Washington, D.C. 20549

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055

| |

| Fund Summary as of January 31, 2014 | BlackRock Emerging Markets Long/Short Equity Fund |

| | |

Investment Objective

BlackRock Emerging Markets Long/Short Equity Fund’s (the “Fund”) investment objective is to seek total return over the long term.

Portfolio Management Commentary

How did the Fund perform?

| • | | For the six-month period ended January 31, 2014, the Fund underperformed its benchmark, the BofA Merrill Lynch 3-Month US Treasury Bill Index. |

What factors influenced performance?

| • | | As part of its investment strategy, the Fund uses derivatives, including total return swaps, to achieve exposure to a market or to manage market and/or equity risks. Through its use of total return swaps, the Fund’s performance is attributable to effective stock selection based on bottom-up security analysis coupled with a long-short approach to controlling the Fund’s exposure to trends in emerging markets. |

| • | | Stock selection had a negative impact on returns during the period, particularly in China. The largest detractors were the Fund’s short positions on stocks that had appreciated significantly and became expensive when measured against the company’s assets and/or earnings. Most notably, a short position in Korean shipbuilder Hyundai Mipo Dockyard hurt results. The fundamentals for this company have been weak due to global overcapacity in shipbuilding. Nevertheless, the stock price surged higher during the period. |

| • | | The Fund’s long net market positioning was a small contributor to performance for the period. (The net market position is the difference between the Fund’s total long positions and total short positions.) Specifically, the Fund held nearly 30% net long exposure in September and October 2013 when the market moved up more than 11%. The Fund’s net long exposure averaged 24% from November 2013 to January 2014, during which the market declined nearly 10%. The Fund used net market exposure as a risk management tool to protect against market volatility by bringing the net exposure down to 15% by January 31, 2014, which is 5% below the Fund’s target level of 20%. |

| • | | The Fund succeeded in mitigating many of the risks inherent in emerging market investing. Throughout this volatile period, the Fund maintained its portfolio volatility at a level that was 40% or lower than that of the emerging equity market. |

Describe recent portfolio activity.

| • | | Throughout this period, the investment advisor continued to rely largely upon measures of consistency in fundamentals to drive decisions in taking key long and short positions but also took into account material price movements or changing information while seeking to capitalize upon these trends. Despite some episodic payoffs, positions driven by companies’ prices relative to their assets and earnings struggled during the period. The Fund reduced exposure to those companies and increased exposure to companies that have improving fundamentals and a positive earnings outlook. |

| • | | The Fund’s cash exposure had no material impact on performance as the Fund expresses long and short positions via the use of derivatives. The Fund was fully invested throughout the period. |

Describe portfolio positioning at period end.

| • | | As of period end, the Fund held a reduced net market exposure driven mainly by market sentiment and the recent decline in global initial public offerings and acquisition announcements. In addition to fundamental stock selection, the Fund sought to capitalize on stock selection within baskets of stocks relating to bigger picture, macro themes. This is particularly important given the divergence in performance across emerging market countries that materialized in 2013. While selecting specific stocks continues to be the Fund’s central investment theme, the importance of macro sensitivities and other factors has expanded and provides a wide range of opportunity for exploring investment themes. The Fund also maintained an allocation to “emerging markets in developed markets” in order to capitalize on the segmentation bias among emerging market investors. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | BLACKROCK FUNDS | JANUARY 31, 2014 |

| |

| | BlackRock Emerging Markets Long/Short Equity Fund |

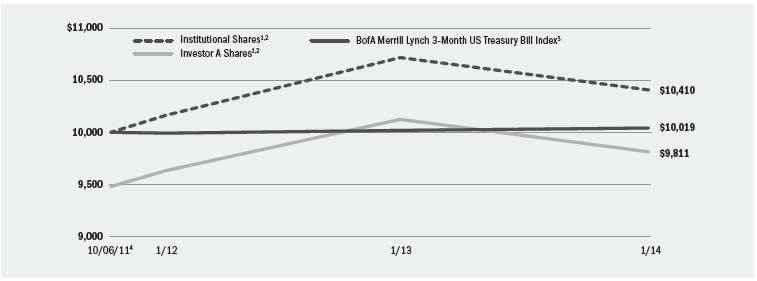

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | Under normal conditions, the Fund invests at least 80% of its total assets in global equity instruments and related derivative instruments issued by, or tied economically to, companies in emerging markets. |

| 3 | | An unmanaged index that tracks 3-month US Treasury securities. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended January 31, 2014

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | Since Inception6 | |

| | | | | 6-Month

Total Returns | | w/o sales

charge | | w/sales

charge | | w/o sales

charge | | w/sales

charge |

Institutional | | | | | (3.46 | )% | | | (2.92 | )% | | | N/A | | | | 1.75 | % | | | N/A | |

Investor A | | | | | (3.55 | ) | | | (3.10 | ) | | | (8.18 | )% | | | 1.51 | | | | (0.82 | )% |

Investor C | | | | | (3.90 | ) | | | (3.90 | ) | | | (4.86 | ) | | | 0.71 | | | | 0.71 | |

BofA Merrill Lynch 3-Month US Treasury Bill Index | | | | | 0.03 | | | | 0.08 | | | | N/A | | | | 0.08 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on October 6, 2011. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| | Actual | | Hypothetical8 |

| | | Beginning

Account Value

August 1, 2013 | | Ending

Account Value

January 31, 2014 | | Expenses Paid

During the Period7 | | Beginning

Account Value

August 1, 2013 | | Ending

Account Value

January 31, 2014 | | Expenses Paid

During the Period7 | | Annualized

Expense Ratio |

| Institutional | | $ | 1,000.00 | | | $ | 966.30 | | | $ | 8.67 | | | $ | 1,000.00 | | | $ | 1,016.38 | | | $ | 8.89 | | | | 1.75 | % |

| Investor A | | $ | 1,000.00 | | | $ | 965.40 | | | $ | 9.56 | | | $ | 1,000.00 | | | $ | 1,015.48 | | | $ | 9.80 | | | | 1.93 | % |

| Investor C | | $ | 1,000.00 | | | $ | 961.00 | | | $ | 13.30 | | | $ | 1,000.00 | | | $ | 1,011.64 | | | $ | 13.64 | | | | 2.69 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated.

| BLACKROCK FUNDS | JANUARY 31, 2014 | 5 |

| |

| Fund Summary as of January 31, 2014 | BlackRock Global Long/Short Equity Fund |

| | |

Investment Objective

BlackRock Global Long/Short Equity Fund’s (the “Fund”) investment objective is to seek total return over the long term.

Portfolio Management Commentary

How did the Fund perform?

| • | | For the six-month period ended January 31, 2014, the Fund outperformed its benchmark, the BofA Merrill Lynch 3-Month US Treasury Bill Index. |

What factors influenced performance?

| • | | As part of its investment strategy, the Fund uses derivatives, including total return swaps, to achieve exposure to a market or to manage market and/or equity risks. Through its use of total return swaps, the Fund’s performance is attributable to effective stock selection based on bottom-up security analysis coupled with a long-short approach to controlling the Fund’s exposure to trends in global equity markets. |

| • | | The largest positive return contributions came from country and industry positioning, while relative stock selection and the Fund’s net long positions also added value. With respect to country positioning, a long position in Spanish stocks had a positive impact as the country exited recession in late 2013 and unemployment started to fall from high levels. This boosted the country’s stocks and long positions in names such as clothing retailer Inditex SA and banks Bankinter SA and Banco Bilbao Vizcaya Argentaria SA performed particularly well. From an industry perspective, the Fund benefited from long positions in aerospace & defense including Raytheon Co. and Northrop Grumman Corp., which rallied on a resolution to the US government shutdown and a deal to raise the debt ceiling. Within internet software & services, long positions in IAC/InterActiveCorp, VeriSign, Inc. and Facebook, Inc. were notable contributors. |

| • | | Relative stock selection in US, UK and French names had a positive impact on results. In particular, a short position in UK supermarket Tesco proved beneficial as the stock declined after the company reported that it had, along with the other big-4 supermarkets, lost further market share to discount retailers Aldi and Lidl. In addition, the Fund benefited from positions that were predicated on the anticipated impact of reduced global liquidity, particularly in US names. The Fund’s overall net long exposure also provided a small lift to performance as equity markets rallied toward the end of 2013. |

| • | | Detracting from performance was a net short position in Japan as a weakening yen supported the country’s exporters and drove stock prices higher. The Fund reduced this short exposure at the end of 2013 as the yen weakened further. Also having a negative impact was a long position in Norwegian stocks, which broadly declined after the country posted disappointing economic data. Norwegian telecom firm Telenor ASA was a particularly poor performer for the period. From an individual stock perspective, the largest detractor was the Fund’s long position in direct selling company Nu Skin Enterprises, Inc. (US). The stock sold off in January 2014 after the Chinese government announced it would open an investigation into the operations of the company. The company derives approximately 25% of revenues from Chinese consumers. |

Describe recent portfolio activity.

| • | | The Fund maintained an overall net long market position for much of the six-month period. (The net market position is the difference between the Fund’s total long positions and total short positions.) However, the Fund reduced its total long positions in the latter part of the period as equities began to look increasingly expensive relative to other asset classes and investor enthusiasm began to show signs of weakening. In January 2014, the Fund moved to a net short market position. |

| • | | The Fund began the period with a net long position in the UK with a focus on stocks with high exposure to the domestic economy. However, after a strong rally, economic indicators weakened in the fourth quarter of 2013 and the Fund moved to a net short position in UK stocks. After maintaining short positions in Australia and Canada for much of 2013, the Fund moved to large long positions in these countries given expectations that both economies will benefit from weakness in their local currencies spurring export growth. Also during the period, the Fund moved from short to long positions in both the energy and materials sectors. |

| • | | The Fund’s cash exposure had no material impact on performance as the Fund expresses long and short positions via the use of derivatives. The Fund was fully invested throughout the period. |

Describe portfolio positioning at period end.

