UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05742

Name of Fund: BlackRock Funds

BlackRock Commodity Strategies Fund

BlackRock Global Long/Short Credit Fund

BlackRock Multi-Asset Real Return Fund

BlackRock Short Obligations Fund

BlackRock Short-Term Treasury Fund

BlackRock Strategic Risk Allocation Fund

BlackRock Ultra-Short Obligations Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 07/31/2013

Date of reporting period: 01/31/2013

Item 1 – Report to Stockholders

JANUARY 31, 2013

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK ® |

BlackRock FundsSM

„ BlackRock Commodity Strategies Fund

„ BlackRock Global Long/Short Credit Fund

| | |

Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | | | | | |

| | | | | | | |

| 2 | | BLACKROCK FUNDS | | JANUARY 31, 2013 | | |

Dear Shareholder

Financial markets have substantially improved over the past year, providing investors with considerable relief compared to where things were during the global turmoil seen in 2011. Despite a number of headwinds, higher-risk asset classes boasted strong returns as investors sought meaningful yields in the ongoing low-interest-rate environment.

Rising investor confidence drove equity markets higher in early 2012, while climbing US Treasury yields pressured higher-quality fixed income assets. The second quarter, however, brought a market reversal as Europe’s debt crisis boiled over once again. Political instability in Greece and severe deficit and liquidity problems in Spain raised the specter of a euro collapse. Alongside the drama in Europe, investors were discouraged by gloomy economic reports from various parts of the world. A slowdown in China, a key powerhouse for global growth, emerged as a particular concern. But as the outlook for the global economy worsened, investors grew increasingly optimistic that the world’s largest central banks would soon intervene to stimulate growth. This theme, along with the European Central Bank’s (“ECB’s”) firm commitment to preserve the euro currency bloc, drove most asset classes higher through the summer. Policy relief came in early September, when the ECB announced its decision to support the eurozone’s troubled peripheral countries with unlimited purchases of short term sovereign debt. Days later, the US Federal Reserve announced its own much-anticipated stimulus package.

Although financial markets world-wide were buoyed by accommodative monetary policy, risk assets weakened in the fall. Global trade slowed as many European countries fell into recession and growth continued to decelerate in China, where a once-a-decade leadership change compounded uncertainty. In the United States, stocks slid on lackluster corporate earnings reports and market volatility rose during the lead up to the US Presidential election. In the post-election environment, investors grew increasingly concerned over automatic tax increases and spending cuts that had been scheduled to take effect at the beginning of 2013 (known as the “fiscal cliff”). There was widespread fear that the fiscal cliff would push the nation into recession unless politicians could agree upon alternate measures to reduce the deficit before the end of 2012. Worries that bipartisan gridlock would preclude a timely budget deal triggered higher levels of volatility in financial markets around the world in the months leading up to the last day of the year. Ultimately, the United States averted the worst of the fiscal cliff with a last-minute tax deal; however, decisions relating to spending cuts and the debt ceiling continue to weigh on investors’ minds.

Investors shook off the nerve-wracking finale to 2012 and began the New Year with a powerful equity rally. Key indicators signaled broad-based improvements in the world’s major economies, particularly China. In the United States, economic data was mixed, but pointed to a continued recovery. The risk of inflation remained low and the US Federal Reserve showed no signs of curtailing its stimulus programs. Additionally, January saw the return of funds that investors had pulled out of the market in late 2012 amid uncertainty about tax-rate increases ahead of the fiscal cliff deadline. In fixed income markets, rising US Treasuries yields dragged down higher-quality asset classes, while high yield bonds continued to benefit from investor demand for yield in the low-rate environment.

On the whole, riskier asset classes outperformed lower-risk investments for the 6- and 12-month periods ended January 31, 2013. International equities were the strongest performers. US stocks and high yield bonds also generated significant returns. Emerging market equities were particularly volatile, but still posted gains for both the 6- and 12-month periods. US Treasury yields remained low, but experienced increasing volatility in recent months. Rising yields near the end of the period resulted in negative returns for Treasuries and investment-grade bonds for the 6-month period. Tax-exempt municipal bonds, however, benefited from favorable supply-and-demand dynamics. Near-zero short term interest rates continued to keep yields on money market securities near their all-time lows.

While investors continue to face a host of unknowns, we believe new opportunities abound. BlackRock was built to provide the global market insight, breadth of capabilities, unbiased investment advice and deep risk management expertise these times require. We encourage you to visit www.blackrock.com/newworld for more information.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“Despite a number of headwinds, higher-risk asset classes boasted strong returns as investors sought meaningful yields in the ongoing low-interest-rate environment.”

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of January 31, 2013 | |

| | | 6-month | | | 12-month | |

US large cap equities

(S&P 500® Index) | | | 9.91 | % | | | 16.78 | % |

US small cap equities

(Russell 2000® Index) | | | 15.51 | | | | 15.47 | |

International equities

(MSCI Europe, Australasia, Far East Index) | | | 18.61 | | | | 17.25 | |

Emerging market equities

(MSCI Emerging Markets Index) | | | 13.11 | | | | 7.64 | |

3-month Treasury bill

(BofA Merrill Lynch

3-Month US Treasury

Bill Index) | | | 0.07 | | | | 0.11 | |

US Treasury securities

(BofA Merrill Lynch

10- Year US Treasury

Index) | | | (2.90 | ) | | | 1.28 | |

US investment grade

bonds (Barclays US

Aggregate Bond Index) | | | (0.29 | ) | | | 2.59 | |

Tax-exempt municipal

bonds (S&P Municipal Bond Index) | | | 2.21 | | | | 5.50 | |

US high yield bonds

(Barclays US Corporate

High Yield 2% Issuer

Capped Index) | | | 7.37 | | | | 13.87 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | | | | | |

| | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | |

| Fund Summary as of January 31, 2013 | | BlackRock Commodity Strategies Fund |

BlackRock Commodity Strategies Fund’s (the “Fund”) investment objective is to seek total return.

|

| Portfolio Management Commentary |

How did the Fund perform?

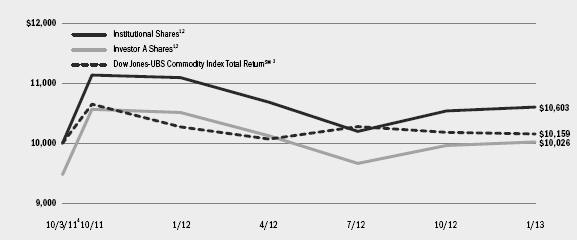

| Ÿ | | For the six-month period ended January 31, 2013, the Fund outperformed its benchmark, the Dow Jones-UBS Commodity Index Total ReturnSM. |

What factors influenced performance?

| Ÿ | | The Fund’s commodity-related equity strategy and commodity-linked derivatives strategy, through the use of commodity-linked notes (“CLN”), both outperformed the benchmark index for the period. The equity strategy was the more significant driver of the Fund’s performance as equities of commodity-related companies outperformed commodity futures returns during the period. The mining and agriculture sectors performed particularly well. Stock selection within mining resulted in notable positive returns for the Fund. In particular, the Fund’s overweight positions in iron ore producers had a positive impact as these stocks benefited from a strong rebound in the price of iron ore during the period. The commodity-linked derivatives strategy outperformed the benchmark index due to the Fund’s positions in deferred-month forwards, which outperformed prompt-month forwards (i.e., contracts priced as of the nearest month of delivery). |

| Ÿ | | There were no detractors from Fund performance relative to the benchmark index during the period. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Fund sought to maintain generally equal weightings between the aggregate equity and derivatives strategies as well as balanced and broad equity exposure across commodity sectors. In the final month of the reporting period, the Dow Jones-UBS Commodity Index Total ReturnSM rebalanced. Accordingly, at the end of January, the Fund rebalanced to reset its strategy and sector allocations. During the rebalance, the Fund increased its target equity sector weightings (relative to the 2012 targets) in agriculture and gold and decreased its weighting in metals and mining. |

| Ÿ | | Also during the period, the Fund maintained a position in cash and cash equivalents, predominantly comprised of US Treasury bills, as collateral against the Fund’s exposure to commodity-linked notes. The Fund’s cash balance did not have a material impact on performance. |

Describe portfolio positioning at period end.

| Ÿ | | At the end of the period, the Fund’s net assets were invested in roughly equal allocations to the commodity-related equity strategy and the commodity-linked derivatives strategy (including collateral held against the commodity-linked note exposure). Aggregating both strategies, the Fund was overweight relative to the benchmark index in energy and metals, and underweight in agriculture and livestock. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Ten Largest Holdings | | Percent of

Long-Term Investments |

| | | | |

International Bank for Reconstruction & Development

3-month LIBOR, 11/05/13-CLN | | | 6 | % |

Swedish Export Credit Corp. 3-month LIBOR,

4/29/13-CLN | | | 6 | |

Canadian Imperial Bank of Commerce 3-month

LIBOR, 11/04/13-CLN | | | 5 | |

Chevron Corp. | | | 4 | |

Exxon Mobil Corp. | | | 3 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR,

