UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05742

Name of Fund: BlackRock Funds

BlackRock Commodity Strategies Fund

BlackRock Global Long/Short Credit Fund

BlackRock Multi-Asset Real Return Fund

BlackRock Short Obligations Fund

BlackRock Short-Term Treasury Fund

BlackRock Strategic Risk Allocation Fund

BlackRock Ultra-Short Obligations Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 07/31/2014

Date of reporting period: 01/31/2014

Item 1 – Report to Stockholders

JANUARY 31, 2014

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

BlackRock FundsSM

„ BlackRock Commodity Strategies Fund

„ BlackRock Global Long/Short Credit Fund

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | | | | | |

| 2 | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | |

Dear Shareholder

One year ago, US financial markets were improving despite a sluggish global economy, as loose monetary policy beckoned investors to take on more risk in their portfolios. Slow but positive growth in the US was sufficient to support corporate earnings, while uncomfortably high unemployment reinforced expectations that the Federal Reserve would continue its aggressive monetary stimulus programs. International markets were not as fruitful in the earlier part of the year given uneven growth rates and more direct exposure to macro risks such as the resurgence of political instability in Italy, the banking crisis in Cyprus and a generally poor outlook for European economies. Additionally, emerging markets significantly lagged the rest of the world due to slowing growth and structural imbalances.

Global financial markets were rattled in May when Fed Chairman Bernanke mentioned the possibility of reducing (or “tapering”) the central bank’s asset purchase programs — comments that were widely misinterpreted as signaling an end to the Fed’s zero-interest-rate policy. US Treasury yields rose sharply, triggering a steep sell-off across fixed income markets. (Bond prices move in the opposite direction of yields.) Equity prices also suffered as investors feared the implications of a potential end of a program that had greatly supported the markets. Markets rebounded in late June, however, when the Fed’s tone turned more dovish, and improving economic indicators and better corporate earnings helped extend gains through most of the summer.

The fall was a surprisingly positive period for most asset classes after the Fed defied market expectations with its decision to delay tapering. Higher volatility returned in late September when the US Treasury Department warned that the national debt would soon breach its statutory maximum. The ensuing political brinksmanship led to a partial government shutdown, roiling global financial markets through the first half of October, but equities and other so-called “risk assets” resumed their rally when politicians engineered a compromise to reopen the government and extend the debt ceiling, at least temporarily.

The remainder of 2013 was generally positive for stock markets in the developed world, although investors continued to grapple with uncertainty about when and how much the Fed would scale back on stimulus. When the long-awaited taper announcement ultimately came in mid-December, the Fed reduced the amount of its monthly asset purchases but at the same time extended its time horizon for maintaining low short-term interest rates. Markets reacted positively, as this move signaled the Fed’s perception of real improvement in the economy and investors were finally relieved from the tenacious anxiety that had gripped them for quite some time.

Investors’ risk appetite diminished in the new year. Heightened volatility in emerging markets and mixed US economic data caused global equities to weaken in January while bond markets found renewed strength. While tighter global liquidity was an ongoing headwind for developing countries, financial troubles in Argentina and Turkey launched a sharp sell-off in a number of emerging market currencies. Unexpectedly poor economic data out of China added to the turmoil. In the US, most indicators continued to signal a strengthening economy; however, stagnant wage growth raised concerns about the sustainability of the overall positive momentum. US stocks underperformed other developed equity markets as a number of disappointing corporate earnings reports prompted investors to take advantage of lower valuations abroad.

While accommodative monetary policy was the main driver behind positive market performance over the period, it was also the primary cause of volatility and uncertainty. Developed market stocks were the strongest performers for the six- and 12-month periods ended January 31. In contrast, emerging markets were weighed down by uneven growth, high debt levels and severe currency weakness. Rising interest rates pressured US Treasury bonds and other high-quality fixed income sectors, including tax-exempt municipals and investment grade corporate bonds. High yield bonds, to the contrary, benefited from income-oriented investors’ search for yield in the low-rate environment. Short-term interest rates remained near zero, keeping yields on money market securities near historical lows.

At BlackRock, we believe investors need to think globally and extend their scope across a broader array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit www.blackrock.com for further insight about investing in today’s world.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“While accommodative monetary policy was the main driver behind positive market performance over the period, it was also the primary cause of volatility and uncertainty.”

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of January 31, 2014 | |

| | | 6-month | | | 12-month | |

US large cap equities

(S&P 500® Index) | | | 6.85 | % | | | 21.52 | % |

US small cap equities

(Russell 2000® Index) | | | 8.88 | | | | 27.03 | |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | 7.51 | | | | 11.93 | |

Emerging market equities

(MSCI Emerging Markets

Index) | | | (0.33 | ) | | | (10.17 | ) |

3-month Treasury bill

(BofA Merrill Lynch

3-Month US Treasury

Bill Index) | | | 0.03 | | | | 0.08 | |

US Treasury securities

(BofA Merrill Lynch

10- Year US Treasury

Index) | | | 0.77 | | | | (2.97 | ) |

US investment grade

bonds (Barclays US

Aggregate Bond Index) | | | 1.78 | | | | 0.12 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | | 3.13 | | | | (1.10 | ) |

US high yield bonds

(Barclays US Corporate

High Yield 2% Issuer

Capped Index) | | | 4.70 | | | | 6.76 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | | | |

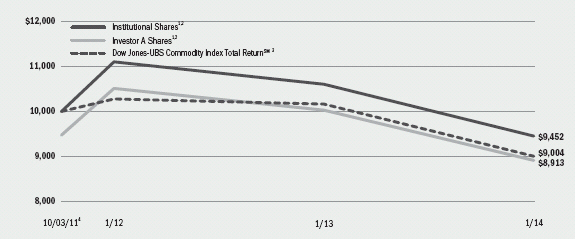

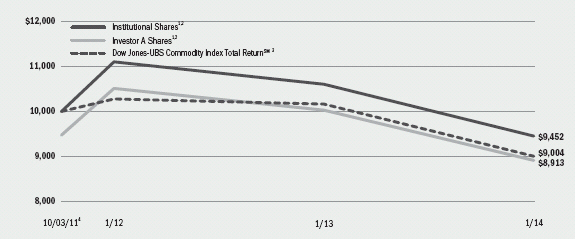

| Fund Summary as of January 31, 2014 | | | BlackRock Commodity Strategies Fund | |

BlackRock Commodity Strategies Fund’s (the “Fund”) investment objective is to seek total return.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended January 31, 2014, the Fund’s Institutional and Investor A Shares outperformed the benchmark, the Dow Jones-UBS Commodity Index Total ReturnSM while the Fund’s Investor C Shares underperformed the benchmark index. |

What factors influenced performance?

| Ÿ | | Stock selection within the buoyant energy sector contributed positively to performance for the period. A number of supply disruptions led to increased uncertainty, which alongside modest demand growth, supported consistently high oil prices. These high prices and a steady recovery in the US economy (the largest consumer of crude oil) generated momentum for energy equities during the period. |

| Ÿ | | The Fund’s holdings in mining equities outperformed as commodity prices traded higher (aluminum was the only base metal to fall during the period) and global demand reached record levels. After having lagged the broader equity market in recent years, the outlook for the mining sector has improved following widespread aggressive cutting of operational costs and reassessing of investment projects. |

| Ÿ | | Positioning within agriculture equities also had a positive impact on returns for the period. The Fund benefited from its overweight in the agribusiness and livestock sub-sectors. These companies performed well as a result of strong harvests which increase demand for storage and transportation from agribusinesses. In addition, lower grain prices should translate into lower input costs for livestock companies, improving their earnings. |

| Ÿ | | Conversely, gold-related equities detracted from performance as precious metals broadly declined during the period. Gold bullion and gold-related equities particularly suffered as the global economy continued to recover and the Fed began tapering its monetary stimulus program. |

| Ÿ | | The Fund’s commodity-linked derivatives strategy underperformed the benchmark index during the period. In late January, extremely cold weather in the US and rapidly declining |

| | | inventories of natural gas caused prices to rally sharply, resulting in the underperformance of the Fund’s positions further out on the futures curve. |

Describe recent portfolio activity.

| Ÿ | | In agricultural equities, the Fund reduced its exposure to fertilizer and agriculture equipment companies. Within precious metals, the Fund reduced exposure to some higher-cost gold holdings, including the sale of Detour Gold Corp., while adding to gold royalty exposure. In energy equities, the Fund rotated exposure toward integrated energy companies. In mining equities, the Fund purchased Trevali Mining Corp. (a zinc-focused mining company) and reduced its underweight to coal stocks. |

| Ÿ | | In the final month of the period, the Dow Jones-UBS Commodity Index Total ReturnSM rebalanced. Accordingly, the futures portion of the Fund (the commodity-linked derivatives strategy), which represents roughly 50% of net assets, rebalanced in line with the index. The commodity-related equity portion of the Fund rebalanced back to its target sector weights: 22.5% in energy, 11.5% in metals and mining, 9.0% in agriculture and 7.0% in precious metals. |

| Ÿ | | Also during the period, the Fund maintained a position in cash and cash equivalents, predominantly comprised of US Treasury bills, as collateral against the Fund’s exposure to commodity-linked notes. The Fund’s cash balance did not have a material impact on performance. |

Describe portfolio positioning at period end.

