UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05742

Name of Fund: BlackRock Funds

BlackRock All-Cap Energy & Resources Portfolio

BlackRock Emerging Markets Dividend Fund

BlackRock Energy & Resources Portfolio

BlackRock Flexible Equity Fund

BlackRock Global Opportunities Portfolio

BlackRock Health Sciences Opportunities Portfolio

BlackRock International Opportunities Portfolio

BlackRock Managed Volatility Portfolio

BlackRock Mid-Cap Growth Equity Portfolio

BlackRock Science & Technology Opportunities Portfolio

BlackRock Small Cap Growth Equity Portfolio

BlackRock U.S. Opportunities Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2014

Date of reporting period: 03/31/2014

Item 1 – Report to Stockholders

MARCH 31, 2014

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

BlackRock FundsSM

„ BlackRock All-Cap Energy & Resources Portfolio

„ BlackRock Emerging Markets Dividend Fund

„ BlackRock Energy & Resources Portfolio

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | | | | | |

| 2 | | BLACKROCK FUNDS | | MARCH 31, 2014 | | |

Shareholder Letter

Dear Shareholder,

One year ago, U.S. financial markets were improving despite a sluggish global economy, as easy monetary policy provided investors with enough conviction to take on more risk in their portfolios. Slow but positive growth in the U.S. was sufficient to support corporate earnings, while uncomfortably high unemployment reinforced expectations that the Federal Reserve would continue to maintain its aggressive monetary stimulus programs.

Sentiment swiftly reversed in May when then-Fed Chairman Bernanke first mentioned the possibility of reducing (or “tapering”) the central bank’s asset purchase programs – comments that were widely misinterpreted as signaling an end to the Fed’s zero-interest-rate policy. U.S. Treasury yields rose sharply, triggering a steep sell-off across fixed income markets. (Bond prices move in the opposite direction of yields.) Global equities also suffered as investors feared the implications of a potential end to a program that had greatly supported the markets. Emerging markets, which are more sensitive to changes in global liquidity, were particularly hurt by the prospect of ebbing cash flows from the U.S. Markets rebounded in late June, however, when the Fed’s tone turned more dovish, and improving economic indicators and better corporate earnings helped extend gains through most of the summer.

Although the tone of economic and financial news was mixed during the autumn, it was a surprisingly positive period for most asset classes. Early on, the Fed defied market expectations with its decision to delay tapering, but higher volatility returned in late September when the U.S. Treasury Department warned that the national debt would soon breach its statutory maximum. The ensuing political brinksmanship led to a partial government shutdown, roiling global financial markets through the first half of October. Equities and other so-called “risk assets” managed to resume their rally when politicians engineered a compromise to reopen the government and extend the debt ceiling.

The remainder of 2013 was generally positive for stock markets in the developed world, although investors continued to grapple with uncertainty about when and how much the Fed would scale back on stimulus. When the Fed ultimately announced its tapering plans in mid-December, markets reacted positively, as this action signaled the Fed’s perception of real improvement in the economy, and investors were finally relieved from the anxiety that had gripped them for quite some time.

The start of the new year brought another turn in sentiment, as heightened risks in emerging markets and mixed U.S. economic data caused global equities to weaken in January while bond markets found renewed strength. Although these headwinds persisted, equities were back on the rise in February as investors were encouraged by a one-year extension of the U.S. debt ceiling and market-friendly comments from the Fed’s new Chairwoman, Janet Yellen. While U.S. economic data pointed to softer growth, investors viewed this trend as temporarily driven by poor winter weather and continued adding risk to their portfolios on the belief that growth would pick up in the coming months. In March, markets focused on decelerating growth in China and tensions between Russia and Ukraine over the disputed region of Crimea. Additionally, investors were caught off guard by a statement from Chairwoman Yellen indicating that the Fed may raise short-term interest rates earlier than the markets had previously forecasted. Bond markets came under pressure as the middle of the yield curve vaulted higher in response to the unexpected shift in forward guidance.

Against a backdrop of modest economic growth, investors over the past year remained highly attuned to potential changes in monetary policy. Despite the fact that markets were gearing up for a modest shift toward tighter conditions from the Fed, equity markets in the developed world generated strong returns for the six- and 12-month periods ended March 31, with stocks in the United States performing particularly well. In contrast, emerging markets were weighed down by concerns about reduced global liquidity, severe currency weakness, high levels of debt and uneven growth.

Interest rate uncertainty posed a headwind for fixed income assets, and higher-quality sectors of the market experienced heightened volatility and poor performance over the reporting period. High yield bonds, however, benefited from income-oriented investors’ search for yield in the overall low-rate environment. Short-term interest rates remained near zero, keeping yields on money market securities close to historic lows.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit www.blackrock.com for further insight about investing in today’s world.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

In a modest global growth environment, expectations around monetary policy changes continued to be a key theme in financial market performance.

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of March 31, 2014 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities (S&P 500® Index) | | | 12.51 | % | | | 21.86 | % |

U.S. small cap equities (Russell 2000® Index) | | | 9.94 | | | | 24.90 | |

International equities (MSCI Europe, Australasia, Far East Index) | | | 6.41 | | | | 17.56 | |

Emerging market equities (MSCI Emerging Markets Index) | | | 1.39 | | | | (1.43 | ) |

3-month Treasury bill (BofA Merrill Lynch

3-Month U.S. Treasury Bill Index) | | | 0.03 | | | | 0.07 | |

U.S. Treasury securities (BofA Merrill Lynch 10- Year U.S. Treasury Index) | | | 0.85 | | | | (4.38 | ) |

U.S. investment grade bonds (Barclays U.S. Aggregate Bond Index) | | | 1.70 | | | | (0.10 | ) |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | | 3.91 | | | | 0.31 | |

U.S. high yield bonds (Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | | 6.66 | | | | 7.53 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | | | |

| Fund Summary as of March 31, 2014 | | | BlackRock All-Cap Energy & Resources Portfolio | |

BlackRock All-Cap Energy & Resources Portfolio’s (the “Fund”) investment objective is to provide long-term growth of capital.

Effective March 17, 2014, the Fund’s performance benchmarks changed from the S&P 500® Index and a customized weighted index, comprised of 70% Wilshire 5000 Modified Energy Cap Weighted Index and 30% MSCI All-Country World Energy Index, to solely the MSCI World Energy Index. The investment advisor believes that this change in the performance benchmark more accurately reflects the investment strategy of the Fund.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended March 31, 2014, the Fund underperformed the MSCI World Energy Index and its former benchmarks, the S&P 500® Index and the customized weighted index. The following discussion of relative performance pertains to the MSCI World Energy Index. |

What factors influenced performance?

| Ÿ | | The Fund’s position in Cairn Energy PLC, a global oil & gas exploration & production company, detracted from performance as the company came under scrutiny from the Indian tax authority due to a matter relating to the initial public offering of their Indian subsidiary, Cairn India, in 2006. India’s tax authority cited retrospective legislation introduced in 2012 regarding the taxation of indirect transfers of Indian assets as the reason for the investigation. Also having a negative impact on results was the Fund’s overweight position in U.S. integrated energy company Chevron Corp. as the company posted disappointing earnings results for the fourth quarter of 2013. |

| Ÿ | | Conversely, the Fund’s position in Phillips 66, a refiner engaged in producing natural gas liquids and petrochemicals, aided relative performance over the six-month period. The company has benefited from the discount between the price of their crude oil inputs (linked to domestic U.S. prices) and the price of the refined product outputs (linked to international |

| | | prices). Southwestern Energy Co. was also a notable contributor as a higher average natural gas price provided an improved earnings outlook for gas producers. |

Describe recent portfolio activity.

