UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | CONFIDENTIAL, FOR USE OF THE

COMMISSION ONLY (AS PERMITTED

BY RULE 14A-6(E)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 | | |

Saks Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Notes:

Reg. (S) 240.14a-101.

SEC 1913 (3-99)

750 Lakeshore Parkway

Birmingham, Alabama 35211

October 26, 2005

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of the Shareholders to be held at 9:00 a.m., Central Standard Time, on Thursday, December 8, 2005, at the Company’s corporate offices located at 750 Lakeshore Parkway, Birmingham, Alabama 35211.

The notice of the meeting and proxy statement accompanying this letter describe the specific business to be acted upon. Your vote is very important. We ask that you vote over the Internet or by telephone or return your proxy card in the postage-paid envelope as soon as possible.

I hope you will be able to join us, and I look forward to seeing you.

Sincerely,

R. Brad Martin

Chairman of the Board and

Chief Executive Officer

750 Lakeshore Parkway

Birmingham, Alabama 35211

NOTICE OF ANNUAL MEETING OF THE SHAREHOLDERS

To the Shareholders of Saks Incorporated:

Notice is hereby given that the Annual Meeting of the Shareholders of Saks Incorporated (the “Company”) will be held at 9:00 a.m., Central Standard Time, on Thursday, December 8, 2005, at the Company’s corporate offices located at 750 Lakeshore Parkway, Birmingham, Alabama, for the following purposes:

1. To elect three Directors to hold office for the term specified or until their respective successors have been elected and qualified;

2. To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the current fiscal year ending January 28, 2006;

3. To approve an amendment to the Company’s Amended and Restated Charter to eliminate specified supermajority voting requirements;

4. To vote on a shareholder proposal concerning the Company’s classified Board of Directors;

5. To vote on a shareholder proposal concerning cumulative voting for the election of Directors;

6. To vote on a shareholder proposal concerning the Company’s Director-election vote standard; and

7. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

Shareholders of record at the close of business on October 7, 2005 are entitled to notice of, and to vote at, the meeting.

Shareholders are cordially invited to attend the meeting in person.

By order of the Board of Directors,

Julia Bentley

Secretary

October 26, 2005

Whether or not you intend to be present at the meeting, you are urged to vote over the Internet, by telephone, or to mark, sign, and date the enclosed proxy card and return it promptly in the envelope provided. Please see the proxy card for procedures and instructions for Internet and telephone voting.

PROXY STATEMENT

Information Concerning the Solicitation

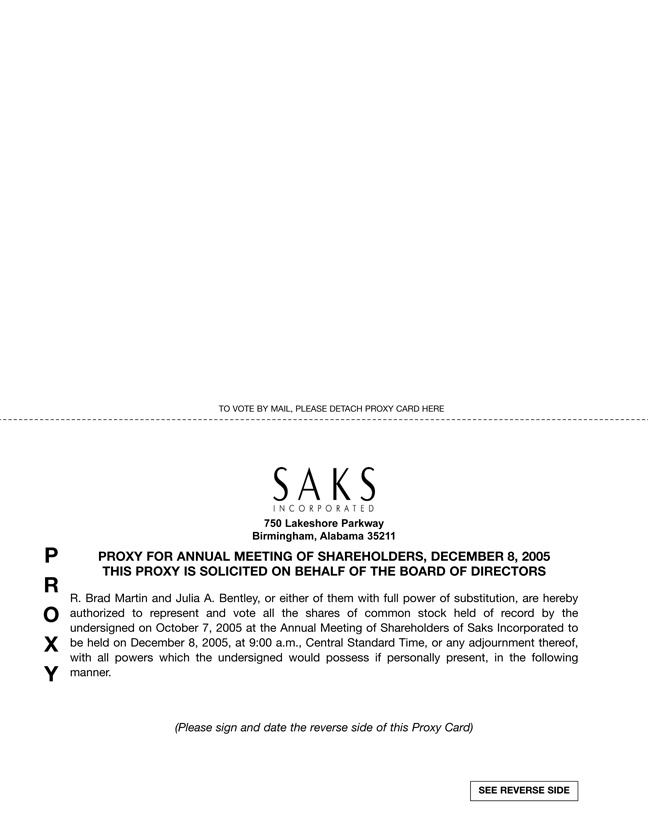

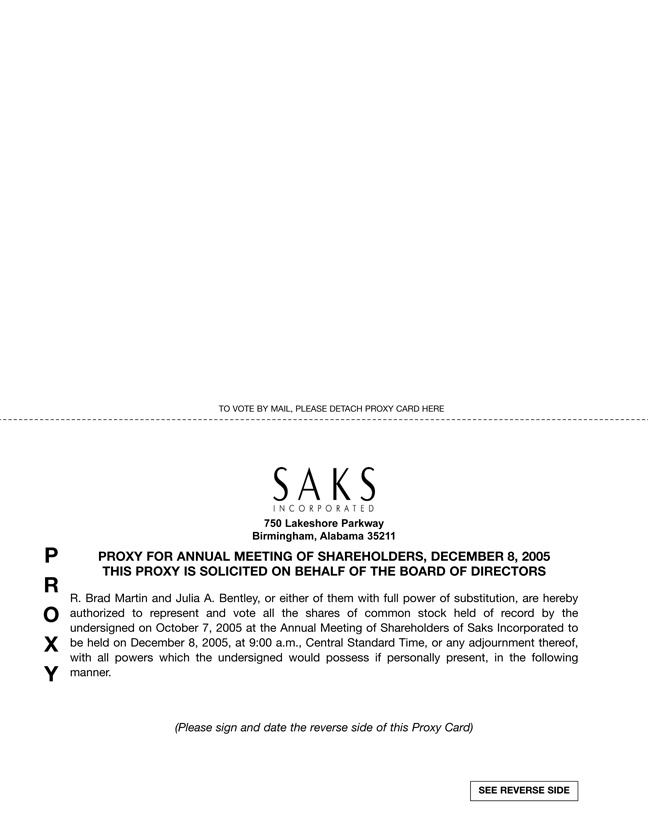

This proxy statement is furnished in connection with the solicitation of proxies to be used at the Annual Meeting of the Shareholders (the “Annual Meeting”) of Saks Incorporated, a Tennessee corporation (the “Company”), to be held on December 8, 2005.

The solicitation of proxies in the enclosed form is made on behalf of the Board of Directors of the Company. Directors, officers, and employees of the Company may solicit proxies by telephone, Internet, telecopier, mail, or personal contact. In addition, the Company has retained Georgeson Shareholder Communications Inc., New York, New York, to assist with the solicitation of proxies for a fee not to exceed $11,500, plus reimbursement for out-of-pocket expenses. Arrangements will be made with brokers, nominees, and fiduciaries to send proxies and proxy materials at the Company’s expense to their principals. The proxy materials are first being mailed to shareholders on or about October 26, 2005.

