July 25, 2007

VIA: EDGAR

Max A. Webb

Assistant Director

Securities and Exchange Commission

100 F. Street, N.E.

Washington, D.C. 20549

RE: Host America Corporation

Preliminary Schedule 14A

Filed June 6, 2007

SEC File No. 000-16196

Mr. Webb:

Thank you for your letter dated June 29, 2007 regarding the review of Host America Corporation’s to Preliminary Schedule 14A. We understand that your process is to assist us in compliance with applicable disclosure requirements and to aid us in enhancing the overall disclosure of these and future filings. Filed electronically on behalf of Host America Corporation is Amendment No. 1 to Preliminary Schedule 14A originally filed on June 6, 2007. On July 25, 2007, we filed our responses to your written comments of June 29, 2007. Pursuant to the Staff’s comment letter, we have included all corresponding Form 14A changes in our Amendment No. 1 to Form 14A. This letter highlights the changes requested by the Staff in its comment letter dated June 29, 2007 and are included in our amended filing.

Further, in response to the comments received from the Securities and Exchange Commission, the Company acknowledges that:

| · | The Company is responsible for the adequacy and accuracy of the disclosures in the filing; |

| · | Staff comments or changes to disclosures in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | The Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

General

Comment No. 1:

The comment is noted and all abbreviations in the document have been spelled out when they are first used to provide a more detailed understanding of the acronym.

Comment No. 2:

The comment is noted and all technical terms in the document have been more fully explained when they are first used to provide a more detailed understanding of the term.

Comment No. 3:

The comment is noted and we have provided our net revenues and net loss for the most recent audited and stub periods, as well as comparable pro forma figures assuming the sale of the food service operations under the “Summary Term Sheet” section.

Comment No. 4:

The comment is noted and we have included language in the “Summary Term Sheet” specifying that the sale of the food service business revenues represent 80% of the Company’s revenues and that our future success will depend on the success of our energy conservation product. In addition, we have included language specifying that the energy conservation product accounts for only 1% of our current revenues. Please also be advised that the application of modifying the sine wave is widely accepted and is utilized in the marketplace.

Summary Term Sheet for the Sale of the Food Service Business, page 1:

Comment No. 5:

The comment is noted and we have revised the first reference to the Principals and disclosed their respective positions within the company.

Reasons for the Corporate Dining and the Lindley Sales, page 1:

Comment No. 6:

The comment is noted and we have revised this section and disclosed and discussed in detail the various strategic alternatives found under “The Asset Sale Transactions, Overview and Background” section.

Principle Parties under the Corporate Dining Sale Agreement, page 2:

Comment No. 7:

The comment is noted and we have made the language consistent to define our energy management division and the two segments: “electrical contracting services” and “energy conservation” throughout the document.

Interests of Host Management and Directors, page 5:

Comment No. 8:

The comment is noted and we have included the language to describe the differing interests of the Directors and Executive Officers that are referenced.

Opinions of our Financial Advisor Regarding the Fairness, page 6:

Comment No. 9:

The comment is noted and we have made the language consistent to the assignment to our financial advisor, to determine whether the sales were fair, from a financial point of view to the shareholders.

Questions and Answers about the Proposals, page 7:

General

Comment No.10:

The comment is noted and we have made the language consistent to disclose the use of proceeds. Additionally, we have deleted redundant discussions within the answers to the fourth, fifth and sixth questions.

Q: What will our business be following the sale of our food service business? page 8

Comment No.11:

The comment is noted and we have revised the language to provide a more straightforward understanding of the way our product improves the efficacy of a lighting system. Please be advised that additionally, we have provided further discussion here about the details of our claim:

When installed in a system of fluorescent lights, the EnerLume-EM™ conditions the input power so that the fluorescent ballasts create the output power to the lamps more efficiently, as fluorescent ballasts draw consistent power 100% of the time. Looking at the voltage sine wave at the zero crossing, florescent ballasts draw very high amounts of current to make up for the lack of voltage. Almost all of this current is wasted and turns into excess heat and not light. The EnerLume-EM™ does not allow florescent ballasts to draw power at and after the zero crossing until there is enough voltage to create meaningful power. By creating this delay, the EnerLume-EM™ increases the efficiency of the ballasts. As a result, electric consumption is reduced while maintaining nearly all of the light output.

The efficacy of a lighting system is defined as the light output per unit of energy consumed. In most installations, the EnerLume-EM™ reduces the consumption in kilowatts by about 15%. At the same time, the light (as measured in foot-candles at the floor) is reduced by less than 5%. This small reduction in light coupled with a much larger reduction in energy consumption, and by definition, increases the efficacy of the lighting system in which the EnerLume-EM™ is installed.

As we feel we have created a more efficient and effective method to conserve electrical energy than our competitors by utilizing and modifying the sine wave as a widely accepted technology as noted in Comment # 4, we also believe that disclosing the above may benefit our competitors when we discuss the voltage sine wave at the zero crossing. The disclosure currently discusses that our “firmware, governed by sophisticated algorithms, provides timing direction to the ballasts as to when to draw power in such a way as to maintain full, peak voltage for maximum light output” which is analogous to the discussion above.

Q: What will happen if the proposal to amend our Articles of Incorporation…? page 8

Comment No.12:

The comment is noted and we have included the language in the answer to describe that all rights to the name “Host America.” will be sold in connection with the proposed Corporate Dining Sale Agreement.

Upon the closing of the sale of our food service business, page 17

Comment No.13:

The comment is noted and we have excluded the language “cash generated from operations after the closing” as to alleviate confusion.

We will require additional capital to implement our plan, page 17

Comment No.14:

Please be advised that the factors involved, both potentially favorable or unfavorable, in business performance from both an economic perspective and a marketing effectiveness perspective can alter the magnitude of forecasts and therefore future fundraisings. We feel that, to quantify the amount of additional capital needed, might mis-inform the shareholders to the extent that there exists numerous variables involved in forecasting.

The consummation of the sale of our food service business, page 18

Comment No.15:

The comment is noted and we have excluded the language associated with the risks of the failure of the sale to be consummated and the potential for loss of business.

Our energy services segment has incurred significant operating losses since inception, page 19

Comment No.16:

The comment is noted and we have included language to quantify the amount of losses in the first sentence of this risk factor.

Patents and other proprietary rights provide uncertain protection, page 19

Comment No.17:

The comment is noted and we have included language to further describe the patent pending and intellectual property rights of the technology for the EnerLume-EM™ light controller.

Our energy conservation segment faces an inherent risk of exposure, page 20

Comment No.18:

The comment is noted and we have included language to further describe the significance of being listed under Underwriters Laboratories. Please be advised, that the relevance of being listed by Underwriters Laboratories is national recognition by consumers and municipalities that the product is safe. Many municipalities require a nationally recognized testing laboratory to test products before they can be sold in their area. The UL Listing Mark on a product is the manufacturer’s representation that samples of the complete product have been tested by UL to nationally recognized Safety Standards and found to be free from reasonably foreseeable risk of fire, electric shock and related hazards.

Overview and Background, page 22

Comment No.19:

The comment is noted and additional language is included under the “Performance of our Food Service Markets…” to further discuss the achievements we have experienced within our food service division. Please be advised however, in calculating and disclosing the net loss per share to discuss specific performance of a segment or a division can create comparability issues and distort the results with respect to the amount of shares used in the calculation. We have been increasing the amount of common shares included in the calculation of net loss per share over five times since the three years and interim period as per your request, as fundraising efforts to sustain the business have been necessary. Therefore we believe that this type of disclosure will not be effective to achieve the desired results.

Alternatives Considered by Management: Business Strategy, page 23

Alternatives Considered by Management: Pursue Inside Buyers, page 24

Final Negotiation and Documentation, page 25

Comment No.20:

The comment is noted and we have included language to further disclose the relative dates with respect to the material events regarding our decision to sell to the inside buyers.

Alternatives Considered by Management: Business Strategy, page 23

Comment No.21:

The comment is noted and we have included language to further disclose how we were advised by Ardour Capital Group in their Business Review and Summary Report discussion to our Board of Directors.

Comment No.22:

The comment is noted and we have included language to further disclose how we plan to utilize investment advisors to access private equity capital markets.

Comment No.23:

The comment is noted and we have excluded the language that if the energy conservation segment is not a public company, its valuation may not be as attractive when viewed as a purely private concern. Our initial reasoning was that we believe that the private equity capital markets will find more attractive a private investment in a public entity. However, after further review we have decided that this disclosure was not relevant to the discussion.

Comment No.24:

Please be advised, that as member of our Board of Directors, Mr. Rossomando has abstained from voting on all Board decisions regarding the sale of our Lindley food service business. Messrs. Cerreta and Hayes were not considered or included in any considerations or decisions of alternative business strategies, in the consideration of possible outside buyers or any other decision to that effect. As Messrs. Rossomando and Cerreta are the original principals of Lindley Food Service since their startup in 1984, and as Mr. Hayes’s sole responsibility as Director of Operations of our Corporate Dining segment, their participation was imperative in order to continue these businesses subsequent to any sale. Therefore, their input as key managers made it necessary for the consideration to pursue inside buyers.

Final Negotiation and Documentation, page 25

Comment No.25:

Please be advised, that we have not received offers from outside buyers. We have disclosed that prior talks never materialized with any possible outside buyers, and the Board of Directors concluded that it is in the best interests of shareholders not to expend additional financial resources and efforts to undertake an additional external review of the potential markets as the external business market platform has not changed from 2002.

