|

Exhibit 99.1

|

Santander Holdings USA, Inc.

Fixed Income Investor Update

Data as of March 31, 2015

June 4, 2015

Disclaimer

2

Santander Holdings USA, Inc. (“SHUSA”) cautions that this presentation may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are found in various places throughout this presentation and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties, and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) increased regulation and regulatory developments; (2) domestic and international market, macro-economic, governmental, regulatory conditions and trends; (3) movements in local and international securities markets, currency exchange rates, and interest rates; (4) competitive pressures; (5) technological developments; and (6) changes in the financial position or creditworthiness of our customers, obligors, and counterparties. The risk factors and other key factors that we have indicated in our past and future filings and reports, including our Annual Report on Form 10-K and those of Santander Bank, N.A. (“Santander Bank” or “SBNA”) or Santander Consumer USA Inc. (“SCUSA”) for the year ended December 31, 2014 and other filings and reports with the Securities and Exchange Commission (the “SEC”), could adversely affect our business and financial performance. Other factors could cause actual results to differ materially from those in the forward-looking statements.

The information contained in this presentation is not complete. It is subject to, and must be read in conjunction with, all other publicly available information, including reports filed with or furnished to the SEC, press releases, and other relevant information. Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest, and in making this presentation available, SHUSA gives no advice and makes no recommendation to buy, sell, or otherwise deal in shares or other securities of Banco Santander, S.A. (“Santander”), SHUSA, Santander Bank, or SCUSA in any other securities or investments.

This presentation is subject to correction, completion, and amendment without notice. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, and tax advisers to evaluate independently the risks, consequences, and suitability of that investment. The information in this presentation is not intended to constitute “research” as that term is defined by applicable regulations.

No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom.

In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, if utilized, may include Pre-Tax Pre-Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results, among others. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to which the items are indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information.

This presentation is provided for information purposes only.

Santander Holdings USA, Inc. (SHUSA)1

3

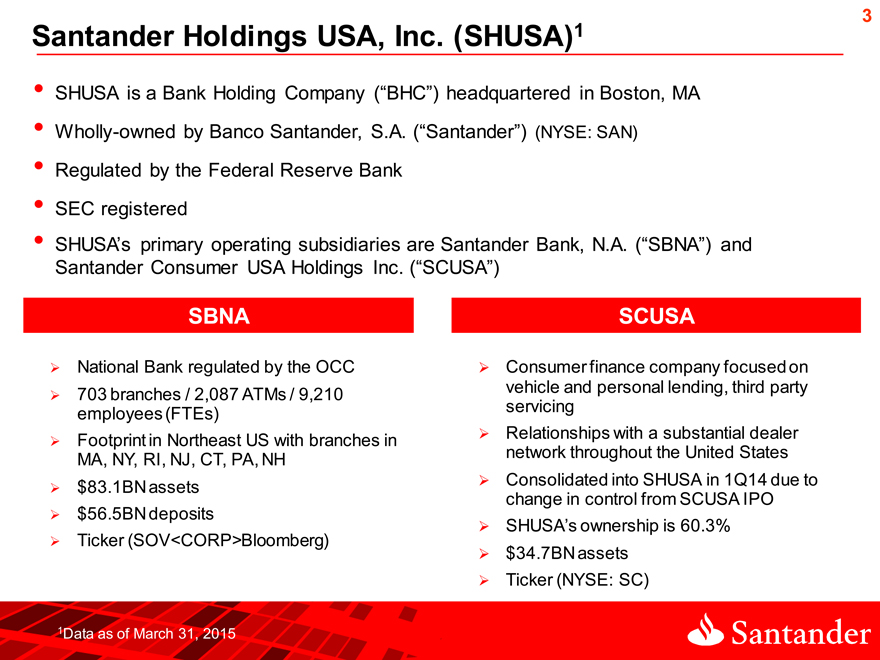

SHUSA is a Bank Holding Company (“BHC”) headquartered in Boston, MA

Wholly-owned by Banco Santander, S.A. (“Santander”) (NYSE: SAN)

Regulated by the Federal Reserve Bank

SEC registered

SHUSA’s primary operating subsidiaries are Santander Bank, N.A. (“SBNA”) and Santander Consumer USA Holdings Inc. (“SCUSA”)

SBNA

National Bank regulated by the OCC

703 branches / 2,087 ATMs / 9,210 employees (FTEs)

Footprint in Northeast US with branches in MA, NY, RI, NJ, CT, PA, NH

$83.1BN assets

$56.5BN deposits

Ticker (SOV<CORP>Bloomberg)

SCUSA

Consumer finance company focused on vehicle and personal lending, third party servicing

Relationships with a substantial dealer network throughout the United States

Consolidated into SHUSA in 1Q14 due to change in control from SCUSA IPO

SHUSA’s ownership is 60.3%

$34.7BN assets

Ticker (NYSE: SC)

Data as of March 31, 2015

4

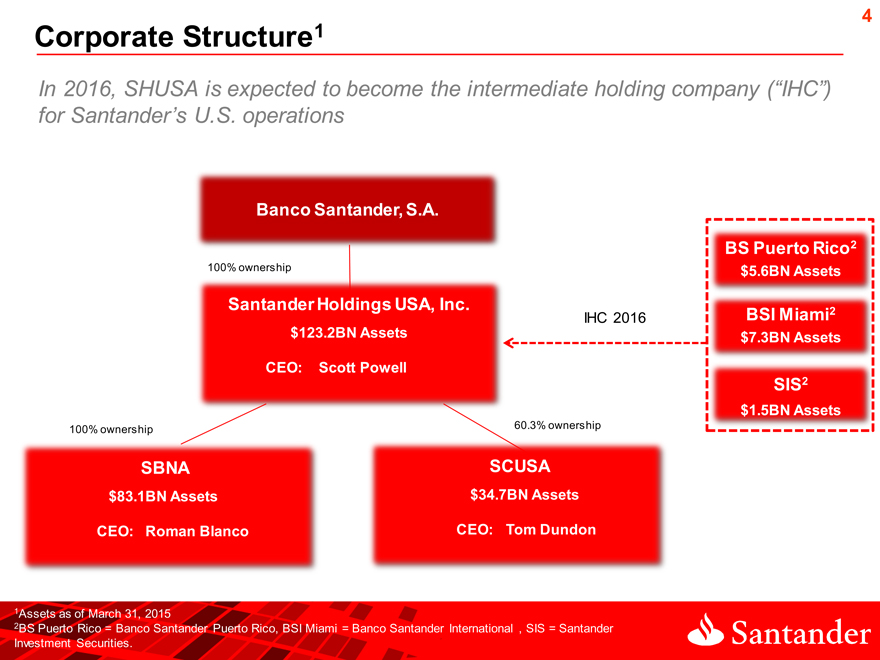

Corporate Structure 1

In 2016, SHUSA is expected to become the intermediate holding company (“IHC”)

for Santander’s U.S. operations

Banco Santander, S.A.

BS Puerto Rico2

100% ownership $ 5.6BN Assets

Santander Holdings USA, Inc. IHC 2016 BSI Miami2

$123.2BN Assets $ 7.3BN Assets

CEO: Scott Powell

SIS2

$ 1.5BN Assets

100% ownership 60.3% ownership

SBNA SCUSA

$83.1BN Assets $ 34.7BN Assets

CEO: Roman Blanco CEO: Tom Dundon

1Assets as of March 31, 2015

2BS Puerto Rico = Banco Santander Puerto Rico, BSI Miami = Banco Santander International , SIS = Santander

Investment Securities.

Q1 2015 Highlights1

5

Strong Profitability

Net Income $252MM; Net Interest Margin 7.20%

Capital Ratios and Liquidity

Common Equity Tier 1 (CET1) 11.9%; 10.9% under U.S. Basel III fully phased in 2

Holdco has $2.0BN cash; stand alone liquidity horizon of 161 months

LCR3 at 1Q15 in excess of regulatory minimum of 90% required at 1/1/2016

Holdco completed a five year senior debt issuance for $1BN4 in April 2015

Balance Sheet Trends

Growth in commercial loan, auto, and auto lease portfolios

Deposit growth continued in MMDA and interest -bearing DDA products

Credit Metrics

SBNA NPLs and Criticized Balances have declined 39% and 13% respectively YOY

SCUSA portfolio performance consistent with retained mix and typical seasonal patterns

1Data as of 3/31/15 unless otherwise noted 4See Borrowing section SHUSA 1Q15 Form 10-Q

2See SHUSA 1Q15 Form 10-Q

3LCR = Liquidity Coverage Ratio

[Graphic Appears Here]

6

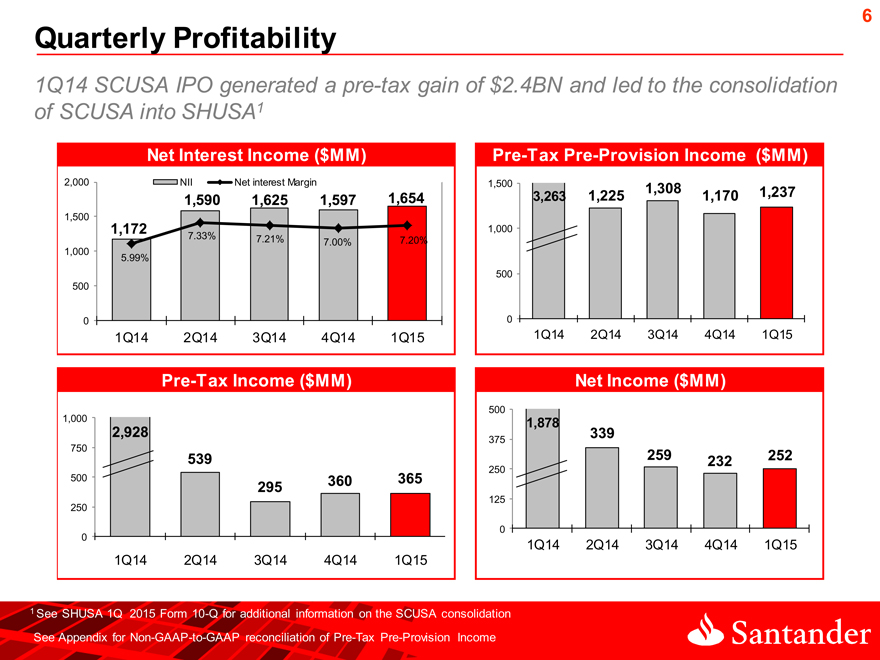

Quarterly Profitability

1Q14 SCUSA IPO generated a pre-tax gain of $2.4BN and led to the consolidation

of SCUSA into SHUSA1

2

Net Interest Income ($MM) Pre-Tax Pre-Provision Income ($MM)

2,000 NII 1,590 Net 1,625 interest Margin 1,597 1,654 1,500 3,263 1,225 1,308 1,170 1,237

1,500

1,172 1,000

7.33% 7.21% 7.20%

7.00%

1,000 5.99%

500

500

0 0

1Q14 2Q14 3Q14 4Q14 1Q15 1Q14 2Q14 3Q14 4Q14 1Q15

Pre-Tax Income ($MM) Net Income ($MM)

