UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

Saks Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

Reg. §240.14a-101.

SEC 1913 (3-99)

750 Lakeshore Parkway

Birmingham, Alabama 35211

April 30, 2003

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of the Shareholders to be held at 1:00 p.m. Central Time on Wednesday, June 11, 2003, at Saks Incorporated’s corporate offices, 750 Lakeshore Parkway, Birmingham, Alabama 35211.

The notice of the meeting and proxy statement accompanying this letter describe the specific business to be acted upon. Your vote is very important. We ask that you vote over the Internet or by telephone or return your proxy card in the postage-paid envelope as soon as possible.

I hope you will be able to join us and look forward to seeing you.

Sincerely,

|

|

R. Brad Martin Chairman of the Board and Chief Executive Officer |

1

750 Lakeshore Parkway

Birmingham, Alabama 35211

NOTICE OF ANNUAL MEETING OF THE SHAREHOLDERS

To the Shareholders of Saks Incorporated:

Notice is hereby given that the Annual Meeting of the Shareholders of Saks Incorporated (the “Company”) will be held at 1:00 p.m. Central Time on Wednesday, June 11, 2003, at Saks Incorporated’s corporate offices, 750 Lakeshore Parkway, Birmingham, Alabama 35211, for the following purposes:

| | 1. | | To elect five Directors to hold office for the term specified or until their respective successors have been elected and qualified; |

| | 2. | | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent accountants for the current fiscal year ending January 31, 2004; |

| | 3. | | To approve the Company’s Senior Executive Bonus Plan; |

| | 4. | | To vote on a shareholder proposal concerning the Company’s classified Board of Directors; |

| | 5. | | To vote on a shareholder proposal concerning cumulative voting for the election of Directors; |

| | 6. | | To vote on a shareholder proposal concerning vendor standards; and |

| | 7. | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Shareholders of record at the close of business on April 15, 2003 are entitled to notice of, and to vote at, the meeting.

Shareholders are cordially invited to attend the meeting in person.

By order of the Board of Directors, |

|

|

Julia Bentley Secretary April 30, 2003 |

WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE MEETING, YOU ARE URGED TO VOTE OVER THE INTERNET, BY TELEPHONE, OR TO MARK, SIGN, AND DATE THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENVELOPE PROVIDED. PLEASE SEE THE PROXY CARD FOR PROCEDURES AND INSTRUCTIONS FOR INTERNET AND TELEPHONE VOTING.

1

PROXY STATEMENT

Information Concerning the Solicitation

This proxy statement is furnished in connection with the solicitation of proxies to be used at the Annual Meeting of the Shareholders (the “Annual Meeting”) of Saks Incorporated (the “Company”), a Tennessee corporation, to be held on June 11, 2003.

The solicitation of proxies in the enclosed form is made on behalf of the Board of Directors of the Company. Directors, officers, and employees of the Company may solicit proxies by telephone, Internet, telecopier, mail, or personal contact. In addition, the Company has retained Georgeson Shareholder Communications, Inc., New York, New York, to assist with the solicitation of proxies for a fee not to exceed $11,500, plus reimbursement for out-of-pocket expenses. Arrangements will be made with brokers, nominees, and fiduciaries to send proxies and proxy materials at the Company’s expense to their principals. The proxy materials are first being mailed to shareholders on or about May 1, 2003.

A shareholder voting over the Internet, by telephone, or by signing and returning a proxy on the enclosed form has the power to revoke the proxy at any time before the shares subject to it are voted by notifying the Secretary of the Company in writing. Attendance at the Annual Meeting by a shareholder who has given a proxy will not have the effect of revoking it unless the shareholder gives written notice of revocation to the Secretary before the proxy is voted. Votes cast by proxy or in person at the Annual Meeting will be tabulated by the election inspectors appointed for the meeting and will determine whether a quorum is present. The election inspectors will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum. If a broker indicates on the proxy that it does not have discretionary authority as to specified shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter. The nominees for Director receiving a plurality of the votes cast at the annual meeting in person or by proxy shall be elected. Abstentions and broker non-votes have no effect on the plurality vote for the election of Directors. All other matters will be approved if the votes cast favoring the action exceed the votes cast opposing the action.

Outstanding Voting Securities

Only shareholders of record at the close of business on April 15, 2003 are entitled to vote at the Annual Meeting. On that day, there were issued and outstanding 142,801,926 shares of Common Stock. Each share has one vote.

Listed in the following table are the number of shares owned by each Director, specified executive officers, and all Directors and officers of the Company as a group as of March 14, 2003. The table also includes the beneficial owners as of March 14, 2003 (unless otherwise noted) of more than 5% of the Company’s outstanding Common Stock who are known to the Company.

Name of Beneficial Owner (and Address if “Beneficial Ownership” Exceeds 5%)

| | Total Shares Beneficially Owned (1)

| | | Percentage of Common Stock Ownership

| |

Directors: | | | | | | |

Bernard E. Bernstein | | 90,652 | (2) | | * | |

Stanton J. Bluestone | | 349,172 | | | * | |

James A. Coggin | | 941,703 | | | * | |

Ronald de Waal | | 4,085,806 | | | 2.84 | % |

Julius W. Erving | | 84,004 | | | * | |

Michael S. Gross | | 73,018 | | | * | |

Donald E. Hess | | 727,821 | (3) | | * | |

George L. Jones | | 870,000 | | | * | |

R. Brad Martin | | 5,076,342 | (4) | | 3.46 | % |

3

Name of Beneficial Owner (and Address if “Beneficial Ownership” Exceeds 5%)

| | Total Shares Beneficially Owned (1)

| | | Percentage of Common Stock Ownership

| |

Nora P. McAniff | | 3,424 | | | * | |

C. Warren Neel | | 79,692 | | | * | |

Stephen I. Sadove | | 1,174,413 | | | * | |

Marguerite W. Sallee | | 65,590 | | | * | |

Christopher J. Stadler | | 29,561 | | | * | |

Named Executive Officer: | | | | | | |

Douglas E. Coltharp | | 544,837 | | | * | |

All Directors and Officers | | | | | | |

as a group (15 persons) | | 14,196,035 | | | 9.47 | % |

Other 5% Owners: | | | | | | |

Fidelity Management and Research Corporation 82 Devonshire Street Boston, Massachusetts | | 13,933,579 | (5) | | 9.70 | % |

Investcorp S.A. | | 7,686,555 | (5)(6) | | 5.35 | % |

Orient Star Holdings LLC | | 17,063,000 | (5)(7) | | 11.87 | % |

SIPCO Limited | | 7,675,075 | (5) | | (8 | ) |

Southeastern Asset Management, Inc. | | 20,048,751 | (5)(9) | | 13.95 | % |

| | * | | Owns less than 1% of the total outstanding Common Stock of the Company. |

| | (1) | | Includes shares that the following persons have a right to acquire within sixty days after March 14, 2003 through the exercise of stock options: Bernstein (57,250), Bluestone (334,750), Coggin (770,004), de Waal (77,250), Erving (51,250), Gross (57,250), Hess (44,850), Jones (760,000), R. Brad Martin (2,799,056), Neel (57,250), Sadove (656,490), Sallee (53,250), Stadler (18,600), and Coltharp (457,581). |

| | (2) | | Includes 6,000 shares owned by the Bernard E. Bernstein Defined Benefit Pension Plan. |

| | (3) | | Includes: (i) 331,859 shares owned directly by Mr. Hess, (ii) 316,524 shares held by Mr. Hess as trustee or co-trustee for his children, and (iii) 34,588 shares held by him as trustee for the children of his sister. Does not include: (i) 4,580 shares owned directly by his wife, (ii) 14,660 shares held by his wife as co-trustee for one of their children, or (iii) 95,796 shares held by another individual as trustee for Mr. Hess’ children. |

| | (4) | | Includes: (i) 20,227 shares held by the RBM Family Limited Partnership, (ii) 2,175 shares owned by RBM Venture Company, a company of which Mr. Martin is sole shareholder, (iii) 402,453 shares held by Mr. Martin as trustee or co-trustee for his children, (iv) 8,510 shares owned by the Martin Family Foundation, (v) 45,834 shares of restricted stock, the restrictions on which lapse based on performance measurements and length of service, and (vi) 250,000 shares of stock which may be awarded on May 30, 2006. |

