The cost of this solicitation of proxies will be borne by the Company. Proxies will be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, personally or by telephone, email or fax. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of Common Stock for their expenses in forwarding solicitation materials to such beneficial owners.

The Company currently has a classified Board currently consisting of three Class 1 directors, three Class 2 directors and three Class 3 directors. The current terms of Class 1 and Class 2 directors continue until the annual meeting of stockholders to be held in 2010 and 2011, respectively, and until their respective successors are elected and qualified. There are currently nine Board members.

At each annual stockholders meeting, directors are elected for a full term of three years to succeed those directors whose term expires at the annual meeting date.

At the Meeting, the holders of Common Stock as of the Record Date will elect three Class 3 directors for three-year terms. Unless otherwise instructed, proxy holders will vote the proxies received by them for the election of the Company’s three nominees named below for Class 3 directors, all of whom are currently directors of the Company. If any of the nominees of the Company is unable or declines to serve as a director at the time of the Meeting, the proxies will be voted for a nominee who will be designated by the current Board to fill the vacancy. It is not, however, expected that any of the nominees will be unable or will decline to serve as a director. Except for the relationship between James J. Leto and Todd Leto described in the section entitled “Certain Relationships and Related Transactions” below, there is no family relationship between any director, nominee for election as a director or executive officer of the Company and any other director, nominee for election as a director or executive officer of the Company.

Following are summaries of the background, business experience and descriptions of the principal occupations of the nominees.

Steven Kelman, Ph.D., age 60, has served as a director since 1997. Since 1997, he has been the Weatherhead Professor of Public Management at Harvard University’s John F. Kennedy School of Government. From 1993 to 1997, Dr. Kelman served as Administrator of the Office of Federal Procurement Policy at the Office of Management and Budget. From 1986 to 1993, he was Professor of Public Policy at Harvard University’s John F. Kennedy School of Government.

Barry L. Reisig, age 63, has served as a director since May 2003. Since July 2006, Mr. Reisig has been a business consultant. From 2002 until 2006, Mr. Reisig was Vice President of Finance of System Planning

Corporation, a developer of high technology systems, and President and Chief Executive Officer of its subsidiary, SPC International. From 1980 to 2002, Mr. Reisig was a partner of Arthur Andersen LLP, involved principally in tax matters.

John M. Toups, age 83, has served as a director since 1997 and as Chairman of the Board since May 2007. From 1978 until his retirement in 1987, Mr. Toups was President and Chief Executive Officer of PRC, Inc. Mr. Toups is also a director of NVR, Inc., a homebuilding and mortgage banking company, Halifax Corporation, an enterprise maintenance solutions company, and Wildan Group, a civil engineering services company.

Other Information

Securities and Exchange Commission (the “SEC”) regulations require the Company to describe material legal proceedings, including bankruptcy and insolvency filings, involving nominees for the Board of Directors or companies of which a nominee was an executive officer. The Board’s Nominating & Governance Committee is not aware of any nominee involved in any of the foregoing types of legal proceedings.

The Board recommends a vote FOR the election of the three nominees listed above.

Class 1 Directors – Term Expiring in 2010

Daniel R. Young, age 75, has served as a director since 2001. From 1977 until 2000, Mr. Young had been a senior executive officer of Federal Data Corporation, a provider of information technology products and services to government agencies, including serving since 1995 as President and Chief Executive Officer and since 1998 as Vice Chairman of the Board of Directors of Federal Data Corporation. Mr. Young is also a director of Halifax Corporation, an enterprise maintenance solutions company, and NCI Corp., an information technology, systems engineering and integration company.

Joseph “Keith” Kellogg, Jr., age 60, has served as a director since April 29, 2004 and previously was a member of the Board from October 29, 2003 until he resigned on December 8, 2003 to provide temporary service to the Federal Government. During this temporary service, General Kellogg served as Chief Operating Officer of the Coalition Provisional Authority in Baghdad, Iraq. General Kellogg was a member of the U.S. Army from 1971 to 2003, when he retired as a Lieutenant General and a highly decorated war veteran. From September 2003 until January 2005, General Kellogg served as Senior Vice President for Homeland Security Solutions for Oracle Corp. Since January 2005, General Kellogg has been employed by CACI International Inc., as an Executive Vice President, Research and Technology Systems.

Lloyd Griffiths, age 67, has served as a director since April 24, 2008. He is the current Dean of The Volgenau School of IT & Engineering at George Mason University, Fairfax, Virginia since 1997. Prior to joining George Mason, Dr. Griffiths was Chair of the Electrical and Computer Engineering Department at the University of Colorado from 1994 to 1997; and Associate Dean for Research and Administration in the School of Engineering for nine years at the University of Southern California. Dr. Griffiths is on the board of directors of Information Systems Laboratories, Inc., a private engineering firm; and also serves as a Member of the Advisory Board of Geographic Services, Inc., a provider of geospatial systems; a Member of the Advisory Board of Vangard Voice Systems, a provider of voice technology for mobile enterprise; and a Member of the Technical Advisory Board of The Centre Tecnològic de

3

Telecomunicacions de Catalunya (CTTC) in Barcelona, Spain. Dr. Griffiths holds M.S. and Ph.D. degrees in Electrical Engineering from Stanford University.

Class 2 Directors – Term Expiring in 2011

Lee Johnson, age 81, has served as a director since March 1996. Since 1984, Mr. Johnson has been the President of Federal Airways Corporation, a provider of highly modified, special mission high altitude aircraft to civilian and defense agencies. From 1986 to 1994, Mr. Johnson served as Chairman of the Board of Directors of Falcon Microsystems, Inc., a government microcomputer reseller that was acquired by the Company in 1994.

James J. Leto, age 65, has served as a director since February 1996 and since February 2006 has served as Chief Executive Officer. From February 2006 until December 2007 he also served as President. From December 2002 to February 2006, Mr. Leto was the Chief Executive Officer of Robbins-Gioia, Inc., a program management consulting firm. From 1996 through 2001, he was the Chairman and Chief Executive Officer of Treev, Inc. (formerly known as Network Imaging Corporation), a developer and marketer of software used to manage client/server, object-oriented, and enterprise-wide information. From 1992 until February 1996, he was the Chairman and Chief Executive Officer of PRC, Inc., a provider of scientific and technology-based systems, products and services to government and commercial clients around the world. Mr. Leto is also a director of Robbins-Gioia, Inc., a program management consulting firm.

Thomas L. Hewitt, age 70, has served as a director since May 2003, and previously served as a director from March 1996 until May 1998. Since January 2000, Mr. Hewitt has been the Chief Executive Officer of Global Governments, Inc., a strategic planning and marketing company. In 1984, Mr. Hewitt founded Federal Sources, Inc., a market research and consulting firm, where he served as Chief Executive Officer and Chairman of the Board until 1999. Mr. Hewitt is also a director of Halifax Corporation, an enterprise maintenance solution company.

BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE

There are currently nine Board members. With the exception of Mr. Lee Johnson and Mr. Jim Leto, all of our current directors are “independent” as defined by the applicable rule of The Nasdaq Stock Market, Inc. (“Nasdaq”). The independent directors regularly have the opportunity to meet without Mr. Johnson and Mr. Leto in attendance, and, as discussed below, the Board has had since 2004 the position of lead independent director (“Lead Independent Director”). In 2007, Mr. Toups, the designated Lead Independent Director was elected to the Chairman of the Board role, and as a result, the Lead Independent Director role has been incorporated into the Chairman role for his tenure. During 2008, there were four regular Board meetings and three special meetings. During 2008 no director attended (in person or by telephone) less than 75% of the aggregate of (a) all Board meetings and (b) all meetings of Board committees of which he was a member. The Company does not have a specific policy regarding attendance of directors at the annual stockholder meeting. All directors, however, are encouraged to attend if available, and the Company tries to ensure that at least one independent director is present at the annual meeting and available to answer any stockholder questions. Messrs. Jim Leto, John Toups, Tom Hewitt, Lee Johnson, Steven Kelman, Keith Kellogg, Barry Reisig and Daniel Young were present at last year’s annual stockholders meeting (the “2008 Annual Meeting”).

4

The Board has an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The current charters of each of these committees, as well as the duties of the Lead Independent Director, are available on the Company’s Internet website,www.GTSI.com (located on the Investor Relations web page). Also posted on such website is a description of the process for stockholders to send communications to the Board or to one or more particular Board members. In addition, the Board utilized a special subcommittee during 2008 to consider strategic opportunities. The special subcommittee met eight times during the year.

