SCHEDULE "C"

ARRANGEMENT AGREEMENT AS AMENDED AND RESTATED

ARRANGEMENT AGREEMENT

between

ALLIED GOLD LIMITED

- and -

NORD PACIFIC LIMITED

December 20, 2003

Execution Copy

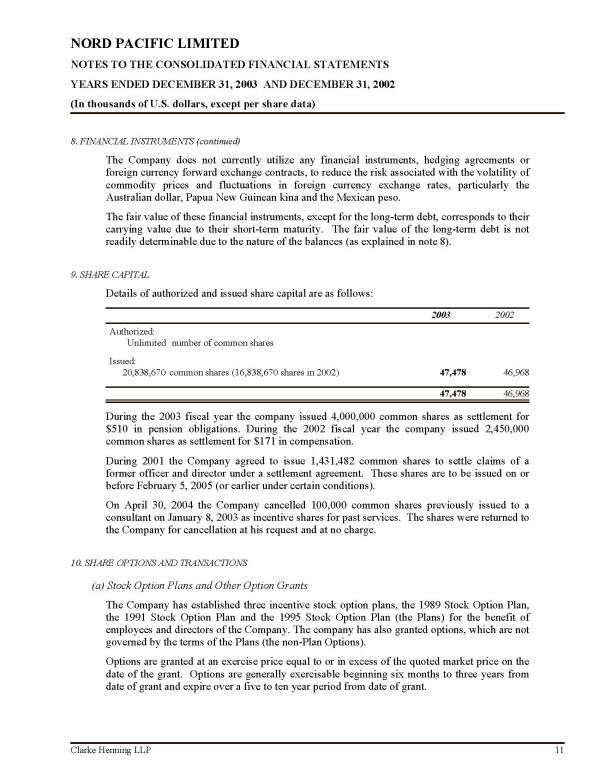

TABLE OF CONTENTS

Page

ARTICLE 1 INTERPRETATION................................................1

1.1 Definitions...................................................1

1.2 Knowledge.....................................................7

1.3 Interpretation Not Affected by Headings, Etc..................8

1.4 Article References............................................8

1.5 Number, Etc...................................................8

1.6 Date For Any Action...........................................8

1.7 Currency......................................................8

1.8 Entire Agreement..............................................8

ARTICLE 2 THE ARRANGEMENT...............................................8

2.1 Arrangement...................................................8

2.2 Interim Order.................................................9

2.3 Alternative Structure.........................................9

ARTICLE 3 REPRESENTATIONS AND WARRANTIES................................9

3.1 Representations and Warranties of Nord........................9

3.2 Representations and Warranties of Allied.....................17

ARTICLE 4 COVENANTS OF NORD............................................19

4.1 Conduct of Business..........................................19

4.2 Non-Solicitation.............................................23

4.3 Superior Proposal............................................24

4.4 Access to Information........................................26

ARTICLE 5 COVENANTS OF ALLIED..........................................26

5.1 Covenants of Allied..........................................26

ARTICLE 6 MUTUAL COVENANTS.............................................27

6.1 Mutual Covenants of Nord and Allied..........................27

ARTICLE 7 CONDITIONS PRECEDENT.........................................28

7.1 Mutual Conditions Precedent..................................28

7.2 Conditions to Obligation of Nord.............................30

7.3 Conditions to Obligation of Allied...........................30

7.4 Notice of Non-Compliance.....................................33

7.5 Satisfaction of Conditions...................................33

7.6 Adjustments in Event of Change in Allied Shares..............33

ARTICLE 8 AMENDMENT....................................................34

8.1 Amendment....................................................34

ARTICLE 9 TERMINATION AND REMEDIES.....................................34

9.1 Termination..................................................34

9.2 Effect of Termination........................................34

9.3 Limitation...................................................35

9.4 Allied Termination Event.....................................35

9.5 Nord Termination Event.......................................35

9.6 Liquidated Damages...........................................35

9.7 Judgment Currency............................................35

ARTICLE 10 GENERAL......................................................36

10.1 Notices......................................................36

10.2 Survival.....................................................37

10.3 Binding Effect and Assignment................................37

10.4 Public Disclosure............................................37

10.5 Expenses.....................................................37

10.6 Time of Essence..............................................37

10.7 Governing Law................................................38

10.8 Counterparts.................................................38

10.9 Further Assurances...........................................38

TABLE OF CONTENTS

(continued)

Page

Schedule 1

ARTICLE 1 INTERPRETATION...............................................39

1.1 Definitions..................................................39

1.2 Interpretation Not Affected by Headings, Etc.................40

1.3 Article References...........................................40

1.4 Number, Etc..................................................40

ARTICLE 2 THE ARRANGEMENT..............................................41

2.1 Arrangement..................................................41

2.2 Fractional Shares............................................41

ARTICLE 3 RIGHTS OF DISSENT............................................42

3.1 Rights of Dissent............................................42

ARTICLE 4 SHARE CERTIFICATES AND SHARES ISSUED.........................42

4.1 Rights of Holders............................................42

4.2 Transmittal..................................................42

4.3 No Entitlement...............................................43

4.4 Termination of Rights........................................43

4.5 Distributions................................................43

ARRANGEMENT AGREEMENT AS AMENDED AND RESTATED

THIS AGREEMENT made as of the 20th day of December, 2003 as amended and

restated the 1st day of June, 2004; the 28th day of June 2004 and the 12th day

of August 2004.

BETWEEN:

ALLIED GOLD LIMITED, a corporation continued under the laws of

Western Australia ("Allied")

- and -

NORD PACIFIC LIMITED, a corporation continued under the laws of

New Brunswick ("Nord")

WHEREAS Nord intends to propose to its securityholders an arrangement under

Section 128 of the Business Corporations Act (New Brunswick) on the terms and

conditions of the Plan of Arrangement annexed hereto as Schedule 1;

AND WHEREAS the parties hereto have entered into this Agreement to provide

for the matter referred to in the foregoing recital and for other matters

relating to such arrangement;

NOW THEREFORE THIS AGREEMENT WITNESSES THAT in consideration of the

premises and the respective covenants and agreements herein contained, the

parties hereto covenant and agree as follows:

ARTICLE 1

INTERPRETATION

1.1 Definitions

In this Agreement, unless there is something in the subject matter or

context inconsistent therewith, the following terms shall have the following

meanings:

"Acquisition Proposal" has the meaning ascribed thereto in subsection 4.2;

"Acquisition Transaction" has the meaning given thereto in Section 4.2;

"Act" means the Business Corporations Act, S.N.B. 1981, c. B-9.1, as

amended;

"affiliate" has the meaning ascribed thereto in the Act;

"Allied" means Allied Gold Limited, a corporation continued under the laws

of Western Australia;

"Allied Financial Statements" means the audited consolidated financial

statements of Allied for the year ended December 31, 2003, including the

notes thereto;

"Allied Meeting" means the special meeting of the holders of Allied Shares

(including any adjournment thereof) to be held to consider and, if thought

fit, to approve the Arrangement or any other matter required for the

implementation of the Arrangement;

"Allied Shares" means common shares of Allied;

"Allied Termination Event" has the meaning given thereto in Section 9.4;

"Amended Transaction" has the meaning given thereto in Section 4.3;

"Arrangement" means an arrangement under the provisions of Section 128 of

the Act on the terms and conditions set forth in the Plan of Arrangement;

"ASX" means the Australian Stock Exchange;

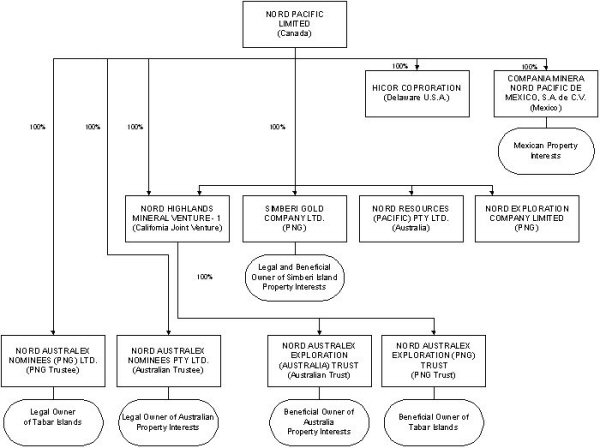

"Australex" means Nord Australex Nominees (PNG) Limited, a corporation

organized under the laws of Papua New Guinea, and which is a wholly-owned

subsidiary of Nord;

