| | OMB APPROVAL |

| | OMB Number: 3235-0570 |

| | Expires: November 30, 2005 |

| | Estimated average burden

hours per response. . . . 5.0 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05309

First American Investment Funds, Inc.

(Exact name of registrant as specified in charter)

800 Nicollet Mall, Minneapolis, MN | | 55402 |

(Address of principal executive offices) | | (Zip code) |

Charles D. Gariboldi 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: September 30

Date of reporting period: September 30, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Report to Shareholders

| 2004

Annual Report |

| |

| INCOME

FUNDS |

First American Income Funds

First American Income Funds are comprised of taxable bonds, which are debt obligations issued by a government, federal agency, or corporation to raise money. Investors lend money to the issuer until the bond matures and, in exchange, receive regular interest payments at a predetermined rate. Income funds generate income that is normally subject to federal, state, and local taxes.

TABLE OF CONTENTS

Message to Shareholders | |

Report of Independent Registered Public Accounting Firm | |

Schedule of Investments | |

Statements of Assets and Liabilities | |

Statements of Operations | |

Statements of Changes in Net Assets | |

Financial Highlights | |

Notes to Financial Statements | |

Notice to Shareholders | |

Mutual fund investing involves risk; principal loss is possible. |

| |

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE |

Message to SHAREHOLDERS November 15, 2004

Dear Shareholders:

We invite you to take a few minutes to review the results of the fiscal year ended September 30, 2004.

This report includes comparative performance graphs and tables, portfolio commentaries, complete listings of portfolio holdings, and additional fund information. We hope you will find this helpful in monitoring your investment portfolio.

Also, through our website, firstamericanfunds.com, we provide quarterly performance fact sheets on all First American funds, the economic outlook as viewed by our senior investment officers, and other information about fund investments and portfolio strategies.

Please contact your financial professional if you have questions about First American Funds or contact First American Investor Services at 800.677.FUND.

We appreciate your investment with First American Funds and look forward to serving your financial needs in the future.

Sincerely,

/s/ Virginia L. Stringer | | /s/ Thomas S. Schreier | |

Virginia L. Stringer | Thomas S. Schreier, Jr. |

Chairperson of the Board | President |

First American Investment Funds, Inc. | First American Investment Funds, Inc. |

1

Core Bond fund

Investment Objective: high current income consistent with limited risk to capital

How did the Fund perform for the fiscal year ended September 30, 2004?

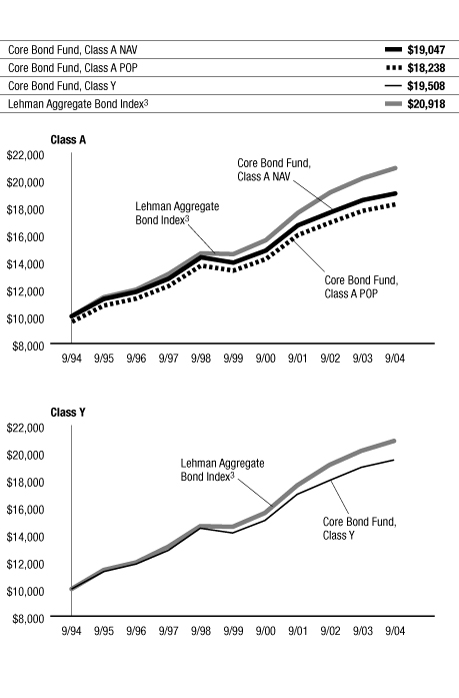

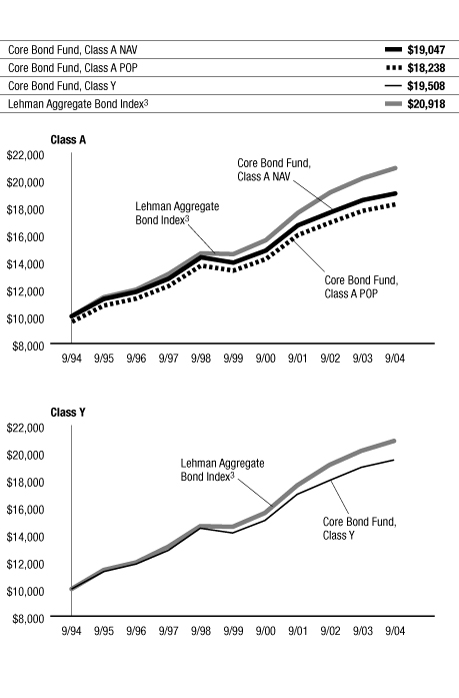

The First American Core Bond Fund, Class Y shares, returned 2.87% for the fiscal year ended September 30, 2004 (Class A shares returned 2.60% at net asset value). By comparison, the Fund's benchmark, the Lehman Aggregate Bond Index*, returned 3.68% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured strong gains in productivity, and a significant rise in corporate profits. Sharp gains in payrolls from March through May 2004, along with higher inflation during the early months of the year, led the Federal Reserve to increase its target interest rate.

However, in spite of three 25-basis-point increases in the Federal Funds rate, long-term rates actually fell during the summer. Rapidly rising oil prices and heightened

geo-political uncertainty fueled fears of slower economic growth, which in turn pushed intermediate rates down by nearly 75 basis points.

During the course of the fiscal year, longer-term interest rates were nearly unchanged while short-term rates were 1% higher. This stability in longer-term rates resulted in fixed-income returns that were much better than those experienced in previous Fed tightening cycles.

What worked for the Fund and why?

The Fund was overweight relative to its benchmark in BBB-rated securities and asset-backed securities, both of which performed very well over the fiscal year. The Fund also benefited from tactical trading (short-term trading) of Treasury Inflation Protected Securities, which offered value at various points during the fiscal year. The Fund

was also positioned to benefit from a flatter yield curve as we built a substantial position in high-quality, one-year adjustable rate mortgages that boosted portfolio income with minor price volatility. As short-term interest rates rose throughout the year, the reset feature of the adjustable rate mortgages was advantageous in generating income.

What did not work for the Fund and why?

While our economic growth forecasts and predictions of Fed tightening were fairly accurate, we underestimated the extent, and perceived economic impact of the rise in crude oil prices in mid-2004. Concurrent with the onset of Fed tightening, we became overly defensive with our interest-rate strategy during a period of falling rates. As a result, while absolute returns were much better than we expected, the portfolio lagged the benchmark during the latter part of the fiscal year.

What strategic moves were made by the Fund and why?

We believe that the economy will continue to expand and inflationary pressures will mount, putting additional upward pressure on interest rates. Accordingly, the Fund's duration is shorter relative to the benchmark and we maintain a significant curve flattening strategy (underweighting intermediate-term securities within this Fund).

We continue to believe that there is upside potential in lower-rated investment-grade credit and are overweight in the BBB credit quality sector as credit fundamentals appear solid.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

Portfolio Allocation as of September 30, 20041 (% of net assets)

| Mortgage Backed | | | 43.6 | % | |

| Corporate Bond | | | 19.5 | % | |

| Asset Backed | | | 18.0 | % | |

| U.S. Government Agency | | | 17.4 | % | |

| Cash Equivalents | | | 2.4 | % | |

| General Obligations | | | 1.6 | % | |

| U.S. Treasury | | | 0.1 | % | |

Credit Quality Distribution as of September 30, 20042 (% of net assets)

| AAA/Aaa | | | 79.5 | % | |

| AA/Aa | | | 1.3 | % | |

| A | | | 4.5 | % | |

| BBB/Baa | | | 13.5 | % | |

| Nonrated | | | 1.2 | % | |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

2The ratings in the above table reflect either the only rating provided by Standard and Poor's or Moody's, or the highest rating provided by the respective rating agency.

