UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

| | |

x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| | | For Fiscal Year Ended: December 31, 2003 |

| |

| | | OR |

| | |

¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| | | For the Transition Period from to . |

Commission File No. 0-22958

INTERPORE INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 95-3043318 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification number) |

| | |

| 181 Technology Drive, Irvine, California | | 92618-2402 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (949) 453-3200

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class

| | Name of each exchange on which registered

|

None | | |

Securities registered pursuant to Section 12(g) of the Act:

common stock, par value $0.01 per share

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by the check mark whether the registrant is an accelerated filer (as defined in Exchange Act Rule 12-b-2). Yes x No ¨

Based on the closing price on the NASDAQ National Market on June 28, 2003 (the last business day of registrant’s most recently completed second fiscal quarter) the aggregate market value of voting stock of Interpore International, Inc. (often referred to herein as “we” and “our”) held by non-affiliates was $188,079,000. For purposes of this calculation, we assume directors, officers and holders of ten percent or more of our common stock outstanding are affiliates. The number of shares of common stock outstanding as of February 27, 2004 was 17,984,212.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

We are filing this Amendment No. 1 on Form 10-K/A to our Annual Report on Form 10-K for the fiscal year ended December 31, 2003 (the “Report”) to amend Part III of the Report to include the information required by Items 10, 11, 12, 13 and 14 because we will not be filing a definitive proxy statement for our 2004 Annual Meeting of Stockholders continuing this information within the prescribed time limits for incorporation by reference. On March 7, 2004, we entered into an Agreement and Plan of Merger with Biomet, Inc., and a wholly-owned subsidiary of Biomet, Inc., pursuant to which, subject to the satisfaction of certain conditions, we will become a wholly-owned subsidiary of Biomet, Inc. If the merger is completed, we will no longer have any public stockholders and we will not hold a 2004 Annual Meeting of Stockholders. Except as described above, no other changes have been made to the Report.

PART III

Item 10. Directors and Executive Officers of the Registrant

Certain information concerning each of our directors is set forth below:

Class III — Term Expiring at the

2004 Annual Meeting of Stockholders:

| | | | |

Name

| | Age

| | Present Position

|

David C. Mercer | | 62 | | Chairman of the Board, Chief Executive Officer and Director |

Joseph A. Mussey | | 55 | | President, Chief Operating Officer and Director |

Lewis Parker | | 62 | | Director |

David C. Mercer has served as Chairman of our Board of Directors since April 1997, as our Chief Executive Officer since March 1992 and also served as our President from March 1992 through May 1998. Mr. Mercer was President, Orthopaedic Division, of Kirschner Medical Corporation, a manufacturer of orthopedic devices, from October 1988 through March 1992, and Senior Vice President, Marketing, Orthopaedic Implant Division of Zimmer, Inc., a manufacturer of orthopedic devices, from April 1986 through October 1988. From April 1983 to April 1986, he was President of Aspen Labs, Inc., the arthroscopic and electrosurgical product subsidiary of Zimmer, Inc.

Joseph A. Mussey has served as our President and Chief Operating Officer, and has served on our Board of Directors, since May 1998. Mr. Mussey had served as President and Chief Executive Officer of Cross Medical Products, Inc., our wholly-owned subsidiary from November 1991 through our acquisition of Cross Medical Products, Inc. (“Cross”) in May 1998, as President of Cross from April 1991 through November 1991, and as Vice President and Chief Financial Officer of Cross from August 1990 through April 1991. Mr. Mussey was previously Executive Vice President of the Process Automation Business of Combustion Engineering, Inc., a division of Asea Brown Boveri from 1987 until joining Cross in August 1990. From 1984 to 1987, he was Vice President, Operations of the Engineered Systems and Controls Group of Combustion Engineering.

Lewis Parker has served on our Board of Directors since July 2001. Mr. Parker has also been a director of DJ Orthopedics Corporation since May 2003. Mr. Parker has operated Lochinvar LLC, a consulting practice specializing in business turnaround situations, since 1998. Mr. Parker was Vice President, Chief Financial Officer and a Director of American OsteoMedix Corporation from 2000 until its merger with us in July 2001. Mr. Parker’s background also includes having served as Senior Vice President and President of Kirschner Medical Corporation, a manufacturer of orthopedic devices that was merged into Biomet, Inc. in 1994. Prior to working at Kirschner, Mr. Parker served as President and CEO of ProScience Corporation, a company he founded to engage in the application of high technology biology to veterinary diagnostics.

Class I — Term Expiring at the

2005 Annual Meeting of Stockholders:

| | | | |

Name

| | Age

| | Present Position

|

David W. Chonette | | 68 | | Director |

Robert J. Williams | | 71 | | Director |

1

David W. Chonette has served on our Board of Directors since November 2000. Mr. Chonette is an Advisor to Versant Ventures, a venture capital firm investing in companies in the medical devices, healthcare services, bio-pharmaceuticals and eHealth areas, a position he has held since 1999. Prior to Versant Ventures, Mr. Chonette was a general partner of Brentwood Venture Capital, which he joined in 1986. Prior to joining Brentwood, Mr. Chonette served in various positions at American Hospital Supply Corporation, including Group Vice President of several medical device and pharmaceutical divisions, and lastly as President of the Edwards Division.

