Stratford Acquisition’s obligation to complete the merger is subject to the following additional conditions:

None of these conditions has yet been satisfied. However, as of the date of this proxy statement, Stratford does not believe that any third party consents or filings will be required (other than filings with the SEC, which Stratford has undertaken, and filings with the Arizona Corporation Commission and the OTC Bulletin Board that will be required only if and after the merger is approved). Further, no statutes, rules, regulations, orders or the like have been issued, and no material adverse effect on Stratford has occurred as of the date of this proxy statement. At this point it is not anticipated that any closing conditions will need to be or will be waived. We will re-circulate revised proxy materials and re-solicit proxies in the event of any material changes in the terms of the merger, including material changes that result in a waiver of any condition of Stratford described above which would adversely affect the unaffiliated shareholders.

Prior to the date that Stratford’s shareholders approve and adopt the merger agreement and the merger at the special meeting, the board of directors is permitted to engage in discussions and negotiations with a third party regarding a competing acquisition offer if:

| · | the board determines in good faith, after consultation with and taking into account the advice of its outside legal counsel and any outside financial advisor retained by Stratford, that any such competing offer is a superior alternative to the merger; |

| · | the board reasonably determines in good faith, after consultation with and taking into account the advice of its outside legal counsel, that board’s fiduciary duties under Arizona law require discussions to be conducted with the third party; and |

| · | Stratford provides Stratford Holdings with written notice of the competing offer and the material terms of such offer. |

The board of directors is permitted by the merger agreement to withdraw its recommendation of the merger agreement and the merger only if it:

| · | reasonably determines in good faith, after consultation with and taking into account the advice of its outside legal counsel, that such action is necessary in order for the board to comply with its fiduciary duties under Arizona law; and |

| · | has given notice of its intention to withdraw its recommendation, and has not received an offer from Stratford Holdings within five business days which matches or exceeds the competing acquisition offer. |

Stratford Acquisition may terminate the merger agreement prior to the completion of the merger if:

| · | Stratford’s board of directors withdraws, modifies or changes its recommendation regarding the merger in accordance with the merger agreement; or |

| · | there has been a material adverse effect on the business, assets, results of operations or financial condition of Stratford and its subsidiaries, taken as a whole. |

Stratford may terminate the merger agreement prior to the completion of the merger to accept a competing acquisition offer from a third party that Stratford Holdings fails to match or exceed.

The merger agreement may also be terminated prior to the completion of the merger under other circumstances that are described in the merger agreement, including an uncured material breach, the failure of the parties to consummate the merger before May 31, 2006, or a final governmental order prohibiting the merger.

Each party to the merger agreement has agreed to pay its own costs and expenses in connection with the merger agreement and the transactions contemplated thereby. If, however, Stratford terminates the merger agreement to accept a competing third party offer, Stratford is required to pay all of the costs and expenses incurred by Stratford Holdings in connection with the merger, in an amount not to exceed $200,000. The merger agreement does not require a “break fee” under any circumstances.

In connection with the merger, Stratford will be required to make certain filings with, and comply with certain laws of, various federal and state governmental agencies. Nevertheless, it is currently expected that no regulatory approvals will be required in order to complete the merger.

If Stratford is insolvent at the time of the merger or becomes insolvent because of the merger, the funds paid to shareholders upon completion of the merger may be deemed to be a “fraudulent conveyance” under applicable law and therefore may be subject to the claims of Stratford’s creditors. If such claims are asserted by Stratford’s creditors, there is a risk that persons who were shareholders at the effective time of the merger would be ordered by a court to return to Stratford’s trustee in bankruptcy all or a portion of the funds received upon the completion of the merger. Stratford’s board of directors has no reason to believe that Stratford and its subsidiaries, on a consolidated basis, will be insolvent immediately after giving effect to the merger.

If the merger agreement and the merger are properly approved by Stratford’s shareholders and the merger is actually consummated, you have the right under Arizona law to dissent and to receive payment equal to the “fair value” of your shares if you do not wish to exchange your shares of Stratford common stock for the merger consideration. This “right of appraisal” is subject to a number of restrictions and technical requirements. Generally, in order to exercise appraisal rights, you must:

| · | before the shareholder vote related to the merger is taken at the special meeting, deliver written notice to Stratford of your intent to demand payment for your shares if the merger is completed; |

| · | not vote for approval and adoption of the merger agreement and the merger; and |

| · | upon receipt of a dissenters’ notice from Stratford, demand payment, certify the date that you acquired beneficial ownership of your shares, and deposit your stock certificates in accordance with the terms of the notice. |

You will not protect your right of appraisal by merely voting against the merger agreement and the merger. A copy of the relevant section of the Arizona Business Corporation Act addressing appraisal rights is attached to this proxy statement as Exhibit B.

This proxy statement contains certain forward-looking statements regarding Stratford that are based on the beliefs of Stratford’s management as well as assumptions made by, and information currently available to, Stratford’s management. Such statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated in such forward-looking statements. Certain factors that could cause actual results to differ materially from Stratford’s expectations include, but are not limited to, general business conditions, competition and other factors which are described from time to time in Stratford’s public filings with the SEC, news releases and other communications. Also, when Stratford uses the words “believes,” “expects,” “anticipates,” “estimates,” “plans,” “intends,” “objectives,” “goals,” “aims,” “projects,” or similar words or expressions, Stratford is making forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. All forward-looking statements contained in this proxy statement speak only as of the date of this proxy statement or as of such earlier date that those statements were made and are based on current expectations or expectations as of such earlier date and involve a number of assumptions, risks and uncertainties that could cause the actual results to differ materially from such forward-looking statements. Stratford will update or amend this proxy statement to further reflect any material changes to the forward-looking information disclosed herein as required by law.

The following table summarizes certain selected consolidated financial data, which should be read in conjunction with our Annual Report on Form 10-KSB for the fiscal year ended December 31, 2005, which is attached as Exhibit C to this proxy statement. The selected consolidated financial data set forth below as of and for each of the years in the two-year period ended December 31, 2005, have been derived from our consolidated financial statements which have been audited by KPMG LLP, who was our independent registered public accounting firm for those periods.

| | | Year Ended December 31, | |

| | | 2005 | | 2004 | |

REVENUES: | | | | | |

| Oil and gas revenues | | $ | 1,605,000 | | $ | 1,002,000 | |

| Gain on restructuring of payables | | | 0 | | | 0 | |

| Interest and other income | | | 194,000 | | | 25,000 | |

| | | | 1,799,000 | | | 1,027,000 | |

| | | | | | | | |

EXPENSES: | | | | | | | |

| General and administrative | | | 625,000 | | | 631,000 | |

| Depreciation, depletion and amortization | | | 337,000 | | | 306,000 | |

| Oil and gas operations | | | 339,000 | | | 229,000 | |

| Interest | | | 0 | | | 0 | |

| | | | 1,301,000 | | | 1,166,000 | |

| Income (loss) from continuing operations before income taxes | | | 498,000 | | | (139,000 | ) |

| Income tax expense | | | 22,000 | | | 17,000 | |

| Income (loss) from continuing operations | | | 476,000 | | | (156,000 | ) |

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2005 | | 2004 | |

DISCONTINUED OPERATIONS: | | | | | | | |

| Income (loss) from operations | | | (6,000 | ) | | 423,000 | |

| Gain on sale of building, net of tax benefit of $49,000 for the year ended December 31, 2005 and net of tax expense of $430,000 for the year ended December 31, 2004 | | | 69,000 | | | 5,326,000 | |