Comment No.26:

Please be advised that our Board of Directors and Audit Committee have adopted written policies and procedures relating to approval or ratification of “related party transactions.” Under the adopted policies and procedures, our Audit Committee is to review the material facts of all interested transactions that require the Committee's review and either approve or disapprove of an entry into the interested transactions, subject to certain exceptions, by taking into account, among other factors it deems appropriate, whether the interested transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related person's interest in the transaction. No director may participate in any discussion or approval of an interested transaction for which he or she is a related party.

The Board determined that from a related party perspective the proposed transactions represented the fair value to the company and its shareholders under the opinion of fairness from the independent valuation firm Marshall & Stevens and not to go below the median range as reported in their fairness opinion. The Board further commented that the final asset purchase agreements, being subject to post-closing adjustments specific to inventory levels and/or potential loss or increases in business and client base, ensures that a fair and equitable procedure has been reached with respect to this related party transaction.

Your comment to disclose the members of the Audit Committee has been included in the language discussing the “Final Negotiations and Documentation”.

Reasons for the Corporate Dining and Lindley Sales, page 26

Comment No.27:

The comment is noted and we have included language to further discuss the critical liquidity challenge as found in the prior risk factor. Please be advised, that the “changes in management” language found in our Overview and Background section has been omitted. The changes in management” language was included to further emphases the legal and regulatory issues and not an underlying reason for the decision to sell the food service business. With this omission, the sentence will not be construed as potentially misleading.

Comment No.28:

Please be advised that the Corporate Dining buyer will not be responsible for the liabilities as you have mentioned. The executed Asset Purchase Agreement specifically states only the select assets and intangibles are part of the asset sales. These assets mainly do not include the open receivables or the cash on hand, and therefore all parties have further agreed that the current liabilities associated with the business will not be part of the agreement. Our independent valuation has taken into consideration the specific attributes of the sale, as mentioned above, when they determined their opinion.

Form of Corporate Dining Sale, page 28

Comment No.29:

Please be advised that we fully explain in detail the liabilities assumed and the liabilities not assumed under the Corporate Dining Asset Purchase Agreement under the heading “Description of Liabilities to be Assumed by Corporate Dining Buyer under Corporate Dining Sale Agreement”, and “Description of Liabilities to be Retained by Host under Corporate Dining Sale Agreement” respectively.

Description of Liabilities to be Assumed by Lindley Buyer, page 35

Comment No.30:

The comment is noted and we have included language to further disclose and quantify the obligations owing to FoodBrokers arising out of the previous FoodBrokers transaction.

Opinion of our Financial Advisor Regarding the Fairness, page 40

Comment No.31:

The comment is noted and we have included the material findings of Marshall & Stevens in addition to their methodologies.

Comment No.32:

The comment is noted and we have included the financial projections from management included in the projected income statement included in the body of the proxy.

Comment No.33:

Please be advised, that we have attached, as Exhibit A, the detailed reports provided to us from Marshall & Stevens.

Methodologies, page 41

Comment No.34:

The comment is noted and we have included the language to further explain the cost approach and the potential impact to the balance sheet.

Comment No.35:

The comment is noted and we have included the language to further explain the Capital Asset Pricing Model and the Gordon Growth Model.

Comment No.36:

The comment is noted and we have removed the qualifying language associated with the methodologies of Marshall & Stevens. Please be advised, that we have summarized the material findings in the proxy as per Comment # 31 and provided to you the report from Marshall & Stevens containing their analysis and findings under Comment # 33.

Interests of Host’s Management and Directors in the Asset Sale, page 43

Comment No.37:

The comment is noted and we have included additional language to further disclose and quantify specifically the interests in obligations owing to current and former inside management arising out of the loans to the company. Please be advised, the role of the Board of Directors, including Mr. Murphy, was of a fiduciary duty to the shareholders of the company in the best interests of the company. Given that the consideration of alternative business strategies and pursuing the inside buyers occurred prior to the current interests and obligations from inside management as listed in this comment, it was managements and the Board’s directive to pursue interests of shareholders.

Comment No.38:

The comment is noted and we have included language to further disclose that Lindley Acquisition Corp. and Timothy Hayes are the Lindley Buyer and the Corporate Dining Buyer, respectively

Use of Proceeds from the Asset Sale Transactions, page 44

Comment No.39:

The comment is noted and we have included additional language to further disclose and quantify the breakdown of proceeds we intend to use for each item.

Pro Forma Financial Information, page 46

Comment No.40:

The comment is noted and we have excluded the language “for informational purposes only”.

Security Ownership of Management, page 59

Comment No.41:

The comment is noted and we have included the corporate titles of each named director and executive officer.

Lindley Food Service, page 67

Comment No.42:

The comment is noted and we have included the 10% and 11% customer in the filing.

Annex D

Comment No.43:

The comment is noted and we have revised the opinions as described.

Thank you for your assistance. If we can be of any assistance in connection with the Staff's review of the enclosed, please do not hesitate to contact the undersigned at your earliest convenience.

| � 60; Very truly yours, |

| |

� 60; /s/ Michael C. Malota |

| � 60; Michael C. Malota |

| � 60; Chief Financial Officer |

EXHIBIT A

Opinion of Fairness & #160; April 16, 2007

Presented to

By

Marshall & Stevens, Inc.

355 S. Grand Ave. Suite 1750

Los Angeles, Ca. 90071

(t) 213.612.8000

(f) 213.612.8010

[Marshall & Stevens LOGO]

Chicago• Los Angeles• New York• Philadelphia• San Francisco• St. Louis• Tampa

[Marshall & Stevens LOGO]

Opinion of Fairness

Summary of the Engagement

On January 17, 2007, Mr. Timothy Hayes (hereinafter referred to as Mr. Hayes or the Buyer), delivered to Host America Corporation (hereinafter referred to as Host America or the Company) a Letter of Intent (hereinafter referred to as the LOI) delineating its interest in acquiring certain assets of Host America’s Business and Industry Services (Corporate Dining) Division (hereinafter referred to as Corporate Dining).

Marshall & Stevens, Inc. (hereinafter referred to as “Marshall & Stevens”) was engaged on February 7, 2007, to render an opinion as to the fairness, from a financial perspective, of the consideration to be received by the shareholders of Host America (hereinafter referred to as the Shareholders) should Host America accept the Buyer’s current offer.

Due to the limited scope of this engagement, Marshall & Stevens did not initiate discussions with third parties regarding a possible acquisition of Host America, provide any advice on the structure of the transaction, or provide services other than investigational analysis necessary to enable it to deliver its opinion of fairness.

[Marshall & Stevens LOGO]

Opinion of Fairness

Table of Contents

Transaction Overview 1

Procedures ; 9

Methodology � 0; 12

Target Company Dossier 16

Industry Dossier &# 160; 26

Income Approach Analysis 35

Public Market Approach Analysis 40

Summary of Value � 0; 45

Appendices ; 48

Comparable Companies Profiles 49

[Marshall & Stevens LOGO]

Opinion of Fairness

Transaction Overview

[Marshall & Stevens LOGO]

Opinion of Fairness

Transaction Timeline

| Date | Event |

| January 17, 2007 | Mr. Hayes expresses interest in acquiring certain assets of Host America’s Corporate Dining Division in a LOI addressed to the management of the Company. |

| February 7, 2007 | Host America retains Marshall & Stevens and charges Marshall & Stevens with the preparation of a Fairness Opinion relating to the potential transaction. |

| February 15, 2007 | Marshall & Stevens conducts due diligence sessions with Mr. David A. Murphy, Chief Executive Officer of Host America, and Mr. Hayes of Host America Corporate Dining, at the Pitney Bowes location where the Company has operations in Hamden, Connecticut to discuss the Company, history, revenue, operations, financials, and long-term strategy. |

| February 19, 2007 | Marshall & Stevens conducts a conference call with the Executive Committee of Host America to discuss Host America’s business, operations, financials, transaction strategy and rationale. |

February 23, 2007 | Marshall & Stevens presents its fairness opinion of Mr. Hayes’ acquisition of Host America Corporate Dining. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Purchase and Sale of Shares

Based on the LOI, the aggregate purchase price for Host America’s Corporate Dining Division will be One Million Two Hundred Thousand ($1,200,000.00) Dollars payable in cash in full at closing (the “Purchase Price”).

