| | OMB APPROVAL |

| | OMB Number: 3235-0570 |

| | Expires: November 30, 2005 |

| | Estimated average burden

hours per response. . . . 5.0 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05309

First American Investment Funds, Inc.

(Exact name of registrant as specified in charter)

800 Nicollet Mall, Minneapolis, MN | | 55402 |

(Address of principal executive offices) | | (Zip code) |

Charles D. Gariboldi 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: September 30

Date of reporting period: September 30, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Report to Shareholders

| 2004

Annual Report |

| |

| STOCK

FUNDS |

First American Stock Funds

Stocks are shares of ownership that a company sells in order to raise money to run its business. As an owner or shareholder, you take part in the company’s achievements and failures.

Stocks and stock funds offer you a number of options. Some are defined by the size of the companies they invest in, some by the style of the company, and others by where they invest – by geographic location or by industry. Because the various types of stocks outperform and underperform at different times, dividing your money among several types may help smooth out your portfolio’s returns.

TABLE OF CONTENTS

Message to Shareholders | |

Report of Independent Registered Public Accounting Firm | |

Sector Funds | |

Schedule of Investments | |

Statements of Assets and Liabilities | |

Statements of Operations | |

Statements of Changes in Net Assets | |

Financial Highlights | |

International Fund | |

Schedule of Investments | |

Statement of Assets and Liabilities | |

Statement of Operations | |

Statement of Changes in Net Assets | |

Financial Highlights | |

Small Cap Funds | |

Schedule of Investments | |

Statements of Assets and Liabilities | |

Statements of Operations | |

Statements of Changes in Net Assets | |

Financial Highlights | |

Mid Cap Funds | |

Schedule of Investments | |

Statements of Assets and Liabilities | |

Statements of Operations | |

Statements of Changes in Net Assets | |

Financial Highlights | |

Large Cap Funds | |

Schedule of Investments | |

Statements of Assets and Liabilities | |

Statements of Operations | |

Statements of Changes in Net Assets | |

Financial Highlights | |

Growth & Income Funds | |

Schedule of Investments | |

Statements of Assets and Liabilities | |

Statements of Operations | |

Statements of Changes in Net Assets | |

Financial Highlights | |

| |

Notes to Financial Statements | |

| |

Notice to Shareholders | |

Mutual fund investing involves risk; principal loss is possible.

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

Message to SHAREHOLDERS November 15, 2004

Dear Shareholders:

We invite you to take a few minutes to review the results of the fiscal year ended September 30, 2004.

This report includes comparative performance graphs and tables, portfolio commentaries, complete listings of portfolio holdings, and additional fund information. We hope you will find this helpful in monitoring your investment portfolio.

Also, through our website, firstamericanfunds.com, we provide quarterly performance fact sheets on all First American funds, the economic outlook as viewed by our senior investment officers, and other information about fund investments and portfolio strategies.

Please contact your financial professional if you have questions about First American Funds or contact First American Investor Services at 800.677.FUND.

We appreciate your investment with First American Funds and look forward to serving your financial needs in the future.

Sincerely,

/s/ Virginia L. Stringer | | /s/ Thomas S. Schreier | |

Virginia L. Stringer | Thomas S. Schreier, Jr. |

Chairperson of the Board | President |

First American Investment Funds, Inc. | First American Investment Funds, Inc. |

1

Real Estate Securities fund

Investment Objective: to provide above-average current income and long-term capital appreciation

How did the Fund perform for the fiscal year ended September 30, 2004?

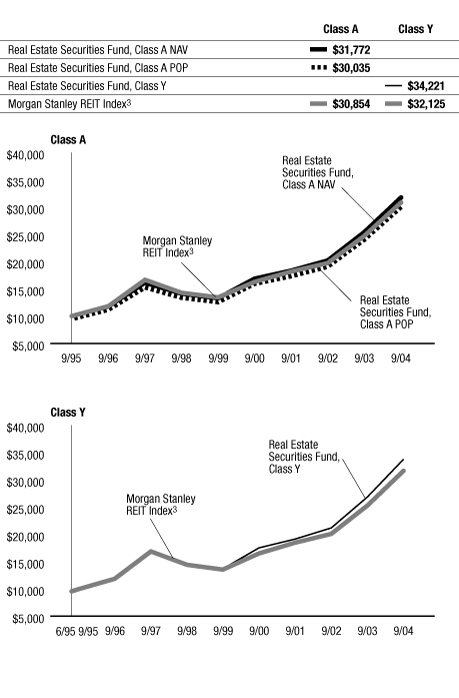

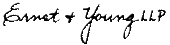

The First American Real Estate Securities Fund, Class Y shares, returned 25.33% for the fiscal year ended September 30, 2004 (Class A shares returned 24.98% at net asset value). By comparison, the Fund's benchmark, the Morgan Stanley REIT Index*, returned 24.85% for the same period.

How did general economic and market conditions affect performance?

Long-term quantitative studies show little correlation between REIT price movement and changes in the

10-year Treasury. However, as the fourth quarter of 2003 and the first quarter of 2004 saw a continued low-yield environment, REITs became the yield alternative for many investors. This changed abruptly on April 2, 2004, with the first strong employment growth numbers and a corresponding rise in interest rates, particularly that of the 10-year Treasury. From April 2, 2004, to May 10, 2004, the Morgan Stanley REIT Index lost 18.61%. Since that time, interest rates have rallied and REITs completely recovered to set a new high on the Morgan Stanley REIT Index on September 7, 2004, and closed out the fiscal year within 2% of that level.

The real estate markets need healthy job growth to generate demand for real estate space. Generally, on average, healthy job growth did not occur during the fiscal year. Thus the fundamental operating environment for most property types remains challenging. The relative strong yield characteristics of REITs was a primary driver in another strong year of stock performance.

What worked for the Fund and why?

The Fund benefited from being overweight in a number of companies that were acquired during the year: Extended Stay America, Keystone Property Group, and Chelsea Property Group. The Fund also benefited by owning and then strategically selling Equity Office Properties and Apartment Investment & Management Co. The Fund was also overweight in LaSalle Hotel Properties, which had a 12-month return of 65.69%.

What did not work for the Fund and why?

In a period when REITs were up more than 25%, even the Fund's cash position of less than 3% was detrimental to the Fund's performance. Owning two stocks not included in the Morgan Stanley REIT Index, Boardwalk Equities, Inc. and Anthracite Capital, detracted from performance.

What strategic moves were made by the Fund and why?

The Fund has increased its weighting in the hotel sector as we believe the return of the business traveler, lack of new construction, and short lease duration will create the greatest potential for growth in this REIT sector.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

| Top 10 Companies as of September 30, 20041 (% of net assets) | |

| Simon Property Group | | | 4.9 | % | |

| Public Storage | | | 4.2 | % | |

| Vornado Realty Trust | | | 3.8 | % | |

| Macerich | | | 3.7 | % | |

| Boston Properties | | | 3.7 | % | |

| Rouse | | | 3.5 | % | |

| Avalonbay Communities | | | 3.5 | % | |

| Essex Property Trust | | | 3.4 | % | |

| Lasalle Hotel Properties | | | 3.2 | % | |

| Apartment Investment & Management | | | 3.0 | % | |

| Sector Allocation as of September 30, 20041 (% of net assets) | |

| | | Fund2 | | Morgan Stanley

REIT Index3 | |

| Apartments | | | 12.9 | % | | | 20.5 | % | |

| Community Centers | | | 9.9 | % | | | 10.7 | % | |

| Diversified | | | 8.7 | % | | | 6.1 | % | |

| Hotels | | | 12.7 | % | | | 5.4 | % | |

| Industrial | | | 10.5 | % | | | 8.5 | % | |

| Malls | | | 15.4 | % | | | 13.9 | % | |

| Office | | | 18.9 | % | | | 27.1 | % | |

| Other | | | 2.6 | % | | | 0.8 | % | |

| Self-Storage | | | 4.2 | % | | | 4.4 | % | |

| Specialty | | | 2.9 | % | | | 2.6 | % | |

1Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

2The percentages shown represent the allocation by industry as a percent of net assets of the Fund.