500

1,000 1,878

2,928 339

375

750

539 259 232 252

250

500 295 360 365

125

250

0

0 1Q14 2Q14 3Q14 4Q14 1Q15

1Q14 2Q14 3Q14 4Q14 1Q15

1 See SHUSA 1Q 2015 Form 10-Q for additional information on the SCUSA consolidation

See Appendix for Non-GAAP-to-GAAP reconciliation of Pre-Tax Pre-Provision Income

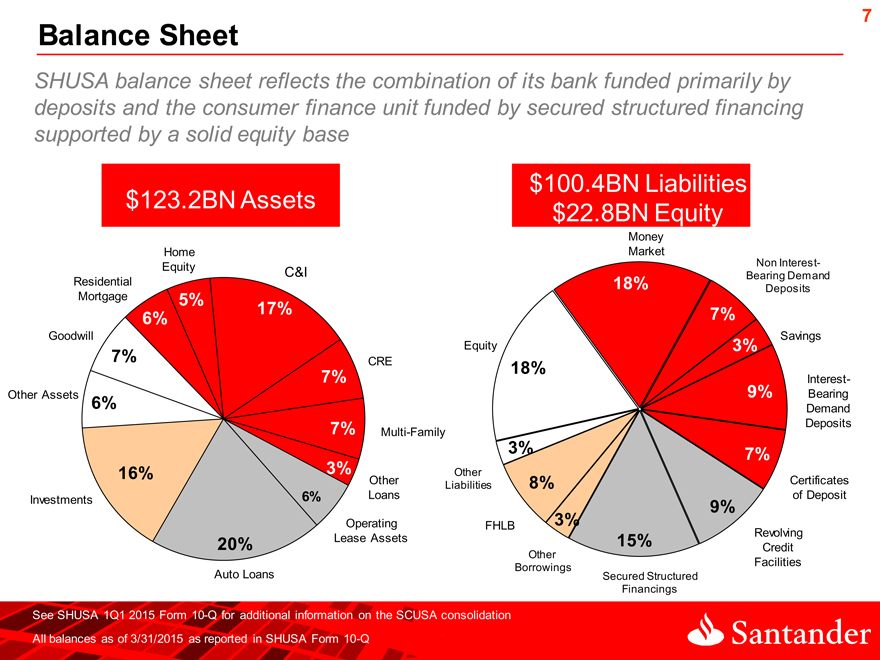

Balance Sheet

7

SHUSA balance sheet reflects the combination of its bank funded primarily by deposits and the consumer finance unit funded by secured structured financing supported by a solid equity base 2

$100.4BN Liabilities

$123.2BN Assets $22.8BN Equity

Money

Home Market

Non Interest-

Equity C&I Bearing Demand

Residential 18% Deposits

Mortgage 5% 17%

6% 7%

Goodwill Savings

Equity 3%

7% CRE 18%

7% Interest-

Other Assets 9% Bearing

6% Demand

7% Multi-Family Deposits

3% 7%

16% 3% Other

Other Liabilities 8% Certificates

Investments 6% Loans of Deposit

9%

Operating FHLB 3% Revolving

20% Lease Assets 15% Credit

Other

Borrowings Facilities

Auto Loans Secured Structured

Financings

See SHUSA 1Q1 2015 Form 10-Q for additional information on the SCUSA consolidation

All balances as of 3/31/2015 as reported in SHUSA Form 10-Q

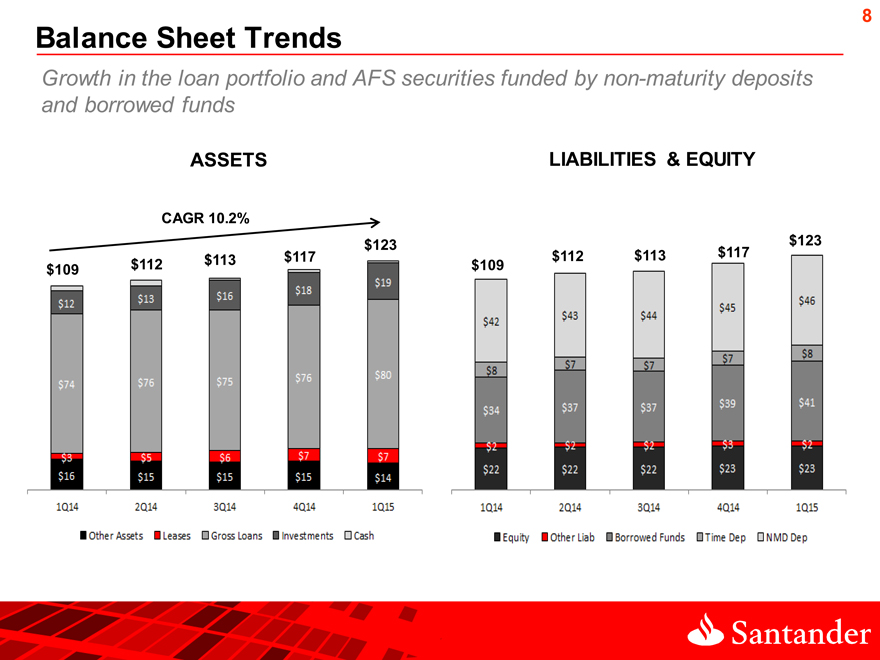

8

Balance Sheet Trends

Growth in the loan portfolio and AFS securities funded by non-maturity deposits and borrowed funds

2

ASSETS LIABILITIES & EQUITY

CAGR 10.2%

$123 $123

$109 $112 $113 $117 $109 $112 $113 $117

9

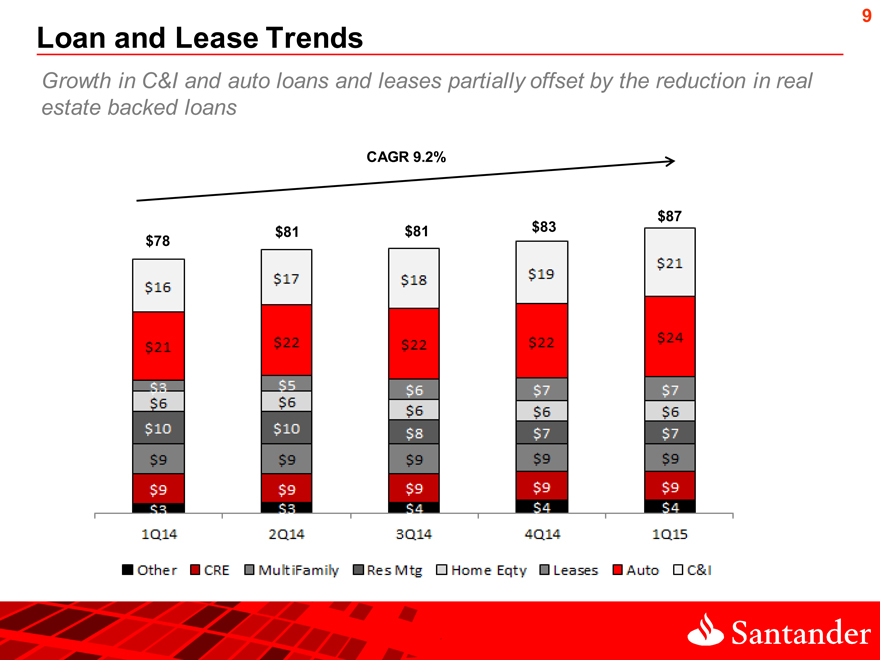

Loan and Lease Trends

Growth in C&I and auto loans and leases partially offset by the reduction in real

estate backed loans

2

CAGR 9.2%

$87

$78 $81 $81 $83

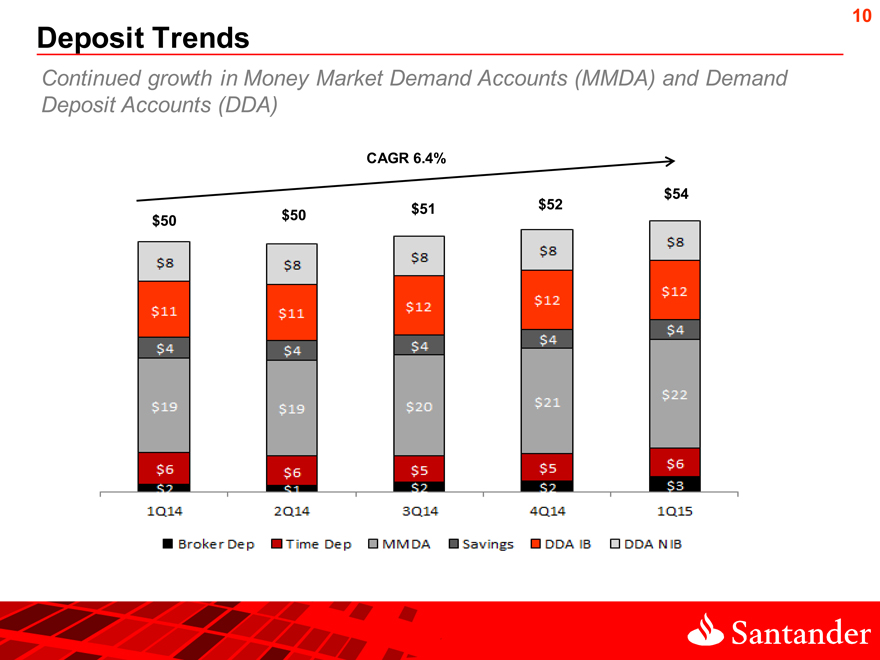

10

Deposit Trends

Continued growth in Money Market Demand Accounts(MMDA) and Demand

Deposit Accounts(DDA)

2

CAGR 6.4%

$54

$51 $52

$50 $50

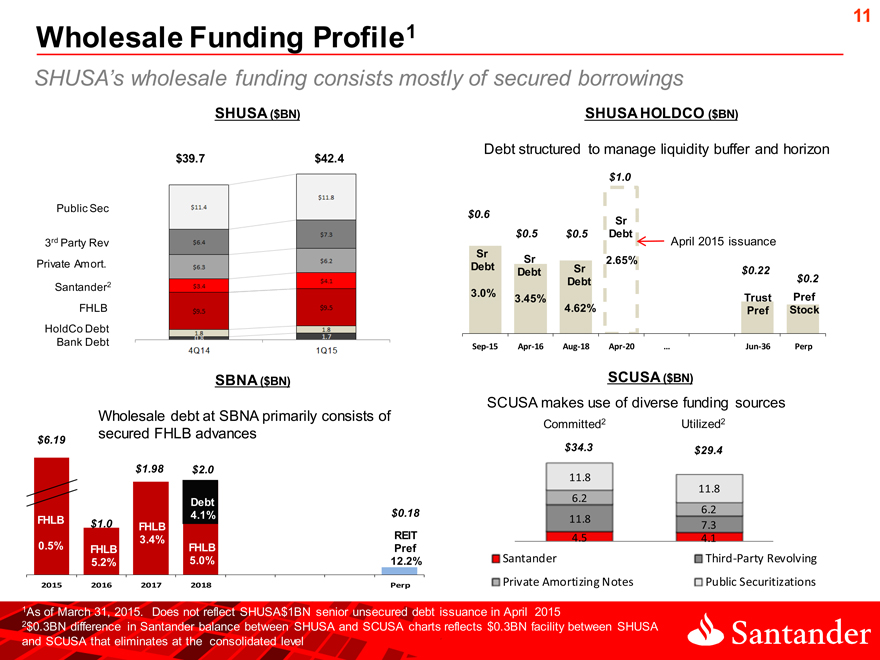

Wholesale Funding Profile1

11

SHUSA’s wholesale funding consists mostly of secured borrowings

SHUSA ($BN)

$39.7 $42.4

Public Sec

3rd Party Rev

Private Amort.

