UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-05742

Name of Fund: BlackRock Funds

BlackRock All-Cap Energy & Resources Portfolio

BlackRock Emerging Markets Dividend Fund

BlackRock Energy & Resources Portfolio

BlackRock Flexible Equity Fund

BlackRock Global Opportunities Portfolio

BlackRock Health Sciences Opportunities Portfolio

BlackRock International Opportunities Portfolio

BlackRock Managed Volatility Portfolio

BlackRock Mid-Cap Growth Equity Portfolio

BlackRock Science & Technology Opportunities Portfolio

BlackRock Small Cap Growth Equity Portfolio

BlackRock U.S. Opportunities Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2015

Date of reporting period: 03/31/2015

Item 1 – Report to Stockholders

MARCH 31, 2015

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

BlackRock FundsSM

„ BlackRock All-Cap Energy & Resources Portfolio

„ BlackRock Emerging Markets Dividend Fund

„ BlackRock Energy & Resources Portfolio

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | | | | | |

| 2 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

Dear Shareholder,

Market volatility has remained low from a long-term perspective, but increased over the course of 2014 amid higher valuations in risk assets (such as equities and high yield bonds), geopolitical risks, uneven global economic growth and uncertainty around policy moves from the world’s largest central banks. As the U.S. Federal Reserve (the “Fed”) gradually reduced its bond buying program (which ultimately ended in October 2014), U.S. interest rates surprisingly trended lower and stock prices forged ahead despite high valuations on the back of a multi-year bull market. Geopolitical tensions intensified in Ukraine and the Middle East and oil prices became highly volatile in the middle of the summer, stoking worries about economic growth outside the United States. As the U.S. economy continued to show steady improvement, the stronger data caused concern among investors that the Fed would raise short-term rates sooner than previously anticipated. The U.S. dollar appreciated and global credit markets tightened, ultimately putting a strain on investor flows, and financial markets broadly weakened in the third quarter.

U.S. economic growth picked up considerably in the fourth quarter while the broader global economy showed signs of slowing. U.S. markets significantly outperformed international markets even as the European Central Bank (“ECB”) and the Bank of Japan eased monetary policy, which drove further strengthening in the U.S. dollar. Oil prices plummeted in the fourth quarter due to a global supply-and-demand imbalance, sparking a selloff in energy-related assets and stress in emerging markets. Fixed income investors piled into U.S. Treasuries as their persistently low yields became relatively attractive as compared to international sovereign debt.

Equity markets reversed in the first quarter of 2015 and U.S. stocks underperformed international markets, notably Europe and Japan, but also emerging markets. Investors had held high expectations for the U.S. economy, but after a harsh winter, first-quarter data disappointed and high valuations took their toll on U.S. stocks. Meanwhile, economic reports in Europe and Asia easily beat investors’ very low expectations for those economies, and accommodative policies from global central banks helped international equities rebound. The ECB’s asset purchase program (announced in January and commenced in March) was the largest in scale and effect on the markets. Overall, market volatility decreased in the first quarter as global risks abated, with a ceasefire in Ukraine and an improving outlook for Greece’s continued membership in the Eurozone.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of March 31, 2015 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities (S&P 500® Index) | | | 5.93 | % | | | 12.73 | % |

U.S. small cap equities (Russell 2000® Index) | | | 14.46 | | | | 8.21 | |

International equities (MSCI Europe, Australasia, Far East Index) | | | 1.13 | | | | (0.92 | ) |

Emerging market equities (MSCI Emerging Markets Index) | | | (2.37 | ) | | | 0.44 | |

3-month Treasury bill (BofA Merrill Lynch 3-Month U.S. Treasury Bill Index) | | | 0.01 | | | | 0.03 | |

U.S. Treasury securities (BofA Merrill Lynch 10- Year U.S. Treasury Index) | | | 6.25 | | | | 9.88 | |

U.S. investment grade bonds (Barclays U.S. Aggregate Bond Index) | | | 3.43 | | | | 5.72 | |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | | 2.29 | | | | 6.60 | |

U.S. high yield bonds (Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | | 1.50 | | | | 2.00 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | | | |

| Fund Summary as of March 31, 2015 | | | BlackRock All-Cap Energy & Resources Portfolio | |

BlackRock All-Cap Energy & Resources Portfolio’s (the “Fund”) investment objective is to provide long-term growth of capital.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended March 31, 2015, the Fund underperformed the MSCI World Energy Index. |

What factors influenced performance?

| Ÿ | | The Fund’s overweight positions in the North American exploration and production (E&P) stocks Encana Corp. and Laredo Petroleum, Inc. weighed on relative returns, as the companies’ growth rates appeared to be at risk following the drop in oil prices. Encana Corp. came under further pressure after announcing it was raising funds by issuing new equity. |

| Ÿ | | Toward the end of the period, a divergence in oil prices between Brent (international crude) and West Texas Intermediate (U.S. crude) was beneficial for the Gulf Coast refiners Valero Energy Corp. and Marathon Oil Corp., as these companies took advantage of the spread between the prices of the two types of oil. The Fund’s underweight in these stocks detracted from relative performance. |

| Ÿ | | Well-capitalized E&P companies with stronger-than-average balance sheets and tier one assets generally outperformed during the first quarter. Devon Energy Corp. and Cimarex Energy Co., both of which outpaced the broader sector, were prime examples of this trend. The Fund held overweights in the two stocks, aiding performance. |

| Ÿ | | Eni S.p.A., a European integrated energy company, announced a cut to its dividend near the end of the period. This was the first instance of a dividend cut by one of the major energy companies during this downturn. The stock fell sharply as a result, so the Fund’s underweight was a positive contributor to relative performance. At the close of the period, the Fund remained underweight in Eni S.p.A. in favor of more compelling value opportunities elsewhere in the sector. |

Describe recent portfolio activity.

| Ÿ | | The Fund initiated a position in Marathon Oil Corp., a high-quality, U.S.-focused oil producer, during the period. This purchase was funded through the sales of CONSOL Energy, Inc. and Laredo Petroleum, Inc. and the distribution company TransCanada Corp. The Fund also exited its position in the offshore service company Cameron International Corp. on concerns that the company’s business model will be particularly challenged by lower oil prices. The proceeds of these sales were rotated into a new position in the U.S.-focused land driller Helmerich & Payne, Inc. |

Describe portfolio positioning at period end.

| Ÿ | | The Fund retained a bias toward higher-quality companies, and a number of the major integrated energy companies remained in its top-ten holdings. The Fund’s investment advisor believed these companies’ strong asset bases and financial flexibility gave them the ability to adapt to a weak oil price environment. |

| Ÿ | | The Fund maintained an overweight to the E&P industry, and it also had significant exposure to U.S. onshore unconventional producers and international E&P companies. The Fund retained a strong focus on assessing valuations, asset bases and companies’ financial flexibility. |

| Ÿ | | Believing lower oil prices will lead to falling profit margins for offshore oil services companies, the Fund’s investment advisor remained cautious with respect to this industry group. In addition, these companies tend to be key beneficiaries of the major integrated companies’ capital expenditures (capex). As a result, the capex cuts that have occurred across the energy sector represent a potential headwind for oil services companies. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Ten Largest Holdings | | Percent of Long-Term Investments |

| | | | |

Exxon Mobil Corp. | | | 11 | % |

Chevron Corp. | | | 8 | |

Royal Dutch Shell PLC, A Shares - ADR | | | 7 | |

ConocoPhillips | | | 6 | |

Anadarko Petroleum Corp. | | | 5 | |

BP PLC | | | 5 | |

TOTAL SA | | | 5 | |

Pioneer Natural Resources Co. | | | 4 | |

Marathon Oil Corp. | | | 4 | |

Enbridge, Inc. | | | 4 | |

| | |

| Industry Allocation | | Percent of Long-Term Investments |

| | | | |

Oil, Gas & Consumable Fuels | | | 93 | % |

Energy Equipment & Services | | | 7 | |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| 4 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

