SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | x Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | For the fiscal year ended June 30, 2008 |

| | ¨ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number 0-16196

ENERLUME ENERGY MANAGEMENT CORP.

(Exact Name of Registrant as specified in its Charter)

Colorado (State or other jurisdiction of incorporation or organization) | | 06-1168423 (IRS Employer Identification No.) |

| | | |

Two Broadway Hamden, Connecticut (Address of Principal Executive Offices) | | 06518 (Zip Code) |

Registrant’s Telephone Number, including area code: (203) 248-4100

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 Par Value (Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of EnerLume Energy Management Corp. as of December 31, 2007, the last business day of EnerLume Energy Management Corp’s most recently completed second fiscal quarter, was $13,913,597, computed by reference to the price at which EnerLume Energy Management Corp’s common stock was last traded on that date.

At September 22, 2008, 13,924,612 shares of common stock of EnerLume Energy Management Corp’s were outstanding.

Documents Incorporated by Reference:

The information required by Part III of this Form 10-K is incorporated by reference to the Company’s Definitive Proxy Statement for the Company’s 2008 Annual Meeting of Shareholders page

1 of 86 pages Exhibits are indexed on page 38

TABLE OF CONTENTS

| | & #160; | Page No |

| 3 |

| | | |

| | 4 |

| | 4 |

| | 12 |

| | 20 |

| | 20 |

| | 21 |

| | 23 |

| | | |

| | 24 |

| | 24 |

| | 25 |

| | 25 |

| | 35 |

| | 36 |

| | 36 |

| | 37 |

| | | |

| | 38 |

| | | |

| | 38 |

| | 38 |

| 41 |

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are not statements of historical fact and may involve a number of risks and uncertainties. These statements relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These statements may also relate to our future prospects, developments and business strategies.

We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “will,” “plan,” “predict,” “project” and similar terms and phrases, including references to assumptions, in this Annual Report on Form 10-K to identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

| | · | our ability to retain and renew customer contracts; |

| | · | uncertainties in the competitive bidding process; |

| | · | our dependence on key personnel; |

| | · | the outcome of existing litigation and the potential for new litigation; |

| | · | intense competition in the industry segments in which we operate on a local and national level; |

| | · | the success of our electrical energy products segment and its ability to produce favorable revenue and profitability; and |

| | · | other factors including those discussed under “Risk Factors” in Item 1A of this Annual Report on Form 10-K. |

You should keep in mind that any forward-looking statement made by us in this Annual Report on Form 10-K or elsewhere speaks only as of the date on which we make it. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. We have no duty to, and do not intend to, update or revise the forward-looking statements in this annual report on Form 10-K after the date of this filing, except as may be required by law. In light of these risks and uncertainties, you should keep in mind that any forward-looking statement made in this Annual Report on Form 10-K or elsewhere might not occur.

Overview

In this Annual Report on Form 10-K, we use the terms “EnerLume,” “the Company,” “we,” “our,” and “us” to refer to EnerLume Energy Management Corp. and its subsidiaries.

Our Company

We are an outsource provider of electrical energy efficiency products and electrical energy management services that enable customers to manage their lighting infrastructure more effectively and reduce energy costs. As the economic cost of energy rises and the demand for energy conservation continues to increase, our mission is to provide products and design systems that provide new levels of efficient utilization of energy and utilities.

Our principal product, EnerLume | EM®, is a computerized energy savings device which improves the efficiency of fluorescent lighting systems. This is accomplished by reducing the amount of electricity needed to operate fluorescent lighting with limited light loss. EnerLume | EM® is most adaptable to large retail and manufacturing facilities that are heavily dependent on fluorescent lighting. With third party independent testing and proven field results of energy savings of up to 15%, EnerLume | EM® improves the efficiency of a lighting system by reducing the electrical energy consumed while maintaining energy loads to keep peak demands within user-defined limits. Once installed and connected to a facility’s utility meters, EnerLume | EM® allows the user to set and adjust electrical lighting demand set points to reduce energy consumption and load limits during peak or off peak usage hours. With the lighting system’s ballasts operating at the use prescribed levels, peak voltage for maximum light output can be regulated, reducing energy consumption and resulting in energy savings. Through a self-contained energy management system, EnerLume | EM® can also be programmed to automatically turn off or curtail the amount of fluorescent fixtures when not required, which can also provide additional energy savings.

We also provide full service electrical contracting and installation of electrical energy management services, through our RS Services segment located in Duncan, Oklahoma, to clients consisting of large retail chains primarily in the southeastern part of the United States. We specialize in the installation and design of electrical systems, energy management systems, telecommunications networks and retrofitting of existing electrical control panels. Our service electricians and technicians provide the necessary evaluation and installation service for our products and services. We also have a certified design engineer and certified alarm personnel on staff to assist with network cabling and compliance with local laws and regulations for high voltage electrical systems.

Our principal executive offices are located at Two Broadway, Hamden, Connecticut 06518 and our telephone number is (203) 248-4100. Our web site is www.enerlume.com. Any reference contained in this report to our web site, or to any other web site, shall not be deemed to incorporate information from those sites into this report.

Market Opportunity and Market Overview

The United States Department of Energy indicates that electrical consumption, which exceeds approximately $200 billion dollars annually, is projected to grow from 3,814 billion kilowatt hours in 2006 to 4,972 billion kilowatt hours in 2030, increasing at an average annual rate of 1.1 percent. The Department of Energy anticipates that increasing electrical demand may exceed the utility industry’s ability to produce sufficient electrical power. During 2004, the northeastern region of the United States and portions of Canada experienced total

grid power failure, in part as a result of insufficient electrical energy to satisfy the increase in demand. In addition, certain states continue to experience brownouts and high rate increases. Electricity prices have increased significantly over the past five years along with other energy commodities, such as oil, coal and natural gas, which have risen in price, further increasing the need for efficiency in energy management. To combat this growing problem, public utility companies throughout the United States have implemented programs to encourage energy conservation and management at the customer level to promote the replacement or retrofitting of inefficient lighting, heating and cooling equipment. Also, the increase in business operating costs due to increased utility costs will continue to diminish operating margins unless companies and residential consumers take proactive measures to increase electrical efficiencies and reduce waste.

We estimate that, in many applications, fluorescent lighting accounts for approximately 40% of a commercial or industrial electric utility bill.

These factors, plus continuing deregulation of utilities and increased competition are forcing electric utilities to become pro-active in promoting the purchase and installation of energy saving products and services by offering incentives similar to those currently being offered to customers of our channel partners within our energy conservation segment.

