ITEM 1

|

| THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION |

|

If you are in any doubtas to any aspect of this circular, you should consult a licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser.

If you have sold or transferredall your shares in PCCW Limited, you should at once hand this circular and the accompanying form of proxy to the purchaser or the transferee or to the bank, a licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee.

The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this circular, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular.

(Stock code: 0008)

MAJOR TRANSACTION

PROPOSED TRANSFER OF

VARIOUS PROPERTY INTERESTS OF

PCCW LIMITED

Financial adviser to PCCW Limited

Citigroup Global Markets Asia Limited

A letter from the board of directors of PCCW Limited is set out on pages 10 to 32 of this circular.

A notice convening the EGM (as defined herein) to be held at 11:00 a.m. on Thursday, 29 April 2004 is set out on pages 62 to 63 of this circular. Whether or not you are able to attend the EGM, you are requested to complete and sign the enclosed form of proxy in accordance with the instructions printed thereon, and to lodge it with the Company’s Share Registrars, Computershare Hong Kong Investor Services Limited, at Rooms 1901-5, 19th Floor, Hopewell Centre, 183 Queen’s Road East, Hong Kong, as soon as possible but in any event not later than 48 hours before the time appointed for the holding of the EGM or any adjourned meeting (as the case may be), otherwise the form of proxy will not be treated as valid. Completion and return of the form of proxy will not preclude you from attending and voting in person at the EGM or any adjourned meeting should you so wish.

26 March 2004

| | | Page | |

| | | | |

| Executive Summary | | 1 | |

| Business Overview | | 1 | |

| Transaction Overview | | 2 | |

| General | | 4 | |

| | | | |

| Definitions | | 5 | |

| | | | |

| Letter from the PCCW Board | | 10 | |

| Introduction | | 10 | |

| The Acquisition Agreement | | 11 | |

| Summary of the Terms and Conditions of the Convertible Notes | | 16 | |

| Shareholding Structures Prior to and After Completion | | 19 | |

| Connection Among the Parties | | 20 | |

| Information on the Property Group and the Sale Assets | | 21 | |

| Information on PCCW | | 24 | |

| Information on DFG | | 25 | |

| Reasons for and Benefits of the Transaction | | 26 | |

| Takeovers Code Implications of the Transaction | | 27 | |

| Maintenance of the Listing of DFG | | 28 | |

| Proposed Capital Reorganisation by DFG | | 29 | |

| General | | 31 | |

| EGM | | 31 | |

| Recommendation | | 32 | |

| Additional information | | 32 | |

| | | | |

| Appendix I — Financial Information on the PCCW Group | | 33 | |

| 1. Indebtedness | | 33 | |

| 2. Working Capital | | 34 | |

| 3. Financial Effects | | 34 | |

| | | | |

| Appendix II — Property Valuations | | 38 | |

| | | | |

| Appendix III — General Information | | 49 | |

| 1. Responsibility Statements | | 49 | |

| 2. Disclosure of Interests | | 49 | |

| 3. Material Contracts | | 56 | |

| 4. Service Contracts | | 58 | |

| 5. PCCW Directors’ Interest in Assets/Contracts and Other Interest | | 59 | |

| 6. Litigation | | 59 | |

| 7. Qualification of Expert | | 60 | |

| 8. Consent | | 61 | |

| 9. Miscellaneous | | 61 | |

| 10. Documents Available for Inspection | | 61 | |

| | | | |

| Notice of Extraordinary General Meeting | | 62 | |

| | | | |

| — i — | | | |

Business Overview

PCCW is the largest telecommunications provider in Hong Kong and one of Asia’s leading integrated communications companies. PCCW provides key services in the areas of: integrated telecommunications; broadband solutions; connectivity; narrowband and interactive broadband (Internet services); information technology solutions and services and infrastructure.

On 5 March 2004, PCCW and DFG jointly announced in the Announcement that the Transaction will result in a separation of PCCW’s property business from its telecommunications-related business. As part of the Transaction, PCCW will transfer ownership of the companies holding PCP Beijing, PCCW Tower, other investment properties and related property and facilities management companies to DFG. PCCW will also transfer ownership of the Cyberport Developer to DFG along with the Cyberport Developer’s continuing role in the development of the Cyberport Project (though the obligations of the Cyberport Developer and PCCW in the Cyberport Project will remain the same following Completion).

The total consideration for the Transaction does not involve any payment by DFG for the Cyberport Project, as the consideration for that part of the Transaction is only represented by the Cyberport Developer’s obligation to repay the Cyberport Loan on a non-recourse basis. In addition, PCCW will grant DFG (through the Property Group) a right of first refusal to jointly redevelop all of the PCCW Group’s local Telephone Exchanges if and when the PCCW Group is permitted by the Government to redevelop the local Telephone Exchanges for other use, where the total consideration for the Transaction also does not involve any payment by DFG for the Redevelopment Right itself.

DFG is an investment holding company and its subsidiaries are principally engaged in manufacturing and trading of building materials, particularly ceramic tiles, securities trading and natural gas supply, storage and related services. DFG has conditionally agreed to purchase from PCCW all of PCCW’s entire equity interest in Property Holdco.

The Property Group is principally engaged in the management of infrastructure and property portfolio in Hong Kong and Greater China, being the property development, investment, property and facilities management functions of the PCCW Group. The core assets of the Property Group include PCP Beijing, PCCW Tower, the development right of the Cyberport Project and various property interests.

After completion of the Transaction, PCCW, as the controlling shareholder of DFG, will continue to be engaged in the property related business through DFG. However, PCCW is not expected to directly engage in any property related business or compete with DFG.

The PCCW Board believes that the telecommunications and property businesses are inherently different in terms of the nature of the industry, competition, funding requirements, and management expertise. The Transaction will allow the two businesses to be run as separately listed companies, each focusing on its particular business. The management of PCCW will be able to focus on its core telecommunications business, while Property Holdco will, as a result of its acquisition by DFG, obtain an independent identity with its management focusing on property development. As part of a separately listed company, Property Holdco will be able to provide investors, research analysts and

— 1—

rating agencies with greater clarity on its business and financial position. The PCCW Board also believes that Property Holdco, as part of DFG, will be able to attract greater interest from investors focused on property, which will be beneficial both for Property Holdco and PCCW, as the controlling shareholder of DFG.

The local economy and the property market have recently shown signs of recovery after facing severe downturn in early 2003. The DFG Board is optimistic about the prospects of the property market and considers that the Transaction will provide a solid ground for DFG to invest in prime residential and hospitality projects. The DFG Board also believes that the Transaction will enlarge DFG’s business scope, broaden its revenue stream and bring a positive contribution to DFG’s overall earnings in the future.

Based on the above reasons, both the PCCW Board and the DFG Board believe that the Transaction will be beneficial to PCCW and DFG, respectively.

After Completion, DFG, while retaining its existing business, will leverage the expertise gained from the Cyberport Project to participate in other high-end residential and hospitality projects. In addition, PCCW will grant to the Property Group a right of first refusal to jointly re-develop all of the PCCW Group’s local Telephone Exchanges if and when the PCCW Group is permitted by the Government to redevelop the local Telephone Exchanges for other use.

Transaction Overview

DFG has conditionally agreed to purchase the Sale Shares and the Sale Assets from PCCW.

The aggregate consideration for the Sale Shares and the Sale Assets, which amounts to HK$6,557 million, will be satisfied:

| | (i) | as to HK$ 2,967 million, by the allotment and issue of approximately 1,648 million new Reorganised DFG Shares by DFG to PCCW (or as it may direct) credited as fully paid at an issue price of HK$ 1.80 per Reorganised DFG Share; and |

| | | |

| | (ii) | as to the remaining HK$3,590 million, by the issue of the Convertible Notes by DFG to PCCW (or as it may direct). |

Based on the average closing price of Existing DFG Shares during the period of 30 trading days up to the Last Trading Day and the Latest Practicable Date respectively, the Consideration Shares would have a market value of approximately HK$6,016.4 million and approximately HK$8,373.5 million, respectively.

The Sale Shares and the Sale Assets represent, in essence, the PCCW Group’s ownership of the companies holding PCP Beijing, PCCW Tower, other investment properties and related property and facilities management companies, including the Cyberport Developer and its interests in the Cyberport Project. The total consideration for the Transaction does not involve any payment by DFG for the Cyberport Project, as the consideration for that part of the Transaction is only represented by the

— 2—

Cyberport Developer’s obligation to repay the Cyberport Loan on a non-recourse basis. In addition, PCCW will grant the Redevelopment Right to DFG (through the Property Group), where the total consideration for the Transaction also does not involve any payment by DFG for the Redevelopment Right itself.