"Australian GAAP" means generally accepted accounting principles as in

effect in Australia from time to time, applied on a basis consistent with

that of prior periods;

"Australian Securities Laws" means all applicable securities laws in

Australia and the respective regulations or rules made thereunder, together

with applicable published policy statements, orders, rulings, notices and

interpretation notes of the Australian Securities and Investments

Commission ("ASIC");

"Board Approval Modification" means the Board of Directors of Nord

approving, recommending or voting in favor of an Acquisition Proposal other

than that of Allied or withdrawing or modifying in a manner adverse to

Allied its approval, recommendation or support of the Arrangement;

"business day" means a day other than a Saturday, Sunday or a day when

banks in Albuquerque, New Mexico generally are not open for business;

"Canadian GAAP" means generally accepted accounting principles as in effect

in Canada from time to time, applied on a basis consistent with that of

prior periods;

"Canadian Securities Laws" means all applicable securities laws in each of

the provinces of British Columbia, Alberta, Ontario and New Brunswick and

the respective regulations or rules made thereunder, together with

applicable published policy statements, orders, rulings, notices and

interpretation notes of the securities regulatory authorities in such

province, including national instruments, multi-jurisdictional instruments

and policy statements of the Canadian Securities Administrators;

"Cease Trade Orders" means the cease trade orders issued by the Alberta

Securities Commission on August 17, 2001; by the British Columbia

Securities Commission on February 19, 2002; and by a temporary order issued

by the Ontario Securities Commission on July 23, 2001, as extended by a

further order dated August 3, 2001;

"CMNP" means Compania Minera Nord Pacific De Mexico, S.A. de C.V., a

corporation organized under the laws of Mexico;

"Competition Act" means the Competition Act, R.S.C. 1985, c. C-34, as

amended;

"Confidentiality Agreement" means the confidentiality agreement dated as of

November 24, 2003 between Allied and Nord;

"Court" means the Court of Queen's Bench of New Brunswick;

"Credit Agreement" means the Credit Facility Agreement dated December 20,

2003 between Nord and Allied, under which Allied has agreed to provide

certain financing to Nord in exchange for convertible notes issued to it by

Nord;

"Dissenting Securityholders" means Nord Securityholders who exercise, and

do not prior to the Effective Date withdraw or otherwise relinquish, the

right of dissent available to such holders in respect of the special

resolution to be placed before the Nord Securityholders at the Nord Meeting

to approve the Arrangement;

"Effective Date" means the date on which the Arrangement becomes effective

under the Act;

"EL 609" means Exploration License 609 which covers substantially all of

the Tabar Islands other than Simberi Island as well as that portion of

Simberi Island not covered by ML 136, as more particularly described in the

Nord Disclosure Letter;

"Employment Agreements" mean all employment, severance, collective

bargaining or similar agreements, policies or arrangements between Nord and

the Nord Subsidiaries and their respective officers, directors, employees

and consultants;

"Encumbrance" includes, without limitation, any mortgage, pledge,

assignment, charge (fixed or floating), lien, security interest, claim or

trust, or any royalty, carried, working, participation, net profits or

other third party interest and any agreement, option, right or privilege

capable of becoming any of the foregoing;

"Environmental Law" includes any principles of equity or common law and any

federal, provincial, state, municipal or local laws, statutes, ordinances,

regulations, rules, permits, approvals, certificates, registrations,

by-laws, guidelines, orders, directives, judgments, decisions or other

instruments having the force of law which are rendered or issued by any

Governmental Authority having jurisdiction, including but not limited to

any judicial or administrative order, consent, decree, judgment or

directive, that relates in any way to the protection of the environment or

to the health and safety of persons or property or product liability,

handling or transportation, and whether applying to or governing any actual

or threatened presence, release, discharge, escape, manufacture,

processing, distribution, use, treatment, storage, disposal, transport,

recycling or handling of any Hazardous Material or any material or

substance capable of becoming a Hazardous Material when in combination with

any other substance;

"Facility Documents" means:

(a) the Credit Agreement,

(b) the Notes evidencing advances thereunder, and

(c) such other documents and certificates which in the opinion of Allied,

acting reasonably, are required to fully document or satisfy the terms

and conditions contained in the Credit Agreement;

"Final Order" means the final order of the Court approving the Arrangement,

as such order may be amended or modified by the highest court to which an

appeal may be applied for;

"Financing" means the financing contemplated by the Credit Agreement;

"Government" means the Government of Papua New Guinea;

"Governmental Authority" includes any federal, provincial, state,

municipal, or other political subdivision, government department,

commission, board, court, bureau, agency, arbitrator or instrumentality,

domestic or foreign;

"Hazardous Material" means pollutants, contaminants, dangerous goods or

substances, toxic or hazardous chemicals, substances, materials or waste,

petroleum products or any derivatives or by-products thereof, other

hydrocarbons or other substances, and any other substance or material

released into or present in the environment, where such release or presence

is prohibited, controlled, managed or regulated in any manner under

Environmental Law or by any Governmental Authority thereunder or pursuant

thereto, and whether or not any release of such substance or material was

permitted by Environmental Law applicable at the relevant time;

"Hicor" means Hicor Corporation, a corporation organized under the laws of

Delaware;

"HSR Act" means the Hart-Scott-Rodino Antitrust Improvements Act of 1976 of

the United States, as amended;

"Interim Order" means the order of the Court providing for, among other

things, the calling and holding of the Nord Meeting;

"Investment Canada Act" means the Investment Canada Act, R.S.C. 1985, c. 28

(1st Supp.);

"Joint Information Circular" means the information circular to be sent by

Nord to Nord Securityholders in connection with the Nord Meeting and by

Allied to the holders of Allied Shares in connection with the Allied

Meeting;

"Joint Venture" means the Simberi Mining Joint Venture and the Tabar

Exploration Joint Venture;

"Joint Venture Agreements" means the agreement dated November 29, 2002, as

amended by an agreement among such parties dated January 27, 2003, the Deed

of Agreement among such parties (dated 28.01.2003 in the footer of the text

thereof) with respect to the Simberi Mining Joint Venture and the Deed of

Agreement among such parties (dated 28.01.2003 in the footer of the text

thereof) with respect to the Tabar Exploration Joint Venture;

"Joint Venture Partner" means each of Nord, SGC, Australex and PGM;

"Lien" means any mortgage, pledge, priority, security interest,

encumbrance, statutory deemed trust, contractual deposit or escrow

arrangement, collateral account, lien (statutory or otherwise) or charge of

any kind (including any agreement to give any of the foregoing, any

conditional sale or other title retention agreement, any lease in the

nature thereof including a sale-leaseback and a capitalized lease) or any

other type of preferential arrangement for the purpose, or having the

effect, of protecting a creditor against loss or securing the payment or

performance of an obligation, but excluding any right of set-off given in

the ordinary course of the mining business;

"Material Adverse Effect" and "Material Adverse Change" mean, with respect

to any party, an effect or change, respectively, in each case which is

materially adverse to the business, financial condition, operations,

property, condition (financial or otherwise) or prospects of such party and

its subsidiaries, taken as a whole, or on the ability of a party to perform

its obligations under this Agreement, the Credit Agreement or to complete

this Arrangement;

"ML 136" means the mining lease granted by the Government covering 2,560

hectares on Simberi Island in the Province of New Ireland, as more

particularly described in the Nord Disclosure Letter;

"NANPL" means Nord Australex Nominees Pty. Ltd., a corporation organized

under the laws of Australia;

"Nord" means Nord Pacific Limited, a corporation organized under the Act,

and includes any successor corporation;