| Minority interest | | | (3,000 | ) | | (1,269,000 | ) |

| Income from discontinued operations | | | 60,000 | | | 4,480,000 | |

Net income | | $ | 536,000 | | $ | 4,324,000 | |

| | | | | | | | |

| Basic and diluted net income (loss) per share: | | | | | | | |

| Income (loss) from continuing operations | | $ | 0.04 | | $ | (0.01 | ) |

| Income from discontinued operations | | | 0.01 | | | 0.40 | |

Basic and diluted net income per share | | $ | 0.05 | | $ | 0.39 | |

Shares used to compute income (loss) per share | | | | | | | |

| Basic | | | 11,078,105 | | | 11,078,105 | |

| Diluted | | | – | | | – | |

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2005 | | 2004 | |

Balance Sheet Data | | | | | |

| Working capital | | $ | 6,487,000 | | $ | 6,392,000 | |

| Total current assets | | $ | 6,728,000 | | $ | 7,029,000 | |

| Total current liabilities | | $ | 241,000 | | $ | 637,000 | |

| Total shareholders’ equity | | $ | 8,023,000 | | $ | 7,487,000 | |

| Book value per share | | $ | 0.72 | | $ | 0.68 | |

| Ratio of earnings to fixed charges | | | 20.14 | | | 4.32 | |

We have not provided any pro forma data giving effect to the merger as we do not believe that such information is material to our shareholders in evaluating the merger and the merger agreement. The merger consideration consists solely of cash and, if the merger is consummated, our common stock will cease to be publicly traded. As a result, we do not believe that the changes to our financial condition resulting from the merger would provide meaningful or relevant information in evaluating the merger and the merger agreement since our shareholders (other than JDMD) will not be shareholders of, and will have no direct interest in, Stratford following the merger.

Stratford’s common stock is listed on the OTC Bulletin Board under the symbol “STFA.OB” The table below sets forth the range of high and low closing bid prices on the OTC Bulletin Board for fiscal years 2004, 2005, and 2006 to date.

| | | High | | Low | |

| Fiscal Year Ending December 31, 2004 | | | | | |

First Quarter | | $ | 0.60 | | $ | 0.20 | |

Second Quarter | | $ | 0.45 | | $ | 0.29 | |

Third Quarter | | $ | 0.41 | | $ | 0.32 | |

Fourth Quarter | | $ | 0.55 | | $ | 0.38 | |

| | | | | | | | |

| Fiscal Year Ending December 31, 2005 | | | | | | | |

First Quarter | | $ | 0.61 | | $ | 0.41 | |

Second Quarter | | $ | 0.64 | | $ | 0.40 | |

Third Quarter | | $ | 0.70 | | $ | 0.54 | |

Fourth Quarter | | $ | 0.75 | | $ | 0.58 | |

| | | | | | | | |

| Fiscal Year Ending December 31, 2006 | | | | | | | |

First Quarter (through April 21, 2006) | | $ | 0.82 | | $ | 0.68 | |

The closing sale price, and the high and low sale prices for shares of Stratford’s common stock on the OTC Bulletin Board on January 30, 2006, the last trading day before Stratford announced the proposed merger and the signing of the merger agreement, was $0.80 per share. On [_______], 2006, the last trading day for which information was practicably available prior to the date of the first mailing of this proxy statement, the closing price per share of Stratford’s common stock as reported on the OTC Bulletin Board was $[____]. We recommend that shareholders obtain a current market quotation for Stratford’s common stock before making any decision with respect to the merger.

As of April 21, 2006, 261 record owners and approximately 460 beneficial owners owned 11,078,105 issued and outstanding shares of Stratford’s common stock.

Stratford has not paid any dividend with respect to shares of its common stock in the past two years. Under the merger agreement, Stratford has agreed not to pay any dividends on its shares of common stock prior to the completion of the merger.

The enclosed proxy is solicited on behalf of our board of directors for use at a special meeting of shareholders to be held on ______, 2006 at 9:00 a.m., local time, or at any adjournments or postponements of the special meeting, for the purposes set forth in this proxy statement and in the accompanying notice of special meeting. The special meeting will be held at Stratford’s executive offices located at 2400 East Arizona Biltmore Circle, Building 2, Suite 1270, Phoenix, Arizona 85016. Stratford intends to mail this proxy statement and the accompanying proxy card on or about [________], 2006 to all shareholders entitled to vote at the special meeting.

The special meeting of the shareholders will be held on ______, 2006 at 9:00 a.m., local time, at Stratford’s executive offices located at 2400 East Arizona Biltmore Circle, Building 2, Suite 1270, Phoenix, Arizona 85016. At the special meeting, you will be asked to consider and vote in favor of proposals to approve and adopt the merger agreement and the merger and to approve the adjournment or postponement of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to adopt the merger agreement and the merger.

Pursuant to the merger, Stratford Acquisition will be merged with and into Stratford, with Stratford as the surviving corporation and becoming a wholly-owned subsidiary of Stratford Holdings. At the effective time of the merger, each share of Stratford’s common stock issued and outstanding immediately prior to the filing of articles of merger with the Arizona Corporation Commission will be converted into the right to receive $0.90 in cash, without interest, except for:

| · | shares for which appraisal rights have been perfected properly under the Arizona Business Corporation Act, which will be entitled to receive the consideration provided for by Arizona law; |

| · | shares held by Stratford in treasury and shares held by Stratford’s wholly-owned subsidiaries, which will be cancelled without payment; and |

| · | shares held by JDMD prior to the merger, which will be cancelled without payment. |

Like all other Stratford shareholders, Stratford’s executive officers and directors (other than Messrs. Colangelo, Eaton, Shultz and Jensen, with respect to their ownership interest in JDMD) will be entitled to receive $0.90 per share in cash, without interest, for each share of Stratford common stock held by them at the time of the merger.

Stratford does not expect a vote to be taken at the special meeting on any matter other than the proposals to approve and adopt the merger agreement and the merger and to approve the adjournment or postponement of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to adopt the merger agreement and the merger. However, if any other matters are properly presented at the special meeting for consideration, the holders of the proxies will have discretion to vote on these matters in accordance with their best judgment. The proxies Stratford is soliciting will grant discretionary authority to vote in favor of adjournment or postponement of the special meeting to the extent the proxy holders may deem such actions appropriate in their discretion.

Only holders of record of Stratford’s common stock at the close of business on April 21, 2006, the record date for the special meeting, are entitled to notice of, and to vote at, the special meeting and any adjournments or postponements thereof. At the close of business on the record date, 11,078,105 shares of Stratford’s common stock were outstanding and entitled to vote at the special meeting. A list of shareholders will be available for review at Stratford’s executive offices during regular business hours beginning two business days after notice of the special meeting is given and continuing to the date of the special meeting and will be available for review at the special meeting or any adjournment thereof. Each holder of record of Stratford’s common stock on the record date will be entitled to one vote for each share held. If you sell or transfer your shares of Stratford’s common stock after the record date, but before the special meeting, you will transfer the right to receive the $0.90 in cash per share, without interest, if the merger is consummated to the person to whom you sell or transfer your shares, but you will retain your right to vote at the special meeting.

All votes will be tabulated by the inspector of elections appointed for the special meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Brokers who hold shares in “street name” for clients typically have the authority to vote on “routine” proposals when they have not received instructions from beneficial owners. Absent specific instructions from the beneficial owner of the shares, however, brokers are not allowed to exercise their voting discretion with respect to the approval of non-routine matters, such as the approval and adoption of the merger agreement and the merger. Proxies submitted without a vote by brokers on these matters are referred to as “broker non-votes.”

A majority of the outstanding shares of common stock will constitute a quorum for the transaction of business related to the proposals and for the transaction of all other business at the special meeting. If a share is represented for any purpose at the special meeting it will be deemed present for purposes of determining whether a quorum exists.

Any shares of common stock held in treasury by Stratford are not considered to be outstanding on the record date or otherwise entitled to vote at the special meeting for purposes of determining a quorum.

Shares represented by proxies reflecting abstentions and properly executed broker non-votes are counted for purposes of determining whether a quorum exists at the special meeting.