| • | | As of period end, the Fund’s overall net market exposure was short at approximately (1.4)% of net assets, reflecting a cautious view on stock price valuations and market sentiment. However, the Fund continued to be positioned to benefit from global growth with long exposure to high-growth, cyclical industries including internet software & services and media, and short exposure to defensive, non-cyclical segments such as utilities, food producers and food retailers. In contrast, the Fund was positioned for a slowdown in emerging economies, with short positions in exporters that have high exposure to emerging markets such as Nestle and Unilever. The Fund’s negative view on core European countries such as the UK, Switzerland and France has been mainly driven by this positioning. The Fund remained long in peripheral European countries including Italy and Spain due to attractive valuations relative to core European countries and the continuation of inflows from foreign investors. The Fund also remained long in Sweden given the central bank’s determination to stimulate the economy and increase inflation with loose monetary policy. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 6 | BLACKROCK FUNDS | JANUARY 31, 2014 |

| |

| | BlackRock Global Long/Short Equity Fund |

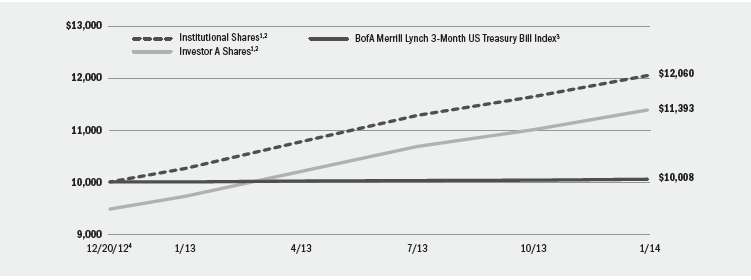

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | Under normal conditions, the Fund invests at least 80% of its total assets in equity instruments and related derivative instruments issued by, or tied economically to, companies located in developed markets. |

| 3 | | An unmanaged index that tracks 3-month US Treasury securities. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended January 31, 2014

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | Since Inception6 | |

| | | | | 6-Month

Total Returns | | w/o sales

charge | | w/sales

charge | | w/o sales

charge | | w/sales

charge |

Institutional | | | | | 6.82 | % | | | 17.55 | % | | | N/A | | | | 18.29 | % | | | N/A | |

Investor A | | | | | 6.60 | | | | 17.20 | | | | 11.05 | % | | | 17.98 | | | | 12.41 | % |

Investor C | | | | | 6.22 | | | | 16.38 | | | | 15.38 | | | | 17.13 | | | | 17.13 | |

BofA Merrill Lynch 3-Month US Treasury Bill Index | | | | | 0.03 | | | | 0.08 | | | | N/A | | | | 0.07 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on December 20, 2012. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| | Actual | | Hypothetical8 | | |

| | | Beginning

Account Value

August 1, 2013 | | Ending

Account Value

January 31, 2014 | | Expenses Paid

During the Period7 | | Beginning

Account Value

August 1, 2013 | | Ending

Account Value

January 31, 2014 | | Expenses Paid

During the Period7 | | Annualized

Expense Ratio |

| Institutional | | $ | 1,000.00 | | | $ | 1,068.20 | | | $ | 8.86 | | | $ | 1,000.00 | | | $ | 1,016.64 | | | $ | 8.64 | | | | 1.70 | % |

| Investor A | | $ | 1,000.00 | | | $ | 1,066.20 | | | $ | 10.05 | | | $ | 1,000.00 | | | $ | 1,015.48 | | | $ | 9.80 | | | | 1.93 | % |

| Investor C | | $ | 1,000.00 | | | $ | 1,062.20 | | | $ | 13.88 | | | $ | 1,000.00 | | | $ | 1,011.75 | | | $ | 13.54 | | | | 2.67 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated.

| BLACKROCK FUNDS | JANUARY 31, 2014 | 7 |

| • | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| • | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. |

| • | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. |

Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in each of the performance tables on the previous pages assume reinvestment of all dividends and distributions, if any, at net asset value (“NAV”) on the ex-dividend dates. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, waived and/or reimbursed a portion of each Fund’s expenses. Without such waiver and/or reimbursement, each Fund’s performance would have been lower. The Manager is under no obligation to waive or reimburse or to continue waiving or reimbursing its fees after the applicable termination date. See Note 4 of the Notes to Financial Statements for additional information on waivers and reimbursements.

Shareholders of each Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, and other Fund expenses. The expense examples shown on the previous pages (which are based on a hypothetical investment of $1,000 invested on August 1, 2013 and held through January 31, 2014) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| 8 | BLACKROCK FUNDS | JANUARY 31, 2014 |

| |

| Derivative Financial Instruments | |

The Funds may invest in various derivative financial instruments, including financial futures contracts, foreign currency exchange contracts and swaps, as specified in Note 3 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to hedge market and/or equity risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment, may result in lower dividends paid to shareholders and/or may cause a Fund to hold an investment that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

Portfolio Information as of January 31, 2014

BlackRock Emerging Markets Long/Short Equity Fund

| | | | Percent of Total Investments1 | |

| Geographic Allocation | | | | Long | | Short | | Total |

Taiwan | | | | | 10 | % | | | 8 | % | | | 18 | % |

China | | | | | 10 | | | | 5 | | | | 15 | |

Republic of Korea | | | | | 8 | | | | 7 | | | | 15 | |

Brazil | | | | | 4 | | | | 4 | | | | 8 | |

Russia | | | | | 4 | | | | 4 | | | | 8 | |

Hong Kong | | | | | 3 | | | | 6 | | | | 9 | |

South Africa | | | | | 3 | | | | 4 | | | | 7 | |

Mexico | | | | | 3 | | | | 3 | | | | 6 | |

Malaysia | | | | | 2 | | | | 1 | | | | 3 | |

Turkey | | | | | 2 | | | | 1 | | | | 3 | |

Thailand | | | | | 2 | | | | 0 | | | | 2 | |

Poland | | | | | 1 | | | | 1 | | | | 2 | |

Philippines | | | | | 1 | | | | 0 | | | | 1 | |

Chile | | | | | 1 | | | | 0 | | | | 1 | |

United Kingdom | | | | | 1 | | | | 0 | | | | 1 | |

Other2 | | | | | 0 | | | | 1 | | | | 1 | |

Total | | | | | 55 | % | | | 45 | % | | | 100 | % |

BlackRock Global Long/Short Equity Fund

| | | | Percent of Total Investments1 | |

| Geographic Allocation | | | | Long | | Short | | Total |

United States | | | | | 21 | % | | | 24 | % | | | 45 | % |

Japan | | | | | 4 | | | | 4 | | | | 8 | |

United Kingdom | | | | | 2 | | | | 5 | | | | 7 | |

Netherlands | | | | | 3 | | | | 2 | | | | 5 | |

Switzerland | | | | | — | | | | 4 | | | | 4 | |

Norway | | | | | 4 | | | | — | | | | 4 | |

France | | | | | — | | | | 4 | | | | 4 | |

China | | | | | 4 | | | | — | | | | 4 | |

Germany | | | | | 1 | | | | 2 | | | | 3 | |

Canada | | | | | 3 | | | | — | | | | 3 | |

Sweden | | | | | 1 | | | | 2 | | | | 3 | |

Australia | | | | | 2 | | | | — | | | | 2 | |

Hong Kong | | | | | 2 | | | | — | | | | 2 | |

Ireland | | | | | — | | | | 2 | | | | 2 | |

Other2 | | | | | 3 | | | | 1 | | | | 4 | |

Total | | | | | 50 | % | | | 50 | % | | | 100 | % |

| 1 | | Total investments include the gross notional values of long and short positions of the underlying derivative contracts utilized by the Fund and exclude short-term securities. |

| 2 | | Includes holdings within countries representing 1% or less of long-term investments. Please refer to the Schedules of Investments for such countries. |

| | | |

| BLACKROCK FUNDS | JANUARY 31, 2014 | 9 |

| |

| Schedule of Investments January 31, 2014 (Unaudited) | BlackRock Emerging Markets Long/Short Equity Fund

(Percentages shown are based on Net Assets) |

Short-Term Securities

| | | | Shares | | Value |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.03% (a)(b) | | | | | | 601,727,131 | | $ | 601,727,131 | |

Total Short-Term Securities

(Cost — $601,727,131*) — 100.2% | | | | | | | | | 601,727,131 | |

Liabilities in Excess of Other Assets — (0.2)% | | | | | | | | | (1,403,979 | ) |

Net Assets — 100.0% | | | | | | | | $ | 600,323,152 | |

Notes to Schedule of Investments

| * | | | | Cost for federal income tax purposes. |

| (a) | | | | Investments in issuers considered to be an affiliate of the Fund during the six months ended January 31, 2014, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

Affiliate

| | | | Shares Held at

July 31, 2013 | | Net

Activity | | Shares Held at

January 31, 2014 | | Income |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | | | 622,257,520 | | | | (20,530,389 | ) | | | 601,727,131 | | | $ | 124,445 | |

| (b) | | | | Represents the current yield as of report date. |

| • | | | | Total return swaps outstanding as of January 31, 2014 were as follows:1 |

Reference Entity

| | | | Counterparty | | Expiration Dates | | Notional

Amount | | Unrealized

Appreciation | | Net Value of

Reference

Entities |

Equity Securities Long/Short: | | | | Goldman Sachs & Co. | | 2/06/14 – 8/03/15 | | $ | 38,076,863 | | | $ | 4,231,006 | 2 | | $ | 42,012,097 | |

| | | | Morgan Stanley & Co, Inc. | | 10/09/14 – 7/11/16 | | $ | 35,629,221 | | | | 7,684,319 | 3 | | | 41,369,851 | |

| | | | UBS AG | | 2/28/14 – 5/02/18 | | $ | 41,822,339 | | | | 1,692,285 | 4 | | | 43,812,781 | |

Total | | | | | | | | | | | | $ | 13,607,610 | | | $ | 127,194,729 | |

| 1 | | The Fund receives or pays the total return on the long and short positions underlying the total return swap and pays or receives a specific LIBOR or Federal Funds floating rate, which is denominated in various foreign currencies based on the currencies of the securities underlying the total return swap. |

| 2 | | Amount includes $295,772 of dividends and financing fee due to/from the Fund and/or the counterparty. |

| 3 | | Amount includes $1,943,689 of dividends and financing fee due to/from the Fund and/or the counterparty. |

| 4 | | Amount includes $(298,157) of dividends and financing fee due to/from the Fund and/or the counterparty. |

Portfolio Abbreviations

To simplify the listings of portfolio holdings in the Schedules of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list: | ADR

AUD

CAD

CHF

EUR

GDR

JPY

NOK

SEK

SGD

USD | American Depositary Receipts

Australian Dollar

Canadian Dollar

Swiss Franc

Euro

Global Depositary Receipts

Japanese Yen

Norwegian Krone

Swedish Krona

Singapore Dollar

US Dollar |

See Notes to Financial Statements.

