Santander Holdings USA, Inc. Fixed Income Investor Update Data as of March 31, 2016 May 16, 2016

2 Disclaimer This presentation of Santander Holdings USA, Inc. (“SHUSA”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and future performance of SHUSA. Words such as “may,” “could,” “should,” “looking forward,” “will,” “would,” “believe,” “expect,” “hope,” “anticipate,” “estimate,” “intend,” “plan,” “assume” or similar expressions are intended to indicate forward-looking statements. Although SHUSA believes that the expectations reflected in these forward-looking statements are reasonable as of the date on which the statements are made, these statements are not guarantees of future performance and involve risks and uncertainties based on various factors and assumptions, many of which are beyond SHUSA’s control. Among the factors that could cause SHUSA’s financial performance to differ materially from that suggested by the forward-looking statements are: (1) the effects of regulation and policies of the Board of Governors of the Federal Reserve System (the “Federal Reserve”), the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau, including changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve, the failure to adhere to which could subject SHUSA to formal or informal regulatory compliance and enforcement actions; (2) the strength of the United States economy in general and regional and local economies in which SHUSA conducts operations in particular, which may affect, among other things, the level of non-performing assets, charge-offs, and provisions for credit losses; (3) continued residual effects of recessionary conditions and uneven spread of positive impacts of recovery on the U.S. economy and SHUSA's counterparties, including adverse impacts on levels of unemployment, loan utilization rates, delinquencies, defaults and counterparties' ability to meet credit and other obligations; (4) the ability of certain European member countries to continue to service their debt and the risk that a weakened European economy could negatively affect U.S.-based financial institutions, counterparties with which SHUSA does business, as well as the stability of global financial markets; (5) inflation, interest rate, market and monetary fluctuations, which may, among other things, reduce net interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets; (6) adverse movements and volatility in debt and equity capital markets and adverse changes in the securities markets, including those related to the financial condition of significant issuers in SHUSA’s investment portfolio; (7) SHUSA’s ability to manage changes in the value and quality of its assets, changing market conditions that may force management to alter the implementation or continuation of cost savings or revenue enhancement strategies and the possibility that revenue enhancement initiatives may not be successful in the marketplace or may result in unintended costs; (8) SHUSA's ability to grow revenue, manage expenses, attract and retain highly-skilled people and raise capital necessary to achieve its business goals and comply with regulatory requirements and expectations; (9) SHUSA’s ability to timely develop competitive new products and services in a changing environment that are responsive to the needs of SHUSA's customers and are profitable to SHUSA, the acceptance of such products and services by customers, and the potential for new products and services to impose additional costs on SHUSA and expose SHUSA to increased operational risk; (10) changes or potential changes to the competitive environment, including changes due to regulatory and technological changes, the effects of industry consolidation and perceptions of SHUSA as a suitable service provider or counterparty; (11) the ability of SHUSA and its third-party vendors to convert and maintain SHUSA’s data processing and related systems on a timely and acceptable basis and within projected cost estimates; (12) SHUSA's ability to control operational risks, data security breach risks and outsourcing risks, and the possibility of errors in quantitative models SHUSA uses to manage its business and the possibility that SHUSA's controls will prove insufficient, fail or be circumvented; (13) the impact of changes in financial services policies, laws and regulations, including laws, regulations and policies concerning taxes, banking, capital, liquidity, proper accounting treatment, securities and insurance, the applications and interpretations thereof by regulatory bodies and the impact of changes in and interpretations of generally accepted accounting principles in the United States of America ("GAAP");

3 Disclaimer (cont.) (14) the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, which is a significant development for the industry, the full impact of which will not be known until the rule-making processes mandated by the legislation are complete, although the impact has involved and will involve higher compliance costs that have affected and will affect SHUSA’s revenue and earnings negatively; (15) SHUSA's ability to promote a strong culture of risk management, operating controls, compliance oversight and governance that meets regulatory expectations; (16) competitors of SHUSA that may have greater financial resources or lower costs, may innovate more effectively, or may develop products and technology that enable those competitors to compete more successfully than SHUSA; (17) acts of terrorism or domestic or foreign military conflicts; and acts of God, including natural disasters; (18) the costs and effects of regulatory or judicial proceedings; (19) the outcome of ongoing tax audits by federal, state and local income tax authorities that may require SHUSA to pay additional taxes or recover fewer overpayments compared to what has been accrued or paid as of period-end; (20) adverse publicity, whether specific to SHUSA or regarding other industry participants or industry- wide factors, or other reputational harm; and (21) SHUSA’s success in managing the risks involved in the foregoing. Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest, and in making this presentation available, SHUSA gives no advice and makes no recommendation to buy, sell, or otherwise deal in shares or other securities of Banco Santander, S.A. (“Santander”), SHUSA, Santander Bank, N.A. (“Santander Bank” or “SBNA”), or SC in any other securities or investments. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, and tax advisers to evaluate independently the risks, consequences, and suitability of that investment. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, if utilized, may include Pre-Tax Pre-Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results, among others. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to which the items are indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information.

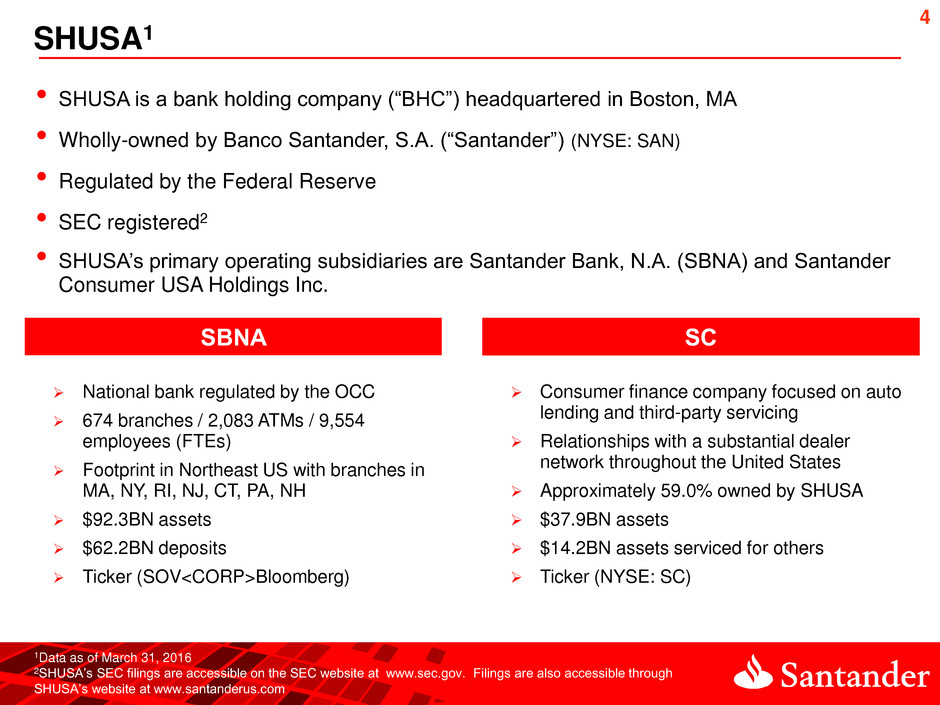

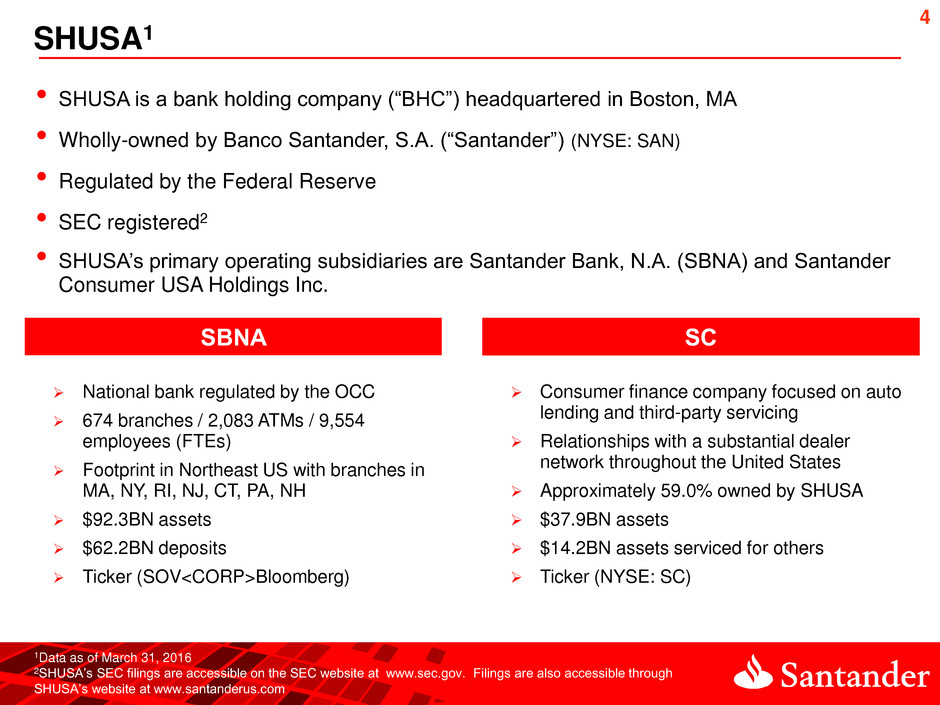

4 SHUSA1 • SHUSA is a bank holding company (“BHC”) headquartered in Boston, MA • Wholly-owned by Banco Santander, S.A. (“Santander”) (NYSE: SAN) • Regulated by the Federal Reserve • SEC registered2 • SHUSA’s primary operating subsidiaries are Santander Bank, N.A. (SBNA) and Santander Consumer USA Holdings Inc. SBNA SC National bank regulated by the OCC 674 branches / 2,083 ATMs / 9,554 employees (FTEs) Footprint in Northeast US with branches in MA, NY, RI, NJ, CT, PA, NH $92.3BN assets $62.2BN deposits Ticker (SOV<CORP>Bloomberg) Consumer finance company focused on auto lending and third-party servicing Relationships with a substantial dealer network throughout the United States Approximately 59.0% owned by SHUSA $37.9BN assets $14.2BN assets serviced for others Ticker (NYSE: SC) 1Data as of March 31, 2016 2SHUSA’s SEC filings are accessible on the SEC website at www.sec.gov. Filings are also accessible through SHUSA’s website at www.santanderus.com

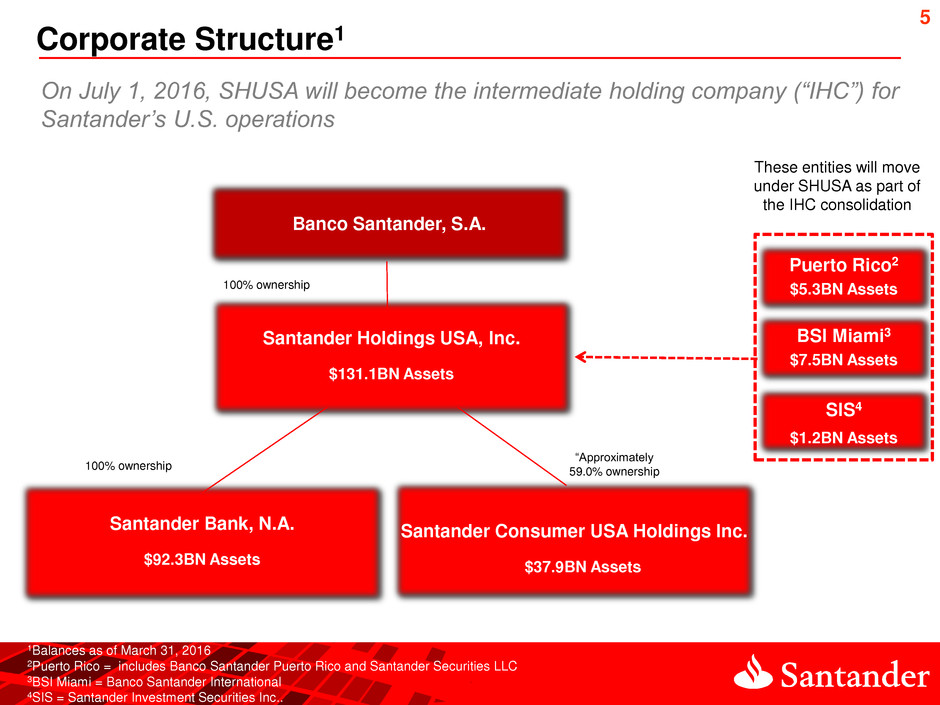

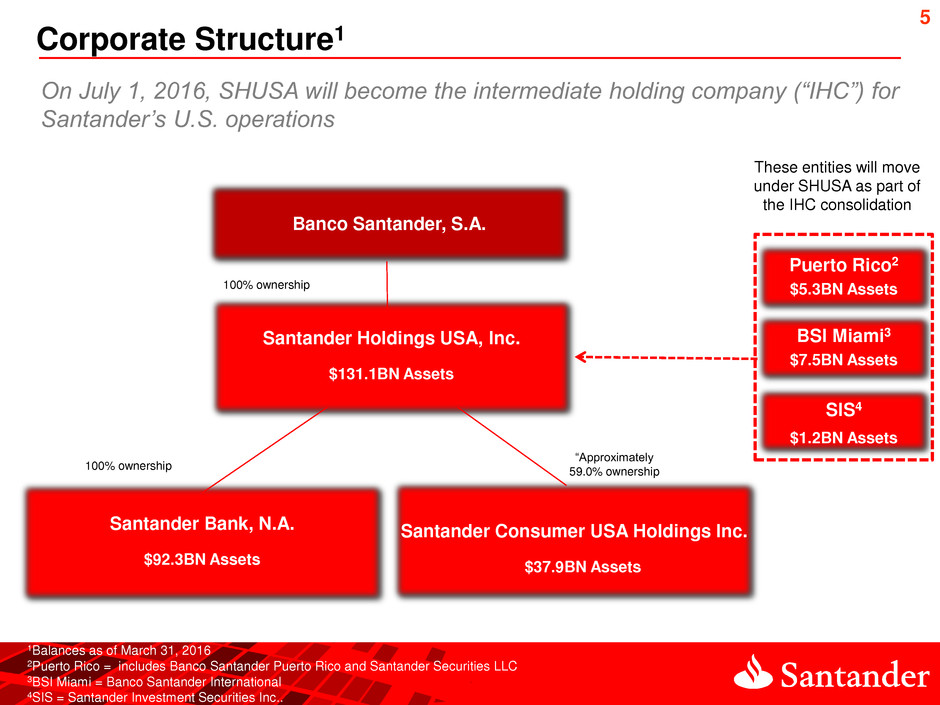

5 Corporate Structure1 Santander Holdings USA, Inc. $131.1BN Assets Santander Bank, N.A. $92.3BN Assets Santander Consumer USA Holdings Inc. $37.9BN Assets On July 1, 2016, SHUSA will become the intermediate holding company (“IHC”) for Santander’s U.S. operations 1Balances as of March 31, 2016 2Puerto Rico = includes Banco Santander Puerto Rico and Santander Securities LLC 3BSI Miami = Banco Santander International 4SIS = Santander Investment Securities Inc.. “Approximately 59.0% ownership Banco Santander, S.A. Puerto Rico2 $5.3BN Assets BSI Miami3 $7.5BN Assets SIS4 $1.2BN Assets 100% ownership 100% ownership These entities will move under SHUSA as part of the IHC consolidation