Approval and adoption of the merger agreement and the merger requires (a) the affirmative vote of holders of a majority of the outstanding unaffiliated shares of Stratford’s common stock (those not owned, directly or indirectly, by JDMD and Eaton Trust), and (b) the affirmative vote of holders of a majority of the outstanding shares of Stratford’s common stock (including those shares owned, directly or indirectly, by JDMD and Eaton Trust). If holders of a majority of the outstanding unaffiliated shares (those not owned, directly or indirectly, by JDMD and Eaton Trust) vote to approve and adopt the merger agreement and the merger, the holders of the interested shares (those owned, directly or indirectly, by JDMD and Eaton Trust, which in the aggregate constitute approximately 30.3% of the total outstanding shares of common stock) are required under the merger agreement to vote their shares in favor of the approval and adoption of the merger agreement and the merger.

The board of directors of Stratford also has been informed that The DRD 97 Trust expects to vote its shares in favor of the approval and adoption of the merger agreement and the merger. The shares held by The DRD 97 Trust represent approximately 23.0% of the total outstanding shares of Stratford’s common stock and approximately 33.0% of the unaffiliated shares of Stratford’s common stock.

Approval and adoption of any adjournment or postponement of the special meeting, if necessary or appropriate, requires the affirmative vote of holders of a majority of the outstanding shares of Stratford’s common stock (including those shares owned, directly or indirectly, by JDMD and Eaton Trust).

Proxies that reflect abstentions and broker non-votes, as well as proxies that are not returned, will have the same effect as a vote against both proposals.

If the special meeting is adjourned or postponed for any reason, at any subsequent reconvening of the special meeting, all proxies will be voted in the same manner as they would have been voted at the original convening of the meeting, except for any proxies that have been revoked or withdrawn.

Shareholders of record may submit proxies by mail. We will not accept proxies to be voted by telephone or internet. After carefully reading and considering the information contained in this proxy statement, you should complete, date and sign your proxy card and mail the proxy card in the enclosed postage paid return envelope as soon as possible so that your shares may be voted at the special meeting, even if you plan to attend the special meeting in person. Submitting a proxy now will not limit your right to vote at the special meeting if you decide to attend in person. If your shares are held of record in “street name” by a broker or other nominee and you wish to vote in person at the special meeting, you must obtain from the record holder a proxy issued in your name.

Proxies received at any time before the special meeting is called to order and not revoked or superseded before being voted will be voted at the special meeting. If the proxy indicates specific voting instructions, it will be voted in accordance with the voting instructions. If no voting instructions are indicated, the proxy will be voted “FOR” approval and adoption of the merger agreement and the merger.

Please do not send in stock certificates at this time. If the merger is consummated, you will receive instructions regarding the procedures for exchanging your existing Stratford stock certificates for the $0.90 per share cash payment, without interest.

Any person giving a proxy pursuant to this solicitation has the power to revoke and change it at any time before the meeting is called to order. It may be revoked and changed by filing a written notice of revocation with Stratford’s Secretary at Stratford’s executive offices located at 2400 East Arizona Biltmore Circle, Building 2, Suite 1270, Phoenix, Arizona 85016, by submitting in writing a proxy bearing a later date, or by attending the special meeting and voting in person. Attendance at the special meeting will not, by itself, revoke a proxy. If you have given voting instructions to a broker or other nominee that holds your shares in “street name,” you may revoke those instructions by following the directions given by the broker or other nominee.

This proxy statement is being furnished in connection with the solicitation of proxies by our board of directors. Stratford will bear the entire cost of soliciting, including costs relating to preparation, assembly, printing and mailing of this proxy statement, the notice of the special meeting of shareholders, the enclosed proxy and any additional information furnished to shareholders. Copies of solicitation materials will also be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Stratford’s common stock beneficially owned by others to forward to these beneficial owners. Stratford may, upon request, reimburse brokers, bankers and other nominees representing beneficial owners of Stratford’s common stock for their costs of forwarding solicitation materials to the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone or personal solicitation by directors, officers or other regular employees of Stratford. No additional compensation will be paid to directors, officers or other regular employees for their services.

Although it is not currently expected, the special meeting may be adjourned or postponed for the purpose of soliciting additional proxies. If the special meeting is adjourned to a different place, date or time, Stratford need not give notice of the new place, date or time if the new place, date or time is announced at the meeting before adjournment or postponement, unless a new record date is or must be set for the adjourned meeting. Stratford’s board of directors must fix a new record date if the meeting is adjourned to a date more than 120 days after the date fixed for the original meeting. Any adjournment or postponement of the special meeting for the purpose of soliciting additional proxies will allow Stratford’s shareholders who have already sent in their proxies to revoke them at any time prior to their use at the special meeting as adjourned or postponed.

In order to attend the special meeting in person, you must be a shareholder of record on the record date, hold a valid proxy from a record holder or be an invited guest of Stratford. You will be asked to provide proper identification at the registration desk on the day of the meeting or any adjournment or postponement of the meeting.

Shareholders who do not vote in favor of approval and adoption of the merger agreement and the merger, and who otherwise comply with the applicable statutory procedures of Arizona law summarized elsewhere in this proxy statement, will be entitled to seek appraisal of the value of their Stratford common stock as set forth in the Arizona Business Corporation Act. See “SPECIAL FACTORS — Appraisal Rights.”

2400 East Arizona Biltmore Circle

Building 2, Suite 1270

Phoenix, Arizona 85016

(602) 956-7809

Stratford is an Arizona corporation that was incorporated on May 13, 1988. Stratford, through its subsidiaries, is engaged principally in the business of natural resource exploration and development. Stratford has the following wholly-owned subsidiaries: Stratford American Car Rental Systems, Stratford American Energy Corporation, Stratford American Gold Venture Corporation, Stratford American Oil and Gas Corporation, Stratford American Properties Corporation, Stratford American Resource Corporation, and SA Oil and Gas Corporation. All of Stratford’s wholly-owned subsidiaries are Arizona corporations, except Stratford American Energy Corporation, which is an Oklahoma corporation, and Stratford American Resource Corporation, which is a Texas corporation. Stratford employs four employees, one of whom works full time.

2400 East Arizona Biltmore Circle

Building 2, Suite 1270

Phoenix, Arizona 85016

(602) 224-2312

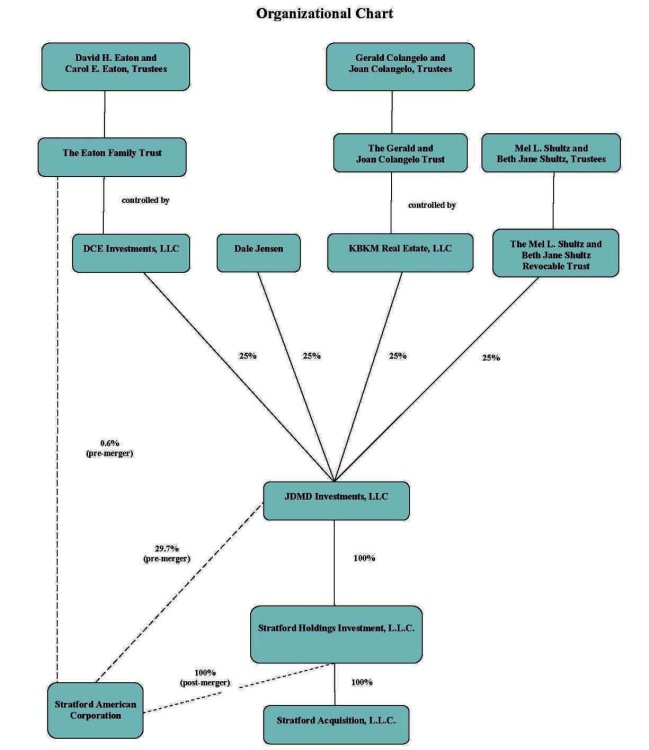

JDMD is an Arizona limited liability company formed in 1996 whose principal business is (i) making investments in businesses, companies, and properties by means of acquisitions of stock, partnership interests, limited liability company memberships, and direct acquisitions of property and assets, and (ii) holding and managing such investments. The managers of JDMD are Gerald Colangelo, a director of Stratford, David Eaton, the Chief Executive Officer and a director of Stratford, Mel Shultz, the President and a director of Stratford, and Dale Jensen, a director of Stratford. The members of JDMD are: (a) the Mel L. Shultz and Beth Jane Shultz Revocable Trust, of which Mr. and Mrs. Shultz are co-trustees; (b) DCE Investments, LLC, which is majority-owned by The Eaton Family Trust, of which David Eaton and Carol Eaton are co-trustees; (c) KBKM Real Estate, LLC, which is majority-owned by The Gerald and Joan Colangelo Family Trust, of which Gerald Colangelo and Joan Colangelo are co-trustees; and (d) Dale Jensen. JDMD currently owns 29.7% of the outstanding common stock of Stratford, and also has significant business interests unrelated to Stratford.

