Item 1: Report to Shareholders| Extended Equity Market Index Fund | June 30, 2005 |

The views and opinions in this report were current as of June 30, 2005. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act of 2002, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Fellow ShareholdersLarge-cap U.S. stocks generally declined in the first half of 2005, as modest second-quarter gains were not enough to offset first-quarter losses. Some small- and mid-cap indexes fared better than large-cap benchmarks and produced slight gains for the six-month period. Nevertheless, the market’s attempts to advance were hindered by concerns about the pace of economic growth amid surging oil prices—which reached $60 per barrel in late June—and rising short-term interest rates.

MARKET ENVIRONMENT

Economic conditions were mostly favorable in the first half of 2005. Although the manufacturing sector decelerated somewhat, the economy expanded at a steady pace. New job growth continued at a reasonable rate, the unemployment rate hovered slightly above 5%, and inflation remained contained, despite skyrocketing oil prices.

Relatively low interest rates continued to provide a helpful stimulus to the economy. Although money market and short-term bond yields increased as the Federal Reserve raised the fed funds target rate, long-term interest rates unexpectedly declined. The result was a flattening of the Treasury yield curve, which currently indicates that long-term Treasury yields are not much higher than short-term yields.

Large-cap U.S. stocks generally declined through April amid fears of slower economic growth accompanied by higher inflation. However, Federal Reserve officials assuaged investor worries by asserting that the economy was on a “reasonably firm footing” and that “underlying inflation remains contained.” Brisk merger activity and generally favorable corporate earnings news helped lift stocks in the second quarter, though a late-June spike in oil prices and prospects for the central bank to continue raising the overnight federal funds target rate—which has already risen from 1.00% to 3.25% over the last 12 months—capped the market’s advance.

Large-cap shares, as measured by the S&P 500 Stock Index, returned -0.81% versus 2.19% for the Dow Jones Wilshire 4500 Completion Index, a broad benchmark for small- and mid-cap stocks. As measured by various Russell indexes, value stocks outperformed their growth counterparts across all market capitalizations.| WILSHIRE 5000 RETURNS BY SECTOR |

| | |

| Periods Ended 6/30/05 | 6 Months | 12 Months |

| Consumer Discretionary | -3.81% | 8.26% |

| Consumer Staples | 0.27 | 2.59 |

| Energy | 20.63 | 40.82 |

| Financials | -1.60 | 8.82 |

| Health Care | 4.53 | 5.18 |

| Industrials and Business Services | -3.52 | 6.68 |

| Information Technology | -5.13 | -2.28 |

| Materials | -7.48 | 6.41 |

| Telecommunication Services | -2.81 | 11.89 |

| Utilities | 14.36 | 35.68 |

The market for initial public offerings (IPOs) was relatively quiet in the first half of the year, though activity picked up in recent months. Fewer than 100 companies went public in the last six months, according to data from Dealogic and Thomson Financial. Nevertheless, the universe of publicly traded companies based in the U.S., as measured by the Dow Jones Wilshire 5000 Composite Index, continued to shrink in the last six months. One likely reason is brisk merger and acquisition activity; another may be insufficient trading activity involving shares of some of the smallest companies. As of June 30, there were 4,905 companies in the index versus 4,971 at the end of 2004.

SECTOR PERFORMANCE

In the U.S. stock market, as measured by the Wilshire 5000, energy stocks and utilities produced vigorous gains and far surpassed other sectors in the last six months. Health care was also modestly higher. The materials and information technology sectors performed worst, but stocks in the consumer discretionary and industrials and business services sectors also struggled.

EQUITY INDEX 500 FUND

| PERFORMANCE COMPARISON |

| | |

| Periods Ended 6/30/05 | 6 Months | 12 Months |

| Equity Index 500 Fund | -0.95% | 6.02% |

| S&P 500 Stock Index | -0.81 | 6.32 |

Your fund returned -0.95% in the last six months and 6.02% for the 12-month period ended June 30, 2005. As shown in the table, the fund closely tracked the performance of its benchmark, the S&P 500 Stock Index, in both periods. The fund usually lags slightly due to annual operating and management expenses.

Energy stocks (8.8% of equities as of June 30) produced outstanding results as oil prices extended last year’s ascent into the first half of 2005. Nearly every energy holding appreciated in value, and many were among our largest contributors to performance. The largest was ExxonMobil, which gained 13% amid rising oil prices and following better-than-expected earnings in the fourth quarter of 2004. (Please refer to the fund’s portfolio of investments for a complete listing of the fund’s holdings and the amount each represents in the portfolio.)

Utility stocks (3.5% of equities) also extended last year’s brisk performance, led by electric utilities. One of our top contributors in this segment was Exelon, which advanced 18%. Independent power producers also performed well, especially TXU Corporation, whose shares surged 30% as its energy division benefited from rising natural gas prices. Gas utility companies trailed.

In the health care sector (13.4% of equities), gains were driven by providers and service companies. UnitedHealth Group, a high-quality, diversified, national managed care provider, was our best holding in the sector. Shares of WellPoint, HCA, and Aetna also performed very well. Pharmaceutical stocks were mixed, as weakness in Merck and Schering-Plough offset gains in Pfizer and Johnson & Johnson. Biotechnology and health care equipment and supply companies generally declined, though Gilead Sciences and Medtronic contributed to our results.

On the downside, information technology shares (15.2% of equities) detracted the most in the last six months. Nearly every underlying industry declined, but semiconductor-related stocks produced gains, thanks primarily to strength in Intel and Texas Instruments. Software stocks were dragged lower by weakness in industry giant Microsoft, but makers of computers and peripherals performed worst, led by IBM, which reported lower-than-expected first-quarter earnings and which tumbled more than 24% in the first half. Hewlett-Packard, however, bucked the negative trend as the company replaced CEO Carly Fiorina and began focusing on increasing its profitability.Consumer discretionary stocks (11.4% of equities) generally fell, though multi-line retailers J.C. Penney, May Department Stores, and Nordstrom performed very well. Media stocks continued to struggle across the board, especially Time Warner and Viacom, while automobile stocks Ford Motor and GM suffered from weakening sales and credit rating downgrades. Specialty retailers were mixed, as gains in Best Buy and Office Depot were offset by weak performance of Home Depot. Toys R Us performed well, however, after the company received a buy-out offer from two private equity firms and a real estate developer.

| PORTFOLIO CHARACTERISTICS |

|

| | | | Extended |

| | Equity | Total Equity | Equity |

| As of 6/30/05 | Index 500 | Market Index | Market Index |

| Market Cap | | | |

| (Investment- | | | |

| Weighted Median) | $48.8 billion | $25.0 billion | $2.6 billion |

| |

| Earnings Growth | | | |

| Rate Estimated | | | |

| Next 5 Years * | 11.2% | 11.3% | 14.4% |

| |

| P/E Ratio (Based | | | |

| on Next 12 Months’ | | | |

| Estimated Earnings) * | 15.4X | 15.8X | 17.5X |

| | | |

| * Source data: IBES. Forecasts are in no way indicative of future investment returns. |

Most major underlying industries in the financial sector (20.3% of equities) declined in the last six months. Real estate-related companies outperformed, however, especially Simon Property Group and Equity Office Properties, which benefited from the booming real estate market. Insurance stocks also held up well, with Prudential and Allstate producing good returns, though shares of American International Group suffered amid regulatory scrutiny of its accounting practices. Commercial banks did worst, especially Bank of America and Wachovia. Brokerage stocks and asset managers also struggled, though Lehman Brothers and Franklin Resources traded higher.The industrials and business services sector (11.2% of equities) also detracted substantially from our performance. Industrial conglomerates GE, 3M, and Tyco International were responsible for a large portion of the sector’s weakness. Machinery stocks also struggled amid fears that slower economic growth would hurt the earnings of these cyclical companies. On the plus side, aerospace and defense firms gained altitude, led by Boeing and Lockheed Martin.

Standard & Poor’s authorized only three changes to the composition of the S&P 500 in the last six months, two of which stemmed from mergers. Adolph Coors, which was acquired by Canadian brewer Molson, was replaced by Molson Coors Brewing; Sears, Roebuck & Co., which merged with K-Mart, was replaced by Sears Holdings; and Power-One was supplanted by National Oilwell Varco.

