SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 | | |

Stratex Networks, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule: 0-11: |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

120 Rose Orchard Way,

San Jose, California 95134

LETTER TO OUR STOCKHOLDERS

July 8, 2005

To My Fellow Stockholders:

We continued the transformation of Stratex Networks in Fiscal 2005, completing a critical step to return the company to an increasingly competitive and valued enterprise. This multi-year strategy that began in 2002 has encompassed change across every part of the company and its products.

Fiscal 2005 was a particularly important year because it was the first significant test of the popularity of the new Eclipse platform. Against that backdrop, Stratex achieved a dramatic ramp for a new product offering with the introduction of the Eclipse™ wireless transmission platform. The company also reduced its cost of doing business while positioning itself for significant margin expansion and profitability. Stratex Networks continued to introduce new product advances every quarter, much of that innovation taking us into new market segments. While the company did not close the year with the overall financial results we had targeted, it is clear that our strategic achievements have established the financial footing to deliver substantially stronger financial results going forward.

Fiscal Year Financial Results

Fiscal year 2005 revenues were $180.3 million compared with $157.3 million in the prior year, an increase of 15 percent. Net loss for 2005 was $45.6 million, or a loss per share of $0.51, compared with a loss of $37.1 million, or a loss per share of $0.44 in 2004. Due to the degree of restructuring of our business, included in these results were substantial restructuring charges and certain reserves associated with our legacy product lines. While these charges and reserves impacted FY05 results, the actions have put Stratex in a better financial position going into FY06 and set the stage, we believe, for steady financial improvements in FY06.

The many changes that we made were driven by a conversion to a solutions-based approach based on a new product platform concept called Eclipse. This platform differs from traditional approaches because of its degree of functional commonality across a large number of customer solutions, its highly software- and signal-processing driven architecture, and its software-based flexibility in our customers’ environments. As a result, Eclipse is replacing almost all of our legacy point-to-point microwave radio products. This allows us to streamline the way we do business and employ a more cost-effective overall delivery system. It has also allowed us to complete the move to an outsourced hardware manufacturing model for all of our products, including Eclipse and the Velox® LE product line, which we acquired in fiscal 2004. Finally, this new architecture has enabled us to reduce our overall operating expenses due to product development efficiencies, and to reduce our general and administrative expenses due to the operating efficiencies realized from a uniform product platform approach. As a result of these actions, we have improved the company’s cost structure, with expected annualized savings of between $7 million and $8 million beginning in the June quarter of calendar 2005.

Always mindful of our balance sheet during this transition and as we invested in the future, we continued to focus on key balance sheet metrics, most importantly our cash available for the continued, successful ramp of Eclipse. In September 2004, we raised net proceeds of $22.9 million in a private placement, and in May of 2005 we negotiated an extension of our $35 million credit facility to April 2007. As part of the extension of the credit facility we also expanded our working capital credit line portion of this facility, thus providing us with additional funds to support the increase in Eclipse business.

Eclipse—The New Wireless Architecture

Eclipse has established a new way of providing high-speed wireless transmission to not only our existing customer base, but also to a new group of customers who have found Eclipse’s value in providing a highly cost-effective and flexible solution to building data networks. By almost any measure, the products derived from the Eclipse platform have been highly popular in the first full year of commercial shipments. Based on the increased order rates for Eclipse—$31 million in the fourth fiscal quarter, an increase of 400 percent from the beginning of fiscal 2005—we believe this platform is driving volume to the critical mass needed to deliver improved financial results. As we complete our annual report to stockholders, Eclipse has shipped to more than 80 customers in over 70 countries. Going forward, our plans remain focused on conversion of our business to an Eclipse-based model, optimizing our resources, and expanding our market opportunities.

At the beginning of the fiscal year, our strategic plan called for technology enhancements—both hardware and software—to be introduced on a quarterly basis. This has been a key goal in rapidly expanding Eclipse’s market footprint. It is with great pride in our staff that I can say we met this aggressive and very critical target. This objective stands and we are committed to meeting these goals in the coming year to maintain our competitive advantage.

In the past fiscal year, we introduced Eclipse software upgrades and new hardware modules every quarter, expanding our served market. These upgrades and new capabilities are many, and demonstrate the power of the Eclipse approach:

| | • | | “Super PDH” allows customers to upgrade their transmission to fiber speeds without the complexity and cost of synchronous networks; |

| | • | | “Liquid Bandwidth” enables a superior Ethernet transport solution for high-speed data backhaul and an elegant way of implementing mixed voice/data networks; |

| | • | | Eclipse Quattro™, an ultra-high capacity extension to Eclipse, offers an alternative to traditional trunking radio systems; |

| | • | | Self-healing ring architecture, for both synchronous and non-synchronous networks, is implemented in software features. The non-synchronous feature is a significant breakthrough, offering a highly cost-effective method for building 100 Mbps Ethernet rings; |

| | • | | Eclipse Gigabit Ethernet, a new solution for ultra high-speed Ethernet transport, features layer 2 switching, QoS (Quality of Service) management, and other data features normally requiring additional cost in other devices; |

| | • | | New network management software releases make our overall network management solutions among the best in the industry. |

Also, importantly, at the end of our fiscal 2005, Stratex Networks began shipping a new Network Edge solution, the Eclipse E100, which better addresses a large portion of today’s market known as the access market. Customer acceptance of this solution was strong, evidenced by the E100 capturing 35 percent of total Eclipse unit shipments in the fourth fiscal quarter. We expect that this low-cost version will expand our market opportunities, enabling Stratex Networks to compete in more regions of the world, providing a valuable capability to our customers, and delivering improved financial performance for Stratex Networks.

The result of all of these upgrades and feature enhancements was significant growth in Eclipse sales every quarter. By fourth quarter, Eclipse sales reached approximately 40 percent of product sales, or about $15 million in the quarter, in line with our stated objective at the beginning of the fiscal year.

Expanded Market Opportunities

Stratex Networks has long been one of the top independent suppliers to our traditional markets. In fiscal 2005, the company made gains in executing its strategy to expand its presence in adjacent markets.

These markets include the data transmission, license exempt point-to-point, and trunking markets, all of which can expand the company’s served available market opportunities to more than $3.0 billion by the end of 2006.

The company’s presence in the data transmission market via Eclipse, a market essentially untapped by Stratex, has resulted in significant revenue gains. By the end of fiscal 2005, data centric applications accounted for $25 million of Stratex Networks’ annual revenue and a significant number of new customers who had previously not used Stratex products. The company also expanded the Velox™ license-exempt wireless transmission platform to include four ranges of transmission capacity that increases the addressable market opportunities for these solutions.

Outlook for Fiscal 2006

Our major tasks in fiscal 2005 were threefold:

| | • | | Commercially ramp Eclipse and expand capabilities each quarter to increase market share and maintain our competitive advantage, |

| | • | | Enter new market segments that will expand our opportunities beyond our traditional short haul mobile market, and |

| | • | | Drive down the overall operating costs of the corporation. |

We believe that we have accomplished these strategic goals. We have now turned our primary attention to completing the transition and delivering strong financial results as planned.

We are excited at the prospects for the continued successful ramp of Eclipse products as witnessed by the strong customer acceptance of this new nodal wireless transmission architecture, and demonstrated by the four consecutive quarters of Eclipse revenue growth in fiscal 2005. In addition, we have tightened our cost structure and strengthened our access to working capital, enabling us to compete more effectively. As a result of these actions and the success of Eclipse, we look forward to returning to sustained profitability in fiscal 2006.