3The percentages shown represent the percent allocation by industry of the index.

FIRST AMERICAN FUNDS Annual Report 2004

2

Real Estate Securities fund continued

| Annualized Performance1 as of September 30, 2004 | |

| | | | | Since Inception | |

| | | 1 year | | 5 years | | 6/30/1995 | | 9/29/1995 | | 2/1/2000 | | 9/24/2001 | |

| Average annual return with sales charge (POP) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | 18.12 | % | | | 17.64 | % | | | - | | | | 12.99 | % | | | - | | | | - | | |

| Class B | | | 19.06 | % | | | 17.92 | % | | | - | | | | 12.83 | % | | | - | | | | - | | |

| Class C | | | 23.12 | % | | | - | | | | - | | | | - | | | | 19.50 | % | | | - | | |

| Average annual return without sales charge (NAV) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | 24.98 | % | | | 18.99 | % | | | - | | | | 13.70 | % | | | - | | | | - | | |

| Class B | | | 24.06 | % | | | 18.13 | % | | | - | | | | 12.83 | % | | | - | | | | - | | |

| Class C | | | 24.12 | % | | | - | | | | - | | | | - | | | | 19.50 | % | | | - | | |

| Class R4 | | | 24.94 | % | | | - | | | | - | | | | - | | | | - | | | | 21.83 | % | |

| Class Y | | | 25.33 | % | | | 19.30 | % | | | 14.22 | % | | | - | | | | - | | | | - | | |

| Morgan Stanley REIT Index3 | | | 24.85 | % | | | 18.07 | % | | | 13.46 | % | | | 13.33 | % | | | 19.39 | % | | | 21.31 | % | |

Value of a $10,000 Investment1, 2 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative purposes only and does not reflect any expenses, transaction costs, or cash flow effects. Investment in the index is not available.

Sector funds such as the First American Real Estate Securities Fund are more vulnerable to price fluctuation as a result of events that may affect the industry in which they focus than are funds that invest in multiple industries. Share prices of sector funds also will fluctuate with changing market conditions, as will share prices of other stock funds. Sector funds should not be treated as a core investment; rather, their role is to round out the growth portion of a well-diversified investment portfolio.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including a maximum front-end sales charge of 5.50% for Class A shares and the maximum contingent deferred sales charge ("CDSC") for Class B and Class C shares for the relevant period. Maximum CDSC is 5.00% for Class B shares in the first year, decreasing annually to 0% in the seventh year following purchase, and 1.00% for Class C shares. Total returns assume reinvestment of all distributions at NAV.

2 Performance for Class B, Class C, and Class R shares is not presented. Performance for these classes will vary due to different expense structures.

3 An unmanaged index of the most actively traded real estate investment trusts.

4 Prior to July 1, 2004, Class R shares were designated Class S shares, which had lower fees and expenses. Performance information prior to that date is based on the performance of the Class S shares. If current fees and expenses had been in effect for the entire period presented, performance would have been lower. Please refer to the prospectus for details.

FIRST AMERICAN FUNDS Annual Report 2004

3

Real Estate Securities fund continued

Expense Example

As a shareholder of the Real Estate Securities Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 1,010.30 | | | $ | 6.18 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.85 | | | $ | 6.21 | | |

| Class B Actual | | $ | 1,000.00 | | | $ | 1,006.60 | | | $ | 9.93 | | |

| Class B Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.10 | | | $ | 9.97 | | |

| Class C Actual | | $ | 1,000.00 | | | $ | 1,006.50 | | | $ | 9.93 | | |

| Class C Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.10 | | | $ | 9.97 | | |

| Class R Actual2 | | $ | 1,000.00 | | | $ | 1,009.50 | | | $ | 6.81 | | |

| Class R Hypothetical (5% return before expenses)2 | | $ | 1,000.00 | | | $ | 1,018.22 | | | $ | 6.84 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 1,011.90 | | | $ | 4.93 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.10 | | | $ | 4.95 | | |

1Expenses are equal to the Fund's annualized expense ratio of 1.23%, 1.98%, 1.98%, 1.36%, and 0.98% for Class A, Class B, Class C, Class R, and Class Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

2Prior to July 1, 2004, Class R had a different expense ratio. Had the current expense ratio been in place for the most recent one-half year, the actual and hypothetical expenses would have been $7.44 and $7.47, respectively.

FIRST AMERICAN FUNDS Annual Report 2004

4

Technology fund

Investment Objective: long-term growth of capital

How did the Fund perform for the fiscal year ended September 30, 2004?

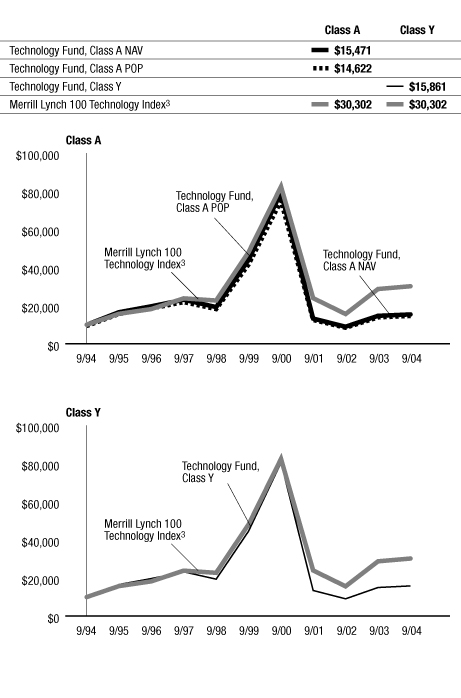

The First American Technology Fund, Class Y shares, returned 5.22% for the fiscal year ended September 30, 2004 (Class A shares returned 4.96% at net asset value). By comparison, the Fund's benchmark, the Merrill Lynch 100 Technology Index*, returned 4.72% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured above-trend economic growth (i.e., exceeding the average of 3.15% since 1970), strong gains in productivity, and a significant rise in corporate profits. The improving economic environment led to sharp gains in payrolls from March through May 2004, which, along with higher inflation readings during the early months of the year, led the Federal Reserve to begin raising its target interest rate. Higher current and expected short-term interest rates, along with steep increases in oil prices during the first nine months of 2004, have led to growing concerns about the economic and profit growth outlook. These concerns have resulted in equity markets generating little in the way of gains since the first months of the calendar year despite solid earnings growth and continued low long-term interest rates. The markets hav e become more attractively valued as a result.

What worked for the Fund and why?

During the past year, several of the Technology Fund's best performers were nonbenchmark names, including Pixelworks, Autodesk, Given Imaging, Sierra Wireless, and Altiris. Perhaps more importantly, much of the Fund's positive performance, when compared with our benchmark, the Merrill Lynch 100 Technology Index, came from not owning a number of poorly performing benchmark names. These included Seagate Technology, Synopsys, LSI Logic, BEA Systems, and Unisys.

What did not work for the Fund and why?

Although the Technology Fund did outperform its benchmark in the last year, our total performance was hindered somewhat by owning names that clearly underperformed, such as MKS Instruments and Maxtor, and not owning names in our benchmark that performed quite well. Those in this latter category included eBay, L.M. Ericsson, Symantec, and QUALCOMM. Fortunately, the shares of these latter companies have weakened in recent months, owing to market factors, and we have been able to invest in these shares at discounted levels. Not owning Yahoo was the biggest negative driver of performance in the internet software and services sectors.

What strategic moves were made by the Fund and why?

