UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-05742

Name of Fund: BlackRock Funds

BlackRock All-Cap Energy & Resources Portfolio

BlackRock China Fund

BlackRock Energy & Resources Portfolio

BlackRock Flexible Equity Fund

BlackRock Global Opportunities Portfolio

BlackRock Health Sciences Opportunities Portfolio

BlackRock International Opportunities Portfolio

BlackRock Managed Volatility Portfolio

BlackRock Mid-Cap Growth Equity Portfolio

BlackRock Science & Technology Opportunities Portfolio

BlackRock Small Cap Growth Equity Portfolio

BlackRock U.S. Opportunities Portfolio

BlackRock World Gold Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd

Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2013

Date of reporting period: 03/31/2013

Item 1 – Report to Stockholders

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

2 | | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | |

Dear Shareholder

Despite continued global headwinds, risk assets (such as equities) have generated strong performance as investors sought meaningful yields in the ongoing low-interest-rate environment. About this time one year ago, concerns about Europe’s debt crisis dominated the markets as political instability in Greece and severe deficit and liquidity problems in Spain raised the specter of a full-blown euro collapse. Investors were also discouraged by gloomy economic reports from various parts of the world, particularly in China. As the outlook for the global economy worsened, however, investors grew increasingly optimistic that the world’s largest central banks would intervene to stimulate growth. This theme, along with the European Central Bank’s (“ECB’s”) firm commitment to preserve the euro currency bloc, drove most asset classes higher through the summer of 2012. In early September, the ECB announced it would purchase unlimited amounts of short term sovereign bonds to support the region’s debt-laden countries. Days later, the US Federal Reserve announced its own much-anticipated stimulus package.

Although financial markets world-wide were buoyed by these aggressive policy actions, risk assets weakened in the fall of 2012. Global trade began to slow as many European countries fell into recession and growth continued to decelerate in China. In the United States, stocks slid on lackluster corporate earnings and volatility rose in advance of the US Presidential election. In the post-election environment, investors grew increasingly concerned over the “fiscal cliff,” the automatic tax increases and spending cuts that had been scheduled to take effect at the beginning of 2013. There was widespread fear that the fiscal cliff would push the United States into recession unless politicians could agree upon alternate measures to reduce the nation’s deficit. Worries that bipartisan gridlock would preclude a timely budget deal triggered high levels of volatility in financial markets around the world in the months leading up to the last day of the year. Ultimately, the worst of the fiscal cliff was averted with a last-minute tax deal, although the postponement of decisions relating to spending cuts and the debt ceiling left some lingering uncertainty.

Investors shook off the nerve-wracking finale to 2012 and the New Year began with a powerful relief rally in risk assets. Money that had been pulled to the sidelines amid year-end tax-rate uncertainty poured back into the markets in January. Key indicators signaling modest but broad-based improvements in the world’s major economies underpinned the rally. Underlying this aura of comfort was the absence of negative headlines out of Europe. Against this backdrop, global equities surged through January while rising US Treasury yields pressured high quality fixed income assets (as prices move in the opposite direction as yields).

However, bond markets regained strength in February when economic momentum slowed and investors toned down their risk appetite. US stocks continued to rise, but at a more moderate pace. Uncertainty about how long the Federal Reserve would maintain its monetary easing bias drove high levels of volatility later in the month, but these fears abated as the budget sequester (automatic spending cuts scheduled to take effect March 1) began to appear imminent and was deemed likely to deter any near-term changes in the central bank’s policy stance. Improving labor market data and rising home prices pushed US stocks higher at the end of the period, with major indices reaching new all-time highs. Outside the United States, equity prices weakened in the final two months of the period due to a resurgence of macro risk out of Europe. Italy’s February presidential election ended in a stalemate, further propagating the ongoing theme of political instability in the eurozone. In March, a severe banking crisis in Cyprus underscored the fragility of the broader European banking system.

For the 6- and 12-month periods ended March 31, 2013, US and international stocks and high yield bonds posted strong gains, while emerging market equities lagged as the pace of global growth failed to impress investors. US Treasury yields were highly volatile over the past 12 months. While remaining relatively low from a historical standpoint, yields began inching higher in the later part of the period, pressuring Treasuries and investment-grade bonds. Tax-exempt municipal bonds, however, benefited from favorable supply-and-demand dynamics. Near-zero short term interest rates continued to keep yields on money market securities near their all-time lows.

Markets have always been unpredictable, but that does not mean investors can delay taking action. At BlackRock, we believe it’s time for a different approach to investing. One that seeks out more opportunities in more places across a broader array of investments in a portfolio designed to move freely as the markets move up and down. People everywhere are asking, “So what do I do with my money?” Visit www.blackrock.com for answers.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“Despite continued global headwinds, risk assets (such as equities) have generated strong performance as investors sought meaningful yields in the ongoing low-interest-rate environment.”

Rob Kapito

President, BlackRock Advisors, LLC

Total Returns as of March 31, 2013

| | | | | | | | |

| | | 6-month | | | 12-month | |

US large cap equities (S&P 500® Index) | | | 10.19 | % | | | 13.96 | % |

US small cap equities (Russell 2000® Index) | | | 14.48 | | | | 16.30 | |

International equities (MSCI Europe, Australasia, Far East Index) | | | 12.04 | | | | 11.25 | |

Emerging market equities (MSCI Emerging Markets Index) | | | 3.87 | | | | 1.96 | |

3-month Treasury bill (BofA Merrill Lynch 3-Month US Treasury Bill Index) | | | 0.06 | | | | 0.12 | |

US Treasury securities (BofA Merrill Lynch 10- Year US Treasury Index) | | | (0.55 | ) | | | 6.19 | |

US investment grade bonds (Barclays US Aggregate Bond Index) | | | 0.09 | | | | 3.77 | |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | | 1.26 | | | | 5.82 | |

US high yield bonds (Barclays US Corporate High Yield 2% Issuer Capped Index) | | | 6.28 | | | | 13.08 | |

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | |

| | |

| | |

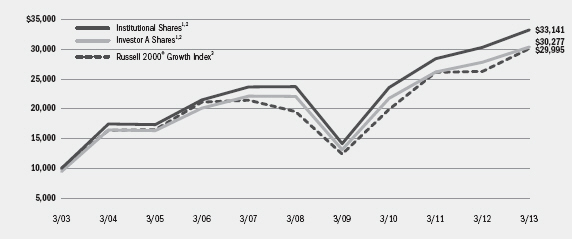

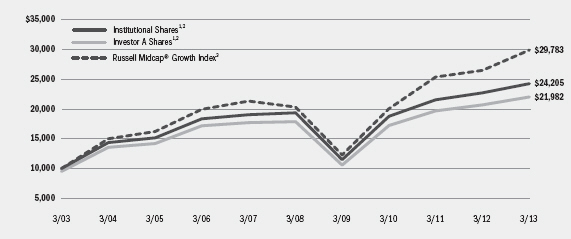

| Fund Summary as of March 31, 2013 | | BlackRock All-Cap Energy & Resources Portfolio |

| | | |

BlackRock All-Cap Energy & Resources Portfolio’s (the “Fund”) investment objective is to provide long-term growth of capital.

|

Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended March 31, 2013, the Fund underperformed its custom benchmark, which is a blend of 70% Wilshire 5000 Modified Energy Cap Weighted Index and 30% MSCI All-Country World Energy Index. The Fund also underperformed the S&P 500® Index. The following discussion of relative performance pertains to the Fund’s custom blended benchmark. |

What factors influenced performance?

| • | | The Fund’s exposure to gold and silver producers was the leading detractor from relative performance as gold and silver prices declined 10% in a rising equity market. In this environment, precious metals-related stocks dramatically underperformed, including key portfolio holdings Silver Wheaton Corp. and Goldcorp, Inc. Additionally, the Fund’s underweight to the oil & gas refining & marketing segment significantly hindered results relative to the benchmark index as refiners generally benefited from the dynamics of US versus global oil prices during the period. Selection among integrated oil & gas stocks also detracted from results as oil-related holdings such as Occidental Petroleum Corp., Cenovus Energy, Inc. and Suncor Energy, Inc. declined due to deteriorating revenues for North American crude oil production. |

| • | | Conversely, stock selection among oil & gas exploration & production companies contributed positively to Fund performance. Several holdings within this group rallied toward the end of the period as natural gas prices began to rise. Following a period during which a glut of North American supply and warmer-than-normal winter weather had pressured |

| | gas prices, these conditions were finally alleviated, allowing gas prices to rise. Gas-related holdings such as EQT Corp., Range Resources Corp. and Cabot Oil & Gas Corp. generated double-digit gains during the period. Additionally, one of the Fund’s largest holdings, Plains Exploration & Production Co., rose more than 25% following the announcement that the company would be acquired by Freeport-McMoRan Copper & Gold, Inc. |

Describe recent portfolio activity.