| | (5) | | Based solely on information provided by the beneficial owner. Information with respect to Fidelity Management and Research Corporation and Orient Star Holdings LLC is from Schedules 13G filed with the Securities and Exchange Commission. |

| | (6) | | Investcorp S.A. does not directly own any shares of Common Stock. Beneficial ownership includes 5,008,634 shares owned by three indirect, wholly owned subsidiaries of Investcorp. The remainder of the shares shown as beneficially owned by Investcorp consists of the shares owned by Cayman Islands corporations, none of which is a beneficial owner of five percent or more of the Common Stock. Investcorp may be deemed to share beneficial ownership of the shares of Common Stock held by such entities because such entities or their stockholders or principals have entered into revocable management services or similar agreements with an affiliate of Investcorp pursuant to which each such entity has granted such affiliate the authority to direct the voting and disposition of the stock owned by such entity for so long as such agreement is in effect. Investcorp is a Luxembourg corporation, with its registered address at 37 rue Notre-Dame, Luxembourg. |

| | (7) | | Orient Star Holdings LLC, a limited liability company organized under the laws of Delaware, has as its sole member Inmobiliaria Carso, S.A. de C.V., a corporation organized under the laws of Mexico. All of the outstanding voting equity securities of Inmobiliaria Carso, S.A. de C.V. are owned by a Mexican trust. The beneficiaries of the trust are Carlos Slim Helu, Carlos Slim Domit, Marco Antonio Slim Domit, Patrick Slim Domit, Maria Soumaya Slim Domit, Vanessa Paola Slim Domit, and Johanna Monique Slim Domit, each a citizen of Mexico. The principal business address for each of the foregoing individuals is Paseo de las Palmas 736, Colonia Lomas de Chapultepec, Mexico D.F. 11000. |

4

| | (8) | | SIPCO Limited (“SIPCO”) does not directly own any Common Stock. The number of shares shown as owned by SIPCO consists of the shares Investcorp is deemed to beneficially own. SIPCO may be deemed to control Investcorp through its ownership of a majority of the stock of a company which indirectly owns a majority of Investcorp’s outstanding stock. SIPCO is a Cayman Islands corporation with its address at P.O. Box 1111, West Wind Building, George Town, Grand Cayman, Cayman Islands, British West Indies. |

| | (9) | | Southeastern Asset Management, Inc. (“Southeastern”) is an investment advisor registered under the Investment Advisors Act of 1940. These shares of Common Stock are held by one or more of Southeastern’s clients. Pursuant to investment advisory agreements with its clients, Southeastern has sole voting and dispositive power over 15,060,751 shares and no voting and no dispositive power over 4,988,000 shares. Southeastern has no interest in dividends or proceeds from the sale of these shares and disclaims beneficial ownership of all of these shares. Southeastern’s address is 6410 Poplar Avenue, Memphis, Tennessee. |

Senior executives and Directors of the Company are strongly encouraged to hold a personally meaningful equity interest in the Company, and stock ownership guidelines have been established for Senior Vice Presidents and above and for Directors. The Company believes such ownership aligns the interests of management, Directors, and shareholders.

ELECTION OF DIRECTORS

(Item No. 1)

The Company’s Charter, as amended, provides that the Board of Directors shall be divided into three classes, designated as Class I, Class II, and Class III. The terms of Class I, II, and III will expire in 2004, 2005, and 2006, respectively. The Board of Directors proposes the election of five Directors to Class III. These five Directors, together with the nine Directors whose terms continue beyond this year’s Annual Meeting, will comprise the Board of Directors. Each Director will hold office for the term specified and until his or her successor is elected and qualified. Unless otherwise instructed by the shareholder, the persons named in the enclosed form of proxy intend to vote for the election of the persons listed in this proxy statement. If any nominee becomes unavailable for any reason or should a vacancy occur before the election (which events are not anticipated), the proxies will be voted for the election of a substitute nominee to be selected by the persons named in the proxy.

The Board of Directors’ current policy is that no Director will be nominated by the Board to stand for re-election after reaching age 72.

The Company’s bylaws require that Directors who are not officers of the Company must submit to the Board a letter of resignation upon any change in the Director’s principal business or other activity in which the Director was engaged at the time of the Director’s election. The Board’s Corporate Governance Committee will review the letter of resignation and make a recommendation, based on all of the relevant facts and circumstances (including the needs of the Board), as to whether the Board should accept the Director’s resignation.

We have provided below information about the nominees and Directors. The business association as shown has been continued for more than five years unless otherwise noted.

Name, Principal Occupation, and Directorships

| | Age

| | Director Since

|

NOMINEES FOR DIRECTOR | | | | |

Class III (terms expiring in 2006): | | | | |

Ronald de Waal Vice Chairman of the Company’s Board of Directors. Chairman of We International, B.V., a Netherlands corporation, which operates fashion specialty stores in Belgium, the Netherlands, Switzerland, Germany, and France. Mr. de Waal serves on the Boards of Directors of Post Properties Inc. and The Body Shop International, PLC. | | 51 | | 1985 |

R. Brad Martin Chief Executive Officer of the Company since 1989 and Chairman of the Board of the Company since 1987. Mr. Martin serves on the Boards of Directors of First Tennessee National Corporation and Harrah’s Entertainment, Inc. | | 51 | | 1984 |

5

Name, Principal Occupation, and Directorships

| | Age

| | Director Since

|

| | |

C. Warren Neel Director of the Center for Corporate Governance at the University of Tennessee, Knoxville, since February 2003. Dr. Neel served as Commissioner of Finance and Administration for the State of Tennessee from July 2000 to January 2003. Dr. Neel served as the Dean of the College of Business Administration at the University of Tennessee, Knoxville, from 1977 until June 2000. Dr. Neel serves on the Boards of Directors of American Healthways, Inc. and Clayton Homes, Inc. | | 64 | | 1987 |

Marguerite W. Sallee President and Chief Executive Officer of The Brown Schools since September 2001. Ms. Sallee served as Chairman and Chief Executive Officer of Frontline Group, Inc. from July 1999 to August 2001, and as Chief Executive Officer of Bright Horizons Family Solutions from July 1998 to January 1999. Ms. Sallee served as President and Chief Executive Officer of CorporateFamily Solutions between February 1987 and July 1998. Ms. Sallee serves on the Board of Directors of Bright Horizons Family Solutions. | | 57 | | 1996 |

Christopher J. Stadler Management Committee Member of Investcorp, S.A. since April 1996 and President of Investcorp, Inc. since February 2000. Mr. Stadler serves on the Boards of Directors of CSK Auto, Inc., U.S. Unwired, and Werner Holdings. | | 38 | | 2000 |

THE BOARD OF DIRECTORS RECOMMENDS THE SHAREHOLDERS VOTE “FOR” THE ELECTION AS DIRECTORS OF THE ABOVE LISTED NOMINEES.

CONTINUING DIRECTORS Class I (terms expiring in 2004): Bernard E. Bernstein Senior Partner in the Knoxville, Tennessee law firm of Bernstein, Stair & McAdams LLP. | | 72 | | 1987 |

Stanton J. Bluestone Chairman of the Carson Pirie Scott group of the Company from February 1998 until his retirement in January 1999. Mr. Bluestone served as Chairman and Chief Executive Officer of Carson Pirie Scott & Co. (“CPS”) between March 1996 and January 1998. Prior to that Mr. Bluestone held other executive positions with CPS. | | 68 | | 1998 |

Julius W. Erving President of the Erving Group and Executive Vice President of RDV Sports/Orlando Magic since September 1997. Mr. Erving was employed by the National Broadcasting Company between December 1994 and June 1997, and by the National Basketball Association between 1987 and September 1997. Mr. Erving serves on the Boards of Directors of Darden Restaurants, Inc. and The Sports Authority. | | 53 | | 1997 |

6

Name, Principal Occupation, and Directorships

| | Age

| | Director Since

|

Donald E. Hess Chief Executive Officer of Southwood Partners since January 1998 and Chairman Emeritus of Parisian. Mr. Hess served as Chairman of the Parisian group of the Company from April 1997 until his retirement in December 1997 and served as President and Chief Executive Officer of Parisian, Inc. from 1986 to April 1997. | | 54 | | 1996 |

George L. Jones President and Chief Executive Officer of Saks Department Store Group since March 2001 and Chief Operating Officer of the Company since October 2002. Mr. Jones served as President of Worldwide Licensing and Studio Stores for Warner Bros. from 1994 to February 2001. | | 52 | | 2001 |

