University

Northeastern Agriculture University

Jilin University

Beijing University

New 30,000 square meter biologics R&D center under

construction

2009 completion

Awarded R&D grants by the Chinese Ministry of Science and

Technology to further develop six Early-Stage Cancer

Diagnostic Kit projects

Staff of 39

18

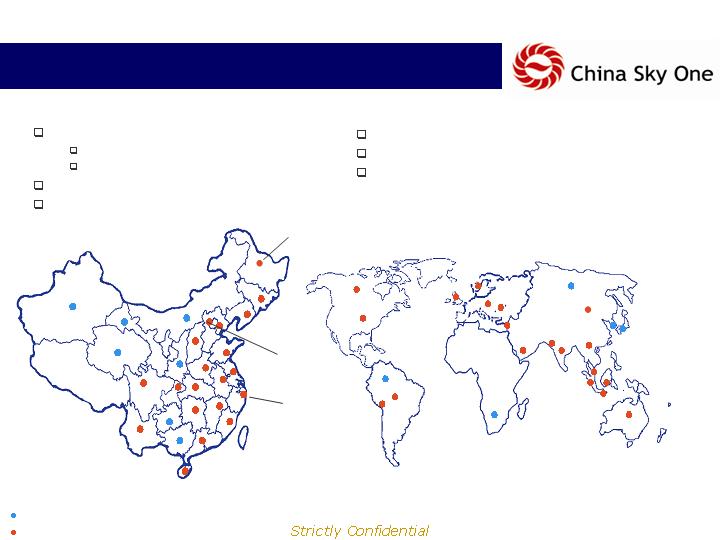

Extensive Distribution Network….

1,400 sales representatives

200 selling to pharmacies

1,200 selling from pharmacies

50 distributors

3,000 pharmacies

Current Distribution Network

Beijing

Shanghai

Harbin (HQ)

22 provincial offices

125 city offices in China

Exports to more than 20 countries

Future Distribution Network

19

…..With Room for Growth

While CSKI’s distribution platform is extensive, there’s still a

lot of runway remaining

Retail Pharmacies

China has more than 24,000 retail pharmacies

Currently, CSKI’s retail pharmacy penetration is <15%

Aggressive organic growth & acquisitions will allow CSKI to

further penetrate the retail pharmacy market

Hospitals

China has more than 2,400 hospitals

Currently, CSKI’s hospital presence is <5%

CSKI’s R&D initiatives on biological diagnostic products will

lead to an increasing penetration of hospitals

CSKI has demonstrated an ability to aggressively grow its

sales and distribution platform, and to leverage its

platform to successfully introduce new products

20

Strong Government Support

$3.3 Million in Government Grants Received in 2007

September 2007: Chinese Ministry of Science and Technology

Two year grant to develop six proprietary

Early-Stage Cancer Diagnostic Kit projects

$1.5 Million

June 2007: Harbin City Government

Annual R&D grant for the next three years through 2010

Additional R&D grant reserved for future investment

$1.3 Million

April 2007: Heilongjiang Provincial Government

First company in the province to receive government grant for

monoclonal antibody research

$0.5 Million

21

Acquisition Strategy

M&A Objectives

Accelerate CSKI’s growth

Capitalize on favorable market and industry dynamics

Leverage CSKI’s extensive sales, marketing and distribution

platform

Expand and diversify CSKI’s product portfolio

Acquisition Target Profiles

Diversified, complimentary product portfolio

High manufacturing standards

Underutilized capacity

Underdeveloped distribution platform

Flagship products

Strong R&D bench

Robust Product Pipeline

Acquisition Status

Four targets identified

Verbal agreements with highest priority targets

22

Acquisition Target 1

Target: “Heilongjiang”

Purchase Price $ 8.0MM

Revenue

2007 $ 4.0MM

2008 $10.0MM

2009 $16.0MM

Acquisition Profile

Diversified, complimentary product

portfolio

75 SFDA approved products,

including

Cardiovascular medications

Anti-gastroenteritis medications

High manufacturing standards

GMP certified

Underutilized capacity

Capacity utilization 45%

Underdeveloped distribution platform

25 sales reps

30 distributors (Northern China

focus)

500 pharmacies, <50% overlap

Flagship products

3 strong candidates

Strong R&D bench

Robust product pipeline

Near term launch of 5 products

23

Acquisition Target 2

Target: “Liaoning”