In general, the only major strategic move during the past year was to gradually increase the Fund's exposure to large-cap names, while decreasing its exposure to small-cap names. Otherwise our strategy has remained constant: to choose companies that we feel will be able to grow revenue, produce positive cash flow, and increase or maintain market share.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

| Top 10 Companies as of September 30, 20041 (% of net assets) | |

| Infosys Technologies | | | 1.9 | % | |

| QUALCOMM | | | 1.6 | % | |

| Marvell Technology Group | | | 1.6 | % | |

| Symantec | | | 1.6 | % | |

| Accenture | | | 1.6 | % | |

| NCR | | | 1.6 | % | |

| Applied Materials | | | 1.5 | % | |

| L.M. Ericsson | | | 1.5 | % | |

| Analog Devices | | | 1.5 | % | |

| Adobe Systems | | | 1.5 | % | |

| Sector Allocation as of September 30, 20041 (% of net assets) | |

| | | Fund2 | | Merrill Lynch

100 Tech Index3 | |

| Application Software | | | 12.1 | % | | | 8.0 | % | |

| Communications Equipment | | | 16.9 | % | | | 18.0 | % | |

| Computer Hardware | | | 4.9 | % | | | 7.5 | % | |

| Data Processing & Outsourced Service | | | 6.2 | % | | | 7.5 | % | |

| Electronic Manufacturing Services | | | 5.6 | % | | | 5.5 | % | |

| IT Consulting & Other Services | | | 4.5 | % | | | 4.2 | % | |

| Other | | | 23.3 | % | | | 18.9 | % | |

| Semiconductor Equipment | | | 4.7 | % | | | 4.4 | % | |

| Semiconductors | | | 15.7 | % | | | 17.1 | % | |

| Systems Software | | | 6.2 | % | | | 8.9 | % | |

1Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

2The percentages shown represent the allocation by industry as a percent of net assets of the Fund.

3The percentages shown represent the percent allocation by industry of the index.

FIRST AMERICAN FUNDS Annual Report 2004

5

Technology fund continued

| Annualized Performance1 as of September 30, 2004 | |

| | | | | Since

Inception | |

| | | 1 year | | 5 years | | 10 years | | 2/1/2000 | |

| Average annual return with sales charge (POP) | | | | | | | | | | | | | | | | | |

| Class A | | | (0.80 | %) | | | (19.85 | %) | | | 3.87 | % | | | - | | |

| Class B | | | (0.87 | %) | | | (19.77 | %) | | | 3.65 | % | | | - | | |

| Class C | | | 3.08 | % | | | - | | | | - | | | | (30.94 | %) | |

| Average annual return without sales charge (NAV) | | | | | | | | | | | | | | | | | |

| Class A | | | 4.96 | % | | | (18.94 | %) | | | 4.46 | % | | | - | | |

| Class B | | | 4.13 | % | | | (19.57 | %) | | | 3.65 | % | | | - | | |

| Class C | | | 4.08 | % | | | - | | | | - | | | | (30.94 | %) | |

| Class Y | | | 5.22 | % | | | (18.72 | %) | | | 4.72 | % | | | - | | |

| Merrill Lynch 100 Technology Index3 | | | 4.72 | % | | | (8.95 | %) | | | 11.70 | % | | | (18.70 | %) | |

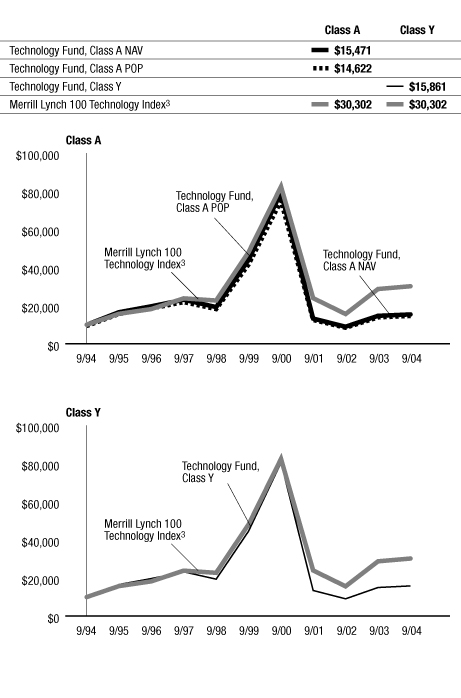

Value of a $10,000 Investment1, 2 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative purposes only and does not reflect any expenses, transaction costs, or cash flow effects. Investment in the index is not available.

Sector funds such as the First American Technology Fund are more vulnerable to price fluctuation as a result of events that may affect the industry in which they focus than are funds that invest in multiple industries. Share prices of sector funds also will fluctuate with changing market conditions, as will share prices of other stock funds. Sector funds should not be treated as a core investment; rather, their role is to round out the growth portion of a well-diversified investment portfolio.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including a maximum front-end sales charge of 5.50% for Class A shares and the maximum contingent deferred sales charge ("CDSC") for Class B and Class C shares for the relevant period. Maximum CDSC is 5.00% for Class B shares in the first year, decreasing annually to 0% in the seventh year following purchase, and 1.00% for Class C shares. Total returns assume reinvestment of all distributions at NAV.

The Technology Fund's 1999 returns were higher due in part to its strategy of investing in IPOs and technology-related stocks in a period favorable for IPO and technology stock investing. Of course, such favorable returns involve accepting the risk of volatility, and there is no assurance that the Fund's future investment in IPOs and technology stocks will have the same effect on performance as it did in 1999. Investments in the First American Technology Fund are more vulnerable to price fluctuation as a result of the narrow focus of technology investing and the fact that the products of companies in which the Fund invests may be subject to rapid obsolescence.

2 Performance for Class B and Class C shares is not presented. Performance for these classes will vary due to different expense structures.

3 An equally weighted index of the 100 largest technology companies, as measured by market capitalization.

FIRST AMERICAN FUNDS Annual Report 2004

6

Technology fund continued

Expense Example

As a shareholder of the Technology Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 871.60 | | | $ | 5.76 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.85 | | | $ | 6.21 | | |

| Class B Actual | | $ | 1,000.00 | | | $ | 867.50 | | | $ | 9.24 | | |

| Class B Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.10 | | | $ | 9.97 | | |

| Class C Actual | | $ | 1,000.00 | | | $ | 867.60 | | | $ | 9.24 | | |

| Class C Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.10 | | | $ | 9.97 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 872.40 | | | $ | 4.59 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.10 | | | $ | 4.95 | | |

1Expenses are equal to the Fund's annualized expense ratio of 1.23%, 1.98%, 1.98%, and 0.98% for Class A, Class B, Class C, and Class Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

FIRST AMERICAN FUNDS Annual Report 2004

7

International fund

Investment Objective: long-term growth of capital

How did the Fund perform for the fiscal year ended September 30, 2004?

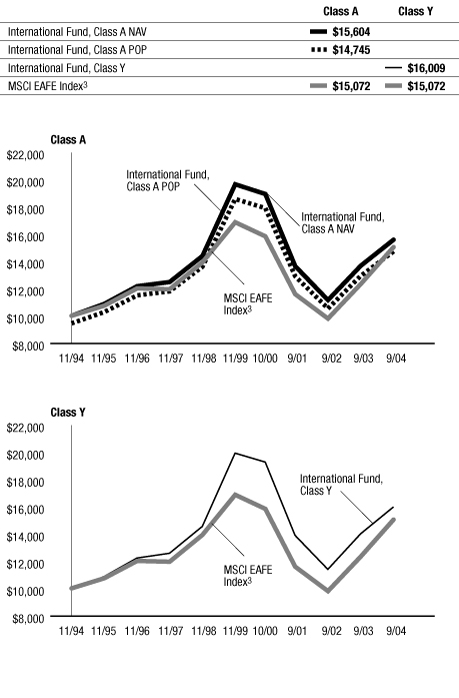

The First American International Fund, Class Y shares, returned 14.13% for the fiscal year ended September 30, 2004 (Class A shares returned 13.91% at net asset value). By comparison, the Fund's benchmark, the MSCI EAFE Index*, returned 22.52% for the same period.

How did general economic and market conditions affect performance?

The fiscal year was highlighted by a transition from a recovery phase to the beginning of a period of slower economic growth. Markets posted positive returns on the back of strong earnings growth and modest valuations. Across the globe, slowing growth, monetary tightening, and rising commodity prices affected markets. Oil had the largest impact of all commodities, with the West Texas Intermediate crude oil price rising through the $50 level by fiscal year end.