Stephen I. Sadove Vice Chairman of the Company since January 2002. Mr. Sadove served as Senior Vice President of Bristol-Myers Squibb and President of Bristol-Myers Squibb Worldwide Beauty Care from 1996 to January 2002. Mr. Sadove serves on the Board of Directors of Ruby Tuesday, Inc. | | 51 | | 1998 |

Class II (terms expiring in 2005): James A. Coggin President and Chief Administrative Officer of the Company since November 1998. Mr. Coggin served as President and Chief Operating Officer of the Company between March 1995 and November 1998. Prior to that, Mr. Coggin held various executive positions with the Company and with McRae’s, Inc. | | 61 | | 1998 |

Michael S. Gross Principal of Apollo Advisors, L.P. Mr. Gross serves on the Boards of Directors of Allied Waste Industries, Inc., Pacer International, Inc., Rare Medium, Inc., Sylvan Learning Systems, Inc., and United Rentals, Inc. | | 41 | | 1994 |

Nora P. McAniff Executive Vice President of Time, Inc. since August 2002. Ms. McAniff served as Group President of the People Magazine Group of Time Inc. between January 2001 and July 2002, President of People Magazine between October 1998 and January 2001, and Publisher of People between September 1993 and October 1998. Ms. McAniff joined Time Inc. in 1982. | | 44 | | 2002 |

Further Information Concerning Directors

Directors’ Fees

Directors who are not officers of the Company each receive an annual fee of $25,000, $2,000 for attendance at each board meeting, and $1,000 for attendance at each meeting of a committee of which the Director is a member (or $750 for participation by telephone in a board or committee meeting). The Audit Committee Chairperson receives an additional annual fee of $7,500; all other committee chairpersons receive an additional annual fee of $2,500. Directors are reimbursed for expenses in connection with their services as Directors of the Company. Directors not employed by the Company may elect to: (i) receive fees earned in Company Common Stock, (ii) receive one-half of fees earned in Company Common Stock with the balance in cash, or (iii) participate in the Company’s Deferred

7

Compensation Plan for Non-Employed Directors and defer all such compensation in lieu of immediate cash payments. The deferred compensation is tied to the value of the Company’s Common Stock.

Pursuant to the Company’s 1994 Long-Term Incentive Plan and the 1997 Stock-Based Incentive Plan, each non-employee Director of the Company annually is granted a nonqualified stock option to purchase 5,000 shares of Company Common Stock (8,000 shares for the Company’s Vice Chairman of the Board). Options are priced at fair market value at the date of grant and vest in one-fifth installments commencing six months from the date of grant (with each subsequent installment vesting on the anniversary date of grant) with full vesting occurring on the fourth anniversary date of grant. In addition, each non-employee Director has been awarded 2,000 shares of restricted Common Stock which vest in one-tenth installments commencing on the first anniversary of the award date. The Company’s Vice Chairman of the Board also receives an annual Common Stock grant of 2,000 shares which vests immediately upon grant.

Board Practices, Committees, and Meeting Attendance

The Board met four times during the last fiscal year. At each Board meeting, the full Board meets and, in addition, the non-employee Directors meet with the Chairman and then separately without the Chairman. The Vice Chairman of the Board, Ronald de Waal, presides over the non-employee Director sessions.

The Company’s Board of Directors has adopted Corporate Governance Guidelines, which are posted on the Company’s web site at www.saksincorporated.com.

The Board reviews its own performance annually and routinely reviews and plans for succession of the Company’s executive team.

The Board of Directors has established Audit, Human Resources/Option, Corporate Governance, and Finance Committees. Each of these Committees is comprised of non-employee Directors, and all members of the Audit, Human Resources/Option, and Corporate Governance Committees are independent within the meaning of the rules of the New York Stock Exchange.

The Board and each of its Committees has access, at the Company’s expense, to outside accounting, legal, corporate governance, and other advisors as and when Board or Committee members determine advisor retention is advisable.

The Audit Committee includes Bernard E. Bernstein (Chair), Julius W. Erving, Michael S. Gross, C. Warren Neel, and Marguerite W. Sallee. The Committee met nine times during the last fiscal year. The Audit Committee reviews the Company’s financial reporting process, system of internal controls, audit processes, and processes for monitoring compliance with laws, regulations, and policies. The Company’s Board of Directors has adopted a written charter for the Audit Committee, which is available at www.saksincorporated.com.

The Human Resources/Option Committee includes Marguerite W. Sallee (Chair), Bernard E. Bernstein, Julius W. Erving, and C. Warren Neel. The Committee met four times during the last fiscal year. The Committee: (i) evaluates the performance of the Chairman/Chief Executive Officer (“CEO”) annually; (ii) reviews and establishes the salary and incentive compensation, including bonus, stock options, and stock grants, for the CEO; (iii) reviews the salaries and sets the incentive compensation for certain senior corporate officers and executives; (iv) reviews and approves incentive compensation programs; (v) reviews and makes decisions regarding the structure of awards granted under the Company’s stock option and incentive plans; and (vi) recommends Director compensation to the Board.

The Corporate Governance Committee includes Ronald de Waal (Chair), Nora P. McAniff, and Christopher J. Stadler. The Committee met twice during the last fiscal year. The Committee: (i) assesses Board and Committee effectiveness; (ii) recommends to the Board Committee composition; (iii) identifies, screens, and recommends new Director candidates; (iv) makes recommendations with respect to shareholder proposals; and (v) develops and adopts, with the Board’s consent, corporate governance guidelines. The Committee also considers any nominees for Director recommended by shareholders.

The Finance Committee includes Michael S. Gross (Chair), Stanton J. Bluestone, Ronald de Waal, Donald E. Hess, and Christopher J. Stadler. The Committee met four times during the last fiscal year. The Committee: (i) ensures the capital structure of the Company is consistent with the long-term value-creating strategy of the Company, (ii) advises management on specific elements of its capital structure strategy, and (iii) approves, based on authority delegated from the Board of Directors, or recommends to the Board of Directors for approval, specific terms and parameters of certain financing transactions.

The Board expects that all Directors will devote sufficient time to the full performance of their Board duties and responsibilities, including attending all Board meetings and all meetings of committees on which the Director serves. Any Director who attends less than 75% of board and committee meetings in a fiscal year is required to provide a written explanation to the Board’s Corporate Governance Committee immediately following the fiscal year end. If the committee finds the explanation inadequate, the Director will submit a letter

8

of resignation to the Committee, which will determine, based on all relevant facts and circumstances (including the needs of the Board), whether to recommend to the Board that it should accept the Director’s resignation.

Each Director attended 75% or more of the aggregate number of meetings of the Board of Directors and the committee(s) on which the Director served, except for Mr. Gross. Mr. Gross was unable to participate in one Board meeting and in six Committee meetings due to unavoidable business conflicts. However, Mr. Gross was fully briefed, both before and after the meetings, by the Chairman on matters discussed, and was able to effectively contribute as a member of the Board. The overall average percentage for all Directors’ meeting attendance was 91%.

