Washington, D.C. 20549

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055

JANUARY 31, 2015

| SEMI-ANNUAL REPORT (UNAUDITED) | |  |

BlackRock FundsSM

> | | BlackRock Emerging Markets Long/Short Equity Fund |

> | | BlackRock Global Long/Short Equity Fund |

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Table of Contents

Page |

The Markets in Review | | | | | 3 | |

Semi-Annual Report:

| | | | | | |

Fund Summaries | | | | | 4 | |

About Fund Performance | | | | | 8 | |

Disclosure of Expenses | | | | | 8 | |

Derivative Financial Instruments | | | | | 9 | |

Portfolio Information | | | | | 9 | |

Financial Statements:

| | | | | | |

Schedules of Investments | | | | | 10 | |

Statements of Assets and Liabilities | | | | | 45 | |

Statements of Operations | | | | | 46 | |

Statements of Changes in Net Assets | | | | | 47 | |

Financial Highlights | | | | | 48 | |

Notes to Financial Statements | | | | | 54 | |

Officers and Trustees | | | | | 66 | |

Additional Information | | | | | 67 | |

| 2 | BLACKROCK FUNDS | JANUARY 31, 2015

|

Dear Shareholder,

Market volatility, while remaining below the long-term average level, increased over the course of 2014 and into 2015, driven largely by higher valuations in risk assets (such as equities and high yield bonds), escalating geopolitical risks, uneven global economic growth and expectations around policy moves from the world’s largest central banks. Surprisingly, U.S. interest rates trended lower through the period even as the U.S. Federal Reserve (the “Fed”) gradually reduced its bond buying program, which ultimately ended in October.

The first half of 2014 was generally a strong period for most asset classes; however, volatility ticked up in the summer as geopolitical tensions intensified in Ukraine and the Middle East and investors feared that better U.S. economic indicators may compel the Fed to increase short-term interest rates sooner than previously anticipated. Global credit markets tightened as the U.S. dollar strengthened versus other currencies, ultimately putting a strain on investor flows, and financial markets broadly weakened in the third quarter.

Several themes dominated the markets in the fourth quarter that resulted in the strong performance of U.S. markets versus other areas of the world. Economic growth strengthened considerably in the United States while the broader global economy showed signs of slowing. The European Central Bank and the Bank of Japan took aggressive measures to stimulate growth while the Fed moved toward tighter policy, causing further strengthening in the U.S. dollar. Fixed income investors piled into U.S. Treasuries where yields, although persistently low, were comparatively higher than yields on international sovereign debt, while equity investors favored the relative stability of U.S.-based companies amid rising global risks.

Oil prices, which had been gradually declining since mid-summer, suddenly plummeted in the fourth quarter due to a global supply-and-demand imbalance. Energy stocks sold off sharply and oil-exporting economies struggled, mainly within emerging markets. Conversely, the consumer sectors benefited from lower oil prices as savings at the gas pumps freed up discretionary income for other goods and services.

These trends shifted at the beginning of 2015. U.S. equity markets starkly underperformed international markets due to stretched valuations and uncertainty around the Fed’s pending rate hike. In addition, the stronger U.S. dollar began to hurt earnings of large cap companies. The energy sector continued to struggle, although oil prices showed signs of stabilizing toward the end of January as suppliers became more disciplined in their exploration and production efforts.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

Total Returns as of January 31, 2015

| | | | 6-month | | 12-month |

U.S. large cap equities (S&P 500® Index) | | | | | 4.37 | % | | | 14.22 | % |

U.S. small cap equities (Russell 2000® Index) | | | | | 4.72 | | | | 4.41 | |

| International equities (MSCI Europe, Australasia, Far East Index) | | | | | (6.97 | ) | | | (0.43 | ) |

| Emerging market equities (MSCI Emerging Markets Index) | | | | | (9.05 | ) | | | 5.23 | |

| 3-month Treasury bill (BofA Merrill Lynch 3-Month U.S. Treasury Bill Index) | | | | | 0.01 | | | | 0.03 | |

| U.S. Treasury securities (BofA Merrill Lynch 10-Year U.S. Treasury Index) | | | | | 9.29 | | | | 12.25 | |

| U.S. investment grade bonds (Barclays U.S. Aggregate Bond Index) | | | | | 4.36 | | | | 6.61 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | | | | 4.51 | | | | 8.81 | |

| U.S. high yield bonds (Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | | | | (0.89 | ) | | | 2.41 | |

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| THIS PAGE NOT PART OF YOUR FUND REPORT | | 3

|

| |

| Fund Summary as of January 31, 2015 | BlackRock Emerging Markets Long/Short Equity Fund

|

Investment Objective

BlackRock Emerging Markets Long/Short Equity Fund’s (the “Fund”) investment objective is to seek total return over the long term.

Portfolio Management Commentary

How did the Fund perform?

| • | For the six-month period ended January 31, 2015, the Fund underperformed its benchmark, the BofA Merrill Lynch 3-month U.S. Treasury Bill Index. |

What factors influenced performance?

| • | As part of its investment strategy, the Fund uses derivatives, including total return swaps, to achieve exposure to a market or to hedge market and/or equity risks. Through its use of total return swaps, the Fund’s performance is attributable to stock selection based on bottom-up security analysis coupled with a long-short approach to controlling the Fund’s exposure to trends in emerging markets. The Fund’s net long market position of approximately 20% in emerging markets was the largest detractor from relative return, as emerging market equities declined in the aggregate over the six months. (The net market position is the difference between the Fund’s total long positions and total short positions.) The Fund’s investments in both emerging and developed market companies that generated meaningful revenues via exposure to emerging markets outperformed the broader emerging markets; however, this positive selection was not sufficient to offset the negative impact from a long net market position. |

| • | The Fund experienced positive contributions from positions designed to benefit from declining energy prices, as well as exposures based on the identification of improving country fundamentals in markets such as India, Taiwan and Thailand. The implementation of top-down macro driven |

insights was also additive to performance. At the industry level, the Fund’s positioning was most effective with respect to the energy and semiconductor industries, and was least effective within the chemicals industry.

Describe recent portfolio activity.

| • | As commodity prices tumbled in the fourth quarter of 2014, the Fund began to overweight oil-importing countries and underweight exporters, on the view that structural factors should keep commodity prices range-bound for some period. After profiting from the country and industry positioning around oil in late 2014, the Fund began to trim these positions in January for risk control purposes. |

| • | The Fund’s cash exposure had no material impact on performance as the Fund expresses long and short positions via the use of derivatives. The Fund was fully invested throughout the period. |

Describe portfolio positioning at period end.

| • | The Fund had an approximately 20% net long market exposure in emerging markets at the end of the period. Reflecting the divergent paths for emerging market economies, the Fund continued to have well-balanced exposure to different groups of investment insights in both emerging market stocks and developed market stocks with exposure to emerging markets. Given the recent volatility in oil prices, the Fund had trimmed its exposure to energy. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | BLACKROCK FUNDS | JANUARY 31, 2015

|

| |

| | BlackRock Emerging Markets Long/Short Equity Fund

|

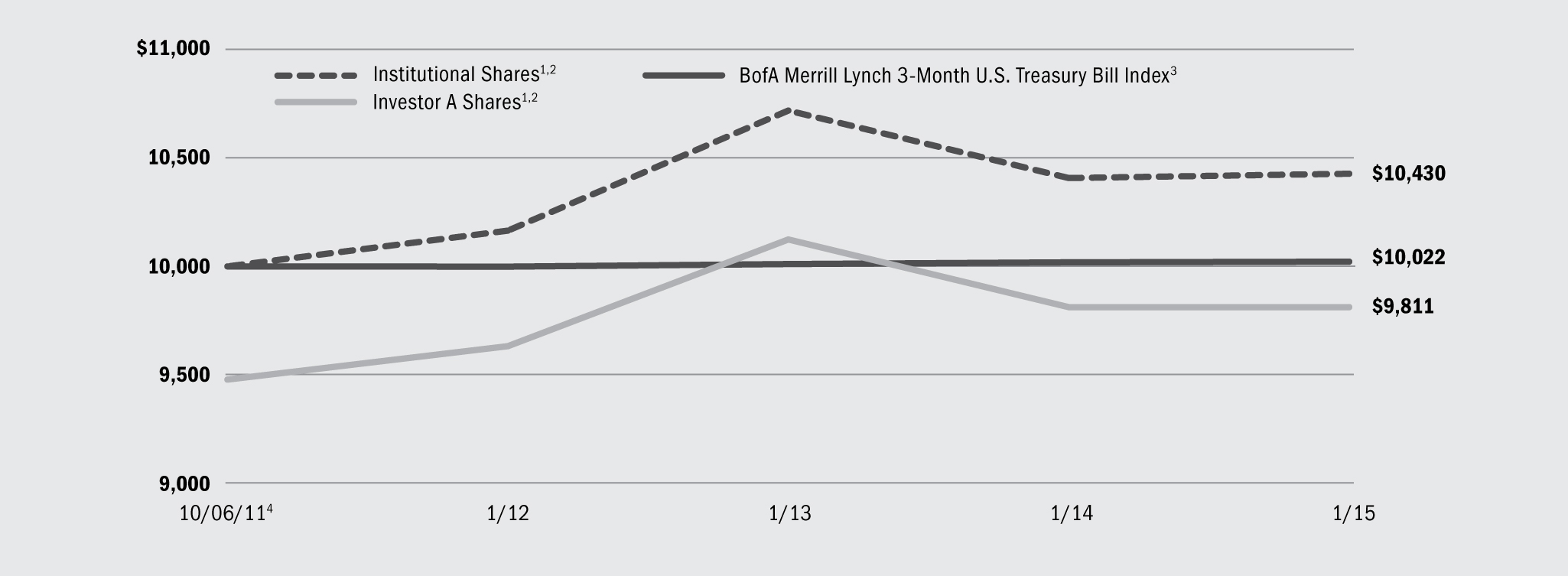

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | Under normal conditions, the Fund invests at least 80% of its total assets in global equity instruments and related derivative instruments issued by, or tied economically to, companies in emerging markets. |

| 3 | | An unmanaged index that tracks 3-month U.S. Treasury securities. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended January 31, 2015

| | | | | | Average Annual Total Returns5

|

| | | | | | 1 Year

|

| | | Since Inception6

|

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge |

Institutional | | (0.19 | )% | | | 0.19 | % | | | N/A | | | | 1.28 | % | | | N/A | |

Investor A | | (0.29 | ) | | | 0.00 | | | | (5.25 | )% | | | 1.06 | | | | (0.57 | )% |