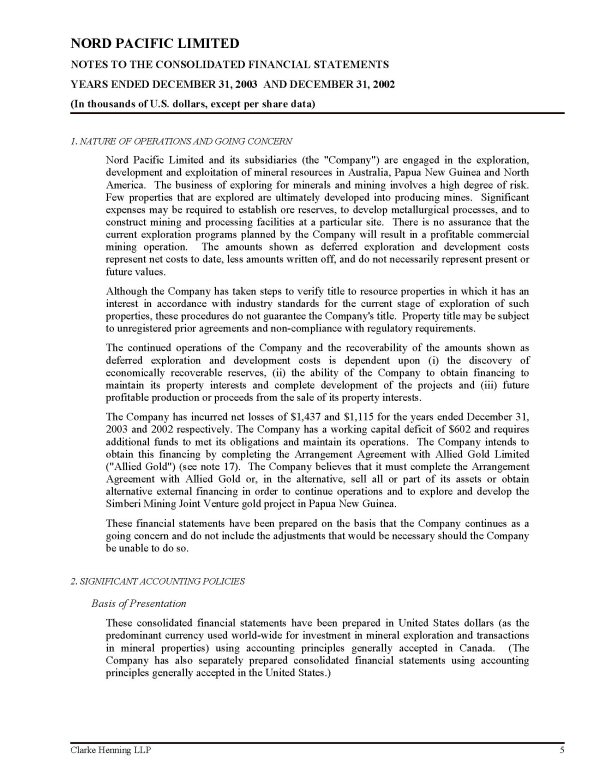

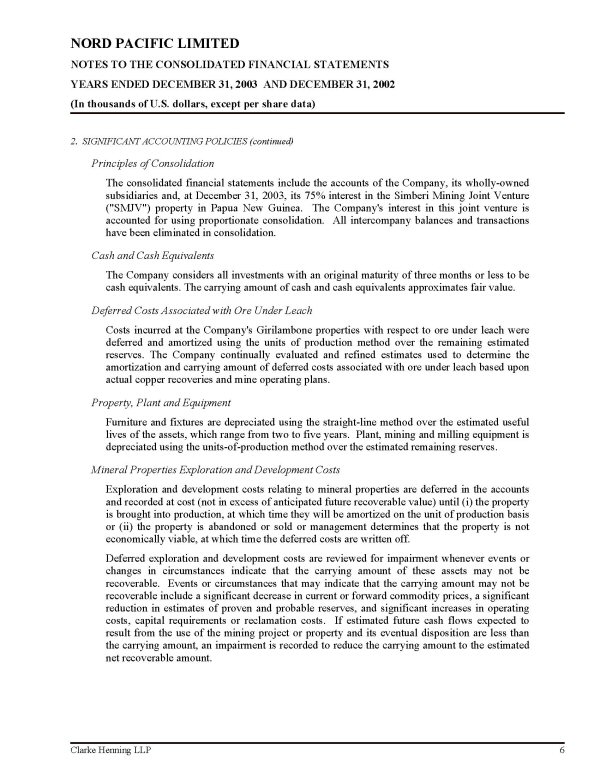

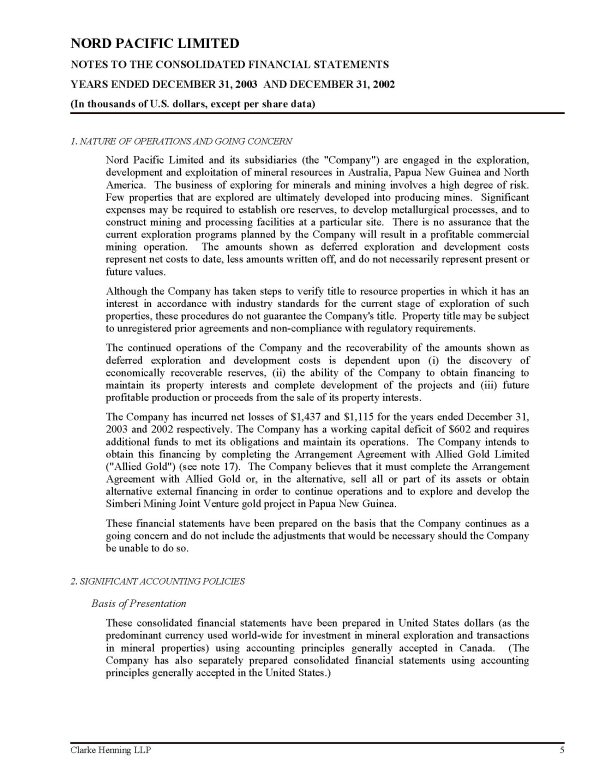

"Nord 2003 Financial Statements" means the audited consolidated financial

statements of Nord for the year ended December 31, 2003, including the

notes thereto;

"Nord Disclosure Letter" means the written disclosure letter dated the date

of this Agreement provided by Nord to Allied concurrently with the

execution of this Agreement;

"Nord Meeting" means the special meeting of Nord Securityholders (including

any adjournment thereof) to be held to consider and, if thought fit, to

approve the Arrangement;

"Nord Optionholders" means the holders of Nord Options;

"Nord Options" means the options to purchase Nord Shares issued and

outstanding or any agreement to issue shares on the occurrence of one or

more conditions in existence under the Nord Stock Option Plans or

otherwise;

"Nord Prior Period Financial Statements" means the audited consolidated

financial statements of Nord for the years ended December 31, 2002,

December 31, 2001 and December 31, 2000 including the notes thereto;

"Nord Securityholders" means the Nord Shareholders and the Nord

Optionholders;

"Nord Shareholders" means the registered holders of Nord Shares;

"Nord Shares" means common shares of Nord;

"Nord Stock Option Plans" means the stock option plans of Nord as set forth

in the Disclosure Letter;

"Nord Subsidiaries" means, collectively, SGC, Australex, NANPL, NRPPL, CMNP

and Hicor;

"NRC" means Nord Resources Corporation, a corporation incorporated under

the laws of Delaware and a holder of 3,697,561 Nord Shares as of December

15, 2003;

"NRPPL" means Nord Resources (Pacific) Pty. Ltd., a corporation organized

under the laws of Australia;

"Permitted Encumbrances" means:

(a) Liens in any judicial proceedings filed against Nord or any of the

Nord Subsidiaries in respect of which final judgment has not been

rendered and which Nord or any of the Nord Subsidiaries shall be

contesting in good faith if and for so long as (i) a stay of

enforcement of such Lien (if enforceable by seizure, sale or other

remedy against any property), as the case may be, shall be in effect

and (ii) in respect of all such Liens which are in excess of $50,000

in the aggregate, an amount in cash (or cash equivalent security)

sufficient to obtain a discharge thereof shall have been deposited

with a court of competent jurisdiction;

(b) Liens incurred or created in the ordinary course of business of Nord

or any of the Nord Subsidiaries and in accordance with sound industry

practice and incidental to

construction or operations which have not at such time been filed

pursuant to law or which relate to obligations not due or delinquent;

(c) Liens incurred or created in the ordinary course of business and in

accordance with sound industry practice in respect of any of the

assets of Nord or any of the Nord Subsidiaries as security in favour

of any other person who is conducting the exploration, development or

operation of the property to which such Liens relate for Nord's or any

of the Nord Subsidiaries' portion of the costs and expenses of such

exploration, development or operation which have not at such time been

filed pursuant to law or which relate to obligations not due or

delinquent;

(d) Liens given to a public utility or any municipality or governmental or

other authority when required by such public utility or municipality

or other authority in connection with the operations of Nord or any of

the Nord Subsidiaries, and which relate to obligations not due or

delinquent;

(e) Liens securing assessments under workers' compensation laws,

unemployment insurance or similar social security legislation which

are not due or delinquent;

(f) Liens for penalties arising under ordinary course non-participation

provisions of operating agreements in respect of Nord or any of the

Nord Subsidiaries mining properties (and related tangibles) which do

not, individually or in the aggregate, materially detract from the use

or value of the property subject thereto;

(g) undetermined or inchoate Liens incidental to operations in the

ordinary course of business which have not been filed pursuant to law

against title to such properties or assets and which relate to

obligations not due or delinquent; and

(h) any security granted under the terms of the Joint Venture Agreements

by Nord, SGC or Australex to PGM or to lenders to the Joint Venture;

"person" includes any individual, partnership, firm, trust, body corporate,

government, governmental body, agency or instrumentality, unincorporated

body or association;

"PGM" means PGM Ventures Corporation, a corporation organized under the

Act;

"Plan of Arrangement" means the plan of arrangement set out as Schedule 1

hereto and any amendment thereto made in accordance with Section 8.1;

"Proposed Agreement" has the meaning given thereto in Section 4.3;

"Registrar" means the Director of Corporations or a Deputy Director of

Corporations for the Province of New Brunswick, duly appointed under the

Act;

"Representative" means, with respect to a person, that person's directors,

officers, employees, financial or professional advisors, accountants and

all other authorized representatives of such person or a subsidiary of such

person, and legal counsel and advisors to any of the foregoing;

"SEC" means the United States Securities and Exchange Commission;