This degree of product transition is significant, and this has been challenging. We believe a large portion of the transition is behind us now as evidenced by the ramp of Eclipse. We need to remain vigilant and manage the transition from lower-margin legacy products to Eclipse, and are committed to doing so.

I’d like to express my appreciation for the energy, the innovative talent and the support of our employees during this transformation, especially over the past year. I believe our combined efforts will continue to deliver a more competitive, cost-effective set of solutions to our customers and partners, and will enable us to unlock shareholder value for our stockholders in fiscal 2006 and beyond.

| | | | |

| | | |

CHARLES D. KISSNER Chairman and Chief Executive Officer |

| | |

| | |

| | |

| | |

| | |

| | |

Safe Harbor Statement

This Letter to Stockholders contains statements that qualify as “forward-looking statements” under the Private Securities Litigation Reform Act of 1995, including statements relating to the Company’s expectations regarding future financial performance including but not limited, projections of financial stability and profitability, during fiscal year 2006, and the continued successful ramp-up of Eclipse. Please refer to the associated risk factors in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2005, on file with the Securities and Exchange Commission.

Notice of Annual Meeting of Stockholders

Proxy Statement

STRATEX NETWORKS, INC.

120 Rose Orchard Way,

San Jose, California 95134

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 9, 2005

The annual meeting of stockholders of Stratex Networks, Inc., a Delaware corporation (the “Corporation” or “the Company”), will be held at our principal executive offices located at 120 Rose Orchard Way, San Jose, California, on Tuesday, August 9, 2005, at 2:30 p.m., local time, for the following purposes, as more fully described in the proxy statement accompanying this notice:

1. Elect six directors to serve until the next annual meeting of stockholders or until their successors have been duly elected and qualified;

2. Approve an amendment and restatement of the Company’s 1999 Employee Stock Purchase Plan (the “Purchase Plan”) to increase the number of shares reserved for issuance under the Purchase Plan by 900,000.

3. Ratify the selection of Deloitte & Touche LLP as the Corporation’s independent auditors.

4. Transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

Only stockholders of record at the close of business on June 13, 2005, are entitled to notice of, and to vote at, the annual meeting and at any adjournment or postponement thereof. Our stock transfer books will remain open between the record date and the date of the annual meeting. A list of stockholders entitled to vote at the annual meeting will be available for inspection at our principal executive offices.

All stockholders are cordially invited and encouraged to attend the annual meeting. Whether or not you attend in person, to ensure your representation at the annual meeting, please carefully read the accompanying proxy statement describing the matters to be voted on at the annual meeting. You may submit your proxy (1) over the Internet, (2) by telephone, or (3) by signing, dating and returning the enclosed proxy card promptly in the accompanying envelope. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be returned to ensure that all your shares will be voted. If you submit your proxy card and then decide to attend the annual meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the attached proxy statement. The prompt return of your proxy card will assist us in preparing for the annual meeting.

We look forward to seeing you at the annual meeting.

|

Sincerely yours, |

|

|

CHARLES D. KISSNER |

| Chairman and Chief Executive Officer. |

San Jose, California

July 8, 2005

TABLE OF CONTENTS

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS OF

STRATEX NETWORKS, INC.

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Stratex Networks, Inc., a Delaware corporation, (the “Corporation” or the “Company”) for the annual meeting of stockholders to be held at 2:30 p.m., local time, on Tuesday, August 9, 2005, and any adjournment or postponement thereof. The annual meeting will be held at our principal executive offices located at 120 Rose Orchard Way, San Jose, California. The telephone number at that location is (408) 943-0777. These proxy materials were first mailed on or about July 8, 2005, to our stockholders entitled to notice of, and vote at, the annual meeting.

All materials filed by us with the Securities and Exchange Commission can be obtained at the Commission’s Public Reference Room at 450 Fifth Street N.W., Washington, D.C. 20549 or through the Commission’s website atwww.sec.gov.You may obtain information on the operation of the Public Reference Room by calling 1-800-SEC-0330.

Purpose of the Annual Meeting

The specific proposals to be considered and acted upon at the annual meeting are summarized in the preceding notice of annual meeting of stockholders. Each proposal is described in more detail in a subsequent section of this proxy statement.

Record Date

The close of business on June 13, 2005 has been fixed as the record date (the “Record Date”) for determining the holders of shares of our common stock, par value $0.01 per share, entitled to notice of, and to vote at, the annual meeting and any adjournment or postponement thereof.

Revocability of Proxies

If the shares of common stock are held in your name, you may revoke your proxy given pursuant to this solicitation at any time before the proxy card is voted by: (i) delivering a written notice of revocation to our Assistant Secretary, Carol A. Goudey, at the address of our principal executive offices; (ii) executing and delivering a proxy bearing a later date to our Assistant Secretary; or (iii) attending the annual meeting and voting in person. If your shares are held in “street name,” you should follow the directions provided by your broker regarding how to revoke your proxy. Your attendance at the annual meeting after having executed and delivered a valid proxy card will not in and of itself constitute a revocation of your proxy. You will be required to give oral notice of your intention to vote in person to the inspector of elections at the annual meeting.

Voting Rights of Stockholders

Each outstanding share of our common stock on the Record Date is entitled to one vote on all matters to come before the annual meeting. As of the close of business on the Record Date, there were 94,885,739 shares of common stock outstanding and entitled to vote on all proposals presented at the annual meeting, held by 390 stockholders of record. The presence at the annual meeting of a majority of these shares of common stock, either in person or by proxy, will constitute a quorum for the transaction of business at the annual meeting. An automated system administered by our transfer agent, Mellon Investor Services LLC, will tabulate votes cast by proxy. A representative of our transfer agent will act as the inspector of elections for the annual meeting and will tabulate the votes cast in person at the annual meeting.

If you are unable to attend the annual meeting, you may vote by proxy. When your proxy card is returned properly completed, it will be voted pursuant to your instructions set forth on the proxy card. You are urged to specify your choices on the enclosed proxy card. If a proxy card is signed and returned without choices specified, in the absence of contrary instructions, the shares of common stock represented by the proxy will be voted “FOR” the director nominees and the other proposals to be presented at the annual meeting, and will be voted in the proxy holders’ discretion as to such other matters that may properly come before the annual meeting. If you choose to vote by proxy, then the proxy card you submit will continue to be valid at any adjournment or postponement of the annual meeting.

Required Vote for Approval

The director nominees will be re-elected by a plurality of the votes cast. Our stockholders may not cumulate votes in the re-election of the director nominees. The director nominees receiving the highest number of affirmative votes of the shares present in person or by proxy at the annual meeting and entitled to vote will be elected. The ratification of the Corporation’s independent auditors shall be by a majority of the shares present in person or by proxy at the annual meeting.

Quorum, Abstentions and Broker “Non-Votes”

Under the General Corporation Law of the State of Delaware, an abstaining vote and a broker “non-vote” are counted as present and are, therefore, included for purposes of determining whether a quorum of shares is present at the annual meeting. A broker “non-vote” occurs when a broker or other nominee holding shares for a beneficial owner signs and returns a proxy with respect to shares of common stock held in a fiduciary capacity (typically referred to as being held in “street name”) but does not vote on a particular matter because the nominee does not have the discretionary voting power with respect to that matter and has not received instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters but not on non-routine matters. Routine matters include the election of directors and the ratification of auditors. As a result, with respect to proposal 1, which requires a plurality vote, broker “non-votes” will have no effect. With respect to proposals 2 and 3 which requires the affirmative vote of a majority of our common stock present and entitled to vote, and because abstentions will be included in the tabulation of shares of our common stock entitled to vote for purposes of determining whether a proposal has been approved, abstentions will have the same effect as negative votes on proposals 2 and 3.

