UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): April 21, 2005

CHINA DIGITAL MEDIA CORPORATION

(Exact Name of Registrant as Specified in Charter)

Nevada (State or Other Jurisdiction of Incorporation) | 000-30212 (Commission File Number) |

| | |

2505-06, 25/F, Stelux House, 698 Prince Edward Road East, Kowloon, Hong Kong Peoples' Republic of China (Address of Principal Executive Offices) (Zip Code) | 13-3422912 (I.R.S. Employer Identification No.) |

| | |

(011) 852-2390-8600 (Registrant's Telephone Number, Including Area Code) |

| |

HAIRMAX INTERNATIONAL, INC. (Former Name or Former Address, if Changed since Last Report) |

This Current Report on Form 8-K/A is filed by China Digital Media Corporation, f/k/a Hairmax International, Inc., a Nevada corporation (the “Registrant”), in connection with the items described below. It amends that certain Current Report on Form 8-K, dated April 11, 2005, and filed by the Registrant with the Commission on April 12, 2005.

Item 9.01 Financial Statements and Exhibits.

On December 28, 2005, Hairmax International, Inc., a Nevada corporation and predecessor of the Registrant (“Hairmax”), executed a Plan of Exchange (the “Agreement”), among Hairmax, Arcotect Digital Technology, Ltd., a corporation organized and existing under the laws of the Hong Kong SAR of the Peoples’ Republic of China (“Arcotect”), the Arcotect Shareholders and the Majority Shareholders (as defined) of Hairmax.

On February 18, 2005, pursuant to the Agreement, Hairmax changed its name to “China Digital Media Corporation” by filing Articles of Amendment with the Secretary of State of Nevada after the filing a Definitive Information Statement on Schedule 14C with the Commission on January 10, 2005. In addition, on March 31, 2005, the NASDAQ awarded the new trading symbol of “CDGT” to the Registrant.

The closing under the Agreement occurred on March 31, 2005, and the Registrant issued 1,500,000 shares of common stock in exchange for all of the issued and outstanding shares of capital stock of Arcotect owned by the Arcotect Shareholders. As a result of these transactions, Arcotect became a wholly-owned subsidiary of the Registrant.

The sole purpose of this Form 8-K amendment is to provide the financial statements of Arcotect as required by Item 9.01(a) of Form 8-K and the proforma financial information required by Item 9.01(b) of Form 8-K, which financial statements and information were excluded from the Current Report on Form 8-K filed on April 12, 2005, in reliance on Items 9.01(a)(4) and 9.01(b)(2), respectively, of that form.

ITEM 9.01(a) - FINANCIAL STATEMENTS OF BUSINESSES ACQUIRED

The following financial statements of Arcotect are set forth below: (i) the audited consolidated balance sheets, (ii) the audited statements of operations, (iii) the audited consolidated statements of stockholders’ deficit and (iv) the audited consolidated statements of cash flows, in each case for years ended December 31, 2004 and December 31, 2003, and (v) the consolidated notes to the financial statements for such period.

| Jimmy C.H. Cheung & Co Certified Public Accountants (A member of Kreston International) |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of:

Arcotect Digital Technology Limited

Hong Kong

We have audited the accompanying consolidated balance sheets of Arcotect Digital Technology Limited, as of December 31, 2004 and 2003 and the related consolidated statements of operations, stockholders’equity and cash flows forthe years ended December 31, 2004 and 2003. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits of the financial statements provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Arcotect Digital Technology Limited, as of December 31, 2004 and 2003, and the results of its operations and its cash flows for the years ended December 31, 2004 and 2003, in conformity with accounting principles generally accepted in the United States of America.

| | | |

| | JIMMY C.H. CHEUNG & CO Certified Public Accountants |

|

|

|

| Date: February 3, 2005 | By: |  |

| |

JIMMY C.H. CHEUNG |

| | Hong Kong |

| | 304 Dominion Centre, 43 Queen’s Road East, Wanchai, Hong Kong Tel: (852) 25295500 Fax: (852) 28651067 Email: jchc@krestoninternational.com.hk Website: http://www.jimmycheungco.com |  |

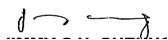

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

AS OF DECEMBER 31, 2004 AND 2003

The accompanying notes are an integral part of these consolidated financial statements