| 10 | BLACKROCK FUNDS | JANUARY 31, 2014

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

The following table represents the individual long and short positions and related values of equity securities underlying the total return swap with Goldman Sachs & Co. as of January 31, 2014, expiration dates 2/06/14 — 8/03/15:

| | | | | Shares | | Value |

Reference Entity — Long |

Brazil | | | | | | | | | | |

AES Tiete SA, Preference Shares | | | | | 114,100 | | | $ | 892,658 | |

Bradespar SA, Preference Shares | | | | | 198,500 | | | | 1,834,269 | |

Braskem SA, Preference A Shares | | | | | 31,900 | | | | 245,603 | |

Cia Brasileira de Distribuicao Grupo Pao de Acucar — ADR | | | | | 89,408 | | | | 3,421,644 | |

Cia Brasileira de Distribuicao Grupo Pao de Acucar, Preference Shares | | | | | 94,700 | | | | 3,665,173 | |

Cia Energetica de Minas Gerais, Preference Shares | | | | | 7,248 | | | | 41,838 | |

Cia Energetica de Sao Paulo, Preference B Shares | | | | | 1,600 | | | | 15,296 | |

Cia Paranaense de Energia — ADR | | | | | 65,107 | | | | 746,126 | |

Cia Paranaense de Energia, Preference B Shares | | | | | 10,282 | | | | 118,574 | |

Estacio Participacoes SA | | | | | 14,400 | | | | 111,644 | |

Even Construtora e Incorporadora SA | | | | | 381,000 | | | | 1,130,409 | |

Randon Participacoes SA, Preference Shares | | | | | 36,300 | | | | 140,191 | |

Vale SA, Preference Shares — ADR | | | | | 346,927 | | | | 4,260,264 | |

Vale SA, Preference A Shares | | | | | 326,900 | | | | 4,063,814 | |

Valid Solucoes e Servicos de Seguranca em Meios de Pagamento e Identificacao SA | | | | | 77,200 | | | | 962,901 | |

| | | | | | | | | 21,650,404 | |

Chile | | | | | | | | | | |

Enersis SA — ADR | | | | | 234,848 | | | | 3,116,433 | |

China | | | | | | | | | | |

Agricultural Bank of China Ltd., Class H | | | | | 873,000 | | | | 381,106 | |

Bank of China Ltd., Class H | | | | | 3,846,000 | | | | 1,623,320 | |

BBMG Corp., Class H | | | | | 808,000 | | | | 631,880 | |

China Citic Bank Corp. Ltd., Class H | | | | | 134,000 | | | | 64,276 | |

China Communications Construction Corp. Ltd., Class H | | | | | 7,153,000 | | | | 5,205,408 | |

China Merchants Bank Co. Ltd., Class H | | | | | 31,111 | | | | 54,799 | |

China Oilfield Services Ltd., Class H | | | | | 758,000 | | | | 2,032,825 | |

China Railway Construction Corp., Class H | | | | | 2,218,000 | | | | 1,850,394 | |

China Railway Group Ltd., Class H | | | | | 759,000 | | | | 337,396 | |

Coolpad Group Ltd. | | | | | 1,292,000 | | | | 695,859 | |

Dongfeng Motor Group Co. Ltd., Class H | | | | | 2,764,000 | | | | 4,069,762 | |

Fosun International Ltd. | | | | | 320,000 | | | | 344,050 | |

Greentown China Holdings Ltd. | | | | | 565,500 | | | | 805,884 | |

Guangzhou Pharmaceutical Co. Ltd. | | | | | 178,000 | | | | 577,675 | |

Guangzhou R&F Properties Co. Ltd., Class H | | | | | 1,085,200 | | | | 1,445,388 | |

Industrial and Commercial Bank of China Ltd., Class H | | | | | 179,000 | | | | 110,364 | |

Jiangsu Expressway Co. Ltd., Class H | | | | | 1,984,000 | | | | 2,490,857 | |

Kingsoft Corp. Ltd. | | | | | 791,000 | | | | 2,581,104 | |

Lonking Holdings Ltd. | | | | | 4,745,000 | | | | 952,298 | |

Shanghai Industrial Holdings Ltd. | | | | | 255,000 | | | | 849,717 | |

Sinopharm Group Co., Class H | | | | | 194,800 | | | | 549,362 | |

Tencent Holdings Ltd. | | | | | 134,500 | | | | 9,429,778 | |

Tingyi Cayman Islands Holding Corp. | | | | | 828,000 | | | | 2,142,239 | |

Zhejiang Expressway Co. Ltd., Class H | | | | | 1,322,000 | | | | 1,179,913 | |

| | | | | | | | | 40,405,654 | |

Hong Kong | | | | | | | | | | |

Anxin-China Holdings Ltd. | | | | | 372,000 | | | | 94,255 | |

Belle International Holdings Ltd. | | | | | 1,045,000 | | | | 1,131,553 | |

China Lumena New Materials Corp. | | | | | 1,822,000 | | | | 323,259 | |

China Power International Development Ltd. | | | | | 1,298,000 | | | | 436,626 | |

China Resources Cement Holdings Ltd. | | | | | 482,000 | | | | 328,945 | |

Geely Automobile Holdings Ltd. | | | | | 19,850,000 | | | | 8,111,864 | |

GOME Electrical Appliances Holding Ltd. | | | | | 24,043,000 | | | | 4,167,170 | |

Guangdong Investment Ltd. | | | | | 142,000 | | | | 130,987 | |

Haier Electronics Group Co. Ltd. | | | | | 226,000 | | | | 655,596 | |

Huabao International Holdings Ltd. | | | | | 945,000 | | | | 478,503 | |

| | | | | | | | | | | |

| | | | | Shares | | Value |

Reference Entity — Long |

Hong Kong (concluded) | | | | | | | | | | |

Kingboard Chemical Holdings Ltd. | | | | | 36,000 | | | $ | 80,456 | |

KWG Property Holding Ltd. | | | | | 801,000 | | | | 417,463 | |

Lee & Man Paper Manufacturing Ltd. | | | | | 280,000 | | | | 187,484 | |

REXLot Holdings Ltd. | | | | | 10,250,000 | | | | 1,599,506 | |

Shenzhen Investment Ltd. | | | | | 1,278,000 | | | | 455,900 | |

| | | | | | | | | 18,599,567 | |

Indonesia | | | | | | | | | | |

Telekomunikasi Indonesia Persero Tbk PT | | | | | 1,951,500 | | | | 361,878 | |

Telekomunikasi Indonesia Persero Tbk PT — ADR | | | | | 18,553 | | | | 672,917 | |

| | | | | | | | | 1,034,795 | |

Malaysia | | | | | | | | | | |

Axiata Group Bhd | | | | | 797,200 | | | | 1,562,931 | |

British American Tobacco Malaysia Bhd | | | | | 116,400 | | | | 2,114,783 | |

DiGi.Com Bhd | | | | | 249,200 | | | | 349,622 | |

Lafarge Malayan Cement Bhd | | | | | 77 | | | | 196 | |

MISC Bhd | | | | | 468,800 | | | | 840,849 | |

PPB Group Bhd | | | | | 122,200 | | | | 563,345 | |

Sapurakencana Petroleum Bhd | | | | | 714,500 | | | | 936,118 | |

Telekom Malaysia Bhd | | | | | 87,900 | | | | 144,699 | |

Tenaga Nasional Bhd | | | | | 1,948,600 | | | | 6,869,688 | |

| | | | | | | | | 13,382,231 | |

Mexico | | | | | | | | | | |

Alfa SAB de CV, Series A | | | | | 328,600 | | | | 926,291 | |

Arca Continental SAB de CV | | | | | 196,000 | | | | 1,076,139 | |

Fomento Economico Mexicano SAB de CV | | | | | 129,400 | | | | 1,172,476 | |

Fomento Economico Mexicano SAB de CV — ADR | | | | | 64,586 | | | | 5,828,241 | |

Gruma SAB de CV, Class B | | | | | 43,900 | | | | 356,938 | |

Grupo Aeroportuario del Pacifico SAB de CV, Class B | | | | | 359,600 | | | | 1,950,455 | |

Grupo Aeroportuario del Pacifico SAB de CV — ADR | | | | | 10,682 | | | | 578,857 | |

Grupo Aeroportuario del Sureste SAB de CV, Class B | | | | | 74,800 | | | | 843,695 | |

Grupo Carso SAB de CV, Series A-1 | | | | | 67,500 | | | | 352,540 | |

Grupo Lala SAB de CV | | | | | 35,900 | | | | 76,503 | |

Infraestructura Energetica Nova SAB de CV | | | | | 168,600 | | | | 725,885 | |

Kimberly-Clark de Mexico SAB de CV | | | | | 1,706,183 | | | | 4,350,295 | |

| | | | | | | | | 18,238,315 | |

Peru | | | | | | | | | | |

Compania de Minas Buenaventura SA — ADR | | | | | 79,036 | | | | 980,046 | |

Philippines | | | | | | | | | | |

Manila Electric Co. | | | | | 29,700 | | | | 169,393 | |

Philippine Long Distance Telephone Co. | | | | | 4,745 | | | | 283,530 | |

Philippine Long Distance Telephone Co. — ADR | | | | | 33,524 | | | | 1,997,360 | |

Universal Robina Corp. | | | | | 160,490 | | | | 417,746 | |

| | | | | | | | | 2,868,029 | |

Poland | | | | | | | | | | |

Cyfrowy Polsat SA | | | | | 93,709 | | | | 585,783 | |

PGE SA | | | | | 441,080 | | | | 2,304,806 | |

Tauron Polska Energia SA | | | | | 32,399 | | | | 43,898 | |

Telekomunikacja Polska SA | | | | | 962,106 | | | | 3,204,985 | |

| | | | | | | | | 6,139,472 | |

Republic of Korea | | | | | | | | | | |

Amorepacific Corp. | | | | | 2,506 | | | | 2,355,527 | |

Amorepacific Group | | | | | 3,091 | | | | 1,356,784 | |

CJ CGV Co. Ltd. | | | | | 1,830 | | | | 82,200 | |

Daewoo Shipbuilding & Marine Engineering Co. Ltd. | | | | | 96,240 | | | | 3,062,686 | |

Doosan Corp. | | | | | 3,538 | | | | 449,164 | |

e-LITECOM Co. Ltd. | | | | | 3,436 | | | | 54,048 | |

Hanjin Kal Corp. | | | | | 1 | | | | 22 | |

Hanwha Corp. | | | | | 238,740 | | | | 8,034,040 | |

Hotel Shilla Co. Ltd. | | | | | 7,692 | | | | 552,408 | |

Hyosung Corp. | | | | | 29,327 | | | | 1,831,891 | |

Hyundai Engineering & Construction Co. Ltd. | | | | | 27,276 | | | | 1,474,328 | |