| • | | During the six-month period, the Fund reduced its overall number of positions, but made a new investment in Cairn Energy Plc, an oil & gas exploration & production company based in the United Kingdom. The Fund also increased its existing position in US exploration & production company Anadarko Petroleum Corp., which has attained access to a valuable natural gas resource in the Rovuma Basin off the coast of Mozambique. |

Describe portfolio positioning at period end.

| • | | As of period end, the Fund continued to maintain its focus on energy stocks, with a slight bias toward oil versus gas. Over half of the Fund’s net assets were invested in exploration & production stocks. The Fund remained overweight in coal producers and underweight in the larger integrated oil & gas companies, the refining segment and storage & transportation companies, while maintaining a neutral weighting in the oil services space. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | |

| Ten Largest Holdings | | Percent of

Long-Term

Investments |

EOG Resources, Inc. | | | | 6 | % |

Whiting Petroleum Corp. | | | | 5 | |

Anadarko Petroleum Corp. | | | | 4 | |

Chevron Corp. | | | | 4 | |

Occidental Petroleum Corp. | | | | 4 | |

Noble Energy, Inc. | | | | 4 | |

CONSOL Energy, Inc. | | | | 4 | |

Range Resources Corp. | | | | 4 | |

Apache Corp. | | | | 3 | |

Denbury Resources, Inc. | | | | 3 | |

| | | | | |

| Industry Allocation | | Percent of

Long-Term

Investments |

Oil, Gas & Consumable Fuels | | | | 85 | % |

Energy Equipment & Services | | | | 15 | |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

4 | | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | |

| | |

| | |

| | |

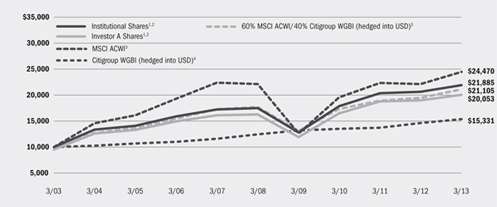

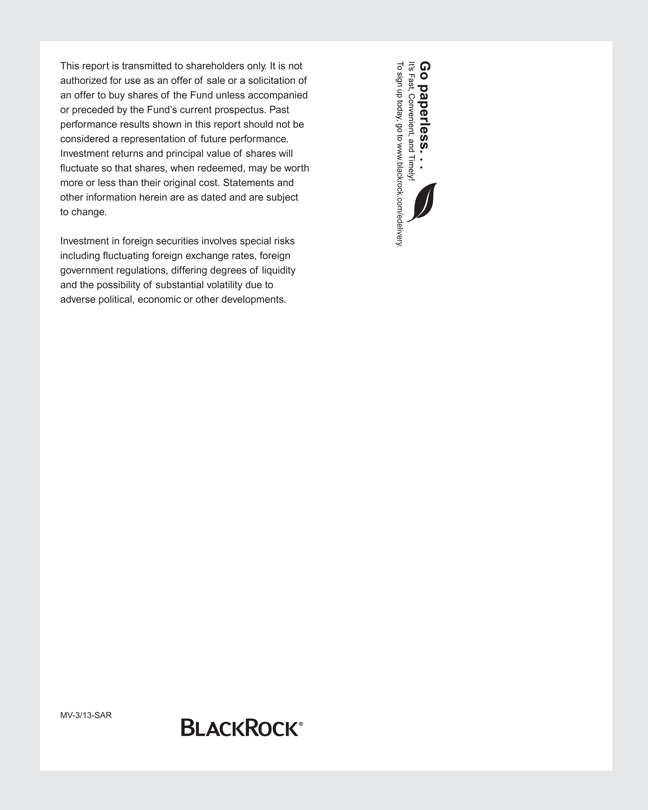

| | BlackRock All-Cap Energy & Resources Portfolio |

| | |

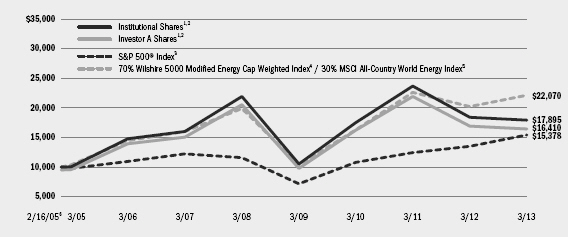

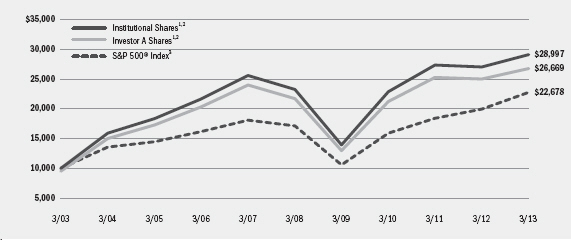

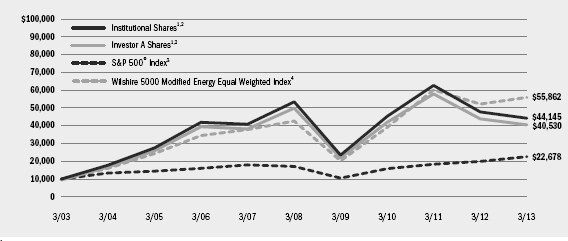

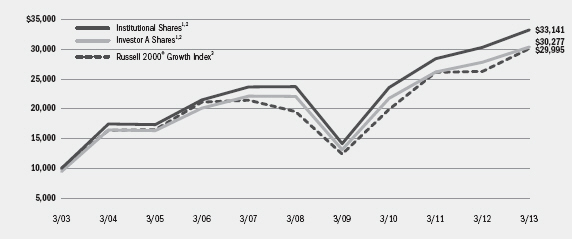

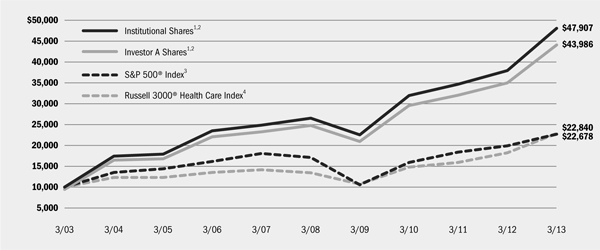

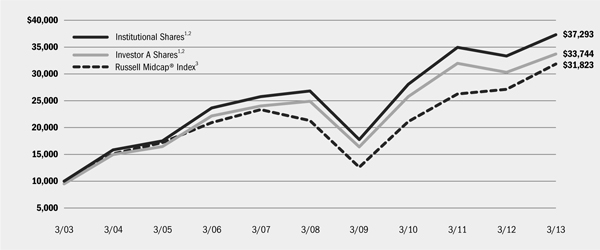

Total Return Based on a $10,000 Investment |

| |  |

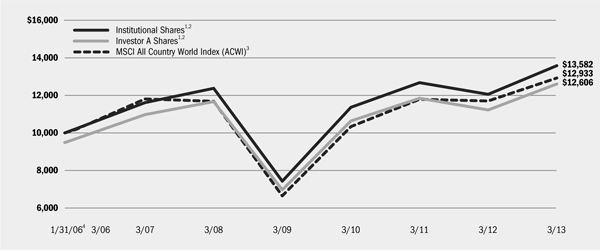

| | 1 Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. 2 Under normal market conditions, the Fund invests at least 80% of its total assets in equity securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). 3 This unmanaged index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly New York Stock Exchange (“NYSE”) issues) representing about 75% of NYSE market capitalization and 30% of NYSE issues. 4 The Wilshire 5000 Modified Energy Cap Weighted Index is a customized index comprised of the energy sector constituents of the Wilshire 5000 (Full Cap) Index which have been market capitalization weighted and the six largest securities and all securities that have a percentage market value below 0.01% have been removed. 5 The MSCI All-Country World Energy Index is comprised of the energy sector constituents of the MSCI All-Country World Index, a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets. 6 Commencement of operations. |

|

Performance Summary for the Period Ended March 31, 2013 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns7 |

| | | | | | | | | | |

| | | | | 1 Year | | | | 5 Years | | Since Inception8 |

| | | 6-Month

Total Returns | | w/o sales

charge | | w/ sales

charge | | | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge |

Institutional | | | | 2.99 | % | | | | (2.43 | )% | | | | N/A | | | | | | | (3.94 | )% | | | | N/A | | | | | 7.43 | % | | | | N/A | |

Service | | | | 2.73 | | | | | (2.80 | ) | | | | N/A | | | | | | | (4.29 | ) | | | | N/A | | | | | 7.01 | | | | | N/A | |

Investor A | | | | 2.73 | | | | | (2.80 | ) | | | | (7.89 | )% | | | | | | (4.32 | ) | | | | (5.35 | )% | | | | 6.99 | | | | | 6.29 | % |

Investor B | | | | 2.38 | | | | | (3.52 | ) | | | | (7.86 | ) | | | | | | (5.04 | ) | | | | (5.36 | ) | | | | 6.22 | | | | | 6.22 | |

Investor C | | | | 2.30 | | | | | (3.51 | ) | | | | (4.48 | ) | | | | | | (5.02 | ) | | | | (5.02 | ) | | | | 6.23 | | | | | 6.23 | |