"Security Interest" means a mortgage, pledge, deposit by way of security,

charge, hypothec, assignment by way of security, security interest, lien

(whether statutory, equitable or at common law), title retention agreement,

possessory lien, lease with option or requirement to purchase, a right of

off-set (if created for the purpose of directly or indirectly securing the

repayment of debt), the rights of a lender or purchaser under a prepaid

obligation, the agreement to give any of the

foregoing, and any other interest in property or assets, howsoever created

or arising, that secures payment or performance of an obligation (including

a lease without option to purchase if the economic effect thereof is to

secure an obligation other than reasonable rent for the current use of the

leased property, and a trust, a statutory deemed trust and statutory lien

or charge);

"SGC" means Simberi Gold Company Limited, a corporation organized under the

laws of Papua New Guinea and which is a wholly-owned subsidiary of Nord;

"Simberi Mining Joint Venture" means the Simberi Mining Joint Venture among

Nord, SGC, Australex and PGM pursuant to the Joint Venture Agreements;

"subsidiary" has the meaning ascribed thereto in the Act and, with respect

to Nord, includes the Nord Subsidiaries;

"Superior Transaction" has the meaning given thereto in Section 4.3;

"Tabar Exploration Joint Venture" means the exploration joint venture among

Nord, SGC, Australex and PGM pursuant to the Joint Venture Agreements;

"Termination Amount" means an amount equal to the sum of:

(a) Allied's actual out of pocket expenses (including fees and

disbursements of legal counsel) incurred in connection with this

Agreement, the Arrangement, and the transactions contemplated thereby;

(b) if requested by Allied, all amounts (including principal and accrued

but unpaid interest) due and owing under the Credit Agreement; and

(c) $240,000.00;

"U.S. Exchange Act" means the United States Securities Exchange Act of

1934, as amended;

"U.S. GAAP" means generally accepted accounting principles as in effect in

the United States from time to time applied on a basis consistent with that

of prior periods;

"U.S. Securities Act" means the United States Securities Act of 1933, as

amended;

"U.S. Securities Filings" means all forms, reports, schedules, statements

and other documents required to be filed by it with the SEC, collectively,

as supplemented and amended since the time of filing; and

"U.S. Securities Laws" means the U.S. Securities Act, the U.S. Exchange

Act, the United States Investment Company Act of 1940, as amended, the

United States Trust Indenture Act of 1939, as amended and applicable state

securities and "blue sky" laws, and the rules, regulations, forms, policies

and orders adopted by the SEC and other Governmental Authorities pursuant

thereto.

1.2 Knowledge

The use in this Agreement of the phrases "Nord's knowledge", "knowledge of

Nord" and "known to Nord" with respect to any matter or thing shall be

interpreted to mean the actual knowledge of the senior officers of Nord after

enquiry by such officers of the management, employees and consultants of Nord

and the Nord Subsidiaries who have significant responsibilities with respect to

the area of business of Nord and the Nord Subsidiaries to which the matter

relates or who would reasonably be expected to have knowledge with respect to

such matter, and the phrases "Allied's knowledge", "knowledge of Allied" and

"known to Allied" have a corresponding meaning.

1.3 Interpretation Not Affected by Headings, Etc.

The division of this Agreement into articles, sections and other portions

and the insertion of headings are for convenience of reference only and shall

not affect the construction or interpretation of this Agreement. The terms "this

Agreement", "hereof", "herein" and "hereunder" and similar expressions refer to

this Agreement and the Schedule hereto and not to any particular article,

section or other portion hereof and include any agreement or instrument

supplementary or ancillary hereto.

1.4 Article References

Unless the contrary intention appears, references in this Agreement

(excluding the Plan of Arrangement) to an Article, Section, subsection,

paragraph or subparagraph by number or letter or both refer to the Article,

Section, subsection, paragraph or subparagraph, respectively, bearing that

designation in this Agreement (excluding the Plan of Arrangement).

1.5 Number, Etc.

Unless the context requires the contrary, words importing the singular

number only shall include the plural and vice versa and words importing the use

of any gender shall include all genders.

1.6 Date For Any Action

If any date on which any action is required to be taken hereunder by any of

the parties hereto is not a business day, such action shall be required to be

taken on the next succeeding day which is a business day.

1.7 Currency

Unless otherwise stated, all references in this Agreement to "$" and sums

of money are expressed in lawful money of the United States.

1.8 Entire Agreement

This Agreement, together with the Credit Agreement, constitutes the entire

agreement among the parties pertaining to the subject matter hereof and

supersedes all prior agreements, understandings, negotiations and discussions,

whether oral or written, among the parties with respect to the subject matter

hereof. If there is any conflict between any provision of the Confidentiality

Agreement and this Agreement, the provisions of this Agreement shall prevail.

ARTICLE 2

THE ARRANGEMENT

2.1 Arrangement

Subject to compliance with the terms and conditions contained herein, Nord

shall:

(a) as soon as reasonably practicable, apply to the Court pursuant to

Section 128 of the Act for an order approving the Arrangement and in

connection with such application shall:

(i) forthwith file, proceed with and diligently prosecute an

application for an Interim Order under Section 128(4) of the Act

providing for, among other things, the calling and holding of the

Nord Meeting for the purpose of considering and, if deemed

advisable, approving the Arrangement; and

(ii) subject to obtaining securityholder approval as contemplated in

the Interim Order, forthwith file, proceed with and diligently

prosecute an application to the Court for a Final Order; and

(b) deliver to the Registrar articles of arrangement and such other

documents as may be required to give effect to the Arrangement on the

earlier of:

(i) September 15, 2004 or as soon thereafter as possible, or

(ii) such date prior to September 15, 2004 as Allied may notify to

Nord.

2.2 Interim Order

The Interim Order sought by Nord shall provide that for the purpose of the

Nord Meeting:

(a) the securities of Nord for which the holders shall be entitled to vote

on the Arrangement shall be the Nord Shares and the Nord Options;

(b) the Nord Shareholders and the Nord Optionholders shall be entitled to

vote on the Arrangement together, and not as separate classes, with

the Nord Shareholders being entitled to one vote for each Nord Share

held and the Nord Optionholders being entitled to one vote for each

Nord Share issuable pursuant to the Nord Options; and

(c) the requisite majority for the approval of the Arrangement by the Nord

Securityholders shall be two-thirds of the votes cast by the Nord

Securityholders present in person or by proxy at the Nord Meeting,

voting together.

2.3 Alternative Structure

If it proves desirable to Allied to do so, Allied may carry out the

Arrangement through a wholly-owned subsidiary as long as the obligations of

Allied hereunder shall be joint and several with such subsidiary and the effect

thereof shall be the same as under the structure contemplated herein.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of Nord

Except as is fully and fairly disclosed and set forth in the corresponding

paragraph of the Nord Disclosure Letter (and subject to the representation and

warranties and covenants made in the Nord Disclosure Letter), Nord represents

and warrants to and in favour of Allied as follows and acknowledges that Allied

is relying upon such representations and warranties in connection with the

matters contemplated by this Agreement:

(a) as of the date hereof, the board of directors of Nord has determined

unanimously that:

(i) the Arrangement is fair to the Nord Securityholders and is in the

best interests of Nord; and

(ii) the board of directors of Nord will recommend that the Nord

Securityholders vote in favour of the Arrangement;

(b) each of Nord and the Nord Subsidiaries is duly incorporated and

validly existing under the laws of its jurisdiction of incorporation

and has the corporate power to own or lease its property and assets

and to carry on business as now conducted;

(c) Nord has the corporate power and authority to enter into this

Agreement and, subject to obtaining the requisite approvals

contemplated hereby, to perform its obligations hereunder;

(d) this Agreement has been duly executed and delivered by Nord and

constitutes a valid and binding obligation of Nord enforceable against

it in accordance with its terms;

(e) the execution and delivery of this Agreement by Nord and the

completion of the transactions contemplated hereby and by the Plan of

Arrangement have been duly authorized by the board of directors of

Nord and do not and will not:

(i) result in the breach of, or violate any term or provision of, the

articles or by-laws of Nord or any of the Nord Subsidiaries;