See Notes to Financial Statements.

| BLACKROCK FUNDS | JANUARY 31, 2014 | 11

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

| | | | | Shares | | Value |

Reference Entity — Long |

Republic of Korea (concluded) | | | | | | | | | | |

Hyundai Mobis | | | | | 5,022 | | | $ | 1,438,343 | |

Jahwa Electronics Co. Ltd. | | | | | 11,730 | | | | 209,735 | |

KCC Corp. | | | | | 5,755 | | | | 2,620,994 | |

Korea Aerospace Industries Ltd. | | | | | 167,810 | | | | 4,961,729 | |

Korea Petrochemical Ind Co. Ltd. | | | | | 1,481 | | | | 103,234 | |

Korea Zinc Co. Ltd. | | | | | 1,436 | | | | 457,192 | |

Korean Air Lines Co. Ltd. | | | | | 9 | | | | 287 | |

Korean Reinsurance Co. | | | | | 8,037 | | | | 84,458 | |

KT Skylife Co. Ltd. | | | | | 16,370 | | | | 423,508 | |

KT&G Corp. | | | | | 3,649 | | | | 258,074 | |

LG Fashion Corp. | | | | | 6,140 | | | | 167,150 | |

LG Hausys Ltd. | | | | | 909 | | | | 132,048 | |

Lotte Chemical Corp. | | | | | 1,920 | | | | 371,884 | |

Lotte Chilsung Beverage Co. Ltd. | | | | | 130 | | | | 196,758 | |

Lotte Food Co. Ltd. | | | | | 253 | | | | 184,583 | |

Lumens Co. Ltd. | | | | | 39,790 | | | | 408,542 | |

Maeil Dairy Industry Co. Ltd. | | | | | 11,776 | | | | 466,791 | |

Mirae Asset Securities Co. Ltd. | | | | | 11,290 | | | | 374,111 | |

Partron Co. Ltd. | | | | | 14,778 | | | | 184,438 | |

Poongsan Corp. | | | | | 3,720 | | | | 90,333 | |

S-1 Corp. | | | | | 3,871 | | | | 280,832 | |

Samsung Electronics Co. Ltd. | | | | | 1,738 | | | | 2,058,154 | |

SFA Engineering Corp. | | | | | 7,854 | | | | 330,523 | |

SK C&C Co. Ltd. | | | | | 918 | | | | 106,082 | |

SK Chemicals Co. Ltd. | | | | | 7,840 | | | | 425,699 | |

SK Networks Co. Ltd. | | | | | 175,460 | | | | 1,373,269 | |

Sungwoo Hitech Co. Ltd. | | | | | 4,814 | | | | 68,854 | |

| | | | | | | | | 37,030,703 | |

Russia | | | | | | | | | | |

Aeroflot - Russian Airlines OJSC | | | | | 109,000 | | | | 257,594 | |

Gazprom OAO | | | | | 1,385,220 | | | | 5,743,265 | |

Lukoil OAO | | | | | 25,539 | | | | 1,446,402 | |

Lukoil OAO — ADR | | | | | 26,698 | | | | 1,515,746 | |

Surgutneftegas OAO | | | | | 566,000 | | | | 434,846 | |

Surgutneftegas OAO, ADR | | | | | 210,149 | | | | 1,613,730 | |

Surgutneftegas OAO, Preference Shares | | | | | 11,780,300 | | | | 8,510,335 | |

Tatneft | | | | | 48,350 | | | | 269,355 | |

| | | | | | | | | 19,791,273 | |

South Africa | | | | | | | | | | |

Coronation Fund Managers Ltd. | | | | | 53,606 | | | | 385,071 | |

FirstRand Ltd. | | | | | 769,479 | | | | 2,163,798 | |

Imperial Holdings Ltd. | | | | | 77,421 | | | | 1,290,835 | |

Liberty Holdings Ltd. | | | | | 76,893 | | | | 792,439 | |

Life Healthcare Group Holdings Ltd. | | | | | 188,211 | | | | 601,881 | |

Reunert Ltd. | | | | | 55,720 | | | | 320,284 | |

Sanlam Ltd. | | | | | 99,990 | | | | 430,150 | |

Sasol Ltd. | | | | | 18,329 | | | | 881,913 | |

The Spar Group Ltd. | | | | | 162,888 | | | | 1,758,992 | |

Steinhoff International Holdings Ltd. | | | | | 159,535 | | | | 658,996 | |

Vodacom Group Ltd. | | | | | 853,092 | | | | 9,032,196 | |

Woolworths Holdings Ltd. | | | | | 272,088 | | | | 1,486,986 | |

| | | | | | | | | 19,803,541 | |

Taiwan | | | | | | | | | | |

Asustek Computer, Inc. | | | | | 154,000 | | | | 1,412,884 | |

Champion Microelectronic Corp. | | | | | 45,000 | | | | 123,268 | |

Cheng Uei Precision Industry Co. Ltd. | | | | | 1,058,000 | | | | 2,243,534 | |

Chimei Materials Technology Corp. | | | | | 2,930,000 | | | | 3,858,946 | |

Compeq Manufacturing Co. Ltd. | | | | | 5,996,000 | | | | 3,333,519 | |

Everlight Electronics Co. Ltd. | | | | | 569,000 | | | | 1,352,580 | |

Far Eastern Department Stores Co. Ltd. | | | | | 1,579,420 | | | | 1,435,972 | |

Far Eastern New Century Corp. | | | | | 659,228 | | | | 679,774 | |

Grape King Bio Ltd. | | | | | 140,000 | | | | 608,473 | |

Hon Hai Precision Industry Co. Ltd. | | | | | 49,000 | | | | 136,886 | |

| | | | | | | | | | | |

| | | | | Shares | | Value |

Reference Entity — Long |

Taiwan (concluded) | | | | | | | | | | |

Inotera Memories, Inc. | | | | | 2,795,000 | | | $ | 2,148,279 | |

King Slide Works Co. Ltd. | | | | | 155,000 | | | | 1,693,256 | |

Merry Electronics Co. Ltd. | | | | | 1,034,000 | | | | 5,941,432 | |

Motech Industries, Inc. | | | | | 661,000 | | | | 1,166,250 | |

Nan Ya Plastics Corp. | | | | | 564,000 | | | | 1,229,113 | |

Pou Chen Corp. | | | | | 4,691,000 | | | | 6,484,562 | |

Realtek Semiconductor Corp. | | | | | 315,000 | | | | 856,597 | |

Taiflex Scientific Co. Ltd. | | | | | 1,082,000 | | | | 1,998,902 | |

Taiwan Cement Corp. | | | | | 3,945,000 | | | | 5,758,967 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | | | 1,338,000 | | | | 4,607,339 | |

Teco Electric and Machinery Co. Ltd. | | | | | 135,000 | | | | 146,626 | |

Vanguard International Semiconductor Corp. | | | | | 360,000 | | | | 393,925 | |

Wistron NeWeb Corp. | | | | | 1,933,000 | | | | 4,935,840 | |

| | | | | | | | | 52,546,924 | |

Thailand | | | | | | | | | | |

BEC World PCL | | | | | 1,265,200 | | | | 1,791,823 | |

PTT Global Chemical PCL | | | | | 3,277,500 | | | | 7,074,277 | |

| | | | | | | | | 8,866,100 | |

Turkey | | | | | | | | | | |

BIM Birlesik Magazalar AS | | | | | 45,777 | | | | 783,086 | |

Enka Insaat ve Sanayi AS | | | | | 1,016,704 | | | | 2,900,263 | |

Eregli Demir ve Celik Fabrikalari TAS | | | | | 1,806,489 | | | | 2,171,653 | |

Tofas Turk Otomobil Fabrikasi | | | | | 10,178 | | | | 47,875 | |

| | | | | | | | | 5,902,877 | |

United Kingdom | | | | | | | | | | |

British American Tobacco PLC | | | | | 114,390 | | | | 5,486,720 | |

Old Mutual PLC | | | | | 88,659 | | | | 251,908 | |

| | | | | | | | | 5,738,628 | |

Total Reference Entity — Long | | | | | | | | | 276,094,992 | |

|

Reference Entity — Short |

Argentina | | | | | | | | | | |

MercadoLibre, Inc. | | | | | (3,302 | ) | | | (318,610 | ) |

Brazil | | | | | | | | | | |

Aliansce Shopping Centers SA | | | | | (18,000 | ) | | | (122,175 | ) |

Anhanguera Educacional Participacoes SA | | | | | (461,500 | ) | | | (2,428,696 | ) |

BR Properties SA | | | | | (130,100 | ) | | | (912,169 | ) |

BRF SA — ADR | | | | | (5,507 | ) | | | (97,364 | ) |

Centrais Eletricas Brasileiras SA, Preference B Shares | | | | | (34,700 | ) | | | (135,162 | ) |

Cia Hering | | | | | (14,400 | ) | | | (159,917 | ) |

EcoRodovias Infraestrutura e Logistica SA | | | | | (146,800 | ) | | | (748,219 | ) |

Equatorial Energia SA | | | | | (15,000 | ) | | | (138,299 | ) |

Gol Linhas Aereas Inteligentes SA — ADR | | | | | (2,506 | ) | | | (9,849 | ) |

Marcopolo SA, Preference Shares | | | | | (108,600 | ) | | | (233,108 | ) |

Telefonica Brasil SA — ADR | | | | | (227,066 | ) | | | (4,314,254 | ) |

| | | | | | | | | (9,299,212 | ) |

Chile | | | | | | | | | | |

Sociedad Quimica y Minera de Chile SA — ADR | | | | | (38,346 | ) | | | (955,199 | ) |

China | | | | | | | | | | |

Aluminum Corp. of China Ltd. — ADR | | | | | (12,349 | ) | | | (109,412 | ) |

China Coal Energy Co. Ltd. | | | | | (2,507,000 | ) | | | (1,254,506 | ) |

China COSCO Holdings Co. Ltd., Class H | | | | | (2,639,500 | ) | | | (1,105,435 | ) |

China Longyuan Power Group Corp., Class H | | | | | (7,447,000 | ) | | | (8,968,407 | ) |

China Shipping Development Co. Ltd., Class H | | | | | (456,000 | ) | | | (272,979 | ) |

ENN Energy Holdings Ltd. | | | | | (516,000 | ) | | | (3,338,593 | ) |

Li Ning Co. Ltd. | | | | | (1,792,000 | ) | | | (1,432,584 | ) |

Shui On Land Ltd. | | | | | (5,799,000 | ) | | | (1,832,992 | ) |

SOHO China Ltd. | | | | | (1,380,500 | ) | | | (1,095,131 | ) |

Sun Art Retail Group Ltd. | | | | | (96,000 | ) | | | (125,690 | ) |

See Notes to Financial Statements.