11/04/13-CLN | | | 3 | |

UBS AG 3-month LIBOR, 10/28/13-CLN | | | 3 | |

ETFS All Commodities DJ-UBSCISM | | | 3 | |

BHP Billiton Plc | | | 2 | |

BP Plc | | | 2 | |

| | |

| Portfolio Composition | | Percent of

Long-Term Investments |

| | | | |

Common Stocks | | | 74 | % |

Commodity-Linked Notes | | | 23 | |

Investment Companies | | | 3 | |

| | | | | | |

| | | | | | | |

| 4 | | BLACKROCK FUNDS | | JANUARY 31, 2013 | | |

| | |

| | | BlackRock Commodity Strategies Fund |

|

| Total Return Based on a $10,000 Investment |

| | 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| | 2 | | The Fund utilizes two strategies and under normal circumstances expects to invest approximately 50% of its total assets in each strategy; provided, however, that from time to time, Fund management may alter the weightings if it deems it prudent to do so based on market conditions, trends or movements or other similar factors. |

| | 3 | | An unmanaged commodity index composed of futures contracts on 19 physical commodities and assumes that the futures positions are fully collateralized. |

| | 4 | | Commencement of operations. |

|

| Performance Summary for the Period Ended January 31, 2013 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | Since Inception6 | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | | 3.95 | % | | | (4.42 | )% | | | N/A | | | | 4.51 | % | | | N/A | |

Investor A | | | 3.73 | | | | (4.63 | ) | | | (9.65 | )% | | | 4.31 | | | | 0.19 | % |

Investor C | | | 3.34 | | | | (5.38 | ) | | | (6.33 | ) | | | 3.50 | | | | 3.50 | |

Dow Jones-UBS Commodity Index Total ReturnSM | | | (1.18 | ) | | | (1.13 | ) | | | N/A | | | | 1.20 | | | | N/A | |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | | The Fund commenced operations on October 3, 2011. |

N/A—Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical8 | | | | |

| | | Beginning

Account Value

August 1, 2012 | | | Ending

Account Value

January 31, 2013 | | | Expenses Paid

During the Period7 | | | Beginning

Account Value

August 1, 2012 | | | Ending

Account Value

January 31, 2013 | | | Expenses Paid

During the Period7 | | | Annualized

Expense Ratio | |

Institutional | | | $1,000.00 | | | | $1,039.50 | | | | $6.68 | | | | $1,000.00 | | | | $1,018.65 | | | | $6.61 | | | | 1.30% | |

Investor A | | | $1,000.00 | | | | $1,037.30 | | | | $7.70 | | | | $1,000.00 | | | | $1,017.64 | | | | $7.63 | | | | 1.50% | |

Investor C | | | $1,000.00 | | | | $1,033.40 | | | | $11.53 | | | | $1,000.00 | | | | $1,013.86 | | | | $11.42 | | | | 2.25% | |

| | 7 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/ 365 (to reflect the one-half year period shown). |

| | 8 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated. |

| | | | | | |

| | | | | | | |

| | BLACKROCK FUNDS | | JANUARY 31, 2013 | | 5 |

| | |

| Fund Summary as of January 31, 2013 | | BlackRock Global Long/Short Credit Fund |

BlackRock Global Long/Short Credit Fund’s (the “Fund”) investment objective is to seek absolute total returns over a complete market cycle.

|

| Portfolio Management Commentary |

How did the Fund perform?

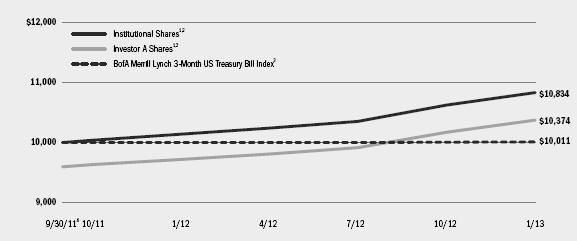

| Ÿ | | For the six-month period ended January 31, 2013, the Fund outperformed its benchmark, the BofA Merrill Lynch 3-Month US Treasury Bill Index. |

What factors influenced performance?

| Ÿ | | The Fund’s net long position in credit drove positive results as risk assets performed well amid improving economic data and supportive global monetary policy during the period. Specifically, long positions in US and European high yield debt generated positive returns. Long positions in higher-quality covered bonds and subordinated debt of European financial issuers also had a positive impact. As credit spreads continued to compress, long positions in select US and European non-financial investment grade corporate bonds contributed positively to results. Additionally, the Fund benefited from its participation in the new-issue market in the United States. |

| Ÿ | | As risk assets rallied during the period, the Fund’s hedges against its long credit positions had a negative impact on performance. Short positions in the senior unsecured debt of select Spanish and French financial issuers also detracted modestly from returns. |

| Ÿ | | As part of its investment strategy, the Fund uses derivatives to fully hedge against duration (sensitivity to interest rate movements) and currency risk. During the period, the Fund’s holdings of foreign exchange contracts had a net negative impact on performance. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Fund established long positions in attractive US investment grade credits, mainly in the aviation sector. More specifically, the Fund took long positions in leasing companies and issuers with high-quality aircraft-backed debt. Given the anticipation of US sequestration and spending cuts, the Fund took short positions in select defense issuers. The Fund also took short positions in technology issuers and then closed those positions later in the period. In Europe, the Fund expressed its high-quality bias in financials by holding subordinated debt issues and covered bonds, while shorting the senior unsecured debt of select Spanish and French banks. In non-financial sectors, the Fund continued to utilize the new-issue market to add long positions in various European credits, with a focus on industrial names. The Fund |

also engaged in long/short paired trades to capitalize on credit spread movements between securities within the same industries.

|

| Ÿ | | In US leveraged finance markets, the Fund increased its exposure to bank loans with a focus on issuers with superior credit fundamentals and stable cash flows. Within US high yield, the Fund’s high-quality bias led to a preference for the communications and capital goods sectors as well as consumer-driven names in light of the improved outlook for the US economy. In the higher-beta (i.e., more volatile) sectors, the Fund favored long positions in fundamentally strong issuers. In European high yield markets, the Fund sought attractive issues on a risk/reward basis, with exposures primarily in communications and select consumer cyclical names. |

| Ÿ | | The Fund also utilized long/short paired trades to capitalize on credit spread movements between European sovereigns. In particular, the Fund established a short position in Belgium versus a long position in Germany, as well as a short position in France versus a long position in the Netherlands. Similar to Germany, sovereign debt in the Netherlands is attractive due to the country’s AAA credit rating, strong balance sheet and low ratio of debt-to-gross domestic product. The Fund also took long positions in local governments including Madrid and Valencia given their attractive risk/reward profiles. |

| Ÿ | | The Fund’s cash exposure had no material impact on performance as the Fund expresses long and short positions via the credit default swap market, which does not require a cash outlay like that of traditional cash bonds. |

Describe portfolio positioning at period end.

| Ÿ | | The Fund’s net long credit position at period end was driven primarily by exposure to US bank loans and high yield debt, along with European investment grade credits. Altogether, the Fund was positioned with less exposure to European credit risk versus the United States given a more cautious outlook for Europe. The Fund continued to seek attractive long and short opportunities in global credit markets while maintaining hedges to protect the Fund against near-term risks. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| 6 | | BLACKROCK FUNDS | | JANUARY 31, 2013 | | |

| | |

| | | BlackRock Global Long/Short Credit Fund |

|

| Total Return Based on a $10,000 Investment |

| | 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| | 2 | | The Fund seeks to provide absolute total returns over a complete market cycle through diversified long and short exposure to the global fixed income markets. |

| | 3 | | An unmanaged index that measures returns of three-month Treasury Bills. |

| | 4 | | Commencement of operations. |

|

| Performance Summary for the Period Ended January 31, 2013 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | Since Inception6 | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | | 4.63 | % | | | 6.85 | % | | | N/A | | | | 6.18 | % | | | N/A | |

Investor A | | | 4.63 | | | | 6.72 | | | | 2.47 | % | | | 6.00 | | | | 2.79 | % |

Investor C | | | 4.15 | | | | 5.90 | | | | 4.90 | | | | 5.23 | | | | 5.23 | |

BofA Merrill Lynch 3-Month US Treasury Bill Index | | | 0.07 | | | | 0.11 | | | | N/A | | | | 0.08 | | | | N/A | |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | | The Fund commenced operations on September 30, 2011. |

N/A—Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical9 | |

| | | | | | | | | Including

Interest Expense | | | Excluding

Interest Expense | | | | | | Including

Interest Expense | | | Excluding

Interest Expense | |

| | | Beginning

Account Value

August 1, 2012 | | | Ending

Account Value

January 31, 2013 | | | Expenses Paid

During the Period7 | | | Expenses Paid

During the Period8 | | | Beginning

Account Value

August 1, 2012 | | | Ending

Account Value

January 31, 2013 | | | Expenses Paid

During the Period7 | | | Ending Account Value

January 31, 2013 | | | Expenses Paid

During the Period8 | |

Institutional | | | $1,000.00 | | | | $1,046.30 | | | | $7.53 | | | | $6.19 | | | | $1,000.00 | | | | $1,017.85 | | | | $7.43 | | | | $1,019.16 | | | | $6.11 | |

Investor A | | | $1,000.00 | | | | $1,046.30 | | | | $8.56 | | | | $7.22 | | | | $1,000.00 | | | | $1,016.84 | | | | $8.44 | | | | $1,018.15 | | | | $7.12 | |

Investor C | | | $1,000.00 | | | | $1,041.50 | | | | $12.40 | | | | $11.06 | | | | $1,000.00 | | | | $1,013.06 | | | | $12.23 | | | | $1,014.37 | | | | $10.92 | |

| | 7 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.46% for Institutional, 1.66% for Investor A and 2.41% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 8 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.20% for Institutional, 1.40% for Investor A and 2.15% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 9 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated.

| | | | | | |

| | | | | | | |

| | BLACKROCK FUNDS | | JANUARY 31, 2013 | | 7 |

| Ÿ | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to eligible investors. |

| Ÿ | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% for BlackRock Commodity Strategies Fund and 4.00% for BlackRock Global Long/Short Credit Fund. These shares are subject to a service fee of 0.25% per year (but no distribution fee). |

| Ÿ | | Investor C Shares are subject to a 1.00% contingent deferred sales charge (“CDSC”) if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder

would pay on fund distributions or the redemption of fund shares. Figures shown in each of the performance tables on the previous pages assume reinvestment of all dividends and distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, waived and/or reimbursed a portion of each Fund’s expenses. Without such waiver and/or reimbursement, each Fund’s performance would have been lower. The Manager is under no obligation to waive or reimburse or to continue waiving or reimbursing its fees after the applicable termination date. See Note 3 of the Notes to Financial Statements for additional information on waivers and reimbursements.