Standard and Poor's and Moody's are nationally recognized independent rating agencies for bonds.

FIRST AMERICAN FUNDS Annual Report 2004

2

Core Bond fund continued

Annualized Performance1 as of September 30, 2004

| | | | | | | | | Since Inception | |

| | | 1 year | | 5 years | | 10 years | | 2/1/1999 | | 9/24/2001 | |

| Average annual return with sales charge (POP) | | | |

| Class A | | | (1.73 | %) | | | 5.49 | % | | | 6.19 | % | | | - | | | | - | | |

| Class B | | | (3.05 | %) | | | 5.32 | % | | | 5.86 | % | | | - | | | | - | | |

| Class C | | | 0.83 | % | | | 5.61 | % | | | - | | | | 4.42 | % | | | - | | |

| Average annual return without sales charge (NAV) | | | |

| Class A | | | 2.60 | % | | | 6.41 | % | | | 6.66 | % | | | - | | | | - | | |

| Class B | | | 1.83 | % | | | 5.64 | % | | | 5.86 | % | | | - | | | | - | | |

| Class C | | | 1.81 | % | | | 5.61 | % | | | - | | | | 4.42 | % | | | - | | |

| Class R4 | | | 2.53 | % | | | - | | | | - | | | | - | | | | 4.70 | % | |

| Class Y | | | 2.87 | % | | | 6.67 | % | | | 6.91 | % | | | - | | | | - | | |

| Lehman Aggregate Bond Index3 | | | 3.68 | % | | | 7.48 | % | | | 7.66 | % | | | 6.38 | % | | | 6.07 | % | |

Value of $10,000 Investment1, 2 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative purposes only, does not reflect any expenses, transaction costs, or cash flow effects, and is not available for investment.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including maximum sales charges of 4.25% for Class A shares and the maximum contingent deferred sales charge ("CDSC") for Class B and Class C shares for the relevant period. Maximum CDSC is 5.00% for Class B shares, decreasing annually to 0% in the seventh year following purchase, and 1.00% for Class C shares. Total returns assume reinvestment of all distributions at NAV.

Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

2 Performance for Class B, Class C, and Class R shares is not presented. Performance for these classes will vary due to different expense structures.

3 An unmanaged index comprised of the Lehman Government/Credit Bond Index, the Lehman Mortgage Backed Securities Index, and the Lehman Asset Backed Securities Index. The Lehman Government/Credit Bond Index is comprised of Treasury securities, other securities issued or guaranteed by the U.S. government or its agencies or instrumentalities, including U.S. agency mortgage securities, and investment-grade corporate debt securities. The Lehman Mortgage Backed Securities Index is comprised of the mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae, and Freddie Mac. The Lehman Asset Backed Securities Index is comprised of debt securities rated investment grade or higher that are backed by credit card, auto, and home equity loans.

4 Prior to July 1, 2004, Class R shares were designated Class S shares, which had lower fees and expenses. Performance information prior to that date is based on the performance of the Class S shares. If current fees and expenses had been in effect for the entire period presented, performance would have been lower. Please refer to the prospectus for details.

FIRST AMERICAN FUNDS Annual Report 2004

3

Core Bond fund continued

Expense Example

As a shareholder of the Core Bond Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 999.30 | | | $ | 4.75 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.25 | | | $ | 4.80 | | |

| Class B Actual | | $ | 1,000.00 | | | $ | 995.50 | | | $ | 8.48 | | |

| Class B Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.50 | | | $ | 8.57 | | |

| Class C Actual | | $ | 1,000.00 | | | $ | 995.50 | | | $ | 8.48 | | |

| Class C Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.50 | | | $ | 8.57 | | |

| Class R Actual2 | | $ | 1,000.00 | | | $ | 998.60 | | | $ | 5.37 | | |

| Class R Hypothetical (5% return before expenses)2 | | $ | 1,000.00 | | | $ | 1,019.62 | | | $ | 5.43 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 1,000.60 | | | $ | 3.50 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.50 | | | $ | 3.54 | | |

1Expenses are equal to the Fund's annualized expense ratio of 0.95%, 1.70%, 1.70%, 1.08%, and 0.70% for Class A, Class B, Class C, Class R, and Class Y, respectively, mulitplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

2Prior to July 1, 2004, Class R had a different expense ratio. Had the current expense ratio been in place for the most recent one-half year, the actual and hypothetical expenses would have been $6.00 and $6.06, respectively.

FIRST AMERICAN FUNDS Annual Report 2004

4

Corporate Bond fund

Investment Objective: high current income consistent with prudent risk to capital

How did the Fund perform for the fiscal year ended September 30, 2004?

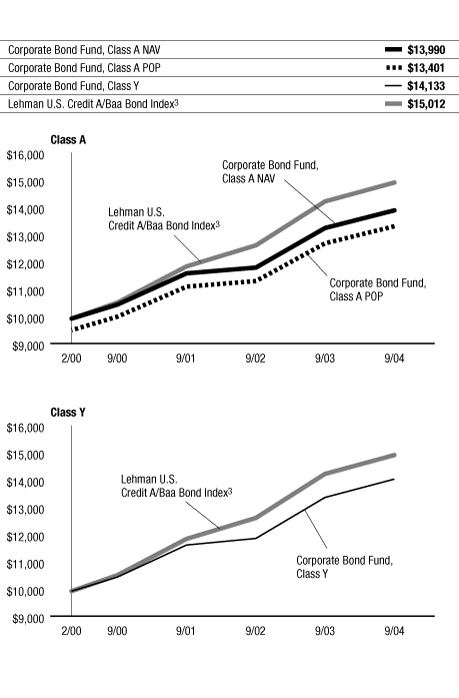

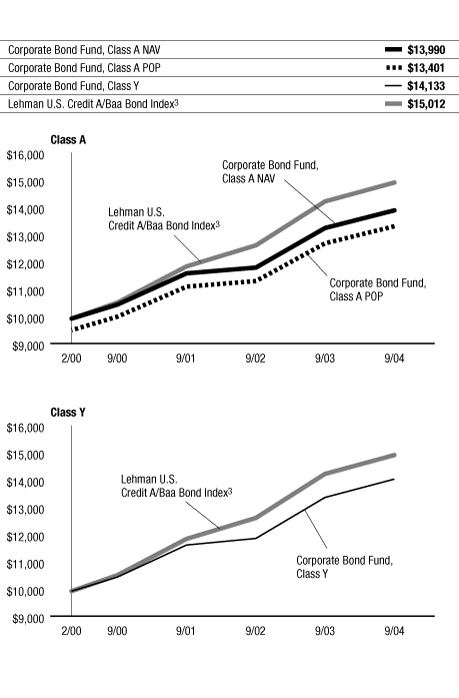

The First American Corporate Bond Fund, Class Y shares, returned 5.05% for the fiscal year ended September 30, 2004 (Class A shares returned 4.89% at net asset value). By comparison, the Fund's benchmark, the Lehman U.S. Credit A/Baa Bond Index*, returned 4.82% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured strong gains in productivity, and a significant rise in corporate profits. Sharp gains in payrolls from March through May 2004, along with higher inflation during the early months of the year, led the Federal Reserve to increase its target interest rate.

