The Company has a classified Board currently consisting of three Class 1 directors, three Class 2 directors and three Class 3 directors. The current terms of Class 1 and Class 2 directors continue until the annual meeting of stockholders to be held in 2007 and 2008, respectively, and until their respective successors are elected and qualified. The Board will set the number of directors at nine as of the Meeting. There are currently nine Board members.

At each annual stockholders meeting, directors are elected for a full term of three years to succeed those directors whose term expires at the annual meeting date, although to maintain classes of similar size, individuals may be elected for terms of two years (or one year). The election of each director requires the vote of holders of a plurality of the outstanding Common Stock present in person or by proxy and entitled to be voted at the Meeting. Votes withheld from any director will be counted for purposes of determining the presence or absence of a quorum, but have no other legal effect under Delaware law.

At the Meeting, the holders of Common Stock as of the Record Date will elect three Class 3 directors for three-year terms. Unless otherwise instructed, proxy holders will vote the proxies received by them for the election of the Company’s three nominees named below for Class 3 directors, all of whom are currently directors of the Company. Giving effect to the election of three Class 3 directors at the Meeting, the Board will have three Class 1 directors, three Class 2 directors, and three Class 3 directors. If any nominee of the Company is unable or declines to serve as a director at the time of the Meeting, the proxies will be voted for any nominee who will be designated by the current Board to fill the vacancy. It is not, however, expected that any nominee will be unable or will decline to serve as a director. There is no family relationship between any director, nominee for election as a director or executive officer of the Company and any other director, nominee for election as a director or executive officer of the Company. See section entitled “Certain Relationships and Related Transactions” below.

The names of the nominees for Class 3 directors and certain information about them are set forth below:

Steven Kelman, Ph.D., age 57, has been a director of the Company since October 1997. Since September 1997, he has been the Weatherhead Professor of Public Management at Harvard University’s John F. Kennedy School of Government. From November 1993 to September 1997, Dr. Kelman served as Administrator of the Office of Federal Procurement Policy at the Office of Management and Budget. From 1986 to 1993, he was Professor of Public Policy at Harvard University’s John F. Kennedy School of Government.

Barry L. Reisig, age 60, has been a director of the Company since May 2003. Since May 1, 2002, Mr. Reisig has been Vice President of Finance of System Planning Corporation, a developer of high technology systems, and President and Chief Executive Officer of its subsidiary, SPC International. From 1971 to 2002, Mr. Reisig was a partner of Arthur Andersen LLP, involved principally in tax matters. Mr. Reisig is also a director of Healthaxis, Inc.

John M. Toups, age 80, has been a director of the Company since October 1997. From January 1978 until his retirement in February 1987, Mr. Toups was President and Chief Executive Officer of PRC, Inc. Mr. Toups is also a director of NVR, Inc. and Halifax Corporation.

CONTINUING DIRECTORS

Class 1 Directors — Term Expiring in 2007

Daniel R. Young, age 72, has been a director since January 2001. From 1977 until October 2000, Mr. D. R. Young had been a senior executive officer of Federal Data Corporation, a provider of information technology products and services to government agencies, including serving since 1995 as President and Chief Executive Officer and since 1998 as Vice Chairman of the Board of Directors of Federal Data Corporation. Mr. D. R. Young is also a director of Halifax Corporation, Analex Corp. and NCI Corp.

M. Dendy Young, age 58, has served as Chairman of the Board since May 1998 and has been a director since December 1995. From December 1995 to February 2006, he was Chief Executive Officer of GTSI. From December 1995 to January 2002, he also served as President. From August 1994 until joining the Company, Mr. M. D. Young was principal and consultant of The Exeter Group, a management-consulting firm he founded. From January 1985 until August 1994, he served as Chief Executive Officer and a director of Falcon Microsystems, Inc., a government microcomputer reseller he founded which was acquired by the Company in 1994.

Joseph “Keith” Kellogg, Jr., age 57, has served on the Board since April 29, 2004, and previously was a member of the Board from October 29, 2003 until he resigned on December 8, 2003 to provide temporary service to the Federal Government. During this temporary service, General Kellogg served as Chief Operating Officer of the Coalition Provisional Authority in Baghdad, Iraq. General Kellogg was a member of the U.S. Army from 1971 to September 2003, when he retired as a Lieutenant General and a highly decorated war veteran. From September 2003 until January 2005, General Kellogg served as Senior Vice President for Homeland Security Solutions for Oracle Corp. Since January 2005, General Kellogg has been employed by CACI International Inc, as an Executive Vice President, Research and Technology Systems.

Class 2 Directors — Term Expiring in 2008

Lee Johnson, age 78, has been a director of the Company since March 1996. Since 1984, Mr. Johnson has been the President of Federal Airways Corporation, a provider of highly modified, special mission high altitude aircraft to civilian and defense agencies. From February 1986 to August 1994, Mr. Johnson served as Chairman of the Board of Directors of Falcon Microsystems, Inc., a government microcomputer reseller founded by Mr. M. D. Young, the Chairman of the Board and the Company’s Chief Executive Officer, and acquired by the Company in 1994.

James J. Leto, age 62, has been a director of the Company since February 1996 and since February 2006 has served as Chief Executive Officer and President. From December 2002 to February 2006, Mr. Leto was the Chief Executive Officer of Robbins-Gioia, Inc., a government consultant. From June 1996 through February 2001, he was the Chairman and Chief Executive Officer of Treev, Inc. (formerly known as Network Imaging Corporation), a developer and marketer of software used to manage client/server, object-oriented, and enterprise-wide information. From January 1992 until February 1996, he was the Chairman and Chief Executive Officer of PRC, Inc., a provider of scientific and technology-based systems, products and services to government and commercial clients around the world.

Thomas L. Hewitt, age 67, has been a director of the Company since May 2003, and previously served as a director from March 1996 until May 1998. Since January 2000, Mr. Hewitt has been the Chief Executive Officer of Global Governments, Inc. In 1984, Mr. Hewitt founded Federal Sources, Inc., a market research and consulting firm, where he served as Chief Executive Officer and Chairman of the Board until 1999. Mr. Hewitt is also a director of Halifax Corporation and Analex Corp.

3

BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE

There are currently nine Board members. With the exception of Mr. M. D. Young, Lee Johnson, and Jim Leto, who serves as the Company’s Chief Executive Officer and President, all of our current directors are “independent” as defined by the applicable rule of The NASDAQ Stock Market, Inc. (“NASDAQ”). The independent directors regularly have the opportunity to meet without Mr. M. D. Young, Mr. Leto, and Mr. Johnson in attendance, and, as discussed below, the Board has had since 2004 the position of lead independent director (“Lead Independent Director”). During 2005, there were four regular Board meetings, and all directors attended all Board meetings (in person or by telephone) and meetings of Board committees of which they were members. The Company does not have a specific policy regarding attendance of directors at the annual stockholder meeting. All directors, however, are encouraged to attend if available, and the Company tries to ensure that at least one independent director is present at the annual meeting and available to answer any stockholder questions. All the directors were present at last year’s annual stockholders meeting.