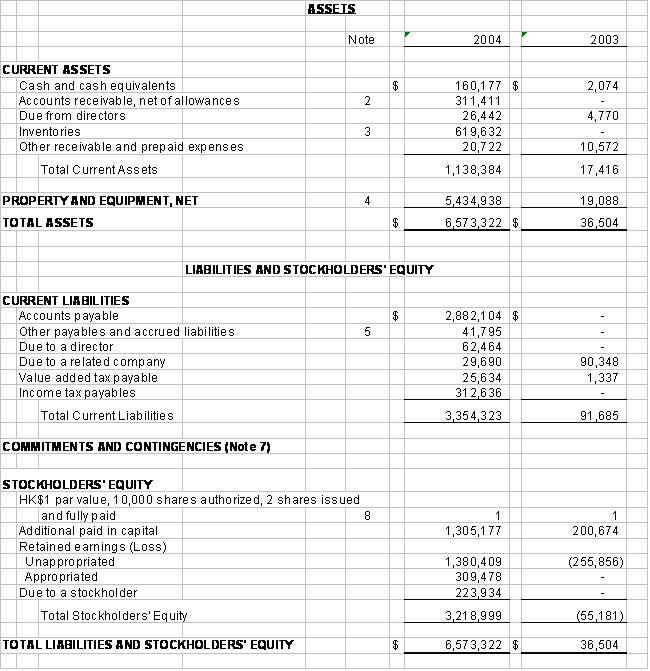

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

CONSOLIDATEDSTATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003

The accompanying notes are an integral part of these consolidated financial statements

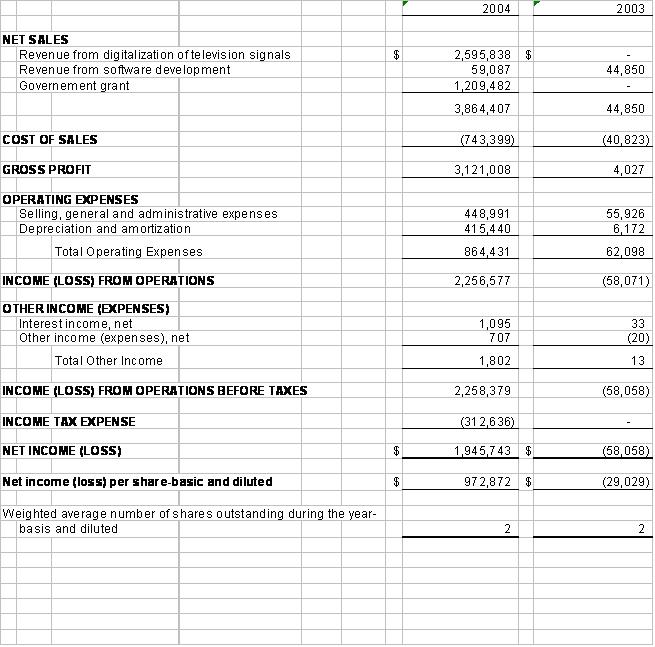

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

CONSOLIDATEDSTATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003

The accompanying notes are an integral part of these consolidated financial statements

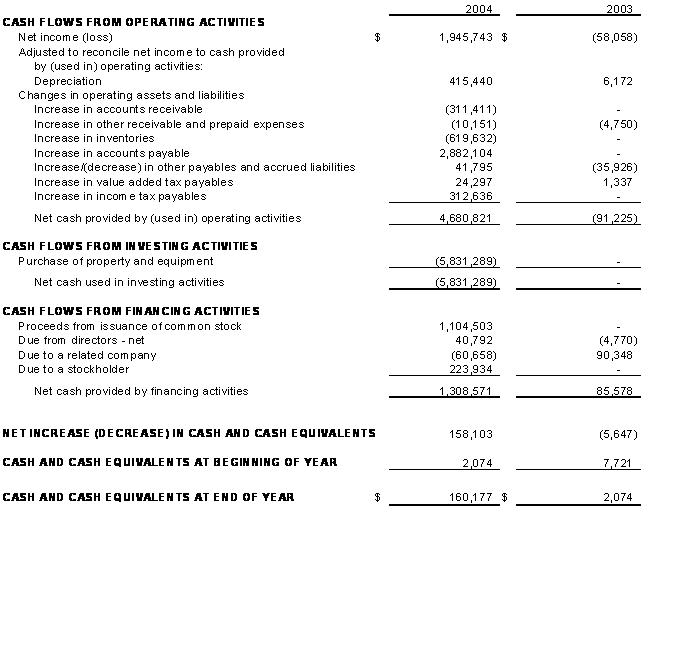

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

CONSOLIDATEDSTATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003

The accompanying notes are an integral part of these consolidated financial statements