Householding of Annual Meeting Material

Some brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one (1) copy of the Proxy Statement and annual report may have been sent to multiple stockholders in a stockholder’s household. The Company will promptly deliver a separate copy of either document to any stockholder who contacts the Company’s Assistant Secretary, Carol A. Goudey, at (408) 943-0777 requesting such copies. If a stockholder is receiving multiple copies of the Proxy Statement and annual report at the stockholder’s household and would like to receive a single copy of the proxy statement and annual report for a stockholder’s household in the future, stockholders should contact their broker, other nominee record holder, or the Company’s investor relations department to request mailing of a single copy of the proxy statement and annual report.

Cost of Solicitation

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional solicitation materials furnished to our stockholders. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable expenses incurred

2

in sending these proxy materials to beneficial owners of our common stock. We may supplement the original solicitation of proxies by mail, by solicitation by telephone, telegram or other means by our directors, officers and employees. No additional compensation will be paid to these individuals for any such services.

Requirements for Stockholder Proposals Including Nominations of Candidates for the Board of Directors to be Brought Before an Annual Meeting

For stockholder proposals, including the nomination of director candidates, to be considered properly brought before an annual meeting, the stockholder must have given timely notice thereof in writing to our Assistant Secretary, Carol A. Goudey, at the address of our principal executive offices. To be timely for the 2006 annual meeting of stockholders, a stockholder’s notice must be delivered to or mailed and received by our Assistant Secretary not less than 60 days or more than 90 days prior to the annual meeting. However, in the event that a stockholder’s notice of annual meeting is given less than 70 days prior to the annual meeting or the date public disclosure of such annual meeting was made and in order for such stockholder’s notice to be considered timely for the 2006 annual meeting, such notice must be delivered to or mailed and received by our Assistant Secretary no later than (i) the close of business on the tenth (10th) day following the day on which the notice of the date of such annual meeting was mailed, or (ii) the date public disclosure of such annual meeting was made. A stockholder’s notice must accompany any stockholder proposal and will set forth as to each matter the stockholder proposes to bring before the annual meeting: (i) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting; (ii) the name and record address of the stockholder proposing such business; (iii) the class and number of shares of our common stock which are beneficially owned by the stockholder; and (iv) any material interest of the stockholder in such business.

Requirements for Stockholder Proposals to be Considered for Inclusion in Our Proxy Materials

Stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, and intended to be presented at our 2006 annual meeting of stockholders must be received by our Assistant Secretary, Carol A. Goudey, at the address of our principal executive offices, no later than March 8, 2006, in order to be considered for inclusion in our proxy materials for the 2006 annual meeting.

Discretionary Authority

The proxies to be solicited by our Board of Directors for the 2006 annual meeting will confer discretionary authority on the proxy holders to vote on any stockholder proposal presented at such annual meeting if we fail to receive notice of such stockholder’s proposal for the meeting by March 22, 2006.

3

EXECUTIVE OFFICERS

The following table sets forth information regarding our senior executives who report directly to the Chief Executive Officer and other officers as of March 31, 2005.

| | | | |

Name

| | Title

| | Age

|

Charles D. Kissner | | Chairman and Chief Executive Officer | | 57 |

Carl A. Thomsen | | Senior Vice President, Chief Financial Officer and Secretary | | 60 |

John C. Brandt* | | Vice President, Global Operations | | 48 |

Carol A. Goudey | | Treasurer and Assistant Secretary | | 57 |

Paul A. Kennard | | Vice President, Corporate Marketing and | | 54 |

| | | Chief Technical Officer | | |

Ryan R. Panos* | | Vice President, Worldwide Sales and Service | | 42 |

Juan B. Otero | | General Counsel and Assistant Secretary | | 41 |

Gregory L. Overholtzer | | Corporate Controller | | 48 |

Mr. Charles D. Kissner. See description, page 5.

Mr. Carl A. Thomsenjoined us in February 1995 as our Vice President, Chief Financial Officer and Secretary. He was promoted to Senior Vice President in April 1999. He was previously Senior Vice President and Chief Financial Officer of Measurex Corporation, a manufacturer of sensor-based process control systems, now a part of Honeywell International. Mr. Thomsen has served on the board of PCTEL, a wireless equipment company, since May 2001.

Mr. John C. Brandtjoined us in August 1997 as our Corporate Controller. He was promoted to Vice President, Corporate Controller in April 1999, and then to Vice President, Finance in April 2003. Prior to joining us, he worked at Measurex Corporation in the positions of Controller, Manager of Internal Audit, Manager of Financial Planning, and Manager of Corporate Reporting and Accounting from 1981 to 1997.

| * | In December 2004, Mr. Brandt was appointed Vice President, Global Operations. |

Ms. Carol A. Goudeyjoined us in April 1996 as our Treasurer and was additionally appointed Assistant Secretary in May 1996. Prior to joining us, she served as Acting Treasurer of California Micro Devices Corporation from 1994 to 1996. Ms. Goudey also held the position of Corporate Treasurer at both Ungermann-Bass, Inc. and System Industries, Inc. MS. Goudey holds a B.A. degree in mathematics from San Jose State University.

Mr. Paul A. Kennardjoined us in April 1996 as our Vice President, Engineering. He was appointed as our Chief Technical Officer and Vice President, Corporate Marketing in October 1998. He was re-appointed as our Chief Technical Officer and appointed as Vice President, Strategy in April 2000. In December 2004 he was appointed Vice President, Corporate Marketing and Chief Technology Officer. Prior to joining us, Mr. Kennard was with California Microwave Corporation, a satellite and wireless communications company, where he served as a Director of the Signal Processing Technology, and as Senior Vice President of Engineering for the Microwave Network Systems Division.

Mr. Ryan R. Panosjoined us in March 1996 as our Director of Business Development. He was promoted to Vice President, Global Accounts in April 1998 and in April 1999 he was appointed as our Vice President, North American Sales. In December 2000, Mr. Panos was appointed as our Vice President, Worldwide Sales and Service. Prior to joining us, Mr. Panos served as Regional Sales Manager at M/A-COM, Inc., a manufacturer of radio and microwave communications products, from March 1992 to March 1996.

| * | On April 15, 2005, the Company entered into a separation agreement (the “Agreement”) with Mr. Panos, setting forth the terms of Mr. Panos’ cessation of service as of April 30, 2005. Mr. Larry M. Brittain was appointed Vice President, Worldwide Sales and Service on April 4, 2005. |

4

Mr. Juan B. Otero joined the Company in July 2002 as Director, Corporate Legal Affairs. He was promoted to General Counsel in July of 2004 and to General Counsel and Assistant Secretary in February of 2005. Prior to joining Stratex Networks, Mr. Otero was Director and Senior Counsel for Compaq Computer Corporation and the Hewlett-Packard Company, and Corporate Counsel for Hitachi Data Systems. Mr. Otero has also practiced law both in the private and public sectors. Mr. Otero holds a B.A. degree in International Relations from the University of California, Davis, and a J.D. from the University of Colorado School of Law. Mr. Otero is a member of the board of the Child Abuse Prevention Center.

Mr. Gregory L. Overholtzer joined the Company in February 2005 as Corporate Controller. Prior to joining us he was Chief Financial Officer for Polymenr Technology Group from September 1998 to January 2005. He is Academic Relations Chair of the Silicon Valley Chapter of Financial Executives International. Mr. Overholtzer holds a B.A. and M.B.A. from the University of California, Berkeley.