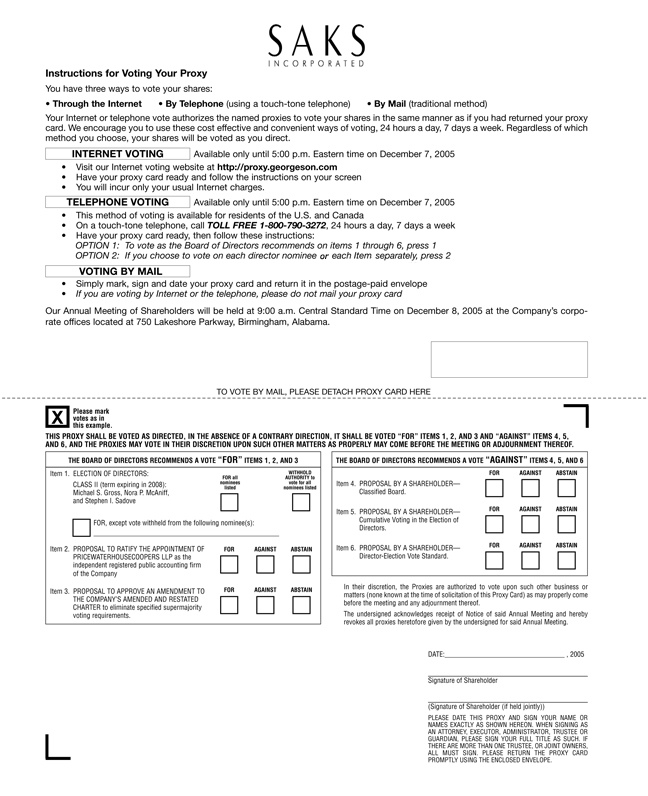

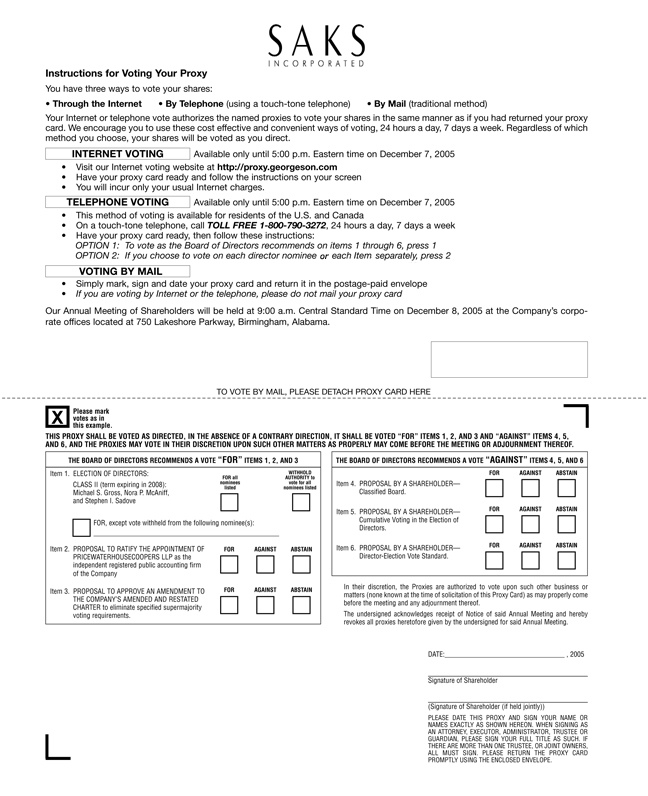

Shareholders whose shares are registered in their own name may vote over the Internet, by telephone, or by signing and returning a proxy in the enclosed form. Instructions for voting over the Internet or by telephone are set forth in the enclosed proxy card. A shareholder has the power to revoke the proxy at any time before the shares subject to it are voted by (i) returning a later-dated proxy card, (ii) entering a new vote by telephone or on the Internet, (iii) delivering written notice of revocation to the Company’s Secretary, or (iv) voting in person by ballot at the Annual Meeting. If your shares are registered in the name of a bank or brokerage firm, you will receive instructions from your holder of record that must be followed in order for the record holder to vote the shares in accordance with your instructions.

If you properly complete your proxy card, your shares will be voted at the Annual Meeting in the manner that you direct. In the event you return a signed proxy card on which no directions are specified, your shares will be voted FOR the election of the three Director nominees (Item 1), FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 28, 2006 (Item 2), FOR the approval of the amendment to the Company’s Charter (Item 3), and AGAINST the three proposals submitted by shareholders (Items 4, 5, and 6).

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the election inspectors appointed for the meeting. A quorum must be present in order for the Annual Meeting to be held. In order for the quorum requirement to be satisfied, a majority of the issued and outstanding shares of Common Stock of the Company (“Common Stock”) entitled to vote at the meeting must be present in person or represented by proxy. The election inspectors will treat abstentions and “broker non-votes” as shares that are present and entitled to vote for purposes of determining the presence of a quorum. A “broker non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Brokers will not have discretionary voting power with respect to the proposal to amend the Amended and Restated Charter or the three proposals submitted by shareholders.

The number of nominees proposed by the Board of Directors to be re-elected as Directors at the Annual Meeting is the same as the number of directors to be elected, and no shareholder has utilized the procedures provided in the Company’s Bylaws to nominate an additional person or persons for election to the Board of Directors at the Annual Meeting (see “Shareholders’ Proposals or Nominations for 2006 Annual Meeting”). As a result, each nominee proposed for re-election at the Annual Meeting who receives affirmative votes at the Annual Meeting in person or by proxy will be elected.

1

You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for election to the Board of Directors. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the other proposals. The approval of the amendment to the Company’s Amended and Restated Charter requires the approval of 80% or more of the outstanding shares of the Company entitled to vote for the election of Directors. Abstentions and broker non-votes will have the effect of a negative vote. All other matters will be approved if the votes cast favoring the action exceed the votes cast opposing the action. As such, abstentions and broker non-votes will have no effect on the outcome of such matters.

Outstanding Voting Securities

Only shareholders of record at the close of business on October 7, 2005 are entitled to vote at the Annual Meeting. On that day, there were issued and outstanding 141,901,225 shares of Common Stock. Each share has one vote.

Listed in the following table are the number of shares owned by each Director, the executive officers named in the Summary Compensation Table under the heading “Executive Compensation,” and all Directors and executive officers of the Company as a group as of October 7, 2005. Except as otherwise noted, each of the persons named in the table below has sole voting and investment power with respect to the shares shown as beneficially owned by him or her. The table also includes the beneficial owners as of October 7, 2005 (unless otherwise noted) of more than 5% of the outstanding Common Stock who are known to the Company.

| | | | | | |

Name of Beneficial Owner (and Address if “Beneficial Ownership” Exceeds 5%)

| | Total Shares

Beneficially

Owned (1)

| | | Percentage of

Common Stock

Ownership

| |

Stanton J. Bluestone | | 317,484 | | | * | |

Robert B. Carter | | 7,000 | | | * | |

James A. Coggin | | 1,414,441 | | | * | |

Douglas E. Coltharp | | 922,911 | | | * | |

Ronald de Waal | | 4,131,490 | | | 2.91 | % |

Julius W. Erving | | 119,308 | | | * | |

Michael S. Gross | | 109,354 | | | * | |

Donald E. Hess | | 638,770 | (2) | | * | |

George L. Jones | | 1,669,580 | | | 1.16 | % |

R. Brad Martin | | 5,135,551 | (3) | | 3.57 | % |

Nora P. McAniff | | 13,023 | | | * | |

C. Warren Neel | | 105,283 | | | * | |

Stephen I. Sadove | | 1,963,504 | | | 1.37 | % |

Marguerite W. Sallee | | 101,042 | | | * | |

Christopher J. Stadler | | 58,420 | | | * | |

Donald Wright | | 575,378 | | | * | |

| | |

All Directors and Executive Officers as a group (17 persons) | | 15,520,315 | | | 10.50 | % |

| | |

5% Owners: | | | | | | |

Inmobiliaria Carso, S.A. de C.V. | | 18,050,000 | (4)(5) | | 12.72 | % |

Southeastern Asset Management, Inc. | | 19,848,100 | (4)(6) | | 13.98 | % |

| * | Owns less than 1% of the total outstanding shares of Common Stock. |

| (1) | Includes, respectively, (a) shares that the following persons have a right to acquire within sixty days after October 7, 2005 through the exercise of stock options and (b) restricted stock awards (including performance shares) for which the restrictions have not lapsed: Mr. Bluestone (301,931; 2,000), Mr. Carter (0; 6,500), Mr. Coggin (1,059,403; 138,334), Mr. Coltharp (673,037; 140,000), Mr. de Waal (59,626; |

2

| | 4,000), Mr. Erving (82,264; 2,600), Mr. Gross (84,506; 2,000), Mr. Hess (74,418; 2,000), Mr. Jones (1,559,580; 0), Mr. Martin (1,927,300; 495,000), Ms. McAniff (6,053; 3,400), Dr. Neel (72,518; 2,000), Mr. Sadove (1,203,744; 325,600), Ms. Sallee (84,506; 2,200), Mr. Stadler (40,796; 3,400), Mr. Wright (478,796; 0), and all Directors and executive officers as a group (5,940,607; 1,253,119). |

| (2) | Includes: (i) 226,040 shares held by Mr. Hess as trustee or co-trustee for his children.Does not include: (i) 4,580 shares owned directly by his wife, (ii) 14,660 shares held by his wife as co-trustee for one of their children, or (iii) 91,984 shares held by another individual as trustee for Mr. Hess’s children. |

| (3) | Includes: (i) 2,375 shares owned by RBM Venture Company, a company of which Mr. Martin is sole shareholder, (ii) 271,666 shares held by Mr. Martin as trustee or co-trustee for his children and (iii) 84,310 shares owned by the Martin Family Foundation. |

| (4) | Information relating to the beneficial owner of Common Stock (and any related entity or person) is derived (i) for Inmobiliaria Carso, S.A. de C.V. (“Inmobiliaria”) from a statement on Form 4 filed with the Securities and Exchange Commission (“SEC”) on May 5, 2005 by Carlos Slim Helu (which includes beneficial ownership of Carlos Slim Helu, Carlos Slim Domit, Marco Antonio Slim Domit, Patrick Slim Domit, Maria Soumaya Slim Domit, Vanessa Paola Slim Domit, Johanna Monique Slim Domit (collectively “the Slim family”), Inmobiliaria, and Orient Star Holdings LLC (“Orient Star”) (see Note 5)) and information furnished on behalf of such persons; and (ii) for Southeastern Asset Management, Inc. from a Schedule 13G/A filed with the SEC on July 7, 2005. |

| (5) | Orient Star beneficially owns directly 1,350,000 shares. Inmobiliaria, a corporation organized under the laws of Mexico, is the sole member of Orient Star, and therefore may be deemed to have indirect beneficial ownership of the 1,350,000 shares owned directly by Orient Star. Inmobiliaria beneficially owns directly 16,700,000 shares. The Slim family beneficially owns all of the outstanding voting equity securities of Inmobiliaria. As a result, each member of the Slim family may be deemed to have indirect beneficial ownership of (i) the 1,350,000 shares beneficially owned indirectly by Inmobiliaria and beneficially owned directly by Orient Star and (ii) the 16,700,000 shares beneficially owned directly by Inmobiliaria. The principal business address for each member of the Slim family is Paseo de las Palmas 736, Colonia Lomas de Chapultepec, 11000 Mexico D.F., Mexico. |

| (6) | Southeastern Asset Management, Inc. (“Southeastern”) is an investment adviser registered under the Investment Advisers Act of 1940. These shares of Common Stock are held by one or more of Southeastern’s clients. Pursuant to investment advisory agreements with its clients, Southeastern has sole voting power over 15,936,400 shares, sole investment power over 19,848,100 shares, and shared voting power and shared investment power over none of the shares. Southeastern disclaims beneficial ownership of all of these shares. Southeastern’s address is 6410 Poplar Avenue, Memphis, Tennessee. |

The Company strongly encourages its senior executives and Directors to hold a personally meaningful equity interest in the Company, and stock ownership guidelines have been established for senior management and Directors. The Company believes such ownership aligns the interests of management, Directors, and shareholders.