The PCCW Group currently holds no interests in the issued share capital of DFG. Immediately after the issue of the Consideration Shares at Completion, but before any exercise of the conversion rights under the Convertible Notes, and on the assumption that there are no other changes in DFG’s issued share capital after the Latest Practicable Date, the shareholding of the PCCW Group in DFG is expected to become approximately 93.4% of the Enlarged DFG Capital. As a result, an obligation to make a mandatory general offer will arise under the Takeovers Code, unless the Share Whitewash Waiver is obtained.

Further, upon the issue and allotment of new Reorganised DFG Shares pursuant to a partial or full exercise of the conversion rights under the Convertible Notes, the shareholding of the PCCW Group in DFG may increase by more than 2% from its lowest collective percentage shareholding in the then preceding 12 month period. In such event, and if such lowest collective percentage shareholding is at or above 30% but below 50%, an obligation to make a mandatory general offer will arise as a result, unless the Convertible Note Whitewash Waiver is obtained.

As the Convertible Notes have a conversion term of up to 10 years, it is uncertain whether the PCCW Group’s shareholding in DFG may drop below any particular level at any particular time. Thus, the Convertible Note Whitewash Waiver was contemplated in order to protect PCCW’s conversion rights under the Convertible Notes. As the Executive has indicated that it will not consider granting such a waiver (without, amongst others, sufficient information on the shareholding structure of DFG prior to and after such conversion), PCCW will waive before the SGM the Convertible Note Whitewash Waiver as a condition precedent to Completion.

If the Share Whitewash Waiver is not available for any reason, the Transaction will not become unconditional and will not proceed (unless that condition is waived by PCCW, but PCCW cannot waive that condition unless it has demonstrated to the satisfaction of the Executive that it has sufficient financial resources to fulfil its obligations under Rule 26 of the Takeovers Code).

Under the Listing Rules, the Transaction constitutes a major transaction for DFG, which requires DFG Shareholders’approval. The Transaction also constitutes a major transaction for PCCW, which requires PCCW Shareholders’approval.

DFG also intends to put forward for approval by the DFG Shareholders at the SGM resolution(s) to approve the Capital Reorganisation pursuant to which the credit to the contributed surplus account of DFG (which will be created as a result of the Capital Reorganisation) will be used to set off against the accumulated losses of DFG. According to the audited accounts of DFG as at 31 March 2003, the accumulated losses of DFG as at that date amounted to approximately HK$559.34 million.

The purpose of this circular is to provide PCCW Shareholders with further details of the Transaction and to give notice of the EGM at which an ordinary resolution will be proposed in order to seek PCCW Shareholders’approval of the Transaction.

— 3—

General

It is the intention of PCCW to maintain the listing of DFG on the Stock Exchange. Accordingly, PCCW and DFG have each undertaken to the Stock Exchange to use their best endeavours to take appropriate steps to ensure that, as soon as possible following issuance of the Consideration Shares upon Completion, the public float of DFG will not be less than 25% after Completion. It is currently intended that steps will be taken with a view to increasing the public float, including effecting possible placing of Reorganised DFG Shares by DFG and/or PCCW. Arrangements relating to the possible placing by DFG and/or PCCW may be entered into at any time from the Latest Practicable Date to Completion, or thereafter. An announcement will be made when a definitive agreement for such placing has been entered into.

The Stock Exchange has stated that if, at the date of Completion, less than 25% of the Reorganised DFG Shares are held by the public or if the Stock Exchange believes that:

- a false market exists or may exist in the trading in the Reorganised DFG Shares; or

- there are too few Reorganised DFG Shares in public hands to maintain an orderly market,

then it will consider exercising its discretion to suspend trading in the Reorganised DFG Shares until a sufficient public float is attained. In this connection, it should be noted that upon Completion, there may be insufficient public float for the Reorganised DFG Shares and therefore trading in the Reorganised DFG Shares may be suspended until a sufficient level of public float is attained.

If DFG remains a listed company, the Stock Exchange will closely monitor all future acquisitions or disposals of assets by DFG. The Stock Exchange has indicated that it has the discretion to require DFG to issue an announcement and a circular to the DFG Shareholders irrespective of the size of the proposed transactions, particularly when such proposed transactions represent a departure from the principal activities of DFG. The Stock Exchange also has the power, pursuant to the Listing Rules, to aggregate a series of transactions of DFG and any such transactions may result in DFG being treated as if it were a new listing applicant as set out in the Listing Rules.

PCCW Shareholders and potential investors should note that the Transaction, which is subject to a number of conditions precedent, may or may not be completed. In particular, the Transaction is subject to, among others, a condition precedent that the Share Whitewash Waiver be obtained, and thus if the Share Whitewash Waiver is not available for any reason and a mandatory general offer is required to be made following Completion, the Transaction will not proceed (unless that condition is Waived).

PCCW Shareholders and potential investors are reminded to exercise caution when dealing in the securities of PCCW.

— 4—

In this circular, the following expressions have the following meanings unless the context requires otherwise:

| “Acquisition Agreement” | | the agreement dated 5 March 2004 under which DFG has conditionally agreed to acquire the Sale Shares and the Sale Assets from PCCW; |

| | | |

| “Announcement” | | the joint announcement issued by PCCW and DFG dated 5 March 2004 in relation to, among other things, the Transaction and the Whitewash Waivers; |

| | | |

| “associate” | | shall have the meaning ascribed to such term under the Listing Rules; |

| | | |

| “Business Day” | | a day on which banks in Hong Kong are generally open for business (excluding Saturday); |

| | | |

| “Bye-Laws” | | the current bye-laws of DFG; |

| | | |

| “Capital Reorganisation” | | the reduction in value by cancelling HK$0.39 of the capital paid up on each issued Existing DFG Share of HK$0.40 so as to form (after a 10:1 share consolidation) one Reorganised DFG Share of HK$0.10, the cancellation of each unissued Existing DFG Share and the Share Premium Cancellation; |

| | | |

| “CBRE” | | CB Richard Ellis Limited, an independent firm of professional surveyors; |

| | | |

| “Completion” | | completion of the sale and purchase of the Sale Shares and the Sale Assets in accordance with the Acquisition Agreement; |

| | | |

| “Concert Parties” | | in respect of a person, means parties acting in concert (within the meaning as ascribed to that term under the Takeovers Code) with such person in relation to DFG; |

| | | |

| “Consents” | | licences, consents, approvals, authorisations, permissions, waivers, orders or exemptions; |

| | | |

| “Consideration Shares” | | 1,648,333,333 new Reorganised DFG Shares to be allotted and issued at HK$1.80 per share to PCCW (or as it may direct) to satisfy in part the consideration for the Sale Shares and the Sale Assets; |

| | | |

| “Convertible Notes” | | the Tranche A Note and the Tranche B Note, to be issued by DFG entitling the holder thereof to convert the principal amount thereof into new Reorganised DFG Shares, which is to be issued by DFG to PCCW (or as it may direct) to satisfy in part the consideration for the Sale Shares and the Sale Assets; |

— 5—

| “Convertible Note Whitewash Waiver” | | a waiver of the obligation of PCCW to make a mandatory offer for all the Reorganised DFG Shares under Rule 26 of the Takeovers Code as a result of the issue of new Reorganised DFG Shares to PCCW (or as it may direct) pursuant to a partial or full exercise of the Convertible Notes or any of them; |

| | | |

| “CSH” | | China Strategic Holdings Limited, the controlling shareholder of DFG and whose shares are listed on the Stock Exchange; |

| | | |

| “Cyberport Developer” | | Cyber-Port Limited, a member of the Property Group and the developer of the Cyberport Project; |

| | | |

| “Cyberport Loan” | | the unsecured, non-interest bearing and non-recourse loans owing by the Cyberport Developer to the PCCW Group (which was approximately HK$4,503 million as at 31 January 2004); |

| | | |

| “Cyberport Project” | | the project known as Cyberport to provide specially designed commercial space dedicated to high-technology industries with related retail, residential, recreational and educational facilities; |

| | | |

| “DFG” | | Dong Fang Gas Holdings Limited, a company incorporated in Bermuda and whose shares are listed on the Stock Exchange; |

| | | |

| “DFG Board” | | the board of directors of DFG; |

| | | |

| “DFG Group” | | DFG and its subsidiaries; |

| | | |

| “DFG Shareholders” | | holders of Existing DFG Shares or, where appropriate, Reorganised DFG Shares; |

| | | |

| “Dr. Chan” | | Dr. Chan Kwok Keung, Charles, the chairman and an executive director of DFG; |

| | | |

| “EGM” | | the extraordinary general meeting of PCCW to be held to seek the PCCW Shareholders’ approval of the Transaction; |

| | | |

| “Enlarged DFG Capital” | | the issued share capital of DFG as to be enlarged by the issue of the Consideration Shares (and assuming no other changes in DFG’s capital structure after the Latest Practicable Date), which will consist of 1,764,459,874 Reorganised DFG Shares; |

| | | |

| “Exchange Company” | | PCCW-HKT Telephone Limited, being a wholly-owned subsidiary of PCCW which uses the Telephone Exchanges; |

| | | |

| “Executive” | | the Executive Director of the Corporate Finance Division of the Securities and Futures Commission, or any delegate for the time being of the Executive Director; |