However, in spite of three 25-basis-point increases in the Federal Funds rate, long-term rates actually fell during the summer. Rapidly rising oil prices and heightened

geo-political uncertainty fueled fears of below-trend growth, which in turn pushed intermediate rates down by nearly 75 basis points.

During the course of the fiscal year, longer-term interest rates were nearly unchanged while short-term rates were 1% higher. This stability in longer-term rates resulted in fixed-income returns that were much better than those experienced in previous Fed tightening cycles.

What worked for the Fund and why?

The Fund's high-yield exposure – primarily in BBs – enhanced performance as high yield outperformed all fixed-income sectors. Average credit quality was slightly lower than the benchmark, aiding performance as lower

credit bonds outperformed. The Fund's overweight positions in utilities and autos and underweight position in banks were positive contributors to performance.

What did not work for the Fund and why?

The Fund's overweight positions in telecommunications and REITs and an underweight position in technology relative to the benchmark hurt the Fund's performance. The Fund's short duration strategy detracted from performance as long-term interest rates fell over the summer on fears of the impact of rising oil prices. Additionally, isolated event risk impacted a few holdings.

What strategic moves were made by the Fund and why?

The Fund's high-yield exposure was modestly increased during the year, as we believed that improving economic fundamentals would benefit lower rated companies. A short duration strategy was adopted given our view that low, longer-term interest rates were not reflective of the general economic conditions. We still believe that the economy will continue to expand and inflationary pressures will mount, putting additional upward pressure on interest rates. Accordingly, the Fund's duration is shorter relative to the benchmark.

The Fund continues to hold overweight positions in electric utilities, cable, and paper and underweight positions in food and beverage, banking, and technology sectors as the new fiscal year begins.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

Portfolio Allocation as of September 30, 20041 (% of net assets)

| Corporate Bond | | | 91.6 | % | |

| U.S. Government Agency | | | 2.7 | % | |

| Cash Equivalents | | | 2.0 | % | |

| Asset Backed | | | 1.4 | % | |

| Mortgage Backed | | | 1.0 | % | |

| Preferred Stock | | | 0.2 | % | |

| U.S. Treasury | | | 0.1 | % | |

Credit Quality Distribution as of September 30, 20042 (% of net assets)

| AAA/Aaa | | | 6.1 | % | |

| AA/Aa | | | 9.0 | % | |

| A | | | 34.4 | % | |

| BBB/Baa | | | 39.0 | % | |

| BB/Ba | | | 7.1 | % | |

| B | | | 2.5 | % | |

| Nonrated | | | 1.9 | % | |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

2The ratings in the above table reflect either the only rating provided by Standard and Poor's or Moody's, or the highest rating provided by the respective rating agency.

Standard and Poor's and Moody's are nationally recognized independent rating agencies for bonds.

FIRST AMERICAN FUNDS Annual Report 2004

5

Corporate Bond fund continued

Annualized Performance1 as of September 30, 2004

| | | | | Since Inception | |

| | | 1 year | | 2/1/20005 | | 9/24/20016 | |

| Average annual return with sales charge (POP) | |

| Class A | | | 0.47 | % | | | 6.48 | % | | | - | | |

| Class B | | | (1.03 | %) | | | 6.30 | % | | | - | | |

| Class C | | | 3.11 | % | | | 6.63 | % | | | - | | |

| Average annual return without sales charge (NAV) | |

| Class A | | | 4.89 | % | | | 7.47 | % | | | - | | |

| Class B | | | 3.97 | % | | | 6.64 | % | | | - | | |

| Class C | | | 4.11 | % | | | 6.63 | % | | | - | | |

| Class R4 | | | 4.82 | % | | | - | | | | 6.46 | % | |

| Class Y | | | 5.05 | % | | | 7.70 | % | | | - | | |

| Lehman U.S. Credit A/Baa Bond Index3 | | | 4.82 | % | | | 9.10 | % | | | 7.97 | % | |

Value of $10,000 Investment1, 2 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative pu rposes only, does not reflect any expenses, transaction costs, or cash flow effects, and is not available for investment.

A significant portion of the Fund's portfolio may consist of lower-rated debt obligations, which are commonly called "high-yield" securities or "junk bonds." High-yield securities generally have more volatile prices and carry more risk to principal than investment-grade securities. The Fund may also invest in foreign securities. International investing involves risks not typically associated with domestic investing including risks of adverse currency fluctuations, potential political and economic instability, different accounting standards, limited liquidity, and volatile prices. Performance reflects voluntary fee waivers in effect. In the absence of such fee w aivers, total returns would be reduced.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including maximum sales charges of 4.25% for Class A shares and the maximum contingent deferred sales charge ("CDSC") for Class B and Class C shares for the relevant period. Maximum CDSC is 5.00% for Class B shares, decreasing annually to 0% in the seventh year following purchase, and 1.00% for Class C shares. Total returns assume reinvestment of all distributions at NAV.

Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

2 Performance for Class B, Class C, and Class R shares is not presented. Performance for these classes will vary due to different expense structures.

3 An unmanaged index comprised of fixed-rate, dollar-denominated U.S. corporate securities with at least one year to final maturity. Securities must be rated BBB or A based on the lower of Moody's and Standard & Poor's ratings, and must have a minimum issue size of $250 million. Rule 144A securities with registration rights are included in the index.

4 Prior to July 1, 2004, Class R shares were designated Class S shares, which had lower fees and expenses. Performance information prior to that date is based on the performance of the Class S shares. If current fees and expenses had been in effect for the entire period presented, performance would have been lower. Please refer to the prospectus for details.

5 The performance since inception for the index is calculated from the previous month end prior to the inception of the class.

6 The performance since inception for the index is calculated from the month-end following the inception of the class.

FIRST AMERICAN FUNDS Annual Report 2004

6

Corporate Bond fund continued

Expense Example

As a shareholder of the Corporate Bond Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 1,003.30 | | | $ | 5.01 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.00 | | | $ | 5.05 | | |

| Class B Actual | | $ | 1,000.00 | | | $ | 999.00 | | | $ | 8.75 | | |

| Class B Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.25 | | | $ | 8.82 | | |

| Class C Actual | | $ | 1,000.00 | | | $ | 1,000.30 | | | $ | 8.75 | | |

| Class C Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.25 | | | $ | 8.82 | | |

| Class R Actual2 | | $ | 1,000.00 | | | $ | 1,002.70 | | | $ | 5.64 | | |

| Class R Hypothetical (5% return before expenses)2 | | $ | 1,000.00 | | | $ | 1,019.37 | | | $ | 5.68 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 1,004.50 | | | $ | 3.76 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.25 | | | $ | 3.79 | | |

1Expenses are equal to the Fund's annualized expense ratio of 1.00%, 1.75%, 1.75%, 1.13%, and 0.75% for Class A, Class B, Class C, Class R, and Class Y, respectively, mulitplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

2Prior to July 1, 2004, Class R had a different expense ratio. Had the current expense ratio been in place for the most recent one-half year, the actual and hypothetical expense would have been $6.26 and $6.31, respectively.

FIRST AMERICAN FUNDS Annual Report 2004

7

High Income Bond fund

Investment Objective: high current income

How did the Fund perform for the fiscal year ended September 30, 2004?