[Marshall & Stevens LOGO]

Opinion of Fairness

Terms of the Transaction

| § | Mr. Hayes proposes to purchase the following assets in regards to the proposed transaction with Host America Corporate Dining: |

| o | The name “Host America”, machinery, equipment including such computer equipment owned by Host America and related exclusively to the Business that is not located at 2 Broadway, Hamden Connecticut, all vehicles as described in Exhibit A of the LOI, customer lists, good will, inventory, furniture, fixtures, except that located at 2 Broadway, Hamden, Connecticut, customer accounts, contract rights, licensees and work in process of the Corporate Dining Division and all of Host America’s rights under all of its existing service agreements relating exclusively to the Company including all agreements to provide refreshment vending through third party providers in force prior to closing. |

| o | Also to be included are sales lists, list of suppliers, sale reports, cost sheets, processes, and know-how and copy rights of Host America relating exclusively to the Company and all rights to the Host America name and all food and non-food inventory of Host America on hand at the time of the closing relating exclusively to the Company (collectively, the “Assets”). |

| o | There is specifically excluded from the Assets to be conveyed hereunder (i) all cash on hand of the Company and (ii) all accounts receivable of the Company and all other indebtedness owing to the Company. |

| o | The parties anticipate the Assets shall be transferred at the closing free of any liens or encumbrances, except capitalized leases in connection with the Assets of the Company described above which the Buyer agrees to assume, with it being understood that (i) bank or other indebtedness secured by other assets will be discharged prior to the closing or contemporaneously with the closing, (ii) the Buyer will assume and agree to pay only designated liabilities of Host America, including without limitation such capitalized Leases, to be identified in the Definitive Agreement, and (iii) to the extent any contracts for the performance of services by the Company, that are assumed by the Buyer, have been prepaid or prebilled (and not payable to the Buyer), adjustments will be made at the closing to reimburse the Buyer for such amount. |

| o | The Buyer shall assume no employment contracts, employee benefit plans, printing contracts or other liabilities which are not in the Buyer’s sole discretion, necessary to conduct the business as conduct by Host America prior to the closing. |

| § | According to the sequence of events described on page 2, the Proposed Transaction has evolved to be defined by the following terms: |

| Consideration: | The Purchase Price for the Assets shall be One Million Two Hundred Thousand ($1,200,000.00) Dollars payable in cash in full at closing. Said Purchase Price shall be adjusted based on Marshall & Stevens’ Fairness Opinion such that the final Purchase Price be the greater of (i) the Purchase Price set forth herein, or (ii) the amount determined by such valuation. In the event of any increase to the Purchase Price, the Buyer may either: (i) advise Host America that it needs additional time, mutually acceptable to both Host America and the Buyer, to arrange financing, or (ii) advise Host America that it is terminating this agreement and Host America shall be free to sell the Company to any other party. Such Purchase Price may also be adjusted by an increase or reduction of the Purchase Price due to any new business obtained by the Company between the date hereof and the Closing Date and/or any cancellation or termination by clients of the Company resulting solely from the sale described herein provided Host America and the Buyer |

[Marshall & Stevens LOGO]

Opinion of Fairness

| | shall use their best efforts to preserve all relationships. These adjustments shall be agreed upon at the time of the Definitive Agreement. |

| | |

| Authorization: | The LOI and the Definitive Agreement shall be approved by the Board of Directors and Stockholders of Host America if necessary and further to the extent necessary any approvals required under relative regulations under federal and state securities laws. Any governmental agencies whose approval is required shall have unconditionally approved the transaction contemplated hereby and any and all waiting periods for consummating the transaction shall have lapsed. |

| Competing Offers: | For a period of 90 days from the date of the LOI, Host America will not directly or indirectly solicit, initiate or encourage the submission of inquiries, proposals or offers from any corporation, partnership, person, entity or any other group relating to any acquisition or purchase of the Company’s Assets, and neither the Buyer nor Host America will unilaterally terminate these negotiations during such period without case, unless the LOI is terminated. |

| Form of Transaction: | Cash payable in full at closing. |

| Final Documentation: | The parties shall use their good faith and best efforts to negotiate, prepare and finalize a merger agreement setting forth the above summarized terms and conditions typical for such transactions. Neither party shall be bound until a final written agreement is executed by both parties. |

| Financing: | Prior to entering into the Definitive Agreement, the Buyer shall demonstrate to the reasonable satisfaction of Host America that the Buyer has commitments with equity and financing sources so as to fully pay the Purchase Price in cash at Closing. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Transaction Rationale

| § | Host America deems necessary the sale of Corporate Dining in order to free up existing assets and attract additional capital to facilitate growth of the energy management segment of operations. |

| § | Management of Host America Corporation deems the divestiture of Corporate Dining to be in the best interest of all shareholders. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Implied Valuation Analysis

HOST AMERICA CORP. - CORPORATE DINING |

$ in 000s | | | | | | | |

| | | | | |

Summary of Value | | Low | | Mean | | High |

| | | | | | | | | |

| Income Approach | | $1,049 | | $1,170 | | $1,331 |

| | | | | | | | | |

| Market Approach | | $940 | | $1,210 | | $1,481 |

| | | | | | | | | |

Value of Common Equity | $995 | | $1,190 | | $1,406 |

[Marshall & Stevens LOGO]

Opinion of Fairness

Premium Analysis

HOST AMERICA CORP. - CORPORATE DINING |

$ in 000s | | | | | | | |

| | | | | |

Summary of Value | | Low | | Mean | | High |

| | | | | | | | | |

| Income Approach | | $1,049 | | $1,170 | | $1,331 |

| | | | | | | | | |

| Market Approach | | $940 | | $1,210 | | $1,481 |

| | | | | | | | | |

Value of Common Equity | $995 | | $1,190 | | $1,406 |

| | | | | | | | | |

| Purchase Price | | | $1,200 | | $1,200 | | $1,200 |

| | | | | | | | | |

| Purchase Price Premium | | 20.7% | | 0.8% | | -14.6% |

[Marshall & Stevens LOGO]

Opinion of Fairness

Procedures

[Marshall & Stevens LOGO]

Opinion of Fairness

Due Diligence

| § | In arriving at our Opinion, we inquired into, analyzed and reviewed, as deemed necessary and appropriate by us, information including, but not limited to: |

| § | Host America’s financial statements for the Fiscal Years ended June 30, 2004, 2005 and 2006, the six month period ended December 31, 2006, and the trailing twelve months ended December 31, 2006; |

| § | Host America’s latest 10-K filed with the Securities and Exchange Commission for the fiscal year ended June 30, 2006; |

| § | Publicly available financial data concerning certain companies deemed comparable, by Marshall & Stevens; |

| § | Third party reports concerning the food contracting services industry; |

| § | Research analyst reports regarding Host America, particularly the Host America’s food contracting services segment of operations; |

| § | Brochures and literature related to Host America; |

| § | Considered the nature of Host America’s business, history, revenue, earnings before interest and taxes, depreciation and amortization (EBITDA), earnings before interest and taxes (EBIT), book capital, and total assets for fiscal years ended June 30, 2004, 2005 and 2006, the six months ended December 31, 2006, and the trailing twelve months ended December 31, 2006; |

| § | Considered Host America’s future revenue, EBITDA, EBIT, dividend-paying capacity, and overall financial health; |

| § | Analyzed financial statements, prices and other materials regarding certain comparable and publicly traded companies involved in the food contracting services industry; |

| § | Compared particular statistical and financial information of Host America to particular statistical and financial information of certain comparable and publicly traded companies; |

| § | Analyzed prevailing rates of return on debt and equity capital; |

| § | Analyzed materials discussing the general industry and specific economic outlook; |

| § | Conducted interviews with management. |

In rendering this Opinion, we have relied upon, without independent verification, the accuracy and completeness of all financial and other information publicly available or furnished to us by the Company. We have assumed there has been no material adverse change in the business or financial condition of the Company subsequent to the date of the latest financial information provided to us or subsequent to the time that such information was provided to us.

[Marshall & Stevens LOGO]

Opinion of Fairness

Assumptions & Limiting Conditions

| § | No investigation of legal title was made, and we render no opinion as to ownership of the property or condition of its title. However, we assume good title to the Company’s assets and that the title of said assets is marketable. |

| § | The date of this Opinion is as of April 16, 2007. The dollar amount of any value reported is based upon the purchasing power of the U.S. dollar as of that date. The analyst assumes no responsibility for economic or physical factors occurring subsequent to the Valuation Date which may affect the Opinion reported. |

| § | The Company’s headquarters was visited during the course of this assignment. In addition, conference calls were conducted with the Senior Management and the Executive Committee of Host America. |

| § | Information supplied by others that was considered in this Opinion is from sources believed to be reliable, and no further responsibility is assumed for its accuracy. We reserve the right to make such adjustments to the Opinion herein reported as may be required by consideration of additional or more reliable data that may become available. |

| § | We assume there are no hidden or unexpected conditions of the assets of the Company that would adversely affect this Opinion. Further, we have inquired of the Company’s management and were informed that there are no hidden or unexpected conditions associated with the Company’s assets that would adversely affect value. |

| § | The fee for the formation and reporting of these conclusions is not contingent upon the Opinion expressed. |

| § | Neither the analysts involved nor any officer or director of Marshall & Stevens has any financial interest in the Company. |

| § | This Opinion and supporting notes are confidential. Neither all nor any part of the contents of this Opinion shall be copied or disclosed to any party other than as set forth herein or conveyed to the public, orally or in writing through advertising, public relations, news, sales or in any other manner without the prior written consent and approval of both Marshall & Stevens and its client. |

| § | Testimony or attendance in court by reason of this Opinion shall not be required unless arrangements for such services have previously been made. |

| § | Our conclusions assume the continuation of prudent management policies over whatever period of time is reasonable and necessary to maintain the character and integrity of the Company. |

| § | Marshall & Steven’s Opinion is based upon facts and data appearing in the Opinion and on current standards of valuation practice and procedure. We assume no responsibility for changes in market conditions. The conclusion stated in this Opinion is for the specific purpose as set forth in this Opinion and it is not valid for any other purpose. |

| § | No opinion is intended to be expressed for matters which require legal or specialized expertise, investigation or knowledge beyond that customarily employed by financial consultants. This Opinion does not address issues of law, engineering or code conformance. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Methodology