Investor C | | (0.59 | ) | | | (0.69 | ) | | | (1.69 | ) | | | 0.28 | | | | 0.28 | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | 0.01 | | | | 0.03 | | | | N/A | | | | 0.07 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on October 6, 2011. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| | Actual | | Hypothetical8 | | |

| | | Beginning

Account Value

August 1, 2014 | | Ending

Account Value

January 31, 2015 | | Expenses

Paid During

the Period7 | | Beginning

Account Value

August 1, 2014 | | Ending

Account Value

January 31, 2015 | | Expenses

Paid During

the Period7 | | Annualized

Expense

Ratio |

Institutional | | $ | 1,000.00 | | | $ | 998.10 | | | $ | 8.81 | | | $ | 1,000.00 | | | $ | 1,016.38 | | | $ | 8.89 | | | | 1.75 | % |

Investor A | | $ | 1,000.00 | | | $ | 997.10 | | | $ | 10.07 | | | $ | 1,000.00 | | | $ | 1,015.12 | | | $ | 10.16 | | | | 2.00 | % |

Investor C | | $ | 1,000.00 | | | $ | 994.10 | | | $ | 13.77 | | | $ | 1,000.00 | | | $ | 1,011.39 | | | $ | 13.89 | | | | 2.74 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated.

| BLACKROCK FUNDS | JANUARY 31, 2015 | 5

|

| |

| Fund Summary as of January 31, 2015 | BlackRock Global Long/Short Equity Fund

|

Investment Objective

BlackRock Global Long/Short Equity Fund’s (the “Fund”) investment objective is to seek total return over the long term.

Portfolio Management Commentary

How did the Fund perform?

| • | For the six-month period ended January 31, 2015, the Fund outperformed its benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index. |

What factors influenced performance?

| • | As part of its investment strategy, the Fund uses derivatives, including total return swaps, to achieve exposure to a market or to manage market and/or equity risks. Through its use of total return swaps, the Fund’s performance is attributable to stock selection based on bottom-up security analysis coupled with a long-short approach to controlling the Fund’s exposure to trends in global equity markets. The largest positive contribution to performance over the period came from macro/thematic strategies, particularly industry positioning. The Fund also benefited from stock selection in U.S. names. Country selection produced more mixed results. The Fund’s close to 0% net market position over the six months meant that the impact on performance from broader market moves was negligible. (The net market position is the difference between the Fund’s total long positions and total short positions.) At the industry level, the most significant contributor was a long position in the semiconductor industry. Semiconductor manufacturers continued to benefit from the increasingly broad usage of their products and their high exposure to the “internet of things” theme. Semiconductor manufacturers are part of the supply chain in areas as diverse as computer hardware, automobiles, telecommunication services and aerospace & defense. |

| • | A long position in the energy equipment & servicing industry detracted from relative performance. These companies had been attractive and profitable investments for much of 2014 (prior to September), as they benefited from the building out of infrastructure in support of the shale oil fracking boom. Additionally, the industry tends to exhibit a low sensitivity to small movements in oil prices, which the Fund managed via long exposure to airlines, which typically perform well when oil prices drop. Nevertheless, the Fund’s holdings within energy equipment & servicing had a notable negative impact on performance given the dramatic decline in oil prices over the fourth quarter of 2014. |

Describe recent portfolio activity.

| • | The most significant change in the Fund’s positioning over the six-month period was with respect to its relative net positions in the United States and Europe. The Fund entered the period with a net long position in U.S. stocks, where short positions in domestically focused firms were more than offset by long positions in export-focused firms which tend to benefit from a weaker domestic currency and lower cost of labor. However, the outlook for U.S. firms weakened based on a number of trends. These included the impact of a strengthening dollar on exports, signs of slowing momentum in economic numbers, expectations that tighter monetary policy would impede domestic demand, and signs of crowding of capital flows into the United States. |

| • | By contrast, the Fund entered the period short European exporters due to weak trends in company fundamentals and headwinds from strong local currencies. However, European Central Bank actions leading to looser monetary policy than in the United States led to a slight weakening of the euro. In addition, there have been signs of domestic demand returning, and the lack of investor attention to the region is expected to reverse at some point. At period end the Fund had a long position in European stocks. |

| • | The Fund’s cash exposure had no material impact on performance as the Fund expresses long and short positions via the use of derivatives that may require cash collateral. The Fund was fully invested throughout the period. |

Describe portfolio positioning at period end.

| • | The Fund’s net market exposure was essentially neutral, or approximately 0%, at the end of the period. At the country level, the Fund held significant long positions in Spain and Germany as well as Canada, while being short U.K. and U.S. equities. At the industry level, the Fund was long real estate, utilities and energy, while being short consumer staples and retail. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 6 | BLACKROCK FUNDS | JANUARY 31, 2015

|

| |

| | BlackRock Global Long/Short Equity Fund

|

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | Under normal conditions, the Fund invests at least 80% of its total assets in equity instruments and related derivative instruments issued by, or tied economically to, companies located in developed markets. |

| 3 | | An unmanaged index that tracks 3-month U.S. Treasury securities. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended January 31, 2015

| | | Average Annual Total Returns5

|

| | | | 1 Year

| | Since Inception6

|

| | 6-Month

Total Returns | | w/o sales

charge | | w/sales

charge | | w/o sales

charge | | w/sales

charge |

Institutional | | 2.35 | % | | | (0.23 | )% | | | N/A | | | | 9.14 | % | | | N/A | |

Investor A | | 2.19 | | | | (0.48 | ) | | | (5.71 | )% | | | 8.86 | | | | 6.12 | % |

Investor C | | 1.77 | | | | (1.25 | ) | | | (2.23 | ) | | | 8.05 | | | | 8.05 | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | 0.01 | | | | 0.03 | | | | N/A | | | | 0.05 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on December 20, 2012. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| | Actual

| | Hypothetical8

|

| |

|

| Beginning

Account Value

August 1, 2014

|

| Ending

Account Value

January 31, 2015

|

| Expenses

Paid During

the Period7

|

| Beginning

Account Value

August 1, 2014

|

| Ending

Account Value

January 31, 2015

|

| Expenses

Paid During

the Period7

|

| Annualized

Expense

Ratio

|

Institutional | | $ | 1,000.00 | | | $ | 1,023.50 | | | $ | 8.06 | | | $ | 1,000.00 | | | $ | 1,017.24 | | | $ | 8.03 | | | | 1.58 | % |

Investor A | | $ | 1,000.00 | | | $ | 1,021.90 | | | $ | 9.58 | | | $ | 1,000.00 | | | $ | 1,015.73 | | | $ | 9.55 | | | | 1.88 | % |

Investor C | | $ | 1,000.00 | | | $ | 1,017.70 | | | $ | 13.32 | | | $ | 1,000.00 | | | $ | 1,012.00 | | | $ | 13.29 | | | | 2.62 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated.

| BLACKROCK FUNDS | JANUARY 31, 2015 | 7

|

| • | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| • | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

| • | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance

results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in each of the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend dates. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, waived and/or reimbursed a portion of each Fund’s expenses. Without such waiver and/or reimbursement, each Fund’s performance would have been lower. The Manager is under no obligation to waive or reimburse or to continue waiving or reimbursing its fees after the applicable termination date of such agreement. See Note 4 of the Notes to Financial Statements for additional information on waivers and reimbursements.

Shareholders of each Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, and other Fund expenses. The expense examples shown on the previous pages (which are based on a hypothetical investment of $1,000 invested on August 1, 2014 and held through January 31, 2015) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| 8 | BLACKROCK FUNDS | JANUARY 31, 2015

|

| |

| Derivative Financial Instruments |

|

The Funds may invest in various derivative financial instruments. Derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage. Derivative financial instruments also involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative

financial instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| |

| Portfolio Information as of January 31, 2015 | |

BlackRock Emerging Markets Long/Short Equity Fund

| | | | Percent of Total Investments1

|

Geographic Allocation

|

|

|

| Long

|

| Short

|

| Total

|

| China | | | | | 11 | % | | | 8 | % | | | 19 | % |

| South Korea | | | | | 6 | | | | 6 | | | | 12 | |

| Taiwan | | | | | 4 | | | | 7 | | | | 11 | |

| Hong Kong | | | | | 3 | | | | 7 | | | | 10 | |

| United States | | | | | 5 | | | | 4 | | | | 9 | |

| Brazil | | | | | 3 | | | | 5 | | | | 8 | |

| South Africa | | | | | 3 | | | | 4 | | | | 7 | |

| Thailand | | | | | 2 | | | | 1 | | | | 3 | |

| Turkey | | | | | 1 | | | | 2 | | | | 3 | |

| Mexico | | | | | 2 | | | | 1 | | | | 3 | |

| Japan | | | | | 1 | | | | 1 | | | | 2 | |

| Poland | | | | | — | | | | 2 | | | | 2 | |

| Indonesia | | | | | 1 | | | | 1 | | | | 2 | |

| United Kingdom | | | | | — | | | | 1 | | | | 1 | |

| Malaysia | | | | | — | | | | 1 | | | | 1 | |

| Philippines | | | | | — | | | | 1 | | | | 1 | |

| Malta | | | | | 1 | | | | — | | | | 1 | |

Other2 | | | | | 2 | | | | 3 | | | | 5 | |

Total

| | | | | 45 | % | | | 55 | % | | | 100 | % |

BlackRock Global Long/Short Equity Fund

| | | | Percent of Total Investments1

|

Geographic Allocation

|

|

|

| Long

|

| Short

|

| Total

|

| United States | | | | | 51 | % | | | 20 | % | | | 71 | % |

| Japan | | | | | 4 | | | | 4 | | | | 8 | |

| Canada | | | | | 3 | | | | 1 | | | | 4 | |

| United Kingdom | | | | | 1 | | | | 3 | | | | 4 | |

| Spain | | | | | 2 | | | | — | | | | 2 | |

| Australia | | | | | 1 | | | | 1 | | | | 2 | |

| Germany | | | | | 2 | | | | — | | | | 2 | |

| Hong Kong | | | | | 1 | | | | — | | | | 1 | |

Other2 | | | | | 2 | | | | 4 | | | | 6 | |

Total

| | | | | 67 | % | | | 33 | % | | | 100 | % |

| 1 | | Total investments include the gross notional values of long and short equity securities of the underlying derivative contracts utilized by the Fund and exclude short-term securities. |

| 2 | | Includes holdings within countries representing 1% or less of long-term investments. Please refer to the Schedules of Investments for such countries. |

| BLACKROCK FUNDS | JANUARY 31, 2015 | 9

|

| |

| Schedule of Investments January 31, 2015 (Unaudited) | BlackRock Emerging Markets Long/Short Equity Fund