6 Management Changes Duke Dayal SHUSA/SBNA CFO Mr. Dayal was named Chief Financial Officer for SHUSA and SBNA in April 2016. Previously he was CFO of BancWest, Bank of the West, and BNP Paribas USA, the company’s holding company in the U.S. Prior to BNP Paribas and Bank of the West, Duke helped lead a private equity start-up for JP Morgan Chase, Brysam Global Partners, Prior to that, Duke spent eight years with Citi in a variety of operations and finance roles in New York, California, South Korea and Brussels. Duke has a Bachelor’s Degree in Accounting and Finance from Trent University in Nottingham, England. He is a member of the Chartered Institute of Management Accountants in England. Mr. Morrin was named SC’s Chief Operating Officer in February 2016. He previously held the role of Executive Vice President of New Business and head of Chrysler Capital at SC, a position he held since 2011. Prior to joining SC, Mr. Morrin held a variety of management positions in 21 years of combined service at Ally Financial and General Motors Acceptance Corp. During his tenure at Ally, he managed the commercial lending operations for Ally automotive dealers in the United States and Canada. Mr. Morrin holds a Bachelor’s Degree in Economics from the University of Pennsylvania and an MBA from the University of Virginia. Ismail Dawood SC CFO Mr. Dawood began serving as SC’s Chief Financial Officer in December 2015. Prior to joining SC, he served as Executive Vice President and Chief Financial Officer of the Investment Services division of The Bank of New York Mellon Corporation (“BNY Mellon”) since April 2013. He also served as Executive Vice President and Director of Investor Relations and Financial Planning and Analysis of BNY Mellon from June 2009 to March 2013. Mr. Dawood holds a Bachelor’s Degree in Finance from St. John's University, Jamaica (Queens), New York, and an MBA from the Wharton School of Business. Mr. Dawood is a Chartered Financial Analyst. Richard Morrin SC COO

7 1Q16 Executive Summary1 Liquidity and Funding Capital Balance Sheet 1Data as of 3/31/16 unless otherwise noted 4LCR = Liquidity Coverage Ratio 2Includes noncontrolling interest 3SC Press Release February 1, 2016 Earnings Credit Quality SHUSA 1Q16 net income of $74MM2, net interest margin of 6.36% SC 1Q16 net income of $201MM2 SBNA 1Q16 earnings impacted by $80MM reserve for Energy Finance SBNA loan growth of 3.5% YoY supported by 7.5% YoY core deposit growth In 1Q16, SBNA sold AFS securities and used gains to terminate $1.3BN FHLB On February 1, 2016, SC sold $0.9BN of its unsecured personal lending portfolio3 HoldCo has $4.7BN cash on hand In 1Q16, SC issued $1.6BN in ABS and sold $0.9BN under asset flow programs SHUSA’s LCR4 at end of 1Q16 in excess of regulatory requirement Common Equity Tier 1 (CET1) 11.9%; 11.2% under U.S. Basel III fully phased-in SBNA CET1 13.9%, 13.5% under U.S. Basel III fully phased-in SC CET1 12.0%; Tangible Common Equity to Tangible Assets (TCE/TA) 11.9% SBNA’s NPLs and criticized balances increased vs. 4Q15 primarily due to the Energy Finance portfolio SC’s delinquencies in line with seasonal trends SC YoY increase in loss rate driven by portfolio mix and aging of the portfolio

8 1Q16 Significant Events Goodwill Impairment1: SHUSA registered a non-cash impairment charge of $4.4BN (pre- tax and including non-controlling interests) in its financial statements for the quarter ended Dec. 31, 2015 related to the goodwill associated with its approximately 59% ownership of SC. Post-tax and excluding non-controlling interests, the charge was $1.6BN No impact to SHUSA’s capital ratios (see Appendix for further details) SC sale of unsecured personal loan portfolio2: On February 1, 2016, SC sold $0.9BN in personal installment loans Sale reflects SC’s announcement in 3Q15 that it would exit the personal lending finance sector to focus on auto lending OCC Consent Order Terminated3: On February 9, 2016, the OCC terminated the mortgage servicing consent order on SBNA AFS Sales and FHLB Terminations4: During 1Q16, SBNA sold AFS securities generating $26MM in gains. These gains were used to terminate $1.3BN of FHLB advances 1SHUSA form 8-K published February 29, 2016 4SHUSA Form 10-Q 1Q16 2SC Press Release February 1, 2016 3OCC Press Release February 9, 2016

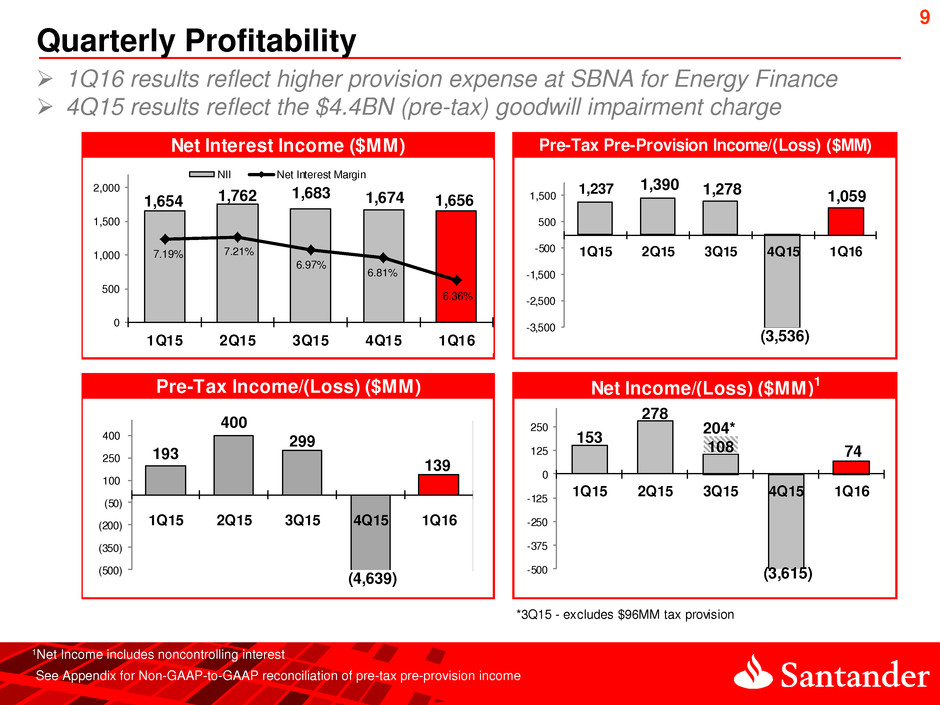

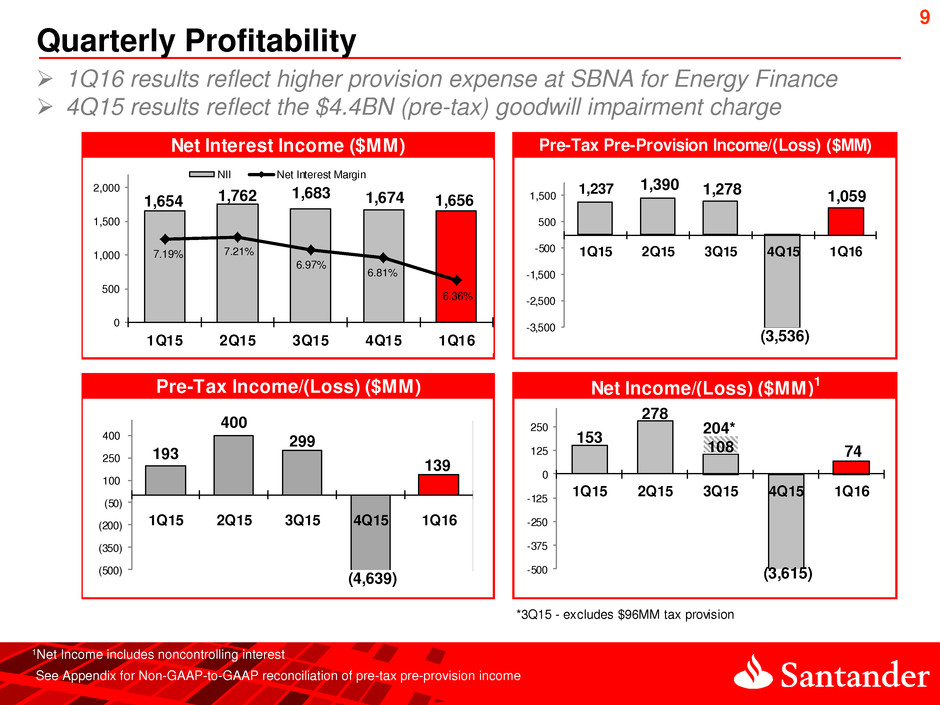

9 Quarterly Profitability 2 See Appendix for Non-GAAP-to-GAAP reconciliation of pre-tax pre-provision income 1Net Income includes noncontrolling interest 1Q16 results reflect higher provision expense at SBNA for Energy Finance 4Q15 results reflect the $4.4BN (pre-tax) goodwill impairment charge Pre-Tax Pre-Provision Income/(Loss) ($MM) Net Income/(Loss) ($MM)1 Net Interest Income ($MM) Pre-Tax Income/(Loss) ($MM) *3Q15 - excludes $96MM tax provision 1,237 1,390 1,278 (3,536) 1,059 -3,500 -2,500 -1,500 -500 500 1,500 1Q15 2Q15 3Q15 4Q15 1Q16 1,654 1,762 1,683 1,674 1,656 7.19% 7.21% 6.97% 6.81% 6.36% 0 500 1,000 1,500 2,000 1Q15 2Q15 3Q15 4Q15 1Q16 NII Net Interest Margin 193 400 299 (4,639) 139 (500) (350) (200) (50) 100 250 400 1Q15 2Q15 3Q15 4Q15 1Q16 153 278 108 (3,615) 74 204* -500 -375 -250 -125 0 125 250 1Q15 2Q15 3Q15 4Q15 1Q16