Audit Committee

The primary purpose of the Audit Committee is to oversee the Company’s accounting and financial reporting processes and the audits of its financial statements. The Audit Committee is directly responsible for, among other things, the appointment, compensation, retention, and oversight of the Company’s independent auditor.

Since the 2008 Annual Meeting, the Audit Committee has been composed of Messrs. Reisig (Chairman), Griffiths, Kellogg and Toups. All of the Audit Committee members during the past year, and all of the members who will be appointed for the current year, are independent in accordance with applicable rules of the SEC and Nasdaq. Each current member is able to read and understand fundamental financial statements, including the Company’s balance sheet, statement of operations and statement of cash flow. The Board has determined that Mr. Reisig is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). During 2008, the Audit Committee met five times.

Compensation Committee

The primary purpose of the Compensation Committee is to provide assistance to the Board in fulfilling its responsibility with respect to oversight of the establishment, administration and appropriate functioning of stock, compensation and related matters for the Company’s employees. The Committee reviews the salaries and bonuses to be paid to the Company’s Chief Executive Officer and the Company’s other principal executive officers (Chief Financial Officer and President), and make recommendations to the Board on such salaries and bonuses. The Compensation Committee reviews and approves the salaries and bonuses for the Company’s other officers, reviews and approves the compensation discussions and analysis, and administers the Company’s stock option and stock incentive plans. Since the 2008 Annual Meeting, the Compensation Committee has been composed of Messrs. Young (Chairman), Hewitt, and Kelman. Each of the committee members is independent in accordance with applicable Nasdaq rules. During 2008, the Compensation Committee formally met six times.

Nominating and Governance Committee

The primary purpose of the Nominating and Governance Committee (“Nominating Committee”) is to provide assistance to the Board in fulfilling its responsibility with respect to oversight of the appropriate and effective governance of the Company, as well as identify and recommend individuals to be presented to the stockholders for election or re-election as Board members. Since the 2008 Annual Meeting, the Nominating Committee has been composed of Messrs. Toups (Chairman), Reisig, and Young, all of whom are independent in accordance with applicable Nasdaq rules. During 2008, the Nominating Committee formally met three times.

5

Lead Independent Director

The Lead Independent Director role was created in 2004, to assist the Chairman of the Board and the other Board members in assuring effective corporate governance. The Lead Independent Director’s responsibilities also include assisting the Chairman in reviewing the functions of Board committees and recommending the creation or discontinuance of committees, considering questions of potential conflicts of interest, acting as a resource on corporate governance matters, and acting as the spokesperson for the Company if the Chairman is absent. For this service, the Lead Independent Director is to receive a yearly retainer of $10,000. Mr. Toups was initially appointed as Lead Independent Director on April 29, 2004, and served in this role until his election to Chairman of the Board in May 2007. At that time, the role of Lead Independent Director was incorporated into the Chairman role for Mr. Toups’ tenure.

Chairman of the Board

In February 2006, the Board separated the duties of the Chairman of the Board and the Company’s Chief Executive Officer. Mr. Toups, who is the current Chairman of the Board, has been Chairman since the 2007 annual meeting of GTSI’s stockholders.

Transactions with Related Persons

We may occasionally participate in transactions with certain “related persons.” Related persons include our executive officers, directors, director nominees, the beneficial owners of more than 5% of our common stock, immediate family members of these persons, and entities in which one of these persons has a direct or indirect material interest. In 2003, we adopted a written policy as part of our audit committee charter that provides for the review and, if applicable, approval at each regularly scheduled meeting any related party transaction as required by Nasdaq. Under this policy, the Audit Committee is responsible for the review and approval of each related person transaction exceeding $120,000. The Audit Committee, or the Chairman, considers all relevant factors when determining whether to approve a related person transaction including, without limitation, whether the proposed transaction is on terms and made under circumstances that are at least as favorable to the Company as would be available in comparable transactions with or involving unaffiliated third parties. Among other relevant factors, they consider the following:

| |

| • the size of the transaction and the amount of consideration payable to the related person(s); |

| |

| • the nature of the interest of the applicable director, director nominee, executive officer, or 5% stockholder, in the transaction; and |

| |

| • whether we have developed an appropriate plan to monitor or otherwise manage the potential for a conflict of interest. |

Based on all relevant facts and circumstances, taking into consideration our contractual obligations, the Audit Committee determines whether it is in our and our stockholders’ best interest to continue, modify or terminate the related person transaction. In 2008, other than as discussed below under the caption “Certain Relationships and Related Transactions” the Audit Committee did not identify any related person transaction.

6

DIRECTOR NOMINATIONS AND QUALIFICATIONS

The Nominating Committee will consider nominees for director recommended by stockholders with respect to elections to be held at an annual stockholders meeting. In accordance with the Company’s Bylaws, to nominate an individual for election to the Board at an annual stockholders meeting, a stockholder must deliver written notice of such nomination to the Company’s Secretary not fewer than 60 days nor more than 90 days prior to the date of the annual meeting (or if less than 60 days notice or prior public disclosure of the date of such annual meeting is given or made to the stockholders, not later than the tenth day following the day on which notice of the date of the annual meeting was mailed or public disclosure was made). The notice of a stockholder’s intention to nominate a director must include:

| | |

| • | information regarding the stockholder making the nomination, including name, address and number of GTSI shares that are beneficially owned by the stockholder; |

| | |

| • | a representation that the stockholder is entitled to vote at the meeting at which directors will be elected, and that the stockholder intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; |

| | |

| • | the name and address of the person or persons being nominated and such other information regarding each nominated person that would be required in a proxy statement filed pursuant to the SEC’s proxy soliciting rules if the person had been nominated for election by the Board; |

| | |

| • | a description of any arrangements or understandings between the stockholder and such nominee and any other persons (including their names), pursuant to which the nomination is made; and |

| | |

| • | the consent of each such nominee to serve as a director if elected. |

The Chairman of the Board, other directors and executive officers may also recommend director nominees to the Nominating Committee. The committee will evaluate nominees recommended by stockholders against the same criteria that it uses to evaluate other nominees. These criteria include the candidate’s experience, skills and personal accomplishments, as well as other factors that are listed as an appendix to the Nominating Committee charter, which is posted on the Company’s Internet website,www.GTSI.com (located on the Investor Relations web page). The committee has not in the past retained any third party to assist it in identifying nominees.

The Nominating Committee utilizes a variety of methods for identifying and evaluating nominees for director. The committee periodically assesses the appropriate size of the Board, and whether any vacancies on the Board are expected due to retirement or otherwise. If vacancies are anticipated, or otherwise arise, the Nominating Committee will consider various potential candidates for director. Candidates may come to the attention of the Nominating Committee through current Board members, professional search firms, stockholders or other persons. These candidates are evaluated at regular or special meetings of the Nominating Committee, and may be considered at any point during the year. As described above, the Nominating Committee will consider properly submitted stockholder nominations for candidates for the Board. Following verification of the stockholder status of persons proposing candidates, recommendations will be aggregated and considered by the Nominating Committee at a meeting. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials will be forwarded to the Nominating Committee. Such committee also will review materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a stockholder. In evaluating such nominations, the Nominating Committee seeks to achieve a balance of knowledge, experience, and capability on the Board.

7

DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS

Proposals of stockholders which are intended to be presented by such stockholders at the annual meeting of stockholders to be held in 2010, including the nomination of persons to serve on the Board, must be received by the Company’s Secretary not later than December 1, 2009, for inclusion in the proxy statement for that annual meeting. Stockholders who wish to present a proposal at the annual meeting of stockholders to be held in 2010, which has not been included in the Company’s proxy materials, must submit such proposal in writing to the Company in care of the Company’s Secretary. Any such proposal received by the Company’s Secretary after January 23, 2010, shall be considered untimely under the provisions of the Company’s bylaws governing nominations and the proposal of other business to be considered by the Company’s stockholders at that annual meeting. As discussed above, the Company’s bylaws contain further requirements relating to timing and content of the notice which stockholders must provide to the Company’s Secretary for any nomination or other business to be properly presented at an annual meeting of stockholders. It is recommended that stockholders submitting proposals direct them to the Company’s Secretary by certified mail, return receipt requested, to ensure timely delivery. No stockholder proposals were received with respect to the Meeting.

Stockholders submitting proposals must have continuously held at least $2,000 in market value, or one percent (1%), of the Company’s securities entitled to be voted on the proposal for at least one year prior to submitting the proposal. The stockholder’s proposal and accompanying supporting statement cannot exceed 500 words. Stockholders may not submit more than one proposal per year.