Santander2

FHLB

HoldCo Debt

Bank Debt

Sr SBNA ($BN)

Debt

Sr Sr

Wholesale debt at SBNA primarily Debt consists of

secured3.0% FHLB advances Debt

$6.19

625% 3.45%

$1.98 $2.0

Debt

4.1% $0.18

FHLB $1.0 FHLB

3.4% REIT

0.5% FHLB FHLB Pref

5.2% 5.0% 12.2%

2015 2016 2017 2018 Perp

SHUSA HOLDCO ($BN)

2

Debt structured to manage liquidity buffer and horizon

$1.0

$0.6 Sr

$0.5 $0.5 Debt

April 2015 issuance

Sr Sr 2.65%

Debt Debt Sr $0.22

Debt $0.2

3.0% 3.45% Trust Pref

4.62% Pref Stock

Sep-15 Apr-16 Aug-18 Apr-20 … Jun-36 Perp

SCUSA ($BN)

SCUSA makes use of diverse funding sources

Committed2 Utilized2

$34.3 $29.4

11.8

11.8

6.2

6.2

11.8 7.3

4.5 4.1

$150

Santander Third-Party Revolving

Private Amortizing Notes Public Securitizations

1As of March 31, 2015. Does not reflect SHUSA$1BN senior unsecured debt issuance in April 2015

2$0.3BN difference in Santander balance between SHUSA and SCUSA charts reflects $0.3BN facility between SHUSA and SCUSA that eliminates at the consolidated level

[Graphic Appears Here]

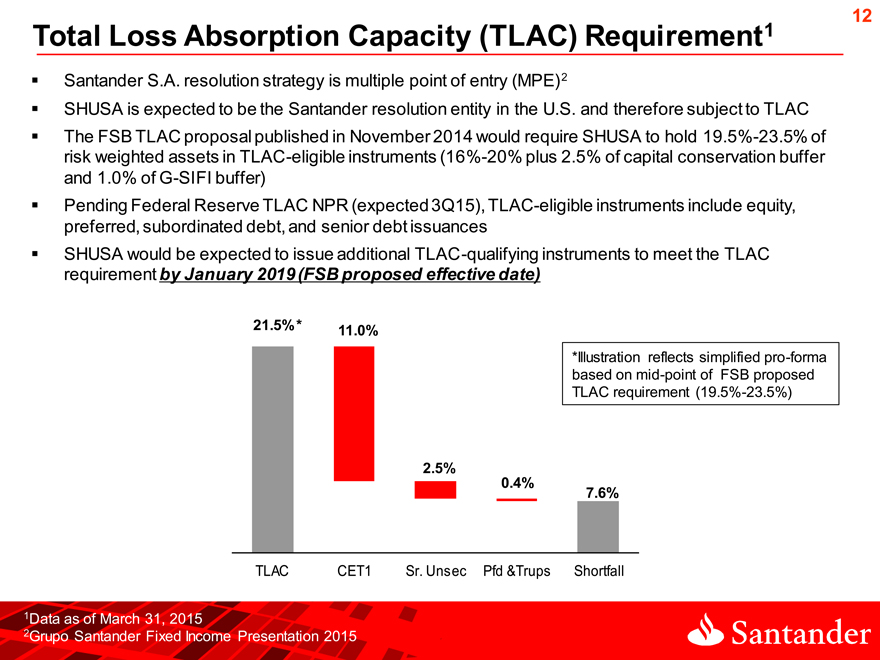

Total Loss Absorption Capacity (TLAC) Requirement1

12

Santander S.A. resolution strategy is multiple point of entry (MPE)2

SHUSA is expected to be the Santander resolution entity in the U.S. and therefore subject to TLAC

The FSB TLAC proposal published in November 2014 would require SHUSA to hold 19.5%-23.5% of risk weighted assets in TLAC-eligible instruments (16%-20% plus 2.5% of capital conservation buffer and 1.0% of G-SIFI buffer)

Pending Federal Reserve TLAC NPR (expected 3Q15), TLAC-eligible instruments include equity, preferred, subordinated debt, and senior debt issuances

SHUSA would be expected to issue additional TLAC -qualifying instruments to meet the TLAC requirement by January 2019 (FSB proposed effective date)

21.5%*

11.0%

*Illustration reflects simplified pro-forma

based on mid-point of FSB proposed

TLAC requirement (19.5%-23.5%)

2.5%

0.4%

7.6%

TLAC CET1 Sr. Unsec Pfd &Trups Shortfall

1Data as of March 31, 2015

2Grupo Santander Fixed Income Presentation 2015

13

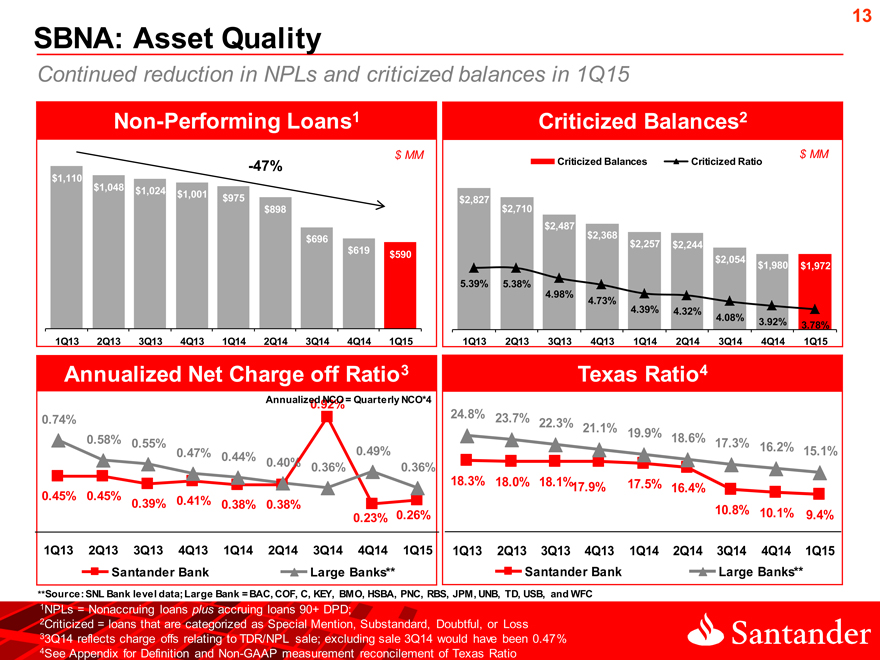

SBNA: Asset Quality

Continued reduction in NPLs and criticized balances in 1Q15

Non-Performing Loans1

$ MM

-47%

$1,110

$1,048

$1,024 $1,001 $975

$898

$696

$619 $590

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Criticized Balances2

$ MM

Criticized Balances Criticized Ratio

$2,827

$2,710

$2,487

$2,368

$2,257 $2,244

$2,054 $1,980 $ 1,972

5.39% 5.38%

4.98% 4.73%

4.39% 4.32%

4.08% 3.92% 3.78%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Annualized Net Charge off Ratio 3

Annualized 0.92% NCO = Quarterly NCO*4

0.74%

0.58% 0.55%

0.47% 0.44% 0.49%

0.40% 0.36% 0.36%

0.45% 0.45% 0.41%

0.39% 0.38% 0.38%

0.23% 0.26%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Santander Bank Large Banks**

Texas Ratio4

24.8% 23.7%

22.3% 21.1%

19.9% 18.6%

17.3% 16.2% 15.1%

18.3% 18.0% 18.1%17.9% 17.5% 16.4%

10.8% 10.1% 9.4%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Santander Bank Large Banks**

**Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC

1NPLs = Nonaccruing loans plus accruing loans 90+ DPD;

2Criticized = loans that are categorized as Special Mention, Substandard, Doubtful, or Loss 33Q14 reflects charge offs relating to TDR/NPL sale; excluding sale 3Q14 would have been 0.47% 4See Appendix for Definition and Non-GAAP measurement reconcilement of Texas Ratio

[Graphic Appears Here]

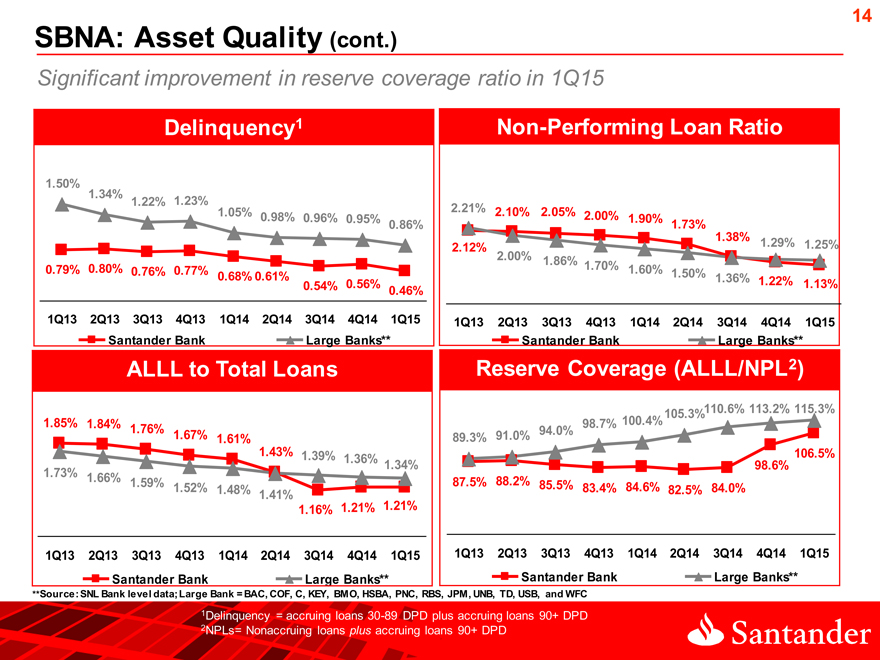

SBNA: Asset Quality (cont.)