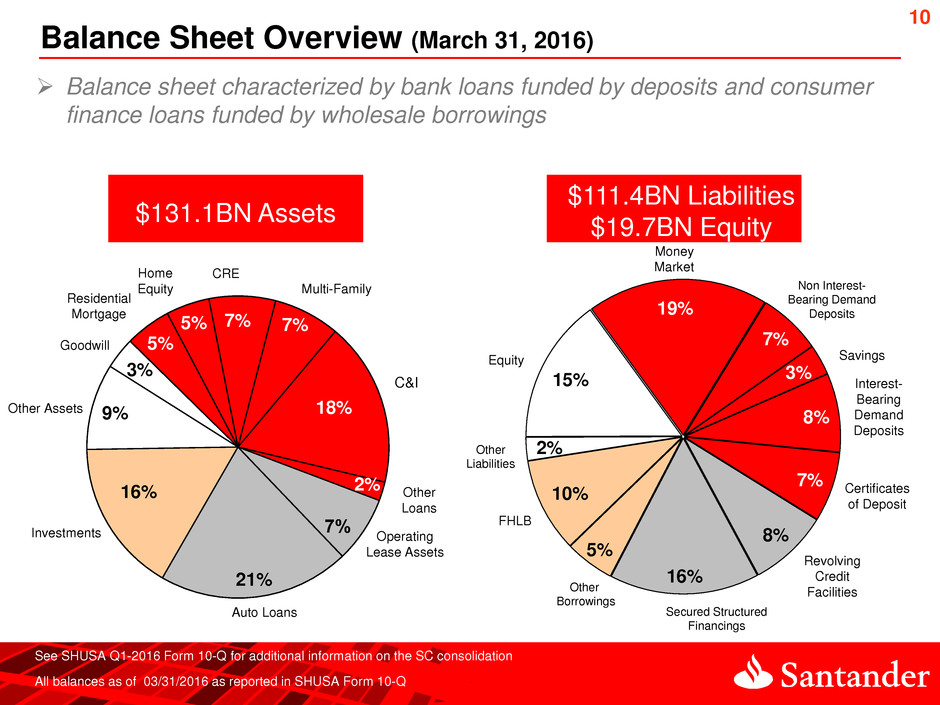

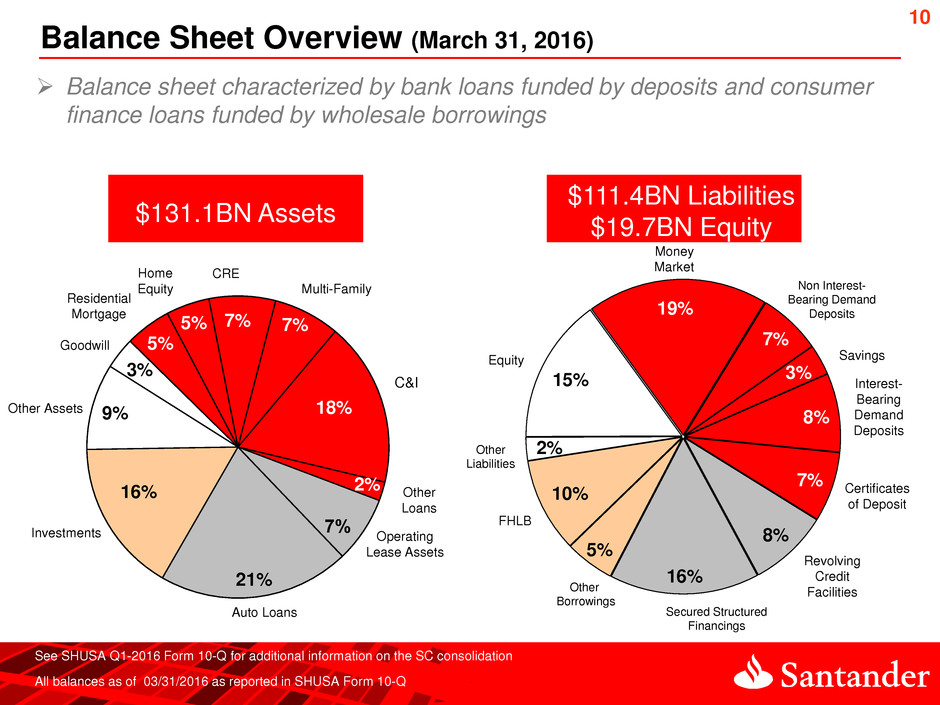

10 2 8% 7% 3% 19% 7% 8% 16% 5% 10% 2% 15% Balance Sheet Overview (March 31, 2016) 9% 3% 5% 5% 18% 7% 7% 2% 16% 21% Investments Auto Loans 7% Non Interest- Bearing Demand Deposits Other Assets C&I CRE Residential Mortgage Other Loans Operating Lease Assets Goodwill Home Equity Multi-Family $131.1BN Assets $111.4BN Liabilities $19.7BN Equity Interest- Bearing Demand Deposits Secured Structured Financings Equity Other Liabilities FHLB Money Market Certificates of Deposit Savings All balances as of 03/31/2016 as reported in SHUSA Form 10-Q Revolving Credit Facilities Other Borrowings See SHUSA Q1-2016 Form 10-Q for additional information on the SC consolidation Balance sheet characterized by bank loans funded by deposits and consumer finance loans funded by wholesale borrowings

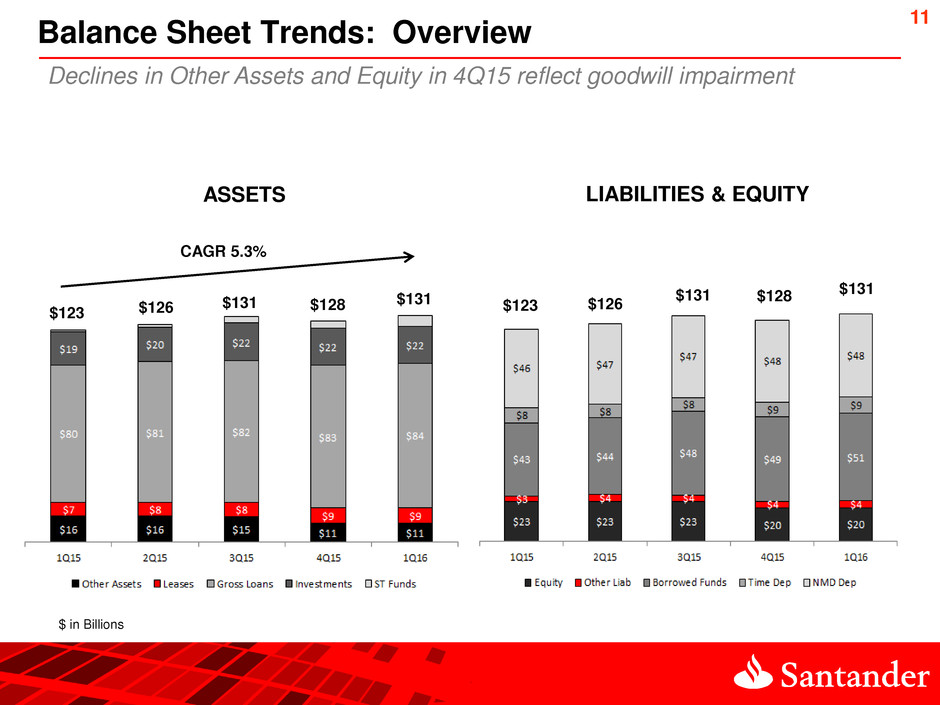

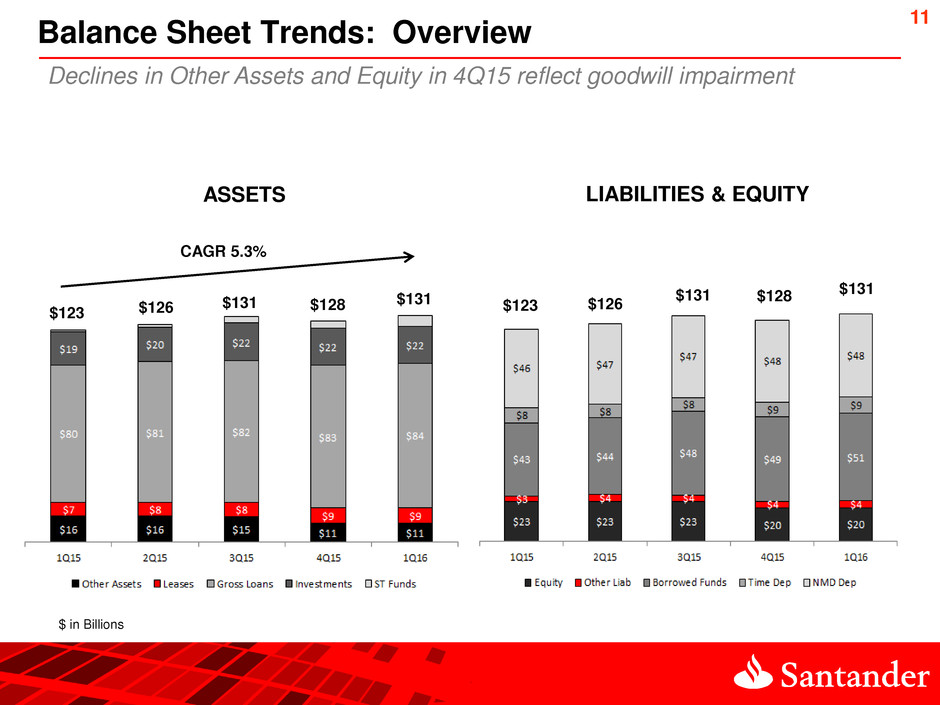

11 2 Balance Sheet Trends: Overview $123 $126 $131 $128 $131 $123 $126 $131 $128 $131 ASSETS LIABILITIES & EQUITY CAGR 5.3% $ in Billions Declines in Other Assets and Equity in 4Q15 reflect goodwill impairment

12 2 Balance Sheet Trends: Loans and Leases $87 $89 $90 $91 $93 CAGR 4.9% $ in Billions Growth led by C&I loans, auto loans, and auto leases

13 2 Balance Sheet Trends: Deposits $54 $55 $56 $56 $57 CAGR 4.5% $ in Billions Continued growth in core MMDA and non-interest bearing DDA

14 $975 $898 $696 $619 $590 $515 $497 $513 $710 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Criticized Balances2 Non-Performing Loans1 Texas Ratio4 Annualized Net Charge off Ratio3 0.12% 0.38% 0.92% 0.23% 0.26% 0.31% 0.43% 0.20% 0.38% 0.39%0.38% 0.44% 0.40% 0.36% 0.49% 0.36% 0.35% 0.36% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Santander Bank Large Banks** SBNA: Asset Quality $ MM -27% Increases in NPLs and Criticized balances were driven by Energy Finance $ MM Annualized NCO = Quarterly NCO*4 **Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC 13.9% 14.0% 14.3% 10.7% 16.4% 10.8% 10.1% 9.3% 8.5% 8.6%7.9% 17.5 14.5% 19.8% 18.5% 17.3% 16.2% 15.1% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Santander Bank Large Banks** 1NPLs = Nonaccruing loans plus accruing loans 90+ DPD; 2Criticized = loans that are categorized as Special Mention, Substandard, Doubtful, or Loss 33Q14 reflects charge offs relating to TDR/NPL sale; excluding sale 3Q14 would have been 0.47% 4See Appendix for Definition and Non-GAAP measurement reconciliation of Texas Ratio $2,257 $2,244 $2,054 $1,980 $1,972 $2,073 $2,171 $2,333 $2,626 4.39% 4.32% 4.08% 3.92% 3.78% 3.95% 4.09% 4.35% 4.81% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Criticized Balances Criticized Ratio

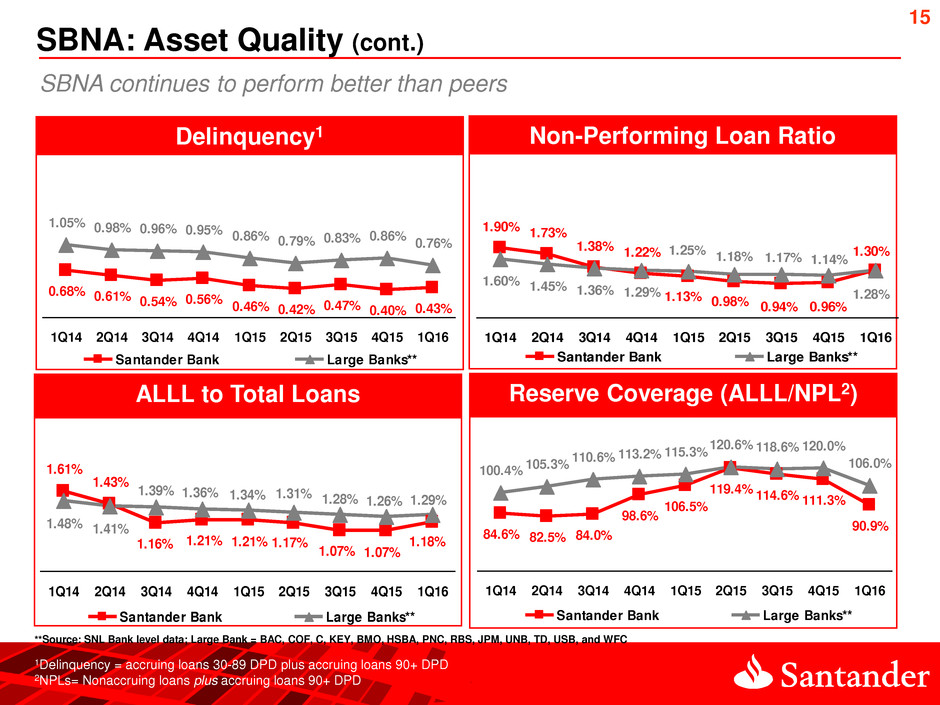

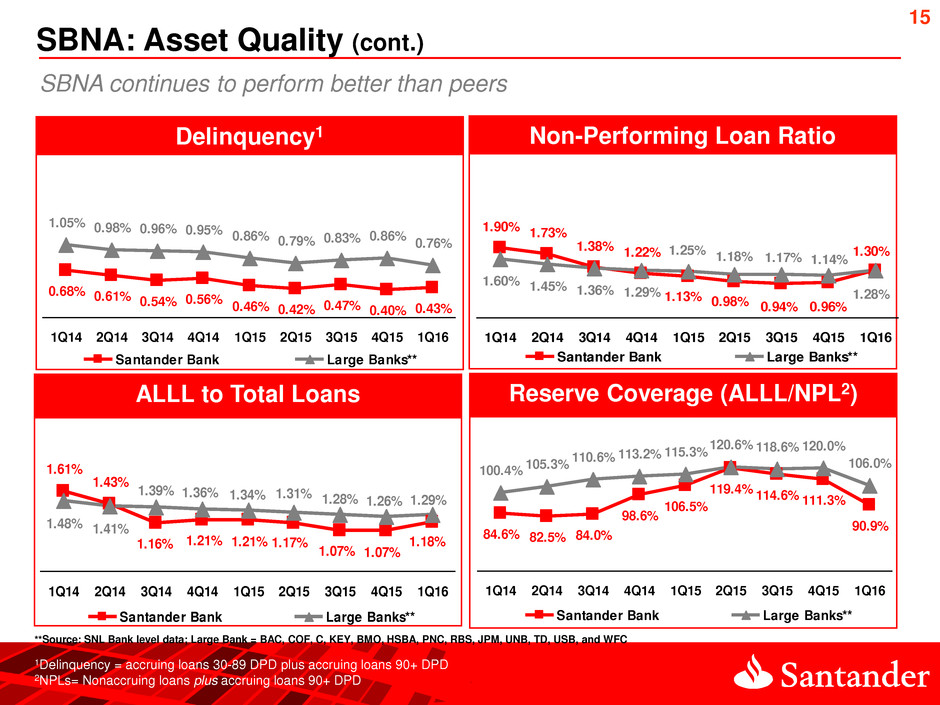

15 1.61% 1.07% 1.07% 1.17%1.21%1.21%1.16% 1.43% 1.18% 1.28%1.31%1.34%1.36% 1.39% 1.41%1.48% 1.26% 1.29% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Santander Bank Large Banks** ALLL to Total Loans Reserve Coverage (ALLL/NPL2) 84.6% 114.6% 111.3% 119.4% 106.5% 98.6% 84.0%8 .5% 90.9% 118.6%120.6%115.3%113.2%110.6% 105.3%100.4% 120.0% 106.0% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Santander Bank Large Banks** Non-Performing Loan Ratio Delinquency1 1.30% 1.73% 1.38% 1.22% 1.13% 0.98% 0.96%0.94% 1.90% 1.28% 1.14% 1.60% 1.45% 1.36% 1.29% 1.25% 1.18% 1.17% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Santander Bank Large Banks** 0.68% 0.47% 0.40%0.42%0.46% 0.56%0.54%0.61% 0.43% 0.83%0.79%0.86% 0.95%0.96%0.98% 1.05% 0.86% 0.76% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q 5 4Q15 1Q16 Santander Bank Large Banks** SBNA: Asset Quality (cont.) **Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC 1Delinquency = accruing loans 30-89 DPD plus accruing loans 90+ DPD 2NPLs= Nonaccruing loans plus accruing loans 90+ DPD SBNA continues to perform better than peers