Executive Compensation

Summary Compensation Table

The following table sets forth, for the fiscal years ended February 1, 2003 (“2002”), February 2, 2002 (“2001”), and February 3, 2001 (“2000”), the cash compensation paid by the Company, as well as other compensation paid or accrued for these years, as to the Company’s Chief Executive Officer and to each of the other four highest compensated executive officers (“Named Officers”). As used in this Proxy Statement, the term “executive officer” has the meaning set forth in Rule 3b-7 under the Securities Exchange Act of 1934. As a consequence, the table is not necessarily a list of the five most highly compensated employees of the Company.

| | | Annual Compensation

| | | Long-Term Compensation Awards

| | | |

Name & Principal Position

| | Year

| | Salary ($)

| | Bonus ($) (1)

| | Other Annual Compensation ($)

| | | Restricted Stock Award(s) ($)

| | | Securities Underlying Options Granted (#)

| | All Other Compensation ($)

| |

R. Brad Martin Chairman of the Board and Chief Executive Officer (“CEO”) | | 2002 2001 2000 | | 1,000,000 962,500 950,000 | | 815,000 — — | | 110,060 119,346 | (4) (4) | | 821,683 688,413 1,472,512 | (2)(3) (3)(5) (3)(8) | | 69,440 465,970 1,889,601 | | 379,874 61,863 | (6)(7) (7) |

Stephen I. Sadove (14) Vice Chairman | | 2002 2001 2000 | | 980,000 67,218 — | | 531,650 — — | | — — — | | | — 4,937,500 — | (10) | | — 1,500,000 — | | 10,324 — — | (9) |

James A. Coggin President and Chief Administrative Officer | | 2002 2001 2000 | | 800,000 787,500 750,000 | | 248,000 105,000 250,000 | | — — — | | | 147,670 167,337 280,213 | (3) (3) | | 44,440 41,670 741,670 | | 24,128 20,817 — | (9) (9) |

George L. Jones (14) President and CEO of Saks Department Store Group and Chief Operating Officer of Saks Incorporated | | 2002 2001 2000 | | 900,000 900,000 — | | 700,000 900,000 — | | 16,692 — — | (11) | | — 1,190,000 — | | | 400,000 1,000,000 — | | 21,058 36,207 — | (12) (12) |

Douglas E. Coltharp Executive Vice President and Chief Financial Officer | | 2002 2001 2000 | | 549,999 515,000 410,000 | | 150,000 61,875 150,000 | | — — 240,000 | (13) | | 39,374 44,618 237,887 | (3) (3) (3) | | 27,500 71,259 480,000 | | 8,053 — — | (9) |

| | (1) | | Amounts awarded under the Company’s bonus compensation plans and arrangements for the respective fiscal years, even if deferred. |

| | (2) | | Includes a restricted stock award to R. Brad Martin (“Martin”) of 68,830 shares of Company Stock. The shares are subject to forfeiture in the event Martin voluntarily leaves his employment before February 28, 2004. This grant was priced as of February 28, 2003, and was valued at $529,303 (at a market price of $7.69). |

| | (3) | | In 1998, Martin, Coggin, and Coltharp were granted 150,000, 75,000, and 20,000 shares of Company Common Stock, respectively, under a Restricted Stock Grant Agreement pursuant to the Company’s 1997 Stock-Based Incentive Plan. Restrictions lapse as a function of the Company achieving certain performance goals and time. In 2000, 8,333, 4,167, and 1,111 shares were earned for Martin, Coggin, and Coltharp, respectively. As of February 3, 2001, the market price of the Common Stock was $13.85, and the value of the shares earned was $115,412, $57,713, and $15,387 for Martin, Coggin, and Coltharp, respectively, as of that date. In 2001, 33,333, 16,667, |

9

and 4,444 shares were earned for Martin, Coggin, and Coltharp, respectively. As of February 2, 2002, the market price of the Common Stock was $10.04, and the value of the shares earned was $334,663, $167,337, and $44,618 for Martin, Coggin, and Coltharp, respectively, as of that date. In 2002, 33,000, 16,667, and 4,444 shares were earned for Martin, Coggin, and Coltharp, respectively. As of February 1, 2003, the market price of the Common Stock was $8.86, and the value of the shares earned was $292,380, $147,670, and $39,374, for Martin, Coggin, and Coltharp, respectively, as of that date. The value of earned shares is included in total Restricted Stock Awards, even if not fully vested.

| | (4) | | In February 1989, the Company entered into a compensation agreement with Martin which provided for a $500,000 interest-free loan due January 31, 1999 or upon Martin’s termination of employment with the Company. Pursuant to Martin’s amended employment agreement, beginning in 1997 and concluding in 2001, one-fifth of the loan balance was forgiven each year. Other Annual Compensation represents one-fifth of the principal balance forgiven and imputed interest on that interest-free loan. |

| | (5) | | Includes a restricted stock award to Martin of 25,000 shares of Company Stock based on achieving certain performance criteria. This grant was priced as of March 19, 2002, and was valued at $353,750 (at a market price of $14.15). The shares were fully vested on March 19, 2003. |

| | (6) | | On October 11, 1996, Martin entered into an agreement with the Company that provided that he would be awarded 50,000 shares of Company stock on October 11, 2001, in the event that he remained employed with the Company continuously for that period. The Company recorded the proper expense over this period and, on October 11, 2001, Martin met the condition to the award. On that date, he was awarded 50,000 shares of common stock valued at $355,000 (at a market price of $7.10 per share on that date). This award is included in “All Other Compensation.” |

| | (7) | | For 2000, represents economic benefit of split dollar life insurance policy ($13,770), tax return preparation and tax planning services ($25,742), and usage of Company aircraft ($22,351). For 2001, includes tax return preparation and tax planning services ($12,500) and usage of Company aircraft ($12,374). |

| | (8) | | Includes 20,000 shares of common stock, which were earned by Martin by achieving certain performance goals for 2000. The shares were subject to forfeiture in the event Martin voluntarily left his employment with the Company before March 14, 2002. This grant was priced as of March 14, 2001, and was valued at $244,600 (at a market price of $12.23). |

| | (9) | | Usage of Company aircraft. |

| | (10) | | Restricted stock award to Sadove. The grant was dated and priced as of January 7, 2002, and was valued at $4,937,500 (at a market price of $9.875). One-fourth of the shares vest on each anniversary date of the grant date, provided Sadove remains employed on those dates. |

| | (11) | | Imputed interest on a $464,000 accelerated tax payment loan. |

| | (12) | | Relocation-related expense ($15,742) and usage of Company aircraft ($5,316) for 2002 and relocation-related expense for 2001. |

| | (13) | | Represents grant of 15,000 shares of Company Stock, pursuant to Coltharp’s initial employment agreement, for completing three years of service. This grant was priced as of January 1, 2001 (at $16.00 per share). |

| | (14) | | Sadove’s hire date was January 7, 2002, and Jones’ hire date was March 1, 2001. |

Note 1: As of February 1, 2003, the number and value (based on the $8.86 closing price of Common Stock as of January 31, 2003) of shares of unvested restricted stock held by each of the Named Officers were as follows: Martin, 295,834 shares ($2,621,089); Sadove, 376,200 shares ($3,333,132); Coggin, 73,334 shares ($649,739); Jones, 100,000 shares ($886,000); and Coltharp, 108,472 shares ($961,062).

Note 2: The Company offers a deferred compensation plan whereby the Named Officers may elect to defer a portion of their pre-tax compensation. Deferrals may be allocated to a choice of investment options, including a fixed interest credit tied to long-term corporate bonds. Distributions are available at retirement and on certain dates before retirement specified by the participant. All Named Officers participate, or have participated, in the Deferred Compensation Plan.

10

Employment Contracts

All of the Named Officers have employment agreements, which are included as exhibits to the Company’s public filings. The agreements set forth the Officer’s minimum base salary, bonus potential, and entitlement to participate in the Company’s benefit plans. The contracts also set forth various equity awards. The current contracts have the following expiration dates: Martin (October 1, 2007), Jones (March 1, 2005), Coggin (March 15, 2006), and Coltharp (March 15, 2006). Mr. Sadove’s contract is essentially a severance agreement that remains in effect as long as he is employed by the Company. The current base salaries of the Named Officers are: Martin $1,000,000, Sadove $980,000, Jones $900,000, Coggin $800,000, and Coltharp $550,000.

Mr. Martin’s contract provides he may earn up to 750,000 shares of Company common stock based upon certain conditions. He will receive 250,000 shares of Company stock on May 31, 2006, provided that he does not voluntarily end his employment prior to that date. He also has the opportunity to earn up to 500,000 shares conditioned upon the average stock price in the twelve months prior to May 31, 2006. The threshold for earning any shares is $17.57, with 100,000 shares to be earned at that price. 500,000 shares will be earned with a stock price of $29.30 or higher. Shares will be pro rated between those prices.

Each of the employment contracts contains severance provisions in the event that the officer’s employment is terminated without cause. In general, the contracts provide for the acceleration of certain equity grants and a lump-sum cash payment. For Martin, Coggin, and Coltharp, the amount of the cash severance payment is determined by the time remaining on the contract, with a guaranteed minimum amount. Sadove’s cash severance would be 3.3 times his base salary. Jones’ severance during the term of his contract is fixed at two times his minimum base salary and minimum bonus, plus an imputed bonus for the number of days worked in the fiscal year of termination.