ELECTION OF DIRECTORS

(Item No. 1)

The Company’s Amended and Restated Charter provides that the Board of Directors shall be divided into three classes, designated as Class I, Class II, and Class III. The terms of Class I, II, and III will expire at the annual meetings of shareholders in 2007, 2005, and 2006, respectively. The Board of Directors proposes the re-election of three Class II Directors: Michael S. Gross, Nora P. McAniff, and Stephen I Sadove. Class II Director James A. Coggin is not standing for re-election. George L. Jones, formerly President and Chief Executive Officer of Saks Department Store Group and a Class II Director, resigned as an officer and Director of the Company effective September 30, 2005.

The three Class II Directors standing for re-election, together with the nine Directors whose terms continue after the Annual Meeting, will comprise the Board of Directors. Each Director will hold office for the term

3

specified and until the Director’s successor is elected and qualified (see “Information Concerning the Solicitation”). Unless otherwise instructed by the shareholder, the persons named in the enclosed form of proxy intend to vote for the election of Messrs. Gross and Sadove and Ms. McAniff as Class II Directors. If any nominee becomes unavailable for any reason or should a vacancy occur before the election (which events are not anticipated), the proxies will be voted for the election of a substitute nominee to be selected by the Board of Directors.

The Board of Directors’ current policy is that no Director will be nominated by the Board to stand for re-election after reaching age 72, although the Board may determine, in special circumstances, that this policy should not apply with respect to any particular director.

The Company’s bylaws require that Directors who are not officers of the Company must submit to the Board a letter of resignation upon any change in the Director’s principal business or other activity in which the Director was engaged at the time of the Director’s election. The Board’s Corporate Governance Committee will review the letter of resignation and make a recommendation, based on all of the relevant facts and circumstances (including the needs of the Board), as to whether the Board should accept the Director’s resignation.

We have provided below information about the nominees and other Directors. The business associations shown have been continued for more than five years unless otherwise noted.

| | | | |

Name, Principal Occupation, and Directorships

| | Age

| | Director

Since

|

NOMINEES FOR DIRECTOR: | | | | |

| | |

Class II (terms expiring in 2008): | | | | |

| | |

Michael S. Gross | | 43 | | 1994 |

| Co-founder and Partner of Apollo Management, L.P., an investment firm. Mr. Gross also has served as Chairman and Chief Executive Officer of Apollo Investment Corporation, a business development company, since April 2004. He serves on the Boards of Directors of Allied Waste Industries, Inc., Educate, Inc. and United Rentals, Inc. | | | | |

| | |

Nora P. McAniff | | 46 | | 2002 |

| Executive Vice President of Time, Inc., a magazine publisher, since September 2002. Ms. McAniff served as Group President of the People Magazine Group of Time Inc. between January 2001 and August 2002 and President of People Magazine between October 1998 and January 2001. | | | | |

| | |

Stephen I. Sadove | | 54 | | 1998 |

| Vice Chairman of the Company since January 2002 and Chief Operating Officer of the Company since March 2004. Mr. Sadove served as Senior Vice President of Bristol-Myers Squibb, a beauty, nutritional, and pharmaceutical company, and President of Bristol-Myers Squibb Worldwide Beauty Care from 1996 to January 2002. Mr. Sadove serves on the Board of Directors of Ruby Tuesday, Inc. and the Board of Trustees of Equity Office Properties Trust. | | | | |

|

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THE SHAREHOLDERS VOTE “FOR” THE ELECTION AS DIRECTORS OF THE ABOVE-LISTED NOMINEES. |

| | |

CONTINUING DIRECTORS: | | | | |

| | |

Class I (terms expiring in 2007): | | | | |

| | |

Stanton J. Bluestone | | 71 | | 1998 |

| Chairman of the Carson Pirie Scott group of the Company from February 1998 until his retirement in January 1999. Mr. Bluestone served as Chairman and Chief Executive Officer of Carson Pirie Scott & Co. (“CPS”) between March 1996 and January 1998. Prior to that, Mr. Bluestone held other executive positions with CPS. | | | | |

4

| | | | |

Name, Principal Occupation, and Directorships

| | Age

| | Director

Since

|

| | |

Robert B.Carter | | 46 | | 2004 |

| Executive Vice President and Chief Information Officer of FedEx Corporation, an international provider of transportation, information, international trade support, and supply chain services. | | | | |

| | |

Julius W. Erving | | 55 | | 1997 |

| President of the Erving Group, a private management company. Mr. Erving also served as Executive Vice President of RDV Sports, a sports management company, between September 1997 and June 2003. Mr. Erving serves on the Board of Directors of Fusion Telecommunications International, Inc. | | | | |

| | |

Donald E. Hess | | 56 | | 1996 |

| Chief Executive Officer of Southwood Partners, a private investment company, and Chairman Emeritus of Parisian. Mr. Hess served as Chairman of the Parisian group of the Company from April 1997 until his retirement in December 1997 and served as President and Chief Executive Officer of Parisian, Inc. from 1986 to April 1997. | | | | |

| | |

Class III (terms expiring in 2006): | | | | |

| | |

Ronald de Waal | | 53 | | 1985 |

| Vice Chairman of the Company’s Board of Directors. Chairman of WE International, B.V., a Netherlands corporation, which operates fashion specialty stores in Belgium, the Netherlands, Switzerland, Germany, and France. Mr. de Waal serves on the Boards of Directors of Post Properties Inc. and The Body Shop International, PLC. | | | | |

| | |

R. Brad Martin | | 53 | | 1984 |

| Chief Executive Officer of the Company since 1989 and Chairman of the Board of the Company since 1987. Mr. Martin serves on the Boards of Directors of First Horizon Corporation and Harrah’s Entertainment, Inc. | | | | |

| | |

C. Warren Neel | | 66 | | 1987 |

| Executive Director of the Center for Corporate Governance at the University of Tennessee, Knoxville, since February 2003. Dr. Neel served as Commissioner of Finance and Administration for the State of Tennessee from July 2000 to January 2003. He served as the Dean of the College of Business Administration at the University of Tennessee, Knoxville, from 1977 until June 2000. Dr. Neel serves on the Board of Directors of American Healthways, Inc. | | | | |

| | |

Marguerite W. Sallee | | 59 | | 1996 |

| Since October 2004, President and Chief Executive Officer of America’s Promise—The Alliance for Youth, a not-for-profit organization founded in 1997 by General Colin Powell to make children and youth a national priority. She served as Staff Director, Senate Subcommittee on Children and Families between April 2003 and September 2004; as President and Chief Executive Officer of The Brown Schools, the nation’s largest provider of treatment services for troubled adolescents, from September 2001 to March 2003; and as President and Chief Executive Officer of Frontline Group, Inc., an employee training company, from July 1999 to August 2001. Ms. Sallee is co-founder, former Chief Executive Officer, and currently a board member of Bright Horizons Family Solutions. | | | | |

| | |

Christopher J. Stadler | | 41 | | 2000 |

| Managing Director of Investcorp International, Inc., an investment company. Mr. Stadler serves on the Boards of Directors of U.S. Unwired, Inc. and Werner Co. | | | | |

5

Further Information Concerning Directors

Directors’ Fees

Each Director who is not employed by the Company receives an annual fee of $30,000, $2,000 for attendance at each board meeting, and $1,000 for attendance at each meeting of a committee of which the Director is a member (and $750 for participation by telephone in a board or committee meeting). The Audit Committee Chairperson receives an additional annual fee of $7,500, the Human Resources Committee Chairperson receives an additional annual fee of $5,000, and each of the Finance and Corporate Governance Chairpersons receives an additional annual fee of $2,500. Directors are reimbursed for expenses in connection with their services as Directors of the Company. Directors not employed by the Company may elect to receive fees in cash or to participate in the Company’s Deferred Compensation Plan.

