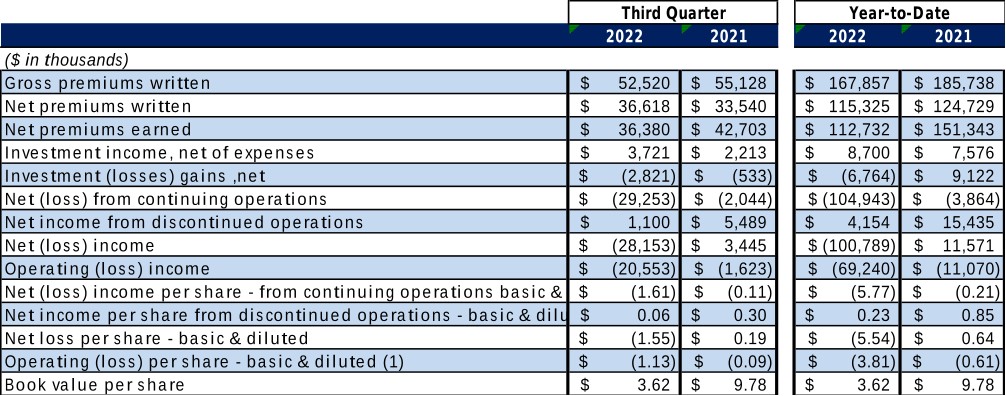

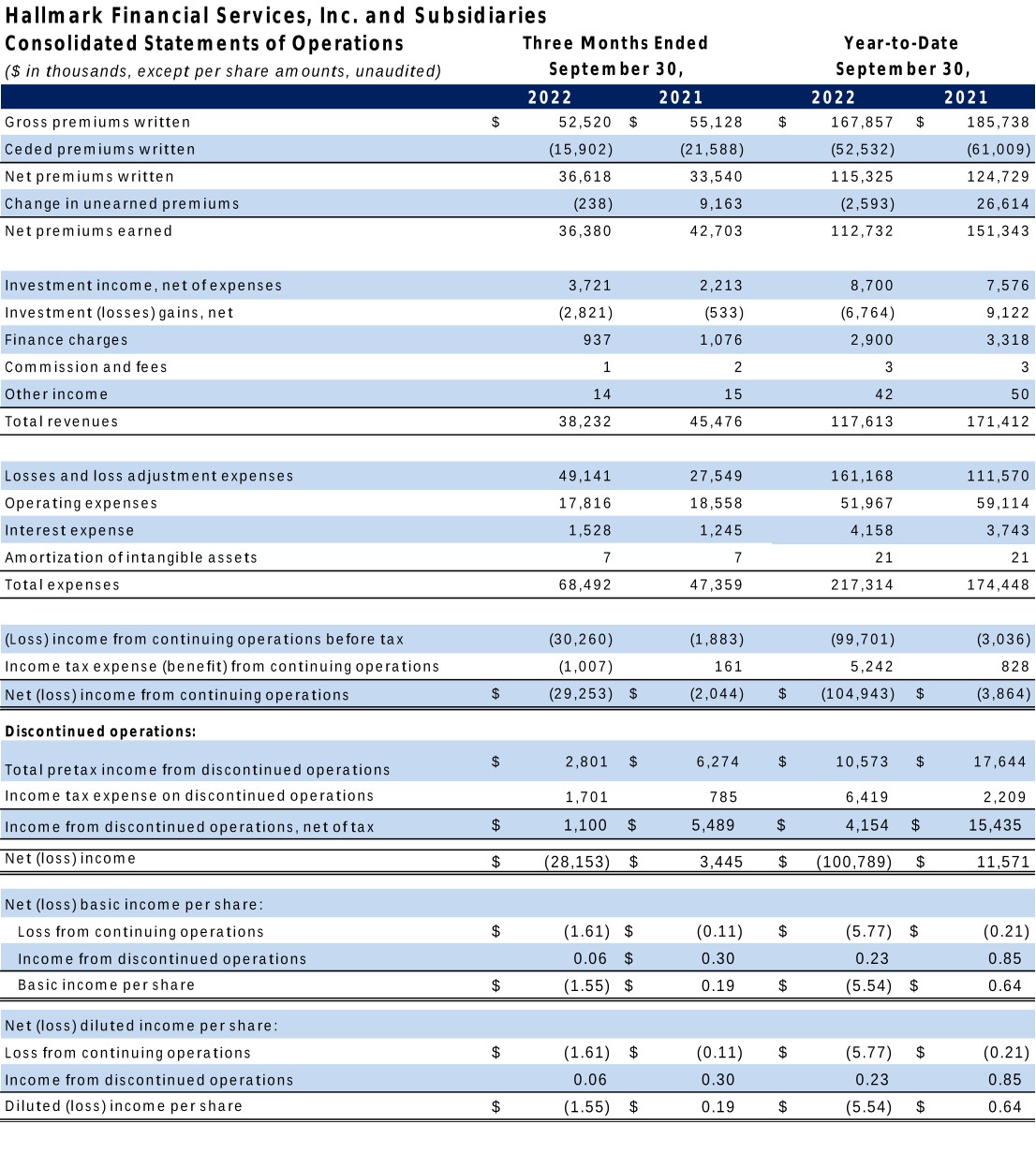

Net investment losses were $2.8 million for the third quarter of 2022 as compared to net investment losses of $0.5 million for the same period in 2021. In the current quarter, net investment losses include $3.3 million unrealized losses on common and preferred stocks.

Net investment losses were $6.8 million for the nine months ended September 30, 2022 as compared to net investment gains of $9.1 million for the same period in 2021. Year to date, net investment losses include $1.1 million realized gains on common stocks and $8.4 million unrealized losses on common and preferred stocks.