S&P 500® Index | | | | 10.19 | | | | | 13.96 | | | | | N/A | | | | | | | 5.81 | | | | | N/A | | | | | 5.44 | | | | | N/A | |

| 70% Wilshire 5000 Modified Energy Cap Weighted Index / 30% MSCI All-Country World Energy Index | | | | 10.64 | | | | | 9.59 | | | | | N/A | | | | | | | 2.13 | | | | | N/A | | | | | 10.23 | | | | | N/A | |

| | 7 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| | 8 | The Fund commenced operations on February 16, 2005. |

| | | N/A - Not applicable as share class and index do not have a sales charge. |

| | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | Hypothetical10 | | |

| | | Beginning

Account Value

October 1, 2012 | | Ending

Account Value

March 31, 2013 | | Expenses Paid

During the Period9 | | | | Beginning

Account Value

October 1, 2012 | | Ending

Account Value

March 31, 2013 | | Expenses Paid

During the Period9 | | Annualized

Expense

Ratio |

Institutional | | | | $1,000.00 | | | | | $1,029.90 | | | | | $ 4.86 | | | | | | | $1,000.00 | | | | | $1,020.14 | | | | | $ 4.84 | | | | | 0.96 | % |

Service | | | | $1,000.00 | | | | | $1,027.30 | | | | | $ 6.77 | | | | | | | $1,000.00 | | | | | $1,018.25 | | | | | $ 6.74 | | | | | 1.34 | % |

Investor A | | | | $1,000.00 | | | | | $1,027.30 | | | | | $ 6.98 | | | | | | | $1,000.00 | | | | | $1,018.05 | | | | | $ 6.94 | | | | | 1.38 | % |

Investor B | | | | $1,000.00 | | | | | $1,023.80 | | | | | $10.60 | | | | | | | $1,000.00 | | | | | $1,014.46 | | | | | $10.55 | | | | | 2.10 | % |

Investor C | | | | $1,000.00 | | | | | $1,023.00 | | | | | $10.59 | | | | | | | $1,000.00 | | | | | $1,014.46 | | | | | $10.55 | | | | | 2.10 | % |

| | 9 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 10 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| | | | | | | | |

| | | | | | | | |

| | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | 5 |

| | |

| | |

| | |

| Fund Summary as of March 31, 2013 | | BlackRock China Fund |

| | |

BlackRock China Fund’s (the “Fund”) investment objective is to seek to maximize total return. Total return means the combination of capital appreciation and investment income.

|

Portfolio Management Commentary |

How did the Fund perform?

| • | | US and certain other financial markets were closed on March 29, 2013, while some foreign financial markets were open. The Fund was re-priced for financial reporting purposes to reflect, in the valuation, the transactions related to foreign market activities. For the six-month period ended March 31, 2013, the Fund outperformed its benchmark, the MSCI China 10/40 Index, and the MSCI China Index. The following discussion of relative performance pertains to the MSCI China 10/40 Index. |

What factors influenced performance?

| • | | Stock selection substantially boosted positive performance during the reporting period, particularly within the financials sector. Overweight positions in property names such as Shenzhen Investment Ltd. and China Vanke Co. Ltd. substantially contributed to relative performance. Also in financials, Hong Kong-listed Asian regional insurer AIA Group Ltd. added to returns. The stock performed well following strong results in the fourth quarter of 2012 that beat expectations. In the information technology sector, outperformance came from a lack of ownership in internet company Tencent, Inc., which missed earnings estimates. The Fund’s substantial underweight in China Mobile Ltd. also aided performance. The stock declined on uncertainty over whether the listed company will bear the capital expenditure costs for the infrastructure required to support new long-term evolution mobile network technology. |

| • | | The largest detractor from performance was the Fund’s investment in tele-communication services company China Unicom Hong Kong Ltd. The stock performed poorly as investors were concerned it would miss earnings esti- |

| | mates. Holdings in enterprise resource planning software developer Kingdee International Software Group Co. Ltd. and online game developer Shanda Games Ltd. also substantially detracted from returns. At the sector level, only utilities had a slight negative effect on overall performance. |

Describe recent portfolio activity.

| • | | During the six-month period, the Fund increased its weighting in China Construction Bank Corp. while taking advantage of the stock’s attractive pricing after a period of selling pressure led to its underperformance relative to other banks. The Fund added exposure to Agricultural Bank of China Ltd. given attractive valuation, but remains underweight in banks. Additions were made to some existing holdings on price weakness, including electric train engine manufacturer ZhuZhou CSR Times Electric Co. Ltd., China Pacific Insurance Co. Ltd., China Unicom Hong Kong Ltd. and CNOOC Ltd. A position was initiated in container board manufacturer Nine Dragons Paper Holdings Ltd. on the prospect of a supply shortage in the second half of 2013. |

Describe portfolio positioning at period end.

| • | | The Fund’s main active overweight positions continued to be in the health care and industrials sectors, where Fund management found attractive valuations and long-term growth potential. The Fund remained overweight in materials due to attractive valuations in select stocks in the sector, and underweight in financials even though exposure to banks was increased given their relative valuation. Within financials, the Fund remained underweight in the real estate segment, but continued to favor brokerage firms in light of financial liberalization and reform. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | |

| Ten Largest Holdings | | Percent of

Long-Term

Investments |

China Construction Bank Corp., H Shares | | | | 10 | % |

CNOOC Ltd. | | | | 7 | |

Industrial & Commercial Bank of China, H Shares | | | | 5 | |

China Petroleum & Chemical Corp., H Shares | | | | 5 | |

China Mobile Ltd. | | | | 4 | |

Agricultural Bank of China Ltd., H Shares | | | | 4 | |

ZhuZhou CSR Times Electric Co. Ltd., H Shares | | | | 4 | |

China Pacific Insurance Group Co. Ltd., H Shares | | | | 3 | |

Bank of China Ltd., H Shares | | | | 3 | |

China Unicom Hong Kong Ltd. | | | | 3 | |

| | | | | |

| Sector Allocation | | Percent of

Long-Term

Investments |

Financials | | | | 38 | % |

Energy | | | | 14 | |

Industrials | | | | 12 | |

Materials | | | | 9 | |

Telecommunication Services | | | | 7 | |

Health Care | | | | 5 | |

Consumer Discretionary | | | | 5 | |

Utilities | | | | 4 | |

Information Technology | | | | 4 | |

Consumer Staples | | | | 2 | |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease.

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

6 | | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | |

| | |

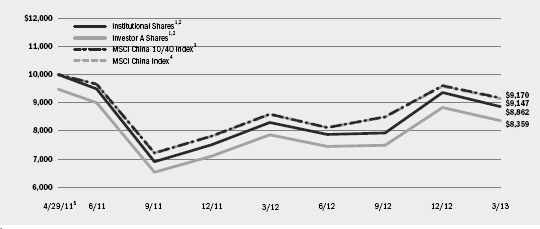

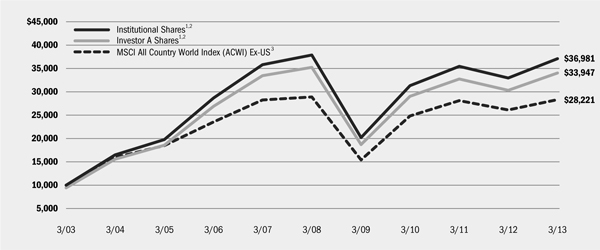

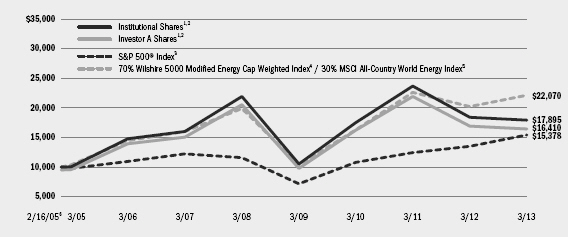

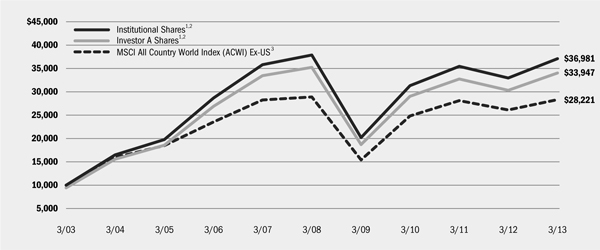

Total Return Based on a $10,000 Investment |

| |  |

| | 1 Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. 2 The Fund seeks to achieve its objective by investing at least 80% of its total assets in equity securities of companies domiciled, or exercising the predominant part of their economic activity, in China, including its special administrative regions such as Hong Kong, or in instruments with similar economic characteristics. 3 A free float-adjusted market capitalization index that is designed to measure equity market performance in China, taking into consideration the concentration constraints of the European Union’s UCITS III regulations. 4 An unmanaged free float-adjusted market capitalization index designed to measure equity market performance of China. 5 Commencement of operations. |

| | |

Performance Summary for the Period Ended March 31, 2013 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns6 |

| | | | | 1 Year | | Since Inception7 |

| | | 6-Month

Total Returns | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge |

Institutional | | | | 11.86 | % | | | | 6.79 | % | | | | N/A | | | | | (6.09 | )% | | | | N/A | |

