PROVIDENT BANKSHARES

CORPORATION

Mid-Atlantic Super Community

Bank Conference

November 4, 2004

FORWARD-LOOKING STATEMENTS AND RISK FACTORS

This presentation, and other written materials and oral statements made by management, may contain certain forward-looking statements, including those regarding the Company’s prospective performance, plans, strategies and expectations, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and is including this statement for purposes of said harbor provisions.

Forward-looking statements, which are based on certain assumptions and describe future events, plans, strategies, and expectations of the Company, are generally identified by use of the words “plan,” “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or other similar expressions. The Company’s ability to predict results or the actual effects of its performance, plans, strategies and expectations, including those with respect to its merger with Southern Financial Bancorp, Inc., is inherently uncertain. Accordingly, actual results may differ materially from anticipated results.

The following factors, among others, could cause the actual results of the merger to differ materially from the expectations stated in this presentation: the ability to successfully integrate the companies following the merger, including the retention of key personnel; the ability to effect the proposed capital recovery and optimization plan; the ability to fully realize the expected cost savings and revenues; and the ability to realize the expected cost savings and revenues on a timely basis.

Factors that could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: changes in general economic conditions, interest rates, deposit flows, loan demand, real estate values, competition, and the demand for financial services and loan, deposit, and investment products in the Company’s local markets; changes in the quality or composition of the loan or investment portfolios; inability to successfully carry out marketing and/or expansion plans; changes in accounting principles, policies, or guidelines; changes in legislation and regulation; changes in the monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; war or terrorist activities; and other economic, competitive, governmental, regulatory, geopolitical, and technological factors affecting the Company’s operations, pricing, and services.

The Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

2

HISTORY

‘THE NEW PROVIDENT’

KEY STRATEGIES

INVESTMENT ATTRIBUTES

AGENDA

3

MILESTONES

1886—Founded as a Mutual Thrift

1987—Converted to Commercial Bank

1993—Totally Free Checking/In-Store Branches

1997 – Citizen’s Savings Bank Merger

2004 – Southern Financial Merger

PROVIDENT BANKSHARES

CORPORATION

4

THE NEW PROVIDENT What We Are

Consumer and Commercial Banking Focus

Access to Executive Management

430,000 Customer Relationships

149 Branches in the Key Urban Metropolitan areas of Baltimore, Washington and Richmond

The “Right Size” Bank

PROVIDENT BANKSHARES

CORPORATION

5

THE “RIGHT SIZE” BANK

“We will continue to provide the products and services of our largest competitors, while delivering the level of service found in only the best community banks.”

PROVIDENT BANKSHARES

CORPORATION

6

THE NEW PROVIDENT What We Are

Commercial and Consumer Banking Focused

Commercial

50% Commercial Business in Virginia

Small Business and Middle Market focus

Consumer

68% Consumer Business in Maryland

Convenient Access

Depth and Breadth of Value Oriented Products and Services

PROVIDENT BANKSHARES

CORPORATION

7

THE NEW PROVIDENT FRANCHISE

Branches located in Maryland and

Virginia’s best markets

County Demographics

PBKS Branches4 - 8% Projected Growth+8% Projected Growth

County Demographics 8

WHAT WE ARE NOT

Trust Department

Mortgage Banking

Large Corporate Banking

International Banking

PROVIDENT BANKSHARES

CORPORATION

9

KEY STRATEGIES

Broaden Presence and Customer Base in Washington Metro and Virginia

Grow Commercial Banking Franchise

in the Maryland and Virginia Markets

Grow Consumer Banking Franchise

in the Maryland and Virginia Markets

Improve Financial Fundamentals

PROVIDENT BANKSHARES

CORPORATION

10

BROADEN PRESENCE AND CUSTOMER BASE IN WASHINGTON METRO AND VIRGINIA

PROVIDENT BANKSHARES

CORPORATION

11

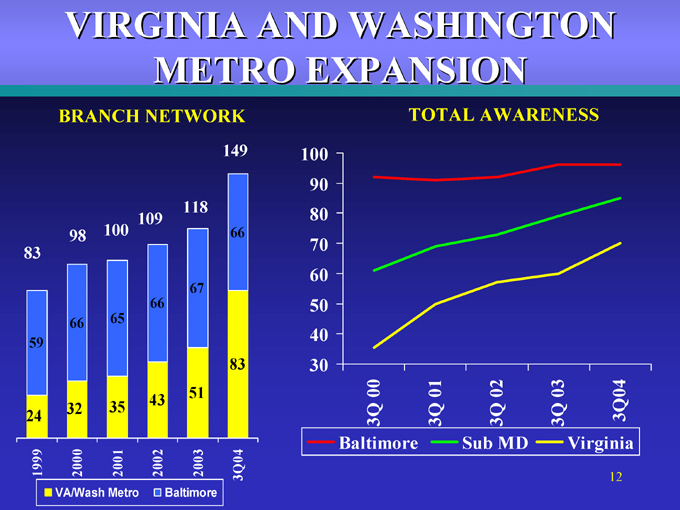

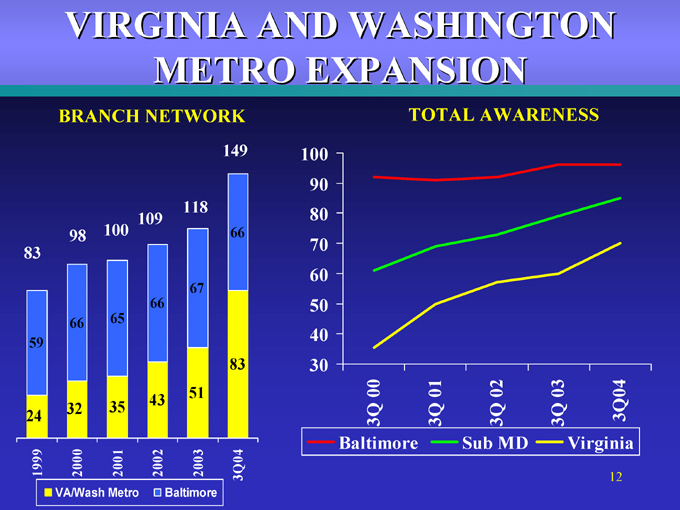

VIRGINIA AND WASHINGTON METRO EXPANSION

BRANCH NETWORK

83 98 100 109 118 149

59 66 65 66 67 66

24 32 35 43 51 83

1999 2000 2001 2002 2003 3Q04

VA/Wash Metro

Baltimore

TOTAL AWARENESS

30 40 50 60 70 80 90 100

3Q 00 3Q 01 3Q 02 3Q 03 3Q04

Baltimore Sub MD Virginia

12

CHECKING BALANCE GROWTH VA/WASHINGTON METRO

Average Balances (millions)