Significant improvement in reserve coverage ratio in 1Q15

14

Delinquency1

1.50% 1.34%

1.22% 1.23%

1.05% 0.98% 0.96% 0.95%

0.86%

0.79% 0.80% 0.76% 0.77% 0.68% 0.61%

0.54% 0.56% 0.46%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Santander Bank Large Banks**

Non-Performing Loan Ratio

2.21% 2.10% 2.05% 2.00% 1.90%

1.73%

2.12% 1.38% 1.29% 1.25%

2.00% 1.86%

1.70% 1.60%

1.50% 1.36% 1.22% 1.13%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Santander Bank Large Banks**

ALLL to Total Loans

1.85% 1.84% 1.76%

1.67% 1.61%

1.43% 1.39% 1.36%

1.34%

1.73% 1.66%

1.59% 1.52% 1.48% 1.41%

1.16% 1.21% 1.21%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Santander Bank Large Banks**

Reserve Coverage(ALLL/NPL 2)

105.3% 110.6% 113.2% 115.3%

98.7% 100.4%

89.3% 91.0% 94.0%

106.5%

98.6%

87.5% 88.2% 85.5% 83.4% 84.6% 82.5% 84.0%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Santander Bank Large Banks**

**Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC

1Delinquency = accruing loans 30-89 DPD plus accruing loans 90+ DPD

2NPLs= Nonaccruing loans plus accruing loans 90+ DPD

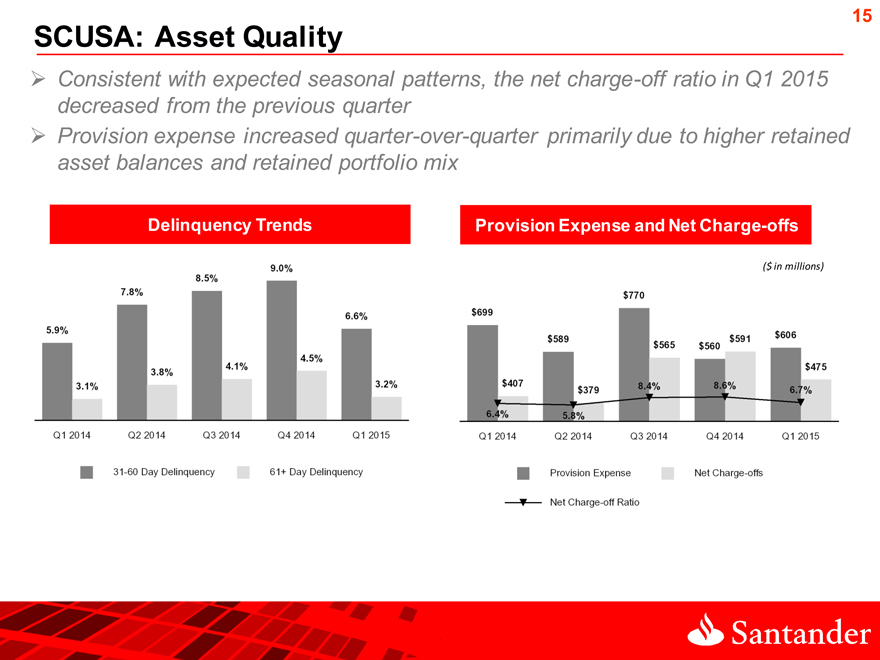

SCUSA: Asset Quality

15

Consistent with expected seasonal patterns, the net charge-off ratio in Q1 2015 decreased from the previous quarter

Provision expense increased quarter-over-quarter primarily due to higher retained asset balances and retained portfolio mix

Delinquency Trends Provision Expense and Net Charge-offs

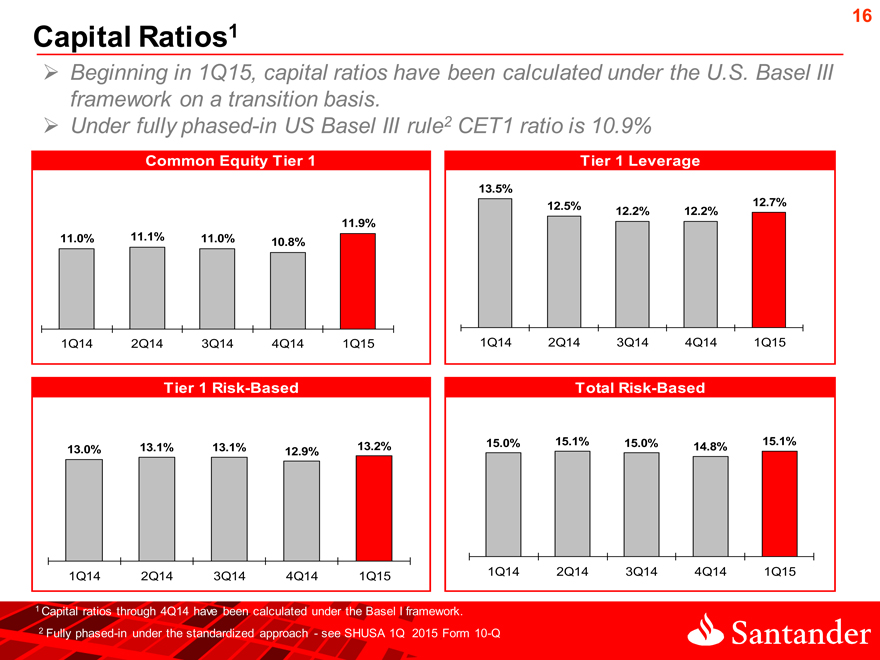

Capital Ratios1

16

Beginning in 1Q15, capital ratios have been calculated under the U.S. Basel III framework on a transition basis.

Under fully phased-in US Basel III rule2 CET1 ratio is 10.9%

Common Equity Tier 1 Tier 1 Leverage

13.5%

12.5% 12.7%

12.2% 12.2%

11.9%

11.0% 11.1% 11.0%

10.8%

1Q14 2Q14 3Q14 4Q14 1Q15 1Q14 2Q14 3Q14 4Q14 1Q15

Tier 1 Risk-Based Total Risk-Based

15.0% 15.1% 15.0% 15.1%

13.0% 13.1% 13.1% 13.2% 14.8%

12.9%

1Q14

2Q14

3Q14

4Q14

1Q15

1Q14

1 Capital ratios through 4Q14 have been calculated under the Basel I framework.

2 Fully phased-in under the standardized approach—see SHUSA 1Q 2015 Form 10-Q

2Q14 3Q14 4Q14 1Q15

17

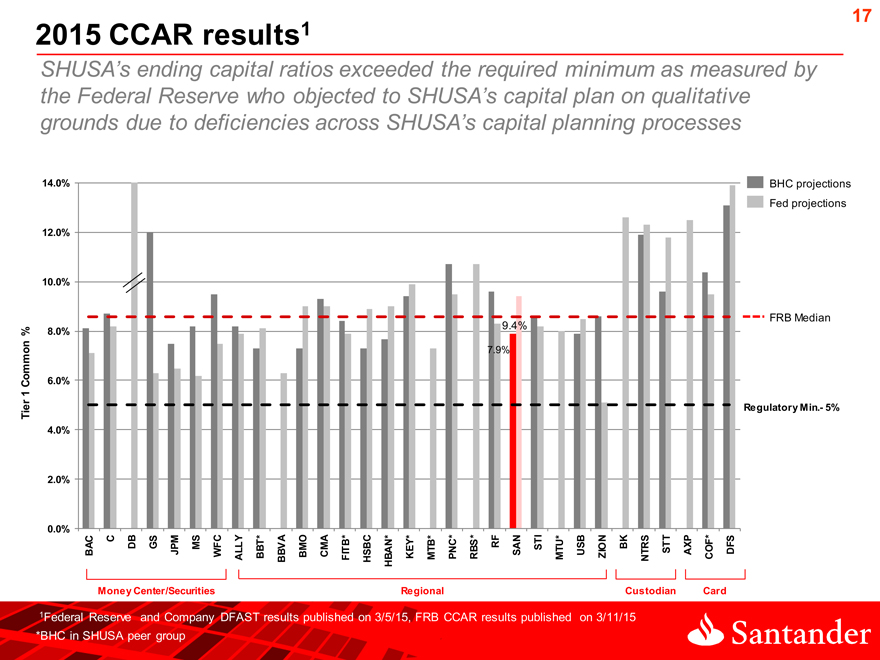

2015 CCAR results1

SHUSA’s ending capital ratios exceeded the required minimum as measured by the Federal Reserve who objected to SHUSA’s capital plan on qualitative grounds due to deficiencies across SHUSA’s capital planning processes

14.0% BHC projections

Fed projections

12.0%

10.0%

FRB Median

% 8.0% 9.4%

7.9%

Common 6.0%

1

Tier Regulatory Min.- 5%

4.0%

2.0%

0.0%

BAC C DB GS JPM MS WFC ALLY BBT* BBVA BMO CMA FITB* HSBC HBAN* KEY* MTB* PNC* RBS* RF SAN STI MTU* USB ZION BK NTRS STT AXP COF* DFS

Money Center/Securities Regional Custodian Card

1Federal Reserve and Company DFAST results published on 3/5/15, FRB CCAR results published on 3/11/15

*BHC in SHUSA peer group

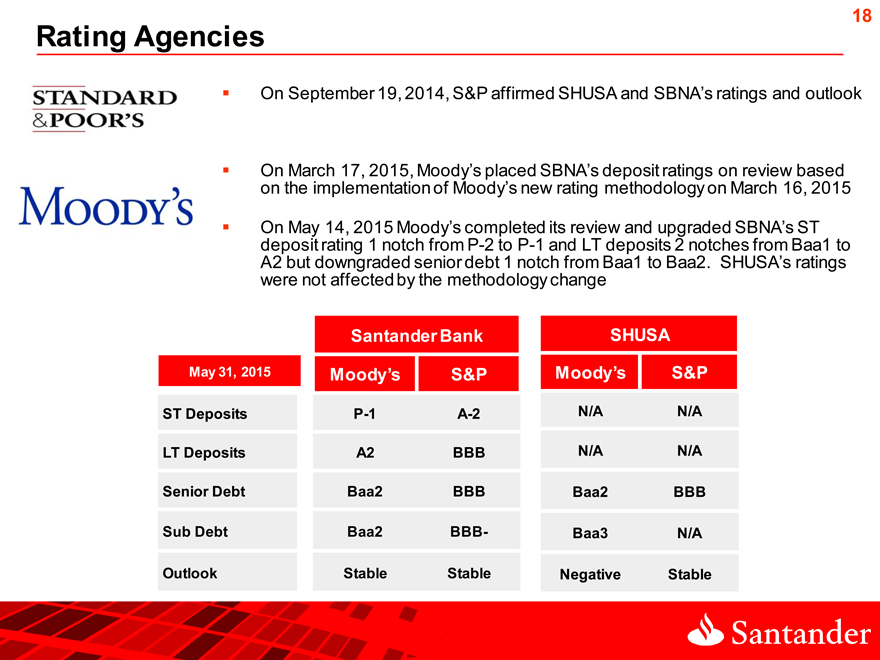

Rating Agencies

18

On September 19, 2014, S&P affirmed SHUSA and SBNA’s ratings and outlook

On March 17, 2015, Moody’s placed SBNA’s deposit ratings on review based on the implementation of Moody’s new rating methodology on March 16, 2015

On May 14, 2015 Moody’s completed its review and upgraded SBNA’s ST deposit rating 1 notch from P-2 to P-1 and LT deposits 2 notches from Baa1 to

A2 but downgraded senior debt 1 notch from Baa1 to Baa2. SHUSA’s ratings were not affected by the methodology change

Santander Bank SHUSA

May 31, 2015 Moody’s S&P Moody’s S&P

ST Deposits P-1 A-2 N/A N/A

LT Deposits A2 BBB N/A N/A

Senior Debt Baa2 BBB Baa2 BBB

Sub Debt Baa2 BBB- Baa3 N/A

Outlook Stable Stable Negative Stable

[Graphic Appears Here]

