SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

Commission File Number: 000-19182

For the month of: February 2005

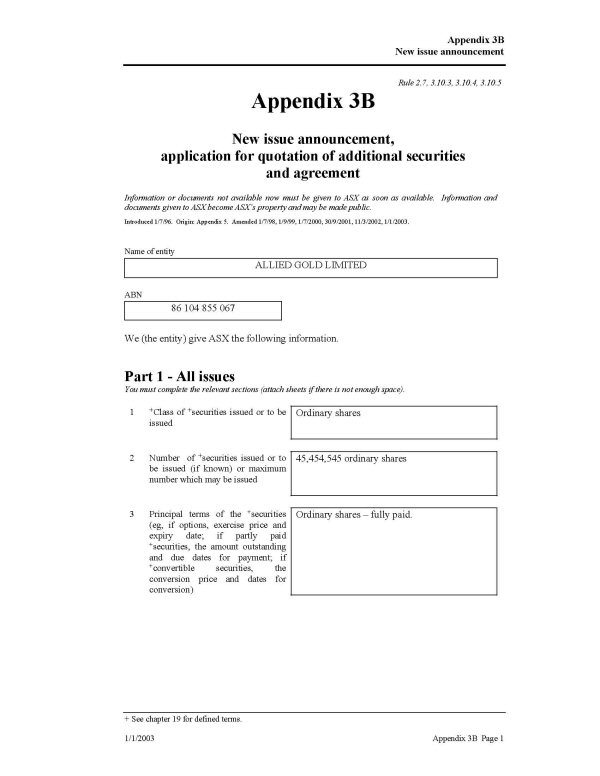

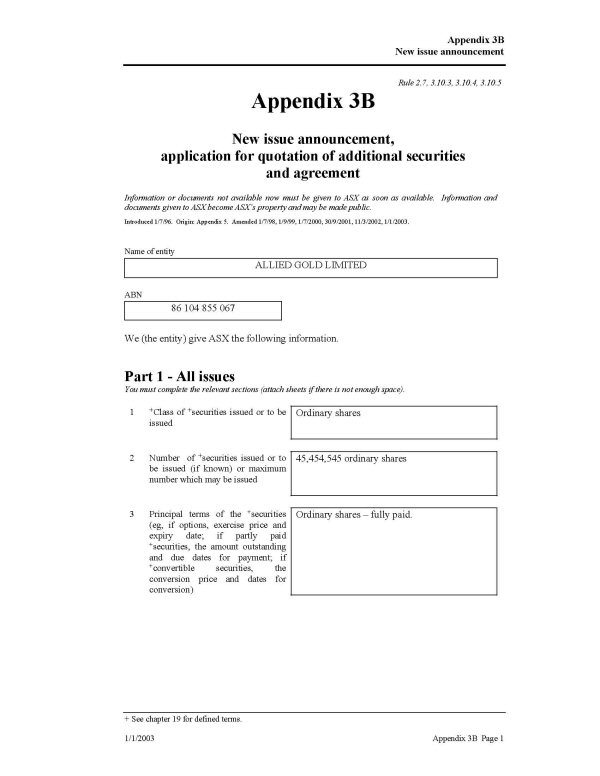

| ALLIED GOLD LIMITED |

| (Translation of registrant’s name into English) |

| Unit 15, Level 1, 51-53 Kewdale Road, Welshpool, W.A. 6106 Australia |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

-1-

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ALLIED GOLD LIMITED

(Registrant) |

| Date: May 12, 2005 | By: /s/ David Lymburn

David Lymburn

Corporate Secretary |

EXHIBIT INDEX

-2-

EXHIBIT 1

EXHIBIT 2

| ALLIED GOLD LTD

ACN 104 855 067

ABN 86 104 855 067 | Unit 15, Level 1, 51-53 Kewdale Road

Welshpool, Western Australia 6106

PO Box 235, Welshpool DC 6986

Telephone: 61 8 9353 3638

Facsimile: 61 8 9353 4894

Email: info@alliedgold.com.au

Web: www.alliedgold.com.au |

22 February 2005

Dear Shareholder

Share Purchase Plan

The Board of Directors of Allied Gold Limited (AlliedorCompany) has approved the introduction of a Share Purchase Plan (Plan). The Plan entitles Eligible Shareholders in the Company, irrespective of the size of their shareholding, to purchase up to $5,000 worth of ordinary fully paid shares in the Company (Shares) free from all brokerage and commissions (Offer).