The Board has an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The current charters of each of these committees, as well as of the Lead Independent Director, are available on the Company’s Internet website,www.GTSI.com (located on the Investor Relations web page). Also posted on such website is a description of the process for stockholders to send communications to the Board or to one or more particular Board members.

Audit Committee

The primary purpose of the Audit Committee is to oversee the Company’s accounting and financial reporting processes and the audits of its financial statements. The Audit Committee is directly responsible for, among other things, the appointment, compensation, retention, and oversight of the Company’s independent registered public accounting firm.

Since the 2005 Annual Meeting, the Audit Committee has been composed of Messrs. Reisig (Chairman), Kellogg and Toups. All of the Audit Committee members during the past year, and all of the members who will be appointed for the current year, are independent in accordance with applicable rules of the Securities and Exchange Commission (the “SEC”) and NASDAQ. Each former and current member is able to read and understand fundamental financial statements, including the Company’s balance sheet, statement of operations and statement of cash flow. The Board has determined that Mr. Reisig is an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). During 2005, the Audit Committee met eleven times.

Compensation Committee

The primary purpose of the Compensation Committee is to review the salary and bonus to be paid to the Company’s Chief Executive Officer and the Company’s other principal Section 16 executive officers (Chief Financial Officer, Executive Vice President, Sales, and Chief Marketing Officer), and make recommendations to the Board on such salary and bonuses. The Compensation Committee reviews and approves the salary and bonuses for the Company’s other officers. The committee also administers the Company’s stock option plans and meets either independently or in conjunction with the Company’s full Board to grant options to eligible individuals in accordance with the respective plans. Since the 2005 Annual Meeting, the Compensation Committee has been composed of Messrs. D. R. Young (Chairman), Hewitt, and Kelman. Each of the committee members is independent in accordance with applicable NASDAQ rules. During 2005, the Compensation Committee met seven times.

Nominating and Governance Committee

The primary purpose of the Nominating and Governance Committee (“Nominating Committee”) is to identify and recommend individuals to be presented to the stockholders for election or re-election as Board members. Since the 2005 Annual Meeting, the Nominating Committee has been composed of Messrs. Toups (Chairman), Leto, and D. R. Young, all of whom are independent in accordance with applicable NASDAQ rules. In February 2006, upon his appointment as the Company’s Chief Executive Officer and President, Mr. Leto resigned from the Nominating and Governance Committee. A replacement for Mr. Leto on the Committee will be identified at the April 28, 2006 Board Meeting. During 2005, the Nominating Committee met six times.

4

Lead Independent Director

Mr. Toups has been Lead Independent Director since the 2004 Annual Meeting. In his role, the Lead Independent Director assists the Board Chairman and the other Board members in assuring effective corporate governance. The Lead Independent Director’s responsibilities also include assisting the Chairman in reviewing the functions of Board committees and recommending the creation or discontinuance of committees, considering questions of potential conflicts of interest, acting as a resource on corporate governance matters, and acting as the spokesperson for the Company if the Chairman is absent. As approved at the 2005 Annual Meeting, the Lead Independent Director received a $10,000 retainer for the year.

Board Chairman

In February 2006, the Board acted to separate the duties of Board Chairman and the Company’s Chief Executive Officer. Mr. M. D. Young resigned as Chief Executive Officer, but remains as Board Chairman. As part of the separation of duties, the Board has provided an annual fee of $50,000 for any non-employee Board Chairman.

DIRECTOR NOMINATIONS AND QUALIFICATIONS

The Nominating Committee will consider nominees for director recommended by stockholders with respect to elections to be held at an annual stockholders meeting. In accordance with the Company’s Bylaws, to nominate an individual for election to the Board at an annual stockholders meeting, a stockholder must deliver written notice of such nomination to the Company’s Secretary not fewer than 60 days nor more than 90 days prior to the date of the annual meeting (or if less than 60 days notice or prior public disclosure of the date of such annual meeting is given or made to the stockholders, not later than the tenth day following the day on which notice of the date of the annual meeting was mailed or public disclosure was made). The notice of a stockholder’s intention to nominate a director must include:

| • | | information regarding the stockholder making the nomination, including name, address and number of GTSI shares that are beneficially owned by the stockholder; |

| • | | a representation that the stockholder is entitled to vote at the meeting at which directors will be elected, and that the stockholder intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; |

| • | | the name and address of the person or persons being nominated and such other information regarding each nominated person that would be required in a proxy statement filed pursuant to the SEC’s proxy soliciting rules if the person had been nominated for election by the Board; |

| • | | a description of any arrangements or understandings between the stockholder and such nominee and any other persons (including their names), pursuant to which the nomination is made; and |

| • | | the consent of each such nominee to serve as a director if elected. |

The Board Chairman, other directors and executive officers may also recommend director nominees to the Nominating Committee. The committee will evaluate nominees recommended by stockholders against the same criteria that it uses to evaluate other nominees. These criteria include the candidate’s experience, skills and personal accomplishments, as well as other factors that are listed as an appendix to the Nominating Committee charter, which is posted on the Company’s Internet website,www.GTSI.com (located on the Investor Relations web page). The committee has not in the past retained any third party to assist it in identifying nominees.

The Nominating Committee utilizes a variety of methods for identifying and evaluating nominees for director. The committee periodically assesses the appropriate size of the Board, and whether any vacancies on the Board are expected due to retirement or otherwise. If vacancies are anticipated, or otherwise arise, the Nominating Committee will consider various potential candidates for director. Candidates may come to the attention of the Nominating Committee through current Board members, professional search firms, stockholders or other persons. These candidates are evaluated at regular or special meetings of the Nominating Committee, and may be considered at any point during the year. As described above, the Nominating Committee will consider properly submitted stockholder nominations for candidates for the Board. Following verification of the stockholder status of persons proposing candidates, recommendations will be aggregated and considered by the Nominating Committee at a meeting. If any materials are provided by a stockholder in connection with the nomination of a director candidate,

5

such materials will be forwarded to the Nominating Committee. Such committee also will review materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a stockholder. In evaluating such nominations, the Nominating Committee seeks to achieve a balance of knowledge, experience, and capability on the Board.

Deadline for Receipt of Stockholder Proposals

Proposals of stockholders, which are intended to be presented by such stockholders at the annual meeting of stockholders to be held in 2007, including the nomination of persons to serve on the Board, must be received by the Company’s Secretary not later than December 17, 2006, for inclusion in the proxy statement for that annual meeting. Stockholders who wish to present a proposal at the annual meeting of stockholders to be held in 2007, which has not been included in the Company’s proxy materials, must submit such proposal in writing to the Company in care of the Company’s Secretary. Any such proposal received by the Company’s Secretary after February 9, 2007, shall be considered untimely under the provisions of the Company’s Bylaws governing nominations and the proposal of other business to be considered by the Company’s stockholders at that annual meeting. As discussed above, the Company’s Bylaws contain further requirements relating to timing and content of the notice which stockholders must provide to the Company’s Secretary for any nomination or other business to be properly presented at an annual meeting of stockholders. It is recommended that stockholders submitting proposals direct them to the Company’s Secretary by certified mail, return receipt requested, to ensure timely delivery. No stockholder proposals were received with respect to the Meeting.