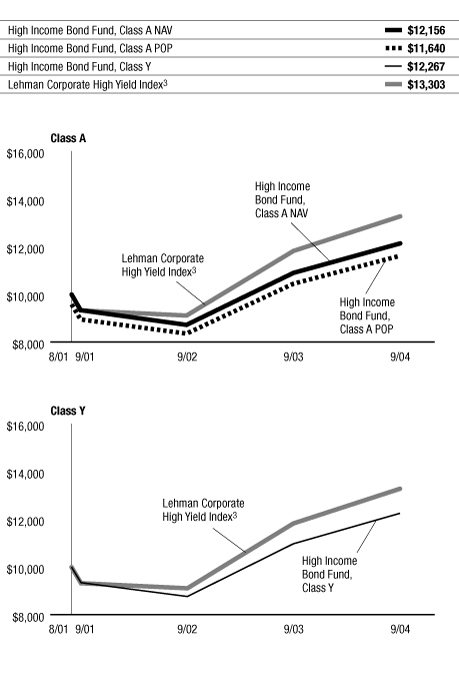

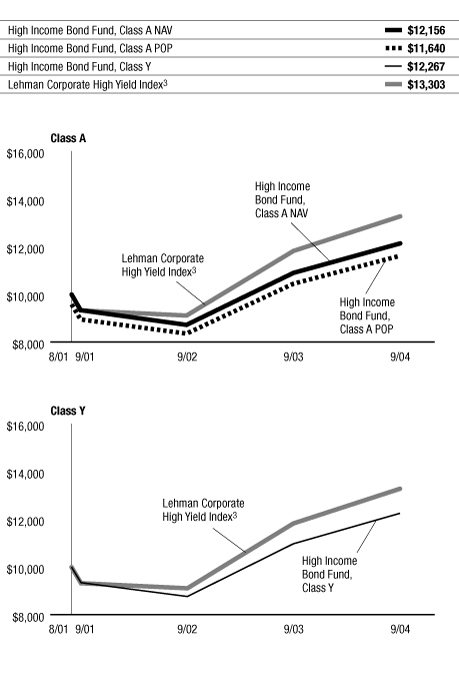

The First American High Income Bond Fund, Class Y shares, returned 11.69% for the fiscal year ended September 30, 2004 (Class A shares returned 11.30% at net asset value). By comparison, the Fund's benchmark, the Lehman Corporate High Yield Index*, returned 12.55% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured strong gains in productivity, and a significant rise in corporate profits. Sharp gains in payrolls from March through May 2004, along with higher inflation during the early months of the year, led the Federal Reserve to increase its target interest rate.

However, in spite of three 25-basis-point increases in the Federal Funds rate, long-term rates actually fell during the summer. Rapidly rising oil prices and heightened

geo-political uncertainty fueled fears of below-trend growth, which in turn pushed intermediate rates down by nearly 75 basis points.

During the course of the fiscal year, longer-term interest rates were nearly unchanged while short-term rates were 1% higher. This stability in longer-term rates resulted in fixed-income returns that were much better than those experienced in previous Fed tightening cycles.

What worked for the Fund and why?

Most of the decisions that affected the Fund during the year were related to individual security selection. Benefiting the Fund were selections in Alamosa, Alliance Imaging, Dynegy, Hollywood Entertainment, Huntsman Chemical, International Steel Group, Levi, Nalco Chemical, and PolyOne. Also contributing to good returns were positions taken in emerging markets, particularly in Russia and Brazil.

What did not work for the Fund and why?

Adverse security selection also impacted performance during the fiscal year. The Fund was hurt by overweights in names such as American Cellular, Bally's Total Fitness, Charter Communications, Duane Reade, Hanger Orthopedics, MGM Mirage, Muzak, Toys-R-Us, and United Airlines.

What strategic moves were made by the Fund and why?

Sector weights remained near the benchmark index, with overweight positions in the basic industries offset by underweight positions in healthcare and consumer cyclicals. Overall credit quality remained near that of the benchmark. We have begun to use the funded Dow Jones CDX (futures contract based on Dow Jones Credit Index) products as a way to enter and exit the market quickly in order to adjust portfolio quality and manage cash balances.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

Portfolio Allocation as of September 30, 20041 (% of net assets)

| Corporate Bonds | | | 94.2 | % | |

| Cash Equivalents | | | 2.1 | % | |

| U.S. Government Agency | | | 0.9 | % | |

| Preferred Stock | | | 0.4 | % | |

Credit Quality Distribution as of September 30, 20042 (% of net assets)

| Aaa | | | 3.0 | % | |

| Baa | | | 2.5 | % | |

| Ba | | | 32.8 | % | |

| B | | | 42.2 | % | |

| Caa | | | 12.4 | % | |

| Ca | | | 0.8 | % | |

| Nonrated | | | 6.3 | % | |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

2The ratings disclosed are provided by Moody's.

Moody's is a nationally recognized independent rating agency for bonds.

FIRST AMERICAN FUNDS Annual Report 2004

8

High Income Bond fund continued

Annualized Performance1 as of September 30, 2004

| | | | | Since Inception | |

| | | 1 year | | 8/30/2001 | | 9/24/2001 | |

| Average annual return with sales charge (POP) | |

| Class A | | | 6.52 | % | | | 5.05 | % | | | - | | |

| Class B | | | 5.52 | % | | | 5.01 | % | | | - | | |

| Class C | | | 9.51 | % | | | 5.76 | % | | | - | | |

| Average annual return without sales charge (NAV) | |

| Class A | | | 11.30 | % | | | 6.53 | % | | | - | | |

| Class B | | | 10.52 | % | | | 5.84 | % | | | - | | |

| Class C | | | 10.51 | % | | | 5.76 | % | | | - | | |

| Class R4 | | | 11.29 | % | | | - | | | | 8.40 | % | |

| Class Y | | | 11.69 | % | | | 6.85 | % | | | - | | |

| Lehman Corporate High Yield Index3 | | | 12.55 | % | | | 9.69 | % | | | 11.93 | % | |

Value of $10,000 Investment1, 2 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative purposes only, does not reflect any expenses, transaction costs, or cash flow effects, and is not available for investment.

A significant portion of the Fund's portfolio may consist of lower-rated debt obligations, which are commonly called "high-yield" securities or "junk bonds." High-yield securities generally have more volatile prices and carry more risk to principal than investment-grade securities. The Fund may also invest in foreign securities including emerging markets. International investing involves risks not typically associated with domestic investing, including risks of adverse currency fluctuations, potential political and economic instability, different accounting standards, limited liquidity, and volatile prices. The risks of International investing are particularly significant in emerging markets.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including maximum sales charges of 4.25% for Class A shares and the maximum contingent deferred sales charge ("CDSC") for Class B and Class C shares for the relevant period. Maximum CDSC is 5.00% for Class B shares, decreasing annually to 0% in the seventh year following purchase, and 1.00% for Class C shares. Total returns assume reinvestment of all distributions at NAV.

2 Performance for Class B, Class C, and Class R shares is not presented. Performance for these classes will vary due to different expense structures.

3 An unmanaged index that covers the universe of fixed-rate, dollar-denominated, below-investment-grade debt with at least one year to final maturity. Payment-in-kind bonds, Eurobonds, and emerging markets debt securities are excluded, but SEC-registered Canadian and global bonds of issuers in non-emerging countries are included. Original issue zero coupon bonds, step-up coupon structures, and Rule 144A securities are also included.

4 Prior to July 1, 2004, Class R shares were designated Class S shares, which had lower fees and expenses. Performance information prior to that date is based on the performance of the Class S shares. If current fees and expenses had been in effect for the entire period presented, performance would have been lower. Please refer to the prospectus for details.