CONSUMER

$81 $106 $134 $242 2001 2002 2003 3Q04

COMMERCIAL

$49 $100 $160 $318 2001 2002 2003 3Q04

CAGR Consumer 2001-3Q04* 20%

CAGR Commercial 2001-3Q04* 58%

*includes SFFB in 2001 base

13

GROW COMMERCIAL BANKING FRANCHISE IN THE MARYLAND AND VIRGINIA MARKETS

PROVIDENT BANKSHARES

CORPORATION

14

PROVIDENT BANKSHARES

CORPORATION

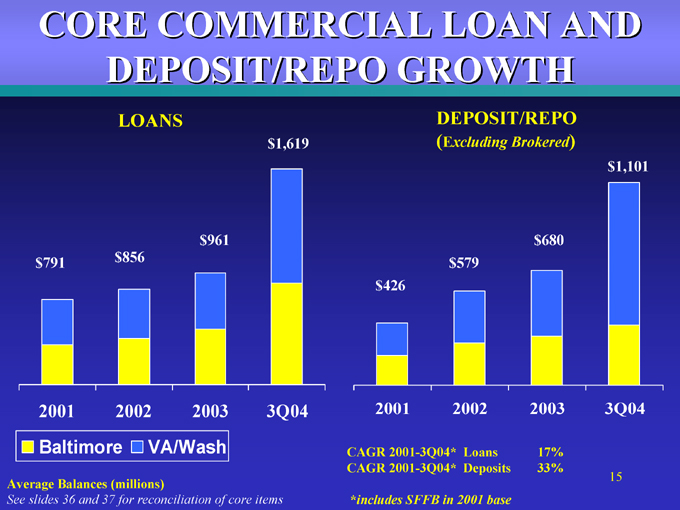

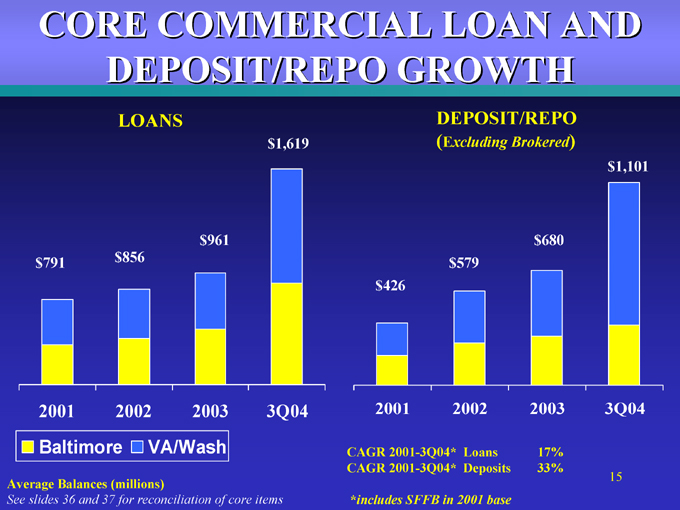

CORE COMMERCIAL LOAN AND DEPOSIT/REPO GROWTH

LOANS

$791 $856 $961 $1,619 2001 2002 2003 3Q04

DEPOSIT/REPO

(Excluding Brokered)

$426 $579 $680 $1,101 2001 2002 2003 3Q04

Baltimore VA/Wash

Average Balances (millions)