CODE OF ETHICS

The Company has adopted a Code of Ethics that applies to all of its directors, officers (including principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions) and employees. The Code of Ethics is posted on the Company’s Internet website,www.GTSI.com (located on the Investor Relations web page). The Company intends to satisfy the disclosure requirements under Item 5.05 of SEC Form 8-K regarding any amendment to or waiver of the Code of Ethics with respect to the Company’s principal executive officer, principal financial officer, principal accounting officer or controller and persons performing similar functions, by posting such information on the Company’s Internet website.

COMPENSATION OF DIRECTORS

Each non-employee director of the Company is compensated by the payment of an annual retainer of $25,000 (without proration thereof in the event of a partial quarter of service). The Chairs of the Compensation and Audit Committees receive a $3,500 annual retainer, and each member of the Compensation and Audit Committees receives $1,500 per meeting attended in person or via telephone. In addition, each Board member receives $1,500 for each Board meeting attended in person and $750 for each Board meeting attended via telephone. Each non-employee director also receives compensation in the form of a long-term incentive award, which may be stock options or restricted stock. In 2008, the non-employee directors received awards of restricted stock. Under the Amended and Restated 2007 Stock Incentive Plan, each eligible non-employee director is granted such restricted stock, restricted stock units, or other forms of long-term compensation available under the Plan, as the Board shall determine based on Compensation Committee recommendations using information provided by an independent executive compensation consultant. Grants of restricted stock or restricted stock units are based on the closing price of Common Stock on Nasdaq on the date of grant. Non-employee directors of the Company are not eligible to participate in the Company’s other stock option plans or the Company’s Employee Stock

8

Purchase Plan. The Lead Independent Director receives an additional annual retainer of $10,000. In 2007, Mr. Toups, the designated Lead Independent Director, was elected to the Chairman of the Board role, and as a result, the Lead Independent Director role he held has been incorporated into the Chairman role for his tenure. During 2008, the non-employee Chairman of the Board received an annual fee of $40,000.

Except as discussed above, directors of the Company do not receive any other compensation for their service on the Board or any committee thereof, but are reimbursed for their reasonable expenses incurred in association with the performance of their duties. In addition, Mr. Johnson received compensation for his services as a consultant to the Company (see section entitled “Certain Relationships and Related Transactions” below for information regarding this compensation.

| | | | | | | | | | | | | | | | |

DIRECTOR COMPENSATION | |

| | | | | | | | | | | | | | | | |

Name

(a) | | Fees

Earned

or

Paid in

Cash

($)

(b) | | Stock

Awards

($) (1)

(c) | | Option

Awards

($)

(d) | | All

Other

Compensation

($)

(e) | | Total

($)

(f) | |

| | | | | | | | | | | | |

Lloyd Griffiths | | | 33,750 | | | 17,123 | | 0 | | | | 0 | | | 50,873 | |

Thomas L. Hewitt | | | 40,750 | | | 35,228 | | 0 | | | | 0 | | | 75,978 | |

Lee Johnson | | | 33,250 | | | 35,228 | | 0 | | | | 121,625 | | | 190,103 | |

Joseph “Keith” Kellogg, Jr. | | | 38,500 | | | 35,228 | | 0 | | | | 0 | | | 73,728 | |

Steven Kelman, Ph.D. | | | 40,750 | | | 35,228 | | 0 | | | | 0 | | | 75,978 | |

James J. Leto (2) | | | 0 | | | 0 | | 0 | | | | 0 | | | 0 | |

Barry L. Reisig | | | 46,500 | | | 35,228 | | 0 | | | | 0 | | | 81,728 | |

John M. Toups | | | 81,500 | | | 35,228 | | 0 | | | | 0 | | | 116,728 | |

Daniel R. Young | | | 45,750 | | | 35,228 | | 0 | | | | 0 | | | 80,978 | |

| |

(1) | Amount reflects the dollar amounts recognized for financial statement reporting purposes for the fiscal year ended December 31, 2008 in accordance with SFAS 123(R), without regard to the possibility of forfeitures. Assumptions used in the calculations of these amounts are included in Note 8 to the Company’s audited consolidated financial statements for the fiscal year ended December 31, 2008, included in the Company’s Annual Report on Form 10-K. Each director with an amount in this column received a restricted stock award of 3,333 shares of restricted stock. |

| |

(2) | Mr. Leto’s compensation as CEO is shown in the Summary Compensation Table. |

9

As of December 31, 2008, each director had the following amounts of options and restricted stock:

| | | | |

DIRECTOR’S OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END |

| |

Name | | Option

Shares

(#) | | Restricted

Stock

Shares

(#) |

| | | | | |

Lloyd Griffiths | | 0 | | 3,333 |

Thomas L. Hewitt | | 20,000 | | 3,333 |

Lee Johnson | | 60,100 | | 3,333 |

Joseph “Keith” Kellogg, Jr. | | 10,000 | | 3,333 |

Steven Kelman, Ph.D. | | 75,000 | | 3,333 |

James J. Leto (1) | | 0 | | 0 |

Barry L. Reisig | | 20,000 | | 3,333 |

John M. Toups | | 77,000 | | 3,333 |

Daniel R. Young | | 50,000 | | 3,333 |

| |

(1) | Mr. Leto’s equity awards as CEO are shown in the Outstanding Equity Awards at Fiscal Year- End Table. |

Executive Compensation and Related Information

Background

At GTSI we recognize and understand that our people drive our success. GTSI operates in an innovative and progressive segment of the professional services industry. Our employees – our human capital – are central to the value that GTSI creates for our clients and stockholders. We believe that our key investments in our human capital management programs and practices have significantly improved our employees’ commitment, engagement and performance. We also believe this investment and improvement in employee engagement will continue to significantly improve our overall business performance.

10

Why human capital is such an important component

GTSI’s business involves several different, but related, elements: the creation and delivery of customized solutions that enable our clients to achieve their performance and business goals; and the management of complex services and solutions.

Our success as a technology and strategic consulting services / solutions company is highly dependent on our employees. We believe we have successfully developed a culture focused on embracing strategic human capital programs as well as our core values of Integrity, Trust, Teamwork, Accountability, Customer Focus and Fun. We reinforce these key principles regularly in our training, our talent acquisition process/programs, performance management systems and internal communications.

Our compensation structure is designed to provide the framework for rewarding our human capital – our employees – for their contribution to our success. The essential nature of their role in value creation is reflected in the industry’s compensation policies and levels, which tend to be highly incentive-driven and reflect generally high levels of compensation for many employees and, in particular, for key executives and producers.

Just as we strive to deliver profitability, and competitive returns on our human capital, our compensation framework must also remain competitive to retain and develop talented employees to serve client and stockholder interests.

Compensation Discussion and Analysis

This discussion describes and analyzes GTSI’s compensation program for the named executive officers, namely, GTSI’s Chief Executive Officer, each of the two individuals who served as GTSI’s Chief Financial Officer during fiscal 2008, and the three most highly compensated executive officers (other than the Chief Executive Officer and each Chief Financial Officer) in fiscal 2008.

In this section we first cover GTSI’s compensation philosophy and objectives, the foundation of which is compensating for performance. Next we review the process the Compensation Committee follows in deciding how to compensate GTSI’s named executive officers and provide a brief overview of the components of GTSI’s compensation program. Finally, we engage in a detailed discussion and analysis of the Compensation Committee’s specific decisions about the compensation of the named executive officers for fiscal 2008.

The Compensation Committee’s Charter can be found on GTSI’s internet web-site under the corporate governance section. For the fiscal year 2008, the Compensation Committee had six formal meetings.

Compensation Philosophy and Objectives

GTSI’s executive compensation program is overseen by the Board’s Compensation Committee, the basic responsibility of which is to review the performance and development of GTSI’s management in achieving corporate goals and objectives and to assure that GTSI’s executive officers are compensated effectively in a manner consistent with GTSI’s strategy, competitive practice, sound corporate governance principles and stockholder interests. The Compensation Committee believes that the compensation programs for GTSI’s named executive officers should be designed to attract, motivate and retain talented executives responsible for the success of GTSI and should be determined within a framework that rewards performance. Within this overall philosophy, the Compensation Committee’s objectives are to:

| | |

| • | Offer a total compensation program that is flexible and competitive and takes into consideration |

11

| | |

| | the compensation practices of a group of peer companies (the “Compensation Peer Group”) identified based on an objective set of criteria. |

| | |

| • | Provide annual variable short-term cash incentive awards based on GTSI’s achievement of designated financial objectives. |

| | |

| • | Align the financial interests of executive officers with those of stockholders by providing appropriate long-term, equity-based incentives and retention awards that encourage a culture of ownership and retention. |

The core of GTSI’s executive compensation philosophy is pay for performance. There are three major components of the compensation of our named executive officers: base salary, short-term variable cash incentive awards, and long-term, equity-based incentive awards. The weighting among the three major components is structured heavily towards performance-based components such as attainment of earnings before tax – EBT.