| | | | |

| | | | BlackRock All-Cap Energy & Resources Portfolio | |

|

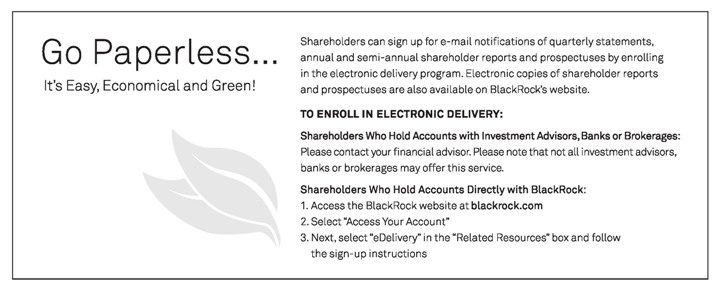

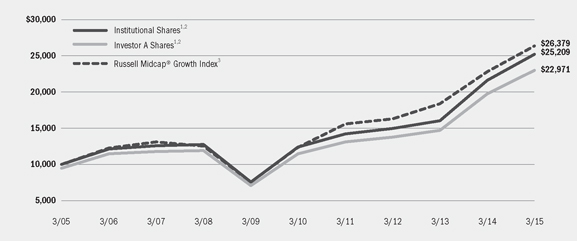

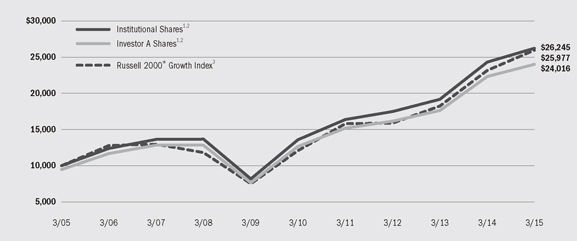

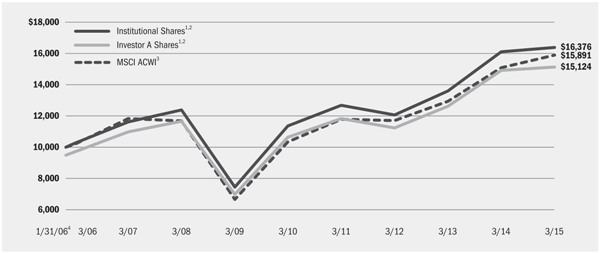

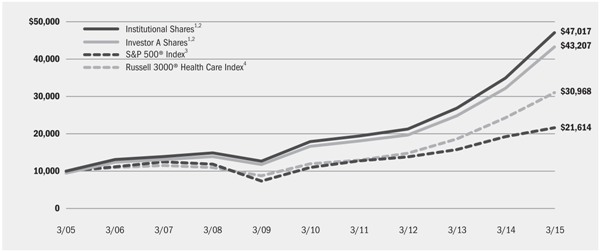

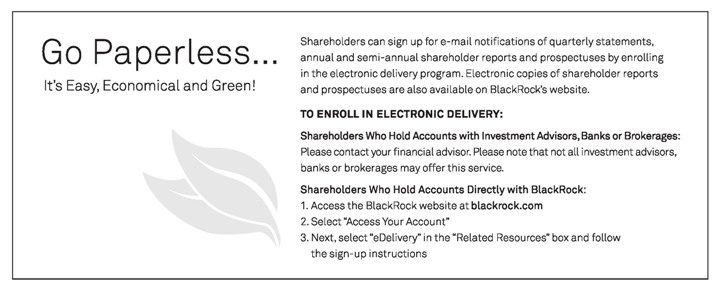

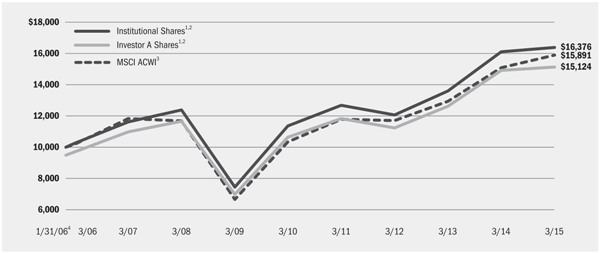

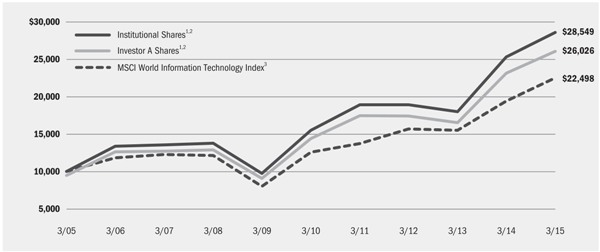

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | Under normal market conditions, the Fund invests at least 80% of its total assets in equity securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). |

| | 3 | A free float-adjusted market capitalization index that represents the energy segment in global developed market equity performance. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended March 31, 2015 | |

| | | | | | Average Annual Total Returns4 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month Total Returns | | | w/o sales charge | | | w/ sales charge | | | w/o sales charge | | | w/ sales charge | | | w/o sales charge | | | w/ sales charge | |

Institutional | | | (18.91 | )% | | | (17.18 | )% | | | N/A | | | | (0.41 | )% | | | N/A | | | | 5.44 | % | | | N/A | |

Service | | | (19.08 | ) | | | (17.46 | ) | | | N/A | | | | (0.80 | ) | | | N/A | | | | 5.02 | | | | N/A | |

Investor A | | | (19.04 | ) | | | (17.52 | ) | | | (21.85 | )% | | | (0.83 | ) | | | (1.90 | )% | | | 5.00 | | | | 4.43 | % |

Investor B | | | (19.38 | ) | | | (18.12 | ) | | | (21.80 | ) | | | (1.57 | ) | | | (1.97 | ) | | | 4.39 | | | | 4.39 | |

Investor C | | | (19.38 | ) | | | (18.12 | ) | | | (18.94 | ) | | | (1.55 | ) | | | (1.55 | ) | | | 4.24 | | | | 4.24 | |

MSCI World Energy Index | | | (17.67 | ) | | | (16.58 | ) | | | N/A | | | | 2.96 | | | | N/A | | | | 4.59 | | | | N/A | |

| | 4 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical6 | | |

| | | Beginning

Account Value

October 1, 2014 | | Ending

Account Value

March 31, 2015 | | Expenses Paid

During the Period5 | | Beginning

Account Value

October 1, 2014 | | Ending

Account Value

March 31, 2015 | | Expenses Paid

During the Period5 | | Annualized

Expense Ratio |

Institutional | | $1,000.00 | | $810.90 | | $4.33 | | $1,000.00 | | $1,020.14 | | $4.84 | | 0.96% |

Service | | $1,000.00 | | $809.20 | | $6.22 | | $1,000.00 | | $1,018.05 | | $6.94 | | 1.38% |

Investor A | | $1,000.00 | | $809.60 | | $6.23 | | $1,000.00 | | $1,018.05 | | $6.94 | | 1.38% |

Investor B | | $1,000.00 | | $806.20 | | $9.46 | | $1,000.00 | | $1,014.46 | | $10.55 | | 2.10% |

Investor C | | $1,000.00 | | $806.20 | | $9.46 | | $1,000.00 | | $1,014.46 | | $10.55 | | 2.10% |

| | 5 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 6 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 11 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2015 | | 5 |

| | | | |

| Fund Summary as of March 31, 2015 | | | BlackRock Emerging Markets Dividend Fund | |

BlackRock Emerging Markets Dividend Fund’s (the “Fund”) investment objective is primarily to seek investment income and, as a secondary objective, to seek capital appreciation.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended March 31, 2015, the Fund underperformed its benchmark, the MSCI Emerging Markets Index. |

What factors influenced performance?

| Ÿ | | Stock selection in China was the largest detractor from performance during the semi-annual period, with the largest negative contribution coming from the Fund’s lack of a position in the internet provider Tencent Holdings Ltd. Stock selection in South Korea also weighed on returns. A lack of exposure to Samsung Co. Ltd., which the Fund does not own due to its low yield, was a notable detractor. The Brazilian industrial stock Marcopolo SA, which suffered as a result of macroeconomic headwinds in Brazil, was the largest detractor among individual stocks. |

| Ÿ | | The most significant contributions to relative performance came from stock selection in Russia, Taiwan and South Africa. The largest individual contributor was the Fund’s lack of exposure to the Brazilian oil & gas stock Petrobras SA, which suffered from an ongoing corruption scandal investigation and the volatility in oil prices. Positions in the Chinese paper products manufacturer Hengan International Group Co. Ltd. and Taiwan Semiconductor Manufacturing Co. Ltd. also contributed positively. |