| Ÿ | | Early in the six-month period, the Fund reduced exposure to oil services while increasing exposure to integrated and exploration & production companies based on attractive valuations. In the latter half of the period, the Fund rotated exposure within the integrated energy segment, exiting positions in Hess Corp. and Eni SpA on the back of their strong 2013 performance, and initiating a position in Statoil ASA. Additionally, the Fund added a new position in Cimarex Energy Co., a U.S. exploration & production company located in the Permian basin. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, nearly half of the Fund’s net assets were invested in integrated oil & gas companies. The Fund also held a large exposure to the oil & gas exploration & production segment with a focus on companies that exhibit the ability to meet or exceed market expectations in terms of earnings and costs and have the potential to surprise on the upside through their development and exploration projects. The Fund maintained a meaningful allocation to oil services as well. The remainder of the Fund was invested in distribution companies, coal and uranium stocks, and names in the oil & gas refining & marketing space. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | |

| Ten Largest Holdings | | Percent of Long-Term Investments | |

Chevron Corp. | | | 11 | % |

Exxon Mobil Corp. | | | 10 | |

Royal Dutch Shell PLC - ADR | | | 9 | |

ConocoPhillips | | | 7 | |

Schlumberger Ltd. | | | 5 | |

BP PLC | | | 5 | |

Anadarko Petroleum Corp. | | | 5 | |

Noble Energy, Inc. | | | 4 | |

EOG Resources, Inc. | | | 4 | |

Statoil ASA | | | 3 | |

| | | | |

| Industry Allocation | | Percent of Long-Term Investments | |

Oil, Gas & Consumable Fuels | | | 91 | % |

Energy Equipment & Services | | | 9 | |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| 4 | | BLACKROCK FUNDS | | MARCH 31, 2014 | | |

| | | | |

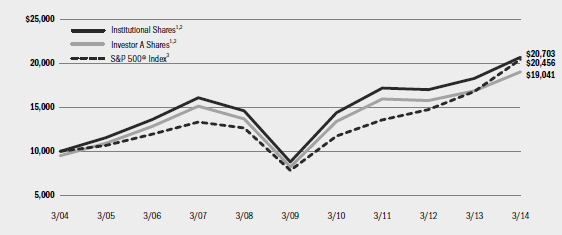

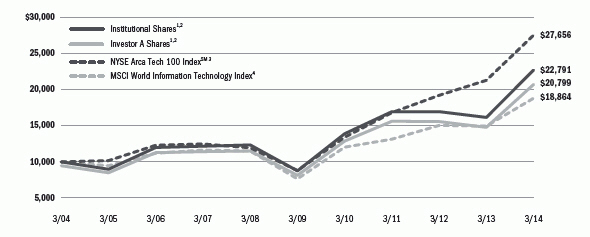

| | | | BlackRock All-Cap Energy & Resources Portfolio | |

| | |

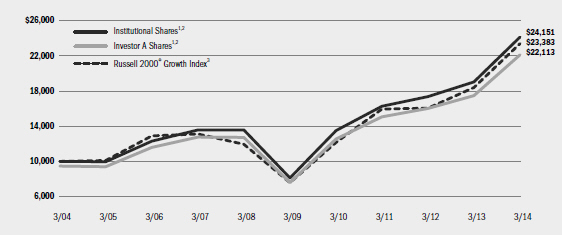

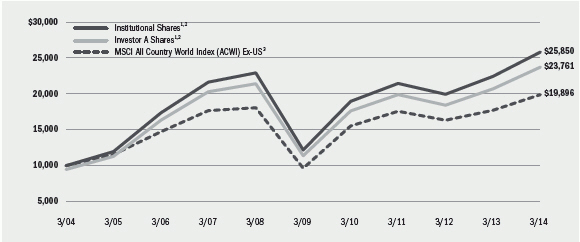

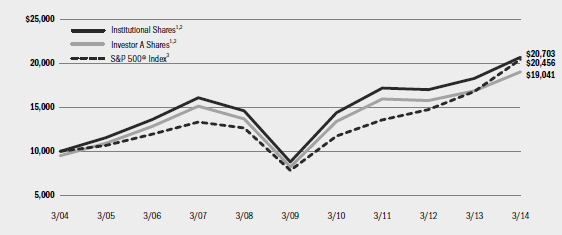

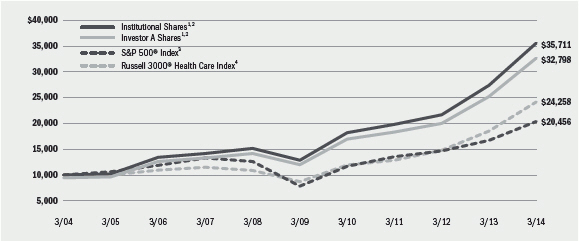

| Total Return Based on a $10,000 Investment | | |

| | |

| | 1 Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. 2 Under normal market conditions, the Fund invests at least 80% of its total assets in equity securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and tele-communications utilities). |

| | 3 | This unmanaged total return index covers 500 industrial, utility, transportation and financial companies of the U.S. markets (mostly New York Stock Exchange (“NYSE”) issues) representing about 75% of NYSE market capitalization and 30% of NYSE issues. |

| | 4 | The Wilshire 5000 Modified Energy Cap Weighted Index is a customized index comprised of the energy sector constituents of the Wilshire 5000 (Full Cap) Index, which have been market capitalization weighted and the six largest securities and all securities that have a percentage market value below 0.01% have been removed. |

| | 5 | The MSCI All-Country World Energy Index is comprised of the energy sector constituents of the MSCI All-Country World Index, a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets. |

| | 6 | An index comprised of the energy sector constituents of the MSCI World Index, a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed markets. Effective March 17, 2014, the Fund now uses this index as its benchmark rather than the S&P 500® Index and a customized weighted index, comprised of 70% Wilshire 5000 Modified Energy Cap Weighted Index and 30% MSCI All-Country World Energy Index because management believes that this benchmark better represents the sector exposures of the Fund and is a more appropriate basis for evaluating performance. |

| | 7 | Commencement of operations. |

|

| Performance Summary for the Period Ended March 31, 2014 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns8 | |

| | | | | | 1 Year | | | 5 Years | | | Since Inception9 | |

| | | 6-Month Total Returns | | | w/o sales charge | | | w/ sales charge | | | w/o sales charge | | | w/ sales

charge | | | w/o sales charge | | | w/ sales

charge | |

Institutional | | | 4.92 | % | | | 15.25 | % | | | N/A | | | | 14.46 | % | | | N/A | | | | 8.26 | % | | | N/A | |

Service | | | 4.63 | | | | 14.73 | | | | N/A | | | | 14.00 | | | | N/A | | | | 7.83 | | | | N/A | |

Investor A | | | 4.69 | | | | 14.73 | | | | 8.71 | % | | | 13.97 | | | | 12.75 | % | | | 7.82 | | | | 7.18 | % |

Investor B | | | 4.26 | | | | 13.89 | | | | 9.39 | | | | 13.14 | | | | 12.89 | | | | 7.12 | | | | 7.12 | |

Investor C | | | 4.33 | | | | 13.94 | | | | 12.94 | | | | 13.15 | | | | 13.15 | | | | 7.05 | | | | 7.05 | |

S&P 500® Index | | | 12.51 | | | | 21.86 | | | | N/A | | | | 21.16 | | | | N/A | | | | 7.13 | | | | N/A | |

70% Wilshire 5000 Modified Energy Cap Weighted Index / 30% MSCI All-Country World Energy Index | | | 9.74 | | | | 15.04 | | | | N/A | | | | 19.60 | | | | N/A | | | | 10.75 | | | | N/A | |

MSCI World Energy Index | | | 8.72 | | | | 14.07 | | | | N/A | | | | 13.52 | | | | N/A | | | | 7.40 | | | | N/A | |

| | 8 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees. |

| | 9 | The Fund commenced operations on February 16, 2005. |

| | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | |

| | | Actual | | Hypothetical11 | | |

| | | Beginning Account Value October 1, 2013 | | Ending Account Value March 31, 2014 | | Expenses Paid During the Period10 | | Beginning Account Value October 1, 2013 | | Ending Account Value March 31, 2014 | | Expenses Paid During the Period10 | | Annualized Expense Ratio |

Institutional | | $1,000.00 | | $1,049.20 | | $4.90 | | $1,000.00 | | $1,020.14 | | $4.84 | | 0.96% |

Service | | $1,000.00 | | $1,046.30 | | $7.04 | | $1,000.00 | | $1,018.05 | | $6.94 | | 1.38% |

Investor A | | $1,000.00 | | $1,046.90 | | $7.04 | | $1,000.00 | | $1,018.05 | | $6.94 | | 1.38% |

Investor B | | $1,000.00 | | $1,042.60 | | $10.69 | | $1,000.00 | | $1,014.46 | | $10.55 | | 2.10% |