Purchase Price $10.0MM

Revenue

2007 $ 5.0MM

2008 $ 7.0MM

2009 $23.0MM

Acquisition Profile

Diversified, complimentary product

portfolio

40 SFDA approved products,

including

Anti-flu medications

Dermatologic medications

Anti-hyperlipidemic medications

High manufacturing standards

New facility, GMP certified

Underutilized capacity

Capacity utilization 40%

Underdeveloped distribution platform

15 sales reps

25 distributors

650 pharmacies, <50% overlap

Flagship products

5 strong candidates

Strong R&D bench

Robust product pipeline

24

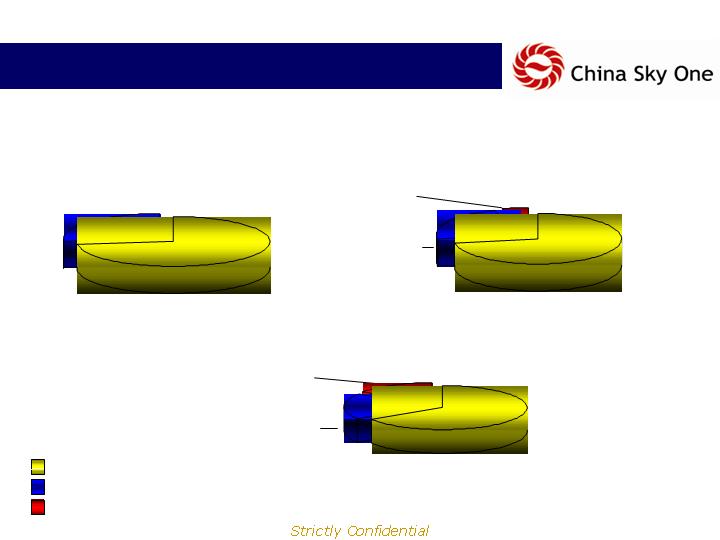

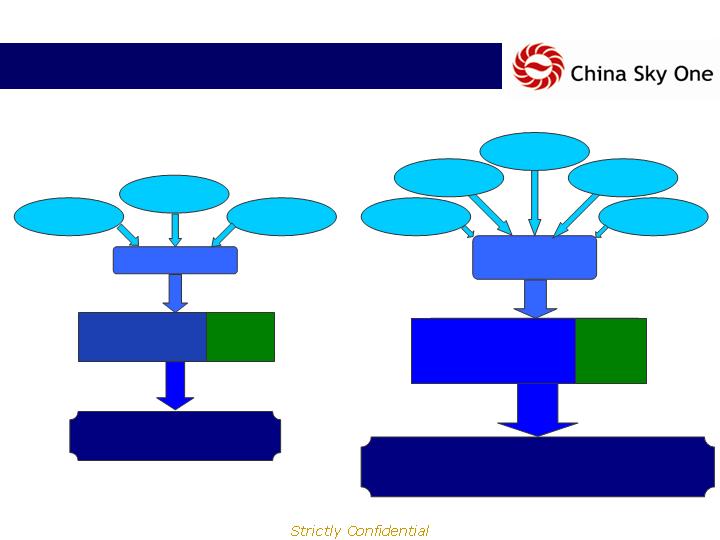

Expanded Distribution Platform

20

Hospitals

2007

43 3rd Party

Products

1,400 Sales Reps

50 Distributors

120 Million People

28 TCM

Products

3 Diagnostic

Products

Post Acquisitions (2009)

21 Diagnostic

Products

2,000 Sales Reps

100 Distributors

4,175 Pharmacies

1,200 in-store promoters

170 Million People

28 TCM

Products

40 Products

from acquisition 2

75 Products

from acquisition 1

43 3rd Party

Products

3,000

Pharmacies

4,200

Pharmacies

200

Hospitals

25

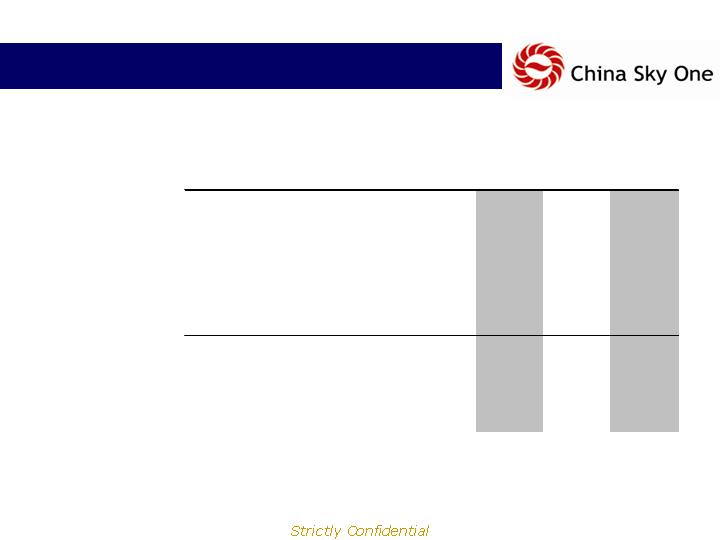

Financial Highlights

Financial Performance & Projections

(1) 2006 included one time costs for recapitalized R&D costs and RTO expenses

(2) As of 6/30/07, CSKI was designated as a high-tech development company, taxed at 15%