(Percentages shown are based on Net Assets) |

Short-Term Securities

|

|

|

| Shares

|

| Value

|

| BlackRock Liquidity Funds, TempFund, Institutional Class, 0.07% (a)(b) | | | | | 506,787,730 | | | $ | 506,787,730 | |

Total Short-Term Securities

(Cost — $506,787,730*) — 100.5% | | | | | | | | | 506,787,730 | |

Liabilities in Excess of Other Assets — (0.5)% | | | | | | | | | (2,686,631 | ) |

Net Assets — 100.0% | | | | | | | | $ | 504,101,099 | |

Notes to Schedule of Investments

| * | | | | Cost for federal income tax purposes. |

| (a) | | | | During the six months ended January 31, 2015, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

Affiliate

|

|

|

| Shares Held at

July 31, 2014

|

| Net

Activity

|

| Shares Held at

January 31, 2015

|

| Income

|

| BlackRock Liquidity Funds, TempFund, Institutional Class | | | | | 591,333,751 | | | | (84,546,021 | ) | | | 506,787,730 | | | $ | 143,783 | |

| (b) | | | | Represents the current yield as of report date. |

| • | | | | Total return swaps outstanding as of January 31, 2015 were as follows:1 |

Reference Entity

|

|

|

| Counterparty

|

| Expiration

Dates

|

| Notional

Amount

|

| Unrealized

Appreciation

|

| Net Value of

Reference

Entities

|

| Equity Securities Long/Short: | | | | Goldman Sachs & Co. | | 1/26/15 — 8/03/16 | | $ | 29,384,796 | | | $ | 5,417,664 | 2 | | $ | 33,840,048 | |

| | | | | Goldman Sachs & Co. | | 8/27/15 — 8/04/16 | | $ | (854,968 | ) | | | 842,245 | 3 | | | (7,921 | ) |

| | | | | Morgan Stanley & Co, Inc. | | 5/16/16 — 1/22/18 | | $ | 33,489,636 | | | | 183,827 | 4 | | | 33,961,483 | |

| | | | | Morgan Stanley & Co, Inc. | | 2/25/16 | | $ | (467,619 | ) | | | 439,064 | 5 | | | (12,012 | ) |

| | | | | UBS AG | | 3/19/15 | | $ | 29,779,219 | | | | 3,187,350 | 6 | | | 32,720,669 | |

| | | | | UBS AG | | 3/19/15 | | $ | (1,086,406 | ) | | | 843,622 | 7 | | | (160,620 | ) |

| |

Total | | | | | | | | | | | | $ | 10,913,772 | | | $ | 100,341,647 | |

| |

| 1 | | The Fund receives or pays the total return on a portfolio of long and short positions underlying the total return swap. In addition, the Fund pays or receives a variable rate of interest, based on a specified benchmark, plus or minus a spread in a range of 20-1200 basis points. The benchmark and spread are determined based upon the country and/or currency of the individual underlying positions. The following are the specified benchmarks used in determining the variable rate of interest: |

IntercontinentalExchange LIBOR:

USD 1 Month; USD Spot Next

Federal Funds Effective Rate — One Day or Overnight

| 2 | | Amount includes $962,412 of dividends and financing fees due to/from the Fund and/or the counterparty. |

| 3 | | Amount includes $(4,802) of dividends and financing fees due to/from the Fund and/or the counterparty. |

| 4 | | Amount includes $(288,020) of dividends and financing fees due to/from the Fund and/or the counterparty. |

| 5 | | Amount includes $(16,543) of dividends and financing fees due to/from the Fund and/or the counterparty. |

| 6 | | Amount includes $245,900 of dividends and financing fees due to/from the Fund and/or the counterparty. |

| 7 | | Amount includes $(82,164) of dividends and financing fees due to/from the Fund and/or the counterparty. |

See Notes to Financial Statements.

| 10 | BLACKROCK FUNDS | JANUARY 31, 2015

|

| |

| Schedule of Investments January 31, 2015 (Unaudited) | BlackRock Emerging Markets Long/Short Equity Fund |

The following table represents the individual long and short positions and related values of equity securities underlying the total return swap with Goldman Sachs & Co. as of January 31, 2015, expiration dates 1/26/15 — 8/03/16:

| | | | | Shares | | Value |

Reference Entity — Long |

Brazil | | | | | | | | | | |

| AES Tiete SA, Preference Shares | | | | | 20,700 | | | $ | 127,753 | |

| AMBEV SA, ADR | | | | | 102,902 | | | | 677,095 | |

| Banco do Brasil SA | | | | | 19,800 | | | | 152,452 | |

| BM&FBovespa SA | | | | | 407,100 | | | | 1,380,643 | |

| Bradespar SA, Preference Shares | | | | | 485,500 | | | | 2,100,682 | |

| Cia Brasileira de Distribuicao Grupo Pao de Acucar, Preference Shares | | | | | 69,400 | | | | 2,304,496 | |

| Cia Energetica de Minas Gerais — ADR | | | | | 3,379 | | | | 15,239 | |

| Cia Energetica de Minas Gerais, Preference Shares | | | | | 103,400 | | | | 458,956 | |

| Cia Energetica de Sao Paulo, Preference B Shares | | | | | 116,400 | | | | 1,022,038 | |

| Cia Paranaense de Energia — ADR | | | | | 11,042 | | | | 128,087 | |

| Cia Paranaense de Energia, Preference B Shares | | | | | 55,200 | | | | 641,849 | |

| Cyrela Brazil Realty SA | | | | | 12,800 | | | | 51,567 | |

| EDP — Energias do Brasil SA | | | | | 326,100 | | | | 1,052,465 | |

| Embraer SA | | | | | 4,900 | | | | 43,353 | |

| Embraer SA, ADR | | | | | 22,222 | | | | 783,548 | |

| Even Construtora e Incorporadora SA | | | | | 518,400 | | | | 836,550 | |

| Gerdau SA, Preference Shares | | | | | 609,400 | | | | 2,068,996 | |

| JBS SA | | | | | 345,500 | | | | 1,473,035 | |

| Light SA | | | | | 10,500 | | | | 55,410 | |

| Metalurgica Gerdau SA, Preference Shares | | | | | 107,900 | | | | 395,690 | |

| MRV Engenharia e Participacoes SA | | | | | 56,400 | | | | 145,243 | |

| Multiplus SA | | | | | 163,000 | | | | 2,110,966 | |

| Petroleo Brasileiro SA — ADR | | | | | 79,460 | | | | 488,679 | |

| Petroleo Brasileiro SA, Preference Shares | | | | | 92,000 | | | | 280,466 | |

| Tractebel Energia SA | | | | | 23,400 | | | | 271,565 | |

| Vale SA, Preference Shares — ADR | | | | | 46,412 | | | | 290,539 | |

| Vale SA, Preference A Shares | | | | | 112,000 | | | | 690,804 | |

| Valid Solucoes e Servicos de Seguranca em Meios de Pagamento e Identificacao S.A | | | | | 28,900 | | | | 414,127 | |

| | | | | | | | | | 20,462,293 | |

China | | | | | | | | | | |

| Agricultural Bank of China Ltd., Class H | | | | | 1,559,000 | | | | 761,281 | |

| Anta Sports Products Ltd. | | | | | 191,000 | | | | 336,553 | |

| Bank of China Ltd., Class H | | | | | 1,200,000 | | | | 669,910 | |

| Beijing Capital International Airport Co. Ltd., Class H | | | | | 888,000 | | | | 843,727 | |

| Beijing Jingneng Clean Energy Co., Ltd., Class H | | | | | 272,000 | | | | 108,768 | |

| China Cinda Asset Management Co., Ltd. | | | | | 3,717,000 | | | | 1,758,135 | |

| China Communications Construction Corp. Ltd., Class H | | | | | 1,598,000 | | | | 1,736,041 | |

| China Communications Services Corp. Ltd., Class H | | | | | 320,000 | | | | 144,100 | |

| China Construction Bank Corp., Class H | | | | | 1,517,000 | | | | 1,214,329 | |

| China Everbright Bank Co., Ltd., Class H | | | | | 398,000 | | | | 212,115 | |

| China Mobile Ltd. | | | | | 359,500 | | | | 4,712,498 | |

| China Railway Group Ltd., Class H | | | | | 555,000 | | | | 405,119 | |

| China Shenhua Energy Co., Ltd., Class H | | | | | 984,500 | | | | 2,702,485 | |

| Country Garden Holdings Co. Ltd. | | | | | 255,000 | | | | 101,606 | |

| Datang International Power Generation Co. Ltd., Class H | | | | | 4,636,000 | | | | 2,534,689 | |

| Dongfeng Motor Group Co. Ltd., Class H | | | | | 2,018,000 | | | | 2,918,513 | |

| Greentown China Holdings Ltd. | | | | | 1,059,000 | | | | 926,179 | |

| Guangzhou Pharmaceutical Co., Ltd. | | | | | 326,000 | | | | 1,154,430 | |

| Guangzhou R&F Properties Co., Ltd., Class H | | | | | 506,400 | | | | 574,132 | |

| Industrial and Commercial Bank of China Ltd., Class H | | | | | 2,468,000 | | | | 1,759,997 | |

| Jiangsu Expressway Co., Ltd., Class H | | | | | 1,336,000 | | | | 1,658,216 | |

| Longfor Properties Co. Ltd. | | | | | 130,500 | | | | 171,443 | |

| Lonking Holdings Ltd. | | | | | 2,050,000 | | | | 387,784 | |

| Metallurgical Corp. of China, Ltd. | | | | | 2,760,000 | | | | 851,762 | |

| | | | | Shares | | Value |

Reference Entity — Long

|

China (concluded) | | | | | | | | | | |

| Ping An Insurance Group Co. of China Ltd., Class H | | | | | 91,000 | | | $ | 964,503 | |

| Shanghai Industrial Holdings Ltd. | | | | | 494,000 | | | | 1,459,448 | |

| Shanghai Pharmaceuticals Holding Co., Ltd., Class H | | | | | 316,300 | | | | 684,923 | |

| Sino-Ocean Land Holdings Ltd. | | | | | 825,000 | | | | 527,556 | |

| Sinopharm Group Co., Class H | | | | | 110,800 | | | | 403,429 | |

| Zhejiang Expressway Co., Ltd., Class H | | | | | 2,395,218 | | | | 3,048,076 | |