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

NOTES TO THECONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2004 AND 2003

| 1. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND ORGANIZATION |

(A) Organization

Arcotect Digital Technology Limited (“ADTL”), formerly known as Cyber Trader Limited, was incorporated in Hong Kong on January 5, 2000 with its principal place of business in Hong Kong. Arcotect (Guangzhou) Technology Limited (“AGTL”) was incorporated in the People’s Republic of China (“PRC”) as a wholly owned foreign limited liability company on September 24, 2001 with its principal place of business in Guangzhou, PRC.

ADTL is an investment holding company and AGTL is principally engaged in software development, digital television subscriber and application platform development (“software development”) and investment holding. AGTL set up a branch in Nanhai, PRC (“the Nanhai Branch”) on July 8, 2004 which is engaged in investment in digital television set-top-box (STB) and smart cards to convert television signal from analogue into digital (“digitalization of television signals”).

During 2004, AGTL’s shareholder, a company under common control and management with ADTL sold 100% of its ownership of AGTL to ADTL under a reorganization plan. The transfer has been accounted for as a reorganization of entities under common control and the financial statements have been prepared as if the reorganization had occurred retroactively. ADTL and AGTL are hereafter referred to as (“the Company”).

The preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| (C) | Principles of consolidation |

The accompanying consolidated financial statements for the year ended December 31, 2004 include the accounts of ADTL, AGTL and its Nanhai Branch. The accompanying consolidated financial statements for the year ended December 31, 2003 include the accounts of ADTL and AGTL. All significant inter-company transactions and balances have been eliminated in consolidation.

| (D) | Cash and cash equivalents |

For purpose of the statements of cash flows, cash and cash equivalents include cash on hand and demand deposits with a bank with a maturity of less than 3 months.

The Company extends unsecured credit to its customers in the ordinary course of business but mitigates the associated risks by performing credit checks and actively pursuing past due accounts.

As of December 31, 2004 and 2003, the Company considers all its accounts receivable to be collectible and no provision for doubtful accounts has been made in the financial statements.

Inventories are stated at lower of cost or market value, cost being determined on a first in first out method. The Company provided inventory allowances based on excess and obsolete inventories determined principally by customer demand.

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

NOTES TO THECONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2004 AND 2003

1.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND ORGANIZATION (CONTINUED)

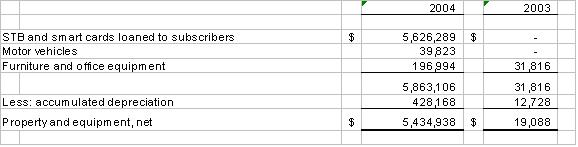

| (G) | Property and equipment |

Property and equipment are stated at cost, less accumulated depreciation. Expenditures for additions, major renewals and betterments are capitalized and expenditures for maintenance and repairs are charged to expense as incurred.

Depreciation is provided on a straight-line basis, less estimated residual value over the assets’ estimated useful lives. The estimated useful lives are as follows:

STB and smart cards 5 Years

Motor vehicles 10 Years

Furniture, fixtures and equipment 5 Years

In accordance with Statement of Financial Accounting Standards No. 121, “Accounting for the impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed of", long-lived assets and certain identifiable intangible assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. For purposes of evaluating the recoverability of long-lived assets, the recoverability test is performed using undiscounted net cash flows related to the long- lived assets. The Company reviews long-lived assets to determine that carrying values are not impaired.

| (I) | Fair value of financial instruments |

Statement of Financial Accounting Standards No. 107, "Disclosure About Fair Value of Financial Instruments," requires certain disclosures regarding the fair value of financial instruments. Trade accounts receivable, accounts payable, and accrued liabilities are reflected in the financial statements at fair value because of the short-term maturity of the instruments.

The Company generates two revenue streams: software development and digitalization of television signals.

Software development

The Company provides various IT professional services to its customers based on a negotiated fixed-price time and materials contracts. The Company recognizes services-based revenue from all of its contracts when the service has been performed, the customer has approved the completion of services and an invoice has been issued and collectibility is reasonably assured.