TOTAL EQUITY MARKET INDEX FUND

| PERFORMANCE COMPARISON |

| | |

| Periods Ended 6/30/05 | 6 Months | 12 Months |

| Total Equity Market Index Fund | -0.08% | 8.11% |

| Dow Jones Wilshire 5000 | | |

| Composite Index * | 0.02 | 8.39 |

|

| * Dow Jones Wilshire 5000 returns through 6/30/05, calculated as of 7/11/05. |

Your fund returned -0.08% in the last six months and 8.11% for the 12-month period ended June 30, 2005. The fund closely tracked the performance of the Dow Jones Wilshire 5000 Composite Index in both periods, as shown in the table, but slightly lagged due to annual operating and management expenses.Because the Wilshire 5000 includes more than 4,900 publicly traded companies, it is impractical for us to buy shares of each. Instead, we use sampling strategies in an attempt to match the performance of the index. We manage the portfolio so that its characteristics—including sector allocations and price/earnings ratio—closely resemble those of the index. At the end of June, the fund owned stocks of approximately 2,000 companies.

| SECTOR DIVERSIFICATION |

| | | |

| Percent of | | | Extended |

| Equities | Equity | Total Equity | Equity |

| As of 6/30/05 | Index 500 | Market Index | Market Index |

| Consumer | | | |

| Discretionary | 11.4% | 13.4% | 18.5% |

| Consumer Staples | 10.1 | 9.1 | 4.9 |

| Energy | 8.8 | 8.3 | 6.9 |

| Financials | 20.3 | 21.3 | 24.9 |

| Health Care | 13.4 | 13.0 | 12.3 |

| Industrials and Business | | | |

| Services | 11.2 | 10.3 | 9.2 |

| Information | | | |

| Technology | 15.2 | 15.3 | 14.5 |

| Materials | 2.9 | 3.1 | 3.7 |

| Telecommunication | | | |

| Services | 3.2 | 2.8 | 2.0 |

| Utilities | 3.5 | 3.4 | 3.1 |

| | | |

| Note: The numbers in this table may not match the sector percentages in each fund’s portfolio of |

| investments, which are calculated as a percentage of net assets. |

| | | | |

In general, what was true about the performance of the Equity Index 500 Fund in the last six months was also true for this fund: energy, health care, and utilities were the sectors that contributed the most to fund performance, while the information technology, financial, consumer discretionary, and industrials and business services sectors detracted the most. The Wilshire 5000, which represents the entire U.S. stock market, includes all S&P 500 companies. In fact, the S&P 500 represents about 74% of the Wilshire 5000’s total market value. The largest components of the Wilshire index—as with the S&P 500—have the greatest influence on performance. In addition, the percentage weightings of the major sectors are similar, as shown in the Sector Diversification table above.

EXTENDED EQUITY MARKET INDEX FUND

| PERFORMANCE COMPARISON |

| | |

| Periods Ended 6/30/05 | 6 Months | 12 Months |

| Extended Equity Market | | |

| Index Fund | 2.11% | 14.10% |

| Dow Jones Wilshire 4500 | | |

| Completion Index * | 2.19 | 14.49 |

| | |

| * Dow Jones Wilshire 4500 returns through 6/30/05, calculated as of 7/11/05. |

Your fund returned 2.11% in the last six months and 14.10% for the 12-month period ended June 30, 2005. The fund closely tracked the performance of the Dow Jones Wilshire 4500 Completion Index in both periods, as shown in the table, but lagged slightly due to annual operating and management expenses.The index includes more than 4,400 small- and mid-cap companies, so it is impractical for us to buy shares of each. Instead, we use sampling strategies (just as we do with the Total Equity Market Index Fund) in an attempt to match the performance of the index. At the end of June, the fund held nearly 2,500 names.

The energy sector (6.9% of equities as of June 30) contributed the most to fund performance in the last six months. Most of our holdings produced gains. Premcor and Murphy Oil led the oil and gas industry, while GlobalSantaFe and Diamond Offshore Drilling were our top contributors in the energy equipment and services industry. Utilities (3.1% of equities) also advanced in the last six months. Gas and electric utilities fared best; water utilities trailed, though Aqua America performed fairly well. (Please refer to the fund’s portfolio of investments for a complete listing of the fund’s holdings and the amount each represents in the portfolio.)

Health care stocks (12.3% of equities) performed very well. Providers and services companies paced the sector’s advance, especially Coventry Health Care, Triad Hospitals, and WellChoice. Biotechnology stocks were fairly lackluster, but Genentech and Celgene were exceptions. Health care equipment and supply companies and pharmaceutical shares were mostly flat.

Consumer discretionary shares (18.5% of equities) made a small contribution to our results in the first half of the year. Specialty retailers did best, led by Chico’s and Abercrombie & Fitch, but PETsMART and Petco were disappointing. In the household durables industry, homebuilders were some of our top contributors to performance, especially Toll Brothers and D.R. Horton, but audio equipment maker Harman International Industries performed poorly. Media stocks struggled, particularly Liberty Media and DIRECTV, though Cablevision Systems and Fox Entertainment Group were two of our largest contributors.

Information technology shares (14.5% of equities) detracted the most from our results in the last six months. Most underlying industries declined, with communications equipment, electronics equipment, and semiconductor stocks among the weakest segments. Internet software and services stocks did best, primarily because of stellar performance of Google, a provider of Web search and online advertising services.

Stocks in the materials sector (3.7% of equities), which produced good returns in 2004, faltered in the first half of 2005 amid concerns that a slowing economy would dent the earnings of these cyclical companies. Chemical companies fared worst. Metals and mining stocks also stumbled, with AK Steel and Steel Dynamics among our worst performers. Construction materials companies held up best, benefiting from the robust real estate market.

Financial stocks (24.9% of equities) generally declined in the last six months. Commercial banks paced the sector’s decline. Thrifts and mortgage finance companies also detracted from our performance. On the plus side, real estate investment trusts (REITs) outperformed, as the real estate market remained hot and investors found REIT yields appealing in an environment of relatively low interest rates. Companies tied to the capital markets also outperformed other financial industries, led by Legg Mason. Online brokerage firm AmeriTrade also performed well: E*Trade initially sought to acquire the company, but AmeriTrade chose instead to purchase TD Waterhouse from Toronto-Dominion Bank.

Industrial and business services stocks (9.2% of equities) also detracted from our performance. Electrical equipment companies faltered, and airline stocks were grounded by record oil prices. Air freight and logistics companies, as well as road and rail stocks, also struggled amid high fuel costs, and machinery stocks were disabled by fears of slower economic growth. Favorable performance of aerospace and defense names helped to limit the losses in the sector, with United Defense Industries among the fund’s largest contributors to performance.

OUTLOOK

The economy is likely to continue expanding this year, despite elevated oil prices, and short-term interest rates are likely to keep rising. Fundamentals in corporate America are generally sound, but unless corporate profit growth remains vigorous, stocks could have difficulty making progress until the Fed signals that rates are at or near a neutral level that neither stimulates nor stifles economic growth.

Although macroeconomic factors are a major influence on the stock market, we are not preoccupied with discerning how individual stocks, sectors, or the market as a whole will react to the latest economic data, interest rate trends, or corporate developments. Our goal is to closely track the broad equity market indexes with the assets you have entrusted to us. Thank you for your support in this endeavor.

Respectfully submitted,

E. Frederick Bair

Chairman of the Investment Advisory Committee,

Equity Index 500 Fund and Extended Equity Market Index Fund

Co-chairman of the Investment Advisory Committee,

Total Equity Market Index Fund

Ken D. Uematsu

Co-chairman of the Investment Advisory Committee,

Total Equity Market Index Fund

July 14, 2005

The committee chairmen have day-to-day responsibility for managing the portfolios and work with committee members in developing and executing the funds’ investment programs.

PROSPECTUS UPDATE

This updates the Total Equity Market Index Fund’s prospectus dated May 1, 2005. The Portfolio Management paragraph in Section 3 of the prospectus is amended to reflect the following change:

Effective May 2005, Ken D. Uematsu became co-chairman of the Total Equity Market Index Fund’s Investment Advisory Committee. Mr. Uematsu, who joined T. Rowe Price in 1997, is an assistant vice president of T. Rowe Price Associates, Inc., a quantitative analyst in the Systematic Equity Group, and a vice president and Investment Advisory Committee member for the Equity Index 500 and Extended Equity Market Index Funds.

RISKS OF INVESTING

As with all stock mutual funds, the fund’s share price can fall because of weakness in the stock market, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment.

GLOSSARY

Fed funds target rate: An overnight lending rate set by the Federal Reserve and used by banks to meet reserve requirements. Banks also use the fed funds rate as a benchmark for their prime lending rates.

S&P 500 Stock Index: Tracks the stocks of 500 mostly large U.S. companies.

Dow Jones Wilshire 5000 Composite Index: Tracks the performance of the most active stocks in the broad U.S. market.