2400 East Arizona Biltmore Circle

Building 2, Suite 1270

Phoenix, Arizona 85016

(602) 224-2312

Stratford Holdings is an Arizona limited liability company formed in January 2006 by JDMD to hold all of the outstanding common stock of Stratford effective upon completion of the merger.

2400 East Arizona Biltmore Circle

Building 2, Suite 1270

Phoenix, Arizona 85016

(602) 224-2312

Stratford Acquisition is an Arizona limited liability company formed in January 2006 and is a wholly-owned subsidiary of Stratford Holdings. The sole purpose of Stratford Acquisition is to merge with and into Stratford pursuant to the merger described in this proxy statement, with Stratford as the surviving corporation.

The following diagram depicts the organizational structure of JDMD and the other Buyout Parties, as well as the structure of Stratford after giving effect to the merger:

SPECIAL FACTORS

Stratford sold its major real estate asset in November 2004, and since that time its sole assets have consisted primarily of the cash proceeds from the sale and minority working interests in various oil and gas properties primarily located in Oklahoma and Texas. In connection with and beginning around the time of the sale, the board of directors and management of Stratford began discussing in general terms the future direction of Stratford’s business, including specifically whether to invest in additional income-producing real estate or oil and gas ventures, or to liquidate Stratford and distribute its assets to the shareholders. These discussions included the disadvantages faced by Stratford as a smaller-sized publicly-traded company. In particular, the directors noted:

| | | Stratford’s difficulty in attracting analyst coverage, market attention and institutional shareholder investment due to its small size, low market capitalization and low share price; |

| | • | the common stock’s small public float, extremely limited trading volume, and bid-asked trading price spread, all of which have: |

| | • | limited Stratford’s ability to use its common stock as acquisition currency, |

| | • | significantly limited the ability of shareholders to sell their shares without also reducing the trading price of the common stock, and |

| | • | impaired Stratford’s ability to use equity-based incentives to successfully attract and retain employees; |

| | • | the existence of competitors in Stratford’s industry with greater resources at their disposal; and |

| | | |

| | • | the costs and associated burdens of being a public company, including: |

| | • | the actual out-of-pocket costs of SEC compliance; |

| | • | the burden on management of compliance efforts; |

| | • | the distraction of investor relations and the focus on short-term goals such as quarterly results per share occasioned by periodic public reporting; |

| | • | the compliance and competitive costs associated with requirements to publicly disclose detailed information regarding Stratford’s business, operations and results; and |

| | • | the enactment of the Sarbanes-Oxley Act of 2002, which has led to increased compliance costs and additional burdens on management. |

As a result of these discussions, management engaged Meagher Oil & Gas Properties, Inc. (“Meagher”) on November 8, 2004 to evaluate Stratford’s oil and gas properties and to assist in offering them for sale. Meagher is a nationally recognized acquisition and divestiture firm that specializes in the oil and gas industry, and had been recommended to Stratford by several of its partners in the oil and gas properties. Stratford had no previous relationship with Meagher. Pursuant to the exclusive Services Agreement with Meagher, Stratford paid an initial retainer of $25,000 and is obligated to pay a commission equal to the sum of: (a) 5% of the cumulative sales price of the oil and gas properties from $1.00 to $1,000,000; plus (b) 4% of the cumulative sales price of the properties from $1,000,001 to $2,000,000; plus (c) 3% of the cumulative sales price of the properties from $2,000,001 to $3,000,000; plus (d) 2% of the cumulative sales price of the properties from $3,000,001 to $4,000,000; plus (e) 1% of the cumulative sales price of the properties from $4,000,001 and above, but in no event will the commission exceed $200,000.

Between November 2004 and early February 2005 the Stratford board did not meet formally, but officers and directors of Stratford worked with Meagher to compile the package of marketing information concerning the oil and gas properties that would be delivered to potential buyers. The package consisted of engineering reports compiled by Meagher based on information provided by management and information publicly available on the Dwight’s databases about oil and gas wells. In early February 2005, Meagher sent solicitations of interest to approximately 3,500 potential buyers, and received requests for information from 61 companies. The marketing information indicated that the oil and gas properties were for sale by state or as a total package, with preference to be given by Stratford to a single buyer.

During February and March, 2005, Meagher engaged in discussions with each of the 61 companies that requested the marketing information, and received eight bids, five of which were for the entire package of oil and gas properties and three of which were for partial packages of properties. The bids for the entire package of properties generally ranged from $1.75 million to $2.925 million, or approximately $0.62 to $0.71 per share based upon the value of Stratford reflected in its financial statements as of March 31, 2005, with one bid management did not believe was legitimate at $750,000. The per share value of the bids was determined using a liquidation analysis, assuming the assets were sold at the bid price and the sales proceeds plus Stratford’s cash and cash equivalents on the relevant date (in this case, March 31, 2005) were distributed to the shareholders in liquidation, after payment of transaction costs, including the Meagher commission, all liabilities of Stratford and taxes as a result of the sale. The liabilities to be satisfied included the liabilities reflected on the balance sheet plus $947,000 for committed drilling costs, professional fees and expenses and employee severance. This same per share determination was used by the board in calculating the various per share amounts which follow in this discussion.

Meagher had ongoing negotiations with each of the bidders in an effort to increase their bids, but none of the bids were increased and ultimately none of the bids was acceptable to or pursued by management because in light of increasing oil and gas prices, Mr. Eaton and Mr. Shultz, representing Stratford as management and directors, did not believe that any of the bids would provide Stratford with fair market value. Meagher’s engineering studies in December 2004 indicated a probable market value of the properties of $2.4 million (or $0.67 per share based upon the value of Stratford reflected in its financial statements as of March 31, 2005) using a 10% discount rate, but using a cash flow multiple the probable market value according to Meagher was $3.3 million (or $0.74 per share based upon the value of Stratford reflected in its financial statements as of March 31, 2005). The engineering studies prepared by Meagher assumed (a) oil prices are $41.85/bbl NYMEX from December 2004 to November 2005, $40.31/bbl NYMEX from December 2005 to November 2006, $38.91/bbl NYMEX from December 2006 to November 2007, $37.98/bbl NYMEX from December 2007 to November 2008, and beginning December 1, 2008 oil prices will be escalated 2% to a cap (or drop) of $30.00 NYMEX, (b) gas prices are $6.53/mmbtu NYMEX from December 2004 to November 2005, $6.34/mmbtu NYMEX from December 2005 to November 2006, $5.99/mmbtu NYMEX from December 2006 to November 2007, $5.67/mmbtu NYMEX from December 2007 to November 2008, and beginning December 1, 2008, gas prices will escalate (or drop) at 4% to a cap of $4.50 NYMEX price, and (c) operating expenses will escalate at 3% per annum starting immediately and running for five years. Accordingly, management decided not to pursue a sale transaction with any of the bidders. While no formal board meetings were held during this time period, management communicated regularly with the individual members of the board during this process and received their support as to strategy and direction.