BOARD STRUCTURE AND CORPORATE GOVERNANCE PRINCIPLES

Stratex Networks believes in and is committed to sound corporate governance principles. For many years the Company has had a Business Code of Conduct applicable to the Company and its subsidiaries. In addition, consistent with its commitment to and continuing evolution of corporate governance principles the Company adopted a Code of Ethics, amended its Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee charters, and adopted new corporate governance guidelines. These were attached to our 2004 Proxy Statement and are available atwww.stratexnet.com. No major amendments to the referenced documents were made during fiscal year 2005.

Board Meetings and Committees

During the fiscal year ended March 31, 2005, our Board of Directors held five meetings. During the same period, each director attended at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors held during the period for which he was a director, and (ii) the total number of meetings of all committees of the Board of Directors on which such director served during the period for which he was a director. Each of our current directors is independent except the Chairman of the Board and Chief Executive Officer. The Board has determined that each of the members of each of the committees has no material relationship with the Corporation and is independent within the Corporation’s director independence standards and consistent with Rule 10A-3 of the 1934 Act and the Nasdaq National Stock Market listing requirements.

The Board of Directors is composed of seven members, six of which are independent:

| | | | |

Name

| | Title

| | Age

|

Charles D. Kissner | | Chairman and Chief Executive Officer | | 57 |

Richard C. Alberding | | Lead Director | | 74 |

John W. Combs | | Director | | 57 |

William A. Hasler | | Director | | 63 |

James D. Meindl, PhD | | Director | | 72 |

V. Frank Mendicino | | Director | | 65 |

Edward F. Thompson | | Director | | 66 |

Board of Directors

Mr. Charles D. Kissnercurrently serves as Chairman and Chief Executive Officer. Mr. Kissner joined us as our President and Chief Executive Officer and was elected a director in July 1995 and Chairman in August 1996. He served as our Chief Executive Officer from July 1995 to May 2000 and again since October 2001. Prior to joining us, he served as Vice President and General Manager of M/A-COM, Inc., a manufacturer of radio and

5

microwave communications products, from July 1993 to July 1995. Prior to that, he was executive vice president of Fujitsu Network Switching, Inc., and held several key positions at AT&T (now Lucent Technologies) in general management, finance, sales, marketing, and engineering. Mr. Kissner is currently Chairman of the Board of Directors of SonicWALL, Inc., a provider of Internet security appliances. Mr. Kissner serves also on the Advisory Board of Santa Clara University’s Leavey School of Business.

Mr. Richard C. Alberdinghas served as a director since July 1993 and as Co-Chairman of our Board of Directors and Co-Chief Executive Officer from September 1994 to July 1995. Mr. Alberding retired from Hewlett-Packard Company in 1991, where he had served since 1984 as an Executive Vice President responsible for worldwide company sales, support and administration activities for measurement and computation products, as well as all corporate-level marketing activities. He also served on Hewlett-Packard’s Executive Committee. Mr. Alberding currently serves on the boards of SyBase, Inc., a computer database and tools company, QuickEagle, a network tools company, PCTEL, a wireless equipment company, and several private companies and organizations. Mr. Alberding is a trustee of the Cazenovia College.

Mr. John W. Combshas served as a director since May 1997. Mr. Combs is currently President and Chief Executive Officer of Shoretel, a voice-over-IP (VoIP) technology solutions company. Mr. Combs served as Chairman and Chief Executive Officer of Littlefeet, Inc., a distributed cover technology company, from July 2001 to January 2004. From September 1999 to July 2001, Mr. Combs served as President and Chief Executive Officer of Internet Connect, a broadband networking solutions provider. Mr. Combs served as President, Southwest Area, for Nextel Communications, Inc., a wireless digital communications system provider, from June 1993 to September 1999. Prior to Nextel Communications, Mr. Combs was President of Mitel Inc., a manufacturer of private branch exchanges. Currently, Mr. Combs serves on the board of Infosonics Corporation, a privately held distribution and services company in the wireless telecommunications industry.

Mr. William A. Haslerwas the co-Chief Executive Officer of Aphton Corp, a biopharmaceutical company from 1998 to 2003. From 1991 to 1998, Mr. Hasler was the Dean of both the Graduate and Undergraduate Schools of Business at the University of California, Berkeley. Prior to his deanship at UC Berkeley, Mr. Hasler was the Vice Chairman of KPMG Peat Marwick. Mr. Hasler serves on the boards of Solectron Corporation, a provider of electronics manufacturing services, Ditech Communications Corp., a supplier of telecommunications equipment, and Genitope Corporation, a biopharmaceutical company. He is also a trustee of the Schwab Funds, and a trustee of Pomona College.

Dr. James D. Meindlhas served as a director since November 1995. Dr. Meindl has held the Joseph M. Pettit Chaired Professorship in Microelectronics at the Georgia Institute of Technology since 1993. Prior to his professorship, Dr. Meindl served as Senior Vice President for Academic Affairs and Provost at Rennselaer Polytechnic Institute, from 1986 to 1993. Dr. Meindl serves on the boards of SanDisk Corp., a company which designs, develops and markets flash memory data storage products, and Zoran Corp., a semiconductor and related devices company.

Mr. V. Frank Mendicinohas served as a director since October 1998. Mr. Mendicino served as a director of Innova Corporation from July 1989 and as its Chairman from February 1992 until October 1998, when the merger of our Company and Innova was consummated. Mr. Mendicino has served as a General Partner of Woodside Fund, Woodside Fund II and Woodside Fund III, each of which is a private investment fund, since September 1983. He currently serves as Managing Director of Access Venture Partners, a private investment fund with which he has served as a General Partner since April 1999. He also serves on the boards of over 15 private companies, and is member of the Board of Directors of the University of Wyoming Foundation.

Mr. Edward F. Thompsonhas served as a director since November 2002. Mr. Thompson has held executive positions at Amdahl Corporation, including those of Chief Financial Officer and Corporate Secretary, as well as Chairman and CEO of Amdahl Capital Corporation. Mr. Thompson has also held positions at U.S. Leasing International, Inc., Computer Sciences Corporation, IBM and Lockheed Missiles and Space Company. Mr.

6

Thompson has contributed as a director or advisor to a number of companies including Fujitsu, Ltd. and several subsidiaries, Niku Corporation, Diamondhead Ventures, LLP and SonicWALL Inc. He is on the Advisory Board of Santa Clara University’s Leavey School of Business.

The board is chaired by Mr. Kissner, with Mr. Alberding serving as Lead Director.

Board of Directors Committees

We currently have an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

Audit Committee

The Audit Committee is primarily responsible for approving the services performed by our independent public accountants and reviewing our accounting practices, our corporate financial reporting and system of internal accounting controls. The Audit Committee, which currently consists of Messrs. Alberding, Hasler, and Thompson, held eight meetings during the fiscal year. In November 2003, the Audit Committee adopted and the Board of Directors approved an amended charter for the Audit Committee which is available atwww.stratexnet.com. No material amendments to Audit Committee Charter were made during fiscal year 2005. The Audit Committee is composed of independent, non-employee members of our Board of Directors. Mr. Thompson serves as the financial expert in the Corporation’s Audit Committee.