Dow Jones Wilshire 4500 Completion Index: Tracks the performance of all stocks in the Dow Jones Wilshire 5000 Composite Index, excluding those in the S&P 500 Stock Index.

| THE EVOLVING S&P 500 STOCK INDEX |

| |

| Changes in the index in 2005 | |

| Additions | Deletions |

| Sears Holdings Corp. | Sears, Roebuck & Co. |

| National Oilwell Varco | Power-One |

| Molson Coors Brewing | Adolph Coors |

| PORTFOLIO HIGHLIGHTS |

| |

| TWENTY-FIVE LARGEST HOLDINGS | |

| | Percent of |

| | Net Assets |

| | 6/30/05 |

| Equity Index 500 Fund | |

| GE | 3.2 |

| ExxonMobil | 3.2 |

| Microsoft | 2.2 |

| Citigroup | 2.1 |

| Pfizer | 1.8 |

| Johnson & Johnson | 1.7 |

| Bank of America | 1.6 |

| Intel | 1.4 |

| Wal-Mart | 1.4 |

| American International Group | 1.3 |

| Altria Group | 1.2 |

| Procter & Gamble | 1.1 |

| J.P. Morgan Chase | 1.1 |

| Cisco Systems | 1.1 |

| IBM | 1.1 |

| Chevron | 1.0 |

| Wells Fargo | 0.9 |

| Dell | 0.8 |

| Verizon Communications | 0.8 |

| Coca-Cola | 0.8 |

| PepsiCo | 0.8 |

| Home Depot | 0.7 |

| ConocoPhillips | 0.7 |

| SBC Communications | 0.7 |

| Time Warner | 0.7 |

| Total | 33.4% |

| |

| Note: Table excludes investments in the T. Rowe Price Reserve Investment Fund. | |

| Total Equity Market Index Fund | |

| ExxonMobil | 2.4% |

| GE | 2.4 |

| Microsoft | 1.8 |

| Citigroup | 1.6 |

| Pfizer | 1.4 |

| Wal-Mart | 1.3 |

| Johnson & Johnson | 1.3 |

| Bank of America | 1.2 |

| Intel | 1.1 |

| American International Group | 1.0 |

| Procter & Gamble | 0.9 |

| Altria Group | 0.9 |

| Berkshire Hathaway | 0.8 |

| Cisco Systems | 0.8 |

| J.P. Morgan Chase | 0.8 |

| IBM | 0.8 |

| Chevron | 0.8 |

| Wells Fargo | 0.7 |

| Coca-Cola | 0.7 |

| Dell | 0.6 |

| Verizon Communications | 0.6 |

| PepsiCo | 0.6 |

| Home Depot | 0.6 |

| Genentech | 0.5 |

| Google | 0.5 |

| Total | 26.1% |

| |

| Note: Table excludes investments in the T. Rowe Price Reserve Investment Fund. | |

| Extended Equity Market Index Fund | |

| Berkshire Hathaway | 3.2% |

| Genentech | 2.1 |

| Google | 2.1 |

| Kraft Foods | 1.4 |

| Liberty Media | 0.7 |

| DIRECTV | 0.5 |

| IAC/InterActiveCorp | 0.4 |

| Genworth Financial | 0.4 |

| Juniper Networks | 0.3 |

| Amazon.com | 0.3 |

| Las Vegas Sands | 0.3 |

| Liberty Global | 0.3 |

| MGM Mirage | 0.3 |

| Legg Mason | 0.3 |

| Vornado Realty Trust | 0.3 |

| UnionBancal | 0.2 |

| Murphy Oil | 0.2 |

| Enterprise Products Partners | 0.2 |

| Chicago Mercantile Exchange Holdings | 0.2 |

| Cablevision Systems | 0.2 |

| Lennar | 0.2 |

| GlobalSantaFe | 0.2 |

| Royal Caribbean Cruises | 0.2 |

| General Growth Properties | 0.2 |

| MCI | 0.2 |

| Total | 14.9% |

| |

| Note: Table excludes investments in the T. Rowe Price Reserve Investment Fund. | |

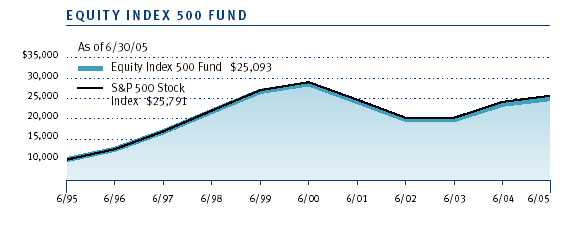

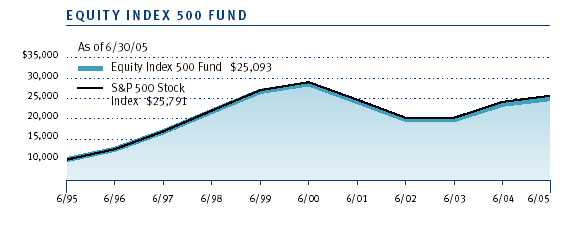

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund and its benchmark would have performed if their actual (or cumulative) returns for the periods shown had been earned at a constant rate.

| Periods Ended 6/30/05 | 1 Year | 5 Years | 10 Years |

| |

| Equity Index 500 Fund | 6.02% | -2.64% | 9.64% |

| |

| S&P 500 Stock Index | 6.32 | -2.37 | 9.94 |

| |

| Current performance may be higher or lower than the quoted past performance, which can- |

| not guarantee future results. Share price, principal value, and return will vary, and you may |

| have a gain or loss when you sell your shares. For the most recent month-end performance |

| information, please visit our Web site (troweprice.com) or contact a T. Rowe Price repre- |

| sentative at 1-800-225-5132. The fund charges a redemption fee of 0.5% on shares held |

| for three months or less. The performance information shown does not reflect the deduc- |

| tion of the redemption fee. If it did, the performance would be lower. | |

| | | |

| Average annual total return figures include changes in principal value, reinvested dividends, and capital |

| gain distributions. Returns do not reflect taxes that the shareholder may pay on fund distributions or the |

| redemption of fund shares. When assessing performance, investors should consider both short- and |

| long-term returns. | | | |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund and its benchmark would have performed if their actual (or cumulative) returns for the periods shown had been earned at a constant rate.

| | | | Since |

| | | | Inception |

| Periods Ended 6/30/05 | 1 Year | 5 Years | 1/30/98 |

| Total Equity Market Index Fund | 8.11% | -1.47% | 4.65% |

| Dow Jones Wilshire 5000 Composite Index | 8.39 | -1.25 | 4.77 |

Dow Jones Wilshire 5000 returns through 6/30/05, calculated as of 7/11/05. | | |

| | | |

| Current performance may be higher or lower than the quoted past performance, which can- |

| not guarantee future results. Share price, principal value, and return will vary, and you may |

| have a gain or loss when you sell your shares. For the most recent month-end performance |

| information, please visit our Web site (troweprice.com) or contact a T. Rowe Price represen- |

| tative at 1-800-225-5132. The fund charges a redemption fee of 0.5% on shares held for |

| three months or less. The performance information shown does not reflect the deduction |

| of the redemption fee. If it did, the performance would be lower. | | |

| | | |

| Average annual total return figures include changes in principal value, reinvested dividends, and capital |

| gain distributions. Returns do not reflect taxes that the shareholder may pay on fund distributions or the |

| redemption of fund shares. When assessing performance, investors should consider both short- and long- |

| term returns. | | | |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund and its benchmark would have performed if their actual (or cumulative) returns for the periods shown had been earned at a constant rate.

| | | | Since |

| | | | Inception |

| Periods Ended 6/30/05 | 1 Year | 5 Years | 1/30/98 |

| Extended Equity Market Index Fund | 14.10% | 1.52% | 6.74% |

| Dow Jones Wilshire 4500 Completion Index | 14.49 | 1.75 | 6.85 |

Dow Jones Wilshire 4500 returns through 6/30/05, calculated as of 7/11/05. | | |

Current performance may be higher or lower than the quoted past performance, which can- |

| not guarantee future results. Share price, principal value, and return will vary, and you may |

| have a gain or loss when you sell your shares. For the most recent month-end performance |

| information, please visit our Web site (troweprice.com) or contact a T. Rowe Price represen- |

| tative at 1-800-225-5132. The fund charges a redemption fee of 0.5% on shares held for |

| three months or less. The performance information shown does not reflect the deduc- |

| tion of the redemption fee. If it did, the performance would be lower. | |

Average annual total return figures include changes in principal value, reinvested dividends, and capital |

| gain distributions. Returns do not reflect taxes that the shareholder may pay on fund distributions or the |

| redemption of fund shares. When assessing performance, investors should consider both short- and long- |

| term returns. | | | |

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs such as redemption fees or sales loads and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and actual expenses. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an account maintenance fee that is not included in the accompanying table. The account maintenance fee is charged on a quarterly basis, usually during the last week of a calendar quarter, and applies to accounts with balances below $10,000 on the day of the assessment. The fee is charged to accounts that fall below $10,000 for any reason, including market fluctuations, redemptions, or exchanges. When an account with less than $10,000 is closed either through redemption or exchange, the fee is charged and deducted from the proceeds. The fee applies to IRA accounts but not to retirement plans directly registered with T. Rowe Price Services or accounts maintained by intermediaries through NSCC® Networking. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

| T. ROWE PRICE EQUITY INDEX 500 FUND |

| |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | 1/1/05 | 6/30/05 | 1/1/05 to 6/30/05 |