— 6—

| “Existing DFG Shares” | | existing shares of HK$0.40 each in the share capital of DFG; |

| | | |

| “Government” | | the Government of the Hong Kong SAR; |

| | | |

| “HK$” | | Hong Kong dollars, the lawful currency of Hong Kong; |

| | | |

| “Hong Kong” | | the Hong Kong Special Administrative Region of the PRC; |

| | | |

| “Last Trading Day” | | 23 February 2004, being the last trading day of the Existing DFG Shares on the Stock Exchange before the suspension of trading of Existing DFG Shares prior to the issue of the Announcement; |

| | | |

| “Latest Practicable Date” | | 21 March 2004, being the latest practicable date prior to the issue of this circular for ascertaining certain information contained herein; |

| | | |

| “Letter” | | the letter from the PCCW Board contained in this circular; |

| | | |

| “Listing Rules” | | the Rules Governing the Listing of Securities on the Stock Exchange; |

| | | |

| “Loans” | | the approximately HK$3,529 million, in aggregate, of interest-bearing loans owing by the relevant members of the Property Group to PCCW (comprising of HK$2,359 million and US$150 million of such loans); |

| | | |

| “PCCW” | | PCCW Limited, a company incorporated in Hong Kong and whose shares are listed on the Stock Exchange; |

| | | |

| “PCCW Board” | | the board of directors of PCCW; |

| | | |

| “PCCW Directors” | | the directors of PCCW; |

| | | |

| “PCCW Group” | | PCCW and its subsidiaries; |

| | | |

| “PCCW Shareholders” | | holders of PCCW Shares; |

| | | |

| “PCCW Shares” | | shares of HK$0.25 each in the capital of PCCW; |

| | | |

| “PCCW Tower” | | PCCW Tower at TaiKoo Place in Quarry Bay, Hong Kong, where TaiKoo Place is situated on the north-eastern side of King’s Road with Tong Chong Street at its northern side; |

| | | |

| “PCP Beijing” | | Pacific Century Place Beijing, situated at No. 2A Worker’s Stadium Road North, about 50 metres west of Dong San Huan Road in Chaoyang District of Beijing, the PRC; |

| | | |

| “PRC” | | the People’s Republic of China; |

— 7—

| “Property Group” | | Property Holdco and its subsidiaries at Completion, being the group of companies holding PCP Beijing, PCCW Tower, other investment properties and related property and facilities management companies of the PCCW Group; |

| | | |

| “Property Holdco” | | Ipswich Holdings Limited, being a company incorporated in the British Virgin Islands, a wholly-owned subsidiary of PCCW and the holding company of the Property Group; |

| | | |

| “Queen’s Road Exchange” | | the property situated at Ko Shing Street and Wo Fung Street, Western, Hong Kong, which are erected on Subsection 3 of Section F of Marine Lot No.58, Subsection 5 of Section F of Marine Lot No.58, The Remaining Portion of Section F of Marine Lot No.58, Subsection 2 of Section F of Marine Lot No.58 and Subsection 1 of Section C of Marine Lot No.58; |

| | | |

| “Redevelopment Right” | | the right of first refusal to participate in a joint venture between a wholly-owned subsidiary of Property Holdco and the Exchange Company (or, if applicable, another member of the PCCW Group) to redevelop each relevant Telephone Exchange if and when that member of the PCCW Group obtains such redevelopment rights in the future; |

| | | |

| “Reorganised DFG Shares” | | shares in the capital of DFG of par value HK$0.10 each immediately following the Capital Reorganisation (including a 10:1 share consolidation) becoming unconditional and effective; |

| | | |

| “Sale Assets” | | the Loans and the Queen’s Road Exchange; |

| | | |

| “Sale Shares” | | the entire issued share capital of Property Holdco; |

| | | |

| “SFO” | | the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong); |

| | | |

| “SGM” | | the special general meeting of DFG to be held to seek, among other things, the DFG Shareholders’ approval of the Transaction and of the Share Whitewash Waiver; |

| | | |

| “Share Premium Cancellation” | | the proposed cancellation of an amount of approximately HK$47.14 million standing to the credit of the share premium account of DFG and the transfer of the amount so cancelled to the contributed surplus account of DFG; |

| | | |

| “Share Whitewash Waiver” | | a waiver of the obligation of PCCW to make a mandatory offer for all the Reorganised DFG Shares under Rule 26 of the Takeovers Code as a result of the issue of the Consideration Shares to PCCW (or as it may direct); |

| | | |

| “Stock Exchange” | | The Stock Exchange of Hong Kong Limited; |

— 8—

| “Takeovers Code” | | the Hong Kong Code on Takeovers and Mergers; |

| | | |

| “Telephone Exchanges” | | the premises which are mostly held at present under private treaty grants from the Government and used by the Exchange Company primarily for the purpose of allowing telephone lines to be connected to one another for the provision of telecommunications services to the public (excluding the Queen’s Road Exchange); |

| | | |

| “Tranche A Note” | | convertible notes, with a face value of HK$1,170 million, which are convertible into new Reorganised DFG Shares, details of which are set out in the section “Summary of the Terms and Conditions of the Convertible Notes” in the Letter; |

| | | |

| “Tranche B Note” | | convertible notes, with a face value of HK$2,420 million, which are convertible into new Reorganised DFG Shares, details of which are set out in the section “Summary of the Terms and Conditions of the Convertible Notes” in the Letter; |

| | | |

| “Transaction” | | the transactions contemplated under the Acquisition Agreement; |

| | | |

| “US” | | the United States of America; |

| | | |

| “US$” | | United States dollars, the lawful currency of the US; |

| | | |

| “Waived” | | in respect of item 4 in the section headed “Conditions Precedent” in the Letter concerning the Share Whitewash Waiver, means the Share Whitewash Waiver being waived by PCCW (in the event that approval by the independent DFG Shareholders is not granted) subject to PCCW having demonstrated to the satisfaction of the Executive that it has sufficient financial resources to fulfil its obligations under Rule 26 of the Takeovers Code; and |

| | | |

| “Whitewash Waivers” | | the Share Whitewash Waiver and the Convertible Note Whitewash Waiver. |

For the purposes of illustration only, amounts denominated in US$ have been translated into HK$ at the rate of US$1.00 to HK$7.80.

— 9—

|

| LETTER FROM THE PCCW BOARD |

|

| Executive Directors: | | Registered office: |

| Li Tzar Kai, Richard (Chairman) | | 39th Floor, PCCW Tower |

So Chak Kwong, Jack (Deputy Chairman and

Group Managing Director) | | TaiKoo Place

979 King’s Road |

| Yuen Tin Fan, Francis (Deputy Chairman) | | Quarry Bay |

| Peter Anthony Allen | | Hong Kong |

| Alexander Anthony Arena | | |

| Michael John Butcher | | |

| Chung Cho Yee, Mico | | |

| Lee Chi Hong, Robert | | |

| | | |

| Non-Executive Directors: | | |

| Sir David Ford, KBE, LVO | | |

| The Hon Raymond George Hardenbergh Seitz | | |

| | | |

| Independent Non-Executive Directors: | | |

| Prof Chang Hsin-kang | | |

| Dr Fung Kwok King, Victor | | |

| Dr The Hon Li Kwok Po, David, GBS, JP | | |

| Sir Roger Lobo, CBE, JP | | |

| Aman Mehta | | |

| | | 26 March 2004 |

| To the PCCW Shareholders | | |

Dear Sir or Madam,

MAJOR TRANSACTION

PROPOSED TRANSFER OF

VARIOUS PROPERTY INTERESTS OF PCCW

INTRODUCTION

On 5 March 2004, PCCW and DFG jointly announced the proposed transfer of various property interests of PCCW to DFG in the Announcement. A summary of the proposal is set out in the section headed“Executive Summary”in this circular. Further details of the Transaction are set out below.