Compensation Committee

The Compensation Committee is responsible for recommending and reviewing the compensation of executive officers and for administering incentive plans. The Compensation Committee, which currently consists of Dr. Meindl, and Messrs. Combs and Mendicino, held six meetings during the fiscal year. The Compensation Committee is composed of independent, non-employee members of our Board of Directors. The Compensation Committee has adopted, and the Board of Directors has approved a Compensation Committee charter, which is available atwww.stratexnet.com.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee assists the board in selecting nominees for election to the board, monitors the composition of the board, and recommends candidates for the Board. The Nominating and Corporate Governance Committee also identifies best practices and recommends steps consistent with sound and current corporate governance principles. The Nominating and Corporate Governance Committee, which currently consists of Messrs. Hasler, Mendicino and Thompson, met three times during fiscal year 2005. The Nominating and Corporate Governance Committee is composed of independent, non-employee members of our Board of Directors. The Nominating and Corporate Governance Committee has adopted, and the Board of Directors has approved, a nominating and corporate governance charter and corporate governance guidelines are available atwww.stratexnet.com.

The Nominating and Corporate Governance Committee will consider and make recommendations to the Board of Directors regarding any stockholder recommendations for candidates to serve on the Board of Directors. The Nominating and Corporate Governance Committee will review periodically whether a more formal policy should be adopted. Stockholders wishing to recommend candidates for consideration by the Nominating and Corporate Governance Committee may do so by writing to the Assistant Secretary of the Corporation at 120 Rose Orchard Way, San Jose, California, providing the candidate’s name, biographical data and qualifications, a document indicating the candidate’s willingness to act if elected, and evidence of the nominating stockholder’s ownership of the Corporation’s Common Stock at least 120 days prior to the next annual meeting to assure time for meaningful consideration by the Nominating and Corporate Governance

7

Committee. There are no differences in the manner in which the Nominating and Corporate Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder. The Corporation currently does not pay any third party to identify or assist in identifying or evaluating potential nominees, although the Corporation may in the future utilize the services of such third parties.

In reviewing potential candidates for the Board of Directors, the Nominating and Corporate Governance Committee considers the individual’s experience and background. Candidates for the position of director should exhibit proven leadership capabilities, high integrity, exercise high level responsibilities within their chosen careers, and have an ability to quickly grasp complex principles of business, finance, international transactions, and communication technologies. In general, candidates will be preferred who hold an established executive level position in business, finance, law, education, research, government or civic activity. In making its selection, the Nominating and Corporate Governance Committee bears in mind that the foremost responsibility of a director of a Corporation is to represent the interests of the stockholders as a whole.

The Board of Directors intends to continue to evaluate candidates for election to the Board of Directors on the basis of the foregoing criteria.

The Nominating and Corporate Governance Committee approved Charles D. Kissner, Richard C. Alberding, William A. Hasler, Dr. James D. Meindl, V. Frank Mendicino and Edward F. Thompson as nominees for the directors to be voted upon at the Annual Meeting.

Stockholder Communications with the Board

Stockholders who wish to communicate directly with our independent directors may do so by sending an e-mail to Juan Otero, the Company’s General Counsel and Assistant Secretary, at Board_of_Directors@stratexnet.com or may send a letter addressed to the Stratex Networks Board of Directors c/o General Counsel and Assistant Secretary, 120 Rose Orchard Way, San Jose, CA 95134. Mr. Otero monitors these communications, consults with Mr. Alberding, our independent Lead Director, and provides a summary of all received messages to the Board of Directors at its regularly scheduled meetings. Where the nature of communications warrants, Mr. Otero may obtain more immediate attention of the appropriate committee or independent director of the Board of Directors, of independent advisors or of our management. Mr. Otero may decide in his judgment whether a response to any stockholder communication is appropriate.

Stock Ownership Guidelines

While the Corporation does not have a minimum stock ownership requirement by members of the Board of Directors, the Corporate Governance Guidelines adopted by the Board of Directors encourages the ownership of its common stock.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Directors

Retainers

During calendar year 2004, we paid each director a retainer of $5,500 per quarter in cash, or at a director’s election, to receive in lieu of such cash payment, the equivalent of $6,250 in shares of our common stock per quarter. The equivalent value of stock to be received in lieu of cash payment for retainer fees is based on the fair market value per share of our common stock on the first trading day in the calendar year in which the stock was granted. The retainer fees and cash equivalent value of our common stock to be received in lieu of cash payment remain the same for calendar year 2005.

8

Meeting Fees

During calendar year 2004, we paid each non-employee director $1,500 in fees for each in-person meeting and $750 for each telephonic meeting attended by such director. The in-person and telephonic meeting fees remain the same for calendar year 2005.

We paid each director who served on a committee in calendar year 2004, committee meeting fees of $1,000 for each in-person committee meeting and $500 for each telephone committee meeting attended by such director. Beginning in January 2004, we paid each director who served on a committee meeting fees of $1,500 for each in-person committee meeting attended and $750 for each telephonic committee meeting attended. In calendar year 2003, the chairman of each committee of our Board of Directors received an additional cash payment of $250 per quarter. Beginning in January 2004, we paid the Chairperson of the Audit Committee an additional $625 per quarter; the chairperson of the Compensation Committee an additional $375 per quarter; and the chairperson of the Nominating and Corporate Governance Committee an additional $250 per quarter. In addition, the Board of Directors approved an additional cash payment to the Lead Director of $625 per quarter beginning in January 2005. Directors were also reimbursed for their out-of-pocket expenses incurred in attending board and committee meetings.

Pursuant to the provisions of our 2002 non-employee director option program, each individual re-elected as a non-employee board member at the 2002 annual meeting of stockholders, and who had been a member of our board for the prior three years, received an option grant at that time for 10,000 shares of our common stock. Dr. Meindl and Messrs. Alberding, Combs, Mendicino, and Hasler received such grants.

Pursuant to a change in 2003 non-employee director option program, beginning with the 2004 annual meeting of stockholders, the Board of Directors approved a reduction of the initial stock options awarded to new members from 30,000 shares to 20,000 shares of our common stock at the time the new director joins the board. Each board member who has served as a director at least six (6) months will be awarded follow-on grants of 10,000 shares upon re-election to the board by the stockholders. Each individual re-elected as a non-employee board member at the upcoming 2005 annual meeting of stockholders, and who will have been a member of our board for the prior three years, will receive an option grant for 10,000 shares. Mr. Thompson has served less than three years and thus did not receive an option grant in 2004; however, due to the change in the initial and follow-on grant option plan, he will be eligible for a grant in 2005. The shares of common stock for each periodic option grant under the program are priced at 100% of the fair market value per share on the date of grant and are fully vested and exercisable on such date. Each option granted under the program has a maximum term of five years measured from the grant date.

Pursuant to the provisions of our 2002 non-employee director stock fee program, non-employee directors may elect to apply all or any portion of their annual retainer fee otherwise payable in cash to the purchase of shares of our common stock. Shares received by these directors in lieu of annual retainer fees vest quarterly during the year after receipt so long as the individual continues to serve as one of our non-employee directors during the year. We will hold such shares in escrow and the vested shares are released in equal installments on June 30, 2005 and December 31, 2005. Immediate vesting of all the issued shares will occur in the event the non-employee director dies or becomes permanently disabled during such non-employee director’s period of service, or a corporate transaction or change of control, both as defined in the 2002 stock incentive plan, occurs during such period.

9

Executive Officers

The following table provides summary information concerning the compensation earned by our Chief Executive Officer and each of our four other most highly compensated executive officers whose salary and bonus for the fiscal year ended March 31, 2005 were in excess of $100,000 for their services to the Company. The executives listed below are hereinafter referred to as the “Named Executive Officers.”