Investor A | | | | 11.65 | | | | | 6.44 | | | | | 0.87 | % | | | | (6.33 | ) | | | | (8.90 | )% |

Investor C | | | | 11.18 | | | | | 5.84 | | | | | 4.84 | | | | | (6.96 | ) | | | | (6.96 | ) |

MSCI China 10/40 Index | | | | 7.96 | | | | | 6.72 | | | | | N/A | | | | | (4.41 | ) | | | | N/A | |

MSCI China Index | | | | 7.75 | | | | | 6.60 | | | | | N/A | | | | | (4.53 | ) | | | | N/A | |

| | 6 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| | 7 | The Fund commenced operations on April 29, 2011. |

| | | N/A - Not applicable as share class and index do not have a sales charge. |

| | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | Hypothetical9 | | |

| | | Beginning

Account Value

October 1, 2012 | | Ending

Account Value

March 31, 2013 | | Expenses Paid

During the Period8 | | | | Beginning

Account Value

October 1, 2012 | | Ending

Account Value

March 31, 2013 | | Expenses Paid

During the Period8 | | Annualized

Expense

Ratio |

Institutional | | | $ | 1,000.00 | | | | $ | 1,118.60 | | | | $ | 8.72 | | | | | | $ | 1,000.00 | | | | $ | 1,016.70 | | | | $ | 8.30 | | | | | 1.65 | % |

Investor A | | | $ | 1,000.00 | | | | $ | 1,116.50 | | | | $ | 10.03 | | | | | | $ | 1,000.00 | | | | $ | 1,015.46 | | | | $ | 9.55 | | | | | 1.90 | % |

Investor C | | | $ | 1,000.00 | | | | $ | 1,111.80 | | | | $ | 13.85 | | | | | | $ | 1,000.00 | | | | $ | 1,011.82 | | | | $ | 13.19 | | | | | 2.63 | % |

| | 8 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 9 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | 7 |

| | |

| | |

| | |

| Fund Summary as of March 31, 2013 | | BlackRock Energy & Resources Portfolio |

| | |

BlackRock Energy & Resources Portfolio’s (the “Fund”) investment objective is to provide long-term growth of capital.

|

Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended March 31, 2013, the Fund underperformed its benchmark, the Wilshire 5000 Modified Energy Equal Weighted Index, as well as the S&P 500® Index. The following discussion of relative performance pertains to the Wilshire 5000 Modified Energy Equal Weighted Index. |

What factors influenced performance?

| • | | Allocation decisions were the key drivers of the Fund’s underperformance relative to the benchmark index. Maintaining a large overweight to oil & gas exploration & production stocks naturally resulted in the Fund’s underweight to other oil & gas segments including equipment & services, drilling, refining & marketing and storage & transportation, all of which generated strong returns during the period. Also detracting from relative performance were the Fund’s positions in miners of precious and base metals not included in the benchmark index composition. Gold and silver prices declined 10% in a rising equity market, resulting in particularly dramatic underperformance among precious metals-related stocks. |

| • | | Conversely, stock selection among oil & gas exploration & production companies contributed positively to Fund performance. Several holdings within this group rallied toward the end of the period as natural gas |

| | prices began to rise. Following a period during which a glut of North American supply and warmer-than-normal winter weather had pressured gas prices, these conditions were finally alleviated, allowing gas prices to rise. Gas-related holdings such as EQT Corp., Range Resources Corp. and Cabot Oil & Gas Corp. generated double-digit gains during the period. Additionally, one of the Fund’s largest holdings, Plains Exploration & Production Co., rose more than 25% following the announcement that the company would be acquired by Freeport-McMoRan Copper & Gold, Inc. |

Describe recent portfolio activity.

| • | | During the six-month period, the Fund reduced its overall number of positions, but made new investments in two oil & gas exploration & production companies offering attractive value, namely Cairn Energy Plc and Noble Energy, Inc. |

Describe portfolio positioning at period end.

| • | | As of period end, the Fund continued to maintain its focus on energy stocks, with roughly equal exposures to oil and natural gas, along with a smaller exposure to coal. Over two-thirds of the Fund’s net assets were invested in exploration & production stocks. As a result, the Fund remained underweight to the refining segment, storage & transportation companies and the oil services space. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | |

| Ten Largest Holdings | | Percent of

Long-Term

Investments |

EQT Corp. | | | | 6 | % |

Plains Exploration & Production Co. | | | | 6 | |

Range Resources Corp. | | | | 6 | |

CONSOL Energy, Inc. | | | | 6 | |

Pioneer Natural Resources Co. | | | | 5 | |

Energy XXI Bermuda Ltd. | | | | 5 | |

Alpha Natural Resources, Inc. | | | | 3 | |

Rosetta Resources, Inc. | | | | 3 | |

Trilogy Energy Corp. | | | | 3 | |

Clayton Williams Energy, Inc. | | | | 3 | |

| | | | | |

| Industry Allocation | | Percent of

Long-Term

Investments |

Oil, Gas & Consumable Fuels | | | | 91 | % |

Energy Equipment & Services | | | | 8 | |

Metals & Mining | | | | 1 | |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

8 | | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | |

| | |

| | |

| | |

| | BlackRock Energy & Resources Portfolio |

| | |

| | |

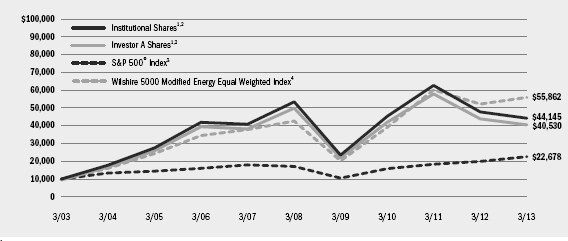

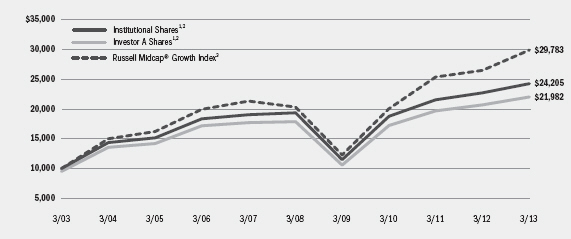

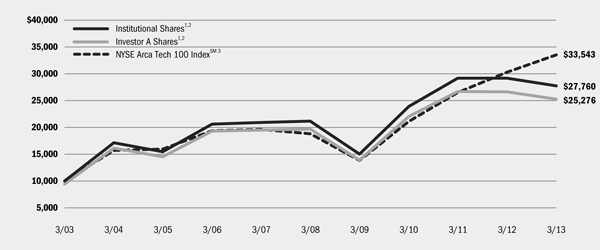

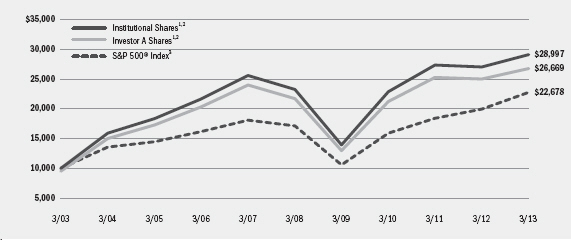

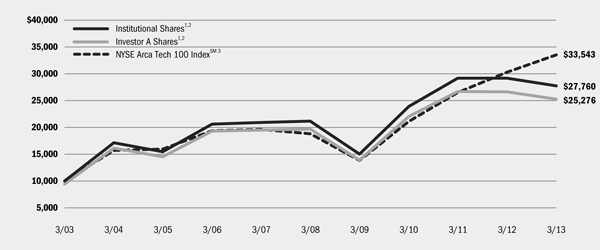

Total Return Based on a $10,000 Investment |

| |

|

| | 1 Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. 2 Under normal market conditions, the Fund invests at least 80% of its total assets in equity securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). 3 This unmanaged index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly NYSE issues) representing about 75% of NYSE market capitalization and 30% of NYSE issues. 4 The Wilshire 5000 Modified Energy Equal Weighted Index is a customized index comprised of the energy sector constituents of the Wilshire 5000 (Full Cap) Index which have been equally weighted and the six largest securities and all securities that have a percentage market value below 0.01% have been removed. |

| | |

Performance Summary for the Period Ended March 31, 2013 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns5 |

| | | | | 1 Year | | 5 Years | | 10 Years |

| | | 6-Month

Total Returns | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge |

Institutional | | | | 4.88 | % | | | | (7.35 | )% | | | | N/A | | | | | (3.69 | )% | | | | N/A | | | | | 16.01 | % | | | | N/A | |

Investor A | | | | 4.70 | | | | | (7.65 | ) | | | | (12.51 | )% | | | | (4.03 | ) | | | | (5.06 | )% | | | | 15.64 | | | | | 15.02 | % |