| | | | | | | | | | 35,731,747 | |

Hong Kong | | | | | | | | | | |

| China Merchants Holdings International Co., Ltd. | | | | | 238,000 | | | | 874,615 | |

| China Mobile, Ltd., ADR | | | | | 5,338 | | | | 348,678 | |

| China Power International Development, Ltd. | | | | | 9,257,000 | | | | 5,255,774 | |

| China Resources Cement Holdings Ltd. | | | | | 3,264,000 | | | | 1,937,004 | |

| China Resources Land Ltd. | | | | | 276,888 | | | | 708,345 | |

| China Resources Power Holdings Co., Ltd. | | | | | 42,000 | | | | 117,599 | |

| China Travel International Inv HK | | | | | 950,000 | | | | 311,748 | |

| China Unicom Hong Kong Ltd. | | | | | 242,000 | | | | 362,225 | |

| China Unicom Hong Kong, Ltd., ADR | | | | | 26,870 | | | | 401,706 | |

| COSCO Pacific Ltd. | | | | | 1,460,000 | | | | 2,112,735 | |

| CSPC Pharmaceutical Group Ltd. | | | | | 2,972,000 | | | | 2,507,164 | |

| Franshion Properties China Ltd. | | | | | 3,074,000 | | | | 902,527 | |

| GOME Electrical Appliances Holding Ltd. | | | | | 26,552,000 | | | | 3,654,954 | |

| Guangdong Investment Ltd. | | | | | 244,000 | | | | 327,530 | |

| Kingboard Chemical Holdings Ltd. | | | | | 244,500 | | | | 395,435 | |

| KWG Property Holding Ltd. | | | | | 2,286,500 | | | | 1,460,290 | |

| Poly Property Group Co. Ltd. | | | | | 236,000 | | | | 108,414 | |

| REXLot Holdings, Ltd. | | | | | 6,175,000 | | | | 482,218 | |

| Shenzhen Investment Ltd. | | | | | 2,062,000 | | | | 595,116 | |

| Shimao Property Holdings Ltd. | | | | | 1,267,000 | | | | 2,659,434 | |

| Sino Biopharmaceutical Ltd. | | | | | 1,536,000 | | | | 1,534,450 | |

| Skyworth Digital Holdings Ltd. | | | | | 184,000 | | | | 103,765 | |

| Yuexiu Property Co., Ltd. | | | | | 370,000 | | | | 71,910 | |

| | | | | | | | | | 27,233,636 | |

Indonesia | | | | | | | | | | |

| Adaro Energy Tbk PT | | | | | 2,166,500 | | | | 170,235 | |

| Indo Tambangraya Megah Tbk PT | | | | | 86,700 | | | | 114,240 | |

| Matahari Putra Prima Tbk PT | | | | | 9,648,900 | | | | 2,894,480 | |

| Perusahaan Gas Negara Persero Tbk PT | | | | | 2,401,300 | | | | 953,954 | |

| Perusahaan Perkebunan London Sumatra Indonesia Tbk PT | | | | | 467,600 | | | | 67,682 | |

| Tambang Batubara Bukit Asam Persero Tbk PT | | | | | 127,700 | | | | 114,129 | |

| United Tractors Tbk PT | | | | | 860,600 | | | | 1,211,002 | |

| | | | | | | | | | 5,525,722 | |

Malaysia | | | | | | | | | | |

| British American Tobacco Malaysia Bhd | | | | | 167,700 | | | | 3,048,484 | |

| Tenaga Nasional Bhd | | | | | 51,900 | | | | 207,004 | |

| YTL Power International Bhd | | | | | 86,400 | | | | 38,061 | |

| | | | | | | | | | 3,293,549 | |

Mexico | | | | | | | | | | |

| Grupo Aeroportuario del Pacifico SAB de CV, Class B | | | | | 415,904 | | | | 2,749,664 | |

| Grupo Aeroportuario del Pacifico SAB de CV — ADR | | | | | 21,914 | | | | 1,455,308 | |

| Grupo Bimbo SAB de CV, Series A | | | | | 588,934 | | | | 1,498,512 | |

| Wal-Mart de Mexico SAB de CV, Series V | | | | | 48,700 | | | | 94,057 | |

| | | | | | | | | | 5,797,541 | |

Peru | | | | | | | | | | |

| Compania de Minas Buenaventura SA — ADR | | | | | 4,920 | | | | 56,186 | |

Philippines | | | | | | | | | | |

| Globe Telecom, Inc. | | | | | 16,005 | | | | 631,742 | |

| Jollibee Foods Corp. | | | | | 60,960 | | | | 320,042 | |

| Universal Robina Corp. | | | | | 160,490 | | | | 752,952 | |

| | | | | | | | | | 1,704,736 | |

See Notes to Financial Statements.

| BLACKROCK FUNDS | JANUARY 31, 2015 | 11

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

| | | | | Shares | | Value |

Reference Entity — Long

|

Poland | | | | | | | | | | |

| Enea SA | | | | | 227,995 | | | $ | 1,012,988 | |

| Grupa Lotos SA | | | | | 59,150 | | | | 390,314 | |

| KGHM Polska Miedz SA | | | | | 25,653 | | | | 727,252 | |

| PGE SA | | | | | 341,060 | | | | 1,787,087 | |

| Polski Koncern Naftowy Orlen SA | | | | | 123,137 | | | | 1,816,833 | |

| Polskie Gornictwo Naftowe i Gazownictwo SA | | | | | 313,738 | | | | 370,211 | |

| Tauron Polska Energia SA | | | | | 168,088 | | | | 226,140 | |

| | | | | | | | | | 6,330,825 | |

South Africa | | | | | | | | | | |

| AngloGold Ashanti Ltd. | | | | | 10,418 | | | | 126,359 | |

| Bidvest Group Ltd. | | | | | 92,259 | | | | 2,546,218 | |

| Clicks Group, Ltd. | | | | | 131,911 | | | | 1,023,117 | |

| Exxaro Resources Ltd. | | | | | 39,918 | | | | 353,692 | |

| FirstRand Ltd. | | | | | 1,223,442 | | | | 5,444,774 | |

| Gold Fields Ltd. | | | | | 17,133 | | | | 98,700 | |

| Gold Fields, Ltd., ADR | | | | | 190,918 | | | | 1,126,416 | |

| Liberty Holdings Ltd. | | | | | 76,893 | | | | 865,665 | |

| Mediclinic International, Ltd. | | | | | 37,359 | | | | 369,406 | |

| MTN Group Ltd. | | | | | 49,493 | | | | 854,680 | |

| Netcare Ltd. | | | | | 1,784,715 | | | | 5,924,962 | |

| Sanlam Ltd. | | | | | 154,574 | | | | 926,477 | |

| Sibanye Gold, Ltd. | | | | | 459,730 | | | | 1,243,061 | |

| | | | | | | | | | 20,903,527 | |

South Korea | | | | | | | | | | |

| AfreecaTV Co., Ltd. | | | | | 2,797 | | | | 72,520 | |

| Amorepacific Corp. | | | | | 322 | | | | 776,024 | |

| Cell Biotech Co., Ltd. | | | | | 10,709 | | | | 571,682 | |

| Doosan Infracore Co., Ltd. | | | | | 94,925 | | | | 878,881 | |

| Hanjin Kal Corp. | | | | | 1 | | | | 30 | |

| Hyundai Mobis | | | | | 1,617 | | | | 365,552 | |

| Hyundai Steel Co. | | | | | 803 | | | | 48,177 | |

| Kangwon Land, Inc. | | | | | 47,459 | | | | 1,399,533 | |

| Kia Motors Corp. | | | | | 49,510 | | | | 2,069,125 | |

| Korea Electric Power Corp. | | | | | 1,600 | | | | 62,558 | |

| Korea Investment Holdings Co., Ltd. | | | | | 2,726 | | | | 128,465 | |

| Korea Line Corp. | | | | | 58,285 | | | | 1,167,725 | |

| Korean Reinsurance Co. | | | | | 7 | | | | 65 | |

| KT Skylife Co., Ltd. | | | | | 27,850 | | | | 411,252 | |

| KT Submarine Co., Ltd. | | | | | 18,442 | | | | 85,580 | |

| LG Corp. | | | | | 34,844 | | | | 1,960,941 | |

| Lotte Confectionery Co., Ltd. | | | | | 143 | | | | 243,694 | |

| Lotte Food Co., Ltd. | | | | | 504 | | | | 285,026 | |

| LS Corp. | | | | | 17,212 | | | | 754,461 | |

| LS Industrial Systems Co., Ltd. | | | | | 6,633 | | | | 365,589 | |

| Mando Corp. | | | | | 20,606 | | | | 1,186,467 | |

| Medy-Tox, Inc. | | | | | 1,337 | | | | 449,247 | |

| Mirae Asset Securities Co., Ltd. | | | | | 1,780 | | | | 74,907 | |

| Poongsan Corp. | | | | | 1,137 | | | | 23,508 | |

| POSCO — ADR | | | | | 1,671 | | | | 97,302 | |

| SK Innovation Co., Ltd. | | | | | 5,150 | | | | 437,335 | |

| SK Networks Co., Ltd. | | | | | 88,276 | | | | 756,175 | |

| SK Telecom Co., Ltd. | | | | | 246 | | | | 64,468 | |

| SK Telecom Co., Ltd., ADR | | | | | 104,968 | | | | 3,017,830 | |

| SKC Co., Ltd. | | | | | 13,407 | | | | 368,177 | |

| Sungwoo Hitech Co., Ltd. | | | | | 26,622 | | | | 293,649 | |

| Tovis Co., Ltd. | | | | | 7,042 | | | | 126,644 | |

| | | | | | | | | | 18,542,589 | |

Taiwan | | | | | | | | | | |

| Advanced Semiconductor Engineering, Inc. | | | | | 160,000 | | | | 200,915 | |

| Advanced Semiconductor Engineering, Inc. — ADR | | | | | 22,869 | | | | 151,164 | |

| Asia Cement Corp. | | | | | 422,000 | | | | 508,771 | |

| Chicony Electronics Co., Ltd. | | | | | 428,000 | | | | 1,174,447 | |

| Chimei Innolux Corp. | | | | | 4,858,000 | | | | 2,340,405 | |

| | | | | Shares | | Value |

Reference Entity — Long

|

Taiwan (concluded) | | | | | | | | | | |

| Chimei Materials Technology Corp. | | | | | 2,360,355 | | | $ | 2,383,640 | |

| China Steel Chemical Corp. | | | | | 166,000 | | | | 802,655 | |

| CTCI Corp. | | | | | 193,000 | | | | 304,976 | |

| Elan Microelectronics Corp. | | | | | 336,000 | | | | 525,432 | |

| Everlight Electronics Co., Ltd. | | | | | 123,000 | | | | 295,045 | |

| Far Eastern Department Stores Co., Ltd. | | | | | 1,279,508 | | | | 1,091,661 | |