— 10—

|

| LETTER FROM THE PCCW BOARD |

|

THE ACQUISITION AGREEMENTDate:

5 March 2004

Parties:

PCCW (as vendor)

DFG (as purchaser)

Subject matter of sale and purchase:

The Sale Shares and the Sale Assets.

The Sale Shares and the Sale Assets are warranted to be sold or procured to be sold by PCCW free from any encumbrance or other security.

The Sale Shares and the Sale Assets represent, in essence, the PCCW Group’s ownership of the companies holding PCP Beijing, PCCW Tower, other investment properties and related property and facilities management companies, including the Cyberport Developer and its interests in the Cyberport Project. In addition, PCCW will grant the Redevelopment Right to DFG (through the Property Group).

Consideration:

The aggregate consideration for the sale and purchase of the Sale Shares and the Sale Assets, which amounts to HK$6,557 million, will be satisfied:

| | (a) | as to HK$2,967 million by the issue and allotment of the Consideration Shares at an issue price of HK$1.80 per Reorganised DFG Share (credited as fully paid) by DFG to PCCW (or as it may direct); and |

| | | |

| | (b) | as to the remaining HK$3,590 million by the issue of the Convertible Notes, credited as fully paid at its full face value, by DFG to PCCW (or as it may direct), |

at Completion.

Based on the average closing price of Existing DFG Shares during the period of 30 trading days up to the Last Trading Day and the Latest Practicable Date respectively, the Consideration Shares would have a market value of approximately HK$6,016.4 million and approximately HK$8,373.5 million, respectively.

— 11—

|

| LETTER FROM THE PCCW BOARD |

|

As part of the Property Group, PCCW will also transfer ownership of the Cyberport Developer to DFG along with the Cyberport Developer’s continuing role in the development of the Cyberport Project (though the obligations of the Cyberport Developer and PCCW in the Cyberport Project will remain the same following Completion). The total consideration for the Transaction does not involve any payment by DFG for the Cyberport Project, as the consideration for that part of the Transaction is only represented by the Cyberport Developer’s obligation to repay the Cyberport Loan on a non-recourse basis, as described in the section headed“Loans and Cyberport Loan”below. In addition, PCCW will grant the Redevelopment Right to DFG (through the Property Group), where the total consideration for the Transaction also does not involve any payment by DFG for the Redevelopment Right itself.

The number of Consideration Shares (i.e. approximately 1,648 million new Reorganised DFG Shares after completion of the Capital Reorganisation) represent approximately 1,419.4% of the existing issued share capital of DFG (and approximately 93.4% of the Enlarged DFG Capital), taking into account the effect of the 10:1 share consolidation in the Capital Reorganisation.

The consideration was determined after arm’s length negotiations, taking into account the independent valuations of the underlying properties of the Property Group and the Queen’s Road Exchange performed by CBRE of approximately HK$6,756.5 million as at 31 December 2003. Despite the discount for the consideration compared to the independent valuations, and taking into account the value of the Sale Shares and the Sale Assets (including the amount of the Loans), the PCCW Board believes that the consideration is fair and reasonable to PCCW in the context of the Transaction as a whole.

The issue price of the Consideration Shares of HK$1.80 per Reorganised DFG Share (taking into account the effect of the 10:1 share consolidation in the Capital Reorganisation) represents:

| | (i) | a discount of approximately 62.5% from HK$4.80, being the adjusted closing price of the Existing DFG Shares on the Stock Exchange on the Last Trading Day; |

| | | |

| | (ii) | a discount of approximately 63.0% from HK$4.87, being the adjusted average closing price of Existing DFG Shares on the Stock Exchange during the period of 10 trading days up to the Last Trading Day; |

| | | |

| | (iii) | a discount of approximately 50.7% from HK$3.65, being the adjusted average closing price of Existing DFG Shares on the Stock Exchange during the period of 30 trading days up to the Last Trading Day; |

| | | |

| | (iv) | a discount of approximately 70.5% from HK$6.10, being the adjusted closing price of the Existing DFG Shares on the Stock Exchange on the Latest Practicable Date, |

| | | |

| | (v) | a discount of approximately 74.8% from HK$7.13, being the adjusted average closing price of Existing DFG Shares on the Stock Exchange during the period of 10 trading days up to the Latest Practicable Date; |

— 12—

|

| LETTER FROM THE PCCW BOARD |

|

| | (vi) | a discount of approximately 64.6% from HK$5.08, being the adjusted average closing price of Existing DFG Shares on the Stock Exchange during the period of 30 trading days up to the Latest Practicable Date; and |

| | | |

| | (vii) | a premium of approximately 13.2% to the latest adjusted audited net tangible assets of DFG of HK$1.59 per Existing DFG Share as at 31 March 2003. |

| | | |

| | Note: | The closing prices of the Existing DFG Shares and the latest audited net tangible assets value per Existing DFG Share referred to above have been adjusted to take into account the effect of the 10:1 share consolidation in the Capital Reorganisation, as the Consideration Shares to be issued are new Reorganised DFG Shares after implementation of the Capital Reorganisation |

An application will be made by DFG for the listing of, and permission to deal in, the Consideration Shares.

A summary of the terms of the Convertible Notes is set out in the section headed“Summary of the terms and conditions of the Convertible Notes”below.

Conditions precedent:

Completion is subject to, among others, a number of conditions precedent, the principal ones are summarised as follows:

| | 1. | the passing of resolutions by the DFG Shareholders at a general meeting including approving the Capital Reorganisation and the increase in the authorised share capital of DFG from HK$11,612,654.06 to HK$1,000,000,000 by the creation of an additional 9,883,873,460 Reorganised DFG Shares and the Capital Reorganisation becoming effective; |

| | | |

| | 2. | approval by the DFG Shareholders of: (a) the acquisition by DFG of the Sale Shares and the Sale Assets; (b) the issue and allotment of the Consideration Shares to PCCW (or as it may direct); (c) the issue of the Convertible Notes to PCCW (or as it may direct); (d) the issue and allotment of Reorganised DFG Shares which may be issued upon any exercise of the conversion rights under the Convertible Notes; and (e) all other transactions contemplated under the Acquisition Agreement, at a general meeting of DFG; |

| | | |

| | 3. | approval by the PCCW Shareholders of: (a) the disposal by PCCW of the Sale Shares and the Sale Assets; and (b) all other transactions contemplated under the Acquisition Agreement, at a general meeting of PCCW; |

| | | |

| | 4. | the passing of an ordinary resolution by an independent DFG Shareholders’ vote (within the meaning of Note 1 of the Notes on dispensations from Rule 26 of the Takeovers Code or as may be required by the Executive) taken by way of a poll approving the Share Whitewash Waiver, and the Executive granting such a waiver; |

| | | |

| | 5. | the passing of an ordinary resolution by an independent DFG Shareholders’ vote (within the meaning of Note 1 of the Notes on dispensations from Rule 26 of the Takeovers Code or as may be required by the Executive) taken by way of a poll approving the Convertible Note Whitewash Waiver, and the Executive granting such a waiver; |

— 13—

|

| LETTER FROM THE PCCW BOARD |

|

| | 6. | the Listing Committee of the Stock Exchange granting the listing of and permission to deal in the Consideration Shares and the Reorganised DFG Shares which may be issued upon any exercise of the conversion rights under the Convertible Notes; |

| | | |

| | 7.

| the compliance with announcement and DFG Shareholders’approval requirements under the Listing Rules or otherwise of the Stock Exchange in relation to present and future transactions contemplated at present with PCCW and/or any of its subsidiaries and/or their respective associates (both present and immediately after Completion) which will constitute connected transactions of DFG following Completion, including, if required, the approval by independent DFG Shareholders in respect of those connected transactions; |

| | | |

| | 8. | the fulfilment by DFG of any other requirements of the Stock Exchange in relation to the sale and purchase of the Sale Shares and the Sale Assets, the issue of the Consideration Shares, the issue of the Convertible Notes and the other transactions contemplated under the Acquisition Agreement; |

| | | |

| | 9.

| (where required) the Bermuda Monetary Authority granting its permission for the issue of the Consideration Shares and the Convertible Notes and the issue of Reorganised DFG Shares which may be issued upon any exercise of the conversion rights under the Convertible Notes; |

| | | |

| | 10.

| the obtaining of all Consents from government or regulatory authorities or third parties which are necessary or desirable in connection with the execution and performance of the Acquisition Agreement and any of the transactions contemplated under the Acquisition Agreement; |

| | | |

| | 11. | completion of legal and financial due diligence on the DFG Group to the reasonable satisfaction of PCCW; |

| | | |

| | 12. | completion of legal and financial due diligence on the Property Group to the reasonable satisfaction of DFG; and |

| | | |

| | 13.

| all the Consents referred to above remaining in full force and effect as at Completion.

|

PCCW and DFG may jointly waive the condition precedent in item 10 above at any time if it is agreed that the Consents which have not been obtained are not material to the business of the DFG Group and the Property Group taken as a whole.

