UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05742

Name of Fund: BlackRock Funds

BlackRock Commodity Strategies Fund

BlackRock Global Long/Short Credit Fund

BlackRock Macro Themes Fund

BlackRock Multi-Asset Real Return Fund

BlackRock Short Obligations Fund

BlackRock Short-Term Treasury Fund

BlackRock Strategic Risk Allocation Fund

BlackRock Ultra-Short Obligations Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 07/31/2015

Date of reporting period: 01/31/2015

Item 1 – Report to Stockholders

JANUARY 31, 2015

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

BlackRock FundsSM

„ BlackRock Commodity Strategies Fund

„ BlackRock Global Long/Short Credit Fund

„ BlackRock Macro Themes Fund

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | |

| |

| | Shareholders can sign up for e-mail notifications of quarterly statements, annual and semi-annual shareholder reports and prospectuses by enrolling in the electronic delivery program. Electronic copies of shareholder reports and prospectuses are also available on BlackRock’s website. |

| | TO ENROLL IN ELECTRONIC DELIVERY: |

| | Shareholders Who Hold Accounts with Investment Advisors, Banks or Brokerages: Please contact your financial advisor. Please note that not all investment advisors, banks or brokerages may offer this service. |

| | Shareholders Who Hold Accounts Directly with BlackRock: 1. Access the BlackRock website at blackrock.com 2. Select “Access Your Account” 3. Next, select “eDelivery” in the “Related Resources” box and follow the sign-up instructions |

| | | | | | |

| 2 | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | |

Dear Shareholder,

Market volatility, while remaining below the long-term average level, increased over the course of 2014 and into 2015, driven largely by higher valuations in risk assets (such as equities and high yield bonds), escalating geopolitical risks, uneven global economic growth and expectations around policy moves from the world’s largest central banks. Surprisingly, U.S. interest rates trended lower through the period even as the U.S. Federal Reserve (the “Fed”) gradually reduced its bond buying program, which ultimately ended in October.

The first half of 2014 was generally a strong period for most asset classes; however, volatility ticked up in the summer as geopolitical tensions intensified in Ukraine and the Middle East and investors feared that better U.S. economic indicators may compel the Fed to increase short-term interest rates sooner than previously anticipated. Global credit markets tightened as the U.S. dollar strengthened versus other currencies, ultimately putting a strain on investor flows, and financial markets broadly weakened in the third quarter.

Several themes dominated the markets in the fourth quarter that resulted in the strong performance of U.S. markets versus other areas of the world. Economic growth strengthened considerably in the United States while the broader global economy showed signs of slowing. The European Central Bank and the Bank of Japan took aggressive measures to stimulate growth while the Fed moved toward tighter policy, causing further strengthening in the U.S. dollar. Fixed income investors piled into U.S. Treasuries where yields, although persistently low, were comparatively higher than yields on international sovereign debt, while equity investors favored the relative stability of U.S.-based companies amid rising global risks.

Oil prices, which had been gradually declining since mid-summer, suddenly plummeted in the fourth quarter due to a global supply-and-demand imbalance. Energy stocks sold off sharply and oil-exporting economies struggled, mainly within emerging markets. Conversely, the consumer sectors benefited from lower oil prices as savings at the gas pumps freed up discretionary income for other goods and services.

These trends shifted at the beginning of 2015. U.S. equity markets starkly underperformed international markets due to stretched valuations and uncertainty around the Fed’s pending rate hike. In addition, the stronger U.S. dollar began to hurt earnings of large cap companies. The energy sector continued to struggle, although oil prices showed signs of stabilizing toward the end of January as suppliers became more disciplined in their exploration and production efforts.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of January 31, 2015 | |

| | | 6-month | | | 12-month | |

U.S large cap equities

(S&P 500® Index) | | | 4.37 | % | | | 14.22 | % |

U.S. small cap equities

(Russell 2000® Index) | | | 4.72 | | | | 4.41 | |

International equities

(MSCI Europe, Australasia, Far East Index) | | | (6.97 | ) | | | (0.43 | ) |

Emerging market equities

(MSCI Emerging Markets Index) | | | (9.05 | ) | | | 5.23 | |

3-month Treasury bill

(BofA Merrill Lynch

3-Month U.S. Treasury

Bill Index) | | | 0.01 | | | | 0.03 | |

U.S. Treasury securities

(BofA Merrill Lynch

10- Year U.S. Treasury

Index) | | | 9.29 | | | | 12.25 | |

U.S. investment grade

bonds (Barclays U.S.

Aggregate Bond Index) | | | 4.36 | | | | 6.61 | |

Tax-exempt municipal

bonds (S&P Municipal Bond Index) | | | 4.51 | | | | 8.81 | |

U.S. high yield bonds

(Barclays U.S. Corporate

High Yield 2% Issuer

Capped Index) | | | (0.89 | ) | | | 2.41 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | | | |

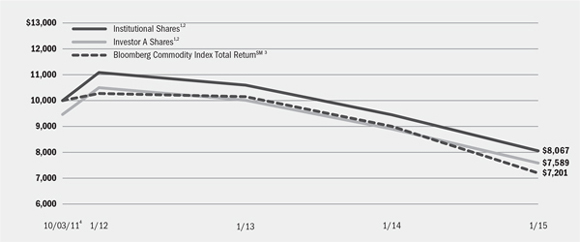

| Fund Summary as of January 31, 2015 | | | BlackRock Commodity Strategies Fund | |

BlackRock Commodity Strategies Fund’s (the “Fund”) investment objective is to seek total return.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended January 31, 2015, the Fund outperformed its benchmark, the Bloomberg Commodity Index Total ReturnSM. |

What factors influenced performance?

| Ÿ | | Commodities and natural resources equities came under pressure during the period. The combination of slower-than-expected global economic growth and ample commodity supply set the stage for a steep decline in commodity prices during the second half of 2014. While the plunge in crude oil dominated headlines, the price weakness was widespread across the commodity complex. Industrial metals were particularly weak during the period. |

| Ÿ | | In the stock market, the metals & mining industry was the hardest hit of the natural resources sectors. Exposure to this market segment was the largest drag on relative performance, with a number of copper producers among the Fund’s most significant laggards. |

| Ÿ | | The Fund’s position in energy stocks also detracted from returns given the sector’s weak performance during the six-month period. |

| Ÿ | | Agriculture-related equities outperformed in an otherwise difficult period for commodities and natural resources equities. Agricultural equities as a whole were flat, but a number of the Fund’s holdings generated strong absolute returns. Notable outperformers included grain handlers and transporters that benefited from bumper harvests, as well as some lumber companies that were well positioned to benefit from a pick-up in North American construction activity. |

| Ÿ | | The Fund’s position in gold-related equities contributed positively due to the strong rally in gold shares in January. Gold benefited from rising |

| | | demand for “safe haven” assets, and gold stocks showed heightened sensitivity to the metal’s rise. |

| Ÿ | | The Fund’s commodity futures linked strategy generated outperformance, with positioning in crude oil, natural gas and coffee contributing strongly at various points during the period. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Fund sought to maintain generally equal weightings between the equity and derivatives strategies, as well as balanced and broad equity exposure across commodity sectors. The Fund rebalanced its strategy allocations in January 2015. This resulted in a reduction in the Fund’s position in mining stocks and an increase in its allocation to agriculture stocks. |

| Ÿ | | The Fund maintained a position in cash and cash equivalents, predominantly comprised of U.S. Treasury bills, as collateral against the Fund’s exposure to commodity-linked notes. The Fund’s cash balance did not have a material impact on performance. |

Describe portfolio positioning at period end.

| Ÿ | | The Fund ended the period with approximately 50% of net assets allocated to the commodity-related equity strategy and 50% allocated to the commodity-linked derivatives strategy (including collateral held against the commodity-linked note exposure). Aggregating both strategies, the Fund was overweight relative to the benchmark index in energy and underweight in agriculture and precious metals. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Ten Largest Holdings | | Percent of