| Foxconn Technology Co., Ltd. | | | | | 353,000 | | | | 955,799 | |

| King Yuan Electronics Co., Ltd. | | | | | 3,907,000 | | | | 3,263,926 | |

| Pegatron Corp. | | | | | 403,000 | | | | 1,071,609 | |

| President Chain Store Corp. | | | | | 10,000 | | | | 76,873 | |

| Sigurd Microelectronics Corp. | | | | | 2,336,000 | | | | 2,224,219 | |

| Siliconware Precision Industries Co. | | | | | 1,450,000 | | | | 2,445,035 | |

| Sitronix Technology Corp. | | | | | 100,000 | | | | 327,408 | |

| Soft-World International Corp. | | | | | 72,000 | | | | 228,119 | |

| Taiwan Cement Corp. | | | | | 1,279,000 | | | | 1,726,795 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | | | | 255,000 | | | | 1,121,395 | |

| Unity Opto Technology Co., Ltd. | | | | | 125,000 | | | | 115,737 | |

| Win Semiconductors Corp. | | | | | 139,000 | | | | 146,016 | |

| Wistron Corp. | | | | | 1,770,000 | | | | 1,613,691 | |

| Yuanta Financial Holding Co., Ltd. | | | | | 3,727,500 | | | | 1,788,184 | |

| | | | | | | | | | 26,883,917 | |

Thailand | | | | | | | | | | |

| PTT PCL | | | | | 251,700 | | | | 2,660,807 | |

Turkey | | | | | | | | | | |

| Enka Insaat ve Sanayi AS | | | | | 897,342 | | | | 1,812,903 | |

| KOC Holding AS | | | | | 25,003 | | | | 129,647 | |

| Koza Altin Isletmeleri AS | | | | | 30,199 | | | | 238,850 | |

| Pegasus Hava Tasimaciligi AS | | | | | 24,784 | | | | 307,030 | |

| Tofas Turk Otomobil Fabrikasi AS | | | | | 113,768 | | | | 757,336 | |

| Tupras Turkiye Petrol Rafinerileri AS | | | | | 7,654 | | | | 165,891 | |

| Turk Telekomunikasyon AS | | | | | 183,885 | | | | 550,155 | |

| | | | | | | | | | 3,961,812 | |

United Kingdom | | | | | | | | | | |

| Old Mutual PLC | | | | | 88,659 | | | | 277,896 | |

Total Reference Entity — Long | | | | | | | | | 179,366,783 | |

| |

Reference Entity — Short |

Brazil | | | | | | | | | | |

| Aliansce Shopping Centers SA | | | | | (18,000 | ) | | | (108,003 | ) |

| Equatorial Energia SA | | | | | (71,101 | ) | | | (662,452 | ) |

| Gafisa SA | | | | | (174,000 | ) | | | (123,209 | ) |

| Marcopolo SA, Preferred Shares | | | | | (1,398,700 | ) | | | (1,397,006 | ) |

| Oi SA | | | | | (5,898 | ) | | | (10,969 | ) |

| Smiles SA | | | | | (240,600 | ) | | | (3,788,447 | ) |

| | | | | | | | | | (6,090,086 | ) |

China | | | | | | | | | | |

| AAC Technologies Holdings, Inc. | | | | | (588,500 | ) | | | (3,760,933 | ) |

| Airtac International Group | | | | | (262,000 | ) | | | (2,274,790 | ) |

| AviChina Industry & Technology Co., Ltd. | | | | | (6,292,000 | ) | | | (4,065,483 | ) |

| China Coal Energy Co., Ltd. | | | | | (1,323,000 | ) | | | (728,839 | ) |

| China COSCO Holdings Co., Ltd., Class H | | | | | (429,000 | ) | | | (212,052 | ) |

| China Eastern Airlines Corp., Ltd., Class H, Class H | | | | | (370,000 | ) | | | (187,648 | ) |

| China Longyuan Power Group Corp., Class H | | | | | (29,000 | ) | | | (31,125 | ) |

| China Molybdenum Co., Ltd., Class H | | | | | (1,267,000 | ) | | | (801,617 | ) |

| China Shanshui Cement Group, Ltd. | | | | | (2,165,000 | ) | | | (950,772 | ) |

| China Shipping Container Lines Co., Ltd. | | | | | (457,000 | ) | | | (143,418 | ) |

| China Tian Lun Gas Holdings, Ltd. | | | | | (78,000 | ) | | | (82,001 | ) |

| CITIC Securities Co., Ltd., Class H | | | | | (488,000 | ) | | | (1,567,820 | ) |

| CNOOC, Ltd. | | | | | (211,000 | ) | | | (279,968 | ) |

| Dongfang Electric Corp., Ltd., Class H | | | | | (638,400 | ) | | | (1,400,146 | ) |

| ENN Energy Holdings Ltd. | | | | | (142,000 | ) | | | (839,399 | ) |

See Notes to Financial Statements.

| 12 | BLACKROCK FUNDS | JANUARY 31, 2015

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

| | | | | Shares | | Value |

Reference Entity — Short |

China (concluded) | | | | | | | | | | |

| First Tractor Co., Ltd., Class H, Class H | | | | | (350,000 | ) | | $ | (257,233 | ) |

| Great Wall Motor Co., Ltd. | | | | | (54,000 | ) | | | (308,226 | ) |

| Haitian International Holdings, Ltd. | | | | | (57,000 | ) | | | (110,511 | ) |

| Hengan International Group Co., Ltd. | | | | | (81,500 | ) | | | (967,414 | ) |

| Hilong Holding, Ltd. | | | | | (14,000 | ) | | | (4,322 | ) |

| Lenovo Group, Ltd. | | | | | (920,000 | ) | | | (1,184,587 | ) |

| PetroChina Co., Ltd. | | | | | (2,382,000 | ) | | | (2,586,617 | ) |

| Semiconductor Manufacturing International Corp. | | | | | (8,998,000 | ) | | | (779,935 | ) |

| Shanghai Electric Group Co., Ltd. | | | | | (1,242,000 | ) | | | (761,537 | ) |

| Shui On Land Ltd. | | | | | (5,799,000 | ) | | | (1,305,426 | ) |

| Sinopec Shanghai Petrochemical Co., Ltd., Class H | | | | | (1,276,000 | ) | | | (369,314 | ) |

| SOHO China, Ltd. | | | | | (1,380,500 | ) | | | (958,749 | ) |

| Sohu.com, Inc. | | | | | (2,199 | ) | | | (123,452 | ) |

| TCL Communication Technology Holdings, Ltd. | | | | | (798,000 | ) | | | (702,943 | ) |

| Tingyi Cayman Islands Holding Corp. | | | | | (634,000 | ) | | | (1,561,618 | ) |

| Uni-President China Holdings, Ltd. | | | | | (3,409,000 | ) | | | (2,946,261 | ) |

| Weichai Power Co., Ltd., Class H | | | | | (748,000 | ) | | | (2,959,170 | ) |

| Yanzhou Coal Mining Co., Ltd., Class H | | | | | (1,062,000 | ) | | | (844,547 | ) |

| | | | | | | | | | (36,057,873 | ) |

Hong Kong | | | | | | | | | | |

| Brilliance China Automotive Holdings Ltd. | | | | | (2,314,000 | ) | | | (4,244,557 | ) |

| China Agri-Industries Holdings Ltd. | | | | | (268,000 | ) | | | (108,249 | ) |

| China Everbright International, Ltd. | | | | | (2,829,000 | ) | | | (4,173,977 | ) |

| China Gas Holdings, Ltd. | | | | | (130,000 | ) | | | (200,921 | ) |

| China Mengniu Dairy Co., Ltd. | | | | | (160,000 | ) | | | (729,049 | ) |

| China Oceanwide Holdings, Ltd. | | | | | (5,098,000 | ) | | | (548,363 | ) |

| China Resources Enterprise, Ltd. | | | | | (1,947,985 | ) | | | (4,264,854 | ) |

| Kunlun Energy Co., Ltd. | | | | | (166,000 | ) | | | (172,841 | ) |

| Lee & Man Paper Manufacturing, Ltd. | | | | | (67,000 | ) | | | (35,178 | ) |

| Towngas China Co., Ltd. | | | | | (78,000 | ) | | | (68,118 | ) |

| | | | | | | | | | (14,546,107 | ) |

Indonesia | | | | | | | | | | |

| Charoen Pokphand Indonesia Tbk PT | | | | | (1,470,500 | ) | | | (456,731 | ) |

| Sawit Sumbermas Sarana Tbk PT | | | | | (2,547,500 | ) | | | (331,471 | ) |

| Siloam International Hospitals Tbk PT | | | | | (95,000 | ) | | | (100,493 | ) |

| Surya Citra Media Tbk PT | | | | | (2,749,400 | ) | | | (738,049 | ) |

| Tower Bersama Infrastructure Tbk PT | | | | | (317,500 | ) | | | (237,736 | ) |

| XL Axiata Tbk PT | | | | | (1,329,500 | ) | | | (502,035 | ) |

| | | | | | | | | | (2,366,515 | ) |

Malaysia | | | | | | | | | | |

| Berjaya Sports Toto BHD | | | | | (79 | ) | | | (74 | ) |

Mexico | | | | | | | | | | |

| Alsea SAB de C.V. | | | | | (327,400 | ) | | | (876,299 | ) |

| Cemex SAB de CV | | | | | (1,600,800 | ) | | | (1,421,438 | ) |

| Cemex SAB de CV — ADR | | | | | (108,196 | ) | | | (961,862 | ) |

| Empresas ICA SAB de CV | | | | | (608,937 | ) | | | (632,519 | ) |

| Fibra Uno Administracion SA de CV | | | | | (2,291,200 | ) | | | (6,908,986 | ) |

| Grupo Carso SAB de C.V. | | | | | (35,300 | ) | | | (154,416 | ) |

| Grupo Televisa SAB | | | | | (13,500 | ) | | | (87,866 | ) |

| Grupo Televisa SAB, ADR | | | | | (10,149 | ) | | | (330,959 | ) |

| Mexichem SAB de CV | | | | | (16,000 | ) | | | (44,362 | ) |

| Mexico Real Estate Management SA de C.V. | | | | | (1,452,378 | ) | | | (2,391,320 | ) |