Emerging markets continued to outperform developed markets as rising commodity prices supported these resource-rich economies. Japan was the weakest performing region, as the high oil price and slower economic growth weighed on the market. The escalating price of oil also hindered the performance of economically sensitive sectors, such as industrials and information technology, while energy and materials groups were among the best performers.

What worked for the Fund and why?

The Fund was well served by its exposure to the emerging markets, which are not represented in the benchmark. Led by stellar results from our holdings in Brazil, Mexico, China, Turkey, and South Africa, the emerging market portion of the Fund returned 31.4%. With oil prices soaring during the period, the Fund benefited from its positions in Eni and Total, allowing the Fund to outpace the benchmark return in the European energy sector. Other positive factors during the period included a strong return from our Japanese financials exposure, led by Mitsubishi Tokyo Financial, and outperformance in Hong Kong.

What did not work for the Fund and why?

The underperformance of growth stocks relative to more value-oriented shares had a significantly negative impact on Fund results in both Europe and Asia for the 12-month period. The Fund was also hampered by the preference of investors for companies with higher operational leverage over many of their higher-quality, economically sensitive peers. These factors, combined with several stock-specific disappointments, including Nichii Gakkan, Nokia, and Compass Group, caused the Fund to fall short of the benchmark return in Europe and Japan. An underweight to the former region and an overweight to the latter further eroded results.

What strategic moves were made by the Fund and why?

We have been reducing the amount of risk in the portfolio relative to the benchmark. Notably, exposure to the emerging markets, which are not a part of the index, has been reduced to 5.7%. During the fiscal year, the portfolio maintained overweights to the emerging markets and Japan, while underweighting Europe. Also during the period, we increased our weighting in the Pacific Basin ex Japan, as we found many attractive opportunities in the Hong Kong market.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

| Top 10 Companies as of September 30, 20041 (% of net assets) | |

| Vodafone | | | 3.5 | % | |

| Total | | | 3.3 | % | |

| Eni | | | 2.7 | % | |

| Royal Bank of Scotland | | | 2.6 | % | |

| BNP Paribas | | | 2.5 | % | |

| Roche | | | 2.4 | % | |

| Sanofi-Aventis | | | 2.3 | % | |

| HBOS | | | 2.0 | % | |

| Siemens | | | 1.7 | % | |

| Mitsubishi Tokyo Financial Group | | | 1.7 | % | |

| Country Allocation as of September 30, 20041 (% of net assets) | |

| Japan | | | 24.2 | % | |

| Great Britain | | | 17.4 | % | |

| France | | | 14.3 | % | |

| Germany | | | 6.6 | % | |

| Switzerland | | | 5.9 | % | |

| Hong Kong | | | 5.8 | % | |

| Italy | | | 5.0 | % | |

| Australia | | | 4.4 | % | |

| Ireland | | | 3.5 | % | |

| Spain | | | 3.0 | % | |

| Other | | | 9.9 | % | |

1Fund holdings and country holdings are subject to change at any time and are not recommendations to buy or sell any security.

FIRST AMERICAN FUNDS Annual Report 2004

8

International fund continued

| Annualized Performance1 as of September 30, 2004 | |

| | | | | Since Inception4 | |

| | | 1 year | | 5 years | | 10 years | | 3/6/1995 | | 9/24/2001 | |

| Average annual return with sales charge (POP) | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | 7.68 | % | | | (3.53 | %) | | | 3.61 | % | | | - | | | | - | | |

| Class B | | | 8.12 | % | | | (3.48 | %) | | | - | | | | 4.35 | % | | | - | | |

| Class C | | | 12.14 | % | | | - | | | | - | | | | - | | | | 5.49 | % | |

| Average annual return without sales charge (NAV) | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | 13.91 | % | | | (2.43 | %) | | | 4.20 | % | | | - | | | | - | | |

| Class B | | | 13.12 | % | | | (3.16 | %) | | | - | | | | 4.35 | % | | | - | | |

| Class C | | | 13.14 | % | | | - | | | | - | | | | - | | | | 5.49 | % | |

| Class R5 | | | 13.16 | % | | | (2.58 | %) | | | 4.09 | % | | | - | | | | - | | |

| Class Y | | | 14.13 | % | | | (2.19 | %) | | | 4.47 | % | | | - | | | | - | | |

| MSCI EAFE Index3 | | | 22.52 | % | | | (0.51 | %) | | | 4.34 | % | | | 4.47 | % | | | 9.52 | % | |

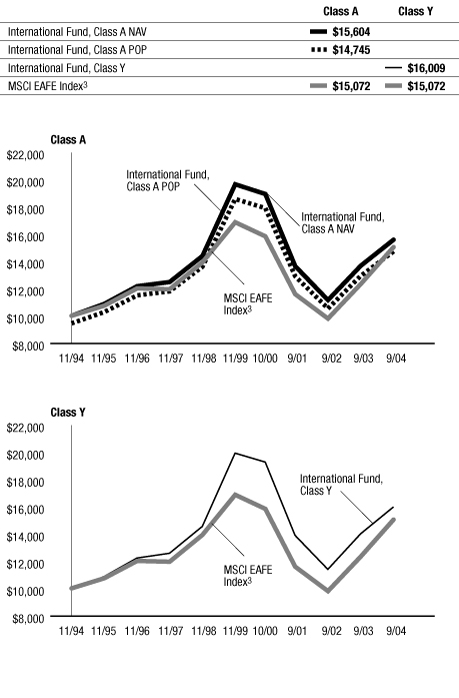

Value of a $10,000 Investment1, 2 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative purposes only and does not reflect any expenses, transaction costs, or cash flow effects. Investment in the index is not available.

International investing involves risks not typically associated with domestic investing, including risks of adverse currency fluctuations, potential political and economic instability, different accounting standards, foreign government regulations, currency exchange rates, limited liquidity, and volatile prices.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including a maximum front-end sales charge of 5.50% for Class A shares and the maximum contingent deferred sales charge ("CDSC") for Class B and Class C shares for the relevant period. Maximum CDSC is 5.00% for Class B shares in the first year, decreasing annually to 0% in the seventh year following purchase, and 1.00% for Class C shares. Total returns assume reinvestment of all distributions at NAV.

On July 1, 2001, Clay Finlay Inc. was hired as subadvisor to manage the Fund's assets. On September 24, 2001, the First American International Fund merged with Firstar International Growth Fund and Firstar International Value Fund, both subadvised by Clay Finlay Inc. Performance history prior to September 24, 2001, represents that of the Firstar International Growth Fund.

2 Performance for Class B, Class C, and Class R shares is not presented. Performance for these classes will vary due to different expense structures.

3 The MSCI EAFE (Morgan Stanley Capital International, Europe, Australasia, Far East) Index is an unmanaged index including approximately 1,000 companies representing the stock markets of 21 countries in Europe, Australasia, and the Far East.

4 The performance since inception for the index is calculated from the month end following the inception of the class.

5 Prior to July 1, 2004, Class R shares were designated Class S shares, which had lower fees and expenses. Performance information prior to that date is based on the performance of the Class S shares. If current fees and expenses had been in effect for the entire period presented, performance would have been lower. Please refer to the prospectus for details.

FIRST AMERICAN FUNDS Annual Report 2004

9

International fund continued

Expense Example

As a shareholder of the International Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 956.80 | | | $ | 7.83 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.00 | | | $ | 8.07 | | |

| Class B Actual | | $ | 1,000.00 | | | $ | 953.50 | | | $ | 11.48 | | |

| Class B Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,013.25 | | | $ | 11.83 | | |

| Class C Actual | | $ | 1,000.00 | | | $ | 954.10 | | | $ | 11.48 | | |

| Class C Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,013.25 | | | $ | 11.83 | | |

| Class R Actual2 | | $ | 1,000.00 | | | $ | 951.10 | | | $ | 8.42 | | |

| Class R Hypothetical (5% return before expenses)2 | | $ | 1,000.00 | | | $ | 1,016.37 | | | $ | 8.70 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 958.20 | | | $ | 6.61 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.25 | | | $ | 6.81 | | |

1Expenses are equal to the Fund's annualized expense ratio of 1.60%, 2.35%, 2.35%, 1.73%, and 1.35% for Class A, Class B, Class C, Class R, and Class Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

2Prior to July 1, 2004, Class R had a different expense ratio. Had the current expense ratio been in place for the most recent one-half year, the actual and hypothetical expenses would have been $9.02 and $9.32, respectively.