Investor B | | | | 4.30 | | | | | (8.36 | ) | | | | (12.48 | ) | | | | (4.75 | ) | | | | (4.97 | ) | | | | 14.98 | | | | | 14.98 | |

Investor C | | | | 4.34 | | | | | (8.35 | ) | | | | (9.26 | ) | | | | (4.72 | ) | | | | (4.72 | ) | | | | 14.82 | | | | | 14.82 | |

S&P 500® Index | | | | 10.19 | | | | | 13.96 | | | | | N/A | | | | | 5.81 | | | | | N/A | | | | | 8.53 | | | | | N/A | |

Wilshire 5000 Modified Energy Equal Weighted Index | | | | 9.71 | | | | | 7.33 | | | | | N/A | | | | | 5.61 | | | | | N/A | | | | | 18.77 | | | | | N/A | |

| | 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| | | N/A - Not applicable as share class and index do not have a sales charge. |

| | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical7 | | |

| | | Beginning

Account Value

October 1, 2012 | | Ending

Account Value

March 31, 2013 | | Expenses Paid

During the Period6 | | Beginning

Account Value

October 1, 2012 | | Ending

Account Value

March 31, 2013 | | Expenses Paid

During the Period6 | | Annualized

Expense

Ratio |

Institutional | | | $ | 1,000.00 | | | | $ | 1,048.80 | | | | $ | 5.26 | | | | $ | 1,000.00 | | | | $ | 1,019.80 | | | | $ | 5.19 | | | | | 1.03 | % |

Investor A | | | $ | 1,000.00 | | | | $ | 1,047.00 | | | | $ | 6.84 | | | | $ | 1,000.00 | | | | $ | 1,018.25 | | | | $ | 6.74 | | | | | 1.34 | % |

Investor B | | | $ | 1,000.00 | | | | $ | 1,043.00 | | | | $ | 10.70 | | | | $ | 1,000.00 | | | | $ | 1,014.46 | | | | $ | 10.55 | | | | | 2.10 | % |

Investor C | | | $ | 1,000.00 | | | | $ | 1,043.40 | | | | $ | 10.70 | | | | $ | 1,000.00 | | | | $ | 1,014.46 | | | | $ | 10.55 | | | | | 2.10 | % |

| | 6 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 7 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | 9 |

| | |

| | |

| | |

| Fund Summary as of March 31, 2013 | | BlackRock World Gold Fund |

| | |

BlackRock World Gold Fund’s (the “Fund”) investment objective is to seek to maximize total return. Total return means the combination of capital appreciation and investment income.

|

Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended March 31, 2013, the Fund outperformed its benchmark, the FTSE Gold Mines Index. |

What factors influenced performance?

| • | | While both the Fund and its benchmark index generated negative returns for the six-month period, the Fund’s non-gold holdings were key contributors to outperformance. In particular, holdings in silver producers, such as Industrias Penoles SAB de CV, and more diversified producers, including Rio Tinto Plc, delivered stronger performance than the gold segment. |

| • | | The Fund’s underweight exposure to gold miner Cia de Minas Buenaventura SA aided returns. The company delivered a disappointing update from its Chucapaca open-pit mine, a growth development project in southern Peru, suggesting that it may no longer be economic to develop using just open pit mining. The company also reported faster-than-expected grade declines (the amount of metal contained in the ore) guiding the market toward lower production in 2013. An underweight in Osisko Mining Corp., a North American developer, also positively contributed to performance, as the company continued to face challenges to its ability to increase its production as planned at its large, low-grade Malartic mine in Quebec, Canada. |

| • | | During the six-month period, the price of gold has been challenged by strong economic data in the United States which has been supportive of a stronger US dollar. This has contributed to concerns that the Federal Reserve may end its asset purchase program earlier than initially expected. Both of these factors have acted as a headwind for the price of gold. Over this period, gold producers exhibited a high level of sensitivity to the declining gold price. The share price of small-cap development gold producer, Banro Corp., struggled following a disappointing |

| | update at its Nemoya gold development asset operating in the Democratic Republic of Congo and the departure of the company’s CEO. While only a small holding, the Fund’s allocation to Banro Corp. detracted from performance. The Fund’s underweight exposures to large-cap gold producers Barrick Gold Corp., Newmont Mining Corp. and Goldcorp, Inc. hampered returns. In a falling gold price environment, these companies have tended to hold up better than their mid-cap counterparts. |

Describe recent portfolio activity.

| • | | During the six months, the Fund took profits on its position in Fresnillo Plc, a silver and gold producer operating in Mexico, which had delivered strong performance. The proceeds were rotated into gold producers with good development projects and attractive valuations. During the reporting period, a position was initiated in precious metal streaming company Silver Wheaton Corp. and a silver developer operating in Central America. Silver Wheaton Corp. benefits from being able to purchase precious metals at a cost significantly below its current value and is not exposed to cost inflation in the mining industry. As financing risk remains a key focus for resources companies, the Fund has sought to reduce exposure to companies that may have a capital requirement in the near term. With that in mind, the Fund sold several small-cap gold names during the reporting period. |

Describe portfolio positioning at period end.

| • | | At period end, the Fund had approximately 81% of its portfolio invested in gold companies, 14% in silver companies and 1% in platinum names, with the remaining assets allocated to other metals and minerals and cash. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | |

| Ten Largest Holdings | | Percent of

Long-Term

Investments |

Newcrest Mining Ltd. | | | | 8 | % |

Fresnillo Plc | | | | 7 | |

Yamana Gold, Inc. | | | | 7 | |

Eldorado Gold Corp. | | | | 7 | |

Goldcorp, Inc. | | | | 6 | |

Randgold Resources Ltd. - ADR | | | | 5 | |

Kinross Gold Corp. | | | | 4 | |

New Gold, Inc. | | | | 4 | |

Industrias Penoles SAB de CV | | | | 3 | |

Agnico-Eagle Mines Ltd. | | | | 3 | |

| | | | | |

| Geographic Allocation | | Percent of

Long-Term

Investments |

Canada | | | | 49 | % |

Australia | | | | 16 | |

Mexico | | | | 10 | |

United States | | | | 7 | |

Jersey, Channel Islands | | | | 7 | |

South Africa | | | | 5 | |

Peru | | | | 3 | |

United Kingdom | | | | 2 | |

Other1 | | | | 1 | |

1Other includes a 1% or less investment in each of the following countries: Russia, Hong Kong and China.

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

10 | | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | |

| | |

| | |

| | |

| | BlackRock World Gold Fund |

|

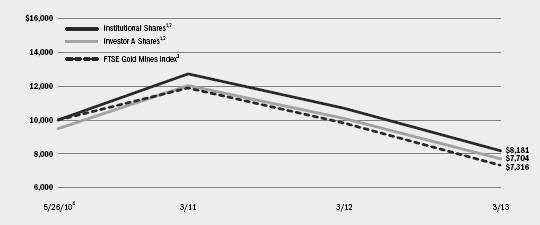

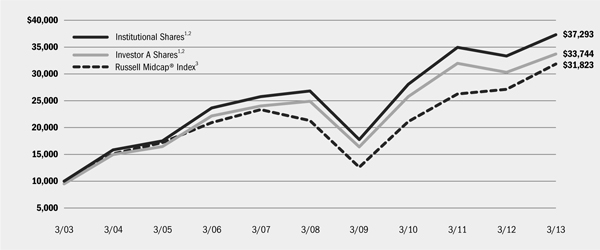

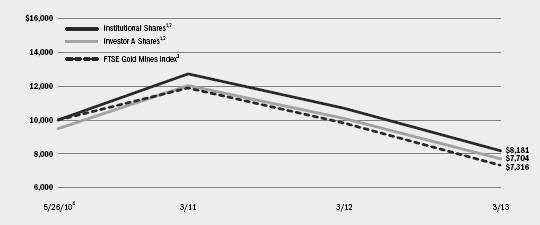

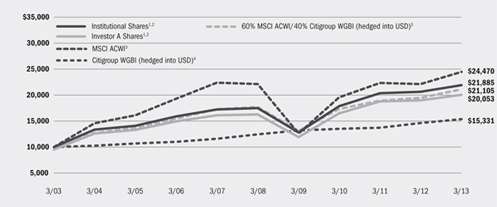

Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| | 2 | Under normal circumstances, the Fund will invest at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of gold-related companies. |

| | 3 | An index designed to reflect the performance of the worldwide market in the shares of companies whose principal activity is the mining of gold. |

| | 4 | Commencement of operations. |

|

Performance Summary for the Period Ended March 31, 2013 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns5 |

| | | | | 1 Year | | Since Inception6 |

| | | 6-Month

Total Returns | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge |

Institutional | | | | (27.33 | )% | | | | (23.50 | )% | | | | N/A | | | | | (6.81 | )% | | | | N/A | |

Investor A | | | | (27.40 | ) | | | | (23.70 | ) | | | | (27.73 | )% | | | | (7.03 | ) | | | | (8.76 | )% |