[Marshall & Stevens LOGO]

Opinion of Fairness

Income Approach Methodology

| § | The Income Approach is based upon the principle of anticipation. The Market Value of Invested Capital of a company is equal to the total present value of the perpetual stream of free cash flow it is expected to generate. |

| § | To apply the Income Approach, we project revenue from the Valuation Date to the end of the current fiscal year and for a certain number of years thereafter, assuming that cash flow is received in the middle of each applicable period. From each period’s revenue projection, we subtract forecasted expenses, depreciation, and taxes; add non-cash charges; and subtract other cash charges to derive net cash flow. |

| § | We calculate the present value of periodic cash flow using the company’s Weighted Average Cost of Capital (WACC). At the end of the projection period, we assume that free cash flow will grow at a constant rate in perpetuity and calculate the present value of the perpetual stream of cash flow. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Market Approach Methodology

| § | The Market Approach is based upon the principle of substitution. That is, if we could find a perfect substitute for the subject company among the Comparable Companies, then the subject company’s equity should be valued as that of the perfect substitute. Unfortunately, companies may differ according to capital structure, organization, corporate strategies, size, competitive environment, profitability and growth, among other factors. It is virtually impossible to identify companies that are identical to the company being valued; hence, use of the Market Approach requires objectivity and sound judgment. |

| § | In theory, multiples of revenue, EBITDA, and EBIT incorporate historical and possibly forecasted free cash flow, the proper discount rate, and industry growth rates. However, since there are no true perfect substitutes among companies, estimation of all such measures are error prone. Since both the Income and Market Approaches are subjective, we review the value indications in tandem to determine the value conclusion. |

| § | We calculated ratios of Enterprise Value to EBITDA and EBIT for each Comparable Company. Such multiples represent the market value of one dollar of EBITDA and EBIT, respectively. By applying selected multiples to the subject company’s EBITDA and EBIT for the forecasted twelve months ended January 31, 2008, we derive estimates of the Enterprise Value of the company. We calculate the value of Stockholders’ Equity using the Market Approach in the same manner in which we compute such value using the Income Approach. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Definitions

| § | Fair Market Value: The amount at which a property would change hands between a willing buyer and willing seller, each having reasonable knowledge of all pertinent facts and neither being under compulsion to buy or sell. |

| § | Market Value of Invested Capital: The total value of capital held by all investors in a company. |

| § | Enterprise Value: Market Value of Invested Capital, less the value of cash and cash equivalents. |

| § | Stockholders’ Equity: The fair value of a company’s net assets. |

| § | Controlling Interest: Any number of shares that represent a swing block that, when exercised, can influence a company’s operating, investing or financing decisions. Generally, an ownership interest of or in excess of 50% constitutes a controlling interest. |

| § | Minority Interest: Any number of shares that is less than a Controlling Interest in a company. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Target Company Dossier

[Marshall & Stevens LOGO]

Opinion of Fairness

Company Overview

| § | Since its formation in 1986, the Company has grown from a food service provider to institutions of higher education primarily in Connecticut to a regional, full-service food service provider for major corporations. The Company’s primary clients are medium-size corporate accounts with annual food sales between $250,000 and $2 million. These accounts provide a wide variety of food services in a single corporate location. At each location, any or all of the following customized services are provided: |

| o | office coffee services; and |

| o | employee gift and sundry stores. |

| § | At most locations, the Company is the exclusive provider of food and beverages and is responsible for hiring and training personnel. On-site managers work closely with corporate officers to ensure continuing food quality and customer satisfaction. |

| § | New accounts are assigned to a member of management who develops a comprehensive plan to meet each client’s specific needs. After extensive interviews and on-site visits, an operating strategy is formulated to best meet the needs of each individual client. Host America considers various factors to maximize profit potential without sacrificing client satisfaction, including a thorough review of: |

| o | labor and product costs; |

| o | facility and menu design; |

| o | training and recruiting; |

| o | specialized needs of the client or its employees; and |

| § | Each location is continually reviewed to monitor client employee satisfaction, evolving menu requirements and quality of food and service. Based upon reports supplied by on-site managers, additional services are added as demand changes, including upgrades of catering facilities and food selection. |

Staffing

| § | Client accounts are staffed by several levels of management-level employees. District managers are responsible for overseeing the client accounts in their region, as well as forecasting the budget for each account and assisting the on-site management at each location. The on-site manager is responsible for the day-to-day activities of the account and for ensuring continuing food quality and satisfaction. In the smaller accounts, a chef/manager will perform these duties. The supporting personnel at each location may include: |

[Marshall & Stevens LOGO]

Opinion of Fairness

Business Strategy

| § | The Company introduced its “Food Serve 2000” as a means of working with customers to evaluate and adapt existing food operations to maximize and maintain client satisfaction. Host America studies the basic elements of food service at each location, including: |

| o | traffic flows and waiting times; |

| o | menu variety and food presentation; |

| § | On-site managers strive to maintain: |

| o | custom designed menus to meet regional and ethnic tastes; |

| o | facilities with state-of-the-art equipment; |

| o | strict cost containment policies; and |

| o | nutritional programs for better health. |

| § | After the Company’s comprehensive evaluations, each facility is reviewed with the client to select the best possible combination of food and service. Food Serve 2000 allows Host America Corporate Dining to make rapid changes at a given location before employee dissatisfaction results in a termination of a contract. If a problem develops at a local level, management has the ability to rapidly deploy individuals specializing in that area and seek a solution. |

Marketing

| § | The Company selectively bids for privately owned facility contracts and contracts awarded by governmental and quasi-governmental agencies. Other potential food service contracts come through: |

| o | conversations with suppliers, such as purveyors and vending machine suppliers; |

| o | trade shows and conventions; and |

| § | New clients generally require that the Company submit a bid and make a proposal outlining a capital investment (if required) and other financial terms. The Company may be required to make capital improvements to the client’s facility at the start of the contract to secure an account. |

| § | Host America also expends a great deal of time and effort preparing proposals and negotiating contracts. In certain cases, a private facility owner may choose to negotiate with the Company exclusively, in which case the Company does not have to participate in any bidding process. |

| § | In attracting office building clients, the Company has constantly upgraded the quality of food service and customer services. Host America Corporate Dining strives to provide menu items which are healthy and higher in quality than typical fast food or cafeteria style products. |

[Marshall & Stevens LOGO]

Opinion of Fairness

| | § | The Company’s philosophy is that to the extent customers are able to satisfy their meal needs at their employer’s cafeteria, the less time those employees are away from their office setting. This results in an increase in corporate and individual productivity. Further, if Host America Corporate Dining can satisfy the employees with more diverse and higher quality food items, employers will frequently subsidize all or a portion of the costs. |

| § | Host America implemented new marketing programs at its facilities such as “cruisin’ cuisine” and “celebrity chefs” to help maximize sales growth. In the cruisin’ cuisine program, corporate chefs travel from location to location in a custom outfitted vehicle and present a complete specialty theme promotion menu such as fresh sushi, a taste of Havana, or authentic Japanese stir-fry. In the celebrity chefs program, the recipes and culinary style of featured world class chefs are presented in the business dining location. Every three months, a different celebrity chef is featured. According to the Company, their clients’ responses to these programs have been very favorable. |

Major Clients and Contracts

| § | Host America has a number of multi-year contracts. These contracts are with Fortune 500 businesses in the Connecticut area, each with multiple locations serving over 4,500 total contracted employees. |

| § | Additional large cafeteria units in the Fairfield, Connecticut and Westchester, New York counties will continue to be pursued. In the past, the Company has had to close facilities due to price competition and relocation. |

| § | As of the fiscal year ended June 30, 2006, Host America’s two largest contracts accounted for approximately 15% of its total revenue. Collectively, contracts with the Company’s two largest customers constituted approximately 27% and 18% of business dining revenues, respectively. However, Host America lost its second largest client at the end of the year 2006 and the Company’s largest customer now accounts for 40% of its total revenue. If the Company was to lose this major contract, such loss may have a material adverse effect on the Company. |

Competition

| § | Host America has encountered significant competition locally and nationally in the contract food service market. Food service companies compete for clients on the basis of: |

| o | quality and service standards; |

| o | local economic conditions; |

| o | innovative approaches to food service facility design; and |

| o | maximization of sales and price (including the making of loans, advances and investments in client facilities and equipment). |

| § | Host America competes with several companies that provide service on a national basis who have greater overall resources at their disposal. |

| § | In addition, existing or potential clients may elect to “self operate” their food service, eliminating the opportunity for the Company to compete for their business. |

| § | Host America believes they can compete with their larger competitors due to: |

| o | direct, hands-on management contact with client facilities on a weekly basis; |

| o | flexible menus to satisfy customer wants and desires; and |

[Marshall & Stevens LOGO]

Opinion of Fairness

| o | intensive training for managers. |

| § | Competition may result in price reductions, decreased gross margins and loss of market share. |

Employees

| § | As of November 1, 2006, Host America had approximately 185 full-time employees and 10 part-time employees employed for special occasions and seasonal busy times. |

| § | None of the Company’s employees are represented by a union. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Analysis of Financial Performance

There are three primary financial statements: the balance sheet, income statement, and statement of cash flows. In accordance with the purpose of this valuation, we deemed most pertinent the analysis of the balance sheet and income statement. The balance sheet records a company’s financial information (assets, liabilities, and net worth) as of a single moment in time. The value of a company’s assets equals the combined value of its liabilities and net worth. The income statement records the flow of revenue and expenses that contribute to net income over a single period of time. Net income is either used to increase a company’s retained earnings (which appear on the balance sheet as part of a company’s net worth) or is distributed to shareholders in the form of dividends.