Robert J. Williams has served on our Board of Directors since May 1998. Mr. Williams has been the Chairman of the Board, President and Chief Executive Officer of Artec, Inc., an Indianapolis-based manufacturer of disposable anesthesia and respiratory products, since 1988. From 1963 through 1985, Mr. Williams was employed by DePuy Inc., a manufacturer and distributor of orthopedic devices, and served as its President from 1970 through 1985.

Class II—Term Expiring at the

2006 Annual Meeting of Stockholders:

| | | | |

Name

| | Age

| | Present Position

|

William A. Eisenecher | | 61 | | Director |

Daniel A. Funk, M.D. | | 48 | | Director |

William A. Eisenecher has served on our Board of Directors since 1983. Mr. Eisenecher has been a business consultant since 1994. From 1987 to 1993, Mr. Eisenecher was the President and Chief Executive Officer of Rehabilitation Technologies, Inc., a manufacturer and marketer of rehabilitation products.

Daniel A. Funk, M.D. has served on our Board of Directors since May 1998. Mr. Funk has been an orthopedic surgeon in private practice since 1989. Dr. Funk obtained his Medical Doctor degree from the University of Cincinnati in 1981 and completed a five year residency in Orthopedic Surgery at The Mayo Clinic in 1986. Dr. Funk served as a member of the Technical Advisory Board of Cross from 1984 through 1990 and as the Medical Advisor of Cross from 1990 to 1998.

EXECUTIVE OFFICERS

Our executive officers are as follows:

| | | | |

Name

| | Age

| | Position

|

David C. Mercer | | 62 | | Chairman of the Board and Chief Executive Officer |

Joseph A. Mussey | | 55 | | President and Chief Operating Officer |

Richard L. Harrison | | 47 | | Senior Vice President, Finance, Chief Financial Officer and Secretary |

M. Ross Simmonds | | 48 | | Senior Vice President, Sales and Distribution |

R. Park Carmon | | 50 | | Vice President, Operations |

Philip A. Mellinger | | 40 | | Vice President, Product Development |

Edwin C. Shors, Ph.D | | 58 | | Vice President, Research and New Technology |

For a description of the business background of Messrs. Mercer and Mussey, see information concerning directors set forth above.

Richard L. Harrison has served as our Chief Financial Officer and Secretary since November 1994, as our Senior Vice President, Finance, since May 1998, and as our Vice President, Finance, from November 1994 through May

2

1998. Prior to joining us, Mr. Harrison worked for Kirschner Medical Corporation, a manufacturer of orthopaedic devices that was merged into Biomet, Inc. in 1994, in a variety of financial positions starting in 1987, most recently as Corporate Controller from February 1992 through October 1994. Mr. Harrison is a Certified Public Accountant.

M. Ross Simmonds has served as our Senior Vice President, Sales and Distribution since January 2003, as our Senior Vice President, Sales and Marketing from May 1998 through January 2003, as our Vice President, Sales and Marketing from August 1991 through May 1998, and as our Director of Sales and Marketing from December 1989 through August 1991. From September 1988 through October 1989, Mr. Simmonds served as Vice President, Sales and Marketing for Implant Technology, Inc., a manufacturer of reconstructive hip implants. From November 1985 through August 1988, he served as Regional Manager, National Sales Manager and Trauma Group Marketing Manager for Kirschner Medical Corporation.

R. Park Carmonhas served as our Vice President, Operations since August 2000. From January 1996 through August 2000, Mr. Carmon worked for Edwards Lifesciences Cardiovascular Resources, formerly Perfusion Services of Baxter Healthcare Corporation, as Director of Materiel Services and Director of Logistics. From 1981 until it was acquired by Baxter in January 1996, Mr. Carmon worked for PSICOR, Inc., a provider of perfusion services, holding various positions including Regional Manager, Division President and Vice President.

Philip A. Mellinger has served as our Vice President, Product Development since our merger with Cross in May 1998. Prior to the merger, Mr. Mellinger was the Vice President, Research and Development for Cross from January 1997 to May 1998. From 1987 to January 1997, Mr. Mellinger was employed by Cross in its research and development department.

Edwin C. Shors, Ph.D, has served as our Vice President, Research and New Technology since May 1998, and as our Vice President, Research and Development from 1983 to May 1998. Dr. Shors was our Executive Vice President from 1978 to 1983, during which time he was responsible for establishing the manufacturing procedures, animal evaluations and clinical trials leading to the FDA approval and marketing of coralline hydroxyapatite. Prior to joining us, he was Director of the Thoracic and Cardiovascular Laboratory at Harbor/UCLA Medical Center.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission (the “SEC”) and the NASDAQ National Market. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of copies of such forms received by us with respect to fiscal 2003, or written representations from certain reporting persons, we believe that during fiscal 2003 all of our directors and executive officers and persons who own more than 10% of the common stock complied with the reporting requirements of Section 16(a).