(ii) conflict with, result in the breach of, constitute a default

under, or accelerate or permit the acceleration of the

performance required by, any agreement, instrument, license,

permit or authority to which Nord or any of the Nord Subsidiaries

is a party or by which Nord or any of the Nord Subsidiaries or

any of their assets is bound, or result in the creation of any

Encumbrance upon any assets of Nord or any of the Nord

Subsidiaries under any such agreement, instrument, license,

permit or authority, or give to others any interest or right,

including rights of purchase, termination, cancellation or

acceleration, under any such agreement, instrument, license,

permit or authority, where such conflict, breach, default,

acceleration, creation or giving would have a Material Adverse

Effect on Nord or could reasonably be expected to prevent or

materially hinder the completion of the Arrangement or the

Financing; or

(iii)violate or contravene any provision of any law or regulation or

any judicial or administrative award, judgment or decree

applicable to Nord or any of the Nord Subsidiaries or any of

their assets, where such violation or contravention would have a

Material Adverse Effect on Nord or could reasonably be expected

to prevent or materially hinder the completion of the Arrangement

or the Financing;

(f) the subsidiaries of Nord consist of (and only of) the Nord

Subsidiaries and Nord does not have any equity securities or have the

right to acquire equity securities of any other entity;

(g) CMNP, Hicor, NRPPL, SGC and Australex are the only subsidiaries of

Nord which actively carry on business or have any assets (other than

tax pools) or liabilities or potential liabilities greater than

$100,000 other than inter-company indebtedness;

(h) Nord owns all of the issued and outstanding shares of the Nord

Subsidiaries, and such shares have been validly issued to Nord as

fully paid and non-assessable and all such shares owned directly or

indirectly by Nord are owned free and clear of all Encumbrances and

there are no outstanding options, rights, entitlements, understandings

or commitments (contingent or otherwise) regarding the right to

acquire any shares or other ownership interests in any subsidiary of

Nord save and except under the Deed of Agreement among such parties

(dated 28.01.2003 in the footer of the text thereof) with respect to

the Simberi Mining Joint Venture, PGM may pledge the shares of SGC;

(i) each of Nord, SGC and Australex and the other Nord Subsidiaries has

all licences, permits, orders or approvals of, and has made all

required registrations with any government or regulatory body that are

material to its assets or the conduct of its business as presently

conducted;

(j) the authorized capital of Nord consists of an unlimited number of

common shares, of which 20,838,670 (and no more) are issued and

outstanding as of the date hereof and all of the outstanding shares of

Nord are validly issued, fully paid and non-assessable;

(k) no person has any agreement, option, right or privilege (including,

without limitation, whether by law, pre-emptive right, contract or

otherwise) to purchase, subscribe for, convert into, exchange for or

otherwise require the issuance of, nor any agreement, option, right or

privilege capable of becoming any such agreement, option, right or

privilege, any of the unissued shares of Nord or any of the Nord

Subsidiaries, except for Nord Options currently granted and

outstanding to purchase an aggregate of 1,651,482 Nord Shares;

(l) the Nord Prior Period Financial Statements are complete and accurate

in all material respects, comply with all applicable requirements of

Canadian Securities Laws and U.S. Securities Laws, and present fairly

the consolidated financial position of Nord and the Nord Subsidiaries

and the results of its operations as of the dates and throughout the

periods indicated in accordance with U.S. GAAP (reconciled to Canadian

GAAP), Nord and the Nord Subsidiaries had no material liabilities

(contingent or otherwise), on a consolidated basis, which were not

fully reflected in such statements in accordance with U.S. GAAP, and

all legal proceedings against Nord or any of the Nord Subsidiaries

which are required in accordance with U.S. GAAP to be reflected in

Nord's financial statements had been properly reflected in the Nord

Prior Period Financial Statements in accordance with such principles;

(m) neither Nord nor any of the Nord Subsidiaries is:

(i) in breach or violation of any of the provisions of its articles

or by-laws, where such breach or violation would have a Material

Adverse Effect on Nord, or

(ii) in breach or violation of any of the terms or provisions of, or

in default under, any indenture, mortgage, deed of trust, loan

agreement or other agreement (written or oral) or instrument to

which Nord or any of the Nord Subsidiaries is a party or by which

Nord or any of the Nord Subsidiaries is bound or to which any of

the assets of Nord or any of the Nord Subsidiaries is subject or

any statute or any order, rule or regulation of any court or

government or governmental agency or authority having

jurisdiction over Nord or any of the Nord Subsidiaries or any of

their assets, where such breach, violation or default has or may

have a Material Adverse Effect on Nord, or

(iii)a party to or is bound by any agreement of guarantee,

indemnification, assumption or endorsement or any other like

commitment of the obligations, liabilities (contingent or

otherwise) or indebtedness of any other person;

except pursuant to the Credit Agreement;

(n) the corporate records and minute books of Nord and the Nord

Subsidiaries are complete and accurate in all material respects;

(o) the books of account and other records of Nord and the Nord

Subsidiaries, whether of a financial or accounting nature or

otherwise:

(i) have been maintained in accordance with prudent business

practices in all material respects, and

(ii) are stated in reasonable detail and accurately and fairly reflect

in all material respects the transactions and acquisitions and

dispositions of assets by Nord and the Nord Subsidiaries;

(p) neither Nord nor, to the knowledge of Nord, any of its Representatives

nor anyone acting on their behalf has made any payment or given

anything of value in violation of section 30A(a) of the U.S. Exchange

Act, commonly known as the "Foreign Corrupt Practices Act", and Nord

and the Nord Subsidiaries have devised and currently maintain a system

of internal accounting controls sufficient to provide reasonable

assurances that transactions are executed in accordance with

management's general or specific authorization, and transactions are

recorded as necessary to permit preparation of financial statements in

conformity with U.S. GAAP and any other criteria applicable to such

financial statements and preparation of non-consolidated financial

statements for tax purposes, and to maintain accountability for

assets;

(q) each of Nord and the Nord Subsidiaries owns its properties and assets

free and clear of all Security Interests other than Permitted

Encumbrances;

(r) there are:

(i) no claims, actions, suits, proceedings or investigations

commenced or, to the knowledge of Nord, contemplated or

threatened against or affecting Nord or any of the Nord

Subsidiaries or any of their assets before or by any Governmental

Authority;

(ii) to the knowledge of Nord, no existing facts or conditions which

may reasonably be expected to be a proper basis for any claims,

actions, suits, proceedings or investigations; and

(iii)no outstanding judgments, awards, decrees, injunctions or orders

against Nord or any of the Nord Subsidiaries;

which in any case could prevent or materially hinder the completion of

the Arrangement or the Financing or which could have a Material

Adverse Effect on Nord;

(s) other than in connection with or in compliance with the provisions of

the Act, Canadian Securities Laws and U.S. Securities Laws:

(i) there is no legal impediment to Nord's consummation of the

transactions contemplated by this agreement; and

(ii) no filing or registration with, or authorization, consent or

approval of, any domestic or foreign public body or authority is

necessary by Nord or any of the Nord Subsidiaries in connection

with the consummation of the Arrangement, except for such filings

or registrations which, if not made, or for such authorizations,

consents or approvals, which, if not received, would not have a

Material Adverse Effect on the ability of Nord to consummate the

transactions contemplated hereby;

(t) the public filings made by Nord under applicable United States and

Canadian disclosure laws up to December 15, 2000 when taken together,

constituted full, true and plain disclosure of all material facts

relating to the business, operations and capital of Nord and the Nord

Subsidiaries on a consolidated basis and the other matters therein and

did not contain any untrue statement of a material fact or omit to

state any material fact required to be stated therein or necessary in

order to make the statements made therein not

misleading in light of the circumstances under which they were made

and, in particular, no material fact existed on December 15, 2000

which had not been disclosed in such public filings and which if

publicly disclosed would reflect that a Material Adverse Change (or an

event, condition or state of facts which might reasonably have been

expected to give rise to any such change) had occurred in the assets,

liabilities, business, operations or capital of Nord and the Nord

Subsidiaries on a consolidated basis;

(u) since April 12, 2000, except as has been publicly disclosed by Nord,

none of Nord or any of the Nord Subsidiaries has:

(i) amended its articles or by-laws;

(ii) conducted its business other than in the ordinary course of

business consistent with normal industry practice;

(iii)made any material loans or advances (other than loans or

advances from Nord to SGC and Australex) or incurred any

indebtedness;

(iv) suffered a Material Adverse Change;

(v) made any change in its accounting principles and practices as

theretofore applied including, without limitation, the basis upon

which its assets and liabilities are recorded on its books and

its earnings and profits and losses are ascertained;

(vi) made any changes to its salary and other compensation levels,

benefits, retention terms or severance arrangements;

(vii)declared, paid or set aside for payment any dividend or

distribution of any kind in respect of any of its outstanding

shares nor made any repayments of share capital;

(viii) acquired or sold any assets which are material;