The Balance Sheet

Every company expects to convert its assets into revenue at a future point in time. To accumulate such assets, the company may incur liabilities. The difference between the value of a company’s assets and the value of its liabilities equals the company’s net worth. A company may expect to convert its assets into revenue within one year (such assets are considered current) or within a period in excess of one year (such assets are considered non-current). Likewise, a company may expect to have to redeem its liabilities within one year (such liabilities are considered current) or within a period in excess of one year (such liabilities are considered non-current).

Current assets typically yield short-term rates of return or represent a short-term cost of capital, and may include cash and cash equivalents, receivables the company expects to collect within one year, inventory the company expects to sell within one year, and prepaid expenses the company expects to offset against revenue within one year. Non-current assets typically yield long-term rates of return or represent a long-term cost of capital, and may include a company’s fixed assets and other long-term investments. Current liabilities may include payables, short-term notes, and the current portion of long-term debt that the company expects to settle within one year. Non-current liabilities may include the portion of long-term debt that is not expected to be redeemed within one year and other long-term liabilities. A company’s equity may be composed of paid-in capital (the amount that the company’s owners have contributed to the company over time), retained earnings (an accumulation of net income earned by the company, less amounts paid to date as dividends to the company’s owners), treasury stock (forms of equity held by the company itself), and other various forms of equity.

The Income Statement

Revenue received during a single period of time and the cost of producing the goods and services sold are recorded on the income statement. After subtracting the cost of sales from revenue, a company realizes its gross profit. Firms also incur expenses related to operating its business. Although these costs cannot be associated directly with any product, they must be reflected in the income a company recognizes in each period. After subtracting such operating expenses from gross profit, a company realizes its operating profit. Typically such operating profit includes the periodic expense associated with depreciation and amortization of the company’s assets. A company realizes its earnings before interest, taxes, depreciation and amortization (EBITDA) by adding such expense for depreciation and amortization back to operating profit. A company may receive income from or pay expenses to other sources, such as external investments. Such income or expenses may include the value of interest due from its holdings or payable on its debt. After subtracting both amounts related to such income or expense and income taxes from operating income, a company may realize its net income for the period.

[Marshall & Stevens LOGO]

Opinion of Fairness

Statement of Financial Position

| | Reported, FYE 30 June | As of |

STATEMENT OF FINANCIAL POSITION | 2004 | 2005 | 2006 | 12/31/2006 |

(in thousands) | | | | |

| Cash & Equivalents | $1,031 | $647 | $167 | $541 |

Percentage of Total Assets | 51.3% | 35.9% | 13.3% | 26.5% |

| Accounts Receivable, Net | 633 | 858 | 796 | 1,218 |

Percentage of Total Assets | 31.5% | 47.5% | 63.4% | 59.6% |

| Inventory, Net | 265 | 258 | 205 | 206 |

Percentage of Total Assets | 13.2% | 14.3% | 16.4% | 10.1% |

| Other Current Assets | 47 | 33 | 79 | 71 |

Percentage of Total Assets | 2.3% | 1.8% | 6.3% | 3.5% |

Current Assets | 1,976 | 1,796 | 1,247 | 2,036 |

Percentage of Total Assets | 98.2% | 99.5% | 99.3% | 99.6% |

| | | | | |

| Fixed Assets, Net | 35 | 9 | 8 | 9 |

Percentage of Total Assets | 1.8% | 0.5% | 0.7% | 0.4% |

| Goodwill | - | - | - | - |

Percentage of Total Assets | 0.0% | 0.0% | 0.0% | 0.0% |

| Note Receivable | - | - | - | - |

Percentage of Total Assets | 0.0% | 0.0% | 0.0% | 0.0% |

| Other Long-Term Assets | - | - | - | - |

Percentage of Total Assets | 0.0% | 0.0% | 0.0% | 0.0% |

Total Assets | $2,012 | $1,805 | $1,255 | $2,045 |

Percentage of Total Assets | 100.0% | 100.0% | 100.0% | 100.0% |

| | | | | |

| Accounts Payable & Accrued Liabilities, Current | 1,005 | 927 | 791 | 1,208 |

Percentage of Total Assets | 50.0% | 51.3% | 63.0% | 59.1% |

| Accrued Liabilities | 128 | 87 | 104 | 96 |

Percentage of Total Assets | 6.4% | 4.8% | 8.3% | 4.7% |

Current Liabilities | 1,133 | 1,013 | 895 | 1,304 |

Percentage of Total Assets | 56.3% | 56.1% | 71.3% | 63.8% |

| | | | | |

| Long-Term Debt | - | - | - | - |

Percentage of Total Assets | 0.0% | 0.0% | 0.0% | 0.0% |

| Other Long-Term Liabilities | - | - | (947) | - |

Percentage of Total Assets | 0.0% | 0.0% | -75.5% | 0.0% |

Total Liabilities | 1,133 | 1,013 | (52) | 1,304 |

Percentage of Total Assets | 56.3% | 56.1% | -4.2% | 63.8% |

| | | | | |

| Stockholders' Equity | 878 | 792 | 1,308 | 740 |

Percentage of Total Assets | 43.7% | 43.9% | 104.2% | 36.2% |

Total Liabilities & Stockholders' Equity | $2,012 | $1,805 | $1,255 | $2,045 |

Percentage of Total Assets | 100.0% | 100.0% | 100.0% | 100.0% |

[Marshall & Stevens LOGO]

Opinion of Fairness

Financial Position Review

Current Assets decreased 9.1% between 2004 and 2005 from $2.0 million to $1.8 million, and decreased 30.6% between 2005 and June 30, 2006 to $1.2 million. Current Assets then increased by 63.3% as of December 31, 2006 to $2.0 million. During this period, Current Assets equaled 98.2%, 99.5%, 99.3%, and 99.6% of Total Assets, respectively. Current Assets declined between 2005 and 2006 due to a reduction in Cash and Cash Equivalents from $0.6 million to $0.2 million. Current Assets managed to increase on December 31, 2006 due to an increase in Cash and Cash Equivalents to $0.5 million and an increase in Net Accounts Receivable from $0.8 million on June 30, 2006 to $1.2 million on December 31, 2006.

Fixed Assets decreased 74.3% from $35,000 in 2004 to $9,000 in 2005. On June 30, 2006, Fixed Assets decreased 12.5% to $8,000, but increased again to $9,000 on December 31, 2006. As a percentage of Total Assets, Fixed Assets equaled 1.8%, 0.5%, 0.7%, and 0.4% in each respective year. Due mainly to the decreases in Current Assets, Total Assets decreased 10.3% between 2004 and 2005 from $2.0 million to $1.8 million, decreased 30.5% on June 30, 2006 to $1.3 million, and increased by 62.9% on December 31, 2006 to $2.0 million.

Current Liabilities declined 10.6% between 2004 and 2005 from $1.1 million to $1.0 million. On June 30, 2006, Current Liabilities decreased 11.6% to $0.9 million. Six months later, Current Liabilities increased by 45.7% to $1.3 million on December 31, 2006. During the historical period, Current Liabilities equaled 56.3%, 56.1%, 71.3%, and 63.8% of Total Assets in each respective period. There was no Long Term Debt incurred by the Company from 2004 to 2006. In 2006, an amount of $947 million was gained as a Long Term Liability from Host America and recorded as a negative liability on the Company’s balance sheet. This caused Total Liabilities to decrease 105.1% between 2005 and June 30, 2006 from $1.0 million to negative $52,000.

Stockholders’ Equity experienced a decrease of 9.8% between 2004 and 2005 from $0.9 million to $0.8 million. Stockholders’ Equity increased by 65.2% on June 30, 2006 to $1.3 million, then decreased by 43.4% on December 30, 2006 to $0.7 million. The increase on June 30, 2006 was primarily due to the large offset of Long Term Liabilities in this period. As a percentage of Current Assets, Stockholders’ Equity was 43.7%, 43.9%, 104.2%, and 36.2% on June 30, 2004, June 30, 2005, June 30, 2006, and December 31, 2006, respectively.