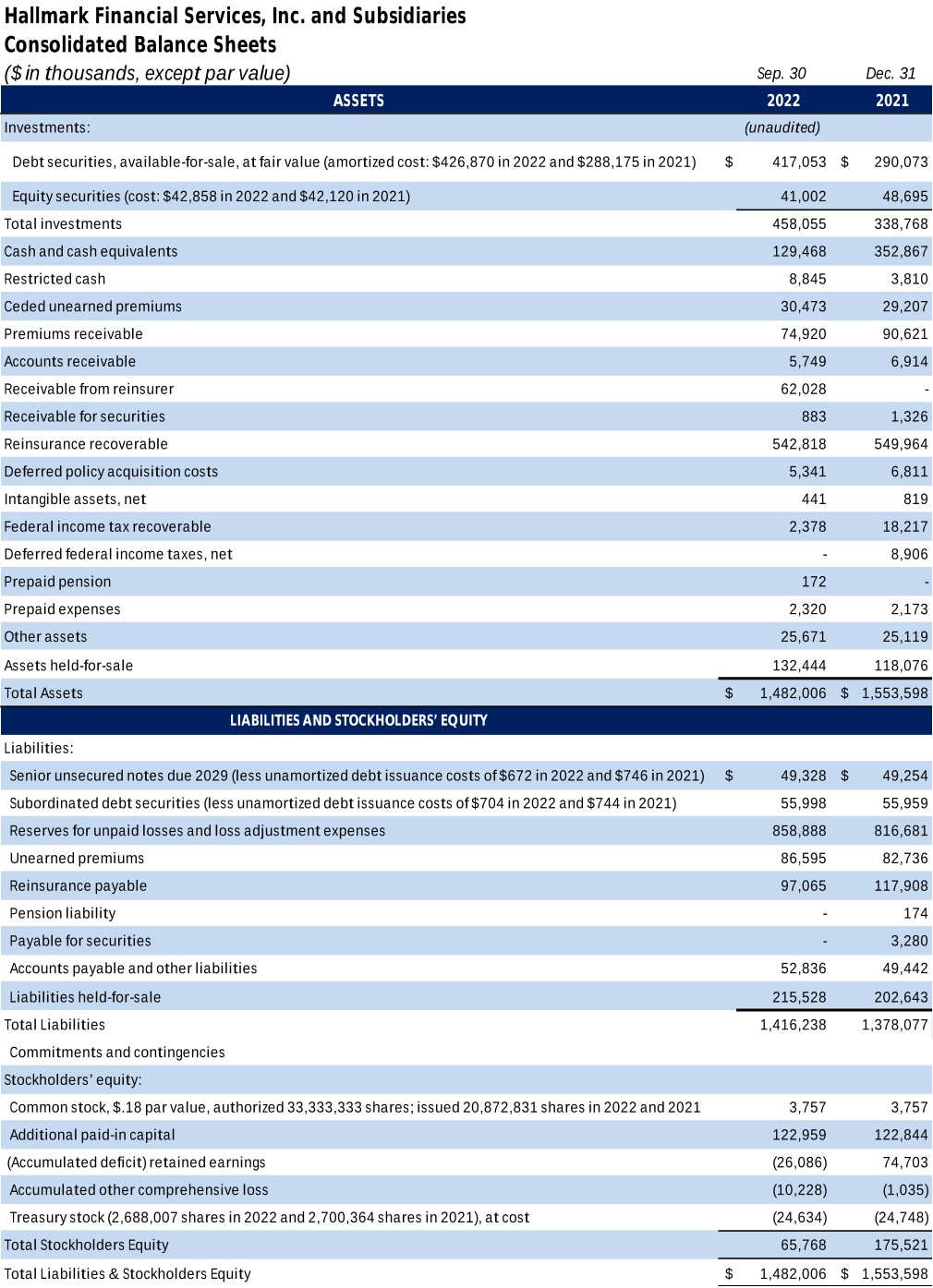

Fixed-income securities were $417.1 million at September 30, 2022, with a tax equivalent book yield of 3.3% compared to 2.4% as of December 31, 2021. As of September 30, 2022, the fixed-income portfolio had an average modified duration of 1.0 years and 85% of the securities had remaining time to maturity of five years or less. As of September 30, 2022, 9% of the investment portfolio was invested in equity securities.

Total investments were $458.1 million at September 30, 2022. Cash and cash equivalents, including restricted cash were $138.3 million. Total investments, cash and cash equivalents, and restricted cash were $596.4 million or $32.79 per share.