Describe recent portfolio activity.

| Ÿ | | During the period, the Fund added to its positions in Taiwan, China and Thailand while reducing its weighting in Brazil and deploying cash. At the sector level, the Fund increased its weightings in information technology and financials while reducing its positions in materials and energy. The Fund initiated a position in Industrial & Commercial Bank of China Ltd. and increased its weighting in the Russian food retailer Magnit PJSC. These moves were partially funded by reducing exposure to MMC Norilsk Nickel OJSC, a Russian mining company, and exiting China Petroleum & Chemical Corp. |

Describe portfolio positioning at period end.

| Ÿ | | Divergence in the performance of individual countries continued to be a theme within the emerging markets. However, the moderation of economic growth, policy reforms and interest rate changes became larger drivers of performance across the asset class. The Fund’s investment advisor retained a positive view on the emerging markets, as valuations remained inexpensive relative to both their own history and valuations in the developed markets. |

| Ÿ | | The Fund held overweight positions in Thailand, Mexico and Taiwan at the close of the period, while its largest underweights were in South Korea, China, Malaysia and Brazil. The underweight position in South Korea was a result of the low dividend yields in that market. At the sector level, the Fund was overweight in industrials and financials and underweight in information technology and utilities. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Ten Largest Holdings | | Percent of

Long-Term Investments |

| | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 6 | % |

Industrial & Commercial Bank of China Ltd., H Shares | | | 4 | |

Hengan International Group Co. Ltd. | | | 4 | |

SK Telecom Co. Ltd. | | | 3 | |

Itau Unibanco Holding SA - ADR | | | 3 | |

Powszechny Zaklad Ubezpieczen SA | | | 3 | |

FirstRand Ltd. | | | 3 | |

Grupo Aeroportuario del Pacifico SAB de CV, Class B | | | 3 | |

Sanlam Ltd. | | | 3 | |

China Merchants Holdings International Co. Ltd. | | | 3 | |

| | |

| Geographic Allocation | | Percent of

Long-Term Investments |

| | | | |

Taiwan | | | 19 | % |

China | | | 17 | |

Mexico | | | 12 | |

Thailand | | | 9 | |

South Africa | | | 8 | |

Russia | | | 5 | |

South Korea | | | 5 | |

Brazil | | | 5 | |

Indonesia | | | 3 | |

Poland | | | 3 | |

Other1 | | | 14 | |

| | 1 | | Includes holdings within countries that are 2% or less of long-term investments. Please refer to the Schedule of Investments for such countries. |

| | | | | | |

| 6 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

| | | | |

| | | | BlackRock Emerging Markets Dividend Fund | |

|

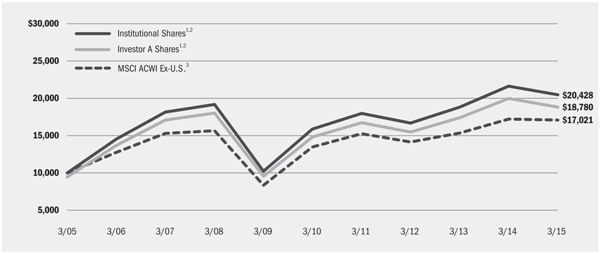

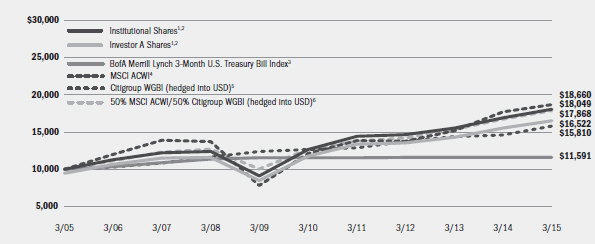

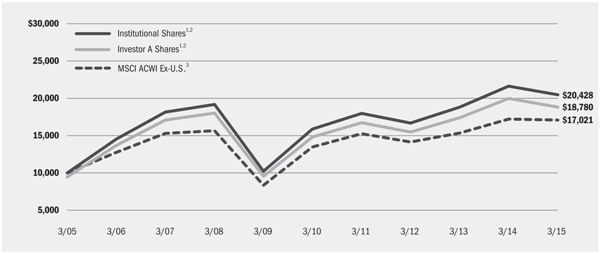

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. The Fund’s total returns prior to August 16, 2013, are the returns of the Fund when it followed different investment strategies under the name BlackRock China Fund. |

| | 2 | Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of, or derivatives having economic characteristics similar to the dividend-paying equity securities of companies domiciled in, or tied economically to, emerging market countries. |

| | 3 | A free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 23 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. |

| | 4 | Commencement of operations. |

| | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended March 31, 2015 | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | Since Inception6 | |

| | | 6-Month Total Returns | | | w/o sales charge | | | w/ sales charge | | | w/o sales charge | | | w/ sales charge | |

Institutional | | | (3.65 | )% | | | (1.99 | )% | | | N/A | | | | (2.76 | )% | | | N/A | |

Investor A | | | (3.80 | ) | | | (2.24 | ) | | | (7.37 | )% | | | (3.01 | ) | | | (4.34 | )% |

Investor C | | | (4.31 | ) | | | (3.04 | ) | | | (3.99 | ) | | | (3.71 | ) | | | (3.71 | ) |

MSCI Emerging Markets Index | | | (2.37 | ) | | | 0.44 | | | | N/A | | | | (2.85 | ) | | | N/A | |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | | The Fund commenced operations on April 29, 2011. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical8 | | |

| | | Beginning

Account Value

October 1, 2014 | | Ending

Account Value

March 31, 2015 | | Expenses Paid

During the Period7 | | Beginning

Account Value

October 1, 2014 | | Ending

Account Value

March 31, 2015 | | Expenses Paid

During the Period7 | | Annualized

Expense Ratio |

Institutional | | $1,000.00 | | $963.50 | | $7.39 | | $1,000.00 | | $1,017.40 | | $7.59 | | 1.51% |

Investor A | | $1,000.00 | | $962.00 | | $8.61 | | $1,000.00 | | $1,016.16 | | $8.85 | | 1.76% |

Investor C | | $1,000.00 | | $956.90 | | $12.25 | | $1,000.00 | | $1,012.42 | | $12.59 | | 2.51% |

| | 7 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 8 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 11 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2015 | | 7 |

| | | | |

| Fund Summary as of March 31, 2015 | | | BlackRock Energy & Resources Portfolio | |

BlackRock Energy & Resources Portfolio’s (the “Fund”) investment objective is to provide long-term growth of capital.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended March 31, 2015, the Fund’s Institutional, Investor A and Investor C Shares outperformed the MSCI World Small and Mid-Cap Energy Index, while the Investor B Shares performed inline with the benchmark index. |

What factors influenced performance?

| Ÿ | | Well-capitalized exploration and production (E&P) companies with stronger-than-average balance sheets and tier one assets generally outperformed during the period. Carrizo Oil & Gas, Inc. and EOG Resources, Inc., both of which outpaced the broader sector, were prime examples of this trend. The Fund held over-weights in the two stocks, aiding performance. |

| Ÿ | | The Fund’s overweight position in the distribution company Enbridge, Inc. was a notable contributor to relative performance. As a distribution company, its share price was less impacted by the decline in oil prices. The market also reacted favorably to the company’s increase in its quarterly dividend and its announcement of a financial restructuring plan. |

| Ÿ | | The Fund’s overweight position in Canadian Oil Sands Ltd. was the largest detractor during the period. The company has relatively high operational costs, which meant that the stock was especially vulnerable to the drop in oil prices. The market also reacted negatively to the company’s announcement of its 2015 outlook. While Canadian Oil Sands Ltd. indicated that it would generate production growth in 2015, its estimate was below investor expectations. The company also made a substantial cut to its dividend. |

| Ÿ | | An overweight positions in North American E&P companies Encana Corp. and Ithaca Energy, Inc. weighed on relative returns, as the companies’ growth rates |

| | | appeared to be at risk following the drop in oil prices. Encana Corp. came under further pressure after announcing it was raising funds by issuing new equity. |