Competitive Strengths

We believe the following competitive strengths will enable us to compete effectively and capitalize on the rapid growth and demand for energy efficiency devices and related electrical installation and contracting services:

| | · | Superior energy efficiency product for fluorescent lighting systems; |

| | · | Proven field results yielding energy savings of 15% in large commercial and industrial applications; |

| | · | Established channel partners and distribution network; |

| | · | Outsourced manufacturing model and product development; and |

| | · | Easy to use on-site or off-site software with reliable monitoring and reporting capabilities. |

Growth Strategy

To attempt to capture a significant market share and optimize our financial performance, we have established broad based initiatives to expand our sales, service network, and marketing directly to large retail and manufacturing entities. Additionally, we have introduced new and innovative products in the existing electrical energy efficiency markets. Our mission complements and is indicative of a series of global economic and social responsibility initiatives that put energy conservation and efficiency in the forefront of future decision making for both businesses and individuals alike.

Recent Developments

Dismissal of Appeal – Hester Action

On August 8, 2008, a Stipulation of Dismissal of Appeal was filed in the United States Court of Appeals for the Second Circuit in re Yorks v. Host America Corp., Docket No. 08-1101-cv. Putative shareholder Bart C. Hester had appealed from an order of the United States District Court for the District of Connecticut on February 5, 2008, which approved the settlement of a shareholders derivative action over Mr. Hester’s objection. By agreement of all parties, the appeal was dismissed with prejudice.

On September 2, 2008, the Connecticut Superior granted the parties’ joint motion to dismiss a derivative action that had named the Company as a nominal defendant. The suit, captioned Bart Hester v. Geoffrey W. Ramsey, et al., Docket No. UWY-CV-05-5001448-S (“Hester” action), had been filed in 2005 and had also named as

defendants the Company’s board, Geoffrey Ramsey and Roger Lockhart. The court’s September 2, 2008 order dismisses the Hester action against all defendants with prejudice.

Private Placement

Between June 2008 and September 2008, we completed the sale of one unit consisting of an 18% convertible unsecured promissory note and common stock purchase warrants to one investor that met the definition of an “accredited investor” pursuant to Regulation D of the Securities Act of 1933. The total net proceeds to the Company were $500,000. The unit was sold for $500,000 and entitled the unit holder to 250,000 common stock purchase warrants which are exercisable for a five year period at $0.54 per warrant. The note bears interest at a rate of 18% per annum, payable at maturity in arrears in cash. The note will mature and be payable in full on January 30, 2009. The holder may convert the note and any accrued interest thereon, on January 30, 2009 into shares of common stock at a conversion rate of $0.47 per share. The Company did not pay a sales commission or other remuneration in connection with the sale of the note. The unit was purchased by the brother of Nicholas Troiano, a current director.

Note Maturity Extensions and Repricing Agreements:

Between June 2008 and July 2008, we entered into a promissory note extension agreement with the holders of $800,000 of the 12% secured convertible promissory note to amend the maturity date of the promissory notes pursuant to a promissory note extension agreement, in which the maturity date for the note was extended to June 30, 2010. The promissory notes shall continue to accrue interest at the rate of 12% per annum in accordance with their original terms. As an inducement to extend maturity, holders received warrants to purchase an aggregate 447,100 shares of the Company’s common stock exercisable until June 30, 2013 at $0.75 per share. On August 4, 2008, we offered to the holders a repricing agreement to reprice the convertible feature from $2.12 per share to $0.47 per share and to reprice the warrants from $0.75 per share to $0.54 per share.

On June 30, 2008, we entered into a promissory note extension agreement with the holders of the notes with a face value of $1,437,500 to amend the terms of the 7.5% unsecured promissory note. Pursuant to the promissory note extension agreement, the maturity date for the unsecured notes were extended to January 31, 2010, interest shall continue to accrue on the unsecured notes, and the Company shall continue to pay interest payments under the terms of the unsecured notes until the amended maturity date. As an inducement to the note holders to extend the maturity date, the Company issued aggregate warrants to purchase 718,750 shares of the Company’s common stock exercisable until June 30, 2014 at $0.75 per share, and on August 11, 2008, we offered a repricing agreement to reprice the warrants to the holders of the unsecured notes from $0.75 per share to $0.54 per share.

On August 4, 2008, we entered into a promissory note amendment agreement with the holders of the 9% unsecured convertible promissory notes to amend the terms of the convertible feature and to reprice the issued warrants. Pursuant to the promissory note extension agreement, the convertible feature for the unsecured note was amended from $1.50 per share to $0.47 per share, and repricing the warrants to the holders of the promissory notes from $1.80 per share to $0.54 per share.

On August 11, 2008 we offered to the holders of warrants issued between November 2007 through January 2008 with a $2.25 exercise price a Warrant Reissue Agreement that provides for the option to allow the Company to reprice the warrants from $2.25 per share to $0.54 per share.

Board Resignation

On September 28, 2008, Gilbert Rossomando resigned as a member of the Board of Directors of EnerLume Energy Management Corp. effective on that date. Mr. Rossomando resigned as a member of the Board due to other business obligations.

History

The Company was incorporated in Delaware on February 6, 1986 under the name University Dining Services, Inc. We subsequently reincorporated in Colorado in 1999 and changed our name to Host America Corporation. Historically, our principal business focus was as a regional food service provider. In 2003, our management decided it would be in our shareholders best interests to expand into the energy efficiency products and electrical services businesses and in February 2005, we acquired RS Services, Inc. In April 2007, in an effort to capitalize on improving margins in energy efficiency, we entered into agreements to sell our two major food service divisions so that we could concentrate exclusively on energy conservation services and products. The sales of these food service divisions were consummated in October 2007. On October 24, 2007, we changed our name to EnerLume Energy Management Corp. to reflect our new direction and business focus.

Products and Services

EnerLume | EM®

EnerLume | EM® is a lighting energy management system designed to reduce electric power required for operating magnetic or electronic ballasts in fluorescent lighting systems. EnerLume | EM® manages the incoming power by providing timing direction to the ballasts within a lighting system and directing or drawing power in such a way as to maintain full, peak voltage for maximum luminosity. This patent pending capability cuts energy costs while reducing light levels by such a small degree that it is virtually undetectable by the human eye.

EnerLume | EM® gives greater flexibility and control over new and existing fluorescent lighting systems by providing remote programming and allowing the user to adjust energy levels. Users can manage and program the system using Windows® based software. For example, this software allows EnerLume | EM® to be programmed to selectively curtail after hours lighting levels or trigger on/off timed events for even greater savings.

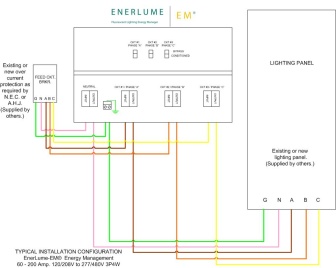

In typical installations, EnerLume | EM® is mounted adjacent to the fluorescent lighting panel to be treated. A single EnerLume | EM® unit can treat all fixtures fed by the lighting panel. EnerLume | EM® is UL and CUL listed and housed in a steel, NEMA rated enclosure. We offer six different models of our product to meet specific voltage and capacity requirements.