Digitalization of television signals

The Company entered into an agreement with Nanhai Network Company to assist the conversion of television signal from analogue into digital by providing STB and smart cards to the subscribers in Nanhai City on a loan basis. The Company is entitled to a portion of fees payable by the existing subscriber under a subscription agreement between the subscriber and the Nanhai Network Company. Revenue is recognized on a straight line basis in accordance with the term of the subscription agreement. The Company also charges installation fees and sells STB and smart cards to new subscribers. Revenue arising from these services is recognized when the subscriber is invoiced for the STB and smart cards upon the completion of installation works.

The local government of Nanhai City also approved a grant of $1,209,482 each year for five years to finance the purchase of STB and smart cards for sale and loan to subscribers. The grant is recognized as revenue on receipt from the local government.

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

NOTES TO THECONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2004 AND 2003

| 1. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND ORGANIZATION (CONTINUED) |

PRC income tax is computed according to the relevant laws and regulations in the PRC. The Company’s applicable tax rate has been 33%.The income tax expenses for 2004 and 2003 were $308,371 and $0 respectively.

| (L) | Foreign currency translation |

The functional currency of ADTL is Hong Kong Dollars and AGTL is the Chinese Renminbi (“RMB”). Transactions denominated in Hong Kong Dollars and RMB are translated into United States dollars using year end exchange rates as to assets and liabilities and average exchange rates as to revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transaction occurred. Net gains and losses resulting from foreign exchange translations are included in the statements of operations and stockholder’s equity as other comprehensive income (loss). No translation differences were recorded for the years ended December 31, 2004 and 2003.

| (M) | Comprehensive income (loss) |

The foreign currency translation gain or loss resulting from translation of the financial statements expressed in Hong Kong Dollars and RMB to United States Dollar is reported as other comprehensive income (loss) in the statements of operations and stockholders’ equity.No translation differences were recorded for the years ended December 31, 2004 and 2003.

| (N) | Income (Loss) per share |

Basic income (loss) per share is computed by dividing income (loss) available to common shareholders by the weighted average number of common shares outstanding during the period. Diluted income per share is computed similar to basic income (loss) per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. There are no potentially dilutive securities for 2004 and 2003.

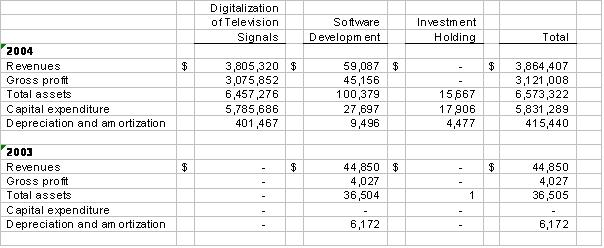

The Company operates in three reportable segments, Digitalization of Television Signals, Software Development and Investment Holding.

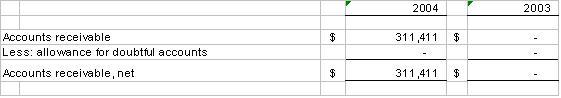

2. ACCOUNTS RECEIVABLE

Accounts receivable at December 31, 2004 and 2003 consisted of the following:

As of December 31, 2004, the Company considered all accounts receivable collectable and has not recorded a provision for doubtful accounts.

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

NOTES TO THECONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2004 AND 2003

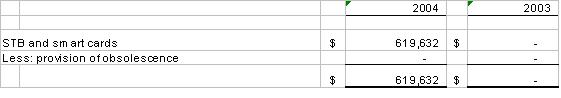

Inventories at December 31, 2004 and 2003 consisted of the following:

For both of the years ended December 31, 2004 and 2003, the Company has not recorded a provision for obsolete inventories.

The following is a summary of property and equipment at December 31:

Depreciation expenses for the years ended December 31, 2004 and 2003 were $415,440 and $6,172 respectively.