CODE OF ETHICS

The Company has adopted a Code of Ethics that applies to all of its directors, officers (including principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions) and employees. The Code of Ethics is posted on the Company’s Internet website,www.GTSI.com (located on the Investor Relations web page). The Company intends to satisfy the disclosure requirements under Item 5.05 of SEC Form 8-K regarding any amendment to or waiver of the Code of Ethics with respect to the Company’s principal executive officer, principal financial officer, principal accounting officer or controller and persons performing similar functions, by posting such information on the Company’s Internet website.

COMPENSATION OF DIRECTORS

Each non-employee director of the Company is compensated at an annual retainer of $25,000 (without proration thereof in the event of a partial quarter of service). In addition, the Chairs of the Compensation and Audit Committees receive a $3,500 annual retainer and the members of the Compensation and Audit Committees receive $1,500 for meetings attended in person or via telephone. The Board also receives compensation in the form of a long term incentive component which may be stock options or restricted stock. In 2005, the Board received restricted stock. Under the 1996 Stock Incentive Plan, each eligible non-employee director is granted such Restricted Stock, Restricted Stock Units, or other forms of long-term compensation available under the Plan, as the Board shall determine based on Compensation Committee recommendations using information provided by an independent executive compensation consultant. Grants of Restricted Stock or Restricted Stock Units are based on the closing price of Common Stock on NASDAQ on the date of grant. During 2005, an aggregate of 26,664 restricted shares were granted to the Company’s non-employee directors under the 1996 Plan. On the date such restricted shares were granted, the closing price of Common Stock was $8.19 per share. Non-employee directors of the Company are not eligible to participate in the Company’s other stock option plans or the Company’s Employee Stock Purchase Plan. Effective in 2006, any non-employee Board Chairman receives an annual fee of $50,000.

Except as discussed above, directors of the Company do not receive any other compensation for their service on the Board or any committee thereof, but are reimbursed for their reasonable out-of-pocket expenses incurred in association with the performance of their duties. See section entitled “Certain Relationships and Related Transactions” below.

6

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information about Common Stock that may be issued upon exercise of options, warrants and rights under the Company’s equity compensation plans as of December 31, 2005, including the Company’s 1997 Stock Option Plan, 1996 Stock Incentive Plan, 1994 Stock Option Plan and the Company’s Employee Stock Purchase Plan.

Plan Category

| | | | Number of Shares to be

Issued upon Exercise of

Outstanding Options

(a)

| | Weighted Average

Exercise Price of

Outstanding Options

(b)

| | Number of Shares

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (excluding shares

reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by stockholders | | | | | 1,825,350 | | | $ | 8.3615 | | | | 675,252 | |

| Equity compensation plans not approved by stockholders (1) | | | | | 263,000 | | | $ | 9.9930 | | | | N/A | |

| Total | | | | | 2,088,350 | | | $ | 8.5670 | | | | 675,252 | |

| (1) | | Represents an aggregate of shares issuable under options granted from time to time to persons not previously employed by the Company, as an inducement essential to such persons entering into offer letters or employment agreements with the Company. |

7

COMMON STOCK OWNERSHIP OF

PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of Common Stock as of February 23, 2006 (except as noted otherwise) by: (a) each person who is known by the Company to own beneficially more than 5% of the outstanding Common Stock; (b) each of the Company’s directors who owns Common Stock; (c) each of the executive officers named in the Summary Compensation Table set forth below under “Executive Compensation and Other Information;” and (d) all current directors and executive officers of the Company as a group.

Name of Beneficial Owner (1)

| | | | Shares

Beneficially Owned

| | Percent

of Class

|

|---|

Linwood A. (“Chip”) Lacy, Jr. (2)

c/o Solomon, Ward, Seidenwurm & Smith

401 B Street Suite 1200

San Diego, CA 92101

| | | | | 1,419,600 | | | | 14.7 | % |

M. Dendy Young (3)

3901 Stonecroft Boulevard

Chantilly, VA 20151-1010

| | | | | 893,484 | | | | 9.2 | % |

Dimensional Fund Advisors, Inc.

1299 Ocean Avenue, 11(th) Floor

Santa Monica, CA 90401

| | | | | 776,626 | | | | 8.1 | % |

T. Rowe Price

100 Light Street

Baltimore, MD 21202

| | | | | 525,000 | | | | 5.4 | % |

Peninsula Capital Management, Inc.

235 Pine Street, Suite 1818

San Francisco, CA 94104

| | | | | 500,507 | | | | 5.2 | % |

| Lee Johnson (4) | | | | | 191,000 | | | | 1.9 | % |

| Thomas A. Mutryn (5) | | | | | 136,362 | | | | 1.4 | % |

| John M. Toups (6) | | | | | 112,000 | | | | 1.2 | % |

| James J. Leto (7) | | | | | 105,000 | | | | 1.1 | % |

| Steven Kelman, Ph.D. (8) | | | | | 102,000 | | | | 1.0 | % |

| Scott W. Friedlander (9) | | | | | 71,523 | | | | * | |

| Daniel R. Young (10) | | | | | 70,000 | | | | * | |

| Thomas L. Hewitt (11) | | | | | 25,000 | | | | * | |

| Scot T. Edwards (12) | | | | | 25,000 | | | | * | |

| Barry L. Reisig (13) | | | | | 23,000 | | | | * | |

| Joseph “Keith” Kellogg, Jr. (14) | | | | | 12,500 | | | | * | |

| All Directors and Executive Officers as a group (12 persons) (15) | | | | | 1,766,869 | | | | 16.7 | % |

| (1) | | Such persons have sole voting and investment power with respect to all Common Stock shown as being beneficially owned by them, subject to community property laws, where applicable, and the information contained in the footnotes to this table. |

| (2) | | Excludes 500,000 shares owned by the Linwood A. Lacy, Jr. 2004 Charitable Lead Annuity Trust; Mr. Lacy has no beneficial interest in such shares. |

8

| (3) | | Includes 100,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006, 200 shares held in the name of Mr. Young’s minor child and 5,000 shares held in an IRA. |

| (4) | | Includes 186,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

| (5) | | Includes 135,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

| (6) | | Includes 102,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

| (7) | | Includes 105,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. Does not include options to purchase up to 400,000 shares expected to be granted by the Board on April 28, 2006 under GTSI 1996 Stock Incentive Plan, such options will first become exercisable in part on the second anniversary of the grant date. |

| (8) | | Includes 100,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

| (9) | | Includes 70,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

| (10) | | Includes 50,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

| (11) | | Includes 20,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006, and 5,000 shares registered in the name of Thomas L. Hewitt FIT Trust. |

| (12) | | Includes 25,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

| (13) | | Includes 20,000 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

| (14) | | Includes 12,500 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

| (15) | | Includes 925,500 shares for which options are exercisable or become exercisable within 60 days after February 23, 2006. |

9

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Exchange Act Section 16(a) requires the Company’s directors and officers, and persons who own more than 10% of the Common Stock, to file with the SEC reports concerning their beneficial ownership of the Company’s equity securities. Directors, officers and greater than 10% beneficial owners are required by SEC regulations to furnish the Company with copies of all such SEC reports they file. Pursuant to Item 405 of SEC Regulation S-K, the Company is required in this Proxy Statement to provide disclosure of “insiders” who do not timely file such reports. Based on a review of such reports filed with the SEC, we believe that all Section 16(a) filing requirements applicable to our directors, officers and shareholders were complied with during 2005.