| Minera Frisco SAB de CV, Series A-1 | | | | | (300,800 | ) | | | (394,123 | ) |

| | | | | | | | | | (14,204,150 | ) |

Poland | | | | | | | | | | |

| Grupa Azoty SA | | | | | (5,215 | ) | | | (99,727 | ) |

South Africa | | | | | | | | | | |

| Aspen Pharmacare Holdings, Ltd. | | | | | (6,252 | ) | | | (234,103 | ) |

| Discovery Holdings Ltd. | | | | | (385,280 | ) | | | (3,794,747 | ) |

| Massmart Holdings Ltd. | | | | | (195,851 | ) | | | (2,787,610 | ) |

| | | | | Shares | | Value |

Reference Entity — Short |

South Africa (concluded) | | | | | | | | | | |

| Nampak Ltd. | | | | | (168,277 | ) | | $ | (613,460 | ) |

| Remgro Ltd. | | | | | (526,106 | ) | | | (12,173,958 | ) |

| Resilient Property Income Fund, Ltd. | | | | | (15,734 | ) | | | (119,346 | ) |

| RMB Holdings, Ltd. | | | | | (18,021 | ) | | | (101,784 | ) |

| Sappi Ltd. | | | | | (56,907 | ) | | | (233,648 | ) |

| Tiger Brands, Ltd. | | | | | (8,975 | ) | | | (302,671 | ) |

| | | | | | | | | | (20,361,327 | ) |

South Korea | | | | | | | | | | |

| CJ Korea Express Co., Ltd. | | | | | (6,060 | ) | | | (1,061,312 | ) |

| Daewoo Engineering & Construction Co., Ltd. | | | | | (178,078 | ) | | | (1,099,811 | ) |

| Daewoo International Corp. | | | | | (2,057 | ) | | | (51,429 | ) |

| Daewoo Shipbuilding & Marine Engineering Co., Ltd. | | | | | (15,454 | ) | | | (272,492 | ) |

| Doosan Heavy Industries & Construction Co., Ltd. | | | | | (1,070 | ) | | | (22,702 | ) |

| Eo Technics Co., Ltd. | | | | | (23,666 | ) | | | (2,769,698 | ) |

| Gamevil, Inc. | | | | | (1,527 | ) | | | (254,800 | ) |

| Halla Visteon Climate Control Corp. | | | | | (18,895 | ) | | | (795,408 | ) |

| Hotel Shilla Co., Ltd. | | | | | (38,845 | ) | | | (3,604,368 | ) |

| Hyundai Heavy Industries Co., Ltd. | | | | | (13,349 | ) | | | (1,367,897 | ) |

| Hyundai Hysco Co., Ltd. | | | | | (3,273 | ) | | | (229,072 | ) |

| Hyundai Merchant Marine Co., Ltd. | | | | | (3,082 | ) | | | (8,398 | ) |

| Hyundai Merchant Marine Co., Ltd. | | | | | (20,068 | ) | | | (188,092 | ) |

| Hyundai Mipo Dockyard | | | | | (90,291 | ) | | | (6,336,520 | ) |

| LG International Corp. | | | | | (46,476 | ) | | | (1,552,740 | ) |

| NHN Entertainment Corp. | | | | | (1,733 | ) | | | (117,601 | ) |

| Orion Corp. | | | | | (65 | ) | | | (62,025 | ) |

| Samsung Electro-Mechanics Co., Ltd. | | | | | (3,974 | ) | | | (241,862 | ) |

| Samsung Fine Chemicals Co., Ltd. | | | | | (47,309 | ) | | | (1,471,980 | ) |

| | | | | | | | | | (21,508,207 | ) |

Spain | | | | | | | | | | |

| Abertis Infraestructuras SA | | | | | (23,492 | ) | | | (460,032 | ) |

Taiwan | | | | | | | | | | |

| Chang Hwa Commercial Bank | | | | | (94,000 | ) | | | (53,040 | ) |

| Evergreen Marine Corp. Taiwan Ltd. | | | | | (6,457,000 | ) | | | (4,600,596 | ) |

| Formosa Chemicals & Fibre Corp. | | | | | (222,000 | ) | | | (475,048 | ) |

| Formosa Petrochemical Corp. | | | | | (152,000 | ) | | | (323,818 | ) |

| Giant Manufacturing Co., Ltd. | | | | | (12,000 | ) | | | (104,736 | ) |

| Gigasolar Materials Corp. | | | | | (40,000 | ) | | | (608,731 | ) |

| Gigastorage Corp. | | | | | (1,412,000 | ) | | | (1,140,052 | ) |

| Hermes Microvision, Inc. | | | | | (77,000 | ) | | | (3,635,748 | ) |

| Hiwin Technologies Corp. | | | | | (299,000 | ) | | | (2,459,913 | ) |

| Hotai Motor Co., Ltd. | | | | | (346,000 | ) | | | (4,971,632 | ) |

| Parade Technologies, Ltd. | | | | | (100,000 | ) | | | (995,429 | ) |

| Ruentex Industries, Ltd. | | | | | (1,118,000 | ) | | | (2,423,640 | ) |

| ScinoPharm Taiwan, Ltd. | | | | | (506,880 | ) | | | (849,631 | ) |

| Taiflex Scientific Co., Ltd. | | | | | (530,000 | ) | | | (755,091 | ) |

| Taiwan Glass Industry Corp. | | | | | (69,000 | ) | | | (50,147 | ) |

| Taiwan Mobile Co., Ltd. | | | | | (1,099,000 | ) | | | (3,623,843 | ) |

| Teco Electric and Machinery Co., Ltd. | | | | | (80,000 | ) | | | (74,681 | ) |

| TPK Holding Co., Ltd. | | | | | (244,000 | ) | | | (1,580,765 | ) |

| U-Ming Marine Transport Corp. | | | | | (533,000 | ) | | | (823,675 | ) |

| Unimicron Technology Corp. | | | | | (62,000 | ) | | | (42,460 | ) |

| Yulon Motor Co., Ltd. | | | | | (32,000 | ) | | | (46,732 | ) |

| | | | | | | | | | (29,639,408 | ) | | |

Thailand | | | | | | | | | | |

| Samart Corp. PCL | | | | | (155,200 | ) | | | (193,229 | ) |

Total Reference Entity — Short | | | | | | | | | (145,526,735 | ) |

Net Value of Reference Entity — Goldman Sachs & Co. | $ | 33,840,048 | |

See Notes to Financial Statements.

| BLACKROCK FUNDS | JANUARY 31, 2015 | 13

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

The following table represents the individual long and short positions and related values of equity securities underlying the total return swap with Goldman Sachs & Co. as of January 31, 2015, expiration dates 8/27/15 — 8/04/16:

| | | | | Shares | | Value |

Reference Entity — Long |

Belgium | | | | | | | | | | |

| Nyrstar NV | | | | | 5,253 | | | $ | 19,761 | |

Canada | | | | | | | | | | |

| Dominion Diamond Corp. | | | | | 2,046 | | | | 33,990 | |

| Methanex Corp. | | | | | 15,118 | | | | 668,157 | |

| Parex Resources, Inc. | | | | | 7,927 | | | | 42,919 | |

| | | | | | | | | | 745,066 | |

Denmark | | | | | | | | | | |

| Novo Nordisk A/S, Class B | | | | | 192 | | | | 8,557 | |

| Vestas Wind Systems A/S | | | | | 1,280 | | | | 49,733 | |

| | | | | | | | | | 58,290 | |

France | | | | | | | | | | |

| BioMerieux | | | | | 885 | | | | 96,635 | |

| Ipsen SA | | | | | 4,741 | | | | 241,290 | |

| Teleperformance | | | | | 240 | | | | 17,195 | |

| | | | | | | | | | 355,120 | |

Germany | | | | | | | | | | |

| Aurubis AG | | | | | 105 | | | | 5,692 | |

| Beiersdorf AG | | | | | 991 | | | | 87,123 | |

| Kloeckner & Co. SE | | | | | 9,470 | | | | 97,573 | |

| Krones AG | | | | | 33 | | | | 3,136 | |

| Merck KGaA | | | | | 3,638 | | | | 363,496 | |

| | | | | | | | | | 557,020 | |

Hong Kong | | | | | | | | | | |

| Dah Sing Financial Holdings, Ltd. | | | | | 10,000 | | | | 57,770 | |

| Hang Lung Properties Ltd. | | | | | 2,000 | | | | 5,895 | |

| HKT Trust and HKT Ltd. | | | | | 4,000 | | | | 5,242 | |

| Kerry Properties Ltd. | | | | | 29,500 | | | | 104,241 | |

| Luk Fook Holdings International, Ltd. | | | | | 39,000 | | | | 144,728 | |

| NWS Holdings Ltd. | | | | | 1,000 | | | | 1,856 | |

| Orient Overseas International Ltd. | | | | | 21,000 | | | | 136,991 | |

| Wheelock & Co. Ltd. | | | | | 4,000 | | | | 22,631 | |

| | | | | | | | | | 479,354 | |

Iran | | | | | | | | | | |

| Smurfit Kappa Group PLC | | | | | 5,511 | | | | 135,490 | |

Ireland | | | | | | | | | | |

| Ingersoll-Rand PLC | | | | | 2,286 | | | | 151,790 | |

| Kerry Group PLC, Class A | | | | | 976 | | | | 70,735 | |

| | | | | | | | | | 222,525 | |

Italy | | | | | | | | | | |

| Ansaldo STS SpA | | | | | 20,495 | | | | 205,953 | |

| Parmalat SpA | | | | | 4,267 | | | | 12,103 | |

| Recordati SpA | | | | | 21,056 | | | | 347,986 | |

| | | | | | | | | | 566,042 | |

Japan | | | | | | | | | | |

| Alps Electric Co. Ltd. | | | | | 300 | | | | 6,245 | |

| Citizen Holdings Co. Ltd. | | | | | 4,500 | | | | 35,920 | |

| Daifuku Co. Ltd. | | | | | 8,000 | | | | 91,648 | |

| Disco Corp. | | | | | 9,000 | | | | 824,521 | |

| Enplas Corp. | | | | | 4,000 | | | | 142,739 | |

| Hitachi Capital Corp. | | | | | 200 | | | | 3,932 | |

| Hitachi Maxell, Ltd. | | | | | 100 | | | | 1,697 | |

| Hitachi Metals Ltd. | | | | | 4,000 | | | | 65,181 | |

| Keihin Corp. | | | | | 3,800 | | | | 60,570 | |

| Mazda Motor Corp. | | | | | 14,200 | | | | 291,674 | |

| Mitsubishi Materials Corp. | | | | | 67,000 | | | | 211,275 | |

| Murata Manufacturing Co. Ltd. | | | | | 3,500 | | | | 377,840 | |

| | | | | Shares | | Value |

Reference Entity — Long |

Japan (concluded) | | | | | | | | | | |

| Nachi-Fujikoshi Corp. | | | | | 4,000 | | | $ | 21,509 | |

| Nifco, Inc. | | | | | 2,600 | | | | 89,562 | |

| Omron Corp. | | | | | 400 | | | | 15,992 | |

| OSG Corp. | | | | | 8,200 | | | | 150,977 | |

| Sanrio Co. Ltd. | | | | | 900 | | | | 22,301 | |

| Shimano, Inc. | | | | | 2,400 | | | | 317,264 | |

| Sumitomo Metal Mining Co. Ltd. | | | | | 1,000 | | | | 14,292 | |

| Sysmex Corp. | | | | | 100 | | | | 4,469 | |

| Tadano Ltd. | | | | | 9,000 | | | | 108,322 | |

| Takata Corp. | | | | | 8,000 | | | | 93,306 | |

| TDK Corp. | | | | | 600 | | | | 37,393 | |

| Topcon Corp. | | | | | 600 | | | | 11,889 | |

| Yamato Kogyo Co. Ltd. | | | | | 200 | | | | 5,147 | |

| | | | | | | | | | 3,005,665 | |

Netherlands | | | | | | | | | | |

| Arcadis NV | | | | | 13,268 | | | | 401,560 | |

| Heineken NV | | | | | 4,846 | | | | 361,648 | |

| NXP Semiconductor NV | | | | | 3,306 | | | | 262,298 | |

| | | | | | | | | | 1,025,506 | |

Singapore | | | | | | | | | | |

| ComfortDelGro Corp. Ltd. | | | | | 42,800 | | | | 90,758 | |

| Flextronics International Ltd. | | | | | 81,356 | | | | 904,679 | |

| Indofood Agri Resources, Ltd. | | | | | 15,700 | | | | 8,208 | |

| Noble Group Ltd. | | | | | 107,500 | | | | 84,091 | |

| Singapore Airlines Ltd. | | | | | 12,900 | | | | 120,493 | |

| | | | | | | | | | 1,208,229 | |

Spain | | | | | | | | | | |

| Gamesa Corp. Tecnologica SA | | | | | 526 | | | | 5,200 | |

| Gas Natural SDG SA | | | | | 11,057 | | | | 259,550 | |

| Inmobiliaria Colonial SA | | | | | 5,844 | | | | 3,960 | |

| | | | | | | | | | 268,710 | |

Sweden | | | | | | | | | | |

| Telefonaktiebolaget LM Ericsson, Class B | | | | | 12,640 | | | | 153,251 | |

Switzerland | | | | | | | | | | |

| Garmin Ltd. | | | | | 288 | | | | 15,080 | |

| Kuoni Reisen Holding AG | | | | | 272 | | | | 91,239 | |

| Straumann Holding AG, Registered Shares | | | | | 72 | | | | 16,263 | |

| | | | | | | | | | 122,582 | |

United Kingdom | | | | | | | | | | |

| Inchcape PLC | | | | | 21,959 | | | | 229,381 | |

| Pace PLC | | | | | 86,172 | | | | 432,463 | |

| | | | | | | | | | 661,844 | |

United States | | | | | | | | | | |

| Adobe Systems, Inc. | | | | | 1,431 | | | | 100,356 | |

| Akamai Technologies, Inc. | | | | | 3,680 | | | | 214,010 | |

| AmTrust Financial Services, Inc. | | | | | 3,250 | | | | 164,515 | |

| Aruba Networks, Inc. | | | | | 12,745 | | | | 211,312 | |

| Aspen Technology, Inc. | | | | | 25,109 | | | | 887,478 | |

| The Boeing Co. | | | | | 685 | | | | 99,578 | |

| Briggs & Stratton Corp. | | | | | 183 | | | | 3,369 | |

| Cabot Corp. | | | | | 13,595 | | | | 576,564 | |

| Calpine Corp. | | | | | 12,460 | | | | 260,165 | |

| Caterpillar, Inc. | | | | | 3,455 | | | | 276,296 | |

| CBRE Group, Inc., Class A | | | | | 128 | | | | 4,140 | |

| Century Aluminum Co. | | | | | 2,717 | | | | 62,790 | |

| Citrix Systems, Inc. | | | | | 2,011 | | | | 119,172 | |

| Columbia Sportswear Co. | | | | | 6,284 | | | | 267,070 | |

| Cytec Industries, Inc. | | | | | 7,134 | | | | 342,361 | |

| The Dow Chemical Co. | | | | | 62 | | | | 2,800 | |

| The Estee Lauder Cos., Inc., Class A | | | | | 336 | | | | 23,718 | |

| Foot Locker, Inc. | | | | | 2,778 | | | | 147,845 | |

See Notes to Financial Statements.

| 14 | BLACKROCK FUNDS | JANUARY 31, 2015

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

| | | | | Shares | | Value |

Reference Entity — Long |

United States (concluded) | | | | | | | | | | |

| Greatbatch, Inc. | | | | | 95 | | | $ | 4,613 | |

| Hasbro, Inc. | | | | | 8,113 | | | | 445,566 | |

| HCA Holdings, Inc. | | | | | 8,885 | | | | 629,058 | |

| Houghton Mifflin Harcourt Co. | | | | | 2,692 | | | | 52,979 | |

| Huntsman Corp. | | | | | 1,673 | | | | 36,739 | |

| Hyster-Yale Materials Handling, Inc. | | | | | 1,316 | | | | 82,447 | |

| IAC/InterActiveCorp | | | | | 4,199 | | | | 255,929 | |

| Iconix Brand Group, Inc. | | | | | 25,685 | | | | 853,769 | |

| Ingram Micro, Inc., Class A | | | | | 25,694 | | | | 646,975 | |

| The Interpublic Group of Cos., Inc. | | | | | 14,233 | | | | 283,806 | |

| Invesco Ltd. | | | | | 4,748 | | | | 174,394 | |

| ITT Corp. | | | | | 7,592 | | | | 271,870 | |

| Jones Lang LaSalle, Inc. | | | | | 3,483 | | | | 512,280 | |

| Las Vegas Sands Corp. | | | | | 763 | | | | 41,484 | |

| Lear Corp. | | | | | 2,080 | | | | 208,728 | |

| Liberty TripAdvisor Holdings, Inc., Series A | | | | | 4,755 | | | | 113,835 | |

| Linear Technology Corp. | | | | | 3,956 | | | | 177,783 | |

| LogMeIn, Inc. | | | | | 2,694 | | | | 128,100 | |

| Manpowergroup, Inc. | | | | | 2,850 | | | | 207,708 | |

| Micron Technology, Inc. | | | | | 35,945 | | | | 1,051,930 | |

| Moog, Inc., Class A | | | | | 106 | | | | 7,452 | |

| Newfield Exploration Co. | | | | | 6,542 | | | | 194,821 | |

| Penske Automotive Group, Inc. | | | | | 4,356 | | | | 210,613 | |

| Progress Software Corp. | | | | | 19,446 | | | | 487,122 | |

| Rockwell Automation, Inc. | | | | | 648 | | | | 70,580 | |

| Rovi Corp. | | | | | 17,556 | | | | 405,719 | |

| Sealed Air Corp. | | | | | 5,906 | | | | 239,193 | |

| Skyworks Solutions, Inc. | | | | | 1,335 | | | | 110,872 | |

| Spectrum Brands Holdings, Inc. | | | | | 1,230 | | | | 110,306 | |

| SPX Corp. | | | | | 2,273 | | | | 189,955 | |

| The Timken Co. | | | | | 5,042 | | | | 191,646 | |

| World Fuel Services Corp. | | | | | 11,799 | | | | 577,797 | |

| Xilinx, Inc. | | | | | 3,811 | | | | 147,009 | |

| Zebra Technologies Corp., Class A | | | | | 3,295 | | | | 275,001 | |

| | | | | | | | | | 13,161,618 | |

Total Reference Entity — Long | | | | | | | | | 22,746,073 | |

| | | | | | | | | | | |

Reference Entity — Short |

Australia | | | | | | | | | | |

| New Hope Corp., Ltd. | | | | | (6,338 | ) | | | (11,548 | ) |

| Nufarm, Ltd. | | | | | (3,276 | ) | | | (14,395 | ) |

| Orica Ltd. | | | | | (653 | ) | | | (9,166 | ) |

| | | | | | | | | | (35,109 | ) |

Austria | | | | | | | | | | |

| IMMOFINANZ AG | | | | | (3,185 | ) | | | (7,278 | ) |

Finland | | | | | | | | | | |

| Outokumpu OYJ | | | | | (70,334 | ) | | | (380,537 | ) |

France | | | | | | | | | | |

| Kering | | | | | (2,408 | ) | | | (485,846 | ) |

Germany | | | | | | | | | | |

| Dialog Semiconductor PLC | | | | | (6,797 | ) | | | (259,950 | ) |

| ElringKlinger AG | | | | | (12,465 | ) | | | (434,320 | ) |

| Puma SE | | | | | (18 | ) | | | (3,426 | ) |

| | | | | | | | | | (697,696 | ) |

Hong Kong | | | | | | | | | | |

| Chow Tai Fook Jewellery Group, Ltd. | | | | | (109,800 | ) | | | (145,570 | ) |

| Esprit Holdings Ltd. | | | | | (400 | ) | | | (450 | ) |

| Hong Kong & China Gas Co., Ltd. | | | | | (66,000 | ) | | | (151,138 | ) |

| Hong Kong Exchanges and Clearing, Ltd. | | | | | (45,800 | ) | | | (1,054,094 | ) |

| Melco International Development, Ltd. | | | | | (111,000 | ) | | | (221,009 | ) |