Investor C | | $1,000.00 | | $1,043.30 | | $10.70 | | $1,000.00 | | $1,014.46 | | $10.55 | | 2.10% |

| | 10 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 11 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | See “Disclosure of Expenses” on page 11 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2014 | | 5 |

| | | | |

| Fund Summary as of March 31, 2014 | | | BlackRock Emerging Markets Dividend Fund | |

BlackRock Emerging Markets Dividend Fund’s (the “Fund”) investment objective is primarily to seek investment income and, as a secondary objective, to seek capital appreciation.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended March 31, 2014, the Fund underperformed its benchmark, the MSCI Emerging Markets Index. |

What factors influenced performance?

| Ÿ | | Relative to the benchmark index, the Fund’s underweight to India and stock selection in Russia hurt performance during the period. On a sector basis, stock selection in telecommunication services (“telecom”), consumer staples and materials detracted from returns. The largest individual detractor for the period was a position in Lukoil OAO, which suffered due to geopolitical tensions in Russia and Ukraine. |

| Ÿ | | Conversely, stock selection in South Korea, China and Taiwan contributed positively to relative performance. Additionally, stock selection in the energy and consumer discretionary sectors had a positive impact. The largest individual contributor to returns was Macau casino operator Sands China Ltd., which continued to benefit from growth in gaming revenues and a positive outlook for growth in the mass market. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Fund increased exposure to financials. Specifically, the Fund purchased Brazilian bank Itau Unibanco Holding SA given a positive outlook for improving asset quality and diminishing |

| | non-performing loans in the sector. In addition, the Fund added to positions in Kasikornbank PCL in Thailand and Powszechny Zaklad Ubezpieczen SA in Poland. In other sectors, the Fund reduced its position in Tata Motors Ltd. due to concerns about increased capital expenditures. The Fund also exited a holding in Brazilian exchange BM&FBovespa SA as the company suffered from weaker trading volumes in both equities and derivatives. A position in Copa Holdings SA was eliminated given concerns about the company’s currency exposure given its cash balance in Venezuela. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the MSCI Emerging Markets Index, the Fund ended the period with overweight exposures to Mexico and the Philippines. The Fund held a structural underweight in Korea given low dividend yields in that market. Other significant underweights included India and China. From a sector perspective, the Fund was overweight in industrials, telecom and consumer staples, and underweight in information technology and energy. The investment advisor continues to monitor a number of factors that may drive growth in emerging markets including corporate earnings growth, net exports and government reform in a number of developing countries. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | |

| Ten Largest Holdings | | Percent of Long-Term Investments | |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 4 | % |

Lukoil OAO - ADR | | | 4 | |

Powszechny Zaklad Ubezpieczen SA | | | 3 | |

CCR SA | | | 3 | |

Itau Unibanco Holding SA - ADR | | | 3 | |

China Petroleum & Chemical Corp., H Shares | | | 3 | |

Kimberly-Clark de Mexico SAB de CV, Class A | | | 3 | |

Philippine Long Distance Telephone Co. - ADR | | | 2 | |

China Merchants Holdings International Co. Ltd | | | 2 | |

BB Seguridade Participacoes SA | | | 2 | |

| | | | |

| Geographic Allocation | | Percent of Long-Term Investments | |

China | | | 15 | % |

Brazil | | | 14 | |

Taiwan | | | 12 | |

Mexico | | | 10 | |

South Africa | | | 7 | |

Russia | | | 5 | |

Thailand | | | 5 | |

South Korea | | | 5 | |

Philippines | | | 5 | |

Poland | | | 3 | |

Indonesia | | | 3 | |

Other1 | | | 16 | |

| 1 | Includes holdings within countries that are 2% or less of long-term investments. Please refer to the Schedule of Investments for such countries. |

| | | | | | |

| 6 | | BLACKROCK FUNDS | | MARCH 31, 2014 | | |

| | | | |

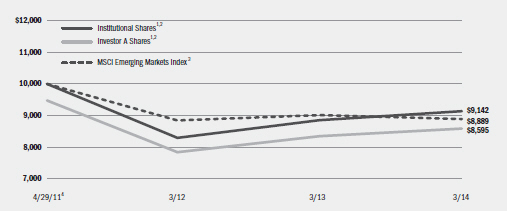

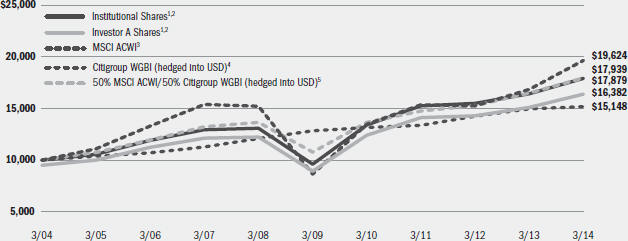

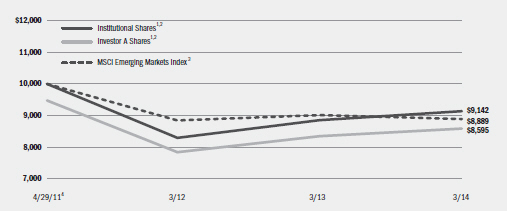

| | | | BlackRock Emerging Markets Dividend Fund | |

|

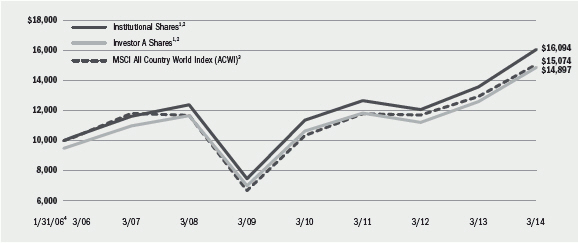

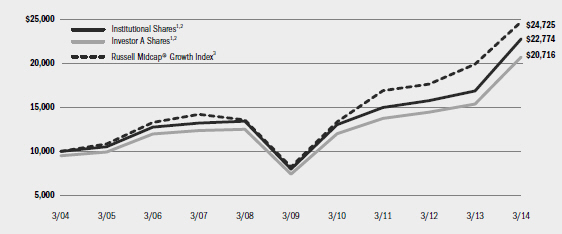

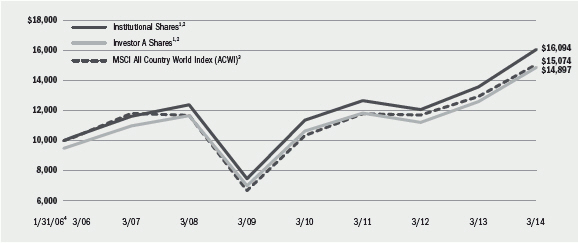

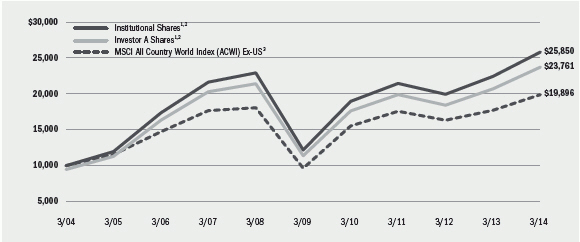

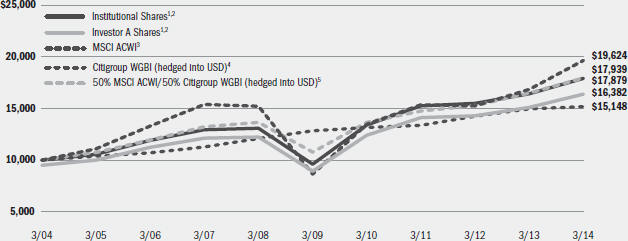

| Total Return Based on a $10,000 Investment |

| | |

| | 1 Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. The Fund’s total returns prior to August 16, 2013, are the returns of the Fund when it followed different investment strategies under the name BlackRock China Fund. |

| | 2 | Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in dividend-paying equity securities of, or derivatives having economic characteristics similar to the dividend-paying equity securities of, companies domiciled in, or tied economically to, emerging market countries and at least 80% of its net assets (plus any borrowings for investment purposes) in dividend paying securities. |

| | 3 | A free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey. |

| | 4 | Commencement of operations. |

| | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended March 31, 2014 | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | Since Inception6 | |

| | | 6-Month Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | | (0.66 | )% | | | 3.16 | % | | | N/A | | | | (3.02 | )% | | | N/A | |