(ix) made any payment to or entered into any agreement with any person

not dealing at arms length with Nord; or

(x) entered into any agreement or commitment to do any of the

foregoing;

(v) Nord has fully disclosed the terms and conditions of all Employment

Agreements to Allied, and such Employment Agreements, as disclosed,

are unamended as at the date hereof;

(w) neither Nord nor any of the Nord Subsidiaries:

(i) has any Employment Agreements, whether written or oral, which

cannot be terminated without cause by Nord or such subsidiary, as

the case may be, upon giving such notice as may be required by

law and without the payment of any bonus, damages or penalty, and

(ii) is a party to any written or oral policy, agreement, obligation

or understanding providing for severance or termination payments

to, or any employment agreements with, any person;

(x) neither Nord nor any of the Nord Subsidiaries has made, nor will any

of them make any payment to any officer, director, consultant,

employee or agent in respect of any increase in compensation in any

form, nor make any loan to any such person, nor make any payment to

any such person in respect of any severance or termination pay arising

from the Arrangement or a change of control of Nord other than

pursuant to pre-existing agreements, and the amounts of such payments

and the terms of such agreements shall have been disclosed in the Nord

Disclosure Letter;

(y) all operations of Nord and the Nord Subsidiaries have been and are now

in compliance with all Environmental Laws, except where the failure to

be in compliance would not individually or in the aggregate have a

Material Adverse Effect on Nord;

(z) neither Nord nor any of the Nord Subsidiaries is aware of, or is

subject to:

(i) any proceeding, application, order, or directive which relates to

environmental, health or safety matters, and which may require

any material work, repairs, construction or expenditures; or

(ii) any demand or notice with respect to the breach of any

Environmental Laws applicable to Nord, any of the Nord

Subsidiaries or any other party to the Joint Venture, including,

without limitation, any regulations respecting the use, storage,

treatment, transportation or disposition of Hazardous Material,

which individually or in the aggregate would have a Material Adverse

Effect on Nord;

(aa) each of Nord and the Nord Subsidiaries has filed all tax returns and

information returns required to be filed by it in all applicable

jurisdictions and has paid all taxes, levies, assessments,

reassessments, penalties, interest and fines due and payable by it on

the basis of such tax returns or demands from taxation authorities;

(bb) provision has been made, in accordance with U.S. GAAP, in the Nord

Prior Period Financial Statements for all taxes, governmental charges

and assessments, whether relating to income, sales, real or personal

property, or other types of taxes, governmental charges or

assessments, including interest and penalties thereon, payable in

respect of the business or assets of Nord and the Nord Subsidiaries or

otherwise;

(cc) there are no material actions, suits or other proceedings or claims in

progress or, to Nord's knowledge, pending or threatened against Nord

or any of the Nord Subsidiaries in respect of any taxes, governmental

charges or assessments and, in particular, there are no currently

outstanding material reassessments or written enquiries which have

been issued or raised by any Governmental Authority relating to any

such taxes, governmental charges and assessments;

(dd) to the knowledge of Nord, each of Nord and the Nord Subsidiaries has

withheld or collected and remitted all amounts required to be withheld

or collected and remitted by it in respect of any taxes, governmental

charges or assessments, and has received no indication or notice of

any sort from any Governmental Authority to the contrary;

(ee) in respect of each taxation year ending on or after December 31, 1998

of Nord, each of its affiliates and subsidiaries, and the predecessors

of such corporations, Nord has provided to Allied:

(i) full and complete disclosure with respect to the status of any

audits carried out by taxation authorities in Canada, the United

States, Papua New Guinea or elsewhere;

(ii) copies of all objections or waivers with respect to such years

pursuant to the Income Tax Act (Canada) or other similar

legislation, tax rulings and opinions from applicable taxing

authorities pursuant to which Nord, its affiliates and any

predecessors of such corporations operated or now operate; and

(iii) copies of all tax returns;

which comprise all of the information necessary to form a reasonably

accurate understanding of the current tax position of Nord and the

Nord Subsidiaries;

(ff) the tax pools of each of Nord, SGC, Australex and the other Nord

Subsidiaries as of December 31, 2002 was as set forth in the Nord

Disclosure Letter;

(gg) Nord and the Nord Subsidiaries maintain business and property

insurance in connection with their assets and business and liability

insurance with respect to claims for personal injury, death or

property damage in relation to the operation of their businesses, all

with responsible and reputable insurance companies in such amounts and

with such deductibles as are customary in the case of businesses of

established reputation engaged in the mining industry;

(hh) none of Nord or the Nord Subsidiaries have any outstanding

indebtedness, including letters of credit, nor have Nord or the Nord

Subsidiaries guaranteed the obligations of any other person or each

other, as of the date hereof;

(ii) Nord, SGC and Australex are the legal, beneficial and registered owner

of a current undivided 50% participating interest in and to the

Simberi Mining Joint Venture and a current 99% participating interest

in the Tabar Exploration Joint Venture (in the future the Borrower's

interest is subject to, and may be modified by, the terms of the Joint

Venture Agreements), free and clear of any Security Interests other

than Permitted Encumbrances;

(jj) none of Nord, SGC or Australex is in default of any of their

respective obligations under the Joint Venture Agreements or any

right, licence, permit, authorization or consent, governmental or

otherwise related to the Joint Venture;

(kk) each of the Joint Venture Agreements is in full force and effect and,

to the best of Nord's knowledge, PGM is not in default of any of its

obligations thereunder; PGM currently does not have any right to

terminate any of the Joint Venture Agreements; PGM has not given any

notice of any assignment of its interest in the Joint Venture or any

Joint Venture Agreement; PGM has not threatened to terminate any Joint

Venture Agreement or to fail to perform any obligations thereunder; no

person has threatened to terminate any right, licence, permit,

authorization or consent, governmental or otherwise related to the

Joint Venture;

(ll) Nord has provided to Allied a true and complete copy of each Joint

Venture Agreement and each licence, permit, authorization or consent,

governmental or otherwise, issued in connection therewith and there

are no other material contracts or agreements that pertain to the

Joint Venture that are not one of the Joint Venture Agreements;

(mm) there are no material services, materials or rights required for the

current and foreseeable stages of development of the Joint Venture

that are not available to the Joint Venture Partners;

(nn) all conditions precedent to the obligations of the respective parties

under the Joint Venture Agreements have been satisfied or waived

except for such conditions precedent

which need not and cannot be satisfied until a later stage of

development of the Joint Venture, and Nord has no reason to believe

that any such condition precedent cannot be satisfied on or prior to

the commencement of the appropriate stage of development of the Joint

Venture;

(oo) to the knowledge of Nord, all permits, licenses, trademarks, patents

or agreements with respect to the usage of technology or other similar

property that are necessary for the current stage of the development

of the Joint Venture have been obtained, are final and are in full

force and effect;

(pp) Nord is not aware of any event or circumstance currently existing or

threatened that could reasonably be expected to hinder the development

of the Joint Venture on its current schedule;

(qq) the completion of the Arrangement and the Financing (including all

transactions contemplated by the Credit Agreement) will not result in

any person having any right or entitlement to assert any claims

adverse to the interest of Nord, SGC and Australex in the Joint

Venture or the Joint Venture Agreements;

(rr) no person has any right or option to acquire any of Nord's, SGC's or

Australex's interest in the Joint Venture or the Joint Venture

Agreements other than under the express written terms of the Joint

Venture Agreements;

(ss) no person has taken any steps or asserted or threatened any action

against Nord, SGC or Australex or the Joint Venture which would, if

carried out, hinder the development of the Joint Venture on its

current schedule;

(tt) Nord, SGC and Australex have not failed to disclose to Allied any

information relating to the Joint Venture within the possession or

control of Nord, SGC or Australex that could reasonably be considered

to be material to Allied for purposes of its technical evaluation of

the Joint Venture;

(uu) Nord, SGC and Australex have not failed to disclose to Allied any

material fact or circumstance relating to the development of the Joint

Venture on its current schedule that could reasonably be expected to

hinder or delay such development;

(vv) to the knowledge of Nord, the data and information in respect of Nord,

the Nord Subsidiaries and their respective assets, liabilities,

business and operations, including without limitation the engineering,

geological, geophysical and technical information relating to the

Joint Venture, provided by Nord to Allied prior to the date of this

Agreement was accurate and correct in all material respects at the

time it was provided and did not omit any data or information

necessary to make any data or information provided not misleading at

the time it was provided, and there has been no Material Adverse

Change with respect to any such data or information since the time it

was provided;

(ww) Nord has not incurred any obligation or liability contingent or

otherwise for brokerage fees, finders fees, agent's commission,

financial advisory fees or other similar forms of compensation with

respect to the transactions contemplated herein;

(xx) Nord is a "reporting issuer" or its equivalent in the provinces of

British Columbia, Alberta, Ontario and New Brunswick and the Nord

Shares are registered with the SEC under section 12(g) of the U.S.