Each contract also includes change-in-control provisions. A “Change in Control” is defined as: (i) the acquisition of 25% or more of the combined voting power of the Company’s outstanding securities, (ii) a tender offer, merger, sale of assets, or other business combination which results in the transfer of a majority of the combined voting power of the Company or any successor entity, or (iii) during any period of two consecutive years, the failure to elect a majority of the individuals constituting the Board of Directors of the Company prior to the commencement of such period, unless the election or nomination of any replacement Directors was approved by vote of at least two-thirds of the Directors of the Company then still in office who were Directors of the Company at the beginning of such period. A “Potential Change in Control” is defined as: (i) the approval by the shareholders of the Company of an agreement which, if consummated, will result in a change of control or (ii) the acquisition of 5% or more of the outstanding voting securities of the Company and the adoption by the Company’s Directors of a resolution to the effect that a potential change in control of the Company has occurred.

In the case of the CEO, if Mr. Martin’s termination is without cause or by Mr. Martin for Good Reason after a change in control or a potential change in control, Mr. Martin is entitled to receive (a) a sum equal to the base Salary then in effect plus 25% of Executive’s Maximum Bonus Potential times the longer of 3 years or the balance of the time remaining in the Term, and (b) immediate vesting of all stock options and restricted stock awards (including service grants) with the ability to exercise the stock options for the shorter of two years or the original expiration period of the option, and (c) participation in the Company’s health plans, with family coverage, for his life, and (d) if any payment, right, or benefit paid to Mr. Martin is treated as an “excess parachute payment “ under Section 280 (G) (b) of the Internal Revenue Code of 1986, as amended (the “Code”), the Company shall indemnify and hold harmless and make whole, on an after-tax basis, Mr. Martin for any adverse tax consequences, including but not limited to providing to him on an after-tax basis the amount necessary to pay any tax imposed by Code Section 4999.

For each of Sadove and Jones, if the termination is without Cause or by the officer for Good Reason after a Change in Control, he will receive a sum equal to the severance described above in addition to continuation in the Company’s health plans for three years at no cost. For each of Coggin and Coltharp, such a termination of employment after a Change in Control would entitle them to three years’ base salary as severance and free continuation in the health plans for three years. If any payment, right or benefit paid to him by the Company is treated as an “excess parachute payment” under Section 280 (G) (b) of the Code, the Company shall indemnify and hold harmless and make whole, on an after-tax basis, him for any adverse tax consequences, including but not limited to providing to him on an after-tax basis the amount necessary to pay any tax imposed by Code Section 4999.

11

Loans to Executive Officers

The Human Resources/Option Committee of the Board has followed a policy of compensating Executive Officers with cash and equity-based awards. The grant of equity awards means that a significant portion of an executive’s compensation is at risk. In accordance with this policy, over time, Executive Officers have received shares of common stock as compensation. Those awards are taxable to the executive as income. In 2000, the Human Resources/Option Committee granted loans to certain Named Officers to assure that they had the cash to pay their income tax obligations without the need to sell shares of Company stock earned as part of their compensation. The Company entered into five-year loan agreements with Named Officers as follows: Martin, $865,000; Coggin, $265,000; and Coltharp, $250,000. The loans accrue simple interest at 8% per year.

As noted in last year’s proxy statement, the Human Resources/Option Committee in 2001 added potential forgiveness terms to the loans in consideration of continued employment. For Coggin and Coltharp, the loans will be forgiven on November 1, 2003, provided that they remain employed by the Company on that date. Mr. Martin has elected not to participate in this forgiveness program and has repaid the Company loan in full with accrued interest.

The Company agreed in 2001 to make a $464,000 loan to Mr. Jones. At the Company’s request, Mr. Jones elected to pay taxes on his 2001 restricted stock grant although the shares subject to the grant would not vest, and generally would not be taxable, until 2004. The Company received a benefit from Mr. Jones’s election, and the purpose of the loan was to assist Mr. Jones with respect to his accelerated tax payment obligations that arose from the election. The Company made the loan on March 29, 2002 before Mr. Jones became a Named Officer. Mr. Jones must repay the loan, without interest, upon the earlier of March 1, 2005 or his termination of employment.

Stock Options

The following table contains information concerning the grant of stock options under the Company’s incentive plans to the Named Officers as of fiscal year end.

Option Grants in Last Fiscal Year

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (3)

|

Name

| | Options Granted (#) (1)

| | | % of Total Options Granted to Employees in Fiscal Year

| | | Exercise or Base Price ($/share)(2)

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

| | | | | | | | | | | | | | | |

R. Brad Martin | | 69,440 | (4) | | 2.94 | % | | 13.40 | | 6/18/09 | | 444,416 | | 1,063,820 |

Stephen I. Sadove | | 0 | | | — | | | — | | — | | — | | — |

James A. Coggin | | 44,440 | (4) | | 1.88 | % | | 14.91 | | 5/4/09 | | 316,412 | | 757,702 |

Douglas E. Coltharp | | 27,500 | (4) | | 1.16 | % | | 14.91 | | 5/4/09 | | 195,800 | | 468,875 |

| | | 72,051 | (4) | | 3.05 | % | | 11.98 | | 11/1/10 | | 412,131 | | 987,098 |

| | | 51,275 | (5) | | 2.17 | % | | 12.70 | | 11/1/10 | | 310,726 | | 744,513 |

George L. Jones | | 400,000 | (4) | | 16.95 | % | | 11.85 | | 3/1/12 | | 2,264,000 | | 5,420,000 |

| | (1) | | Under the terms of the 1994 Plan and the 1997 Plan, the Human Resources/Option Committee administers the option program. |

| | (2) | | All options were granted at the market closing price on the date of grant. No incentive stock options were granted. The exercise price and tax withholding obligations related to exercise may be paid by delivery of already owned shares, subject to certain conditions. |

| | (3) | | Potential gains are reported net of the option exercise price but before taxes associated with exercise. These amounts represent certain assumed rates of appreciation only. Actual gains, if any, on stock option exercises are dependent on the future performance of the Common Stock of the Company and overall stock market conditions, as well as the optionholder’s continued employment through the vesting period. The amounts reflected in this table may not necessarily be achieved. |

12

| | (4) | | Options are exercisable in cumulative one-fifth installments commencing six months from the date of grant (with each subsequent installment vesting on the anniversary date of grant) with full vesting occurring on the fourth anniversary of the date of grant. |

| | (5) | | Options are fully vested six months from the date of grant. These options were granted when the Named Officer exercised previously vested options by tendering shares of Common Stock that he owned to pay the exercise price and the tax withholding obligation. The new options equal the amount of shares used by the Named Officer to pay for those items, and thus the Human Resources/Option Committee granted the new options to restore the equity position of the Named Officer. The Named Officer did not receive cash on the exercise of these options, but instead received shares equal to the spread between the exercise price and the fair market value of the stock on the exercise date. The Committee permitted this exercise to promote outright ownership of shares of Company Common Stock, and this method of exercising options currently is available to other selected senior officers. |

Note: The Company’s policy is to not re-price stock options.

Option Exercises and Holdings

The following table sets forth information with respect to the Named Officers concerning the exercise of options during 2002 and unexercised options held at fiscal year end.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Name

| | Shares Acquired on Exercise(#)

| | Value Realized ($)

| | Unexercised Options Held at Fiscal Year End (#) Exercisable/Unexercisable

| | Value of Unexercised In-the-Money Options at Fiscal Year End ($) (1) Exercisable/Unexercisable

|

R. Brad Martin | | 0 | | 0 | | 2,636,210/1,152,432 | | 0/0 |

Stephen I. Sadove | | 0 | | 0 | | 652,740/921,100 | | 0/0 |

James A. Coggin | | 160,000 | | 660,081 | | 711,670/375,000 | | 0/0 |

George L. Jones | | 0 | | 0 | | 480,000/920,000 | | 0/0 |

Douglas E. Coltharp | | 162,776 | | 414,473 | | 413,481/291,075 | | 0/0 |

| | (1) | | Represents the difference between the closing price of the Company’s Common Stock on January 31, 2003 ($8.86) and the exercise price of the options. |