The conditions precedent in items 4, 5 and 11 can be waived by PCCW and item 12 can be waived by DFG, respectively. All the other conditions precedent above cannot be waived (unless PCCW and DFG so agree), but the conditions precedent in items 1 to 3 and 6 will not be waived in any event (except the part concerning the Capital Reorganisation) and the condition precedent in item 4 cannot be waived by PCCW unless it has demonstrated to the satisfaction of the Executive that it has sufficient financial resources to fulfil its obligations under Rule 26 of the Takeovers Code.

— 14—

|

| LETTER FROM THE PCCW BOARD |

|

As the Executive has indicated that it will not consider granting the Convertible Note Whitewash Waiver (without, amongst others, sufficient information on the shareholding structure of DFG prior to and after such conversion), PCCW will waive before the SGM that requirement as a condition precedent to Completion.

Completion:

Completion is to take place on the fifth Business Day after all the conditions precedent have either been fulfilled or waived. It is expected that Completion would take place within 75 days after the date of the Acquisition Agreement.

If any of the conditions precedent to Completion has not been fulfilled (or waived by the parties) by 30 June 2004 (or such other date as the parties to the Acquisition Agreement may agree), the Acquisition Agreement will lapse and be terminated and thereafter all rights, obligations and liabilities of all parties thereto will cease and determine except for antecedent breaches.

Additional Matters:

Loans and Cyberport Loan

The Loans of approximately HK$3,529 million to be assigned to DFG at Completion represent part of the shareholder loans owing by the relevant members of the Property Group to PCCW. After Completion, the Loans will be owed to DFG. However, the Cyberport Loan will continue to be owed by the Cyberport Developer to the PCCW Group and is repayable on demand.

Pursuant to the Acquisition Agreement, DFG has undertaken to procure that the Cyberport Loan is repaid in priority to all other debts of the Cyberport Developer as and when the Cyberport Developer has the funds to repay all or part of the Cyberport Loan. The Cyberport Loan was used to part finance the development of the Cyberport Project. Since this is an unsecured non-interest bearing and non-recourse loan, PCCW and DFG have agreed that the financing arrangement stays in place. Such arrangement will not be subject to any disclosure or shareholders approval requirement pursuant to Rule 14A.11(5) of the revised Listing Rules which will come into effect on 31 March 2004. The Cyberport Loan amounted to approximately HK$4,503 million as at 31 January 2004.

Redevelopment Right

As part of the Transaction, PCCW has undertaken to procure that the Redevelopment Right is granted to a wholly-owned subsidiary of Property Holdco, subject to and with effect from Completion.

Accrued Profit

When the Cyberport Loan has been repaid, the Cyberport Developer will also pay, out of its surplus funds, an amount equivalent to its audited accounting profit (accrued up to the date of Completion) in respect of the Cyberport Project to PCCW.

— 15—

|

| LETTER FROM THE PCCW BOARD |

|

SUMMARY OF THE TERMS AND CONDITIONS OF THE CONVERTIBLE NOTES

The principal terms of the Convertible Notes are summarised below:

Issuer:

DFG

Principal amount:

HK$1,170 million of Tranche A Note and HK$2,420 million of Tranche B Note, credited as fully paid at their face values as satisfaction in part of the consideration for the Sale Shares and the Sale Assets.

Maturity date:

Unless previously converted, the outstanding principal amount of the Convertible Notes (together with all unpaid and accrued interest) will be repaid by DFG upon its maturity on the seventh (in the case of the Tranche A Note) or tenth (in the case of the Tranche B Note) anniversary of the date of issue of the Convertible Notes. The Tranche A Note will be redeemed at 100% of the then outstanding principal amount, whilst the Tranche B Note will be redeemed at 120% of the then outstanding principal amount.

Coupon:

The Tranche A Note will bear no interest, but the Tranche B Note will bear a coupon from its date of issue at the rate of 1% per annum, which will be payable once every six months in arrears on the principal amount of the Tranche B Note outstanding from time to time.

Conversion rights:

The outstanding principal amount of the Convertible Notes or any part thereof may, at the discretion of the holders, be converted into new Reorganised DFG Shares to be issued to the holder of the Convertible Notes (or as it may direct) at any time and from time to time on or after the date of issue (but on or prior to the maturity date) at the relevant conversion price (which is initially HK$2.25 per Reorganised DFG Share in the case of the Tranche A Note and HK$3.60 per Reorganised DFG Share in the case of the Tranche B Note, subject to adjustment).

No fraction of a Reorganised DFG Share will be issued on conversion, but (except in cases where any such cash payment would amount to less than HK$10) a cash payment will be made to the holder of the Convertible Notes in respect of such fraction.

— 16—

|

| LETTER FROM THE PCCW BOARD |

|

Assuming that the entire principal amount of the Convertible Notes is converted at their initial conversion price, a total of approximately 1,192.2 million new Reorganised DFG Shares will be issued (representing approximately 1,026.7% of the existing issued capital of DFG and approximately 40.32% of DFG’s issued share capital as enlarged by the issue of the Consideration Shares and the new Reorganised DFG Shares to be issued upon the exercise of all conversion rights attaching to the Convertible Notes on that basis, taking into account the effect of the 10:1 share consolidation in the Capital Reorganisation).

Ranking of shares to be issued upon conversion:

The Reorganised DFG Shares to be issued by DFG upon any exercise of the conversion rights under the Convertible Notes will rank pari passu in all respects with all other Reorganised DFG Shares in issue on the date of the conversion notice and will be entitled to all dividends, bonuses and other distributions the record date of which falls on a date on or after the date of the conversion notice.

Conversion price:

The initial conversion price of HK$2.25 and HK$3.60 per Reorganised DFG Share (in respect of the Tranche A Note and the Tranche B Note respectively), subject to adjustment in accordance with the terms of the Convertible Notes (e.g. for dilutive events such as DFG issuing shares or other securities convertible into shares, where such shares are to be issued at less than 95% of the then market price), was determined after arm’s length negotiations.

The initial conversion price of HK$2.25 and HK$3.60 per Reorganised DFG Share (taking into account the effect of the 10:1 share consolidation in the Capital Reorganisation) respectively represents:

| | (i) | a discount of approximately 53.1% and 25.0% from HK$4.80, being the adjusted closing price of the Existing DFG Shares on the Stock Exchange on the Last Trading Day; |

| | | |

| | (ii) | a discount of approximately 53.8% and 26.1% from HK$4.87, being the adjusted average closing price of Existing DFG Shares on the Stock Exchange during the period of 10 trading days up to the Last Trading Day; |

| | | |

| | (iii) | a discount of approximately 38.4% and 1.4% from HK$3.65, being the adjusted average closing price of Existing DFG Shares on the Stock Exchange during the period of 30 trading days up to the Last Trading Day; |

| | | |

| | (iv) | a discount of approximately 63.1% and 41.0% from HK$6.10, being the adjusted closing price of the Existing DFG Shares on the Stock Exchange on the Latest Practicable Date; |

| | | |

| | (v) | a discount of approximately 68.4% and 49.5% from HK$7.13, being the adjusted average closing price of Existing DFG Shares on the Stock Exchange during the period of 10 trading days up to the Latest Practicable Date; |

| | | |

— 17—

|

| LETTER FROM THE PCCW BOARD |

|

| | (vi) | a discount of approximately 55.7% and 29.2% from HK$5.08, being the adjusted average closing price of Existing DFG Shares on the Stock Exchange during the period of 30 trading days up to the Latest Practicable Date; and |

| | | |

| | (vii) | a premium of approximately 41.5% and 126.4% to the latest adjusted audited net tangible assets of DFG of HK$1.59 per Existing DFG Share as at 31 March 2003. |

| | | |

| | Note: | The closing prices of the Existing DFG Shares and the latest audited net tangible assets value per Existing DFG Share referred to above have been adjusted to take into account the effect of the 10:1 share consolidation in the Capital Reorganisation, as the shares to be issued upon the exercise of conversion rights attaching to the Convertible Notes are the new Reorganised DFG Shares after implementation of the Capital Reorganisation. |

Voting:

The holder of the Convertible Notes will not be entitled to receive notice of, attend or vote at general meetings of DFG by reason only of it being a holder of the Convertible Notes.