Exchange Act and are not listed on any stock exchange, and except as

disclosed in the Nord Disclosure Letter, Nord has not been notified of

any default or possible or alleged default by Nord or any of its

current or former directors or

officers of any requirement of securities or corporate laws,

regulations, rules, orders, notices or policies;

(yy) none of the U.S. Securities Filings at the date of its filing

contained an untrue statement of a material fact or omitted to state a

material fact required to be stated therein or necessary to make the

statements made therein not misleading in light of the circumstances

in which they were made and to the knowledge of Nord, all of Nord's

officers, directors and beneficial owners of Nord's common shares have

complied to the extent required, with sections 16(a) and 13(d) of the

U.S. Exchange Act;

(zz) neither Nord nor the Nord Subsidiaries nor, to Nord's knowledge, any

employee or agent of Nord or any of the Nord Subsidiaries, has made

any payment of funds of Nord or any of the Nord Subsidiaries or

received or retained any funds in violation of any law, rule or

regulation;

(aaa)since July 30, 2002, Nord has not, directly or indirectly, including

through any of the Nord Subsidiaries:

(i) extended credit, arranged to extend credit or renewed any

extension of credit, in the form of a personal loan, to or for

any director or executive officer of Nord, or to or for any

family member or affiliate of any director or executive officer

of Nord; or

(ii) made any material modification, including any renewal thereof, to

any term of any personal loan to any director or executive

officer of Nord, or any family member or affiliate of any

director or executive officer, which loan was outstanding on July

30, 2002; and

(bbb)neither Nord nor any of the Nord Subsidiaries has any outstanding

loans to or extensions of credit to, or any guarantee or any

indebtedness of, any employee, officer or director of Nord or any of

the Nord Subsidiaries.

3.2 Representations and Warranties of Allied

Allied represents and warrants to and in favour of Nord as follows, and

acknowledges that Nord is relying upon such representations and warranties in

connection with the matters contemplated by this Agreement:

(a) Allied is duly incorporated and validly existing under the laws of its

jurisdiction of incorporation and has the corporate power to own or

lease its property and assets and to carry on business as now

conducted;

(b) Allied has the corporate power and authority to enter into this

Agreement and, subject to obtaining the requisite approvals

contemplated hereby, to perform its obligations hereunder;

(c) subject to the approval of the holders of the Allied Shares at the

Allied Meeting, all necessary corporate action on the part of Allied

has been taken to authorize the execution and delivery of this

Agreement by Allied and the completion of the transactions

contemplated hereby and by the Plan of Arrangement, and this Agreement

has been duly executed and delivered by Allied and constitutes a valid

and binding obligation of Allied enforceable against it in accordance

with its terms;

(d) the execution and delivery of this Agreement by Allied and the

completion of the transactions contemplated hereby and by the Plan of

Arrangement do not and will not:

(i) result in the breach of, or violate any term or provision of, the

articles or by-laws of Allied;

(ii) conflict with, result in the breach of, constitute a default

under, or accelerate or permit the acceleration of the

performance required by, any agreement, instrument, license,

permit or authority to which Allied is a party or is bound, or

result in the creation of any Encumbrance upon any assets of

Allied under any such agreement, instrument, licence, permit or

authority, or give to others any interest or right, including

rights of purchase, termination, cancellation or acceleration,

under any such agreement, instrument, license, permit or

authority, where such conflict, breach, default, acceleration,

creation or giving would have a Material Adverse Effect on Allied

or could reasonably be expected to prevent or materially hinder

the completion of the Arrangement; or

(iii)violate or contravene any provision of any Australian law or

regulation or any judicial or administrative award, judgment or

decree known to Allied, where such violation or contravention

would have a Material Adverse Effect on Allied or could

reasonably be expected to prevent or materially hinder the

completion of the Arrangement;

(e) the authorized capital of Allied consists of an unlimited number of

Allied Shares, of which 28,500,000 (and no more) are issued and

outstanding as of the date hereof;

(f) as of the date of this Agreement, no person has any agreement, right

or option, or any privilege capable of becoming an agreement, right or

option, for the purchase or issuance of any unissued shares of Allied

or any material subsidiary of Allied, except for options to purchase

18,500,000 Allied Shares;

(g) neither Allied nor any of its subsidiaries is:

(i) in breach or violation of any of the provisions of its articles

or by-laws, where such breach or violation would have a Material

Adverse Effect on Allied; or

(ii) in breach or violation of any of the terms or provisions of, or

in default under, any indenture, mortgage, deed of trust, loan

agreement or other agreement (written or oral) or instrument to

which Allied is a party or by which Allied is bound or to which

any of the properties or assets of Allied is subject or any

statute or any order, rule or regulation of any court or

government or governmental agency or authority having

jurisdiction over Allied or any of its properties or assets,

where such breach, violation or default has or may have a

Material Adverse Effect on Allied;

(h) there are:

(i) no claims, actions, suits, proceedings or investigations

commenced or, to the knowledge of Allied, contemplated or

threatened against or affecting Allied or any of its

subsidiaries, before or by any Governmental Authority;

(ii) to the knowledge of Allied, no existing facts or conditions which

may reasonably be expected to be a proper basis for any claims,

actions, suits, proceedings or investigations; and

(iii)no outstanding judgments, awards, decrees, injunctions or orders

against Allied or any of its subsidiaries;

which in any case could prevent or materially hinder the completion of

the Arrangement or the Financing or which could have a Material

Adverse Effect on Allied;

(i) the Prospectus of Allied dated 20 October 2003 and the disclosure

provided in this Agreement, when taken together, constitute full, true

and plain disclosure of all material facts relating to the business,

operations and capital of Allied and its subsidiaries on a

consolidated basis and the other matters therein and do not contain

any untrue statement of a material fact or omit to state any material

fact required to be stated therein or necessary in order to make the

statements made therein not misleading in light of the circumstances

under which they were made and, in particular, no material fact exists

on the date hereof which has not been disclosed in the public filings

made by Allied and which if publicly disclosed would reflect that a

Material Adverse Change (or an event, condition or state of facts

which might reasonably have been expected to give rise to any such

change) had occurred in the assets, liabilities, business, operations

or capital of Allied and its subsidiaries on a consolidated basis; and

ARTICLE 4

COVENANTS OF NORD

4.1 Conduct of Business

Nord covenants in favour of Allied that prior to the Effective Date it

shall, and it shall cause each of the Nord Subsidiaries to, do, take or perform

or refrain from doing, taking and performing such actions and steps as may be

necessary or advisable to ensure compliance with the following:

(a) subject to Section 4.3, neither Nord nor any of the Nord Subsidiaries

will take any action which might, directly or indirectly, interfere or

be inconsistent with or otherwise adversely affect the completion of

the Arrangement or the Financing and, without limiting the generality

of the foregoing, subject to Section 4.3, each of Nord, SGC and

Australex:

(i) will carry on its business in, and only in, the ordinary course

in substantially the same manner as heretofore conducted and, to

the extent consistent with such business, use all reasonable

efforts to preserve intact its present business organization,

licences and permits to the end that its goodwill and business

shall be maintained;

(ii) will not declare any dividends on or make any other distributions

in respect of its outstanding securities and Nord will not amend

its articles or by-laws;

(iii)will not, without prior written consent of Allied, issue,

authorize or propose the issuance of, or purchase or redeem or

propose the purchase or redemption of, any of its shares of any

class or securities convertible into or rights, warrants or

options to acquire any such shares or other exchangeable or

convertible securities, other than the issue of shares pursuant

to the exercise of presently outstanding Nord Options or the

issue of securities to Allied;

(iv) will not reorganize, amalgamate or merge with any other person,

corporation, partnership or other business organization

whatsoever;

(v) will not adopt a plan of liquidation or resolutions providing for

its liquidation, dissolution, merger, amalgamation, consolidation

or reorganization;

(vi) will not relinquish any material contractual rights or enter into

any interest rate, currency or commodity swaps, hedges or other

similar financial instruments;