13

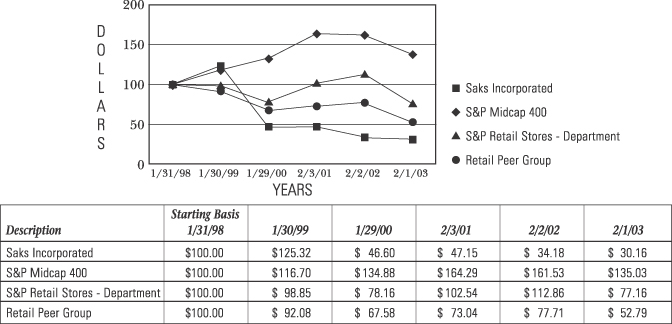

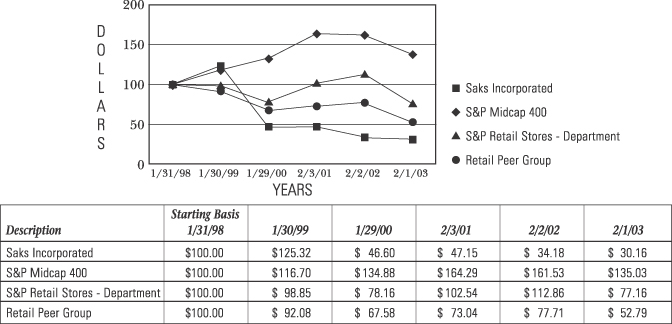

Comparison of Five-Year Cumulative Total Return

The following graph and table compare cumulative total shareholder return among Saks Incorporated, the S&P Midcap 400 Index, the S&P Retail Stores—Department Index, and a Retail Peer Group Index (consisting of Federated, May, Dillard’s, J.C. Penney, Nordstrom, Neiman Marcus, and the Company) assuming an initial investment of $100 and reinvestment of dividends.

These comparisons are not intended to forecast or be indicative of possible future performance of the Company’s stock.

Certain Transactions

Jeffrey C. Martin, a Senior Vice President of the Company and brother of R. Brad Martin, is also a partner of Shea & Gardner, a Washington, D.C., law firm. In his capacity with the Company, Jeffrey C. Martin is responsible for legal compliance and governmental relations. For the fiscal year ended February 1, 2003, the Company paid Shea & Gardner $116,957 in fees and disbursements for litigation defense, legal compliance, and governmental relations services and for reimbursement of support services provided to Jeffrey C. Martin in his capacity with the Company. The Company believes that payments made to Shea & Gardner were less than or equal to payments that would have been made to comparable firms to obtain similar services.

14

Report of the Human Resources/Option Committee of

the Board of Directors on Executive Compensation

Executive Compensation Policies

The Human Resources/Option Committee of the Board of Directors (the “Committee”) is composed of the following independent Directors who are not employees of the Company: Ms. Sallee, Chair of the Committee; Mr. Bernstein; Mr. Erving; and Dr. Neel. The Committee determines all elements of the compensation of the Chief Executive Officer and conducts an extensive evaluation of his annual performance. The Committee also reviews the compensation of the Company’s executive officers, including the Named Officers, and approves the amount and form of equity compensation for all associates.

The Committee’s compensation policies applicable to the Company’s executive officers, including the Named Officers, during the Company’s fiscal year ended February 1, 2003 (“2002”) were designed to align compensation with the achievement of the Company’s business objectives and financial-performance goals and to enable the Company to attract, retain, and reward talented executives who will contribute to the Company’s long-term success. The Company’s compensation strategy applicable to its salaried associates is to provide base salary levels comparable to the median ranges of market compensation for comparable positions (based upon data from independent resources), to provide annual cash-bonus incentives which reflect short-term operating performance, and to provide equity-based incentives that relate to long-term shareholder value creation. The Compensation Committee ensures that a substantial portion of total compensation for the Named Officers is at risk. If established performance criteria are not met, incentive compensation is appropriately reduced.

For purposes of annual bonus compensation, the Committee sets performance targets for executive officers under the 1998 Senior Executive Bonus Plan (“1998 Bonus Plan”), which was approved by shareholders. The Committee establishes those targets shortly after the beginning of each fiscal year. After year-end financial statements become available, the Committee measures performance to the established targets. The Committee retains the discretion to award bonuses for other individual and corporate results that are not directly tied to the pre-determined targets.

The Committee provides long-term incentives by awarding stock options and restricted stock under the Company’s 1994 Long-Term Incentive Plan and its 1997 Stock-Based Incentive Plan. The Committee prices stock options at or above the market price on the date of the grant, so the award has realizable value only if the stock price increases. Pursuant to Board policy, the Committee does not re-price options in the event the market price of the Company’s stock declines. Most options vest in five installments over four years, and the options expire after seven or ten years. Unvested options are generally forfeited if the executive voluntarily leaves employment with the Company. Periodically, the Committee also awards restricted stock that vests over time, provided that the Executive remains employed on the vesting dates. Certain executive officers may be entitled to early vesting of restricted shares if the Company meets annual earnings targets.

CEO Compensation

The Committee determines the compensation of Mr. Martin, the Company’s Chairman and CEO. Mr. Martin’s compensation consists of three basic components:

| | • | | base salary, which is set at the mid-point of salaries for positions in other companies with similar responsibilities |

| | • | | annual contingent bonus opportunities that are tied to financial and operating targets |

| | • | | long-term equity incentives that are linked to the creation of shareholder value |

The Committee, at the beginning of each fiscal year, works with the CEO and creates and approves a personal plan for the CEO. The Committee then presents that plan to the full Board for its approval. Performance is measured against that personal plan.

The CEO is entitled to an annual cash bonus opportunity up to 200% of base salary and a stock-bonus opportunity of 40,000 shares. The Committee selects parts of the CEO’s annual personal plan as the basis for setting targets by which to measure whether a bonus has been earned. In accordance with the bonus plan applicable to all senior corporate officers, for 2002, the Committee used “earnings before certain items” as the basis for the cash bonus. In light of the substantial increase in earnings over the prior year, the Committee awarded the CEO a cash bonus of $815,000, or 41% of the bonus potential. The Committee also determined that Mr. Martin earned 34,000 shares of stock for achieving goals related to earnings, return on invested capital, and operational objectives. The Committee placed a one-year restriction on those shares so that Mr. Martin will forfeit the shares if he voluntarily ends his employment before February 28, 2004.

15

As part of a broad-based option grant on May 3, 2002, Mr. Martin was awarded 69,440 options priced at the market price on that date, $13.40, representing 2.94% of total options granted during 2002. Additionally, the Committee awarded Mr. Martin 34,830 shares of restricted stock during the year. These shares vest on February 28, 2004.

Tax Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code (the “Code”) limits the tax deductibility of compensation in excess of $1 million paid to the Named Officers, unless the payments are made under a performance-based plan as defined in Section 162(m). The Committee believes the payments in 2002 under the 1994 Plan and the 1998 Bonus Plan (both of which were previously approved by the shareholders of the Company) meet the requirements of deductibility as specified under the applicable provisions of the Code. While some portion of other compensation may not qualify as wholly deductible in certain years, any such amount is not expected to be material to the Company. It is the Committee’s intention to continue to utilize performance-based compensation in order to obtain maximum deductibility of executive compensation, while providing a compensation program that will attract, retain, and reward the executive talent necessary to maximize shareholder return.

Human Resources/Option Committee

Marguerite W. Sallee, Chair

Bernard E. Bernstein

Julius W. Erving

C. Warren Neel

April 1, 2003

Audit Committee Report

The primary function of the Audit Committee is to assist the Board of Directors in its oversight and monitoring of the Company’s financial reporting and audit processes, the Company’s system of internal control, and the Company’s process for monitoring compliance with laws, regulations, and policies. The Board of Directors of the Company has adopted an Audit Committee Charter, which describes the responsibilities of the Audit Committee.

The Audit Committee has reviewed and discussed with management and PricewaterhouseCoopers LLP, the Company’s independent accountants, the Company’s audited consolidated financial statements for the fiscal year ended February 1, 2003. The Audit Committee also has discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards AU (S) 380).

The Audit Committee also received the written disclosures and the letter from PricewaterhouseCoopers LLP that are required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with PricewaterhouseCoopers LLP their independence.

Based upon its review of the Company’s audited financial statements and the discussions noted above, the Audit Committee recommended that the Board of Directors include the Company’s audited consolidated financial statements for the fiscal year ended February 1, 2003 in the Company’s Annual Report on Form 10-K for the fiscal year ended February 1, 2003 for filing with the Securities and Exchange Commission.