CODE OF BUSINESS CONDUCT AND ETHICS

We have adopted a Code of Business Conduct and Ethics that applies to all of our directors and employees, including the Chief Executive Officer and all senior financial officers, such as our principal financial officer and principal accounting officer and controller, as required by the Sarbanes-Oxley Act of 2002 and the NASDAQ National Market listing standards. The Code of Business Conduct and Ethics is posted on our website atwww.interpore.com. In addition, a copy of the Code of Business Conduct and Ethics will be provided without charge upon request to the Corporate Secretary, Interpore International, Inc., 181 Technology Drive, Irvine, CA, 92618.

AUDIT COMMITTEE AND AUDIT COMMITTEE FINANCIAL EXPERTS

Our Board of Directors has established a separately-designated standing audit committee for the purpose of assisting the Board of Directors in its oversight of our financial reporting process. The Audit Committee is comprised of

3

Messrs. Eisenecher, Funk, Chonette and Williams, all of whom are independent, as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act and as required by the listing standards of the NASDAQ National Market. The Board of Directors has determined that Mr. Williams is a financial expert within the meaning of the SEC rules.

Item 11. Executive Compensation

The following table sets forth certain information regarding the annual and long-term compensation for services rendered to us in all capacities for the fiscal years ended December 31, 2003, 2002 and 2001 of those persons who were, at December 31, 2003, (i) our Chief Executive Officer, (ii) our other four most highly compensated executive officers whose annual salary and bonuses exceeded $100,000 or (iii) any other executive officer who would have qualified under sections (i) or (ii) of this paragraph but for the fact that the individual was not serving as an executive officer of the registrant at the end of the 2003 fiscal year (collectively, the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long Term

Compensation Awards

| | | |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation(1)

| | Restricted

Stock

Awards

| | | Securities

Underlying

Options

| | All Other

Compensation

| |

David C. Mercer Chairman and Chief Executive Officer | | 2003

2002

2001 | | $

| 283,550

272,500

261,500 | | $

| 21,266

0

32,688 | | $

| 17,112

15,652

14,658 | | $

| 131,700

0

0 | (2)

| | 0

30,000

30,000 | | $

| 4,216

4,259

3,911 | (3)

(3)

(4) |

| | | | | | | |

Joseph A. Mussey President and Chief Operating Officer | | 2003

2002

2001 | |

| 283,550

272,500

261,500 | |

| 21,266

0

32,688 | |

| 18,275

18,376

15,584 | |

| 131,700

0

0 | (2)

| | 0

30,000

30,000 | |

| 4,216

4,259

3,911 | (3)

(3)

(4) |

| | | | | | | |

M. Ross Simmonds Senior Vice President, Sales and Distribution | | 2003

2002

2001 | |

| 215,250

205,000

195,000 | |

| 16,144

0

24,375 | |

| 20,117

16,133

15,779 | |

| 109,750

0

0 | (5)

| | 0

25,000

25,000 | |

| 4,216

4,259

3,781 | (3)

(3)

(4) |

| | | | | | | |

Philip A. Mellinger Vice President, Product Development | | 2003

2002

2001 | |

| 186,300

175,000

165,000 | |

| 41,918

19,688

20,625 | |

| 16,848

16,517

15,813 | |

| 109,750

0

0 | (5)

| | 0

25,000

25,000 | |

| 4,216

4,259

3,720 | (3)

(3)

(4) |

| | | | | | | |

Richard L. Harrison Senior Vice President, Finance

Chief Financial Officer and Secretary | | 2003

2002

2001 | |

| 190,550

180,000

169,000 | |

| 14,291

0

21,125 | |

| 21,313

17,710

17,612 | |

| 109,750

0

0 | (5)

| | 0

25,000

25,000 | |

| 4,216

4,259

3,736 | (3)

(3)

(4) |

| (1) | Represents the cost of company-provided automobiles, including reimbursement of taxes. |

| (2) | Represents 15,000 shares of restricted stock granted on May 16, 2003, which shares vest in four equal annual installments commencing with the first anniversary of the date of grant. The value of these restricted shares on December 31, 2003 was $195,000. Holders of restricted stock would be entitled to a dividend if one is declared for the holders of common stock. |

| (3) | Represents contributions to our retirement savings plan of $4,000 and payments for each individual for term-life insurance premiums of $216 in 2003 and $259 in 2002. |

| (4) | Represents contributions to our retirement savings plan of $3,400 for each individual and payments of term-life insurance premiums of $511 for Messrs. Mercer and Mussey, $381 for Mr. Simmonds, $320 for Mr. Mellinger and $336 for Mr. Harrison. |

4

| (5) | Represents 12,500 shares of restricted stock granted on May 16, 2003, which shares vest in four equal annual installments commencing with the first anniversary of the date of grant. The value of these restricted shares on December 31, 2003 was $162,500. Holders of restricted stock would be entitled to a dividend if one is declared for the holders of common stock. |