Investor C | | | | (27.72 | ) | | | | (24.35 | ) | | | | (25.10 | ) | | | | (7.75 | ) | | | | (7.75 | ) |

FTSE Gold Mines Index | | | | (29.15 | ) | | | | (25.51 | ) | | | | N/A | | | | | (10.39 | ) | | | | N/A | |

| | 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | The Fund commenced operations on May 26, 2010. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical8 | | |

| | | Beginning

Account Value

October 1, 2012 | | Ending

Account Value

March 31, 2013 | | Expenses Paid

During the Period7 | | Beginning

Account Value

October 1, 2012 | | Ending Account Value

March 31, 2013 | | Expenses Paid

During the Period7 | | Annualized Expense Ratio |

Institutional | | | $ | 1,000.00 | | | | $ | 726.70 | | | | $ | 5.34 | | | | $ | 1,000.00 | | | | $ | 1,018.75 | | | | $ | 6.24 | | | | | 1.24 | % |

Investor A | | | $ | 1,000.00 | | | | $ | 726.00 | | | | $ | 6.41 | | | | $ | 1,000.00 | | | | $ | 1,017.50 | | | | $ | 7.49 | | | | | 1.49 | % |

Investor C | | | $ | 1,000.00 | | | | $ | 722.80 | | | | $ | 9.75 | | | | $ | 1,000.00 | | | | $ | 1,013.61 | | | | $ | 11.40 | | | | | 2.27 | % |

| | 7 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 8 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | 11 |

| • | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to eligible investors. |

| • | | Service Shares are not subject to any sales charge (front-end load) or deferred sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee). |

| • | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). |

| • | | Investor B Shares are subject to a maximum contingent deferred sales charge (“CDSC”) of 4.50% declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic share conversions.) All returns for periods greater than eight years reflect this conversion. These shares are only available through exchanges and dividend reinvestments by existing shareholders and for purchase by certain employer-sponsored retirement plans. |

| • | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. |

| | Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the |

| | performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in each of the performance tables on the previous pages assume reinvestment of all dividends and distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders. |

| | Performance for the BlackRock Energy & Resources Portfolio for the periods prior to January 28, 2005 is based on performance of a certain former State Street Research mutual fund that reorganized with BlackRock Energy & Resources Portfolio on that date. |

| | BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, waived and/or reimbursed a portion of each Fund’s expenses. Without such waiver and/or reimbursement, each Fund’s performance would have been lower. The Manager is under no obligation to waive or reimburse or to continue waiving or reimbursing its fees after the applicable termination date. See Note 3 of the Notes to Financial Statements for additional information on waivers and reimbursements. |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

12 | | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | |

Shareholders of the Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on October 1, 2012 and held through March 31, 2013) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the headings entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments, including financial futures contracts and foreign currency exchange contracts, as specified in Note 2 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to hedge market, equity and/or foreign currency exchange rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Funds’ ability to use a

derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment, may result in lower dividends paid to shareholders or may cause a Fund to hold an investment that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | 13 |

| | |

| | |

| | |

| Schedule of Investments March 31, 2013 (Unaudited) | | BlackRock All-Cap Energy & Resources Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

| |

Energy Equipment & Services – 14.5% | | | | | | | | |

Atwood Oceanics, Inc. (a)(b) | | | 47,700 | | | $ | 2,506,158 | |

Baker Hughes, Inc. | | | 82,300 | | | | 3,819,543 | |

Basic Energy Services, Inc. (a) | | | 42,964 | | | | 587,318 | |

Core Laboratories NV | | | 48,300 | | | | 6,661,536 | |

Forum Energy Technologies, Inc. (a)(b) | | | 116,000 | | | | 3,336,160 | |

Halliburton Co. | | | 113,200 | | | | 4,574,412 | |

Key Energy Services, Inc. (a) | | | 306,900 | | | | 2,479,752 | |

National Oilwell Varco, Inc. | | | 74,100 | | | | 5,242,575 | |

Schlumberger Ltd. | | | 75,941 | | | | 5,687,221 | |

Seadrill Ltd. | | | 165,000 | | | | 6,005,703 | |

Technip SA | | | 40,900 | | | | 4,194,944 | |

| | | | | | | | |

| | | | | | | 45,095,322 | |

| |

Oil, Gas & Consumable Fuels – 83.0% | | | | | | | | |

Alpha Natural Resources, Inc. (a)(b) | | | 611,019 | | | | 5,016,466 | |

Anadarko Petroleum Corp. | | | 149,600 | | | | 13,082,520 | |

Angle Energy, Inc. (a) | | | 299,400 | | | | 909,413 | |

Apache Corp. | | | 130,830 | | | | 10,094,843 | |

Bill Barrett Corp. (a)(b) | | | 134,800 | | | | 2,732,396 | |

Cairn Energy Plc (a) | | | 730,000 | | | | 3,039,123 | |

Cenovus Energy, Inc. | | | 188,660 | | | | 5,846,573 | |

Chevron Corp. | | | 110,100 | | | | 13,082,082 | |

Cobalt International Energy, Inc. (a) | | | 75,800 | | | | 2,137,560 | |

Concho Resources, Inc. (a)(b) | | | 76,900 | | | | 7,492,367 | |

CONSOL Energy, Inc. | | | 358,130 | | | | 12,051,075 | |

Continental Resources, Inc. (a) | | | 80,200 | | | | 6,971,786 | |

Crescent Point Energy Corp. | | | 230,170 | | | | 8,676,909 | |

Crew Energy, Inc. (a) | | | 223,400 | | | | 1,574,538 | |

DeeThree Exploration Ltd. (a) | | | 422,653 | | | | 2,737,917 | |

Denbury Resources, Inc. (a)(b) | | | 529,690 | | | | 9,878,719 | |

Energy XXI Bermuda Ltd. | | | 287,900 | | | | 7,836,638 | |

EOG Resources, Inc. | | | 141,570 | | | | 18,130,870 | |

EQT Corp. | | | 79,410 | | | | 5,380,027 | |

Exxon Mobil Corp. | | | 68,400 | | | | 6,163,524 | |

Gulfport Energy Corp. (a)(b) | | | 173,800 | | | | 7,965,254 | |

Kodiak Oil & Gas Corp. (a) | | | 436,700 | | | | 3,969,603 | |

Long Run Exploration Ltd. (a) | | | 167,697 | | | | 746,748 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

| |

Oil, Gas & Consumable Fuels (concluded) | | | | | |

Noble Energy, Inc. | | | 107,900 | | | $ | 12,479,714 | |

Occidental Petroleum Corp. | | | 159,850 | | | | 12,527,445 | |

Peabody Energy Corp. | | | 253,590 | | | | 5,363,429 | |

PetroChina Co. Ltd. - ADR | | | 19,090 | | | | 2,516,444 | |

Pioneer Natural Resources Co. | | | 56,900 | | | | 7,069,825 | |

Plains Exploration & Production Co. (a) | | | 188,610 | | | | 8,953,317 | |

Range Resources Corp. | | | 130,200 | | | | 10,551,408 | |

Rex Energy Corp. (a)(b) | | | 217,800 | | | | 3,589,344 | |

Rosetta Resources, Inc. (a) | | | 118,500 | | | | 5,638,230 | |

Royal Dutch Shell Plc - ADR | | | 95,800 | | | | 6,242,328 | |

Southwestern Energy Co. (a) | | | 86,400 | | | | 3,219,264 | |

Suncor Energy, Inc. | | | 212,980 | | | | 6,391,530 | |

Valero Energy Corp. | | | 81,700 | | | | 3,716,533 | |

Whiting Petroleum Corp. (a) | | | 279,960 | | | | 14,233,166 | |

| | | | | | | | |

| | | | | | | 258,008,928 | |

| |

Total Long-Term Investments (Cost – $241,017,209) – 97.5% | | | | | |

| 303,104,250

|

|

| |

| | | | | | | | |

| | | | | | | | |

| | |

Short-Term Securities | | | | | | | | |

| |

BlackRock Liquidity Funds, TempFund,

Institutional Class, 0.09% (c)(d) | | | 11,981,713 | | | | 11,981,713 | |

| |

| | | Beneficial

Interest

(000) | | | | |

| |

BlackRock Liquidity Series, LLC Money Market Series,

0.23% (c)(d)(e) | | $ | 26,946 | | | | 26,945,615 | |

| |

Total Short-Term Securities (Cost – $38,927,328) – 12.5% | | | | | | | 38,927,328 | |

| |

Total Investments (Cost – $279,944,537) – 110.0% | | | | 342,031,578 | |

Liabilities in Excess of Other Assets – (10.0)% | | | | (31,049,921 | ) |

| | | | | | | | |

Net Assets – 100.0% | | | | | | $ | 310,981,657 | |

| | | | | | | | |

| | | | | | | | |

| To simplify the listings of portfolio holdings in the Schedules of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list: | | ADR | | American Depositary Receipts | | HKD | | Hong Kong Dollar |

| | CAD | | Canadian Dollar | | USD | | US Dollar |

| | GBP | | British Pound | | | | |

| | | | | | | | |

See Notes to Financial Statements. | | | | |

| | | | | | | | |

14 | | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | |

| | |

| | |

| | |

| Schedule of Investments (continued) | | BlackRock All-Cap Energy & Resources Portfolio |

|

Notes to Schedule of Investments |

| | | | | | | | | | | | | | | | | | | | |

(a) | | Non-income producing security. | |

(b) | | Security, or a portion of security, is on loan. | |

(c) | | Investments in issuers considered to be an affiliate of the Fund during the six months ended March 31, 2013, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: | |

| | | |

| | | Affiliate | | Beneficial

Interest Held at

September 30,

2012 | | | Net Activity | | | Shares/

Beneficial

Interest Held at

March 31,

2013 | | | Income | |

| | | |

| | BlackRock Liquidity Funds, TempFund, Institutional Class | | | – | | | | 11,981,713 | | | | 11,981,713 | | | $ | 2,145 | |

| | BlackRock Liquidity Series, LLC Money Market Series | | | $17,312,472 | | | | $ 9,633,143 | | | | $26,945,615 | | | $ | 197,590 | |

| | | |

(d) | | Represents the current yield as of report date. | | | | | | | | | | | | | | | | |