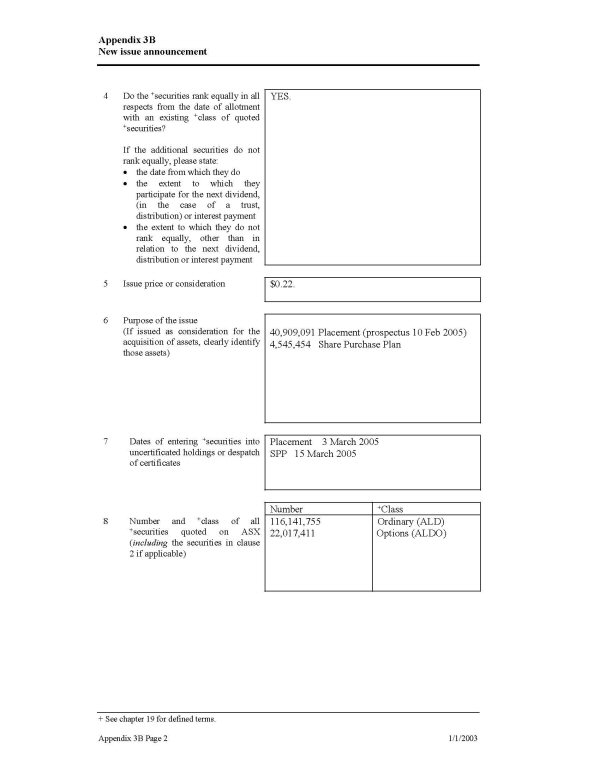

Price of Shares Under the Offer

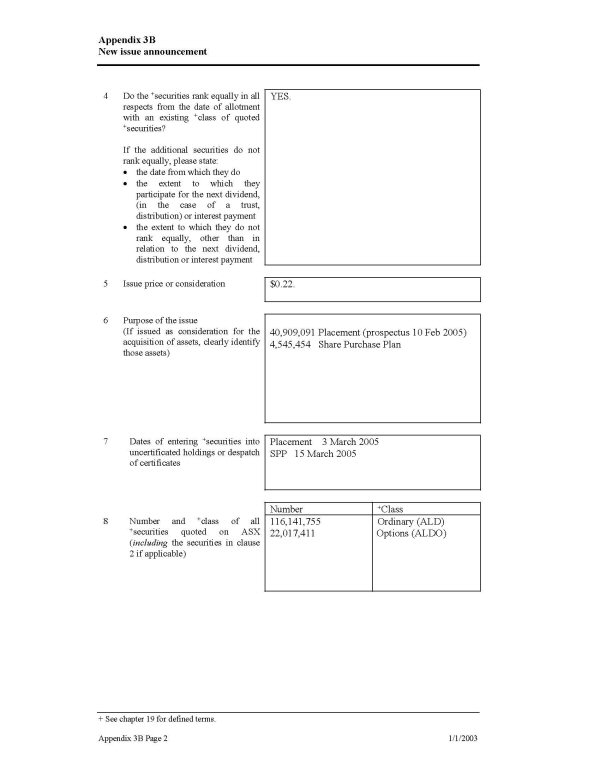

The purchase price of the new shares being offered under the Plan has been set at 22 cents per Share. This represents approximately a10% discount to the average market price calculated over the last 5 days on which sales of Shares were recorded on the ASX before 10 February 2005, the day Allied announced the Offer.

The Offer price has been set at 22 cents to match the offer price in the placement of shares that is currently in progress pursuant to a Prospectus dated 10 February 2005.

The average closing market price of Shares in Allied traded on the ASX during the 5 trading days immediately prior to the date of the announcement of the SPP on 10 February 2005 was 24.3 cents per share.