New Developments

As a company with a focus on providing energy efficiency products, we will continue to search for new and innovative ideas to develop products that will reduce energy consumption. Areas of interest are daylight harvesting, electric heating, demand response, lighting ballast and lamps.

To compliment our EnerLume│EM® product line, we are developing plans for the design of our own ballast for fluorescent lights. The goal is twofold: first to develop an energy efficient ballast, and second, to have the ballast work in conjunction with EnerLume │EM® and potentially provide greater savings. We aspire to develop a complete lighting system, including ballast, lamps and light fixture together with the EnerLume│EM® which, when used together, will provide maximum energy savings.

We are also increasing our research and development efforts to support electrical energy efficiency through light harvesting. Specifically, we have a fluorescent lighting ballast that can detect sunlight and adjust electrical light output to maintain desired light levels that is currently in the research stage. This application will produce energy savings in applications such as exterior perimeter locations in parking garages, the perimeter of buildings with glass enclaves and outdoor lighting.

New products, such as a demand response protocol, can automate and facilitate the communication between utility providers and end users under a utility sponsored load-shed program. This initiative works by allowing utilities to communicate to rate payers who have agreed to cut demand when the utility provider requests. The benefit for the utility companies under a demand response program is to curtail demand on those days when the electrical grid is under pressure to avoid a “brown out” or power failure. This effect would pre-plan the demand response event so that the reduction would not materially effect normal operational consumption and not compromise safety at the rate payers’ location. It would also ensure that the utility provider can rely on the proper demand reduction by allowing multiple rate payers share in the aggregate demand reduction required in an efficient load shed program. This system would be initially directed at lighting and it would be controlled with a direct connection to the internet.

As new ideas emerge from new and existing technology for energy efficiency, we will research the feasibility of developing such technology to help reduce electrical demand to satisfy the global need for energy conservation.

RS Services

RS Services is an electrical contract services firm which specializes in the installation and design of electrical systems, energy management systems, telecommunication networks and retrofitting of existing control panels and lighting systems. RS Services’ goal is to provide both large and small customers with significant savings on their electrical energy consumption and minimize downtime costs associated with power outages. In addition, RS Services provides:

| | · | Installation and Maintenance Services - including product enhancements, installation and product servicing and maintenance support to customers. |

| | · | Switchgear and Retrofit Contracts – services as both contractor and subcontractor for multi-location switchgear and retrofit contracts nationwide. These services include replacing older and inefficient equipment and electrical devices with new and more up-to-date energy efficient devices, such as circuit breakers and florescent lighting tubes and ballasts. |

Business Strategy

We intend to distribute our current and future energy saving products via partner distribution channels. These channels will be aimed to reach end-users through market leaders in different industry segments such as retail, commercial, industrial, and institutional. We believe that this distribution strategy will provide credibility and brand name recognition to our product. In addition, we intend to establish relationships with trade organizations that will endorse our product and offer the sale of our products and services to companies within their industry. This process should streamline and enhance our energy efficiency products operations entry into the marketplace.

Our long-term goal is to conduct research and development efforts, which may include new product launches and product expansions with a view to increasing revenues, market expansion, and name brand recognition and client loyalty. We will also continue to develop our relationships with large electrical suppliers, contractors, national large retail chains, office applications and property management companies.

As the economic cost of energy and demand for energy conservation continue to increase, our mission is to provide products and design systems that provide new levels of efficient utilization of energy and utilities. We will research, develop and provide the customized products, services and responsible information expected of a business committed to the high technology energy management marketplace.

Marketing

We utilize master channel partners and sub-distributors to market and sell for our current and future products. We primarily focus on commercial and industrial customers. We plan to establish brand awareness of our product and services through advertising, business to business, websites, industry and energy conservation seminars and trade exhibits to these customers. We will provide the support to our distributors in an effort to direct sales efforts to our distributors’ customers, who we believe are extremely sensitive to our nation’s growing energy costs. Additionally, we will direct efforts to identify potential customers in a particular industry group and those persons within an organization and who influence the organization’s energy savings program. We can determine which products and services will most benefit the customer and arrange for an onsite demonstration program and product modifications, if necessary, prior to installation. In addition to these demonstrations, our channel partner, with the support of our in-house technical staff, conduct extensive follow-up and initial commissioning of our system to insure customer satisfaction. We believe satisfied customers who have experienced energy savings first-hand are a key component to marketing the product to future customers.

Major Clients and Contracts

EnerLume Corp. currently has contracted with one master channel partner, Power Reduction Services (PRS), which provides channel partner support nationwide for approximately eighteen distributors. We also have contracted with seven direct channel partners, who have not fully committed to master channel partner status. Currently all of EnerLume Corp.’s revenue from product sales and technical services is derived from PRS. If we were to lose this major contract, such loss may have a short term material adverse effect on us.

RS Services pursues new contract services customers through the marketing and promoting of the division’s current network by developing relationships with restaurant, retail, commercial chains, general contractors and manufacturers. RS Services installs test sites of new products if the customer has the potential for a large number of installations.

Three of RS’s largest contracts accounted for approximately 24.1 %, 17.1% and 14.6% of our revenue from continuing operations for fiscal year ended June 30, 2008. If we were to lose these major contracts, such loss may have a material adverse effect on us.

Manufacturing and Research & Development

EnerLume | EM® is licensed to us and manufactured for us by our contract manufacturer, Pyramid Technologies Industrial, Inc. (“Pyramid”). We believe Pyramid has sufficient capacity to handle our anticipated growth in EnerLume | EM® sales for the foreseeable future. In addition, we believe that there are many contract manufacturers across the country that could manufacture EnerLume | EM® for us if for some reason our current contract manufacturer could not meet our needs. Most components of EnerLume | EM® are sourced from multiple suppliers nationwide and overseas, though some components are proprietary to a single manufacturer. Pyramid serves as both our contract manufacturer and assists with in-house research and

development efforts to further refine and test compatibility to certain existing florescent lighting technology and for new product development. Our in-house staff researches, develops and tests new product ideas and new technologies to simplify installations, commissioning and data collection of our existing product line. We work closely with Pyramid with efforts to provide increased efficiencies in procuring materials and product assembly, as well as field testing and compatibility.

Competition

While there have been many power reduction devices available for fluorescent light over the years, they have almost universally worked on the principle of restricting the amount of power a fluorescent light ballast can draw by reducing the peak voltage from the sine wave of the AC electric current. AC power is delivered in a sine wave at a rate of 60 times per second. Fluorescent lighting ballasts require this AC power to operate the fluorescent tubes. Reducing peak voltage or “topping” the sine wave curtails the voltage necessary to properly operate fluorescent ballasts which, in effect, dims ballasts that were not originally designed to be dimmable. The percentage of watts saved in this case is roughly equal to the percentage of lumens lost.