Meagher continued to market the properties. On June 20, 2005, a new bidder submitted a bid of $4 million (or $0.79 per share based upon the value of Stratford reflected in its financial statements as of March 31, 2005) for Stratford’s entire package of oil and gas properties, subject to due diligence, and with an effective date of March 1, 2005 (so that the buyer would get the benefit of the income derived from the properties from and after that date, thereby effectively reducing the purchase price). During this time period, however, the prices of natural gas and oil had increased dramatically and were continuing to increase. Meagher re-ran the engineering studies to determine what impact the higher prices would have on the value of the properties over time. The new analysis indicated a value of $4,895,000 at September 1, 2005 (or $0.86 per share based upon the value of Stratford reflected in its financial statements as of June 30, 2005). The increase in value was due solely to the increase in the prices of natural gas and oil. Meagher sent the new engineering studies to the new bidder and the previous bidders but none responded with an increased bid. Management rejected the new bid as too low (including the fact that the new bidder was requiring all income after March 1st) and so informed the individual board members. Meagher’s new engineering studies assumed (a) oil prices average $67.35/bbl for the remainder of 2005, NYMEX strip data was used for the remaining years out to 2008 and thereafter the price was held fixed for life at $61.16/bbl, (b) gas prices average $9.87/mmbtu for the remainder of 2005, NYMEX strip data was used for the remaining years out to 2008 and thereafter the price was held fixed for life at $8.73/mmbtu, and (c) direct operating expenses were escalated by 3% per year.

In early November, 2005, JDMD had purchased 467,774 shares of Stratford common stock from a shareholder for $0.75 per share, which price was requested by the shareholder and not negotiated. This transaction was not part of the buyout proposal ultimately presented by JDMD. However, the purchase was reflected in an amendment to JDMD’s Schedule 13D, wherein JDMD publicly announced that it was exploring the possibility of taking Stratford private. Messrs. Eaton and Shultz, who are officers and directors of Stratford as well as principals of JDMD, were frustrated by the lack of acceptable bids for the oil and gas properties, and, along with the other principals of JDMD, were working on developing a buyout proposal as an alternative for Stratford if Meagher was unable to secure a bid for the oil and gas properties that approximated their market value as determined by the engineering reports. On December 29, 2005, Mel Shultz and David Eaton, on behalf of JDMD, submitted the buyout proposal to the board of directors of Stratford.

Under JDMD’s proposal, Stratford would be merged with and into a newly formed entity owned by JDMD, with Stratford being the surviving corporation and becoming wholly-owned by JDMD. Pursuant to the merger, each outstanding share of Stratford’s common stock would be converted into the right to receive $0.75 in cash (other than shares held by JDMD and shareholders who validly exercise dissenters’ right under Arizona law). This price was the same price that JDMD paid to acquire the 467,774 shares in a private purchase in November 2005. At the time the buyout proposal was submitted to Stratford’s board of directors, the market price for Stratford’s stock was $0.68 per share. The current market price is $0.89 per share. The original offer by JDMD was substantially identical to the merger described in this proxy statement, except that (a) the merger consideration was $0.75 per share, (b) Stratford’s right to consider a competing offer was limited to offers that were unsolicited, (c) the surviving corporation was obligated to maintain directors’ and officers’ liability insurance for six years following the closing, (d) Stratford was obligated to take the merger to a vote of shareholders even if there was a competing offer that the board desired to accept, and (e) a competing offer was to be considered by the full board of directors. The total price to be paid by JDMD to the non-JDMD shareholders pursuant to the proposal was $5,843,105.

The board engaged Fennemore Craig, P.C. as legal counsel to evaluate the JDMD proposal. At a meeting of the board held on January 18, 2006, with all members present in person or telephonically, the board reviewed the proposal with counsel, including the terms thereof, the pros and cons of the proposal, alternatives to the proposal and the directors’ fiduciary obligations in evaluating the proposal. For a detailed discussion of the alternatives to the merger considered by the board, see “SPECIAL FACTORS - Alternatives to the Merger.” At the conclusion of the meeting, counsel for Stratford was authorized to negotiate the proposal with counsel for JDMD. At this meeting, the board also endorsed an extension of Meagher’s services agreement, and directed management to work with Meagher to continue to offer the oil and gas properties for sale to obtain, if possible, an offer that exceeded the price offered by JDMD.

Counsel for Stratford and JDMD negotiated the terms of the buyout proposal, and then provided drafts of the merger agreement, this proxy statement and Stratford’s Schedule 13E-3 filing to the board for review. As a result of the negotiations, (a) Stratford’s right to consider a competing offer was no longer limited to offers that were unsolicited, so that Stratford could continue marketing the oil and gas properties in an effort to obtain a better price for the shareholders, (b) the time period that the surviving corporation was obligated to maintain directors’ and officers’ liability insurance was shortened from six years to two years following the closing, (c) Stratford was no longer obligated to take the merger to a vote of shareholders if there was a competing offer that the board desired to accept, and (d) a competing offer was to be considered by those members of the board of directors who are not members of the buyout group. JDMD’s original proposal allowed Stratford to consider competing offers, subject to JDMD’s right to match any offer so received that the board considered a superior offer, without Stratford being required to pay JDMD a break-up fee. Stratford would, however, reimburse JDMD for its out-of-pocket expenses not to exceed $200,000. Stratford did not negotiate a similar payment from JDMD if JDMD failed to close the transaction because JDMD did not ask for a financing contingency and because every closing condition was beyond JDMD’s control. If for any reason JDMD failed to close in breach of the agreement, Stratford would have customary legal rights for damages.

In connection with the negotiations and otherwise during the course of this transaction, no material, non-public information, including projections or potential synergies, were exchanged by Stratford and JDMD as JDMD never asked Stratford to prepare or provide any such information. That being said, all of the principals of JDMD are members of the board of Stratford, and in discussing the buyout proposal the board considered the Meagher engineering studies and liquidation value analyses as part of its evaluation process.

On January 30, 2006, a meeting of the board of directors of Stratford was convened, with all members except Gerald Colangelo attending either in person or telephonically, together with representatives of Fennemore Craig. The board and counsel reviewed the proposed definitive draft of the merger agreement and discussed the proposed merger consideration. JDMD agreed, after extensive negotiation with the board, to increase the merger consideration offered by JDMD to $0.80 per share. All other terms and conditions of the merger were as described in this proxy statement. With the increase in the price to $0.80 per share, the total price to be paid by JDMD to the non-JDMD shareholders increased to $6,232,646. The price increase was negotiated based on two primary factors. First, there had been a few sales of Stratford common stock in the days before the meeting at $0.80 per share, compared to $0.68 per share at the time the proposal was submitted and the surrounding time period. While the board did not believe that the limited trading volume established a true fair market value for Stratford’s common stock, the board did believe that it was some evidence of market value and was not willing to proceed at a price less than $0.80 per share. Second, $0.80 per share is the amount the shareholders would have received if Stratford were liquidated following the sale of the oil and gas properties for $4 million, which was the highest price it had ever been offered (although the true price was less than $4 million due to the buyer’s demand for a back-dated effective date for the transaction). Even though the engineering studies indicated a value in excess of $4 million, oil and gas buyers to date had not been willing to pay the full engineering value for Stratford’s oil and gas properties, and the board did not know if they would ever be so willing.

On January 31, 2006, Mr. Colangelo and counsel reviewed the proposed definitive draft of the merger agreement. The meeting of the board of directors was reconvened on January 31, 2006, with all members attending telephonically, together with representatives of Fennemore Craig. The board of directors then unanimously adopted resolutions approving and adopting the merger agreement and the transactions contemplated by the merger agreement, including the merger, determining that the merger agreement and the transactions contemplated by the merger agreement, including the merger, are advisable and fair to, and in the best interests of, the unaffiliated holders of Stratford’s common stock (those other than JDMD and Eaton Trust) and recommending that the holders of Stratford’s common stock vote for the approval of the merger agreement and the transactions contemplated by the merger agreement, including the merger.

On January 31, 2006, in accordance with the authorizations of their respective boards of directors, the parties finalized and thereafter executed the merger agreement.

On the evening of January 31, 2006, Stratford issued a press release announcing the execution of the merger agreement. On February 1, 2006, Stratford filed a Current Report on Form 8-K announcing the execution of the merger agreement and filed both the press release and the merger agreement as exhibits.