(vii)will not, without the prior written consent of Allied, which

shall not be unreasonably withheld, settle any material actions,

claims or liabilities;

(viii) will not, without the prior written consent of Allied, sell,

transfer, assign, convey or otherwise dispose of assets having an

aggregate market value in excess of $10,000, and Nord will not in

any way dispose of its shares of, nor allow the issuance to any

person (other than to Nord) of shares of, any subsidiary of Nord;

(ix) will not dispose of, in any way, its interests in the Joint

Venture;

(x) will not acquire or agree to acquire any assets or acquire or

agree to acquire by amalgamating, merging or consolidating with,

purchasing substantially all of the assets of or otherwise, any

business or any corporation, partnership, association or other

business organization or division thereof, other than with the

prior written consent of Allied;

(xi) will not, and shall cause each of the Nord Subsidiaries not to:

(A) enter into or modify any Employment Agreement with, or grant

any bonuses, salary increases, severance or termination pay

to or make any loan to, any officers or directors of Nord or

any of the Nord Subsidiaries except as approved in writing

by Allied; or

(B) in the case of employees who are not officers or directors,

take any action with respect to the entering into or

modifying of any employment, severance, collective

bargaining or similar agreements, policies or arrangements

or with respect to the grant of any bonuses, salary

increases, stock options, pension benefits, profit sharing,

retirement allowances, deferred compensation, incentive

compensation, severance or termination pay or any other form

of compensation or profit sharing or with respect to any

increase of benefits payable except as approved in writing

by Allied;

(xii)other than under the Facility Documents or with the prior written

consent of Allied, will not guarantee the payment of indebtedness

or incur indebtedness for additional borrowed money or issue any

debt securities;

(xiii) will not, without the prior written consent of Allied, which

shall not be unreasonably withheld, make any tax filings,

including any returns or elections, with any Governmental

Authority, and Allied will be considered to be acting reasonably

in any case where Allied requires that any tax filings not be

made until the final due date;

(xiv)will promptly make and file such corporate filings as are

required and past due under the Act;

(b) Nord, SGC and Australex shall confer on a regular basis with Allied

with respect to operational matters related to the Joint Venture,

including matters related to human resources, safety, environmental,

security, marketing and off-take arrangements as well as all Joint

Venture activities and shall make their best efforts to allow Allied

representatives to attend operation committee meetings of the Joint

Venture;

(c) Nord, SGC and Australex shall confer with Allied with respect to SGC's

and Australex's participation in any meetings of Joint Venture

Partners or the Government regarding the Joint Venture;

(d) Nord, SGC and Australex shall obtain prior written approval or

authorisation from Allied, which shall not be unreasonably withheld,

for any material decisions relating to the Joint Venture and the Joint

Venture Agreements, including, without limitation:

(i) any development proposal contemplated under the Joint Venture

Agreements;

(ii) the amendment of any of the Joint Venture Agreements or the

programs or budgets thereunder;

(iii)material changes to the development plan with respect to the

Simberi Mining Joint Venture;

(iv) material changes in the technical design basis of the Simberi

Mining Joint Venture that would lead to amendments to any of the

Joint Venture Agreements;

(v) material communications with the Government or other Joint

Venture Partners or any communications regarding legal issues;

(vi) payment of any cash calls relating to the Joint Venture;

(vii)membership in the committees under the Joint Venture Agreements

or staffing of the work to be done under the Joint Venture

Agreements;

(viii) material changes to the terms and conditions of employment for

any employee or consultant of Nord, the Nord Subsidiaries or the

Joint Venture; and

(ix) security arrangements for personnel and equipment;

(e) Nord, SGC and Australex shall comply with their obligations under the

Joint Venture Agreements and Nord shall take, and shall cause the Nord

Subsidiaries to take, all action necessary in order to keep the Joint

Venture Agreements in good standing and will make its best efforts to

pay all cash calls thereunder to prevent the interest of Nord, SGC and

Australex from being reduced;

(f) Nord shall ensure that SGC and Australex do not, without the prior

written consent of Allied, which shall not be unreasonably withheld:

(i) amend or modify any Joint Venture Agreement, or terminate or give

any notice of termination thereunder, or fail to comply with any

of its obligations thereunder, or fail to enforce compliance by

the other parties to each Joint Venture Agreement, or fail to

defend and protect its interests therein or in the Joint Venture

from all adverse claims whatsoever; and

(ii) allow any right, licence, approval, consent or authorization

related to the Joint Venture to terminate, lapse or be suspended,

or do or omit to do any act or thing that would entitle any

person to terminate, lapse or suspend the same;

(g) Nord shall not, and shall not permit the Nord Subsidiaries to create,

incur, assume or suffer to exist any Security Interest on its

properties and assets other than under Permitted Encumbrances;

(h) Nord shall comply with its obligations under the Facility Documents;

(i) Nord shall promptly and expeditiously do all acts and things as may be

necessary or desirable to ensure the successful implementation of the

Arrangement and, without limiting the generality of the foregoing:

(i) prepare or cause to be prepared the Nord 2003 Financial

Statements, and the Nord Prior Period Financial Statements (the

latter as notified to Nord by Allied) which shall be complete and

accurate in all material respects, comply with all applicable

requirements of Canadian Securities Laws and U.S. Securities

Laws, and present fairly the consolidated financial position of

Nord and the Nord Subsidiaries and the results of its operations

and cash flows as of the dates and throughout the periods

indicated in accordance with U.S. GAAP (reconciled to Canadian

GAAP), Nord and the Nord Subsidiaries shall have no material

liabilities (contingent or otherwise), on a consolidated basis,

which are not fully reflected in such statements in accordance

with U.S. GAAP, and all legal proceedings against Nord or any of

the Nord Subsidiaries which are required in accordance with U.S.

GAAP to be reflected in Nord's financial statements shall be

properly reflected in the Nord 2003 Financial Statements and the

Nord Prior Period Financial Statements (the latter as notified to

Nord by Allied) in accordance with such principles;

(ii) prepare and file, and correct any defect in any previously

prepared and filed, tax returns and information returns, and pay

all taxes, levies, assessments, reassessments, penalties,

interest and fines due and payable by it on the basis of such tax

returns or demands from taxing authorities, not previously

prepared, filed, corrected and paid, as set out in the Nord

Disclosure Letter;

(iii)subject to the granting of the Interim Order, Nord will use all

reasonable efforts, as soon as practicable and in any event on or

before April 30, 2004, to complete the preparation of the Joint

Information Circular and disseminate to the Nord Securityholders

and file in all jurisdictions where required the Joint

Information Circular and other documentation required in

connection with the Nord Meeting, all in accordance with National

Instrument 54-101 of the Canadian Securities Administrators, the

requirements of the U.S. Securities Laws, the Interim Order and

applicable law, and Nord will use all reasonable efforts to, as

soon as practicable and in any event on or before June 25, 2004,

convene the Nord Meeting for the purpose of approving the

Arrangement in accordance with the Interim Order;

(iv) Nord will cause a list of Nord Securityholders as of the record

date for the Nord Meeting, in a form suitable for soliciting of

Nord Securityholders and prepared by the transfer agent of Nord,

to be delivered to Allied no later than the second business day

after such record date; and

(v) Nord will use all reasonable efforts to promptly and

expeditiously perform its obligations under this Agreement and

cause each of the conditions precedent set forth in Sections 7.1,

7.2 and 7.3, to the extent it is within its control, to be

complied with;

provided that nothing contained herein shall obligate Nord to waive

any condition for its benefit contained herein;

(j) Nord will provide Allied in a timely and expeditious manner with all

information relating to Nord and the Nord Subsidiaries required to be

included in the Joint Information Circular, including the Nord 2003

Financial Statements, in order for the Joint Information Circular to

comply with all applicable disclosure laws and the Interim Order;

(k) Nord shall cause the resignation, effective as of the Effective Date,

of such of the directors of Nord and the Nord Subsidiaries as is

requested by Allied not less than three business days prior to the

Nord Meeting;

(l) Nord shall cause its current insurance policies, whether held by it or

another entity, not to be cancelled or terminated or any of the

coverage thereunder to lapse, unless simultaneously with such

termination, cancellation or lapse, replacement policies underwritten

by insurance companies of nationally recognized standing providing

coverage equal to or greater than the coverage under the cancelled,

terminated or lapsed policies for substantially similar premiums are

in full force and effect; and

(m) Nord shall:

(i) use its best efforts, and cause each of the Nord Subsidiaries to

use its best efforts, to preserve intact their respective