| • | | The Fund ended the period with approximately 50% of net assets allocated to the commodity-related equity strategy and 50% allocated to the commodity-linked derivatives strategy (including collateral held against the commodity-linked note exposure). Aggregating both strategies, the Fund was overweight relative to the benchmark index in energy and industrial metals and underweight in agriculture and precious metals. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Ten Largest Holdings | | Percent of

Long-Term

Investments |

| | | | |

International Bank for Reconstruction & Development

3-month LIBOR, 8/15/14-CLN | | | 6 | % |

Canadian Imperial Bank of Commerce 3-month LIBOR,

2/27/15-CLN | | | 5 | |

Royal Dutch Shell PLC, B Shares | | | 4 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR,

8/08/14-CLN | | | 4 | |

UBS AG 3-month LIBOR, 8/01/14-CLN | | | 4 | |

Exxon Mobil Corp. | | | 4 | |

Chevron Corp. | | | 4 | |

BP PLC | | | 2 | |

ConocoPhillips | | | 2 | |

BHP Billiton PLC | | | 2 | |

| | |

| Portfolio Composition | | Percent of

Long-Term

Investments |

| | | | |

Common Stocks | | | 74 | % |

Commodity-Linked Notes | | | 26 | |

| | | | | | |

| 4 | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | |

| | | | |

| | | | BlackRock Commodity Strategies Fund | |

|

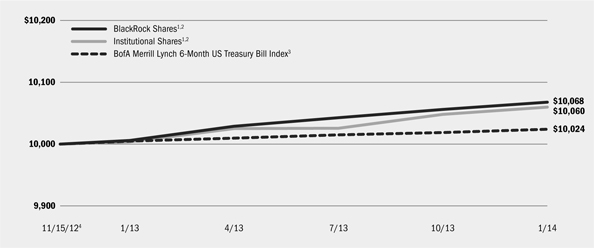

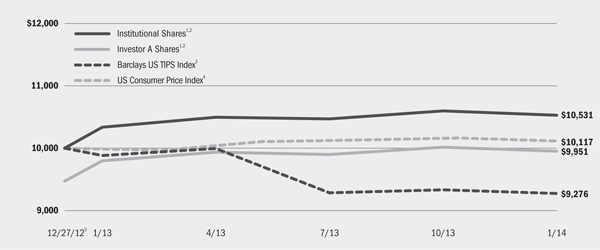

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | The Fund utilizes two strategies and under normal circumstances expects to invest approximately 50% of its total assets in each strategy; provided, however, that from time to time, Fund management may alter the weightings if it deems it prudent to do so based on market conditions, trends or movements or other similar factors. |

| | 3 | An unmanaged commodity index currently composed of futures contracts on 20 physical commodities, and assumes that the futures positions are fully collateralized. |

| | 4 | Commencement of operations. |

| | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended January 31, 2014 | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | Since Inception6 | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | | 0.33 | % | | | (10.85 | )% | | | N/A | | | | (2.39 | )% | | | N/A | |

Investor A | | | 0.11 | | | | (11.07 | ) | | | (15.74 | )% | | | (2.59 | ) | | | (4.82 | )% |

Investor C | | | (0.22 | ) | | | (11.77 | ) | | | (12.65 | ) | | | (3.36 | ) | | | (3.36 | ) |

Dow Jones-UBS Commodity Index Total ReturnSM | | | 0.00 | | | | (11.38 | ) | | | N/A | | | | (4.41 | ) | | | N/A | |

| | 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | The Fund commenced operations on October 3, 2011. |

| | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical8 | | |

| | | Beginning Account Value August 1, 2013 | | Ending Account Value January 31, 2014 | | Expenses Paid During the Period7 | | Beginning Account Value August 1, 2013 | | Ending Account Value January 31, 2014 | | Expenses Paid During the Period7 | | Annualized Expense Ratio |

Institutional | | $1,000.00 | | $1,003.30 | | $6.51 | | $1,000.00 | | $1,018.70 | | $6.56 | | 1.29% |

Investor A | | $1,000.00 | | $1,001.10 | | $7.57 | | $1,000.00 | | $1,017.64 | | $7.63 | | 1.50% |

Investor C | | $1,000.00 | | $997.80 | | $11.33 | | $1,000.00 | | $1,013.86 | | $11.42 | | 2.25% |

| | 7 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 8 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | 5 |

| | | | |

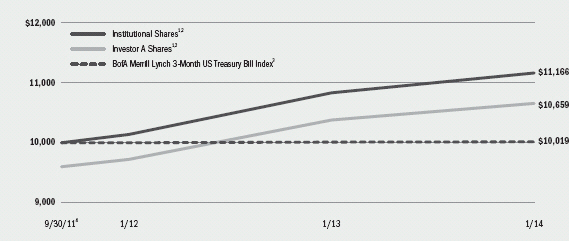

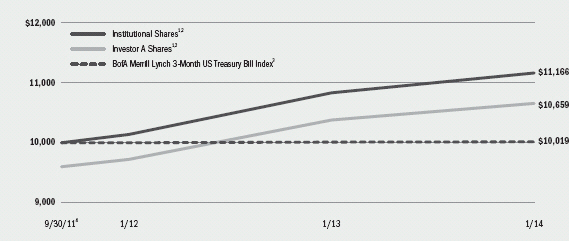

| Fund Summary as of January 31, 2014 | | | BlackRock Global Long/Short Credit Fund | |

BlackRock Global Long/Short Credit Fund’s (the “Fund”) investment objective is to seek absolute total returns over a complete market cycle.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended January 31, 2014, the Fund outperformed its benchmark, the BofA Merrill Lynch 3-Month US Treasury Bill Index. |

What factors influenced performance?

| Ÿ | | The Fund’s net long position in credit (i.e., total long positions minus total short positions) drove positive results as risk assets rallied for the majority of the period despite elevated volatility at times. The summer months, which typically exhibit less liquidity in fixed income markets, gave way to a robust fourth quarter, and while the beginning of 2014 was rocky for risk assets, the Fund performed in line with expectations. The strongest performance in the Fund came from positioning in European financials across the capital structure – from covered bonds to subordinated debt – as the sector benefited from a number of catalysts. A long/short trade in covered bonds and senior unsecured debt of Spanish banks was also positive. Long positions in European and US high yield issuers performed well, with security selection of particular importance given the low level of yields and spreads in the market. |

| Ÿ | | Also contributing positively were trading strategies in UK pub (bar/ tavern) issuers and Italian telecommunications issuers, as well as US communications and consumer-driven issuers. Aviation-related trading added to returns as the Fund was well-positioned for the merger of American Airlines and US Airways in the fourth quarter of 2013. In investment grade credit, exposure to industrial issuers added to returns, especially from securities purchased in the new-issue market. Exposure to longer-dated debt of US communications company Verizon Communications, Inc. generated strong outperformance for the period. Long/short trading in US credits contributed positively to Fund returns, with particularly strong results from a relative value trade between US and European financials. |

| Ÿ | | As credit sectors broadly rallied during the period, the Fund’s hedges against its long European credit positions had a negative impact on performance. Equity index put options and index short positions also detracted from returns. Additionally, short positions in select European sovereigns weighed on results. |

| Ÿ | | As part of its investment strategy, the Fund uses derivatives to hedge against duration (sensitivity to interest rate movements) and currency risk. The Fund may also employ credit derivatives in order to express a positive or negative view on a particular issuer or sector, or to hedge or manage overall credit risk. During the period, the Fund’s derivative holdings had a net negative impact on performance. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Fund tactically increased and decreased risk in response to market conditions. The Fund took advantage of a robust new-issue market in investment grade and high yield corporate credit. The Fund also purchased convertible bonds where attractive entry points were presented. The Fund added exposure to bank loans, both leveraged loans and collateralized loan obligations, seeking higher quality issues in terms of loan structure, credit quality, liquidity and diversification. In addition, the Fund tactically traded aviation-related debt from foreign and domestic airlines and positioned around a merger between two large US airlines. |

| Ÿ | | In investment grade credit, the Fund traded with light exposure in the US. In Europe, the Fund gradually reduced exposure to areas with limited further upside in non-financial sectors in favor of financials, namely subordinated bank debt, given the potential for outperformance in these assets should the European Central Bank’s comprehensive assessment of the banking system have a positive outcome. Within sovereign debt, the Fund held large short positions at the beginning of the period; however, these positions were reduced toward the end of 2013 following the underperformance of peripheral sovereign bonds. Most recently, following a period of weakness in global risk assets, the Fund took the opportunity to increase risk in Europe by purchasing attractive non-financial investment grade credits and taking a long position on the main European credit index. |

| Ÿ | | The Fund’s cash exposure had no material impact on performance as the Fund can express long and short positions via the credit default swap market, which does not require a cash outlay like that of traditional cash bonds. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Fund maintained an allocation to European bank debt given expectations that the European Central Bank’s comprehensive assessment of the banking system will have a positive outcome. The Fund also maintained allocations to higher-quality high yield bonds and bank loans. The Fund held short positions in sovereign debt as a hedge against local risks in non-US assets. |

| Ÿ | | The Fund ended the period with a net long credit position in Europe at 41% of net assets, 19% in the US and 60% overall given a positive environment for credit sectors. The Fund remained positioned to be nimble and tactical to take advantage of long and short opportunities as they arise. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 6 | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | |

| | | | |

| | | | BlackRock Global Long/Short Credit Fund | |

|

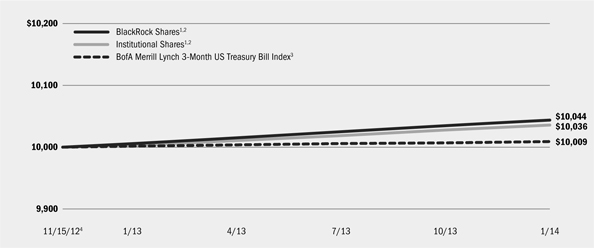

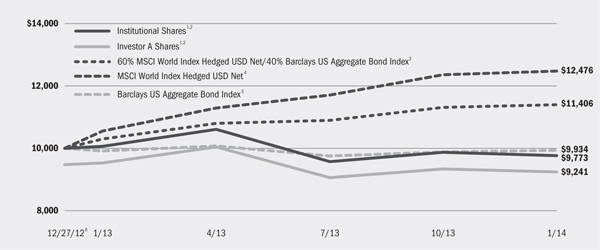

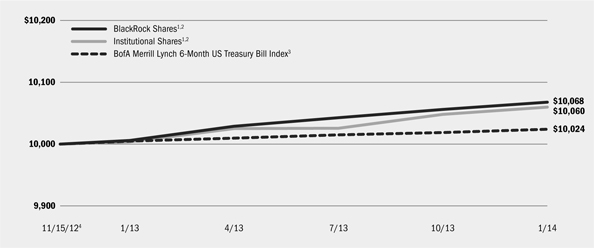

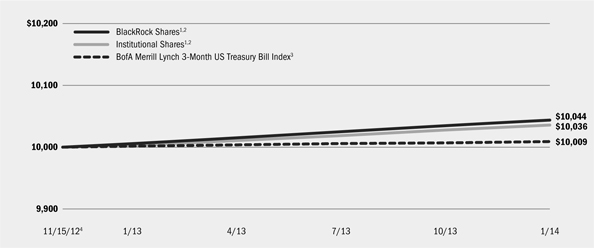

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | The Fund seeks to provide absolute total returns over a complete market cycle through diversified long and short exposure to the global fixed income markets. |

| | 3 | An unmanaged index that tracks 3-month US Treasury securities. |

| | 4 | Commencement of operations. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended January 31, 2014 | |

| | | | | | | | | | | | Average Annual Total Returns5 | |

| | | | | | | | | | | | 1 Year | | | Since Inception6 | |

| | | Standardized 30-Day Yield | | | Unsubsidized 30-Day Yield | | | 6-Month Total Returns | | | w/o sales charge | | | w/ sales

charge | | | w/o sales charge | | | w/ sales charge | |

Institutional | | | 1.64 | % | | | 1.62 | % | | | 2.26 | % | | | 3.06 | % | | | N/A | | | | 4.83 | % | | | N/A | |

Investor A | | | 1.29 | | | | 1.27 | | | | 2.12 | | | | 2.71 | | | | (1.40 | )% | | | 4.58 | | | | 2.77 | % |

Investor C | | | 0.63 | | | | 0.60 | | | | 1.75 | | | | 1.98 | | | | 0.98 | | | | 3.83 | | | | 3.83 | |

BofA Merrill Lynch 3-Month US Treasury Bill Index | | | — | | | | — | | | | 0.03 | | | | 0.08 | | | | N/A | | | | 0.08 | | | | N/A | |

| | 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | The Fund commenced operations on September 30, 2011. |

| | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expense Example | |

| | | Actual | | | Hypothetical9 | |

| | | | | | | | | Including

Interest Expense | | | Excluding

Interest Expense | | | | | | Including

Interest Expense | | | Excluding

Interest Expense | |

| | | Beginning Account Value August 1, 2013 | | | Ending Account Value January 31, 2014 | | | Expenses Paid During the Period7 | | | Expenses Paid During the Period8 | | | Beginning

Account Value August 1, 2013 | | | Ending Account Value January 31, 2014 | | | Expenses Paid During the Period7 | | | Ending Account Value January 31, 2014 | | | Expenses Paid During the Period8 | |

Institutional | | | $1,000.00 | | | | $1,022.60 | | | | $7.49 | | | | 5.15 | | | | $1,000.00 | | | | $1,017.80 | | | | $7.48 | | | | $1,020.11 | | | | $5.14 | |

Investor A | | | $1,000.00 | | | | $1,021.20 | | | | $8.92 | | | | 6.57 | | | | $1,000.00 | | | | $1,016.38 | | | | $8.89 | | | | $1,018.70 | | | | $6.56 | |

Investor C | | | $1,000.00 | | | | $1,017.50 | | | | $12.56 | | | | 10.22 | | | | $1,000.00 | | | | $1,012.75 | | | | $12.53 | | | | $1,015.07 | | | | $10.21 | |

| | 7 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.47% for Institutional, 1.75% for Investor A and 2.47% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 8 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.01% for Institutional, 1.29% for Investor A and 2.01% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 9 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | 7 |

| Ÿ | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| Ÿ | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% for BlackRock Commodity Strategies Fund and 4.00% for BlackRock Global Long/Short Credit Fund. These shares are subject to a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. |

| Ÿ | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures

shown in each of the performance tables on the previous pages assume reinvestment of all dividends and distributions, if any, at net asset value (“NAV”) on the ex-dividend/payable dates. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, waived and/or reimbursed a portion of each Fund’s expenses. Without such waiver and/or reimbursement, each Fund’s performance would have been lower. The Manager is under no obligation to waive or reimburse or to continue waiving or reimbursing its fees after the applicable termination date. See Note 5 of the Notes to Financial Statements for additional information on waivers and reimbursements. The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waiver and/or reimbursements.

Shareholders of the Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on August 1, 2013 and held through January 31, 2014) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the headings entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | | | | | |

| 8 | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | |

| | |

| Derivative Financial Instruments | | |

The Funds may invest in various derivative financial instruments, including financial futures contracts, foreign currency exchange contracts, options and swaps, as specified in Note 4 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to hedge market, equity, credit, interest rate and/or foreign currency exchange rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial

instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment, may result in lower dividends paid to shareholders and/or may cause a Fund to hold an investment that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

|

| BlackRock Global Long/Short Credit Fund’s Portfolio Information |

| | | | | | | | | | | | | | | |

| | | Percent of Total Investments1 |

| Geographic Allocation | | Long | | Short | | Total |

United States | | | | 27 | % | | | | 15 | % | | | | 42 | % |

United Kingdom | | | | 8 | | | | | — | | | | | 8 | |

Italy | | | | 8 | | | | | 2 | | | | | 10 | |

Netherlands | | | | 7 | | | | | — | | | | | 7 | |

Spain | | | | 7 | | | | | 3 | | | | | 10 | |

Cayman Islands | | | | 4 | | | | | — | | | | | 4 | |

Luxembourg | | | | 3 | | | | | — | | | | | 3 | |

France | | | | 3 | | | | | — | | | | | 3 | |

Ireland | | | | 2 | | | | | — | | | | | 2 | |

Germany | | | | 2 | | | | | — | | | | | 2 | |

Denmark | | | | 2 | | | | | — | | | | | 2 | |

Other2 | | | | 7 | | | | | — | | | | | 7 | |

| Total | | 80% | | 20% | | 100% |

| 1 | Total investments include the gross market values of long and short positions and exclude short-term securities. |

| 2 | Includes holdings within countries that are 1% or less of long-term investments. Please refer to the Schedule of Investments for such countries. |

| | | | | |

| Credit Quality Allocation3 | | Percent of Long-Term Investments |

AAA/Aaa4 | | | | 2 | % |

AA/Aa | | | | 2 | |

A | | | | 11 | |

BBB/Baa | | | | 34 | |

BB/Ba | | | | 21 | |

B | | | | 14 | |

CCC/Caa | | | | 3 | |

Not Rated | | | | 13 | |

| 3 | Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investors Service (“Moody’s”) ratings |

| 4 | Includes US Treasury Obligations that are deemed AAA/Aaa by the investment advisor. |

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | 9 |

| | | | |

| Consolidated Schedule of Investments January 31, 2014 (Unaudited) | | | BlackRock Commodity Strategies Fund | |

| | | (Percentages shown are based on Net Assets | |

| | | | | | | | | | | | |

| Commodity-Linked Notes | | | | | Par

(000) | | | Value | |

Canadian Imperial Bank of Commerce 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM , multiplied by 3), 2/27/15 | | | USD | | | | 13,000 | | | $ | 13,000,000 | |

International Bank for Reconstruction & Development 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index 4 Month Forward Total ReturnSM , multiplied by 3), 8/15/14 | | | | | | | 14,000 | | | | 13,967,667 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index 4 Month Forward Total ReturnSM ,multiplied by 3), 3/10/14 | | | | | | | 5,000 | | | | 3,247,500 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM , multiplied by 3), 2/06/14 | | | | | | | 5,000 | | | | 5,000,000 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM , multiplied by 3), 8/08/14 | | | | | | | 10,500 | | | | 10,692,150 | |

Swedish Export Credit Corp. 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index 4 Month Forward Total ReturnSM ,multiplied by 3), 5/29/14 | | | | | | | 6,000 | | | | 5,130,924 | |

UBS AG 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM ,multiplied by 3), 1/05/15 | | | | | | | 5,000 | | | | 5,125,270 | |

UBS AG 3-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Total ReturnSM ,multiplied by 3), 8/01/14 | | | | | | | 10,000 | | | | 10,150,945 | |