See slides 36 and 37 for reconciliation of core items

CAGR 2001-3Q04* Loans 17%

CAGR 2001-3Q04* Deposits 33%

*includes SFFB in 2001 base

15

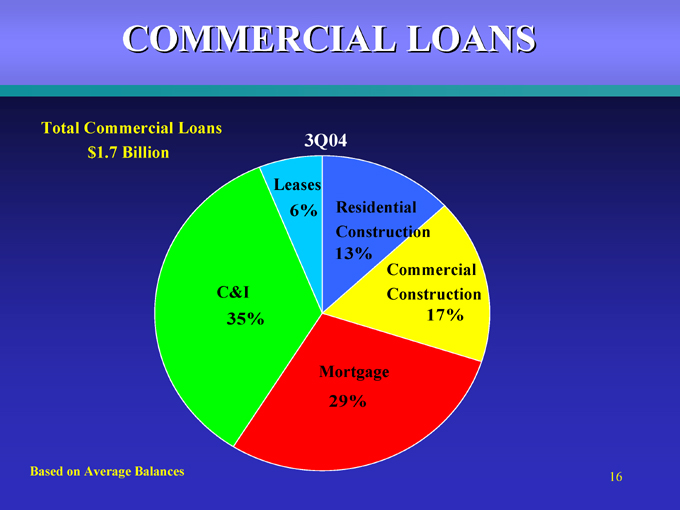

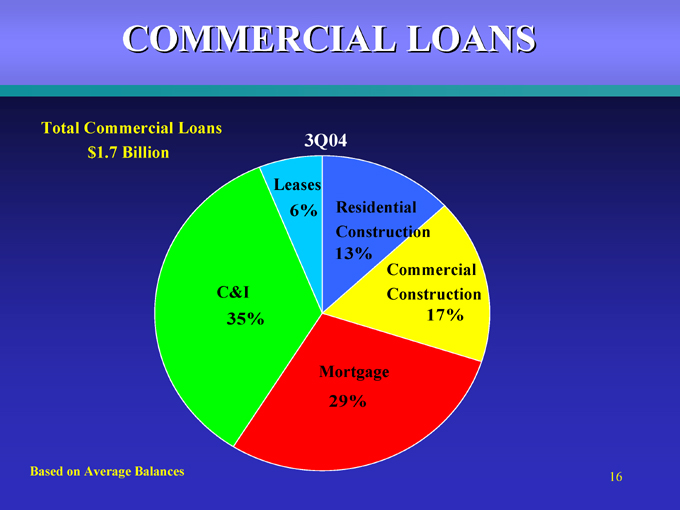

COMMERCIAL LOANS

Total Commercial Loans $1.7 Billion

3Q04

C&I 35%

Leases 6%

Mortgage 29%

Residential Construction 13%

Commercial Construction 17%

Based on Average Balances

16

GROW CONSUMER BANKING FRANCHISE IN MARYLAND AND VIRGINIA MARKETS

PROVIDENT BANKSHARES

CORPORATION

17

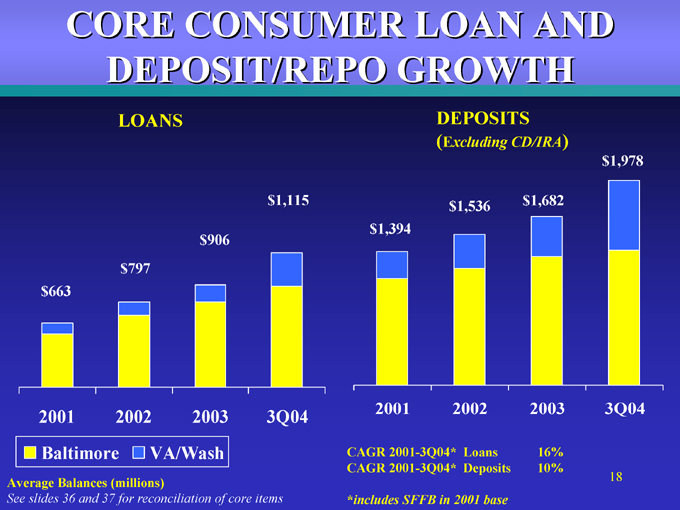

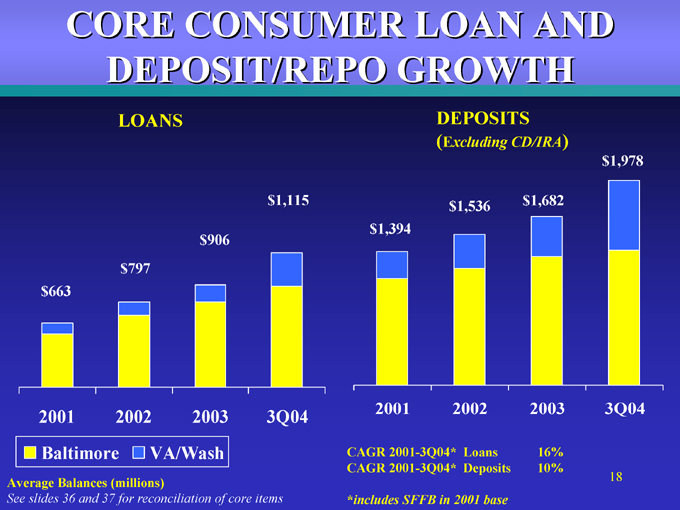

CORE CONSUMER LOAN AND DEPOSIT/REPO GROWTH

LOANS

$663 $797 $906 $1,115 2001 2002 2003 3Q04

Baltimore VA/Wash

Average Balances (millions)

See slides 36 and 37 for reconciliation of core items

DEPOSITS

(Excluding CD/IRA)