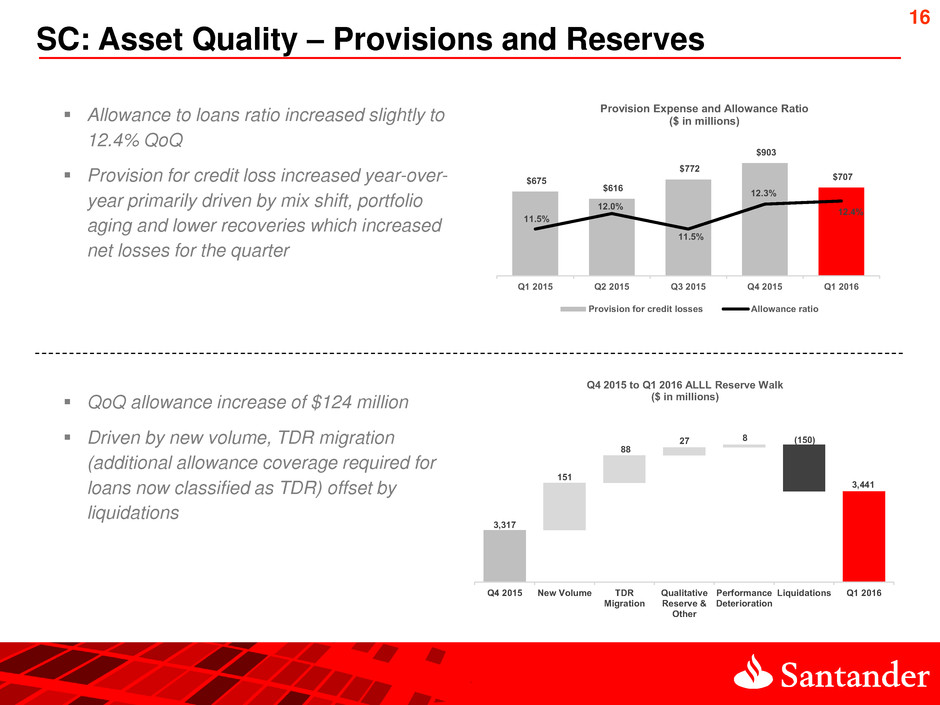

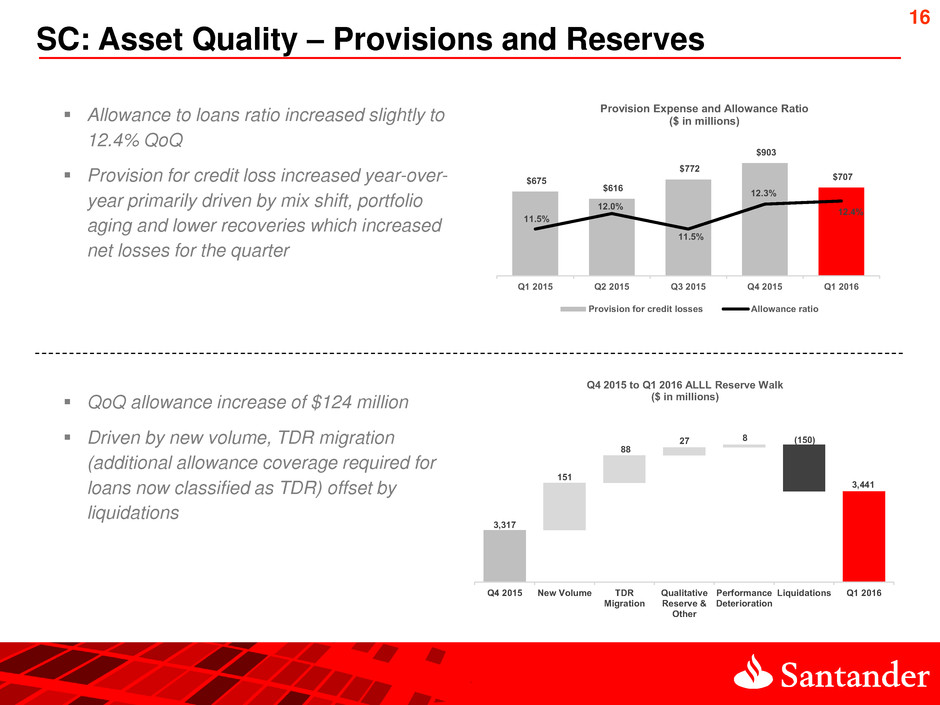

16 $675 $616 $772 $903 $707 11.5% 12.0% 11.5% 12.3% 12.4% 10.00% 10.50% 11.00% 11.50% 12.00% 12.50% 13.00% 13.50% 14.00% $- $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Provision Expense and Allowance Ratio ($ in millions) Provision for credit losses Allowance ratio SC: Asset Quality – Provisions and Reserves 3,317 3,441 151 88 27 8 (150) Q4 2015 New Volume TDR Migration Qualitative Reserve & Other Performance Deterioration Liquidations Q1 2016 Q4 2015 to Q1 2016 ALLL Reserve Walk ($ in millions) Allowance to loans ratio increased slightly to 12.4% QoQ Provision for credit loss increased year-over- year primarily driven by mix shift, portfolio aging and lower recoveries which increased net losses for the quarter QoQ allowance increase of $124 million Driven by new volume, TDR migration (additional allowance coverage required for loans now classified as TDR) offset by liquidations

17 SC: Credit Quality – Loss and Delinquency 14.6 % 12.4 % 16.0 % 17.3 % 16.8 % 6.1 % 4.5 % 8.8 % 9.6 % 8.2 % 59%1 63%1 45 % 45 % 51 % —% 10 % 20 % 30 % 40 % 50 % 60 % 70 % —% 2.0 % 4.0 % 6.0 % 8.0 % 10.0 % 12.0 % 14.0 % 16.0 % 18.0 % 20.0 % Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Credit: Individually Acquired Retail Installment Contracts, Held for Investment Gross Charge-off Ratio Net Charge- off Ratio Recovery Rate 6.7 % 7.7 % 8.1 % 9.1 % 6.9 % 2.9 % 3.3 % 3.8 % 4.4 % 3.1 % —% 2.0 % 4.0 % 6.0 % 8.0 % 10.0 % Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Delinquency: Individually Acquired Retail Installment Contracts, Held for Investment 31-60 61+ Delinquencies consistent with seasonal trends Marginally higher year-over-year Year-over-year gross loss increase driven by mix shift and slower portfolio growth Gross losses increased 220 basis points Net losses also affected by marginally lower recovery rates than in prior year first quarter Recovery rates in Q1 2015 and Q2 2015 benefitted by proceeds from large bankruptcy sales 1 Excluding bankruptcy sales, recovery rates would have been 55% and 56%, respectively

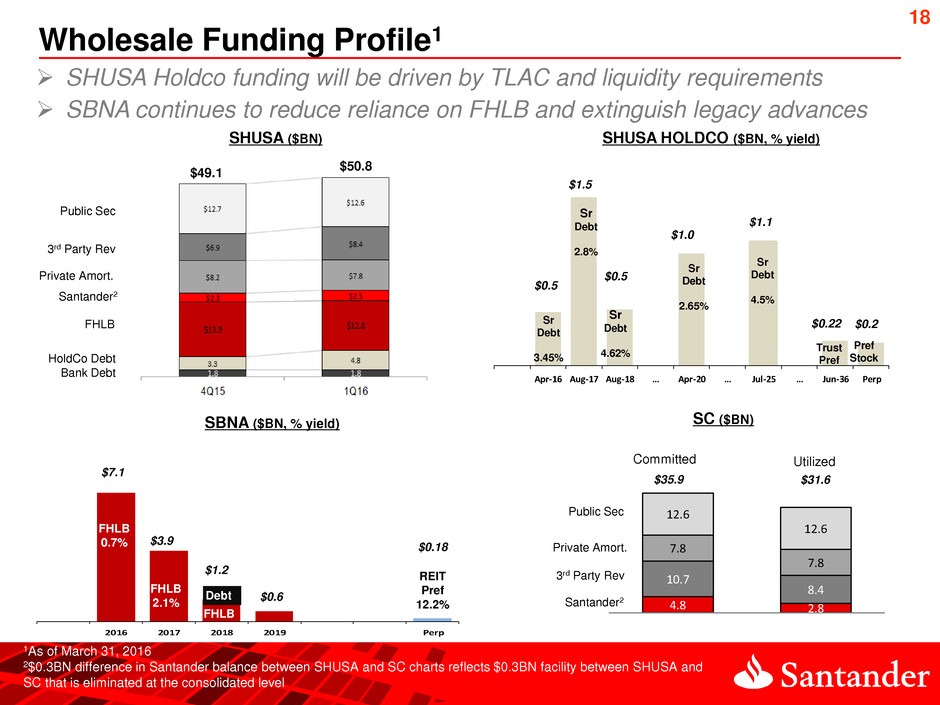

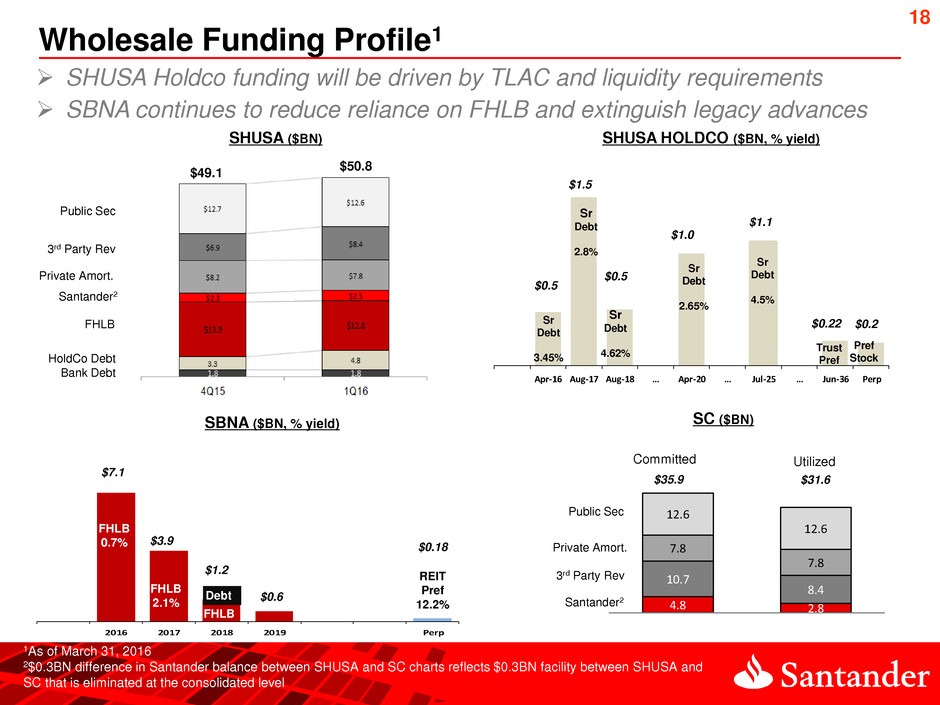

18 Apr-16 Aug-17 Aug-18 … Apr-20 … Jul-25 … Jun-36 Perp Wholesale Funding Profile1 Trust Pref $150 Sr Debt 4.625% Sr Debt 3.0% Sr Debt 3.45% 20 6 2017 2018 2019 Perp 4.8 2.8 10.7 8.4 7.8 7.8 12.6 12.6 Utilized $31.6 SC ($BN) Public Sec Committed FHLB Bank Debt HoldCo Debt 3rd Party Rev Santander2 Trust Pref Pref Stock Sr Debt 4.62% Sr Debt 3.45% REIT Pref 12.2% FHLB 0.6% FHLB 0.7% FHLB 2.1% $0.18 $1.2 $7.1 $3.9 Public Sec $35.9 $0.5 $0.5 $0.22 $0.2 1As of March 31, 2016 2$0.3BN difference in Santander balance between SHUSA and SC charts reflects $0.3BN facility between SHUSA and SC that is eliminated at the consolidated level $49.1 $50.8 $1.0 Sr Debt 2.65% FHLB Private Amort. SBNA ($BN, % yield) SHUSA HOLDCO ($BN, % yield) SHUSA ($BN) $1.1 Sr Debt 4.5% Debt $0.6 $1.5 Sr Debt 2.8% Private Amort. 3rd Party Rev Santander2 SHUSA Holdco funding will be driven by TLAC and liquidity requirements SBNA continues to reduce reliance on FHLB and extinguish legacy advances