Long-Term Investments |

| | | | |

Exxon Mobil Corp. | | | 4 | % |

Royal Dutch Shell PLC, B Shares | | | 4 | |

Chevron Corp. | | | 4 | |

Citigroup, Inc. 1-month LIBOR, 3/02/16* | | | 4 | |

Bank of America Corp. 3-month LIBOR, 1/25/16* | | | 3 | |

PowerShares DB Commodity Index Tracking Fund | | | 3 | |

ConocoPhillips | | | 2 | |

Anadarko Petroleum Corp. | | | 2 | |

Total SA | | | 2 | |

Monsanto Co. | | | 2 | |

| | * | | Represents a commodity-linked note. |

| | |

| Portfolio Composition | | Percent of

Long-Term Investments |

| | | | |

Common Stocks | | | 75 | % |

Commodity-Linked Notes | | | 20 | |

Investment Companies | | | 5 | |

| | | | | | |

| 4 | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | |

| | | | |

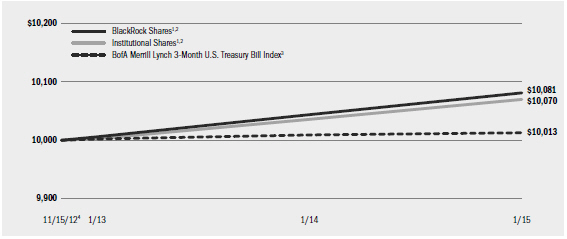

| | | | BlackRock Commodity Strategies Fund | |

|

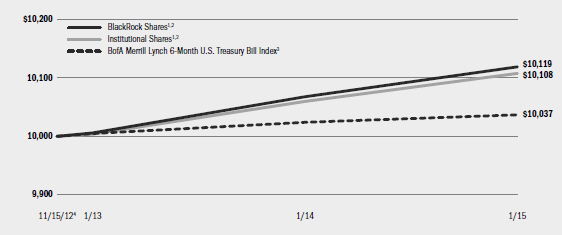

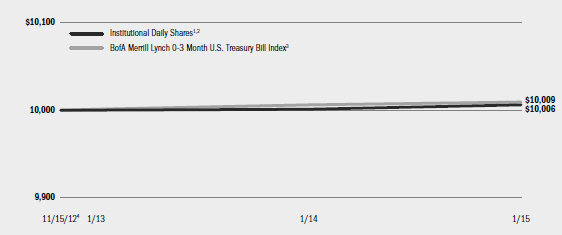

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | The Fund utilizes two strategies and under normal circumstances expects to invest approximately 50% of its total assets in each strategy; provided, however, that from time to time, Fund management may alter the weightings if it deems it prudent to do so based on market conditions, trends or movements or other similar factors. |

| | 3 | An unmanaged commodity index currently composed of futures contracts on 20 physical commodities, and assumes that the futures positions are fully collateralized. Prior to July 1, 2014, the Bloomberg Commodity Index Total ReturnSM was known as the Dow Jones-UBS Commodity Index Total ReturnSM. |

| | 4 | Commencement of operations. |

| | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended January 31, 2015 | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | Since Inception6 | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | | (20.61 | )% | | | (14.65 | )% | | | N/A | | | | (6.25 | )% | | | N/A | |

Investor A | | | (20.81 | ) | | | (14.85 | ) | | | (19.32 | )% | | | (6.45 | ) | | | (7.95 | )% |

Investor C | | | (21.06 | ) | | | (15.45 | ) | | | (16.29 | ) | | | (7.16 | ) | | | (7.16 | ) |

Bloomberg Commodity Index Total ReturnSM | | | (21.16 | ) | | | (20.02 | ) | | | N/A | | | | (9.40 | ) | | | N/A | |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 9 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | | The Fund commenced operations on October 3, 2011. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical8 | | Annualized Expense Ratio |

| | Beginning Account Value

August 1, 2014 | | Ending Account Value

January 31, 2015 | | Expenses Paid

During the Period7 | | Beginning Account Value

August 1, 2014 | | Ending Account Value

January 31, 2015 | | Expenses Paid

During the Period7 | |

Institutional | | $1,000.00 | | $793.90 | | $5.79 | | $1,000.00 | | $1,018.75 | | $6.51 | | 1.28% |

Investor A | | $1,000.00 | | $791.90 | | $6.77 | | $1,000.00 | | $1,017.64 | | $7.63 | | 1.50% |

Investor C | | $1,000.00 | | $789.40 | | $10.15 | | $1,000.00 | | $1,013.86 | | $11.42 | | 2.25% |

| | 7 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 8 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 9 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | 5 |

| | | | |

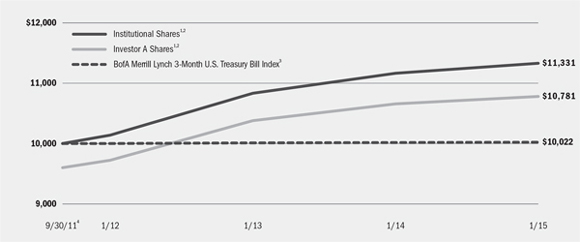

| Fund Summary as of January 31, 2015 | | | BlackRock Global Long/Short Credit Fund | |

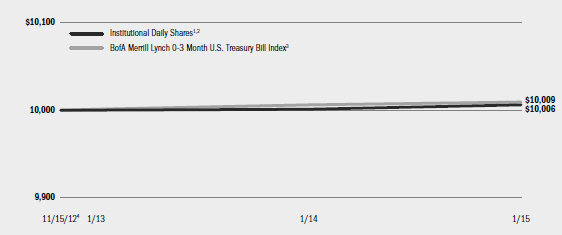

BlackRock Global Long/Short Credit Fund’s (the “Fund”) investment objective is to seek absolute total returns over a complete market cycle.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended January 31, 2015, the Fund underperformed its benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index. |

What factors influenced performance?

| Ÿ | | Long positions in European high yield bonds detracted from returns as the sector experienced substantial volatility during the period. Additionally, short positions in indices providing exposure to credit default swaps on European crossover (issues straddling the line between investment grade and speculative quality) and senior financial issues detracted from performance, as the credit default swaps indices outperformed cash bonds. Within U.S. investment grade credit, long positions in financials and industrials detracted as these markets experienced technical pressure. A small tactical allocation to energy bonds and loans detracted given the severe downward move in oil prices. Likewise, a trade designed to benefit from what the investment advisor viewed as the mispricing of a Brazilian quasi-sovereign issue detracted, as the name is highly correlated to oil. Finally, broad market hedges expressed through U.S. equity put options detracted given the outperformance of equities during the period. |

| Ÿ | | The largest positive contributor to returns was positioning throughout the capital structure in European bank debt, which involved taking profits on senior positions and re-deploying assets to subordinated bonds, which outperformed. Absolute return strategies within U.S. industrial sectors were also a notable contributor to performance. These strategies included tactical positioning within technology issuers in the telecommunication services and semiconductor sectors, a short position in a U.S. capital goods issuer, and an event-related long position in a specialty pharmaceutical company. Positions in U.S. and European bank loans and collateralized loan obligations (CLOs) provided income and in some cases modest price appreciation, as did exposure to enhanced equipment trust certificates which have benefited recently from strong airline earnings releases. Despite a difficult environment for high yield, security selection within the sector proved beneficial as the Fund held higher quality issues which outperformed. In Europe, the Fund benefited from positions in investment grade credit which rallied substantially as low interest rates generated demand for incremental income from higher quality issues. Finally, European hedges were additive, most notably the use of equity put options to minimize the impact of market volatility during the fourth quarter. |

| Ÿ | | As part of its investment strategy, the Fund uses derivatives to manage duration (sensitivity to interest rate movements) and currency risk. The Fund may also employ credit derivatives in order to express a positive or negative view on a particular issuer or sector, or to manage overall credit risk. During the period, the Fund’s derivative holdings had a net positive impact on performance, attributable to currency-related positions. |

Describe recent portfolio activity.

| Ÿ | | Over the course of the period, the regional allocation was shifted to favor European credit. Within Europe, the Fund initially made tactical changes with capital preservation as a primary consideration. This included using equity put options and subsequently moving back to credit index short positions based on our assessment of relative value. In addition, the Fund exited a number of investment grade bond positions including Spanish covered bonds in financials. This capital was redeployed into more attractively valued subordinated debt of European banks and high yield cash bonds. The Fund transitioned from a net short position in sovereign debt to a long position via purchases of Spanish and Italian government bonds, based on the view that the European Central Bank (“ECB”) would announce further bond purchases directly impacting sovereign credit. |

| Ÿ | | In the United States, the Fund initially added to high yield and investment grade bonds on market weakness; however, these positions were trimmed in order to reduce credit exposure. Eventually, the Fund moved to a net short position in investment grade credit and added broad credit hedges. Late in the period, the Fund reduced exposure to U.S. bank loans and CLOs on concerns over liquidity, technical pressures and changing regulations. The Fund implemented a number of event-related trades in U.S. and European issuers, and tactically traded opportunities in the U.S. technology and healthcare sectors. Finally, the Fund employed several long, short and paired trades in the energy sector with an eye toward the relative balance sheet strength and asset quality of companies in the oil & gas exploration & production sector. |

| Ÿ | | The Fund’s cash exposure had no material impact on performance as the Fund may express long and short positions via the credit default swap market, which does not require a cash outlay like that of traditional cash bonds. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the investment advisor continues to monitor the divergence in the ECB’s monetary policy versus that of the U.S. Federal Reserve and other central banks. The Fund’s positioning at period end reflected a preference for European versus the U.S. credit markets. In Europe we continue to see value in subordinated bank debt and high yield cash bonds while tactically managing exposure to sovereigns. In the United States, the Fund is tilted toward high yield versus investment grade credit and is actively seeking absolute return opportunities (long, short and paired trades) within industrial sectors. |

| Ÿ | | The Fund ended the period with a net long credit position in Europe at 30% of net assets, 14% in the U.S., 2% in Asia, and 46% overall given continued strong credit fundamentals and recent spread widening. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 6 | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | |

| | | | |

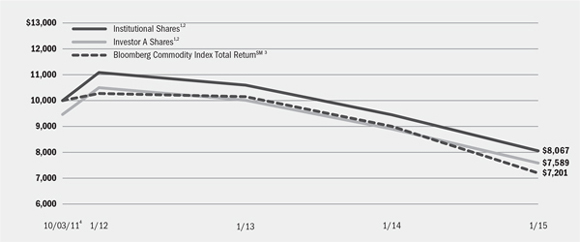

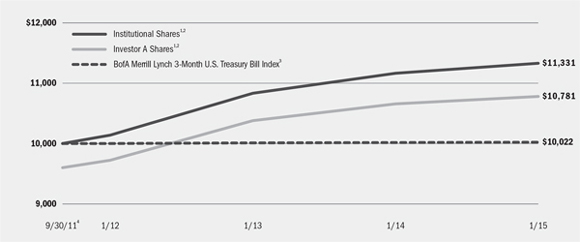

| | | | BlackRock Global Long/Short Credit Fund | |

|

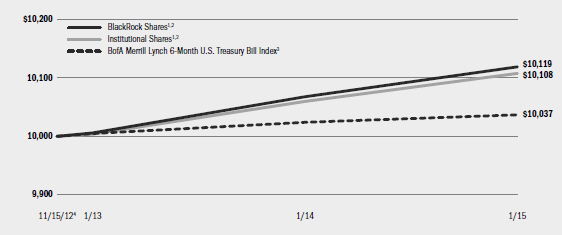

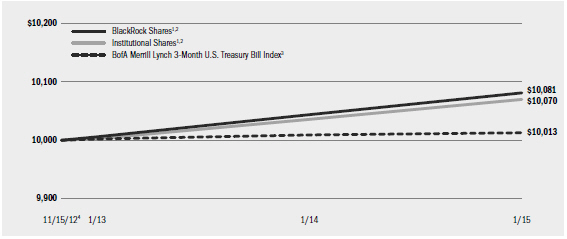

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | The Fund seeks to provide absolute total returns over a complete market cycle through diversified long and short exposure to the global fixed income markets. Under normal circumstances the Fund invests at least 80% of its total assets in credit-related instruments. |

| | 3 | An unmanaged index that tracks 3-month U.S. Treasury securities. |

| | 4 | Commencement of operations. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended January 31, 2015 | | | | | | | | | |

| | | | | | | | | | | | Average Annual Total Returns5 | |

| | | | | | | | | | | | 1 Year | | | Since Inception6 | |

| | | Standardized

30-Day Yield | | | Unsubsidized

30-Day Yield | | | 6-Month

Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | | 3.64 | % | | | 3.63 | % | | | (0.57 | )% | | | 1.47 | % | | | N/A | | | | 3.81 | % | | | N/A | |

Investor A | | | 3.19 | | | | 3.19 | | | | (0.77 | ) | | | 1.14 | | | | (2.90 | )% | | | 3.54 | | | | 2.28 | % |

Investor C | | | 2.64 | | | | 2.63 | | | | (1.10 | ) | | | 0.42 | | | | (0.55 | ) | | | 2.79 | | | | 2.79 | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | — | | | | — | | | | 0.01 | | | | 0.03 | | | | N/A | | | | 0.07 | | | | N/A | |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 9 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | | The Fund commenced operations on September 30, 2011. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | |

| Expense Example | | | | |

| | | Actual | | Hypothetical9 |

| | | | | | | Including

Interest Expense | | Excluding

Interest Expense | | | | Including Interest Expense | | Excluding Interest Expense |

| | | Beginning

Account Value

August 1, 2014 | | Ending Account Value

January 31, 2015 | | Expenses Paid

During the Period7 | | Expenses Paid

During the Period8 | | Beginning

Account Value

August 1, 2014 | | Ending Account Value

January 31, 2015 | | Expenses Paid

During the Period7 | | Ending Account Value

January 31, 2015 | | Expenses Paid

During the Period8 |

Institutional | | $1,000.00 | | $994.30 | | $7.79 | | 5.13 | | $1,000.00 | | $1,017.39 | | $7.88 | | $1,020.06 | | $5.19 |

Investor A | | $1,000.00 | | $992.30 | | $9.39 | | 6.78 | | $1,000.00 | | $1,015.78 | | $9.50 | | $1,018.40 | | $6.87 |

Investor C | | $1,000.00 | | $989.00 | | $12.88 | | 10.28 | | $1,000.00 | | $1,012.25 | | $13.03 | | $1,014.87 | | $10.41 |

| | 7 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.55% for Institutional, 1.87% for Investor A and 2.57% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 8 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.02% for Institutional, 1.35% for Investor A and 2.05% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 9 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 9 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | 7 |

| | | | |

| Fund Summary as of January 31, 2015 | | | BlackRock Macro Themes Fund | |

BlackRock Macro Themes Fund’s (the “Fund”) investment objective is to seek total return.

| | |

| Ten Largest Holdings | | Percent of

Long-Term Investments |

| | | | |

U.S. Treasury Bonds | | | 8 | % |

Portugal Obrigacoes do Tesouro OT | | | 5 | |

Health Care Select Sector SPDR Fund | | | 5 | |

Italy Buoni Poliennali Del Tesoro | | | 4 | |

ETFS Physical PM Basket | | | 4 | |

Republic of Colombia | | | 4 | |

Brazil Notas do Tesouro Nacional, Series B | | | 3 | |

Financial Select Sector SPDR Fund | | | 3 | |

Hellenic Republic | | | 3 | |

Republic of Indonesia | | | 3 | |

| | |

| Portfolio Composition | | Percent of

Long-Term Investments |

| | | | |

Corporate Bonds | | | 47 | % |

Foreign Government Obligations | | | 28 | |

Investment Companies | | | 15 | |

U.S. Treasury Obligations | | | 8 | |

Foreign Agency Obligations | | | 2 | |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical2 | | |

| | | Beginning Account Value

December 4, 2014 | | Ending Account Value

January 31, 2015 | | Expenses Paid

During the Period1 | | Beginning Account Value

December 4, 2014 | | Ending Account Value

January 31, 2015 | | Expenses Paid

During the Period1 | | Annualized Expense Ratio |

Institutional | | $1,000.00 | | $997.30 | | $1.90 | | $1,000.00 | | $1,006.04 | | $1.91 | | 1.20% |

Investor A | | $1,000.00 | | $997.00 | | $2.30 | | $1,000.00 | | $1,005.64 | | $2.31 | | 1.45% |

Investor C | | $1,000.00 | | $996.10 | | $3.49 | | $1,000.00 | | $1,004.45 | | $3.50 | | 2.20% |

| | 1 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 58/365 (to reflect the period from December 4, 2014, the commencement of operations, to January 31, 2015). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 2 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal period divided by 365. |

| | | | See “Disclosure of Expenses” on page 9 for further information on how expenses were calculated. |

| | | | | | |

| 8 | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | |

| | |

The Benefits and Risks of Leveraging | | |

BlackRock Global Long/Short Credit Fund may utilize leverage to seek to enhance yield and net asset value (“NAV”). However, these objectives cannot be achieved in all interest rate environments.

BlackRock Global Long/Short Credit Fund may utilize leverage by entering into reverse repurchase agreements. In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of BlackRock Global Long/Short Credit Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, BlackRock Global Long/Short Credit Fund’s shareholders benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is distributed to BlackRock Global Long/Short Credit Fund shareholders, and the value of these portfolio holdings is reflected in BlackRock Global Long/Short Credit Fund’s per share NAV. However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other ongoing costs of leverage exceed BlackRock Global Long/Short Credit Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if BlackRock Global Long/Short Credit Fund had not used leverage.

Furthermore, the value of BlackRock Global Long/Short Credit Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can also influence the value of portfolio investments. As a result, changes in interest rates can influence BlackRock Global Long/Short Credit Fund’s NAV positively or negatively in addition to the impact on BlackRock Global Long/Short Credit Fund performance from leverage. Changes in the direction of interest rates are difficult to predict accurately, and there is no assurance that a Fund’s leveraging strategy will be successful.

The use of leverage also generally causes greater changes in BlackRock Global Long/Short Credit Fund’s NAV and distribution rates than a comparable fund that does not use leverage. In a declining market, leverage is likely to cause a greater decline in the NAV of BlackRock Global Long/Short Credit Fund’s shares than if BlackRock Global Long/Short Credit Fund were not leveraged. In addition, BlackRock Global Long/Short Credit Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause BlackRock Global Long/Short Credit Fund to incur losses. The use of leverage may limit BlackRock Global Long/Short Credit Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. BlackRock Global Long/Short Credit Fund incurs expenses in connection with the use of leverage, all of which are borne by BlackRock Global Long/Short Credit Fund shareholders and may reduce income.

| Ÿ | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| Ÿ | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% for BlackRock Commodity Strategies Fund and BlackRock Macro Themes Fund and 4.00% for BlackRock Global Long/Short Credit Fund. These shares are subject to a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

| Ÿ | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder

would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend/payable dates. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, has contractually agreed to waive and/or reimburse a portion of each Fund’s expenses. Without such waiver and/or reimbursement, each Fund’s performance would have been lower. The Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See Note 5 of the Notes to Financial Statements for additional information on waivers and/or reimbursements. The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waiver and/or reimbursements.