Audit Committee

Bernard E. Bernstein, Chair

Julius W. Erving

Michael S. Gross

C. Warren Neel

Marguerite W. Sallee

April 1, 2003

16

RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS

(Item No. 2)

Subject to ratification by the shareholders, the Board of Directors has reappointed PricewaterhouseCoopers LLP as independent accountants to audit the financial statements of the Company for the fiscal year ending January 31, 2004. PricewaterhouseCoopers LLP (or their predecessor firm Coopers & Lybrand) has examined the financial statements of the Company since 1991.

Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting and will have an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.

THE AUDIT COMMITTEE AND THE BOARD OF DIRECTORS RECOMMEND THE SHAREHOLDERS VOTE “FOR” SUCH RATIFICATION (ITEM NO. 2).

PricewaterhouseCoopers LLP Fees and Services in 2002 and 2001

Aggregate fees billed for professional services rendered and out-of-pocket expenses incurred for the Company by PricewaterhouseCoopers LLP as of or for the years ended February 1, 2003 and February 2, 2002 were:

| | | February 1, 2003

| | February 2, 2002

|

Audit—Professional services for audits of the consolidated | | $ | 998,500 | | $ | 1,081,666 |

financial statements of the Company and the financial | | | | | | |

statements of National Bank of the Great Lakes, the Company’s | | | | | | |

wholly owned subsidiary; for the review of the financial | | | | | | |

statements included in the Company’s Quarterly Report on | | | | | | |

Form 10-Q; and for the issuance of comfort letters and consents | | | | | | |

for financing transactions. | | | | | | |

Audit-Related—Assurance and related services including | | | 271,341 | | | 103,727 |

benefit plan audits, transaction due diligence, internal | | | | | | |

control reviews, consultations concerning financial | | | | | | |

accounting and reporting standards, and analysis of and | | | | | | |

compliance with accounting pronouncements and | | | | | | |

disclosure requirements. | | | | | | |

Tax—Tax return preparation and tax services for employee | | | 11,381 | | | 6,135 |

benefit plans. | | | | | | |

All Other—All other services including litigation support and | | | 180,265 | | | 73,880 |

employee benefit plan and human resource advisory services. | | | | | | |

Total | | $ | 1,461,487 | | $ | 1,265,408 |

17

ADOPTION OF THE SAKS INCORPORATED SENIOR EXECUTIVE BONUS PLAN

(Item No. 3)

On February 25, 2003 the Board of Directors adopted the Saks Incorporated 2003 Senior Executive Bonus Plan (the “Bonus Plan”). The Board of Directors adopted the Bonus Plan to provide to a select group of the Company’s executive officers an annual incentive opportunity that is based on the achievement of pre-established objective performance goals, to earn additional compensation to attract and retain the executive officers, and to motivate them to enhance the value of the Company’s business. The following description summarizes the Bonus Plan but is qualified by reference to the text of the Bonus Plan attached to this Proxy Statement as Attachment A.

Summary of the Bonus Plan

The Bonus Plan is intended to provide an annual incentive compensation opportunity that is not subject to the limitation on deductions for federal income tax purposes in Section 162(m) of the Internal Revenue Code of 1986 and is to be construed as providing for “qualified performance-based compensation” within the meaning of Section 162(m).

Bonus Plan participants include those executive officers selected by the Human Resources/Option Committee of the Board of Directors (the “Committee”) within 90 days following the beginning of each annual performance period, which will be the Company’s fiscal year beginning February 2, 2003 and ending with the Company’s 2007 fiscal year. Participation in the Bonus Plan will cease upon death, permanent and total disability, or termination of employment.

The Committee will establish written performance goals for each participant for each annual performance period, the outcome of which at the time of establishment must be substantially uncertain, and bonus potential amounts. Each performance goal will consist of, and achievement will be measured against, one or more of the following business criteria: revenue; net or gross sales; comparable store sales; gross margin; operating profit; earnings before all or any of interest, taxes, depreciation or amortization, or a percentage to revenue; cash flow; working capital; return on equity, assets, capital or investment; market share; earnings or book value per share; earnings from continuing operations; net worth; turnover in inventory; expense control within budgets; appreciation in the price of the Company’s common stock; total shareholder return; new unit growth; and implementation of critical projects or processes. The performance goals may be expressed in terms of attaining a specified level or may be applied relative to a market index, a group of other companies or a combination, as determined by the Committee. All performance goals will be determined in accordance with generally accepted accounting principles. Financial performance will be determined by excluding all items of gain, loss, and expense for the fiscal year determined to be extraordinary or unusual in nature or infrequent in occurrence or related to the disposal of a segment of a business or related to a change in accounting principle. Different annual performance periods may have different performance goals, and different participants may have different performance goals.

Bonus awards are payable in cash or stock. Bonus payments will be determined as follows: no bonus payment will be made if achievement is below the established minimum; a maximum bonus payment will be made if achievement equals or is greater than the established maximum; and a prorated bonus payment will be made if achievement is between the minimum and maximum levels of performance. The Committee may reduce or eliminate a bonus payment based on extraordinary changes, such as changes in accounting practices or law.

A cash bonus award may not exceed 200% of a participant’s salary. A stock bonus for the Company’s Chief Executive Officer may not exceed 50,000 shares of the Company’s common stock, and for other participants may not exceed 25,000 shares. To receive a bonus payment, a participant must be employed by the Company on the last day of the Company’s fiscal year. Upon the request of a participant, the Company will defer payment of the participant’s bonus within limits specified by the Committee. Deferred bonus payments, together with earnings based on a reasonable rate of return or rate of return on specified investments, will be distributed to participants when they request except as limited by the Committee. The Company’s obligation to pay deferred bonus payments will be unfunded and unsecured. The Bonus Plan is intended to be unfunded for purposes of the Employee Retirement Income Security Act of 1974 and the Internal Revenue Code. A participant may not assign, pledge, or encumber a deferred bonus payment, but the participant may designate beneficiaries to receive deferred bonus payments upon the participant’s death.

The Committee will administer the Bonus Plan and is authorized to take all actions necessary or desirable to effect the purposes of the Bonus Plan, in its sole discretion, including but not limited to the following: providing rules for the management, operation, and administration of the Bonus Plan; interpreting the Bonus Plan in its sole discretion to the fullest extent permitted by law; and correcting any defect or omission or reconciling any inconsistency in the Bonus Plan in the manner and to extent the Committee deems appropriate in its sole discretion. The decisions of the Committee will be final and conclusive for all purposes.

18

The Company has reserved the right, exercisable by the Committee, to amend the Bonus Plan at any time and in any respect and to discontinue and terminate the Bonus Plan in whole or in part at any time.

The Bonus Plan will be interpreted in accordance with Tennessee law. If the Company’s shareholders approve the Bonus Plan, it will become effective as of February 2, 2003.

Participants in the Bonus Plan

The Committee has determined that over 100 senior executives of the Company are eligible to participate in the Bonus Plan for the fiscal year beginning February 2, 2003. The amount of benefits to be received pursuant to the Bonus Plan by participants cannot be determined at this time.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THIS PROPOSAL (ITEM NO. 3).

SHAREHOLDER PROPOSALS

The following proposals were submitted by shareholders. We include each proposal plus any supporting statement exactly as submitted by the proponent for the proposal. To make sure readers can easily distinguish between material provided by each proponent and material provided by the Company, we have placed a box around material provided by the proponents.

PROPOSAL BY A SHAREHOLDER CONCERNING CLASSIFIED BOARD OF DIRECTORS

(Item No. 4)

On behalf of the New York City Employees’ Retirement System, which owns 145,086 shares of the Company’s Common Stock, William C. Thompson, Comptroller of the City of New York, submitted the following proposal, which is OPPOSED by the Board of Directors:

REPEAL CLASSIFIED BOARD

Submitted on behalf of the New York City Employees’ Retirement System by William C. Thompson, Comptroller of the City of New York.

BE IT RESOLVED, that the stockholders of Saks Incorporated request that the Board of Directors take the necessary steps to declassify the Board of Directors and establish annual elections of directors, whereby directors would be elected annually and not by classes. This policy would take effect immediately, and be applicable to the reelection of any incumbent director whose term, under the current classified system, subsequently expires.

SUPPORTING STATEMENT

We believe that the ability to elect directors is the single most important use of the shareholder franchise. Accordingly, directors should be accountable to shareholders on an annual basis. The election of directors by classes, for three-year terms, in our opinion, minimizes accountability and precludes the full exercise of the rights of shareholders to approve or disapprove annually the performance of a director or directors.