Investor A | | | (0.84 | ) | | | 2.87 | | | | (2.53 | )% | | | (3.28 | ) | | | (5.05 | )% |

Investor C | | | (1.21 | ) | | | 2.14 | | | | 1.14 | | | | (3.95 | ) | | | (3.95 | ) |

MSCI Emerging Markets Index | | | 1.39 | | | | (1.43 | ) | | | N/A | | | | (3.95 | ) | | | N/A | |

| | 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | The Fund commenced operations on April 29, 2011. |

| | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical8 | | |

| | | Beginning Account Value October 1, 2013 | | Ending Account Value March 31, 2014 | | Expenses Paid During the Period7 | | Beginning Account Value October 1, 2013 | | Ending Account Value March 31, 2014 | | Expenses Paid

During the Period7 | | Annualized Expense Ratio |

Institutional | | $1,000.00 | | $993.40 | | $7.55 | | $1,000.00 | | $1,017.35 | | $7.64 | | 1.52% |

Investor A | | $1,000.00 | | $991.60 | | $8.74 | | $1,000.00 | | $1,016.16 | | $8.85 | | 1.76% |

Investor C | | $1,000.00 | | $987.90 | | $12.49 | | $1,000.00 | | $1,012.37 | | $12.64 | | 2.52% |

| | 7 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 8 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | See “Disclosure of Expenses” on page 11 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2014 | | 7 |

| | | | |

| Fund Summary as of March 31, 2014 | | | BlackRock Energy & Resources Portfolio | |

BlackRock Energy & Resources Portfolio’s (the “Fund”) investment objective is to provide long-term growth of capital.

Effective March 17, 2014, the Fund’s performance benchmarks changed from the S&P 500® Index and the Wilshire 5000 Modified Energy Equal Weighted Index, to solely the MSCI World Small and Mid-Cap Energy Index. The investment advisor believes that this change in the performance benchmark more accurately reflects the investment strategy of the Fund.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended March 31, 2014, all classes outperformed the MSCI World Small and Mid-Cap Energy Index but underperformed its former benchmarks, the S&P 500® Index and the Wilshire 5000 Modified Energy Equal Weighted Index. The following discussion of relative performance pertains to the MSCI World Small and Mid-Cap Energy Index. |

What factors influenced performance?

| Ÿ | | Relative to the benchmark index, the Fund’s overweight in Cairn Energy PLC, a global oil & gas exploration & production company, detracted from performance as the company came under scrutiny from the Indian tax authority due to a matter relating to the initial public offering of their Indian subsidiary, Cairn India, in 2006. India’s tax authority cited retrospective legislation introduced in 2012 regarding the taxation of indirect transfers of Indian assets as the reason for the investigation. The Fund’s performance was also hurt by exposure to U.S. onshore exploration & production stocks that declined as investors took profits on these names following a period of their strong performance. In particular, holdings in Rosetta Resources, Inc., Gulfport Energy Corp. and Trilogy Energy Corp. detracted from returns. |

| Ÿ | | Conversely, a position in Helmerich & Payne, Inc. a U.S. oil services company, contributed positively to performance. The company has benefited from the development of unconventional resources driving increased demand for onshore drilling rigs in the U.S. The Fund’s position in Clayton Williams Energy, Inc., a U.S.-based exploration & production company, buoyed performance after the firm posted strong third-quarter results and a positive operational update. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Fund continued reducing positions in companies with coal exposure. Within the exploration & production space, the Fund initiated positions in Cimarex Energy Co. and RSP Permian, Inc., two North American companies. In the integrated space, the Fund initiated a position in Murphy Oil Corp. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Fund was invested mostly in oil & gas exploration & production companies while maintaining underweight exposures in the oil services and refining & marketing segments. The investment advisor maintains caution on oil services given ongoing rhetoric from integrated oil & gas companies regarding their capital expenditure discipline. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | |

| Ten Largest Holdings | | Percent of Long-Term Investments | |

Cimarex Energy Co. | | | 5 | % |

CONSOL Energy, Inc. | | | 5 | |

Helmerich & Payne, Inc. | | | 4 | |

Southwestern Energy Co. | | | 4 | |

EOG Resources, Inc. | | | 4 | |

Superior Energy Services, Inc. | | | 4 | |

AltaGas Ltd. | | | 4 | |

Cameron International Corp. | | | 3 | |

Pioneer Natural Resources Co. | | | 3 | |

Foster Wheeler AG | | | 3 | |

| | | | |

| Industry Allocation | | Percent of Long-Term Investments | |

Oil, Gas & Consumable Fuels | | | 79 | % |

Energy Equipment & Services | | | 15 | |

Construction & Engineering | | | 6 | |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| 8 | | BLACKROCK FUNDS | | MARCH 31, 2014 | | |

| | | | |

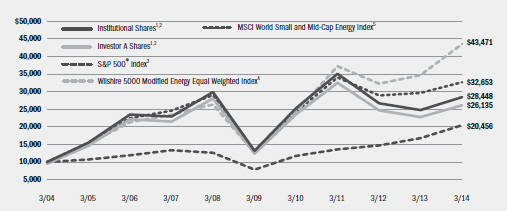

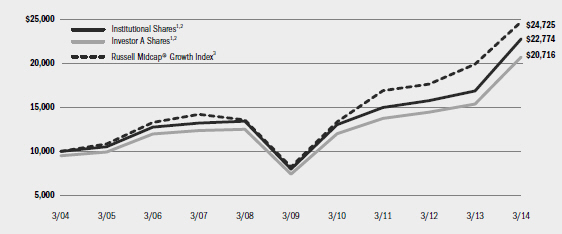

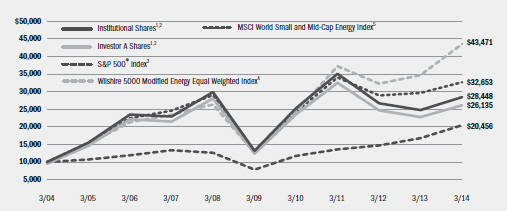

| | | | BlackRock Energy & Resources Portfolio | |

| | |

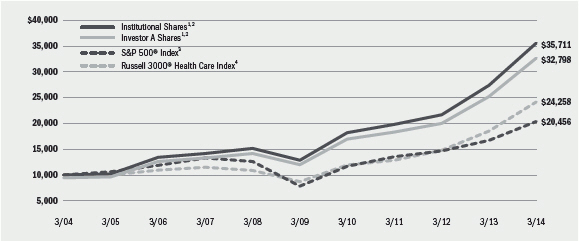

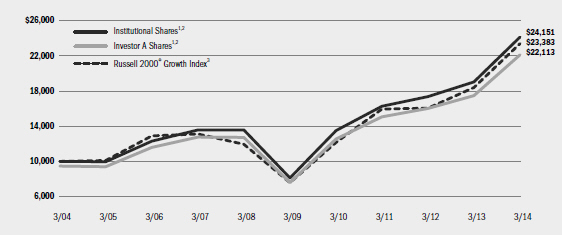

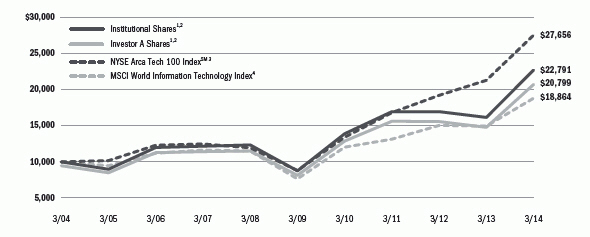

| Total Return Based on a $10,000 Investment | | |

| | |

| | 1 Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. 2 Under normal conditions, the Fund invests at least 80% of its total assets in equity securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). |

| | 3 | This unmanaged total return index covers 500 industrial, utility, transportation and financial companies of the U.S. markets (mostly New York Stock Exchange (“NYSE”) issues) representing about 75% of NYSE market capitalization and 30% of NYSE issues. |

| | 4 | The Wilshire 5000 Modified Energy Equal Weighted Index is a customized index comprised of the energy sector constituents of the Wilshire 5000 (Full Cap) Index, which have been equally weighted and the six largest securities and all securities that have a percentage market value below 0.01% have been removed. |

| | 5 | An index comprised of the energy sector constituents of the MSCI World SMID Index, a free float-adjusted market capitalization weighted index designed to measure the equity market performance of the mid and small cap developed market Effective March 17, 2014, the Fund now uses this index as its benchmark rather than the S&P 500 Index® and the Wilshire 5000 Modified Energy Equal Weighted Index because management believes that this benchmark better represents the sector exposures of the Fund and is a more appropriate basis for evaluating performance. |

| | | | | | | | | | | | | | |

| Performance Summary for the Period Ended March 31, 2014 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns6 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month Total Returns | | | w/o sales charge | | | w/ sales charge | | | w/o sales charge | | | w/ sales charge | | | w/o sales charge | | | w/ sales charge | |