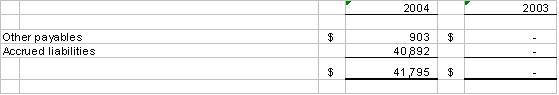

| 5. | OTHER PAYABLES AND ACCRUED LIABILITIES |

Other payables and accrued liabilities at December 31, 2004 and 2003 consist of the following:

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

NOTES TO THECONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2004 AND 2003

The Company operates in three reportable segments, Digitalization of Television Signals, Software Development and Investment Holding. The accounting policies of the segments are the same as described in the summary of significant accounting policies. The Company evaluates segment performance based on income from operations. All inter-company transactions between segments have been eliminated. As a result, the components of operating income for one segment may not be comparable to another segment. The following is a summary of the Company’s segment information for the years ended December 31, 2004 and 2003:

| 7. | COMMITMENTS AND CONTINGENCIES |

The full time employees of the Company in China are entitled to employee benefits including medical care, welfare subsidies, unemployment insurance and pension benefits through a Chinese government mandated multi-employer defined contribution plan. The Company is required to accrue for those benefits based on certain percentages of the employees’ salaries and make contributions to the plans out of the amounts accrued for medical and pension benefits. The total provision and contributions made for such employee benefits was $11,662 and $7,204 for the years ended December 31, 2004 and 2003, respectively. The Chinese government is responsible for the medical benefits and the pension liability to be paid to these employees.

The Company also operates a Mandatory Provident Fund plan (“the plan”) which is available to all employees in Hong Kong. Both the Company and the employees are required to contribute 5% (subject to an aggregate amount of $256) per month of the employees’ relevant income. Contributions from the Company are 100% vested in the employees as soon as they are paid to the plan. Contributions to the plan are expensed as they become payable in accordance with the rules of the plan and amounted to $1,795 and $0for the years ended December 31, 2004 and 2003 respectively. The assets of the plan are held separately from those of the Company and are managed by independent professional fund managers.

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

NOTES TO THECONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2004 AND 2003

| 7. | COMMITMENTS AND CONTINGENCIES (Continued) |

| (B) | Operating leases commitments |

The Company leases office spaces from third parties under two operating leases which expire on May 31, 2005 and August 7, 2005 at monthly rental of $1,448 and $1,734. The Company also leases spaces for staff quarters from third parties under four operating leases which expire from March 1, 2005 to June 27, 2005 with total monthly rental of $584. Accordingly, for the years ended December 31, 2004 and 2003, the Company recognized rental expense for these spaces in the amount of $24,020 and $20,781, respectively.

As of December 31, 2004, the Company has outstanding commitments with respect to the above non-cancelable operating leases, which are due as follows:

According to the amended Articles of Association of AGTL, ADTL has to fulfill registered capital contributions of $5 million within two years from July 16, 2004. As of December 31, 2004, the Company has fulfilled $1,305,177 of the registered capital requirement and has registered capital commitments of $3,694,823.

During 2000, the Company issued 2 shares of common stock to founders for cash of $1.

| (B) | Appropriated retained earnings |

The Company is required to make appropriations to reserves funds, comprising the statutory surplus reserve, statutory public welfare fund and discretionary surplus reserve, based on after-tax net income determined in accordance with generally accepted accounting principles of the People’s Republic of China (the “PRC GAAP”). Appropriation to the statutory surplus reserve should be at least 10% of the after tax net income determined in accordance with the PRC GAAP until the reserve is equal to 50% of the entities’ registered capital. Appropriations to the statutory public welfare fund are at 5% to 10% of the after tax net income determined in accordance with the PRC GAAP. The statutory public welfare fund is established for the purpose of providing employee facilities and other collective benefits to the employees and is non-distributable other than in liquidation. Appropriations to the discretionary surplus reserve are made at the discretion of the Board of Directors.

During 2004 and 2003, the Company appropriated $309,478 and $0, respectively to the reserves funds based on its net income under PRC GAAP.

During 2004, the Company’s stockholder contributed capital of $1,104,503 to the Company.

ARCOTECT DIGITAL TECHNOLOGY LIMITED

AND SUBSIDIARY

NOTES TO THECONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2004 AND 2003

| 9. | RELATED PARTY TRANSACTIONS |

In 2004, the Company loaned $26,442 to a director of AGTL as a short-term unsecured loan free of interest payment.

During the year ended December 31, 2004, the Company received service revenue of $70,416 from a related company. The Company owed to this related company $29,690 as of December 31, 2004.

In 2004, the Company owed a director $62,464 for short-term advance and in 2003 a director owed the Company $4,764 for short-term advance.

In 2004, a stockholder loaned the Company $223,934 as short-term unsecured loan free of interest payment.

| 10. | CONCENTRATIONS AND RISKS |

During 2004 and 2003, 99% of the Company’s assets were located in China and 100% of the Company’s revenues were derived from customers in China.