Appendix

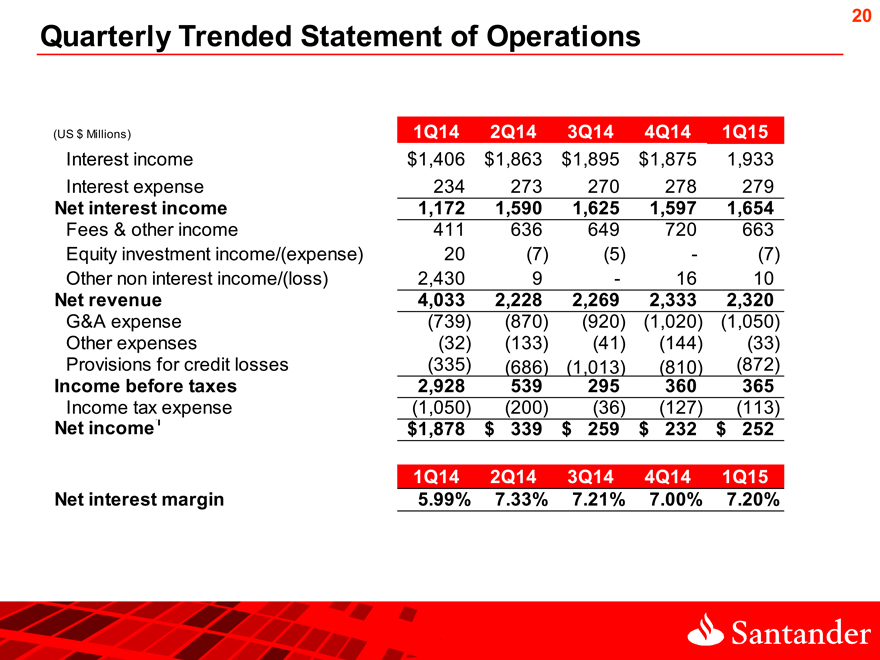

Quarterly Trended Statement of Operations

20

(US $ Millions) 1Q14 2Q14 3Q14 4Q14 1Q15

Interest income $1,406 $ 1,863 $1,895 $1,875 1,933

Interest expense 234 273 270 278 279

Net interest income 1,172 1,590 1,625 1,597 1,654

Fees & other income 411 636 649 720 663

Equity investment income/(expense) 20(7)(5) -(7)

Other non interest income/(loss) 2,430 9—16 10

Net revenue 4,033 2,228 2,269 2,333 2,320

G&A expense(739)(870)(920)(1,020)(1,050)

Other expenses(32)(133)(41)(144)(33)

Provisions for credit losses(335)(686)(1,013)(810)(872)

Income before taxes 2,928 539 295 360 365

Income tax expense(1,050)(200)(36)(127)(113)

Net income1 $1,878 $ 339 $ 259 $ 232 $ 252

1Q14 2Q14 3Q14 4Q14 1Q15

Net interest margin 5.99% 7.33% 7.21% 7.00% 7.20%

[Graphic Appears Here]

21

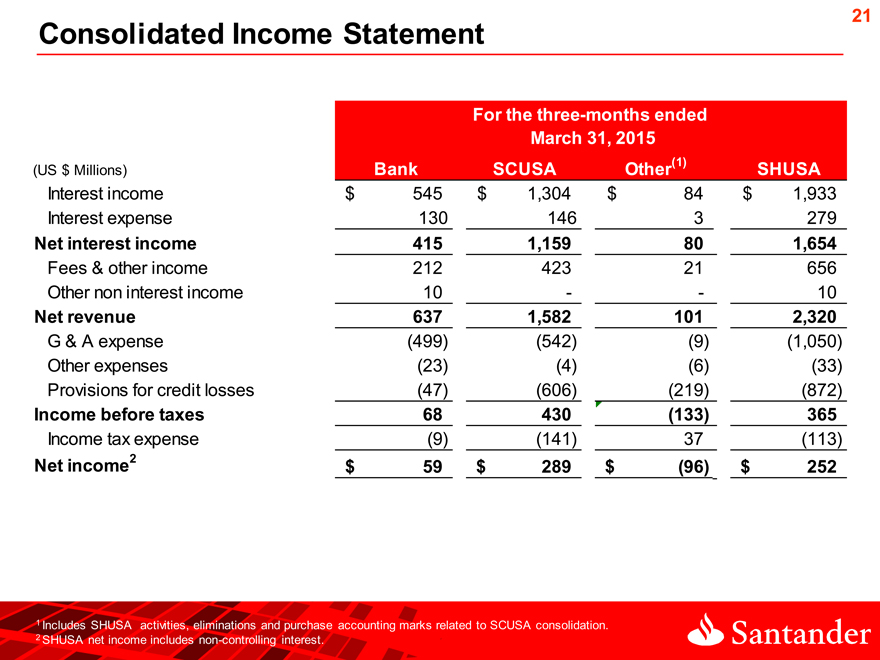

Consolidated Income Statement

For the three-months ended

March 31, 2015

(US $ Millions) Bank SCUSA Other(1) SHUSA

Interest income $ 545 $ 1,304 $ 84 $ 1,933

Interest expense 130 146 3 279

Net interest income 415 1,159 80 1,654

Fees & other income 212 423 21 656

Other non interest income 10 — 10

Net revenue 637 1,582 101 2,320

G & A expense(499)(542)(9)(1,050)

Other expenses(23)(4)(6)(33)

Provisions for credit losses(47)(606)(219)(872)

Income before taxes 68 430(133) 365

Income tax expense(9)(141) 37(113)

Net income2 $ 59 $ 289 $(96) $ 252

1 Includes SHUSA activities, eliminations and purchase accounting marks related to SCUSA consolidation.

2 SHUSA net income includes non-controlling interest.

[Graphic Appears Here]

22

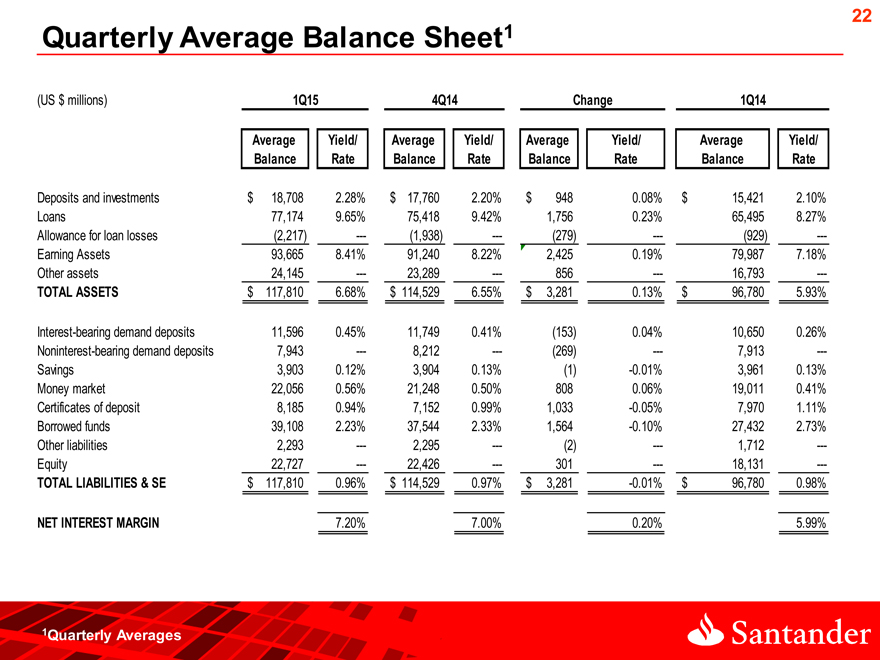

Quarterly Average Balance Sheet1

(US $ millions) 1Q15 4Q14 Change 1Q14

Average Yield/ Average Yield/ Average Yield/ Average Yield/

Balance Rate Balance Rate Balance Rate Balance Rate

Deposits and investments $ 18,708 2.28% $ 17,760 2.20% $ 948 0.08% $ 15,421 2.10%

Loans 77,174 9.65% 75,418 9.42% 1,756 0.23% 65,495 8.27%

Allowance for loan losses(2,217) —-(1,938) —-(279) —-(929) —-

Earning Assets 93,665 8.41% 91,240 8.22% 2,425 0.19% 79,987 7.18%

Other assets 24,145 —- 23,289 —- 856 —- 16,793 —-

TOTAL ASSETS $ 117,810 6.68% $ 114,529 6.55% $ 3,281 0.13% $ 96,780 5.93%

Interest-bearing demand deposits 11,596 0.45% 11,749 0.41%(153) 0.04% 10,650 0.26%

Noninterest-bearing demand deposits 7,943 —- 8,212 —-(269) —- 7,913 —-

Savings 3,903 0.12% 3,904 0.13%(1) -0.01% 3,961 0.13%

Money market 22,056 0.56% 21,248 0.50% 808 0.06% 19,011 0.41%

Certificates of deposit 8,185 0.94% 7,152 0.99% 1,033 -0.05% 7,970 1.11%

Borrowed funds 39,108 2.23% 37,544 2.33% 1,564 -0.10% 27,432 2.73%

Other liabilities 2,293 —- 2,295 —-(2) —- 1,712 —-

Equity 22,727 —- 22,426 —- 301 —- 18,131 —-

TOTAL LIABILITIES & SE $ 117,810 0.96% $ 114,529 0.97% $ 3,281 -0.01% $ 96,780 0.98%

NET INTEREST MARGIN 7.20% 7.00% 0.20% 5.99%

1Quarterly Averages

23

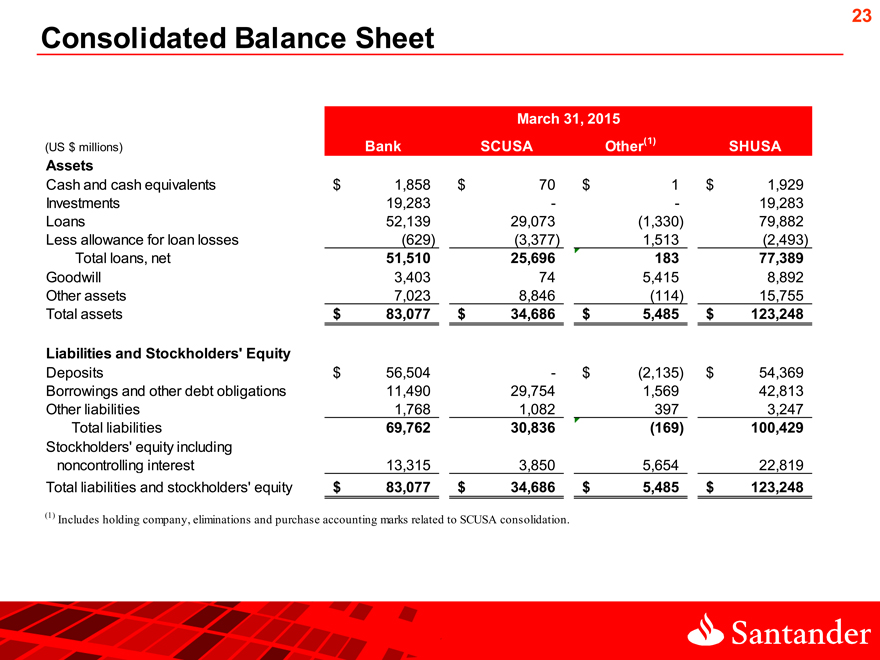

Consolidated Balance Sheet

March 31, 2015

(US $ millions) Bank SCUSA Other(1) SHUSA

Assets

Cash and cash equivalents $ 1,858 $ 70 $ 1 $ 1,929

Investments 19,283 — 19,283

Loans 52,139 29,073(1,330) 79,882

Less allowance for loan losses(629)(3,377) 1,513(2,493)

Total loans, net 51,510 25,696 183 77,389

Goodwill 3,403 74 5,415 8,892

Other assets 7,023 8,846(114) 15,755

Total assets $ 83,077 $ 34,686 $ 5,485 $ 123,248

Liabilities and Stockholders’ Equity

Deposits $ 56,504—$(2,135) $ 54,369

Borrowings and other debt obligations 11,490 29,754 1,569 42,813

Other liabilities 1,768 1,082 397 3,247

Total liabilities 69,762 30,836(169) 100,429

Stockholders’ equity including

noncontrolling interest 13,315 3,850 5,654 22,819

Total liabilities and stockholders’ equity $ 83,077 $ 34,686 $ 5,485 $ 123,248

(1) Includes holding company, eliminations and purchase accounting marks related to SCUSA consolidation.