EXECUTIVE OFFICERS

The Company’s executive officers, and certain information about each of them, are as follows:

Name

| | | | Age

| | Title

|

|---|

| James J. Leto | | | | | 62 | | | Chief Executive Officer and President

|

| Thomas A. Mutryn | | | | | 52 | | | Senior Vice President and Chief Financial Officer

|

| Scott W. Friedlander | | | | | 46 | | | Executive Vice President, Sales

|

| Scot T. Edwards | | | | | 49 | | | Chief Marketing Officer and Group Vice President

|

Officers are appointed by and serve at the discretion of the Board, except that officers at the Vice President level are appointed by and serve at the discretion of the Chief Executive Officer.

For information concerning Mr. Leto, see “Election of Directors.”

Mr. Mutryn joined the Company in January 2003 as Chief Financial Officer and Senior Vice President of Finance. From November 1998 until April 2002, Mr. Mutryn served as Senior Vice President — Finance and Chief Financial Officer at US Airways, Inc. From 1989 to November 1998, Mr. Mutryn held a number of executive positions at United Airlines, Inc., including Vice President and Treasurer and Vice President of Revenue Management.

Mr. Friedlander joined the Company in November 2001 as Vice President, Sales, Technology Teams. He was promoted in November 2003 to Group Vice President, Sales, Enterprise Technology Practices. In July 2005 he was promoted to Executive Vice President, Sales. From February 2000 until June 2001, he served as Executive Vice President of Sideware Corp., an internet customer service system company. From June 1982 until February 2000, Mr. Friedlander was employed by Xerox Corp., where he was promoted to Vice President/General Manager.

Mr. Edwards joined the company in March 2004 as Chief Marketing Officer. He was promoted in January 2005 to Chief Marketing Officer and Group Vice President. From February 2002 until July 2003, he served as Executive Vice President of ReturnBuy/Jabil Global Services, an asset management, supply chain management and direct marketing technology company. From January 2000 until August 2001, Mr. Edwards served as Chief Marketing Officer/Executive Vice President of Xyan, Inc., a provider of digital printing and imaging services.

10

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary Compensation Table

The following table sets forth certain information for the three years ended December 31, 2005 concerning compensation paid or accrued by the Company to or on behalf of: (a) the Company’s CEO, and (b) the four most highly compensated executive officers other than the CEO whose compensation during 2005 exceeded $100,000 (collectively, the “Named Executive Officers”):

| | | | | Annual

Compensation

| | Long-Term

Compensation Awards

|

|---|

Name and Principal Position

| | | | Year

| | Salary

($)(1)

| | Bonus

($)(2)

| | Other

Annual

Compensation

($)(3)

| | Restricted

Stock Award(s)

($)

| | Securities

Underlying

Options

(#)

| | All Other

Compensation

($)

|

|---|

M. Dendy Young (4)

Chairman and CEO | | | | | 2005

2004

2003 | | | | 374,823

350,000

323,167 | | | | 92,029

326,451

314,722 | | | | 0

0

0 | | | | 0

0

0 | | | | 40,000

100,000

0 | | | | 2,654,000

483,000

276,000 | (5)

(6)

(7) |

Thomas A. Mutryn

CFO and Senior Vice President | | | | | 2005

2004

2003 | | | | 334,015

273,295

215,109 | | | | 65,784

197,175

107,333 | | | | 0

0

0 | | | | 0

0

0 | | | | 25,000

10,000

125,000 | | | | 0

0

60,000 |

(8) |

Scott W. Friedlander

Executive Vice

President, Sales | | | | | 2005

2004

2003 | | | | 262,502

204,242

185,000 | | | | 69,993

178,087

126,843 | | | | 0

0

0 | | | | 0

0

0 | | | | 80,000

0

30,000 | | | | 0

0

104,668 |

(9) |

Scot T. Edwards

Chief Marketing Officer

and Group Vice President | | | | | 2005

2004 | | | | 219,224

144,787 | | | | 44,336

60,220 | | | | 0

0 | | | | 0

0 | | | | 20,000

25,000 | | | | 0

15,000 |

(10) |

Terri S. Allen (11)

Senior Vice

President, Sales | | | | | 2005

2004

2003 | | | | 214,060

237,027

210,289 | (12) | | | 0

186,571

122,751 | | | | 0

0

0 | | | | 0

0

0 | | | | 0

7,500

30,000 | | | | 153,255

0

0 | (13) |

| (1) | | Includes amounts, if any, deferred by the Named Executive Officer pursuant to the Company’s 401(k) plan. |

| (2) | | Bonuses under any Executive Bonus Plan are based on corporate and individual performance. See “Compensation Committee Report on Executive Compensation — Executive Bonus Plan.” |

| (3) | | Pursuant to SEC rules, perquisites exceeding neither $50,000 nor 10% of a Named Executive Officer’s combined annual salary and bonus are not required to be reported. |

| (4) | | Mr. Young resigned as Chief Executive Officer February 15, 2006. Mr. Leto was appointed as Chief Executive Officer as of February 16, 2006. |

| (5) | | Amount realized upon option exercise. |

| (6) | | Amount realized upon option exercise. |

| (7) | | Amount realized upon option exercise. |

| (8) | | Amount received for sign-on bonus. |

| (9) | | Amount realized upon option exercise. |

| (10) | | Amount received for sign-on bonus. |

| (11) | | Ms. Allen resigned as an officer and employee of the Company, effective July 22, 2005. |

| (12) | | Amount includes $62,500 of severance pay. |

| (13) | | Amount realized upon option exercise. |

11

Option Grants in the Year Ended December 31, 2005

The following table contains information concerning the grant of stock options made during the year ended December 31, 2005 to each of the Named Executive Officers:

Individual Grants

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation For

Option Term(4)

| |

|---|

Name

| | | | Number of

Securities

Underlying

Options

Granted(1)

| | % of Total

Options /

Restricted

Stock

Granted to

Employees

In 2005(2)

| | Exercise

Price(3)

($/Sh)

| | Expiration

Date

| | Hypothetical

Value

Realized

at 5%

($)

| | Hypothetical

Value

Realized

at 10%

($)

|

|---|

| M. Dendy Young | | | | | 40,000 | | | | 10.60 | % | | | 8.09 | | | | 7/21/2012 | | | | 131,738 | | | | 307,005 | |

| Thomas A. Mutryn | | | | | 25,000 | | | | 6.62 | % | | | 8.09 | | | | 7/21/2012 | | | | 82,336 | | | | 191,878 | |

| Scott W. Friedlander | | | | | 80,000 | | | | 21.19 | % | | | 8.09 | | | | 7/21/2012 | | | | 263,475 | | | | 614,010 | |

| Scot T. Edwards | | | | | 20,000 | | | | 5.30 | % | | | 8.09 | | | | 7/21/2012 | | | | 65,869 | | | | 153,502 | |

| Terri S. Allen | | | | | 0 | | | | 0.00 | % | | | | | | | | | | | | | | | | |

| (1) | | Such options were granted under the Company’s 1996 Plan, vest and become exercisable in 34%, 33% and 33% installments on the third, fourth and fifth anniversaries of the grant date. |

| (2) | | During 2005, employees were granted under the Company’s 1996 Plan or in accordance with employment offers, and non-employee directors were granted under the 1996 Plan, restricted stock and/or options to purchase an aggregate of 377,498 shares of Common Stock. |

| (3) | | Represents the closing price of Common Stock on NASDAQ on the grant date. |

| (4) | | Potential values are net of exercise price and before taxes payable in connection with the exercise of such options or the subsequent sale of shares acquired upon the exercise of such options. These values are based on certain assumed rates of appreciation (i.e., 5% and 10% compounded annually over the term of such options) based on SEC rules. The actual values, if any, will depend upon, among other factors, the future performance of Common Stock, overall market conditions and the Named Executive Officer’s continued employment with the Company. Therefore, the potential values reflected in this table may not necessarily be achieved. |