EXECUTIVE SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | |

| | | | | LONG-TERM

COMPENSATION

AWARDS

| | ALL OTHER

COMPENSATION(4)

|

| | | ANNUAL COMPENSATION

| | NUMBER OF

SECURITIES

UNDERLYING

OPTIONS

| |

NAME AND

PRINCIPAL POSITION

| | FISCAL

YEAR

| | SALARY(1)

| | BONUS(2)

| | OTHER ANNUAL

COMPENSATION(3)

| | |

Charles D. Kissner Chief Executive Officer and Chairman of the Board | | 2005

2004

2003 | | $

| 473,799

460,000

410,000 | |

| —

—

— | | $

| 14,400

14,400

14,400 | | — 430,000

535,000 | | $

| 5,822

5,822

4,863 |

| | | | | | |

Carl A. Thomsen Senior Vice President, Chief Financial Officer and Secretary | | 2005

2004

2003 | | $

| 302,850

294,000

290,500 | |

| —

—

— | | $

| 10,800

10,800

12,150 | | — 190,000

200,000 | | $

| 6,132

5,822

5,822 |

| | | | | | |

Paul A. Kennard Vice President, Product Development and Chief Technical Officer | | 2005

2004

2003 | | $

| 270,375

262,500

259,375 | |

| —

—

— | | $

| 10,800

10,800

12,150 | | — 150,000

160,000 | | $

| 4,742

4,742

4,742 |

| | | | | | |

Ryan R. Panos(5) Vice President, Worldwide Sales and Service | | 2005

2004

2003 | | $

| 262,849

255,200

255,200 | | $

| 107,710

137,857

91,535 | | $

| 10,800

10,800

10,800 | | — 150,000

110,000 | | $

| 4,085

4,040

4,040 |

| | | | | | |

Robert J. Schlaefli(6) Vice President, Global Operations | | 2005

2004

2003 | |

| 179,550

233,200

229,900 | |

| —

—

— | | $

| 8,100

10,800

11,850 | | — 150,000

160,000 | | $

| 3,201

4,249

44,899 |

| | | | | | |

John Brandt, Vice President, Finance(7) | | 2005

2004

2003 | | $

| 219,314

212,000

208,999 | |

| —

—

— | | $

| 9,000

9,000

9,000 | | — 150,000

110,000 | | $

| 4,200

4,173

4,267 |

| (1) | The Compensation Committee approved a four percent (4%) increase in base salary for fiscal year 2004. The difference in base salary between fiscal years 2004 and 2003 is due to a base salary increase effective July 2002. |

| (2) | Our executive officers are eligible for annual cash bonuses. Such bonuses are generally based upon individual achievement, as well as corporate performance objectives determined by our Compensation Committee. No annual bonuses were earned during fiscal year 2005. Mr. Panos earned $107,710 under the Company’s incentive sales commission program. |

| (3) | “Other Annual Compensation” represents car allowances provided during the fiscal year. |

| (4) | “All Other Compensation” includes (i) contributions made by us on behalf of our Named Executive Officers to our 401(k) plan for all the three fiscal years and (ii) premiums paid by us on behalf of our Named Executive Officers for group life insurance. |

10

| (5) | Mr. Panos’ fiscal years 2005, 2004, and 2003 bonuses were earned under the Company’s incentive sales commission program. |

| (6) | Through December 31, 2004. Mr. Schlaefli ceased providing services to the Company on December 31, 2004. |

| (7) | Mr. Brandt was appointed Vice President, Global Operations effective January 1, 2005. |

OPTION AND SAR GRANTS IN FISCAL YEAR ENDED MARCH 31, 2005

There were no stock option grants to Named Executives during fiscal year 2005.

AGGREGATED OPTION/SAR EXERCISES

AND FISCAL YEAR-END VALUE

The following table provides information with respect to the Named Executive Officers concerning their unexercised stock options held by them at such fiscal year end. No stock options or stock appreciation rights were exercised by any Named Executive Officer during the fiscal year ended March 31, 2005, and no stock appreciation rights were outstanding at such fiscal year end.

| | | | | | | | | | | | |

Name

| | Shares

Acquired on

Exercise(#)

| | Value

Realized($)(1)

| | Number of Securities

Underlying Unexercised

Options at March 31, 2005

| | Value of Unexercised In-the-Money Options at March 31, 2005(2)

|

| | | | Exercisable(#)

| | Unexercisable(#)

| | Exercisable($)

| | Unexercisable($)

|

Charles D. Kissner | | — | | — | | 1,269,539 | | 1,019,062 | | — | | — |

Carl A. Thomsen | | — | | — | | 418,804 | | 228,750 | | — | | — |

Paul A. Kennard | | — | | — | | 349,253 | | 181,874 | | — | | — |

Ryan R. Panos | | — | | — | | 187,625 | | 164,375 | | — | | — |

Robert J. Schlaefli | | — | | — | | 217,376 | | 0 | | — | | — |

John C. Brandt | | — | | — | | 247,527 | | 169,500 | | — | | — |

| (1) | Based upon the market price of the purchased shares of common stock on the exercise date less the option price paid for such shares. |

| (2) | Based upon the fair market value of our common stock as of March 31, 2005 ($1.84 per share), less the option exercise price paid for those shares. |

11

OTHER INFORMATION

Employment Agreements

Messrs. Kissner, Thomsen, Kennard, Panos, and Brandt each have a written employment agreement with us.

We entered into an employment agreement with each of Messrs. Kissner and Thomsen effective as of May 14, 2002. Either the Company or the respective officer may terminate the agreement upon notice. However, the agreement for each of these executive officers includes the following provisions:

(1) If Mr. Kissner is terminated without cause or should he resign for good reason and he signs a general release he will be entitled to receive the following severance benefits: (i) severance payments at his final base for a period of 36 months following his termination; (ii) payment of premiums necessary to continue his group health insurance under COBRA or to purchase other comparable health insurance coverage on an individual or group basis when he is no longer eligible for COBRA coverage until the earlier of (a) 36 months, or (b) the date on which he first becomes eligible to participate in another employer’s group health insurance; (iii) the prorated portion of any incentive bonus that he would have earned during the incentive bonus period in which his employment was terminated; (iv) with respect to any stock options granted to Mr. Kissner, that are unvested as of the date of his termination, 60% of such unvested options will immediately vest and become exercisable as of the date of his termination. Mr. Kissner will also be entitled to purchase any vested shares of stock that are subject to the outstanding options until the earlier of (a) 36 months or (b) the date on which the applicable option(s) expire; (v) payment of his then-provided car allowance for a period of 36 months; and (vi) outplacement assistance selected and paid for by us.

(2) If Mr. Thomsen is terminated without cause or should he resign for good reason and he signs a general release he will be entitled to receive the following severance benefits: (i) severance payments at his final base salary for a period of 18 months following his termination; (ii) payment of premiums necessary to continue his group health insurance under COBRA until the earlier of (a) 18 months, (b) the date on which he first becomes eligible to participate in another employer’s group health insurance or (c) the date on which he is no longer eligible for COBRA coverage; (iii) the prorated portion of any incentive bonus that he would have earned during the incentive bonus period in which his employment was terminated; (iv) any stock options granted to the executive officer will stop vesting as of his termination date however he will be entitled to purchase any vested shares of stock that are subject to the outstanding options until the earlier of (a) 18 months or (b) the date on which the applicable option(s) expire; (v) payment of his then-provided car allowance for a period of 18 months; and (vi) outplacement assistance selected and paid for by us.