| Actual | $1,000.00 | $990.50 | $1.73 |

| Hypothetical (assumes 5% | | | |

| return before expenses) | 1,000.00 | 1,023.06 | 1.76 |

| * Expenses are equal to the fund’s annualized expense ratio for the six-month period (0.35%), multiplied |

| by the average account value over the period, multiplied by the number of days in the most recent fiscal |

| half year (181) divided by the days in the year (365) to reflect the half-year period. |

| |

| |

| T. ROWE PRICE TOTAL EQUITY MARKET INDEX FUND |

| |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | 1/1/05 | 6/30/05 | 1/1/05 to 6/30/05 |

| Actual | $1,000.00 | $999.20 | $1.98 |

| Hypothetical (assumes 5% | | | |

| return before expenses) | 1,000.00 | 1,022.81 | 2.01 |

| * Expenses are equal to the fund’s annualized expense ratio for the six-month period (0.40%), multiplied |

| by the average account value over the period, multiplied by the number of days in the most recent fiscal |

| half year (181) divided by the days in the year (365) to reflect the half-year period. |

| |

| |

| T. ROWE PRICE EXTENDED EQUITY MARKET INDEX FUND |

| |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | 1/1/05 | 6/30/05 | 1/1/05 to 6/30/05 |

| Actual | $1,000.00 | $1,021.10 | $2.00 |

| Hypothetical (assumes 5% | | | |

| return before expenses) | 1,000.00 | 1,022.81 | 2.01 |

| * Expenses are equal to the fund’s annualized expense ratio for the six-month period (0.40%), multiplied |

| by the average account value over the period, multiplied by the number of days in the most recent fiscal |

| half year (181) divided by the days in the year (365) to reflect the half year-period. |

Unaudited

| FINANCIAL HIGHLIGHTS | For a share outstanding throughout each period |

| | | 6 Months | | Year | | | | | | | | |

| | | Ended | | Ended | | | | | | | | |

| | | 6/30/05** | | 12/31/04 | | 12/31/03 | | 12/31/02 | | 12/31/01 | | 12/31/00 |

| NET ASSET VALUE | | | | | | | | | | | | |

| Beginning of period | $ | 13.25 | $ | 11.27 | $ | 7.94 | $ | 9.77 | $ | 11.12 | $ | 14.05 |

|

|

| |

| Investment activities | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | |

| (loss) | | 0.05 | | 0.09 | | 0.07 | | 0.06 | | 0.10 | | 0.09 |

| Net realized and | | | | | | | | | | | | |

| unrealized gain (loss) | | 0.23 | | 1.98 | | 3.33 | | (1.83) | | (1.17) | | (2.26) |

|

|

| Total from investment | | | | | | | | | | | | |

| activities | | 0.28 | | 2.07 | | 3.40 | | (1.77) | | (1.07) | | (2.17) |

|

|

| |

| Distributions | | | | | | | | | | | | |

| Net investment income | | – | | (0.09) | | (0.07) | | (0.06) | | (0.10) | | (0.09) |

| Net realized gain | | – | | – | | – | | – | | (0.18) | | (0.67) |

|

|

| Total distributions | | – | | (0.09) | | (0.07) | | (0.06) | | (0.28) | | (0.76) |

|

|

| |

| NET ASSET VALUE | | | | | | | | | | | | |

| End of period | $ | 13.53 | $ | 13.25 | $ | 11.27 | $ | 7.94 | $ | 9.77 | $ | 11.12 |

|

|

| |

| |

| Ratios/Supplemental Data | | | | | | | | | | |

| Total return^ | | 2.11% | | 18.38% | | 42.85% | (18.12)% | | (9.55)% | (15.58)% |

| Ratio of total expenses to | | | | | | | | | | | | |

| average net assets | | 0.40%† | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% |

| Ratio of net investment | | | | | | | | | | | | |

| income (loss) to average | | | | | | | | | | | | |

| net assets | | 0.81%† | | 0.83% | | 0.89% | | 0.74% | | 0.96% | | 0.78% |

| Portfolio turnover rate | | 7.0%† | | 11.2% | | 8.5% | | 21.0% | | 31.3% | | 30.5% |

| Net assets, end of period | | | | | | | | | | | | |

| (in thousands) | $ | 179,873 | $ | 161,118 | $ | 118,880 | $ | 66,658 | $ | 77,331 | $ | 86,322 |

| ^ | Total return reflects the rate that an investor would have earned on an investment in the fund during each period, |

| | assuming reinvestment of all distributions and payment of no redemption or account fees. |

| ** Per share amounts calculated using average shares outstanding method. |

| † | Annualized |

The accompanying notes are an integral part of these financial statements.