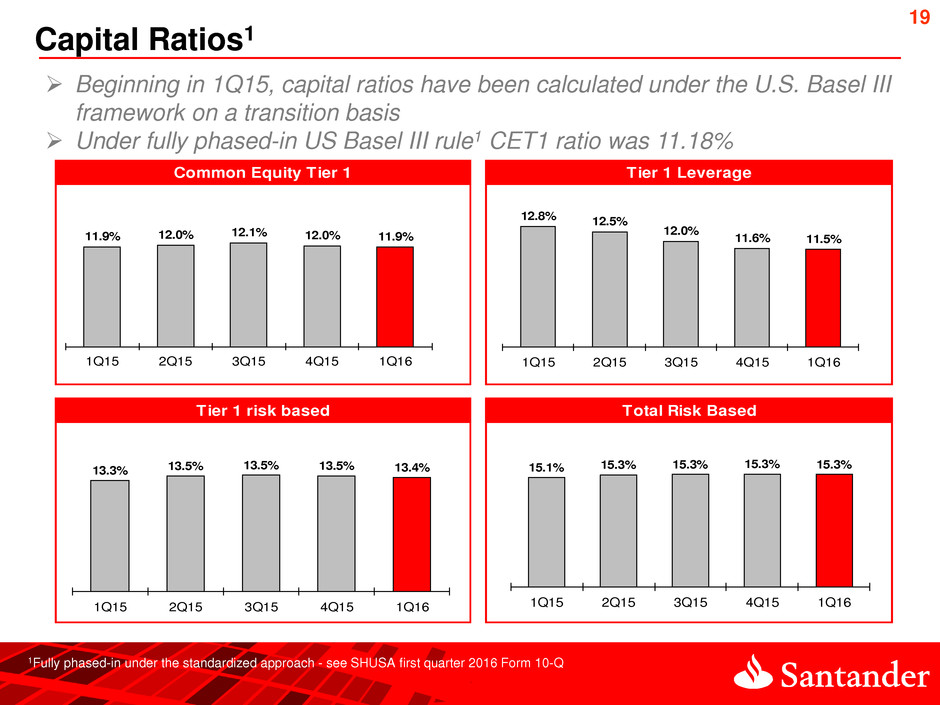

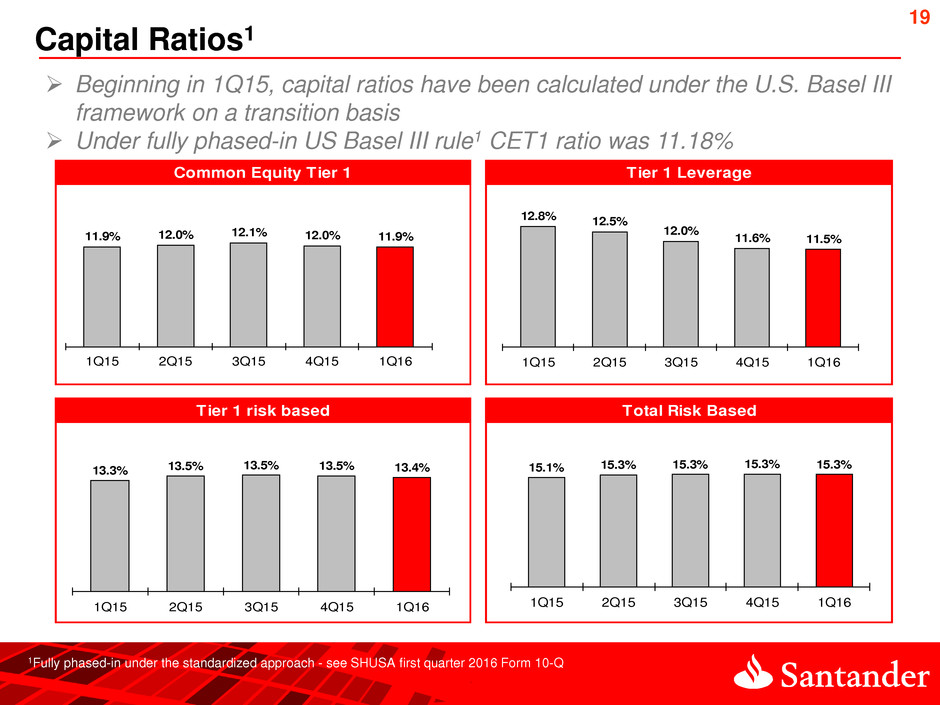

19 Capital Ratios1 1Fully phased-in under the standardized approach - see SHUSA first quarter 2016 Form 10-Q Beginning in 1Q15, capital ratios have been calculated under the U.S. Basel III framework on a transition basis Under fully phased-in US Basel III rule1 CET1 ratio was 11.18% Tier 1 Leverage Tier 1 risk based Common Equity Tier 1 Total Risk Based 11.9% 12.0% 12.1% 12.0% 11.9% 1Q15 2Q15 3Q15 4Q15 1Q16 12.8% 12.5% 12.0% 11.6% 11.5% 1Q15 2Q15 3Q15 4Q15 1Q16 13.3% 13.5% 13.5% 13.5% 13.4% 1Q15 2Q15 3Q15 4Q15 1Q16 15.1% 15.3% 15.3% 15.3% 15.3% 1Q15 2Q15 3Q15 4Q15 1Q16

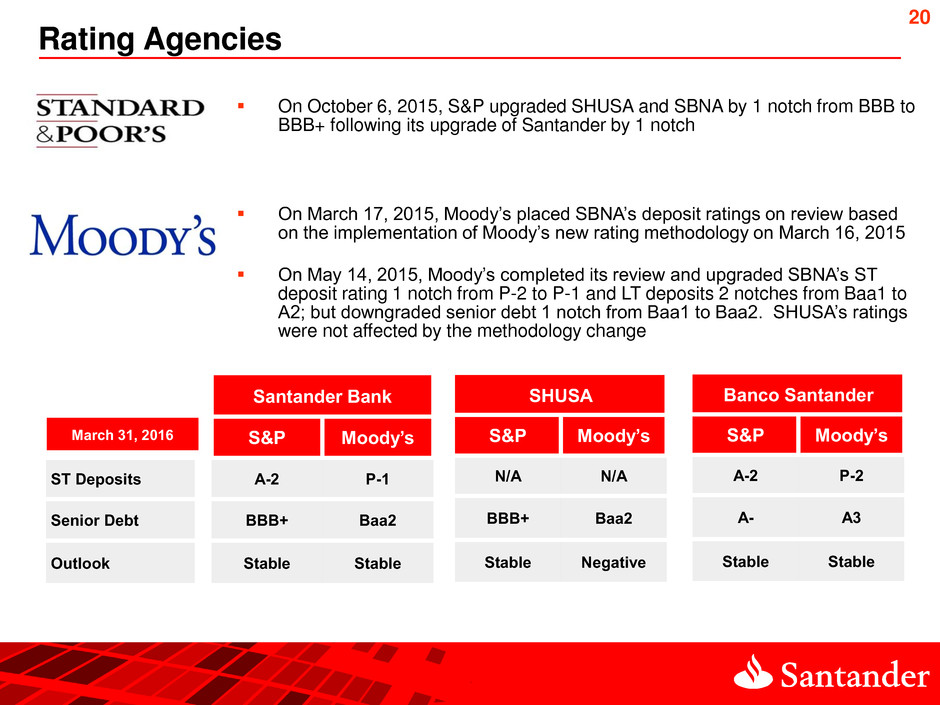

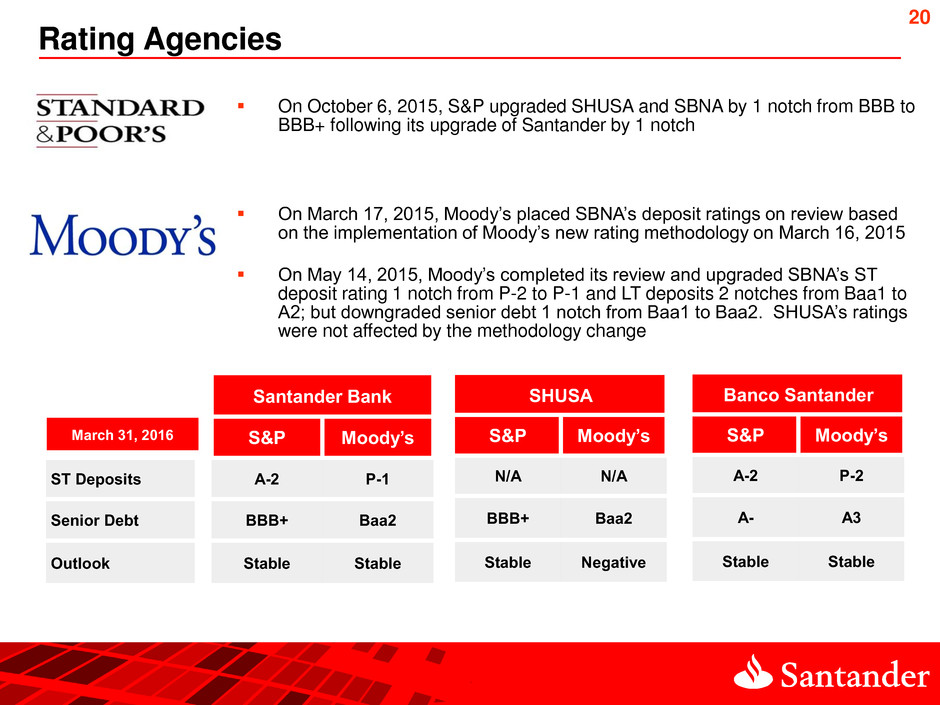

20 Rating Agencies Santander Bank Te S&P Moody’s ST Deposits A-2 P-1 Senior Debt BBB+ Baa2 Outlook Stable Stable SHUSA S&P Moody’s N/A N/A BBB+ Baa2 Stable Negative On October 6, 2015, S&P upgraded SHUSA and SBNA by 1 notch from BBB to BBB+ following its upgrade of Santander by 1 notch On March 17, 2015, Moody’s placed SBNA’s deposit ratings on review based on the implementation of Moody’s new rating methodology on March 16, 2015 On May 14, 2015, Moody’s completed its review and upgraded SBNA’s ST deposit rating 1 notch from P-2 to P-1 and LT deposits 2 notches from Baa1 to A2; but downgraded senior debt 1 notch from Baa1 to Baa2. SHUSA’s ratings were not affected by the methodology change March 31, 2016 Banco Santander S&P Moody’s A-2 P-2 A- A3 Stable Stable

21 Santander U.S. Web site SantanderUS.com At-a-Glance • Up to date key Santander US information in one institutional website • 6 sections: • About Us • Structure and governance • Board of Directors • Management • Financial Services • Investor and Shareholder Relations (includes link to SEC filings and fixed income investor presentations) • Media Relations • Communities • Careers • Links to U.S. business units WWW.SANTANDERUS.COM

Appendix

23 SHUSA Goodwill Impairment1 1SHUSA form 8-K dated February 29, 2016 SHUSA registered a non-cash impairment charge of $4.4BN (pre-tax and including non-controlling interests) in its financial statements for the quarter ended Dec. 31, 2015, related to the goodwill associated with its approximately 59% ownership of SC. Post-tax and excluding non-controlling interests the charge was $1.6BN This charge, primarily a result of the decline in the SC share price during the fourth quarter, was required under U.S. GAAP The impairment did not impact SHUSA’s risk-based capital ratios adversely, as goodwill is excluded in calculating such ratios. o SHUSA’s Common Equity Tier 1 (CET1) was 11.95% at December 31, 2015 The impairment did not affect the capital or activities of SBNA, SC or other units of Santander US. o The stake in SC is held at the holding company, not the Bank

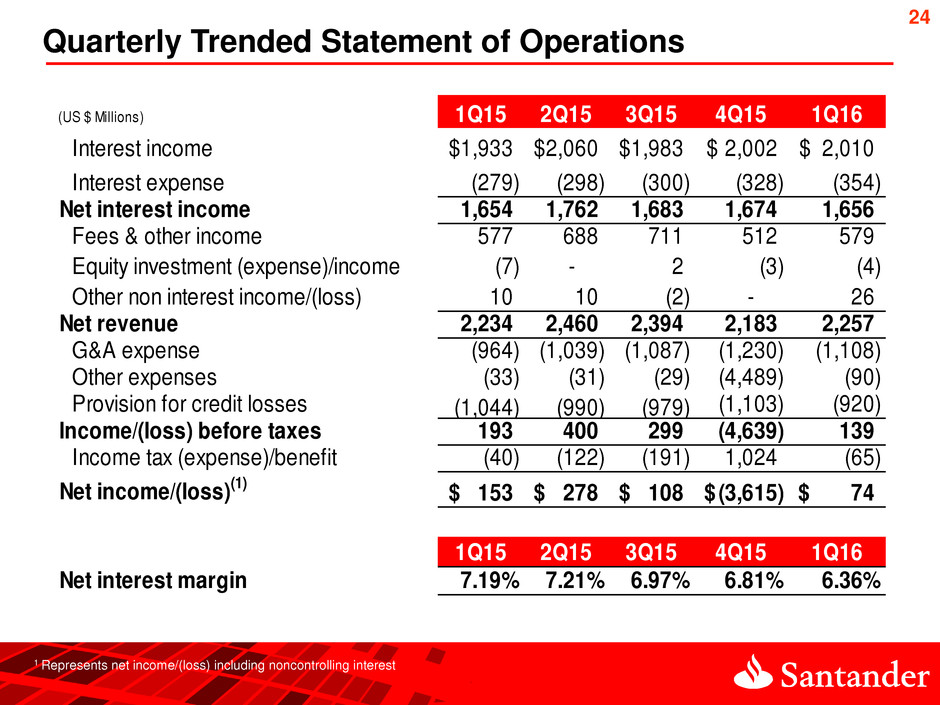

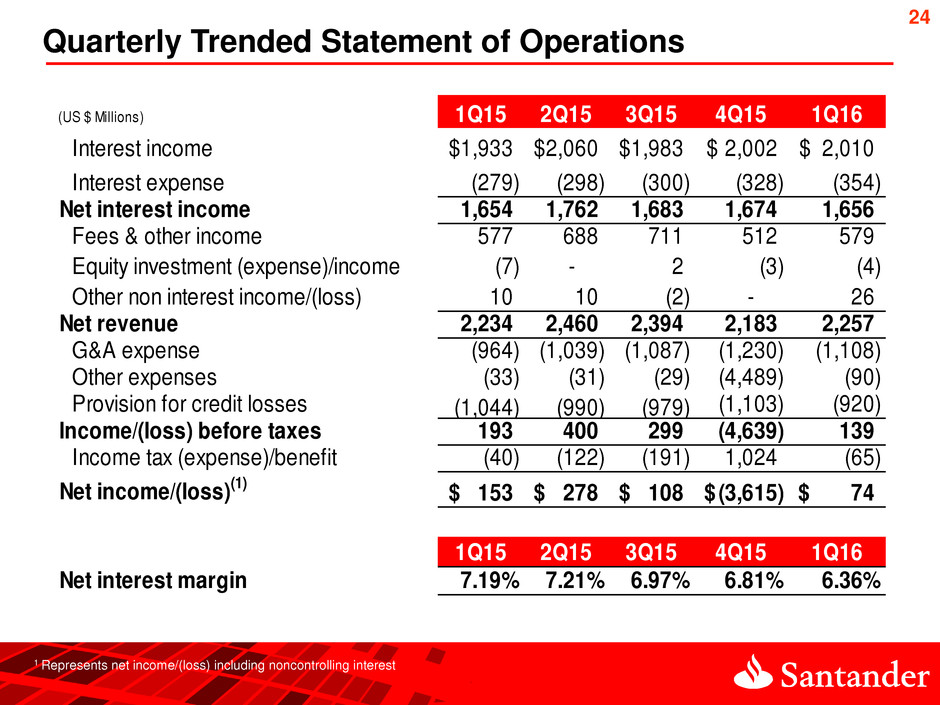

24 Quarterly Trended Statement of Operations 1 Represents net income/(loss) including noncontrolling interest (US $ Millions) 1Q15 2Q15 3Q15 4Q15 1Q16 Interest income 1,933$ 2,060$ 1,983$ 2,002$ 2,010$ Interest expense (279) (298) (300) (328) (354) Net interest income 1,654 1,762 1,683 1,674 1,656 Fees & other income 577 688 711 512 579 Equity investment (expense)/income (7) - 2 (3) (4) Other non interest income/(loss) 10 10 (2) - 26 Net revenue 2,234 2,460 2,394 2,183 2,257 G&A expense (964) (1,039) (1,087) (1,230) (1,108) Other expenses (33) (31) (29) (4,489) (90) Provision for credit losses (1,044) (990) (979) (1,103) (920) Income/(loss) before taxes 193 400 299 (4,639) 139 Income tax (expense)/benefit (40) (122) (191) 1,024 (65) Net income/(loss)(1) 153$ 278$ 108$ (3,615)$ 74$ 1Q15 2Q15 3Q15 4Q15 1Q16 Net interest margin 7.19% 7.21% 6.97% 6.81% 6.36%