2001 2002 2003 3Q04

$1,394 $1,536 $1,682 $1,978

CAGR 2001-3Q04* Loans 16%

CAGR 2001-3Q04* Deposits 10%

*includes SFFB in 2001 base

18

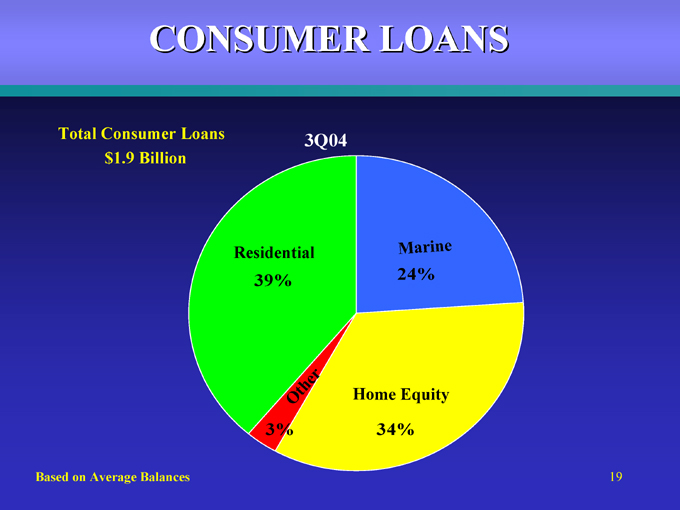

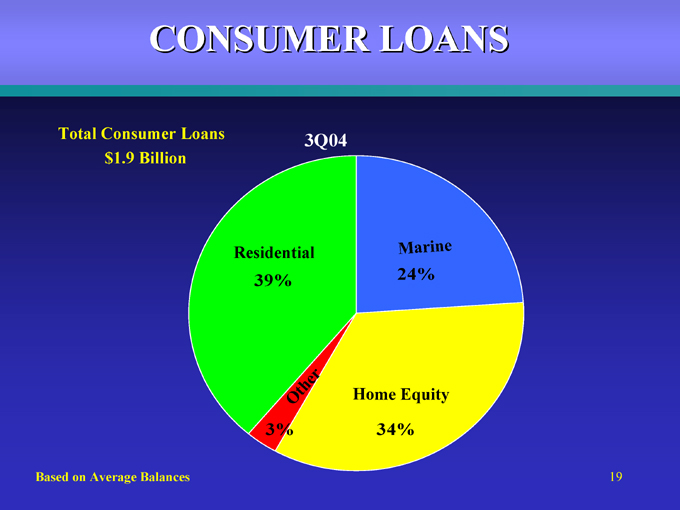

CONSUMER LOANS

Total Consumer Loans

$1.9 Billion

3Q04

Marine 24%

Other 3%

Home Equity 34%

Residential 39%

Based on Average Balances

19

PROVIDENT’S IN-STORE DIFFERENCE

*PEOPLE* *PARTNERS

*PRODUCT* *PROGRAM

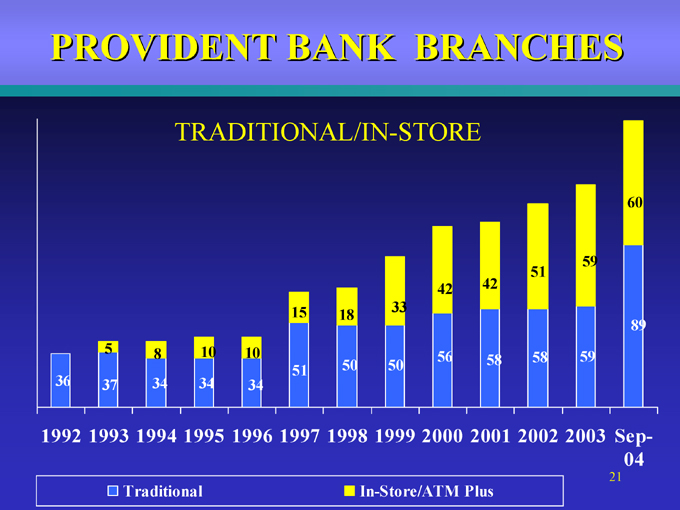

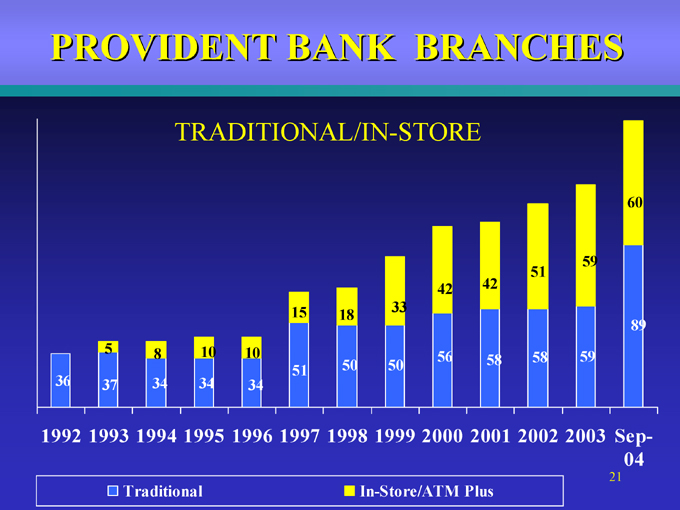

PROVIDENT BANK BRANCHES

TRADITIONAL/IN-STORE

58 58 89 59 56 36 34 34 51 50 50 37 34 60 59 51 42 42 33 15 18 10 10 5 8

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

Sep-04

Traditional

In-Store/ATM Plus

21

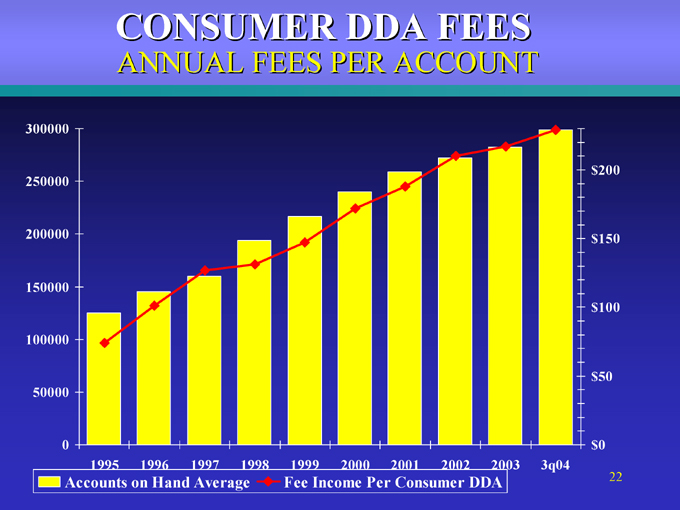