Transferability:

Subject to the relevant laws and other requirements, the Convertible Notes are freely transferable. The outstanding principal amount of the Convertible Notes may be transferred in full or in part (but only in multiples of HK$1,000,000 if in part).

DFG has undertaken to the Stock Exchange to promptly notify it upon DFG becoming aware of any dealings with the Convertible Notes by any connected person (as defined in the Listing Rules) of DFG.

Listing:

No application will be made for the listing of the Convertible Notes on the Stock Exchange or any other stock exchange. Application will be made to the Stock Exchange for the listing of, and permission to deal in, the Reorganised DFG Shares falling to be issued on any exercise of the conversion rights attaching to the Convertible Notes.

— 18—

|

| LETTER FROM THE PCCW BOARD |

|

SHAREHOLDING STRUCTURES PRIOR TO AND AFTER COMPLETION

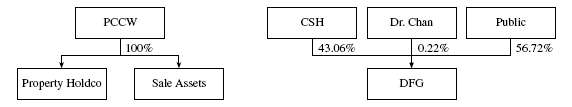

The following charts show the respective shareholding structures of Property Holdco and DFG immediately prior to Completion:

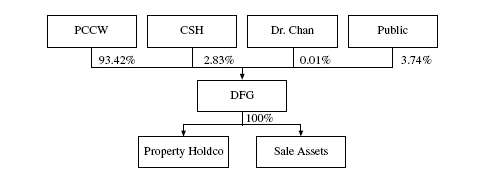

The following chart shows the shareholding structures of Property Holdco and DFG immediately following Completion, but before exercise of any conversion rights under the Convertible Notes:

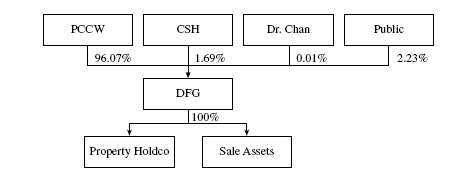

The following chart shows the proforma shareholding structures of Property Holdco and DFG immediately following Completion, as if the Convertible Notes are fully converted at their initial conversion prices:

| | Notes: | |

| | (i) | The percentage figures shown in all of the above charts are approximate percentages rounded to 2 decimal places. |

| | | |

| | (ii) | All of the above charts assume that there are no other changes in DFG’s issued share capital after the Latest Practicable Date. |

— 19—

|

| LETTER FROM THE PCCW BOARD |

|

| | (iii) | CSH’s holding of Reorganised DFG Shares immediately after Completion will be regarded as being held in public hands under the Listing Rules, as it would no longer be a substantial shareholder of DFG. |

| | | |

| | (iv) | As at the Latest Practicable Date, Dr. Chan held 2,520,900 Existing DFG Shares (equivalent to 252,090 Reorganised DFG Shares after the Capital Reorganisation). Besides, Dr. Chan is the controlling shareholder of ITC Corporation Limited (“ITC”), which is the holding company of Paul Y. ITC Construction Holdings Limited (“Paul Y.”). Hanny Holdings Limited (“Hanny”) is an associated company of ITC but is not controlled by ITC for the purposes of the Listing Rules and the Takeovers Code. Paul Y. and Hanny each has an approximately 29.88% equity interest in CSH. Therefore, Dr. Chan is deemed to be interested in approximately 29.88% of the issued share capital of CSH as at the date of this circular. Save for Dr. Chan, none of the directors or chief executive of DFG, nor any of their associates, had any interest in the securities of DFG. |

| | | |

| | (v) | Save as stated in (iv) above, none of the directors, chief executive or substantial shareholders of DFG or PCCW, nor any of the respective subsidiaries of DFG or PCCW, nor any of their respective associates or PCCW’s Concert Parties, had any interest in the securities of DFG. |

It is the intention of PCCW to maintain the listing of the Reorganised DFG Shares on the Stock Exchange after Completion. Accordingly, PCCW and DFG have each undertaken to the Stock Exchange to use their best endeavours to take appropriate steps to ensure that, as soon as possible following issuance of the Consideration Shares upon Completion, the public float of DFG will not be less than 25% after Completion. Further details are set out in the section “Maintenance of the Listing of DFG” below.

CONNECTION AMONG THE PARTIES

The PCCW Group currently holds no interests in the issued share capital of DFG or any member of the DFG Group.

No director of PCCW or PCCW’s subsidiaries is also a director of DFG or DFG’s subsidiaries.

PCCW is not a connected person of DFG and is independent of and not connected or acting in concert with DFG or any of the directors, chief executive or substantial shareholders of DFG or its subsidiaries or any of their respective associates. DFG is not a connected person of PCCW and is independent of and not connected or acting in concert with PCCW or any of the directors, chief executive or substantial shareholders of PCCW or its subsidiaries or any of their respective associates.

The PCCW Group has not engaged in any dealings in the securities of DFG in the period commencing from six months before the date of the Announcement and ending on the Latest Practicable Date. So far as PCCW is aware and save as disclosed in the circular by DFG to the DFG Shareholders in respect of the Transaction, PCCW’s Concert Parties currently hold no interests in the issued share capital of DFG and have not engaged in any dealings in the securities of DFG in the period commencing from six months before the date of the Announcement and ending on the Latest Practicable Date.

— 20 —

|

| LETTER FROM THE PCCW BOARD |

|

INFORMATION ON THE PROPERTY GROUP AND THE SALE ASSETS The Sale Shares and the Sale Assets represent, in essence, the PCCW Group’s ownership of the companies holding PCP Beijing, PCCW Tower, other investment properties and related property and facilities management companies, including the Cyberport Developer and its interests in the Cyberport Project. In addition, PCCW will grant the Redevelopment Right to DFG (through the Property Group).

The Property Group manages an infrastructure and property portfolio in Hong Kong and Greater China including all of the property development, investment, property and facilities management functions for the PCCW Group.

After the Transaction, PCCW is not expected to directly engage in any property related businesses or compete with DFG. The DFG Group will continue to provide existing property and facilities management functions and lease premises to the PCCW Group.

The Property Group’s property portfolio includes:

Property Development—Cyberport

In May 2000, PCCW and the Cyberport Developer signed an agreement with the Government under which the Cyberport Developer was granted the exclusive right and obligation to design, develop, construct and market the Cyberport, a project which is located on approximately 24 hectares at Telegraph Bay on Hong Kong Island. The Cyberport consists of specially designed commercial space dedicated to high-technology industries with related retail, residential, recreational and educational facilities.

This technology-themed project is being built to create a business environment with which Hong Kong can attract and retain promising information technology and related businesses. The Cyberport contains a wide range of information technology facilities including a network operations center, a digital media center and a central data exchange, all connected by an internal private network.

Under the project agreement, the Government has provided the site, while the Cyberport Developer is responsible for the provision and procurement of funds to complete the project. PCCW and the Cyberport Developer did not acquire or pay for the Government’s land and, accordingly, does not have title to the site.

The Cyberport Project consists of two“Portions”and several phases. The“Cyberport Portion”includes office towers, a retail center, a hotel and ancillary facilities. This portion will be handed over to the Government on completion. Other than the right to develop the Cyberport Portion, neither PCCW nor the Cyberport Developer has ownership rights in it nor will they receive rental or other project income from it.

The first two phases of the Cyberport Portion, consisting of office and retail premises, were completed on schedule in 2002. The remaining of the Cyberport campus, comprising office space, the retail centre and Le Meridien Cyberport, will be completed before the end of 2004.