FIRST AMERICAN FUNDS Annual Report 2004

9

High Income Bond fund continued

Expense Example

As a shareholder of the High Income Bond Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 1,036.90 | | | $ | 5.09 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.00 | | | $ | 5.05 | | |

| Class B Actual | | $ | 1,000.00 | | | $ | 1,033.10 | | | $ | 8.89 | | |

| Class B Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.25 | | | $ | 8.82 | | |

| Class C Actual | | $ | 1,000.00 | | | $ | 1,033.10 | | | $ | 8.89 | | |

| Class C Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.25 | | | $ | 8.82 | | |

| Class R Actual2 | | $ | 1,000.00 | | | $ | 1,037.40 | | | $ | 5.73 | | |

| Class R Hypothetical (5% return before expenses)2 | | $ | 1,000.00 | | | $ | 1,019.37 | | | $ | 5.68 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 1,038.10 | | | $ | 3.82 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,034.35 | | | $ | 3.81 | | |

1Expenses are equal to the Fund's annualized expense ratio of 1.00%, 1.75%, 1.75%, 1.13%, and 0.75% for Class A, Class B, Class C, Class R, and Class Y, respectively, mulitplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

2Prior to July 1, 2004, Class R had a different expense ratio. Had the current expense ratio been in place for the most recent one-half year, the actual and hypothetical expenses would have been $6.37 and $6.31, respectively.

FIRST AMERICAN FUNDS Annual Report 2004

10

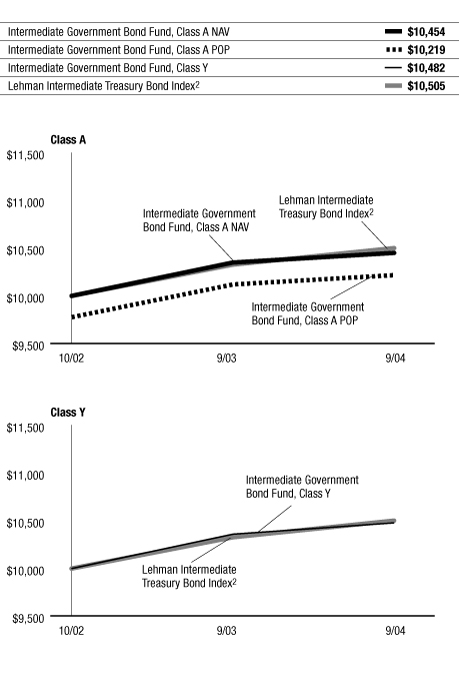

Intermediate Government Bond fund

Investment Objective: provide investors with current income that is exempt from state income tax, to the extent consistent with the preservation of capital

How did the Fund perform for the fiscal year ended September 30, 2004?

The First American Intermediate Government Bond Fund, Class Y shares, returned 1.14% for the fiscal year ended September 30, 2004 (Class A shares returned 0.98% at net asset value). By comparison, the Fund's benchmark, the Lehman Intermediate Treasury Bond Index*, returned 1.69% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured strong gains in productivity, and a significant rise in corporate profits. Sharp gains in payrolls from March through May 2004, along with higher inflation during the early months of the year, led the Federal Reserve to increase its target interest rate.

However, in spite of three 25-basis-point increases in the Federal Funds rate, long-term rates actually fell during the summer. Rapidly rising oil prices and heightened

geo-political uncertainty fueled fears of below-trend growth, which in turn pushed intermediate rates down by nearly 75 basis points.

During the course of the fiscal year, longer-term interest rates were nearly unchanged while short-term rates were 1% higher. This stability in longer-term rates resulted in fixed-income returns that were much better than those experienced in previous Fed tightening cycles.

What worked for the Fund and why?

The Fund maintained a shorter duration relative to the benchmark throughout the year, which had a positive impact on returns during most of the fiscal year. Bonds

generally decrease in value when interest rates rise, but the impact is generally greater for longer-term bonds. The Fund also benefited from tactical trading (short-term trading) of Treasury Inflation Protected Securities, which offered value at various points during the fiscal year.

What did not work for the Fund and why?

The Fund maintained a 30% position in U.S. Government Agency Securities during part of the year resulting in a negative impact on performance. This is a result of the increased scrutiny Fannie Mae faced regarding its accounting practices, which negatively impacted the overall sector. We reached a soft patch in the economy in 2004 due to a run up in oil prices and sluggish job growth. Our defensive duration strategy (shorter duration positioned for rising longer-term interest rates) negatively impacted the Fund as long-term interest rates fell and the bond market rallied later in the fiscal year.

What strategic moves were made by the Fund and why?

We continued to have a shorter duration strategy relative to the benchmark during the fiscal year. Strategically, we continued to follow a curve flattening strategy by reducing exposure in the intermediate part of the yield curve. As the yield curve flattens (short-term interest rates increase more than longer-term interest rates) intermediate maturities will experience poorer price performance. We also took a strateg ic allocation to Treasury Inflation Protected Securities that should be beneficial in an increasing inflationary environment.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

Portfolio Allocation as of September 30, 20041 (% of net assets)

| U.S. Government Agency | | | 92.3 | % | |

| Mortgage Backed | | | 6.6 | % | |

| Cash Equivalents | | | 0.2 | % | |

Credit Quality Distribution as of September 30, 20042 (% of net assets)

| AAA/Aaa | | | 99.1 | % | |

| Nonrated | | | 0.9 | % | |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

2The ratings in the above table reflect either the only rating provided by Standard and Poor's or Moody's, or the highest rating provided by the respective rating agency.

Standard and Poor's and Moody's are nationally recognized independent rating agencies for bonds.

FIRST AMERICAN FUNDS Annual Report 2004

11

Intermediate Government Bond fund continued

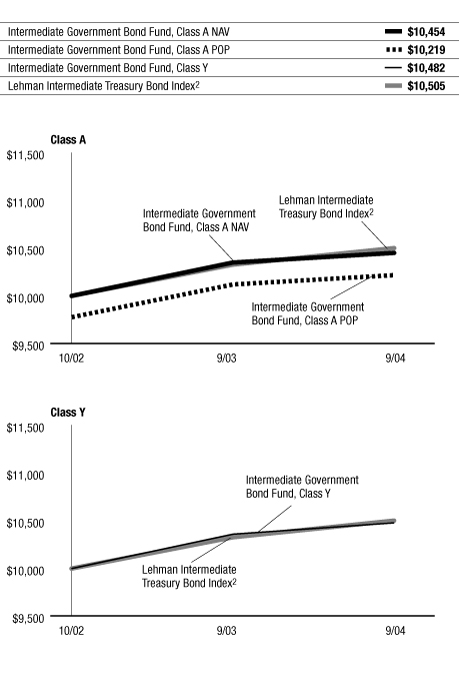

Annualized Performance1 as of September 30, 2004

| | | | | Since Inception3 | |

| | | 1 year | | 10/25/2002 | |

| Average annual return with sales charge (POP) | | | | | | | | | |

| Class A | | | (1.29 | %) | | | 1.13 | % | |

| Average annual return without sales charge (NAV) | | | | | | | | | |

| Class A | | | 0.98 | % | | | 2.33 | % | |

| Class Y | | | 1.14 | % | | | 2.47 | % | |

| Lehman Intermediate Treasury Bond Index2 | | | 1.69 | % | | | 2.60 | % | |

Value of $10,000 Investment1 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative purposes only, does not reflect any expenses, transaction costs, or cash flow effects, and is not available for investment.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including maximum sales charges of 2.25% for Class A Shares. Total returns assume reinvestment of all distributions at NAV.

Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

2 An unmanaged index comprised of public obligations of the U.S. Treasury with a remaining maturity between one and 10 years.

3 The performance since inception for the index is calculated from the month end following the Fund's inception.

FIRST AMERICAN FUNDS Annual Report 2004

12

Intermediate Government Bond fund continued

Expense Example

As a shareholder of the Intermediate Government Bond Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 993.40 | | | $ | 3.74 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.25 | | | $ | 3.79 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 995.20 | | | $ | 2.99 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.00 | | | $ | 3.03 | | |

1Expenses are equal to the Fund's annualized expense ratio of 0.75% and 0.60% for Class A and Class Y, respectively, mulitplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

FIRST AMERICAN FUNDS Annual Report 2004

13

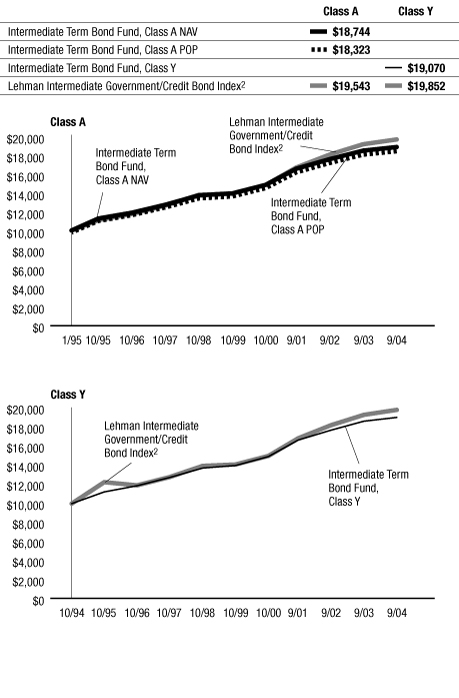

Intermediate Term Bond fund

Investment Objective: current income to the extent consistent with preservation of capital

How did the Fund perform for the fiscal year ended September 30, 2004?

The First American Intermediate Term Bond Fund, Class Y shares, returned 2.22% for the fiscal year ended September 30, 2004 (Class A shares returned 2.06% at net asset value). By comparison, the Fund's benchmark, the Lehman Intermediate Government/Credit Bond Index*, returned 2.65% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured strong gains in productivity, and a significant rise in corporate profits. Sharp gains in payrolls from March through May 2004, along with higher inflation during the early months of the year, led the Federal Reserve to increase its target interest rate.

However, in spite of three 25-basis-point increases in the Federal Funds rate, long-term rates actually fell during the summer. Rapidly rising oil prices and heightened

geo-political uncertainty fueled fears of below-trend growth, which in turn pushed intermediate rates down by nearly 75 basis points.

During the course of the fiscal year, longer-term interest rates were nearly unchanged while short-term rates were 1% higher. This stability in longer-term rates resulted in fixed-income returns that were much better than those experienced in previous Fed tightening cycles.

What worked for the Fund and why?

The Fund was overweight relative to its benchmark in BBB-rated corporate bonds, mortgage-backed securities, and asset-backed securities. These strategies boosted performance as the combination of additional income

and strong price performance benefited the portfolio. The Fund was also positioned to benefit from a flatter yield curve as we built a substantial position in high-quality, one-year adjustable rate mortgages that boosted portfolio income with minor price volatility. As short-term interest rates rose throughout the year, the reset feature of the adjustable rate mortgages was advantageous in generating income.

What did not work for the Fund and why?

While our economic growth forecasts and predictions of Fed tightening were fairly accurate, we underestimated the extent, and perceived economic impact of the rise in crude oil prices in mid-2004. Concurrent with the onset of Fed tightening, we became overly defensive with our interest-rate strategy during a period of falling rates. As a result, while absolute returns were much better than we expected, the portfolio lagged the benchmark during the latter part of the fiscal year.

What strategic moves were made by the Fund and why?

We believe that the economy will continue to expand and inflationary pressures will mount, putting additional upward pressure on interest rates. Accordingly, the Fund's duration is shorter relative to the benchmark and we maintain a significant curve flattening strategy (underweight intermediate-term securities within the Fund).

We continue to believe that there is upside potential in lower-rated investment-grade bonds and have an overweight position in the BBB credit quality sector as credit fundamentals appear solid.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

Portfolio Allocation as of September 30, 20041 (% of net assets)

| Corporate Bonds | | | 31.0 | % | |

| Asset Backed | | | 27.1 | % | |

| U.S. Government Agency | | | 24.6 | % | |

| Mortgage Backed | | | 16.8 | % | |

Credit Quality Distribution as of September 30, 20042 (% of net assets)

| AAA/Aaa | | | 67.5 | % | |

| AA/Aa | | | 1.3 | % | |

| A | | | 8.6 | % | |

| BBB/Baa | | | 19.6 | % | |

| Nonrated | | | 3.0 | % | |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

2The ratings in the above table reflect either the only rating provided by Standard and Poor's or Moody's, or the highest rating provided by the respective rating agency.

Standard and Poor's and Moody's are nationally recognized independent rating agencies for bonds.

FIRST AMERICAN FUNDS Annual Report 2004

14

Intermediate Term Bond fund continued

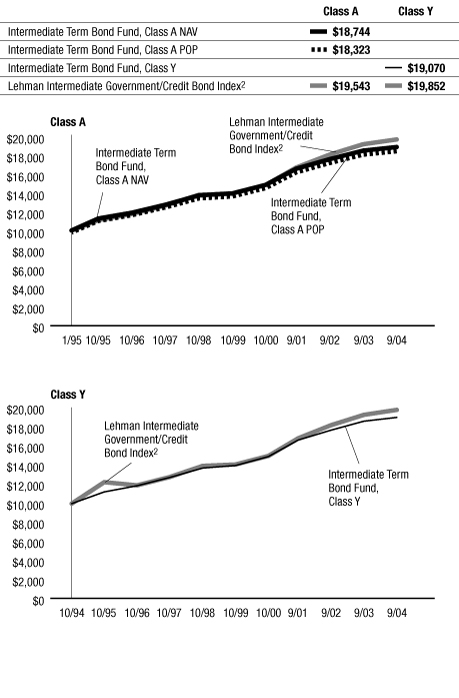

Annualized Performance1 as of September 30, 2004

| | | | | | | | | Since Inception3 | |

| | | 1 year | | 5 years | | 10 years | | 1/9/1995 | |

| Average annual return with sales charge (POP) | | | | | | | | | | | | | | | | | |

| Class A | | | (0.23 | %) | | | 5.78 | % | | | - | | | | 6.43 | % | |

| Average annual return without sales charge (NAV) | | | | | | | | | | | | | | | | | |

| Class A | | | 2.06 | % | | | 6.26 | % | | | - | | | | 6.68 | % | |

| Class Y | | | 2.22 | % | | | 6.45 | % | | | 6.67 | % | | | - | | |

| Lehman Intermediate Government/Credit Bond Index2 | | | 2.65 | % | | | 7.13 | % | | | 7.10 | % | | | 7.18 | % | |

Value of $10,000 Investment1 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative purposes only, does not reflect any expenses, transaction costs, or cash flow effects, and is not available for investment.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including maximum sales charges of 2.25% for Class A shares for the relevant period. Total returns assume reinvestment of all distributions at NAV.

Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

2 An unmanaged index of Treasury Securities, other securities issued or guaranteed by the U.S. government or its agencies or instrumentalities, and investment-grade corporate debt securities. In each case with maturities of one to 10 years.