Describe recent portfolio activity.

| Ÿ | | The Fund initiated a position in Marathon Oil Corp., a high-quality, U.S.-focused oil producer, during the period. This purchase was funded through the sales of two U.S. E&P stocks, Denbury Resources, Inc. and Stone Energy Corp. The Fund also initiated a position in the distribution company Enbridge, Inc. due to its lower sensitivity to oil prices weakness compared to the energy sector as a whole. |

Describe portfolio positioning at period end.

| Ÿ | | The Fund retained a bias toward higher-quality companies, and it maintained an overweight to the E&P industry. The Fund also had significant exposure to U.S. onshore unconventional producers and international E&P companies. The Fund retained a strong focus on assessing valuations, asset bases and companies’ financial flexibility. |

| Ÿ | | Believing lower oil prices will lead to falling profit margins for offshore oil services companies, the Fund’s investment advisor remained cautious with respect to this industry group. In addition, these companies tend to be key beneficiaries of the major integrated companies’ capital expenditures (capex). As a result, the capex cuts that have occurred across the energy sector represent a potential headwind for oil services companies. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Ten Largest Holdings | | Percent of

Long-Term Investments |

| | | | |

Enbridge, Inc. | | | 7 | % |

Cimarex Energy Co. | | | 6 | |

Cabot Oil & Gas Corp. | | | 5 | |

EQT Corp. | | | 5 | |

AltaGas Ltd. | | | 5 | |

Murphy Oil Corp. | | | 5 | |

Range Resources Corp. | | | 4 | |

Marathon Oil Corp. | | | 4 | |

Carrizo Oil & Gas, Inc. | | | 4 | |

Southwestern Energy Co. | | | 4 | |

| | |

| Industry Allocation | | Percent of

Long-Term Investments |

| | | | |

Oil, Gas & Consumable Fuels | | | 93 | % |

Energy Equipment & Services | | | 7 | |

For Fund compliance purposes, the Fund’s industry classifications refer to any one

or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| 8 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

| | | | |

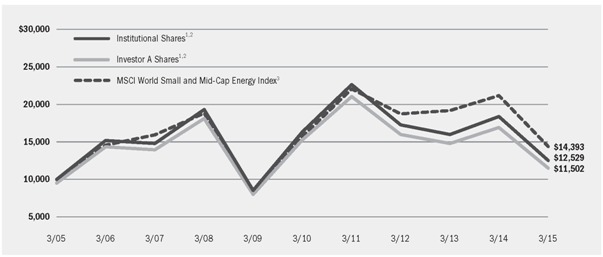

| | | | BlackRock Energy & Resources Portfolio | |

|

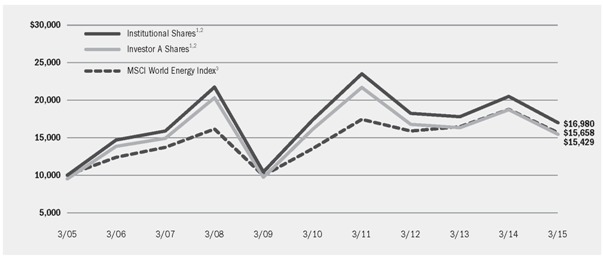

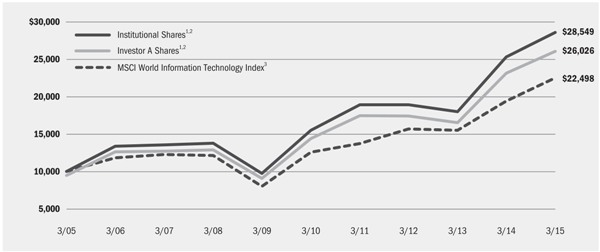

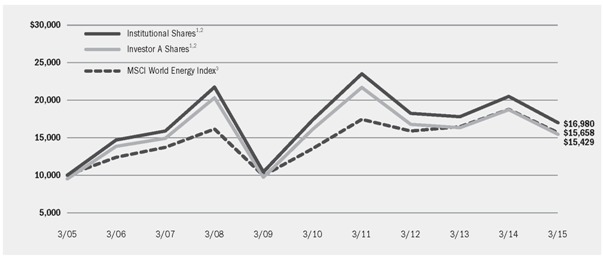

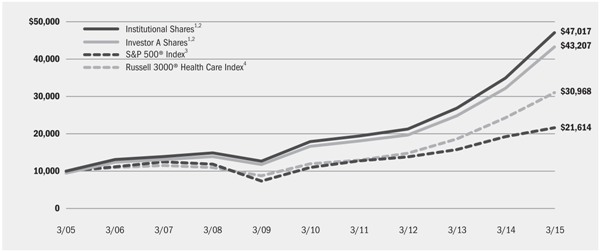

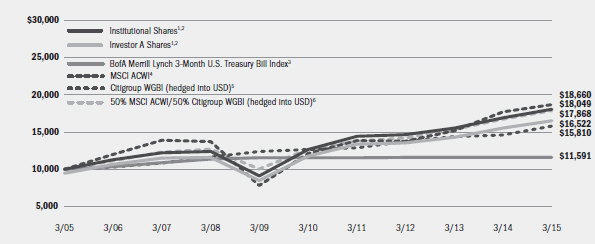

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | Under normal conditions, the Fund invests at least 80% of its total assets in equity securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). |

| | 3 | An index comprised of the energy sector constituents of the MSCI World SMID Index, a free float-adjusted market capitalization weighted index designed to measure the equity market performance of the mid and small cap developed market. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended March 31, 2015 | |

| | | | | | Average Annual Total Returns4 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | | (28.72 | )% | | | (31.79 | )% | | | N/A | | | | (5.17 | )% | | | N/A | | | | 2.28 | % | | | N/A | |

Investor A | | | (28.82 | ) | | | (31.99 | ) | | | (35.56 | )% | | | (5.48 | ) | | | (6.49 | )% | | | 1.96 | | | | 1.41 | % |

Investor B | | | (29.12 | ) | | | (32.56 | ) | | | (35.59 | ) | | | (6.20 | ) | | | (6.56 | ) | | | 1.35 | | | | 1.35 | |

Investor C | | | (29.07 | ) | | | (32.49 | ) | | | (33.16 | ) | | | (6.18 | ) | | | (6.18 | ) | | | 1.22 | | | | 1.22 | |

MSCI World Small and Mid-Cap Energy Index | | | (29.14 | ) | | | (31.91 | ) | | | N/A | | | | (1.74 | ) | | | N/A | | | | 3.71 | | | | N/A | |

| | 4 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical6 | | |

| | | Beginning

Account Value

October 1, 2014 | | Ending

Account Value

March 31, 2015 | | Expenses Paid

During the Period5 | | Beginning

Account Value

October 1, 2014 | | Ending

Account Value

March 31, 2015 | | Expenses Paid

During the Period5 | | Annualized

Expense Ratio |

Institutional | | $1,000.00 | | $712.80 | | $4.57 | | $1,000.00 | | $1,019.60 | | $5.39 | | 1.07% |

Investor A | | $1,000.00 | | $711.80 | | $5.89 | | $1,000.00 | | $1,018.05 | | $6.94 | | 1.38% |

Investor B | | $1,000.00 | | $708.80 | | $8.95 | | $1,000.00 | | $1,014.46 | | $10.55 | | 2.10% |

Investor C | | $1,000.00 | | $709.30 | | $8.95 | | $1,000.00 | | $1,014.46 | | $10.55 | | 2.10% |

| | 5 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 6 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 11 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2015 | | 9 |

| Ÿ | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| Ÿ | | Service Shares are not subject to any sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are only available to certain eligible investors. |

| Ÿ | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

| Ÿ | | Investor B Shares are subject to a maximum CDSC of 4.50%, declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic share conversions.) All returns for periods greater than eight years reflect this conversion. These shares are only available through exchanges and distribution reinvestments by current holders and for purchase by certain employer-sponsored retirement plans. |

| Ÿ | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, has contractually agreed to waive and/or reimburse a portion of certain Funds’ expenses. Without such waiver and/or reimbursement, such Funds’ performance would have been lower. The Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See Note 5 of the Notes to Financial Statements for additional information on waivers and/or reimbursements.