In addition the agreements provide that if there is a change of control, Messrs. Kissner’s and Thomsen’s employment with the Company will terminate upon such change of control. If, upon termination, Messrs. Kissner and Thomsen sign a general release of known and unknown claims in a form satisfactory to us, (i) the severance benefits described above shall be increased by an additional 12 months; (ii) they will receive a payment equal to the greater of (a) the average of the annual incentive bonus received by them, if any, for the previous three years or (b) their target incentive bonus for the year in which their employment terminates; and (iii) we will accelerate the vesting of all unvested stock options granted to them such that all of their stock options will be fully vested as of the date of their termination.

We also entered into an employment agreement with each of Messrs. Kennard, Panos, Brandt and Schlaefli effective as of May 14, 2002. Either the Company or the respective officer may terminate the agreement upon notice. However, the agreement for each of these executive officers includes the following provisions: (1) if the executive officer is terminated without cause or should he resign for good reason and he signs a general release he will be entitled to receive the following severance benefits: (i) severance payments at his final base salary for a period of 12 months following his termination; (ii) payment of premiums necessary to continue his group health insurance under COBRA until the earlier of (a) 12 months, (b) the date on which he first becomes eligible

12

to participate in another employer’s group health insurance or (c) the date on which he is no longer eligible for COBRA coverage; (iii) the prorated portion of any incentive bonus that he would have earned during the incentive bonus period in which his employment was terminated; (iv) any stock options granted to the executive officer will stop vesting as of his termination date however he will be entitled to purchase any vested shares of stock that are subject to the outstanding options until the earlier of (a) 12 months or (b) the date on which the applicable option(s) expire; (v) payment of his then-provided car allowance for a period of 12 months; and (vi) outplacement assistance selected and paid for by us.

In addition the agreement provides that if within 18 months of a change of control the executive officer is terminated without cause or resigns for good reason and he signs a general release of known and unknown claims in a form satisfactory to us, (i) the severance benefits described above shall be increased by an additional 12 months; (ii) he will receive a payment equal to the greater of (a) the average of the annual incentive bonus received by him, if any, for the previous three years or (b) his target incentive bonus for the year in which his employment terminates; and (iii) we will accelerate the vesting of all unvested stock options granted to him such that all of his stock options will be fully vested as of the date of his termination.

Other Equity Compensation Plan Information

The following table gives information about our common stock that may be issued upon the exercise of options, warrants and rights under all of our existing equity compensation plans as of March 31, 2005, including the 1994 stock incentive plan, the 1996 non-officer employee stock option plan, the 1998 non-officer employee stock option plan, the 1999 stock incentive plan and the 2002 stock incentive plan.

| | | | | | |

Plan Category

| | (a) Number of Securities to be Issued Upon Exercise

of Outstanding Options,

Warrants, and Rights

| | (b) Weighted-average

Exercise Price of

Outstanding

Options, Warrants,

and Rights

| | (c) Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column (a))

|

Equity compensation plans approved by security holders (1) | | 11,379,446 | | 6.02 | | 7,392,437 |

Equity compensation plans not approved by security holders (2) | | 418,397 | | 5.35 | | 335,229 |

Total | | 11,797,843 | | 6.00 | | 7,727,666 |

| (1) | Issued under the 1994 stock incentive plan, the 1999 stock incentive plan, and the 2002 stock incentive plan. |

| (2) | Issued under the 1996 non-officer employee stock option plan and the 1998 non-officer employee stock option plan which are described below. |

In April 1996, we adopted the 1996 non-officer employee stock option plan. The 1996 non-officer employee stock option plan authorizes 1,000,000 shares of common stock to be reserved for issuance to non-officer key employees as an incentive to continue to serve with us. The 1996 non-officer employee stock option plan is administered by the Compensation Committee. The 1996 non-officer employee stock option plan will terminate on the date on which all shares available have been issued.

In November 1997, we adopted the 1998 non-officer employee stock option plan, which became effective on January 2, 1998. The 1998 non-officer employee stock option plan authorizes 500,000 shares of common stock to be reserved for issuance to non-officer employees as an incentive to continue to serve with us. The 1998 non-officer employee stock option plan is administered by the Compensation Committee. The 1998 non-officer employee stock option plan will terminate on the date on which all shares available have been issued.

13

Compensation Committee Interlocks and Insider Participation

The Compensation Committee currently consists of three members of our Board of Directors, which are Dr. Meindl and Messrs. Combs and Mendicino. No member of this committee is a present or former officer or employee of our Company or any of our subsidiaries.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who own greater than 10% of our common stock, to file with the Securities and Exchange Commission, initial reports of ownership and reports of changes in beneficial ownership of our common stock. Officers, directors and greater than 10% beneficial owners are required by the Commission to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on our review of copies of such reports furnished to us and written representations that no other reports were required during the fiscal year ended March 31, 2005, all of our officers, directors and greater than 10% beneficial owners complied with applicable Section 16(a) filing requirements during the 2005 fiscal year.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to us regarding the beneficial ownership of our common stock as of June 13, 2005, by (i) all persons who own beneficially more than 5% or more of our outstanding common stock, (ii) each director, (iii) the Named Executive Officers, and (iv) all senior executives who report directly to the Chief Executive Officer and other officers as a group. Unless otherwise indicated, the principal address of each of the stockholders listed below is c/o Stratex Networks, Inc., 120 Rose Orchard Way, San Jose, California 95134.

| | | | | | |

Name

| | Shares Beneficially Owned(1)

| | | Percent Beneficially Owned(2)

| |

5% Stockholders | | | | | | |

State of Wisconsin Investment Board P.O. Box 7842 Madison, WI 53707 | | 14,755,100 | (3) | | 15.6 | % |

| | |

Kopp Investment Advisors, Inc 7701 France Avenue South, Suite 500 Edina, Minnesota 55435 | | 11,864,803 | (4) | | 12.5 | % |

| | |

Perkins, Wolf, McDonnell & Company 310 S. Michigan Ave., Suite 2600 Chicago, IL 60604. | | 7,244,000 | (5) | | 7.6 | % |

| | |

Firsthand Capital Management, Inc 125 South Market, Suite 1200 San Jose, CA 95113 | | 4,714,591 | (6) | | 5 | % |

14

| | | | | | |

Name

| | Shares Beneficially Owned(1)

| | | Percent Beneficially Owned(2)

| |

Named Executive Officers and Directors | | | | | | |

Charles D. Kissner | | 1,854,748 | (7) | | 1.9 | % |

Richard C. Alberding | | 84,000 | (8) | | * | |

John W. Combs | | 177,866 | (9) | | * | |

William A. Hasler | | 45,499 | (10) | | * | |

James D. Meindl, PhD | | 103,775 | (11) | | * | |

V. Frank Mendicino | | 173,520 | (12) | | * | |

Edward F. Thompson | | 40,000 | (13) | | * | |

Carl A. Thomsen | | 444,424 | (14) | | * | |

Paul A. Kennard | | 286,274 | (15) | | * | |

Ryan R. Panos | | 383,898 | (16) | | * | |

Robert J. Schlaefli | | 247,576 | (17) | | * | |

John C. Brandt | | 265,860 | (18) | | | |

All directors and named executive officers as a group (12 persons) | | 4,107,440 | (19) | | 4.56 | % |

| 1. | To our knowledge, except as set forth in the footnotes to this table, and subject to applicable community property laws, each person named in this table has sole voting and investment power with respect to the shares set forth opposite such person’s name. |

| 2. | Beneficial ownership of shares of common stock is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to such shares. Shares of common stock subject to stock options which are currently exercisable or will become exercisable within 60 days of May 25, 2004 are deemed outstanding for computing the beneficial ownership of the person or group holding such option grants but are not deemed outstanding for computing the percentage of beneficial ownership of any other person or group. There were 94,885,739 shares of our common stock outstanding on May 31, 2005. |