Institutional | | | 6.00 | % | | | 14.98 | % | | | N/A | | | | 16.57 | % | | | N/A | | | | 11.02 | % | | | N/A | |

Investor A | | | 5.86 | | | | 14.67 | | | | 8.65 | % | | | 16.17 | | | | 14.93 | % | | | 10.68 | | | | 10.08 | % |

Investor B | | | 5.45 | | | | 13.81 | | | | 9.31 | | | | 15.29 | | | | 15.06 | | | | 10.03 | | | | 10.03 | |

Investor C | | | 5.46 | | | | 13.79 | | | | 12.79 | | | | 15.31 | | | | 15.31 | | | | 9.88 | | | | 9.88 | |

S&P 500® Index | | | 12.51 | | | | 21.86 | | | | N/A | | | | 21.16 | | | | N/A | | | | 7.42 | | | | N/A | |

Wilshire 5000 Modified Energy Equal Weighted Index | | | 17.59 | | | | 25.57 | | | | N/A | | | | 28.11 | | | | N/A | | | | 15.83 | | | | N/A | |

MSCI World Small and Mid-Cap Energy Index | | | 4.97 | | | | 10.38 | | | | N/A | | | | 20.48 | | | | N/A | | | | 12.56 | | | | N/A | |

| | 6 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees. |

| | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | |

| | | Actual | | Hypothetical8 | | |

| | | Beginning Account Value October 1, 2013 | | Ending Account Value March 31, 2014 | | Expenses Paid During the Period7 | | Beginning Account Value October 1, 2013 | | Ending Account Value March 31, 2014 | | Expenses Paid During the Period7 | | Annualized Expense Ratio |

Institutional | | $1,000.00 | | $1,060.00 | | $5.50 | | $1,000.00 | | $1,019.60 | | $5.39 | | 1.07% |

Investor A | | $1,000.00 | | $1,058.60 | | $6.83 | | $1,000.00 | | $1,018.30 | | $6.69 | | 1.33% |

Investor B | | $1,000.00 | | $1,054.50 | | $10.76 | | $1,000.00 | | $1,014.46 | | $10.55 | | 2.10% |

Investor C | | $1,000.00 | | $1,054.60 | | $10.76 | | $1,000.00 | | $1,014.46 | | $10.55 | | 2.10% |

| | 7 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 8 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | See “Disclosure of Expenses” on page 11 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2014 | | 9 |

| Ÿ | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| Ÿ | | Service Shares are not subject to any sales charge (front-end load) or deferred sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are only available to eligible investors. |

| Ÿ | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. |

| Ÿ | | Investor B Shares are subject to a maximum CDSC of 4.50% declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic share conversions.) All returns for periods greater than eight years reflect this conversion. These shares are only available through exchanges and dividend reinvestments by existing shareholders and for purchase by certain employer-sponsored retirement plans. |

| Ÿ | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the

performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in each of the performance tables on the previous pages assume reinvestment of all dividends and distributions, if any, at net asset value (“NAV”) on the ex-dividend/payable dates. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

Performance for the BlackRock Energy & Resources Portfolio for the periods prior to January 28, 2005 is based on performance of a certain former State Street Research mutual fund that reorganized with BlackRock Energy & Resources Portfolio on that date.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, waived and/or reimbursed a portion of each Fund’s expenses. Without such waiver and/or reimbursement, each Fund’s performance would have been lower. The Manager is under no obligation to waive or reimburse or to continue waiving or reimbursing its fees after the applicable termination date. See Note 5 of the Notes to Financial Statements for additional information on waivers and reimbursements.

| | | | | | |

| 10 | | BLACKROCK FUNDS | | MARCH 31, 2014 | | |

Shareholders of the Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on October 1, 2013 and held through March 31, 2014) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the headings entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

|

| Derivative Financial Instruments |

The Funds may invest in various derivative financial instruments, including forward foreign currency exchange contracts, as specified in Note 4 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to hedge market and/or foreign currency exchange rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Funds’ ability to use a derivative financial instrument

successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment, may result in lower dividends paid to shareholders and/or may cause a Fund to hold an investment that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2014 | | 11 |

| | | | |

| Schedule of Investments March 31, 2014 (Unaudited) | | | BlackRock All-Cap Energy & Resources Portfolio | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Energy Equipment & Services — 9.0% | | | | | | | | |

Cameron International Corp. (a) | | | 57,688 | | | $ | 3,563,388 | |

Halliburton Co. | | | 84,600 | | | | 4,982,094 | |

Schlumberger Ltd. | | | 103,941 | | | | 10,134,247 | |

| | | | | | | | |

| | | | | | | | 18,679,729 | |

Oil, Gas & Consumable Fuels — 89.0% | | | | | | | | |

Anadarko Petroleum Corp. | | | 112,500 | | | | 9,535,500 | |

BG Group PLC | | | 338,900 | | | | 6,326,988 | |

BP PLC | | | 1,251,235 | | | | 10,053,675 | |

Cairn Energy PLC (a) | | | 509,200 | | | | 1,417,997 | |

Canadian Oil Sands Ltd. | | | 81,704 | | | | 1,713,899 | |

Caracal Energy, Inc. (a) | | | 282,000 | | | | 1,631,362 | |

Chevron Corp. | | | 178,598 | | | | 21,237,089 | |

Cimarex Energy Co. | | | 46,000 | | | | 5,479,060 | |

ConocoPhillips | | | 189,700 | | | | 13,345,395 | |

CONSOL Energy, Inc. | | | 62,530 | | | | 2,498,073 | |

Devon Energy Corp. | | | 44,000 | | | | 2,944,920 | |

Enbridge, Inc. | | | 62,500 | | | | 2,838,648 | |

EOG Resources, Inc. | | | 40,770 | | | | 7,997,851 | |

Exxon Mobil Corp. | | | 205,700 | | | | 20,092,776 | |

Imperial Oil Ltd. | | | 54,000 | | | | 2,514,627 | |

Kosmos Energy Ltd. (a) | | | 225,314 | | | | 2,478,454 | |

Murphy Oil Corp. | | | 33,500 | | | | 2,105,810 | |

Noble Energy, Inc. | | | 125,400 | | | | 8,908,416 | |

Oil Search Ltd. | | | 616,287 | | | | 4,837,476 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (concluded) | | | | | | | | |

Phillips 66 | | | 55,200 | | | $ | 4,253,712 | |

Pioneer Natural Resources Co. | | | 11,100 | | | | 2,077,254 | |

Range Resources Corp. | | | 59,700 | | | | 4,953,309 | |

Royal Dutch Shell PLC — ADR | | | 258,300 | | | | 18,871,398 | |

Southwestern Energy Co. (a) | | | 142,900 | | | | 6,574,829 | |

Statoil ASA | | | 242,612 | | | | 6,845,230 | |

Total SA | | | 95,000 | | | | 6,253,369 | |

TransCanada Corp. | | | 138,900 | | | | 6,313,636 | |

| | | | | | | | |

| | | | | | | | 184,100,753 | |

Total Long-Term Investments (Cost — $165,453,327) — 98.0% | | | | 202,780,482 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.03% (b)(c) | | | 4,560,360 | | | | 4,560,360 | |

Total Short-Term Securities (Cost — $4,560,360) — 2.2% | | | | 4,560,360 | |

Total Investments (Cost — $170,013,687) — 100.2% | | | | | | | 207,340,842 | |

Liabilities in Excess of Other Assets — (0.2)% | | | | | | | (385,245 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 206,955,597 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | Investments in issuers considered to be an affiliate of the Fund during the six months ended March 31, 2014, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares/Beneficial Interest Held at