Unaudited

| PORTFOLIO OF INVESTMENTS (1) | Shares/$ Par | Value |

| (Cost and value in $ 000s) | | |

| | | |

| COMMON STOCKS 95.2% | | |

| |

| CONSUMER DISCRETIONARY 17.7% | | |

| Auto Components 0.5% | | |

| Aftermarket Technology * | 1,800 | 31 |

| American Axle & Manufacturing Holdings | 2,200 | 56 |

| Amerigon *§ | 1,200 | 4 |

| Arvinmeritor | 4,025 | 72 |

| Bandag § | 900 | 41 |

| Borg-Warner | 2,400 | 129 |

| Drew Industries *§ | 1,200 | 54 |

| Dura Automotive Systems, Class A *§ | 1,300 | 6 |

| Gentex § | 6,700 | 122 |

| IMPCO Technologies *§ | 1,800 | 9 |

| Keystone Automotive * | 1,200 | 30 |

| Lear | 3,000 | 109 |

| Modine Manufacturing | 1,300 | 42 |

| Noble International § | 1,000 | 24 |

| Sauer-Danfoss § | 2,100 | 37 |

| Sports Resorts International *§ | 4,000 | 3 |

| Standard Motor Products | 1,900 | 25 |

| Superior Industries International § | 1,500 | 36 |

| TRW * | 4,100 | 100 |

| Zapata Corporation * | 3,200 | 20 |

| | | 950 |

| Automobiles 0.1% | | |

| Coachmen Industries | 1,800 | 23 |

| Fleetwood *§ | 3,100 | 31 |

| Monaco Coach § | 1,500 | 26 |

| National RV Holdings * | 1,600 | 13 |

| Thor Industries | 2,800 | 88 |

| Winnebago § | 1,500 | 49 |

| | | 230 |

| Distributors 0.1% | | |

| ACR Group * | 1,400 | 4 |

| Aristotle * | 900 | 6 |

| Building Material Holding | 900 | 62 |

| Design Within Reach *§ | 800 | 15 |

| Educational Development § | 800 | 9 |

| Handleman | 1,900 | 31 |

| Prestige Brands * | 2,500 | 49 |

| Source Information Management *§ | 2,400 | 30 |

| Transnet * | 2,200 | 3 |

| | | 209 |

| Diversified Consumer Services 1.0% | | |

| Bright Horizons Family Solutions * | 1,200 | 49 |

| Career Education * | 4,900 | 179 |

| Carriage Services *§ | 1,600 | 10 |

| Corinthian Colleges *§ | 3,800 | 49 |

| Devry * | 3,200 | 64 |

| Education Management * | 3,100 | 105 |

| EVCI Career Colleges * | 2,300 | 15 |

| Greg Manning Auctions *§ | 2,300 | 27 |

| ITT Educational Services * | 1,900 | 102 |

| Jackson Hewitt Tax Service § | 7,000 | 165 |

| Laureate * | 1,834 | 88 |

| Matthews International, Class A | 1,500 | 58 |

| Prepaid Legal Services § | 1,100 | 49 |

| Regis | 2,200 | 86 |

| Service Corp. International | 14,300 | 115 |

| ServiceMaster | 13,650 | 183 |

| Sotheby's, Class A * | 2,700 | 37 |

| Stewart Enterprises, Class A | 4,000 | 26 |

| Strayer Education | 650 | 56 |

| The Princeton Review *§ | 2,800 | 16 |

| Universal Technical Institute *§ | 1,400 | 46 |

| Weight Watchers *§ | 5,200 | 268 |

| | | 1,793 |

| Hotels, Restaurants & Leisure 3.2% | | |

| Alliance Gaming *§ | 3,000 | 42 |

| Ameristar Casinos | 2,000 | 52 |

| Applebee's | 3,775 | 100 |

| Archon Corporation *§ | 1,100 | 31 |

| Argosy Gaming * | 1,600 | 75 |

| Aztar * | 2,100 | 72 |

| Bally Total Fitness Holdings *§ | 1,500 | 5 |

| Bob Evans Farms | 1,500 | 35 |

| Bowl America, Class A | 300 | 4 |

| Boyd Gaming | 3,900 | 199 |

| Brinker * | 4,350 | 174 |

| BUCA * | 1,100 | 6 |

| California Pizza Kitchen * | 1,500 | 41 |

| CEC Entertainment * | 1,650 | 69 |

| Cedar Fair § | 2,000 | 64 |

| Choice Hotels International | 1,700 | 112 |

| Churchill Downs § | 700 | 30 |

| CKR Restaurants § | 2,850 | 40 |

| Cracker Barrel § | 2,400 | 93 |

| Dave & Buster's *§ | 1,200 | 22 |

| Diamondhead Casino * | 10,500 | 6 |

| Domino's Pizza | 3,200 | 71 |

| Dover Downs Gaming and Entertainment § | 388 | 5 |

| Dover Motorsports § | 4,000 | 24 |

| Empire Resorts *§ | 1,400 | 6 |

| Famous Dave's of America * | 2,600 | 26 |

| Frisch's Restaurants | 800 | 20 |

| Gaming Partners International *§ | 600 | 11 |

| Gaylord Entertainment * | 1,700 | 79 |

| Golf Trust of America, REIT * | 1,900 | 3 |

| Great Wolf Resorts *§ | 2,000 | 41 |

| GTECH | 5,400 | 158 |

| Harrah's Entertainment | 2,985 | 215 |

| IHOP § | 900 | 39 |

| International Speedway, Class A | 2,100 | 118 |

| Isle of Capris Casinos *§ | 1,700 | 45 |

| Jack In The Box * | 1,500 | 57 |

| John Q Hammons Hotels * | 300 | 7 |

| Krispy Kreme *§ | 2,400 | 17 |

| La Quinta Properties * | 9,300 | 87 |

| Landry's Seafood Restaurant § | 1,500 | 45 |

| Las Vegas Sands *§ | 15,600 | 558 |

| Life Time Fitness * | 1,100 | 36 |

| Lone Star Steakhouse & Saloon | 1,300 | 40 |

| Marcus | 1,500 | 32 |

| MGM Mirage * | 12,592 | 498 |

| Mikohn Gaming *§ | 1,200 | 18 |

| MTR Gaming Group * | 2,800 | 33 |

| Multimedia Games *§ | 1,500 | 16 |

| O'Charley's * | 1,300 | 23 |

| Outback Steakhouse | 3,400 | 154 |

| Panera Bread, Class A *§ | 1,500 | 93 |

| Papa John's International *§ | 1,100 | 44 |

| Penn National Gaming * | 3,600 | 131 |

| PF Chang's China Bistro *§ | 1,300 | 77 |

| Pinnacle Entertainment * | 2,300 | 45 |

| Rare Hospitality International * | 1,650 | 50 |

| Red Robin Gourmet Burgers *§ | 700 | 43 |

| Royal Caribbean Cruises § | 8,610 | 416 |

| Ruby Tuesday § | 2,800 | 73 |

| Ryan's Restaurant Group * | 1,700 | 24 |

| Scientific Games, Class A * | 3,000 | 81 |

| Shuffle Master *§ | 2,248 | 63 |

| Six Flags *§ | 5,400 | 25 |

| Sonic * | 2,562 | 78 |

| Speedway Motorsports | 1,800 | 66 |

| Station Casinos | 2,950 | 196 |

| Steak 'N Shake * | 2,000 | 37 |

| Texas Roadhouse, Class A *§ | 2,000 | 69 |

| The Cheesecake Factory * | 3,475 | 121 |

| Triarc, Class B § | 3,300 | 49 |

| Vail Resorts * | 1,500 | 42 |

| WMS Industries *§ | 1,300 | 44 |

| Wyndham International, Class A * | 9,400 | 10 |

| Wynn Resorts *§ | 4,500 | 213 |

| | | 5,844 |

| Household Durables 2.1% | | |

| American Greetings, Class A | 3,000 | 80 |

| Applica * | 1,300 | 4 |

| Beazer Homes § | 1,700 | 97 |

| Blyth Industries | 2,000 | 56 |

| Brillian Corp. *§ | 237 | 1 |

| Brookfield Homes § | 1,200 | 55 |

| Champion Enterprises * | 4,800 | 48 |

| D. R. Horton | 9,317 | 350 |

| Department 56 * | 1,400 | 14 |

| Emerson Radio Corporation *§ | 4,200 | 12 |

| Enesco Group *§ | 1,800 | 5 |

| Ethan Allen Interiors § | 1,500 | 50 |

| Flexsteel Industries | 900 | 13 |

| Foamex International *§ | 1,700 | 2 |

| Furniture Brands International § | 2,600 | 56 |

| Harman International | 2,740 | 223 |

| Helen of Troy Limited * | 900 | 23 |

| Hovnanian Enterprises * | 2,740 | 179 |

| Jarden *§ | 1,250 | 67 |

| Kimball International, Class B § | 2,600 | 34 |

| Knape & Vogt Manufacturing | 1,400 | 17 |

| La-Z-Boy § | 2,600 | 38 |

| Lennar, Class A | 6,728 | 427 |

| Levitt, Class A | 1,475 | 44 |

| Libbey | 1,200 | 19 |

| MDC Holdings | 1,955 | 161 |

| Meritage * | 1,400 | 111 |

| Mohawk Industries * | 3,054 | 252 |

| NVR * | 280 | 227 |

| Oneida *§ | 500 | 1 |

| Palm Harbor Homes *§ | 1,800 | 34 |

| Rockford Corporation * | 2,600 | 10 |

| Russ Berrie | 1,500 | 19 |

| Ryland Group | 2,260 | 171 |

| Skyline | 600 | 24 |

| Standard Pacific | 1,500 | 132 |

| Stanley Furniture | 1,200 | 30 |

| Technical Olympic USA § | 2,687 | 65 |

| Tempur-Pedic *§ | 4,100 | 91 |