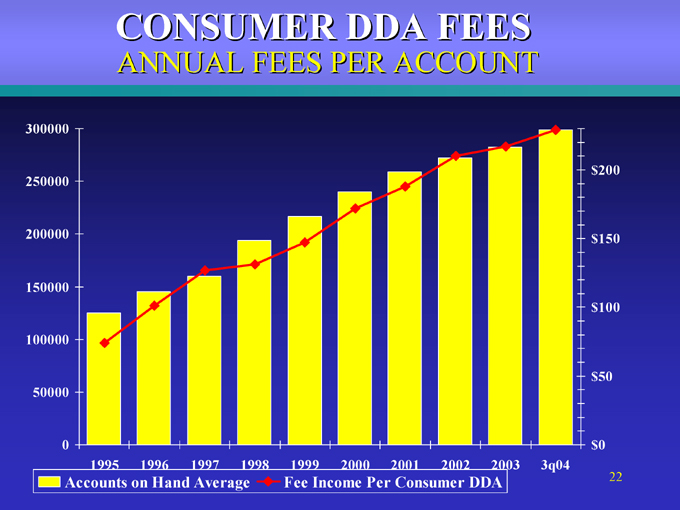

CONSUMER DDA FEES ANNUAL FEES PER ACCOUNT

0 50000 100000 150000 200000 250000 300000

1995 1996 1997 1998 1999 2000 2001 2002 2003

3q04

$0 $50 $100 $150 $200

Accounts on Hand Average

Fee Income Per Consumer DDA

22

IMPROVE FINANCIAL

FUNDAMENTALS

PROVIDENT BANKSHARES

CORPORATION

23

THE NEW PROVIDENT

TRANSFORMED BALANCE SHEET

HIGHER ABSOLUTE EARNINGS

IMPROVED EARNINGS QUALITY

24

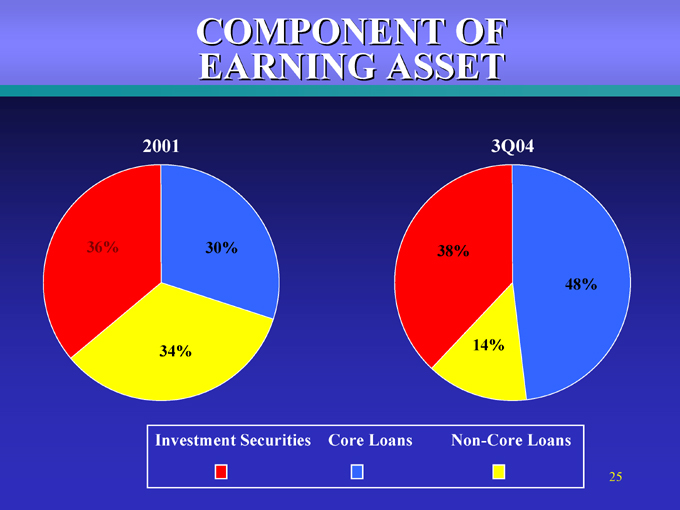

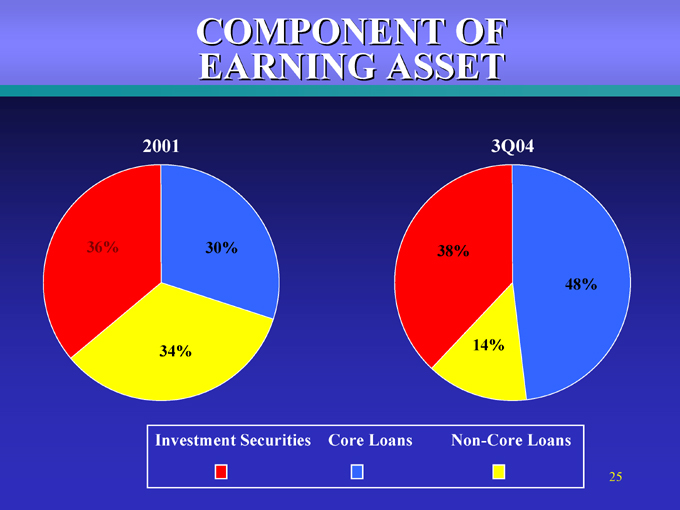

COMPONENT OF EARNING ASSET

Investment Securities Core Loans Non-Core Loans

2001

36% 34% 30%

3Q04

48% 14% 38% 25

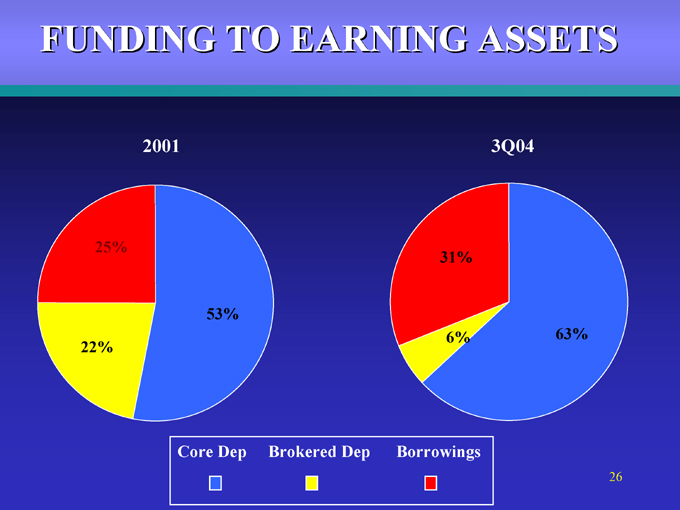

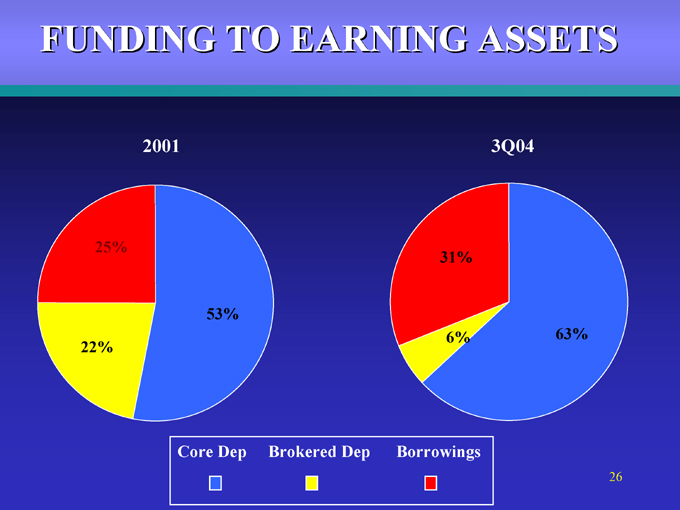

FUNDING TO EARNING ASSETS

Core Dep Brokered Dep Borrowings

2001

25% 22% 53%