EnerLume | EM® works on a completely different principle. It does not limit the amount of power the fluorescent lighting ballast can draw. This patent pending process regulates the sine wave cycle as to when it may draw power. By regulating when on the sine wave cycle the fluorescent ballast may draw power, EnerLume | EM® allows the ballast to get the power it needs when it is efficient to do so. This prevents the “topping” of the sine wave and results in less power consumption and peak efficiency. Under this method, the ballast still provides very nearly all the power the fluorescent tubes need to maintain full brightness. This is the reason that there is no detectable loss of light despite a very significant electrical savings of up to 15%. This is simply because the EnerLume | EM® does not restrict the draw of electrical power to the ballasts, therefore guiding the ballast to create the needed power for the fluorescent tubes with less power pulled from the utility grid. This can lead to a lower operating temperature and extended ballast life.

Under our method, ballasts still provide very nearly all the power needed to maintain full brightness in the fluorescent tubes. As a result, the user can realize very significant electrical savings of 15% with no detectable loss of light. This is simply because the fluorescent tubes are still provided the AC power they need for operation. EnerLume | EM® guides the ballast to create the needed power for the fluorescent tubes with less power pulled from the utility grid. This leads to longer ballast life and reduced cooling costs.

There are currently a number of products and services on the market that indirectly compete with our existing product and directly or indirectly compete with our services. Many of these are offered by companies that are larger and better financed. However, we believe that although energy saving technology currently exists, our EnerLume | EM® light controller is capable of controlling, monitoring and saving electric kilowatt hours through a unique mechanism that has a limiting effect to luminosity which does not restrict the amount of power by reducing the peak voltage. Our product will also be capable of providing real-time variability of savings levels and operational control at off-site locations. Further, our equipment processor is digital, which is faster, more compact and more efficient than our competitors’ products. Finally, we believe that the installation of our equipment is less invasive and creates less of a disruption to a customer’s operation than that of our competition.

Favorable Governmental Regulation

Favorable government regulations like the Energy Policy Act of 2005 (“EPACT”) have provided incentives for organizations to take advantage and utilize energy conservation products. EPACT has brought sweeping changes to the benefit of organizations willing to participate in programs that curtail energy consumption. These changes include immediate tax deductions for qualifying investments that reduce energy costs on commercial applications of up to a maximum of $1.80 per square foot. This allows organizations a larger return on their investment via direct tax reductions and reduces the breakeven point associated with the purchase of our

systems and services. The U.S. Department of Energy’s longer term goal is for organizations to achieve a “Zero Energy Based” system, through which the net of total energy generated at an organization’s site and the total energy utilized at the site is zero, therefore eliminating the necessity to require energy from the power grid.

Intellectual Property

We rely upon a combination of patent applications, copyright, trade secret and trademark laws and contractual restrictions, such as confidentiality agreements and licenses, to establish and protect any proprietary rights owned by us or Pyramid Technologies Industrial, LLC.

We entered into a Proposal with Pyramid dated June 30, 2005 (the “Proposal”), whereby Pyramid agreed to apply for two patents for technologies related to reduction in harmonic distortion and to brownout protection. Pyramid has applied for one U.S. patent with respect to the EnerLume | EM®. This patent application, entitled “Apparatus and Methods for Reducing the Power Consumption of Fluorescent Lights” was filed on March 30, 2007.

According to the terms of the Proposal, Pyramid recognizes that certain intellectual property developed by Pyramid belongs to us upon completion of the project and payment in full by us. These intellectual property rights include “all patent rights for patents granted on the designs.” We believe that the project has been completed and payment in full including royalty payments will be completed upon the sale of 20,000 units.

Although we rely on patent, copyright, trade secret and trademark laws to protect our technology, we believe that factors such as the technological and creative skills of our personnel and those of our channel partners, creation of features and functionality and frequent enhancements to our energy solution are more essential to establishing and maintaining a technology ownership position.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or obtain and use our technology to develop products with the same functionality as our solution. Policing unauthorized use of our technology is difficult. Our competitors could also independently develop technologies equivalent to ours, and our intellectual property rights may not be broad enough for us to prevent competitors from selling products incorporating those technologies. Reverse engineering, unauthorized copying or other misappropriation of our proprietary technology could enable third parties to benefit from our technology without paying us for it, which would significantly harm our business.

We expect that energy saving products in our industry may be subject to third-party infringement claims as the number of competitors grows and the functionality of products in different industry segments overlaps. Such competitors could make a claim of infringement against us with respect to our EnerLume | EM® and underlying technology. Third parties may currently have, or may eventually be issued, patents upon which our current solution or future technology infringe. Any of these third parties might make a claim of infringement against us at any time.

Employees

As of September 22, 2008 our corporate office had 4 full time employees. Our RS Services subsidiary had approximately 45 full-time employees and no part-time employee. Our EnerLume Corp subsidiary had approximately 10 full-time employees and no part-time employees. None of our employees are represented by a union.

Properties

Our corporate offices are located at Two Broadway, Hamden, Connecticut 06518. Our telephone number is (203) 248-4100. We also have established a location on 1180 Sherman Avenue, Hamden, CT 06518. RS Services’ main office is located at 7806 N. Highway 81, Duncan, Oklahoma 73533.

We lease our corporate offices in Hamden under the terms of a month-to-month lease agreement, with a monthly payment of $4,040. We have recently entered into a lease agreement at 1180 Sherman Avenue, Hamden, CT for a five year agreement commencing on June 1, 2008. This location is expected to house our research and development and training operations. We lease RS Services’ offices in Duncan, Oklahoma from Ronald Sparks, the President of our RS Services subsidiary, pursuant to the terms of a five-year agreement with a monthly payment of $5,000. The RS Services lease has been determined to be at market rate. We also lease property at 233 S. Lindsay, Gilbert, AZ as a satellite office for south west operations for RS Services.

In addition to risk and uncertainties in the ordinary course of business that are common to all businesses, important factors that are specific to our industry and our company could materially impact our future performance and results. We have provided below a list of these risks factors that should be reviewed when considering our business and securities. These are not all the risks we face, and other factors currently considered immaterial or unknown to us may impact our future operations.

Risks Related to Our Business

We have a history of losses and our future profitability on a quarterly or annual basis is uncertain, which could have a harmful effect on our business and the value of our common stock.

Our consolidated statements of operations and our statements of operating cash flows reveal significant losses and the utilization of significant amounts of cash to support our operating activities. Although a substantial portion of the net loss in prior years was related to non-cash charges, there can be no assurance that adequate sources of financing will be obtained as required or that our assets will be realized and liabilities settled in the ordinary course of business. Our consolidated financial statements do not include any adjustments related to the recoverability of assets that might be necessary if we are unable to continue as a going concern nor the potential need to make sizable payments in connection with pending litigation.