Shareholders of the Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on August 1, 2012 and held through January 31, 2013) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the headings entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | | | | | |

| | | | | | | |

| 8 | | BLACKROCK FUNDS | | JANUARY 31, 2013 | | |

| | |

| Derivative Financial Instruments | | |

The Funds may invest in various derivative financial instruments, including financial futures contracts, foreign currency exchange contracts, options and swaps, as specified in Note 2 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to hedge market, equity, credit, interest rate and/or foreign currency exchange rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial

instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment, may result in lower dividends paid to shareholders or may cause a Fund to hold an investment that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

|

| BlackRock Global Long/Short Credit Fund’s Portfolio Information |

| | | | |

| Geographic Allocation | | Percent of Long Investments | |

United States | | | 42 | % |

United Kingdom | | | 12 | |

Spain | | | 9 | |

Germany | | | 7 | |

Netherlands | | | 6 | |

France | | | 5 | |

Italy | | | 5 | |

Luxembourg | | | 3 | |

Portugal | | | 3 | |

Ireland | | | 2 | |

Bermuda | | | 2 | |

Cayman Islands | | | 1 | |

Canada | | | 1 | |

Cyprus | | | 1 | |

Japan | | | 1 | |

| | | | |

| Geographic Allocation | | Percent of

Short Investments | |

United States | | | 98 | % |

Italy | | | 1 | |

France | | | 1 | |

| | | | |

| Credit Quality Allocation1 | | Percent of Long-Term Investments | |

AAA/Aaa2 | | | 1 | % |

AA/Aa | | | 2 | |

A | | | 10 | |

BBB/Baa | | | 27 | |

BB/Ba | | | 21 | |

B | | | 15 | |

CCC/Caa | | | 4 | |

Not Rated | | | 20 | |

| 1 | | Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investors Service ratings. |

| 2 | | Includes US Treasury Obligations which are deemed AAA/Aaa by the investment advisor. |

| | | | | | |

| | | | | | | |

| | BLACKROCK FUNDS | | JANUARY 31, 2013 | | 9 |

| | |

Consolidated Schedule of Investments January 31, 2013 (Unaudited) | | BlackRock Commodity Strategies Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Commodity-Linked Notes | | Par

(000) | | | Value | |

Canadian Imperial Bank of Commerce 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM 4 Month Forward, multiplied by 3), 11/04/13 | | | USD 14,000 | | | $ | 12,719,000 | |

International Bank for Reconstruction & Development 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM, multiplied by 3), 11/05/13 | | | 16,000 | | | | 13,960,474 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM 4 Month Forward, multiplied by 3), 11/04/13 | | | 8,000 | | | | 7,302,400 | |

Swedish Export Credit Corp. 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM 4 Month Forward, multiplied by 3), 4/29/13 | | | 14,000 | | | | 13,321,143 | |

UBS AG 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM 4 Month Forward, multiplied by 3), 10/28/13 | | | 8,000 | | | | 7,278,419 | |

Total Commodity-Linked Notes — 14.4% | | | | | | | 54,581,436 | |

| | | | | | | | |

| | |

| | |

| Common Stocks | | Shares | | | | |

Biotechnology — 0.1% | | | | | | | | |

Genus Plc | | | 13,950 | | | | 314,120 | |

Chemicals — 4.1% | | | | | | | | |

Agrinos AS (a) | | | 35,000 | | | | 237,054 | |

Agrium, Inc. | | | 14,850 | | | | 1,685,327 | |

American Vanguard Corp. | | | 7,300 | | | | 247,470 | |

CF Industries Holdings, Inc. | | | 5,850 | | | | 1,340,645 | |

China BlueChemical Ltd., H Shares | | | 70,000 | | | | 50,293 | |

Israel Chemicals Ltd. | | | 14,600 | | | | 193,912 | |

Monsanto Co. | | | 30,075 | | | | 3,048,101 | |

The Mosaic Co. | | | 44,500 | | | | 2,725,625 | |

Nufarm Ltd. | | | 21,034 | | | | 122,311 | |

Potash Corp. of Saskatchewan, Inc. | | | 39,040 | | | | 1,659,200 | |

Sinofert Holdings Ltd. | | | 300,000 | | | | 74,672 | |

Syngenta AG | | | 7,420 | | | | 3,190,881 | |

Uralkali OJSC — GDR | | | 18,600 | | | | 712,380 | |

Yara International ASA | | | 6,300 | | | | 335,969 | |

| | | | | | | | |

| | | | | | | | 15,623,840 | |

Energy Equipment & Services — 4.3% | | | | | | | | |

Cameron International Corp. (a) | | | 21,750 | | | | 1,376,993 | |

Ensco Plc | | | 33,850 | | | | 2,151,845 | |

Halliburton Co. | | | 107,200 | | | | 4,360,896 | |

National Oilwell Varco, Inc. | | | 30,750 | | | | 2,279,805 | |

Rowan Cos. Plc | | | 47,500 | | | | 1,637,800 | |

Schlumberger Ltd. | | | 58,250 | | | | 4,546,413 | |

| | | | | | | | |

| | | | | | | | 16,353,752 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Food & Staples Retailing — 0.1% | | | | | | | | |

The Andersons, Inc. | | | 7,000 | | | $ | 330,050 | |

Olam International Ltd. | | | 31,000 | | | | 40,540 | |

| | | | | | | | |

| | | | | | | | 370,590 | |

Food Products — 2.3% | | | | | | | | |

Adecoagro SA (a) | | | 63,750 | | | | 541,875 | |

Archer-Daniels-Midland Co. | | | 35,700 | | | | 1,018,521 | |

Astra Agro Lestari Tbk PT | | | 75,000 | | | | 145,183 | |

BRF-Brasil Foods SA — ADR | | | 26,500 | | | | 588,300 | |

Bunge Ltd. | | | 26,045 | | | | 2,074,745 | |

China Agri-Industries Holdings Ltd. | | | 59,800 | | | | 36,538 | |

First Resources Ltd. | | | 153,000 | | | | 241,482 | |

Golden Agri-Resources Ltd. | | | 700,000 | | | | 359,689 | |

GrainCorp Ltd. | | | 15,764 | | | | 198,573 | |

Indofood Agri Resources Ltd. | | | 186,000 | | | | 196,280 | |

Ingredion, Inc. | | | 11,700 | | | | 773,019 | |

Kuala Lumpur Kepong Bhd | | | 34,500 | | | | 240,956 | |

New Britain Palm Oil Ltd. | | | 30,200 | | | | 268,702 | |

Origin Enterprises Plc (a) | | | 13,424 | | | | 79,834 | |

Perusahaan Perkebunan London Sumatra Indonesia Tbk PT | | | 690,000 | | | | 156,150 | |

Smithfield Foods, Inc. (a) | | | 28,100 | | | | 655,011 | |

Tate & Lyle Plc | | | 18,300 | | | | 235,819 | |

Tyson Foods, Inc., Class A | | | 19,400 | | | | 429,128 | |

Wilmar International Ltd. | | | 174,000 | | | | 536,603 | |

| | | | | | | | |

| | | | | | | | 8,776,408 | |

Machinery — 1.2% | | | | | | | | |

AGCO Corp. | | | 18,800 | | | | 996,400 | |

CNH Global NV | | | 21,100 | | | | 1,007,314 | |

Deere & Co. | | | 25,140 | | | | 2,364,668 | |

Kubota Corp. | | | 28,000 | | | | 319,817 | |

| | | | | | | | |

| | | | | | | | 4,688,199 | |

Metals & Mining — 16.1% | | | | | | | | |

African Minerals Ltd. (a) | | | 36,430 | | | | 176,521 | |

African Rainbow Minerals Ltd. | | | 17,357 | | | | 390,846 | |

Agnico-Eagle Mines Ltd. | | | 17,349 | | | | 793,698 | |

Alamos Gold, Inc. | | | 36,201 | | | | 556,408 | |

Anglo American Plc | | | 41,773 | | | | 1,249,484 | |

AngloGold Ashanti Ltd. | | | 12,828 | | | | 358,579 | |

Antofagasta Plc | | | 105,356 | | | | 1,910,383 | |

Aquarius Platinum Ltd. | | | 35,755 | | | | 35,749 | |

Atlas Iron Ltd. | | | 229,137 | | | | 355,167 | |

B2Gold Corp. (a) | | | 52,223 | | | | 201,059 | |

Banro Corp. (a) | | | 89,124 | | | | 218,923 | |

Barrick Gold Corp. | | | 60,896 | | | | 1,939,099 | |

Beadell Resources Ltd. (a) | | | 277,609 | | | | 286,625 | |

BHP Billiton Plc | | | 164,427 | | | | 5,638,487 | |

Centerra Gold, Inc. | | | 29,000 | | | | 263,425 | |

Cia de Minas Buenaventura SA — ADR | | | 5,880 | | | | 173,989 | |

Detour Gold Corp. (a) | | | 15,000 | | | | 317,024 | |

Discovery Metals Ltd. (a) | | | 408,213 | | | | 458,667 | |

Eldorado Gold Corp. | | | 96,416 | | | | 1,077,841 | |

| | | | |

| To simplify the listings of portfolio holdings in the Schedules of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list: | | ADR American Depositary Receipts CAD Canadian Dollar CHF Swiss Franc DIP Debtor In Possession ETF Exchange Traded Fund EUR Euro FKA Formerly Known As | | GBP British Pound GDR Global Depositary Receipts LIBOR London Interbank Offered Rate SEK Swedish Krona SPDR Standard & Poor’s Depositary Receipts USD US Dollar |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 10 | | BLACKROCK FUNDS | | JANUARY 31, 2013 | | |

| | |

Consolidated Schedule of Investments (continued) | | BlackRock Commodity Strategies Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Metals & Mining (concluded) | | | | | | | | |