3 The performance since inception for the index is calculated from the month end following the Fund's inception.

FIRST AMERICAN FUNDS Annual Report 2004

15

Intermediate Term Bond fund continued

Expense Example

As a shareholder of the Intermediate Term Bond Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 998.20 | | | $ | 3.75 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.25 | | | $ | 3.79 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 999.00 | | | $ | 3.00 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.00 | | | $ | 3.03 | | |

1Expenses are equal to the Fund's annualized expense ratio of 0.75% and 0.60% for Class A and Class Y, respectively, mulitplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

FIRST AMERICAN FUNDS Annual Report 2004

16

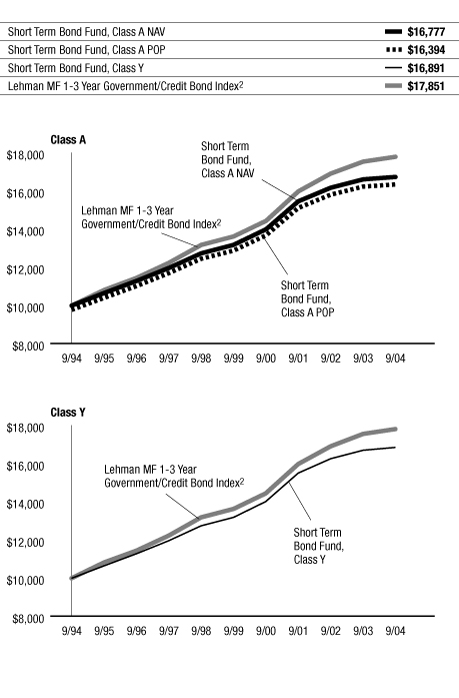

Short Term Bond fund

Investment Objective: current income while maintaining a high degree of principal stability

How did the Fund perform for the fiscal year ended September 30, 2004?

The First American Short Term Bond Fund, Class Y shares, returned 0.91% for the fiscal year ended September 30, 2004 (Class A shares returned 0.76% at net asset value). By comparison, the Fund's benchmark, the Lehman MF 1-3 Year Government/Credit Bond Index*, returned 1.44% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured strong gains in productivity, and a significant rise in corporate profits. Sharp gains in payrolls from March through May 2004, along with higher inflation during the early months of the year, led the Federal Reserve to increase its target interest rate.

However, in spite of three 25-basis-point increases in the Federal Funds rate, long-term rates actually fell during the summer. Rapidly rising oil prices and heightened

geo-political uncertainty fueled fears of below-trend growth, which in turn pushed intermediate rates down by nearly 75 basis points.

During the course of the fiscal year, longer-term interest rates were nearly unchanged while short-term rates were 1% higher. This stability in longer-term rates resulted in fixed-income returns that were much better than those experienced in previous Fed tightening cycles.

What worked for the Fund and why?

The portfolio was positioned for an increasing Federal Funds rate throughout 2004 and was managed with a duration shorter than its benchmark over this time frame. This modestly added to the portfolio performance, as

yields on short-term bonds were roughly 1% higher during the course of the fiscal year. The Fund was significantly overweight relative to the benchmark in lower-rated investment-grade corporate bonds and asset-backed securities. These sectors were among the top performing areas of investment-grade securities and had positive impact to performance.

What did not work for the Fund and why?

While our economic growth forecasts and predictions of Fed tightening were fairly accurate, we underestimated the extent, and perceived economic impact of the rise in crude oil prices in mid-2004. Concurrent with the onset of Fed tightening, we became overly defensive with our interest-rate strategy during a period of falling rates. As a result, while absolute returns were much better than we expected, the portfolio lagged the benchmark during the latter part of the fiscal year.

What strategic moves were made by the Fund and why?

We have increased the exposure to spread products (non-Treasury securities). We believe this will continue to increase the income of the portfolio in a low-yield environment. We also remain underweight relative to the benchmark in U.S. Government Agency securities and overweight in asset backed securities. Finally, we will continue to structure the Fund with a short duration strategy with the expectation of rising interest rates. The Fund is also positioned with a bias to a flattening yield curve (underweight intermediate maturities within this Fund's maturity range).

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

Portfolio Allocation as of September 30, 20041 (% of net assets)

| Corporate Bonds | | | 36.9 | % | |

| Asset Backed | | | 33.1 | % | |

| Mortgage Backed | | | 14.8 | % | |

| U.S. Government Agency | | | 14.4 | % | |

| Cash Equivalents | | | 1.0 | % | |

Credit Quality Distribution as of September 30, 20042 (% of net assets)

| AAA/Aaa | | | 61.2 | % | |

| AA/Aa | | | 5.9 | % | |

| A | | | 20.1 | % | |

| BBB/Baa | | | 12.3 | % | |

| Nonrated | | | 0.5 | % | |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

2The ratings in the above table reflect either the only rating provided by Standard and Poor's or Moody's, or the highest rating provided by the respective rating agency.

Standard and Poor's and Moody's are nationally recognized independent rating agencies for bonds.

FIRST AMERICAN FUNDS Annual Report 2004

17

Short Term Bond fund continued

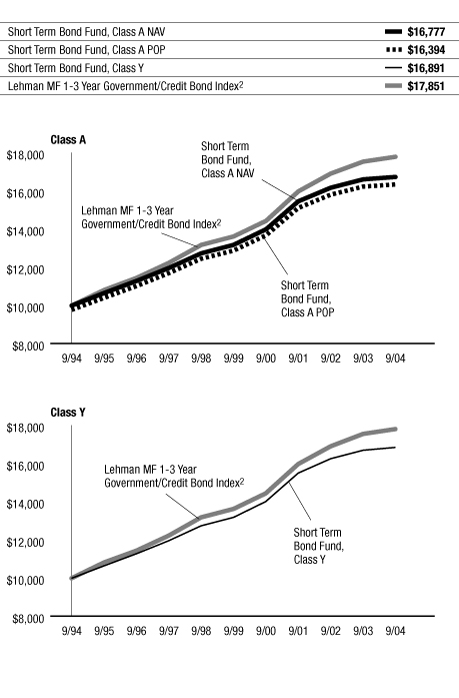

Annualized Performance1 as of September 30, 2004

| | | 1 year | | 5 years | | 10 years | |

| Average annual return with sales charge (POP) | | | | | | | | | | | | | |

| Class A | | | (1.54 | %) | | | 4.43 | % | | | 5.07 | % | |

| Average annual return without sales charge (NAV) | | | | | | | | | | | | | |

| Class A | | | 0.76 | % | | | 4.92 | % | | | 5.31 | % | |

| Class Y | | | 0.91 | % | | | 5.04 | % | | | 5.37 | % | |

| Lehman MF 1-3 Year Government/Credit Bond Index2 | | | 1.44 | % | | | 5.52 | % | | | 5.97 | % | |

Value of $10,000 Investment1 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative purposes only, does not reflect any expenses, transaction costs, or cash flow effects, and is not available for investment.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including maximum sales charges of 2.25% for Class A shares for the relevant period. Total returns assume reinvestment of all distributions at NAV.

Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

2 An unmanaged index of one-to-three-year Treasury securities, other securities issued or guaranteed by the U.S. Government or its agencies or Instrumentalities, and investment-grade corporate debt securities.