Compensation Process

In its process for deciding how to compensate GTSI’s named executive officers, the Compensation Committee begins by considering the competitive market data provided by its independent compensation consultant. The Compensation Committee engaged an independent compensation consultant, Longnecker and Associates (“Longnecker”), to provide advice and recommendations on competitive market practices and specific compensation decisions. For purposes of evaluating competitive practices, the Compensation Committee, with assistance from Longnecker, identified criteria to select a list of companies which constitute GTSI’s Compensation Peer Group. The Compensation Peer Group is reviewed annually and was last updated during fiscal 2007. GTSI’s Compensation Peer Group consists of companies that provide services, solutions and/or product to the federal and state and local governments. With this in mind, we research and retain information about competitive pay levels through relevant and specific executive salary surveys. The Compensation Peer Group data prepared by Longnecker as well as key selected survey instruments is used for year-end compensation benchmarking. The members and data of the Compensation Peer Group (as of 12/05/08) are as follows:

| | | | | | | | | | | |

Company | | Fiscal

Year | | Revenue (MM) | | Assets (MM) | | Market Value (MM) |

| | | | | | | | | |

ScanSource Inc | | 6/30/08 | | $ | 2,715.5 | | $ | 722.2 | | $ | 479.0 |

PC Connection | | 12/31/07 | | $ | 1,785.4 | | $ | 380.9 | | $ | 142.4 |

SRA International | | 6/30/08 | | $ | 1,506.9 | | $ | 1,136.6 | | $ | 849.2 |

PC Mall, Inc. | | 12/31/07 | | $ | 1,215.4 | | $ | 296.2 | | $ | 60.1 |

CIBER, Inc. | | 12/31/07 | | $ | 1,082.0 | | $ | 849.1 | | $ | 267.4 |

ePlus, Inc. | | 3/31/07 | | $ | 849.3 | | $ | 379.7 | | $ | 91.4 |

Pomeroy IT Solutions | | 1/5/08 | | $ | 586.9 | | $ | 206.6 | | $ | 34.9 |

SI International | | 12/31/07 | | $ | 510.8 | | $ | 461.4 | | $ | 411.5 |

EnPointe Technologies | | 9/30/07 | | $ | 347.1 | | $ | 86.0 | | $ | 4.9 |

References to the “Compensation Peer Group” hereafter refer to the Compensation Peer Group in effect at the time of the point of reference.

The Company provides named executive officers and other employees with base salary to compensate them for services rendered during the fiscal year. Base salary ranges and total target compensation (base salary plus annual short-term incentive opportunity) for named executive officers are determined for each executive based on his or her position and responsibility by using the following weighted formula:

12

| | |

| 1. | 50% = Comparison of the positions of GTSI’s named executive officers to their counterpart positions in the Compensation Peer Group, plus |

| | |

| 2. | 50% = Comparison of the positions of GTSI’s named executive officers in select executive compensation salary surveys. Specific surveys used including: Mercer, Watson Wyatt, Economic Research Incorporated (“ERI”), Culpepper and WTPF. |

During its review of base salaries for executives, the Committee primarily considers:

| | |

| • | Market data provided by our outside consultant; |

| | |

| • | Internal review of the executive’s compensation, both individually and relative to other officers; and |

| | |

| • | Individual performance and contribution of the executive. |

For competitive benchmarking purposes, the positions of GTSI’s named executive officers were compared to their counterpart positions in the Compensation Peer Group, and the compensation levels for comparable positions in the Compensation Peer Group were examined for guidance in determining base salaries, annual cash incentives, total cash compensation, long-term incentive grant values and total compensation. The Compensation Committee considers the value of each item of compensation, both separately and in the aggregate.

The Compensation Committee retains and does not delegate any of its exclusive power to determine all matters of executive compensation and benefits, although the Chief Executive Officer and the Human Resources Department present industry-specific competitive market data, proposals and recommendations to the Compensation Committee. The Compensation Committee reports to the Board on the major items covered at each Compensation Committee meeting. Longnecker works directly with the Compensation Committee (and not on behalf of management) to assist the Compensation Committee in satisfying its responsibilities and will undertake no projects for management except at the request of the Compensation Committee chair and in the capacity of the Compensation Committee’s agent. To date, Longnecker has not undertaken any projects for management.

Compensation Components

To attract and retain key executives, GTSI follows a best practices pay model of providing total compensation to its named executive officers consisting of base salaries, annual cash bonuses and long-term, equity-based incentive awards. Under this pay model, cash compensation is generally modest such that salary ranges for a given position will be between 80% and 125% of the midpoint of the base salary and total target compensation (“TTC”) range established for each position.

The three major elements of GTSI’s executive officer compensation continue to be: (a) base salary, (b) short-term variable cash incentive awards, and (c) long-term, equity-based incentive awards. Similar to the market, GTSI has gradually shifted toward restricted stock and stock settled appreciation rights (“SSARs”) as the primary equity component of executive officer compensation through its long-term incentive plan (“LTIP”).

13

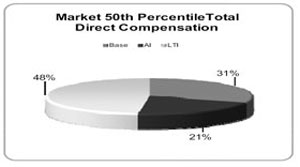

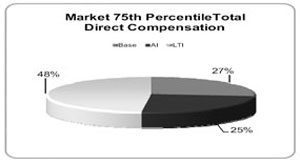

For named executive officers, the Compensation Committee decided that for fiscal 2008 and 2009, for retention purposes, it would set individual base salaries and at-target annual cash compensation with reference to the 50th percentile of the Compensation Peer Group and salary survey pool. The total value of long-term, equity-based incentive awards would continue to be targeted with reference to the 75th percentile of the Compensation Peer Group and salary survey pool which, when combined with the 50th percentile-based target for cash compensation, results in an overall total target compensation at approximately the 65th percentile of the Compensation Peer Group and salary survey pool for these named executive officers. These target percentiles are subject to the Compensation Committee’s discretion to pay below or above the stated percentiles based on recruiting needs, retention requirements, individual or company performance, succession planning, etc.

Base Salary

The Compensation Committee believes that the Company pays base salaries to its executive officers that are set conservatively and near the median, compared with executive officers of the Compensation Peer Group and salary survey pool. The Committee, among other things, reviews and recommends to the Board the annual salaries of the Company’s principal named executive officers (CEO, President/COO and CFO). The Committee, with input from the Chief Executive Officer, has been delegated by the Board the authority to set the annual base salaries of the remaining, less senior executive officer positions. The Committee does not receive input from the Chief Executive Officer with regard to the Senior Vice President Sales, Todd Leto.

Salary levels are typically considered annually as part of the Company’s performance review process as well as upon a promotion or other significant change in job responsibility. Merit based increases to salaries of executive officers are based on the Committee’s assessment of the individual’s performance. Reviews for all executives are usually made in February of each year. Any adjustments are made effective as of the start of the then current year thereby giving the named executive officer a potential adjustment each twelve months.

Short-Term Variable Cash Incentive Awards

The Compensation Committee believes that the primary portion of the annual cash compensation of each named executive officer should be in the form of short-term variable cash incentive pay. The pay philosophy is to target annual compensation with reference to the 50th percentile of the Compensation Peer Group, with the opportunity to earn annual incentives in excess of that level based on achieving performance superior to the objectives the Compensation Committee has determined to reward. Annual cash incentives are paid to reward achievement of critical short-term operating, financial and strategic goals that are expected to contribute to shareholder value creation over time.

The annual short-term incentive awards for named executive officers for fiscal 2008 were determined under GTSI’s Executive Incentive Plan (“EIP”) and are intended to comply with the exception for performance-based compensation under Internal Revenue Code Section 162(m). Under the EIP, cash incentive awards are based on GTSI’s achievement of established financial performance goals (earnings before tax – EBT). EBT is used as a performance measure because we believe that it currently represents the best measurement of our operating earnings. The annual short-term incentive is intended to be paid or not paid primarily based on actions and decisions taken for that fiscal year which directly affect earnings. Taxes are excluded because tax payments are not related to annual decisions on business operations. The Compensation Committee established the financial performance goals so that they are consistent with the goals in GTSI’s fiscal 2008 business plan established by the Board.