September 30, 2013 | | | Net Activity | | | Shares/Beneficial Interest Held at March 31, 2014 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 6,884,032 | | | | (2,323,672 | ) | | | 4,560,360 | | | $ | 1,094 | |

BlackRock Liquidity Series, LLC, Money Market Series | | $ | 4,708,251 | | | $ | (4,708,251 | ) | | | — | | | $ | 945 | |

|

| (c) Represents the current yield as of report date. |

| | | | |

| Portfolio Abbreviations |

ADR American Depositary Receipts | | MXN Mexican Peso | | PLN Polish Zloty |

CLP Chilean Peso | | NVDR Non-Voting Depository Receipts | | USD U.S. Dollar |

GDR Global Depositary Receipts | | | | |

See Notes to Financial Statements.

| | | | | | |

| 12 | | BLACKROCK FUNDS | | MARCH 31, 2014 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock All-Cap Energy & Resources Portfolio | |

| Ÿ | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| | Ÿ | | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments is based on the pricing transparency of the investment and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments, please refer to Note 2 of the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy as of March 31, 2014:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Energy Equipment & Services | | $ | 18,679,729 | | | | — | | | | — | | | $ | 18,679,729 | |

Oil, Gas & Consumable Fuels | | | 148,366,018 | | | $ | 35,734,735 | | | | — | | | | 184,100,753 | |

Short-Term Securities | | | 4,560,360 | | | | — | | | | — | | | | 4,560,360 | |

Total | | $ | 171,606,107 | | | $ | 35,734,735 | | | | — | | | $ | 207,340,842 | |

| | | | |

The carrying amount for certain of the Fund’s assets approximates fair value for financial statement purposes. As of March 31, 2014, foreign currency at value of $223,722 is categorized as Level 1 within the disclosure hierarchy.

There were no transfers between levels during the six months ended March 31, 2014.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2014 | | 13 |

| | | | |

| Schedule of Investments March 31, 2014 (Unaudited) | | | BlackRock Emerging Markets Dividend Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Brazil — 14.0% | | | | | | | | |

Ambev SA — ADR (a) | | | 9,441 | | | $ | 69,958 | |

BB Seguridade Participacoes SA | | | 8,732 | | | | 95,863 | |

CCR SA | | | 19,410 | | | | 147,906 | |

EDP — Energias do Brasil SA | | | 4,894 | | | | 21,979 | |

Itau Unibanco Holding SA — ADR | | | 9,579 | | | | 142,344 | |

Mahle-Metal Leve SA Industria e Comercio | | | 3,841 | | | | 40,374 | |

Marcopolo SA, Preference | | | 10,361 | | | | 20,777 | |

Vale SA — ADR | | | 5,252 | | | | 72,635 | |

Vale SA, Preference — ADR | | | 3,532 | | | | 43,973 | |

| | | | | | | | |

| | | | | | | | 655,809 | |

Cambodia — 0.9% | | | | | | | | |

NagaCorp Ltd. | | | 42,000 | | | | 43,847 | |

Chile — 1.6% | | | | | | | | |

Banco de Chile — ADR | | | 669 | | | | 50,362 | |

Cia Cervecerias Unidas SA — ADR | | | 1,173 | | | | 26,252 | |

| | | | | | | | |

| | | | | | | | 76,614 | |

China — 14.8% | | | | | | | | |

Bank of China Ltd., H Shares | | | 55,000 | | | | 24,435 | |

Beijing Capital International Airport Co. Ltd., H Shares | | | 66,000 | | | | 45,429 | |

China Hongqiao Group Ltd. | | | 134,000 | | | | 84,793 | |

China Merchants Holdings International Co. Ltd. | | | 30,000 | | | | 103,436 | |

China Petroleum & Chemical Corp., H Shares | | | 149,000 | | | | 133,275 | |

Great Wall Motor Co. Ltd., H Shares | | | 4,500 | | | | 22,670 | |

Hengan International Group Co. Ltd. | | | 6,500 | | | | 67,480 | |

Jiangsu Expressway Co. Ltd., H Shares | | | 66,000 | | | | 75,242 | |

Sands China Ltd. | | | 8,400 | | | | 62,999 | |

Want Want China Holdings Ltd. | | | 33,000 | | | | 49,372 | |

Yashili International Holdings Ltd. | | | 51,000 | | | | 23,057 | |

| | | | | | | | |

| | | | | | | | 692,188 | |

Cyprus — 0.7% | | | | | | | | |

Globaltrans Investment PLC — GDR | | | 2,905 | | | | 33,524 | |

Czech Republic — 1.0% | | | | | | | | |

Komercni Banka AS | | | 201 | | | | 48,030 | |

India — 2.1% | | | | | | | | |

Infosys Ltd. — ADR | | | 1,279 | | | | 69,296 | |

Tata Motors Ltd. — ADR | | | 761 | | | | 26,947 | |

| | | | | | | | |

| | | | | | | | 96,243 | |

Indonesia — 2.6% | | | | | | | | |

Bank Central Asia Tbk PT | | | 62,801 | | | | 58,983 | |

Media Nusantara Citra Tbk PT | | | 159,500 | | | | 37,281 | |

Semen Indonesia Persero Tbk PT | | | 16,728 | | | | 23,515 | |

| | | | | | | | |

| | | | | | | | 119,779 | |

Ireland — 1.1% | | | | | | | | |

Dragon Oil PLC | | | 5,396 | | | | 50,961 | |

Kazakhstan — 0.4% | | | | | | | | |

Kcell JSC — GDR | | | 1,523 | | | | 20,865 | |

Malaysia — 1.6% | | | | | | | | |

DiGi.Com Bhd | | | 45,600 | | | | 75,330 | |

Mexico — 10.0% | | | | | | | | |

Bolsa Mexicana de Valores SAB de CV | | | 23,508 | | | | 46,420 | |

Fibra Uno Administracion SA de CV | | | 13,858 | | | | 44,836 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Mexico (concluded) | | | | | | | | |

Fomento Economico Mexicano SAB de CV — ADR | | | 343 | | | $ | 31,981 | |

Grupo Aeroportuario del Pacifico SAB de CV, Class B | | | 12,853 | | | | 75,254 | |