[Graphic Appears Here]

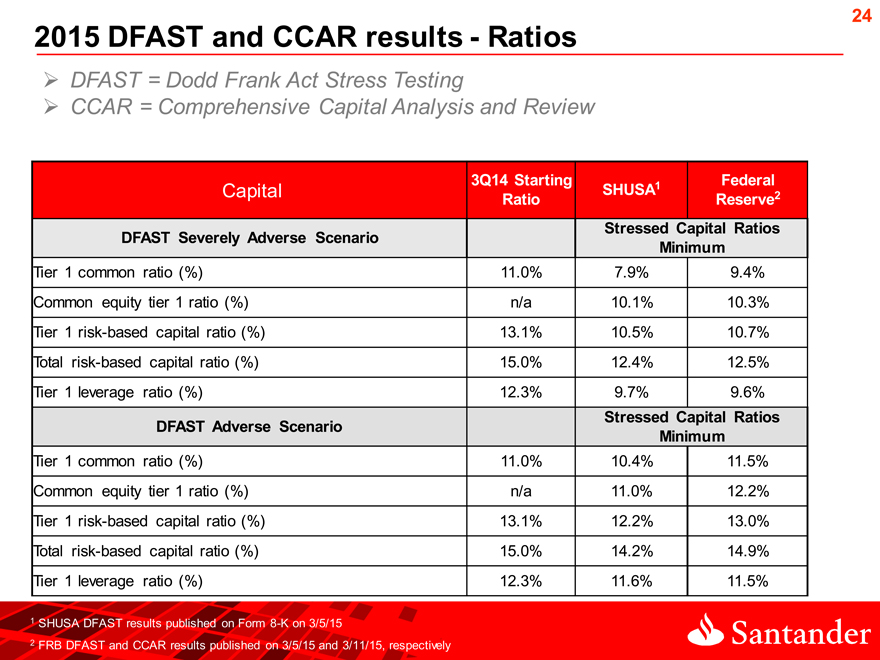

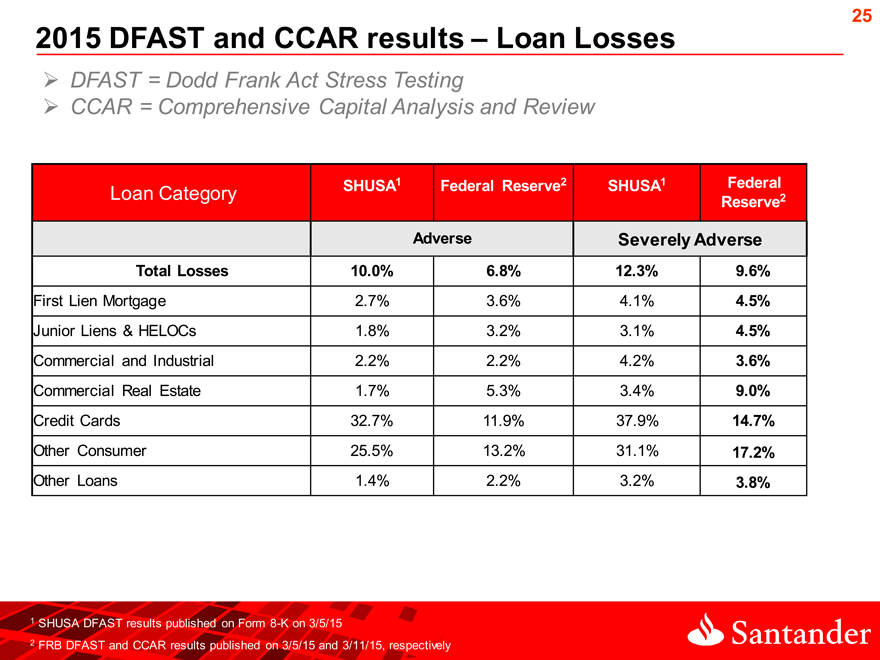

2015 DFAST and CCAR results—Ratios

24

DFAST = Dodd Frank Act Stress Testing

CCAR = Comprehensive Capital Analysis and Review

3Q14 Starting Federal

Capital Ratio SHUSA1 Reserve2

DFAST Severely Adverse Scenario Stressed Capital Ratios

Minimum

Tier 1 common ratio (%) 11.0% 7.9% 9.4%

Common equity tier 1 ratio (%) n/a 10.1% 10.3%

Tier 1 risk-based capital ratio (%) 13.1% 10.5% 10.7%

Total risk-based capital ratio (%) 15.0% 12.4% 12.5%

Tier 1 leverage ratio (%) 12.3% 9.7% 9.6%

DFAST Adverse Scenario Stressed Capital Ratios

Minimum

Tier 1 common ratio (%) 11.0% 10.4% 11.5%

Common equity tier 1 ratio (%) n/a 11.0% 12.2%

Tier 1 risk-based capital ratio (%) 13.1% 12.2% 13.0%

Total risk-based capital ratio (%) 15.0% 14.2% 14.9%

Tier 1 leverage ratio (%) 12.3% 11.6% 11.5%

1 SHUSA DFAST results published on Form 8-K on 3/5/15

2 FRB DFAST and CCAR results published on 3/5/15 and 3/11/15, respectively

[Graphic Appears Here]

25

2015 DFAST and CCAR results – Loan Losses

DFAST = Dodd Frank Act Stress Testing

CCAR = Comprehensive Capital Analysis and Review

SHUSA1 Federal Reserve2 SHUSA1 Federal

Loan Category Reserve2

Adverse Severely Adverse

Total Losses 10.0% 6.8% 12.3% 9.6%

First Lien Mortgage 2.7% 3.6% 4.1% 4.5%

Junior Liens & HELOCs 1.8% 3.2% 3.1% 4.5%

Commercial and Industrial 2.2% 2.2% 4.2% 3.6%

Commercial Real Estate 1.7% 5.3% 3.4% 9.0%

Credit Cards 32.7% 11.9% 37.9% 14.7%

Other Consumer 25.5% 13.2% 31.1% 17.2%

Other Loans 1.4% 2.2% 3.2% 3.8%

1 SHUSA DFAST results published on Form 8-K on 3/5/15

2 FRB DFAST and CCAR results published on 3/5/15 and 3/11/15, respectively

[Graphic Appears Here]

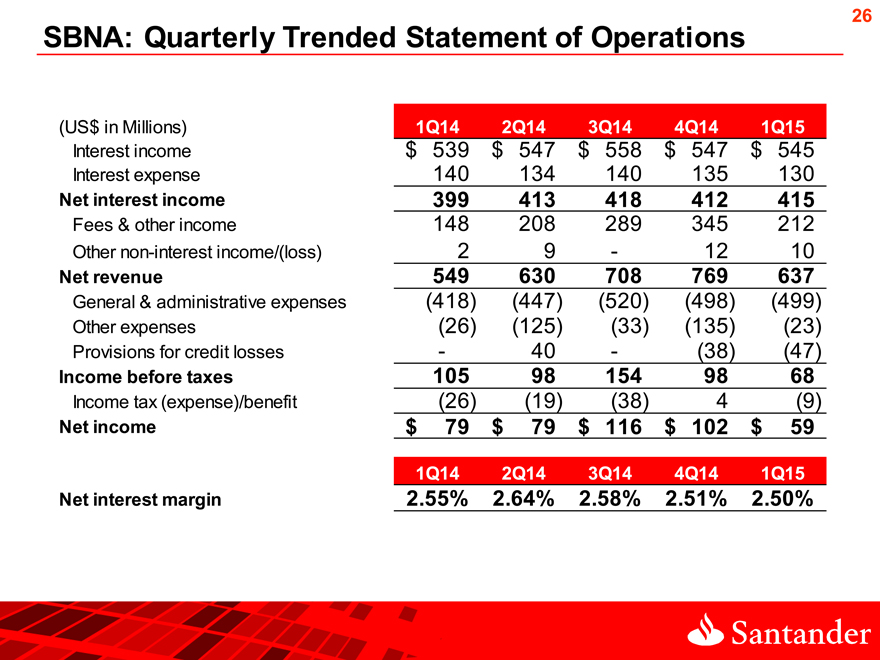

SBNA: Quarterly Trended Statement of Operations

26

(US$ in Millions) 1Q14 2Q14 3Q14 4Q14 1Q15

Interest income $ 539 $ 547 $ 558 $ 547 $ 545

Interest expense 140 134 140 135 130

Net interest income 399 413 418 412 415

Fees & other income 148 208 289 345 212

Other non-interest income/(loss) 2 9—12 10

Net revenue 549 630 708 769 637

General & administrative expenses(418)(447)(520)(498)(499)

Other expenses(26)(125)(33)(135)(23)

Provisions for credit losses—40 -(38)(47)

Income before taxes 105 98 154 98 68

Income tax (expense)/benefit(26)(19)(38) 4(9)

Net income $ 79 $ 79 $ 116 $ 102 $ 59

1Q14 2Q14 3Q14 4Q14 1Q15

Net interest margin 2.55% 2.64% 2.58% 2.51% 2.50%

[Graphic Appears Here]