Evolution Mining Ltd. (a) | | | 59,876 | | | $ | 96,909 | |

First Quantum Minerals Ltd. | | | 103,063 | | | | 2,078,000 | |

Fortescue Metals Group Ltd. | | | 389,858 | | | | 1,912,282 | |

Franco-Nevada Corp. | | | 13,947 | | | | 745,453 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 46,000 | | | | 1,621,500 | |

Fresnillo Plc | | | 62,555 | | | | 1,644,416 | |

Glencore International Plc | | | 306,384 | | | | 1,912,559 | |

Goldcorp, Inc. | | | 68,691 | | | | 2,419,405 | |

Harmony Gold Mining Co. Ltd. | | | 66,230 | | | | 426,806 | |

IAMGOLD Corp. | | | 35,940 | | | | 295,116 | |

Iluka Resources Ltd. | | | 56,667 | | | | 574,402 | |

Impala Platinum Holdings Ltd. | | | 52,571 | | | | 952,853 | |

Industrias Penoles SAB de CV | | | 13,793 | | | | 676,242 | |

Kenmare Resources Plc (a) | | | 432,416 | | | | 228,277 | |

Kinross Gold Corp. | | | 63,823 | | | | 523,433 | |

Kumba Iron Ore Ltd. | | | 15,603 | | | | 1,050,724 | |

London Mining Plc (a) | | | 157,625 | | | | 416,297 | |

Metminco Ltd. (a) | | | 2,726,370 | | | | 168,636 | |

Mineral Deposits Ltd. (a) | | | 78,012 | | | | 332,861 | |

New Gold, Inc. (a) | | | 193,152 | | | | 1,876,522 | |

Newcrest Mining Ltd. | | | 67,854 | | | | 1,662,013 | |

Newmont Mining Corp. | | | 17,722 | | | | 761,337 | |

Osisko Mining Corp. (a) | | | 18,667 | | | | 129,325 | |

PanAust Ltd. | | | 435,792 | | | | 1,345,545 | |

Petropavlovsk Plc | | | 4,540 | | | | 25,030 | |

Polymetal International Plc | | | 16,000 | | | | 271,407 | |

Randgold Resources Ltd. — ADR | | | 20,029 | | | | 1,885,931 | |

Rio Tinto Plc | | | 83,753 | | | | 4,731,543 | |

Romarco Minerals, Inc. (a) | | | 200,000 | | | | 178,464 | |

SEMAFO, Inc. | | | 71,759 | | | | 200,729 | |

Silver Lake Resources Ltd. (a) | | | 173,919 | | | | 463,369 | |

Silver Wheaton Corp. | | | 32,500 | | | | 1,131,016 | |

Sociedad Minera Cerro Verde SAA | | | 27,747 | | | | 1,054,386 | |

Tahoe Resources, Inc. (a) | | | 16,500 | | | | 266,177 | |

Teck Resources Ltd., Class B | | | 71,792 | | | | 2,616,442 | |

Vale SA — ADR | | | 162,424 | | | | 3,126,662 | |

Vedanta Resources Plc | | | 23,000 | | | | 439,221 | |

Volcan Cia Minera SAA, Class B | | | 405,373 | | | | 417,215 | |

Xstrata Plc | | | 126,821 | | | | 2,375,070 | |

Yamana Gold, Inc. | | | 71,965 | | | | 1,176,087 | |

Zhaojin Mining Industry Co. Ltd., H Shares | | | 86,500 | | | | 130,178 | |

| | | | | | | | |

| | | | | | | | 60,741,814 | |

Oil, Gas & Consumable Fuels — 17.9% | | | | | | | | |

Alpha Natural Resources, Inc. (a) | | | 17,640 | | | | 156,290 | |

Anadarko Petroleum Corp. | | | 44,213 | | | | 3,537,924 | |

BG Group Plc | | | 193,600 | | | | 3,436,175 | |

BP Plc | | | 695,500 | | | | 5,148,427 | |

Chevron Corp. | | | 76,850 | | | | 8,849,277 | |

ConocoPhillips | | | 56,250 | | | | 3,262,500 | |

Cosan Ltd., Class A | | | 17,300 | | | | 340,291 | |

Devon Energy Corp. | | | 33,200 | | | | 1,898,708 | |

Enbridge, Inc. | | | 28,000 | | | | 1,231,001 | |

ENI SpA | | | 109,300 | | | | 2,730,029 | |

EOG Resources, Inc. | | | 27,600 | | | | 3,449,448 | |

EQT Corp. | | | 20,300 | | | | 1,206,023 | |

Exxon Mobil Corp. | | | 89,632 | | | | 8,064,191 | |

Hess Corp. | | | 55,450 | | | | 3,724,022 | |

Hyperdynamics Corp. (a) | | | 69,000 | | | | 35,397 | |

Nexen, Inc. | | | 47,200 | | | | 1,262,579 | |

Noble Energy, Inc. | | | 23,800 | | | | 2,565,402 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (concluded) | | | | | | | | |

Oil Search Ltd. | | | 158,250 | | | $ | 1,208,454 | |

Peabody Energy Corp. | | | 9,404 | | | | 236,511 | |

Phillips 66 | | | 26,169 | | | | 1,585,056 | |

Range Resources Corp. | | | 28,050 | | | | 1,884,119 | |

Royal Dutch Shell Plc, B Shares | | | 112,600 | | | | 4,092,645 | |

Scorpio Tankers, Inc. | | | 84,000 | | | | 708,120 | |

Sterling Resources Ltd. (a) | | | 99,517 | | | | 64,855 | |

Suncor Energy, Inc. | | | 61,500 | | | | 2,090,285 | |

TransCanada Corp. | | | 61,000 | | | | 2,887,317 | |

Valero Energy Corp. | | | 36,000 | | | | 1,574,280 | |

Whitehaven Coal Ltd. | | | 122,589 | | | | 420,572 | |

| | | | | | | | |

| | | | | | | | 67,649,898 | |

Total Common Stocks — 46.1% | | | | | | | 174,518,621 | |

| | | | | | | | |

Investment Companies | | | | | | | | |

ELEMENTSSM Linked to the Rogers International Commodity Index — Total Return | | | 97,000 | | | | 1,767,090 | |

ETFS All Commodities DJ-UBSCISM | | | 467,000 | | | | 5,152,950 | |

Total Investment Companies — 1.9% | | | | 6,920,040 | |

Total Long-Term Investments

(Cost — $236,666,037) — 62.4% | | | | 236,020,097 | |

| | | | | | | | |

| | | | | | | | | |

Short-Term Securities | | | | | | | | |

Money Market Funds — 27.7% | | | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.10% (b)(c) | | | 104,752,052 | | | | 104,752,052 | |

| | |

| | | Par (000) | | | | |

U.S. Treasury Bills — 31.7% | | | | | | | | |

0.09%, 2/28/13 (d) | | | USD 9,000 | | | | 8,999,967 | |

0.07%, 4/04/13 (d) | | | 19,000 | | | | 18,998,195 | |

0.08%, 5/23/13 (d) | | | 92,000 | | | | 91,977,276 | |

| | | | | | | | |

| | | | | | | | 119,975,438 | |

Total Short-Term Securities (Cost — $224,728,006) — 59.4% | | | | 224,727,490 | |

| Total Investments (Cost — $461,394,043) — 121.8% | | | | 460,747,587 | |

| Liabilities in Excess of Other Assets — (21.8)% | | | | (82,316,336 | ) |

| | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 378,431,251 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK FUNDS | | JANUARY 31, 2013 | | 11 |

| | |

| Consolidated Schedule of Investments (continued) | | BlackRock Commodity Strategies Fund |

|

| Notes to Consolidated Schedule of Investments |

| (a) | | Non-income producing security. |

| (b) | | Investments in issuers considered to be an affiliate of the Fund during the six months ended January 31, 2013, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares Held at