Grupo Aeroportuario del Sureste SAB de CV — ADR | | | 397 | | | | 48,688 | |

Grupo Financiero Santander Mexico SAB de CV,

Class B — ADR | | | 3,534 | | | | 43,433 | |

Kimberly-Clark de Mexico SAB de CV, Class A | | | 43,786 | | | | 116,881 | |

Mexico Real Estate Management SA de CV | | | 31,780 | | | | 59,931 | |

| | | | | | | | |

| | | | | | | | 467,424 | |

Peru — 1.6% | | | | | | | | |

Credicorp Ltd. | | | 558 | | | | 76,959 | |

Philippines — 4.9% | | | | | | | | |

Alliance Global Group, Inc. | | | 64,100 | | | | 40,834 | |

Philippine Long Distance Telephone Co. | | | 375 | | | | 22,828 | |

Philippine Long Distance Telephone Co. — ADR | | | 1,892 | | | | 115,450 | |

Robinsons Land Corp. | | | 101,700 | | | | 49,803 | |

| | | | | | | | |

| | | | | | | | 228,915 | |

Poland — 3.3% | | | | | | | | |

Powszechny Zaklad Ubezpieczen SA | | | 1,084 | | | | 154,038 | |

Portugal — 0.9% | | | | | | | | |

Jeronimo Martins SGPS SA | | | 2,519 | | | | 42,271 | |

Russia — 5.1% | | | | | | | | |

Lukoil OAO — ADR | | | 3,073 | | | | 171,858 | |

MMC Norilsk Nickel OJSC — ADR | | | 2,644 | | | | 44,287 | |

Mobile Telesystems OJSC — ADR | | | 1,336 | | | | 23,367 | |

| | | | | | | | |

| | | | | | | | 239,512 | |

South Africa — 7.0% | | | | | | | | |

FirstRand Ltd. | | | 20,073 | | | | 68,825 | |

Life Healthcare Group Holdings Ltd. | | | 13,360 | | | | 48,815 | |

Mr. Price Group Ltd. | | | 4,313 | | | | 64,463 | |

Sanlam Ltd. | | | 16,685 | | | | 91,141 | |

Sasol Ltd. | | | 1,018 | | | | 56,932 | |

| | | | | | | | |

| | | | | | | | 330,176 | |

South Korea — 4.0% | | | | | | | | |

Grand Korea Leisure Co. Ltd. | | | 1,520 | | | | 62,657 | |

Hyundai Motor Co., Preference | | | 495 | | | | 63,314 | |

SK Telecom Co. Ltd. | | | 184 | | | | 37,341 | |

SK Telecom Co. Ltd. — ADR | | | 1,034 | | | | 23,337 | |

| | | | | | | | |

| | | | | | | | 186,649 | |

Taiwan — 11.3% | | | | | | | | |

Cleanaway Co. Ltd. | | | 5,000 | | | | 30,567 | |

Delta Electronics, Inc. | | | 11,000 | | | | 68,126 | |

Far EasTone Telecommunications Co. Ltd. | | | 43,000 | | | | 91,022 | |

Mega Financial Holding Co. Ltd. | | | 30,299 | | | | 23,514 | |

Quanta Computer, Inc. | | | 12,000 | | | | 32,354 | |

Taiwan Cement Corp. | | | 46,000 | | | | 71,148 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 4,000 | | | | 15,738 | |

Taiwan Semiconductor Manufacturing Co. Ltd. — ADR | | | 8,791 | | | | 175,996 | |

Tripod Technology Corp. | | | 12,000 | | | | 23,665 | |

| | | | | | | | |

| | | | | | | | 532,130 | |

See Notes to Financial Statements.

| | | | | | |

| 14 | | BLACKROCK FUNDS | | MARCH 31, 2014 | | |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Emerging Markets Dividend Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Thailand — 5.1% | | | | | | | | |

Advanced Info Service PCL — NVDR | | | 6,600 | | | $ | 46,094 | |

Bangkok Expressway PCL — NVDR | | | 20,500 | | | | 20,885 | |

BEC World PCL — NVDR | | | 44,900 | | | | 75,577 | |

Kasikornbank PCL — NVDR | | | 14,400 | | | | 79,244 | |

Siam City Cement PCL — NVDR | | | 1,600 | | | | 17,107 | |

| | | | | | | | |

| | | | | | | | 238,907 | |

Turkey — 2.2% | | | | | | | | |

BIM Birlesik Magazalar AS | | | 2,453 | | | | 55,255 | |

Turk Traktor ve Ziraat Makineleri AS | | | 914 | | | | 23,492 | |

Turkiye Halk Bankasi AS | | | 4,228 | | | | 26,187 | |

| | | | | | | | |

| | | | | | | | 104,934 | |

Total Common Stocks — 96.2% | | | | | | | 4,515,105 | |

| | | | | | | | |

| Participation Notes (a) | | | | | | |

Qatar — 1.3% | | | | | | | | |

Deutsche Bank AG (Qatar Electricity & Water Co.),

due 4/14/17 | | | 1,277 | | | | 60,321 | |

| | | | | | | | |

| Participation Notes (a) | | Shares | | | Value | |

South Korea — 1.0% | | | | | | | | |

Deutsche Bank AG (Hyundai Motor & Finance Co.),

due 8/15/23 | | | 1,630 | | | $ | 47,011 | |

Total Participation Notes — 2.3% | | | | | | | 107,332 | |

Total Long-Term Investments (Cost — $4,504,594) — 98.5% | | | | 4,622,437 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional

Class, 0.03% (b)(c) | | | 68,894 | | | | 68,894 | |

Total Short-Term Securities (Cost — $68,894) — 1.4% | | | | 68,894 | |

Total Investments (Cost — $4,573,488) — 99.9% | | | | | | | 4,691,331 | |

Other Assets Less Liabilities — 0.1% | | | | | | | 2,890 | |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 4,694,221 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | Investments in issuers considered to be an affiliate of the Fund during the six months ended March 31, 2014, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares Held at

September 30, 2013 | | | Net Activity | | | Shares Held at

March 31, 2014 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 68,511 | | | | 383 | | | | 68,894 | | | $ | 34 | |

| (c) | Represents the current yield as of report date. |

| Ÿ | | Forward foreign currency exchange contracts outstanding as of March 31, 2014 were as follows: |

| | | | | | | | | | | | | | | | | | | | | | |

Currency Purchased | | | Currency

Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| MXN | | | 1,126,742 | | | | USD | | | | 84,649 | | | JPMorgan Chase Bank N.A. | | | 4/29/14 | | | $ | 1,462 | |

| MXN | | | 1,167,170 | | | | USD | | | | 87,738 | | | JPMorgan Chase Bank N.A. | | | 4/29/14 | | | | 1,463 | |

| PLN | | | 269,760 | | | | USD | | | | 87,246 | | | Citibank N.A. | | | 4/29/14 | | | | 1,800 | |

| PLN | | | 196,240 | | | | USD | | | | 64,455 | | | Deutsche Bank AG | | | 4/29/14 | | | | 322 | |

| USD | | | 170,548 | | | | MXN | | | | 2,293,912 | | | Citibank N.A. | | | 4/29/14 | | | | (4,765 | ) |

| USD | | | 148,801 | | | | PLN | | | | 466,000 | | | Morgan Stanley & Co. International PLC | | | 4/29/14 | | | | (5,022 | ) |

| USD | | | 43,250 | | | | CLP | | | | 24,267,577 | | | Citibank N.A. | | | 5/28/14 | | | | (734 | ) |

| USD | | | 853 | | | | CLP | | | | 478,641 | | | Citibank N.A. | | | 5/28/14 | | | | (14 | ) |

| Total | | | | | | | | | | | | | | | | | | | | $ | (5,488 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| | Ÿ | | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2014 | | 15 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Emerging Markets Dividend Fund | |

| | assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instrument and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments, please refer to Note 2 of the Notes to Financial Statements.

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy as of March 31, 2014:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Brazil | | $ | 655,809 | | | | — | | | | — | | | $ | 655,809 | |

Cambodia | | | — | | | $ | 43,847 | | | | — | | | | 43,847 | |

Chile | | | 76,614 | | | | — | | | | — | | | | 76,614 | |

China | | | — | | | | 692,188 | | | | — | | | | 692,188 | |

Cyprus | | | 33,524 | | | | — | | | | — | | | | 33,524 | |

Czech Republic | | | — | | | | 48,030 | | | | — | | | | 48,030 | |

India | | | 96,243 | | | | — | | | | — | | | | 96,243 | |

Indonesia | | | — | | | | 119,779 | | | | — | | | | 119,779 | |

Ireland | | | — | | | | 50,961 | | | | — | | | | 50,961 | |

Kazakhstan | | | 20,865 | | | | — | | | | — | | | | 20,865 | |

Malaysia | | | — | | | | 75,330 | | | | — | | | | 75,330 | |

Mexico | | | 467,424 | | | | — | | | | — | | | | 467,424 | |

Peru | | | 76,959 | | | | — | | | | — | | | | 76,959 | |

Philippines | | | 115,450 | | | | 113,465 | | | | — | | | | 228,915 | |

Poland | | | — | | | | 154,038 | | | | — | | | | 154,038 | |

Portugal | | | — | | | | 42,271 | | | | — | | | | 42,271 | |

Russia | | | 239,512 | | | | — | | | | — | | | | 239,512 | |

South Africa | | | — | | | | 330,176 | | | | — | | | | 330,176 | |

South Korea | | | 23,337 | | | | 163,312 | | | | — | | | | 186,649 | |

Taiwan | | | 175,996 | | | | 356,134 | | | | — | | | | 532,130 | |

Thailand | | | — | | | | 238,907 | | | | — | | | | 238,907 | |

Turkey | | | — | | | | 104,934 | | | �� | — | | | | 104,934 | |

Participation Notes: | | | | | | | | | | | | | | | | |

Qatar | | | — | | | | 60,321 | | | | — | | | | 60,321 | |

South Korea | | | — | | | | 47,011 | | | | — | | | | 47,011 | |

Short-Term Securities | | | 68,894 | | | | — | | | | — | | | | 68,894 | |

Total | | $ | 2,050,627 | | | $ | 2,640,704 | | | | — | | | $ | 4,691,331 | |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| 16 | | BLACKROCK FUNDS | | MARCH 31, 2014 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock Emerging Markets Dividend Fund | |