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | 9 |

Shareholders of the Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on August 1, 2014 or commencement of operations and held through January 31, 2015) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the headings entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | |

| Derivative Financial Instruments | | |

The Funds may invest in various derivative financial instruments. Derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage. Derivative financial instruments also involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative

financial instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| 10 | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | |

|

| BlackRock Global Long/Short Credit Fund’s Portfolio Information |

| | | | | | | | | | | | |

| | | Percent of Total Investments1 | |

| Geographic Allocation | | Long | | | Short | | | Total | |

United States | | | 38 | % | | | 16 | % | | | 54 | % |

Italy | | | 8 | | | | — | | | | 8 | |

Spain | | | 7 | | | | — | | | | 7 | |

United Kingdom | | | 5 | | | | — | | | | 5 | |

Ireland | | | 4 | | | | — | | | | 4 | |

France | | | 4 | | | | — | | | | 4 | |

Netherlands | | | 3 | | | | — | | | | 3 | |

Denmark | | | 3 | | | | — | | | | 3 | |

Cayman Islands | | | 3 | | | | — | | | | 3 | |

Germany | | | 2 | | | | — | | | | 2 | |

Portugal | | | 2 | | | | — | | | | 2 | |

Other2 | | | 4 | | | | 1 | | | | 5 | |

Total | | | 83 | % | | | 17 | % | | | 100 | % |

| | 1 | | Total investments include the gross market values of long and short positions and exclude short-term securities. |

| | 2 | | Includes holdings within countries that are 1% or less of long-term investments. Please refer to the Schedule of Investments for such countries. |

| | |

| Credit Quality Allocation3 | | Percent of Long-Term Investments |

| | | | |

AAA/Aaa4 | | | 16 | |

AA/Aa | | | 1 | |

A | | | 11 | |

BBB/Baa | | | 25 | |

BB/Ba | | | 29 | |

B | | | 17 | |

CCC/Caa | | | 1 | |

| | 3 | | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | 4 | | The investment advisor evaluates the credit quality of not-rated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment advisor has deemed not-rated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations as AAA/Aaa. |

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | 11 |

| | | | |

| Consolidated Schedule of Investments January 31, 2015 (Unaudited) | | | BlackRock Commodity Strategies Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | | | | | |

| Commodity-Linked Notes | | | | | Par (000) | | | Value | |

Bank of America Corp. 3-month LIBOR (Indexed to the Bloomberg Commodity Index Total ReturnSM, multiplied by 3), 1/25/16 | | | USD | | | | 10,000 | | | $ | 8,111,679 | |

Citigroup, Inc. 1-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Curve CompositeSM, multiplied by 3), 1/08/16 | | | | | | | 5,000 | | | | 3,863,060 | |

Citigroup, Inc. 1-month LIBOR (Indexed to the Dow Jones-UBS Commodity Index Curve CompositeSM, multiplied by 3), 3/02/16 | | | | | | | 14,000 | | | | 8,912,848 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR (Indexed to the Dow Jones-JM Enhanced Beta Select Alternative Benchmark Total ReturnSM, multiplied by 3), 1/04/16 | | | | | | | 5,000 | | | | 3,297,020 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR (Indexed to the Dow Jones-JM Enhanced Beta Select Alternative Benchmark Total ReturnSM, multiplied by 3), 1/11/16 | | | | | | | 5,000 | | | | 3,577,701 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR (Indexed to the Dow Jones-JM Enhanced Beta Select Alternative Benchmark Total ReturnSM, multiplied by 3), 1/15/16 | | | | | | | 5,000 | | | | 3,996,745 | |

JPMorgan Chase Bank, N.A. 3-month LIBOR (Indexed to the Dow Jones-JM Enhanced Beta Select Alternative Benchmark Total ReturnSM, multiplied by 3), 12/04/15 | | | | | | | 5,000 | | | | 3,108,185 | |

UBS AG 3-month LIBOR (Indexed to the Bloomberg Commodity Index Total ReturnSM, multiplied by 3), 1/04/16 | | | | | | | 5,000 | | | | 3,503,650 | |

UBS AG 3-month LIBOR (Indexed to the Bloomberg Commodity Index Total ReturnSM, multiplied by 3), 1/19/16 | | | | | | | 5,000 | | | | 4,214,218 | |

UBS AG 3-month LIBOR (Indexed to the Bloomberg Commodity Index Total ReturnSM, multiplied by 3), 12/24/15 | | | | | | | 6,000 | | | | 3,807,188 | |

UBS AG 3-month LIBOR (Indexed to the Bloomberg Commodity Index Total ReturnSM, multiplied by 3), 2/29/16 | | | | | | | 4,000 | | | | 4,000,000 | |

Total Commodity-Linked Notes — 12.5% | | | | | | | | | | | 50,392,294 | |

| | | | | | | | | | | | |

| Common Stocks | | | | | Shares | | | | |

Biotechnology — 0.1% | | | | | | | | | | | | |

Genus PLC | | | | | | | 29,802 | | | | 549,428 | |

Chemicals — 4.5% | | | | | | | | | | | | |

Agrinos AS (a) | | | | | | | 66,903 | | | | 12,989 | |

Agrium, Inc. | | | | | | | 12,482 | | | | 1,331,205 | |

Auriga Industries A/S, Class B | | | | | | | 5,507 | | | | 260,591 | |

CF Industries Holdings, Inc. | | | | | | | 7,698 | | | | 2,350,815 | |

Israel Chemicals Ltd. | | | | | | | 72,816 | | | | 523,245 | |

Johnson Matthey PLC | | | | | | | 7,890 | | | | 385,986 | |

Monsanto Co. | | | | | | | 36,408 | | | | 4,295,416 | |

The Mosaic Co. | | | | | | | 36,928 | | | | 1,798,024 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Chemicals (concluded) | | | | | | | | |

Potash Corp. of Saskatchewan, Inc. | | | 75,969 | | | $ | 2,773,729 | |

Syngenta AG, Registered Shares | | | 6,242 | | | | 2,033,231 | |

Umicore SA | | | 23,364 | | | | 978,504 | |

Uralkali OJSC — GDR, Registered Shares | | | 34,328 | | | | 426,385 | |

Yara International ASA | | | 16,644 | | | | 866,526 | |

| | | | | | | | |

| | | | | | | | 18,036,646 | |

Energy Equipment & Services — 0.9% | | | | | | | | |

Halliburton Co. | | | 21,100 | | | | 843,789 | |

Schlumberger Ltd. | | | 32,408 | | | | 2,670,095 | |

| | | | | | | | |

| | | | | | | | 3,513,884 | |

Food & Staples Retailing — 0.3% | | | | | | | | |

The Andersons, Inc. | | | 11,442 | | | | 514,661 | |

Fyffes PLC | | | 280,872 | | | | 356,422 | |

Total Produce PLC | | | 436,914 | | | | 508,522 | |

| | | | | | | | |

| | | | | | | | 1,379,605 | |

Food Products — 5.1% | | | | | | | | |

Adecoagro SA (a) | | | 70,736 | | | | 548,911 | |

Archer-Daniels-Midland Co. | | | 74,898 | | | | 3,492,494 | |

Astra Agro Lestari Tbk PT | | | 208,000 | | | | 380,176 | |

BRF SA — ADR | | | 96,742 | | | | 2,294,720 | |

Bunge Ltd. | | | 29,126 | | | | 2,607,651 | |

Darling Ingredients, Inc. (a) | | | 20,804 | | | | 353,252 | |

First Resources Ltd. | | | 624,000 | | | | 857,082 | |

Glanbia PLC | | | 52,011 | | | | 837,376 | |

GrainCorp Ltd., Class A | | | 37,202 | | | | 256,790 | |

Hormel Foods Corp. | | | 5,202 | | | | 266,446 | |

Ingredion, Inc. | | | 15,604 | | | | 1,258,307 | |

Kernel Holding SA (a) | | | 8,322 | | | | 69,893 | |

New Britain Palm Oil Ltd. | | | 31,415 | | | | 329,803 | |

Origin Enterprises PLC (a) | | | 70,736 | | | | 628,260 | |

Pilgrim’s Pride Corp. | | | 34,328 | | | | 932,005 | |

Scandi Standard AB (a) | | | 57,923 | | | | 365,798 | |

Select Harvests Ltd. | | | 50,523 | | | | 259,404 | |

SunOpta, Inc. (a) | | | 20,804 | | | | 217,610 | |

Tyson Foods, Inc., Class A | | | 81,138 | | | | 3,167,627 | |

Wilmar International Ltd. | | | 691,000 | | | | 1,639,875 | |

| | | | | | | | |

| | | | | | | | 20,763,480 | |

Household Durables — 0.0% | | | | | | | | |

TRI Pointe Homes, Inc. | | | 6,091 | | | | 87,284 | |

Machinery — 0.4% | | | | | | | | |

Deere & Co. | | | 8,010 | | | | 682,372 | |

Kubota Corp. | | | 62,000 | | | | 920,415 | |

| | | | | | | | |

| | | | | | | | 1,602,787 | |

Metals & Mining — 13.9% | | | | | | | | |

African Barrick Gold PLC | | | 150,506 | | | | 639,048 | |

African Rainbow Minerals Ltd. | | | 28,625 | | | | 287,865 | |

Agnico-Eagle Mines Ltd. | | | 73,626 | | | | 2,482,205 | |

| | | | | | | | | | | | | | |

| ADR | | American Depositary Receipts | | COP | | Colombian Peso | | INR | | Indian Rupee | | REIT | | Real Estate Investment Trust |