[Marshall & Stevens LOGO]

Opinion of Fairness

Statement of Operations

| | Reported, FYE 30 June | TTM |

STATEMENT OF OPERATIONS | 2004 | 2005 | 2006 | 12/31/2006 |

(in thousands) | | | | |

| Revenue | $12,820 | $13,135 | $12,113 | $12,699 |

Percentage of Revenue | 100.0% | 100.0% | 100.0% | 100.0% |

| | | | | |

| Cost of Goods Sold | 11,653 | 12,002 | 10,944 | 11,359 |

Percentage of Revenue | 90.9% | 91.4% | 90.4% | 89.4% |

| | | | | |

| Gross Profit | 1,167 | 1,133 | 1,169 | 1,340 |

Percentage of Revenue | 9.1% | 8.6% | 9.6% | 10.6% |

| | | | | |

| Operating Expenses | 613 | 615 | 611 | 641 |

Percentage of Revenue | 4.8% | 4.7% | 5.0% | 5.0% |

| | | | | |

EBITDA | 555 | 519 | 558 | 700 |

Percentage of Revenue | 4.3% | 3.9% | 4.6% | 5.5% |

| | | | | |

| Depreciation & Amortization | 89 | 26 | 30 | 31 |

Percentage of Revenue | 0.7% | 0.2% | 0.2% | 0.2% |

Operating Income | 466 | 492 | 528 | 669 |

Percentage of Revenue | 3.6% | 3.7% | 4.4% | 5.3% |

| | | | | |

| Interest Expenses/(Income) | - | - | - | - |

Percentage of Revenue | 0.0% | 0.0% | 0.0% | 0.0% |

| Non-Operating Expenses/(Income) | 59 | (6) | - | - |

Percentage of Revenue | 0.5% | 0.0% | 0.0% | 0.0% |

Earnings Before Taxes | 407 | 498 | 528 | 669 |

Percentage of Revenue | 3.2% | 3.8% | 4.4% | 5.3% |

| | | | | |

| Income Taxes | 10 | 9 | 12 | 13 |

Percentage of Revenue | 0.1% | 0.1% | 0.1% | 0.1% |

Net Income | $397 | $489 | $516 | $656 |

Percentage of Revenue | 3.1% | 3.7% | 4.3% | 5.2% |

| | | | | |

Loss (income) from discont. Ops | | | | |

Net Income (including (loss) income from discont. Ops | $397 | $489 | $516 | $656 |

| Capital Expenditures | - | - | - | - |

Percentage of Revenue | 0.0% | 0.0% | 0.0% | 0.0% |

[Marshall & Stevens LOGO]

Opinion of Fairness

Operations Review

The Company’s Revenue, in absolute dollar value, increased 2.5% between 2004 and 2005 from $12.8 million to $13.1 million. Revenue then experienced a decrease of 7.8% in 2006 to $12.1 million. The decrease in Revenue in 2006 is primarily attributable to the loss of the Company’s second largest client, United Health, who purchased Oxford Health during this period. From fiscal year 2004 to fiscal year 2006, Revenue declined at a CAGR of 2.8%. On a trailing twelve month (TTM) basis, Revenue increased by 4.8% to $12.7 million for the twelve months ended December 31, 2006, compared to Revenue of $12.1 million in fiscal year 2006.

Cost of Goods Sold (COGS) increased by 3.0% between 2004 and 2005 from $11.7 million to $12.0 million. In fiscal year 2006, COGS decreased by 8.8% to $10.9 million. As a percentage of Revenue, COGS equaled 90.9%, 91.4%, and 90.4% in fiscal years 2004, 2005, and 2006, respectively. In this two year period, COGS decreased at a CAGR of 3.1%. On a TTM basis, COGS increased by 3.8% to $11.4 million for the twelve months ended December 31, 2006, compared to fiscal year 2006.

From 2004 to 2005, Operating Expenses increased 0.3% from $613,000 to $615,000. In 2006, Operating Expenses experienced a decrease of 0.7% to $611,000. As a percentage of Revenue, Operating Expenses was 4.8%, 4.7%, and 5.0% in fiscal years 2004, 2005, and 2006, respectively. This represents a decline in CAGR of 0.2% between 2004 and 2006. According to Company management, Operating Expenses in TTM 2006 are estimated to stay at approximately the same percentage of Revenue as in fiscal year 2006.

EBITDA decreased by 6.5% between 2004 and 2005 from $555,000 to $519,000. In 2006, EBITDA increased by 7.5% to $558,000. As a percentage of Revenue, EBITDA fluctuated at 4.3%, 3.9%, and 4.6% in 2004, 2005, and 2006, respectively. EBITDA increased at a CAGR of 0.3% between 2004 and 2006. On a TTM basis, EBITDA increased by 25.4% to $0.7 million for the twelve months ended December 31, 2006, compared to fiscal year 2006.

Income from Operations, or EBIT, increased by 5.6% between 2004 and 2005 from $466,000 to $492,000. In fiscal year 2006, EBIT increased by 7.3% to $528,000. As a percentage of Revenue, EBIT was 3.6%, 3.7%, and 4.4% in fiscal years 2004, 2005, and 2006, respectively. Between fiscal years 2004 and 2006, EBIT grew at a CAGR of 6.4%. On a TTM basis, EBIT grew by 26.7% to $0.7 million for the twelve months ended December 31, 2006, compared to fiscal year 2006.

[Marshall & Stevens LOGO]

Opinion of Fairness

Industry Dossier

[Marshall & Stevens LOGO]

Opinion of Fairness

Industry Overview

| § | This industry comprises establishments primarily engaged in providing food services at institutional, governmental, commercial, or industrial locations of others based on contractual arrangements with these types of organizations for a specified period of time. |

| § | The establishments of this industry provide food services for the convenience of the contracting organization or the contracting organization's customers. The contractual arrangement of these establishments with contracting organizations may vary from type of facility operated (e.g., cafeteria, restaurant, fast-food eating place), revenue sharing, cost structure, to providing personnel. Management staff is always provided by the food service contractors. |

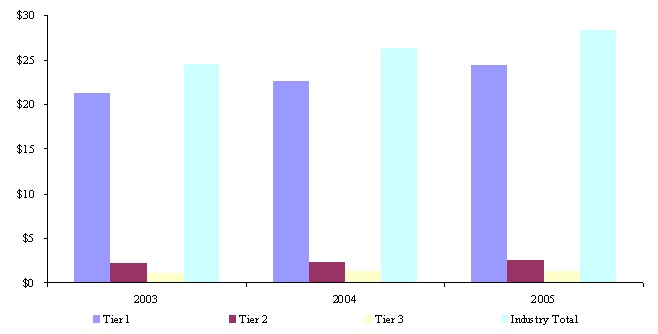

Industry Revenue Growth

| § | According to the industry consensus report released by Food Service Director (FSD) Magazine, an organization which reports on the non-commercial foodservice market, food service contractors experienced revenue growth from 2003 through 2005. |

| § | Revenues at 50 contract management firms participating in FSD’s annual Contractor Industry Census Report rose 8.3% last year, topping $28 billion (up from about $26.2 billion). They did so by adding nearly 2,300 accounts to their portfolios and, they hope, by increasing sales at existing locations. |

| § | At $28.4 billion, the contractors’ share of market increased from 24% in 2004 to 25.5% in 2005, according to FSD calculations of data each company submitted and revenue projections issued by industry researcher Technomic. In some cases, total revenue figures include facilities management businesses (which some companies do not itemize separately from foodservice). |

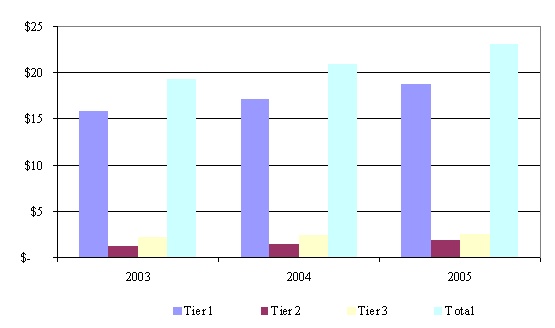

| § | The industry is segmented into three tiers. Each tier consists of companies that serve a variety of markets including colleges, hospitals, long-term care facilities, schools (excluding colleges), correctional facilities, recreational facilities and military complexes. Tier 1 consists of the largest firms in the industry classified as those that generate $1 billion or more in revenue. Tier 2 consists of firms that generate revenue ranging from $100 million - $999 million, and Tier 3 consists of firms that generate revenue under $100 million. |

| § | Revenue for all firms combined (Industry Total) experienced an increase in 2004 revenue of 7.6%, or $1.9 billion, to $26.4 billion and an increase of 7.6% in 2005, or $2.0 billion, to $28.4 billion. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Performance Report for 50 Top Contract Firms |