25 Average Balance Sheet1 1Quarterly Averages (US $ millions) Average Yield/ Average Yield/ Average Yield/ Average Yield/ Balance Rate Balance Rate Balance Rate Balance Rate Deposits and investments 26,292$ 1.80% 22,113$ 1.85% 4,179$ -0.05% 18,694$ 2.30% Loans 82,939 9.26% 80,393 9.46% 2,546 -0.20% 77,165 9.67% Allowance for loan losses (3,288) --- (2,586) --- (702) --- (1,861) --- Intercompany Investment 15 6.18% 15 6.07% - --- 15 --- Earning assets 105,958 7.70% 99,935 8.02% 6,023 -0.32% 94,013 8.39% Other assets 22,888 --- 25,870 --- (2,982) --- 25,073 --- TOTAL ASSETS 128,846$ 6.31% 125,805$ 6.43% 3,041$ -0.12% 119,086$ 6.68% Interest-bearing demand deposits 10,794 0.54% 11,523 0.62% (729) -0.08% 11,596 0.45% Noninterest-bearing demand deposits 8,413 --- 8,146 --- 267 --- 7,943 --- Savings 4,012 0.10% 3,953 0.12% 59 -0.02% 3,903 0.12% Money market 24,369 0.54% 22,958 0.56% 1,411 -0.02% 22,056 0.57% Certificates of deposit 9,014 0.93% 8,144 1.12% 870 -0.19% 8,185 0.94% Borrowed funds 49,435 2.32% 44,383 2.13% 5,052 0.19% 39,076 2.24% Other liabilities 3,088 --- 3,499 --- (411) --- 3,393 --- Equity 19,721 --- 23,199 --- (3,478) --- 22,934 --- TOTAL LIABILITIES & SE 128,846$ 1.11% 125,805$ 0.97% 3,041$ 0.14% 119,086$ 0.96% NET INTEREST MARGIN 6.36% 6.81% -0.45% 7.19% 1Q16 4Q15 Change 1Q15

26 Consolidating Income Statement 1 Includes holding company activities, eliminations and purchase accounting marks related to SCUSA consolidation. 2 SHUSA net income includes non-controlling interest. (US $ Millions) Bank Interest income 576$ 1,406$ 28$ 2,010$ Interest expense (143) (185) (26) (354) Net interest income 433 1,221 2 1,656 Fees & other income/(expense) 247 346 (18) 575 Other non interest income 26 - (0) 26 Net revenue/(loss) 706 1,567 (16) 2,257 G & A expense (540) (539) (29) (1,108) Other expenses (56) (4) (30) (90) Provision for credit losses (113) (707) (100) (920) Income/(loss) before taxes (3) 317 (175) 139 Income tax (expense)/benefit (2) (116) 53 (65) Net income/(loss) 2 (5)$ 201$ (122)$ 74$ SC SHUSA Three months ended March 31, 2016 Other (1)

27 Consolidating Balance Sheet (US $ millions) Bank SC Other (1) SHUSA Assets Cash and cash equivalents 6,561$ 86$ - 6,647$ Investments 21,512 - - 21,512 Loans 54,482 30,020 (745) 83,757 Less allowance for loan losses (643) (3,614) 723 (3,534) Total loans, net 53,839 26,406 (22) 80,223 Goodwill 3,403 74 967 4,444 Other assets 6,982 11,339 (49) 18,273 Total assets 92,297$ 37,905$ 897$ 131,099$ Liabilities and Stockholders' Equity Deposits 62,183$ - (4,719) 57,464$ Borrowings and other debt obligations 14,740 31,505 4,512 50,757 Other liabilities 1,918 1,810 (592) 3,136 Total liabilities 78,841 33,315 (799) 111,357 Stockholders' equity including noncontrolling interest 13,456 4,590 1,696 19,742 Total liabilities and stockholders' equity 92,297$ 37,905$ 897$ 131,099$ (1) Includes holding company, eliminations and purchase accounting marks related to SC consolidation. March 31, 2016

28 The Federal Reserve TLAC proposal, released 10/30/15, would require SHUSA to hold 18.5% of risk-weighted assets (RWA) in TLAC-eligible instruments by January 2019 and 20.5% by January 2022 (16% and then 18% plus 2.5% capital conservation buffer). The proposal also includes a requirement of 7% of RWA in long-term debt by January 2019 Under the current FRB proposal, TLAC-eligible instruments for IHCs consist of subordinated debt issued to the parent with point of non-viability (PONV) clauses TLAC Requirement : Current FRB proposal1 1Comment period on the FRB proposal ended February 19, 2016 ILLUSTRATION

29 SBNA: Quarterly Profitability US $ Millions See appendix for Non-GAAP to GAAP reconciliation of pre-tax pre-provision income *3Q15 - $96MM tax provision Net Interest Income ($MM) Pre-Tax Pre-Provision Income ($MM) Pre-Tax Income/(Loss) ($MM) Net Income/(Loss) ($MM) 115 148 116 71 110 0 20 40 60 80 100 120 140 160 180 200 1Q15 2Q15 3Q15 4Q15 1Q16 415 408 419 424 433 2.50% 2.33% 2.22% 2.19% 2.22% 0 100 200 300 400 500 1Q15 2Q15 3Q15 4Q15 1Q16 NII Net Interest Margin 68 111 134 1 (3) -5 20 45 70 95 120 145 1Q15 2Q15 3Q15 4Q15 1Q16 59 98 107* 7 (5) 11 -10 15 40 65 90 115 1Q15 2Q15 3Q15 4Q15 1Q16

30 SBNA: Quarterly Trended Statement of Operations (US$ in Millions) 1Q15 2Q15 3Q15 4Q15 1Q16 Interest income 545$ 542$ 554$ 564$ 576$ Interest expense (130) (134) (135) (140) (143) Net interest income 415 408 419 424 433 Fees & other income 212 291 258 270 247 Other non-interest income/(loss) 10 10 (1) - 26 Net revenue 637 709 676 694 706 General & administrative expenses (499) (545) (543) (607) (540) Other expenses (23) (16) (18) (16) (56) (Provision for)/release of credit losses (47) (37) 19 (70) (113) Income/(loss) before taxes 68 111 134 1 (3) Income tax (expense)/benefit (9) (13) (123) 6 (2) Net income/(loss) 59$ 98$ 11$ 7$ (5)$ 1Q15 2Q15 3Q15 4Q15 1Q16 Net interest margin 2.50% 2.33% 2.22% 2.19% 2.22%

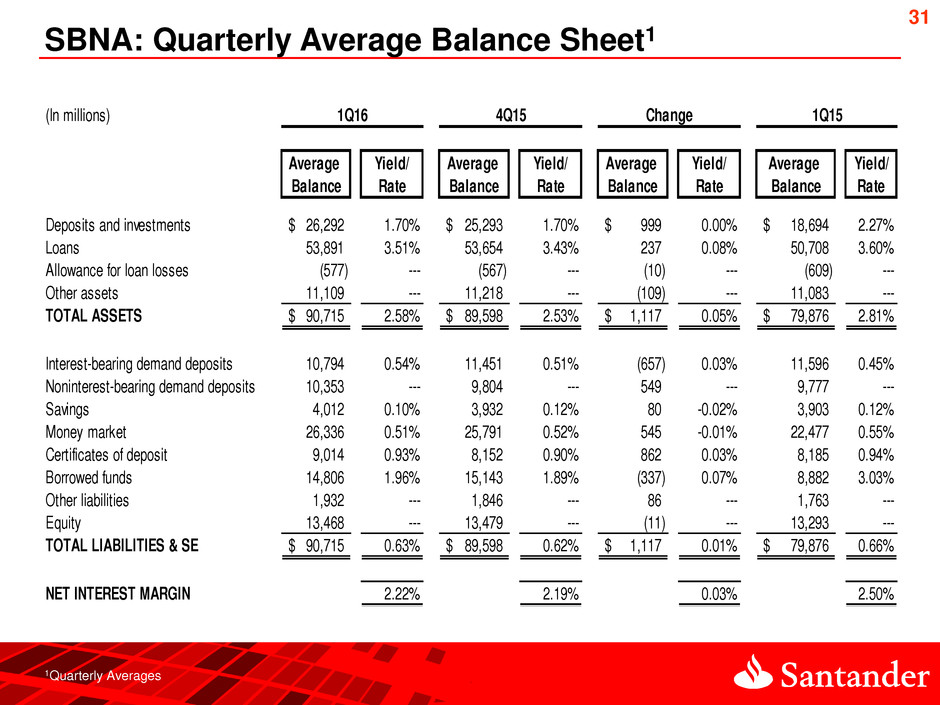

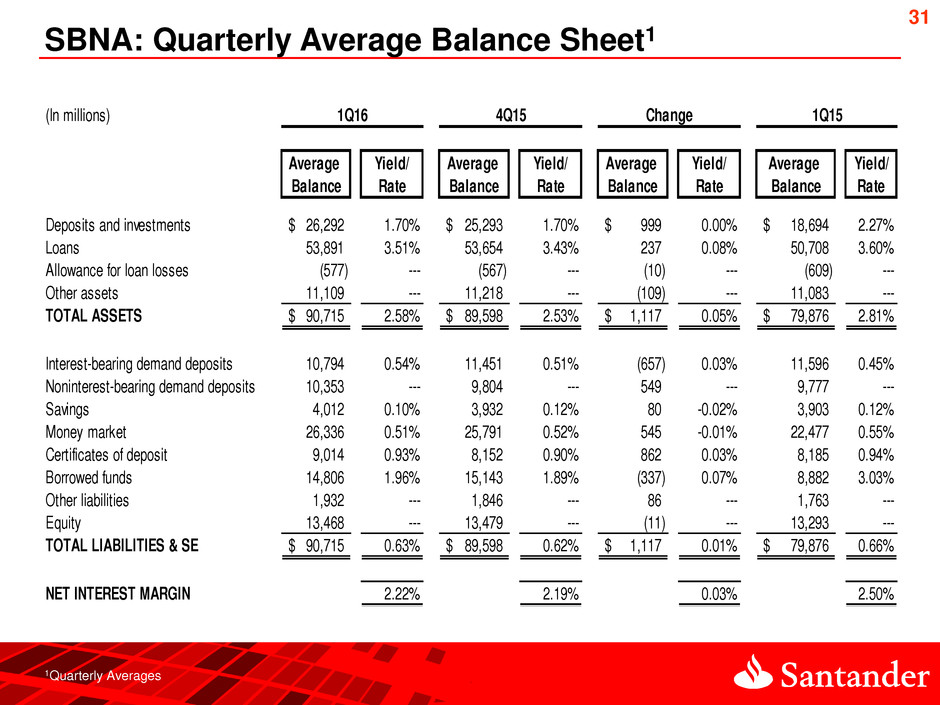

31 SBNA: Quarterly Average Balance Sheet1 1Quarterly Averages (In millions) Average Yield/ Average Yield/ Average Yield/ Average Yield/ Balance Rate Balance Rate Balance Rate Balance Rate Deposits and investments 26,292$ 1.70% 25,293$ 1.70% 999$ 0.00% 18,694$ 2.27% Loans 53,891 3.51% 53,654 3.43% 237 0.08% 50,708 3.60% Allowance for loan losses (577) --- (567) --- (10) --- (609) --- Other assets 11,109 --- 11,218 --- (109) --- 11,083 --- TOTAL ASSETS 90,715$ 2.58% 89,598$ 2.53% 1,117$ 0.05% 79,876$ 2.81% Interest-bearing demand deposits 10,794 0.54% 11,451 0.51% (657) 0.03% 11,596 0.45% Noninterest-bearing demand deposits 10,353 --- 9,804 --- 549 --- 9,777 --- Savings 4,012 0.10% 3,932 0.12% 80 -0.02% 3,903 0.12% Money market 26,336 0.51% 25,791 0.52% 545 -0.01% 22,477 0.55% Certificates of deposit 9,014 0.93% 8,152 0.90% 862 0.03% 8,185 0.94% Borrowed funds 14,806 1.96% 15,143 1.89% (337) 0.07% 8,882 3.03% Other liabilities 1,932 --- 1,846 --- 86 --- 1,763 --- Equity 13,468 --- 13,479 --- (11) --- 13,293 --- TOTAL LIABILITIES & SE 90,715$ 0.63% 89,598$ 0.62% 1,117$ 0.01% 79,876$ 0.66% NET INTEREST MARGIN 2.22% 2.19% 0.03% 2.50% 1Q16 1Q154Q15 Change