FIRST AMERICAN FUNDS Annual Report 2004

10

Small Cap Growth Opportunities fund

Investment Objective: growth of capital

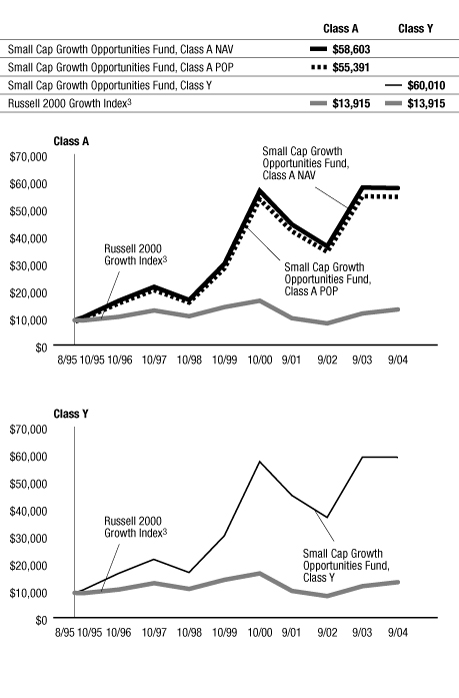

How did the Fund perform for the fiscal year ended September 30, 2004?

The First American Small Cap Growth Opportunities Fund, Class Y shares, returned (0.11%) for the fiscal year ended September 30, 2004 (Class A shares returned (0.39%) at net asset value). By comparison, the Fund's benchmark, the Russell 2000 Growth Index*, returned 11.92% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured above-trend economic growth (i.e., exceeding the average of 3.15% since 1970), strong gains in productivity, and a significant rise in corporate profits. The improving economic environment led to sharp gains in payrolls from March through May 2004 which, along with higher inflation readings during the early months of the year, led the Federal Reserve to begin raising its target interest rate. Higher current and expected short-term interest rates, along with steep increases in oil prices during the first nine months of 2004, have led to growing concerns about the economic and profit growth outlook. These concerns have resulted in equity markets generating little in the way of gains since the first months of the calendar year despite solid earnings growth and continued low long-term interest rates. The markets have beco me more attractively valued as a result.

What worked for the Fund and why?

The Fund benefited from good stock selection in the information technology and materials sectors, as well as a general overweight in the energy sector relative to the Russell 2000 Growth Index. Within the technology sector, electronic equipment and instrument companies Aeroflex and FARO Technologies drove performance while chemical company Headwaters Inc. and metal and mining company Century Aluminum added value in the materials sector.

| Top 10 Companies as of September 30, 20041 (% of net assets) | |

| Spanish Broadcasting System | | | 3.1 | % | |

| Taro Pharmaceutical Industries | | | 2.9 | % | |

| Watson Pharmaceuticals | | | 2.8 | % | |

| Encore Medical | | | 2.7 | % | |

| Landry's Restaurants | | | 2.6 | % | |

| ADTRAN | | | 2.3 | % | |

| SAFENET | | | 2.2 | % | |

| Bradley Pharmaceuticals | | | 2.1 | % | |

| Amylin Pharmaceuticals | | | 2.0 | % | |

| Cullen/Frost Bankers | | | 2.0 | % | |

What did not work for the Fund and why?

Adverse stock selection across a number of different sectors was the primary reason for the underperformance relative to the Russell 2000 Growth Index. Commercial service and supply companies within the industrial sector took the biggest toll on performance. Among these companies were Exult and Gevity, both human resource outsourcing companies, and Integrated Alarm Services Group, a provider of security alarm servicing systems. Healthcare stocks Encore Medical and Select Medical also had a negative impact on Fund performance. Select Medical fell victim to a change in government policies regarding the reimbursement for outpatient rehabilitation while Encore Medical's acquisitions of noncore businesses hurt the stock performance. Lastly, specialty retail companies Wet Seal, Sports Authority, and Select Comfort disappointed in the consumer discretionary sector. Wet Seal, a teen clothing distribut or under new management, saw slow sales of its new line of merchandise while the merger between The Sport Authority and Gart Sports did not result in increased sales. Finally, Select Comfort, a producer of specialty mattresses, received complaints that their beds were developing mold, causing the market to fear a potential for significant warranty claims.

What strategic moves were made by the Fund and why?

During the second half of the fiscal year, the First American Small Cap Growth Opportunities Fund came under new management. The new management team's strategy is to focus on companies that are leveraged to secular trends (e.g., the aging population). As a result, the Fund has taken underweight positions in the basic materials, industrials, transportation, and utilities sectors. Conversely, the Fund has taken overweight positions in the consumer cyclical, staples, energy, and technology sectors.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

| Sector Allocation as of September 30, 20041 (% of net assets) | |

| | | Fund2 | | Russell 2000

Growth Index3 | |

| Consumer Discretionary | | | 18.8 | % | | | 15.8 | % | |

| Consumer Staples | | | 0.0 | % | | | 2.2 | % | |

| Energy | | | 5.9 | % | | | 5.1 | % | |

| Financials | | | 9.2 | % | | | 9.9 | % | |

| Healthcare | | | 28.2 | % | | | 21.8 | % | |

| Industrials | | | 0.5 | % | | | 14.1 | % | |

| Information Technology | | | 30.2 | % | | | 26.7 | % | |

| Materials | | | 0.0 | % | | | 3.5 | % | |

| Telecommunication Services | | | 2.0 | % | | | 0.9 | % | |

1Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

2The percentages shown represent the allocation by industry as a percent of net assets of the Fund.

3The percentages shown represent the percent allocation by industry of the index.

FIRST AMERICAN FUNDS Annual Report 2004

11

Small Cap Growth Opportunities fund continued

| Annualized Performance1 as of September 30, 2004 | |

| | | | | Since Inception | |

| | | 1 year | | 5 years | | 8/1/1995 | | 3/1/1999 | | 12/11/2000 | | 9/24/2001 | |

| Average annual return with sales charge (POP) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | (5.88 | %) | | | 14.08 | % | | | 20.54 | % | | | - | | | | - | | | | - | | |

| Class B | | | (6.04 | %) | | | 14.26 | % | | | - | | | | 20.95 | % | | | - | | | | - | | |

| Class C | | | (2.13 | %) | | | - | | | | - | | | | - | | | | - | | | | 9.41 | % | |

| Average annual return without sales charge (NAV) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | (0.39 | %) | | | 15.38 | % | | | 21.28 | % | | | - | | | | - | | | | - | | |

| Class B | | | (1.13 | %) | | | 14.49 | % | | | - | | | | 21.03 | % | | | - | | | | - | | |

| Class C | | | (1.14 | %) | | | - | | | | - | | | | - | | | | - | | | | 9.41 | % | |

| Class R4 | | | (0.39 | %) | | | - | | | | - | | | | - | | | | 2.39 | % | | | - | | |

| Class Y | | | (0.11 | %) | | | 15.67 | % | | | 21.60 | % | | | - | | | | - | | | | - | | |

| Russell 2000 Growth Index3 | | | 11.92 | % | | | (0.68 | %) | | | 3.67 | % | | | 1.46 | % | | | (3.39 | %) | | | 9.75 | % | |

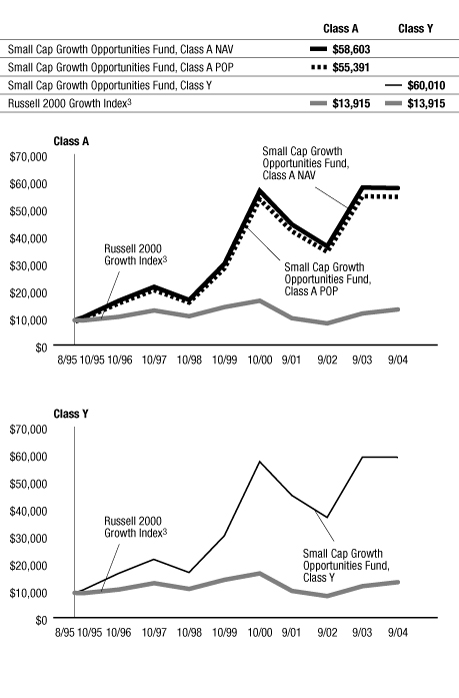

Value of a $10,000 Investment1, 2 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrati ve purposes only and does not reflect any expenses, transaction costs, or cash flow effects. Investment in the index is not available.