14

The actual formula applied to each eligible executive officer is based on the executive’s overall market compensation analysis and is tied to overall Company performance, a result that is not within the individual executive’s control. Individual bonuses are calculated as a percentage of base salary and range from 30% to 70% in the case of officers generally, other than the Chief Executive Officer. Under his 2006 Employment Agreement, as approved by the Board, in 2008 Mr. James Leto was entitled to a short-term incentive opportunity of $500,000 at 100% payout and $1,000,000 at 200%, payable periodically in accordance with the Company’s then senior bonus plan. The maximum payout on the incentive plan is 350% following the guidelines outlined below.

The Short-Term Incentive Plan is an annual program set up to reward executives for attaining significant “stretch” profitability goals throughout the calendar year. Bonus payments are payable in the ratio of the percentage of the goal achieved upon attainment of EBT (adjusted, if necessary, for Board-approved one-time charges). The program is measured in four quarterly segments and weighted in the following manner: 1/4th (Q1), 1/4th (Q2), 1/4th (Q3), 1/4th (Q4). The Short-Term Incentive Plan has a minimum threshold (50% performance against the quarterly EBT goal), that needs to be met for a payout to be awarded and has a maximum payout of 350% of the Executive’s eligible incentive. For goals attained between 125% and 225%, 25% of the amount earned over 100% attainment is deferred to year end. For goals attained between 225.1% and 250%, 40% of the amount earned over 100% attainment is deferred to year-end measurement. For goals attained between 250.1% and 350% the award is given in restricted stock assuming the annual goal is achieved. At the end of the year the Company will release any and all deferred variable incentive (cash and restricted stock) if the Company is successful in attaining its annual performance goal of at least the 125% level. Any restricted stock awarded is given with a market price set at the first Board meeting after the start of the next year (i.e., January 30, 2009). The EIP does include a favorable look-back provision throughout the year and at year end.

Favorable Look-Back Provision

The nature of the business consistently delivers some revenue fluctuations between quarters. In each quarter significant deals may be delayed in being awarded due to funding delays at the client level. When this happens the incentive awarded as measured by quarterly EBT results may not adequately reflect the actual performance or work accomplished. The favorable look-back provision applied at both the end of each quarter and again at the end of the year would allow the Company to reward the executives for overall performance and not be penalized by the quarterly unevenness. For example: if at the end of Q2 the cumulative annual EBT goal is attained at the 100% level and the Company had only awarded a Q1 award of 50%, the Company would pay out both the current quarter at 100% and the previous quarter (Q1) at 100%.

In general, the following methodology was applied in setting the profitability goals/executive incentive targets:

| |

| The probability of hitting the 100% profitability/incentive goal is 75% of the time |

| The probability of hitting the 150% profitability/incentive goal is 50% of the time |

| The probability of hitting the 200% profitability/incentive goal is 25% of the time |

The Board establishes the EBT goals at the beginning of each year. In 2008, bonuses were earned by executive officers based on application of the Short-Term Incentive Plan’s formula. The Chief Executive Officer additionally employs the occasional use of “spot” bonuses in recognition of extraordinary performance.

Mr. Whitfield was appointed Senior Vice President and Chief Financial Officer on October 29, 2008. In

15

connection with his promotion, Mr. Whitfield’s target award percentage under the EIP was set at 50% of his base salary. In addition, Mr. Whitfield was granted a 25,000 time-based stock option award with four- year vesting in connection with his promotion (strike price set as of date of approval October 29, 2008). The purpose of the grant, and the basis for the choice of this form of award, was to encourage his long-term employment retention and provide him with a meaningful carrier-interest ownership position.

Each of the named executive officers for the fiscal year ended December 31, 2008 received the following payments under the Short-Term Incentive Plan in 2008, and in February 2009 for fiscal 2008 Q4 performance.

| | | | | | | | | | |

Named Executive

Officer | | Base Salary | | 2008 Target

Award Percentage | | 2008 EBT Target

Achieved | | 2008 EIP

Payment |

| | | | | | | | | |

James Leto | | $ | 525,000 | | 95% | | 160% | | $ | 802,058 |

Scott Friedlander | | $ | 340,000 | | 70% | | 160% | | $ | 399,771 |

Peter Whitfield | | $ | 199,623 | | 50% | | 160% | | $ | 144,431 |

Joseph Ragan | | $ | 209,687 | | 70% | | Partial year | | $ | 227,653 |

Todd Leto | | $ | 250,000 | | 70% | | 160% | | $ | 295,714 |

William Weber | | $ | 235,000 | | 70% | | 160% | | $ | 275,621 |

The cumulative awards made in 2008 to named executive officers under the Short-Term Incentive Plan for performance in 2008 are reflected in column (g) of the Summary Compensation Table on page 22.

Summary Overview of Compensation to Market

As determined by the recently completed executive compensation analysis and benchmarking study facilitated through Longnecker, the current mix of pay analysis for total direct compensation is aligned with the market and the peer companies identified above. This is clearly evident in the below summary graphics:

16

Long-Term Incentive Compensation

In 2004, the Board and stockholders approved the GTSI Long-Term Incentive Plan (the “LTIP”). The purpose of the LTIP is to encourage behavior that creates superior financial performance and to strengthen the commonality of interests between LTIP participants and the Company’s owners in creating superior stockholder value. The LTIP is designed and intended to comply, to the extent applicable, with Section 162(m) of the Internal Revenue Code.

The awards, in the form of cash incentive compensation, may be granted to officers of the Company and its subsidiaries in the Compensation Committee’s sole discretion, taking into account such factors as the Committee deems relevant in connection with accomplishing the purposes of the LTIP. Prior to 2007, GTSI made no awards under the LTIP. In February 2007, the Board approved an LTIP Program for 2007 that was disclosed in GTSI’s 2007 proxy soliciting material, with subsequent awards made to the executives.

For 2009, there are currently 18 officers eligible to participate in the LTIP. There were no awards granted under the LTIP in 2008 to those officers who received awards in 2007, except for Mr. Whitfield in connection with his promotion to CFO in October 2008.

Amendment to LTIP

In May 2007, the stockholders approved amendments to the LTIP authorizing in addition to cash awards, the issuance of restricted stock awards and stock-settled appreciation rights (“SSARs”) under GTSI’s Amended and Restated 2007 Stock Incentive Plan (the “2007 Incentive Plan”). Under the 2007 Incentive Plan, the Committee approved awards providing each executive with a market competitive grant of long-term incentives (50% restricted stock and 50% SSARs by value on the date of grant) with stock price appreciation to determine the value of the award. The LTIP program that was approved in 2007 for all GTSI executives is described below:

17

| | |

a. | The LTIP award amount is intended to be market competitive based upon the position and experience of the individual as benchmarked to the market and to internal positions as described above in the discussion of setting base salary. |

| | |

b. | With the addition of the 50% SSARs component, the LTIP is substantially based upon improving stock price over time (award is weighted 50% restricted stock and 50% SSARs). |

| | |

c. | The value of the SSARs component of the LTIP awards was based upon realistic stock price appreciation assumptions. |

| | |

d. | The program length is five years with an equal amount of award being available to each eligible executive each year (except for the second year), contingent on the Company’s then annual performance and the executive’s contribution in the measurement year. |

| | |

e. | All awards will have a five-year vesting schedule. A qualified change of control will immediately vest all awards (stock options, restricted stock and SSARs). |

| | |

f. | For the first plan year (2007), the Board approved accelerating the 2008 award thereby providing two years worth of awards (2007 and 2008) in 2007 to all eligible participants for the following reasons: |

| | |

| Ø | To minimize the charge to earnings for restricted stock and SSARs as opposed to annual stock awards made in future years at a potentially higher stock price. |

| | |

| Ø | The motivation to increase the stock price quicker will be accelerated with the leverage of two year’s worth of awards. |

| | |

| Ø | To improve the retention value via a multiple year grant in 2007. |

The restricted stock awards and SSARs awards made under the LTIP 2007 program were issued under the 2007 Incentive Plan. This Plan is part of the Company’s stock option and stock incentive programs, under which the Company may, separate from the LTIP, make stock awards to employees and non-employee directors as discussed below.