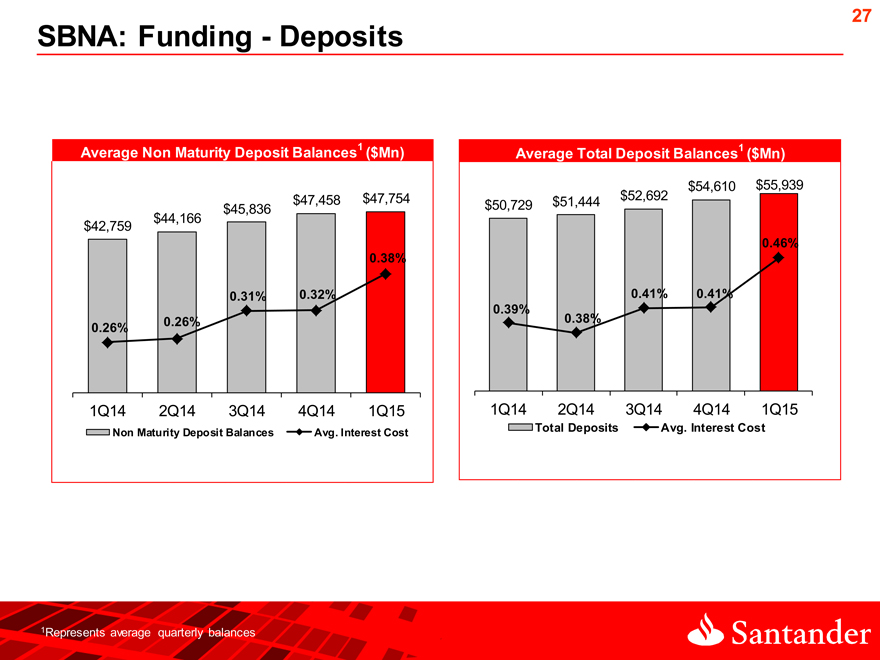

SBNA: Funding—Deposits

27

Average Non Maturity Deposit Balances1 ($Mn) Average Total Deposit Balances1 ($Mn)

$54,610 $55,939

$45,836 $47,458 $47,754 $50,729 $51,444 $52,692

$42,759 $44,166

0.46%

0.38%

0.31% 0.32% 0.41% 0.41%

0.39%

0.26% 0.26% 0.38%

1Q14 2Q14 3Q14 4Q14 1Q15 1Q14 2Q14 3Q14 4Q14 1Q15

Non Maturity Deposit Balances Avg. Interest Cost Total Deposits Avg. Interest Cost

1Represents average quarterly balances

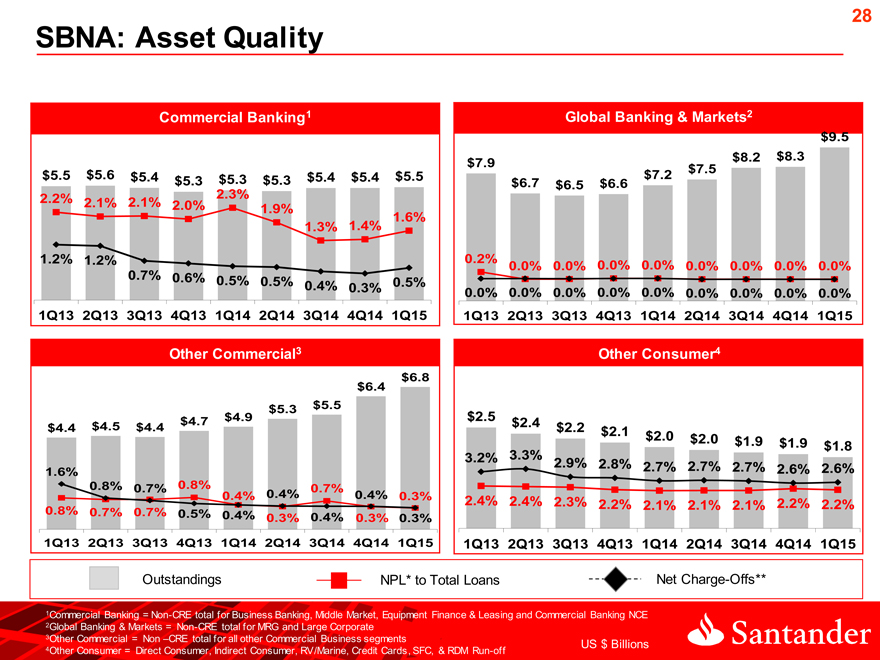

28

SBNA: Asset Quality

Commercial Banking1 Global Banking & Markets2

$9.5

$7.9 $8.2 $8.3

$7.5

$5.5 $5.6 $5.4 $5.3 $5.3 $5.3 $5.4 $5.4 $5.5 $6.7 $6.5 $6.6 $7.2

2.3%

2.2% 2.1% 2.1% 2.0% 1.9%

1.3% 1.4% 1.6%

1.2% 1.2% 0.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

0.7% 0.6% 0.5% 0.5% 0.4% 0.3% 0.5%

0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Other Commercial3 Other Consumer4

$6.8

$6.4

$5.3 $5.5

$4.7 $4.9 $2.5 $2.4

$4.4 $4.5 $4.4 $2.2 $2.1 $2.0 $2.0 $1.9 $1.9 $1.8

3.2% 3.3% 2.9% 2.8% 2.7% 2.7% 2.7%

1.6% 2.6% 2.6%

0.8% 0.7% 0.8% 0.7%

0.4% 0.4% 0.4% 0.3% 2.4% 2.4% 2.3% 2.2% 2.1% 2.1% 2.1% 2.2% 2.2%

0.8% 0.7% 0.7% 0.5% 0.4% 0.3% 0.4% 0.3% 0.3%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Outstandings NPL* to Total Loans Net Charge-Offs**

1Commercial Banking = Non-CRE total for Business Banking, Middle Market, Equipment Finance & Leasing and Commercial Banking NCE

2Global Banking & Markets = Non-CRE total for MRG and Large Corporate

3Other Commercial = Non –CRE total for all other Commercial Business segments US $ Billions

4Other Consumer = Direct Consumer, Indirect Consumer, RV/Marine, Credit Cards, SFC, & RDM Run-off

[Graphic Appears Here]

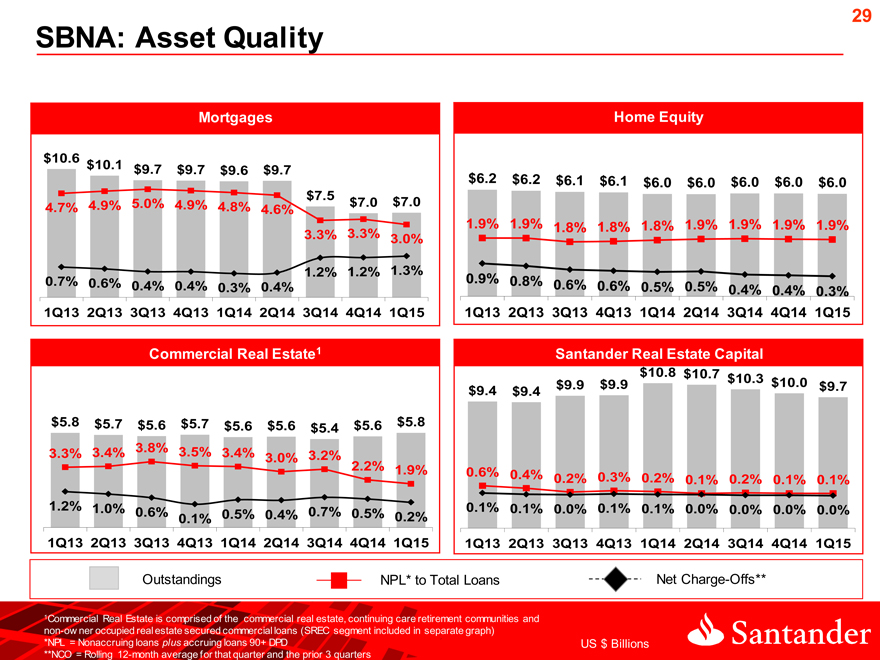

SBNA: Asset Quality

29

Mortgages

$10.6

$10.1 $9.7 $9.7 $9.6 $9.7

$7.5

4.7% 4.9% 5.0% 4.9% 4.8% 4.6% $7.0 $7.0

3.3% 3.3% 3.0%

1.2% 1.2% 1.3%

0.7% 0.6% 0.4% 0.4% 0.3% 0.4%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Commercial Real Estate1

$5.8 $5.7 $5.6 $5.7 $5.6 $5.6 $5.6 $5.8

$5.4

3.3% 3.4% 3.8% 3.5% 3.4%

3.0% 3.2%

2.2% 1.9%

1.2% 1.0%

0.6% 0.5% 0.4% 0.7% 0.5% 0.2%

0.1%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Home Equity

$6.2 $6.2 $6.1 $6.1 $6.0 $6.0 $6.0 $6.0 $6.0

1.9% 1.9% 1.8% 1.8% 1.8% 1.9% 1.9% 1.9% 1.9%

0.9% 0.8% 0.6% 0.6% 0.5% 0.5% 0.4% 0.4% 0.3%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Santander Real Estate Capital

$10.8 $10.7 $10.3

$9.4 $9.4 $9.9 $9.9 $10.0 $9.7

0.6% 0.4% 0.2% 0.3% 0.2% 0.1% 0.2% 0.1% 0.1%

0.1% 0.1% 0.0% 0.1% 0.1% 0.0% 0.0% 0.0% 0.0%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

Outstandings NPL* to Total Loans Net Charge-Offs**

1Commercial Real Estate is comprised of the commercial real estate, continuing care retirement communities and

non-ow ner occupied real estate secured commercial loans (SREC segment included in separate graph)

*NPL = Nonaccruing loans plus accruing loans 90+ DPD US $ Billions

**NCO = Rolling 12-month average for that quarter and the prior 3 quarters

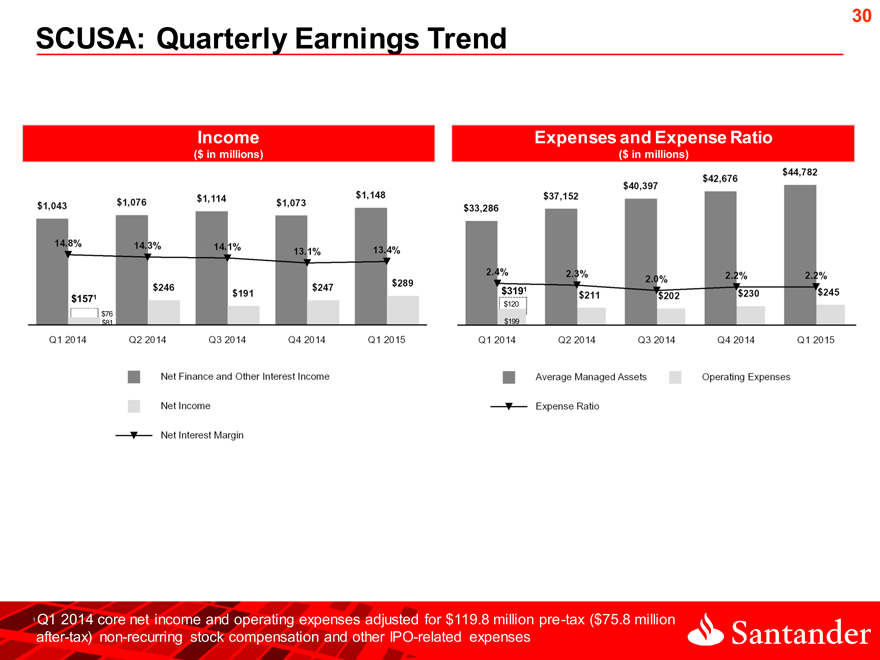

30

SCUSA: Quarterly Earnings Trend

Income

$3191

$ 1571 $120

$ 76

$81 $199

1 Q1 2014 core net income and operating expenses adjusted for $119.8 million pre-tax ($75.8 million after-tax) non-recurring stock compensation and other IPO-related expenses