| AKA | | Also Known As | | DKK | | Danish Krone | | JPY | | Japanese Yen | | S&P | | Standard & Poor’s |

| ASX | | Australian Securities Exchange | | ETF | | Exchange Traded Fund | | KRW | | Korean Won | | SEK | | Swedish Krona |

| AUD | | Australian Dollar | | EUR | | Euro | | LIBOR | | London Interbank Offered Rate | | SGD | | Singapore Dollar |

| BRL | | Brazilian Real | | EURIBOR | | Euro Interbank Offered Rate | | LP | | Limited Partnership | | SPDR | | Standard & Poor’s Depositary Receipts |

| CAD | | Canadian Dollar | | FKA | | Formerly Known As | | MXN | | Mexican Peso | | THB | | Thai Baht |

| CDO | | Collateralized Debt Obligation | | FTSE | | Financial Times Stock Exchange | | MYR | | Malaysian Ringgit | | TRY | | Turkish Lira |

| CHF | | Swiss Franc | | GBP | | British Pound | | NOK | | Norwegian Krone | | TWD | | Taiwan New Dollar |

| CLO | | Collateralized Loan Obligation | | GDR | | Global Depositary Receipts | | NZD | | New Zealand Dollar | | USD | | U.S. Dollar |

| CLP | | Chilean Peso | | HUF | | Hungarian Forint | | OTC | | Over-the-counter | | ZAR | | South African Rand |

| CNH | | Chinese Yuan | | IDR | | Indonesian Rupiah | | PIK | | Payment-in-kind | | | | |

| CNY | | Chinese Yuan Offshore | | ILS | | Israeli Shekel | | PLN | | Polish Zloty | | | | |

See Notes to Financial Statements.

| | | | | | |

| 12 | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | |

| | | | |

| Consolidated Schedule of Investments (continued) | | | BlackRock Commodity Strategies Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Metals & Mining (concluded) | | | | | | | | |

Alamos Gold, Inc. | | | 78,487 | | | $ | 418,778 | |

Alumina Ltd. | | | 451,601 | | | | 675,964 | |

Anglo American PLC | | | 30,840 | | | | 515,142 | |

AngloGold Ashanti Ltd. | | | 50,847 | | | | 616,718 | |

Aurubis AG | | | 8,151 | | | | 441,891 | |

Barrick Gold Corp. | | | 34,576 | | | | 442,166 | |

BHP Billiton PLC | | | 124,988 | | | | 2,714,816 | |

Boliden AB | | | 75,266 | | | | 1,175,786 | |

Centamin PLC | | | 403,384 | | | | 407,516 | |

Century Aluminum Co. (a) | | | 24,599 | | | | 568,483 | |

Eldorado Gold Corp. | | | 453,995 | | | | 2,179,405 | |

First Majestic Silver Corp. (a) | | | 61,016 | | | | 376,938 | |

First Quantum Minerals Ltd. | | | 74,023 | | | | 675,161 | |

Fortescue Metals Group Ltd. | | | 108,020 | | | | 195,872 | |

Franco-Nevada Corp. | | | 45,253 | | | | 2,611,476 | |

Freeport-McMoRan, Inc. | | | 42,435 | | | | 713,332 | |

Fresnillo PLC | | | 180,855 | | | | 2,442,906 | |

Glencore PLC | | | 720,136 | | | | 2,685,094 | |

Gold Fields Ltd. — ADR | | | 170,000 | | | | 1,003,000 | |

Goldcorp, Inc. | | | 164,741 | | | | 3,978,832 | |

HudBay Minerals, Inc. | | | 176,015 | | | | 1,281,293 | |

Iluka Resources Ltd. | | | 64,521 | | | | 350,392 | |

Industrias Penoles SAB de CV | | | 34,067 | | | | 679,067 | |

Kinross Gold Corp. | | | 146,600 | | | | 497,242 | |

Lundin Mining Corp. (a) | | | 419,192 | | | | 1,491,106 | |

MAG Silver Corp. (a) | | | 68,300 | | | | 506,324 | |

Metals X Ltd. | | | 154,379 | | | | 131,839 | |

Nevsun Resources Ltd. | | | 145,393 | | | | 502,302 | |

New Gold, Inc. (a) | | | 260,000 | | | | 1,139,687 | |

Newcrest Mining Ltd. | | | 220,000 | | | | 2,375,447 | |

Northern Star Resources Ltd. | | | 280,000 | | | | 405,096 | |

Nyrstar NV | | | 240,855 | | | | 906,037 | |

Osisko Gold Royalties Ltd. | | | 31,000 | | | | 416,928 | |

OZ Minerals Ltd. | | | 54,011 | | | | 161,335 | |

Petra Diamonds Ltd. | | | 142,370 | | | | 328,266 | |

Polymetal International PLC | | | 30,359 | | | | 273,388 | |

Randgold Resources Ltd. — ADR | | | 46,979 | | | | 4,005,430 | |

Rio Tinto PLC | | | 88,290 | | | | 3,879,741 | |

Romarco Minerals, Inc. (a) | | | 406,776 | | | | 182,468 | |

Royal Gold, Inc. | | | 34,982 | | | | 2,534,796 | |

Silver Wheaton Corp. | | | 84,926 | | | | 1,950,885 | |

Sirius Resources NL | | | 118,958 | | | | 230,503 | |

Sociedad Minera Cerro Verde SAA | | | 18,201 | | | | 400,422 | |

Tahoe Resources, Inc. | | | 30,978 | | | | 422,726 | |

Teck Resources Ltd., Class B | | | 45,895 | | | | 594,139 | |

Trevali Mining Corp. (a) | | | 771,153 | | | | 594,735 | |

Vale SA — ADR, Preference Shares | | | 61,615 | | | | 385,710 | |

Volcan Cia Minera SAA, Class B | | | 837,855 | | | | 131,299 | |

Western Areas Ltd. | | | 65,354 | | | | 202,461 | |

Yamana Gold, Inc. | | | 185,963 | | | | 769,785 | |

| | | | | | | | |

| | | | | | | | 55,979,243 | |

Oil, Gas & Consumable Fuels — 20.9% | | | | | | | | |

Anadarko Petroleum Corp. | | | 56,613 | | | | 4,628,113 | |

BG Group PLC | | | 67,730 | | | | 903,377 | |

BP PLC | | | 295,600 | | | | 1,898,950 | |

Cabot Oil & Gas Corp. | | | 66,400 | | | | 1,759,600 | |

Cairn Energy PLC (a) | | | 203,100 | | | | 585,337 | |

Cameco Corp. | | | 43,661 | | | | 614,353 | |

Canadian Natural Resources Ltd. | | | 41,400 | | | | 1,200,264 | |

Chevron Corp. | | | 90,450 | | | | 9,273,839 | |

China Shenhua Energy Co. Ltd., H Shares | | | 286,500 | | | | 786,453 | |

Cimarex Energy Co. | | | 15,400 | | | | 1,589,280 | |

ConocoPhillips | | | 93,850 | | | | 5,910,673 | |

CONSOL Energy, Inc. | | | 28,637 | | | | 829,041 | |

Devon Energy Corp. | | | 56,900 | | | | 3,429,363 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (concluded) | | | | | | | | |

Enbridge, Inc. | | | 64,400 | | | $ | 3,119,399 | |

EnCana Corp. | | | 149,300 | | | | 1,825,861 | |

EOG Resources, Inc. | | | 33,000 | | | | 2,937,990 | |

EQT Corp. | | | 18,800 | | | | 1,399,472 | |

Exxon Mobil Corp. | | | 113,932 | | | | 9,959,935 | |

Genel Energy PLC (a) | | | 55,200 | | | | 515,882 | |

Green Plains, Inc. | | | 5,202 | | | | 121,779 | |

Imperial Oil Ltd. | | | 27,000 | | | | 1,003,762 | |

Kosmos Energy Ltd. | | | 144,221 | | | | 1,264,818 | |

Marathon Oil Corp. | | | 87,800 | | | | 2,335,480 | |

Murphy Oil Corp. | | | 24,500 | | | | 1,100,295 | |

Noble Energy, Inc. | | | 49,600 | | | | 2,367,904 | |

Oil Search Ltd. | | | 256,950 | | | | 1,546,268 | |

Phillips 66 | | | 24,969 | | | | 1,755,820 | |

Pioneer Natural Resources Co. | | | 10,900 | | | | 1,640,777 | |

Range Resources Corp. | | | 33,050 | | | | 1,529,223 | |

Royal Dutch Shell PLC, B Shares | | | 302,390 | | | | 9,573,691 | |

Southwestern Energy Co. (a) | | | 42,100 | | | | 1,043,659 | |

Statoil ASA | | | 95,279 | | | | 1,595,570 | |

Total SA | | | 84,700 | | | | 4,347,682 | |

| | | | | | | | |

| | | | | | | | 84,393,910 | |

Paper & Forest Products — 0.3% | | | | | | | | |

Canfor Corp. | | | 19,764 | | | | 387,752 | |

Interfor Corp. | | | 21,324 | | | | 372,545 | |

Louisiana-Pacific Corp. | | | 14,563 | | | | 238,396 | |

| | | | | | | | |

| | | | | | | | 998,693 | |

Real Estate Investment Trusts (REITs) — 0.2% | | | | | | | | |

Weyerhaeuser Co. | | | 22,885 | | | | 820,427 | |

Total Common Stocks — 46.6% | | | | | | | 188,125,387 | |

| | | | | | | | |

| Investment Companies | | | | | | |

ELEMENTSSM Linked to the Rogers International Commodity Index — Total Return (a)(b) | | | 315,000 | | | | 1,867,950 | |