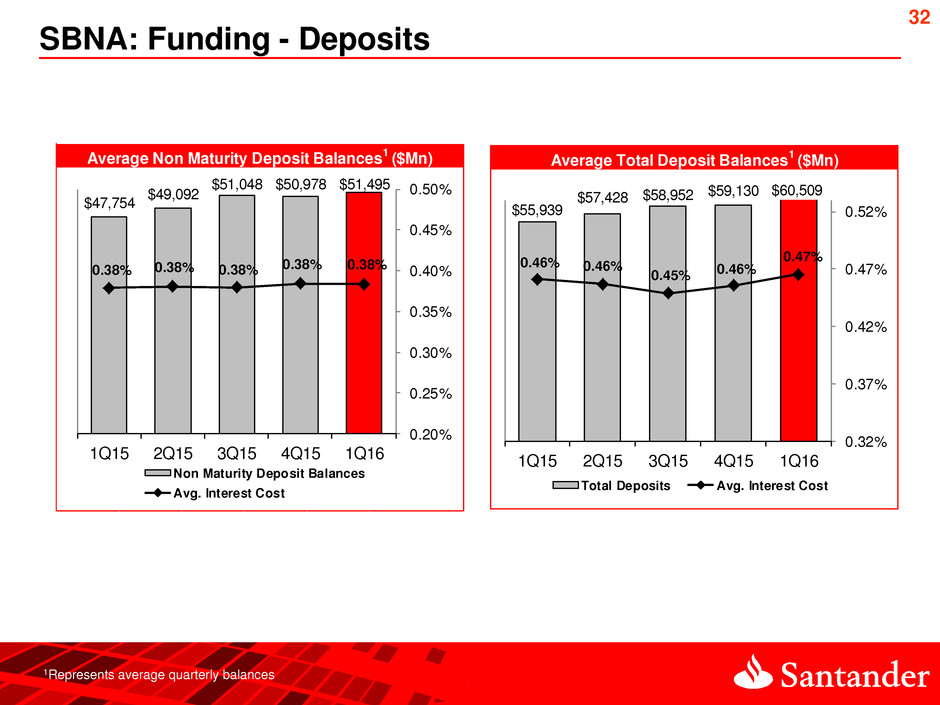

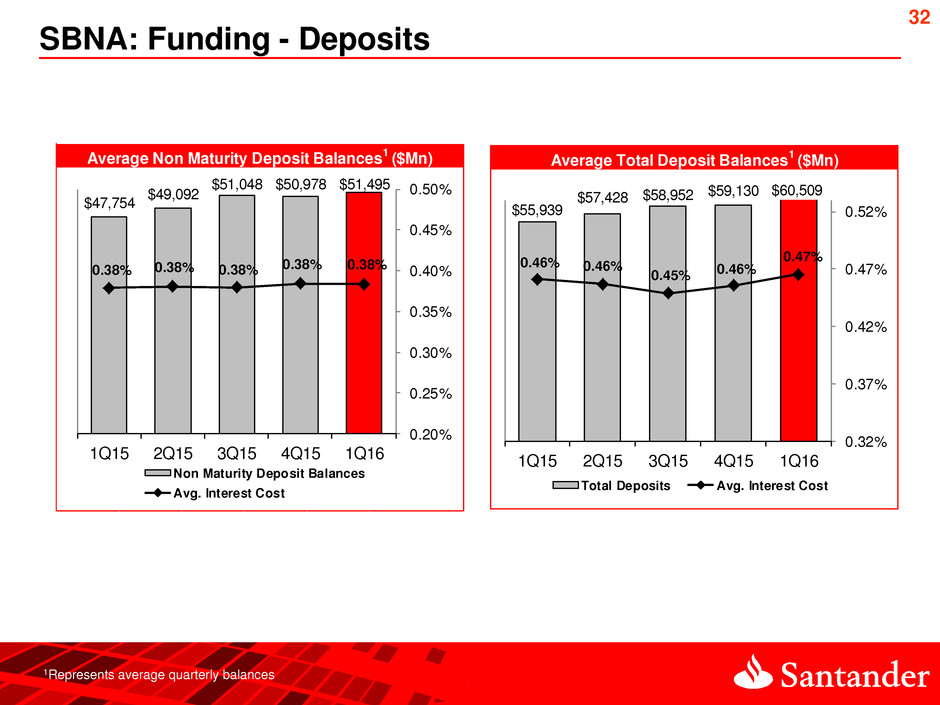

32 SBNA: Funding - Deposits 1Represents average quarterly balances Average Non Maturity Deposit Balances 1 ($Mn) $47,754 $49,092 $51,048 $50,978 $51,495 0.38% 0.38% 0.38% 0.38% 0.38% 0.20% 0.25% 0.30% 0.35% 0.40% 0.45% 0.50% 1Q15 2Q15 3Q15 4Q15 1Q16 Non Maturity Deposit Balances Avg. Interest Cost Average Total Deposit Balances 1 ($Mn) $55,939 $57,428 $58,952 $59,130 $60,509 0.46% 0.46% 0.45% 0.46% 0.47% 0.32% 0.37% 0.42% 0.47% 0.52% 1Q15 2Q15 3Q15 4Q15 1Q16 Total Deposits Avg. Interest Cost

33 $7.2 $7.5 $8.2 $8.3 $9.5 $10.1 $9.7 $10.0 $10.1 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.1% 0.2% 0.6% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.3% 0.3% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 1Commercial Banking = Non-CRE total for Business Banking, Middle Market, Equipment Finance & Leasing and Commercial Banking NCE 2Global Corporate Banking = Non-CRE total for MRG and Large Corporate 3Other Commercial = Non –CRE total for all other Commercial Business segments 4Other Consumer = Direct Consumer, Indirect Consumer, RV/Marine, Credit Cards, SFC, & RDM Run-off Global Corporate Banking2 Commercial Banking1 Other Consumer4 Other Commercial3 Outstandings NPL* to Total Loans Net Charge-Offs** SBNA: Asset Quality *NPL = Nonaccruing loans plus accruing loans 90+ DPD **NCO = Rolling 12-month average for that quarter and the prior 3 quarters US $ Billions $4.9 $5.3 $5.5 $6.4 $6.8 $6.7 $6.8 $7.1 $7.4 0.4% 0.3% 0.7% 0.3% 0.3% 0.3% 0.3% 0.4% 1.9% 0.4% 0.4% 0.4% 0.4% 0.3% 0.2% 0.2% 0.2% 0.2% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 $2.0 $2.0 $1.9 $1.9 $1.8 $1.7 $1.7 $1.7 $1.6 2.1% 2.1% 2.1% 2.2% 2.2% 2.0% 2.0% 1.8% 1.7% 2.7 2 7 2.7 2.6 2.6 2.5 2.6 2.7% 2.5% Q14 2Q14 3Q 4 4Q14 1Q15 2Q15 3Q 5 4Q15 1Q16 $5.3 $5.3 $5.4 $5.4 $5.5 $5.5 $5.7 $6.0 $6.2 2.3% 1.9% 1.3% 1.4% 1.6% 1.4% 1.1% 1.1% 1.5% 0.5% 0.5% 0.4% 0.3% 0.5% 0.4% 0.4% 0.5% 0.2 1Q14 2Q 4 3Q14 4Q14 Q15 2Q15 3Q15 4Q15 Q16

34 Santander Real Estate Capital Commercial Real Estate1 Home Equity Mortgages Outstandings NPL* to Total Loans Net Charge-Offs** SBNA: Asset Quality *NPL = Nonaccruing loans plus accruing loans 90+ DPD **NCO = Rolling 12-month average for that quarter and the prior 3 quarters 1Commercial Real Estate is comprised of the commercial real estate, continuing care retirement communities and non-owner occupied real estate secured commercial loans (SREC segment included in separate graph) US $ Billions $9.6 $9.7 $7.5 $7.0 $7.0 $6.8 $6.7 $6.5 $6.44.8% 4.6% 3.3% 3.3% 3.0% 2.9% 2.8% 2.7% 2.6% 0.3% 0.4% 1.2% 1.2% 1.3% 1.3% 0.3% 0.2% 0.2% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 $6.0 $6.0 $6.0 $6.0 $6.0 $6.0 $6.0 $6.0 $5.9 1.8% 1.9% 1.9% 1.9% 1.9% 1.8% 1.7% 1.8% 1.8% 0.5% 0.5% 0.4% 0.4% 0.3% 0.3% 0.3% 0.3% 0.3% Q14 2Q14 3Q 4 4Q14 Q15 2Q15 3Q 5 4Q15 1Q16 $5.6 $5.6 $5.4 $5.6 $5.8 $5.9 $5.8 $6.0 $6.6 3.4 3.0% 3.2% 2.2% 1.9% 1.3% 1.3% 1.3% 1.7% 0.5% 0.4% 0.7% 0.5% 0.2% 0.4% 0.1% 0.2% 0.2% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 $10.8 $10.7 $10.3 $10.0 $9.7 $9.7 $10.7 $10.5 $10.3 0.2% 0.1% 0.2% 0. % 0. % 0. % 0. % 0. % 0. % 0.1% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Q14 2Q14 3Q 4 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16

35 SBNA: Capital Ratios 1Fully phased-in under the standardized approach - see SHUSA 2016 first quarter Form 10-Q Beginning in 1Q15, capital ratios have been calculated under the U.S. Basel III framework on a transition basis Under fully phased-in US Basel III rule1 CET1 ratio is 13.5% 13.8% 13.8% 13.9% 13.8% 13.9% 1Q15 2Q15 3Q15 4Q15 1Q16 13.8% 13.8% 13.9% 13.8% 13.9% 1Q15 2Q15 3Q15 4Q15 1Q16 12.7% 12.4% 11.7% 11.5% 11.3% 1Q15 2Q15 3Q15 4Q15 1Q16 15.3% 15.2% 15.1% 15.1% 15.4% 1Q15 2Q15 3Q15 4Q15 1Q16 Common Equity Tier 1 Tier 1 Leverage Ratio Tier 1 Risk-Based Capital Ratio Total Risk-Based Capital Ratio

36 SC: Serviced For Others Flow Programs 1,384 1,385 1,137 919 995 1,348 1,081 860 CCART 1,028 768 788 Residual Sales 1,710 Leased Vehicles 369 561 756 Other 18 253(877)2 Capital-efficient, higher-ROE strategy continues to generate incremental returns, and will contribute more meaningfully to ROA as SC continues to grow over time Scalability of SC IT platform and operations allow SC to efficiently execute serviced for others growth Composition at 3/31/2016 RIC 72 % Leases 21 % RV/Marine 7 % Total 100 % 1 Runoff includes principal paid or charged-off from 3/31/2014 to 3/31/2016 2 On October 1, 2014, the Company transferred $877 million of dealer loans serviced for others to SHUSA 1 - 6,223 7,976 10,407 10,667 12,147 14,919 17,977 19,846 6,471 6,223 1,753 2,431 260 1,480 2,772 3,058 1,869 860 14,235 - 5,000 10,000 15,000 20,000 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Runoff Ending Balance ($ in millions)

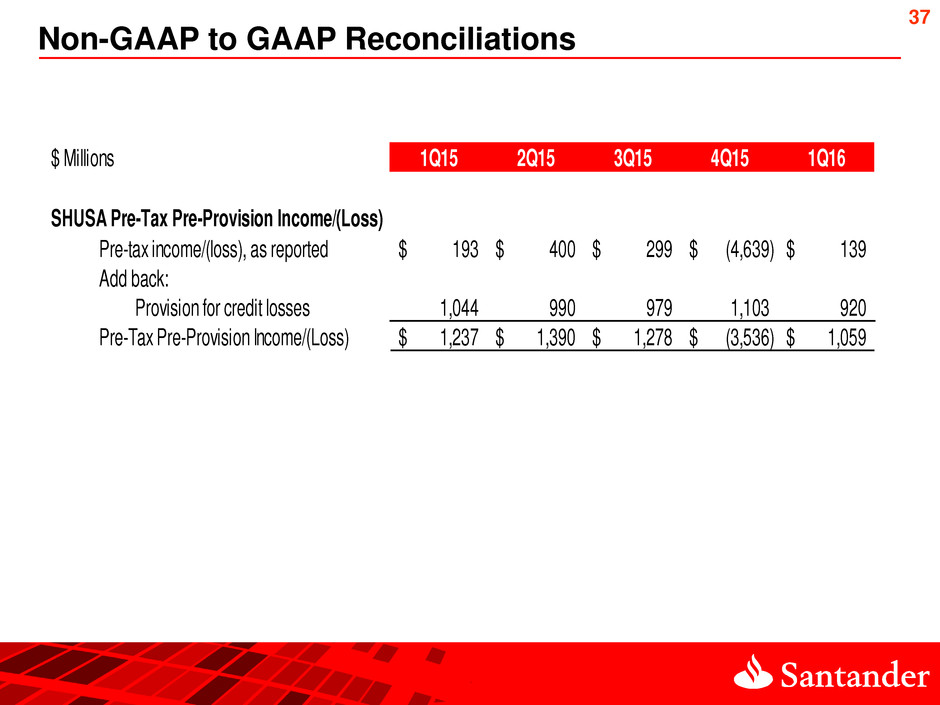

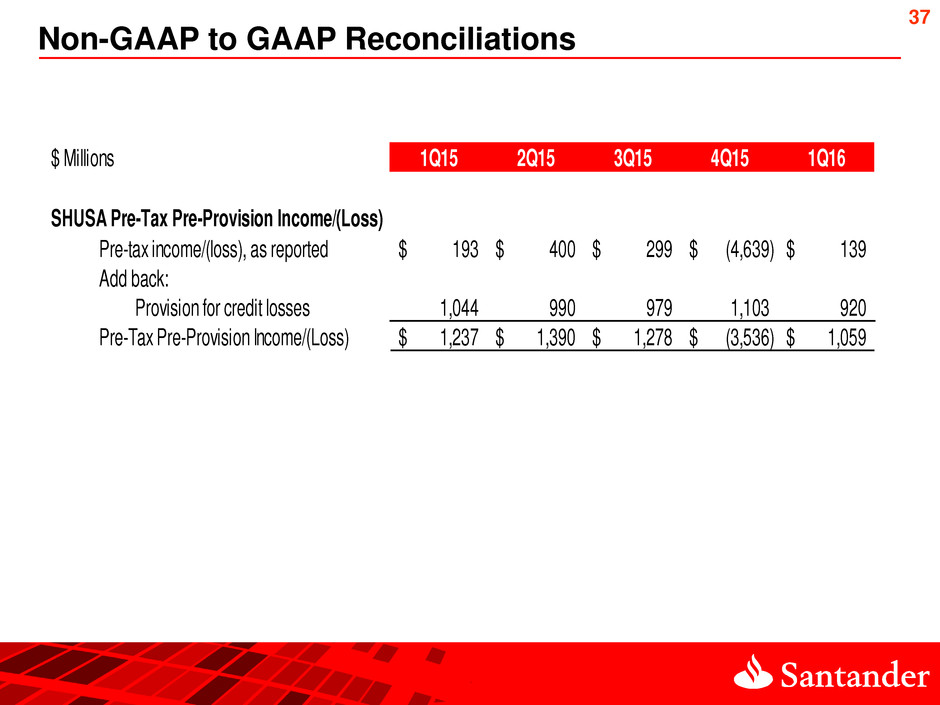

37 Non-GAAP to GAAP Reconciliations $ Milli n 1Q15 2Q15 3Q15 4Q15 1Q16 SHUSA Pre-Tax Pre-Provision Income/(Loss) Pre-tax income/(loss), as reported 193$ 400$ 299$ (4,639)$ 139$ Add back: Provision for credit losses 1,044 990 979 1,103 920 Pre-Tax Pre-Provision Income/(Loss) 1,237$ 1,390$ 1,278$ (3,536)$ 1,059$