Total Commodity-Linked Notes — 16.2% | | | | | | | | | | | 66,314,456 | |

| | | | | | | | | | | | |

| Common Stocks | | | | | Shares | | | | |

Biotechnology — 0.2% | | | | | | | | | | | | |

Genus PLC | | | | | | | 28,650 | | | | 617,487 | |

Chemicals — 2.7% | | | | | | | | | | | | |

Agrinos AS (a) | | | | | | | 70,000 | | | | 71,367 | |

Agrium, Inc. | | | | | | | 10,000 | | | | 871,000 | |

American Vanguard Corp. | | | | | | | 4,300 | | | | 99,932 | |

CF Industries Holdings, Inc. | | | | | | | 1,000 | | | | 230,860 | |

Johnson Matthey PLC | | | | | | | 7,605 | | | | 403,116 | |

Monsanto Co. | | | | | | | 25,000 | | | | 2,663,750 | |

The Mosaic Co. | | | | | | | 43,500 | | | | 1,942,710 | |

Potash Corp. of Saskatchewan, Inc. | | | | | | | 47,000 | | | | 1,472,040 | |

Syngenta AG, Registered Shares | | | | | | | 5,300 | | | | 1,873,720 | |

Umicore | | | | | | | 3,000 | | | | 128,279 | |

Uralkali OJSC — GDR, Registered Shares | | | | | | | 44,000 | | | | 1,068,804 | |

Yara International ASA | | | | | | | 5,000 | | | | 206,488 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 11,032,066 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Energy Equipment & Services — 1.8% | | | | | | | | |

Cameron International Corp. (a) | | | 23,250 | | | $ | 1,394,303 | |

Halliburton Co. | | | 39,000 | | | | 1,911,390 | |

Schlumberger Ltd. | | | 45,308 | | | | 3,967,622 | |

| | | | | | | | |

| | | | | | | | 7,273,315 | |

Food & Staples Retailing — 0.3% | | | | | | | | |

The Andersons, Inc. | | | 9,000 | | | | 744,660 | |

Total Produce PLC | | | 380,000 | | | | 456,133 | |

| | | | | | | | |

| | | | | | | | 1,200,793 | |

Food Products — 4.6% | | | | | | | | |

Adecoagro SA (a) | | | 63,750 | | | | 478,763 | |

Archer-Daniels-Midland Co. | | | 75,500 | | | | 2,980,740 | |

BRF-Brasil Foods SA — ADR | | | 130,000 | | | | 2,298,400 | |

Bunge Ltd. | | | 34,000 | | | | 2,575,840 | |

China Agri-Industries Holdings Ltd. | | | 709,800 | | | | 315,349 | |

Darling International, Inc. (a)(b) | | | 20,000 | | | | 391,200 | |

Devro PLC | | | 20,000 | | | | 101,790 | |

First Resources Ltd. | | | 435,000 | | | | 678,690 | |

Glanbia PLC | | | 50,000 | | | | 726,954 | |

GrainCorp Ltd., Class A | | | 35,764 | | | | 237,624 | |

Hormel Foods Corp. | | | 5,000 | | | | 227,200 | |

Ingredion, Inc. | | | 15,000 | | | | 934,500 | |

Kernel Holding SA (a) | | | 8,000 | | | | 96,448 | |

New Britain Palm Oil Ltd. | | | 30,200 | | | | 167,554 | |

Origin Enterprises PLC (a) | | | 63,424 | | | | 577,398 | |

Pilgrim’s Pride Corp. | | | 25,500 | | | | 426,615 | |

SunOpta, Inc. (a) | | | 65,000 | | | | 607,750 | |

Tate & Lyle PLC | | | 17,000 | | | | 211,423 | |

Tyson Foods, Inc., Class A | | | 84,000 | | | | 3,141,600 | |

Wilmar International Ltd. | | | 664,000 | | | | 1,621,409 | |

| | | | | | | | |

| | | | | | | | 18,797,247 | |

Machinery — 0.7% | | | | | | | | |

AGCO Corp. | | | 6,000 | | | | 319,979 | |

Deere & Co. | | | 9,000 | | | | 773,640 | |

Kubota Corp. | | | 115,000 | | | | 1,769,997 | |

| | | | | | | | |

| | | | | | | | 2,863,616 | |

Metals & Mining — 14.3% | | | | | | | | |

African Rainbow Minerals Ltd. | | | 51,190 | | | | 1,011,749 | |

Agnico-Eagle Mines Ltd. | | | 24,200 | | | | 753,106 | |

Alamos Gold, Inc. | | | 66,180 | | | | 607,281 | |

Anglo American PLC | | | 47,766 | | | | 1,126,274 | |

AngloGold Ashanti Ltd. | | | 67,465 | | | | 982,532 | |

Antofagasta PLC | | | 60,000 | | | | 834,199 | |

B2Gold Corp. (a)(b) | | | 84,644 | | | | 199,878 | |

Barrick Gold Corp. | | | 69,726 | | | | 1,343,497 | |

Beadell Resources Ltd. (a) | | | 622,037 | | | | 383,010 | |

BHP Billiton PLC | | | 187,212 | | | | 5,511,258 | |

Eldorado Gold Corp. | | | 203,926 | | | | 1,296,338 | |

First Quantum Minerals Ltd. | | | 123,825 | | | | 2,215,786 | |

| | | | |

| Portfolio Abbreviations | | | | |

| To simplify the listings of portfolio holdings in the Schedules of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list: | | ADR American Depositary Receipts AKA Also Known As AUD Australian Dollar CHF Swiss Franc CLO Collateralized Loan Obligation ETF Exchange Traded Fund EUR Euro EURIBOR Euro Interbank Offered Rate FKA Formerly Known As | | GBP British Pound GDR Global Depositary Receipts LIBOR London Interbank Offered Rate PIK Payment-in-kind REIT Real Estate Investment Trust SEK Swedish Krona USD US Dollar ZAK South African Rand |

See Notes to Financial Statements.

| | | | | | |

| 10 | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | |

| | | | |

| Consolidated Schedule of Investments (continued) | | | BlackRock Commodity Strategies Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Metals & Mining (concluded) | | | | | | | | |

Fortescue Metals Group Ltd. | | | 430,604 | | | $ | 1,997,338 | |

Franco-Nevada Corp. | | | 34,864 | | | | 1,691,941 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 65,302 | | | | 2,116,438 | |