(e) | | Security was purchased with the cash collateral from loaned securities. The Fund may withdraw up to 25% of its investment daily, although the manager of the BlackRock Liquidity Series LLC, Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day. | |

| |

• | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |

| |

• | | Foreign currency exchange contracts as of March 31, 2013 were as follows: | |

| | | |

| | | Currency Purchased | | Currency Sold | | Counterparty | | | Settlement

Date | | | Unrealized

Appreciation | |

| | | |

| | | | | |

| | GBP 409,481 | | USD 619,955 | | | State Street Corp. | | | | 4/02/13 | | | | $2,375 | |

| | | |

| |

• | | Fair Value Measurements – Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: | |

| | • Level 1 - unadjusted price quotations in active markets/exchanges for identical assets and liabilities that the Fund has the ability to access | |

| | • Level 2 - other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices | |

| | for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) | |

| | • Level 3 - unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available | |

| | (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) | |

| |

| | The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety. | |

| |

| | Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instrument and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements. | |

| | | | | | | | |

See Notes to Financial Statements. | | | | |

| | | | | | | | |

| | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | 15 |

| | |

| | |

| | |

| Schedule of Investments (concluded) | | BlackRock All-Cap Energy & Resources Portfolio |

| | |

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy as of March 31, 2013:

| | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | Total | |

Assets: | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | |

Energy Equipment & Services | | $ | 34,894,675 | | | $ | 10,200,647 | | | – | | $ | 45,095,322 | |

Oil, Gas & Consumable Fuels | | | 254,969,805 | | | | 3,039,123 | | | – | | | 258,008,928 | |

Short-Term Securities | | | 11,981,713 | | | | 26,945,615 | | | – | | | 38,927,328 | |

Total | | $ | 301,846,193 | | | $ | 40,185,385 | | | – | | $ | 342,031,578 | |

| | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | Total | |

Derivative Financial Instruments1 | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | |

Foreign currency exchange contracts | | $ | 2,375 | | | | – | | | – | | $ | 2,375 | |

|

| 1 Derivative financial instruments are foreign currency exchange contracts which are valued at the unrealized appreciation/depreciation on the instrument. | |

|

Certain of the Fund’s assets and liabilities are held at carrying amount, which approximates fair value for financial statement purposes. As of March 31, 2013, such assets and liabilities are categorized within the disclosure hierarchy as follows: | |

| | | Level 1 | | | Level 2 | | | Level 3 | | Total | |

Assets: | | | | | | | | | | | | | | |

Foreign currency at value | | $ | 944,228 | | | | – | | | – | | $ | 944,228 | |

Liabilities: | | | | | | | | | | | | | | |

Bank overdraft | | | – | | | $ | (319,620 | ) | | – | | | (319,620 | ) |

Foreign bank overdraft | | | – | | | | (943,776 | ) | | – | | | (943,776 | ) |

Collateral on securities loaned at value | | | – | | | | (26,945,615 | ) | | – | | | (26,945,615 | ) |

Total | | $ | 944,228 | | | $ | (28,209,011 | ) | | – | | $ | (27,264,783 | ) |

There were no transfers between levels during the six months ended March 31, 2013.

| | | | | | | | |

See Notes to Financial Statements. | | | | |

| | | | | | | | |

16 | | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | |

| | | | |

| | | | |

| | | | |

| Schedule of Investments March 31, 2013 (Unaudited) | | BlackRock China Fund | | |

| | (Percentages shown are based on Net Assets) | | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

| |

Aerospace & Defense – 0.9% | | | | | | | | |

AviChina Industry & Technology Co. Ltd., H Shares | | | 72,000 | | | $ | 35,473 | |

| |

Automobiles – 0.8% | | | | | | | | |

Dongfeng Motor Group Co. Ltd., Class H | | | 22,000 | | | | 31,008 | |

| |

Capital Markets – 1.8% | | | | | | | | |

Haitong Securities Co. Ltd., H Shares | | | 51,200 | | | | 70,551 | |

| |

Chemicals – 1.5% | | | | | | | | |

Huabao International Holdings Ltd. | | | 134,000 | | | | 58,201 | |

| |

Commercial Banks – 24.2% | | | | | | | | |

Agricultural Bank of China Ltd., H Shares | | | 296,000 | | | | 142,430 | |

Bank of China Ltd., H Shares | | | 257,000 | | | | 119,559 | |

China CITIC Bank Corp. Ltd., H Shares | | | 120,200 | | | | 72,465 | |

China Construction Bank Corp., H Shares | | | 465,000 | | | | 381,128 | |

China Minsheng Banking Corp. Ltd., H Shares | | | 14,500 | | | | 18,547 | |

Industrial & Commercial Bank of China, H Shares | | | 290,000 | | | | 203,934 | |

| | | | | | | | |

| | | | | | | 938,063 | |

| |

Communications Equipment – 0.3% | | | | | | | | |

ZTE Corp., H Shares | | | 6,800 | | | | 11,796 | |

| |

Construction & Engineering – 1.6% | | | | | | | | |

China Communications Construction Co. Ltd., H Shares | | | 68,000 | | | | 63,493 | |

| |

Construction Materials – 1.8% | | | | | | | | |

China Resources Cement Holdings Ltd. | | | 54,000 | | | | 30,689 | |

China Shanshui Cement Group Ltd. | | | 39,000 | | | | 22,503 | |

TCC International Holdings Ltd. | | | 66,000 | | | | 17,741 | |

| | | | | | | | |

| | | | | | | 70,933 | |

| |

Diversified Telecommunication Services – 3.0% | | | | | |

China Unicom Hong Kong Ltd. | | | 85,327 | | | | 114,977 | |

| |

Electrical Equipment – 5.5% | | | | | | | | |

Dongfang Electric Corp. Ltd., H Shares | | | 12,000 | | | | 19,952 | |

Shanghai Electric Group Co. Ltd., H Shares | | | 58,000 | | | | 22,659 | |

Xinjiang Goldwind Science & Technology Co. Ltd., H Shares | | | 51,610 | | | | 31,080 | |

ZhuZhou CSR Times Electric Co. Ltd., H Shares | | | 49,000 | | | | 139,547 | |

| | | | | | | | |

| | | | | | | 213,238 | |

| |

Food Products – 1.8% | | | | | | | | |

Uni-President China Holdings Ltd. | | | 60,000 | | | | 68,656 | |

| |

Health Care Equipment & Supplies – 1.0% | | | | | | | | |

Mindray Medical International Ltd. - ADR | | | 1,016 | | | | 40,579 | |

| |

Health Care Providers & Services – 2.0% | | | | | | | | |

Sinopharm Group Co. Ltd., H Shares | | | 24,000 | | | | 77,544 | |

| |

Hotels, Restaurants & Leisure – 0.9% | | | | | | | | |

Home Inns & Hotels Management,

Inc. - ADR (a) | | | 355 | | | | 10,575 | |

REXLot Holdings Ltd. | | | 275,000 | | | | 24,135 | |

| | | | | | | | |

| | | | | | | 34,710 | |

| |

Independent Power Producers & Energy Traders – 3.8% | |

China Resources Power Holdings Co. Ltd. | | | 32,000 | | | | 95,843 | |

Datang International Power Generation Co. Ltd., H Shares | | | 116,000 | | | | 51,286 | |

| | | | | | | | |

| | | | | | | 147,129 | |

| |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

| |

Insurance – 6.5% | | | | | | | | |

China Life Insurance Co. Ltd., H Shares | | | 31,000 | | | $ | 80,870 | |

China Pacific Insurance Group Co. Ltd., H Shares | | | 37,800 | | | | 124,831 | |