Pre-Tax (Loss) Income from Continuing Operations

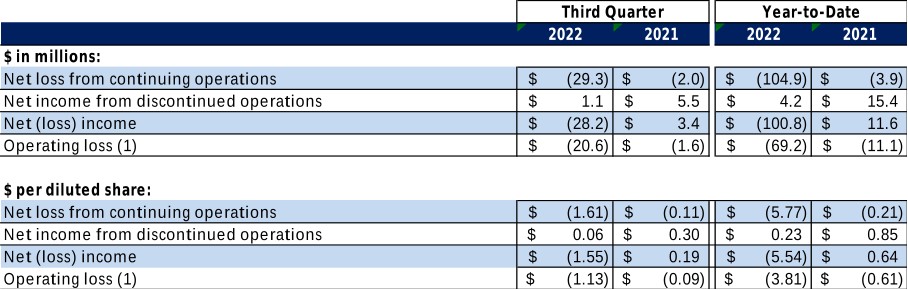

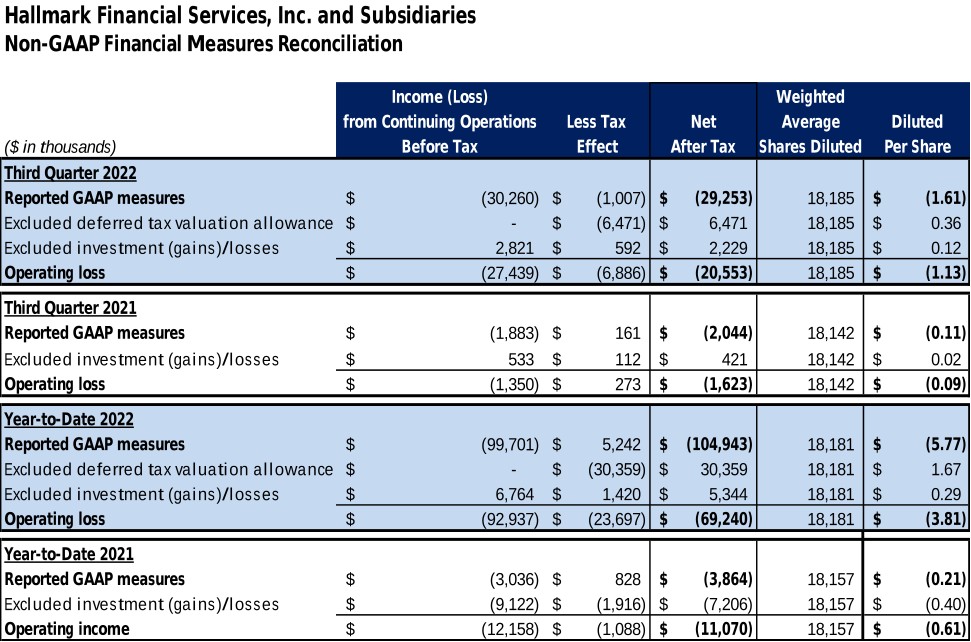

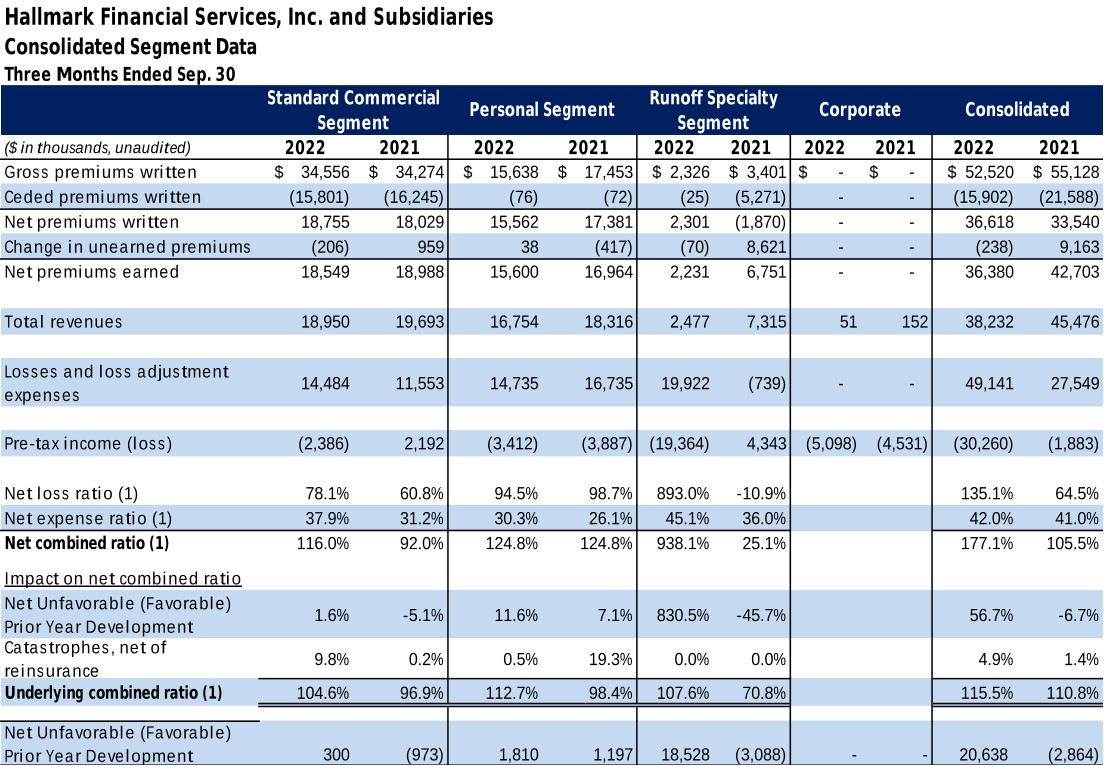

Pre-tax loss from continuing operations was $30.3 million for the three months ended September 30, 2022, as compared to a pre-tax loss from continuing operations of $1.9 million reported during the same period in 2021. The decline in pre-tax results from continuing operations for the third quarter of 2022 compared to the same period of the prior year was driven by higher losses and LAE of $21.6 million, lower net premiums earned of $6.3 million, higher net investment losses of $2.3 million, higher interest expense of $0.3 million and lower finance charges of $0.1 million, partially offset by higher net investment income of $1.5 million and lower operating expenses of $0.7 million.