There were no stock option grants made to any of our Named Executive Officers in the year ended December 31, 2003. The following table sets forth certain information with respect to exercised and unexercised options held by the Named Executive Officers as of December 31, 2003 pursuant to our stock option plans:

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | | | | | | | | |

| | | Shares Acquired on Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at Fiscal Year End

| | Value of Unexercised In-the-Money Options at Fiscal Year End(1)

|

Name

| | | | Exercisable/ Unexercisable

| | Exercisable/ Unexercisable

|

David C. Mercer | | 32,697 | | $ | 340,575 | | 283,803 / 47,500 | | $ | 1,751,229 / $292,233 |

Joseph A. Mussey | | 12,113 | | | 39,407 | | 112,500 / 47,500 | | | 824,697 / 292,233 |

M. Ross Simmonds | | 110,498 | | | 498,745 | | 152,502 / 40,000 | | | 1,058,106 / 245,663 |

Philip A. Mellinger | | 3,825 | | | 14,854 | | 107,500 / 32,500 | | | 846,778 / 199,093 |

Richard L. Harrison | | 57,498 | | | 450,089 | | 150,502 / 40,000 | | | 999,106 / 245,663 |

| (1) | Calculated based on the closing sales price of the common stock on the NASDAQ National Market on December 31, 2003 ($13.00), minus the exercise price of the option, multiplied by the number of shares to which the option relates. |

Employment Agreements and Indemnification Agreements

We have Employment Agreements with each of our executive officers. Pursuant to the Employment Agreements, each of the executive officers receives an annual base salary as determined from time to time by the Board of Directors. In addition, the executive officers are entitled to receive incentive compensation, including bonuses and stock options pursuant to the terms of the plans adopted by the Board of Directors at their sole discretion. In the event an executive officer is terminated in anticipation of, or within one year following, a change in control, the executive officer will be entitled to receive an amount equal to approximately two times the executive officer’s current annual base salary and bonus, to be paid out over a period of twenty-four months. We have entered into an Agreement and Plan of Merger with Biomet, Inc., pursuant to which, subject to the satisfaction of certain conditions, we will become a wholly-owned subsidiary of Biomet, Inc. If this transaction is completed as contemplated by the Agreement and Plan of Merger, it will constitute a change in control for the purposes of the Employment Agreements. The Employment Agreements also provide each of the executive officers with insurance, vacation and sick leave benefits.

The Employment Agreements provide that employment of each of the executive officers is “at-will” and may be terminated by us at any time. If the executive officer is terminated by us without cause (as defined in the agreement), we will continue to pay the executive officer his base salary and provide fringe benefits at the level in place at the termination date for 12 months and will provide outplacement services at a cost to us not to exceed the executive officer’s base salary for one month. We may terminate payment of the base salary, fringe benefits and outplacement services during the 12-month severance period if the executive officer accepts other employment or is in breach of the non-competition and confidentiality obligations of the Employment Agreement.

We have also entered into Indemnification Agreements with our executive officers and directors providing for indemnification of such persons to the fullest extent authorized, permitted or allowed by law.

5

Board Compensation and Benefits

The Stock Option Plan for Non-Employee Directors (the “Non-Employee Directors Plan”) provides for the automatic grant of non-qualified stock options to purchase shares of common stock to eligible non-employee directors. On May 25, 1995, under the terms of the Non-Employee Directors Plan, each director who was not an employee was automatically granted an initial option to purchase 15,000 shares of common stock, effective as of May 25, 1995, at an exercise price of $5.75 per share. Non-employee directors who are first appointed or elected to the Board of Directors after May 25, 1995 are automatically granted an initial option to purchase 15,000 shares of common stock, effective on the date of election or appointment to the Board of Directors. In addition to the initial grant, non-employee directors are automatically granted options to purchase 10,000 shares (this was increased from 5,000 shares effective May 16, 2003, subject to stockholder approval of the amendment) on the date of the annual meeting of stockholders in every year following the initial grant to such director, provided that the director is re-elected at the meeting if such director’s term is expiring.

Each non-employee director is entitled to be paid a fee of $5,000 (this was increased from $2,000 effective May 16, 2003) per regularly scheduled quarterly board meeting attended in person or by telephone the (the “Directors’ Fee”). No fee is payable for other meetings of the board or for committee meetings. Prior to May 16, 2003, a fee of $2,000 was payable for regularly scheduled board meetings, other than quarterly meetings. Alternatively, pursuant to an irrevocable election made at least six months prior to the board meeting date, a non-employee director may elect to automatically receive non-qualified stock options under the Non-Employee Directors Plan covering 2,500 shares (this was increased from 1,000 shares effective May 16, 2003, subject to stockholder approval of the amendment) of common stock in lieu of the Directors’ Fee payable for regularly scheduled quarterly board meeting attended in person or by telephone. The price per share of common stock subject to each option granted under the plan is 100% of the closing price of the common stock on the NASDAQ National Market on the day prior to such meeting. The options become exercisable in four cumulative annual installments of 25% of the shares covered by the option, commencing with the first anniversary from the date of grant, which is the date of the applicable board or committee meeting. The Board of Directors implemented these increases for the 2003 annual meeting and following meetings by making discretionary grants under our 2003 Equity Participation Plan equal to the amount of the increase, in addition to the existing automatic grants under the Non-Employee Directors Plan.