2008 Award under the Amended and Restated 2007 Stock Incentive Plan

The following table sets forth information regarding awards of SSARs and restricted stock made in 2008 pursuant to the 2007 Incentive Plan. Peter Whitfield received in 2008 a long-term incentive grant composed 50% of restricted stock and 50% of SSARs, with all restricted stock and SSARs granted at a price of $9.60 per share, the closing market price per share on February 2, 2007, as approved by the Board.

| | | | | | | |

NAME AND POSITION | | NUMBER OF SSARs | | NUMBER OF

RESTRICTED SHARES | |

| | | | | | |

Peter Whitfield, Chief Financial Officer | | 15,569 | | | 5,402 | | |

18

Stock Option and Stock Incentive Programs

Stock Option Program

Separate from the Company’s LTIP program, options to purchase Common Stock are a component of the Company’s executive compensation program. The Committee views the grant of stock options as an incentive that serves to align the interests of executive officers with the Company’s goal of enhancing stockholder value. The stock option program assists the Company to:

| | |

| • | enhance the link between the creation of stockholder value and long-term executive incentive compensation; |

| | |

| • | maintain and improve long-term retention of key personnel; |

| | |

| • | ensure the company provides a very competitive total compensation program for its key personnel; |

| | |

| • | provide an opportunity for increased equity ownership by executives; and |

| | |

| • | maintain competitive levels of total compensation. |

The Committee reviews and acts upon recommendations by the Chief Executive Officer with regard to the grant of stock options to executive officers (other than to himself and Todd Leto). Stock option award levels are determined based on market data, vary among participants based on their positions and responsibilities within the Company and previous stock option grants (if any) and are granted at the Committee’s regularly scheduled April meeting. On occasion, options are awarded at other times throughout the year for exceptional performance. Newly hired or promoted executives, other than executive officers, receive their award of stock options on either their first day of regular employment or the day the award is approved by the Compensation Committee.

Options are awarded at the Nasdaq exchange’s closing price of the Common Stock on the date of the grant and reflect fair market value (“FMV”). Options will only have value to an executive officer if the stock price increases over the exercise price. The Committee has never granted options with an exercise price that is less than the closing price of the Common Stock on the grant date nor has it granted options which are priced on a date other than the grant date. The majority of the options granted by the Committee vest at a rate of 25% per year on each of the first four anniversaries of the date of grant, provided that the option holder is a GTSI employee on the vesting date. The option term is typically seven years. Vesting ceases upon termination of employment and vested options can be exercised within three months of termination. Prior to the exercise of an option, the holder has no rights as a stockholder with respect to the shares subject to such option, including voting rights or dividends.

Stock Incentive Program

Given the recent industry trend to move away from stock options as a key component of an executive compensation program, in 2005 the Committee initiated a review of other stock incentive programs from Longnecker. As a result, in 2005 stockholders approved the addition of a stock incentive program to the Company’s then existing 1996 Stock Option Plan (which was changed to the title “1996 Stock Incentive Plan”), that provides for options and alternative incentive programs to encourage performance and improve retention of key executives.

The Board, in February 2007, approved the amendment to the 1996 Stock Incentive Plan to provide for stock appreciation rights as a component of the stock incentive program and as a component of the 2007 LTIP program and stockholders approved the Board’s action at the 2007 annual stockholders meeting. A full description of the Plan, as amended by the 2007 Incentive Plan, was provided in GTSI’s 2007 proxy

19

soliciting material.

Under the 2007 Incentive Plan, the Company may, upon approval by the Compensation Committee (except for awards made to the Chief Executive Officer that requires the Board’s approval) make stock awards in the form of restricted stock, restricted stock units, or performance awards to select participants, including the named executive officers, whose annual non-equity incentive compensation represents a portion of their total annual compensation. Under the stock incentive program, participants may be awarded a number of shares based on the individual’s performance or as part of the annual review of the executive’s compensation portfolio.

Group Benefits/Perquisites and Other Personal Benefits

GTSI’s named executive officers generally do not receive any special benefits. The Company does not offer a retirement program. However the Company does provide certain named executive officers with perquisites and other personal benefits that the Company and the Committee believe are reasonable and consistent with its overall compensation program to better enable the Company to attract and retain superior employees for key positions. The Committee periodically reviews and benchmarks the levels of perquisites and other personal benefits provided to named executive officers via its external executive consultant Longnecker.

The named executive officers are provided annual executive physicals (by a certified third party), supplemental disability insurance and long-term care insurance. The Company’s Chief Executive Officer, Mr. Leto, has the following additional benefits: $15,000 annual car allowance (plus gross up for taxes which was announced on February 15, 2008); $50,000 (plus gross up for taxes which was announced on February 15, 2008) annual long-term extended-stay residence in the Northern Virginia area; and $50,000 annual budget for travel to and from Mr. Leto’s primary residence and his Northern Virginia long-term extended-stay residence. Additionally GTSI pays for various strategic business club memberships.

Severance and Change of Control Provisions for Named Executive Officers

See detail listing on page 30 titled:EMPLOYMENT AGREEMENTS AND TERMINATION OF EMPLOYMENT AND CHANGE OF CONTROL ARRANGEMENTS.

Tax and Accounting Implications

Deductibility of Executive Compensation

As part of its role, the Committee reviews and considers the deductibility of executive compensation under Code Section 162(m), which provides that a publicly held corporation such as the Company will not be allowed a federal income tax deduction for compensation paid to the chief executive officer or one of the four most highly compensated officers (other than the chief executive officer) to the extent that compensation (including stock-based compensation) paid to each such officer exceeds $1 million in any year unless such compensation was based on performance goals. The 2007 Incentive Plan is designed so that amounts realized on the award of shares and the exercise of options granted thereunder may qualify as “performance-based compensation” that is not subject to the deduction limitation of Section 162(m). The Committee intends to evaluate other elements of compensation in light of Section 162(m) but may enter into arrangements that do not satisfy exceptions to Section 162(m), as the Committee determines to be appropriate.

20

Accounting for Stock-Based Compensation

Beginning on January 1, 2006, the Company began accounting for stock-based payments including its LTIP, stock option and stock incentive programs, in accordance with the requirements of FASB Statement No. 123(R).

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Executive Compensation and Related Information above, which includes the Compensation Discussion and Analysis, with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Executive Compensation and Related Information be included in this Proxy Statement.

| |

| THE COMPENSATION COMMITTEE |

| |

| Daniel R. Young, Chairman |

| Thomas L. Hewitt |

| Steven Kelman |

21

SUMMARY COMPENSATION TABLE

The following table sets forth certain information for the year ended December 31, 2008 concerning compensation paid or accrued by the Company to or on behalf of: (a) the Company’s CEO, and (b) the Company’s CFO, and (c) the three most highly compensated executive officers other than the CEO and CFO whose compensation during 2008 exceeded $100,000 (collectively, the “Named Executive Officers”). Discussion about this table and the Grants of Plan-Based Awards table (below) are set out in the above Compensation Discussion and Analysis section.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | |

Name and Principal

Position

(a) | | Year

(b) | | Salary

($)(1)

(c) | | Bonus

($)(2)

(d) | | Stock

Awards

($) (4)

(e) | | Option

Awards ($)

(4)

(f) | | Non-Equity Incentive

Plan Compensation

($)(2)(3)

(g) | | Nonqualified Deferred

Compensation

Earnings ($)

(h) | | All Other

Compensation

($)(5)

(i) | | Total ($)

(j) | |

| | | | | | | | | | | | | | | | | | | | |

James Leto (6) | | 2008 | | 524,439 | | 0 | | 200,580 | | 631,837 | | 802,058 | | 0 | | 125,594 | (7) | 2,284,508 | |

CEO | | 2007 | | 497,727 | | 0 | | 133,099 | | 529,925 | | 642,500 | | 0 | | 123,882 | (8) | 1,945,497 | |

| | 2006 | | 340,741 | | 573,000 | | 0 | | 1,311,520 | | 529,167 | | 0 | | 111,173 | (9) | 2,865,601 | |

| | | | | | | | | | | | | | | | | | | |

Scott Friedlander | | 2008 | | 340,000 | | 0 | | 90,029 | | 217,158 | | 399,771 | | 0 | | 7,850 | (10) | 1,054,808 | |

President and COO | | 2007 | | 301,705 | | 0 | | 63,175 | | 170,196 | | 215,642 | | 0 | | 7,878 | (11) | 758,596 | |

| | 2006 | | 265,000 | | 196,500 | | 51,380 | | 131,152 | | 186,701 | | 0 | | 10,000 | (12) | 840,733 | |

| | | | | | | | | | | | | | | | | | | |

Peter Whitfield Senior Vice President and CFO | | 2008 | | 199,623 | | 17,500 | (13) | 18,586 | | 45,088 | | 144,431 | | 0 | | 5,750 | | 430,978 | |

| | | | | | | | | | | | | | | | | | | |

Joseph Ragan (14) | | 2008 | | 209,687 | | 28,961 | (15) | 78,049 | | 157,724 | | 227,653 | | 0 | | 28,354 | (16) | 730,428 | |

Senior Vice | | 2007 | | 274,432 | | 7,500 | (17) | 43,258 | | 105,138 | | 172,769 | | 0 | | 7,725 | (18) | 610,822 | |