Upon initial election or appointment to the Board each non-employee Director is awarded 5,000 shares of restricted stock. The restriction period is ten years, with 10% lapsing on each anniversary date of the award. The restrictions will fully lapse on the earlier of the tenth anniversary of the grant date or upon retirement. Immediately following each annual meeting of shareholders, each non-employee Director is awarded 2,000 shares of restricted stock. Restrictions lapse upon retirement or resignation from the Board. The Company’s Vice Chairman of the Board also receives an additional annual award of 2,000 shares that vests immediately. Directors may elect to defer awards of restricted stock into the Company’s Deferred Compensation Plan. All restricted stock awards to Directors are made under the Saks Incorporated 2004 Long-Term Incentive Plan.

Board Practices

The Board met seven times during the fiscal year ended January 29, 2005. At each regular Board meeting, the non-employee Directors also meet separately with Messrs. Martin and Sadove and then without them. The Chairman of the Corporate Governance Committee, Ronald de Waal, presides over the non-employee Director sessions.

The Company’s Board of Directors has adopted Corporate Governance Guidelines. The Company’s Board of Directors has also adopted a Code of Business Conduct and Ethics (the “Code”) in compliance with New York Stock Exchange (“NYSE”) and Securities and Exchange Commission (“SEC”) standards. The Chief Executive Officer, the Chief Financial Officer, the Chief Accounting Officer, other employees of the Company, and members of the Board must comply with the Code. The Code and the Corporate Governance Guidelines are posted on the Company’s web site atwww.saksincorporated.com and are available in print to any person who sends a written request to Charles J. Hansen, the Company’s Executive Vice President and General Counsel, at 750 Lakeshore Parkway, Birmingham, Alabama 35211. Waivers of the policies and procedures set forth in the Code will, to the extent required by law or applicable regulation, be disclosed by means of an appropriate statement onwww.saksincorporated.com.

The Board reviews its own performance annually and routinely reviews and plans for succession of the Company’s executive team.

Director Independence

Under the Company’s Corporate Governance Guidelines, a significant majority of the Board should be composed of Independent Directors as those terms are defined in the NYSE rules. The Board of Directors has adopted categorical independence standards that supplement the NYSE listing standards. Under these standards, (i) no director will qualify as “independent” unless the Board of Directors affirmatively determines that the director does not have a material relationship with the Company (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company), and (ii) a director will not be independent if the director has any of the following relationships:

| | • | | The director is an employee of the Company or has been an employee of the Company at any time within the preceding three years. |

6

| | • | | A member of the director’s immediate family is an executive officer of the Company or has been an executive officer of the Company at any time within the preceding three years. |

| | • | | The director or an immediate family member of the director received during any 12 month period within the last three years more than $100,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided that such compensation is not contingent in any way on continued service). |

| | • | | The director is a current partner or employee of the Company’s internal or external audit firm, or the director was within the past three years (but is no longer) a partner or employee of such a firm and personally worked on the Company’s audit within that time. |

| | • | | A member of director’s immediate family (A) is a current partner of a firm that is the Company’s internal or external auditor, (B) is a current employee of such a firm and participates in the firm’s audit, assurance or tax compliance (but not tax planning) practice or (C) was within the past three years (but is no longer) a partner or employee of such a firm and personally worked on the Company’s audit within that time. |

| | • | | The director is, or within the preceding three years has been, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on the other company’s compensation committee. |

| | • | | A member of the director’s immediate family is, or within the preceding three years has been, employed as an executive officer of another company where any of the Company’s present executive officers serves or served on the other company’s compensation committee. |

| | • | | The director is an employee of another company that has made payments to, or received payments from, the Company for property or services in an amount which, in any one of the three most recent fiscal years, exceeded the greater of $1 million, or 2% of the other company’s consolidated gross revenues. |

| | • | | A member of the director’s immediate family is an executive officer of another company that has made payments to, or received payments from, the Company for property or services in an amount which, in any one of the three most recent fiscal years, exceeded the greater of $1 million, or 2% of the other company’s consolidated gross revenues. |

| | • | | The director or an immediate family member is, or has been within the last three years, a director or executive officer of another company that is indebted to the Company, or to which the Company is indebted, if the total amount of either company’s indebtedness for borrowed money to the other is or was 2% or more of the other company’s total consolidated assets. |

| | • | | The director or an immediate family member is, or has been within the last three years, an officer, director or trustee of a charitable organization if the annual charitable contributions to the organization by the Company or any executive officer of the Company exceeds or exceeded the greater of $1 million, or 2% of such charitable organization’s gross revenue. |

The Board has reviewed all relationships between each non-employee director and the Company and has affirmatively determined that no non-employee director has a material relationship with the Company directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company. The Board has also concluded that no non-employee director has any of the disqualifying relationships identified above. Consequently, the Board has determined that all non-employee directors are independent within the meaning of the NYSE rules and the Board’s categorical standards.

Board Committees

The Board of Directors has established Audit, Human Resources, Corporate Governance, and Finance Committees. The Board has determined that all members of the Audit, Human Resources, and Corporate

7

Governance Committees are independent within the meaning of the rules of the NYSE and the Board’s categorical standards. All members of the Audit Committee satisfy the heightened standard for audit committee independence provided in the SEC rules.

The Company’s Board of Directors has adopted written charters for the Audit, Human Resources, and Corporate Governance Committees that meet the requirements of the NYSE rules. Each charter is available atwww.saksincorporated.com and in print to any person who sends a written request to Charles J. Hansen, the Company’s Executive Vice President and General Counsel, at 750 Lakeshore Parkway, Birmingham, Alabama 35211. Each committee conducts an annual performance appraisal of itself.

The Board and each of its Committees has access, at the Company’s expense, to outside accounting, legal, corporate governance, and other advisors as and when Board or Committee members determine advisor retention is advisable.

Audit Committee

The Audit Committee includes C. Warren Neel (Chair), Stanton J. Bluestone, Michael S. Gross, and Marguerite W. Sallee. The Committee met twelve times during the fiscal year ended January 29, 2005. The purpose of the Committee is to (i) assist the Board in its oversight of (a) the integrity of the Company’s financial statements, (b) the Company’s compliance with legal and regulatory requirements, (c) the qualifications and independence of the Company’s external auditor, and (d) the performance of the Company’s internal auditors and the external auditors; and (ii) prepare the report of the Committee required to be included in the Company’s annual proxy statement.

No member of the Audit Committee may serve on more than two other audit committees of public companies.

The Board of Directors has determined that C. Warren Neel is an “audit committee financial expert” as that term is defined in rules of the SEC implementing requirements of the Sarbanes-Oxley Act of 2002. In reaching this determination, the Board of Directors considered, among other things, the relevant experience of Dr. Neel as described under “Election of Directors.”

Human Resources Committee

The Human Resources Committee includes Christopher J. Stadler (Chair), Robert B. Carter, Julius W. Erving, Donald E. Hess, and Nora P. McAniff. The Committee met five times during the fiscal year ended January 29, 2005. The primary purpose of the Committee is to (i) discharge the Board’s responsibilities relating to compensation of the Company’s directors and executive officers and (ii) review and recommend to the Board human resource plans, policies, and programs, as well as approve individual executive officer compensation intended to attract, motivate, retain, and appropriately reward associates in order to motivate their performance in the achievement of the Company’s business objectives and align their interests with the long-term interests of the Company’s shareholders.

Corporate Governance Committee

The Corporate Governance Committee includes Ronald de Waal (Chair), Robert B. Carter, Nora P. McAniff, C. Warren Neel, and Christopher J. Stadler. The Committee met four times during the fiscal year ended January 29, 2005. The primary purpose of the Committee is to (i) identify, evaluate, and recommend to the Board individuals qualified to be directors of the Company for either appointment to the Board or to stand for election at a meeting of the shareholders, and (ii) develop and recommend to the Board corporate governance guidelines for the Company. The Committee also makes recommendations with respect to shareholder proposals.

8

The Corporate Governance Committee does not have any single method for identifying director candidates, but will consider candidates suggested by a wide range of sources. Board candidates must possess personal and business integrity, accountability, informed judgment, business literacy, and high performance standards and be able to contribute knowledge, experience, and skills in at least one of the following core competencies: accounting and finance, management, marketing, industry knowledge, leadership, or strategy.

The Committee also considers any nominees for Director recommended by shareholders. The Committee will apply the same standards in considering Director candidates recommended by shareholders as it applies to other candidates. Shareholders wishing to recommend to the Committee a nominee should write to the Committee c/o the Corporate Secretary at the address provided for such communications onwww.saksincorporated.com. Any recommendation submitted by a shareholder must include the same information concerning the candidate and the shareholder as would be required under the Company’s bylaws if the shareholder were nominating that candidate directly, which information requirements are described in this Proxy Statement under the heading “Shareholders’ Proposals or Nominations for 2006 Annual Meeting.”