— 21—

|

| LETTER FROM THE PCCW BOARD |

|

Construction of the“Residential Portion”commenced in 2002. It consists of approximately 2,900 units, which are expected to be completed in phases between 2004 and 2007. The development right entitles the Cyberport Developer to receive a percentage of the surplus proceeds from the sale of units in the Residential Portion. These proceeds will be shared by the Government and the Cyberport Developer based on a ratio determined by their respective contributions to the Cyberport Project as described below. The residential units may be pre-sold prior to their completion. Pre-sales of units for the initial phase commenced in the first quarter of 2003.

PCCW and the Cyberport Developer have agreed to design, develop and construct the Cyberport Project for a maximum fixed cost of approximately HK$15.8 billion, subject to certain adjustments, in accordance with an agreed timetable. The maximum fixed cost was based on a cost assessment conducted by professional quantity surveyors. PCCW and the Cyberport Developer are obligated to fund the entire cost of the Cyberport Project, as well as other project expenses, to the extent that these costs and expenses are not funded by the sale or pre-sale proceeds from units in the Residential Portion or other specified project income. PCCW and the Cyberport Developer are also obligated to fund certain other expenses and any cost overruns, which include any costs above the maximum fixed cost. Cost overruns and these other expenses must be funded by PCCW and the Cyberport Developer using their own resources and cannot be funded by pre-sale or sale proceeds from the units in the Residential Portion or other project income.

PCCW has so far invested (through the Cyberport Developer) approximately HK$4.5 billion in the Cyberport Project. Under the project agreement, proceeds from the sale of the Residential Portion units and other agreed project income will be used to pay: (i) construction costs of the Cyberport Portion first, and then construction costs of the Residential Portion; and (ii) certain other agreed project expenses and other items, all in priorities specified in the project agreement. After the payment of these items and setting aside agreed reserves, and after completion of the Cyberport Portion, the surplus of the proceeds arising from the sale of the units in the Residential Portion will be shared between the Cyberport Developer and the Government based on the ratio of their respective contributions to the Cyberport Project.

Property Investment Portfolio—Key buildings

PCP Beijing

PCP Beijing is a prestigious development occupying a site area of 29,350 sq.m. The main building of the development consists of two office blocks (Towers A and B) and two residential blocks (Towers C and D), all located on a common 6-storey commercial podium (of which the upper basement forms part) and a lower basement for car parking purposes. There is an ancillary block with 7 car park floors. The complex including car park has 212,712 sq.m. of gross area. The four towers and the ancillary car park block were completed between 1998 and 2000 and the commercial podium was opened for business in 2001.

— 22—

|

| LETTER FROM THE PCCW BOARD |

|

PCCW Tower

PCCW Tower was completed in 1994 and forms part of an office and commercial complex in TaiKoo Place, Quarry Bay, Hong Kong. A portion of the ground to the 3rd floors, the whole of the 4th to the 18th floors, the 20th to 42nd floors, as well as certain basement car parks and the apportioned common areas of PCCW Tower, totalling approximately 620,147 sq.ft. of gross floor area, are held by the PCCW Group.

Other investment property

Queen’s Road Exchange is a building, with a floor area of approximately 50,000 sq. ft., being used as a Telephone Exchange and other uses. With the existing surplus plot ratio, the site can be redeveloped into a commercial/residential property with additional floor area. Both the government lease and outline zoning permit such redevelopment.

Redevelopment Right of Telephone Exchanges

Most of the existing Telephone Exchange sites being used primarily by the Exchange Company were granted by the Government by way of private treaty. In the future, the PCCW Group may seek the Government’s approval for redeveloping the sites to allow other uses. The Property Group will have a right of first refusal to jointly re-develop all of the PCCW Group’s local Telephone Exchanges if and when the PCCW Group is permitted by the Government to redevelop the local Telephone Exchanges for other use.

Negotiations for the redevelopment of the Telephone Exchanges have not yet commenced, and there is no assurance that any such redevelopment right may be obtained and, if obtained, whether the terms of such redevelopment rights are commercially acceptable to the Property Group.

As part of the Transaction, PCCW has undertaken to procure that the Redevelopment Right is granted to a wholly-owned subsidiary of Property Holdco, subject to and with effect from Completion. As the Redevelopment Right is in the nature of a right of first refusal to participate in any redevelopment of each relevant Telephone Exchange (if and when the relevant member of the PCCW Group obtains such redevelopment right in the future), it is uncertain whether DFG will (through that subsidiary of Property Holdco) exercise the right to participate. If the Redevelopment Right is not exercised, such decision has to be approved by the independent non-executive directors of DFG and an announcement would be made by DFG if and when appropriate. In that event, the PCCW Group may consider proceeding with the redevelopment of the relevant site itself or together with other parties.

Property and Facilities Management

The Property Group’s property and facilities management operations provide support to the information technology and communications network of the PCCW Group and an associated company, as well as to the investment property portfolio and other premises occupied by the PCCW Group in Hong Kong and Greater China.

— 23—

|

| LETTER FROM THE PCCW BOARD |

|

Summary Financial Information

The audited results of the Property Group for the years ended 31 December 2002 and 31 December 2003 show a combined net profit after tax of approximately HK$95.5 million and approximately HK$2.7 million respectively (and a combined net profit before tax of approximately HK$155.1 million and approximately HK$32.5 million respectively).

As at 31 December 2003, the audited combined net liability of the Property Group was approximately HK$372.6 million (which included approximately HK$2,441.6 million of shareholder loans owing to the PCCW Group which will be capitalised before Completion).

The independent valuation of the Queen’s Road Exchange (which is not currently owned by the Property Group) was approximately HK$158.3 million as at 31 December 2003. The independent valuations of all the underlying properties of the Property Group and the Queen’s Road Exchange was approximately HK$6,756.5 million as at 31 December 2003. Further details of such independent valuations are set out in Appendix II to this circular.

INFORMATION ON PCCW

Business Overview

PCCW is the largest telecommunications provider in Hong Kong and one of Asia’s leading integrated communications companies. PCCW provides key services in the areas of: integrated telecommunications; broadband solutions; connectivity; narrowband and interactive broadband (Internet Services); information technology solutions and services and infrastructure.

Financial and Trading Prospects

Looking forward to 2004, an economic recovery appears to be gathering momentum in Hong Kong although the operating environment is expected to continue to be challenging.

The PCCW Board believes that many of the innovative and aggressive actions which the PCCW Group is pursuing are positioning it well to deliver acceptable operating results over the medium-term. Contributions from the new products and services launched in 2003 and other new value-added services coming in 2004, such as multimedia applications and advanced new generation fixed-line services, will become more material this year.

The PCCW Board expects that the PCCW Group’s core business will stabilise whilst broadband, value-added services, and the information technology business will continue to grow. This change in business mix over time could negatively impact the PCCW Group’s margin. Management will continue to maintain a regime of strict cost control and further lift operating efficiency.

— 24—

|

| LETTER FROM THE PCCW BOARD |

|

Leveraging the new brand name Unihub, and as CEPA (Closer Economic Partnership Arrangement) promises stronger economic ties between Hong Kong and mainland China, the PCCW Group will continue to actively increase its presence in mainland China.

Further afield, the PCCW Group’s home-grown expertise in broadband technology and marketing is driving a wireless broadband business opportunity in the United Kingdom, with a soft launch planned for the second quarter of 2004. The PCCW Group’s United Kingdom wireless broadband experience, if successful, could provide an excellent basis for expansion into other markets, including mainland China.

Financial Effects of the Transaction

The financial effects of the Transaction on the PCCW Group are set out in Appendix I to this circular.

INFORMATION ON DFG

Business Overview

DFG is an investment holding company and its subsidiaries have been engaging in the manufacturing and trading of building materials, particularly ceramic tiles, and securities trading. Since July 2003, DFG diversified into natural gas supply, storage and related services.

Summary Financial Information

The audited results of DFG for the years ended 31 March 2002 and 31 March 2003 show a consolidated net loss after tax and minority interests of approximately HK$459.0 million and approximately HK$113.2 million respectively (and a consolidated net loss before tax of approximately HK$489.3 million and approximately HK$126.1 million respectively). The unaudited results of DFG for the six months ended 30 September 2003 show a consolidated net loss after tax and minority interests of approximately HK$12.3 million (and a consolidated net loss before tax of approximately HK$10.7 million).

The audited consolidated net asset value of DFG was approximately HK$184.6 million as at 31 March 2003 and the unaudited consolidated net asset value of DFG was approximately HK$172.4 million as at 30 September 2003.