In addition, since only one-third of the Board of Directors is elected annually, we believe that classified boards could frustrate, to the detriment of long-term shareholder interest, the efforts of a bidder to acquire control or a challenger to engage successfully in a proxy contest.

We urge your support for the proposal to repeal the classified board and establish that all directors be elected annually

Statement Against Shareholder Proposal

The Board of DirectorsOPPOSES the foregoing resolution.

This same proposal was submitted by the proponent at both the 2001 and 2002 Annual Meetings of Shareholders and was rejected by shareholders. The Board of Directors believes that a classified board is more advantageous to the Company and its shareholders than a board that would be elected annually for the following reasons:

19

| | • | | A classified board facilitates director continuity and experience, because a majority of the Company’s directors at any given time have prior experience as members of the Board of Directors. The Board of Directors believes that this enhances the likelihood of continuity in Board-formulated policies. |

| | • | | A classified board encourages those who might seek to acquire control of the Company to initiate an acquisition through negotiations with the Board of Directors. This is likely to assure sufficient time for the Board to review the proposal and recommend appropriate alternatives. The Board of Directors believes that a classified board would be in a better position to protect the interests of all of the Company’s shareholders. |

In accordance with the Company’s Amended and Restated Charter and Tennessee law, the Company may declassify its Board of Directors only if (1) the Board of Directors approves and (2) the holders of 80% or more of the then-outstanding shares of the Company’s Common Stock, voting together as a single class, also approve. The Board of Directors has taken into consideration the 2001 and 2002 shareholder rejection of this shareholder proposal in deciding not to initiate actions intended to result in the annual election of all directors.

ACCORDINGLY, THE BOARD OF DIRECTORS RECOMMENDS A VOTE “AGAINST” THIS PROPOSAL (ITEM NO. 4).

PROPOSAL BY A SHAREHOLDER CONCERNING CUMULATIVE VOTING

(Item No. 5)

Evelyn Y. Davis, 2600 Virginia Avenue, NW, Suite 215, Washington, D.C. 20037, owner of 600 shares of the Company’s Common Stock, submitted the following proposal, which is OPPOSED by the Board of Directors:

RESOLVED: “That the stockholders of Saks Inc. assembled in Annual Meeting in person and by proxy, hereby request the Board of Directors to take the necessary steps to provide for cumulative voting in the election of directors, which means each stockholder shall be entitled to as many votes as shall equal the number of shares he or she owns multiplied by the number of directors to be elected, and he or she may cast all of such votes for a single candidate, or any two or more of them as he or she may see fit.”

REASONS: “Many states have mandatory cumulative voting, so do National Banks.”

“In addition, many corporations have adopted cumulative voting.”

“Last year the owners of 26,248,233 shares, representing approximately 22% of shares voting, voted FOR this proposal.”

“If you AGREE, please mark your proxy FOR this resolution.”

Statement Against Shareholder Proposal

The Board of DirectorsOPPOSES the foregoing resolution.

This same proposal was submitted at last year’s Annual Meeting of shareholders and was rejected by shareholders.

The Board of Directors believes that the present system of voting for Directors is more likely to assure that the Board will act in the interests of all of the Company’s shareholders.

Directors are elected by a plurality of the votes cast at a shareholder meeting. This means that the holders of a majority of the Company’s outstanding shares elect all of the directors. This permits each director elected to represent the interests of all of the Company’s shareholders. If, on the other hand, cumulative voting for the election of directors were implemented, an individual shareholder or group of shareholders who own far less than a majority of the Company’s outstanding shares could elect a director to the Company’s Board of Directors. Such a shareholder or group could have interests and goals that were inconsistent, and could conflict, with the interests and goals of the majority of the Company’s shareholders. The director elected by such a narrow constituency could disrupt and impair the efficient functioning of the Board of Directors, which would be detrimental to the interests of all shareholders.

ACCORDINGLY, THE BOARD OF DIRECTORS RECOMMENDS A VOTE “AGAINST” THIS PROPOSAL (ITEM NO. 5).

20

PROPOSAL BY A SHAREHOLDER CONCERNING VENDOR STANDARDS

(Item No. 6)

Aaron Merle Epstein, 13455 Ventura Boulevard, #209, Sherman Oaks, California 91423-6122, owner of 211 shares of the Company’s Common Stock, submitted the following proposal, which isOPPOSED by the Board of Directors:

SAKS INC.

VENDOR STANDARDS RESOLUTION

WHEREAS: Consumers and shareholders continue to be seriously concerned about whether abusive working conditions and absence of a living wage exist in facilities where the products they buy are produced or assembled.

Three-quarters of the US consumers surveyed would avoid shopping at a retailer that they knew sold garments made in sweatshops. An overwhelming 86% of those surveyed would pay a 5% mark-up to ensure decent working conditions. (“The Consumer and Sweatshops,” Marymount University Survey, November 1999).

Students have persuaded their universities to adopt codes requiring that clothing sold in university stores is made under humane conditions. (Business Week, 5/3/99)

Nearly half the global workforce involved in producing textiles, garments and shoes are women and wage inequalities are their universal lot. (International Labor Organization 10/16/00)

Our company purchased goods produced in countries like China where human rights abuses and unfair labor practices have been well documented. (U.S. State Department’s “China Country Report on Human Rights Practices—1999”)

Reports that suppliers are exploiting workers may damage our company’s reputation and generate a consumer backlash. Our company should demonstrate enforcement of its standards by developing independent monitoring programs with local, respected and independent religious, human rights and labor groups. To be credible, the process of monitoring and verification must be transparent, with the contents of compliance reports made public.

To improve the quality of life of workers who make its products, our company should implement ongoing wage adjustments, ensuring that workers have a sustainable living wage.

And rather than terminating contracts SAKS INC. should establish incentives to encourage its suppliers and vendors to raise labor standards.

RESOLVED: Request the Board of Directors to:

| | 1. | | Amend the SAKS INC. Buying Policy and standard purchase contracts to reflect implementation of a code of conduct based on the ILO standards. |

| | 2. | | Establish an independent monitoring process that assesses adherence to these conventions and, |

| | 3. | | Report annually on adherence to the amended Policy through an independent and transparent process, the first such report to be completed by January 2004. |

SUPPORTING STATEMENT

| | 1. | | All workers have the right to form and join trade unions and to bargain collectively. (ILO Conventions 87 and 98). |

| | 2. | | Workers representatives shall not be the subject of discrimination and shall have access to all workplaces necessary to enable them to carry out their representation functions. (ILO Convention 135). |

| | 3. | | There shall be no discrimination or intimidation in employment. Equality of opportunity and treatment shall be provided regardless of race, color, sex, religion, political opinion, age, nationality, social origin or other distinguishing characteristics. (ILO Convention 100 and 111). |

| | 4. | | Employment shall be freely chosen. There shall be no use of force, including bonded or prison labor. (ILO Convention 29 and 105). |

| | 5. | | There shall be no use of child labor. (ILO Convention 138 and 182). |

21

Statement Against Shareholder Proposal

The Board of DirectorsOPPOSES the foregoing resolution. The Company believes that it should obtain appropriate assurances from its suppliers that the merchandise sold in its stores is manufactured in accordance with all applicable laws, including those relating to the rights and welfare of the workers producing the merchandise.

The Company’s Department Store Group (1) obtains appropriate assurances from its suppliers that they comply with all federal, state, and local laws and regulations as part of the Company’s purchase order terms and conditions, (2) has adopted the National Retail Federation’s policies relating to the production of goods in accordance with law and safe and humane working conditions, (3) with respect to its private-branded goods, has published and requires compliance with the “Saks Incorporated Code of Conduct for Saks Incorporated Suppliers” and the Company’s “International Vendor Compliance Guide,” (4) in its routine interaction with new and existing suppliers of private-branded goods, the Company ascertains that they either have an internal human rights auditing program in place or utilize the services of an accredited third party monitoring company, and (5) with respect to its private-branded goods, has retained a well-respected independent monitoring company to inspect supplier facilities designated by the Company. The Company’s Saks Fifth Avenue Enterprises business has implemented, or is implementing, many comparable practices that it believes appropriately encourage the production of private-label goods in accordance with law and safe and humane working conditions.