Fresnillo PLC | | | 119,444 | | | | 1,491,769 | |

Glencore Xstrata PLC | | | 689,692 | | | | 3,636,379 | |

Goldcorp, Inc. | | | 147,986 | | | | 3,692,508 | |

Harmony Gold Mining Co. Ltd. | | | 70,024 | | | | 200,163 | |

IAMGOLD Corp. | | | 32,939 | | | | 120,961 | |

Iluka Resources Ltd. | | | 72,866 | | | | 556,277 | |

Industrias Penoles SAB de CV | | | 23,258 | | | | 541,104 | |

Kenmare Resources PLC (a) | | | 831,782 | | | | 239,289 | |

Kinross Gold Corp. | | | 69,062 | | | | 316,864 | |

Kumba Iron Ore Ltd. | | | 6,425 | | | | 261,147 | |

London Mining PLC (a) | | | 116,978 | | | | 179,590 | |

Lonmin PLC | | | 100,000 | | | | 502,395 | |

Lundin Mining Corp. (a) | | | 375,000 | | | | 1,639,731 | |

MAG Silver Corp. (a) | | | 20,000 | | | | 122,828 | |

Mineral Deposits Ltd. (a) | | | 119,541 | | | | 233,295 | |

Nevsun Resources Ltd. | | | 248,000 | | | | 910,725 | |

New Gold, Inc. (a) | | | 134,059 | | | | 769,147 | |

Newcrest Mining Ltd. | | | 56,619 | | | | 467,005 | |

Newmont Mining Corp. | | | 12,000 | | | | 259,200 | |

Petra Diamonds Ltd. (a) | | | 55,000 | | | | 124,683 | |

Platinum Group Metals Ltd. (a)(b) | | | 250,000 | | | | 294,052 | |

Polymetal International PLC | | | 29,854 | | | | 280,940 | |

Polyus Gold International Ltd. | | | 119,567 | | | | 364,951 | |

Randgold Resources Ltd. — ADR | | | 39,485 | | | | 2,720,517 | |

Rio Tinto PLC | | | 65,371 | | | | 3,476,979 | |

Romarco Minerals, Inc. (a) | | | 281,341 | | | | 133,882 | |

Royal Gold, Inc. | | | 15,013 | | | | 839,827 | |

Silver Wheaton Corp. | | | 58,281 | | | | 1,265,829 | |

Sirius Resources NL | | | 128,340 | | | | 244,876 | |

Sociedad Minera Cerro Verde SAA | | | 25,787 | | | | 569,893 | |

Southern Copper Corp. | | | 46,000 | | | | 1,287,080 | |

Tahoe Resources, Inc. (a) | | | 33,004 | | | | 586,145 | |

Teck Resources Ltd., Class B | | | 77,307 | | | | 1,860,227 | |

Trevali Mining Corp. (a) | | | 800,000 | | | | 739,843 | |

Vale SA — ADR, Preference Shares | | | 236,053 | | | | 2,898,731 | |

Vedanta Resources PLC | | | 60,132 | | | | 794,883 | |

Volcan Cia Minera SAA, Class B | | | 684,861 | | | | 276,564 | |

Western Areas Ltd. | | | 143,917 | | | | 333,898 | |

Yamana Gold, Inc. | | | 114,285 | | | | 1,070,251 | |

Zhaojin Mining Industry Co. Ltd., H Shares (b) | | | 147,500 | | | | 86,066 | |

| | | | | | | | |

| | | | | | | | 58,461,119 | |

Oil, Gas & Consumable Fuels — 20.8% | | | | | | | | |

Anadarko Petroleum Corp. | | | 50,613 | | | | 4,083,963 | |

BG Group PLC | | | 190,400 | | | | 3,200,231 | |

BP PLC | | | 758,300 | | | | 5,942,841 | |

Cairn Energy PLC (a) | | | 252,900 | | | | 896,859 | |

Cameco Corp. | | | 34,458 | | | | 732,319 | |

Caracal Energy, Inc. (a) | | | 159,916 | | | | 1,147,496 | |

Chevron Corp. | | | 80,750 | | | | 9,014,123 | |

China Shenhua Energy Co. Ltd., H Shares | | | 345,000 | | | | 885,525 | |

Cimarex Energy Co. | | | 14,000 | | | | 1,371,720 | |

ConocoPhillips | | | 87,750 | | | | 5,699,363 | |

CONSOL Energy, Inc. | | | 43,828 | | | | 1,636,976 | |

Cosan Ltd., Class A | | | 17,300 | | | | 199,988 | |

Devon Energy Corp. | | | 31,300 | | | | 1,853,586 | |

Enbridge, Inc. | | | 26,800 | | | | 1,125,179 | |

ENI SpA | | | 79,716 | | | | 1,810,255 | |

EOG Resources, Inc. | | | 19,500 | | | | 3,222,180 | |

EQT Corp. | | | 18,600 | | | | 1,726,266 | |

Exxon Mobil Corp. | | | 100,232 | | | | 9,237,381 | |

Imperial Oil Ltd. | | | 22,000 | | | | 899,753 | |

Kosmos Energy Ltd. | | | 86,121 | | | | 890,491 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (concluded) | | | | | | | | |

Noble Energy, Inc. | | | 62,100 | | | $ | 3,870,693 | |

Oil Search Ltd. | | | 254,150 | | | | 1,785,582 | |

Phillips 66 | | | 24,769 | | | | 1,810,366 | |

Range Resources Corp. | | | 33,650 | | | | 2,900,293 | |

Royal Dutch Shell PLC, B Shares | | | 310,600 | | | | 11,360,865 | |

Scorpio Tankers, Inc. | | | 300 | | | | 3,000 | |

Statoil ASA | | | 117,500 | | | | 2,784,829 | |

Suncor Energy, Inc. | | | 59,300 | | | | 1,948,181 | |

TransCanada Corp. | | | 66,700 | | | | 2,899,766 | |

| | | | | | | | |

| | | | | | | | 84,940,070 | |

Paper & Forest Products — 0.2% | | | | | | | | |

Canfor Corp. | | | 21,000 | | | | 480,619 | |

Louisiana-Pacific Corp. | | | 27,000 | | | | 473,310 | |

| | | | | | | | |

| | | | | | | | 953,929 | |

Real Estate Investment Trusts (REITs) — 0.2% | | | | | |

Weyerhaeuser Co. | | | 31,000 | | | | 926,280 | |

Total Common Stocks — 45.8% | | | | | | | 187,065,922 | |

Total Long-Term Investments (Cost — $262,658,657) — 62.0% | | | | | | | 253,380,378 | |

| | | | | | | | |

| | | Shares /

Beneficial

Interest (000) | | | | |

| Short-Term Securities | | | | | | |

Money Market Funds — 4.0% | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.03% (c)(d) | | | 15,606,778 | | | | 15,606,778 | |

BlackRock Liquidity Series, LLC, Money Market Series, 0.14% (c)(d)(e) | | $ | 720,425 | | | | 720,425 | |

| | | | | | | | |

| | | | | | | | 16,327,203 | |

| | | | | | | | |

| | |

| | | Par (000) | | | | |

U.S. Treasury Bills — 33.3% | | | | | | | | |

0.01%, 2/06/14 (f) | | | 101,000 | | | | 100,999,830 | |

0.09%, 5/15/14 (f) | | | 7,000 | | | | 6,999,363 | |

0.09%, 6/05/14 (f) | | | 10,000 | | | | 9,998,810 | |

0.08%, 6/12/14 (f) | | | 18,000 | | | | 17,994,652 | |

| | | | | | | | |

| | | | | | | | 135,992,655 | |

Total Short-Term Securities (Cost — $152,316,928) — 37.3% | | | | | | | 152,319,858 | |

Total Investments (Cost — $414,975,585) — 99.3% | | | | 405,700,236 | |

Other Assets Less Liabilities — 0.7% | | | | 2,814,184 | |

| | | | | | | | |

Net Assets — 100.0% | | | $ | 408,514,420 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | 11 |

| | | | |

| Consolidated Schedule of Investments (continued) | | | BlackRock Commodity Strategies Fund | |

|

| Notes to Consolidated Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of security, is on loan. |

| (c) | Investments in issuers considered to be an affiliate of the Fund during the six months ended January 31, 2014, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares/Beneficial

Interest Held at

July 31, 2013 | | | Net Activity | | | Shares/Beneficial

Interest Held at

January 31, 2014 | | | Value at

January 31, 2014 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 15,958,082 | | | | (351,304 | ) | | | 15,606,778 | | | $ | 15,606,778 | | | $ | 2,783 | |

BlackRock Liquidity Series, LLC Money Market Series | | | — | | | $ | 720,425 | | | $ | 720,425 | | | $ | 720,425 | | | $ | 2,919 | |

| (d) | Represents the current yield as of report date. |

| (e) | Security was purchased with the cash collateral from loaned securities. The Fund may withdraw up to 25% of its investment daily, although the manager of the BlackRock Liquidity Series, LLC, Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day. |

| (f) | Rate shown reflects the discount rate at the time of purchase. |

| Ÿ | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| Ÿ | | Foreign currency exchange contracts outstanding as of January 31, 2014 were as follows: |

| | | | | | | | | | | | | | | | | | | | | | |

Currency Purchased | | | Currency

Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| EUR | | | 91,336 | | | | USD | | | | 124,344 | | | Citibank N.A. | | | 2/03/14 | | | $ | (1,159 | ) |

| EUR | | | 46,809 | | | | USD | | | | 63,726 | | | Citibank N.A. | | | 2/03/14 | | | | (594 | ) |

| USD | | | 249,425 | | | | AUD | | | | 285,038 | | | HSBC Bank PLC | | | 2/03/14 | | | | (26 | ) |

| USD | | | 19,184 | | | | GBP | | | | 11,635 | | | Goldman Sachs International | | | 2/03/14 | | | | 57 | |

| USD | | | 140,452 | | | | GBP | | | | 85,184 | | | Goldman Sachs International | | | 2/03/14 | | | | 417 | |

| USD | | | 14,845 | | | | GBP | | | | 9,013 | | | UBS AG | | | 2/04/14 | | | | — | |

| USD | | | 494,675 | | | | GBP | | | | 300,349 | | | UBS AG | | | 2/04/14 | | | | — | |

| ZAR | | | 2,707,128 | | | | USD | | | | 242,502 | | | Deutsche Bank AG | | | 2/06/14 | | | | 1,131 | |

| Total | | | | | | | | | | | | | | | | | | | | $ | (174 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| | Ÿ | | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instrument and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments, please refer to Note 2 of the Notes to Financial Statements.

See Notes to Financial Statements.

| | | | | | |

| 12 | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | |

| | | | |

| Consolidated Schedule of Investments (continued) | | | BlackRock Commodity Strategies Fund | |

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy as of January 31, 2014:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Commodity-Linked Notes | | | — | | | | — | | | $ | 66,314,456 | | | $ | 66,314,456 | |

Common Stocks: | | | | | | | | | | | | | | | | |

Biotechnology | | | — | | | $ | 617,487 | | | | — | | | | 617,487 | |

Chemicals | | $ | 8,420,463 | | | | 2,611,603 | | | | — | | | | 11,032,066 | |

Energy Equipment & Services | | | 7,273,315 | | | | — | | | | — | | | | 7,273,315 | |

Food & Staples Retailing | | | 1,200,793 | | | | — | | | | — | | | | 1,200,793 | |

Food Products | | | 15,636,304 | | | | 3,160,943 | | | | — | | | | 18,797,247 | |

Machinery | | | 1,093,619 | | | | 1,769,997 | | | | — | | | | 2,863,616 | |

Metals & Mining | | | 33,612,758 | | | | 24,848,361 | | | | — | | | | 58,461,119 | |

Oil, Gas & Consumable Fuels | | | 56,273,083 | | | | 28,666,987 | | | | — | | | | 84,940,070 | |

Paper & Forest Products | | | 953,929 | | | | — | | | | — | | | | 953,929 | |

Real Estate Investment Trusts (REITs) | | | 926,280 | | | | — | | | | — | | | | 926,280 | |

Short-Term Securities: | | | | | | | | | | | | | | | | |

Money Market Funds | | | 15,606,778 | | | | 720,425 | | | | — | | | | 16,327,203 | |

U.S. Treasury Bills | | | — | | | | 135,992,655 | | | | — | | | | 135,992,655 | |

Total | | $ | 140,997,322 | | | $ | 198,388,458 | | | $ | 66,314,456 | | | $ | 405,700,236 | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Derivative Financial Instruments1 | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Foreign currency exchange contracts | | $ | 1,605 | | | | — | | | | — | | | $ | 1,605 | |