(3) Assumes issuance of 3 Million shares in 2008

YTD

($1,000s)

2005

2006

(1)

3Q07

2007E

w/o Acq

w/ Acq

w/o Acq

w/ Acq

Revenue

7,712

19,882

36,595

47,153

70,000

87,000

110,000

149,000

Revenue Growth

157.8%

137.2%

48.5%

84.5%

57.1%

71.3%

Gross Profit

5,498

14,819

28,491

36,657

54,600

68,904

86,900

119,945

Gross Margin

71.3%

74.5%

77.9%

77.7%

78.0%

79.2%

79.0%

80.5%

R&D

64

2,027

1,752

3,329

6,300

6,960

9,350

11,175

SG&A

2,914

10,738

12,798

16,019

21,561

26,501

33,990

46,861

PreTax Income

2,445

1,704

13,657

17,309

26,739

35,444

43,560

61,909

Income Tax

(2)

356

1,080

2,434

2,443

3,869

4,809

6,564

8,891

Net Income

2,089

624

11,223

14,866

22,870

30,635

36,996

53,018

Net Margin

27.1%

3.1%

30.7%

31.5%

32.7%

35.2%

33.6%

35.6%

Net Growth

-70.1%

2281.7%

53.8%

106.1%

61.8%

73.1%

Fully Diluted Shares

(3)

10,929

13,908

13,908

13,908

16,908

16,908

16,908

16,908

EPS

0.19

0.04

0.81

1.07

1.35

1.81

2.19

3.14

2008E

2009E

26

Financial Highlights

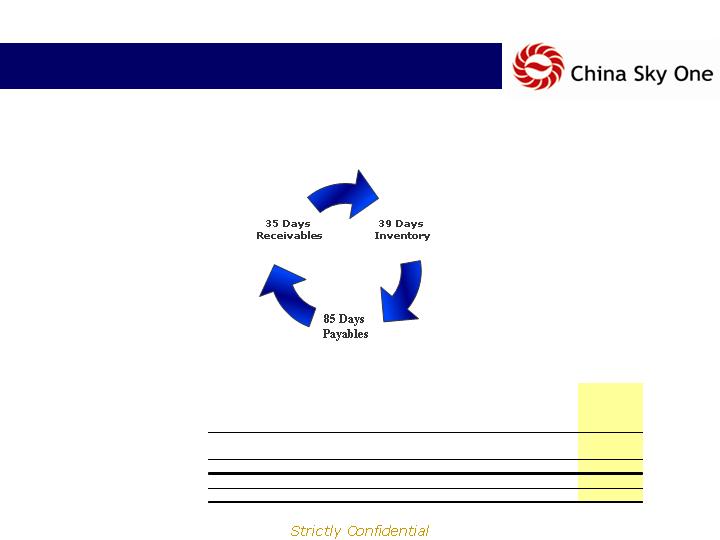

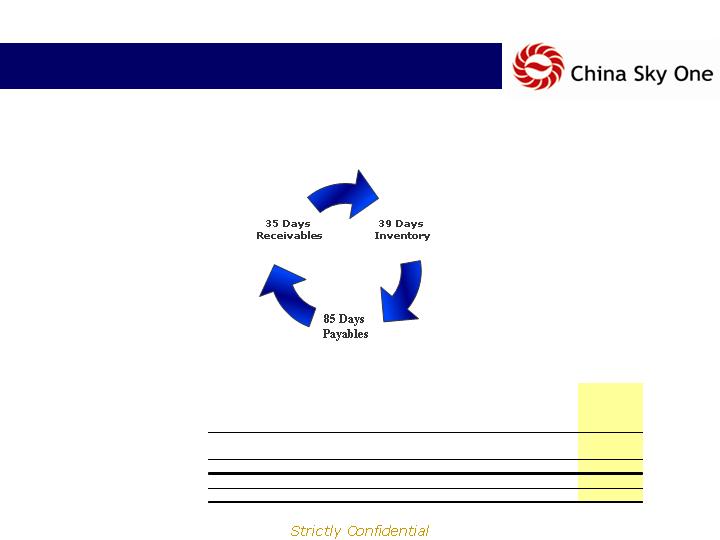

Comparable Company Operating & Cash Cycle Analysis

74 Day

Operating

Cycle

CSKI

LTM ending June 30, 2007

*CSKI 1H 07 Cash Cycle (32) days

(11) Day

Cash Cycle

Tongjitang

Chinese

Medicines

China

Medicine

Corporation

American

Oriental

Bioengineering

China

Pharma

Average

China

Sky One

Medical

Days' Receivable

124

63

29

162

95

35

Plus: Days' Inventory

79

69

99

223

117

39

Equals: Operating Cycle

203

133

128

284

212

74

Minus: Day's Payables

43

8

26

19

24

85

Equals: Cash Cycle

160

125

102

365

188

-11

27

Pharmaceutical Companies

Pharmaceutical Companies > Market Multiples

(in $ Millions, except per share data)

11/08/07

Company

Ticker

Exchange

Stock Price

China Based Healthcare Companies

Tongjitang Chinese Medicines Co.