Finance Committee

The Finance Committee includes Donald E. Hess (Chair), Ronald de Waal, Michael S. Gross, and Christopher J. Stadler. The Committee met twice during the fiscal year ended January 29, 2005. The Committee: (i) ensures the capital structure of the Company is consistent with the long-term value-creating strategy of the Company, (ii) advises management on specific elements of its capital structure strategy, and (iii) approves, based on authority delegated from the Board of Directors, or recommends to the Board of Directors for approval, specific terms and parameters of certain financing transactions.

Meeting Attendance

The Board expects that all Directors will devote sufficient time to the full performance of their Board duties and responsibilities, including attending all Board meetings and all meetings of committees on which the Director serves. Any Director who attends less than 75% of board and committee meetings in a fiscal year is required to provide a written explanation to the Board’s Corporate Governance Committee immediately following the fiscal year end. If the Committee finds the explanation inadequate, the Director will submit a letter of resignation to the Committee, which will determine, based on all relevant facts and circumstances (including the needs of the Board), whether to recommend to the Board that it should accept the Director’s resignation.

Each Director attended 75% or more of the aggregate number of meetings of the Board of Directors and the committee(s) on which such Director served during the fiscal year ended January 29, 2005. The overall average percentage for Directors’ meeting attendance was 96%.

Directors are encouraged, but not required, to attend annual meetings of shareholders. Twelve members of the Board of Directors attended the Company’s June 2004 Annual Meeting.

Policy and Process Regarding Communications with the Board

The Board of Directors has adopted a policy and process for shareholders and other interested parties to communicate with the Board or an individual Director, including Mr. de Waal, who presides over the non-employee Director sessions, or with the non-employee Directors as a group. Shareholders and other interested parties may communicate with the Board collectively, or with any of its individual members, by writing to them c/o the Corporate Secretary at the address provided for such communications onwww.saksincorporated.com. Additional information concerning the Company’s process regarding communications with the Board may be found atwww.saksincorporated.com.

9

Executive Compensation

Summary Compensation Table

The following table sets forth, for the fiscal years ended January 29, 2005 (“2004”), January 31, 2004 (“2003”), and February 1, 2003 (“2002”), the cash compensation paid by the Company, as well as other compensation paid or accrued for these years, to the Company’s Chief Executive Officer, to each of the other four most highly compensated individuals who were executive officers of the Company at January 29, 2005, and to George L. Jones, who in March 2004 ceased to be an executive officer, but remained an officer and director of the Company until September 30, 2005 (“Named Executive Officers”). As used in this Proxy Statement, the term “executive officer” has the meaning set forth in Rule 3b-7 under the Securities Exchange Act of 1934.

Summary Compensation Table

| | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | Long-Term Compensation Awards

| | |

Name & Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual

Compensation

($)

| | | Restricted

Stock

Award(s)

($)(1)

| | | Securities

Underlying

Options

Granted (#)

| | All Other

Compensation

($)(2)

|

R. Brad Martin Chairman of the Board and Chief Executive Officer (“CEO”) | | 2004

2003

2002 | | 1,050,000

1,050,000

1,000,000 | | 0

1,077,500

815,000 | | 83,970

94,162

— | (3)

(4)

| | 7,357,250

651,000

529,303 | (5,6,7)

(8)

(9) | | —

—

69,440 | | 5,125

11,050

2,550 |

| | | | | | | |

Stephen I. Sadove(11) Vice Chairman and Chief Operating Officer (“COO”) | | 2004

2003

2002 | | 980,000

980,000

980,000 | | 250,000

739,214

531,650 | | 79,275

21,933

— | (10)

| | 1,833,322

—

— | (6,7)

| | —

—

— | | 5,125

7,250

— |

| | | | | | | |

George L. Jones(11) President and CEO of Saks Department Store Group | | 2004

2003

2002 | | 950,000

900,000

900,000 | | 650,000

700,000

700,000 | | 2,584

3,665

— | (12)

(13)

| | —

—

— |

| | 280,188

250,000

400,000 | | 20,562

28,030

16,692 |

| | | | | | | |

James A. Coggin President and Chief Administrative Officer | | 2004

2003

2002 | | 800,000

800,000

800,000 | | 200,000

431,040

248,000 | | 2,348

246,344

— | (14)

(15)

| | 566,625

—

449,500 | (6)

(16) | | —

158,362

44,440 | | 5,197

349,471

2,550 |

| | | | | | | |

Douglas E. Coltharp Executive Vice President and Chief Financial Officer | | 2004

2003

2002 | | 587,500

550,000

550,000 | | 0

237,050

150,000 | | 4,313

226,251

— | (17)

(15)

| | 679,950

—

899,000 | (6)

(16,18) | | —

84,997

150,826 | | 5,181

330,237

2,550 |

| | | | | | | |

Donald Wright(20) Executive Vice President and Chief Accounting Officer | | 2004

2003

2002 | | 396,517

384,176

376,374 | | 0

145,586

122,776 | | —

181,339

993 |

(15)

| | 169,988

—

359,600 | (6)

(19) | | —

108,696

80,303 | | 5,194

5,090

6,000 |

| (1) | As of January 29, 2005, the number and value (based on the January 29, 2005 closing price of $13.80) of shares of restricted stock (including performance shares) held by each of the Named Executive Officers were as follows: Mr. Martin, 730,000 shares ($10,074,000) of restricted stock (including 475,000 performance shares); Mr. Sadove, 248,667 shares ($3,431,604) of restricted stock (including 121,667 performance shares); Mr. Coggin, 70,834 shares ($977,509) of restricted stock (including 37,500 performance shares); Mr. Coltharp, 95,000 shares ($1,311,000) of restricted stock (including 45,000 performance shares), and Mr. Wright, 24,584 shares ($339,259) of restricted stock (including 11,250 performance shares). Mr. Jones did not hold any shares of restricted stock or any performance shares as of such date. Dividends would be paid on the shares by crediting the dividend to a Company account for the holder of the shares. If the shares were to fully vest, the dividend paid on the shares would be paid in cash to the holder of the shares. If a change in control or potential change in control were to occur, the shares held by the Named Executive Officers would vest in accordance with the terms of the Company’s stock incentive plans. |

10

| (2) | For 2004 includes (i) matching contributions under the Company’s 401(k) plan as follows: Mr. Martin, $5,125; Mr. Sadove, $5,125; Mr. Coggin, $5,197; Mr. Jones, $5,119; Mr. Coltharp, $5,181; and Mr. Wright, $5,194; and (ii) for Mr. Jones, $15,443 of imputed interest on a loan made to him in 2001. See “Loan Agreement.” |

| (3) | Includes (i) personal use of airplane valued at $42,673, (ii) Medicare taxes of $9,984 paid on restricted shares and (iii) $10,992 for the portion of interest credited to deferred compensation account balances that exceeded 120% of the “long-term applicable federal rate” specified in Internal Revenue Code Section 1274(d). |

| (4) | Consists of reimbursement of (i) $28,642 for the cost of long-term disability insurance, (ii) Medicare taxes of $30,610 paid on restricted shares and (iii) $34,910 for the portion of interest credited to deferred compensation account balances that exceeded 120% of the “long-term applicable federal rate” specified in Internal Revenue Code Section 1274(d). |

| (5) | Includes an award to Mr. Martin of 5,000 shares of restricted stock, granted on May 1, 2004 and valued at $72,000 ($14.40 closing price), which fully vested on May 1, 2005. |

| (6) | Performance share awards based on cumulative performance for 2004 and the fiscal year ending January 28, 2006 (“2005”). These awards are subject to future cancellation in whole or in part if the Company does not meet the applicable performance criteria. Shares earned will vest on January 31, 2007. Threshold to earn shares is 90% of plan achievement which earns 30% of target. Maximum shares that can be earned are as follows: Mr. Martin, 75,000 shares ($1,113,250); Mr. Sadove, 75,000 shares ($1,113,250); Mr. Coggin, 37,500 shares ($566,625); Mr. Coltharp, 45,000 shares ($679,950); and Mr. Wright, 11,250 shares ($169,988). Shares were priced as of June 16, 2004 (grant date) and are valued at the closing price of $15.11. Mr. Wright resigned his employment with the Company on June 17, 2005 and is not eligible to earn any of these shares. Mr. Jones did not receive an award of these shares. |