New China Life Insurance Co. Ltd., H Shares | | | 13,912 | | | | 47,566 | |

| | | | | | | | |

| | | | | | | 253,267 | |

| |

Internet Software & Services – 0.8% | | | | | | | | |

SINA Corp. | | | 636 | | | | 30,903 | |

| |

Life Sciences Tools & Services – 2.0% | | | | | | | | |

WuXi PharmaTech Cayman, Inc. - ADR (a) | | | 4,581 | | | | 78,702 | |

| |

Machinery – 0.7% | | | | | | | | |

China Rongsheng Heavy Industries Group Holdings Ltd. | | | 37,000 | | | | 6,032 | |

CSR Corp. Ltd., H Shares | | | 27,860 | | | | 19,854 | |

| | | | | | | | |

| | | | | | | 25,886 | |

| |

Marine – 0.6% | | | | | | | | |

China Shipping Development Co. Ltd., H Shares | | | 46,000 | | | | 22,432 | |

| |

Metals & Mining – 1.8% | | | | | | | | |

Shougang Fushan Resources Group Ltd. | | | 84,000 | | | | 37,572 | |

Zijin Mining Group Co. Ltd., H Shares | | | 94,000 | | | | 31,155 | |

| | | | | | | | |

| | | | | | | 68,727 | |

| |

Oil, Gas & Consumable Fuels – 14.1% | | | | | | | | |

China Coal Energy Co. Ltd., H Shares | | | 65,000 | | | | 58,195 | |

China Petroleum & Chemical Corp., H Shares | | | 156,000 | | | | 182,922 | |

CNOOC Ltd. | | | 133,000 | | | | 255,718 | |

PetroChina Co. Ltd., H Shares | | | 38,000 | | | | 50,035 | |

| | | | | | | | |

| | | | | | | 546,870 | |

| |

Paper & Forest Products – 2.1% | | | | | | | | |

Lee & Man Paper Manufacturing Ltd. | | | 51,000 | | | | 40,086 | |

Nine Dragons Paper Holdings Ltd. | | | 42,000 | | | | 39,660 | |

| | | | | | | | |

| | | | | | | 79,746 | |

| |

Real Estate Management & Development – 4.6% | | | | | |

China Vanke Co. Ltd., B Shares | | | 20,800 | | | | 40,189 | |

Franshion Properties China Ltd. | | | 120,000 | | | | 39,340 | |

Poly Property Group Co. Ltd. (a) | | | 11,000 | | | | 6,988 | |

Shenzhen Investment Ltd. | | | 110,201 | | | | 44,363 | |

Shimao Property Holdings Ltd. | | | 6,500 | | | | 12,531 | |

Shui On Land Ltd. | | | 84,500 | | | | 36,446 | |

| | | | | | | | |

| | | | | | | 179,857 | |

| |

Semiconductors & Semiconductor Equipment – 0.4% | |

Trina Solar Ltd. - ADR (a) | | | 3,996 | | | | 14,506 | |

| |

Software – 2.1% | | | | | | | | |

Kingdee International Software Group

Co. Ltd. (a) | | | 146,000 | | | | 24,150 | |

Kingsoft Corp. Ltd. | | | 35,000 | | | | 32,280 | |

Shanda Games Ltd. - ADR | | | 8,544 | | | | 25,461 | |

| | | | | | | | |

| | | | | | | 81,891 | |

| |

Specialty Retail – 0.7% | | | | | | | | |

GOME Electrical Appliances Holding Ltd. (a) | | | 232,000 | | | | 25,468 | |

| |

Textiles, Apparel & Luxury Goods – 0.7% | | | | | | | | |

Peak Sport Products Co. Ltd. | | | 86,000 | | | | 13,881 | |

| | | | | | | | |

See Notes to Financial Statements. | | | | |

| | | | | | | | |

| | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | 17 |

| | |

| | |

| | |

| Schedule of Investments (continued) | | BlackRock China Fund |

| | (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

| |

Textiles, Apparel & Luxury Goods (concluded) | | | | | | | | |

Ports Design Ltd. | | | 15,500 | | | $ | 12,967 | |

| | | | | | | | |

| | | | | | | 26,848 | |

| |

Transportation Infrastructure – 2.8% | | | | | | | | |

Beijing Capital International Airport Co. Ltd., H Shares | | | 96,000 | | | | 70,078 | |

COSCO Pacific Ltd. | | | 26,000 | | | | 37,642 | |

| | | | | | | | |

| | | | | | | 107,720 | |

| |

Wireless Telecommunication Services – 4.1% | | | | | |

China Mobile Ltd. | | | 14,784 | | | | 156,788 | |

| |

Total Common Stocks – 94.9% | | | | | | | 3,675,962 | |

| |

| | | | | | | | |

Participation Notes (a) | | | | | | | | |

| |

Automobiles – 1.6% | | | | | | | | |

Citigroup Global Markets Holding (SAIC Motor Corp. Ltd.), due 1/20/15 | | | 16,600 | | | | 40,728 | |

Deutsche Bank AG (BYD Co. Ltd.), due 11/10/16 | | | 3,500 | | | | 11,158 | |

Deutsche Bank AG (SAIC Motor Corp. Ltd.), due 7/13/17 | | | 4,200 | | | | 10,305 | |

| | | | | | | | |

| | | | | | | 62,191 | |

| |

Commercial Banks – 0.9% | | | | | | | | |

Citigroup Global Markets Holding (China Merchants Bank Co. Ltd.), due 1/20/15 | | | 17,400 | | | | 34,001 | |

| |

| | | | | | | | |

| Participation Notes (a) | | Shares | | | Value | |

| |

Construction Materials – 0.7% | | | | | | | | |

Citigroup Global Markets Holding (Anhui Conch Cement Co. Ltd.), due 1/20/15 | | | 9,000 | | | $ | 24,648 | |

Deutsche Bank AG (Anhui Conch Cement Co. Ltd.), due 10/10/17 | | | 1,300 | | | | 3,559 | |

| | | | | | | | |

| | | | | | | 28,207 | |

| |

Metals & Mining – 0.9% | | | | | | | | |

Citigroup Global Markets Holding (Baoshan Iron & Steel Co. Ltd.), due 1/20/15 | | | 40,100 | | | | 30,555 | |

UBS AG (Baoshan Iron & Steel Co. Ltd.), due 6/18/13 | | | 6,487 | | | | 4,943 | |

| | | | | | | | |

| | | | | | | 35,498 | |

| |

Total Participation Notes – 4.1% | | | | | | | 159,897 | |

| |

Total Long-Term Investments (Cost – $4,071,517) – 99.0% | | | | | | | 3,835,859 | |

| |

| | | | | | | | |

Short-Term Securities | | | | | | | | |

| |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.09% (b)(c) | | | 59,987 | | | | 59,987 | |

| |

Total Short-Term Securities (Cost – $59,987) – 1.6% | | | | | | | 59,987 | |

| |

Total Investments (Cost – $4,131,504) – 100.6% | | | | 3,895,846 | |

Liabilities in Excess of Other Assets – (0.6)% | | | | (22,891 | ) |

| | | | | | | | |

Net Assets – 100.0% | | | | | | $ | 3,872,955 | |

| | | | | | | | |

| | | | | | | | | | | | | | |

| Notes to Schedule of Investments |

(a) | | Non-income producing security. |

| (b) | | Investments in issuers considered to be an affiliate of the Fund during the six months ended March 31, 2013, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | |

| | | Affiliate | | Shares Held at September 30, 2012 | | Net Activity | | Shares Held at

March 31, 2013 | | Income |

| | |

| | BlackRock Liquidity Funds, TempFund, Institutional Class | | 172,872 | | (112,885) | | 59,987 | | $111 |

| | |

| |

(c) | | Represents the current yield as of report date. |

| |

— | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| |

— | | Financial futures contracts as of March 31, 2013 were as follows: |

| | |

| | | Contracts | | Issue | | Exchange | | Expiration | | Notional Value | | Unrealized

Depreciation |

| | |

| | 5 | | FTSE China A50 | | Singapore Exchange | | April 2013 | | $39,850 | | $(2,352) |

| | |

| |

— | | Foreign currency exchange contracts as of March 31, 2013 were as follows: |

| |

| | |

| | | Currency

Purchased | | | | Currency Sold | | | | Counterparty | | Settlement Date | | Unrealized Depreciation |

| | |

| | USD | | 18,559 | | HKD | | 144,102 | | Goldman Sachs Group, Inc. | | 4/03/13 | | $(3) |

| | |

| | | | | | | | |

See Notes to Financial Statements. |

| | | | | | | | |

18 | | | | BLACKROCK FUNDS | | MARCH 31, 2013 | | |

| | |

| | |

| | |

| Schedule of Investments (continued) | | BlackRock China Fund |

| | | | | | | | | | | | |

— | | Fair Value Measurements – Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| | |

| | — | | Level 1 - unadjusted price quotations in active markets/exchanges for identical assets and liabilities that the Fund has the ability to access |

| | |

| | — | | Level 2 - other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | |

| | — | | Level 3 - unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

| |