TCM

NYSE

8.96

12.88

7.50

299.47

196.52

American Oriental Bioengineering Inc.

AOB

NYSE

12.24

14.48

6.83

911.48

806.08

Simcere Pharmaceutical Group.

SCR

NYSE

14.15

19.30

10.81

852.31

768.69

US Generic Pharmaceutical Companies

Beckman Coulter Inc.

BEC

NYSE

70.22

77.00

58.64

4,368.52

5,210.72

Bio-Rad Laboratories Inc.

BIO

AMEX

105.99

115.23

66.80

2,872.22

2,800.13

Celera Group

CRA

NYSE

15.85

16.55

11.39

1,224.48

663.06

King Pharmaceuticals Inc.

KG

NYSE

11.42

22.25

10.05

2,454.91

1,932.21

Par Pharmaceutical Companies Inc.

PRX

NYSE

17.33

30.68

16.61

614.78

596.57

ViroPharma Inc.

VPHM

NASDAQ

7.53

18.39

7.11

526.23

205.85

China Sky One Medical, Inc.

CSKI

OTC

10.30

14.35

4.75

124.72

138.10

52 Week

High

52 Week

Low

Market

Cap

TEV

28

Pharmaceutical Companies’ P/E Multiples

Company

FY 07

FY 08

FY 09

FY 07

FY 08

FY 09

China Based Healthcare Companies

Tongjitang Chinese Medicines Co.

0.84

0.92

1.08

10.7x

9.7x

8.3x

American Oriental Bioengineering Inc.

0.60

0.79

0.99

20.3x

15.6x

12.4x

Simcere Pharmaceutical Group.

0.63

0.83

0.99

22.4x

17.0x

14.3x

US Generic Pharmaceutical Companies

Beckman Coulter Inc.

3.20

3.59

3.97

21.9x

19.6x

17.7x

Bio-Rad Laboratories Inc.

3.76

4.53

5.39

28.2x

23.4x

19.7x

Celera Group

-0.32

0.16

0.44

NA

NA

NA

King Pharmaceuticals Inc.

1.81

1.38

0.97

6.3x

8.3x

11.8x

Par Pharmaceutical Companies Inc.

1.13

0.82

1.22

15.3x

21.2x

14.2x

ViroPharma Inc.

1.15

0.65

0.47

6.5x

11.7x

16.0x

Mean

1.42

1.52

1.72

16.4x

15.8x

14.3x

CSKI without Acquisition

(1)

1.07

1.35

2.19

9.6x

7.6x

4.7x

CSKI with Acquisition

(1)

1.07

1.81

3.14

9.6x

5.7x

3.3x

(1)

Assumes issuance of 3 Million shares in 2008

Earnings Per Share ($)

Price / EPS

29

Management Team

Yan-qing Liu

CEO, Chairman and Director

Over 15 years of experience in pharmaceutical sales and marketing,

new drug research & development and enterprise management

8 years of experience as a reporter for the Family Health Newspaper

Bachelor’s degree from Prophylactic Department of Harbin Medicine

University and an EMBA from Tsinghua University

Xiao-yan Han

CFO, Vice President and Director

Over 10 years of financial management experience

Appointed the general manager of TDR in 2004

MBA from Harbin Industrial University

Hai-feng Wang

Executive Vice President and Director

Joined TDR in 2003 as the manager of the international business

department

Bachelor’s degree in both international trade and English literature

from Heilongjiang University

30

Investment Summary

Highly favorable market conditions

Pharmaceutical sales growth outpacing GDP growth

Highly robust organic top line growth

2006: 157%

2007E: 137%

Extensive distribution network

1,400 Sales Reps, 50 Distributors, >20 Countries

Diverse portfolio of SFDA approved products

70+ OTC products: TCM, Western medicines & diagnostic kits

Robust R&D pipeline

18 biological diagnostic kits to launch in near term

Well known brands

“TDR” and “Kangxi” ubiquitous

Strong government support

$3.3 Million in grants issued in 2007

Experienced management team

31