In order to continue as a going concern, we will require additional financing. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms.

In addition, we are involved in litigation that can have an adverse effect on our operations. If an unfavorable ruling with these legal matters occurs, we may be forced to either restructure operations, or take other necessary and appropriate measures that could potentially limit our ability to exist further as a going concern.

Our independent registered public accounting firm has indicated substantial doubt about our ability to continue as a “going concern.” If we are unable to successfully implement our business plan and secure equity financing, we may be unable to continue as a going concern.

Our independent registered public accounting firm, in their report with respect to our financial statements as of June 30, 2008, and for two years in the period ended June 30, 2008, included a “going concern” qualification. As discussed in Note 2 to the audited financial statements, we have incurred significant losses and have negative cash flows from operations for the years ended June 30, 2008 and 2007, have a working capital deficiency and shareholders’ deficiency at June 30, 2008 and are currently involved in litigation that can have

an unfavorable effect on the Company’s operations. We plan to improve cash flow through continued focus, deployment and promotion of our energy conservation segment and the underlying technology associated with our EnerLume|EM®. We also plan to continue our efforts to identify ways of reducing operating costs and to increase liquidity through additional equity or debt financing.

We have financed our operations since inception primarily through equity and debt financings. We have recently entered into a number of financing transactions and are continuing to seek other financing initiatives. We will need to raise additional capital to implement our business plan. Such capital is expected to come from the sale of securities or the raising of additional debt. No assurance can be given that such financing will be available in sufficient amounts or at all. Our ability to continue our operations will be dependent upon obtaining such further financing. These conditions raise substantial doubt about our ability to continue as a going concern.

Material adverse legal judgments, fines, penalties or settlements could adversely affect our financial health and prevent us from fulfilling our obligations under our outstanding indebtedness.

Material adverse legal judgments, fines, penalties or settlements arising from our pending litigation could require additional funding. If such developments require us to obtain additional funding, we cannot provide assurance that we will be able to obtain the additional funding that we need on commercially reasonable terms or at all, which could have a material adverse effect on our results of operations and cash flows.

Such an outcome could have important consequences. For example, it could:

| | · | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other general corporate purposes, including debt reduction or dividend payments; |

| | · | increase our vulnerability to general adverse economic and industry conditions; |

| | · | limit our flexibility in planning for, or reacting to, changes in our businesses and the industries in which we operate; |

| | · | restrict our ability to introduce new technologies or exploit business opportunities; |

| | · | make it more difficult for us to satisfy our payment obligations with respect to our outstanding indebtedness; and |

| | · | increase the difficulty and/or cost to us of refinancing our indebtedness. |

Because our share price has been volatile, we may be the target of additional securities litigation, which is costly and time-consuming to defend.

In the past, following periods of volatility in the market price of a company’s securities, shareholders have often instituted class action securities litigation against those companies. We can provide no assurance that our share price will remain stable on a going-forward basis. Such litigation, coupled with existing shareholder litigation, could result in substantial costs and a diversion of management attention and resources, which could significantly harm our profitability and reputation. These market fluctuations, as well as general economic, political and market conditions such as recessions, may adversely affect the market price of our common stock.

Effective control by current officers and directors and significant sales of shares by officers and directors could have a negative impact on share price.

As of September 22, 2008, our officers, directors and their affiliates beneficially own 21.42% of the total voting stock outstanding, including options, convertible securities and warrants for common stock such individuals may have the right to exercise. Our articles of incorporation do not authorize cumulative voting

in the election of directors and, as a result, our officers and directors are in a position to have a significant impact on the outcome of substantially all matters on which shareholders are entitled to vote, including the election of directors. In addition, based on the large number of shares currently owned by management, any sales of significant amounts of shares by our officers and directors, or the prospect of such sales, could adversely affect the market price of our common stock. These individuals, if and when they sell their shares, are subject to the volume limitations imposed by Rule 144 with respect to sales by affiliates.

We may be required to reduce or eliminate some or all of our sales and marketing efforts or research and development activities if we fail to obtain additional funding that may be required to satisfy future capital needs.

We plan to continue to spend substantial funds to expand our sales and marketing efforts and our research and development activities related to our energy conservation product. Any cash generated from the operations of the on-going business, and/or other current sources of liquidity, the long-term financing of these marketing activities could require additional funding in the future. Our future liquidity and capital requirements will depend upon numerous factors, the cost and timing of sales and marketing, manufacturing and research and development activities, and competitive developments. Any additional required financing may not be available to us on satisfactory terms or at all. If we are unable to obtain financing, we may be required to reduce or eliminate some or all of these activities.

Any decrease in capital spending by our potential “end user” customer markets could have a material adverse effect on our business and results of operations.

Our “end user” target markets include distribution centers, warehouses, retail store chains, parking garages and the like. The capital spending policies of our potential “end user” customers can have a significant effect on the demand for our products. Such policies are based on a variety of factors, including the resources available to make such purchases, spending priorities and policies regarding capital expenditures. Any decrease in capital spending by our potential “end user” customers could have a material adverse effect on our business and results of operations.

Any failure to obtain and sustain market acceptance of our product could have a material adverse effect on our plan for growth and on our business and results of operations.

Our product represents alternatives and new concepts to traditional instruments and methods. As a result, our product may be slow to achieve, or may not achieve, market acceptance, as customers may seek further validation of the efficiency and efficacy of our technology. This is particularly true where the purchase of the product requires a significant capital commitment. Our failure to obtain and sustain such acceptances could have a material adverse effect on our plan for growth and on our business and results of operations.

Any changes in government regulations may adversely affect consumer demand for our products.

The market for our product in the United States is subject to or influenced by various domestic laws and acts. We design, develop and market our products to meet customer needs created by existing and anticipated regulations, and any changes in these regulations may adversely affect consumer demand for our products.

We have a limited operating history as an energy efficiency product company upon which to evaluate our potential for future success. Due to our limited operating history, it is difficult to forecast our future success.

To date, we have generated only limited revenues as an electrical energy efficiency products and services company. Significant marketing investment will be required in order to establish a sufficient market for our electrical energy efficiency product and build revenues. The technology underlying this product may not

become a preferred technology to address the energy management needs of our customers and potential customers. Failure to successfully develop and market future products on a timely and cost-effective basis could have a material adverse effect on our ability to compete in the energy management market.

The likelihood of our success must be considered in light of the risks and uncertainties frequently encountered by early stage companies in an evolving market. If we are unsuccessful in addressing these risks and uncertainties, our business will be materially harmed.