| 12 | BLACKROCK FUNDS | JANUARY 31, 2014

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

| | | | | Shares | | Value |

Reference Entity — Short |

China (concluded) | | | | | | | | | | |

Tsingtao Brewery Co. Ltd., Class H | | | | | (432,000 | ) | | $ | (3,168,575 | ) |

Uni-President China Holdings Ltd. | | | | | (2,497,000 | ) | | | (2,258,862 | ) |

Weichai Power Co. Ltd., Class H | | | | | (10,000 | ) | | | (38,000 | ) |

| | | | | | | | | (25,001,166 | ) |

Hong Kong | | | | | | | | | | |

Beijing Enterprises Holdings Ltd. | | | | | (831,000 | ) | | | (7,020,737 | ) |

Brilliance China Automotive Holdings Ltd. | | | | | (1,184,000 | ) | | | (1,804,640 | ) |

China Everbright International Ltd. | | | | | (195,000 | ) | | | (256,635 | ) |

China Mengniu Dairy Co. Ltd. | | | | | (2,894,000 | ) | | | (13,255,625 | ) |

China Resources Enterprise Ltd. | | | | | (992,000 | ) | | | (2,944,664 | ) |

China Singyes Solar Technologies Holdings Ltd. | | | | | (57,000 | ) | | | (64,705 | ) |

China State Construction International Holdings Ltd. | | | | | (2,556,000 | ) | | | (4,632,884 | ) |

Digital China Holdings Ltd. | | | | | (516,000 | ) | | | (505,233 | ) |

GCL-Poly Energy Holdings Ltd. | | | | | (573,000 | ) | | | (194,085 | ) |

Kunlun Energy Co. Ltd. | | | | | (1,064,000 | ) | | | (1,756,428 | ) |

| | | | | | | | | (32,435,636 | ) |

Indonesia | | | | | | | | | | |

Charoen Pokphand Indonesia Tbk PT | | | | | (1,518,500 | ) | | | (512,236 | ) |

Indofood Sukses Makmur Tbk PT | | | | | (160,000 | ) | | | (91,465 | ) |

Semen Indonesia Persero Tbk PT | | | | | (372,700 | ) | | | (432,994 | ) |

Unilever Indonesia Tbk PT | | | | | (632,200 | ) | | | (1,485,798 | ) |

XL Axiata Tbk PT | | | | | (787,400 | ) | | | (313,384 | ) |

| | | | | | | | | (2,835,877 | ) |

Malaysia | | | | | | | | | | |

Maxis Bhd | | | | | (217,700 | ) | | | (452,776 | ) |

Petronas Dagangan BHD | | | | | (11,400 | ) | | | (104,404 | ) |

| | | | | | | | | (557,180 | ) |

Mexico | | | | | | | | | | |

Alpek SA de CV | | | | | (81,300 | ) | | | (161,944 | ) |

America Movil SAB de CV, Series L | | | | | (3,513,900 | ) | | | (3,751,944 | ) |

America Movil SAB de CV — ADR, Series L | | | | | (273,456 | ) | | | (5,813,675 | ) |

Cemex SAB de CV — ADR | | | | | (114,385 | ) | | | (1,414,942 | ) |

Empresas ICA SAB de CV | | | | | (695,999 | ) | | | (1,344,224 | ) |

Mexichem SAB de CV | | | | | (3,819,620 | ) | | | (13,263,283 | ) |

Minera Frisco SAB de CV, Series A-1 | | | | | (230,500 | ) | | | (363,312 | ) |

| | | | | | | | | (26,113,324 | ) |

Philippines | | | | | | | | | | |

Aboitiz Equity Ventures, Inc. | | | | | (560,000 | ) | | | (640,628 | ) |

Energy Development Corp. | | | | | (1,239,900 | ) | | | (143,606 | ) |

| | | | | | | | | (784,234 | ) |

Poland | | | | | | | | | | |

Jastrzebska Spolka Weglowa SA | | | | | (35,580 | ) | | | (520,370 | ) |

Polski Koncern Naftowy Orlen SA | | | | | (91,393 | ) | | | (1,121,898 | ) |

| | | | | | | | | (1,642,268 | ) |

Republic of Korea | | | | | | | | | | |

Cheil Industries, Inc. | | | | | (1,709 | ) | | | (118,828 | ) |

CJ CheilJedang Corp. | | | | | (9,370 | ) | | | (2,307,245 | ) |

CJ Korea Express Co. Ltd. | | | | | (9,456 | ) | | | (936,863 | ) |

CrucialTec Co. Ltd. | | | | | (15,765 | ) | | | (160,429 | ) |

Daewoo Engineering & Construction Co. Ltd. | | | | | (547,740 | ) | | | (3,467,798 | ) |

GS Engineering & Construction Corp. | | | | | (2 | ) | | | (62 | ) |

Hyundai Heavy Industries Co. Ltd. | | | | | (18,842 | ) | | | (3,894,286 | ) |

Hyundai Mipo Dockyard | | | | | (89,091 | ) | | | (14,292,291 | ) |

Nexen Tire Corp. | | | | | (19,010 | ) | | | (260,279 | ) |

OCI Co. Ltd. | | | | | (9,709 | ) | | | (1,701,604 | ) |

Orion Corp. | | | | | (644 | ) | | | (523,750 | ) |

S-Oil Corp. | | | | | (1,291 | ) | | | (81,984 | ) |

Samsung Electro-Mechanics Co. Ltd. | | | | | (16,509 | ) | | | (1,018,917 | ) |

Samsung Engineering Co. Ltd. | | | | | (100,704 | ) | | | (6,709,670 | ) |

Samsung Fine Chemicals Co. Ltd. | | | | | (28,421 | ) | | | (1,072,907 | ) |

| | | | | | | | | | | |

| | | | | Shares | | Value |

Reference Entity — Short |

Republic of Korea (concluded) | | | | | | | | | | |

Samsung SDI Co. Ltd. | | | | | (500 | ) | | $ | (66,341 | ) |

WeMade Entertainment Co. Ltd. | | | | | (1,286 | ) | | | (50,299 | ) |

| | | | | | | | | (36,663,553 | ) |

Russia | | | | | | | | | | |

AK Transneft OAO, Preference Shares | | | | | (444 | ) | | | (1,013,194 | ) |

Novolipetsk Steel OJSC — GDR | | | | | (206,817 | ) | | | (2,973,100 | ) |

RusHydro JSC | | | | | (4,503,000 | ) | | | (71,093 | ) |

Uralkali OJSC — GDR | | | | | (13,281 | ) | | | (321,955 | ) |

| | | | | | | | | (4,379,342 | ) |

South Africa | | | | | | | | | | |

Anglo American Platinum Ltd. | | | | | (23,743 | ) | | | (948,327 | ) |

Discovery Holdings Ltd. | | | | | (385,280 | ) | | | (2,605,721 | ) |

Exxaro Resources Ltd. | | | | | (365,726 | ) | | | (4,937,117 | ) |

The Foschini Group Ltd. | | | | | (79,802 | ) | | | (668,484 | ) |

Impala Platinum Holdings Ltd. | | | | | (311,832 | ) | | | (3,257,625 | ) |

Massmart Holdings Ltd. | | | | | (509,967 | ) | | | (5,560,661 | ) |

Northam Platinum Ltd. | | | | | (352,944 | ) | | | (1,322,204 | ) |

Pick n Pay Stores Ltd. | | | | | (601,869 | ) | | | (2,463,919 | ) |

Remgro Ltd. | | | | | (1,137,626 | ) | | | (19,029,149 | ) |

Sappi Ltd. | | | | | (514,132 | ) | | | (1,591,191 | ) |

| | | | | | | | | (42,384,398 | ) |

Spain | | | | | | | | | | |

Abertis Infraestructuras SA | | | | | (22,374 | ) | | | (499,279 | ) |

Taiwan | | | | | | | | | | |

Asia Cement Corp. | | | | | (311,000 | ) | | | (381,441 | ) |

Cheng Shin Rubber Industry Co. Ltd. | | | | | (1,205,000 | ) | | | (3,055,165 | ) |

China Airlines Ltd. | | | | | (2,099,888 | ) | | | (738,653 | ) |

China Petrochemical Development Corp. | | | | | (6,371,425 | ) | | | (2,811,043 | ) |

Chipbond Technology Corp. | | | | | (1,445,000 | ) | | | (2,203,001 | ) |

Compal Electronics, Inc. | | | | | (718,000 | ) | | | (533,762 | ) |

Evergreen Marine Corp. Taiwan Ltd. | | | | | (5,457,000 | ) | | | (3,200,756 | ) |

FLEXium Interconnect, Inc. | | | | | (191,000 | ) | | | (574,750 | ) |

Formosa Petrochemical Corp. | | | | | (1,216,000 | ) | | | (3,066,178 | ) |

Foxconn Technology Co. Ltd. | | | | | (1,758,000 | ) | | | (3,949,180 | ) |

Giant Manufacturing Co. Ltd. | | | | | (189,000 | ) | | | (1,193,478 | ) |

Hotai Motor Co. Ltd. | | | | | (447,000 | ) | | | (5,425,664 | ) |

HTC Corp. | | | | | (3,349,000 | ) | | | (15,018,007 | ) |

Hua Nan Financial Holdings Co. Ltd. | | | | | (181,000 | ) | | | (101,954 | ) |

LCY Chemical Corp. | | | | | (107,000 | ) | | | (135,800 | ) |

Lotus Pharmaceutical Co. Ltd. | | | | | (46,000 | ) | | | (137,713 | ) |

Nan Kang Rubber Tire Co. Ltd. | | | | | (49,112 | ) | | | (59,517 | ) |

Phison Electronics Corp. | | | | | (54,000 | ) | | | (337,868 | ) |

Radium Life Tech Co. Ltd. | | | | | (306,000 | ) | | | (233,368 | ) |

Standard Foods Corp. | | | | | (371,000 | ) | | | (1,089,909 | ) |

Taiwan Glass Industry Corp. | | | | | (69,000 | ) | | | (67,455 | ) |

Ton Yi Industrial Corp. | | | | | (175,000 | ) | | | (172,629 | ) |

TTY Biopharm Co. Ltd. | | | | | (282,000 | ) | | | (834,412 | ) |

U-Ming Marine Transport Corp. | | | | | (111,000 | ) | | | (184,174 | ) |

Winbond Electronics Corp. | | | | | (1,724,000 | ) | | | (415,535 | ) |

Wintek Corp. | | | | | (1,761,000 | ) | | | (585,770 | ) |

| | | | | | | | | (46,507,182 | ) |

Thailand | | | | | | | | | | |

Bangkok Dusit Medical Services PCL | | | | | (104,800 | ) | | | (374,626 | ) |

Indorama Ventures PCL, Class F | | | | | (329,200 | ) | | | (206,435 | ) |

| | | | | | | | | (581,061 | ) |

Turkey | | | | | | | | | | |

Anadolu Efes Biracilik Ve Malt Sanayii AS | | | | | (123,533 | ) | | | (1,252,290 | ) |