The Company relied on one supplier for approximately 85% of its purchases in 2004. As of December 31, 2004, accounts payable to this supplier amounted to $2,768,019.

In 2004, the Company has not derived revenue from any one customer for more than 10% of its total revenue. In 2003, the Company derived revenue of $22,886, $17,115 and $4,849 respectively from three customers totaling $44,850 which represented in aggregate 100% of its total revenue.

On December 28, 2004, the Company entered into a Plan of Exchange (“the Agreement”) with Hairmax International, Inc. (“Hairmax”), pursuant to which the shareholders of Company has agreed to transfer all of its common stock to Hairmax, subject to the completion of certain customary conditions set forth in the Agreement. In the event that the proposed transaction with Hairmax closes, Hairmax will become the holding company of the Company; the current shareholders of the Company will own 91% of Hairmax shares of common stock outstanding. As of February 3, 2005, the transaction has not closed.

ITEM 9.01(b) - PROFORMA FINANCIAL INFORMATION

The following proforma financial statements, of China Digital Media Corporation and Arcotect are set forth below: Consolidated (Unaudited) Condensed Pro Forma Balance Sheet of China Digital Media Corporation and Arcotect as of December 31, 2004, Consolidated (Unaudited) Condensed Pro Forma Statement of Operations for the twelve months ended December 31, 2004, and Consolidated (Unaudited) Condensed Pro Forma Statement of Operations for the year ended December 31, 2003.

PRO FORMA FINANCIAL STATEMENTS

The following consolidated (unaudited) condensed pro forma balance sheet reflects the financial position of China Digital Media Corporation as of December 31, 2004 as if the merger with Arcotect had been completed as of that date, and the consolidated (unaudited) condensed pro forma statements of income for China Digital Media Corporation for the year ended December 31, 2004 and for the year ended December 31, 2003, as if the merger had been completed as of those dates. The merger was actually consummated on March 31, 2005.

These financial statements are presented for informational purposes only and do not purport to be indicative of the financial position that would have resulted if the merger had been consummated at each company's year end. The pro forma financial statements should be read in conjunction with China Digital Media Corporation’s financial statements and related notes thereto contained in China Digital Media Corporation’s SEC quarterly and annual filings (including its Current Reports on Form 8-K filed with the Commission in connection with the reverse merger) and Arcotect’s financial statements and related notes thereto contained elsewhere in this Form 8-K.

A final determination of required purchase accounting adjustments, including the allocation of the purchase price to the assets acquired based on their respective fair values, has not yet been made. Accordingly, the purchase accounting adjustments made in connection with the development of the pro forma financial statements are preliminary and have been made solely for purposes of developing the pro forma combined financial information.

CHINA DIGITAL MEDIA CORPORATION AND ARCOTECT DIGITAL TECHNOLOGY LIMIT Consolidated (Unaudited) Condensed Balance Sheet As of December 31, 2004 | |

| | | China | | Arcotect | | | | | |

| ASSETS | | Digital | | Digital | | (Unaudited) | | (Unaudited) | |

| | | Media | | Technology | | Adjustments | | Total | |

| CURRENT ASSETS | | | | | | | | | |

| Cash and Cash Equivalents | | $ | - | | $ | 160,177 | | $ | - | | $ | 160,177 | |

| Account Receivable | | | - | | | 311,411 | | | - | | | 311,411 | |

| Due From Directors | | | - | | | 26,442 | | | - | | | 26,442 | |

| Inventories | | | - | | | 619,632 | | | - | | | 619,632 | |

| Other Receivable and Prepaid Expenses | | | - | | | 20,722 | | | - | | | 20,722 | |

| TOTAL CURRENT ASSETS | | | - | | | 1,138,384 | | | - | | | 1,138,384 | |

| | | | | | | | | | | | | | |

| PROPERTY AND EQUIPMENT | | | | | | | | | | | | | |

| Property and Equipment | | | - | | | 5,863,106 | | | - | | | 5,863,106 | |

| Accumulated Depreciation | | | - | | | (428,168 | ) | | - | | | (428,168 | ) |

| Net Property and Equipment | | | - | | | 5,434,938 | | | - | | | 5,434,938 | |

| | | | | | | | | | | | | | |

| TOTAL ASSETS | | $ | - | | $ | 6,573,322 | | $ | - | | $ | 6,573,322 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | | | | |

| Accounts Payable | | $ | 141,809 | | $ | 2,882,104 | | | - | | $ | 3,023,913 | |

| Other Payables and Accrued Liabilities | | | - | | | 41,795 | | | - | | | 41,795 | |

| Due to a Director | | | - | | | 62,464 | | | - | | | 62,464 | |

| Due to a Related Company | | | - | | | 29,690 | | | - | | | 29,690 | |

| Value Added Taxes Payable | | | - | | | 25,634 | | | - | | | 25,634 | |

| Income Taxes Payable | | | - | | | 312,636 | | | - | | | 312,636 | |

| TOTAL CURRENT LIABILITIES | | | 141,809 | | | 3,354,323 | | | - | | | 3,496,132 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| STOCKHOLDERS' EQUITY (DEFICIT) | | | | | | | | | | | | | |

| Registered Capital ($1 par, 10,000 shares authorized, 2 shares issued and paid) | | $ | - | | | 1 | | | (1 | )A | $ | - | |

| Series A Convertible Preferred Stock ($.001 par value, 40,000,000 shares | | | | | | | | | | | | | |

| authorized, 1,975,000 shares issued and outstanding) | | | 1,975 | | | - | | | - | | | 1,975 | |

| Series B 2% Convertible Preferred Stock ($.001 par value, 1,000 shares | | | | | | | | | | | | | |

| authorized, no shares issued and outstanding) | | | - | | | - | | | - | | | - | |

| Common Stock ($.001 par value, 100,000,000 shares authorized: | | | | | | | | | | | | | |

| 1,993,363 shares issued and outstanding) | | | 1,993 | | | - | | | - | | | 1,993 | |

| Additional Paid-in-Capital | | | 6,763,555 | | | 1,305,177 | | | 1,689,888 | A | | 9,758,620 | |

| Due to a Stockholder | | | - | | | 223,934 | | | - | | | 223,934 | |

| Retained Earnings (Deficit) | | | (6,909,332 | ) | | 1,689,887 | | | (1,689,887 | )A | | (6,909,332 | ) |

| TOTAL STOCKHOLDERS' EQUITY (DEFICIT) | | | (141,809 | ) | | 3,218,999 | | | - | | | 3,077,190 | |

| | | | | | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | | | - | | | 6,573,322 | | $ | - | | $ | 6,573,322 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| See accompanying notes to (unaudited) pro forma financial statements. | | | | | | |

CHINA DIGITAL MEDIA CORPORATION AND ARCOTECT DIGITAL TECHNOLOGY LIMITED Consolidated (Unaudited) Condensed Pro Forma Statement of Operations For the Year Ended December 31, 2004 | |

| | | China | | Arcotect | | | | | |

| | | Digital | | Digital | | (Unaudited) | | (Unaudited) | |

| | | Media | | Technology | | Adjustments | | Total | |

| SALES AND COST OF SALES: | | | | | | | | | |

| Sales | | $ | - | | $ | 3,864,407 | | $ | - | | $ | 3,864,407 | |

| Cost of Sales | | | - | | | 743,399 | | | - | | | 743,399 | |

| Gross Profit | | | - | | | 3,121,008 | | | - | | | 3,121,008 | |

| | | | | | | | | | | | | | |

| OPERATING EXPENSES: | | | | | | | | | | | | | |

| Selling, general and administrative | | | 914,904 | | | 864,431 | | | - | | | 1,779,335 | |

| | | | 914,904 | | | 864,431 | | | - | | | 1,779,335 | |

| | | | | | | | | | | | | | |

| OPERATING INCOME (LOSS) | | | (914,904 | ) | | 2,256,577 | | | - | | | 1,341,673 | |

| | | | | | | | | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | | | | | | |

| Interest Income | | | - | | | 1,095 | | | - | | | 1,095 | |

| Other Income | | | - | | | 707 | | | - | | | 707 | |

| Interest Expense | | | (2,762 | ) | | - | | | - | | | (2,762 | ) |

| | | | | | | | | | | | | | |

| NET INCOME (LOSS) FROM DISCONTINUED OPERATIONS | | | (917,666 | ) | | 2,258,379 | | | - | | | 1,340,713 | |

| | | | | | | | | | | | | | |

| Loss from discontinued operations | | | (306,258 | ) | | - | | | - | | | (306,258 | ) |

| | | | | | | | | | | | | | |

| NET INCOME (LOSS) BEFORE TAXES | | | (1,223,924 | ) | | 2,258,379 | | | - | | | 1,034,455 | |

| | | | | | | | | | | | | | |

| Income Taxes | | | - | | | (312,636 | ) | | - | | | (312,636 | ) |

| | | | | | | | | | | | | | |

| NET INCOME (LOSS) | | $ | (1,223,924 | ) | $ | 1,945,743 | | $ | - | | $ | 721,819 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| See accompanying notes to (unaudited) pro forma financial statements. |