FIRST AMERICAN FUNDS Annual Report 2004

18

Short Term Bond fund continued

Expense Example

As a shareholder of the Short Term Bond Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 997.20 | | | $ | 3.74 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.25 | | | $ | 3.79 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 996.90 | | | $ | 3.00 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.00 | | | $ | 3.03 | | |

1Expenses are equal to the Fund's annualized expense ratio of 0.75% and 0.60% for Class A and Class Y, respectively, mulitplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

FIRST AMERICAN FUNDS Annual Report 2004

19

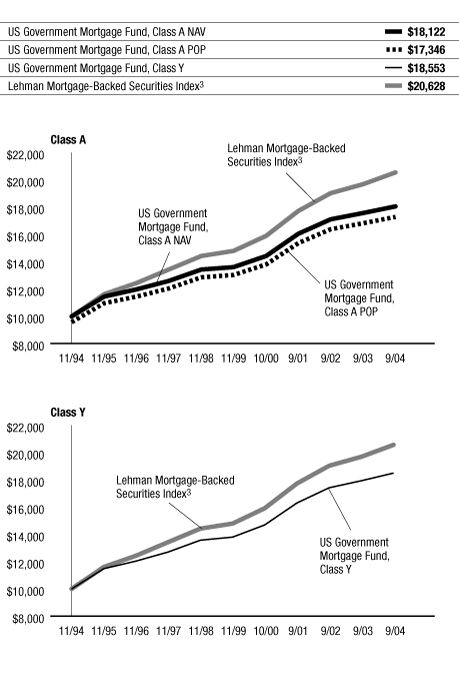

U.S. Government Mortgage fund

Investment Objective: high current income to the extent consistent with the preservation of capital

How did the Fund perform for the fiscal year ended September 30, 2004?

The First American U.S. Government Mortgage Fund, Class Y shares, returned 3.09% for the fiscal year ended September 30, 2004 (Class A shares returned 2.74% at net asset value). By comparison, the Fund's benchmark, the Lehman Mortgage-Backed Securities Index*, returned 4.36% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured strong gains in productivity, and a significant rise in corporate profits. Sharp gains in payrolls from March through May 2004, along with higher inflation during the early months of the year, led the Federal Reserve to increase its target interest rate.

However, in spite of three 25-basis-point increases in the Federal Funds rate, long-term rates actually fell during the summer. Rapidly rising oil prices and heightened

geo-political uncertainty fueled fears of below-trend growth, which in turn pushed intermediate rates down by nearly 75 basis points.

During the course of the fiscal year, longer-term interest rates were nearly unchanged while short-term rates were 1% higher. This stability in longer-term rates resulted in fixed-income returns that were much better than those experienced in previous Fed tightening cycles.

What worked for the Fund and why?

The Fund was positioned defensively with an emphasis on premium, higher-coupon mortgage securities, which benefited fund performance. The rise in mortgage rates, particularly on short-term maturities, resulted in a

significant decline in refinancing activity and a large slowdown in prepayments on these securities. Additionally, we opportunistically added to our non-agency mortgage exposure over the course of the fiscal year, which proved beneficial to the fund, as these securities outperformed agency securities.

What did not work for the Fund and why?

While our economic growth forecasts and predictions of Fed tightening were fairly accurate, we underestimated the duration, magnitude, and perceived economic impact of the rise in crude oil prices in mid-2004 and, concurrent with the onset of Fed tightening, became too defensive with our interest-rate strategy during a period of falling rates. As a result, the portfolio lagged the benchmark during the latter part of the fiscal year. Additionally, we expected that Fed tightening would result in underperformance of the mortgage sector as rates rose and mortgage duration extended. Accordingly, we underweighted longer-duration and lower-coupon mortgages, which ended up performing well as rates dropped in the third quarter.

What strategic moves were made by the Fund and why?

We believe that the economy will continue to expand and inflationary pressures will mount, putting additional upward pressure on interest rates. Accordingly, we have shortened the Fund's duration relative to the benchmark and positioned our mortgage allocation more defensively, focusing on shorter- and higher-quality mortgage securities as the sector currently appears to be fairly expensive based upon long-term valuations.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

Portfolio Allocation as of September 30, 20041 (% of net assets)

| Mortgage Backed | | | 99.1 | % | |

| U.S. Government Agency | | | 3.1 | % | |

| Cash Equivalents | | | 1.6 | % | |

| Asset Backed | | | 1.2 | % | |

Credit Quality Distribution as of September 30, 20042 (% of net assets)

| AAA/Aaa | | | 95.4 | % | |

| AA/Aa | | | 2.2 | % | |

| A | | | 0.5 | % | |

| Nonrated | | | 1.9 | % | |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

2The ratings in the above table reflect either the only rating provided by Standard and Poor's or Moody's, or the highest rating provided by the respective rating agency.

Standard and Poor's and Moody's are nationally recognized independent rating agencies for municipal bonds.

FIRST AMERICAN FUNDS Annual Report 2004

20

U.S. Government Mortgage fund continued

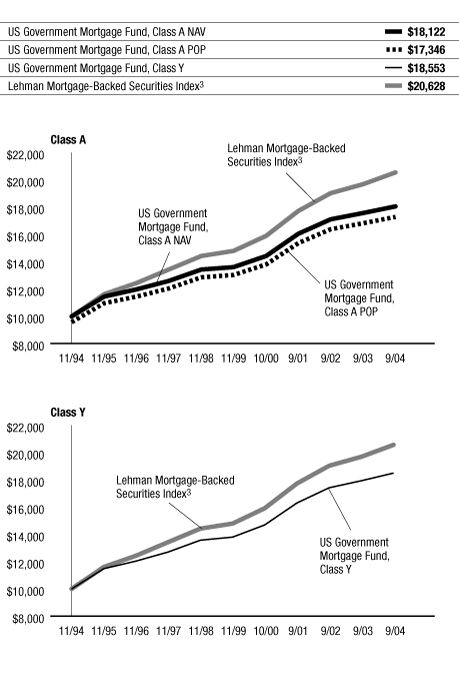

Annualized Performance1 as of September 30, 2004

| | | | | | | | | Since Inception | |

| | | 1 year | | 5 years | | 10 years | | 5/11/1995 | | 9/24/2001 | |

| Average annual return with sales charge (POP) | |

| Class A | | | (1.60 | %) | | | 5.05 | % | | | 5.67 | % | | | - | | | | - | | |

| Class B | | | (2.90 | %) | | | 4.64 | % | | | - | | | | 4.88 | % | | | - | | |

| Class C | | | 1.04 | % | | | - | | | | - | | | | - | | | | 3.26 | % | |

| Average annual return without sales charge (NAV) | |

| Class A | | | 2.74 | % | | | 5.96 | % | | | 6.13 | % | | | - | | | | - | | |

| Class B | | | 2.02 | % | | | 5.14 | % | | | - | | | | 4.88 | % | | | - | | |

| Class C | | | 2.02 | % | | | - | | | | - | | | | - | | | | 3.26 | % | |

| Class R4 | | | 2.74 | % | | | 5.86 | % | | | 6.08 | % | | | - | | | | - | | |

| Class Y | | | 3.09 | % | | | 6.15 | % | | | 6.38 | % | | | - | | | | - | | |

| Lehman Mortgage-Backed Securities Index3 | | | 4.36 | % | | | 6.95 | % | | | 7.47 | % | | | 6.99 | % | | | 5.20 | % | |

Value of $10,000 Investment1, 2 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index is for illustrative purposes only, does not reflect any expenses, transaction costs, or cash flow effects, and is not available for investment.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.