| 3. | The address and number of shares of our common stock beneficially owned by the State of Wisconsin Investment Board is based on the Schedule 13G as filed with the U.S. Securities and Exchange Commission on February 15, 2005. |

| 4. | Kopp Investment Advisors, Inc. had shared dispositive power over 7,934,803 shares, sole dispositive power over 2,920,000 shares, sole voting power over 9,026,638 shares and aggregate beneficial ownership of 11,014,803 shares. The address and number of shares of our common stock beneficially owned by Kopp Investment Advisors, Inc. is based on the Schedule 13G as filed with the U.S. Securities and Exchange Commission on January 26, 2005. According to this Schedule 13G, Kopp Investment Advisors, Inc. is a wholly-owned subsidiary of Kopp Holding Company, which also reported aggregate beneficial ownership of 11,014,803 shares. The filing also stated that Kopp Holding Company is wholly owned by Leroy C. Kopp, who on such filing reported sole voting and disparities power of 1,010,000 shares in addition to the shares that may be deemed beneficially owned by Kopp Investment Advisors, Inc. |

| 5. | Perkins, Wolf, McDonnell & Company had sole voting and dispositive power over 7,244,000 shares and aggregate beneficial ownership of 7,244,000 shares. The address and number of shares of our common stock beneficially owned by Perkins, Wolf, McDonnell & Company is based on the Schedule 13G as filed with the U.S. Securities and Exchange Commission on January 31, 2005. |

| 6. | The address and number of shares of our common stock beneficially owned by Firsthand Capital Management, Inc. is based on the Schedule 13G as filed with the U.S. Securities and Exchange Commission on January 21, 2005. |

| 7. | Includes 1,834,748 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

15

| 8. | Includes 78,000 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 9. | Includes 62,000 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 10. | Includes 40,000 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 11. | Includes 87,000 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 12. | Includes 40,500 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 13. | Includes 30,000 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 14. | Includes 439,424 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 15. | Includes 370,398 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 16. | Includes 206,166 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 17. | Includes 217,376 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 18. | Includes 265,860 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

| 19. | Includes an aggregate of 3,428,020 shares of common stock subject to options that are currently exercisable or will become exercisable within 60 days of May 31, 2005. |

16

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following report is not “soliciting material,” is not deemed “filed” with the Securities and Exchange Commission and shall not be deemed to be incorporated by reference into any of our previous or future filings under the Securities Act or the Exchange Act.

The audit committee currently consists of three members of the Board, each of who is independent of the company and its management, as defined by the Nasdaq listing standards. The Board has adopted, and periodically reviews, an audit committee charter. The charter specifies the scope of the audit committee’s responsibilities and how it carries out those responsibilities.

The audit committee reviews the procedures of management for the design, implementation and maintenance of a comprehensive system of internal and disclosure controls and procedures focused on the accuracy of our financial statements and the integrity of our financial reporting systems. The audit committee provides our board of directors with the results of the committee’s examinations and recommendations and reports to the board of directors as the committee may deem necessary to make the board aware of significant financial matters that require the board’s attention.

The audit committee does not conduct auditing reviews or procedures. The audit committee relies on management’s representation that our financial statements have been prepared accurately and in conformity with United States generally accepted accounting principles and on the representations of the independent auditors included in such auditors’ report on our financial statements and on the effectiveness of our internal control over financial reporting. The audit committee has also adopted a written policy, and management has implemented a reporting system, that is intended to encourage our employees to bring to the attention of management and the audit committee any complaints regarding the integrity of our internal financial controls or the accuracy or completeness of financial or other information related to our financial statements.

The audit committee reviews reports and provides guidance to our independent auditors with respect to their annual audit and approves in advance all audit and non-audit services provided by our independent auditors in accordance with applicable regulatory requirements. The audit committee also considers, in advance of the provision of any non-audit services by our independent auditors, whether the provision of such services is compatible with maintaining the independence of the external auditors.

In accordance with its responsibilities, the audit committee has reviewed and discussed with management the audited financial statements for the year ended March 31, 2005 and the process designed to achieve compliance with Section 404 of the Sarbanes-Oxley Act of 2002. The audit committee has also discussed with Deloitte & Touche, LLP the matters required to be discussed by SAS No. 61,Communication with Audit Committees.The audit committee has received the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees,and has discussed with Deloitte & Touche LLP its independence, including whether Deloitte & Touche LLP ‘s provision of non-audit services is compatible with its independence.

Based on these reviews and discussions, the audit committee recommended to our board of directors that our audited financial statements for the year ended March 31, 2005 be included in our Annual Report on Form 10-K.

Edward F. Thompson, Chairman

Richard C. Alberding

William A. Hasler

17

Deloitte & Touche LLP was recommended by our audit committee, and approved by our Board of Directors to act as our independent auditors for the fiscal year ending March 31, 2006. Representatives of Deloitte & Touche LLP will be present at the annual meeting, will have opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Audit Fees Billed to the Company by Deloitte & Touche LLP for the Fiscal Year Ended March 31, 2005 are as follows:

| | | | | | |

| | | 2005

| | 2004

|

Audit Fees(1) | | $ | 595,390 | | $ | 414,098 |

Audit-Related Fees(2) | | | 57,325 | | | — |

Tax Fees(3) | | | 344,538 | | | 303,076 |

All Other Fees(4) | | | 644,000 | | | 67,270 |

| | |

|

| |

|

|

Total Fees for Services Provided | | $ | 1,637,253 | | $ | 784,444 |

| | |

|

| |

|

|

| (1) | Audit Feeswere for professional services rendered for the audit of the Company’s annual financial statements and the reviews of the financial statements included in the Company’s forms 10-Q for that fiscal year. Audit fees also include those fees billed for services rendered for accounting consultations, issuance of consents, completion of statutory audits and services associated with SEC registration statements, and periodic reports. |

| (2) | Audit-Related Fees were for consultations related to the Company’s follow-on stock offering in September 2004. |

| (3) | Tax Fees were for services related to tax compliance, tax advice and tax planning services. |

| (4) | All Other Fees for fiscal year 2005 were related to Sarbanes-Oxley Section 404 required implementation and documentation of internal controls in order for management to be able to issue reports on internal controls for financial reporting. |

The Audit Committee reviews and approves the independent accountants’ annual audit plan and any subsequent engagements. The committee requires that all significant audit and permissible non-audit services be submitted to it for review and approval in advance.

18

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

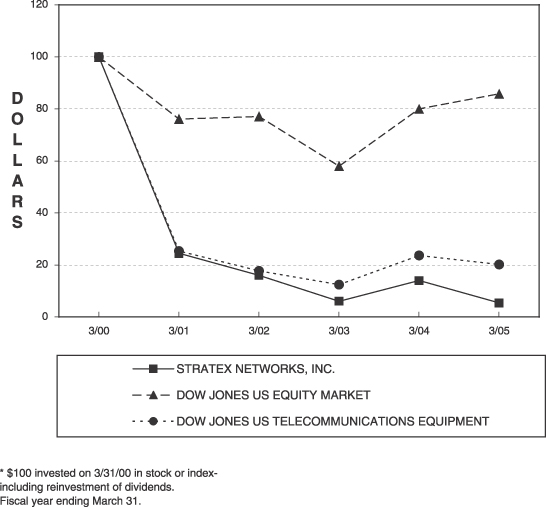

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following report is not “soliciting material,” is not deemed “filed” with the Securities and Exchange Commission and shall not be deemed to be incorporated by reference into any of our previous or future filings under the Securities Act or the Exchange Act.