| Toll Brothers *§ | 3,400 | 345 |

| Tupperware § | 2,400 | 56 |

| Universal Electronics * | 1,400 | 23 |

| WCI Communities *§ | 2,100 | 67 |

| Yankee Candle Company | 2,200 | 71 |

| | | 3,804 |

| Internet & Catalog Retail 0.6% | | |

| 1-800-Flowers.com * | 3,700 | 26 |

| Alloy Online *§ | 3,200 | 16 |

| Amazon.com *§ | 18,100 | 599 |

| Audible *§ | 1,700 | 30 |

| Blue Nile *§ | 1,400 | 46 |

| Bluefly *§ | 700 | 1 |

| Celebrate Express * | 500 | 7 |

| Coldwater Creek * | 2,268 | 56 |

| Drugstore.com *§ | 5,500 | 23 |

| Ecost *§ | 965 | 4 |

| Global Sports *§ | 3,700 | 62 |

| Hollywood Media *§ | 2,500 | 11 |

| Insight Enterprises * | 1,900 | 38 |

| J. Jill Group *§ | 1,150 | 16 |

| Mediabay *§ | 3,800 | 2 |

| Netflix *§ | 2,900 | 48 |

| Overstock.com *§ | 1,100 | 39 |

| PC Mall *§ | 800 | 4 |

| priceline.com *§ | 2,033 | 47 |

| Sportsman's Guide * | 300 | 6 |

| ValueVision International * | 2,200 | 26 |

| | | 1,107 |

| Leisure Equipment & Products 0.4% | | |

| Action Performance § | 2,300 | 20 |

| Arctic Cat | 1,057 | 22 |

| Callaway Golf | 3,800 | 59 |

| JAKKS Pacific *§ | 1,600 | 31 |

| Johnson Outdoors, Class A * | 700 | 13 |

| K2 * | 1,800 | 23 |

| Leapfrog Enterprises *§ | 2,700 | 30 |

| MarineMax * | 1,000 | 31 |

| Marvel Enterprises *§ | 5,099 | 100 |

| Nature Vision *§ | 600 | 3 |

| Nautilus Group § | 1,737 | 49 |

| Oakley | 3,400 | 58 |

| Polaris Industries § | 2,000 | 108 |

| RC2 Corporation * | 900 | 34 |

| SCP Pool | 1,812 | 63 |

| Steinway Musical Instruments * | 600 | 18 |

| The Boyds Collection *§ | 4,000 | 7 |

| | | 669 |

| Media 5.0% | | |

| 4Kids Entertainment *§ | 1,400 | 28 |

| Acme Communications * | 1,700 | 7 |

| ADVO | 1,550 | 49 |

| Arbitron | 1,600 | 69 |

| Beasley Broadcast Group, Class A *§ | 1,200 | 17 |

| Belo Corporation, Class A | 5,600 | 134 |

| Cablevision Systems, Class A * | 13,360 | 430 |

| Cadmus Communications | 1,500 | 27 |

| Catalina Marketing § | 2,550 | 65 |

| Charter Communications, Class A *§ | 13,400 | 16 |

| Citadel Broadcasting * | 5,500 | 63 |

| Cox Radio, Class A * | 1,800 | 28 |

| Crown Media, Class A *§ | 4,500 | 42 |

| Cumulus Media, Class A * | 2,405 | 28 |

| Daily Journal * | 600 | 23 |

| Dex Media | 6,200 | 151 |

| Digital Generation Systems * | 5,200 | 5 |

| Directv * | 61,879 | 959 |

| Dreamworks Animation, Class A * | 5,000 | 131 |

| EchoStar Communications, Class A | 9,900 | 299 |

| EMAK Worldwide * | 800 | 9 |

| Emmis Communications *§ | 2,600 | 46 |

| Entercom Communications * | 2,500 | 83 |

| Entravision Communications, Class A * | 5,244 | 41 |

| Fisher Communications *§ | 500 | 24 |

| Gemstar TV Guide * | 19,800 | 71 |

| Getty Images * | 2,600 | 193 |

| Harris Interactive * | 4,300 | 21 |

| Harte-Hanks | 3,550 | 106 |

| Hearst-Argyle Television § | 3,191 | 78 |

| Hollinger International § | 4,600 | 46 |

| Insight Communications *§ | 2,900 | 32 |

| Insignia Systems *§ | 700 | 1 |

| Interactive Data | 4,000 | 83 |

| John Wiley & Sons | 2,500 | 99 |

| Journal Communications, Class A | 3,600 | 60 |

| Journal Register * | 2,600 | 46 |

| Lamar Advertising * | 4,500 | 192 |

| Lee Enterprises | 2,100 | 84 |

| Liberty § | 800 | 29 |

| Liberty Global * | 10,880 | 508 |

| Liberty Media, Class A * | 130,875 | 1,334 |

| LIN TV, Class A * | 2,000 | 28 |

| LodgeNet Entertainment * | 1,700 | 28 |

| Martha Stewart Living, Class A *§ | 2,400 | 70 |

| McClatchy | 1,900 | 124 |

| Media General, Class A | 1,000 | 65 |

| Mediacom Communications *§ | 5,500 | 38 |

| Morningstar *§ | 1,700 | 48 |

| Navarre *§ | 2,600 | 21 |

| Nexstar Broadcasting *§ | 1,100 | 7 |

| Paxson Communications * | 6,000 | 4 |

| Penton Media * | 1,700 | 1 |

| Pixar * | 5,200 | 260 |

| Playboy Enterprises, Class B * | 2,500 | 32 |

| Primedia *§ | 10,736 | 43 |

| ProQuest * | 1,300 | 43 |

| R.H. Donnelley * | 1,600 | 99 |

| Radio One *§ | 4,400 | 56 |

| Reader's Digest | 3,900 | 64 |

| Regal Entertainment Group, Class A § | 6,400 | 121 |

| Regent Communications * | 4,000 | 23 |

| Rentrak * | 1,000 | 9 |

| Saga Communications * | 1,150 | 16 |

| Salem Communications, Class A *§ | 1,400 | 28 |

| Scholastic * | 1,600 | 62 |

| Scripps, Class A | 7,340 | 358 |

| Sinclair Broadcasting, Class A | 2,700 | 25 |

| Sirius Satellite Radio *§ | 55,800 | 362 |

| Spanish Broadcasting, Class A * | 2,500 | 25 |

| TiVo *§ | 3,900 | 26 |

| Valassis Communications * | 2,700 | 100 |

| Value Line | 800 | 31 |

| Warner Music Group * | 6,700 | 109 |

| Washington Post, Class B | 450 | 376 |

| Westwood One | 4,100 | 84 |

| World Wrestling | 3,500 | 40 |

| WPT Enterprises *§ | 1,100 | 21 |

| XM Satellite Radio Holdings, Class A *§ | 9,500 | 320 |

| Young Broadcasting *§ | 1,400 | 6 |

| | | 8,930 |

| Multiline Retail 0.4% | | |

| 99 Cents Only Stores *§ | 3,465 | 44 |

| Bon-Ton Stores | 1,200 | 23 |

| Dollar Tree Stores * | 5,225 | 125 |

| Fred's § | 1,525 | 25 |

| Neiman Marcus, Class A | 2,400 | 233 |

| Saks * | 5,675 | 108 |

| Shopko Stores * | 2,000 | 49 |

| Tuesday Morning § | 1,600 | 50 |

| | | 657 |

| Specialty Retail 3.4% | | |

| Aaron Rents | | |

| Class A | 1,575 | 36 |

| Class B | 2,175 | 54 |

| Abercrombie & Fitch | 3,900 | 268 |

| AC Moore Arts & Crafts * | 1,400 | 44 |

| Advance Auto Parts * | 3,512 | 227 |

| Aeropostale * | 2,550 | 86 |

| American Eagle Outfitters | 6,700 | 205 |

| AnnTaylor Stores * | 3,000 | 73 |

| Asbury Automotive Group * | 2,200 | 34 |

| Barnes & Noble * | 3,000 | 116 |

| bebe stores § | 3,375 | 89 |

| Big 5 Sporting Goods | 1,500 | 43 |

| Blockbuster, Class A § | 7,700 | 70 |

| Borders Group | 3,000 | 76 |

| Buckle | 1,200 | 53 |

| Build-A-Bear Workshop *§ | 600 | 14 |

| Burlington Coat Factory | 2,100 | 90 |

| Cabela's, Class A *§ | 2,700 | 58 |

| CarMax * | 4,600 | 123 |

| Cato Corporation, Class A | 2,250 | 46 |

| Charlotte Russe Holding *§ | 1,800 | 22 |

| Charming Shoppes * | 5,200 | 49 |

| Chico's * | 7,800 | 267 |

| Christopher & Banks | 1,812 | 33 |

| Claire's Stores | 3,800 | 91 |

| Cost Plus * | 800 | 20 |

| CSK Auto * | 2,100 | 35 |

| Dick's Sporting Goods *§ | 1,600 | 62 |

| Dress Barn * | 2,000 | 45 |

| E Com *§ | 2,500 | 33 |

| Electronics Boutique Holdings *§ | 1,100 | 70 |

| Finlay Enterprises *§ | 1,100 | 14 |

| Foot Locker | 6,600 | 180 |

| Franklin Covey * | 2,900 | 22 |

| GameStop, Class B * | 2,674 | 80 |

| Genesco * | 1,400 | 52 |

| Group One Automotive * | 1,000 | 24 |

| Guess ? *§ | 2,600 | 43 |

| Guitar Center * | 1,100 | 64 |

| Gymboree * | 600 | 8 |

| Hancock Fabrics § | 1,100 | 7 |

| Haverty Furniture | 1,700 | 25 |

| Hibbett Sporting Goods * | 1,512 | 57 |

| Hot Topic * | 2,450 | 47 |

| Linens 'n Things * | 2,100 | 50 |

| Lithia Motors, Class A § | 1,400 | 40 |

| Men's Wearhouse * | 2,400 | 83 |

| Michaels Stores | 6,100 | 252 |

| Monro Muffler Brake * | 1,000 | 29 |