Stocks of small-capitalization companies involve substantial risk. These stocks historically have experienced greater price volatility than stocks of larger companies, and they may be expected to do so in the future.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including a maximum front-end sales charge of 5.50% for Class A shares and the maximum contingent deferred sales charge ("CDSC") for Class B and Class C shares for the relevant period. Maximum CDSC is 5.00% for Class B shares in the first year, decreasing annually to 0% in the seventh year following purchase, and 1.00% for Class C shares. Total returns assume reinvestment of all distributions at NAV.

On December 12, 2002, the Fund changed its main investment strategy such that it was permitted to invest in securities of companies with market capitalizations within the range of companies in the Russell 2000 Index. Previously, the Fund invested primarily in companies with market capitalizations of below $500 million at the time of purchase.

On September 24, 2001, the First American Small Cap Growth Opportunities Fund became the successor by merger to the Firstar MicroCap Fund, a series of Firstar Funds, Inc. Prior to the merger, the First American fund had no assets or liabilities. Performance presented prior to September 24, 2001, represents that of the Firstar MicroCap Fund.

The First American Small Cap Growth Opportunities Fund's 1999 returns were higher due in substantial part to its strategy of investing in IPOs in a period favorable for IPO investing. Of course, such favorable returns involve accepting the risk of volatility, and there is no assurance that the Fund's future investment in IPOs will have the same effect on performance as it did in 1999.

2 Performance for Class B, Class C, and Class R shares is not presented. Performance for these classes will vary due to different expense structures.

3 An unmanaged index that measures the performance of those companies in the Russell 2000 Index with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

4 Prior to July 1, 2004, Class R shares were designated Class S shares, which had lower fees and expenses. Performance information prior to that date is based on the performance of the Class S shares. If current fees and expenses had been in effect for the entire period presented, performance would have been lower. Please refer to the prospectus for details.

FIRST AMERICAN FUNDS Annual Report 2004

12

Small Cap Growth Opportunities fund continued

Expense Example

As a shareholder of the Small Cap Growth Opportunities Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 833.60 | | | $ | 8.85 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.35 | | | $ | 9.72 | | |

| Class B Actual | | $ | 1,000.00 | | | $ | 830.90 | | | $ | 12.27 | | |

| Class B Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,011.60 | | | $ | 13.48 | | |

| Class C Actual | | $ | 1,000.00 | | | $ | 830.60 | | | $ | 12.27 | | |

| Class C Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,011.60 | | | $ | 13.48 | | |

| Class R Actual2 | | $ | 1,000.00 | | | $ | 832.90 | | | $ | 9.42 | | |

| Class R Hypothetical (5% return before expenses)2 | | $ | 1,000.00 | | | $ | 1,014.72 | | | $ | 10.35 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 834.60 | | | $ | 7.71 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.60 | | | $ | 8.47 | | |

1Expenses are equal to the Fund's annualized expense ratio of 1.93%, 2.68%, 2.68%, 2.06%, and 1.68% for Class A, Class B, Class C, Class R, and Class Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

2Prior to July 1, 2004, Class R had a different expense ratio. Had the current expense ratio been in place for the most recent one-half year, the actual and hypothetical expenses would have been $9.99 and $10.98, respectively.

FIRST AMERICAN FUNDS Annual Report 2004

13

Small Cap Select fund

Investment Objective: capital appreciation

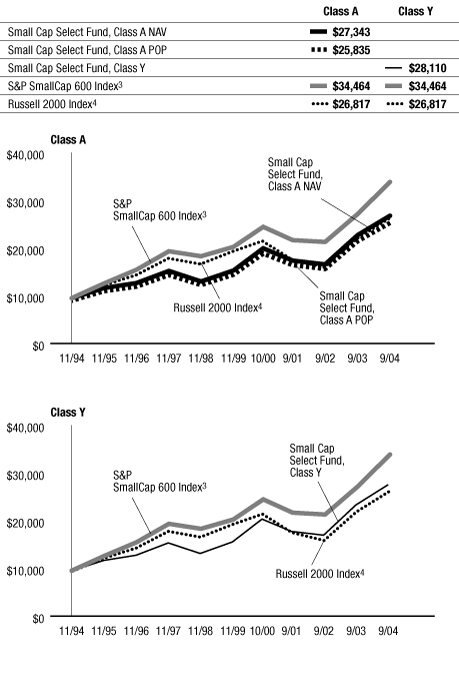

How did the Fund perform for the fiscal year ended September 30, 2004?

The First American Small Cap Select Fund, Class Y shares, returned 17.98% for the fiscal year ended September 30, 2004 (Class A shares returned 17.64% at net asset value). By comparison, the Fund's benchmark, the Russell 2000 Index*, returned 18.77% for the same period. During the past year, the Fund's benchmark changed from The Standard and Poor's Small Cap 600 Composite Index to the Russell 2000 Index. The benchmark was changed to reflect the advisor's belief that the Russell 2000 Index was a better measure of the Fund's investment objective, capital appreciation.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured above trend economic growth (i.e., exceeding the average of 3.15% since 1970), strong gains in productivity, and a significant rise in corporate profits. The improving economic environment led to sharp gains in payrolls from March through May 2004 which, along with higher inflation readings during the early months of the year, led the Federal Reserve to begin raising its target interest rate. Higher current and expected short-term interest rates, along with steep increases in oil prices during the first nine months of 2004, have led to growing concerns about the economic and profit growth outlook. These concerns have resulted in equity markets generating little in the way of gains since the first months of the calendar year despite solid earnings growth and continued low long-term interest rates. The markets have beco me more attractively valued as a result.

What worked for the Fund and why?

Good stock selection in the technology, healthcare, and energy sectors was the reason for the Fund's outperformance relative to the Russell 2000 Index in these areas. Research in Motion was the biggest positive driver of performance in the technology sector. Research in Motion, a manufacturer of wireless data devices, saw earnings estimates rise 10-fold during the fiscal year as sales of its BlackBerry wireless devices were strong. Within healthcare, good general stock selection in the biotech industry and the acquisition of healthcare provider and service company Inveresk Research Group by Charles River Labs added value. Finally, energy stock Ultra Petroleum added the most performance to the Fund overall relative to the benchmark as commodity prices, an efficient production process, and a positive reg ulatory environment helped the stock.

What did not work for the Fund and why?

Adverse stock selection across the materials, consumer discretionary, financials, and consumer staples sectors detracted from performance relative to the Russell 2000 Index. Anchor Glass Container Corp. hurt performance in the materials sector as the demand for their products declined and the raw input costs for their products increased. Media companies and specialty retailers negatively impacted performance in the consumer discretionary sector. Specifically in the specialty retail area, the merger between Sports Authority and Gart Sports did not result in increased sales and led to poor stock performance. In the financial sector, thrift, mortgage, and insurance stocks disappointed. Lastly, Performance Food Group was the leading detractor in the consumer staples sector.

What strategic moves were made by the Fund and why?