ETFS All Commodities DJ-UBSCISM (a)(b) | | | 185,000 | | | | 1,865,725 | |

PowerShares DB Commodity Index Tracking

Fund (a)(b) | | | 441,000 | | | | 7,673,400 | |

Total Investment Companies — 2.8% | | | | | | | 11,407,075 | |

| | | | | | | | |

| Preferred Stocks | | | | | | |

Food Products — 0.1% | | | | | | | | |

Tyson Foods, Inc., 4.75% | | | 10,085 | | | | 487,811 | |

Total Long-Term Investments | | | | | | | | |

(Cost — $281,766,405) — 62.0% | | | | | | | 250,412,567 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

Money Market Funds — 2.3% | | | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.06% (c)(d) | | | 9,144,893 | | | | 9,144,893 | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | 13 |

| | | | |

| Consolidated Schedule of Investments (continued) | | | BlackRock Commodity Strategies Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | | | | | |

| Short-Term Securities | | | | | Par (000) | | | Value | |

U.S. Treasury Bills — 32.1% | | | | | | | | | | | | |

0.02%, 2/12/15 (e) | | | USD | | | | 17,000 | | | $ | 16,999,949 | |

0.03%, 3/05/15 (e) | | | | | | | 2,000 | | | | 1,999,974 | |

0.04%, 3/05/15 (e) | | | | | | | 27,000 | | | | 26,999,645 | |

0.04%, 4/09/15 (e) | | | | | | | 30,000 | | | | 29,999,730 | |

0.03%, 5/07/15 (e) | | | | | | | 2,000 | | | | 1,999,874 | |

0.05%, 5/07/15 (e) | | | | | | | 10,000 | | | | 9,999,370 | |

0.05%, 6/04/15 (e) | | | | | | | 5,000 | | | | 4,999,620 | |

0.07%, 6/04/15 (e) | | | | | | | 16,000 | | | | 15,998,784 | |

0.05%, 7/09/15 (e) | | | | | | | 5,000 | | | | 4,999,345 | |

0.07%, 7/09/15 (e) | | | | | | | 16,000 | | | | 15,997,904 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 129,994,195 | |

Total Short-Term Securities (Cost — $139,128,592) — 34.4% | | | | 139,139,088 | |

| | | | |

| | | Value | |

Total Investments (Cost — $420,894,997) — 96.4% | | $ | 389,551,655 | |

Other Assets Less Liabilities — 3.6% | | | 14,668,865 | |

| | | | |

Net Assets — 100.0% | | $ | 404,220,520 | |

| | | | |

|

| Notes to Consolidated Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | Security is held by a wholly owned subsidiary. See Note 1 of the Notes to Financial Statements for details on the wholly owned subsidiary. |

| (c) | During the six months ended January 31, 2015, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares/Beneficial

Interest Held at

July 31, 2014 | | | Net

Activity | | | Shares/Beneficial

Interest Held at

January 31, 2015 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 12,539,789 | | | | (3,394,896 | ) | | | 9,144,893 | | | $ | 6,772 | |

BlackRock Liquidity Series, LLC Money Market Series | | $ | 39,840 | | | $ | (39,840 | ) | | | — | | | $ | 2,822 | |

| (d) | Represents the current yield as of report date. |

| (e) | Rate shown reflects the discount rate at the time of purchase. |

| Ÿ | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The categorization of a value determined for investments is based on the pricing transparency of the investment and is not necessarily an indication of the risks associated with investing in those securities. The three levels of the fair value hierarchy are as follows: |

| | Ÿ | | Level 1 — unadjusted quoted prices in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

See Notes to Financial Statements.

| | | | | | |

| 14 | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | |

| | | | |

| Consolidated Schedule of Investments (continued) | | | BlackRock Commodity Strategies Fund | |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. For information about the Fund’s policy regarding valuation of investments, refer to Note 2 of the Notes to Financial Statements.

As of January 31, 2015, the following table summarizes the Fund’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Commodity-Linked Notes | | | — | | | $ | 23,636,735 | | | $ | 26,755,559 | | | $ | 50,392,294 | |

Common Stocks: | | | | | | | | | | | | | | | | |

Biotechnology | | $ | 549,428 | | | | — | | | | — | | | | 549,428 | |

Chemicals | | | 12,988,563 | | | | 5,048,083 | | | | — | | | | 18,036,646 | |

Energy Equipment & Services | | | 3,513,884 | | | | — | | | | — | | | | 3,513,884 | |

Food & Staples Retailing | | | 1,379,605 | | | | — | | | | — | | | | 1,379,605 | |

Food Products | | | 16,097,086 | | | | 4,666,394 | | | | — | | | | 20,763,480 | |

Household Durables | | | 87,284 | | | | — | | | | — | | | | 87,284 | |

Machinery | | | 682,372 | | | | 920,415 | | | | — | | | | 1,602,787 | |

Metals & Mining | | | 35,481,205 | | | | 20,498,038 | | | | — | | | | 55,979,243 | |

Oil, Gas & Consumable Fuels | | | 62,640,700 | | | | 21,753,210 | | | | — | | | | 84,393,910 | |

Paper & Forest Products | | | 998,693 | | | | — | | | | — | | | | 998,693 | |

Real Estate Investment Trusts (REITs) | | | 820,427 | | | | — | | | | — | | | | 820,427 | |

Investment Companies | | | 11,407,075 | | | | — | | | | — | | | | 11,407,075 | |

Preferred Stocks | | | 487,811 | | | | — | | | | — | | | | 487,811 | |

Short-Term Securities: | | | | | | | | | | | | | | | | |

Money Market Funds | | | 9,144,893 | | | | — | | | | — | | | | 9,144,893 | |

U.S. Treasury Bills | | | — | | | | 129,994,195 | | | | — | | | | 129,994,195 | |

| |

Total | | $ | 156,279,026 | | | $ | 206,517,070 | | | $ | 26,755,559 | | | $ | 389,551,655 | |

| | | | |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of January 31, 2015, cash of $13,894,719 is categorized as Level 1 within the disclosure hierarchy. | |

| |

| | | Transfers into

Level 1 | | | Transfers out

of Level 1 1 | | | Transfers into

Level 2 1 | | | Transfers out

of Level 2 | |

| |

Assets: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Chemicals | | | — | | | $ | (709,661 | ) | | $ | 709,661 | | | | — | |

Food Products | | | — | | | | (2,805,965 | ) | | | 2,805,965 | | | | — | |

Metals & Mining | | | — | | | | (18,870,512 | ) | | | 18,870,512 | | | | — | |

Oil, Gas & Consumable Fuels | | | — | | | | (15,239,290 | ) | | | 15,239,290 | | | | — | |

| |

Total | | | — | | | $ | (37,625,428 | ) | | $ | 37,625,428 | | | | — | |

| | | | |

1 External pricing service used to reflect any significant market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | 15 |

| | | | |

| Consolidated Schedule of Investments (concluded) | | | BlackRock Commodity Strategies Fund | |

A reconciliation of Level 3 investments is presented when the Fund had a significant amount of Level 3 investments at the beginning and/or end of the period in relation to net assets. The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used in determining fair value:

| | | | |

| | | Commodity-Linked

Notes | |

Assets: | |

Opening Balance, as of July 31, 2014 | | $ | 29,554,915 | |

Transfers into Level 3 | | | — | |

Transfers out of Level 3 | | | — | |

Accrued discounts/premiums | | | — | |

Net realized gain (loss) | | | (14,366,997 | ) |

Net change in unrealized appreciation/depreciation1,2 | | | (9,799,356 | ) |

Purchases | | | 41,000,000 | |

Sales | | | (19,633,003 | ) |

Closing Balance, as of January 31, 2015 | | $ | 26,755,559 | |

| | | | |

Net change in unrealized appreciation/depreciation on investments still held at January 31, 20151 | | $ | (12,244,441 | ) |

| | | | |

| | 1 | | Included in the related net change in unrealized appreciation/depreciation in the Statements of Operations. |

| | 2 | | Any difference between Net change in unrealized appreciation/depreciation and Net change in unrealized appreciation/depreciation on investments still held at January 31, 2015, is generally due to investments no longer held or categorized as Level 3 at period end. |

The Fund’s investments that are categorized as Level 3 were valued utilizing third party pricing information without adjustment. Such valuations are based on unobservable inputs. A significant change in third party information could result in a significantly lower or higher value of such Level 3 investments.