3Q04

31% 6% 63% 26

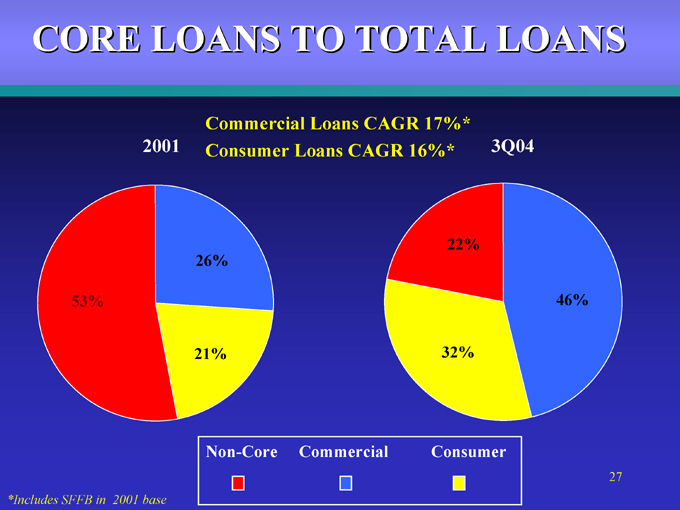

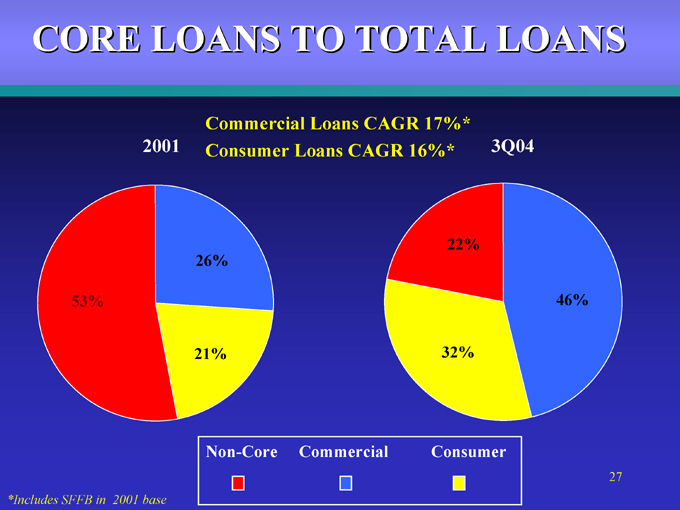

CORE LOANS TO TOTAL LOANS

Commercial Loans CAGR 17%*

Consumer Loans CAGR 16%*

Non-Core Commercial Consumer

2001

*Includes SFFB in 2001 base

53% 21% 26% 3Q04 22% 32% 46% 27

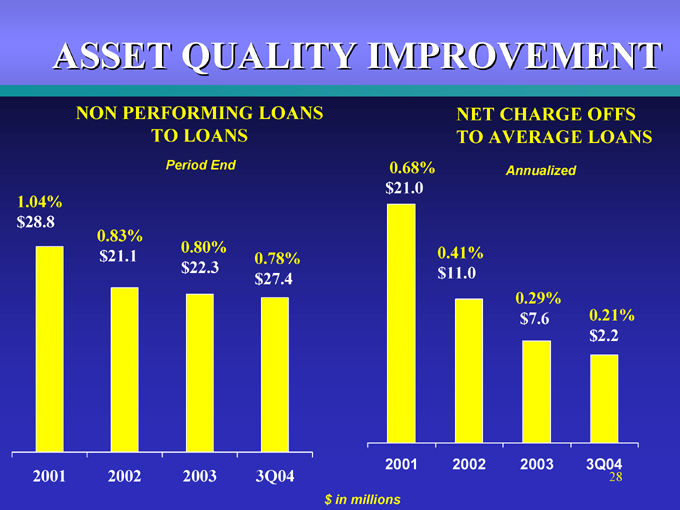

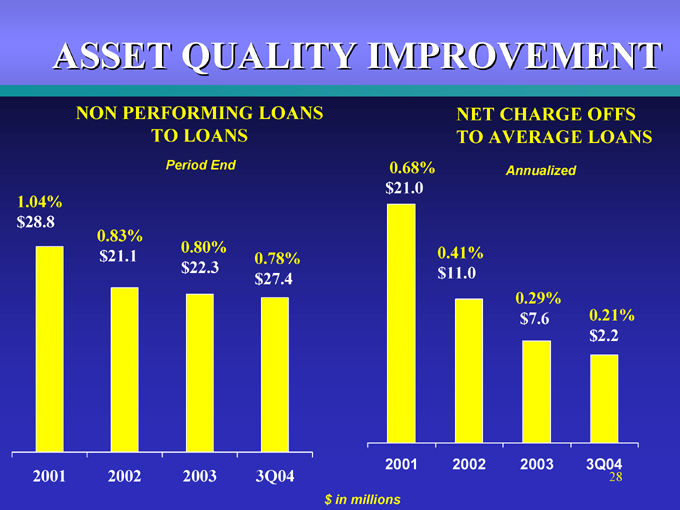

ASSET QUALITY IMPROVEMENT

$ in millions

NON PERFORMING LOANS

TO LOANS

Period End

1.04% $28.8

0.83% $21.1

0.80% $22.3

0.78% $27.4

2001 2002 2003 3Q04

NET CHARGE OFFS TO AVERAGE LOANS

Annualized

0.68% $21.0

0.41% $11.0

0.29% $7.6

0.21% $2.2

2001 2002 2003 3Q04

28

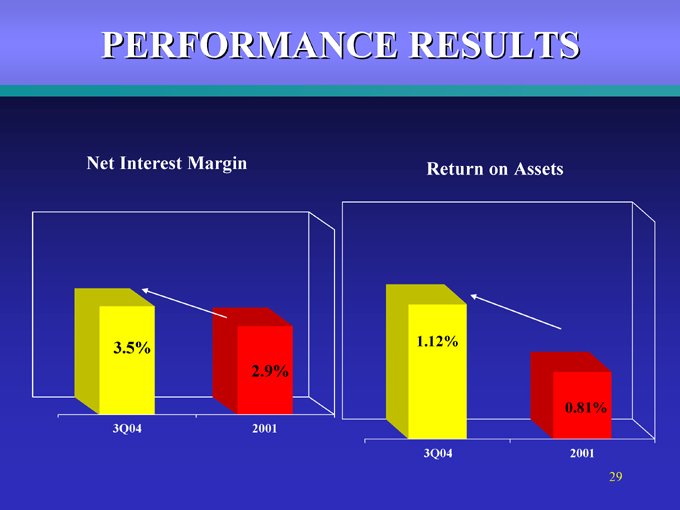

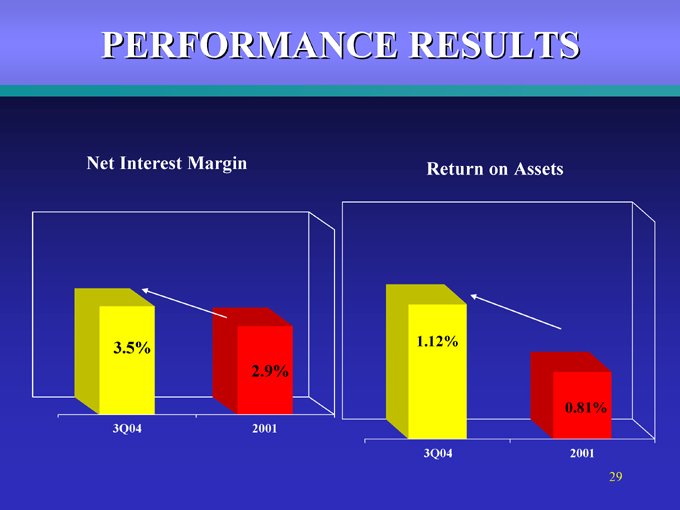

PERFORMANCE RESULTS

Net Interest Margin

2.9% 3.5% 3Q04 2001