12

Aggregated Option Exercises in 2005 and Option Values at December 31, 2005

The following table sets forth information with respect to the Named Executive Officers concerning the exercise of options during the year ended, and unexercised options held as of, December 31, 2005:

| | | |

|

| | | | | |

|---|

Name

| | | | Shares

Acquired on

Exercise (#)

| Value

Realized

($)(1)

| | Number of Securities

Underlying Unexercised

Options at 12/31/05 ($)

Exercisable/

Unexercisable

| | Value of

Unexercised

In-the-Money

Options at

12/31/05 ($)(2)

Exercisable/

Unexercisable

| |

|---|

| |

| M. Dendy Young | | | | | 600,000 | | $2,654,000 | | 100,000

0 | | $300,000

$0 | |

| Thomas A. Mutryn | | | | | 0 | | $0 | | 0

0 | | $0

$0 | |

| Scott W. Friedlander | | | | | 0 | | $0 | | 40,000

0 | | $9,600

$0 | |

| Scot T. Edwards | | | | | 0 | | $0 | | 0

0 | | $0

$0 | |

| Terri S. Allen | | | | | 100,000 | | $153,255 | | 0

0 | | $0

$0 | |

| (1) | | Represents the excess of the value received of the shares acquired upon exercise of such options over the exercise price of such options. |

| (2) | | Represents the excess of the market value of the shares subject to such options over the exercise price of such options. |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee currently consists of three non-employee directors: Messrs. D. R. Young (Chairman), Hewitt and Kelman. No member of the Compensation Committee is a current or former officer or employee of the Company. No executive officer of the Company serves or has served as a member of the compensation committee of another entity, one of whose executive officers serves on the Company’s compensation committee. No executive officer of the Company serves or has served as a director of another entity, one of whose executive officers serves on the Company’s compensation committee. Although Mr. M. D. Young was not a member of the Compensation Committee, in 2005, he attended portions of the Compensation Committee meetings at the request of such committee to provide information to, and respond to questions from, the Compensation Committee. During his attendance, Mr. M. D. Young did not exercise any of the rights or have any of the responsibilities of a Compensation Committee member. He was not entitled to vote on any matters before the Compensation Committee and did not participate in any Compensation Committee decisions regarding CEO compensation. See “Compensation Committee Report on Executive Compensation.”

13

EMPLOYMENT AGREEMENTS AND TERMINATION OF EMPLOYMENT

AND CHANGE OF CONTROL ARRANGEMENTS

Pursuant to an employment agreement dated January 1, 2001 (the “2001 Employment Agreement”), Mr. M. D. Young served as the Company’s CEO. Mr. M. D. Young was paid a salary at the rate of $350,000 per year, as of January 1, 2005, and had a $350,000 targeted annual bonus. The salary was increased in April 2005 to $400,000, with a $400,000 targeted annual bonus. The bonus was payable periodically in accordance with the Company’s then current bonus plan for senior officers. Bonus payments are payable in ratio to the percentage of the goal (as established under the Board approved Earnings Before Taxes Schedule) achieved upon attainment of earnings before taxes. Mr. M. D. Young is also entitled to such other benefits and perquisites as provided to other senior officers pursuant to policies established by the Board from time to time.

In February 2006, Mr. Young resigned as Chief Executive Officer of GTSI. As of February 15, 2006, the Company entered into a Transition Agreement with M. Dendy Young in connection with his resignation as Chief Executive Officer and President of the Company (the “Transition Agreement”). Pursuant to the Transition Agreement, Mr. Young will remain Chairman of the Board through August 15, 2006 and receive $50,000 annually in addition to any fees he would receive as a Director. Mr. Young will also receive payments aggregating $1,092,000 over an eighteen month period representing salary and bonuses. Mr. Young will also be entitled to reimbursement for payment of COBRA coverage for the eighteen month period.

Pursuant to an employment agreement dated February 16, 2006 (the “2006 Employment Agreement”), Mr. Leto’s employment commenced on February 16, 2006 and will continue until February 16, 2007. This Agreement automatically renews for successive one-year terms unless the Company or Mr. Leto gives the other party at least 60 days notice prior to expiration of the initial term or any renewal term. Mr. Leto serves as the President and CEO and he is nominated every three years to serve as a Board member. Mr. Leto is paid a salary at the rate of $400,000 per year for 2006, reviewed at least annually by the Board, plus a $500,000 targeted annual bonus at 100% payout and $1,000,000 at 200% payable periodically in accordance with the Company’s then bonus plan for senior officers. Under the 2006 Employment Agreement, GTSI agreed to grant Mr. Leto options under the 1996 Stock Incentive Plan to purchase up to 400,000 shares; such options are expected to be granted on April 28, 2006, and shall be initially exercisable on the second anniversary of the grant date.

The Compensation Committee and the Board have approved change of control agreements with the four Named Executive Officers and eleven other officers. These agreements provide that if, within six months prior to or eighteen months following a change of control, such an officer is terminated as an employee of the Company other than for cause; his or her compensation is reduced; his or her responsibilities are substantively diminished; or he or she is required to relocate, he or she will receive certain payments based on his or her then current annual salary and targeted annual bonus. Mr. Mutryn will receive such payments equal to one and one-half times his then current annual salary and targeted annual bonus; Mr. Edwards will receive one-half of his then current annual salary and targeted annual bonus and Mr. Friedlander will receive nine months of his then current annual salary and targeted annual bonus. Any unvested options held by the foregoing will immediately vest upon a change of control. Change of control is defined as (a) control of 50% or more of the outstanding Common Stock; (b) a change in a majority of the Board members if the change occurred during any 12 consecutive months and the new directors were not elected by the Company’s stockholders or by a majority of the directors who were in office at the beginning of the 12-month period; or (c) the stockholders approve a merger or consolidation of the Company with another corporation, other than a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent more than 50% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such merger or consolidation.

See discussion of the Company’s Long Term Incentive Plan in the section entitled “Compensation Committee Report on Executive Compensation.”