During the second half of the fiscal year the Fund came under new management and the Fund's benchmark, the Standard and Poor's SmallCap 600 Index, was changed to the Russell 2000 Index. The Index change was a result of the advisor's belief that the Russell 2000 Index was more representative of the Fund's investment objective of capital appreciation. The biggest strategic change by the new management team was decreasing the weight in the consumer discretionary sector based on the team's feeling that a decrease in refinancing activity and tax-rebate-driven spending, coupled with a slow recovery in employment, has put pressure on the sector.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

| Top 10 Companies as of September 30, 20041 (% of net assets) | |

| TIBCO Software | | | 2.2 | % | |

| Logitech International | | | 2.2 | % | |

| Georgia Gulf | | | 2.0 | % | |

| FactSet Research Systems | | | 2.0 | % | |

| Marvel Enterprises | | | 1.8 | % | |

| City National | | | 1.7 | % | |

| Chicago Bridge & Iron | | | 1.6 | % | |

| Station Casinos | | | 1.5 | % | |

| Cullen/Frost Bankers | | | 1.5 | % | |

| Covance | | | 1.5 | % | |

| Sector Allocation as of September 30, 20041 (% of net assets) | |

| | | Fund2 | | Russell 2000

Index3 | |

| Consumer Discretionary | | | 17.2 | % | | | 14.8 | % | |

| Consumer Staples | | | 0.0 | % | | | 2.7 | % | |

| Energy | | | 6.2 | % | | | 5.5 | % | |

| Financials | | | 16.7 | % | | | 22.5 | % | |

| Healthcare | | | 13.1 | % | | | 12.9 | % | |

| Industrials | | | 17.9 | % | | | 14.0 | % | |

| Information Technology | | | 21.2 | % | | | 17.0 | % | |

| Materials | | | 4.6 | % | | | 6.3 | % | |

| Telecommunication Services | | | 0.5 | % | | | 0.9 | % | |

| Utilities | | | 0.0 | % | | | 3.3 | % | |

1Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

2The percentages shown represent the allocation by industry as a percent of net assets of the Fund.

3The percentages shown represent the percent allocation by industry of the index.

FIRST AMERICAN FUNDS Annual Report 2004

14

Small Cap Select fund continued

Annualized Performance1 as of September 30, 2004

| | | | | Since Inception | |

| | | 1 year | | 5 years | | 10 years | | 3/6/1995 | | 9/24/2001 | |

| Average annual return with sales charge (POP) | | | |

| Class A | | | 11.13 | % | | | 11.82 | % | | | 9.81 | % | | | - | | | | - | | |

| Class B | | | 11.88 | % | | | 12.03 | % | | | - | | | | 9.62 | % | | | - | | |

| Class C | | | 15.79 | % | | | - | | | | - | | | | - | | | | 15.05 | % | |

| Average annual return without sales charge (NAV) | | | |

| Class A | | | 17.64 | % | | | 13.08 | % | | | 10.44 | % | | | - | | | | - | | |

| Class B | | | 16.88 | % | | | 12.28 | % | | | - | | | | 9.62 | % | | | - | | |

| Class C | | | 16.79 | % | | | - | | | | - | | | | - | | | | 15.05 | % | |

| Class R5 | | | 17.60 | % | | | 13.13 | % | | | 10.46 | % | | | - | | | | - | | |

| Class Y | | | 17.98 | % | | | 13.38 | % | | | 10.75 | % | | | - | | | | - | | |

| S&P SmallCap 600 Index3 | | | 24.58 | % | | | 11.49 | % | | | 12.62 | % | | | 13.18 | % | | | 17.34 | % | |

| Russell 2000 Index4 | | | 18.77 | % | | | 7.41 | % | | | 9.87 | % | | | 10.27 | % | | | 14.71 | % | |

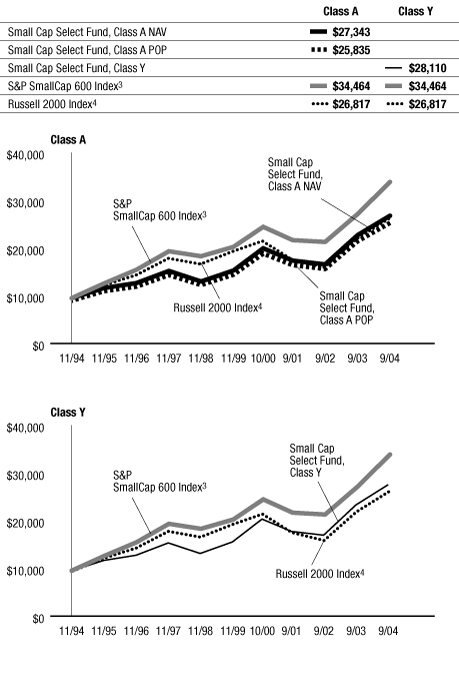

Value of $10,000 Investment1, 2 as of September 30, 2004

The performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by calling 800.677.FUND.

1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance reflects voluntary fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. Index performance is for illustrative purposes only and does not reflect any expenses, transaction costs, or cash flow effects. Investment in an index is not available.

Stocks of small-capitalization companies involve substantial risk. These stocks historically have experienced greater price volatility than stocks of larger companies, and they may be expected to do so in the future.

Total returns at net asset value ("NAV") reflect performance over the time period indicated without including the Fund's maximum sales charge and assume reinvestment of all distributions at NAV.

Total returns at public offering price ("POP") reflect performance over the time period indicated including a maximum front-end sales charge of 5.50% for Class A shares and the maximum contingent deferred sales charge ("CDSC") for Class B and Class C shares for the relevant period. Maximum CDSC is 5.00% for Class B shares in the first year, decreasing annually to 0% in the seventh year following purchase, and 1.00% for Class C shares. Total returns assume reinvestment of all distributions at NAV.

On September 24, 2001, the First American Small Cap Select Fund became the successor by merger to the Firstar SmallCap Core Equity Fund, a series of Firstar Funds, Inc. Prior to the merger, the First American fund had no assets or liabilities. Performance presented prior to September 24, 2001, represents that of the Firstar SmallCap Core Equity Fund. The Firstar SmallCap Core Equity Fund was organized on November 27, 2000, and prior to that, was a separate series of Mercantile Funds, Inc.

2 Performance for Class B, Class C, and Class R shares is not presented. Performance for these classes will vary due to different expense structures.

3 An unmanaged, capitalization-weighted index that measures the performance of selected U.S. stocks with small market capitalizations.

4 An unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

5 Prior to July 1, 2004, Class R shares were designated Class S shares, which had lower fees and expenses. Performance information prior to that date is based on the performance of the Class S shares. If current fees and expenses had been in effect for the entire period presented, performance would have been lower. Please refer to the prospectus for details.

FIRST AMERICAN FUNDS Annual Report 2004

15

Small Cap Select fund continued

Expense Example

As a shareholder of the Small Cap Select Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2004, to September 30, 2004.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Examples

| | | Beginning Account

Value (4/1/2004) | | Ending Account

Value (9/30/2004) | | Expenses Paid During

Period1 (4/1/2004 to

9/30/2004) | |

| Class A Actual | | $ | 1,000.00 | | | $ | 964.30 | | | $ | 5.94 | | |

| Class A Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.95 | | | $ | 6.11 | | |

| Class B Actual | | $ | 1,000.00 | | | $ | 961.10 | | | $ | 9.61 | | |

| Class B Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.20 | | | $ | 9.87 | | |

| Class C Actual | | $ | 1,000.00 | | | $ | 960.60 | | | $ | 9.61 | | |

| Class C Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.20 | | | $ | 9.87 | | |

| Class R Actual2 | | $ | 1,000.00 | | | $ | 964.20 | | | $ | 6.56 | | |

| Class R Hypothetical (5% return before expenses)2 | | $ | 1,000.00 | | | $ | 1,018.32 | | | $ | 6.74 | | |

| Class Y Actual | | $ | 1,000.00 | | | $ | 965.60 | | | $ | 4.72 | | |

| Class Y Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.20 | | | $ | 4.85 | | |

1Expenses are equal to the Fund's annualized expense ratio of 1.21%, 1.96%, 1.96%, 1.34%, and 0.96% for Class A, Class B, Class C, Class R, and Class Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year/366 days (to reflect the one-half year period).