Liabilities: | | | | | | | | | | | | | | | | |

Foreign currency exchange contracts | | | (1,779 | ) | | | — | | | | — | | | | (1,779 | ) |

Total | | $ | (174 | ) | | | — | | | | — | | | $ | (174 | ) |

| | | | |

1 Derivative financial instruments are foreign currency exchange contracts which are valued at the unrealized appreciation/depreciation on the instrument. | |

|

| The carrying amount for certain of the Fund’s assets and/or liabilities approximates fair value for financial statement purposes. As of January 31, 2014, such assets and/or liabilities are categorized within the disclosure hierarchy as follows: | |

|

| |

| |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Cash | | $ | 3,722,844 | | | | — | | | | — | | | $ | 3,722,844 | |

Foreign currency at value | | | 28,025 | | | | — | | | | — | | | | 28,025 | |

Liabilities: | | | | | | | | | | | | | | | | |

Collateral on securities loaned at value | | | — | | | $ | (720,425 | ) | | | — | | | | (720,425 | ) |

Total | | $ | 3,750,869 | | | $ | (720,425 | ) | | | — | | | $ | 3,030,444 | |

| | | | |

There were no transfers between Level 1 and Level 2 during the six months ended January 31, 2014.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | 13 |

| | | | |

| Consolidated Schedule of Investments (concluded) | | | BlackRock Commodity Strategies Fund | |

A reconciliation of Level 3 investments is presented when the Fund had a significant amount of Level 3 investments at the beginning and/or end of the period in relation to net assets. The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used in determining fair value:

| | | | |

| | | Commodity-Linked

Notes | |

Assets: | | | | |

Opening Balance, as of July 31, 2013 | | $ | 58,525,843 | |

Transfers into Level 3 | | | — | |

Transfers out of Level 3 | | | — | |

Accrued discounts/premiums | | | — | |

Net realized gain (loss) | | | (5,918,972 | ) |

Net change in unrealized appreciation/depreciation1 | | | 5,288,613 | |

Purchases | | | 23,000,000 | |

Sales | | | (14,581,028 | ) |

Closing Balance, as of January 31, 2014 | | $ | 66,314,456 | |

| | | | |

Net change in unrealized appreciation/depreciation on investments held as of January 31, 2014 | | $ | (309,044 | ) |

| | | | |

| 1 | Included in the related net change in unrealized appreciation/depreciation in the Statements of Operations. |

The Fund’s investments that are categorized as Level 3 were valued utilizing third party pricing information without adjustment. Such valuations are based on unobservable inputs. A significant change in third party information inputs could result in a significantly lower or higher value of such Level 3 investments.

See Notes to Financial Statements.

| | | | | | |

| 14 | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | |

| | | | |

| Schedule of Investments January 31, 2014 (Unaudited) | | | BlackRock Global Long/Short Credit Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | | | | | |

| Asset-Backed Securities | | Par (000) | | | Value | |

Cayman Islands — 2.8% | | | | | | | | | | | | |

ACAS CLO Ltd.: | | | | | | | | | | | | |

Series 2007-1A, Class A1S,

0.45%, 4/20/21 (a)(b) | | | USD | | | | 3,962 | | | $ | 3,908,513 | |

Series 2012-1A, Class D, 5.10%, 9/20/23 (a)(b) | | | | | | | 1,685 | | | | 1,693,425 | |

Series 2013-1A, Class C, 2.99%, 4/20/25 (a)(b) | | | | | | | 1,000 | | | | 975,000 | |

Adirondack Park CLO Ltd., Series 2013-1A, Class D, 3.89%, 4/15/24 (a)(b) | | | | | | | 1,250 | | | | 1,213,079 | |

ALM V Ltd., Series 2012-5A, Class C,

4.74%, 2/13/23 (a)(b) | | | | | | | 500 | | | | 501,269 | |

ALM VI Ltd.: | | | | | | | | | | | | |

Series 2012-6A, Class A2, 2.74%, 6/14/23 (a)(b) | | | | | | | 3,930 | | | | 3,961,001 | |

Series 2012-6A, Class C, 4.99%, 6/14/23 (a)(b) | | | | | | | 2,000 | | | | 2,005,345 | |

ALM VII Ltd., Series 2012-7A, Class C,

4.74%, 10/19/24 (a)(b) | | | | | | | 3,675 | | | | 3,685,290 | |

ALM VII R Ltd., Series 2013-7RA, Class C, 3.71%, 4/24/24 (a)(b) | | | | | | | 3,920 | | | | 3,778,668 | |

ALM VIII Ltd.: | | | | | | | | | | | | |

Series 2013-8A, Class A1A,

1.69%, 1/20/26 (a)(b) | | | | | | | 5,440 | | | | 5,426,625 | |

Series 2013-8A, Class B, 2.99%, 1/20/26 (a)(b) | | | | | | | 1,520 | | | | 1,484,132 | |

Series 2013-8A, Class D, 4.74%, 1/20/26 (a)(b) | | | | | | | 3,355 | | | | 3,088,068 | |

Apidos CDO: | | | | | | | | | | | | |

Series 2013-16A, Class A1,

1.71%, 1/19/25 (a)(b) | | | | | | | 4,985 | | | | 4,950,105 | |

Series 2013-16A, Class B, 3.06%, 1/19/25 (a)(b) | | | | | | | 3,625 | | | | 3,561,563 | |

Apidos CLO XII, Series 2013-12A, Class D, 3.29%, 4/15/25 (a)(b) | | | | | | | 1,500 | | | | 1,411,614 | |

Ares XXV CLO Ltd., Series 2012-3X, Class C, 3.39%, 1/17/24 (b) | | | | | | | 1,300 | | | | 1,292,463 | |

Atlas Senior Loan Fund Ltd., Series 2013-2A, Class A3L, 2.94%, 2/17/26 (a)(b) | | | | | | | 3,800 | | | | 3,648,000 | |

Babson CLO Ltd.: | | | | | | | | | | | | |

Series 2012-2A, Class C, 4.49%, 5/15/23 (a)(b) | | | | | | | 1,285 | | | | 1,287,106 | |

Series 2013-IIA, Class B1, 2.93%, 1/18/25 (a)(b) | | | | | | | 2,500 | | | | 2,438,116 | |

Battalion CLO IV Ltd., Series 2013-4A, Class C, 3.59%, 10/22/25 (a)(b) | | | | | | | 1,750 | | | | 1,652,525 | |

Benefit Street Partners CLO Ltd.: | | | | | | | | | | | | |

Series 2012-IA, Class C, 4.74%, 10/15/23 (a)(b) | | | | | | | 500 | | | | 501,332 | |

Series 2013-IIIA, Class C, 3.49%, 1/20/26 (a)(b) | | | | | | | 2,100 | | | | 1,970,946 | |

Carlyle Global Market Strategies CLO Ltd.: | | | | | | | | | | | | |

Series 2011-1A, Class E, 5.69%, 8/10/21 (a)(b) | | | | | | | 4,600 | | | | 4,542,161 | |

Series 2012-2A, Class D, 4.94%, 7/20/23 (a)(b) | | | | | | | 5,000 | | | | 5,022,240 | |

Chatham Light CLO Ltd., Series 2005-2A, Class B, 0.94%, 8/03/19 (a)(b) | | | | | | | 4,250 | | | | 4,125,561 | |

CIFC Funding Ltd.: | | | | | | | | | | | | |

Series 2012-1A, Class B1L,

5.51%, 8/14/24 (a)(b) | | | | | | | 500 | | | | 502,500 | |

Series 2013-3A, Class C, 3.51%, 10/24/25 (a)(b) | | | | | | | 2,000 | | | | 1,912,680 | |

ECP CLO Ltd.: | | | | | | | | | | | | |

Series 2008-1A, Class A2, 3.24%, 3/17/22 (a)(b) | | | | | | | 3,250 | | | | 3,250,000 | |

Series 2013-5A, Class C, 3.74%, 1/20/25 (a)(b) | | | | | | | 1,750 | | | | 1,684,159 | |

| | | | | | | | | | | | |

| Asset-Backed Securities | | Par (000) | | | Value | |

Cayman Islands (concluded) | | | | | | | | | | | | |

Figueroa CLO Ltd., Series 2013-1A, Class C, 3.89%, 3/21/24 (a)(b) | | | USD | | | | 500 | | | $ | 486,432 | |

Flatiron CLO Ltd.: | | | | | | | | | | | | |

Series 2012-1A, Class C,

4.74%, 10/25/24 (a)(b) | | | | | | | 625 | | | | 633,869 | |

Series 2013-1A, Class A1,

1.69%, 1/17/26 (a)(b) | | | | | | | 3,205 | | | | 3,187,978 | |

Series 2013-1A, Class C,

3.89%, 1/17/26 (a)(b) | | | | | | | 3,000 | | | | 2,877,737 | |

Galaxy XII CLO Ltd., Series 2012-12A, Class B, 2.84%, 5/19/23 (a)(b) | | | | | | | 1,895 | | | | 1,897,369 | |

Galaxy XV CLO Ltd., Series 2013-15A, Class C, 2.84%, 4/15/25 (a)(b) | | | | | | | 1,000 | | | | 962,989 | |

ING IM CLO Ltd., Series 2012-3A, Class D, 4.99%, 10/15/22 (a)(b) | | | | | | | 2,321 | | | | 2,328,105 | |