| | | | | | |

| 10 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

Shareholders of the Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on October 1, 2014 and held through March 31, 2015) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the headings entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | |

| Derivative Financial Instruments | | |

The Funds may invest in various derivative financial instruments. Derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to manage equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage. Derivative financial instruments also involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial

instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2015 | | 11 |

| | | | |

| Schedule of Investments March 31, 2015 (Unaudited) | | | BlackRock All-Cap Energy & Resources Portfolio | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Energy Equipment & Services — 7.0% | | | | | | | | |

Halliburton Co. | | | 38,300 | | | $ | 1,680,604 | |

Helmerich & Payne, Inc. | | | 49,000 | | | | 3,335,430 | |

Schlumberger Ltd. | | | 65,641 | | | | 5,477,085 | |

| | | | | | | | |

| | | | | | | | 10,493,119 | |

Oil, Gas & Consumable Fuels — 92.4% | | | | | | | | |

Anadarko Petroleum Corp. | | | 96,100 | | | | 7,958,041 | |

BG Group PLC | | | 116,825 | | | | 1,433,873 | |

BP PLC | | | 1,125,600 | | | | 7,296,290 | |

Cabot Oil & Gas Corp. | | | 130,900 | | | | 3,865,477 | |

Cairn Energy PLC (a) | | | 512,600 | | | | 1,187,670 | |

Canadian Natural Resources Ltd. | | | 50,300 | | | | 1,541,705 | |

Chevron Corp. | | | 109,098 | | | | 11,453,108 | |

Cimarex Energy Co. | | | 29,200 | | | | 3,360,628 | |

ConocoPhillips | | | 156,600 | | | | 9,749,916 | |

Devon Energy Corp. | | | 92,100 | | | | 5,554,551 | |

Enbridge, Inc. | | | 116,900 | | | | 5,634,791 | |

Encana Corp. | | | 404,400 | | | | 4,514,797 | |

EOG Resources, Inc. | | | 59,140 | | | | 5,422,546 | |

Exxon Mobil Corp. | | | 190,900 | | | | 16,226,500 | |

Kosmos Energy Ltd. (a) | | | 173,414 | | | | 1,371,705 | |

Marathon Oil Corp. | | | 222,200 | | | | 5,801,642 | |

Murphy Oil Corp. | | | 45,900 | | | | 2,138,940 | |

Noble Energy, Inc. | | | 81,500 | | | | 3,985,350 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (concluded) | | | | | | | | |

Oil Search Ltd. | | | 520,787 | | | $ | 2,841,519 | |

Phillips 66 | | | 55,500 | | | | 4,362,300 | |

Pioneer Natural Resources Co. | | | 37,600 | | | | 6,147,976 | |

Range Resources Corp. | | | 60,000 | | | | 3,122,400 | |

Royal Dutch Shell PLC, A Shares — ADR | | | 184,542 | | | | 11,007,930 | |

Southwestern Energy Co. (a) | | | 138,700 | | | | 3,216,453 | |

Statoil ASA | | | 151,612 | | | | 2,680,714 | |

TOTAL SA | | | 141,700 | | | | 7,043,456 | |

| | | | | | | | |

| | | | | | | | 138,920,278 | |

Total Long-Term Investments (Cost — $154,561,727) — 99.4% | | | | | | | 149,413,397 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.06% (b)(c) | | | 1,312,983 | | | | 1,312,983 | |

Total Short-Term Securities (Cost — $1,312,983) — 0.9% | | | | | | | 1,312,983 | |

Total Investments (Cost — $155,874,710) — 100.3% | | | | | | | 150,726,380 | |

Liabilities in Excess of Other Assets — (0.3)% | | | | | | | (515,247 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 150,211,133 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | During the six months ended March 31, 2015, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares/

Beneficial

Interest

Held at

September 30,

2014 | | | Net Activity | | | Shares/

Beneficial

Interest

Held at

March 31,

2015 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 3,666,592 | | | | (2,353,609 | ) | | | 1,312,983 | | | $ | 1,483 | |

BlackRock Liquidity Series, LLC, Money Market Series | | | — | | | | — | | | | — | | | $ | 41 | |

| (c) | Represents the current yield as of report date. |

| | | | | | | | | | |

| Portfolio Abbreviations |

| ADR | | American Depositary Receipts | | NVDR | | Non-Voting Depository Receipts | | ZAR | | South African Rand |

| GDR | | Global Depositary Receipts | | USD | | U.S. Dollar | | | | |

See Notes to Financial Statements.

| | | | | | |

| 12 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock All-Cap Energy & Resources Portfolio | |

| Ÿ | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The categorization of a value determined for investments is based on the pricing transparency of the investment and is not necessarily an indication of the risks associated with investing in those securities. The three levels of the fair value hierarchy are as follows: |

| | Ÿ | | Level 1 — unadjusted quoted prices in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. For information about the Fund’s policy regarding valuation of investments, refer to Note 2 of the Notes to Financial Statements.

As of March 31, 2015, the following table summarizes the Fund’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | Total | |

Assets: | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | |

Energy Equipment & Services | | $ | 10,493,119 | | | | — | | | — | | $ | 10,493,119 | |

Oil, Gas & Consumable Fuels | | | 116,436,756 | | | $ | 22,483,522 | | | — | | | 138,920,278 | |

Short-Term Securities | | | 1,312,983 | | | | — | | | — | | | 1,312,983 | |

| | | | |

Total | | $ | 128,242,858 | | | $ | 22,483,522 | | | — | | $ | 150,726,380 | |

| | | | |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of March 31, 2015, foreign currency at value of $24,324 is categorized as Level 1 within the disclosure hierarchy.

During the six months ended March 31, 2015, there were no transfers between levels.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2015 | | 13 |

| | | | |

| Schedule of Investments March 31, 2015 (Unaudited) | | | BlackRock Emerging Markets Dividend Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Brazil — 4.7% | | | | | | | | |

BB Seguridade Participacoes SA | | | 5,020 | | | $ | 51,450 | |

Itau Unibanco Holding SA — ADR | | | 11,983 | | | | 132,532 | |

Marcopolo SA, Preference | | | 29,175 | | | | 21,116 | |

| | | | | | | | |

| | | | | | | | 205,098 | |

Cambodia — 0.7% | | | | | | | | |

NagaCorp Ltd. | | | 48,000 | | | | 31,870 | |

Chile — 2.0% | | | | | | | | |

Banco de Chile — ADR | | | 1,301 | | | | 87,245 | |

China — 16.5% | | | | | | | | |

Beijing Capital International Airport Co. Ltd., H Shares | | | 66,000 | | | | 64,452 | |

China Hongqiao Group Ltd. | | | 40,500 | | | | 24,261 | |

China Merchants Holdings International Co. Ltd. | | | 28,432 | | | | 111,419 | |

China Mobile Ltd. | | | 3,500 | | | | 45,613 | |

Hengan International Group Co. Ltd. | | | 13,000 | | | | 156,479 | |

Industrial & Commercial Bank of China Ltd., H Shares | | | 218,000 | | | | 161,251 | |