[Graphic Appears Here]

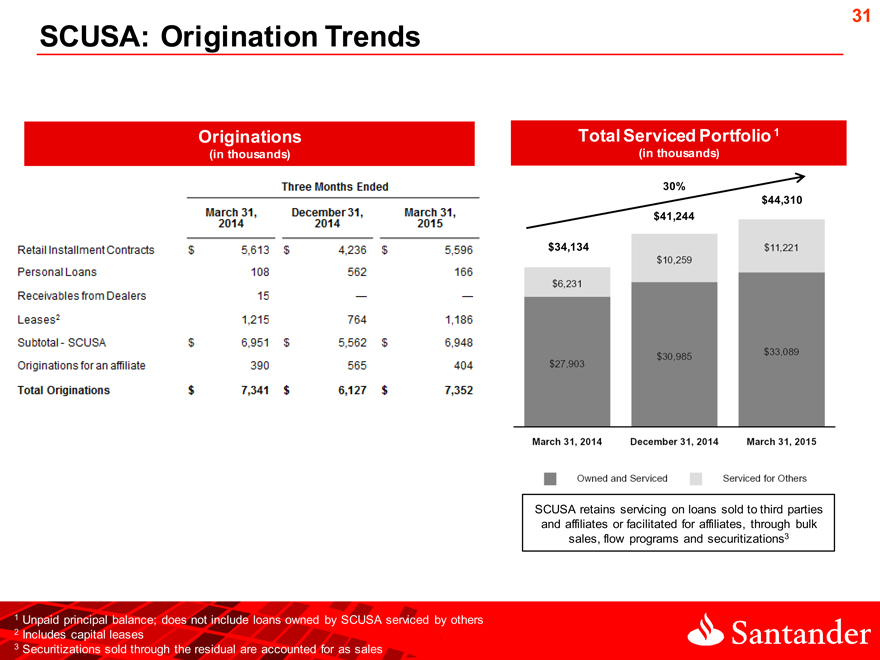

SCUSA: Origination Trends

31

Originations Total Serviced Portfolio 1

(in thousands)(in thousands)

30%

$44,310

$41,244

$34,134

SCUSA retains servicing on loans sold to third parties

and affiliates or facilitated for affiliates, through bulk

sales, flow programs and securitizations3

1 Unpaid principal balance; does not include loans owned by SCUSA serviced by others

2 Includes capital leases

3 Securitizations sold through the residual are accounted for as sales

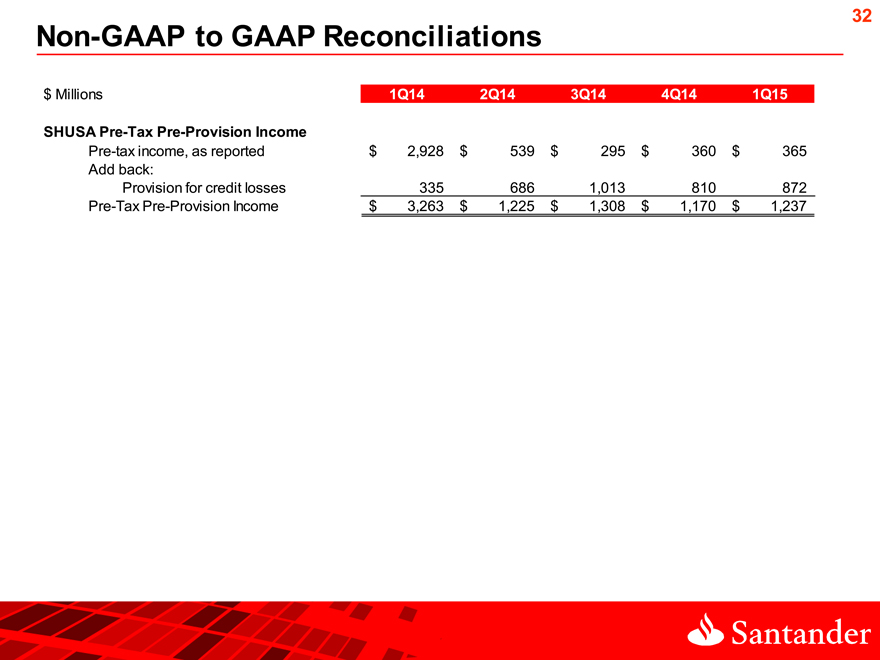

32

Non-GAAP to GAAP Reconciliations

$ Millions 1Q14 2Q14 3Q14 4Q14 1Q15

SHUSA Pre-Tax Pre-Provision Income

Pre-tax income, as reported $ 2,928 $ 539 $ 295 $ 360 $ 365 Add back: Provision for credit losses 335 686 1,013 810 872 Pre-Tax Pre-Provision Income $ 3,263 $ 1,225 $ 1,308 $ 1,170 $ 1,237

[Graphic Appears Here]

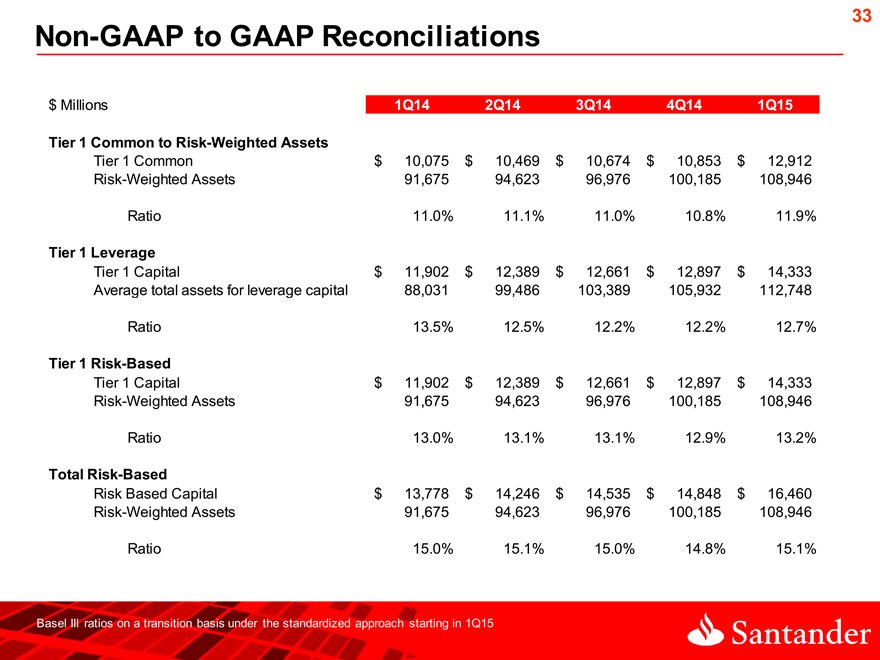

Non-GAAP to GAAP Reconciliations

33

$ Millions 1Q14 2Q14 3Q14 4Q14 1Q15

Tier 1 Common to Risk-Weighted Assets

Tier 1 Common $ 10,075 $ 10,469 $ 10,674 $ 10,853 $ 12,912

Risk-Weighted Assets 91,675 94,623 96,976 100,185 108,946

Ratio 11.0% 11.1% 11.0% 10.8% 11.9%

Tier 1 Leverage

Tier 1 Capital $ 11,902 $ 12,389 $ 12,661 $ 12,897 $ 14,333

Average total assets for leverage capital 88,031 99,486 103,389 105,932 112,748

Ratio 13.5% 12.5% 12.2% 12.2% 12.7%

Tier 1 Risk-Based

Tier 1 Capital $ 11,902 $ 12,389 $ 12,661 $ 12,897 $ 14,333

Risk-Weighted Assets 91,675 94,623 96,976 100,185 108,946

Ratio 13.0% 13.1% 13.1% 12.9% 13.2%

Total Risk-Based

Risk Based Capital $ 13,778 $ 14,246 $ 14,535 $ 14,848 $ 16,460

Risk-Weighted Assets 91,675 94,623 96,976 100,185 108,946

Ratio 15.0% 15.1% 15.0% 14.8% 15.1%

[Graphic Appears Here]

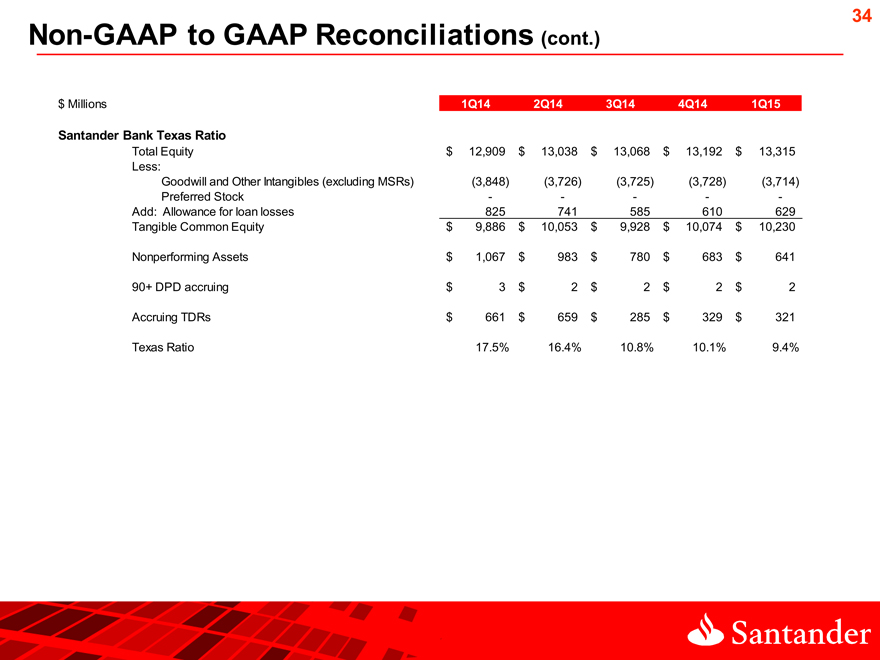

Non-GAAP to GAAP Reconciliations (cont.)

34

$ Millions 1Q14 2Q14 3Q14 4Q14 1Q15

Santander Bank Texas Ratio

Total Equity $ 12,909 $ 13,038 $ 13,068 $ 13,192 $ 13,315

Less:

Goodwill and Other Intangibles (excluding MSRs)(3,848)(3,726)(3,725)(3,728)(3,714)

Preferred Stock — — -

Add: Allowance for loan losses 825 741 585 610 629

Tangible Common Equity $ 9,886 $ 10,053 $ 9,928 $ 10,074 $ 10,230

Nonperforming Assets $ 1,067 $ 983 $ 780 $ 683 $ 641

90+ DPD accruing $ 3 $ 2 $ 2 $ 2 $ 2

Accruing TDRs $ 661 $ 659 $ 285 $ 329 $ 321

Texas Ratio 17.5% 16.4% 10.8% 10.1% 9.4%

[Graphic Appears Here]