Coca-Cola Icecek AS | | | | | (63,791 | ) | | | (1,335,792 | ) |

Turkcell Iletisim Hizmetleri AS — ADR | | | | | (43,156 | ) | | | (537,292 | ) |

| | | | | | | | | (3,125,374 | ) |

Total Reference Entity — Short | | | | | | | | | (234,082,895 | ) |

Net Value of Reference Entity — Goldman Sachs & Co. | $ | 42,012,097 | |

See Notes to Financial Statements.

| BLACKROCK FUNDS | JANUARY 31, 2014 | 13

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

The following table represents the individual long and short positions and related values of equity securities underlying the total return swap with Morgan Stanley & Co., Inc. as of January 31, 2014, expiration dates 10/09/14 — 7/11/16:

| | | | | Shares | | Value |

Reference Entity — Long |

Brazil | | | | | | | | | | |

AMBEV SA | | | | | 8,500 | | | $ | 56,673 | |

Bradespar SA, Preference Shares | | | | | 27,400 | | | | 253,194 | |

Braskem SA, Preference A Shares | | | | | 42,600 | | | | 327,984 | |

Cia Brasileira de Distribuicao Grupo Pao de Acucar — ADR | | | | | 35,302 | | | | 1,351,008 | |

Cia Brasileira de Distribuicao Grupo Pao de Acucar, Preference Shares | | | | | 37,800 | | | | 1,462,973 | |

Cia Paranaense de Energia — ADR | | | | | 16,144 | | | | 185,010 | |

Cia Paranaense de Energia, Preference B Shares | | | | | 2,800 | | | | 32,290 | |

Even Construtora e Incorporadora SA | | | | | 47,000 | | | | 139,447 | |

Klabin SA, Preference Shares | | | | | 287,400 | | | | 1,469,602 | |

Petroleo Brasileiro SA, Preference Shares | | | | | 134,000 | | | | 816,244 | |

Randon Participacoes SA, Preference Shares | | | | | 76,300 | | | | 294,671 | |

Vale SA, Preference Shares — ADR | | | | | 20,150 | | | | 247,442 | |

Vale SA, Preference A Shares | | | | | 26,600 | | | | 330,674 | |

| | | | | | | | | 6,967,212 | |

Chile | | | | | | | | | | |

AES Gener SA | | | | | 1,412,455 | | | | 699,031 | |

Enersis SA | | | | | 2,317,617 | | | | 612,431 | |

| | | | | | | | | 1,311,462 | |

China | | | | | | | | | | |

Anhui Conch Cement Co. Ltd., Class H | | | | | 247,500 | | | | 954,688 | |

Bank of China Ltd., Class H | | | | | 7,282,000 | | | | 3,073,587 | |

BBMG Corp., Class H | | | | | 270,000 | | | | 211,148 | |

China Citic Bank Corp. Ltd., Class H | | | | | 2,212,000 | | | | 1,061,030 | |

China Communications Construction Co. Ltd., Class H | | | | | 3,825,000 | | | | 2,783,544 | |

China Construction Bank Corp., Class H | | | | | 1,640,000 | | | | 1,136,103 | |

China Galaxy Securities Co. Ltd., Class H | | | | | 141,000 | | | | 101,573 | |

China Merchants Bank Co. Ltd., Class H | | | | | 382,137 | | | | 673,102 | |

China Oilfield Services Ltd., Class H | | | | | 1,210,000 | | | | 3,245,012 | |

China Petroleum & Chemical Corp., Class H | | | | | 1,282,000 | | | | 1,012,643 | |

China Railway Construction Corp., Class H | | | | | 3,596,500 | | | | 3,000,424 | |

China Railway Group Ltd., Class H | | | | | 2,013,000 | | | | 894,832 | |

Dongfeng Motor Group Co. Ltd., Class H | | | | | 54,000 | | | | 79,511 | |

Fosun International Ltd. | | | | | 773,000 | | | | 831,095 | |

GOME Electrical Appliances Holding Ltd. | | | | | 19,635,000 | | | | 3,403,169 | |

Great Wall Motor Co. Ltd., Class H | | | | | 34,500 | | | | 162,363 | |

Greentown China Holdings Ltd. | | | | | 1,046,000 | | | | 1,490,635 | |

Guangzhou Baiyunshan Pharmaceutical Holdings Co. Ltd. | | | | | 198,000 | | | | 642,582 | |

Guangzhou R&F Properties Co. Ltd., Class H | | | | | 2,240,000 | | | | 2,983,476 | |

Industrial & Commercial Bank of China Ltd., Class H | | | | | 28,000 | | | | 17,264 | |

Jiangsu Expressway Co. Ltd., Class H | | | | | 444,000 | | | | 557,430 | |

Kingboard Chemical Holdings Ltd. | | | | | 120,500 | | | | 269,303 | |

Kingsoft Corp. Ltd. | | | | | 189,000 | | | | 616,724 | |

Lonking Holdings Ltd. | | | | | 2,211,000 | | | | 443,737 | |

Shanghai Industrial Holdings Ltd. | | | | | 173,000 | | | | 576,475 | |

Tencent Holdings Ltd. | | | | | 5,500 | | | | 385,604 | |

Tingyi Cayman Islands Holding Corp. | | | | | 222,000 | | | | 574,368 | |

Zhejiang Expressway Co. Ltd., Class H | | | | | 1,398,000 | | | | 1,247,744 | |

| | | | | | | | | 32,429,166 | |

Hong Kong | | | | | | | | | | |

COSCO Pacific Ltd. | | | | | 560,000 | | | | 716,546 | |

Geely Automobile Holdings Ltd. | | | | | 745,000 | | | | 304,450 | |

Guangdong Investment Ltd. | | | | | 70,000 | | | | 64,571 | |

Haier Electronics Group Co. Ltd. | | | | | 81,000 | | | | 234,970 | |

Huabao International Holdings Ltd. | | | | | 1,662,000 | | | | 841,557 | |

KWG Property Holding Ltd. | | | | | 531,000 | | | | 276,746 | |

| | | | | | | | | | | |

| | | | | Shares | | Value |

Reference Entity — Long |

Hong Kong (concluded) | | | | | | | | | | |

Lee & Man Paper Manufacturing Ltd. | | | | | 206,000 | | | $ | 137,935 | |

REXLot Holdings Ltd. | | | | | 9,875,000 | | | | 1,540,987 | |

Shenzhen Investment Ltd. | | | | | 2,540,000 | | | | 906,093 | |

| | | | | | | | | 5,023,855 | |

Malaysia | | | | | | | | | | |

Axiata Group Bhd | | | | | 628,700 | | | | 1,232,582 | |

British American Tobacco Malaysia Bhd | | | | | 57,300 | | | | 1,041,040 | |

IJM Corp. Bhd | | | | | 37,100 | | | | 65,656 | |

MISC Bhd | | | | | 212,200 | | | | 380,606 | |

Sapurakencana Petroleum Bhd | | | | | 139,900 | | | | 183,293 | |

Tenaga Nasional Bhd | | | | | 946,600 | | | | 3,337,189 | |

| | | | | | | | | 6,240,366 | |

Mexico | | | | | | | | | | |

Alfa SAB de CV, Series A | | | | | 148,100 | | | | 417,480 | |

Arca Continental SAB de CV | | | | | 276,200 | | | | 1,516,477 | |

Fomento Economico Mexicano SAB de CV | | | | | 85,200 | | | | 771,986 | |

Gruma SAB de CV, Class B | | | | | 87,000 | | | | 707,371 | |

Grupo Aeroportuario del Pacifico SAB de CV — ADR | | | | | 2,621 | | | | 142,032 | |

Grupo Aeroportuario del Pacifico SAB de CV, Class B | | | | | 245,200 | | | | 1,329,954 | |

Grupo Aeroportuario del Sureste SAB de CV, Class B | | | | | 119,300 | | | | 1,345,626 | |

Infraestructura Energetica Nova SAB de CV | | | | | 195,800 | | | | 842,991 | |

Kimberly-Clark de Mexico SAB de CV, Class A | | | | | 128,800 | | | | 328,404 | |

Promotora y Operadora de Infraestructura SAB de CV | | | | | 40,200 | | | | 488,839 | |

| | | | | | | | | 7,891,160 | |

Philippines | | | | | | | | | | |

Manila Electric Co. | | | | | 31,390 | | | | 179,032 | |

Philippine Long Distance Telephone Co. | | | | | 54,865 | | | | 3,278,369 | |

Philippine Long Distance Telephone Co. — ADR | | | | | 57,267 | | | | 3,411,968 | |

Universal Robina Corp. | | | | | 213,240 | | | | 555,051 | |

| | | | | | | | | 7,424,420 | |

Poland | | | | | | | | | | |

PGE SA | | | | | 220,741 | | | | 1,153,453 | |

Republic of Korea | | | | | | | | | | |

Amorepacific Group | | | | | 2,157 | | | | 946,808 | |

e-LITECOM Co. Ltd. | | | | | 11,610 | | | | 182,625 | |

E-Mart Co. Ltd. | | | | | 1,970 | | | | 474,837 | |

Hana Financial Group, Inc. | | | | | 2 | | | | 76 | |

Hanjin Kal Corp. | | | | | 9 | | | | 196 | |

Hanwha Corp. | | | | | 9,430 | | | | 317,337 | |

Hyosung Corp. | | | | | 14,730 | | | | 920,100 | |

Hyundai Engineering & Construction Co. Ltd. | | | | | 36,377 | | | | 1,966,257 | |