Our energy services segment has incurred significant operating losses since inception and may not achieve or sustain profitability in the future. The energy services segment’s failure to achieve profitability could result in our failure to continue as a going concern.

Our electrical energy services segment incurred losses in fiscal 2008 and fiscal 2007 of $25,750 and $2,044,706, respectively. We must overcome significant sales and operational challenges. In addition, our electrical energy services segment may be required to reduce the prices of its services in order to increase sales. If we reduce prices, we may not be able to decrease costs sufficiently to achieve acceptable profit margins. As our electrical energy services segment strives to grow its business, we expect to spend significant funds for general corporate purposes, including working capital, marketing, recruiting and hiring additional personnel, and research and development. To the extent that revenues do not increase as quickly as these costs and expenditures, our results of operations and liquidity could be materially adversely affected. If our electrical energy services segment experiences slower than anticipated revenue growth or if its operating expenses exceed its expectations, we may be required to cease operations. Even if it achieves profitability in the future, it may not be able to sustain it.

Our electrical energy services segment currently experiences volatility in its cash flows and is subject to an extended sales cycle in connection with the bidding process, purchasing of materials and the installation and testing of electrical systems. This business cycle could lead to significant operating losses for the foreseeable future.

Our electrical energy services segment is currently obligated, pursuant to the majority of its installation and service contracts, to pay all the costs of materials, labor, travel and installation of its systems prior to being paid by its customers. In addition, many of its projects extend over a lengthy period of time from the initial invitation to bid, to final installation and testing. Although our electrical energy services segment hopes to shorten this cycle, there can be no assurance its cash flow will improve or that it can profitably market this concept. If this trend continues or worsens due to the inability to convince our customers to pay as the project progresses from its initial stages through completion, our energy services segment’s cash flow and operating losses will continue to be significant, and we may be required to cease operations.

Patents and other proprietary rights provide uncertain protection of our proprietary information and our inability to protect a third party patent or other proprietary right may harm our business.

The patent position of companies engaged in the sale of products such as ours is uncertain and involves complex legal and factual questions. Issued patents can later be held invalid by a patent office or by a court. We cannot assure you that the pending patent rights to the technology for our EnerLume|EM® will not be challenged, invalidated, or circumvented or that the rights granted thereunder will provide us a competitive advantage. In addition, many other organizations are engaged in research and development of products similar to our energy conservation analytical instrumentation. Such organizations may currently have or may obtain in the future, legally blocking proprietary rights, including patent rights, in one or more products or methods under development or consideration by us. These rights may prevent us from commercializing new technology, or may require us to obtain a license from the organizations to use their technology.

We currently have limited trademark or patent protection with respect to the energy efficiency product developed. Our failure to protect our proprietary rights could result in substantial operating losses and the failure to effectively pursue our business plan.

We cannot assure that any patents, trademarks or copyrights or our other proprietary rights issued to, licensed or otherwise used by us, will not be challenged, invalidated or circumvented, or that the rights granted thereunder will provide competitive advantages to us. Furthermore, others may be able independently to develop substantially equivalent or superseding proprietary technology and an equivalent product or system may be marketed in competition with our products, thereby substantially reducing the value of any proprietary rights we may obtain in the future. We also may not be able to protect our proprietary technology from duplication. Additionally, the prevention of unauthorized use and disclosure of our intellectual property will likely become more difficult as our business grows. We could incur additional legal costs in defending any patent, trademark, copyright or other infringement claims or in asserting any patent rights, copyrights or other proprietary rights, including those granted by third parties, in a suit with another party. Our failure to protect our proprietary rights could have a material adverse effect on our business, financial condition and our overall results of operations.

Successful infringement claims by third parties could result in substantial damages, lost product sales and the loss of important proprietary rights.

There has been substantial litigation regarding patent and other intellectual property in various technology industries. In the future, we may be notified of allegations that we may be infringing on intellectual property rights with respect to the technology we are currently marketing for our electrical energy efficiency device. Should litigation be brought against us, such litigation could be extremely expensive and time consuming and could materially adversely affect our business, financial condition and results of operations, regardless of the outcome of the litigation. Such litigation could also result in loss of certain proprietary rights, significant monetary liability and barriers to product manufacturing.

Our future in energy efficiency largely depends upon the success of our EnerLume|EM® which relies solely upon the inherent software and firmware for its implementation as an energy savings device, for which we have contracted with the manufacturer for the ownership of the intellectual property. We anticipate expanding into new products utilizing this existing technology. Any potential successful litigation would stop the progress of our product line and seriously impede our ability to expand into the energy conservation industry. While our service division would continue to maintain contractual relationships with existing clients, our product line would cease. Any successful litigation against our intellectual property could materially harm our business.

Our energy products segment faces an inherent risk of exposure to product liability claims in the event that the use of its products results in injury. Product liability claims that fall outside of our insurance coverage would further contribute to our negative cash flows.

Our energy products segment faces the risk that materials used in the manufacture of the final product may be flawed or faulty, causing the product to fail or malfunction. Additionally, the product may not be used in the manner provided for in the instructions or in the way contemplated by the manufacturer. In the event that insurance coverage or contractual indemnification is not adequate, product liability claims could have a material adverse effect on our business. The successful assertion or settlement of any uninsured claim, a significant number of insured claims, or a claim exceeding our insurance coverage could have a material adverse effect on our business.

Our energy products segment faces an inherent risk of exposure to product liability claims in the event that the use of its products results in injury. Negative publicity related to a product liability claim could lead to the loss of customers and corresponding revenues.

Our energy products segment is highly dependent upon consumer perception of the safety and quality of our product, as well as similar products distributed by other companies. While our EnerLume|EM® is listed by Underwriter’s Laboratories, a nationally recognized safety standard that tests products for reasonably foreseeable risk of fire, electric shock and related hazards, the mere publication of reports asserting that such products may be harmful could have a material adverse effect on our operations, regardless of whether such reports are scientifically supported and regardless of whether the products are being used to their specifications.

Our service segment does not have any long-term agreements with our customers and our future success is dependent on repeat business and obtaining new customers.

Our electrical energy service segment’s success depends on attracting and retaining customers. Although we have client purchase orders, we do not have long-term contracts and depend on fluctuating demand for our product or services. One major service customer accounted for approximately 39.3% of our revenue for the 2008 fiscal year. There can be no assurance that we will be able to retain existing customers or attract new customers. The failure to retain existing customers or attract new customers would likely have a material adverse effect on future profitability.

The energy management industry and products designed to maximize energy efficiency are subject to rapidly changing customer demands and preferences in light of rapid technological advances. We will face substantial losses should our products not meet the demands of customers.