July 31, 2012 | | | Net Activity | | | Shares Held at

January 31, 2013 | | | Income | | | Realized

Gain | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 1,457,853 | | | | 103,294,199 | | | | 104,752,052 | | | $ | 8,721 | | | $ | 105 | |

| (c) | | Represents the current yield as of report date. |

| (d) | | Rate shown reflects the discount rate at the time of purchase. |

| Ÿ | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| Ÿ | | Foreign currency exchange contracts as of January 31, 2013 were as follows: |

| | | | | | | | | | | | | | | | | | | | |

Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| GBP | | | 127,378 | | | USD | | | 200,684 | | | UBS AG | | | 2/01/13 | | | $ | 1,336 | |

| USD | | | 1,119,647 | | | CAD | | | 1,122,138 | | | Citigroup, Inc. | | | 2/01/13 | | | | (5,416 | ) |

| Total | | | | | | | | | | | | | | | | | | $ | (4,080 | ) |

| | | | | | | | | | | | | | | | | | | | |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| Ÿ | | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets and liabilities that the Fund has the ability to access |

| Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instrument and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements.

| | | | | | |

See Notes to Financial Statements. | | | | |

| | | | | | | |

| 12 | | BLACKROCK FUNDS | | JANUARY 31, 2013 | | |

| | |

| Consolidated Schedule of Investments (continued) | | BlackRock Commodity Strategies Fund |

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy as of January 31, 2013:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Commodity-Linked Notes | | | — | | | | — | | | $ | 54,581,436 | | | $ | 54,581,436 | |

Common Stocks: | | | | | | | | | | | | | | | | |

Biotechnology | | | — | | | $ | 314,120 | | | | — | | | | 314,120 | |

Chemicals | | $ | 11,655,802 | | | | 3,968,038 | | | | — | | | | 15,623,840 | |

Energy Equipment & Services | | | 16,353,752 | | | | — | | | | — | | | | 16,353,752 | |

Food & Staples Retailing | | | 330,050 | | | | 40,540 | | | | — | | | | 370,590 | |

Food Products | | | 6,670,091 | | | | 2,106,317 | | | | — | | | | 8,776,408 | |

Machinery | | | 4,368,382 | | | | 319,817 | | | | — | | | | 4,688,199 | |

Metals & Mining | | | 28,889,544 | | | | 31,852,270 | | | | — | | | | 60,741,814 | |

Oil, Gas & Consumable Fuels | | | 50,613,596 | | | | 17,036,302 | | | | — | | | | 67,649,898 | |

Investment Companies | | | 6,920,040 | | | | — | | | | — | | | | 6,920,040 | |

Short-Term Securities: | | | | | | | | | | | | | | | | |

Money Market Funds | | | 104,752,052 | | | | — | | | | — | | | | 104,752,052 | |

U.S. Treasury Bills | | | — | | | | 119,975,438 | | | | — | | | | 119,975,438 | |

Total | | $ | 230,553,309 | | | $ | 175,612,842 | | | $ | 54,581,436 | | | $ | 460,747,587 | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Derivative Financial Instruments1 | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Foreign currency exchange contracts | | $ | 1,336 | | | | — | | | | — | | | $ | 1,336 | |

Liabilities: | | | | | | | | | | | | | | | | |

Foreign currency exchange contracts | | | (5,416 | ) | | | — | | | | — | | | | (5,416 | ) |

Total | | $ | (4,080 | ) | | | — | | | | — | | | $ | (4,080 | ) |

| | | | |

1 Derivative financial instruments are foreign currency exchange contracts which are valued at the unrealized appreciation/depreciation on the instrument. | |

Certain of the Fund’s assets are held at carrying amount, which approximates fair value for financial statement purposes. As of January 31, 2013, such assets and liabilities are categorized within the disclosure hierarchy as follows: | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Foreign currency at value | | $ | 16,984 | | | | — | | | | — | | | $ | 16,984 | |

Liabilities: | | | | | | | | | | | | | | | | |

Bank overdraft | | | — | | | $ | (350,854 | ) | | | — | | | | (350,854 | ) |

Total | | $ | 16,984 | | | $ | (350,854 | ) | | | — | | | $ | (333,870 | ) |

| | | | |

There were no transfers between Level 1 and Level 2 during the six months ended January 31, 2013.

Certain of the Fund’s investments are categorized as Level 3 were valued utilizing transaction prices or third party pricing information without adjustment. Such valuations are based on unobservable inputs. A significant change in third party information inputs could result in a significantly lower or higher value in such Level 3 investments.

| | | | | | |

See Notes to Financial Statements. | | | | |

| | | | | | | |

| | BLACKROCK FUNDS | | JANUARY 31, 2013 | | 13 |

| | |

| Consolidated Schedule of Investments (concluded) | | BlackRock Commodity Strategies Fund |

A reconciliation of Level 3 investments is presented when the Fund had a significant amount of Level 3 investments at the beginning and/or end of the period in relation to net assets. The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used in determining fair value:

| | | | |

| | | Commodity-Linked

Notes | |

| Assets: | |

Opening Balance, as of July 31, 2012 | | | $13,009,726 | |

Transfers into Level 32 | | | — | |

Transfers out of Level 32 | | | — | |

Accrued discounts/premiums | | | — | |

Net realized gain (loss) | | | — | |

Net change in unrealized appreciation/depreciation3 | | | (4,428,290 | ) |

Purchases | | | 46,000,000 | |

Sales | | | — | |

Closing Balance, as of January 31, 2013 | | | $54,581,436 | |

| 2 | | Transfers into and transfers out of Level 3 represent the values as of the beginning of the reporting period. |

| 3 | | Included in the related net change in unrealized appreciation/depreciation in the Statement of Operations. The change in unrealized appreciation/depreciation on investments still held as of January 31, 2013 was $(4,428,290). |

| | | | | | |

See Notes to Financial Statements. | | | | |

| | | | | | | |

| 14 | | BLACKROCK FUNDS | | JANUARY 31, 2013 | | |

| | |

Schedule of Investments January 31, 2013 (Unaudited) | | BlackRock Global Long/Short Credit Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

Belgium — 0.1% | | | | | | | | |

Ontex IV SA, 9.00%, 4/15/19 | | EUR | 350 | | | $ | 484,732 | |

Bermuda — 1.3% | | | | | | | | |

Aircastle Ltd.: | | | | | | | | |

6.25%, 12/01/19 | | USD | 2,455 | | | | 2,651,400 | |

7.63%, 4/15/20 | | | 1,000 | | | | 1,147,500 | |

Digicel Group Ltd., 8.25%, 9/30/20 (a) | | | 679 | | | | 757,085 | |

Seadrill Ltd., 5.63%, 9/15/17 (a) | | | 2,950 | | | | 2,986,875 | |

| | | | | | | | |

| | | | | | | | 7,542,860 | |

Brazil — 0.1% | | | | | | | | |

OGX Austria GmbH, 8.38%, 4/01/22 (a) | | | 500 | | | | 448,750 | |

Canada — 0.4% | | | | | | | | |

Bombardier, Inc., 4.25%, 1/15/16 (a) | | | 490 | | | | 504,700 | |

Methanex Corp., 3.25%, 12/15/19 | | | 2,000 | | | | 2,010,732 | |

| | | | | | | | |

| | | | | | | | 2,515,432 | |

Cayman Islands — 0.8% | | | | | | | | |

Affinity Water Programme Finance Ltd.,

4.50%, 3/31/36 | | GBP | 955 | | | | 1,522,711 | |

MCE Finance Ltd., 5.00%, 2/15/21 (a) | | USD | 454 | | | | 454,000 | |

Punch Taverns Finance B Ltd: | | | | | | | | |

Series A6, 5.94%, 12/30/24 | | GBP | 83 | | | | 123,739 | |

Series A7, 4.77%, 6/30/33 | | | 630 | | | | 924,171 | |

Transocean, Inc.: | | | | | | | | |

2.50%, 10/15/17 | | USD | 170 | | | | 170,580 | |

6.50%, 11/15/20 | | | 300 | | | | 350,668 | |

6.38%, 12/15/21 | | | 850 | | | | 1,000,364 | |

| | | | | | | | |

| | | | | | | | 4,546,233 | |

Finland — 0.3% | | | | | | | | |

Nokia Oyj, 4.25%, 10/26/17 (b) | | EUR | 800 | | | | 1,466,958 | |

France — 3.6% | | | | | | | | |

Accor SA, 2.88%, 6/19/17 | | | 300 | | | | 414,502 | |

Autoroutes Du Sud de la France SA: | | | | | | | | |

4.13%, 4/13/20 | | | 1,400 | | | | 2,092,756 | |

2.88%, 1/18/23 | | | 1,900 | | | | 2,547,562 | |

Banque Federative du Credit Mutuel SA,

1.63%, 1/11/18 | | | 2,700 | | | | 3,601,442 | |

Electricite de France SA: | | | | | | | | |

2.75%, 3/10/23 | | | 1,300 | | | | 1,741,300 | |

5.25%, 12/29/49 (a)(c) | | USD | 7,800 | | | | 7,614,430 | |

Eutelsat SA, 3.13%, 10/10/22 | | EUR | 1,100 | | | | 1,502,443 | |

La Financiere Atalian SA, 7.25%, 1/15/20 | | | 1,230 | | | | 1,665,909 | |

| | | | | | | | |

| | | | | | | | 21,180,344 | |

Germany — 2.0% | | | | | | | | |

Bayerische Landesbank, 4.50%, 2/07/19 (c) | | | 2,650 | | | | 3,130,749 | |

Deutsche Bank AG, 2.38%, 1/11/23 | | | 2,400 | | | | 3,152,988 | |

Hella KGaA Hueck & Co., 2.38%, 1/24/20 | | | 1,540 | | | | 2,066,129 | |

HSH Nordbank AG: | | | | | | | | |

1.03%, 2/14/17 (c) | | | 70 | | | | 70,338 | |

1.15%, 2/14/17 (c) | | | 480 | | | | 482,287 | |

SAP AG, 2.13%, 11/13/19 | | | 970 | | | | 1,304,577 | |

Techem Energy Metering Service GmbH & Co. KG, 7.88%, 10/01/20 | | | 452 | | | | 658,217 | |

Techem GmbH: | | | | | | | | |

6.13%, 10/01/19 | | | 301 | | | | 433,217 | |

6.13%, 10/01/19 (a) | | | 169 | | | | 243,235 | |

| | | | | | | | |

| | | | | | | | 11,541,737 | |

| | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

Guernsey — 0.3% | | | | | | | | |

Doric Nimrod Air Finance Alpha Ltd.

