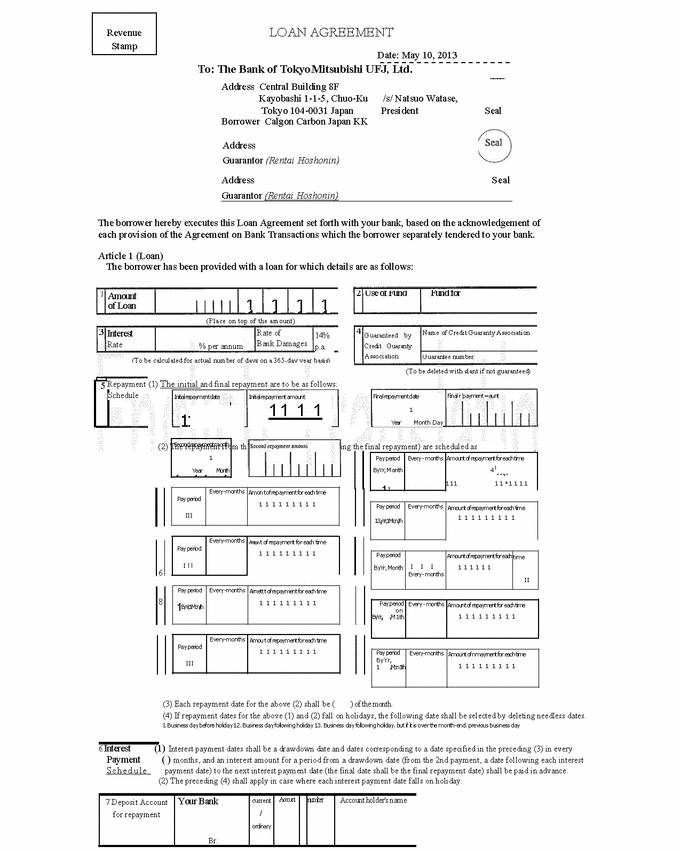

Article 2 (Partial Accelerated Repayment)

In the event that the borrower executes a partial accelerated repayment, unless otherwise requested, the borrower shall continue to make the subsequent repayment pursuant to the schedule provided in the preceding article, and the final repayment date shall be moved up to the otherwise preceding repayment date.

Article 3 (Withdrawal of Principal and/or Interest from Deposit Account)

(A) With regard to the principals payable by the borrower, your Bank may debit from the deposit account for repayment specified in Article 1-7 such amount payable by the borrower and appropriate it to such principal repayment on the contracted repayment date.

Notwithstanding any provisions specified in the rules for current deposit, ordinary deposit, multipurpose deposit accounts, the submission of checks, passbook and withdrawal slip for ordinary deposit and multi-purpose deposit accounts may be omitted.

If the outstanding balance in the deposit account for repayment fall short of the amount to be repaid on the repayment date,your Bank may, at any time, handle the repayment process in the same manner, when the balance subsequently reaches the amount to be repaid.

(B) Your Bank may debit from the account for repayment any amount payable by the borrower, including interests, damages or other fees related to this loan, mutatis mutandis to this Article 3-(A).

(C) The borrower will follow your Bank’s instructions if methods specified in this Article 3-(A) or (B) are not adopted.

Article 4 (Burden of Expenses)

The borrower will bear any and all expenses incurred in relation to the preparation of this Certificate and deed specified in Article 6, disposal of collaterals, and this Agreement.

Article 5 (Guarantee)

i. The guarantor (“Rentai Hoshonin”) shall owe obligations on guarantees jointly and severally (“Rentai Hosho”) with the borrower for any and all obligations owed by the borrower under this Agreement, and, in the performance thereof, shall abide by each provisions of the Agreement on Bank Transactions separately tendered by the borrower to your Bank and this Agreement.

ii. The Rentai Hoshonin shall not claim immunity against changes or cancellation of collaterals or other guarantees made by your Bank at your Bank’s own convenience.

iii. The Rentai Hoshonin shall not offset any debts with deposits or any other credits the borrower has against your Bank.

iv. The Rentai Hoshonin shall not exercise its rights obtained from your Bank in subrogation by performing obligations on guarantees if transactions between the borrower and your Bank continue without consent of your Bank. If your Bank so demands, the Rentai Hoshonin shall assign its rights or ranks to your Bank without any consideration thereof.

v. If the Rentai Hoshonin tenders or may tender in future guarantees on obligations owed by the borrower other than this guarantee, total amount of guarantees shall be an aggregate amount of these guarantees, unless otherwise specifically agreed, and other guarantees shall not be affected by this guarantee.

The English translation of this Loan Agreement is prepared solely for the purpose of convenience, and is superseded by the Japanese text. All questions that may arise within or without courts of law in regard to the meaning of the words, provisions, and stipulations of the following agreement shall be decided in accordance with the Japanese agreement.

Article 6 (Preparation of Notarial Deed)

If your Bank so demands, the borrower and Rentai Hoshonin shall forthwith make necessary arrangement to prepare a notarial deed authorizing compulsory execution regarding obligations under this Agreement.

Article 7 (Rivision of the Interset Rate)

Your Bank and the borrower may demand the rivision of the Interset Rate (specified in Article 1-3) each other in situations such as follows:

In the event of a change in the condition of financial market

In cases other than above, when a reasonable reason to revise the Interest Rate exists.

(Special Agreement)

(Seal)

(Reference) Irrespective of regular year or leap year, interest shall be calculated using a formula shown on the right. | | Principal (unit of calc. of int.: ¥100) x days x annual rate = Interest (rounding down less than ¥1)

365 |