There can be no assurance that customers will continue to favor the product and services provided by us. A significant shift in customer preferences could have a material adverse effect on our business, financial condition and results of operations. In addition, products that gain wide acceptance with consumers may result in a greater number of competitors entering the market, which could result in downward price pressure that could adversely impact our gross profit margins. In addition, new products would require employee retraining, which we must commit to long before the ultimate sale to our customers. There can be no assurance that sufficient consumer demand will still exist at the time a final product is available for sale or that favorable gross profit margins will be maintained.

We believe our growth will be materially dependent upon our ability to provide new technologies, processes and products necessary to meet the needs of our customers and potential customers. The inability to anticipate and respond to these rapidly changing demands could have an adverse effect on our business.

The energy management industry is highly competitive. Our failure to effectively compete in the industry could result in operating losses and the inability to continue as a going concern.

Numerous companies, many of which have greater assets, personnel, distribution and other resources than us, compete with us in supplying newer and more technologically-advanced products and services. Our principal competition comes from similar companies that install products designed to maximize energy efficiency. With generally low barriers to entry, particularly in terms of employee training, additional competitors could enter the market. There can be no assurance that national or international companies will not seek to enter, or increase their presence in the industry. Several companies market and sell products that compete with us. Competition from any of these companies could have a material adverse effect on our operations.

There is limited reliable, comprehensive data available regarding the size of the energy management industry and the historic and future expected growth of such industry. We may be unable to implement our business plan, which is based on available data, resulting in operating losses and the potential inability to continue as a going concern.

Industry data and projections are inherently uncertain and subject to change. There can be no assurance that the industry is as large as we anticipated or that projected growth will occur or continue. In addition, underlying market conditions are subject to change based on economic conditions, consumer preferences and other factors that are beyond our control. There can be no assurance that an adverse change in the size or growth rate of the market will not have a material adverse effect on our business.

A decrease in electric retail rates could lessen demand for our energy efficiency product.

Energy efficiency products have the greatest profit potential in areas where commercial electric rates are relatively high. However, retail electric rates for commercial establishments in the United States may not remain at their current high levels. Due to a potential overbuilding of power generating stations throughout certain regions of the United States, wholesale power prices may decrease in the future. Because the price of commercial retail electric power is largely attributed to the wholesale cost of power, it is reasonable to expect that commercial retail rates may decrease as well. In addition, much of the wholesale costs of power are directly related to the price of certain fuels, such as natural gas, oil and coal. If the prices of those fuels decrease, the prices of the wholesale cost of power may also decrease. This could result in lower electric retail rates and reduced demand for our energy saving devices or to be developed devices.

Failure to effectively market our energy efficiency product could impair our ability to sell large quantities of our product.

One of the challenges we face in commercializing our energy efficiency product is demonstrating the advantages of our product over more traditional products and competitive products. As our energy products segment grows, we will need to further develop our marketing and sales force. If we are unable to expand our internal sales force, our ability to generate significant revenues could be harmed.

We depend upon our key personnel and may experience difficulty attracting and retaining key employees. The failure to retain existing management or the failure to hire new talent as needed could result in our inability to profitably and professionally run our business.

The future success of our business depends to a significant extent on the efforts and abilities of our operating executive officers, including David Murphy, CEO and Ronald Sparks, the President of RS Services. Although we have employment agreements with these individuals, the loss of their services could have a material adverse effect on our business, financial condition and results of operations. Mr. Sparks has highly technical, electrical skills relating to electrical services, specific knowledge of high voltage applications and extensive relationships with clients and suppliers in sales, marketing and manufacturing. The loss of the services of Mr. Sparks and other key personnel, or our inability to attract or retain additional qualified personnel could have a material adverse effect on our business, financial condition and results of operations. We believe that our future success in energy products and services will hinge upon our ability to attract, motivate and retain the current highly-skilled managerial personnel. Competition for such personnel is intense, and there can be no assurance that we will be successful in attracting, assimilating and retaining the personnel we require to grow and operate profitability.

Production of our EnerLume|EM® depends on our manufacturer’s ability to purchase raw materials and components. The failure to procure materials and increases in component costs may result in our inability to profitably run our business.

Raw materials and components constitute a significant portion of our manufacturer’s cost of goods. Factors that are largely beyond our control, such as movements in commodity prices for the specific materials required, may affect the future cost of raw materials and components. In addition, the inability of our manufacturer to timely procure raw materials or components could be disruptive and costly. If we are unable to obtain product on a timely basis at an affordable cost or if we experience any significant delays or interruptions of supply, our financial results could be significantly impacted.

Risks Related to Our Securities

Any future fundraising efforts will dilute current shareholder ownership interests. Any investor who purchases our securities could face future dilution as we pursue future equity fundraising.

As of September 22, 2008, we had 13,924,612 outstanding shares of common stock. Any future material equity fundraising efforts will have the effect of increasing the amount of shares outstanding, thereby creating dilution for our existing shareholders. We believe that the most efficient manner in increasing shareholder value is to properly and effectively execute our business plan, which will require raising additional capital. We have partnered with investment banking firms to assist and achieve this initiative, and will continue our efforts to raise additional capital, via equity financings or otherwise, until we can achieve positive cash flow.

Our common stock currently trades on the OTCBB trading platform, which could result in limited liquidity for any investor purchasing our securities.

There is a limited trading market for our common stock on the OTCBB and the ability to trade our common stock on the OTCBB depends on the presence and investment decisions of willing buyers and sellers. There can be no guarantee that our common stock will be accepted for quotation by any other quotation system, market or exchange. As such, our stock has the potential for very limited liquidity and marketability.

Our common stock is considered “penny stock,” which may make selling the common stock difficult.

Our common stock is considered to be a “penny stock” under the definitions in Rules 15g-2 through 15g-6 promulgated under Section 15(g) of the Securities Exchange Act of 1934, as amended. Under the rules, stock is considered “penny stock” if: (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Stock Market, or even if quoted, has a price less than $5.00 per share; or (iv) is issued by a company with net tangible assets less than $2.0 million, if in business more than a continuous three years, or with average revenues at less than $6.0 million for the past three years. The principal result or effect of being designated a “penny stock” is that securities broker-dealers cannot recommend our stock but must trade it on an unsolicited basis.

Section 15(g) of the Exchange Act and Rule 15g-2 promulgated thereunder by the SEC require broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor’s account. Potential investors in our common stock are urged to obtain and read such disclosure carefully before purchasing any shares that are deemed to be “penny stocks.” Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of

evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

We do not plan to pay cash dividends to holders of common stock. Investors must rely on appreciation of our securities as the sole method to realize a gain on their investment.

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends to the holders of our common stock at any time. It is the present policy of the Board of Directors to retain all earnings to provide for our growth. Accordingly, investors in our securities must rely upon subsequent sales after price appreciation as the sole method to realize a gain on investment. There are no assurances that the price of common stock will ever appreciate in value. Investors seeking cash dividends should not buy our securities.