| | | | | |

| | | Total Contracts | % Revenue |

Contractor (headquarters location) | 2005 Revenues | 2005 | 2004 | Change +/- |

TIER 1 (5 companies) | $24,400,000,000 | 18,676 | 17,077 | 7.3 |

TIER 2 (9 Companies) | $2,644,387,084 | 1,837 | 1,443 | 11 |

TIER 3 (36 companies) | $1,367,183,484 | 2,523 | 2,362 | 9.5 |

GRAND TOTAL | $28,411,570,568 | 23,036 | 20,882 | 8.3 |

TIER 1: NATIONAL CONTRACT FIRMS ($1 BILLION-PLUS REVENUE) |

COMPASS GROUP (Charlotte, NC) | $7,400,000,000b | 8,342 | 7,448 | 14.7 |

ARAMARK (Philadelphia, PA) | $7,130,000,000b | 4,240 | 3,291 | 3.3 |

SODEXHO (Gaithersburg, MD) | $6,300,000,000b | 5,850 | 6,073 | 5 |

DELAWARE NORTH COMPANIES (Buffalo, NY) | $1,870,000,000 | 155 | 178 | 10 |

HMS HOST (Bethesda, MD) | $1,700,000,000 | 89 | 87 | NC |

TOTAL | $24,400,000,000 | 18,676 | 17,077 | 7.3 |

TIER 2: MIDSIZE CONTRACT FIRMS ($100-999 MILLION REVENUE) |

LEVY RESTAURANTS (Chicago, IL)c | $610,000,000 | 95 | 96 | 29.8 |

CENTERPLATE (Spartanburg, NC) | $607,000,000 | 133 | 129 | -1.5 |

GUEST SERVICES (Fairfax,VA) | $260,000,000 | 92 | 87 | 8.3 |

GUCKENHEIMER (Redwood Shores, CA) | $254,000,000 | 405 | 375 | 10.4 |

VALLEY SERVICES (Jackson, MS) | $223,387,084 | 281 | 275 | 5.2 |

BOSTON CULINARY GROUP (Cambridge, MA) | $212,000,000 | 152 | 140 | 6 |

THOMPSON HOSPITALITY (Herndon, VA) | $188,000,000 | 222 | 200 | 13.9 |

GOURMET SERVICES, INC. (Atlanta, GA) | $170,000,000 | 297 | NA | NA |

ANTON AIRFOOD (Washington, DC) | $120,000,000 | 160 | 141 | 25 |

TOTAL | $2,644,387,084 | 1,837 | 1,443 | 11 |

TIER 3: REGIONAL CONTRACT FIRMS (UNDER $100 MILLION REVENUE) |

CULINART (Lake Success, NY) | $97,000,000 | 102 | 125 | 2.1 |

LACKMANN CULINARY SVCS. (Woodbury, NY) | $83,726,484 | 124 | 121 | 5.1 |

METZ & ASSOCIATES (Dallas, PA) | $75,000,000 | 90 | 93 | 2.5 |

SOUTHERN FOODSERVICE MGMT. (Birmingham, AL) | $68,000,000 | 90 | 91 | NC |

PARKHURST DINING SVCS. (Harrisburg, PA) | $67,000,000 | 35 | 32 | 21.8 |

WHITSONS CULINARY GROUP (Islandia, NY) | $66,000,000 | 110 | 100 | 10 |

MMI DINING SYSTEMS (Jackson, MS) | $63,000,000 | 110 | 113 | 14.6 |

G.A. FOODSERVICE (Saint Petersburg, FL)a | $59,400,000 | 300 | 300 | NC |

ALADDIN FOOD MGMT SERVICES (Wheeling, WV) | $59,000,000 | 129 | 64 | 25.5 |

CURA HOSPITALITY, INC. (Orefield, PA) | $53,400,000 | 72 | 67 | 6.6 |

CL SWANSON CORP (Madison, WI) | $52,000,000 | 100 | 36 | 409.8 |

SANESE SERVICES (Columbus, OH) | $52,000,000 | 105 | 103 | -1.9 |

CREATIVE DINING SERVICES (Zeeland, MI) | $42,000,000 | 52 | 48 | 5 |

FITZ VOGT & ASSOCIATES, LTD (Walpole, NH) | $40,500,000 | 120 | 131 | -12.1 |

ALL SEASONS SERVICES INC. (Brockton, MA) | $35,000,000 | 101 | 100 | NC |

EPICUREAN FEAST (Maynard, MA) | $35,000,000 | 85 | 75 | 2.9 |

CORPORATE CHEFS (Haverhill, MA) | $35,000,000 | 103 | 100 | 6.1 |

UNIDINE CORP. (Newton, MA) | $35,000,000 | 62 | NA | NA |

POMPTONIAN FOOD SERVICES (Fairfield, NJ) | $33,800,000 | 56 | 51 | 21.6 |

BROCK & COMPANY (Malvern, PA) | $30,000,000 | 50 | 65 | NC |

MGR FOODSERVICES (Atlanta, GA) | $30,000,000 | 2 | 2 | NC |

ARBOR MANAGEMENT (Addison, IL) | $28,500,000 | 72 | 70 | 4 |

FAME FOOD MANAGEMENT (Wakefield, MA) | $27,500,000 | 43 | 45 | -2.8 |

RESTAURANT MARKETING ASSOCS. (Media, PA) | $27,500,000 | 21 | 21 | NC |

HOST AMERICA CORP. (Hamden, CT) | $27,040,000 | 76 | 76 | NC |

PRINCE FOOD SYSTEMS (Houston, NJ) | $24,000,000 | 28 | 30 | 3.9 |

WILLIAMSON HOSPITALITY SVCS. (Bluebell, PA) | $18,267,000 | 36 | 34 | 14.2 |

FOOD SERVICES INC. (Milwaukee, WI) | $13,150,000 | 29 | 28 | 7.4 |

LINTON’S MANAGED SERVICES (East Norton, PA) | $13,000,000 | 55 | 43 | 42.9 |

L.A. FOOD SERVICES (Summerville, NJ) | $12,000,000 | 58 | 58 | NC |

QUEST FOOD MANAGEMENT SVCS. (Glen Ellyn, IL) | $11,500,000 | 42 | 37 | 21.1 |

TRIPLE-A SERVICES (Romeoville, IL) | $11,000,000 | 8 | 8 | -50 |

ALLEN & OHARA (Memphis, TN) | $10,400,000 | 5 | 5 | 11 |

EXPOSERVE MANAGEMENT (Tulsa, OK) | $8,500,000 | 6 | NA | NA |

CONSOLIDATED MGMT. CO. (Des Moines, IA) | $8,000,000 | 32 | 43 | 14.3 |

METROPOLITAN FOODSERVICE (Massapequa, NY) | $8,000,000 | 6 | 6 | NC |

ACORN FOOD SERVICES (Newton Square. PA) | $7,000,000 | 8 | 10 | -17.6 |

TOTAL | $1,367,183,484 | 2,523 | 2,362 | 9.5 |

| NOTES: NC = no change; NA = not available; a = 2004 data; b = includes facilities management and vending; c = to become part of Compass Group in April 2006 |

[Marshall & Stevens LOGO]

Opinion of Fairness

Revenue for the Top 3 Tiers in the Food Service Industry

Revenue in Billions

Source: Food Service Magazine, 2006

Food Service Contractors

| § | Food service contractors engage in competitive bidding for client contracts. The number of clients a contractor can obtain, the agreeability of the terms of the contract into which both parties enter, and the number of those contracts that a contractor is able to renew, are critical factors of success. Food Service Director Magazine provides data relating to the number of contracts held by each firm in Tiers 1, 2 and 3 in 2003 through 2005. |

| § | Contracts held by Tier 1 companies remained flat at 17,100 in 2003 and 2004 and increased 9.4% to 18,700 in 2005. Contracts associated with Tier 2 companies decreased 6.7% from 1,500 in 2003 to 1,400 in 2004 and increased 28.6% to 1,800 in 2005. Contracts held by Tier 3 companies declined 11.1% from 2,700 in 2003 to 2,400 in 2004 and increased 4.2% to 2,500 in 2005. Overall, total contracts decreased 1.9% from 21,300 in 2003 to 20,900 in 2004 and increased 10.0% to 23,000 in 2005. |

| § | It is worth noting the disparity between the number of contracts held by the five companies in Tier 1 and those held by the 45 companies constituting Tiers 2 and 3. Tier 1 companies, through economies of scale, are afforded substantial bargaining power as it relates to contract negotiation and, therefore, are awarded the majority of contracts. For Example, the largest contracts negotiated during 2005 went to companies in Tiers 1 and 2. In April 2005, Sodexho (Tier 1) was granted a contract to cover 3,200 beds in 12 hospitals for Memorial Hermann Healthcare System; in May 2005, Chartwells-Thompson Hospitality (Tier 2) was awarded a contract worth over $100 million annually, covering 613 schools and over 400,000 students; Aramark (Tier 1), in September 2005, was awarded a contract of a Philadelphia school district worth about $24 million per year covering 115 schools and over 100,000 schools. |

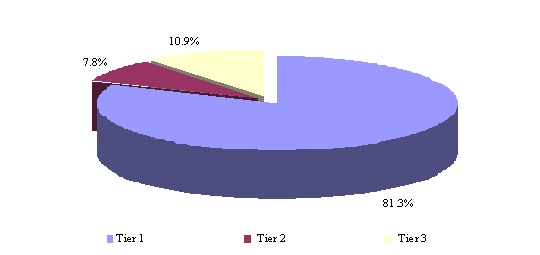

[Marshall & Stevens LOGO]

Opinion of Fairness

| § | From 2003 through 2005, total contracts held by companies in Tiers 1, 2 and 3 averaged 21,700. In 2005, of the 23,000 contracts outstanding, approximately 81.3%, 7.8% and 10.9% were associated with Tier 1, 2 and 3, respectively. |

Source: Food Service Magazine, 2006

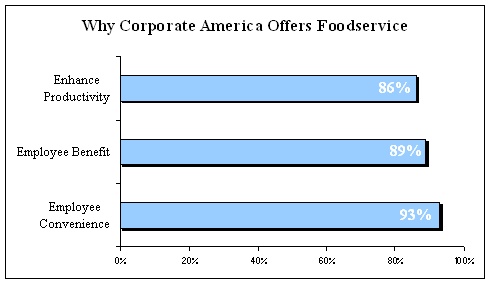

Corporate Dining Market

| § | Total foodservice sales remained relatively unchanged at 100 business-and-industry (B&I) foodservice operations from 2004 to 2005, according to FSD’s annual B&I Industry Census Report. Sales in the corporate dining market was $20.9 billion in 2005, representing 4.3% of the industry market share. |

| § | That follows an increase of 5.2% from 2003 to 2004, indicating how the market, while idle, has stabilized after several years of economic adversity. Technomic’s Outlook for the B&I segment in 2006 predicts nominal growth of 2%, while the NRA Forecast says it will grow 3.7% (though contract accounts will grow 4.2%, NRA says). |

| § | Meanwhile, the B&I market as a whole continues to face a formidable adversary: containing costs. This has been difficult because of gas, food costs and weather (specifically, 2005’s hurricanes). |

| § | The FSD census shows that just 8% of survey participants reported increases in customer counts last year, while counts remained flat at most. Given this, the challenge of maintaining value for customers in the meal experience will remain critical in 2006 and into 2007. Consumers in this market are price-sensitive, forcing companies to keep creating value-driven meals. |