See Notes to Financial Statements.

| | | | | | |

| 16 | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | |

| | | | |

| Schedule of Investments January 31, 2015 (Unaudited) | | | BlackRock Global Long/Short Credit Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | | | | | |

| Asset-Backed Securities | | | | | Par (000) | | | Value | |

Cayman Islands — 3.0% | | | | | | | | | | | | |

ACAS CLO Ltd., Series 2014-1A, Class C, 3.13%, 7/18/26 (a)(b) | | | USD | | | | 1,795 | | | $ | 1,706,248 | |

Adams Mill CLO Ltd., Series 2014-1A, Class D1, 3.70%, 7/15/26 (a)(b) | | | | | | | 767 | | | | 709,475 | |

Adirondack Park CLO Ltd., Series 2013-1A, Class D, 3.90%, 4/15/24 (a)(b) | | | | | | | 1,000 | | | | 948,359 | |

ALM VI Ltd.: | | | | | | | | | | | | |

Series 2012-6A, Class A2,

2.74%, 6/14/23 (a)(b) | | | | | | | 3,930 | | | | 3,938,911 | |

Series 2012-6A, Class C,

4.99%, 6/14/23 (a)(b) | | | | | | | 2,000 | | | | 1,999,891 | |

ALM VII Ltd., Series 2012-7A, Class C, 4.76%, 10/19/24 (a)(b) | | | | | | | 7,360 | | | | 7,359,887 | |

ALM VIII Ltd.: | | | | | | | | | | | | |

Series 2013-8A, Class B,

3.01%, 1/20/26 (a)(b) | | | | | | | 1,520 | | | | 1,453,723 | |

Series 2013-8A, Class D,

4.76%, 1/20/26 (a)(b) | | | | | | | 3,355 | | | | 2,867,818 | |

ALM XIV Ltd.: | | | | | | | | | | | | |

Series 2014-14A, Class B,

3.18%, 7/28/26 (a)(b) | | | | | | | 2,290 | | | | 2,218,798 | |

Series 2014-14A, Class C,

3.68%, 7/28/26 (a)(b) | | | | | | | 2,625 | | | | 2,442,349 | |

Apidos CLO XII, Series 2013-12A, Class D, 3.28%, 4/15/25 (a)(b) | | | | | | | 1,500 | | | | 1,376,504 | |

Apidos CLO XVI, Series 2013-16A, Class B, 3.03%, 1/19/25 (a)(b) | | | | | | | 1,313 | | | | 1,265,510 | |

Apidos CLO XVII, Series 2014-17A, Class B, 3.08%, 4/17/26 (a)(b) | | | | | | | 1,580 | | | | 1,526,178 | |

Apidos CLO XVIII, Series 2014-18A, Class C, 3.88%, 7/22/26 (a)(b) | | | | | | | 1,380 | | | | 1,305,119 | |

Ares XXV CLO Ltd., Series 2012-3X, Class C, 3.40%, 1/17/24 (b) | | | | | | | 1,300 | | | | 1,275,069 | |

Atlas Senior Loan Fund IV Ltd., Series 2013-2A, Class A3L, 2.93%, 2/17/26 (a)(b) | | | | | | | 1,800 | | | | 1,695,747 | |

Atlas Senior Loan Fund V Ltd.: | | | | | | | | | | | | |

Series 2014-1A, Class C,

3.25%, 7/16/26 (a)(b) | | | | | | | 500 | | | | 483,455 | |

Series 2014-1A, Class D,

3.70%, 7/16/26 (a)(b) | | | | | | | 980 | | | | 899,967 | |

Avalon IV Capital Ltd., Series 2012-1AR, Class CR, 3.08%, 4/17/23 (a)(b) | | | | | | | 1,185 | | | | 1,165,376 | |

Babson CLO Ltd.: | | | | | | | | | | | | |

Series 2012-2A, Class C,

4.48%, 5/15/23 (a)(b) | | | | | | | 1,285 | | | | 1,278,215 | |

Series 2013-IIA, Class B1,

2.90%, 1/18/25 (a)(b) | | | | | | | 2,500 | | | | 2,379,978 | |

Battalion CLO IV Ltd., Series 2013-4A, Class C, 3.58%, 10/22/25 (a)(b) | | | | | | | 1,750 | | | | 1,617,753 | |

Benefit Street Partners CLO IV Ltd., Series 2014-IVA, Class C, 3.73%, 7/20/26 (a)(b) | | | | | | | 1,000 | | | | 920,629 | |

Benefit Street Partners CLO Ltd.: | | | | | | | | | | | | |

Series 2012-IA, Class C,

4.75%, 10/15/23 (a)(b) | | | | | | | 1,620 | | | | 1,592,914 | |

Series 2013-IIIA, Class C,

3.50%, 1/20/26 (a)(b) | | | | | | | 1,070 | | | | 973,034 | |

Bluemountain CLO Ltd., Series 2011-1A, Class D, 4.23%, 8/16/22 (a)(b) | | | | | | | 2,000 | | | | 1,994,936 | |

Carlyle Global Market Strategies CLO Ltd.: | | | | | | | | | | | | |

Series 2011-1A, Class E,

5.68%, 8/10/21 (a)(b) | | | | | | | 4,600 | | | | 4,589,952 | |

Series 2012-2AR, Class ER,

6.33%, 7/20/23 (a)(b) | | | | | | | 4,435 | | | | 4,401,942 | |

Series 2012-3A, Class C,

4.75%, 10/04/24 (a)(b) | | | | | | | 3,495 | | | | 3,485,518 | |

Cedar Funding III CLO Ltd.: | | | | | | | | | | | | |

Series 2014-3A, Class C,

3.03%, 5/20/26 (a)(b) | | | | | | | 1,320 | | | | 1,245,563 | |

| | | | | | | | | | | | |

| Asset-Backed Securities | | | | | Par (000) | | | Value | |

Cayman Islands (continued) | | | | | | | | | | | | |

Series 2014-3A, Class D,

3.79%, 5/20/26 (a)(b) | | | USD | | | | 1,105 | | | $ | 1,020,456 | |

Cent CLO 21 Ltd., Series 2014-21A, Class C, 3.73%, 7/27/26 (a)(b) | | | | | | | 1,750 | | | | 1,619,719 | |

CIFC Funding Ltd.: | | | | | | | | | | | | |

Series 2012-1AR, Class B1R,

4.38%, 8/14/24 (a)(b) | | | | | | | 1,500 | | | | 1,466,822 | |

Series 2014-1A, Class D,

3.50%, 4/18/25 (a)(b) | | | | | | | 850 | | | | 771,524 | |

Series 2014-2A, Class B1L,

3.73%, 5/24/26 (a)(b) | | | | | | | 1,355 | | | | 1,250,130 | |

Series 2014-3A, Class C1,

2.95%, 7/22/26 (a)(b) | | | | | | | 886 | | | | 847,780 | |

Series 2014-3A, Class D,

3.55%, 7/22/26 (a)(b) | | | | | | | 791 | | | | 727,935 | |

Series 2014-4A, Class C1,

3.18%, 10/17/26 (a)(b) | | | | | | | 2,850 | | | | 2,739,069 | |

Series 2014-4A, Class D,

3.68%, 10/17/26 (a)(b) | | | | | | | 3,250 | | | | 2,988,443 | |

Dryden 34 Senior Loan Fund, Series 2014-34A, Class C, 3.09%, 10/15/26 (a)(b) | | | | | | | 1,000 | | | | 961,263 | |

Eaton Vance CLO Ltd., Series 2014-1A, Class INC, 0.00%, 7/15/26 (a) | | | | | | | 4,000 | | | | 3,172,268 | |

ECP CLO Ltd., Series 2013-5A, Class C, 3.76%, 1/20/25 (a)(b) | | | | | | | 1,750 | | | | 1,629,980 | |

Flatiron CLO Ltd.: | | | | | | | | | | | | |

Series 2013-1A, Class A1,

1.63%, 1/17/26 (a)(b) | | | | | | | 3,205 | | | | 3,171,158 | |

Series 2013-1A, Class C,

3.83%, 1/17/26 (a)(b) | | | | | | | 3,000 | | | | 2,837,124 | |

Fraser Sullivan CLO VII Ltd., Series 2012-7X, Class SUB, 0.00%, 4/20/23 | | | | | | | 2,500 | | | | 2,050,000 | |

Galaxy XII CLO Ltd., Series 2012-12A, Class B, 2.83%, 5/19/23 (a)(b) | | | | | | | 1,895 | | | | 1,912,883 | |

Galaxy XV CLO Ltd., Series 2013-15A, Class C, 2.83%, 4/15/25 (a)(b) | | | | | | | 1,000 | | | | 953,248 | |