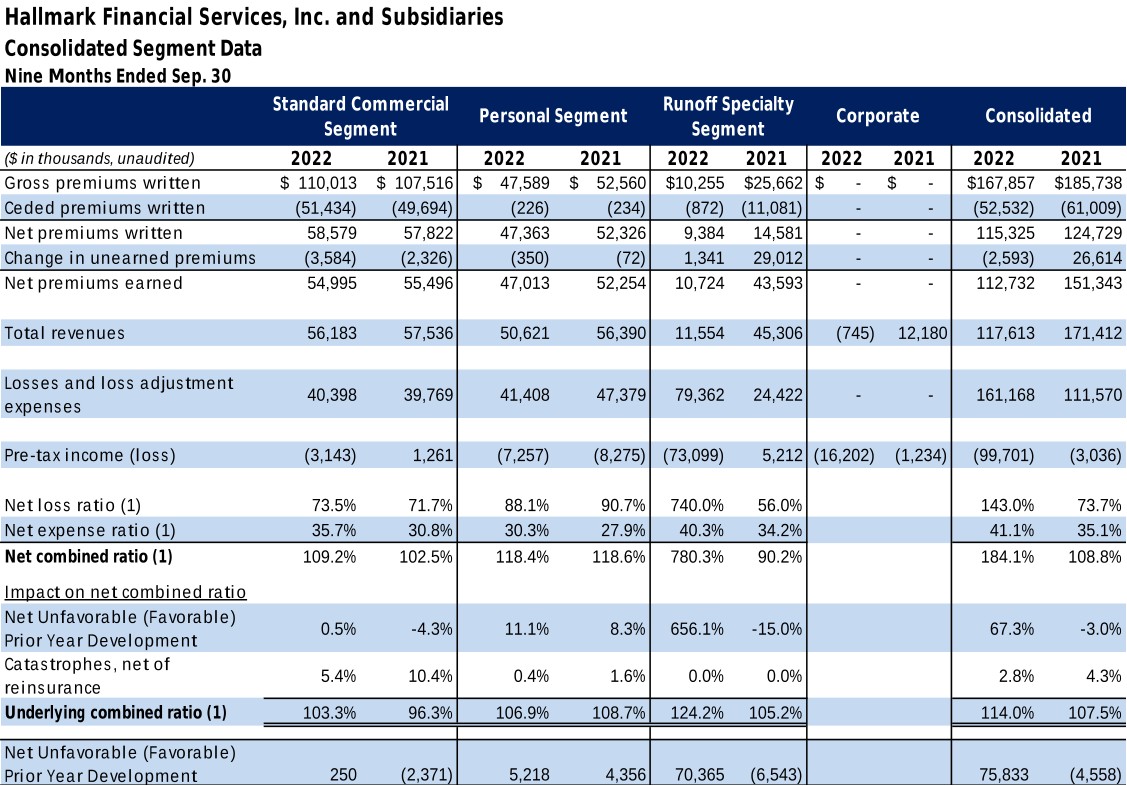

Pre-tax loss from continuing operations was $99.7 million for the nine months ended September 30, 2022, as compared to a pre-tax loss from continuing operations of $3.0 million reported for the same period the prior year. The decline in pre-tax results from continuing operations for the nine months ended September 30, 2022, was driven by higher losses and LAE of $49.6 million, lower net premiums earned of $38.6 million, net investment losses of $6.8 million compared to net investment gains of $9.1 million the prior year, lower finance charges of $0.4 million and higher interest expense of $0.4 million, partially offset by lower operating expenses of $7.1 million and higher net investment income of $1.1 million.

Loss and Loss Adjustment Expenses (“LAE”) from Continuing Operations

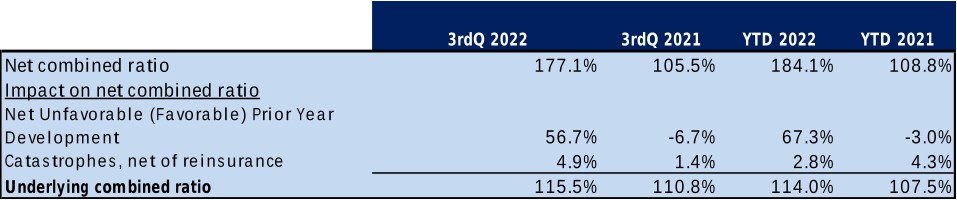

Losses and LAE increased by $21.6 million to $49.1 million for the three months ended September 30, 2022, as compared to the same period of the previous year. The increase in losses and LAE during the third quarter 2022 was primarily due to $20.6 million of adverse prior year loss reserve development, $14.0 million of which was from the exited contract binding line of the primary commercial automobile business, as compared to $2.9 million of favorable prior year loss reserve development for the same period the prior year, as well as higher catastrophe loss. Losses and LAE for the third quarter of 2022 included $1.8 million of net catastrophe losses as compared to $0.6 million during the same period of the prior year.

Losses and LAE increased by $49.6 million to $161.2 million for the nine months ended September 30, 2022, as compared to the same period of the previous year. The increase in losses and LAE for the first nine months of 2022 was primarily due to $75.8 million of unfavorable prior year loss reserve development, $58.4 million of which was from the exited contract binding line of the primary commercial automobile business, as compared to $4.6 million of favorable prior year loss reserve development for the prior year period, partially offset by lower net catastrophe losses. Losses and LAE for the nine months ended September 30, 2022,