President & CFO | | 2006 | | 147,948 | | 57,500 | (19) | 0 | | 157,529 | | 66,907 | | 0 | | 0 | | 429,884 | |

| | | | | | | | | | | | | | | | | | | |

Todd Leto Senior Vice President | | 2008 | | 250,000 | | 0 | | 81,087 | | 111,501 | | 295,714 | | 0 | | 9,169 | (20) | 747,470 | |

| | | | | | | | | | | | | | | | | | | |

William Weber | | 2008 | | 235,000 | | 0 | | 60,444 | | 92,475 | | 275,621 | | 0 | | 7,850 | (21) | 671,390 | |

Senior Vice | | 2007 | | 234,205 | | 0 | | 43,540 | | 66,993 | | 147,639 | | 0 | | 7,725 | (22) | 517,793 | |

President | | 2006 | | 195,278 | | 41,500 | | 51,380 | | 65,576 | | 186,762 | | 0 | | 0 | | 540,496 | |

| |

1 | Includes amounts, if any, deferred by the Named Executive Officer pursuant to the Company’s 401(k) plan. |

| |

2 | Bonuses and Incentives under any Executive Bonus Plan are based on corporate and individual performance. See “Compensation Discussion and Analysis.” |

| |

3 | For Year 2006, includes incentive earned in 2006, but paid in 2007; for Year 2007, includes incentive earned in 2007, but paid in 2008, and for Year 2008, includes incentive earned in 2008, but paid in 2009. |

| |

4 | Amounts reflect the dollar amounts recognized for financial statement reporting purposes for the fiscal year ended December 31, 2008 in accordance with SFAS 123R, without regard to the possibility of forfeitures. Assumptions used in the calculations of these amounts are included in Note 8 to the Company’s audited consolidated financial statements for the fiscal year ended December 31, 2008, included in the Company’s Annual Report on Form 10-K. |

| |

5 | All other Compensation includes Company contribution to 401(k), if any, which in each is less than $10,000 per person. |

| |

6 | Mr. Leto was appointed President and Chief Executive Officer as of February 16, 2006; he relinquished the President title on December 1, 2007. |

| |

7 | Amount includes housing allowance ($50,000), car allowance ($15,000), and commuting allowance ($50,000). Other perquisites include club memberships, physical exam, and supplemental disability insurance. |

| |

8 | Amount includes housing allowance ($50,000), car allowance ($15,000), commuting allowance ($50,000), and relocation ($2,084). Other perquisites include club memberships, physical exam, and supplemental disability |

22

| |

| insurance. |

| |

9 | Amount includes housing allowance ($43,750), car allowance ($13,125), and commuting allowance ($43,750). Other perquisites include club memberships, physical exam, and supplemental disability insurance. |

| |

10 | Amount includes perquisites of physical exam, and supplemental disability insurance. |

| |

11 | Amount includes perquisites of physical exam, and supplemental disability insurance. |

| |

12 | Amount includes perquisites of physical exam, and supplemental disability insurance. |

| |

13 | Amount reflects bonus for duties as Interim CFO and year-end audit. |

| |

14 | Mr. Ragan resigned as an officer and employee of the Company, effective September 26, 2008. |

| |

15 | Amount reflects performance-based bonus. |

| |

16 | Amount includes PTO payout. Other perquisites include physical exam, and supplemental disability insurance. |

| |

17 | Amount reflects sign-on bonus ($7,500). |

| |

18 | Amount includes perquisites of physical exam, and supplemental disability insurance. |

| |

19 | Amount includes sign-on bonus ($7,500). |

| |

20 | Amount includes perquisites of club membership, physical exam, and supplemental disability insurance. |

| |

21 | Amount includes perquisites of physical exam, and supplemental disability insurance. |

| |

22 | Amount includes perquisites of physical exam, and supplemental disability insurance. |

NOTE: Stock Award compensation is included in Option Exercises and Stock Vested table

| | | | | | | | | | | | | | | | | | | | | |

GRANTS OF PLAN-BASED AWARDS |

| |

| | | | | | | | | | | | All Other

Stock

Awards:

Number of

Shares of

Stocks or

Units

(#)

(i)(1) | | All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#)

(j)(1) | | Exercise

or Base

Price of

Option

Awards

($/Sh)

(k) | | Grant

Date

Fair

Value

of

Stock

and

Option

Awards

(l) | |

| | | | | | | | | | | | | | | |

| | | | | | Estimated Future Payouts Under

Non-Equity Incentive Plan

Awards (5) | | | | | |

| | | | | | | | | | | |

Name

(a) | | Grant

Date

(b) | | Approval

Date

(b) | | Threshold

($)

(c) | | Target

($)

(d) | | Maximum

($)

(e) | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | 10/29/08 | | | | | | | | | | 5,402 | (2) | | | �� | | | | 5.55 | |

Peter | | 10/29/08 | | | | | | | | | | | | | 15,569 | (3) | | 9.60 | | 5.55 | |

Whitfield | | 10/29/08 | | | | | | | | | | | | | 25,000 | (4) | | 5.55 | | 5.55 | |

| | | | | | 0 | | 125,000 | | 250,000 | | | | | | | | | | | |

| |

(1) | All grants were made under the 2007 Amended and Restated Stock Incentive Plan. |

| |

(2) | Shares vest as follows: 1,080 on 10/29/2009, 1,080 on 10/29/2010, 1,080 on 10/29/2011, 1,081 on 10/29/2012 and 1,081 on 10/29/2013. |

| |

(3) | SSARs vest as follows: 3,113 on 10/29/2009, 3,113 on 10/29/2010, 3,113 on 10/29/2011, 3,115 on 10/29/2012 and 3,115 on 10/29/2013. |

| |

(4) | Shares vest as follows: 6,250 on 10/29/2009, 6,250 on 10/29/2010, 6,250 on 10/29/2011, and 6,250 on 10/29/2012. |

| |

(5) | Target represents attainment of 100% of Annual Short Term Incentive Plan; maximum represents attainment of 200% of Annual Short Term Incentive Plan. |

23

| | | | | | | | | | | | | | | | | | | |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END |

| |

OPTION AWARDS | | STOCK AWARDS |

| | | |

Name

(a) | | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

(b) | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

(c) | | Equity Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

(d) | | Option

Exercise

Price

($)

(e) | | Option

Expiration

Date

(f) | | Number of

Shares or

Units of

Stock That

Have Not

Vested

(#)

(g) | | Market

Value of

Shares or

Units of

Stock That

Have Not

Vested

($)

(h) | | Equity

Incentive Plan

Awards:

Number of

Unearned

Shares, Units

or Other

Rights That

Have Not

Vested

(#)

(i) | | Equity

Incentive Plan

Awards:

Market or

Payout Value

of Unearned

Shares, Units or

Other Rights

That Have Not

Vested

(#)

(j) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | 0 | |

| | 15,000 | | 0 | | 0 | | 3.875 | | 5/18/2009 | | | | | | 0 | | 0 | |

| | 15,000 | | 0 | | 0 | | 2.813 | | 5/16/2010 | | | | | | 0 | | 0 | |

| | 15,000 | | 0 | | 0 | | 6.20 | | 5/15/2011 | | | | | | 0 | | 0 | |

James Leto | | 10,000 | | 0 | | 0 | | 8.48 | | 5/9/2012 | | | | | | 0 | | 0 | |

| | 10,000 | | 0 | | 0 | | 8.30 | | 5/9/2013 | | | | | | 0 | | 0 | |

| | 10,000 | | 0 | | 0 | | 10.15 | | 5/10/2014 | | | | | | 0 | | 0 | |

| | 136,000 | | 264,000 | (1) | 0 | | 6.75 | | 4/28/2013 | | | | | | 0 | | 0 | |

| | 41,517 | | 166,071 | (2) | 0 | | 9.60 | | 2/2/2014 | | | | | | 0 | | 0 | |

| | | | | | | | | | | | 62,954 | (3) | 377,724 | | 0 | | 0 | |

| | | | | | | | | | | | | | | | | | | |

| | 15,000 | | 0 | | 0 | | 11.30 | | 1/28/2010 | | | | | | 0 | | 0 | |

| | 15,000 | | 0 | | 0 | | 12.48 | | 12/1/2010 | | | | | | 0 | | 0 | |

| | 27,200 | | 52,800 | (4) | 0 | | 8.09 | | 7/21/2012 | | | | | | 0 | | 0 | |

Scott | | 20,000 | | 20,000 | (5) | 0 | | 6.75 | | 4/28/2013 | | | | | | 0 | | 0 | |