ING Investment Management Co., Series 2013-3A, Class B, 2.94%, 1/18/26 (a)(b) | | | | | | | 2,520 | | | | 2,472,841 | |

Jamestown CLO I Ltd., Series 2012-1A, Class A1, 1.67%, 11/05/24 (a)(b) | | | | | | | 1,750 | | | | 1,731,415 | |

KKR Financial CLO Ltd., Series 2013-1A, Class A1, 1.39%, 7/15/25 (a)(b) | | | | | | | 1,640 | | | | 1,606,784 | |

Madison Park Funding XI Ltd., Series 2013-11A, Class C, 3.01%, 10/23/25 (a)(b) | | | | | | | 2,680 | | | | 2,640,380 | |

Mountain Hawk II CLO Ltd., Series 2013-2A, Class A1, 1.40%, 7/22/24 (a)(b) | | | | | | | 2,320 | | | | 2,270,574 | |

Neuberger Berman CLO Ltd., Series 2012-12A, Class D, 5.74%, 7/25/23 (a)(b) | | | | | | | 2,000 | | | | 1,999,969 | |

North End CLO Ltd., Series 2013-1A, Class D, 3.74%, 7/17/25 (a)(b) | | | | | | | 750 | | | | 724,143 | |

Oaktree CLO Ltd., Series 2014-1A, Class A2A, 2.29%, 2/13/25 (a)(b) | | | | | | | 5,470 | | | | 5,389,919 | |

Octagon Investment Partners XVII Ltd.,

Series 2013-1A, Class D, 3.42%, 10/25/25 (a)(b) | | | | | | | 1,000 | | | | 951,023 | |

Octagon Investment Partners XVIII Ltd.,

Series 2013-1A, Class C, 3.94%, 12/16/24 (a)(b) | | | | | | | 2,250 | | | | 2,194,758 | |

OHA Credit Partners VI Ltd., Series 2012-6A, Class D, 4.74%, 5/15/23 (a)(b) | | | | | | | 3,200 | | | | 3,208,647 | |

OHA Credit Partners VII Ltd., Series 2012-7A, Class A, 1.66%, 11/20/23 (a)(b) | | | | | | | 3,350 | | | | 3,334,075 | |

OZLM Funding III Ltd., Series 2013-3A, Class A1, 1.57%, 1/22/25 (a)(b) | | | | | | | 725 | | | | 717,714 | |

OZLM Funding Ltd., Series 2013-4A, Class C, 3.44%, 7/22/25 (a)(b) | | | | | | | 1,000 | | | | 951,846 | |

Race Point CLO Ltd., Series 2012-7A, Class A, 1.66%, 11/08/24 (a)(b) | | | | | | | 1,750 | | | | 1,743,128 | |

Race Point V CLO Ltd., Series 2011-5A, Class B, 2.74%, 12/15/22 (a)(b) | | | | | | | 4,300 | | | | 4,302,367 | |

Sudbury Mill CLO Ltd., Series 2013-1A, Class C, 3.24%, 1/17/26 (a)(b) | | | | | | | 2,500 | | | | 2,461,019 | |

Symphony CLO VIII LP, Series 2012-8A, Class B, 2.74%, 1/09/23 (a)(b) | | | | | | | 4,050 | | | | 4,050,000 | |

Symphony CLO XI Ltd., Series 2013-11A, Class D, 4.24%, 1/17/25 (a)(b) | | | | | | | 1,750 | | | | 1,724,497 | |

Tyron Park CLO Ltd., Series 2013-1A, Class C, 3.77%, 7/15/25 (a)(b) | | | | | | | 1,000 | | | | 969,524 | |

Waterfront CLO Ltd., Series 2007-1A, Class B, 1.19%, 8/02/20 (a)(b) | | | | | | | 3,500 | | | | 3,318,343 | |

West CLO Ltd., Series 2013-1A, Class B, 3.14%, 11/07/25 (a)(b) | | | | | | | 2,250 | | | | 2,201,498 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 138,812,429 | |

Italy — 0.2% | | | | | | | | | | | | |

Berica PMI Srl, Series 2013-1, Class A1X, 2.63%, 5/31/57 | | | EUR | | | | 8,414 | | | | 11,498,045 | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | 15 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Global Long/Short Credit Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | | | | | |

| Asset-Backed Securities | | Par (000) | | | Value | |

Netherlands — 0.9% | | | | | | | | | | | | |

North Westerly CLO BV, Series IV-X, Class A-1, 1.00%, 1/15/26 | | | EUR | | | | 31,266 | | | $ | 41,418,801 | |

United States — 0.1% | | | | | | | | | | | | |

Hilton USA Trust, Series 2013-HLT, Class EFX, 4.45%, 11/05/30 (a)(b) | | | USD | | | | 4,673 | | | | 4,765,904 | |

Total Asset-Backed Securities — 4.0% | | | | | | | | | | | 196,495,179 | |

| | | | | | | | | | | | |

| Common Stocks | | | | | Shares | | | | |

Australia — 0.1% | | | | | | | | | | | | |

Fortescue Metals Group Ltd. | | | | | | | 1,200,000 | | | | 5,597,466 | |

Ireland — 0.1% | | | | | | | | | | | | |

Smurfit Kappa Group PLC | | | | | | | 211,800 | | | | 4,950,427 | |

Netherlands — 0.1% | | | | | | | | | | | | |

NXP Semiconductor NV | | | | | | | 125,135 | | | | 6,050,277 | |

United Kingdom — 0.0% | | | | | | | | | | | | |

International Consolidated Airlines Group (c) | | | | | | | 50,585 | | | | 346,514 | |

United States — 0.5% | | | | | | | | | | | | |

Apple, Inc. | | | | | | | 19,321 | | | | 9,672,093 | |

Atmel Corp. (c) | | | | | | | 64,445 | | | | 538,760 | |

CSX Corp. | | | | | | | 56,450 | | | | 1,519,069 | |

Deere & Co. | | | | | | | 8,650 | | | | 743,554 | |

EMC Corp. | | | | | | | 290,128 | | | | 7,032,703 | |

Oracle Corp. | | | | | | | 33,535 | | | | 1,237,441 | |

The Western Union Co. | | | | | | | 147,505 | | | | 2,271,577 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 23,015,197 | |

Total Common Stocks — 0.8% | | | | | | | | | | | 39,959,881 | |

| | | | | | | | | | | | |

| Corporate Bonds | | | | | Par (000) | | | | |

Australia — 0.6% | | | | | | | | | | | | |

Virgin Australia Trust: | | | | | | | | | | | | |

Series 2013-1, Class B, 6.00%, 4/23/22 (a) | | | USD | | | | 5,030 | | | | 5,243,775 | |

Series 2013-1, Class C, 7.13%, 10/23/18 (a) | | | | | | | 11,620 | | | | 11,910,500 | |

Series 2013-1, Class D, 8.50%, 10/23/16 (a) | | | | | | | 10,730 | | | | 10,935,707 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 28,089,982 | |

Belgium — 0.2% | | | | | | | | | | | | |

Anheuser-Busch InBev NV, 4.00%, 9/24/25 | | | GBP | | | | 5,790 | | | | 9,760,698 | |

Bermuda — 0.2% | | | | | | | | | | | | |

Aircastle Ltd.: | | | | | | | | | | | | |

6.25%, 12/01/19 | | | USD | | | | 2,455 | | | | 2,642,194 | |

7.63%, 4/15/20 | | | | | | | 1,000 | | | | 1,132,500 | |

Digicel Ltd., 6.00%, 4/15/21 (a) | | | | | | | 4,175 | | | | 4,049,750 | |

Ingersoll-Rand Global Holding Co. Ltd., 2.88%, 1/15/19 (a) | | | | | | | 682 | | | | 686,329 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 8,510,773 | |

Canada — 0.7% | | | | | | | | | | | | |

Air Canada, 6.75%, 10/01/19 (a) | | | | | | | 8,000 | | | | 8,540,000 | |

Air Canada Pass-Through Trust: | | | | | | | | | | | | |

Series 2013-1, Class B, 5.38%, 11/15/22 (a) | | | | | | | 2,000 | | | | 2,000,000 | |

Series 2013-1, Class C, 6.63%, 5/15/18 (a) | | | | | | | 3,045 | | | | 3,077,581 | |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

Canada (concluded) | | | | | | | | | | | | |

Barrick Gold Corp.: | | | | | | | | | | | | |

3.85%, 4/01/22 | | | USD | | | | 1,599 | | | $ | 1,492,700 | |

4.10%, 5/01/23 | | | | | | | 11,666 | | | | 10,768,966 | |

Ultra Petroleum Corp., 5.75%, 12/15/18 (a) | | | | | | | 1,882 | | | | 1,947,870 | |

Valeant Pharmaceuticals International,

6.75%, 8/15/18 (a) | | | | | | | 5,594 | | | | 6,132,423 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 33,959,540 | |

Cayman Islands — 0.6% | | | | | | | | | | | | |

Punch Taverns Finance B Ltd.: | | | | | | | | | | | | |

Series A3, 7.37%, 6/30/22 | | | GBP | | | | 1,023 | | | | 1,766,013 | |

Series A6, 5.94%, 12/30/24 | | | | | | | 3,963 | | | | 6,286,755 | |

Series A7, 4.77%, 6/30/33 | | | | | | | 4,027 | | | | 6,255,847 | |

Seagate HDD Cayman, 3.75%, 11/15/18 (a) | | | USD | | | | 10,050 | | | | 10,251,000 | |