Jiangsu Expressway Co. Ltd., H Shares | | | 56,000 | | | | 75,198 | |

Want Want China Holdings Ltd. | | | 78,000 | | | | 83,005 | |

| | | | | | | | |

| | | | | | | | 721,678 | |

Czech Republic — 1.1% | | | | | | | | |

Komercni Banka AS | | | 224 | | | | 48,316 | |

Greece — 0.5% | | | | | | | | |

OPAP SA | | | 2,589 | | | | 24,165 | |

Hong Kong — 0.9% | | | | | | | | |

Chow Tai Fook Jewellery Group Ltd. | | | 17,600 | | | | 18,977 | |

Sands China Ltd. | | | 5,200 | | | | 21,503 | |

| | | | | | | | |

| | | | | | | | 40,480 | |

India — 2.3% | | | | | | | | |

Infosys Ltd. — ADR | | | 2,932 | | | | 102,855 | |

Indonesia — 3.5% | | | | | | | | |

Bank Central Asia Tbk PT | | | 63,301 | | | | 71,742 | |

Bank Mandiri Persero Tbk PT | | | 40,666 | | | | 38,782 | |

Media Nusantara Citra Tbk PT | | | 186,524 | | | | 40,832 | |

| | | | | | | | |

| | | | | | | | 151,356 | |

Kazakhstan — 0.3% | | | | | | | | |

KCell JSC — GDR | | | 1,523 | | | | 14,240 | |

Mexico — 11.4% | | | | | | | | |

Bolsa Mexicana de Valores SAB de CV | | | 34,189 | | | | 58,276 | |

Fibra Uno Administracion SA de CV | | | 16,418 | | | | 43,484 | |

Fomento Economico Mexicano SAB de CV — ADR (a) | | | 666 | | | | 62,271 | |

Grupo Aeroportuario del Pacifico SAB de CV, Class B | | | 18,101 | | | | 118,941 | |

Grupo Aeroportuario del Sureste SAB de CV — ADR (a) | | | 699 | | | | 93,960 | |

Kimberly-Clark de Mexico SAB de CV, Class A | | | 27,619 | | | | 57,706 | |

Mexico Real Estate Management SA de CV | | | 41,142 | | | | 64,814 | |

| | | | | | | | |

| | | | | | | | 499,452 | |

Peru — 1.6% | | | | | | | | |

Credicorp Ltd. | | | 497 | | | | 69,893 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Philippines — 1.5% | | | | | | | | |

Alliance Global Group, Inc. | | | 113,000 | | | $ | 66,845 | |

Poland — 3.4% | | | | | | | | |

Powszechna Kasa Oszczednosci Bank Polski SA | | | 2,944 | | | | 26,350 | |

Powszechny Zaklad Ubezpieczen SA | | | 964 | | | | 124,382 | |

| | | | | | | | |

| | | | | | | | 150,732 | |

Russia — 5.4% | | | | | | | | |

Lukoil OAO — ADR | | | 2,396 | | | | 110,983 | |

Magnit PJSC — GDR | | | 1,566 | | | | 79,944 | |

MMC Norilsk Nickel OJSC — ADR | | | 2,574 | | | | 45,727 | |

| | | | | | | | |

| | | | | | | | 236,654 | |

South Africa — 8.3% | | | | | | | | |

FirstRand Ltd. | | | 26,670 | | | | 122,603 | |

Mr. Price Group Ltd. | | | 2,517 | | | | 53,834 | |

Sanlam Ltd. | | | 18,110 | | | | 116,715 | |

Truworths International Ltd. | | | 9,508 | | | | 69,015 | |

| | | | | | | | |

| | | | | | | | 362,167 | |

South Korea — 3.8% | | | | | | | | |

SK Telecom Co. Ltd. | | | 568 | | | | 139,766 | |

SK Telecom Co. Ltd. — ADR | | | 929 | | | | 25,278 | |

| | | | | | | | |

| | | | | | | | 165,044 | |

Taiwan — 19.1% | | | | | | | | |

Chipbond Technology Corp. | | | 37,000 | | | | 77,995 | |

Delta Electronics, Inc. | | | 8,000 | | | | 50,412 | |

Eclat Textile Co. Ltd. | | | 2,000 | | | | 26,208 | |

Far EasTone Telecommunications Co. Ltd. | | | 39,000 | | | | 94,085 | |

Himax Technologies, Inc. — ADR | | | 2,853 | | | | 18,059 | |

Lite-On Technology Corp. | | | 28,000 | | | | 36,221 | |

Makalot Industrial Co. Ltd. | | | 4,000 | | | | 28,713 | |

MediaTek, Inc. | | | 3,000 | | | | 40,517 | |

Quanta Computer, Inc. | | | 21,000 | | | | 50,687 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 9,000 | | | | 41,828 | |

Taiwan Semiconductor Manufacturing Co. Ltd. — ADR | | | 10,311 | | | | 242,102 | |

Tripod Technology Corp. | | | 20,000 | | | | 40,226 | |

Yageo Corp. | | | 42,902 | | | | 88,400 | |

| | | | | | | | |

| | | | | | | | 835,453 | |

Thailand — 8.8% | | | | | | | | |

Advanced Info Service PCL — NVDR | | | 7,900 | | | | 57,412 | |

Bangkok Expressway PCL — NVDR | | | 14,500 | | | | 17,362 | |

BEC World PCL — NVDR | | | 33,200 | | | | 41,819 | |

Kasikornbank PCL — NVDR | | | 15,700 | | | | 110,394 | |

PTT PCL — NVDR | | | 4,500 | | | | 44,639 | |

Siam City Cement PCL — NVDR | | | 2,284 | | | | 26,796 | |

The Siam Commercial Bank PCL — NVDR | | | 11,700 | | | | 63,989 | |

Thai Oil PCL — NVDR | | | 13,800 | | | | 22,026 | |

| | | | | | | | |

| | | | | | | | 384,437 | |

Turkey — 0.6% | | | | | | | | |

Tupras Turkiye Petrol Rafinerileri AS | | | 1,198 | | | | 28,383 | |

See Notes to Financial Statements.

| | | | | | |

| 14 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Emerging Markets Dividend Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

United Arab Emirates — 1.3% | | | | | | | | |

Dragon Oil PLC | | | 6,228 | | | $ | 54,941 | |

Total Common Stocks — 97.7% | | | | | | | 4,281,304 | |

| | | | | | | | |

| Participation Notes (a) | | | | | | |

South Korea — 1.3% | | | | | | | | |

Deutsche Bank AG (Hyundai Motor & Finance Co.), due 8/12/23 | | | 2,530 | | | | 56,554 | |

Total Long-Term Investments (Cost — $4,215,044) — 99.0% | | | | | | | 4,337,858 | |

| | | | | | | | |

| Short-Term Securities | | Shares | | | Value | |

BlackRock Liquidity Funds, TempFund,

Institutional Class, 0.06% (b)(c) | | | 52,359 | | | $ | 52,359 | |

Total Short-Term Securities (Cost — $52,359) — 1.2% | | | | | | | 52,359 | |

Total Investments (Cost — $4,267,403) — 100.2% | | | | | | | 4,390,217 | |

Liabilities in Excess of Other Assets — (0.2)% | | | | | | | (6,788 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 4,383,429 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | During the six months ended March 31, 2015, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares/ Beneficial

Interest Held at

September 30, 2014 | | | Net

Activity | | | Shares/ Beneficial

Interest Held at

March 31, 2015 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 147,277 | | | | (94,918 | ) | | | 52,359 | | | $ | 24 | |

BlackRock Liquidity Series, LLC, Money Market Series | | | — | | | | — | | | | — | | | $ | 90 | |

| (c) | Represents the current yield as of report date. |

| Ÿ | | As of March 31, 2015, forward foreign currency exchange contracts outstanding were as follows: |

| | | | | | | | | | | | | | | | | | | | | | |

Currency

Purchased | | | Currency

Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| USD | | | 69,139 | | | | ZAR | | | | 802,351 | | | Deutsche Bank AG | | | 4/22/15 | | | $ | 3,241 | |

| ZAR | | | 802,351 | | | | USD | | | | 69,065 | | | BNP Paribas S.A. | | | 4/22/15 | | | | (3,167 | ) |

| Total | | | | | | | | | | | | | | | | | | | | $ | 74 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instruments and is not necessarily an indication of the risks associated with investing in those securities. The three levels of the fair value hierarchy are as follows: |

| | Ÿ | | Level 1 — unadjusted quoted prices in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments, refer to Note 2 of the Notes to Financial Statements.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2015 | | 15 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Emerging Markets Dividend Fund | |

As of March 31, 2015, the following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets: | | | | | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | | | | | |

Brazil | | | $ | 205,098 | | | | | — | | | | | — | | | | $ | 205,098 | |

Cambodia | | | | — | | | | $ | 31,870 | | | | | — | | | | | 31,870 | |

Chile | | | | 87,245 | | | | | — | | | | | — | | | | | 87,245 | |

China | | | | — | | | | | 721,678 | | | | | — | | | | | 721,678 | |

Czech Republic | | | | — | | | | | 48,316 | | | | | — | | | | | 48,316 | |

Greece | | | | — | | | | | 24,165 | | | | | — | | | | | 24,165 | |

Hong Kong | | | | — | | | | | 40,480 | | | | | — | | | | | 40,480 | |

India | | | | 102,855 | | | | | — | | | | | — | | | | | 102,855 | |

Indonesia | | | | — | | | | | 151,356 | | | | | — | | | | | 151,356 | |

Kazakhstan | | | | 14,240 | | | | | — | | | | | — | | | | | 14,240 | |

Mexico | | | | 499,452 | | | | | — | | | | | — | | | | | 499,452 | |

Peru | | | | 69,893 | | | | | — | | | | | — | | | | | 69,893 | |

Philippines | | | | — | | | | | 66,845 | | | | | — | | | | | 66,845 | |

Poland | | | | — | | | | | 150,732 | | | | | — | | | | | 150,732 | |

Russia | | | | 236,654 | | | | | — | | | | | — | | | | | 236,654 | |

South Africa | | | | — | | | | | 362,167 | | | | | — | | | | | 362,167 | |

South Korea | | | | 25,278 | | | | | 139,766 | | | | | — | | | | | 165,044 | |

Taiwan | | | | 260,161 | | | | | 575,292 | | | | | — | | | | | 835,453 | |

Thailand | | | | — | | | | | 384,437 | | | | | — | | | | | 384,437 | |

Turkey | | | | — | | | | | 28,383 | | | | | — | | | | | 28,383 | |

United Arab Emirates | | | | — | | | | | 54,941 | | | | | — | | | | | 54,941 | |

Participation Notes: | | | | | | | | | | | | | | | | | | | | |

South Korea | | | | — | | | | | 56,554 | | | | | — | | | | | 56,554 | |

Short-Term Securities | | | | 52,359 | | | | | — | | | | | — | | | | | 52,359 | |

| | | | | |

Total | | | $ | 1,553,235 | | | | $ | 2,836,982 | | | | | — | | | | $ | 4,390,217 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Derivative Financial Instruments1 | | | | | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | | | | | |

Forward foreign currency exchange contracts | | | | — | | | | | $3,241 | | | | | — | | | | $ | 3,241 | |

Liabilities: | | | | | | | | | | | | | | | | | | | | |

Forward foreign currency exchange contracts | | | | — | | | | | (3,167) | | | | | — | | | | | (3,167 | ) |

| | | | | |

Total | | | | — | | | | | $74 | | | | | — | | | | $ | 74 | |

| | | | | |

1 Derivative financial instruments are forward foreign currency exchange contracts, which are valued at the unrealized appreciation/depreciation on the instrument. | |

|

| The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of March 31, 2015, such assets are categorized within the disclosure hierarchy as follows: | |

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets: | | | | | | | | | | | | | | | | | | | | |

Cash | | | $ | 12,988 | | | | | — | | | | | — | | | | $ | 12,988 | |

Foreign currency at value | | | | 6,045 | | | | | — | | | | | — | | | | | 6,045 | |

| | | | | |

Total | | | $ | 19,033 | | | | | — | | | | | — | | | | $ | 19,033 | |

| | | | | |

See Notes to Financial Statements.

| | | | | | |

| 16 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock Emerging Markets Dividend Fund | |

Transfers between Level 1 and Level 2 were as follows:

| | | | | | | | | | | | | | | | |

| | | Transfers into

Level 1 | | | Transfers out

of Level 11 | | | Transfers into

Level 21 | | | Transfers out

of Level 2 | |

Assets: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Thailand | | | — | | | $ | (50,794 | ) | | $ | 50,794 | | | | — | |

1 External pricing service used to reflect any significant market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2015 | | 17 |

| | | | |

| Schedule of Investments March 31, 2015 (Unaudited) | | | BlackRock Energy & Resources Portfolio | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Commercial Services & Supplies — 0.0% | | | | | | | | |

Republic Resources, Inc. (Acquired 7/18/97 to 2/24/99, cost $779,869) (a)(b) | | | 28,750 | | | | — | |

Energy Equipment & Services — 6.8% | | | | | | | | |

Cameron International Corp. (b) | | | 181,200 | | | $ | 8,175,744 | |

Helmerich & Payne, Inc. | | | 180,500 | | | | 12,286,635 | |

Poseidon Concepts Corp. (b) | | | 35,081 | | | | 14 | |

Superior Energy Services, Inc. | | | 330,357 | | | | 7,380,175 | |

| | | | | | | | |

| | | | | | | | 27,842,568 | |

Oil, Gas & Consumable Fuels — 93.4% | | | | | | | | |

AltaGas Ltd. | | | 618,100 | | | | 20,623,668 | |

Cabot Oil & Gas Corp. | | | 763,700 | | | | 22,552,061 | |

Cairn Energy PLC (b) | | | 4,115,600 | | | | 9,535,652 | |

Canadian Oil Sands Ltd. | | | 758,000 | | | | 5,894,990 | |

Carrizo Oil & Gas, Inc. (b) | | | 349,800 | | | | 17,367,570 | |

Cimarex Energy Co. | | | 197,510 | | | | 22,731,426 | |

Concho Resources, Inc. (b) | | | 38,100 | | | | 4,416,552 | |

CONSOL Energy, Inc. | | | 443,600 | | | | 12,372,004 | |

Enbridge, Inc. | | | 561,000 | | | | 27,041,214 | |

Encana Corp. | | | 1,341,000 | | | | 14,971,174 | |

EOG Resources, Inc. | | | 174,800 | | | | 16,027,412 | |

EQT Corp. | | | 265,744 | | | | 22,022,205 | |

Genel Energy PLC (b) | | | 366,200 | | | | 2,550,245 | |

Gulfport Energy Corp. (b) | | | 220,835 | | | | 10,138,535 | |

Ithaca Energy, Inc. (b) | | | 4,702,200 | | | | 2,376,067 | |

Kosmos Energy Ltd. (b) | | | 1,398,788 | | | | 11,064,413 | |

Laredo Petroleum, Inc. (b) | | | 682,200 | | | | 8,895,888 | |

Longview Energy Co. (Acquired 8/13/04, cost $1,281,000) (a)(b) | | | 85,400 | | | | 150,304 | |

Marathon Oil Corp. | | | 674,500 | | | | 17,611,195 | |

Murphy Oil Corp. | | | 419,900 | | | | 19,567,340 | |

Noble Energy, Inc. | | | 218,600 | | | | 10,689,540 | |

Oil Search Ltd. | | | 3,041,800 | | | | 16,596,678 | |

Painted Pony Petroleum Ltd. (b) | | | 635,900 | | | | 2,972,270 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (concluded) | | | | | | | | |

Pioneer Natural Resources Co. | | | 99,937 | | | $ | 16,340,699 | |

Range Resources Corp. | | | 346,940 | | | | 18,054,758 | |

Rosetta Resources, Inc. (b) | | | 452,600 | | | | 7,703,252 | |

RSP Permian, Inc. (b) | | | 303,342 | | | | 7,641,185 | |

SM Energy Co. | | | 248,900 | | | | 12,863,152 | |

Southwestern Energy Co. (b) | | | 744,600 | | | | 17,267,274 | |

TransGlobe Energy Corp. | | | 817,600 | | | | 2,911,355 | |

| | | | | | | | |

| | | | | | | | 380,950,078 | |

Total Common Stocks — 100.2% | | | | | | | 408,792,646 | |

| | | | | | | | |

| Warrants (c) | | | | | | |

Oil, Gas & Consumable Fuels — 0.0% | | | | | | | | |

Magnum Hunter Resources Corp. (Issued/Exercisable 10/15/13, 1 Share for 1 Warrant, Expires 4/15/16, Strike Price $8.50) | | | 235,700 | | | | 2 | |

Total Warrants — 0.0% | | | | | | | 2 | |

Total Long-Term Investments (Cost — $448,055,319) — 100.2% | | | | 408,792,648 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.06% (d)(e) | | | 577,947 | | | | 577,947 | |