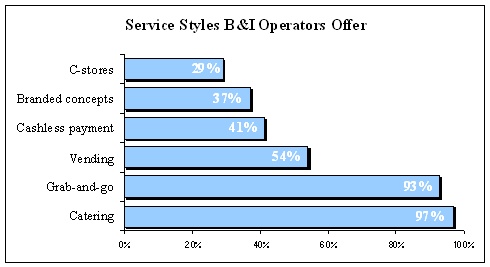

| § | Meal volume averaged 60% lunch and 40% breakfast among the 100 companies, according to census calculations, with scant dinner volume. More operators, in fact, continue to look at the morning day part for growth opportunities: among those saying breakfast meal counts grew last year, they averaged 21% more meals, compared to a 16% boost for those reporting more lunch volume. |

| § | Other B&I census data indicate that: |

| o | Operators oversee an average of 3.4 cafeterias, 2.2 dining rooms, 2.6 kiosks and two “other” facilities, such as a conference center, coffee shop or food cart. |

| o | 54% operate vending, with close to 100 machines available. |

[Marshall & Stevens LOGO]

Opinion of Fairness

| o | 29% operate c-stores, running an average of 1.67 units. |

| o | Most (97%) do catering, which averages 23% of total sales. |

Source: FoodService Director B&I Census Report, March 2006

Employee Culture

| § | An office worker survey shows that 75% of B&I customers frequently eat at the desk. More than 90% of corporate dining operations participating in the FSD B&I Census offer foods for grab-and-go, confirming that the shift away from meal consumption in the dining facility is now a way of life. |

| § | The trend created what Impulse Research Corp., of Los Angeles calls “Cubicle Culture” and prompted it to conduct a survey last fall to determine the extent to which workers are eating at their desks. |

| § | According to survey results, three-quarters of desk-workers eat at their desk at least two to three times per week. Nearly half, though, say they eat at their desk “nearly every day.” Lunch, of course, is the most frequently consumed “desk meal,” eaten by 75% of respondents. Almost 60% typically consume snacks throughout the day while 31% have breakfast at their desk. |

| § | Frequency of desk-eating may be correlated to length of lunch hour. Just under 10% say they get an hour or more for lunch; about 37% say they take 30 minutes to an hour, while one-third get 15 to 30 minutes for their mid-day meal. When asked to describe their workplace culture at lunchtime, 38% of respondents said: “What lunchtime? Most people are lucky to get a bite at their desks.” Just under one-third say lunchtime offers a chance to socialize with colleagues, while the remainder call it a “relaxing diversion from work.” |

| § | For nearly half of the respondents, a typical lunch included sandwiches, fruits and vegetables. About one-fifth bring leftovers from home, while another one-fifth get themselves a hot lunch (though the study doesn’t specify the source: cafeteria or restaurant). |

| § | The rise of desk-eating, while convenient for workers, has health officials concerned. There are concerns that desk-eating limits workers’ physical activity and could encourage over-eating. |

[Marshall & Stevens LOGO]

Opinion of Fairness

Source: FoodService Director B&I Census Report, March 2006

Competitive Landscape

| § | Large international companies dominate the cost foodservice market globally. Their success is a result of the increased cost efficiencies and high standard production of meals achievable through their large economies of scale. |

| § | M&A activity has created a less threatening business environment for the key players and a greater international presence. However, the rising price of basic foodstuffs may affect profit margins moving forward. |

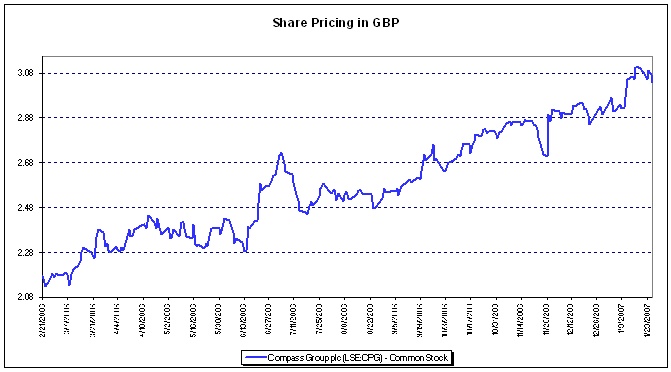

| § | Troubled Compass Group has benefited from a strong performance in the US market. The embattled company is expected to retain a small part of its travel concessions arm in the US. The struggling group is set to sell off its UK and continental European travel concession operations, the company will then possess a similar shape to its primary competitor in the US, Sodexho Alliance. |

| § | Sodexho also posted a strong performance in the US market, particularly in the health and education sectors. Sodexho School Services has developed a healthy range of snacks, beverages and lunches under the increasing pressure to offer healthier school meals using the United States Department of Agriculture (USDA) guidelines. The company also runs nutrition fairs at schools, offering education on the benefits of healthy food and tasters. Sodexho is also a provider for the US Marine Corps. Ongoing efforts in the Middle East should ensure consistent demand moving forward. |

Leading Companies

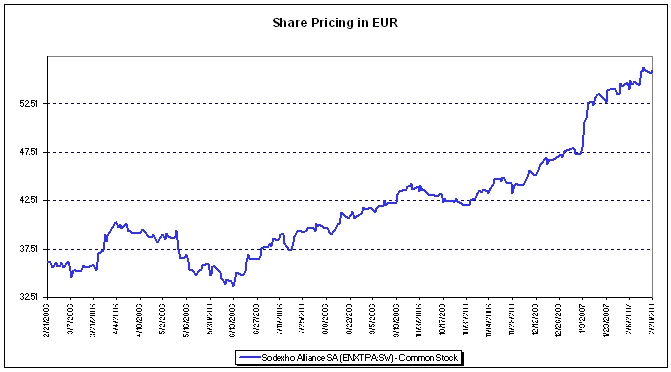

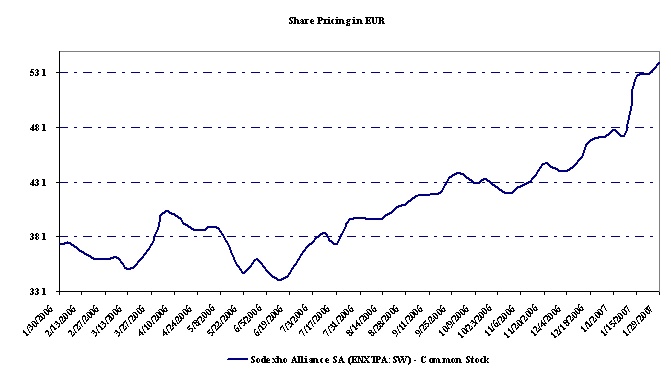

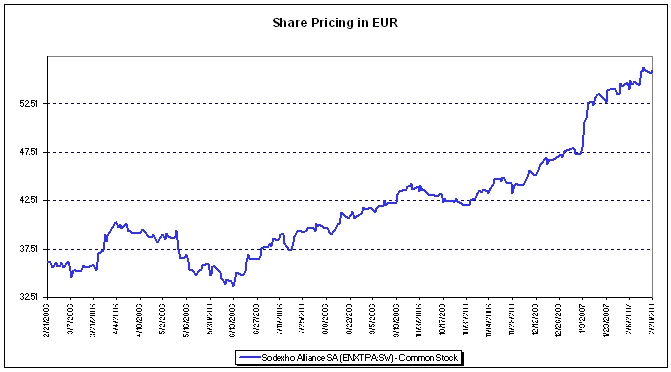

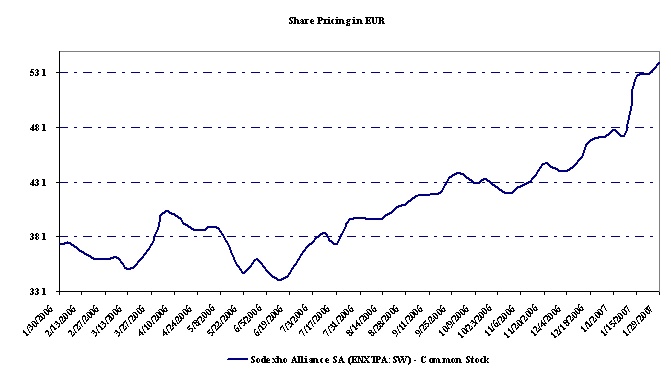

| o | Sodexho Alliance (Sodexho) is a leading global provider of services of food and management services, and service vouchers and cards. Worldwide, it is the second largest provider of food services and facilities management solutions. The company operates in more than 76 countries around the world. It is headquartered in Montigny Le Bretonneux, France and employs about 313,000 people. |

[Marshall & Stevens LOGO]

Opinion of Fairness