| (7) | Includes awards made on June 8, 2004 to Messrs. Martin and Sadove of 400,000 and 46,667 performance shares, respectively, having a value of $6,172,000 and $720,072, respectively, based on the closing price of the Company’s Common Stock on June 8, 2004 (the date of grant) of $15.43. The award of 400,000 performance shares was in lieu of Mr. Martin’s rights to receive 1,387,867 “reload” stock options, which rights arose upon Mr. Martin’s exercise in November 2003 of stock options awarded to him in 1995, 2000, and 2001 to purchase a total of 1,806,262 shares of the Company’s Common Stock. The award of 46,667 performance shares was in lieu of Mr. Sadove’s rights to receive 153,193 “reload” stock options, which rights arose upon Mr. Sadove’s exercise in November 2003 of stock options awarded to him in 2000 and 2002 to purchase a total of 198,967 shares of the Company’s Common Stock. The performance share awards provided that they would vest if at any time during the period from and including June 16, 2005 to and including June 17, 2009 the average of the closing prices of the Company’s Common Stock on the New York Stock Exchange for twenty consecutive trading days was $17.50 or greater, and the awards vested in July 2005. |

| (8) | Awards to Mr. Martin of (i) 5,000 shares of restricted stock, priced as of May 1, 2003 and valued at $44,450 ($8.89 closing price), fully vested on May 1, 2004, and (ii) 35,000 shares of restricted stock based on achievement of 2003 performance criteria, which were priced as of April 1, 2004, valued at $606,550 ($17.33 closing price), and fully vested on April 1, 2005. |

| (9) | An award to Mr. Martin of 68,830 restricted shares (34,000 of which were based on the achievement of 2002 performance criteria and 34,830 of which were based on the achievement of other performance criteria). This award, which was priced as of February 28, 2003 and valued at $529,303 ($7.69 closing price), fully vested on February 28, 2004. |

| (10) | Includes (i) personal use of airplane valued at $28,224, (ii) Medicare taxes of $27,532 paid on restricted shares and (iii) $16,769 for an automobile lease. |

| (11) | Mr. Sadove’s employment as Vice Chairman commenced on January 7, 2002, and he assumed the additional role of COO in March 2004. In addition to the position of President and CEO of Saks Department Store Group, Mr. Jones served as COO of the Company from September 2002 until March 2004. Mr. Jones ceased to be an executive officer of the Company in March 2004 and resigned as an officer and director of the Company effective September 30, 2005. |

11

| (12) | Includes $2,584 for the portion of interest credited to deferred compensation account balances that exceeded 120% of the “long-term applicable federal rate” specified in Internal Revenue Code Section 1274(d). |

| (13) | Includes $3,665 for the portion of interest credited to deferred compensation account balances that exceeded 120% of the “long-term applicable federal rate” specified in Internal Revenue Code Section 1274(d). |

| (14) | Includes $2,348 for the portion of interest credited to deferred compensation account balances that exceeded 120% of the “long-term applicable federal rate” specified in Internal Revenue Code Section 1274(d). |

| (15) | Includes tax gross-up for forgiveness of loans to Messrs. Coggin, Coltharp and Wright of $233,978, $218,551, and $174,840, respectively. |

| (16) | Awards to Messrs. Coggin and Coltharp each of 50,000 shares of restricted stock. These awards, priced as of August 16, 2002 and valued at $449,500 ($8.99 closing price), will fully vest on the tenth anniversary of the grant date if the recipients remain employed by the Company on that date, but are subject to accelerated vesting in one-third installments in 2004, 2005, and 2006 if the Company achieves performance goals for 2003, 2004, and 2005, respectively. In 2004, 16,666 of the shares fully vested for Messrs. Coggin and Coltharp each based on the achievement of the 2003 performance goals. |

| (17) | Consists of reimbursement of Medicare taxes of $4,313 paid on restricted shares. |

| (18) | An award to Mr. Coltharp of 50,000 shares of restricted stock priced as of August 16, 2002 and valued at $449,500 ($8.99 closing price). 16,666 shares fully vested on November 1, 2003, 16,666 shares fully vested on November 1, 2004 and one installment of 16,667 shares will fully vest on November 1, 2005 if Mr. Coltharp remains employed on such date. |

| (19) | An award to Mr. Wright of 40,000 shares of restricted stock priced as of August 16, 2002 and valued at $359,600 ($8.99 closing price). 13,333 shares fully vested on November 1, 2003, 13,333 shares fully vested on November 1, 2004 and 11,667 shares vested as a result of Mr. Wright’s resignation. |

| (20) | Mr. Wright resigned his employment with the Company effective June 17, 2005. |

Stock Options

The following table contains information concerning the grant of stock options under the Company’s incentive plans to the Named Executive Officers during the last fiscal year. Mr. Martin, Mr. Sadove, Mr. Coggin, Mr. Coltharp and Mr. Wright did not receive stock option grants in 2004.

Option Grants in Last Fiscal Year

| | | | | | | | | | | | | | | |

| | | Individual Grants

| | |

Name

| | Number of

Securities

Underlying

Options

Granted

(#) (1)

| | | % of Total

Options Granted

to Employees

in Fiscal Year

| | | Exercise or

Base Price

($/share) (2)

| | Expiration

Date

| | Potential Realizable Value

at Assumed Annual Rates of

Stock Price Appreciation for

Option Term (3)

|

| | | | | | 5%($)

| | 10%($)

|

George L. Jones | | 280,188 | (4) | | 99.0 | % | | $ | 15.70 | | 3/1/2014 | | 2,425,266 | | 5,973,546 |

| (1) | In the event of a change in control or potential change in control of the Company, options become exercisable in full. |

| (2) | All options were granted at the market closing price on the date of grant. No incentive stock options were granted. The exercise price and tax withholding obligations related to exercise may be paid by delivery of already owned shares, subject to certain conditions. |

| (3) | Potential gains are reported net of the option exercise price but before taxes associated with exercise. These amounts represent assumed rates of appreciation only. Actual gains, if any, on stock option exercises are dependent on the future performance of the Common Stock and overall stock market conditions, as well as the optionholder’s continued employment through the vesting period. Mr. Jones resigned as a director and officer of the Company effective September 30, 2005. Accordingly, the amounts reflected in this table may not necessarily be achieved. |

12

| (4) | This option is exercisable in cumulative one-fifth installments that commenced six months from the date of grant (with each subsequent installment becoming exercisable on the anniversary date of grant). Upon Mr. Jones’s resignation of employment, the installment that would have become exercisable on March 1, 2006 became immediately exercisable and exercisability for installments that would have become exercisable on March 1, 2007 and March 1, 2008 ceased. |

The Company’s policy is to not “reprice” stock options.

Option Exercises and Holdings

The following table sets forth information with respect to the Named Executive Officers concerning the exercise of options during the last fiscal year and unexercised options held at the end of the last fiscal year.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | | | | | | |

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized ($)

| | Number of

Securities

Underlying Unexercised

Options Held at

Fiscal Year End (#)

Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money Options

at Fiscal Year End ($) (1)

Exercisable/Unexercisable

|

R. Brad Martin | | 0 | | 0 | | 1,807,288/135,577 | | 2,518,249/413,528 |

Stephen I. Sadove | | 0 | | 0 | | 1,203,072/336,897 | | 5,826,775/1,679,913 |

George L. Jones | | 200,000 | | 937,020 | | 1,133,694/795,732 | | 3,861,801/2,458,698 |

James A. Coggin | | 0 | | 0 | | 1,084,932/29,262 | | 2,116,485/36,767 |

Douglas E. Coltharp | | 0 | | 0 | | 659,551/25,104 | | 1,223,427/19,352 |

Donald Wright | | 0 | | 0 | | 474,141/10,560 | | 761,048/10,219 |

| (1) | Represents the difference between the closing price of the Company’s Common Stock on January 29, 2005 ($13.80) and the exercise price of the options. |

Employment Agreements

All of the Named Executive Officers have been employed pursuant to agreements with the Company. Each Employment Agreement sets forth the Named Executive Officer’s minimum base salary, bonus potential, entitlement to participate in the Company’s benefit plans, equity awards, severance benefits and change-in-control protections. Mr. Martin’s Employment Agreement was amended and restated effective December 8, 2004. The current Employment Agreements have the following expiration dates: Mr. Martin, October 1, 2008; Mr. Coggin, March 15, 2006; and Mr. Coltharp, March 15, 2006. Mr. Wright’s Employment Agreement, which would have expired on March 15, 2006, terminated effective June 17, 2005, upon his resignation of employment with the Company, described below. Mr. Jones, whose Employment Agreement would have expired on February 28, 2007, resigned as an officer and director of the Company effective on September 30, 2005. Mr. Sadove’s contract is a severance agreement that remains in effect as long as he is employed by the Company.