Pursuant to the board’s directive, Meagher has continued to market the oil and gas properties. They were featured on Meagher’s website in January and February, 2006, and at an industry convention in February. In light of continuing volatility in the oil and gas markets, Meagher re-ran the engineering studies using statistical information as of January 1, 2006, which resulted in the properties having a value of $4,283,000 (or $0.82 per share based upon the value of Stratford reflected in its financial statements as of June 30, 2005). The differences in value in this analysis compared to the prior analyses are attributable solely to fluctuating prices of natural gas and oil during the relevant time period. Meagher’s new engineering studies assumed (a) oil prices average $65.82/bbl for the remainder of 2006, NYMEX strip data was used for the remaining years out to 2008 and thereafter the price was held fixed for life at $65.42/bbl, (b) gas prices average $9.24/mmbtu for the remainder of 2006, NYMEX strip data was used for the remaining years out to 2008 and thereafter the price was held fixed for life at $9.23/mmbtu, and (c) direct operating expenses were escalated by 3% per year for three years and thereafter were held fixed for life.

Following the February convention, 60 prospective purchasers asked for information about Stratford’s properties, and on March 17, 2006, Meagher received four bids ranging from $1,625,000 to $3,555,000, and two bids in excess of $4,000,000 at $4,100,000 and $4,325,000, respectively. These latter two bids correlate to per share values of $0.81 and $0.83, respectively, based on the value of Stratford reflected in its financial statements as of December 31, 2005. Then on March 21, 2006, Meagher received a bid to purchase Stratford (as opposed to the oil and gas properties) for $4,500,000 plus the amount of Stratford’s cash in excess of its liabilities at the closing, which correlates to a per share value of approximately $0.85 based on the number of shares currently outstanding and assuming cash and liabilities remain constant from the date of this proxy statement to the closing date. This bidder spoke with Meagher and Mr. Shultz on March 21, 2006 to discuss this bid. All of the foregoing bids were extremely preliminary. None of the bids included any details of the proposed transaction, including whether the buyer would assume any liabilities, timing, conditions to closing, required representations and warranties, escrow or hold back provisions, required indemnities or the like, all of which have economic consequences to Stratford and its shareholders and may reduce the proceeds ultimately available to the shareholders. Further, none of the bidders provided financial statements or references that would support their ability to pay the purchase price.

Management then directed Meagher to obtain from those bidders who offered in excess of $4,000,000 letters of intent or purchase agreements that more definitively set forth the terms of their proposals. Mr. Shultz encouraged the bidder he spoke with to do the same. The bidder who originally offered $4,325,000 declined to move forward. The bidder who originally offered $4,100,000 increased its offer on March 27, 2006 to $4,425,000, or approximately $0.84 per share based on the value of Stratford reflected in its financial statements as of December 31, 2005. However, the revised offer letter included a termination right which would permit the bidder to terminate the transaction in the event that, among other things, preferential purchase rights on the oil and gas properties exceeded 10% of the purchase price. Because this bid was structured as an asset purchase, the preferential purchase rights associated with Stratford’s oil and gas properties would be triggered, as such rights cover approximately 34% of the assets. As a result, this condition of the bidder could never be satisfied by Stratford. Management instructed Meagher to explain this situation to the bidder. In addition, Stratford’s legal counsel spoke to this bidder about its bid and the preferential rights issue. The bidder was advised that the preferential purchase rights would apply to any sale of assets transaction, but would not apply to a purchase of Stratford’s equity in a merger transaction. After these discussions, the bidder declined to revise its offer, either to eliminate the termination right or to change the transaction structure to a merger, and no further discussions have occurred.

The third bidder, who originally offered to purchase Stratford for $4,500,000 plus the amount of Stratford’s cash in excess of its liabilities at the closing, continued to be interested. This bidder spoke to Meagher to further understand the oil and gas properties. Further, its outside accountant and counsel discussed Stratford and the JDMD merger agreement with Stratford’s counsel. On April 6, 2006, the principal of the bidder signed a confidentiality agreement with Stratford and, together with its accountant and legal counsel, met at Stratford’s office in Phoenix, Arizona for the purpose of conducting due diligence and discussing the offer. Also present at the meeting were Mel Shultz, Stratford’s President, Dan Matthews, its Controller, Karen McConnell, representing Stratford’s law firm Fennemore Craig, P.C., and Teri Williams of Meagher. At the conclusion of the meeting, the bidder indicated that a revised bid would follow. Over the next several days, Stratford management and counsel answered further questions posed by the bidder and its representatives. On April 14, 2006, Stratford received a revised offer to undertake a merger for consideration to the shareholders of $0.90 per share, contingent on net working capital at the closing not decreasing below $5,310,500. Management distributed the offer to the board of directors and noticed a special meeting of the board for April 19, 2006 to consider the offer. On April 18, 2006, Mr. Shultz and Ms. Williams of Meagher discussed the offer with the bidder to clarify a number of points. On April 19, 2006, the special meeting of the board was held with all directors except for Mr. Colangelo participating.

The board concluded at the special meeting that the bidder’s offer was, in fact, a superior proposal that the board would accept if not matched by JDMD. This determination was made unanimously by the board members present at the meeting, including Messrs. Dozer and Vance as the non-JDMD board members. Messrs. Dozer and Vance indicated that JDMD would have five business days to match the offer. The JDMD board members then unanimously agreed to waive on behalf of JDMD the benefit of the specific notice and procedural requirements contained in the merger agreement. Speaking on behalf of JDMD, Mr. Shultz advised the board that JDMD would match the $0.90 price, would not require a minimum net working capital and would deposit into a segregated account the additional funds necessary to pay the merger consideration at the closing. Messrs. Dozer and Vance determined that JDMD’s offer matched and in fact exceeded the superior proposal, and accepted JDMD’s offer. Following the meeting, Mr. Colangelo was apprised of the board’s discussion at the meeting and concurred in the board’s decisions and actions.

On April 20, 2006, JDMD and Stratford executed an amendment to the merger agreement reflecting an increase in the merger consideration from $0.80 per share to $0.90 per share, with all other terms and conditions of the merger remaining the same, including JDMD’s right to match any subsequent superior proposal. As a result of the amendment, the total price to be paid by JDMD to the non-JDMD shareholders is increased to $7,011,726. Mr. Shultz so notified the bidder, a press release was issued and a Form 8-K was filed.

Under the merger agreement, as amended, the board continues to have the right to accept a superior proposal that is not matched by JDMD without paying any break up fee to JDMD other than reimbursement of its actual, out-of-pocket expenses up to $200,000. Meagher has not marketed the oil and gas properties since the last round of bids was received on March 17, 2006, and at this point there are no plans to commence marketing since industry conditions have not changed materially and there is no reason to expect that offers valued in excess of $0.90 per share could be obtained. Accordingly, there can be no assurance that another superior proposal, or any definitive proposal at all, will be made for consideration by the board. If another proposal is received by Stratford prior to the date of the special meeting, Stratford’s board will consider the proposal and, if necessary, will postpone the special meeting in order to finalize, evaluate and respond to the other proposal. As provided in the merger agreement, JDMD will continue to have the right to match another proposal if the board concludes the other offer is a superior proposal.

The purpose of the merger for Stratford is to eliminate the costs and burdens associated with being a publicly traded company, giving Stratford greater flexibility to make operating decisions based on long-term strategic goals without the concern of short-term market expectations. Stratford’s board of directors believes, based upon the reasons discussed under “SPECIAL FACTORS — Recommendations of the Board of Directors; Reasons for Recommending the Approval and Adoption of the Merger Agreement and the Merger,” that the merger is advisable, fair to and in the best interests of, Stratford and its unaffiliated shareholders (those other than JDMD and Eaton Trust).