| | | | | Shares | | Value |

Reference Entity — Short |

Hong Kong (concluded) | | | | | | | | | | |

| Shangri-La Asia, Ltd. | | | | | (2,000 | ) | | $ | (2,596 | ) |

| Swire Pacific, Ltd. | | | | | (2,000 | ) | | | (26,783 | ) |

| | | | | | | | | | (1,601,640 | ) |

Ireland | | | | | | | | | | |

| Accenture PLC, Class A | | | | | (6,891 | ) | | | (579,051 | ) |

Italy | | | | | | | | | | |

| Saipem SpA | | | | | (9,504 | ) | | | (85,504 | ) |

Japan | | | | | | | | | | |

| Chiyoda Corp. | | | | | (4,000 | ) | | | (30,808 | ) |

| Daikin Industries, Ltd. | | | | | (1,200 | ) | | | (83,503 | ) |

| DIC Corp. | | | | | (1,000 | ) | | | (2,476 | ) |

| Eisai Co., Ltd. | | | | | (2,900 | ) | | | (144,589 | ) |

| Ibiden Co., Ltd. | | | | | (4,400 | ) | | | (66,147 | ) |

| The Japan Steel Works, Ltd. | | | | | (11,000 | ) | | | (44,002 | ) |

| Nabtesco Corp. | | | | | (500 | ) | | | (12,908 | ) |

| NGK Insulators, Ltd. | | | | | (9,000 | ) | | | (181,361 | ) |

| Nippon Paint Co., Ltd. | | | | | (10,500 | ) | | | (328,915 | ) |

| Nisshinbo Holdings, Inc. | | | | | (4,000 | ) | | | (44,949 | ) |

| Pigeon Corp. | | | | | (1,300 | ) | | | (81,170 | ) |

| Sharp Corp. | | | | | (60,000 | ) | | | (117,451 | ) |

| Shimadzu Corp. | | | | | (3,000 | ) | | | (31,169 | ) |

| Shinko Electric Industries Co., Ltd. | | | | | (3,000 | ) | | | (21,013 | ) |

| Sumco Corp. | | | | | (4,500 | ) | | | (75,523 | ) |

| Sumitomo Rubber Industries, Ltd. | | | | | (1,700 | ) | | | (26,436 | ) |

| Teijin Ltd. | | | | | (47,000 | ) | | | (140,006 | ) |

| Toray Industries, Inc. | | | | | (28,000 | ) | | | (238,506 | ) |

| Toyo Tire & Rubber Co., Ltd. | | | | | (7,100 | ) | | | (159,917 | ) |

| Ube Industries, Ltd. | | | | | (3,000 | ) | | | (4,493 | ) |

| Ushio, Inc. | | | | | (6,200 | ) | | | (71,828 | ) |

| The Yokohama Rubber Co., Ltd. | | | | | (1,000 | ) | | | (9,408 | ) |

| | | | | | | | | | (1,916,578 | ) |

Netherlands | | | | | | | | | | |

| SBM Offshore NV | | | | | (19,881 | ) | | | (216,909 | ) |

Norway | | | | | | | | | | |

| Opera Software ASA | | | | | (101,693 | ) | | | (1,347,163 | ) |

Portugal | | | | | | | | | | |

| Jeronimo Martins SGPS SA | | | | | (35,808 | ) | | | (385,164 | ) |

Singapore | | | | | | | | | | |

| DBS Group Holdings, Ltd. | | | | | (1,700 | ) | | | (24,785 | ) |

| Sembcorp Marine, Ltd. | | | | | (1,000 | ) | | | (2,213 | ) |

| | | | | | | | | | (26,998 | ) |

Switzerland | | | | | | | | | | |

| Clariant AG | | | | | (1,588 | ) | | | (25,513 | ) |

| Dufry AG | | | | | (469 | ) | | | (68,897 | ) |

| Holcim Ltd. | | | | | (1,028 | ) | | | (71,870 | ) |

| OC Oerlikon Corp. AG | | | | | (1,190 | ) | | | (13,536 | ) |

| SGS SA | | | | | (69 | ) | | | (130,886 | ) |

| Sulzer AG | | | | | (3,162 | ) | | | (334,793 | ) |

| The Swatch Group AG | | | | | (11 | ) | | | (4,375 | ) |

| | | | | | | | | | (649,870 | ) |

United Kingdom | | | | | | | | | | |

| AVEVA Group PLC | | | | | (6,948 | ) | | | (137,407 | ) |

| CNH Industrial NV | | | | | (86,125 | ) | | | (655,650 | ) |

| HSBC Holdings PLC | | | | | (4,962 | ) | | | (45,398 | ) |

| Inmarsat PLC | | | | | (33,170 | ) | | | (415,630 | ) |

| Ophir Energy PLC | | | | | (74,375 | ) | | | (150,580 | ) |

| Rotork PLC | | | | | (463 | ) | | | (16,005 | ) |

| Smiths Group PLC | | | | | (2,719 | ) | | | (46,017 | ) |

| Spectris PLC | | | | | (8,856 | ) | | | (278,292 | ) |

| | | | | | | | | | (1,744,979 | ) |

See Notes to Financial Statements.

| BLACKROCK FUNDS | JANUARY 31, 2015 | 15

|

| |

| Schedule of Investments (continued) | BlackRock Emerging Markets Long/Short Equity Fund |

| | | | | Shares | | Value |

Reference Entity — Short |

United States | | | | | | | | | | |

| Aflac, Inc. | | | | | (3,685 | ) | | $ | (210,340 | ) |

| Amazon.com, Inc. | | | | | (1,157 | ) | | | (410,191 | ) |

| American Tower Corp. | | | | | (155 | ) | | | (15,027 | ) |

| Arthur J Gallagher & Co. | | | | | (11,868 | ) | | | (527,295 | ) |

| Balchem Corp. | | | | | (3,070 | ) | | | (162,618 | ) |

| Brady Corp., Class A Class A | | | | | (2,906 | ) | | | (76,050 | ) |

| The Brink’s Co. | | | | | (592 | ) | | | (13,267 | ) |

| CACI International, Inc., Class A Class A | | | | | (6,389 | ) | | | (540,445 | ) |

| Cinemark Holdings, Inc. | | | | | (562 | ) | | | (20,889 | ) |

| Colfax Corp. | | | | | (2,807 | ) | | | (127,185 | ) |

| CommVault Systems, Inc. | | | | | (2,327 | ) | | | (101,411 | ) |

| Coty, Inc., Class A | | | | | (51,186 | ) | | | (973,558 | ) |

| Cray, Inc. | | | | | (15,420 | ) | | | (500,996 | ) |

| Cree, Inc. | | | | | (27,451 | ) | | | (970,667 | ) |

| Crown Castle International Corp. | | | | | (2,135 | ) | | | (184,699 | ) |

| Cypress Semiconductor Corp. | | | | | (9,277 | ) | | | (136,650 | ) |

| Dealertrack Technologies, Inc. | | | | | (8,897 | ) | | | (357,659 | ) |

| Deere & Co. | | | | | (72 | ) | | | (6,134 | ) |

| Diebold, Inc. | | | | | (4,343 | ) | | | (135,502 | ) |

| Donaldson Co., Inc. | | | | | (853 | ) | | | (31,186 | ) |

| Dycom Industries, Inc. | | | | | (572 | ) | | | (17,623 | ) |

| Emerson Electric Co. | | | | | (653 | ) | | | (37,182 | ) |

| Essex Property Trust, Inc. | | | | | (259 | ) | | | (58,547 | ) |

| FARO Technologies, Inc. | | | | | (359 | ) | | | (19,871 | ) |

| First Cash Financial Services, Inc. | | | | | (3,548 | ) | | | (176,407 | ) |

| FleetCor Technologies, Inc. | | | | | (25 | ) | | | (3,512 | ) |

| Franklin Electric Co., Inc. | | | | | (10,626 | ) | | | (363,515 | ) |

| FTI Consulting, Inc. | | | | | (401 | ) | | | (16,309 | ) |

| General Mills, Inc. | | | | | (535 | ) | | | (28,077 | ) |

| General Motors Co. | | | | | (11,779 | ) | | | (384,231 | ) |

| Gentex Corp. | | | | | (2,934 | ) | | | (48,968 | ) |

| Groupon, Inc. | | | | | (17,462 | ) | | | (125,028 | ) |

| HeartWare International, Inc. | | | | | (4,740 | ) | | | (395,932 | ) |

| HEICO Corp. | | | | | (1,735 | ) | | | (105,280 | ) |

| Hillenbrand, Inc. | | | | | (71 | ) | | | (2,230 | ) |

| Infinera Corp. | | | | | (45,136 | ) | | | (727,592 | ) |

| Ingredion, Inc. | | | | | (700 | ) | | | (56,448 | ) |

| Jabil Circuit, Inc. | | | | | (19,009 | ) | | | (391,775 | ) |

| KBR, Inc. | | | | | (4,635 | ) | | | (76,617 | ) |

| McDermott International, Inc. | | | | | (1,143 | ) | | | (2,572 | ) |

| Microsemi Corp. | | | | | (1,654 | ) | | | (46,080 | ) |

| Navistar International Corp. | | | | | (2,883 | ) | | | (84,818 | ) |

| NetSuite, Inc. | | | | | (936 | ) | | | (92,130 | ) |

| Peabody Energy Corp. | | | | | (68,364 | ) | | | (425,908 | ) |

| PriceSmart, Inc. | | | | | (3,081 | ) | | | (251,964 | ) |

| Republic Services, Inc. | | | | | (98 | ) | | | (3,889 | ) |

| Rogers Corp. | | | | | (289 | ) | | | (21,346 | ) |

| Schweitzer-Mauduit International, Inc. | | | | | (2,658 | ) | | | (103,290 | ) |

| Sotheby’s | | | | | (11,851 | ) | | | (504,260 | ) |

| The Spectranetics Corp. | | | | | (10,625 | ) | | | (347,544 | ) |

| TAL International Group, Inc. | | | | | (37,457 | ) | | | (1,522,627 | ) |

| Universal Display Corp. | | | | | (708 | ) | | | (22,557 | ) |

| UTi Worldwide, Inc. | | | | | (8,864 | ) | | | (105,216 | ) |

| Veeco Instruments, Inc. | | | | | (6,302 | ) | | | (183,829 | ) |

| The Western Union Co. | | | | | (13,798 | ) | | | (234,566 | ) |

| WR Grace & Co. | | | | | (203 | ) | | | (17,596 | ) |

| XPO Logistics, Inc. | | | | | (2,353 | ) | | | (86,567 | ) |

| | | | | | | | | | (12,593,672 | ) |

Total Reference Entity — Short | | | | | | | | | (22,753,994 | ) |

Net Value of Reference Entity — Goldman Sachs & Co. | | (7,921 | ) |

The following table represents the individual long and short positions and related values of equity securities underlying the total return swap with Morgan Stanley & Co., Inc. as of January 31, 2015, expiration dates 5/16/16 — 1/22/18:

| | | | | Shares | | Value |

Reference Entity — Long |