Hyundai Mobis | | | | | 1,193 | | | | 341,685 | |

Hyundai Steel Co. | | | | | 8,545 | | | | 601,840 | |

i-SENS, Inc. | | | | | 1,533 | | | | 62,820 | |

Jahwa Electronics Co. Ltd. | | | | | 23,350 | | | | 417,503 | |

Kangwon Land, Inc. | | | | | 3,020 | | | | 94,917 | |

KCC Corp. | | | | | 924 | | | | 420,816 | |

Korea Petrochemical Ind Co. Ltd. | | | | | 8,023 | | | | 559,251 | |

KT Skylife Co. Ltd. | | | | | 67,340 | | | | 1,742,153 | |

LG Hausys Ltd. | | | | | 683 | | | | 99,218 | |

LiHOM-CUCHEN Co. Ltd. | | | | | 16,290 | | | | 99,902 | |

Lotte Chemical Corp. | | | | | 6,159 | | | | 1,192,933 | |

Lotte Chilsung Beverage Co. Ltd. | | | | | 228 | | | | 345,083 | |

Lumens Co. Ltd. | | | | | 14,327 | | | | 147,102 | |

Macrogen, Inc. | | | | | 8 | | | | 229 | |

Maeil Dairy Industry Co. Ltd. | | | | | 7,585 | | | | 300,663 | |

Mirae Asset Securities Co. Ltd. | | | | | 7,070 | | | | 234,275 | |

NongShim Co. Ltd. | | | | | 1,431 | | | | 362,258 | |

S-1 Corp. | | | | | 1,975 | | | | 143,282 | |

See Notes to Financial Statements.

| 14 | BLACKROCK FUNDS | JANUARY 31, 2014

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

| | | | | Shares | | Value |

Reference Entity — Long |

Republic of Korea (concluded) | | | | | | | | | | |

Samsung Electronics Co. Ltd. | | | | | 2,647 | | | $ | 3,134,600 | |

SEOWONINTECH Co. Ltd. | | | | | 13,291 | | | | 169,995 | |

SFA Engineering Corp. | | | | | 16,002 | | | | 673,419 | |

SK Chemicals Co. Ltd. | | | | | 5,612 | | | | 304,722 | |

SK Networks Co. Ltd. | | | | | 291,690 | | | | 2,282,964 | |

| | | | | | | | | 18,539,866 | |

Russia | | | | | | | | | | |

Aeroflot — Russian Airlines OJSC | | | | | 222,300 | | | | 525,350 | |

Lukoil OAO | | | | | 36,172 | | | | 2,048,603 | |

Lukoil OAO — ADR | | | | | 7,375 | | | | 418,706 | |

Surgutneftegas OAO | | | | | 4,132,476 | | | | 3,659,171 | |

Surgutneftegas OAO, Preference Shares | | | | | 3,969,500 | | | | 2,867,650 | |

| | | | | | | | | 9,519,480 | |

South Africa | | | | | | | | | | |

Clicks Group Ltd. | | | | | 18,910 | | | | 97,050 | |

Coronation Fund Managers Ltd. | | | | | 31,886 | | | | 229,048 | |

FirstRand Ltd. | | | | | 584,477 | | | | 1,643,567 | |

Imperial Holdings Ltd. | | | | | 87,940 | | | | 1,466,217 | |

Liberty Holdings Ltd. | | | | | 11,438 | | | | 117,877 | |

MMI Holdings Ltd. | | | | | 163,409 | | | | 347,193 | |

Reunert Ltd. | | | | | 40,920 | | | | 235,212 | |

The Spar Group Ltd. | | | | | 36,479 | | | | 393,929 | |

Steinhoff International Holdings Ltd. | | | | | 98,780 | | | | 408,034 | |

Vodacom Group Ltd. | | | | | 169,170 | | | | 1,791,104 | |

| | | | | | | | | 6,729,231 | |

Spain | | | | | | | | | | |

Cemex Latam Holdings SA | | | | | 22,821 | | | | 152,825 | |

Taiwan | | | | | | | | | | |

Asustek Computer, Inc. | | | | | 193,000 | | | | 1,770,692 | |

Chimei Materials Technology Corp. | | | | | 867,000 | | | | 1,141,879 | |

Compeq Manufacturing Co. Ltd. | | | | | 648,000 | | | | 360,260 | |

Far Eastern Department Stores Ltd. | | | | | 1,390,600 | | | | 1,264,301 | |

Hon Hai Precision Industry Co. Ltd. | | | | | 209,000 | | | | 583,860 | |

Inotera Memories, Inc. | | | | | 950,000 | | | | 730,184 | |

King Slide Works Co. Ltd. | | | | | 102,000 | | | | 1,114,272 | |

Merry Electronics Co. Ltd. | | | | | 178,000 | | | | 1,022,800 | |

Motech Industries, Inc. | | | | | 678,000 | | | | 1,196,245 | |

Nan Ya Plastics Corp. | | | | | 702,000 | | | | 1,529,854 | |

Pou Chen Corp. | | | | | 1,785,000 | | | | 2,467,479 | |

Radiant Opto-Electronics Corp. | | | | | 262,000 | | | | 1,137,129 | |

Realtek Semiconductor Corp. | | | | | 965,150 | | | | 2,624,587 | |

Synnex Technology International Corp. | | | | | 85,000 | | | | 144,117 | |

Taiwan Cement Corp. | | | | | 2,320,000 | | | | 3,386,769 | |

Taiwan Semiconductor Manufacturing Co. Ltd. — ADR | | | | | 21,121 | | | | 357,367 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | | | 76,000 | | | | 261,702 | |

Tong Hsing Electronic Industries Ltd. | | | | | 47,000 | | | | 240,875 | |

Vanguard International Semiconductor Corp. | | | | | 56,000 | | | | 61,277 | |

Wistron NeWeb Corp. | | | | | 83,000 | | | | 211,937 | |

Yungtay Engineering Co. Ltd. | | | | | 146,000 | | | | 399,625 | |

| | | | | | | | | 22,007,211 | |

Thailand | | | | | | | | | | |

BEC World PCL, Foreign Registered Shares | | | | | 1,116,600 | | | | 1,581,371 | |

PTT Global Chemical PCL, Foreign Registered Shares | | | | | 38,600 | | | | 83,316 | |

| | | | | | | | | 1,664,687 | |

Turkey | | | | | | | | | | |

Enka Insaat ve Sanayi AS | | | | | 925,554 | | | | 2,640,247 | |

Kardemir Karabuk Demir Celik Sanayi ve Ticaret AS, Class D | | | | | 1,085,876 | | | | 466,820 | |

Pegasus Hava Tasimaciligi AS | | | | | 65,246 | | | | 752,878 | |

| | | | | | | | | 3,859,945 | |

| | | | | | | | | | | |

| | | | | Shares | | Value |

Reference Entity — Long |

United Kingdom | | | | | | | | | | |

Old Mutual PLC | | | | | 622,016 | | | $ | 1,767,340 | |

United States | | | | | | | | | | |

The AES Corp. | | | | | 89,671 | | | | 1,260,774 | |

Total Reference Entity — Long | | | | | | | | | 133,942,453 | |

|

Reference Entity — Short |

Argentina | | | | | | | | | | |

MercadoLibre, Inc. | | | | | (3,349 | ) | | | (323,145 | ) |

Brazil | | | | | | | | | | |

Aliansce Shopping Centers SA | | | | | (109,600 | ) | | | (743,913 | ) |

ALL—America Latina Logistica SA | | | | | (769,800 | ) | | | (2,108,517 | ) |

AMBEV SA — ADR | | | | | (55,900 | ) | | | (365,586 | ) |

Anhanguera Educacional Participacoes SA | | | | | (1,521,337 | ) | | | (8,006,207 | ) |

BR Malls Participacoes SA | | | | | (151,100 | ) | | | (951,712 | ) |

BRF SA | | | | | (333,800 | ) | | | (5,980,944 | ) |

BRF SA — ADR | | | | | (420,425 | ) | | | (7,433,114 | ) |

Centrais Eletricas Brasileiras SA, Preferred B Shares | | | | | (54,900 | ) | | | (213,844 | ) |

Cia Hering | | | | | (212,500 | ) | | | (2,359,888 | ) |

EcoRodovias Infraestrutura e Logistica SA | | | | | (309,700 | ) | | | (1,578,498 | ) |

Equatorial Energia SA | | | | | (166,252 | ) | | | (1,532,832 | ) |

Mills Estruturas e Servicos de Engenharia SA | | | | | (7,300 | ) | | | (84,669 | ) |

Natura Cosmeticos SA | | | | | (25,600 | ) | | | (416,580 | ) |

Telefonica Brasil SA, Preferred Shares | | | | | (18,500 | ) | | | (351,640 | ) |

Tim Participacoes SA | | | | | (166,300 | ) | | | (871,038 | ) |

| | | | | | | | | (32,998,982 | ) |

Chile | | | | | | | | | | |

Empresa Nacional de Electricidad SA — ADR | | | | | (6,752 | ) | | | (260,492 | ) |

China | | | | | | | | | | |

China COSCO Holdings Co. Ltd., Class H | | | | | (1,367,000 | ) | | | (572,506 | ) |

China Longyuan Power Group Corp., Class H | | | | | (1,927,000 | ) | | | (2,320,682 | ) |

China Shipping Development Co. Ltd., Class H | | | | | (1,826,000 | ) | | | (1,093,112 | ) |

ENN Energy Holdings Ltd. | | | | | (44,000 | ) | | | (284,686 | ) |

Li Ning Co. Ltd. | | | | | (319,500 | ) | | | (255,419 | ) |

Shandong Weigao Group Medical Polymer Co. Ltd., Class H | | | | | (32,000 | ) | | | (37,719 | ) |

SOHO China Ltd. | | | | | (344,500 | ) | | | (273,287 | ) |

Sun Art Retail Group Ltd. | | | | | (51,500 | ) | | | (67,428 | ) |

Tsingtao Brewery Co. Ltd., Class H | | | | | (12,000 | ) | | | (88,016 | ) |

Zhongsheng Group Holdings Ltd. | | | | | (83,000 | ) | | | (122,423 | ) |

| | | | | | | | | (5,115,278 | ) |

Hong Kong | | | | | | | | | | |

Beijing Enterprises Holdings Ltd. | | | | | (14,500 | ) | | | (122,504 | ) |

Brilliance China Automotive Holdings Ltd. | | | | | (18,000 | ) | | | (27,435 | ) |

China Everbright International Ltd. | | | | | (106,000 | ) | | | (139,504 | ) |

China Mengniu Dairy Co. Ltd. | | | | | (28,000 | ) | | | (128,251 | ) |

China Resources Enterprise Ltd. | | | | | (32,000 | ) | | | (94,989 | ) |

China State Construction International Holdings Ltd. | | | | | (186,000 | ) | | | (337,135 | ) |