Return on Assets

1.12% 0.81% 3Q04 2001

29

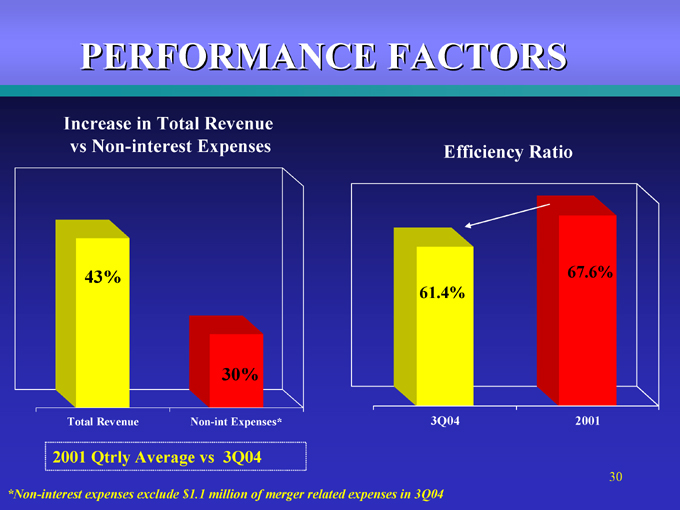

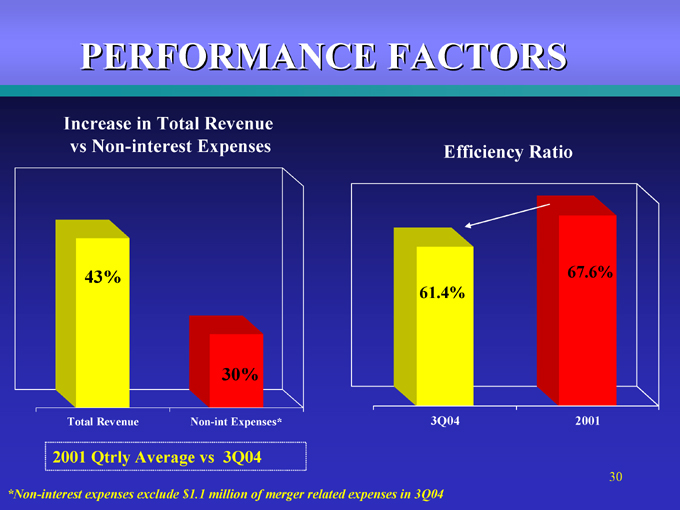

PERFORMANCE FACTORS

Increase in Total Revenue

vs Non-interest Expenses

43%

30%

3Q04

2001

Total Revenue

Non-int Expenses*

Efficiency Ratio

2001 Qtrly Average vs 3Q04

67.6%

61.4%

3Q04

2001

*Non-interest expenses exclude $1.1 million of merger related expenses in 3Q04

30

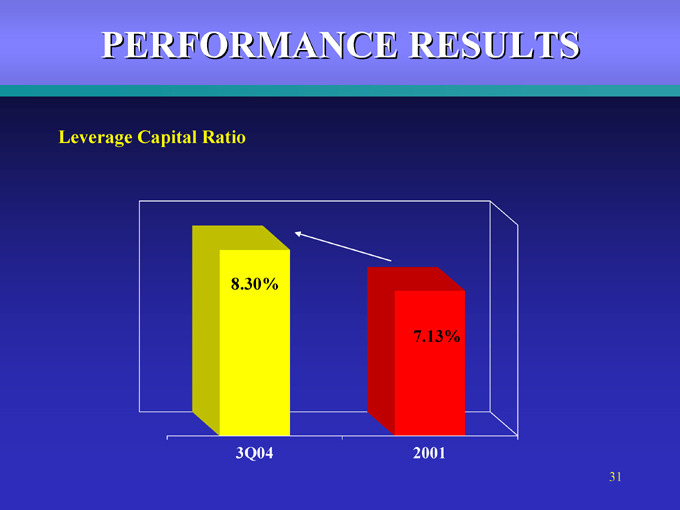

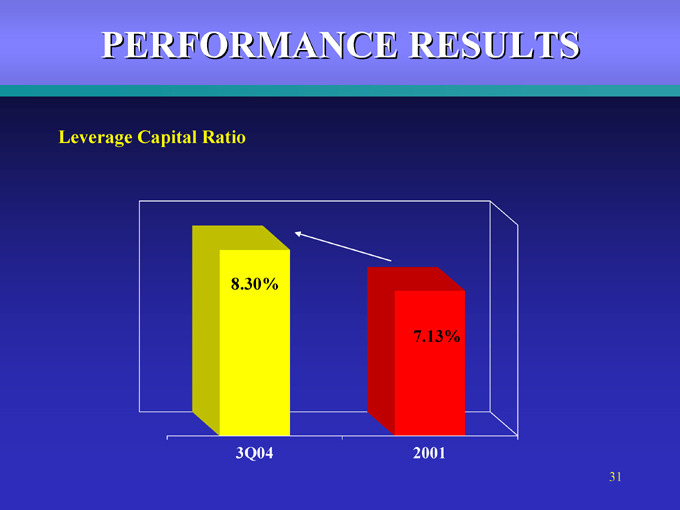

PERFORMANCE RESULTS

Leverage Capital Ratio

8.30%

7.13%

3Q04

2001

31

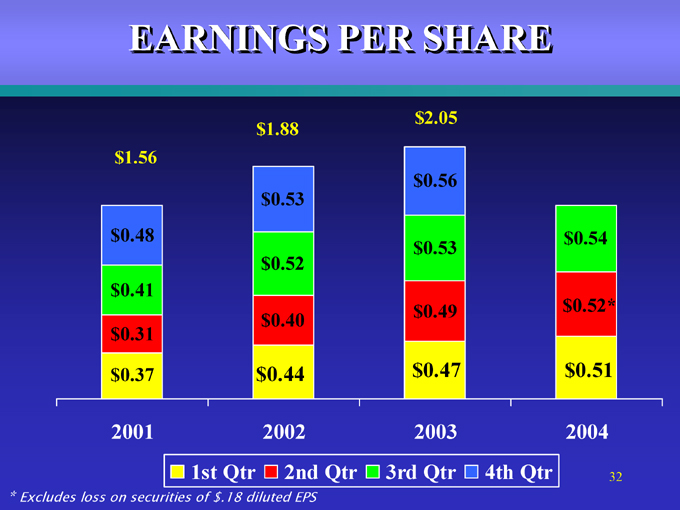

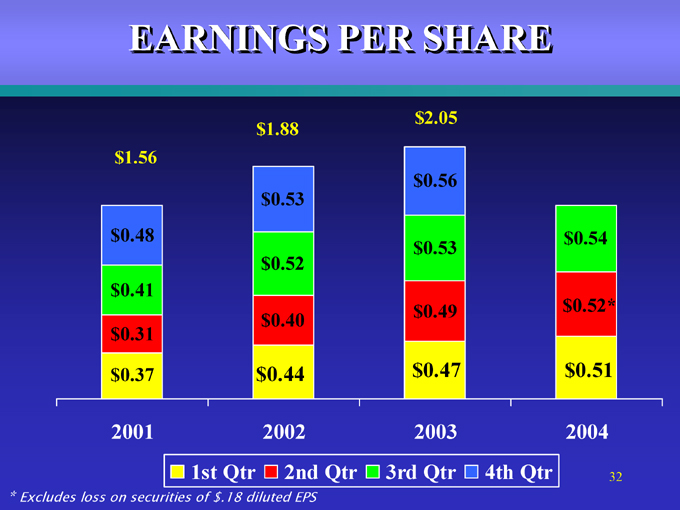

EARNINGS PER SHARE

$1.56 $1.88 $2.05 $0.40 $0.49 $0.41 $0.52 $0.53 $0.54 $0.48 $0.53 $0.56 $0.37 $0.44 $0.47 $0.51 $0.31 $0.52*