The minimum base salaries for the Named Executive Officers specified in their Employment Agreements are: Mr. Martin, $1,000,000; Mr. Sadove, $980,000; Mr. Jones, $950,000; Mr. Coggin, $800,000; Mr. Coltharp, $550,000; and Mr. Wright, $378,500. Each of the Employment Agreements provides bonus opportunities for the Named Executive Officers. Mr. Martin’s annual bonus potential is 100% of his base salary for target achievement of applicable performance measures and up to 200% of base salary for maximum achievement of applicable performance objectives, in each case determined in accordance with the Company’s 2003 Senior Executive Bonus Plan. Mr. Sadove’s standard bonus potential under his Employment Agreement is 70% of base salary for achievement of specific financial plans with the potential of 140% of base salary for breakthrough

13

results, as determined in advance by the Human Resources Committee. Mr. Jones’s annual bonus was no less than $650,000 during the term of his Employment Agreement and could have been as much as 120% of base salary (at the end of the relevant fiscal year) for achievement over planned performance, for each year as established by the Company’s Chief Executive Officer and the Human Resources Committee. The target annual cash bonus for achieving plan for Mr. Coggin is 50%, Mr. Coltharp is 40%, and Mr. Wright is 35% under their respective Employment Agreements, each with an opportunity to earn more than the target bonus. In addition to his salary and bonus, unless his employment is terminated for cause, Mr. Martin is entitled to receive $50,000 annually for fourteen years ending December 31, 2018 in lieu of the Company’s obligation under his prior Employment Agreement to pay split-dollar life insurance premiums. For information concerning 2004 and 2005 annual cash bonuses for Messrs. Martin and Coltharp see “Report of the Human Resources Committee of the Board of Directors on Executive Compensation.”

Under his prior Employment Agreement, Mr. Martin received 250,000 shares of Common Stock in the form of restricted stock that will vest on May 31, 2006, provided that he does not voluntarily end his employment prior to that date. Mr. Martin’s prior Employment Agreement provided that he had the opportunity to earn up to 500,000 additional shares depending on the average of the closing prices for the Company’s Common Stock during the twelve-month period ending May 31, 2006 (the “Average Closing Price”). This obligation has been carried over into Mr. Martin’s current Employment Agreement, and the performance targets to earn the shares have been adjusted to reflect the $2.00 per common share cash dividend paid by the Company to shareholders of record on April 30, 2004. The adjusted threshold for earning any shares is an Average Closing Price of $15.68, with 100,000 shares to be earned if the Average Closing Price is more than that amount. 500,000 shares will be earned if the Average Closing Price is $26.14 or higher. Shares will be pro rated for Average Closing Prices between those prices and will be awarded pursuant to the Company’s 2004 Long-Term Incentive Plan approved by the Company’s shareholders on June 8, 2004 (the “2004 Plan”). Notwithstanding that the terms of this award are set forth in Mr. Martin’s Employment Agreement, this award has not yet been granted by the Human Resources Committee. Beginning with the Company’s 2005 fiscal year, Mr. Martin is entitled to receive 40,000 performance shares annually pursuant to the 2004 Plan. The performance shares will have a one-year performance period and will include performance targets and performance measures determined by the Human Resources Committee. If the Human Resources Committee determines that an award has been earned in whole or in part, the shares will vest on the last day of the fiscal year following the fiscal year used as the performance period if Mr. Martin is continuously employed by the Company to that date. In 2005, Mr. Martin began receiving an annual award of 5,000 shares of restricted stock under the 2004 Plan. Each 5,000 share award will fully vest on the third anniversary of the award date if he has been continuously employed by the Company to that date.

Mr. Sadove received options to purchase 1,500,000 shares of the Company’s Common Stock at an exercise price equal to the greater of $9.875 or the average closing price of the stock for the first two weeks after his start date (January 7, 2002). The options were granted pursuant to the Company’s 1994 Long Term Incentive Plan. With respect to these options, 20% became exercisable on the six-month anniversary of his start date, 20% on each of the first, second, and third anniversaries of his start date, and 20% will become exercisable on the fourth anniversary of the start date. Any portion of the options not exercised by the seventh anniversary of the start date shall expire. Mr. Sadove is also entitled to receive 125,000 shares of the Company’s Common Stock on the fourth anniversary of his start date if he remains employed on that date.

Mr. Coggin and Mr. Coltharp have each been granted 50,000 shares of the Company’s Common Stock, which shares will vest on November 1, 2012 if the executive remains employed by the Company on that date. One-third of the shares may be earned and the vesting accelerated based on the Company’s earnings per share for each of fiscal years 2004 and 2005. The Human Resources Committee sets the earnings per share targets at the beginning of each fiscal year. The executive will earn 100% of the eligible shares for a fiscal year upon the Company achieving the earnings per share target, and he shall earn 50% of the eligible shares upon the Company achieving 85% of the target. Shares will be prorated between those two levels. In addition, Mr. Coltharp received a grant of 50,000 shares of restricted stock on November 1, 2002, of which 16,667 shares vested on November 1, 2003, 16,667 shares vested on November 1, 2004 and 16,666 are scheduled to vest on November 1, 2005,

14

provided he remains employed by the Company on such date and, if he is terminated by the Company without cause, he will be entitled to a pro rata number of such shares. Mr. Wright received a grant of 40,000 shares of restricted stock on November 1, 2002, of which 13,333 shares vested on November 1, 2003, 13,333 shares fully vested on November 1, 2004 and 11,667 shares vested as a result of Mr. Wright’s resignation, as described below.

Donald Wright resigned from his employment with the Company effective June 17, 2005. The Company agreed to treat Mr. Wright’s resignation as a termination without cause for purposes of his March 15, 2003 Employment Agreement with the Company. Pursuant to the terms of Mr. Wright’s March 15, 2003 Employment Agreement with the Company, Mr. Wright has been provided the following: a lump sum severance payment equal to 18 months base salary, payment for unused accrued vacation, pro rata vesting in 11,667 shares of the unvested portion of his November 1, 2002 restricted stock grant, the lump sum distribution of his Deferred Compensation Plan account and, as in the case of other holders of stock options who have been precluded from exercising their options until the filing with the SEC of all of the Company’s periodic reports, a 90-day extension for the exercise of his stock options.

In addition to the compensation and benefits described above, each Named Executive Officer will be entitled to participate in each employee benefit plan and to receive each benefit that the Company provides to senior executives at the level of each Named Executive Officer’s position. Mr. Martin is also entitled to receive (1) appropriate security for his residences or reimbursement for the cost of such security, (2) long-term disability insurance providing for a benefit of $30,000 per month for his lifetime to age 65, (3) reimbursement of the cost of an annual physical examination, (4) $50,000 annually for 14 years unless the Company terminates Mr. Martin’s employment for Cause and except in the event of Mr. Martin’s death, which payments the Company has agreed to make as a continuation of the Company’s agreement contained in the prior agreement (in lieu of payments for split-dollar life premiums). Mr. Sadove is entitled to reimbursement for reasonable tax and financial planning services, and transportation or a transportation allowance. Prior to his resignation as an officer and director of the Company, which resignation was effective on September 30, 2005, Mr. Jones was entitled to a long-term disability insurance benefit of $30,000 per month, life insurance with a $1 million death benefit, and coverage of up to $100,000 per year for medical expenses for him and his family not otherwise covered by the Company’s general health plan. Mr. Coltharp is, and Mr. Wright was, entitled to reimbursement for reasonable tax services.

Each Employment Agreement contains severance provisions in the event that the Named Executive Officer’s employment is terminated without “cause.” Messrs. Martin and Sadove each may terminate, and Mr. Jones previously had the right to terminate, his employment relationship for “good reason.” Mr. Martin’s Employment Agreement defines “good reason” as a Change in Control, if Mr. Martin terminates his employment after the first anniversary of the Change in Control, and mandatory relocation of Mr. Martin’s principal place of employment from the Memphis, Tennessee area. Mr. Sadove’s Employment Agreement defines “good reason” as a demotion from his position as Vice Chairman of the Company, required relocation from the New York, New York area, and a Change in Control. Under these circumstances, the Employment Agreements generally provide for the acceleration of equity grants and a lump-sum cash payment. If Mr. Martin’s employment is terminated without “cause” or he terminates his employment for “good reason,” he is entitled to (i) a sum equal to three times his base salary if his employment is terminated prior to a change of control, (ii) to the extent permitted by the Company’s applicable plans, immediate vesting of all options, performance share awards, and restricted stock awards with the ability to exercise the options for the shorter of two years or the original expiration period of the option, (iii) participation in the Company’s health plans, with family coverage, for his life, and following his death, participation in the Company’s health plans for his then spouse and children under the age of 21 for one additional year, except if and during a period he is working full time for a third party providing health plans comparable to the Company’s health plans, he will not be entitled to participate in the Company’s health plans, (iv) reimbursement of reasonable costs for an off-site office and full-time secretarial services for the longer of three years or the remaining term of his Employment Agreement, and (v) associate merchandise discount privileges for merchandise purchased from the Company for his lifetime. If Mr. Sadove’s employment is

15

terminated without “cause” or he terminates his employment for “good reason,” he is entitled to (i) a cash payment of three times his base salary then in effect plus three times an imputed bonus of 30% of base salary, (ii) immediate vesting of all options with one year to exercise those options, (iii) immediate vesting of all restricted stock awards, and (iv) continuation in the Company’s medical plans for three years. Prior to his resignation, Mr. Jones’ Employment Agreement provided that if Mr. Jones’ employment were terminated without “cause” or he terminated his employment for “good reason,” he would be entitled to (i) a cash payment of two times his annual base salary in effect at the time of termination, (ii) immediate vesting of all options that are exercisable within one year following the date of termination, with 90 days following the date of termination to exercise the options, and (iii) continuation, at the Company’s expense, in the Company’s medical, dental, vision, disability, group life insurance, and supplemental insurance benefits, with the coverage in effect immediately prior to the date of termination, for a period equal to the lesser of three years or until Mr. Jones accepts other employment. If Mr. Coggin or Mr. Coltharp is terminated without “cause,” he will be entitled to receive his base salary through the end of the term of his Employment Agreement (in a lump sum). In the event such termination occurs during the final two years of Mr. Coggin’s or Mr. Coltharp’s Employment Agreement or thereafter if he is working without an agreement, he will be entitled to receive two years of base salary and will have one year after termination to exercise any vested options.