14

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company and Federal Airways Corporation, a company of which Mr. Johnson is the owner and president, are parties to a consulting agreement, which began in 1997 and will continue until Mr. Johnson ceases to be a director of the Company or either party terminates the agreement. Under the agreement, if the Company calls upon Mr. Johnson to provide services in respect of Company matters, the Company pays Mr. Johnson a fee of $2,000 per day for his services and reimburses his related out-of-pocket expenses. During 2005, the Company paid Federal Airways Corporation $460,337, plus reimbursement of related out-of-pocket expenses of $3,563, for a total of $463,900 for services performed by Mr. Johnson during the year. A substantial portion of Mr. Johnson’s consulting services on the Company’s behalf during 2005 related to assistance with GTSI’s Enterprise Resource Planning implementation, as well as support on a major Department of Defense contract. During 2000 and 2001, the Company provided substantial equipment financing to a customer (“the Customer”) that was not otherwise affiliated with the Company or Mr. Johnson. In 2002 the Customer was acquired by a “Fortune 100” company for which the Company continues to provide equipment and services. During 2004 the Company obtained additional contracts from the Customer for five new locations. Since 2000 the Company has provided the Customer more than $170 million of equipment and services in which Mr. Johnson continues to assist the Company in the support of the Customer.

Chief Executive Officer James J. Leto’s son James Todd Leto (Todd Leto) serves as Vice President, Customer Teams, a division of the Company’s Sales organization. During 2005, Todd Leto received a salary of $199,087, commissions of $32,187, and a bonus of $56,357. By agreement between the Company and James J. Leto, he does not participate in any decision making at GTSI with respect to Todd Leto’s performance or compensation.

On March 3, 2005, the Board approved the acceleration of the vesting of unvested stock options with an exercise price above $8.09, the market value on the date of the acceleration which was November 18, 2005, previously awarded to employees, officers and directors under GTSI’s stock option plans. Forfeiture of these accelerated options will occur on the date that an employee or officer’s employment with GTSI terminates, or on the date that a non-employee director is no longer a director of GTSI, if such termination date is prior to the original vesting date of such options. The vesting of these options was accelerated to avoid recognizing compensation expense in future financial statements upon the adoption of SFAS 123R.

The following report on executive compensation by the Compensation Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act or the Exchange Act, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Policy and Objectives

The Company’s compensation program for executive officers is designed to attract, motivate, and retain qualified executive officers and is generally administered by the Compensation Committee. The Company’s program is based on compensation policies and plans which seek to enhance the profitability of the Company, and thus stockholder value, by aligning closely the financial interests of the executive officers of the Company with those of its stockholders. Accordingly, the Committee, which is composed entirely of non-employee directors, structures such policies and plans to pay competitive levels of compensation for competitive levels of performance, and to provide for superior compensation opportunities for superior levels of performance.

The Company actively collects and analyzes compensation information, including compensation surveys from consulting firms such as Longnecker & Associates, Watson Wyatt and Aon Consulting. This information, and other market and competitive information collected by the Company’s Human Resources department, is used as the basis for comparing the compensation of the Company’s executive officers to amounts paid to executive officers with comparable qualifications, experience and responsibilities at other companies engaged in the same industry as the Company.

Components

The Company’s executive compensation program includes three components, each of which is intended to serve the overall compensation approach described above: base salary, an executive bonus and long term incentive (a choice between stock options or restricted stock).

15

Base Salary

The Committee believes that the Company pays base salaries to its executive officers that are set conservatively, and near the median, compared with executive officers employed at competing companies. The Committee, among other things, reviews and recommends to the Board the annual salaries of the Company’s primary Section 16 executive officers (Chief Executive Officer and Chief Financial Officer). The Committee, with input from the CEO, has been delegated by the Board the authority to set the annual base salaries of the remaining, less senior executive officer positions. Additionally, all full-time executive officers are eligible to participate in the Company’s broad-based employee benefit plans.

Executive Bonus Plan

The Committee believes that a significant portion of each executive officer’s total compensation should be “at risk” in the form of incentive compensation. Accordingly, under an annual Executive Bonus Plan developed and implemented under the Committee’s supervision, the Company pays cash bonuses to all its eligible executive officers according to a formula based upon the Company’s earnings before taxes. Individual bonuses are calculated as a percentage of base salary and range from 30% to 70% in the case of officers generally, other than the CEO. Under the 2006 Employment Agreement, as approved by the Board on February 15, 2006, Mr. James Leto is entitled to a $500,000 targeted annual bonus at 100% payout, and $1,000,000 at 200% in 2006 payable periodically in accordance with the Company’s then senior bonus plan. Bonus payments are payable in the ratio of the percentage of the goal achieved upon attainment of earnings before taxes (adjusted for Board-approved one-time charges (e.g., acquisition costs)). The Board establishes the earnings before taxes goal at the beginning of each year. In 2005, bonuses were earned by executive officers based on application of the Executive Bonus Plan’s formula. The CEO additionally employs the occasional use of “spot” bonuses in recognition of extraordinary performance.

Long-Term Incentive Plan

The Company’s Long-Term Incentive Plan (“LTIP”) provides for the granting of cash awards with respect to the performance periods as the Committee may determine (each such period, a “Performance Period”). The receipt of each award will be subject to the achievement of such performance factor or factors as the Committee may determine (the “Performance Factors”). Performance Factors may include any or all of the following: stock price; total stockholders return; earnings per share; revenue; net sales; operating income or margin; earnings before all or any of interest, taxes, depreciation and/or amortization; cash flow; working capital; return on equity; return on assets; market share; sales (net or gross) measured by product line, territory, customer(s), or other category; earnings from continuing operations; net worth; levels of expense, cost or liability by category, operating unit or any other delineation; any increase or decrease of one or more of the foregoing over a specified period or the performance relative to one or more of the foregoing relative to other peer companies over a specified period. Such Performance Factors may relate to the Company’s performance, a business unit, product line, territory, or any combination thereof. Except with respect to any LTIP participant who is an “executive officer” (within the meaning of Exchange Act Rule 3b-7), Performance Factors may also include such objective or subjective performance goals as the Committee may from time to time establish. Performance Factors may include a level of performance below which no payment will be made, a target performance level at which the full amount of the award will be made, and a maximum performance level at which the maximum amount will be paid. Unless otherwise provided by the Committee in connection with specified terminations of employment or upon a change of control of the company, payment in respect of awards will be made only if and to the extent that the Performance Factors with respect to such Performance Period are attained.

The Company did not make any awards under the LTIP in the year ended December 31, 2005 to any Company employees. For 2006, there are no current plans for awards under the LTIP, however, if this changes, the Compensation Committee will determine which executive officers will participate and, subject to Board approval, after consultation with the Company’s executive officers, which other Company employees may participate (collectively, the “Participants”).

Participants in any LTIP Plans must be employed by the Company at the end of a Performance Period to receive any compensation under such Plans. In addition, to be eligible for 100% of the possible awards for a Performance Period, a Participant must be employed by the Company at least 18 months prior to the beginning of such Performance Period. If a Participant commences employment less than 18 months prior to the beginning of a

16

Performance Period, the percentage of award to which such Participant will be entitled will be reduced on a pro rata basis, determined by multiplying the total award by a fraction, the numerator of which is the number of months such Participant was employed by the Company prior to the end of the Performance Period and the denominator of which is 40 (18 months prior to Performance Period plus the Performance Period).