During fiscal year 2003, non-employee directors received options to purchase 1,000 shares of common stock, in lieu of the Director’s Fee, as follows: at an exercise price of $6.40, Messrs. Chonette, Eisenecher and Funk; at exercise prices of $7.27 and $7.75, Messrs. Chonette, Eisenecher, Funk and Williams. In addition, Mr. Eisenecher received options to purchase 2,500 shares each at exercise prices of $14.40 and $11.40 in lieu of the Director’s Fee. Each non-employee director, on the date of the annual meeting held May 16, 2003, also received options to purchase 10,000 shares of common stock at an exercise price of $9.05 per share.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation and Stock Option Committee is a current or former officer or employee of us or any of our subsidiaries. None of our executive officers served on the board of directors or compensation committee of any entity that has one or more executive officers serving as members of our Board of Directors or Compensation and Stock Option Committee.

Compensation and Stock Option Committee Report on Executive Compensation

General Philosophy. The Compensation and Stock Option Committee reviews and determines salaries, bonuses and all other elements of the compensation packages offered to the executive officers, including its Chief Executive Officer, and establishes our general compensation policies.

We desire to attract, motivate and retain high quality employees who will enable us to achieve our short- and long-term strategic goals and values. We participate in a high-growth environment where substantial competition exists for skilled employees. Our ability to attract, motivate and retain high caliber individuals is dependent in large part upon the compensation packages we offer.

6

We believe that our executive compensation programs should reflect our financial and operating performance. In addition, individual contribution to our success should be supported and rewarded. Our executive compensation has been based on four primary components: base salary, incentive bonus, long-term incentives in the form of stock options and an executive automobile program. The Committee believes that these incentive components have maintained annual executive compensation at competitive levels and have provided an effective means of retaining, motivating and rewarding high quality management.

Under the 1993 Omnibus Budget Reconciliation Act (“OBRA”), income tax deductions of publicly-traded companies in tax years beginning on or after January 1, 1994 may be limited to the extent total compensation (including base salary, annual bonus, stock option exercises and non-qualified benefits) for certain executive officers exceeds $1 million (less the amount of any “excess parachute-payments” as defined in Section 280G of the Code) in any one year. Under OBRA, the deduction limit does not apply to payments which qualify as “performance-based.” To qualify as “performance-based,” compensation payments must be based solely upon the achievement of objective performance goals and made under a plan that is administered by a committee of outside directors. In addition, the material terms of the plan must be disclosed to and approved by stockholders, and the compensation committee must certify that the performance goals were achieved before payments can be made. The Committee attempts to design our compensation programs to conform with the OBRA legislation and related regulations so that total compensation paid to any employee will not exceed $1 million in any one year, except for compensation payments which qualify as “performance-based.” We may, however, pay compensation which is not deductible in limited circumstances when sound management so requires.

Base Salary. Base salary for each of the executive officers, including the Chief Executive Officer, is targeted at the average salaries paid for such positions by competitive medical device companies of similar size, with additional consideration given to biotech companies for selected positions. Industry and custom surveys are used to establish competitive practices. Salaries for executive officers are reviewed by the Committee on an annual basis and may be adjusted at that time based on our performance, the Committee’s assessment of the individual’s contribution to our operations and changes in competitive pay levels. Effective as of July 1, 2003, the base salaries of the executive officers, including the Chief Executive Officer, were evaluated and adjusted according to the factors discussed above including a review of the market pay trends. Mr. Mercer’s base salary was increased from $278,000 to $289,100, effective as of July 1, 2003.

Incentive Bonus Plan. In an effort to encourage and reward operating performance on an annual basis, all employees, including executive officers but excluding those employees compensated by commission or some other form of bonus compensation, are eligible for annual bonuses. Target bonus awards for each employment level were established by surveying awards paid by competitive companies of similar size. The target bonus awards range from 5% to 25% of base compensation, depending on employment level, with the target award for all executive officers, including the CEO, established at 25% of base salary. Actual bonus awards can range from 0% to 150% of the targeted award, based upon our financial performance against targeted objectives approved by the Committee at the beginning of each fiscal year. For 2003, Messrs. Mercer, Mussey, Harrison, Simmonds and Carmon earned bonuses at 30% of their targeted awards. Mr. Mellinger earned a bonus at 90% of his targeted award.