2001 2002 2003 2004

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

* Excludes loss on securities of $.18 diluted EPS

32

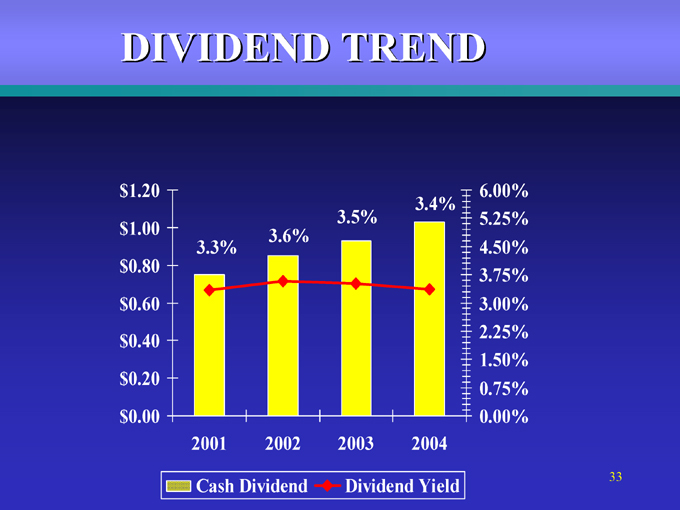

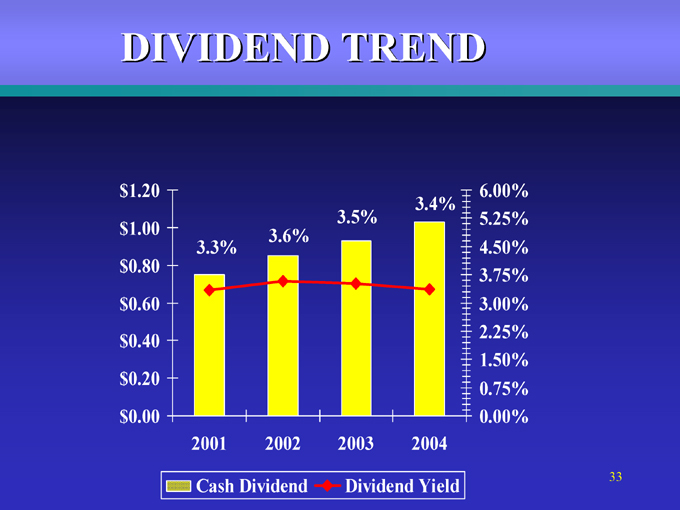

DIVIDEND TREND

3.3% 3.6% 3.5% 3.4%

$0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20

2001 2002 2003 2004

0.00% 0.75% 1.50% 2.25% 3.00% 3.75% 4.50% 5.25% 6.00%

Cash Dividend

Dividend Yield

33

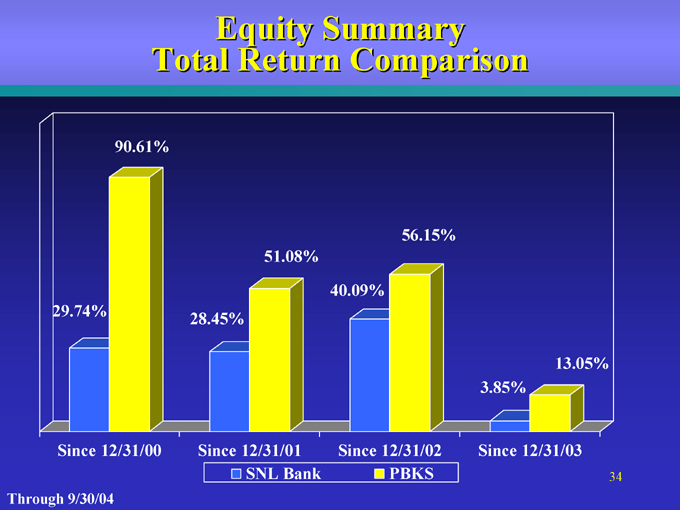

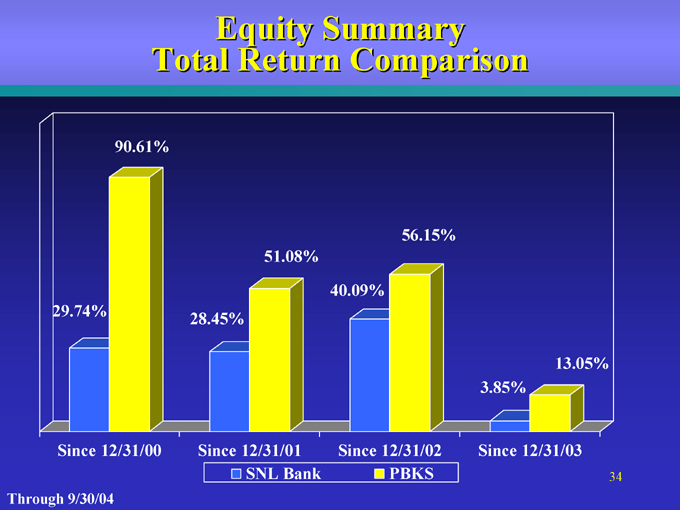

Equity Summary

Total Return Comparison

Through 9/30/04

29.74% 90.61% 28.45% 51.08% 40.09% 56.15% 3.85% 13.05%

Since 12/31/00

Since 12/31/01

Since 12/31/02

Since 12/31/03

SNL Bank

PBKS

34

INVESTMENT ATTRIBUTES

Core balance sheet momentum

Effective expansion strategy

Growing market share in attractive markets

Stable and improving credit quality

Experienced management team

PROVIDENT BANKSHARES

CORPORATION

35

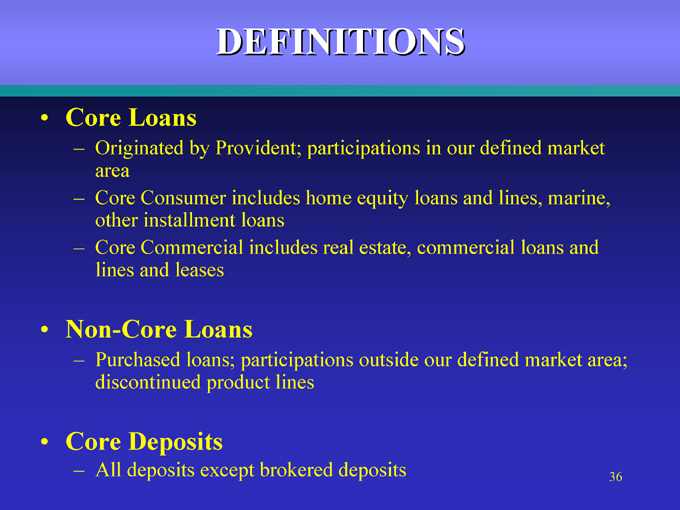

DEFINITIONS

Core Loans

Originated by Provident; participations in our defined market area

Core Consumer includes home equity loans and lines, marine, other installment loans

Core Commercial includes real estate, commercial loans and lines and leases

Non-Core Loans

Purchased loans; participations outside our defined market area; discontinued product lines

Core Deposits

All deposits except brokered deposits

36

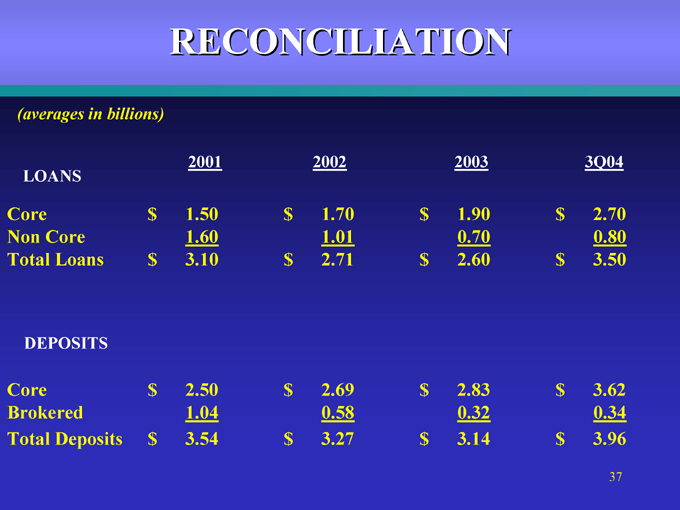

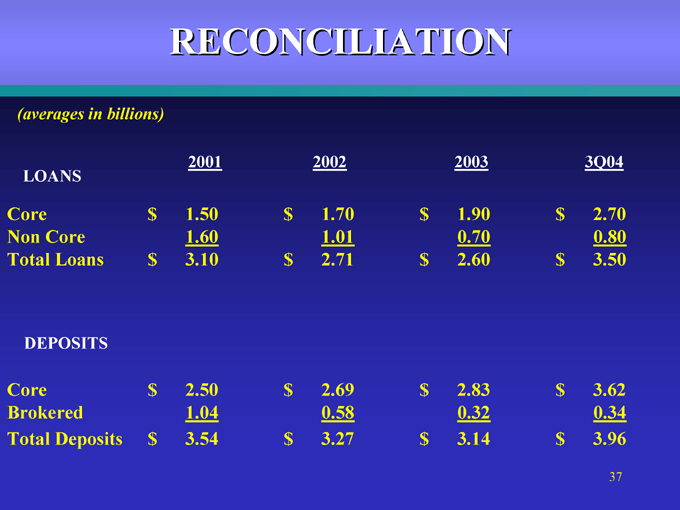

RECONCILIATION

(averages in billions)

LOANS

Core $ 1.50 $ 1.70 $ 1.90 $ 2.70

Non Core 1.60 1.01 0.70 0.80

Total Loans $ 3.10 $ 2.71 $ 2.60 $ 3.50

DEPOSITS

Core $ 2.50 $ 2.69 $ 2.83 $ 3.62

Brokered 1.04 0.58 0.32 0.34

Total Deposits $ 3.54 $ 3.27 $ 3.14 $ 3.96

2001

2002

2003

3Q04

37

PROVIDENT BANKSHARES

CORPORATION

(www.provbank.com)

Contact:

Media: Lillian Kilroy: (410) 277-2833

Investment Community: Tricia Ferrick: (703) 352-2583

PROVIDENT BANKSHARES

CORPORATION

38