Friedlander | | | | | | | | | | | | 7,000 | (6) | 42,000 | | 0 | | 0 | |

| | 16,503 | | 66,013 | (7) | 0 | | 9.60 | | 2/2/2014 | | | | | | 0 | | 0 | |

| | | | | | | | | | | | 25,024 | (8) | 150,144 | | 0 | | 0 | |

| | | | | | | | | | | | | | | | | | | |

| | 3,750 | | 11,250 | (9) | 0 | | 11.00 | | 3/22/2014 | | | | | | 0 | | 0 | |

| | 3,632 | | 14,532 | (10) | 0 | | 9.60 | | 2/2/2014 | | | | | | 0 | | 0 | |

| | | | | | | | | | | | 5,509 | (11) | 33,054 | | 0 | | 0 | |

Peter Whitfield | | 0 | | 25,000 | (12) | 0 | | 5.55 | | 10/29/2015 | | | | | | 0 | | 0 | |

| | 0 | | 15,569 | (13) | 0 | | 9.60 | | 10/29/2015 | | | | | | 0 | | 0 | |

| | | | | | | | | | | | 5,402 | (14) | 32,412 | | 0 | | 0 | |

| | | | | | | | | | | | | | | | | | | |

Joseph Ragan

(15) | | 0 | | 0 | | 0 | | 0 | | | | | | | | 0 | | 0 | |

| | | | | | | | | | | | | | | | | | | |

| | 20,000 | | 0 | | 0 | | 11.06 | | 10/24/2009 | | | | | | 0 | | 0 | |

| | 20,000 | | 0 | | 0 | | 8.79 | | 7/8/2010 | | | | | | 0 | | 0 | |

| | 5,000 | | 0 | | 0 | | 12.10 | | 3/19/2011 | | | | | | 0 | | 0 | |

Todd Leto | | | | | | | | | | | | 3,300 | (16) | 19,800 | | 0 | | 0 | |

| | | | | | | | | | | | 7,000 | (17) | 42,000 | | 0 | | 0 | |

| | 10,000 | | 10,000 | (18) | 0 | | 6.75 | | 4/28/2013 | | | | | | 0 | | 0 | |

| | 12,974 | | 51,897 | (19) | 0 | | 9.60 | | 2/2/2014 | | | | | | 0 | | 0 | |

| | | | | | | | | | | | 19,673 | (20) | 118,038 | | 0 | | 0 | |

| | | | | | | | | | | | | | | | | | | |

| | 20,000 | | 0 | | 0 | | 8.40 | | 6/1/2012 | | | | | | 0 | | | |

William Weber | | 10,000 | | 10,000 | (21) | 0 | | 6.75 | | 4/28/2013 | | | | | | 0 | | 0 | |

| | | | | | | | | | | | 7,000 | (22) | 42,000 | | 0 | | 0 | |

| | 10,379 | | 41,518 | (23) | 0 | | 9.60 | | 2/2/2014 | | | | | | 0 | | 0 | |

| | | | | | | | | | | | 15,739 | (24) | 94,434 | | | | 0 | |

24

| |

(1) | Shares vest as follows: 132,000 on 4/28/2009 and 132,000 on 4/28/2010. |

| |

(2) | SSARs vest as follows: 41,518 on 2/2/2009, 41,517 on 2/2/2010, 41,518 on 2/2/2011 and 41,518 on 2/2/2012. |

| |

(3) | Shares vest as follows: 15,738 on 2/2/2009, 15,739 on 2/2/2010, 15,738 on 2/2/2011 and 15,739 on 2/2/2012. |

| |

(4) | Shares vest as follows: 26,400 on 7/21/2009 and 26,400 on 7/21/2010. |

| |

(5) | Shares vest as follows: 10,000 on 4/28/2009, and 10,000 on 4/28/2010. |

| |

(6) | Shares vest as follows: 2,380 on 7/20/2009, 2,310 on 7/20/2010 and 2,310 on 7/20/2011. |

| |

(7) | SSARs vest as follows: 16,503 on 2/2/2009, 16,503 on 2/2/2010, 16,503 on 2/2/2011 and 16,504 on 2/2/2012. |

| |

(8) | Shares vest as follows: 6,256 on 2/2/2009, 6,256 on 2/2/2010, 6,256 on 2/2/2011 and 6,256 on 2/2/2012. |

| |

(9) | Shares vest as follows: 3,750 on 3/22/2009, 3,750 on 3/22/2010 and 3,750 on 3/22/2011. |

| |

(10) | SSARs vest as follows: 3,633 on 2/2/2009, 3,633 on 2/2/2010, 3,633 on 2/2/2011 and 3,633 on 2/2/2012. |

| |

(11) | Shares vest as follows: 1,377 on 2/2/2009, 1,377 on 2/2/2010, 1,377 on 2/2/2011 and 1,378 on 2/2/2012. |

| |

(12) | Shares vest as follows: 6,250 on 10/29/2009, 6,250 on 10/29/2010, 6,250 on 10/29/2011 and 6,250 on 10/29/2012. |

| |

(13) | SSARS vest as follows: 3,113 on 10/29/2009, 3,113 on 10/29/2010, 3,113 on 10/29/2011, 3,115 on 10/29/2012 and 3,115 on 10/29/2013. |

| |

(14) | Shares vest as follows: 1,080 on 10/29/2009, 1,080 on 10/29/2010, 1,080 on 10/29/2011, 1,081 on 10/29/2012 and 1,081 on 10/29/2013. |

| |

(15) | Mr. Ragan resigned as an officer and employee of the Company effective September 26, 2008. All vested and unvested shares of options and SSARS and all unvested shares of restricted stock were cancelled as of December 26, 2008. |

| |

(16) | Shares vest as follows: 1,650 on 7/21/2009 and 1,650 on 7/21/2010. |

| |

(17) | Shares vest as follows: 2,380 on 7/20/2009, 2,310 on 7/20/2010 and 2,310 on 7/20/2011. |

| |

(18) | Shares vest as follows: 5,000 on 4/28/2009 and 5,000 on 4/28/2010. |

| |

(19) | SSARS vest as follows: 12,974 on 2/2/2009, 12,974 on 2/2/2010, 12,974 on 2/2/2011 and 12,975 on 2/2/2012. |

| |

(20) | Shares vest as follows: 4,918 on 2/2/2009, 4,918 on 2/2/2010, 4,918 on 2/2/2011 and 4,919 on 2/2/2012. |

| |

(21) | Shares vest as follows: 5,000 on 4/28/2009, and 5,000 on 4/28/2010. |

| |

(22) | Shares vest as follows: 2,380 on 7/20/2009, 2,310 on 7/20/2010, and 2,310 on 7/20/2011. |

| |

(23) | SSARs vest as follows: 10,379 on 2/2/2009, 10,380 on 2/2/2010, 10,379 on 2/2/2011 and 10,380 on 2/2/2012. |

| |

(24) | Shares vest as follows: 3,935 on 2/2/2009, 3,934 on 2/2/2010, 3,935 on 2/2/2011 and 3,935 on 2/2/2012. |

| | | | | | | | | |

OPTION EXERCISES AND STOCK VESTED |

|

| | OPTION AWARDS | | STOCK AWARDS | |

| | | | | |

Name

(a) | | Number of

Shares

Acquired

on Exercise

(#)

(b) | | Value

Realized

on

Exercise

($)

(c) | | Number of

Shares

Acquired

on

Vesting

(#)

(d) | | Value

Realized

on

Vesting

($)

(e) | |

| | | | | | | | | | |

Jim Leto | | 15,000 | | 43,957 | | 15,738 | | 142,586 | |

Scott Friedlander | | 0 | | 0 | | 6,256 | | 56,679 | |

Peter Whitfield | | 0 | | 0 | | 1,377 | | 12,476 | |

Joseph Ragan | | 0 | | 0 | | 5,115 | | 46,342 | |

Todd Leto | | 0 | | 0 | | 6,618 | | 57,851 | |

William Weber | | 0 | | 0 | | 3,934 | | 35,642 | |

25

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information about Common Stock that has been issued as restricted stock and that may be issued upon future grants of stock incentive awards and future exercise of options under the Company’s equity compensation plans as of December 31, 2008, including the Company’s 1997 Stock Option Plan, Amended and Restated 2007 Stock Incentive Plan (formerly the 1996 Stock Incentive Plan), 1994 Stock Option Plan and the Company’s Employee Stock Purchase Plan.

| | | | | | | | | | | | | |

Plan Category | | | Number of Shares to be

Issued upon Exercise of

Outstanding Options/