Transocean, Inc.: | | | | | | | | | | | | |

6.50%, 11/15/20 | | | | | | | 300 | | | | 340,653 | |

6.38%, 12/15/21 | | | | | | | 850 | | | | 947,593 | |

Wynn Macau Ltd., 5.25%, 10/15/21 (a) | | | | | | | 3,555 | | | | 3,555,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 29,402,861 | |

Czech Republic — 0.0% | | | | | | | | | | | | |

RPG Byty Sro, 6.75%, 5/01/20 | | | EUR | | | | 811 | | | | 1,113,163 | |

Czechoslovakia — 0.1% | | | | | | | | | | | | |

CE Energy AS, 7.00%, 2/01/21 | | | | | | | 5,565 | | | | 7,505,563 | |

Denmark — 0.6% | | | | | | | | | | | | |

Allianz SE, 5.05%, 10/24/70 | | | | | | | 7,000 | | | | 9,728,839 | |

Deutsche Pfandbriefbank AG, 2.96%, 9/11/17 | | | | | | | 13,550 | | | | 18,649,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 28,377,839 | |

Finland — 0.2% | | | | | | | | | | | | |

Citycon Oyj, 3.75%, 6/24/20 | | | | | | | 6,380 | | | | 8,917,974 | |

France — 2.0% | | | | | | | | | | | | |

Autoroutes du Sud de la France SA, 2.95%, 1/17/24 | | | | | | | 20,200 | | | | 27,595,360 | |

BPCE SA, 5.15%, 7/21/24 (a) | | | USD | | | | 16,209 | | | | 15,931,664 | |

Electricite de France: | | | | | | | | | | | | |

2.75%, 3/10/23 | | | EUR | | | | 800 | | | | 1,103,136 | |

6.00%, 1/22/99 (a) | | | USD | | | | 15,000 | | | | 15,064,455 | |

Eutelsat SA, 3.13%, 10/10/22 | | | EUR | | | | 1,100 | | | | 1,505,192 | |

Gecina SA, 2.88%, 5/30/23 | | | | | | | 2,200 | | | | 2,921,928 | |

Imerys SA, 2.50%, 11/26/20 | | | | | | | 6,200 | | | | 8,473,710 | |

Plastic Omnium SA, 2.88%, 5/29/20 | | | | | | | 13,300 | | | | 17,918,631 | |

Societe Des Autoroutes Paris-Rhin-Rhone, 2.25%, 1/16/20 | | | | | | | 5,300 | | | | 7,249,659 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 97,763,735 | |

Germany — 2.0% | | | | | | | | | | | | |

Bayerische Landesbank, 4.50%, 2/07/19 (b) | | | | | | | 3,950 | | | | 5,078,077 | |

Commerzbank AG: | | | | | | | | | | | | |

3.63%, 7/10/17 | | | | | | | 4,490 | | | | 6,516,359 | |

7.75%, 3/16/21 | | | | | | | 14,400 | | | | 22,140,401 | |

8.13%, 9/19/23 (a) | | | USD | | | | 7,614 | | | | 8,356,365 | |

FTE Verwaltungs GmbH, 9.00%, 7/15/20 | | | EUR | | | | 4,980 | | | | 7,421,809 | |

HSH Nordbank AG: | | | | | | | | | | | | |

1.02%, 2/14/17 (b) | | | | | | | 5,423 | | | | 5,591,589 | |

1.06%, 2/14/17 (b) | | | | | | | 9,248 | | | | 9,523,027 | |

Muenchener Rueckversicherungs AG,

6.00%, 5/26/41 (b) | | | | | | | 1,100 | | | | 1,740,271 | |

ThyssenKrupp AG, 4.00%, 8/27/18 | | | | | | | 3,200 | | | | 4,510,082 | |

Volkswagen Leasing GmbH, 2.63%, 1/15/24 | | | | | | | 19,895 | | | | 27,063,318 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 97,941,298 | |

See Notes to Financial Statements.

| | | | | | |

| 16 | | BLACKROCK FUNDS | | JANUARY 31, 2014 | | |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Global Long/Short Credit Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

Guernsey — 0.2% | | | | | | | | | | | | |

Doric Nimrod Air Finance Alpha Ltd. Pass-Through Trust, 5.25%, 5/30/23 (a) | | | USD | | | | 8,700 | | | $ | 8,917,500 | |

Ireland — 1.6% | | | | | | | | | | | | |

AIB Mortgage Bank: | | | | | | | | | | | | |

4.88%, 6/29/17 | | | EUR | | | | 5,586 | | | | 8,326,587 | |

2.63%, 7/28/17 | | | | | | | 1,390 | | | | 1,931,921 | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc., 6.25%, 1/31/19 (a) | | | USD | | | | 2,649 | | | | 2,678,801 | |

Bank of Ireland, 3.25%, 1/15/19 | | | EUR | | | | 22,987 | | | | 31,398,050 | |

Bank of Ireland Mortgage Bank, 3.63%, 10/02/20 | | | | | | | 2,750 | | | | 3,995,024 | |

Cloverie PLC for Zurich Insurance Co. Ltd., 7.50%, 7/24/39 (b) | | | | | | | 7,150 | | | | 11,763,937 | |

CRH Finance Ltd., 3.13%, 4/03/23 | | | | | | | 2,675 | | | | 3,687,744 | |

DEPFA Bank PLC, 0.98%, 12/15/15 (b) | | | | | | | 14,007 | | | | 17,380,053 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 81,162,117 | |

Italy — 5.9% | | | | | | | | | | | | |

A2A SpA, 4.38%, 1/10/21 | | | | | | | 6,050 | | | | 8,874,096 | |

ACEA SpA, 3.75%, 9/12/18 | | | | | | | 6,300 | | | | 9,090,200 | |

Assicurazioni Generali SpA, 2.88%, 1/14/20 | | | | | | | 6,965 | | | | 9,540,298 | |

Astaldi SpA, 7.13%, 12/01/20 | | | | | | | 3,480 | | | | 4,904,714 | |

Banca Monte dei Paschi di Siena SpA, 4.88%, 9/15/16 | | | | | | | 5,122 | | | | 7,316,823 | |

Banca Popolare dell’Emilia Romagna SC, 3.38%, 10/22/18 | | | | | | | 12,100 | | | | 16,761,629 | |

Credito Emiliano SpA, 3.25%, 7/09/20 | | | | | | | 3,560 | | | | 5,027,049 | |

Gtech SpA, 3.50%, 3/05/20 | | | | | | | 1,000 | | | | 1,426,219 | |

Intesa Sanpaolo SpA: | | | | | | | | | | | | |

3.00%, 1/28/19 | | | | | | | 19,120 | | | | 26,070,092 | |

5.25%, 1/12/24 | | | USD | | | | 20,000 | | | | 20,253,140 | |

3.25%, 2/10/26 | | | EUR | | | | 10,400 | | | | 14,153,089 | |

IVS F. SpA, 7.13%, 4/01/20 | | | | | | | 4,211 | | | | 5,949,184 | |

Mediaset SpA, 5.13%, 1/24/19 | | | | | | | 7,085 | | | | 9,959,325 | |

Mediobanca SpA, 3.63%, 10/17/23 | | | | | | | 11,905 | | | | 16,904,474 | |

Snai SpA, 7.63%, 6/15/18 | | | | | | | 2,475 | | | | 3,379,779 | |

Telecom Italia SpA: | | | | | | | | | | | | |

6.38%, 6/24/19 | | | GBP | | | | 6,600 | | | | 11,504,786 | |

4.50%, 1/25/21 | | | EUR | | | | 14,755 | | | | 19,935,459 | |

5.88%, 5/19/23 | | | GBP | | | | 5,650 | | | | 9,175,830 | |

UniCredit SpA: | | | | | | | | | | | | |

3.25%, 1/14/21 | | | EUR | | | | 22,694 | | | | 30,584,638 | |

6.95%, 10/31/22 | | | | | | | 2,920 | | | | 4,328,508 | |

5.90%, 10/28/25 (b) | | | | | | | 23,290 | | | | 32,549,145 | |

Unione di Banche Italiane SCPA: | | | | | | | | | | | | |

3.25%, 10/14/20 | | | | | | | 7,715 | | | | 10,847,824 | |

3.13%, 2/05/24 | | | | | | | 9,530 | | | | 12,846,638 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 291,382,939 | |

Jersey — 0.6% | | | | | | | | | | | | |

AA Bond Co. Ltd.: | | | | | | | | | | | | |

9.50%, 7/31/19 | | | GBP | | | | 2,430 | | | | 4,403,130 | |

6.27%, 7/31/25 | | | | | | | 7,055 | | | | 13,052,872 | |

Atrium European Real Estate Ltd., 4.00%, 4/20/20 | | | EUR | | | | 3,570 | | | | 4,907,047 | |

Enterprise Funding Ltd., 3.50%, 9/10/20 (d) | | | GBP | | | | 3,000 | | | | 5,656,656 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 28,019,705 | |

Luxembourg — 2.8% | | | | | | | | | | | | |

Aguila 3 SA, 7.88%, 1/31/18 (a) | | | USD | | | | 3,310 | | | | 3,512,737 | |

Altice Financing SA, 6.50%, 1/15/22 (a) | | | | | | | 6,075 | | | | 6,166,125 | |