Long Term Incentives. We offer our executive officers and other key employees long-term incentives primarily through stock option grants under our stock option plans, and beginning in 2003 for our executive officers, through grants of restricted stock. Stock option and restricted stock grants are intended to motivate executive officers to improve long-term stock performance, and thus are tied directly to stockholders’ interests. Stock options are granted at the prevailing market price on the date of grant and will, thus, only have value if our stock price rises. Shares of common stock issued as restricted stock are subject to restrictions on transfer and repurchase rights that lapse as the grants vest. While there is no exercise price associated with restricted stock grants, due to the restrictions on transfer the holder cannot realize value until the grant vests, creating greater value if our stock rises. Stock options and restricted stock generally vest over four years. The Compensation and Stock Option Committee administers our equity plans and determines which executive officers and other employees are to receive option grants and the number of options or shares of restricted stock to be granted.

Executive Automobile Program.We provide most of our executive officers with an automobile on a three-year, closed-end lease. We believe that providing the executive officer with the use of an automobile increases the value of the after-tax compensation of the executive officer to more competitive levels.

7

This report has been provided by the Compensation and Stock Option Committee:

William A. Eisenecher (Chairman)

David W. Chonette

Daniel A. Funk, M.D.

Lewis Parker

Robert J. Williams

Date: April 26, 2004

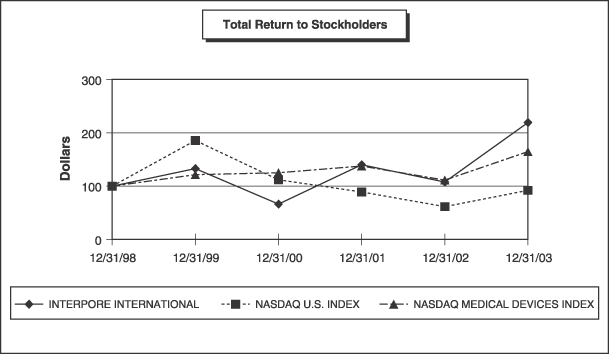

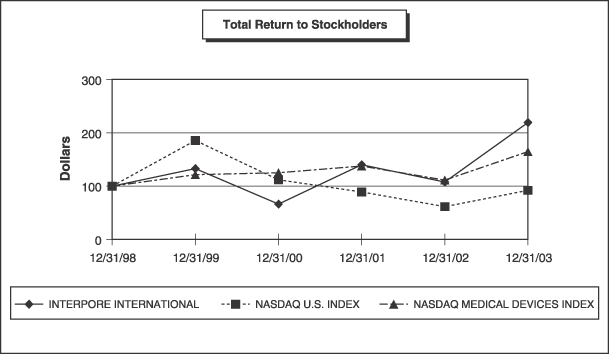

Company Performance

The following line graph compares the annual cumulative total stockholder return of our common stock against the cumulative total return of the NASDAQ U.S. Index and the NASDAQ Medical Devices Index for the period from December 31, 1998 to December 31, 2003. On April 15, 2004 the closing market price per share of our common stock was $14.36, as reported on the NASDAQ National Market.

| | | | | | | | | | | | |

| | | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

|

INTERPORE INTERNATIONAL | | 100.00 | | 132.62 | | 66.32 | | 140.11 | | 107.78 | | 218.93 |

NASDAQ U.S. INDEX | | 100.00 | | 185.43 | | 111.83 | | 88.76 | | 61.37 | | 91.75 |

NASDAQ MEDICAL DEVICES INDEX | | 100.00 | | 121.11 | | 124.94 | | 137.25 | | 111.09 | | 164.29 |

8

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

Security Ownership of Certain Beneficial Owners and Management of Interpore

The following table sets forth the amount and percentage of the outstanding shares of our common stock, which, according to the information supplied to us, are beneficially owned by (1) each person who, to our knowledge based exclusively on Schedules 13G and 13D filed with the Securities and Exchange Commission, is the beneficial owner of more than 5% of our outstanding common stock; (2) each person who is currently a director; (3) each Named Executive Officer, as defined on page 4 hereof; and (4) all current directors and executive officers as a group. Except for information based on Schedules 13G and 13D, as indicated in the footnotes, beneficial ownership is stated as of April 15, 2004. As of April 15, 2004, we had 18,009,337 shares of common stock outstanding. Except to the extent indicated in the footnotes to the following table, to our knowledge, the person or entity listed has sole voting or dispositive power to the shares which are deemed beneficially owned by such person or entity. Except as otherwise noted, the address of each person listed is c/o Interpore International, Inc., 181 Technology Drive, Irvine, California 92618.

| | | | | | | | | |

Name and Address of Beneficial Owner

| | Outstanding

Common

Stock

| | Options

Exercisable

Within

60 Days

| | Total

Outstanding

Common Stock

Beneficially

Owned

| | Percent of

Shares of

Common Stock

Beneficially

Owned(1)