Galaxy XVIII CLO Ltd.: | | | | | | | | | | | | |

Series 2014-18A, Class B,

2.28%, 10/15/26 (a)(b) | | | | | | | 2,260 | | | | 2,218,462 | |

Series 2014-18A, Class C1,

3.23%, 10/15/26 (a)(b) | | | | | | | 2,000 | | | | 1,948,438 | |

Gramercy Park CLO Ltd., Series 2012-1AR, Class DR, 5.73%, 7/17/23 (a)(b) | | | | | | | 1,000 | | | | 984,995 | |

ING Investment Management CLO Ltd.: | | | | | | | | | | | | |

Series 2012-1RA, Class CR,

3.93%, 3/14/22 (a)(b) | | | | | | | 2,350 | | | | 2,329,851 | |

Series 2012-3A, Class D,

5.00%, 10/15/22 (a)(b) | | | | | | | 2,321 | | | | 2,296,934 | |

Series 2013-3A, Class B,

2.93%, 1/18/26 (a)(b) | | | | | | | 2,520 | | | | 2,408,316 | |

Jamestown CLO IV Ltd., Series 2014-4A, Class C, 3.73%, 7/15/26 (a)(b) | | | | | | | 1,375 | | | | 1,281,910 | |

KKR Financial CLO Ltd., Series 2013-1A, Class A1, 1.40%, 7/15/25 (a)(b) | | | | | | | 1,640 | | | | 1,605,157 | |

LCM X LP: | | | | | | | | | | | | |

Series -10AR, Class CR,

3.08%, 4/15/22 (a)(b) | | | | | | | 645 | | | | 637,985 | |

Series -10AR, Class DR,

3.98%, 4/15/22 (a)(b) | | | | | | | 2,000 | | | | 1,981,381 | |

Madison Park Funding Ltd., Series 2012-9A, Class D, 4.58%, 8/15/22 (a)(b) | | | | | | | 1,500 | | | | 1,491,944 | |

Madison Park Funding VIII Ltd.: | | | | | | | | | | | | |

Series 2012-8AR, Class CR,

3.06%, 4/22/22 (a)(b) | | | | | | | 1,252 | | | | 1,236,503 | |

Series 2012-8AR, Class DR,

4.11%, 4/22/22 (a)(b) | | | | | | | 864 | | | | 845,430 | |

Madison Park Funding X Ltd., Series 2012-10A, Class D, 4.51%, 1/20/25 (a)(b) | | | | | | | 2,630 | | | | 2,601,075 | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | JANUARY 31, 2015 | | 17 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Global Long/Short Credit Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | | | | | |

| Asset-Backed Securities | | | | | Par

(000) | | | Value | |

Cayman Islands (continued) | | | | | | | | | | | | |

Madison Park Funding XI Ltd., Series 2013-11A, Class C, 3.01%, 10/23/25 (a)(b) | | | USD | | | | 2,680 | | | $ | 2,570,927 | |

Mountain Hawk II CLO Ltd., Series 2013-2A, Class A1, 1.39%, 7/22/24 (a)(b) | | | | | | | 2,320 | | | | 2,267,796 | |

Neuberger Berman CLO XII Ltd., Series 2012-12AR, Class DR, 4.23%, 7/25/23 (a)(b) | | | | | | | 2,000 | | | | 1,975,918 | |

Neuberger Berman CLO XVII Ltd., Series 2014-17A, Class D, 3.71%, 8/04/25 (a)(b) | | | | | | | 568 | | | | 525,754 | |

Oaktree CLO Ltd., Series 2014-1A, Class A2A,

2.28%, 2/13/25 (a)(b) | | | | | | | 3,470 | | | | 3,390,493 | |

Octagon Investment Partners XIX Ltd., Series 2014-1A, Class D, 3.75%, 4/15/26 (a)(b) | | | | | | | 2,500 | | | | 2,335,701 | |

Octagon Investment Partners XVII Ltd., Series 2013-1A, Class D, 3.43%, 10/25/25 (a)(b) | | | | | | | 1,000 | | | | 919,505 | |

Octagon Investment Partners XVIII Ltd., Series 2013-1A, Class C, 3.93%, 12/16/24 (a)(b) | | | | | | | 1,000 | | | | 949,049 | |

Octagon Investment Partners XX Ltd., Series 2014-1A, Class D, 3.88%, 8/12/26 (a)(b) | | | | | | | 1,175 | | | | 1,101,553 | |

OHA Credit Partners VI Ltd., Series 2012-6A, Class D, 4.73%, 5/15/23 (a)(b) | | | | | | | 3,200 | | | | 3,208,366 | |

OHA Credit Partners VII Ltd., Series 2012-7A, Class A, 1.65%, 11/20/23 (a)(b) | | | | | | | 3,350 | | | | 3,325,086 | |

OZLM Funding IV Ltd., Series 2013-4A, Class C, 3.43%, 7/22/25 (a)(b) | | | | | | | 1,000 | | | | 916,212 | |

OZLM VII Ltd.: | | | | | | | | | | | | |

Series 2014-7A, Class B1,

3.11%, 7/17/26 (a)(b) | | | | | | | 430 | | | | 412,064 | |

Series 2014-7A, Class C,

3.86%, 7/17/26 (a)(b) | | | | | | | 1,062 | | | | 989,313 | |

OZLM VIII Ltd.: | | | | | | | | | | | | |

Series 2014-8A, Class B,

3.28%, 10/17/26 (a)(b) | | | | | | | 3,000 | | | | 2,913,662 | |

Series 2014-8A, Class C,

3.78%, 10/17/26 (a)(b) | | | | | | | 2,000 | | | | 1,851,492 | |

Palmer Square CLO Ltd.: | | | | | | | | | | | | |

Series 2014-1A, Class B,

2.78%, 10/17/22 (a)(b) | | | | | | | 2,005 | | | | 1,954,426 | |

Series 2014-1A, Class C,

4.08%, 10/17/22 (a)(b) | | | | | | | 1,215 | | | | 1,197,970 | |

Race Point V CLO Ltd., Series 2011-5AR, Class DR, 3.98%, 12/15/22 (a)(b) | | | | | | | 1,645 | | | | 1,641,364 | |

Rait Preferred Funding II Ltd., Series 2007-2A, Class A1T, 0.46%, 6/25/45 (a)(b) | | | | | | | 3,372 | | | | 3,102,067 | |

Regatta IV Funding Ltd.: | | | | | | | | | | | | |

Series 2014-1A, Class C,

3.18%, 7/25/26 (a)(b) | | | | | | | 550 | | | | 531,159 | |

Series 2014-1A, Class D,

3.77%, 7/25/26 (a)(b) | | | | | | | 660 | | | | 611,671 | |

Seneca Park CLO Ltd., Series 2014-1A, Class D, 3.72%, 7/17/26 (a)(b) | | | | | | | 1,435 | | | | 1,346,122 | |

Silver Spring CLO Ltd., Series 2014-1A, Class D, 3.71%, 10/15/26 (a)(b) | | | | | | | 2,000 | | | | 1,832,051 | |

Steele Creek CLO Ltd.: | | | | | | | | | | | | |

Series 2014-1A, Class B,

2.48%, 8/21/26 (a)(b) | | | | | | | 1,110 | | | | 1,076,878 | |

Series 2014-1A, Class C,

3.43%, 8/21/26 (a)(b) | | | | | | | 1,110 | | | | 1,078,920 | |

| | | | | | | | | | | | |

| Asset-Backed Securities | | | | | Par

(000) | | | Value | |

Cayman Islands (concluded) | | | | | | | | | | | | |

Sudbury Mill CLO Ltd., Series 2013-1A, Class C, 3.23%, 1/17/26 (a)(b) | | | USD | | | | 2,500 | | | $ | 2,418,232 | |

TICP CLO II Ltd.: | | | | | | | | | | | | |

Series 2014-2A, Class A1A,

1.68%, 7/26/26 (a)(b) | | | | | | | 3,400 | | | | 3,367,204 | |

Series 2014-2A, Class B,

3.23%, 7/26/26 (a)(b) | | | | | | | 870 | | | | 839,785 | |

Tyron Park CLO Ltd., Series 2013-1A, Class C, 3.73%, 7/15/25 (a)(b) | | | | | | | 1,000 | | | | 941,847 | |

Venture XIII CLO Ltd., Series 2013-13A, Class D, 3.78%, 6/10/25 (a)(b) | | | | | | | 500 | | | | 469,428 | |

Venture XVI CLO Ltd., Series 2014-16A, Class A3L, 2.98%, 4/15/26 (a)(b) | | | | | | | 1,750 | | | | 1,671,982 | |

Venture XVII CLO Ltd., Series 2014-17A, Class C, 3.10%, 7/15/26 (a)(b) | | | | | | | 1,163 | | | | 1,107,967 | |

Venture XVIII CLO Ltd., Series 2014-18A, Class C, 3.39%, 10/15/26 (a)(b) | | | | | | | 1,457 | | | | 1,420,190 | |

Voya CLO Ltd., Series 2014-3A, Class C,

3.83%, 7/25/26 (a)(b) | | | | | | | 1,850 | | | | 1,743,336 | |