Upon a change of control of the Company in the 24-month period before the end of a Performance Period, Participants may be entitled to receive pro rata amounts under the 2006 and 2007 LTIP Plans, determined by projecting through the end of the applicable Performance Period the Company’s actual trailing twelve months’ net income prior to such change of control. If such projected net income meets the targets described above for a Performance Period, the Participants will be entitled to a pro rata share of the amount to which they would have been entitled if such Performance Period had been completed. The pro rata amount will be determined by multiplying the potential award amount by a fraction, the numerator of which is the number of complete months between the date of the change of control and the end of a Performance Period, and the denominator of which is 24.

Stock Incentive and Stock Option Program

Given the recent industry trend to move away from stock options as a key component of an executive compensation program, in 2005 the Committee initiated a review of other stock incentive programs from various compensation consultants. As a result, stockholders approved the inclusion of a stock incentive program into the Company’s existing 1996 Plan that provides for alternative incentive programs for the Company to encourage performance.

Options to purchase Common Stock are a component of the Company’s executive compensation program. The Committee views the grant of stock options as an incentive that serves to align the interests of executive officers with the Company’s goal of enhancing stockholder value. Options will only have value to an executive officer if the stock price increases over the exercise price. The Committee reviews and acts upon recommendations by the Company’s CEO with regard to the grant of stock options to executive officers (other than to himself). In determining the size and other terms of an option grant to an executive officer, the Committee considers a number of factors, including such officer’s position, responsibilities and previous stock option grants (if any). Options typically vest in equal installments over three to five years and, therefore, encourage an officer to remain in the employ of the Company.

Chief Executive Officer Compensation

In evaluating the CEO’s compensation, the Committee reviewed the compensation for similar positions. The Committee reviewed executive compensation reports from Longnecker & Associates, Watson Wyatt and Aon Consulting. The Committee studied the base salary, annual bonuses, stock options and grants, and other long-term compensation of the chief executive officers in each of the other companies, and recommended Mr. Leto’s salary to the Board by targeting the 50th percentile of base and target bonus based upon the Committee’s research. Mr. Leto’s current compensation plan is intended to provide significant incentives to him to increase the Company’s value (as reflected in its stock price) to the benefit of all Company stockholders, while the focus of his annual bonus is on achieving short-term financial goals.

Mr. Leto’s compensation, as set forth in the 2006 Employment Agreement (see “Employment Agreements and Termination of Employment and Change of Control Arrangements” above), was unanimously approved by the Board. Mr. Leto has been the Company’s CEO since February 16, 2006, and a member of its Board since February 1996.

Other Matters

Mr. Leto from time to time may consult with, and make recommendations to, the Committee with respect to the compensation of the Company’s executive officers other than himself. Other than as delegated by the Board (as set forth above), Mr. Leto will not participate in decisions relating to executive officer compensation, excluding his own, and will not participate on matters relating to the administration of the Company’s stock option plans, or any compensation decision involving Todd Leto.

Under Code Section 162(m), a publicly held corporation such as the Company will not be allowed a federal income tax deduction for compensation paid to the chief executive officer or one of the four most highly

17

compensated officers (other than the chief executive officer) to the extent that compensation (including stock-based compensation) paid to each such officer exceeds $1 million in any year unless such compensation was based on performance goals or paid under a written contract that was in effect on February 17, 1993. The 1996 Plan is designed so that amounts realized on the exercise of options granted thereunder may qualify as “performance-based compensation” that is not subject to the deduction limitation of Section 162(m). The Committee intends to evaluate other elements of compensation in light of Section 162(m), but may enter into arrangements that do not satisfy exceptions to Section 162(m), as the Committee determines to be appropriate.

COMPENSATION COMMITTEE

Daniel R. Young, Chairman

Thomas L. Hewitt

Steven Kelman

18

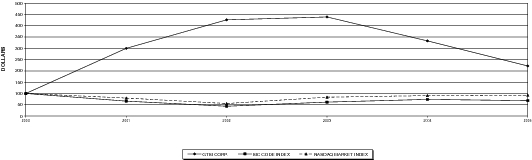

The following performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act or the Exchange Act, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

PERFORMANCE GRAPH

The following graph compares the annual percentage change in the cumulative total return on Common Stock with the cumulative total return of the NASDAQ Composite Index and a Peer Index of companies with the same four-digit standard industrial classification (SIC) code as the Company (SIC Code 5045 — Computers and Peripheral Equipment and Software)1 for the period commencing January 1, 2000 and ending December 31, 2005. The stock price performance shown on the graph below is not necessarily indicative of future price performance.

| | | | Dec. 31,

2000

| | Dec. 31,

2001

| | Dec. 31,

2002

| | Dec. 31,

2003

| | Dec. 31,

2004

| | Dec. 31,

2005

|

|---|

| GTSI Corp. | | | | | 100.00 | | | | 300.06 | | | | 426.17 | | | | 438.88 | | | | 333.02 | | | | 221.80 | |

| Peer Index(1) | | | | | 100.00 | | | | 66.19 | | | | 43.50 | | | | 61.87 | | | | 73.68 | | | | 68.20 | |

| NASDAQ Index | | | | | 100.00 | | | | 79.71 | | | | 55.60 | | | | 83.60 | | | | 90.63 | | | | 92.62 | |

COMPARES 5-YEAR CUMULATIVE TOTAL RETURN

AMONG GTSI CORP., NASDAQ MARKET INDEX AND

SIC CODE INDEX

ASSUMES $100 INVESTED ON DEC. 31, 2000

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2005

| (1) | | The 24 companies listed in SIC Code 5045 are: CDW Corporation; Counterpath Solutions; Electronics for Imaging; En Pointe Technologies.; Enigma Software Group; GTSI Corp.; Ikon Office Solutions; Info Tech USA, Inc.; Ingram Micro, Inc.; INX, Inc.; MTM Technologies, Inc.; Navarre Corp.; OCG Technology Inc.; Pacific Magtron Intl CP; Palm, Inc.; Peerless Systems Corp.; Pomeroy IT Solutions, Inc.; Programmers Paradise, Inc.; San Holdings, Inc.; Sand Technology, Inc., CL A; Scansource, Inc.; Sharp Holding Corp.; Tech Data Corporation; and Transnet Corp. |

| | | Since last year’s proxy statement, CNTV Entertainment Group; I-Sector Corporation; Palmone, Inc.; SED Intl. Holdings, Inc. were deleted from SIC Code 5045, and Counterpath Solutions; Enigma Software Group; INX, Inc.; Palm, Inc.; Pomeroy IT Solutions, Inc. were added to SIC Code 5045. |

19

REPORT OF THE AUDIT COMMITTEE OF THE BOARD

The following Report of the Audit Committee of the Board (the “Audit Committee”) does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act or the Exchange Act, except to the extent the Company specifically incorporates this Report by reference in any of those filings.

The Board adopted a written Audit Committee Guideline, a copy of which is posted on the Company’s Internet website,www.GTSI.com (located on the Investor Relations web page). The Board and the Audit Committee believe that the Audit Committee members are and were at the time of the actions described in this report “independent” as independence is defined in NASDAQ Rule 4200(a)(15).