Digital China Holdings Ltd. | | | | | (184,000 | ) | | | (180,161 | ) |

GCL-Poly Energy Holdings Ltd. | | | | | (3,889,000 | ) | | | (1,317,270 | ) |

Kunlun Energy Co. Ltd. | | | | | (58,000 | ) | | | (95,745 | ) |

Sinopec Kantons Holdings Ltd. | | | | | (290,000 | ) | | | (338,400 | ) |

| | | | | | | | | (2,781,394 | ) |

See Notes to Financial Statements.

| BLACKROCK FUNDS | JANUARY 31, 2014 | 15

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

| | | | | Shares | | Value |

Reference Entity — Short |

Mexico | | | | | | | | | | |

Alpek SA de CV | | | | | (153,484 | ) | | $ | (305,729 | ) |

America Movil SAB de CV, Series L | | | | | (1,559,000 | ) | | | (1,664,612 | ) |

America Movil SAB de CV — ADR, Series L | | | | | (1,990 | ) | | | (42,307 | ) |

Cemex SAB de CV | | | | | (375,900 | ) | | | (464,605 | ) |

Cemex SAB de CV — ADR | | | | | (120,738 | ) | | | (1,493,529 | ) |

Minera Frisco SAB de CV, Series A-1 | | | | | (198,800 | ) | | | (313,347 | ) |

| | | | | | | | | (4,284,129 | ) |

Poland | | | | | | | | | | |

Polski Koncern Naftowy Orlen SA | | | | | (428,226 | ) | | | (5,256,702 | ) |

Polskie Gornictwo Naftowe i Gazownictwo SA | | | | | (158,280 | ) | | | (232,464 | ) |

| | | | | | | | | (5,489,166 | ) |

Republic of Korea | | | | | | | | | | |

Cheil Industries, Inc. | | | | | (3,790 | ) | | | (263,521 | ) |

Daewoo Engineering & Construction Co. Ltd. | | | | | (154,890 | ) | | | (980,624 | ) |

GS Engineering & Construction Corp. | | | | | (3 | ) | | | (93 | ) |

Hyundai Heavy Industries Co. Ltd. | | | | | (108 | ) | | | (22,321 | ) |

Hyundai Mipo Dockyard | | | | | (24,310 | ) | | | (3,899,896 | ) |

Kolon Industries, Inc. | | | | | (6 | ) | | | (281 | ) |

S-Oil Corp. | | | | | (265 | ) | | | (16,828 | ) |

Samsung Electro-Mechanics Co. Ltd. | | | | | (4,435 | ) | | | (273,723 | ) |

Samsung Engineering Co. Ltd. | | | | | (29,921 | ) | | | (1,993,566 | ) |

Samsung Fire & Marine Insurance Co. Ltd. | | | | | (722 | ) | | | (166,664 | ) |

Samsung Heavy Industries Co. Ltd. | | | | | (57,360 | ) | | | (1,779,802 | ) |

Samsung SDI Co. Ltd. | | | | | (28,421 | ) | | | (3,770,952 | ) |

WeMade Entertainment Co. Ltd. | | | | | (2,537 | ) | | | (99,230 | ) |

| | | | | | | | | (13,267,501 | ) |

Russia | | | | | | | | | | |

Federal Grid Co. Unified Energy System JSC | | | | | (266,300,000 | ) | | | (640,127 | ) |

Magnit OJSC | | | | | (2,030 | ) | | | (483,999 | ) |

Magnit OJSC — GDR | | | | | (11,984 | ) | | | (630,906 | ) |

MMC Norilsk Nickel OJSC — ADR | | | | | (1,453 | ) | | | (22,075 | ) |

NovaTek OAO — GDR | | | | | (10,035 | ) | | | (1,224,885 | ) |

Novolipetsk Steel OJSC — GDR | | | | | (106,843 | ) | | | (1,535,923 | ) |

| | | | | | | | | (4,537,915 | ) |

South Africa | | | | | | | | | | |

Discovery Holdings Ltd. | | | | | (23,248 | ) | | | (157,230 | ) |

Exxaro Resources Ltd. | | | | | (79,321 | ) | | | (1,070,794 | ) |

Impala Platinum Holdings Ltd. | | | | | (153,875 | ) | | | (1,607,491 | ) |

Massmart Holdings Ltd. | | | | | (231,904 | ) | | | (2,528,672 | ) |

Nampak Ltd. | | | | | (63,770 | ) | | | (199,906 | ) |

Remgro Ltd. | | | | | (100,700 | ) | | | (1,684,416 | ) |

| | | | | | | | | (7,248,509 | ) |

| | | | | | | | | | | |

| | | | | Shares | | Value |

Reference Entity — Short |

Taiwan | | | | | | | | | | |

Asia Cement Corp. | | | | | (307,000 | ) | | $ | (376,535 | ) |

Chang Hwa Commercial Bank | | | | | (239,000 | ) | | | (141,334 | ) |

Cheng Shin Rubber Industry Co. Ltd. | | | | | (75,000 | ) | | | (190,155 | ) |

Chin-Poon Industrial Co. Ltd. | | | | | (75,000 | ) | | | (124,008 | ) |

China Petrochemical Development Corp. | | | | | (1,021,000 | ) | | | (450,460 | ) |

China Steel Corp. | | | | | (710,000 | ) | | | (609,899 | ) |

Compal Electronics, Inc. | | | | | (1,939,000 | ) | | | (1,441,454 | ) |

Formosa Petrochemical Corp. | | | | | (424,000 | ) | | | (1,069,128 | ) |

Foxconn Technology Co. Ltd. | | | | | (65,150 | ) | | | (146,353 | ) |

Hotai Motor Co. Ltd. | | | | | (67,000 | ) | | | (813,243 | ) |

Innolux Corp. | | | | | (919,000 | ) | | | (318,691 | ) |

MStar Semiconductor, Inc. | | | | | (383,000 | ) | | | (4,196,914 | ) |

Nan Kang Rubber Tire Co. Ltd. | | | | | (933 | ) | | | (1,131 | ) |

Powertech Technology, Inc. | | | | | (75,000 | ) | | | (103,494 | ) |

Standard Foods Corp. | | | | | (41,000 | ) | | | (120,448 | ) |

Transcend Information, Inc. | | | | | (130,000 | ) | | | (387,699 | ) |

TTY Biopharm Co. Ltd. | | | | | (57,000 | ) | | | (168,658 | ) |

Wintek Corp. | | | | | (3,000 | ) | | | (998 | ) |

| | | | | | | | | (10,660,602 | ) |

Thailand | | | | | | | | | | |

Siam Commercial Bank PCL | | | | | (32,400 | ) | | | (146,247 | ) |

Turkey | | | | | | | | | | |

Akbank TAS | | | | | (33,480 | ) | | | (85,649 | ) |

Arcelik AS | | | | | (716,731 | ) | | | (3,541,159 | ) |

Tupras Turkiye Petrol Rafinerileri AS | | | | | (7,928 | ) | | | (130,680 | ) |

Turk Telekomunikasyon AS | | | | | (30,823 | ) | | | (76,632 | ) |

Turkcell Iletisim Hizmetleri AS — ADR | | | | | (115,890 | ) | | | (1,442,830 | ) |

Turkiye Garanti Bankasi AS | | | | | (68,853 | ) | | | (182,292 | ) |

| | | | | | | | | (5,459,242 | ) |

Total Reference Entity — Short | | | | | | | | | (92,572,602 | ) |

Net Value of Reference Entity — Morgan Stanley & Co., Inc. | $ | 41,369,851 | |

See Notes to Financial Statements.

| 16 | BLACKROCK FUNDS | JANUARY 31, 2014

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

The following table represents the individual long and short positions and related values of equity securities underlying the total return swap with UBS AG as of January 31, 2014, expiration dates 2/28/14 — 5/02/18:

| | | | | Shares | | Value |

Reference Entity — Long |

Brazil | | | | | | | | | | |

AES Tiete SA, Preference Shares | | | | | 32,200 | | | $ | 251,916 | |

Bradespar SA, Preference Shares | | | | | 250,800 | | | | 2,317,555 | |

Braskem SA — ADR | | | | | 24,549 | | | | 371,917 | |

Braskem SA, Preference A Shares | | | | | 23,400 | | | | 180,160 | |

Cia Brasileira de Distribuicao Grupo Pao de Acucar — ADR | | | | | 60,124 | | | | 2,300,945 | |

Cia Brasileira de Distribuicao Grupo Pao de Acucar, Preference Shares | | | | | 34,300 | | | | 1,327,513 | |

Cia Energetica de Minas Gerais, Preference Shares | | | | | 23,818 | | | | 137,485 | |

Cia Energetica de Sao Paulo, Preference ‘B’ Shares | | | | | 66,700 | | | | 637,633 | |

Cia Paranaense de Energia — ADR | | | | | 28,387 | | | | 325,315 | |

Cia Paranaense de Energia, Preference B Shares | | | | | 34,300 | | | | 395,553 | |

Cyrela Brazil Realty SA | | | | | 122,400 | | | | 724,281 | |

Klabin SA, Preference Shares | | | | | 124,700 | | | | 637,646 | |

Petroleo Brasileiro SA, Preference Shares | | | | | 371,200 | | | | 2,261,117 | |

Transmissora Alianca de Energia Eletrica SA | | | | | 31,800 | | | | 233,501 | |

Vale SA, Preference Shares — ADR | | | | | 334,421 | | | | 4,106,690 | |

Vale SA, Preference A Shares | | | | | 471,000 | | | | 5,855,175 | |

Valid Solucoes e Servicos de Seguranca em Meios de Pagamento e Identificacao SA | | | | | 24,800 | | | | 309,326 | |

Via Varejo SA | | | | | 49,300 | | | | 471,907 | |

| | | | | | | | | 22,845,635 | |

Chile | | | | | | | | | | |

Companhia Cervecerias Unidas SA | | | | | 179,141 | | | | 1,908,328 | |

Enersis SA | | | | | 5,980,089 | | | | 1,580,242 | |

Enersis SA — ADR | | | | | 24,052 | | | | 319,170 | |

| | | | | | | | | 3,807,740 | |

China | | | | | | | | | | |

Agricultural Bank of China Ltd., Class H | | | | | 855,000 | | | | 373,249 | |

Airtac International Group | | | | | 8,000 | | | | 72,175 | |

Anhui Conch Cement Co. Ltd., Class H | | | | | 258,000 | | | | 995,190 | |

Bank of China Ltd., Class H | | | | | 7,624,000 | | | | 3,217,938 | |