For the Buyout Parties and the Other Filers, the purpose of the merger is to allow JDMD to benefit from the future earnings and growth of Stratford, if any, after Stratford’s common stock ceases to be publicly traded. The Buyout Parties and the Other Filers believe that public company status imposes a number of limitations on Stratford and its management in conducting Stratford’s operations, including the costs of being a public company such as accounting expenses, expenses associated with the reporting obligations under the Exchange Act and compliance with the Sarbanes-Oxley Act of 2002, and transfer agent fees. Accordingly, one of the purposes of the merger for the Buyout Parties and the Other Filers is to afford greater operating flexibility, allowing management to concentrate on long-term growth and to reduce its focus on the quarter-to-quarter performance often emphasized by the public markets. The merger is also intended to enable Stratford to use in its operations those funds that would otherwise be expended in complying with requirements applicable to public companies.

The Buyout Parties and the Other Filers determined to conduct the merger at this time rather than at a future time because:

| · | new requirements under the Sarbanes-Oxley Act of 2002 and related SEC regulations — such as expanded disclosure obligations in periodic reports filed under the Exchange Act and new requirements for the attestation by Stratford’s accounting firm regarding the effectiveness of Stratford’s internal control over financial reporting — will significantly increase Stratford’s cost of continuing as a public company, and by becoming a private company, Stratford will eliminate those newly imposed and future costs. Stratford has cash reserves remaining from the sale of its real estate assets that it is using for operating expenses and required capital expenditures in connection with its oil and gas properties, but these reserves will be significantly reduced by ongoing compliance costs. The Buyout Parties and the Other Filers do not believe that Stratford’s use of its cash for compliance purposes is in the best interests of the shareholders in light of the limited benefits they receive from being public; see “SPECIAL FACTORS — Effects of the Merger;” and |

| · | cost savings from Stratford’s becoming a private company are expected to approximate $66,700 in the first year, including the elimination of printers’ fees, transfer agent fees, OTC Bulletin Board listing fees, and reduced legal fees, without taking into consideration reductions in accounting fees and insurance costs and without considering Sarbanes-Oxley compliance costs. |

Further, despite over a year of marketing the oil and gas properties, no offer has surfaced that would provide the Stratford shareholders, in liquidation of the company, more than the current offer by JDMD. If a definitive offer is secured that the board concludes is a superior proposal, JDMD will continue to have the right to match the offer as provided in the merger agreement. Meagher has not marketed the oil and gas properties since the last round of bids was received on March 17, 2006, and at this point there are no plans to commence marketing since industry conditions have not changed materially and there is no reason to expect that offers valued in excess of $0.90 per share could be obtained. Accordingly, there can be no assurance that another superior proposal, or any definitive proposal at all, will be made for consideration by the board. If another proposal is received by Stratford prior to the date of the special meeting, Stratford’s board will consider the proposal and, if necessary, will postpone the special meeting in order to finalize, evaluate and respond to the other proposal. As provided in the merger agreement, JDMD will continue to have the right to match another proposal if the board concludes the other offer is a superior proposal.

Stratford’s financial condition has been and is currently relatively stable. It has positive net worth and cash flow from operations and has been break even to slightly negative over the past year. Stratford is not currently in financial difficulty and does not anticipate encountering financial difficulty in the short term. However, the economic cost of remaining public is growing, particularly in light of Sarbanes-Oxley, and compliance costs will erode cash reserves as 2006 progresses. Stratford will be required to comply with the internal control reporting requirements of Sarbanes-Oxley by the end of 2007 unless the SEC further extends the compliance deadline. To so comply, Stratford will need to begin work in 2006. Further, the oil and gas markets have continued to be volatile. Prices in 2005 and 2006 are among the highest management has ever seen, and whether the high prices are sustainable is not known and beyond Stratford’s control. Stratford believes that on the whole, the current business and industry conditions are relatively the same today as they were when the merger was first considered by the board and do not weigh against the merger.

The proposed transaction is a merger of Stratford Acquisition with and into Stratford, with Stratford surviving in the merger as a wholly-owned subsidiary of Stratford Holdings.

The principal steps that will accomplish the merger are as follows:

Financing. The total amount of funds required to consummate the merger and to pay related fees and expenses is estimated to be approximately $7,157,476. JDMD intends to finance the merger through use of the cash reserves of Stratford, which will become available immediately upon the effectiveness of the merger, and $900,000 of cash on hand available to JDMD from its business activities unrelated to Stratford. Stratford and JDMD have sufficient funds available to finance the merger, and therefore the merger is not conditioned on any third party financing arrangements. Pending the closing and subject to the conditions of closing, JDMD has deposited $900,000 of its own funds on a non-refundable basis in a segregated account to cover the estimated shortfall in anticipated funds necessary to consummate the merger over Stratford’s cash reserves.

The Merger. Following the satisfaction or waiver of conditions to the merger, the following will occur in connection with the merger:

| · | each share of Stratford’s common stock that is held by Stratford in its treasury or by any wholly-owned subsidiary of Stratford immediately before the effective time of the merger will automatically be cancelled, and no consideration will be delivered in exchange for such shares; |

| · | each share of Stratford’s common stock that is held by JDMD immediately before the effective time of the merger will automatically be cancelled, and no consideration will be delivered in exchange for such shares; |

| · | each share of Stratford common stock issued and outstanding immediately before the merger becomes effective (other than those shares that are described in the preceding two paragraphs and other than the shares that are held by dissenting shareholders who exercise and perfect their appraisal rights under Arizona law) will be converted into the right to receive $0.90 in cash, without interest; and |

| · | each unit of Stratford Acquisition will be converted into one share of Stratford’s common stock, and will constitute the only shares of outstanding Stratford capital stock after the completion of the merger. |

As a result of the merger:

| · | Stratford’s shareholders (other than JDMD) will no longer have any interest in, and will no longer be shareholders of, Stratford and will not participate in any future earnings or growth of Stratford, if any; |

| · | the total number of outstanding shares of Stratford common stock will decrease from 11,078,105 to 1,000, all of which will be owned by Stratford Holdings; |

| · | JDMD will own all of the outstanding membership interests in Stratford Holdings; and |

| · | shares of Stratford common stock will no longer be listed on the OTC Bulletin Board, and price quotations with respect to sales of shares of Stratford in the public market will no longer be available. The registration of Stratford common stock under the Exchange Act will be terminated, and Stratford will cease filing reports with the SEC. |

Board of Directors of Stratford. The directors of Stratford Acquisition immediately prior to the effective time of the merger will become the directors of Stratford after the completion of the merger.

Management of Stratford. The executive officers of Stratford immediately prior to the effective time of the merger will remain as executive officers of Stratford after the completion of the merger.

For additional details regarding the merger, and the interests of JDMD and its affiliates in the transaction, see “SPECIAL FACTORS — Merger Financing,” “— Interests of Certain Persons in the Merger” and “MERGER AGREEMENT.”

At the meetings of the board of directors held on January 30, 2006, January 31, 2006 and April 19, 2006, the members of the board of directors considered and discussed the merger and terms of the merger agreement, and unanimously determined that the merger agreement and the transactions contemplated by it, including the merger, are advisable and fair to, and in the best interests of, Stratford and its unaffiliated shareholders (those other than JDMD and Eaton Trust). The board of directors declared the merger advisable and approved and adopted the merger agreement and resolved to recommend to Stratford’s shareholders that they vote “FOR” approval and adoption of the merger agreement and the merger. See “SPECIAL FACTORS - Interests of Certain Persons in the Merger.”