| Mothers Work *§ | 700 | 9 |

| Movie Gallery | 1,000 | 26 |

| New York & Company * | 2,500 | 53 |

| O'Reilly Automotive * | 4,800 | 143 |

| Pacific Sunwear * | 3,525 | 81 |

| Pantry * | 900 | 35 |

| Party City *§ | 1,900 | 23 |

| Payless Shoesource * | 2,715 | 52 |

| Pep Boys § | 2,400 | 32 |

| Petco * | 2,900 | 85 |

| PETsMART | 6,400 | 194 |

| Pier 1 Imports | 4,000 | 57 |

| Pomeroy Computer Resources *§ | 1,400 | 14 |

| Rent Way *§ | 2,000 | 20 |

| Rent-A-Center * | 3,150 | 73 |

| Restoration Hardware * | 4,100 | 34 |

| Rex Stores * | 750 | 11 |

| Ross Stores | 6,600 | 191 |

| Select Comfort *§ | 2,000 | 43 |

| Sharper Image *§ | 1,600 | 20 |

| Shoe Carnival * | 900 | 20 |

| Sonic Automotive | 1,600 | 34 |

| Stage Stores * | 1,000 | 44 |

| Stein Mart | 2,400 | 53 |

| Syms § | 1,400 | 21 |

| Talbots | 2,400 | 78 |

| TBC Corp. * | 1,100 | 30 |

| The Children's Place *§ | 1,100 | 51 |

| The Finish Line, Class A | 2,200 | 42 |

| The Sports Authority *§ | 1,396 | 44 |

| Too * | 1,600 | 37 |

| Trans World Entertainment * | 4,200 | 50 |

| TSC *§ | 1,800 | 88 |

| Tweeter Home Entertainment Group *§ | 2,600 | 6 |

| Ultimate Electronics * | 1,000 | 0 |

| United Auto Group | 1,800 | 54 |

| United Retail Group * | 1,000 | 8 |

| Urban Outfitters * | 3,700 | 210 |

| West Marine *§ | 1,400 | 25 |

| Wet Seal, Class A *§ | 1,875 | 13 |

| Whitehall Jewellers *§ | 1,200 | 8 |

| Williams-Sonoma * | 5,300 | 210 |

| Wilsons Leather *§ | 1,900 | 13 |

| Winmark * | 900 | 18 |

| Zale * | 2,400 | 76 |

| | | 6,038 |

| Textiles, Apparel, & Luxury Goods 0.9% | | |

| Brown Shoe | 1,100 | 43 |

| Carters * | 1,300 | 76 |

| Charles & Colvard § | 1,575 | 39 |

| Cherokee | 900 | 31 |

| Columbia Sportswear *§ | 1,850 | 91 |

| Culp *§ | 1,600 | 7 |

| Cutter & Buck | 1,500 | 19 |

| Forward Industries *§ | 1,900 | 30 |

| Fossil * | 3,387 | 77 |

| Giant * | 6 | 3 |

| Haggar | 1,000 | 20 |

| Iconix Brand Group *§ | 1,300 | 9 |

| K-Swiss, Class A | 2,000 | 65 |

| Kellwood § | 1,400 | 38 |

| Kenneth Cole Productions | 1,400 | 44 |

| Lazare Kaplan International * | 1,600 | 16 |

| Madden Steven * | 1,600 | 28 |

| Mossimo *§ | 3,300 | 15 |

| Movado Group | 2,000 | 38 |

| Movie Star * | 2,500 | 2 |

| Oshkosh B'Gosh, Class A | 1,100 | 29 |

| Phillips-Van Heusen | 1,900 | 62 |

| Polo Ralph Lauren | 4,300 | 185 |

| Quaker Fabric § | 1,900 | 8 |

| Quiksilver * | 6,200 | 99 |

| Russell | 1,400 | 29 |

| Saucony, Class B | 1,200 | 27 |

| Stride Rite | 2,800 | 39 |

| Superior Uniform Group § | 1,200 | 17 |

| Tandy Brands § | 1,400 | 15 |

| Tarrant Apparel *§ | 2,400 | 7 |

| Timberland, Class A * | 3,200 | 124 |

| Unifi * | 6,200 | 26 |

| UniFirst | 900 | 36 |

| Warnaco Group * | 2,100 | 49 |

| Weyco Group | 1,000 | 20 |

| Wolverine World Wide | 2,700 | 65 |

| | | 1,528 |

| Total Consumer Discretionary | | 31,759 |

| |

| CONSUMER STAPLES 4.7% | | |

| Beverages 0.3% | | |

| Coca-Cola Bottling | 500 | 25 |

| Constellation Brands, Class A * | 10,000 | 295 |

| Hansen Natural *§ | 200 | 17 |

| Midwest Grain Products § | 1,800 | 15 |

| National Beverage * | 1,900 | 15 |

| PepsiAmericas | 6,700 | 172 |

| Willamette Valley Vineyards *§ | 4,200 | 17 |

| | | 556 |

| Food & Staples Retailing 0.7% | | |

| 7-Eleven * | 5,100 | 154 |

| Arden Group, Class A § | 200 | 16 |

| BJ's Wholesale Club * | 3,100 | 101 |

| Casey's General Stores | 2,200 | 44 |

| Fresh Brands * | 800 | 5 |

| Great Atlantic & Pacific Tea *§ | 3,600 | 105 |

| Longs Drug Stores | 1,600 | 69 |

| Marsh Supermarkets § | 1,500 | 21 |

| Nash Finch § | 900 | 33 |

| Pathmark Stores * | 1,100 | 10 |

| Performance Food Group * | 1,900 | 57 |

| PriceSmart *§ | 1,500 | 13 |

| Rite Aid *§ | 23,300 | 97 |

| Ruddick | 2,200 | 56 |

| Smart & Final *§ | 1,800 | 22 |

| United Natural Foods * | 1,800 | 55 |

| Weis Markets § | 1,000 | 39 |

| Whole Foods Market | 2,700 | 319 |

| Wild Oats Markets *§ | 2,000 | 23 |

| | | 1,239 |

| Food Products 2.9% | | |

| Alico § | 600 | 31 |

| American Italian Pasta, Class A § | 1,200 | 25 |

| Bridgford Foods *§ | 1,000 | 8 |

| Bunge Limited § | 4,800 | 304 |

| Chiquita § | 1,700 | 47 |

| Corn Products International | 3,300 | 78 |

| Cuisine Solutions * | 4,500 | 27 |

| Dean Foods * | 7,158 | 252 |

| Del Monte Foods * | 9,200 | 99 |

| Delta Pine & Land | 1,900 | 48 |

| Dreyer's Grand Ice Cream § | 4,000 | 326 |

| Farmer Bros. § | 1,200 | 27 |

| Flowers Foods | 1,710 | 60 |

| Fresh Del Monte Produce § | 2,700 | 73 |

| Gold Kist *§ | 1,700 | 37 |

| Green Mountain Coffee *§ | 800 | 27 |

| Hain Celestial Group * | 1,900 | 37 |

| Hormel Foods | 5,700 | 167 |

| J & J Snack Foods | 700 | 37 |

| J.M. Smucker § | 2,436 | 114 |

| Kraft Foods, Class A | 76,400 | 2,430 |

| Lancaster Colony | 1,400 | 60 |

| Lance | 1,100 | 19 |

| Lifeway Foods *§ | 1,800 | 22 |

| Maui Land & Pineapple *§ | 600 | 23 |

| Peet's Coffee & Tea *§ | 1,100 | 36 |

| Pilgrim's Pride § | 3,000 | 102 |

| Ralcorp Holdings | 1,000 | 41 |

| Rocky Mountain Chocolate Factory § | 3,390 | 75 |

| Sanderson Farms § | 1,050 | 48 |

| Seaboard | 50 | 83 |

| Smithfield Foods * | 5,200 | 142 |

| Tootsie Roll Industries § | 2,052 | 60 |

| Treehouse Foods * | 1,431 | 41 |

| Tyson Foods, Class A | 15,119 | 269 |

| | | 5,275 |

| Household Products 0.3% | | |

| Central Garden & Pet * | 1,200 | 59 |

| Church & Dwight | 2,950 | 107 |

| Energizer * | 3,400 | 211 |

| Katy Industries * | 1,700 | 5 |

| Oil-Dri | 1,800 | 33 |

| Spectrum Brands * | 2,200 | 73 |

| | | 488 |

| Personal Products 0.4% | | |

| Chattem * | 1,300 | 54 |

| Elizabeth Arden *§ | 1,600 | 38 |

| Estee Lauder, Class A | 6,000 | 235 |

| Inter Parfums § | 1,400 | 27 |

| NBTY * | 3,100 | 80 |

| Nu Skin Asia Pacific, Class A | 2,900 | 68 |

| Playtex Products * | 4,400 | 47 |

| Reliv International § | 2,300 | 24 |

| Revlon, Class A *§ | 15,600 | 48 |

| | | 621 |

| Tobacco 0.1% | | |

| Alliance One International | 4,600 | 28 |

| Carolina Group | 3,100 | 103 |

| Star Scientific *§ | 3,400 | 15 |

| Universal Corporation | 1,100 | 48 |

| Vector Group § | 2,110 | 39 |

| | | 233 |

| Total Consumer Staples | | 8,412 |

| |

| ENERGY 6.6% | | |

| Energy Equipment & Services 2.3% | | |

| Atwood Oceanics * | 700 | 43 |

| Cal Dive International * | 1,700 | 89 |

| Carbo Ceramics | 700 | 55 |

| Cooper Cameron * | 2,400 | 149 |

| Dawson Geophysical * | 200 | 4 |

| Diamond Offshore Drilling § | 5,800 | 310 |

| Dril-Quip * | 1,400 | 41 |

| ENSCO International | 7,000 | 250 |

| FMC Technologies * | 3,000 | 96 |

| Global Industries * | 4,200 | 36 |

| GlobalSantaFe | 10,359 | 423 |

| Grant Prideco * | 5,390 | 143 |

| Grey Wolf *§ | 8,200 | 61 |

| Gulf Island Fabrication § | 1,100 | 22 |

| Gulfmark Offshore *§ | 1,600 | 44 |

| Hanover Compressor *§ | 4,200 | 48 |

| Helmerich & Payne | 2,300 | 108 |

| Hydril * | 1,000 | 54 |