Total Short-Term Securities (Cost — $577,947) — 0.2% | | | | 577,947 | |

Total Investments (Cost — $448,633,266) — 100.4% | | | | 409,370,595 | |

Liabilities in Excess of Other Assets — (0.4)% | | | | (1,447,517 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 407,923,078 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Restricted security as to resale. As of report date, the Fund held restricted securities with a current value of $150,304 and an original cost of $2,060,869, which was less than 0.01% of its net assets. |

| (b) | Non-income producing security. |

| (c) | Warrants entitle the Fund to purchase a predetermined number of shares of common stock and are non-income producing. The purchase price and number of shares are subject to adjustment under certain conditions until the expiration date of the warrants, if any. |

| (d) | During the six months ended March 31, 2015, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares Held at

September 30, 2014 | | | Net Activity | | | Shares Held at

March 31, 2015 | | | Income | | | Realized

Gain | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 9,547,958 | | | | (8,970,011 | ) | | | 577,947 | | | $ | 3,011 | | | $ | 1,503 | |

| (e) | Represents the current yield as of report date. |

See Notes to Financial Statements.

| | | | | | |

| 18 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock Energy & Resources Portfolio | |

| Ÿ | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The categorization of a value determined for investments is based on the pricing transparency of the investment and is not necessarily an indication of the risks associated with investing in those securities. The three levels of the fair value hierarchy are as follows: |

| | Ÿ | | Level 1 — unadjusted quoted prices in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. For information about the Fund’s policy regarding valuation of investments, refer to Note 2 of the Notes to Financial Statements.

As of March 31, 2015, the following table summarizes the Fund’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Energy Equipment & Services | | $ | 27,842,554 | | | $ | 14 | | | | — | | | $ | 27,842,568 | |

Oil, Gas & Consumable Fuels | | | 352,117,199 | | | | 28,682,575 | | | $ | 150,304 | | | | 380,950,078 | |

Warrants | | | — | | | | 2 | | | | — | | | | 2 | |

Short-Term Securities | | | 577,947 | | | | — | | | | — | | | | 577,947 | |

| | | | |

Total | | $ | 380,537,700 | | | $ | 28,682,591 | | | $ | 150,304 | | | $ | 409,370,595 | |

| | | | |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of March 31, 2015, foreign currency at value of $80,671 is categorized as Level 1 within the disclosure hierarchy.

During the six months ended March 31, 2015, there were no transfers between levels.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2015 | | 19 |

| | |

| Statements of Assets and Liabilities | | |

| | | | | | | | | | | | |

| March 31, 2015 (Unaudited) | | BlackRock

All-Cap Energy &

Resources

Portfolio | | | BlackRock

Emerging

Markets

Dividend

Fund | | | BlackRock

Energy &

Resources

Portfolio | |

| | | | | | | | | | | | |

| Assets | | | | | | | | | | | | |

Investments at value — unaffiliated1 | | $ | 149,413,397 | | | $ | 4,337,858 | | | $ | 408,792,648 | |

Investments at value — affiliated2 | | | 1,312,983 | | | | 52,359 | | | | 577,947 | |

Cash | | | — | | | | 12,988 | | | | — | |

Foreign currency at value3 | | | 24,324 | | | | 6,045 | | | | 80,671 | |

Investments sold receivable | | | — | | | | 35,521 | | | | — | |

Unrealized appreciation on forward foreign currency exchange contracts | | | — | | | | 3,241 | | | | — | |

Capital shares sold receivable | | | 273,353 | | | | 11,968 | | | | 513,972 | |

Dividends receivable — unaffiliated | | | 98,951 | | | | 13,197 | | | | 366,796 | |

Receivable from Manager | | | 17,841 | | | | 13,989 | | | | 14,306 | |

Dividends receivable — affiliated | | | 123 | | | | 1 | | | | 245 | |

Securities lending income receivable — affiliated | | | 41 | | | | 79 | | | | — | |

Prepaid expenses | | | 52,588 | | | | 34,408 | | | | 43,060 | |

| | | | |

Total assets | | | 151,193,601 | | | | 4,521,654 | | | | 410,389,645 | |

| | | | |

| | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

Investments purchased payable | | | — | | | | 7,121 | | | | — | |

Unrealized depreciation on forward foreign currency exchange contracts | | | — | | | | 3,167 | | | | — | |

Capital shares redeemed payable | | | 604,990 | | | | 24,296 | | | | 1,625,373 | |

Transfer agent fees payable | | | 137,478 | | | | 1,509 | | | | 339,081 | |

Investment advisory fees payable | | | 96,103 | | | | — | | | | 262,107 | |

Service and distribution fees payable | | | 57,445 | | | | 639 | | | | 100,267 | |

Professional fees payable | | | 40,318 | | | | 64,779 | | | | 40,006 | |

Other affiliates payable | | | 6,445 | | | | 10 | | | | 34,089 | |

Pricing fees payable | | | 5,802 | | | | 22,438 | | | | 6,920 | |

Officer’s and Trustees’ fees payable | | | 2,611 | | | | 767 | | | | 5,885 | |

Other accrued expenses payable | | | 31,276 | | | | 13,499 | | | | 52,839 | |

| | | | |

Total liabilities | | | 982,468 | | | | 138,225 | | | | 2,466,567 | |

| | | | |

Net Assets | | $ | 150,211,133 | | | $ | 4,383,429 | | | $ | 407,923,078 | |

| | | | |

| | | | | | | | | | | | |

| Net Assets Consist of | | | | | | | | | | | | |

Paid-in capital | | $ | 207,169,550 | | | $ | 5,126,786 | | | $ | 560,534,804 | |

Undistributed (distributions in excess of) net investment income (loss) | | | 849,177 | | | | (19,557 | ) | | | (2,390,690 | ) |

Accumulated net realized loss | | | (52,656,018 | ) | | | (846,323 | ) | | | (110,953,068 | ) |

Net unrealized appreciation/depreciation | | | (5,151,576 | ) | | | 122,523 | | | | (39,267,968 | ) |

| | | | |

Net Assets | | $ | 150,211,133 | | | $ | 4,383,429 | | | $ | 407,923,078 | |

| | | | |

1 Investments at cost — unaffiliated | | $ | 154,561,727 | | | $ | 4,215,044 | | | $ | 448,055,319 | |

2 Investments at cost — affiliated | | $ | 1,312,983 | | | $ | 52,359 | | | $ | 577,947 | |

3 Foreign currency at cost | | $ | 24,321 | | | $ | 6,050 | | | $ | 80,664 | |

See Notes to Financial Statements.

| | | | | | |

| 20 | | BLACKROCK FUNDS | | MARCH 31, 2015 | | |

| | |

| Statements of Assets and Liabilities (concluded) | | |

| | | | | | | | | | | | |

| March 31, 2015 (Unaudited) | | BlackRock

All-Cap Energy

& Resources

Portfolio | | | BlackRock

Emerging

Markets

Dividend

Fund | | | BlackRock

Energy &

Resources

Portfolio | |

| | | | | | | | | | | | |

| Net Asset Value | | | | | | | | | | | | |

Institutional | | | | | | | | | | | | |

Net assets | | $ | 30,878,629 | | | $ | 2,702,577 | | | $ | 119,420,591 | |

| | | | |

Shares outstanding1 | | | 2,384,903 | | | | 326,164 | | | | 4,421,314 | |

| | | | |

Net asset value | | $ | 12.95 | | | $ | 8.29 | | | $ | 27.01 | |

| | | | |

Service | | | | | | | | | | | | |

Net assets | | $ | 1,369,112 | | | | — | | | | — | |

| | | | |

Shares outstanding1 | | | 108,367 | | | | — | | | | — | |

| | | | |

Net asset value | | $ | 12.63 | | | | — | | | | — | |

| | | | |

Investor A | | | | | | | | | | | | |

Net assets | | $ | 69,389,743 | | | $ | 1,290,234 | | | $ | 230,249,697 | |

| | | | |

Shares outstanding1 | | | 5,502,499 | | | | 156,394 | | | | 9,866,359 | |

| | | | |