Pass-Through Trust, Series 2012-1,

Class A, 5.13%, 11/30/24 (a) | | USD | 1,500 | | | $ | 1,612,500 | |

Ireland — 1.4% | | | | | | | | |

AIB Mortgage Bank, 2.63%, 7/28/17 | | EUR | 1,390 | | | | 1,879,404 | |

Ardagh Packaging Finance Plc/Ardagh MP Holdings USA, Inc.: | | | | | | | | |

7.38%, 10/15/17 | | | 300 | | | | 435,851 | |

7.00%, 11/15/20 (a) | | USD | 489 | | | | 492,668 | |

4.88%, 11/15/22 (a) | | | 200 | | | | 199,000 | |

Depfa Bank Plc, 0.95%, 12/15/15 (c) | | EUR | 3,130 | | | | 3,430,378 | |

Nara Cable Funding Ltd., 8.88%, 12/01/18 | | | 535 | | | | 744,940 | |

Porsche International Financing Plc,

3.88%, 2/01/16 | | | 594 | | | | 855,596 | |

| | | | | | | | |

| | | | | | | | 8,037,837 | |

Italy — 1.8% | | | | | | | | |

Buzzi Unicem SpA, 6.25%, 9/28/18 | | | 1,948 | | | | 2,844,939 | |

Cerved Technologies SpA: | | | | | | | | |

6.38%, 1/15/20 | | | 691 | | | | 931,197 | |

8.00%, 1/15/21 | | | 710 | | | | 956,802 | |

Davide Campari-Milano SpA, 4.50%, 10/25/19 | | | 484 | | | | 687,191 | |

Intesa Sanpaolo SpA, 3.88%, 1/16/18 | | USD | 1,690 | | | | 1,661,071 | |

Lottomatica Group SpA, 3.50%, 3/05/20 | | EUR | 1,000 | | | | 1,358,837 | |

Snam SpA, 3.88%, 3/19/18 | | | 1,419 | | | | 1,995,536 | |

| | | | | | | | |

| | | | | | | | 10,435,573 | |

Japan — 0.3% | | | | | | | | |

Nippon Life Insurance Co.,

5.00%, 10/18/42 (a)(c) | | USD | 2,000 | | | | 2,039,782 | |

Luxembourg — 1.6% | | | | | | | | |

Cirsa Funding Luxembourg SA, 8.75%, 5/15/18 | | EUR | 4,370 | | | | 5,874,214 | |

GCL Holdings SCA, 9.38%, 4/15/18 | | | 1,550 | | | | 2,251,898 | |

Intelsat Jackson Holdings SA,

7.25%, 10/15/20 (a) | | USD | 500 | | | | 535,000 | |

Schmolz + Bickenbach Luxembourg SA,

9.88%, 5/15/19 | | EUR | 391 | | | | 477,807 | |

Trinseo Materials Operating SCA/Trinseo Materials Finance, Inc., 8.75%, 2/01/19 (a) | | USD | 349 | | | | 345,510 | |

| | | | | | | | |

| | | | | | | | 9,484,429 | |

Netherlands — 1.7% | | | | | | | | |

Allianz Finance II BV, 5.75%, 7/08/41 (c) | | EUR | 500 | | | | 736,982 | |

Cooperatieve Centrale Raiffeisen- Boerenleenbank BA, 3.95%, 11/09/22 | | USD | 2,860 | | | | 2,861,012 | |

Enel Finance International NV, 4.88%, 4/17/23 | | EUR | 1,196 | | | | 1,642,513 | |

ING Bank NV: | | | | | | | | |

0.99%, 5/23/16 (c) | | USD | 150 | | | | 141,600 | |

1.13%, 11/21/16 (c) | | | 300 | | | | 279,300 | |

1.01%, 7/03/17 (c) | | | 230 | | | | 212,750 | |

IVG Finance BV, 1.75%, 3/29/17 (b) | | EUR | 200 | | | | 248,856 | |

LyondellBasell Industries NV, 5.75%, 4/15/24 | | USD | 660 | | | | 763,950 | |

NXP BV/NXP Funding LLC, 5.75%, 2/15/21 (a) | | | 1,540 | | | | 1,540,000 | |

Siemens Financieringsmaatschappij NV,

2.75%, 9/10/25 | | GBP | 1,000 | | | | 1,492,752 | |

| | | | | | | | |

| | | | | | | | 9,919,715 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK FUNDS | | JANUARY 31, 2013 | | 15 |

| | |

Schedule of Investments (continued) | | BlackRock Global Long/Short Credit Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

Portugal — 0.6% | | | | | | | | |

Banco Espirito Santo SA, 4.75%, 1/15/18 | | EUR | 1,000 | | | $ | 1,342,986 | |

Caixa Geral de Depositos SA, 5.63%, 12/04/15 | | | 1,600 | | | | 2,256,758 | |

| | | | | | | | |

| | | | | | | | 3,599,744 | |

Spain — 2.4% | | | | | | | | |

AyT Cedulas Cajas Global: | | | | | | | | |

4.00%, 3/21/17 | | | 1,400 | | | | 1,850,491 | |

3.75%, 12/14/22 | | | 900 | | | | 1,020,478 | |

4.75%, 5/25/27 | | | 800 | | | | 931,310 | |

AyT Cedulas Cajas IX Fondo de Titulizacion,

3.75%, 3/31/15 | | | 2,000 | | | | 2,706,709 | |

AyT Cedulas Cajas VIII Fondo de Titulizacion de Activos, 4.25%, 11/18/19 | | | 100 | | | | 126,302 | |

AyT Cedulas Cajas X Fondo de Titulizacion: | | | | | | | | |

0.26%, 6/30/15 (c) | | | 1,100 | | | | 1,370,974 | |

3.75%, 6/30/25 | | | 1,400 | | | | 1,498,524 | |

Banco Santander SA, 3.25%, 2/17/15 | | | 200 | | | | 275,713 | |

Bankinter SA, 3.88%, 10/30/15 | | | 1,050 | | | | 1,462,179 | |

Cedulas TDA 6 Fondo de Titulizacion de Activos: | | | | | | | | |

3.88%, 5/23/25 | | | 400 | | | | 431,941 | |

4.25%, 4/10/31 | | | 400 | | | | 401,387 | |

Kutxabank SA, 3.00%, 2/01/17 | | | 1,500 | | | | 2,023,999 | |

| | | | | | | | |

| | | | | | | | 14,100,007 | |

Sweden — 0.1% | | | | | | | | |

Scandinavian Airlines System Denmark-Norway- Sweden: | | | | | | | | |

9.65%, 6/16/14 | | | 500 | | | | 678,977 | |

10.50%, 6/16/14 | | SEK | 1,000 | | | | 154,533 | |

| | | | | | | | |

| | | | | | | | 833,510 | |

Switzerland — 0.2% | | | | | | | | |

Dufry Finance SCA, 5.50%, 10/15/20 (a) | | USD | 1,153 | | | | 1,204,885 | |

United Kingdom — 7.2% | | | | | | | | |

Abbey National Treasury Services Plc,

1.75%, 1/15/18 | | EUR | 2,015 | | | | 2,659,448 | |

Algeco Scotsman Global Finance Plc,

9.00%, 10/15/18 | | | 1,311 | | | | 1,851,267 | |

Annington Finance No. 4 Plc, Series B3,

1.51%, 1/10/23 (c) | | GBP | 2,302 | | | | 3,468,450 | |

Annington Finance No. 5 Plc,

13.00%, 1/15/23 (d) | | | 1,000 | | | | 1,823,892 | |

Co-Operative Group Ltd.: | | | | | | | | |

5.63%, 7/08/20 (e) | | | 830 | | | | 1,388,985 | |

6.25%, 7/08/26 (e) | | | 800 | | | | 1,342,821 | |

Enterprise Inns Plc, 6.50%, 12/06/18 | | | 1,120 | | | | 1,749,703 | |

Gala Group Finance Plc, 8.88%, 9/01/18 | | | 908 | | | | 1,508,486 | |

Great Places Housing Group Ltd.,

4.90%, 10/22/42 | | | 685 | | | | 1,101,720 | |

House of Fraser Funding Plc, 8.88%, 8/15/18 | | | 200 | | | | 334,115 | |

Imperial Tobacco Finance Plc, 4.50%, 7/05/18 | | EUR | 588 | | | | 891,952 | |

Lloyds TSB Bank Plc, 11.88%, 12/16/21 (c) | | | 91 | | | | 151,681 | |

Marks & Spencer Plc, 4.75%, 6/12/25 | | GBP | 500 | | | | 788,993 | |

Mondi Finance Plc, 5.75%, 4/03/17 | | EUR | 1,000 | | | | 1,529,824 | |

Phones4u Finance Plc, 9.50%, 4/01/18 | | GBP | 483 | | | | 811,997 | |

Severn Trent Utilities Finance Plc,

3.63%, 1/16/26 | | | 845 | | | | 1,324,886 | |

Standard Chartered Plc, 3.95%, 1/11/23 (a) | | USD | 3,000 | | | | 2,955,093 | |

Together Housing Finance Plc, 4.50%, 12/17/42 | | GBP | 940 | | | | 1,464,868 | |

| | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

United Kingdom (concluded) | | | | | | | | |

The Unique Pub Finance Co. Plc: | | | | | | | | |

Series 2012-02, Class A4, 5.66%, 6/30/27 | | GBP | 2,225 | | | $ | 3,272,994 | |

Series 2012-99, Class A3, 6.54%, 3/30/21 | | | 2,400 | | | | 3,787,351 | |

Vodafone Group Plc, 8.13%, 11/26/18 | | | 1,700 | | | | 3,528,065 | |

Voyage Care Bondco Plc, 11.00%, 2/01/19 | | | 1,950 | | | | 3,120,521 | |

WM Treasury Plc, 4.63%, 12/03/42 | | | 865 | | | | 1,351,579 | |

| | | | | | | | |

| | | | | | | | 42,208,691 | |

United States — 21.2% | | | | | | | | |

313 Group, Inc., 6.38%, 12/01/19 (a) | | USD | 525 | | | | 514,500 | |

The ADT Corp., 4.13%, 6/15/23 (a) | | | 480 | | | | 486,885 | |

Ally Financial, Inc., 8.00%, 11/01/31 | | | 700 | | | | 884,625 | |

Altria Group, Inc., 4.25%, 8/09/42 | | | 300 | | | | 281,571 | |

American Tower Corp., 3.50%, 1/31/23 | | | 4,810 | | | | 4,696,676 | |

Amgen, Inc., 4.38%, 12/05/18 | | EUR | 1,000 | | | | 1,539,193 | |

AvalonBay Communities, Inc., 2.85%, 3/15/23 | | USD | 4,000 | | | | 3,891,720 | |

Aviation Capital Group Corp., 6.75%, 4/06/21 (a) | | | 500 | | | | 543,035 | |

Axiall Corp., 4.88%, 5/15/23 (a) | | | 180 | | | | 181,350 | |

Bank of America Corp., 3.30%, 1/11/23 | | | 2,600 | | | | 2,564,162 | |

Brocade Communications Systems, Inc.,

4.63%, 1/15/23 (a) | | | 1,200 | | | | 1,197,000 | |

CCO Holdings LLC/CCO Holdings Capital Corp.,

6.50%, 4/30/21 | | | 500 | | | | 535,000 | |

Ceridian Corp., 8.88%, 7/15/19 (a) | | | 745 | | | | 830,675 | |

CHS/Community Health Systems, Inc.,

5.13%, 8/15/18 | | | 1,000 | | | | 1,052,500 | |

CIT Group, Inc.: | | | | | | | | |

5.50%, 2/15/19 (a) | | | 690 | | | | 738,300 | |

5.00%, 8/15/22 | | | 530 | | | | 559,745 | |

Clean Harbors, Inc., 5.25%, 8/01/20 | | | 750 | | | | 783,750 | |

Clear Channel Worldwide Holdings, Inc.: | | | | | | | | |

7.63%, 3/15/20 | | | 740 | | | | 773,300 | |

6.50%, 11/15/22 (a) | | | 741 | | | | 789,165 | |

6.50%, 11/15/22 (a) | | | 554 | | | | 584,470 | |

CNH Capital LLC, 3.88%, 11/01/15 (a) | | | 1,500 | | | | 1,541,250 | |

Comcast Corp., 4.25%, 1/15/33 | | | 4,500 | | | | 4,385,201 | |

Continental Airlines Pass-Through Certificates: | | | | | | | | |

Series 2012-2, Class A, 4.00%, 4/29/26 | | | 2,800 | | | | 2,922,500 | |

Series 2012-2, Class B, 5.50%, 4/29/22 | | | 1,000 | | | | 1,046,250 | |

Series 2012-3, Class C, 6.13%, 4/29/18 | | | 4,500 | | | | 4,477,500 | |

Series 2012-3, Class RJ03,

7.88%, 1/02/20 | | | 465 | | | | 483,322 | |

Continental Rubber of America Corp.,

4.50%, 9/15/19 (a) | | | 4,360 | | | | 4,469,000 | |

Crown Americas LLC/Crown Americas Capital Corp. IV, 4.50%, 1/15/23 (a) | | | 883 | | | | 869,755 | |

Crown Castle International Corp.,

5.25%, 1/15/23 (a) | | | 1,000 | | | | 1,050,000 | |

Denbury Resources, Inc., 4.63%, 7/15/23 | | | 813 | | | | 796,740 | |

DigitalGlobe, Inc., 5.25%, 2/01/21 (a) | | | 562 | | | | 560,595 | |

DIRECTV Holdings LLC/DIRECTV Financing Co., Inc., 3.80%, 3/15/22 | | | 1,000 | | | | 1,008,802 | |

The Dun & Bradstreet Corp., 4.38%, 12/01/22 | | | 2,250 | | | | 2,274,554 | |

Eagle Spinco, Inc., 4.63%, 2/15/21 (a) | | | 208 | | | | 209,300 | |

El Paso Pipeline Partners Operating Co. LLC,

5.00%, 10/01/21 | | | 1,355 | | | | 1,503,458 | |

Energy Future Intermediate Holding Co. LLC/EFIH Finance, Inc., 10.00%, 12/01/20 | | | 850 | | | | 975,375 | |

Energy Transfer Partners LP, 6.50%, 2/01/42 | | | 500 | | | | 576,787 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 16 | | BLACKROCK FUNDS | | JANUARY 31, 2013 | | |

| | |

Schedule of Investments (continued) | | BlackRock Global Long/Short Credit Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

United States (continued) | | | | | | | | |

Entergy Mississippi, Inc., 3.10%, 7/01/23 | | USD | 4,000 | | | $ | 3,917,756 | |

Enterprise Products Operating LLC, 4.45%, 2/15/43 | | | 3,000 | | | | 2,850,318 | |

First Data Corp., 7.38%, 6/15/19 (a) | | | 500 | | | | 526,250 | |

Ford Motor Credit Co. LLC, 2.38%, 1/16/18 | | | 5,000 | | | | 4,933,840 | |

HCA, Inc.: | | | | | | | | |

6.50%, 2/15/20 | | | 570 | | | | 634,125 | |

4.75%, 5/01/23 | | | 736 | | | | 740,600 | |

HD Supply, Inc.: | | | | | | | | |

8.13%, 4/15/19 (a) | | | 655 | | | | 741,787 | |

7.50%, 7/15/20 (a) | | | 1,080 | | | | 1,066,500 | |

11.50%, 7/15/20 (a) | | | 715 | | | | 824,037 | |

IAC/InterActiveCorp., 4.75%, 12/15/22 (a) | | | 582 | | | | 577,635 | |

Infor US, Inc., 9.38%, 4/01/19 | | | 660 | | | | 745,800 | |

Jefferies Group, Inc.: | | | | | | | | |

5.13%, 1/20/23 | | | 2,000 | | | | 2,051,430 | |

6.50%, 1/20/43 | | | 400 | | | | 407,217 | |

Lear Corp., 4.75%, 1/15/23 (a) | | | 400 | | | | 398,000 | |

Level 3 Communications, Inc.,

8.88%, 6/01/19 (a) | | | 500 | | | | 543,750 | |

Level 3 Financing, Inc., 8.13%, 7/01/19 | | | 509 | | | | 554,810 | |

MarkWest Energy Partners LP/MarkWest Energy Finance Corp., 4.50%, 7/15/23 | | | 800 | | | | 796,000 | |

Meccanica Holdings USA, Inc.: | | | | | | | | |

6.25%, 7/15/19 (a) | | | 2,205 | | | | 2,250,864 | |

6.25%, 1/15/40 (a) | | | 1,270 | | | | 1,089,826 | |

NCR Corp., 5.00%, 7/15/22 (a) | | | 500 | | | | 506,250 | |

Nuance Communications, Inc.,

5.38%, 8/15/20 (a) | | | 500 | | | | 515,000 | |

Owens Corning, 4.20%, 12/15/22 | | | 1,500 | | | | 1,521,805 | |

Packaging Corp. of America, 3.90%, 6/15/22 | | | 1,800 | | | | 1,839,515 | |

Penske Truck Leasing Co. LP/PTL Finance Corp.: | | | | | | | | |

2.50%, 3/15/16 (a) | | | 1,500 | | | | 1,525,047 | |

3.38%, 3/15/18 (a) | | | 1,500 | | | | 1,536,323 | |

Post Holdings, Inc., 7.38%, 2/15/22 | | | 603 | | | | 669,330 | |

Precision Castparts Corp.: | | | | | | | | |

2.50%, 1/15/23 | | | 2,000 | | | | 1,950,726 | |

3.90%, 1/15/43 | | | 400 | | | | 389,347 | |

Prudential Financial, Inc., 5.63%, 6/15/43 (c) | | | 3,500 | | | | 3,609,375 | |

QEP Resources, Inc., 5.25%, 5/01/23 | | | 605 | | | | 635,250 | |

Rain CII Carbon LLC/CII Carbon Corp., 8.50%, 1/15/21 | | EUR | 930 | | | | 1,310,099 | |

Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer Luxembourg SA, 5.75%, 10/15/20 | | USD | 1,085 | | | | 1,109,413 | |