Each Employment Agreement also includes change-in-control provisions. A “Change in Control” generally means: (i) the acquisition of 25% or more of the combined voting power of the Company’s outstanding securities, (ii) a tender offer, merger, sale of assets, or other business combination which results in the transfer of a majority of the combined voting power of the outstanding voting securities of the Company or any successor entity, or (iii) during any period of two consecutive years, the failure to elect a majority of the individuals constituting the Board of Directors of the Company at the beginning of such period, unless the election or nomination of any replacement Directors was approved by vote of at least two-thirds of the Directors of the Company then still in office who were Directors of the Company at the beginning of such period. A “Potential Change in Control” generally means: (i) the approval by the shareholders of the Company of an agreement which, if consummated, will result in a change of control or (ii) the acquisition of 5% or more of the outstanding voting securities of the Company and the adoption by the Company’s Directors of a resolution to the effect that a potential change in control of the Company has occurred.

In the event of a Change in Control, any options and restricted stock granted to the Named Executive Officers prior to such Change in Control will immediately vest to the extent permitted by the Company’s Amended and Restated 1994 Long-Term Incentive Plan (the “1994 Plan”), the Company’s Amended and Restated Stock-Based Incentive Plan (the “1997 Plan”) and the 2004 Plan. If Mr. Martin terminates his employment for “good reason,” as defined in Mr. Martin’s Employment Agreement, after the first anniversary of a Change in Control, or if he is terminated without “cause” following a Change in Control, he will receive three times the sum of his annual base salary plus his target bonus potential, both as then in effect and the other severance benefits described above. If Mr. Sadove terminates his employment for “good reason” after a Change in Control or his employment is terminated by the Company in connection with a Change in Control or Potential Change in Control, he will receive the severance payment described above, will be entitled to continuation in the Company’s health plans for three years at no cost, and will become vested in the Company’s Supplemental Savings Plan at the retirement rate. For each of Messrs. Coggin and Coltharp, a termination of employment by the executive for “good reason” after a Change in Control, or a termination of employment by the Company in any way connected to a Change in Control or Potential Change in Control, entitles the executive to three times his base salary then in effect and continuation in the Company’s health plans for three years at no cost to the executive. Mr. Coltharp’s and Mr. Coggin’s Employment Agreements define “good reason” as mandatory relocation from their primary place of employment, a reduction in status or duties as a result of a Change in Control, and termination by the executive during the 13th month after a change in control which the executive deems “good reason.”

If any payment, right or benefit paid to a Named Executive Officer by the Company is treated as an “excess parachute payment” under Section 280(G)(b) of the Internal Revenue Code, the Company will indemnify and

16

hold harmless and make whole, on an after-tax basis, the Named Executive Officer for any adverse tax consequences, including but not limited to providing to the Named Executive Officer on an after-tax basis the amount necessary to pay any tax imposed by Internal Revenue Code Section 4999.

Each of the Employment Agreements contains non-competition covenants following termination of employment.

Mr. Jones resigned as an officer and director of the Company effective on September 30, 2005. In accordance with the terms of his employment agreement with the Company, Mr. Jones has been provided with the following pursuant to the terms of an Agreement and Release: two times annual base salary at the rate in effect on September 30, 2005; continuation at the Company’s expense of medical, dental, vision, disability, group life insurance, and supplemental insurance benefits, with the coverage in effect immediately prior to September 30, 2005, for a period equal to the lesser of three years or until Mr. Jones accepts other employment; stock options exercisable on or before September 30, 2006 will immediately vest and will be exercisable for ninety days; lump sum distribution of deferred compensation account; and, as in the case of other holders of stock options who have been precluded from exercising their stock options until the filing with the SEC of all of the Company’s periodic reports, a 90-day extension for the exercise of stock options. In addition, if a Change in Control occurs on or before September 30, 2006 the Company will pay to Mr. Jones $1,300,000 in a lump sum. This amount would have been payable to Mr. Jones in accordance with his employment agreement if the Company had terminated his employment without Cause following a Change in Control or if Mr. Jones had terminated his own employment upon a material reduction in his duties or status as a result of a Change in Control. In the Agreement and Release Mr. Jones released the Company and its shareholders, subsidiaries, affiliates, directors, employees, and agents from all claims and demands, if any, that Mr. Jones may have arising out of his employment agreement, his employment with the Company, and the termination of his employment.

Loan Agreement

The Human Resources Committee of the Board has followed a policy of compensating executive officers with cash and equity-based awards. The grant of equity awards means that a significant portion of an executive’s compensation is at risk. In accordance with this policy, over time executive officers have received shares of Common Stock as compensation. Those awards are taxable to the executive as income. The Company agreed in 2001 to make a $464,000 interest-free loan to Mr. Jones. At the Company’s request, Mr. Jones elected to pay taxes on his 2001 restricted stock grant although the shares subject to the grant would not vest, and would not be taxable had he not so elected, until 2004. The Company received a tax benefit from Mr. Jones’s election, and the purpose of the loan was to assist Mr. Jones with respect to his accelerated tax payment obligations that arose from the election. The Company made the loan on March 29, 2002 before Mr. Jones became a Named Executive Officer. Mr. Jones repaid his loan on March 10, 2005.

Certain Relationships and Related Transactions

Brian J. Martin, a brother of R. Brad Martin, the Company’s Chairman and Chief Executive Officer, was employed by the Company, and received salary of $131,250 and $47,836 for his services during 2004 and 2005, respectively. With respect to 2004 he received a bonus of $36,325 (which was paid in April 2005). He did not receive a bonus for 2005. In addition to salary and bonus, during 2004 he earned and received accelerated vesting for 16,666 shares of Common Stock granted to him in 2002 under a TARSAP program. He did not earn or receive accelerated vesting for any TARSAP shares in 2005. During 2004 and 2005 he received other benefits valued at $4,569 and $4,808, respectively, for federal income tax purposes. Mr. Martin resigned his employment with the Company on June 17, 2005.

Jeffrey C. Martin, a Senior Vice President of the Company and a brother of R. Brad Martin, is employed by, and primarily performs government relations services for, the Company and received salary of $244,110 and

17

$162,836 for his services during 2004 and 2005 (through September 30, 2005), respectively. For 2004 he received a bonus of $69,962 (which was paid in May 2005). In 2004 he received other benefits valued at $210 for federal income tax purposes, and he received no such benefits in 2005. In addition to the compensation and benefits described above, Jeffrey C. Martin received a grant of 7,500 performance shares under the 2004 Plan, subject to future cancellation in whole or in part if the Company does not meet certain performance criteria. Effective October 15, 2005, Mr. Martin’s annual base salary will be $25,000. During 2004 and 2005 (through September 30, 2005) the Company incurred expenses of $1,471 and $51,990, respectively, with respect to Mr. Martin’s medical insurance claims.

Jeffrey C. Martin also was of counsel to Goodwin Proctor LLP, a law firm, until October 1, 2005. For 2004 and 2005 (through September 30, 2005), the Company paid Goodwin Proctor LLP $97,381 and $67,269, respectively, in fees and disbursements for litigation defense, legal compliance, and governmental relations services and for reimbursement of support services provided to Jeffrey C. Martin in his capacity with the Company. The Company believes that payments made to Goodwin Proctor were not greater than payments that would have been made to comparable firms to obtain similar services.

James A. Coggin, Jr., an adult child of James A. Coggin, a Named Executive Officer and director, is employed by the Company as Vice President-Energy Procurement. During 2004 and 2005 (through September 30, 2005) he received salary of $173,349 and $117,010, respectively. He received a bonus of $21,287 (which was paid in April 2005) for his services during 2004. During 2004 and 2005 he also received other benefits valued at $134 and $0, respectively, for federal income tax purposes. In addition to the compensation and benefits described above, in 2004 James A. Coggin, Jr. received a grant of 4,050 performance shares of Common Stock under the 2004 Plan, subject to future cancellation in whole or in part if the Company does not meet certain performance criteria.

Section 16(a) Beneficial Ownership Reporting Compliance