Historically, our stock price has been volatile, which may make it more difficult to resell shares at prices that are attractive.

The trading price of our common stock has been subject to wide fluctuations. Our stock price fluctuated in response to a number of events and factors, such as announcements from management, quarterly variations in operating results, or new customer accounts and acquisitions by us or our competitors, changes to financial estimates and recommendations by securities analysts, the operating and stock price performance of other companies that investors may deem comparable, and news reports relating to trends in our markets.

If we issue shares of preferred stock, your investment could be diluted or subordinated to the rights of the holders of preferred stock.

Our Board of Directors is authorized by our Articles of Incorporation to establish classes or series of preferred stock and fix the designation, powers, preferences and rights of the shares of each such class or series without any further vote or action by our shareholders. Any shares of preferred stock so issued could have priority over our common stock with respect to dividend or liquidation rights. Although we have no plans to issue any shares of preferred stock or to adopt any new series, preferences or other classification of preferred stock, any such action by our Board of Directors or issuance of preferred stock by us could dilute your investment in our common stock and warrants or subordinate your holdings to the shares of preferred stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Our corporate offices are located at Two Broadway, Hamden, Connecticut 06518. Our telephone number is (203) 248-4100. We also have established a location on 1180 Sherman Avenue, Hamden, CT 06518. RS Services’ main office is located at 7806 N. Highway 81, Duncan, Oklahoma 73533.

We lease our corporate offices in Hamden under the terms of a month-to-month lease agreement, with a monthly payment of $4,040. We have recently entered into a lease agreement at 1180 Sherman Avenue, Hamden, CT for a five year agreement commencing on June 1, 2008. This location is expected to house our research and development and training operations. We lease RS Services’ offices in Duncan, Oklahoma from

Ronald Sparks, the President of our RS Services subsidiary, pursuant to the terms of a five-year agreement with a monthly payment of $5,000. The RS Services lease has been determined to be at market rate. We also lease property at 233 S. Lindsay, Gilbert, AZ as a satellite office for south west operations for RS Services.

ITEM 3. LEGAL PROCEEDINGS

Legal Proceedings

Federal Class and Derivative Actions

In August 2005 and September 2005, the Company and certain of its past and present officers and directors were named as defendants in securities class action suits in the United States District Court for the District of Connecticut, which were eventually consolidated under the caption, In re Host America Securities Litigation, Civil Action No. 05-cv-1250 (VLB) (the “Class Action”). A purported shareholder derivative suit, naming the Company’s board and others as defendants, was also brought during the same period in the federal district court and consolidated under the same caption (“Derivative Action”). The lawsuits arose out of a press release issued by the Company on July 12, 2005, regarding its commercial relationship with Wal-Mart Stores, Inc. Thereafter, on May 22 and 23, 2007, the Company and its past and present directors and officers were named as defendants in the Class and Derivative Actions (the “Host America defendants”), and the plaintiffs filed agreements to settle and fully resolve all claims against the Host America defendants in both actions. Following a settlement fairness hearing, on February 5, 2008, the Court issued orders granting final approval of both settlements.

Under the Class Action settlement, the Host America defendants agreed to a gross payment of $2.45 million to the Class in exchange for dismissal of all claims against them with prejudice. Of that amount, $1,700,000 has been paid by insurance and the remainder by the Company. In the Derivative Action settlement, the Company has implemented and/or maintained certain specified corporate governance policies and procedures, and paid $140,000 funded by insurance proceeds for the shareholder plaintiffs’ attorney fees and costs. The changes in corporate governance policies include, among other things, a ten-year term limit for newly-elected directors, limits on the number of public company boards a director may serve on, director attendance policies, maintaining disclosure and nominating committees and applicable charters, and guidelines regarding approval of related party transactions. The settlement amounts for both the Class and Derivative actions have been paid in full.

On March 5, 2008, a putative Host America shareholder, Bart Hester, who had earlier brought a separate derivative lawsuit in state court (see below), sought to intervene in the Derivative Action. Hester later submitted the only objection to the settlement. Hester filed a notice of appeal from the approval of the Derivative Action settlement to the Court of Appeals for the Second Circuit. On August 12, 2008, Hester and all appellees stipulated to a dismissal of Hester’s appeal with prejudice.

As part of the settlements, the Company and all other settling defendants continue to deny any liability or wrongdoing. Payments under the Class and Derivative settlements exhausted the available proceeds from the Host America defendants’ insurance policy.

State Court Derivative Action

On or about September 28, 2005, the Company was named as a nominal defendant in a separate derivative action filed in the Connecticut Superior Court in Bart Hester v. Geoffrey W. Ramsey, et al., Docket No. UWY-CV-05-5001448-S (“Hester” action). The action named as defendants the Company’s then existing board, Geoffrey Ramsey and Roger Lockhart. The Hester complaint contained allegations and claims substantially similar to those of the federal Derivative Action described above. Following the settlement of the Federal

Derivative Action, all parties filed a joint motion to dismiss the Hester action. On September 2, 2008, the court granted the motion and dismissed the Hester action against all defendants with prejudice.

State Court Individual Suit

On May 2, 2006, 47 plaintiffs who alleged that they had purchased the Company’s securities at artificially inflated prices in reliance on the July 12, 2005 press release brought suit in the Connecticut Superior Court, naming the Company as the sole defendant in Enrique Jose Contreras, et al., v. Host America Corp., Docket No. No. UWY-CV-06-4013754-S (“Contreras” action). The Contreras amended complaint, filed on January 25, 2008, concerns substantially the same allegations as the Class Action. The amended complaint asserts various causes of action under state law, including claims for fraud, negligent misrepresentation and respondeat superior, and claimed aggregate damages in amount of approximately $3,436,800. Subsequently, several did not exclude themselves from the Class Action settlement and therefore should be barred from any further claim against or any recovery from the Company in Contreras or the defendants in the related Federal action (see below). The Company estimates that the remaining Contreras plaintiffs claim losses in a range of $2.93 million to $3.13 million. The Company has filed a motion to dismiss the amended complaint. The Company believes it has substantial and meritorious defenses to the action.

Federal Court Individual Suit

On June 25, 2007, substantially the same group of plaintiffs in the state court Contreras matter filed a complaint in the United States District Court for the District of Connecticut against David J. Murphy, Geoffrey Ramsey, Peter Sarmanian, and Roger D. Lockhart in the matter Anil Sawant, et al. v. Geoffrey W. Ramsey, et. al., Civil Action No. 07-cv-980 (VLB). The Sawant complaint, which does not name the Company as a defendant, asserts substantially the same allegations and claims as the Class Action Consolidated Complaint. On August 7, 2008, the federal court denied the defendants’ motions to dismiss the complaint.

Anne and Debra Ramsey Arbitration