— 25—

|

| LETTER FROM THE PCCW BOARD |

|

REASONS FOR AND BENEFITS OF THE TRANSACTION

The PCCW Board believes that the telecommunications and property businesses are inherently different in terms of the nature of the industry, competition, funding requirements, and management expertise. The Transaction will allow the two businesses to be run as separately listed companies, each focusing on its particular business. The management of PCCW will be able to focus on its core telecommunications business, while Property Holdco will, as a result of its acquisition by DFG, obtain an independent identity with its management focusing on property development. As part of a separately listed company, Property Holdco will be able to provide investors, research analysts and rating agencies with greater clarity on its business and financial position. The PCCW Board also believes that Property Holdco, as part of DFG, will be able to attract greater interest from investors focused on property, which will be beneficial both for Property Holdco and PCCW, as the controlling shareholder of DFG.

The local economy and the property market have recently shown signs of recovery after facing severe downturn in early 2003. The DFG Board is optimistic about the prospects of the property market and considers that the Transaction will provide a solid ground for DFG to invest in prime residential and hospitality projects. The DFG Board also believes that the Transaction will enlarge DFG’s business scope, broaden its revenue stream and bring a positive contribution to DFG’s overall earnings in future.

The DFG Group at present participates in the property market indirectly through its principal activities of manufacture and trading of building materials, particularly ceramic tiles. The Transaction affords the DFG Group the opportunity to take a significant direct position in the property and property development markets in Hong Kong.

By entering into the Transaction, DFG has the opportunity to acquire in a single step a well established and profitable property business and increase its asset base and market capitalisation very substantially. The DFG Board considers that the DFG Group is acquiring both substantial and high quality assets, with the potential to enhance the DFG Group’s standing and reputation and to promote its future growth.

The scope of business of the DFG Group will be expanded by virtue of the Transaction, where property development would then form a substantial part of its business. It is the current intention of PCCW that DFG will continue the existing principal business of DFG after Completion and PCCW has no plan to inject any assets of its own into the DFG Group or to redeploy any assets of the DFG Group immediately after Completion. PCCW will appoint new members who have expertise in property development and management to join the DFG Board. As the total consideration payable by DFG will be satisfied by issuance of the Consideration Shares and the Convertible Notes, the Transaction will not strain the liquidity of the DFG Group. In fact, the two tranches of Convertible Notes with respective maturity of seven years and ten years will provide further long term funding for the DFG Group.

Based on the above reasons, both the PCCW Board and the DFG Board believe that the Transaction will be beneficial to PCCW and DFG, respectively.

— 26—

|

| LETTER FROM THE PCCW BOARD |

|

TAKEOVERS CODE IMPLICATIONS OF THE TRANSACTION

Immediately after the issue of the Consideration Shares at Completion but before any exercise of the conversion rights under the Convertible Notes, the aggregate shareholding of the PCCW Group in DFG will become approximately 93.4% of the Enlarged DFG Capital, assuming that there have been no other changes in the shareholdings in DFG since the Latest Practicable Date. As a result, under the Takeovers Code, PCCW will have an obligation to make a mandatory general offer following Completion to acquire all the Reorganised DFG Shares other than those already owned or agreed to be acquired by the PCCW Group, unless the Share Whitewash Waiver is obtained.

Even if the percentage shareholding of the PCCW Group at Completion is lower than that level because of any other changes in shareholding in DFG (including any transactions to maintain the public float of Reorganised DFG Shares as referred to in the section“Maintenance of the Listing of DFG”below), as long as the aggregate percentage shareholding in DFG held by the PCCW Group and its Concert Parties is 30% or above, that obligation to make a mandatory general offer will still arise under the Takeovers Code following Completion, unless the Share Whitewash Waiver is obtained. As the terms of the possible placing (including the timing, the size and the price) by DFG and/or PCCW have not yet been finalised, it is uncertain whether the PCCW Group’s shareholding in DFG will drop below any particular level at any particular time.

In addition, upon the issue and allotment of Reorganised DFG Shares to the PCCW Group pursuant to a partial or full exercise of the conversion rights under the Convertible Notes, the shareholding of the PCCW Group in DFG may increase by more than 2% from its lowest collective percentage shareholding in the then preceding 12 month period. In such event, and if such lowest collective percentage shareholding is at or above 30% but at or below 50%, under the Takeovers Code, PCCW will have an obligation to make a mandatory general offer to acquire all the Reorganised DFG Shares other than those already owned or agreed to be acquired by the PCCW Group, unless the Convertible Note Whitewash Waiver is obtained. As the Convertible Notes have a conversion term of up to 10 years, it is uncertain whether the PCCW Group’s shareholding in DFG may drop below any particular level at any particular time. Thus, the Convertible Note Whitewash Waiver was contemplated in order to protect PCCW’s conversion rights under the Convertible Notes. As the Executive has indicated that it will not consider granting such a waiver (without, amongst others, sufficient information on the shareholding structure of DFG prior to and after such conversion), PCCW will waive before the SGM the Convertible Note Whitewash Waiver as a condition precedent to Completion.

An application will be made to the Executive for the Share Whitewash Waiver under Note 1 of the Notes on dispensation from Rule 26 of the Takeovers Code.

— 27—

|

| LETTER FROM THE PCCW BOARD |

|

CSH is the controlling shareholder of DFG holding approximately 43.06% of the DFG’s issued share capital. The Chairman of DFG, Dr. Chan, also holds beneficially approximately 0.22% of the issued share capital of DFG. Dr. Chan is also the Chairman of CSH. There are two common directors on the board of both CSH and DFG, namely Dr. Chan and Dr. Yap, Allan but Dr. Yap, Allan has no shareholding in DFG. Accordingly, except for Dr. Chan who has a direct personal interest in DFG and who was involved in the negotiation of the Transaction in his capacity as chairman of DFG, no other shareholders of DFG are interested in the Transaction (other than as a DFG Shareholder). The representatives of the board of directors of CSH on the DFG Board were only involved in the discussion of the Transaction in their capacity as directors or employees of DFG. All DFG Shareholders are entitled to vote on the Transaction, except that any DFG Shareholders who are PCCW’s Concert Parties will not be allowed to vote on the Share Whitewash Waiver. Further, any DFG Shareholders who are otherwise involved in or interested in the Transaction, other than as a DFG Shareholder, and parties acting or presumed to be acting in concert with them, will not be allowed to vote on the Share Whitewash Waiver. PCCW understands that Dr. Chan and CSH and their respective Concert Parties must abstain from voting on the Share Whitewash Waiver.

It is a condition precedent to Completion that the Share Whitewash Waiver be obtained. However, there is no assurance that the approval by independent DFG Shareholders will be obtained.If the Share Whitewash Waiver is not available for any reason, the Transaction will not become unconditional and will not proceed (unless that condition is Waived).

MAINTENANCE OF THE LISTING OF DFG

The PCCW Group currently holds no interest in the issued share capital of DFG. Immediately after the issue of the Consideration Shares at Completion but before any exercise of the conversion rights under the Convertible Notes, and assuming that there have been no other changes in the issued share capital of DFG after the Latest Practicable Date, the PCCW Group will hold approximately 93.4% of DFG’s Enlarged DFG Capital. Accordingly, in the absence of other changes in the shareholdings in DFG, DFG will become a subsidiary of PCCW immediately after Completion.

It is the intention of PCCW to maintain the listing of the Reorganised DFG Shares on the Stock Exchange after Completion. It is the current intention of PCCW that DFG will continue the existing principal business of DFG after Completion.

Accordingly, PCCW and DFG have each undertaken to the Stock Exchange to use their best endeavours to take appropriate steps to ensure that, as soon as possible following issuance of the Consideration Shares upon Completion, the public float of DFG will not be less than 25% after Completion.

PCCW has also undertaken to the Stock Exchange not to exercise the conversion rights under the Convertible Notes to the extent that such conversion would result in insufficient public float of DFG. It is currently intended that steps will be taken with a view to increasing the public float, including effecting possible placing of Reorganised DFG Shares by DFG and/or PCCW. Arrangements relating to the possible placing by DFG and/or PCCW may be entered into at any time from the Latest Practicable Date to Completion, or thereafter. An announcement will be made when a definitive agreement for such placing has been entered into.

— 28—

|

| LETTER FROM THE PCCW BOARD |

|

The Stock Exchange has stated that if, at the date of Completion, less than 25% of the Reorganised DFG Shares are held by the public or if the Stock Exchange believes that:

- a false market exists or may exist in the trading in the Reorganised DFG Shares; or

- there are too few Reorganised DFG Shares in public hands to maintain an orderly market,