The Offer is not underwritten.

Current Projects

Details of the Company’s current activities are set out in the announcements made by Allied to the ASX and are available from the ASX or Allied’s website at www.alliedgold.com.au.

The funds raised under the Plan will be used by the Company to increase working capital and to fund the Company’s current activities.

Shareholders Eligible to Participate in the Plan

The right to participate in the Offer under the Plan is available exclusively to shareholders who are registered as holders of Shares in Allied at 5pm (WST) on the record date of21 February 2005 and whose registered address is in Australia or New Zealand (Eligible Shareholders).

Subscription and Application Procedure

If you would like to participate in the Offer, please return your completed Application Form, together with your cheque for the subscription monies for the number of Shares you wish to acquire to Computershare Investor Services Pty Ltd on or before theclosing date of 5pm (WST) on 8 March 2005.No late applications will be accepted.

Please note that the statutory maximum investment per shareholder under the Plan is $5,000.

Under the Plan, a shareholder may only elect to purchase shares from one of the offers outlined below:

|

| Offer | Number of shares | Payment |

|---|

|

| A | | 22,727 | | $ 4,999.94 | |

|

| B | | 18,182 | | $ 4,000.04 | |

|

| C | | 13,636 | | $ 2,999.92 | |

|

| D | | 9,091 | | $ 2,000.02 | |

|

| E | | 4,545 | | $ 999.90 | |

|

The maximum investment that each shareholder may apply for will remain $5,000 even if a shareholder receives more than one Offer (whether in respect of a joint holding or because the shareholder has more than one holding under a separate account).

Additional Information and Important Dates

The Offer cannot be transferred and the Directors of the Company reserve the right to reject any application over $5,000. Shares allotted under the Plan will be issued no later than 5 business days after the closing date of the Offer. Application for quotation on ASX of the new Shares will be made immediately following the issue of those Shares.

The Offer of Shares under the Plan is limited to 4,545,454. However, the Company reserves the right to accept oversubscriptions. In the event that oversubscriptions are not accepted, Shares will be allocated to applicants on a pro-rata basis.

If the Company rejects or scales-back an application or purported application, the Company will promptly return to the shareholder the relevant application monies, without interest.

The market price of the Shares in the Company may rise and fall between the date of the Offer and the date that any Shares are allotted to you as a result of your acceptance of this Offer. This means that the subscription price you pay for the Shares may exceed the market price of the Shares at the date of allotment of Shares under this Offer. The Board recommends that you obtain your own financial advice in relation to the Offer and consider price movements of Shares in the Company prior to accepting this Offer.

Offers made under the Plan are not renounceable (i.e. eligible shareholders may not transfer their rights to any Allied Shares offered under the Plan).

Indicative Timetable

| |

|---|

|

| Opening date of Offer | | 22 February 2005 | |

|

| Closing date of Offer | | 8 March 2005 | |

|

| Issue of Shares under the Plan | | 15 March 2005 | |

|

| Quotation of Shares on ASX | | 16 March 2005 | |

|

These dates are indicative only. The Company may vary the dates and times of the Offer without notice. Accordingly, shareholders are encouraged to submit their Entitlement and Acceptance Forms as early as possible.

Should you wish to discuss any information contained in this letter further, do not hesitate to contact the Company Secretary, David Lymburn, on (08) 9353 3638.

Yours faithfully

Jeff Moore

Managing Director

ALLIED GOLD LIMITED

ACN 104 855 067

SHARE PURCHASE PLAN

TERMS AND CONDITIONS

Purpose

The purpose of the Share Purchase Plan (the Plan) is to offer shareholders of Allied Gold Limited (CompanyorAllied) the opportunity to acquire additional fully paid ordinary shares in the Company (Allied Shares) without the need for Allied to issue a prospectus, upon such terms and conditions as the board of directors of Allied, in its absolute discretion, sees fit.

Shareholders eligible to participate

Eligible holders of Allied Shares that are registered with an Australian or New Zealand address at the relevant record date may participate in the Plan. Due to foreign securities laws, it is not practical for shareholders resident in other countries to be offered the opportunity to participate in the Plan.