| |

Directors and Executive Officers: | | | | | | | | | |

| | | | |

David W. Chonette | | 10,000 | | 21,500 | | 31,500 | | * | |

| | | | |

William A. Eisenecher | | 9,500 | | 49,625 | | 59,125 | | * | |

| | | | |

Daniel A. Funk, M.D. | | 234,676 | | 22,375 | | 257,051 | | 1.4 | % |

| | | | |

Richard L. Harrison | | 32,131 | | 171,752 | | 203,883 | | 1.1 | % |

| | | | |

Philip A. Mellinger | | 30,960 | | 125,000 | | 155,960 | | * | |

| | | | |

David C. Mercer | | 77,641 | | 308,803 | | 386,444 | | 2.1 | % |

| | | | |

Joseph A. Mussey | | 175,550 | | 137,500 | | 313,050 | | 1.7 | % |

| | | | |

Lewis Parker | | 132,126 | | 12,500 | | 144,626 | | * | |

| | | | |

M. Ross Simmonds | | 24,998 | | 173,752 | | 198,750 | | 1.1 | % |

| | | | |

Robert J. Williams | | 7,650 | | 21,875 | | 29,525 | | * | |

| | | | |

All directors and executive officers as a group (12 persons) | | 821,732 | | 1,341,182 | | 2,162,914 | | 11.2 | % |

| | | | |

5% Beneficial Holders: | | | | | | | | | |

| | | | |

Mario J. Gabelli(2) | | 1,686,471 | | 0 | | 1,686,471 | | 9.4 | % |

One Corporate Center | | | | | | | | | |

Rye, New York 10580-1435 | | | | | | | | | |

| | | | |

Paulson & Co., Inc.(3) | | 1,629,326 | | 0 | | 1,629,326 | | 9.0 | % |

277 Park Avenue, 26th Floor | | | | | | | | | |

New York, NY 10172 | | | | | | | | | |

| | | | |

Kopp Investment Advisors, Inc., et. al.(4) | | 1,443,019 | | 0 | | 1,443,019 | | 8.0 | % |

7701 France Avenue South, Suite 500 | | | | | | | | | |

Edina, MN 55435 | | | | | | | | | |

9

| | | | | | | | | |

| | | | |

Biomet, Inc.(5) | | 1,417,421 | | 0 | | 1,417,421 | | 7.9 | % |

56 East Bell Drive | | | | | | | | | |

Warsaw, IN 46582 | | | | | | | | | |

| | | | |

Roger E. King(6) | | 1,388,113 | | 0 | | 1,388,113 | | 7.7 | % |

1980 Post Oak Boulevard, Suite 2400 | | | | | | | | | |

Houston, TX 77056 | | | | | | | | | |

| (1) | Percentage of beneficial ownership as of April 15, 2004, for each person includes shares subject to options exercisable within 60 days after April 15, 2004, as if such shares were outstanding on April 15, 2004. |

| (2) | According to a Schedule 13D, amended as of March 29, 2004, the shares listed include shares beneficially owned by Mr. Gabelli or entities under his direct or indirect control, including 917,435 shares beneficially owned by GAMCO Investors, Inc.; 106,000 shares beneficially owned by Gabelli Funds, LLC; 35,500 shares beneficially owned by MJG Associates, Inc.; 60,000 shares beneficially owned by Gabelli Advisors, Inc.; and 567,536 shares beneficially owned by Gabelli Securities, Inc. All such shares are also beneficially owned by Mr. Gabelli. According to the Schedule 13D, GAMCO has sole dispositive power over all, and sole voting power over 880,735, of the shares it beneficially owns, and each of the other Gabelli-controlled entities has sole dispositive and voting power over all of the shares it beneficially owns. |

| (3) | Based on Schedule 13G filed by Paulson & Co., Inc. on April 2, 2004. Paulson & Co., Inc. has sole voting power and sole dispositive power over all of the shares. Paulson & Co., Inc., an investment advisor, disclaims beneficial ownership of these shares. |

| (4) | Based on Amendment No. 4 to Schedule 13G filed on January 28, 2004, by Kopp Investment Advisors, LLC on behalf of Kopp Investment Advisors, LLC, Kopp Holding Company, Kopp Holding Company LLC and LeRoy C. Kopp. Kopp Investment Advisors, LLC owns 1,348,019 shares, of which it holds sole voting power over 1,130,069 shares, sole dispositive power over 400,000 shares and shared dispositive power over 883,019 shares. Kopp Investment Advisors, LLC is a wholly-owned subsidiary of Kopp Holding Company, LLC. LeRoy C. Kopp is the owner of an additional 160,000 shares and holds 100% of the outstanding capital stock of Kopp Holding Company. |

| (5) | Based on Schedule 13D filed by Biomet, Inc. on March 17, 2004. These shares represent the aggregate number of shares of common stock of Interpore International, Inc. subject to the Voting and Support Agreements dated March 7, 2004 between Biomet, Inc. and each of Daniel A. Funk, M.D., David C. Mercer, Joseph A. Mussey, Lewis Parker and Edwin C. Shors, Ph.D. (collectively, the “Stockholders”), whereby the Stockholders have agreed to vote for the merger with Biomet, Inc. and against any other acquisition proposal. 720,928 of the 1,417,421 shares of common stock are not currently issued and outstanding but only issuable upon the exercise of outstanding options held by the Stockholders which are either currently exercisable or exercisable within 60 days of March 7, 2004. Biomet, Inc. may be deemed to beneficially own these shares, over which it shares voting power with the stockholders. Biomet, Inc. disclaims beneficial ownership of these shares. |

| (6) | Based on information provided by Roger E. King. Includes 1,327,163 shares held by King Investment Advisors, Inc., for the benefit of its clients. King Investment Advisors, Inc. has sole voting power over 1,311,955 shares and has shared dispositive power over 1,327,163 shares. Mr. King is the President and Chief Investment Officer of King Investment Advisors, Inc., and as such exercises voting and investment control over shares held by King Investment Advisors, Inc. |