Rockwood Specialties Group, Inc., 4.63%, 10/15/20 | | | 960 | | | | 980,400 | |

Sabine Pass Liquefaction LLC,

5.63%, 2/01/21 (a) | | | 3,062 | | | | 3,073,483 | |

SABMiller Holdings, Inc., 1.88%, 1/20/20 | | EUR | 970 | | | | 1,288,594 | |

Six Flags Entertainment Corp.,

5.25%, 1/15/21 (a) | | USD | 3,038 | | | | 3,022,810 | |

Spectrum Brands Escrow Corp., 6.38%, 11/15/20 (a) | | | 2,000 | | | | 2,127,500 | |

Sprint Nextel Corp., 9.00%, 11/15/18 (a) | | | 500 | | | | 618,750 | |

SunGard Data Systems, Inc.,

6.63%, 11/01/19 (a) | | | 1,200 | | | | 1,239,000 | |

Tenet Healthcare Corp.: | | | | | | | | |

4.75%, 6/01/20 (a) | | | 574 | | | | 577,587 | |

4.50%, 4/01/21 (a) | | | 767 | | | | 754,536 | |

| | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

United States (concluded) | | | | | | | | |

U.S. Airways Pass-Through Trust: | | | | | | | | |

Series 2012-1, Class B, 8.00%, 10/01/19 | | USD | 1,000 | | | $ | 1,080,000 | |

Series 2012-2, Class A, 4.63%, 6/03/25 | | | 4,000 | | | | 4,130,000 | |

Series 2012-2, Class B, 6.75%, 6/03/21 | | | 3,000 | | | | 3,120,000 | |

U.S. Coatings Acquisition, Inc./Flash Dutch 2 BV, 7.38%, 5/01/21 (a) | | | 243 | | | | 250,290 | |

Unifrax I LLC/Unifrax Holding Co., 7.50%, 2/15/19 (a) | | | 245 | | | | 248,675 | |

Verisk Analytics, Inc., 4.13%, 9/12/22 | | | 1,500 | | | | 1,530,991 | |

The Williams Cos, Inc., 3.70%, 1/15/23 | | | 2,070 | | | | 2,038,526 | |

Wyndham Worldwide Corp., 2.95%, 3/01/17 | | | 1,300 | | | | 1,321,484 | |

Zayo Group LLC/Zayo Capital, Inc., 8.13%, 1/01/20 | | | 820 | | | | 914,300 | |

| | | | | | | | |

| | | | | | | | 123,662,962 | |

Total Corporate Bonds — 47.4% | | | | | | | 276,866,681 | |

| | | | | | | | |

| | | | | | | | | |

Floating Rate Loan Interests | | | | | | | | |

Australia — 0.2% | | | | | | | | |

FMG Resources August 2006 Pty Ltd., Term Loan, 5.25%, 10/18/17 | | | 823 | | | | 832,969 | |

Germany — 0.1% | | | | | | | | |

Kabel Deutschland GmbH, Facility F, 4.25%, 2/01/19 | | | 740 | | | | 740,925 | |

Ireland — 0.3% | | | | | | | | |

AWAS Finance Luxembourg 2012 SA,

Term B-1 Loan, 4.75%, 7/16/18 | | | 1,729 | | | | 1,740,745 | |

Luxembourg — 0.5% | | | | | | | | |

Alpha Topco Ltd. (Formula One), Facility B-2, 6.00%, 4/30/19 | | | 576 | | | | 582,436 | |

Intelsat Jackson Holdings S.A. (FKA Intelsat Jackson Holdings Ltd.), Term B-1 Loan, 4.50%, 4/02/18 | | | 1,244 | | | | 1,258,975 | |

Mirror Bidco Corp., Term B Loan, 5.25%, 12/28/19 | | | 875 | | | | 881,930 | |

| | | | | | | | |

| | | | | | | | 2,723,341 | |

Netherlands — 0.2% | | | | | | | | |

NXP BV/NXP Funding LLC, Tranche C Loan, 4.75%, 1/10/20 | | | 1,250 | | | | 1,265,625 | |

United States — 7.4% | | | | | | | | |

ACCO Brands Corp., Term B Loan, 4.25%, 5/01/19 | | | 145 | | | | 146,856 | |

Alcatel-Lucent USA, Inc.: | | | | | | | | |

Term B Loan, 6.50%, 6/29/16 | | | 440 | | | | 444,950 | |

Term C Loan, 7.50%, 1/24/19 | | | 490 | | | | 494,777 | |

Term D Loan, 7.50%, 12/15/18 | | | 190 | | | | 189,118 | |

Alliance Laundry Systems LLC, Initial Term Loan (First Lien), 5.50%, 12/10/18 | | EUR | 285 | | | | 288,206 | |

Alliant Holdings I LLC, Initial Term Loan, 5.00%, 12/20/19 | | USD | 465 | | | | 470,036 | |

Altegrity, Inc. (FKA US Investigations Services, Inc.), Tranche D Term Loan, 7.75%, 2/21/15 | | | 337 | | | | 335,465 | |

American Capital Ltd. (FKA American Capital Strategies Ltd.), Senior Secured Term Loan, 5.50%, 8/22/16 | | | 303 | | | | 309,060 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK FUNDS | | JANUARY 31, 2013 | | 17 |

| | |

Schedule of Investments (continued) | | BlackRock Global Long/Short Credit Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Floating Rate Loan Interests | | Par (000) | | | Value | |

United States (continued) | | | | | | | | |

Ameriforge Group, Inc., Term Loan, 5.00%, 12/19/19 | | USD | 205 | | | $ | 207,243 | |

Apex Tool Group LLC, Term B Loan, 4.50%, 1/08/20 | | | 995 | | | | 1,003,915 | |

Ascend Performance Materials Operations LLC, Term B Loan, 6.75%, 4/10/18 | | | 199 | | | | 199,989 | |

Asurion, LLC (FKA Asurion Corp.), Term Loan (First Lien), 5.50%, 5/24/18 | | | 724 | | | | 731,049 | |

Bausch & Lomb, Inc., Parent Term Loan, 5.25%, 5/17/19 | | | 704 | | | | 710,684 | |

Biomet, Inc., Dollar Term B-1 Loan, 4.06%, 7/25/17 | | | 788 | | | | 795,905 | |

Booz Allen Hamilton, Inc, Initial Tranche B Term Loan, 4.50%, 7/31/19 | | | 379 | | | | 383,394 | |

Bright Horizons Family Solutions LLC (FKA Bright Horizons Family Solutions, Inc.), Term B Loan, 4.00%, 1/23/20 | | | 635 | | | | 638,702 | |

CCC Holdings, Inc., Term Loan, 5.25%, 12/20/19 | | | 470 | | | | 473,525 | |

CDW LLC (FKA CDW Corp.), Extended Term Loan, 4.00%, 7/15/17 | | | 287 | | | | 288,125 | |

Cequel Communications, LLC, Term Loan, 4.00%, 2/14/19 | | | 213 | | | | 215,060 | |

Ceridian Corp., Extended US Term Loan, 6.06%, 5/09/17 | | | 495 | | | | 499,826 | |

CHG Buyer Corp., Term Loan (First Lien), 5.00%, 11/19/19 | | | 718 | | | | 726,581 | |

DaVita, Inc., Tranche B-2 Term Loan, 4.00%, 11/01/19 | | | 445 | | | | 449,450 | |

DJO Finance LLC (ReAble Therapeutics Finance LLC), Tranche B-3 Term Loan, 6.25%, 9/15/17 | | | 179 | | | | 180,347 | |

Eastman Kodak Co., Term Loan (DIP), 8.50%, 7/20/13 | | | 166 | | | | 166,053 | |

Evergreen Acquisition Co. 1 LP, New Term Loan, 5.00%, 7/09/19 | | | 998 | | | | 1,005,809 | |

Federal-Mogul Corp.: | | | | | | | | |

Tranche B Term Loan, 2.24%, 12/29/14 | | | 997 | | | | 944,289 | |

Tranche C Term Loan, 2.24%, 12/28/15 | | | 319 | | | | 302,016 | |

First Data Corp., 2018 Term Loan,

5.31%, 9/24/18 | | | 705 | | | | 705,000 | |

Flash Dutch 2 BV & U.S. Coatings Acquisition, Inc.: | | | | | | | | |

Term B Loan, 5.25%, 1/15/20 | | EUR | 90 | | | | 122,812 | |

Term B Loan, 4.75%, 1/31/20 | | | 1,215 | | | | 1,232,253 | |

Freescale Semiconductor, Inc., Tranche B-1 Term Loan, 4.46%, 12/01/16 | | USD | 1,040 | | | | 1,040,437 | |

Getty Images, Inc., Tranche B Term Loan, 4.75%, 10/18/19 | | | 230 | | | | 232,530 | |

GMACM Borrower LLC (RFC Borrower LLC): | | | | | | | | |

Term A-1 Loan, 6.00%, 11/18/13 | | | 370 | | | | 370,348 | |

Term A-2 Loan, 7.75%, 11/18/13 | | | 65 | | | | 65,305 | |

Harrah’s Las Vegas Propco LLC, Senior Loan, 3.31%, 2/13/13 | | | 4,000 | | | | 3,691,680 | |

HD Supply, Inc., Term Loan, 7.25%, 10/12/17 | | | 1,432 | | | | 1,469,010 | |

INEOS U.S. Finance LLC, Cash Dollar Term Loan, 6.50%, 5/04/18 | | | 516 | | | | 526,948 | |

Interactive Data Corp., Term B Loan, 4.50%, 2/11/18 | | | 499 | | | | 500,521 | |