CHINA DIGITAL MEDIA CORPORATION AND ARCOTECT DIGITAL TECHNOLOGY LIMITED Consolidated (Unaudited) Condensed Pro Forma Statement of Operation For the Year Ended December 31, 2003 | |

| | | China | | Arcotect | | | | | |

| | | Digital | | Digital | | (Unaudited) | | (Unaudited) | |

| | | Media | | Technology | | Adjustments | | Total | |

| SALES AND COST OF SALES: | | | | | | | | | |

| Sales | | $ | - | | $ | 44,850 | | $ | - | | $ | 44,850 | |

| Cost of Sales | | | - | | | 40,823 | | | - | | | 40,823 | |

| Gross Profit | | | - | | | 4,027 | | | - | | | 4,027 | |

| | | | | | | | | | | | | | |

| OPERATING EXPENSES: | | | | | | | | | | | | | |

| Selling, general and administrative | | | 1,023,811 | | | 62,098 | | | - | | | 1,085,909 | |

| | | | 1,023,811 | | | 62,098 | | | - | | | 1,085,909 | |

| | | | | | | | | | | | | | |

| OPERATING (LOSS) | | | (1,023,811 | ) | | (58,071 | ) | | - | | | (1,081,882 | ) |

| | | | | | | | | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | | | | | | |

| Interest Income | | | - | | | 33 | | | - | | | 33 | |

| Other Expense | | | - | | | (20 | ) | | - | | | (20 | ) |

| Loss from impairment of asset acquisition | | | (2,200,000 | ) | | - | | | - | | | (2,200,000 | ) |

| Unrelaized gain from trading securities | | | 5,416 | | | - | | | - | | | 5,416 | |

| Interest Expense | | | (1,656 | ) | | - | | | - | | | (1,656 | ) |

| | | | | | | | | | | | | | |

| NET (LOSS) FROM DISCONTINUED OPERATIONS | | | (3,220,051 | ) | | (58,058 | ) | | - | | | (3,278,109 | ) |

| | | | | | | | | | | | | | |

| Loss from discontinued operations | | | (293,236 | ) | | - | | | - | | | (293,236 | ) |

| | | | | | | | | | | | | | |

| NET (LOSS) BEFORE TAXES | | | (3,513,287 | ) | | (58,058 | ) | | - | | | (3,571,345 | ) |

| | | | | | | | | | | | | | |

| Income Taxes | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | |

| NET (LOSS) | | $ | (3,513,287 | ) | $ | (58,058 | ) | $ | - | | $ | (3,571,345 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| See accompanying notes to (unaudited) pro forma financial statements. |

CHINA DIGITAL MEDIA CORPORATION AND ARCOTECT DIGITAL TECHNOLOGY LIMITED Notes to Consolidated (Unaudited) Condensed Pro Forma Statements 31-Dec-04 |

A = On December 28, 2004, China Digital Media Corporation executed a Plan of Exchange among the registrant, Arcotect Digital Technology Limited, the shareholders of Arcotect, and the majority shareholders of the registrant. As a result, Arcotect Digital Technology Limited became a wholly owned subsidiary of China Digital Media Corporation. The transaction is properly accounted for as a reverse purchase acquisition/merger wherein Arcotect Digital Technology Limited is the accounting acquirer and China Digital Media Corp. is the legal acquirer. Accordingly, the accounting acquirer records the assets purchased and liabilities assumed as part of the merger and entire equity section of the legal acquirer is eliminated with negative book value acquired offset against the paid in capital of the accounting acquirer. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | |

| | CHINA DIGITAL MEDIA CORPORATION |

|

|

|

| Date: April 21, 2005 | By: | /s/ Ng Chi Shing |

| |

Ng Chi Shing |

| | Chairman |

EXHIBIT INDEX |

| | |

Exhibit Number | Description |

| | |

| 99.1 | |