In overseeing the preparation of the Company’s financial statements, the Audit Committee met with both management and the Company’s independent registered public accounting firm to review and discuss significant accounting issues. The Audit Committee members have reviewed and discussed with the Company’s management the Company’s audited consolidated financial statements as of and for the year ended December 31, 2005, and the prior period restatements included therein. Management advised the Audit Committee that all of the Company’s consolidated financial statements as of and for the year ended December 31, 2005 were prepared in accordance with U.S. generally accepted accounting principles and the Audit Committee discussed such financial statements with both management and the Company’s independent registered public accounting firm.

Prior to the commencement of the audit, the Audit Committee discussed with Company’s management and the independent registered public accounting firm the overall scope and plans for the audit. Subsequent to the audit and each of the quarterly reviews, the Audit Committee discussed with the independent registered public accounting firm, with and without management present, the results of their examinations or reviews, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of specific judgments and the clarity of disclosures in the consolidated financial statements.

The Audit Committee members’ review included discussion with the Company’s independent registered public accounting firm of matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (Communication with Audit Committees), as amended, issued by the Auditing Standard Board of the American Institute of Certified Public Accountants.

With respect to the Company’s independent registered public accounting firm, members of the Audit Committee, among other things, discussed with Ernst & Young LLP matters relating to its independence, including the disclosures made to the Audit Committee as required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committee). The Audit Committee reviewed and pre-approved the non-audit services described below provided by the Company’s independent registered public accounting firm. The Audit Committee has considered whether the provision by Ernst & Young LLP of non-audit services to the Company is compatible with maintaining Ernst & Young’s independence.

The Audit Committee also works with the internal auditor that reports directly to the Audit Committee and the Chief Financial Officer.

During the course of closing the accounting records for the year ended December 31, 2005, management completed the documentation, testing and evaluation of the Company’s system of internal controls over financial reporting in response to the requirements set forth in Section 404 of the Sarbanes-Oxley Act and related regulations. The Audit Committee was kept apprised of the progress of the evaluation and provided oversight and advice to management during the process. The Audit Committee reviewed the report of management contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 filed with the SEC, as well as the independent registered public accounting firm’s Report of Independent Registered Public Accounting Firm included in the Company’s Annual Report on Form 10-K related to its audit of (i) the consolidated financial statements, (ii) management’s assessment of the effectiveness of internal control over financial reporting and (iii) the effectiveness of internal control over financial reporting. The Audit Committee continues to oversee the Company’s efforts related to its internal control over financial reporting and management’s remediation efforts with respect to the Company’s material weaknesses and preparations for the evaluation of internal control over financial reporting in the year ending December 31, 2005.

20

On the basis of the reviews and discussions referred to above, the Audit Committee recommends to the Board that the Board approve the inclusion of the Company’s audited consolidated financial statements referred to above in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, for filing with the SEC.

Audit Committee members for the year ended December 31, 2005:

Barry L. Reisig, Chairman

Joseph Keith Kellogg, Jr.

John Toups

21

AUDIT FEES

The following table shows the fees paid or accrued by the Company for the audit and other services provided by Ernst & Young, LLP for 2005 and 2004.

| | | | 2005

| | 2004

|

|---|

| Audit Fees | | | | $ | 1,232,000 | (1) | | $ | 1,104,500 | (1) |

| Audit Related Fees | | | | $ | — | | | $ | — | |

| Tax Fees | | | | $ | 74,805 | (2) | | $ | 94,737 | (2) |

| Total | | | | $ | 1,306,805 | | | $ | 1,199,237 | |

| (1) | | Includes fees for audit of consolidated financial statements, audit of internal controls over financial reporting, quarterly reviews, and fees incurred related to Form S-8 registration statements, and advisory services related to certain accounting issues. |

| (2) | | Includes fees for tax return preparation and tax consultation. |

Effective May 6, 2003, GTSI was required to obtain pre-approval by our Audit Committee for all audit and permissible non-audit related fees incurred with our independent registered public accounting firm. The Audit Committee has adopted additional pre-approval policies and procedures. All audit and non-audit related fees were approved in advance by the Audit Committee. When it is efficient to do so, we use third parties other than our auditors to perform non-audit work, such as tax work, on behalf of the Company.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Company’s independent registered public accounting firm for the year ended December 31, 2005 was Ernst & Young LLP. The Board has not yet selected the independent registered public accounting firm for the Company’s year ending December 31, 2006. A representative of Ernst & Young LLP is expected to be present at the Meeting, will have an opportunity to make a statement if he or she so desires, and is expected to be available to respond to appropriate questions.

ANNUAL REPORT

A copy of the Company’s 2005 Annual Report to Stockholders is being delivered to each stockholder as of the Record Date.The Company’s Annual Report on Form 10-K for the year ended December 31, 2005, as filed with the SEC, is also available free of charge to all stockholders of record as of the Record Date by writing to the Company at 3901 Stonecroft Boulevard, Chantilly, Virginia 20151-1010, Attention: Investor Relations.

OTHER MATTERS

The Company currently knows of no matters to be submitted at the Meeting other than those described herein. If any other matters properly come before the Meeting, the proxies will vote the Common Stock they represent as they deem advisable. The persons named as attorneys-in-fact in the proxies are officers of the Company.

By Order of the Board of Directors

Charles E. DeLeon

Secretary

Chantilly, Virginia

April 14, 2006

22

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF GTSI CORP.

2006 Annual Meeting of Stockholders

The undersigned stockholder(s) of GTSI Corp., a Delaware corporation (the “Company”), hereby acknowledges receipt of the Company’s Notice of Annual Meeting of Stockholders and Proxy Statement, each dated April 14, 2006, and Annual Report for the fiscal year ended December 31, 2005, and hereby appoints James Leto and Charles E. De Leon, and each of them, proxies and attorneys-in-fact, with full power to each of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the Annual Meeting of Stockholders of the Company to be held at 8:30 a.m., local time, on May 9, 2006, at the Company’s headquarters located at 3901 Stonecroft Boulevard in Chantilly, Virginia, and at any adjournment(s) thereof, and to vote all Common Stock to which the undersigned would be entitled, if then and there personally present, on the matters set forth below and as more particularly described in the Company’s above-mentioned Proxy Statement:

1. | | Election of Directors. |

[ ] For All Nominees Listed Below

(except as marked to the contrary below) | [ ] Withhold Authority to Vote

For All Nominees Listed |

(Instruction: To withhold the authority to vote for any individual nominee, mark the box next to that nominee’s name below.)

Name of Nominees for election as a Class 3 director of the Company:

[ ] Steven Kelman [ ] Barry L. Reisig [ ] John M. Toups

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting or any adjournment(s) thereof.

Any one of such attorneys-in-fact or substitutes as shall be present and shall act at said Annual Meeting or any adjournment(s) thereof shall have and may exercise all powers of said attorneys-in-fact hereunder.

THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED FOR THE ELECTION AS DIRECTORS OF THE NOMINEES LISTED IN PROPOSAL 1 ABOVE AND AS SAID PROXIES DEEM ADVISABLE ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING.

This Proxy should be marked, dated and signed by each stockholder exactly as his or her name appears hereon, and returned promptly in the enclosed envelope. Persons signing in a fiduciary capacity should so indicate. If shares are held by joint tenants or as community property, both parties should sign.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.