In reaching its determination at the meetings, the board of directors considered the following factors to conclude that it was in the best interests of Stratford and its shareholders for Stratford to no longer be a public company, that the merger was in the best interests of the shareholders to accomplish the going private transaction, and that the merger consideration was fair:

| · | the relationship of the $0.80 per share cash merger consideration reviewed by the board of directors at its January 30, 2006 and January 31, 2006 meetings to (a) the trading price of Stratford’s common stock on November 9, 2005, the last trading day prior to the public announcement by way of an amendment to its Schedule 13D of JDMD’s intention to possibly take Stratford private ($0.65 per share), (b) the trading price of Stratford’s common stock on January 30, 2006, the last trading day prior to Stratford announcing the execution of the merger agreement ($0.80 per share), (c) the volume weighted average price of Stratford’s common stock over the 30, 60, 90, and 120 day periods prior to the board’s determination ($0.80, $0.70, $0.66 and $0.66 per share, respectively), (d) the price paid by JDMD to acquire shares in a private transaction in November 2005 ($0.75), (e) the book value of Stratford’s common stock at December 31, 2005 ($0.72 per share); and (f) the going concern value of Stratford at December 31, 2005, which Stratford believes is the same as the value of its assets (or book value) because Stratford has no on-going operating business and its only significant assets are cash and investments in oil and gas properties ($0.72 per share). The board concluded that the merger consideration related favorably to these other measures of value and supported the fairness of the price; |

| · | the relationship of the $0.80 per share cash merger consideration reviewed by the board of directors at its January 30, 2006 and January 31, 2006 meetings to the value the Stratford shareholders would receive in liquidation ($0.72 if Stratford’s liquidation value equaled its book value at December 31, 2005; and $0.80 per share if the oil and gas properties can be sold at $4 million after payment of commissions to Meagher and other estimated transaction costs and satisfaction of Stratford’s liabilities and obligations), and the fact that despite extensive marketing efforts, to the date of the board’s determination Stratford had not received any firm offers for its oil and gas properties that exceed $4 million. In this regard, the board considered the various Meagher engineering studies, and concluded that the merger consideration related favorably to the likely liquidation value. Since the initial board determination, Stratford received three preliminary bids for its investment in oil and gas properties or the stock of Stratford in excess of $4 million and Stratford subsequently has received one offer for consideration to the shareholders of $0.90 per share, contingent on net working capital at the closing not decreasing below $5,310,500. See “SPECIAL FACTORS - Background of the Merger;” |

| · | the relationship of the $0.90 per share cash merger consideration reviewed by the Board at its April 19, 2006 meeting to (a) the trading price of Stratford’s common stock on March 31, 2006, the last trading day prior to Stratford announcing the execution of the amendment to the merger agreement ($0.78 per share), (b) the highest trading price of Stratford’s common stock over the past year ($0.89 per share), (c) the value that Stratford shareholders would receive in a merger with the offeror of the highest other bid received to date ($0.90 per share), while also taking into account that this other bid contains specified working capital requirements that are not present in the Buyout Parties’ proposal and completion of a merger with the other bidder will require additional time and expense which may result in a lower price to shareholders, and (d) the value of Stratford based upon the value of the oil and gas properties calculated by Meagher at various times over the 14 months prior to the date of this proxy statement, in each case calculated based upon the value of Stratford reflected in its most recent financial statements as of the date of the applicable Meagher report ($0.62, $0.67, $0.71, $0.74 and $0.82 per share); |

| · | the fact that the consideration to be received by Stratford’s shareholders in the merger will consist entirely of cash rather than stock, which will provide liquidity and certainty of value to Stratford’s shareholders and which the board viewed favorably; |

| · | Stratford’s inability to attract analyst coverage, market attention and institutional shareholder investment, which in the board’s view limited the value to Stratford’s shareholders of Stratford being a public company; |

| · | the limited public float for Stratford’s common stock, as well as the extremely limited trading market for the common stock, which have limited Stratford’s ability to use its common stock as acquisition currency, and significantly limited the ability of shareholders to sell their shares without also reducing the trading price of the common stock; |

| · | the costs and associated burdens of continuing to be a public company, including (a) the actual out-of-pocket costs of SEC compliance, (b) the burden on management of compliance efforts, (c) the distraction of investor relations and the focus on short-term goals such as quarterly results per share occasioned by periodic public reporting, (d) the compliance and competitive costs associated with requirements to publicly disclose detailed information regarding Stratford’s business, operations and results, and (e) the enactment of the Sarbanes-Oxley Act of 2002, which will lead to increased compliance costs and additional burdens on management as Stratford becomes subject to Section 404; |

| · | the cost savings from Stratford’s becoming a private company, which are expected to approximate $66,700 in the first year, including the elimination of printers’ fees, transfer agent fees, OTC Bulletin Board listing fees, and reduced legal fees, without taking into consideration reductions in accounting fees and insurance costs; |

| · | the fact that Stratford has publicly stated in each of its quarterly and annual reports since November 2004 that management was exploring ways to maximize shareholder returns, including a liquidation, and not a single firm offer to buy Stratford or its assets has emerged apart from the oil and gas bids; |

| · | the fact that after JDMD and its principals amended their Schedule 13D filings in November 2005 to publicly state their intent to possibly take Stratford private, Stratford’s common stock price generally stayed at about $0.68 per share (there were trades as high as $0.82 per share, but trading at this level was not sustained), and not a single potential buyer for Stratford or its assets emerged from such announcement; |

| · | the board’s belief that the principal advantage of Stratford continuing as a public company would be to allow public shareholders to continue to participate in any growth in the value of Stratford’s equity, but that, under all of the relevant circumstances and in light of the proposed $0.90 per share price, the value to shareholders that would be achieved by continuing as a public company was not likely to be as great as the merger consideration of $0.90; |

| · | the terms of the merger agreement that essentially give the unaffiliated shareholders veto power over the merger. The merger agreement requires JDMD and Eaton Trust to vote their shares of Stratford common stock in favor of the adoption and approval of the merger agreement and the merger if holders of a majority of the unaffiliated shares of Stratford’s common stock (those not owned, directly or indirectly, by JDMD or Eaton Trust) vote in favor of the adoption and approval of the merger agreement and the merger; |

| · | the terms of the merger agreement that permit the board to explore third party acquisition offers that it might receive after announcement of the merger and before the shareholder vote if the board reasonably determines in good faith that a competing offer is a superior alternative to the merger and the board’s fiduciary duties under Arizona law require discussions to be conducted with the third party advancing the competing offer; |

| · | the terms of the merger agreement that permit the board to withdraw its recommendation to Stratford’s shareholders and accept a competing acquisition offer if the board reasonably determines in good faith that such action is necessary in order for the board to comply with it fiduciary duties under Arizona law, and, after giving notice of its intention to withdraw its recommendation and terminate the merger agreement due to receipt of a superior acquisition offer, does not receive a timely offer from Stratford Holdings which meets or exceeds the competing offer; |

| · | the fact that there is no break-up fee payable by Stratford if it elects to accept a competing offer that Stratford Holdings does not match, although Stratford will be required to reimburse Stratford Holdings’ expenses up to $200,000; |

| · | the fact that the Buyout Parties are essentially acquiring Stratford “as-is,” the representations and warranties are limited and do not survive the closing, and there are no holdbacks or escrows that would affect the proceeds received by the shareholders; |

| · | the fact that the merger agreement would be available promptly following the public disclosure of the merger via the SEC’s EDGAR database as part of a current report on Form 8-K to be filed by Stratford (such Form 8-K was filed by Stratford on February 1, 2006), so that if there are any other parties interesting in acquiring Stratford they will have ready and complete access to the terms of this transaction; |

| · | the fact that the merger consideration will be financed out of Stratford’s cash reserves and JDMD’s cash deposit, and thus the merger agreement is not conditioned upon the acquisition by JDMD of any third party financing arrangements; |

| · | the availability of appraisal rights under Arizona law to holders of shares of Stratford common stock who dissent from the merger, which provides shareholders who dispute the fairness of the merger consideration with an opportunity to have a court determine the fair value of their shares; and |

| · | the fact that the value of Stratford’s oil and gas properties may decline after the merger which would decrease the potential sales price of Stratford and the value received by its shareholders. |

Each of these factors favored the board’s conclusion that the merger is advisable, fair to, and in the best interests of, Stratford and its unaffiliated shareholders (those other than JDMD and Eaton Trust). The board relied on Stratford’s management to provide accurate and complete financial information, projections and assumptions (based on the best information available to management at that time), as the starting point for its analysis. The board of directors also considered a variety of risks and other potentially negative factors concerning the merger agreement and the transactions contemplated by it, including the merger. These negative factors included:

| · | the fact that, following the merger, Stratford’s shareholders will cease to participate in any future earnings of Stratford or benefit from any future increase in Stratford’s value, if any; |