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Derivative Financial Instruments1 | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Foreign currency exchange contracts | | | — | | | $ | 5,047 | | | | — | | | $ | 5,047 | |

Liabilities: | | | | | | | | | | | | | | | | |

Foreign currency exchange contracts | | | — | | | | (10,535 | ) | | | — | | | | (10,535 | ) |

Total | | | — | | | $ | (5,488 | ) | | | — | | | $ | (5,488 | ) |

| | | | |

1 Derivative financial instruments are forward foreign currency exchange contracts, which are valued at the unrealized appreciation/depreciation on the instrument. | |

|

| The carrying amount for certain of the Fund’s assets approximates fair value for financial statement purposes. As of March 31, 2014, such assets are categorized within the disclosure hierarchy as follows: | |

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Cash | | $ | 14,000 | | | | — | | | | — | | | $ | 14,000 | |

Foreign currency at value | | | 3,860 | | | | — | | | | — | | | | 3,860 | |

Total | | $ | 17,860 | | | | — | | | | — | | | $ | 17,860 | |

| | | | |

There were no transfers between levels during the six months ended March 31, 2014.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2014 | | 17 |

| | | | |

| Schedule of Investments March 31, 2014 (Unaudited) | | | BlackRock Energy & Resources Portfolio | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Commercial Services & Supplies — 0.0% | | | | | | | | |

Republic Resources, Inc. (Acquired 7/18/97 to 2/24/99, cost $779,869) (a)(b) | | | 28,750 | | | | — | |

Construction & Engineering — 5.8% | | | | | | | | |

Foster Wheeler AG (b) | | | 600,000 | | | $ | 19,452,000 | |

KBR, Inc. | | | 544,000 | | | | 14,513,920 | |

| | | | | | | | |

| | | | | | | | 33,965,920 | |

Energy Equipment & Services — 11.7% | | | | | | | | |

Cameron International Corp. (b) | | | 330,000 | | | | 20,384,100 | |

Helmerich & Payne, Inc. | | | 240,000 | | | | 25,814,400 | |

Poseidon Concepts Corp. (b) | | | 35,081 | | | | 18 | |

Superior Energy Services, Inc. | | | 738,257 | | | | 22,708,785 | |

| | | | | | | | |

| | | | | | | | 68,907,303 | |

Machinery — 0.0% | | | | | | | | |

Railpower Technologies Corp. (Acquired 4/26/04 to 6/17/04, cost $1,010,377) (a)(b) | | | 360,600 | | | | — | |

Oil, Gas & Consumable Fuels — 82.1% | | | | | | | | |

AltaGas Ltd. | | | 506,500 | | | | 20,754,817 | |

Arch Coal, Inc. | | | 1,384,800 | | | | 6,674,736 | |

Bellatrix Exploration Ltd. (b) | | | 862,632 | | | | 7,295,892 | |

Cabot Oil & Gas Corp. | | | 429,400 | | | | 14,548,072 | |

Cairn Energy PLC (b) | | | 3,247,000 | | | | 9,042,096 | |

Canadian Oil Sands Ltd. | | | 900,000 | | | | 18,879,240 | |

Caracal Energy, Inc. (b) | | | 1,173,200 | | | | 6,786,930 | |

Carrizo Oil & Gas, Inc. (b) | | | 301,500 | | | | 16,118,190 | |

Cimarex Energy Co. | | | 235,010 | | | | 27,992,041 | |

CONSOL Energy, Inc. | | | 689,200 | | | | 27,533,540 | |

Crocotta Energy, Inc. (b) | | | 2,268,300 | | | | 6,955,710 | |

Denbury Resources, Inc. | | | 887,338 | | | | 14,552,343 | |

EnQuest PLC (b) | | | 5,414,000 | | | | 11,199,018 | |

EOG Resources, Inc. | | | 118,400 | | | | 23,226,528 | |

EQT Corp. | | | 171,744 | | | | 16,654,016 | |

Gulfport Energy Corp. (b) | | | 126,135 | | | | 8,978,289 | |

Ithaca Energy, Inc. (b) | | | 5,071,000 | | | | 12,614,428 | |

Kosmos Energy Ltd. (b) | | | 1,761,588 | | | | 19,377,468 | |

Longview Energy Co. (Acquired 8/13/04,

cost $1,281,000) (a)(b) | | | 85,400 | | | | 727,608 | |

Murphy Oil Corp. | | | 190,000 | | | | 11,943,400 | |

Noble Energy, Inc. | | | 272,000 | | | | 19,322,880 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (concluded) | | | | | | | | |

Oil Search Ltd. | | | 2,400,000 | | | $ | 18,838,531 | |

Painted Pony Petroleum Ltd. (b) | | | 1,970,000 | | | | 15,931,072 | |

PDC Energy, Inc. (b) | | | 203,800 | | | | 12,688,588 | |

Pioneer Natural Resources Co. | | | 108,337 | | | | 20,274,186 | |

Range Resources Corp. | | | 187,640 | | | | 15,568,491 | |

Rex Energy Corp. (b) | | | 379,600 | | | | 7,102,316 | |

Rosetta Resources, Inc. (b) | | | 373,400 | | | | 17,392,972 | |

RSP Permian, Inc. (b) | | | 317,842 | | | | 9,182,455 | |

SM Energy Co. | | | 210,000 | | | | 14,970,900 | |

Southwestern Energy Co. (b) | | | 507,500 | | | | 23,350,075 | |

Stone Energy Corp. (b) | | | 375,538 | | | | 15,761,330 | |

Tourmaline Oil Corp. (b) | | | 154,420 | | | | 7,299,855 | |

TransGlobe Energy Corp. (b) | | | 690,000 | | | | 5,261,601 | |

| | | | | | | | |

| | | | | | | | 484,799,614 | |

Total Common Stocks — 99.6% | | | | | | | 587,672,837 | |

| | | | | | | | |

| Warrants (c) | | | | | | |

Oil, Gas & Consumable Fuels — 0.0% | | | | | | | | |

Magnum Hunter Resources Corp. (Issued/Exercisable 10/15/13, 1 Share for 1 Warrant, Expires 4/15/16, Strike Price USD 8.50) | | | 235,700 | | | | 2 | |

Total Warrants — 0.0% | | | | | | | 2 | |

Total Long-Term Investments (Cost — $451,474,985) — 99.6% | | | | 587,672,839 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional

Class, 0.03% (d)(e) | | | 4,401,608 | | | | 4,401,608 | |

Total Short-Term Securities (Cost — $4,401,608) — 0.7% | | | | 4,401,608 | |

Total Investments (Cost — $455,876,593) — 100.3% | | | | | | | 592,074,447 | |

Liabilities in Excess of Other Assets — (0.3)% | | | | | | | (1,863,820 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 590,210,627 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Restricted security as to resale. As of report date, the Fund held restricted securities with a current value of $727,608 and an original cost of $3,071,246, which was 0.2% of its net assets. |

| (b) | Non-income producing security. |

| (c) | Warrants entitle the Fund to purchase a predetermined number of shares of common stock and are non-income producing. The purchase price and number of shares are subject to adjustment under certain conditions until the expiration date of the warrants, if any. |

| (d) | Investments in issuers considered to be an affiliate of the Fund during the six months ended March 31, 2014, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares Held at

September 30, 2013 | | | Net Activity | | | Shares Held at

March 31, 2014 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 14,345,070 | | | | (9,943,462 | ) | | | 4,401,608 | | | $ | 5,428 | |

| | | | | | | | |

(e) Represents the current yield as of report date. |

See Notes to Financial Statements.

| | | | | | |

| 18 | | BLACKROCK FUNDS | | MARCH 31, 2014 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock Energy & Resources Portfolio | |

| Ÿ | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| | Ÿ | | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments is based on the pricing transparency of the investment and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments, please refer to Note 2 of the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy as of March 31, 2014:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Construction & Engineering | | $ | 33,965,920 | | | | — | | | | — | | | $ | 33,965,920 | |