10

Equity Compensation Plan Information

The following table sets forth information concerning the shares of common stock that may be issued upon exercise of options under all of our equity compensation plans as of December 31, 2003:

| | | | | | | |

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

|

| | | (a) | | (b) | | (c) |

Equity compensation plans

approved by

stockholders | | 2,220,807 | | $ | 6.78 | | 574,613 |

Equity compensation plans

not approved by

stockholders(1) | | 245,000 | | $ | 7.33 | | — |

Interpore International

Employee Qualified

Stock Purchase Plan | | — | | | — | | 105,997 |

| | |

| |

|

| |

|

Total | | 2,465,807 | | $ | 6.83 | | 680,610 |

| | |

| |

|

| |

|

| (1) | In connection with the acquisition of all the assets of Quantic Biomedical, Inc. in 1999, we issued warrants to purchase 200,000 shares of Interpore common stock to Quantic, of which warrants to purchase 175,000 shares were outstanding at December 31, 2003. The warrants were issued at a weighted average exercise price of $7.875 per share, are currently exercisable, and expire on various dates between June 2005 and December 2006. In 2001, Interpore issued non-qualified stock options outside of its formal stock option plans to two entities as compensation for consulting services. One such option, for 60,000 shares of Interpore common stock, was issued at an exercise price of $5.24 per share, was exercisable as to 40,000 shares as of December 31, 2003, and expires on July 10, 2006. This option was exercised as to 40,000 shares in January, 2004. The other option, for 10,000 shares, was issued at an exercise price of $8.39 per share, is currently exercisable, and expires on November 1, 2004. |

11

Item 13. Certain Relationships and Related Transactions

None.

Item 14. Principal Accountant Fees and Services

The firm of Ernst & Young LLP, our independent auditors for the fiscal year ended December 31, 2003, was appointed by the Audit Committee to act in the same capacity for the fiscal year ending December 31, 2004. Neither the firm nor any of its members has any relationship with us nor any of our affiliates except in the firm’s capacity as our auditor.

Independent Auditor Fee Information

Fees for professional services provided by our independent auditors in each of the last two fiscal years, in each of the following categories are:

| | | | | | |

| | | 2003

| | 2002

|

Audit fees | | $ | 210,350 | | $ | 144,800 |

Audit-related fees | | | 34,966 | | | 11,700 |

Tax fees | | | 144,630 | | | 289,737 |

All other fees | | | 0 | | | 0 |

| | |

|

| |

|

|

| | | $ | 389,946 | | $ | 446,237 |

| | |

|

| |

|

|

Audit fees includes fees associated with the audit of our annual financial statements, the review of the financial statements included in each of our quarterly reports on Form 10-Q, and assistance with the review of other documents filed with the SEC.Audit-related fees includes fees associated with our 401(k) plan audits and accounting consultations relating to internal controls over financial reporting, recent accounting pronouncements and consents for registration statements.Tax fees includes tax compliance, tax advice and tax planning services, including assistance with tax return preparation, calculation of estimated tax payments and preparation of tax return filing deadline extensions, and in 2003 includes $75,900 for income tax savings projects and studies supporting specific tax deductions and tax credits that had not been utilized in prior tax periods.

Ernst & Young LLP did not render any professional services to us resulting in financial information systems design and implementation fees.

The Audit Committee has reviewed the non-audit services provided by Ernst & Young LLP and determined that the provision of these services is compatible with maintaining the independence of Ernst & Young LLP.

Audit Committee Pre-Approval Policy

Since the May 6, 2003 effective date of the Securities and Exchange Commission rules stating that an auditor is not independent of an audit client if the services it provides to the client are not appropriately approved, each new engagement of Ernst & Young LLP was approved in advance by our Audit Committee, and none of those engagements made use of thede minimus exception to pre-approval contained in the Commission’s rules.

12

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Amendment No. 1 on Form 10-K/A to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| INTERPORE INTERNATIONAL, INC. |

| |

| By: | | /s/ DAVID C. MERCER |

| | |

|

| | | David C. Mercer Chairman and Chief Executive Officer |

Date: April 29, 2004

13

EXHIBIT INDEX

| | |

Exhibit Number

| | Description

|

| |

| 31.01 | | Certifications of Chief Executive Officer pursuant to Section 302 of Sarbanes-Oxley Act of 2002 |

| |

| 31.02 | | Certifications of Chief Financial Officer pursuant to Section 302 of Sarbanes-Oxley Act of 2002 |

| |

| 32.01 | | Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

| 32.02 | | Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

14