Participation in the Plan is optional and is subject to these terms and conditions. Offers made under the Plan are not renounceable (ie. eligible shareholders may not transfer their rights to any Allied Shares offered under the Plan).

An offer may, at the discretion of the directors of Allied, be made under the Plan once a year. The maximum amount, which any shareholder may subscribe for in any consecutive 12 month period, is A$5,000. The directors may also determine in their discretion the minimum amount for participation, the multiple of Allied Shares to be offered under the Plan and the period the offer is available to eligible shareholders.

Price of Allied Shares

The price of Allied Shares to be issued under the Plan will be determined by calculating a discount to the average market price of Allied Shares traded on the ASX during the period of five days immediately prior to an announcement by Allied and/or the relevant record date specified by the directors of Allied as the date for determining eligibility of shareholders to participate in an offer of shares under the Plan.

Applications and Notices

At the discretion of the directors of Allied, Allied will send eligible shareholders a letter of offer and acceptance procedures, inviting them to subscribe for Allied Shares under the Plan, and accompanied by the terms and conditions of the Acceptance Form. Applications will not be accepted after the closing date of an offer. Over subscriptions to an offer may be refunded without interest.

Notices and statements made by Allied to participants may be given in any manner prescribed by its Constitution.

Underwriting

An Offer may be underwritten and the underwriters and/or sub-underwriters may be issued with Shares pursuant to the Plan where one or more of the eligible shareholders fail to subscribe for the maximum number of shares available to them under the Offer. The Directors may pay a brokers fee to Underwriters.

Issue of Allied Shares

Allied Shares to be issued under the Plan will be issued as soon as reasonably

practicable after the closing date specified by the Directors of Allied in the relevant offer.

Allied Shares issued under the Plan will rank equally in all respects with all other fully paid ordinary shares in Allied from the date of issue.

Shareholding statements or CHESS notification will be issued in respect of all Allied Shares issued under the Plan. Allied will, promptly after the issue of Allied Shares under the Plan, make application for those Allied Shares to be listed for quotation on the official list of ASX.

Modification and Termination of the Plan

Allied may modify or terminate the Plan at any time.

Allied will notify ASX of any modification to, or termination of, the Plan. The omission to give notice of any modification to, or termination of, the Plan or the failure of ASX to receive such notice will not invalidate the modification or termination.

Without limiting the above, Allied may issue to any person fewer Allied Shares than the person applied for under the Plan if the issue of the Allied Shares applied for would contravene any applicable law or the Listing Rules of ASX.

Dispute Resolution

Allied may, in any manner it thinks fit, settle any difficulties, anomalies or disputes which may arise in connection with or by reason of the operation of the Plan, whether generally or in relation to any participant, application or Allied Shares. The decision of Allied in this respect will be conclusive and binding on all shareholders and other persons to whom that determination relates.

Allied reserves the right to waive strict compliance with any provision of these terms and conditions. The powers of Allied under these conditions maybe exercised by the directors of Allied or any delegate of the directors of Allied.

Questions and Contact Details

If you have any questions regarding the Share Purchase Plan or how to deal with this Offer, please contact your stockbroker or professional adviser or the Company Secretary, David Lymburn, on (08) 9353 3638.

EXHIBIT 3

| ALLIED GOLD LTD

ACN 104 855 067

ABN 86 104 855 067 | Unit 15, Level 1, 51-53 Kewdale Road

Welshpool, Western Australia 6106

PO Box 235, Welshpool DC 6986

Telephone: 61 8 9353 3638

Facsimile: 61 8 9353 4894

Email: info@alliedgold.com.au

Web: www.alliedgold.com.au |

28 February 2005

Australian Stock Exchange

Company Announcements Office

Closure of Placement

Allied Gold Limited advises that the placement to raise $9,000,000 pursuant to a prospectus dated 10 February 2005 has now closed, fully subscribed.

The expected dated of allotment of the shares is 4 March 2005.

David Lymburn

Director / Company Secretary