2Prior to July 1, 2004, Class R had a different expense ratio. Had the current expense ratio been in place for the most recent one-half year, the actual and hypothetical expenses would have been $7.17 and $7.36, respectively.

FIRST AMERICAN FUNDS Annual Report 2004

16

Small Cap Value fund

Investment Objective: capital appreciation

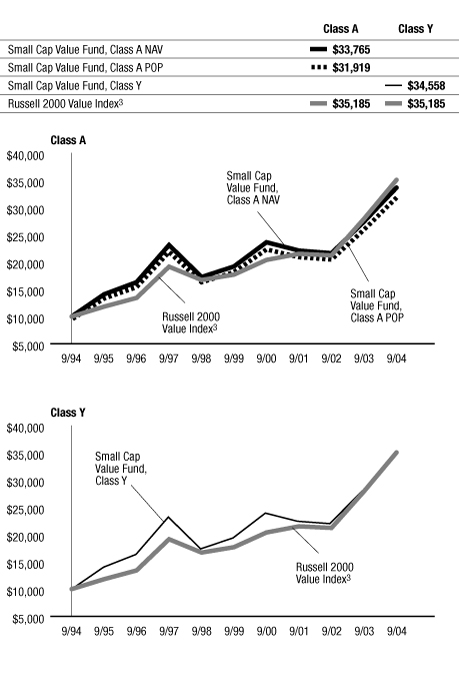

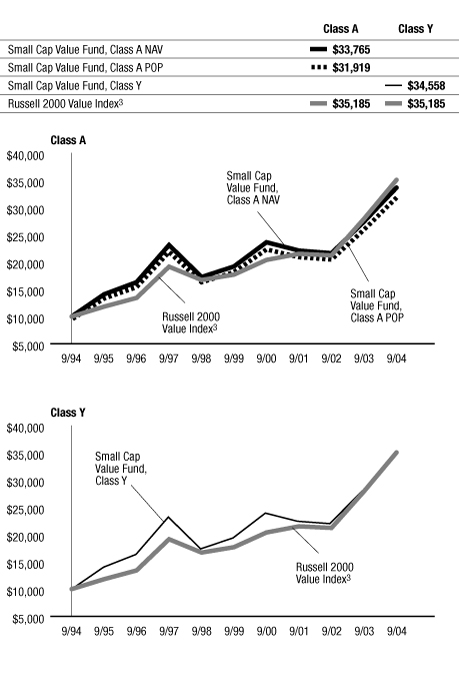

How did the Fund perform for the fiscal year ended September 30, 2004?

The First American Small Cap Value Fund, Class Y shares, returned 23.02% for the fiscal year ended September 30, 2004 (Class A shares returned 22.70% at net asset value). By comparison, the Fund's benchmark, the Russell 2000 Value Index*, returned 25.66% for the same period.

How did general economic and market conditions affect performance?

During the past year, we saw an improving economic environment that featured above trend economic growth (i.e., exceeding the average of 3.15% since 1970), strong gains in productivity, and a significant rise in corporate profits. The improving economic environment led to sharp gains in payrolls from March through May 2004 which, along with higher inflation readings during the early months of the year, led the Federal Reserve to begin raising its target interest rate. Higher current and expected short-term interest rates, along with steep increases in oil prices during the first nine months of 2004, have led to growing concerns about the economic and profit growth outlook. These concerns have resulted in equity markets generating little in the way of gains since the first months of the calendar year despite solid earnings growth and continued low long-term interest rates. The markets have beco me more attractively valued as a result.

What worked for the Fund and why?

The Fund benefited from good stock selection in the healthcare and materials sectors, as well as the private banking industry. Additionally, a general overweight in the energy sector added to performance relative to the Russell 2000 Value Index. Within healthcare, Serological Corp., a biotechnology company that provides the raw materials used in a number of drugs, added to performance as end-user demand for certain drugs increased. Chemical stock, Georgia Gulf Corp., was the best performing stock in the materials sector as demand for their product increased due to the global demand for PVC plastic. Lastly, First Republic Bank of California aided performance, driven by continued stability and strength in the California real estate market and solid growth in asset management.

What did not work for the Fund and why?

Adverse stock selection in the technology, consumer discretionary, and industrials sectors was the primary reason for the Fund's underperformance relative to the Russell 2000 Value Index. Within the technology sector, slower-than-expected adoption of a new product, coupled with pricing pressure that offset unit growth, led to poor performance from data storage company Advanced Digital Information. Auto components company, Tower Automotive, had disappointing results in the consumer discretionary sector as the auto industry realized excess inventory and the company increased balance sheet leverage to support anticipated growth from recent successes in obtaining new customers. Finally, Integrated Alarm Services Group hurt results in the industrials sector as the management team failed to execute on transforming the company's business model.

What strategic moves were made by the Fund and why?

One of the largest strategic moves the management team made during the fiscal year was to tilt the financial sector toward firms that would be less impacted by an increasing interest-rate environment. This entailed moving away from real estate investment trusts (REITs) and thrifts and toward asset management companies more leveraged to a better economic environment. The Fund also moved to an overweight position in the energy sector, as fundamental conditions for exploration and production companies remained strong.

*Unlike mutual funds, index returns do not reflect any expenses, transaction costs, or cash flow effects.

| Top 10 Companies as of September 30, 20041 (% of net assets) | |

| Georgia Gulf | | | 2.0 | % | |

| Cooper | | | 1.7 | % | |

| Radian Group | | | 1.7 | % | |

| NCO Group | | | 1.6 | % | |

| First Republic Bank – California | | | 1.6 | % | |

| City National | | | 1.5 | % | |

| Artesyn Technologies | | | 1.5 | % | |

| Sky Financial Group | | | 1.5 | % | |

| American Capital Strategies | | | 1.5 | % | |

| Men's Wearhouse | | | 1.4 | % | |

| Sector Allocation as of September 30, 20041 (% of net assets) | |

| | | Fund2 | | Russell 2000

Value Index3 | |

| Consumer Discretionary | | | 12.2 | % | | | 13.9 | % | |

| Consumer Staples | | | 1.3 | % | | | 3.1 | % | |

| Energy | | | 8.1 | % | | | 5.9 | % | |

| Financials | | | 30.6 | % | | | 33.9 | % | |

| Healthcare | | | 6.7 | % | | | 4.9 | % | |

| Industrials | | | 19.2 | % | | | 13.8 | % | |

| Information Technology | | | 6.9 | % | | | 8.4 | % | |

| Materials | | | 8.2 | % | | | 8.8 | % | |

| Telecommunication Services | | | 0.7 | % | | | 1.0 | % | |

| Utilities | | | 4.7 | % | | | 6.3 | % | |

1Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

2The percentages shown represent the allocation by industry as a percent of net assets of the Fund.

3The percentages shown represent the percent allocation by industry of the index.

FIRST AMERICAN FUNDS Annual Report 2004

17

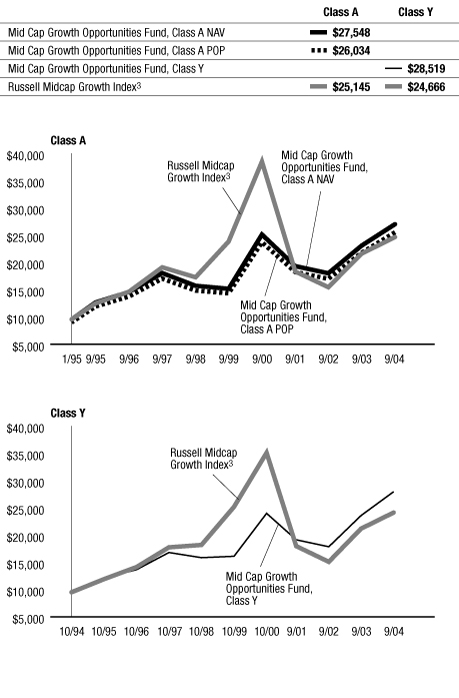

Small Cap Value fund continued