38 Non-GAAP to GAAP Reconciliations (cont.) $ Millions 1Q15 2Q15 3Q15 4Q15 1Q16 Tier 1 Common to Risk-Weighted Assets Tier 1 Common 12,981$ 13,112$ 13,229$ 12,963$ 12,644$ Risk-Weighted Assets 109,123 109,503 109,237 108,455 106,446 Ratio 11.9% 12.0% 12.1% 12.0% 11.9% Tier 1 Leverage Tier 1 Capital 14,491$ 14,775$ 14,776$ 14,647$ 14,281$ 113,129 118,100 123,319 126,627 123,964$ Ratio 12.8% 12.5% 12.0% 11.6% 11.5% Tier 1 Risk-Based Tier 1 Capital 14,491$ 14,775$ 14,776$ 14,647$ 14,281$ Risk-Weighted Assets 109,123 109,503 109,237 108,455 106,446$ Ratio 13.3% 13.5% 13.5% 13.5% 13.4% Total Risk-Based Risk-Based Capital 16,520$ 16,733$ 16,713$ 16,628$ 16,288$ Risk-Weighted Assets 109,123 109,503 109,237 108,455 106,446$ Ratio 15.1% 15.3% 15.3% 15.3% 15.3% Average total assets for leverage capital

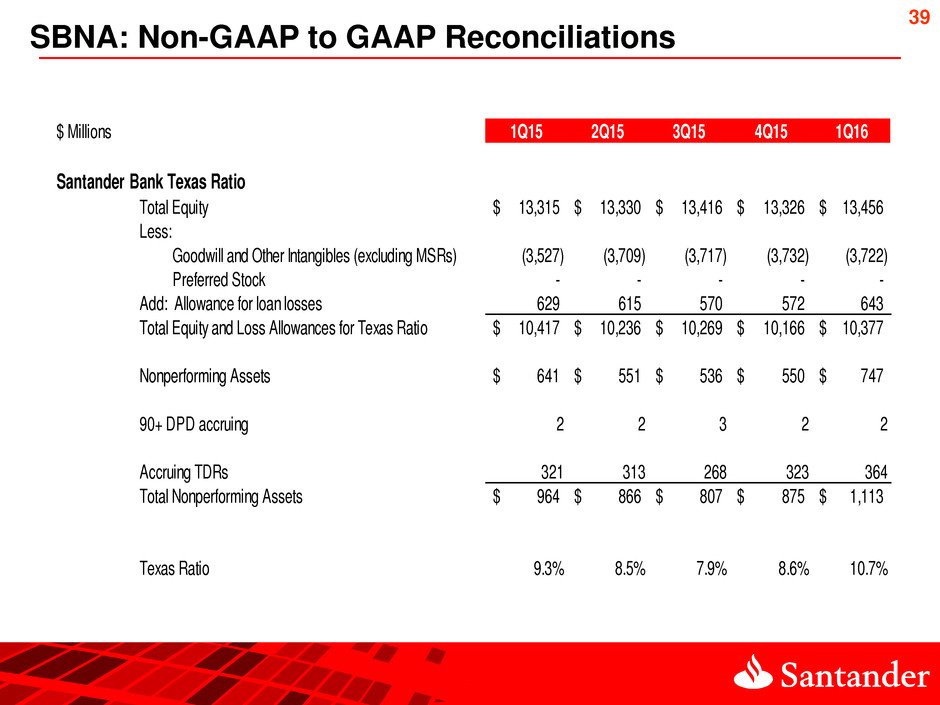

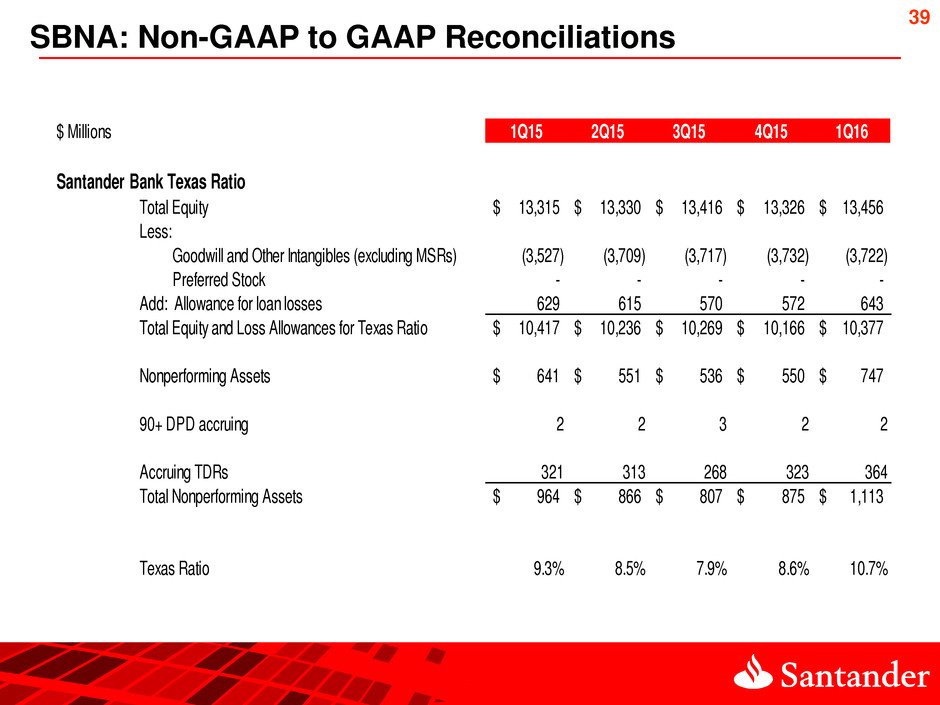

39 SBNA: Non-GAAP to GAAP Reconciliations $ Millions 1Q15 2Q15 3Q15 4Q15 1Q16 Santander Bank Texas Ratio Total Equity 13,315$ 13,330$ 13,416$ 13,326$ 13,456$ Less: Goodwill and Other Intangibles (excluding MSRs) (3,527) (3,709) (3,717) (3,732) (3,722) Preferred Stock - - - - - Add: Allowance for loan losses 629 615 570 572 643 Total Equity and Loss Allowances for Texas Ratio 10,417$ 10,236$ 10,269$ 10,166$ 10,377$ Nonperforming Assets 641$ 551$ 536$ 550$ 747$ 90+ DPD accruing 2 2 3 2 2 Accruing TDRs 321 313 268 323 364 Total Nonperforming Assets 964$ 866$ 807$ 875$ 1,113$ Texas Ratio 9.3% 8.5% 7.9% 8.6% 10.7%

40 SBNA: Non-GAAP to GAAP Reconciliations $ Millions 1Q15 2Q15 3Q15 4Q15 4Q15 Santander Bank Pre-Tax Pre-Provision Income Pre-tax income, as reported 68$ 111$ 134$ 1$ (3)$ Add back: Provision for credit losses 47 37 (19) 70 113 Pre-Tax Pre-Provision Income 115$ 148$ 116$ 71$ 110$

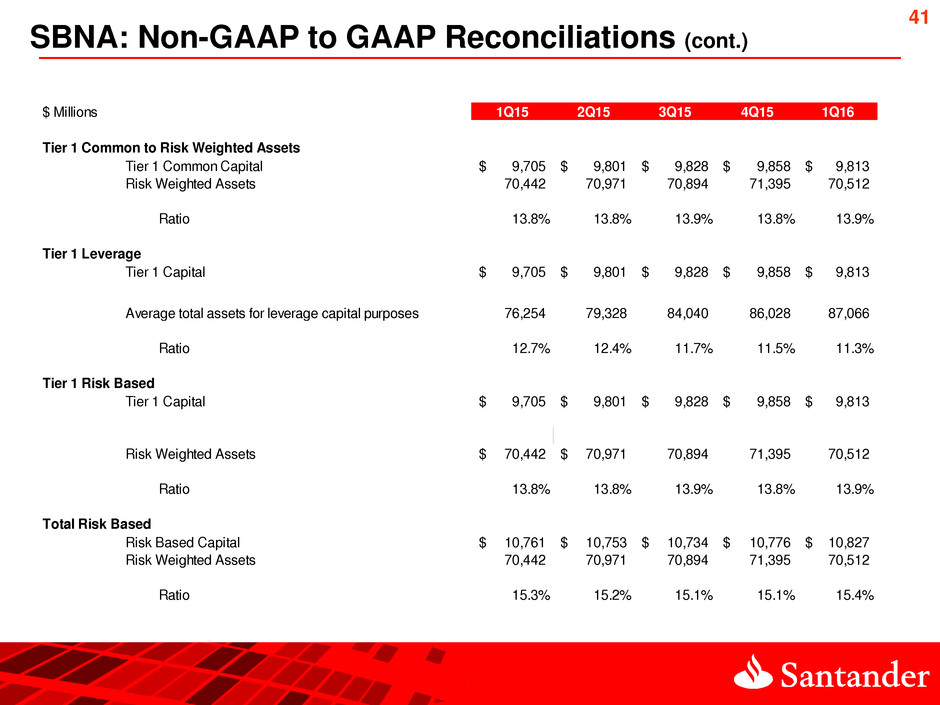

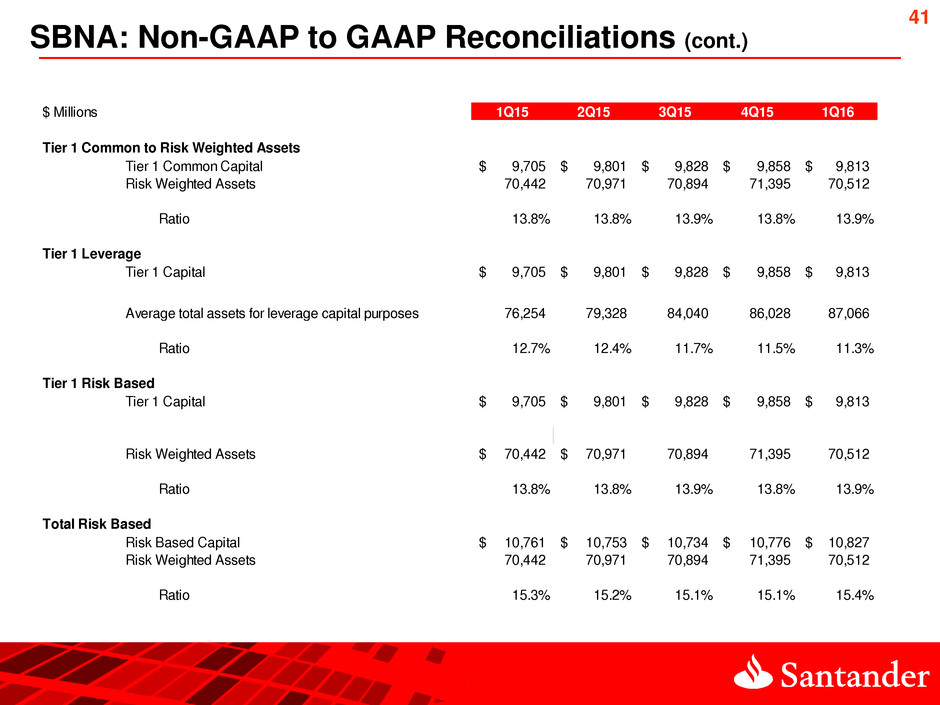

41 SBNA: Non-GAAP to GAAP Reconciliations (cont.) $ Millions 1Q15 2Q15 3Q15 4Q15 1Q16 Tier 1 Common to Risk Weighted Assets Tier 1 Common Capital 9,705$ 9,801$ 9,828$ 9,858$ 9,813$ Risk Weighted Assets 70,442 70,971 70,894 71,395 70,512 Ratio 13.8% 13.8% 13.9% 13.8% 13.9% Tier 1 Leverage Tier 1 Capital 9,705$ 9,801$ 9,828$ 9,858$ 9,813$ 76,254 79,328 84,040 86,028 87,066 Ratio 12.7% 12.4% 11.7% 11.5% 11.3% Tier 1 Risk Based Tier 1 Capital 9,705$ 9,801$ 9,828$ 9,858$ 9,813$ Risk Weighted Assets 70,442$ 70,971$ 70,894 71,395 70,512 Ratio 13.8% 13.8% 13.9% 13.8% 13.9% Total Risk Based Risk Based Capital 10,761$ 10,753$ 10,734$ 10,776$ 10,827$ Risk Weighted Assets 70,442 70,971 70,894 71,395 70,512 Ratio 15.3% 15.2% 15.1% 15.1% 15.4% Average total assets for leverage capital purposes