| Input/Output *§ | 3,800 | 24 |

| Lone Star Technologies * | 1,310 | 60 |

| Matrix Service *§ | 2,200 | 10 |

| Maverick Tube *§ | 1,900 | 57 |

| NATCO Group, Class A * | 1,900 | 25 |

| Newpark Resources * | 5,100 | 38 |

| NS Group *§ | 2,000 | 65 |

| Oceaneering International * | 1,300 | 50 |

| Offshore Logistics * | 1,100 | 36 |

| Oil States International * | 2,300 | 58 |

| Omni Energy Services *§ | 1,900 | 4 |

| Parker Drilling * | 6,500 | 46 |

| Patterson-UTI Energy | 7,800 | 217 |

| Petroleum Helicopters * | 300 | 7 |

| Pride International * | 6,000 | 154 |

| Seacor Holdings * | 900 | 58 |

| Smith International | 4,700 | 299 |

| Superior Energy * | 3,600 | 64 |

| TETRA Technologies * | 1,350 | 43 |

| Tidewater | 2,600 | 99 |

| Todco, Class A * | 3,100 | 80 |

| Unit * | 2,100 | 92 |

| Universal Compression Holdings * | 1,500 | 54 |

| Veritas DGC * | 1,700 | 47 |

| W-H Energy Services * | 1,400 | 35 |

| Weatherford International * | 5,890 | 341 |

| | | 4,039 |

| Oil, Gas & Consumable Fuels 4.3% | | |

| Adams Resources & Energy § | 2,300 | 46 |

| Alliance Resource Partners *§ | 800 | 59 |

| Alpha Natural Resources * | 2,800 | 67 |

| Arch Coal § | 2,600 | 142 |

| Berry Petroleum § | 1,000 | 53 |

| Bill Barrett *§ | 2,100 | 62 |

| BP Prudhoe Bay Royalty Trust § | 1,300 | 93 |

| Buckeye Partners, Equity Units *§ | 1,800 | 83 |

| Cabot Oil & Gas | 3,300 | 114 |

| Callon Petroleum *§ | 1,600 | 24 |

| Carrizo Oil & Gas *§ | 2,300 | 39 |

| Castle Energy | 1,400 | 17 |

| Chesapeake Energy | 14,000 | 319 |

| Cimarex Energy *§ | 3,783 | 147 |

| Comstock Resources * | 1,600 | 40 |

| CONSOL Energy | 4,400 | 236 |

| Copano Energy | 700 | 26 |

| Cross Timbers Royalty Trust § | 953 | 39 |

| Denbury Resources * | 2,000 | 79 |

| Edge Petroleum * | 2,000 | 31 |

| Encore Acquisition * | 1,100 | 45 |

| Energy Partners * | 1,800 | 47 |

| Enterprise Products Partners, Equity Units *§ | 16,600 | 445 |

| Forest Oil * | 2,500 | 105 |

| Foundation Coal Holdings § | 1,900 | 49 |

| Frontier Oil | 3,200 | 94 |

| General Maritime § | 1,700 | 72 |

| Georesources *§ | 3,100 | 40 |

| Giant Industries * | 1,900 | 68 |

| GMX Resources *§ | 2,300 | 33 |

| Harken Energy * | 8,500 | 4 |

| Houston Exploration * | 1,200 | 64 |

| Hugoton Royalty Trust § | 2,200 | 67 |

| Kaneb Services *§ | 900 | 39 |

| KCS Energy *§ | 4,300 | 75 |

| KFX *§ | 3,000 | 43 |

| Kinder Morgan Management | 2,715 | 125 |

| Magellan Midstream Partners § | 2,800 | 92 |

| Magellan Petroleum *§ | 5,100 | 12 |

| Maritrans § | 1,100 | 30 |

| Markwest Hydrocarbon | 2,585 | 60 |

| Massey | 3,700 | 140 |

| Meridian Resource * | 5,300 | 25 |

| Murphy Oil | 8,520 | 445 |

| Newfield Exploration * | 6,400 | 255 |

| Noble Energy | 3,800 | 287 |

| OMI § | 3,900 | 74 |

| Peabody Energy | 5,600 | 291 |

| Penn Virginia | 800 | 36 |

| Petrohawk Energy *§ | 1,850 | 20 |

| Petroleum Development *§ | 1,400 | 45 |

| Pioneer Natural Resources | 6,600 | 278 |

| Plains All American Pipeline *§ | 3,000 | 132 |

| Plains Exploration & Production * | 3,806 | 135 |

| Pogo Producing | 2,800 | 145 |

| Premcor | 4,100 | 304 |

| Pyr Energy *§ | 7,400 | 11 |

| Quicksilver Resources *§ | 2,800 | 179 |

| Range Resources | 3,700 | 99 |

| Remington Oil & Gas * | 1,700 | 61 |

| Southwestern Energy * | 3,000 | 141 |

| Spinnaker Exploration * | 1,500 | 53 |

| St. Mary Land Exploration | 5,300 | 154 |

| Stone Energy * | 1,300 | 64 |

| Swift Energy * | 1,900 | 68 |

| Syntroleum *§ | 4,900 | 50 |

| TC Pipelines * | 1,200 | 40 |

| Tel Offshore Trust § | 61 | 1 |

| Teppco Partners *§ | 3,000 | 124 |

| Tesoro Petroleum | 3,100 | 144 |

| TransMontaigne *§ | 3,600 | 38 |

| Ultra Petroleum * | 7,200 | 219 |

| USEC | 4,200 | 61 |

| Vintage Petroleum | 2,600 | 79 |

| W&T Offshore | 2,900 | 70 |

| Western Gas Resources | 3,200 | 112 |

| Westmoreland Coal *§ | 1,200 | 25 |

| Whiting Petroleum * | 800 | 29 |

| World Fuel Services | 1,600 | 37 |

| | | 7,796 |

| Total Energy | | 11,835 |

| |

| FINANCIALS 23.6% | | |

| Capital Markets 1.5% | | |

| A.G. Edwards | 3,800 | 172 |

| Aether Systems *§ | 5,700 | 19 |

| Affiliated Managers Group *§ | 1,500 | 103 |

| AmeriTrade * | 19,600 | 364 |

| Blackrock § | 900 | 72 |

| Calamos, Class A | 1,300 | 35 |

| Cohen & Steers § | 800 | 16 |

| Eaton Vance | 6,700 | 160 |

| Gabelli Asset Management § | 1,700 | 75 |

| GFI Group *§ | 1,200 | 43 |

| Greenhill § | 1,800 | 73 |

| International Assets *§ | 1,100 | 7 |

| Investment Technology Group * | 2,750 | 58 |

| Investors Financial Services | 3,300 | 125 |

| Jefferies Group | 2,900 | 110 |

| John Nuveen § | 4,200 | 158 |

| Knight Capital Group *§ | 4,600 | 35 |

| LaBranche & Co. *§ | 2,600 | 16 |

| Ladenburg Thalmann Financial Services * | 506 | 0 |

| Legg Mason | 4,600 | 479 |

| National Financial Partners | 1,700 | 67 |

| optionsXpress Holdings § | 2,700 | 41 |

| Piper Jaffray * | 1,000 | 30 |

| Raymond James Financial | 3,250 | 92 |

| Sanders Morris Harris Group § | 2,600 | 45 |

| SEI | 4,900 | 183 |

| Southwest Securities | 1,283 | 22 |

| Waddell & Reed Financial, Class A | 4,450 | 82 |

| Westwood Holdings Group | 620 | 11 |

| | | 2,693 |

| Commercial Banks 4.7% | | |

| 1st Source | 1,641 | 38 |

| Abigail Adams § | 220 | 4 |

| Alabama National Bancorp § | 800 | 52 |

| Amcore Financial | 1,600 | 48 |

| Amegy Bancorp | 3,100 | 69 |

| Arrow Financial § | 1,059 | 30 |

| Associated Banc Corp. | 5,654 | 190 |

| BanCorpSouth § | 3,625 | 86 |

| BancTrust Financial Group § | 1,200 | 23 |

| Bank of Hawaii | 2,600 | 132 |

| Banner § | 1,160 | 33 |

| Bay View Capital | 480 | 7 |

| BNCCORP * | 300 | 4 |

| BOK Financial | 2,936 | 135 |

| Boston Private Financial § | 1,459 | 37 |

| BWC Financial § | 1,127 | 29 |

| Camden National | 900 | 30 |

| Capital Corp. of the West § | 1,207 | 34 |

| Cathay Bancorp § | 2,674 | 90 |

| Center Bancorp § | 1,018 | 12 |

| Central Pacific Financial | 1,273 | 45 |

| Century Bancorp, Class A § | 600 | 18 |

| Chemical Financial | 1,116 | 37 |

| Chittenden | 2,312 | 63 |

| Citizens Banking § | 2,000 | 60 |

| City Holding Company § | 900 | 33 |

| City National | 2,400 | 172 |

| CoBiz § | 1,650 | 30 |

| Codorus VY Bancorp § | 441 | 8 |

| Colonial BancGroup | 6,200 | 137 |

| Commerce Bancorp § | 7,300 | 221 |

| Commerce Bancshares § | 3,111 | 157 |

| Community Banks § | 1,044 | 27 |

| Community Bankshares of Indiana | 1,210 | 28 |

| Cullen/Frost Bankers | 2,200 | 105 |

| CVB Financial § | 3,345 | 66 |

| East West Bancorp | 2,600 | 87 |

| Farmers Capital Bank § | 700 | 24 |

| First Charter § | 1,700 | 37 |

| First Citizens Bancshares | 450 | 65 |

| First Commonwealth Financial § | 3,600 | 49 |

| First Community Bancorp | 1,000 | 48 |

| First Financial Bancorp § | 2,402 | 45 |

| First Financial Bankshares § | 1,216 | 41 |

| First Indiana | 1,408 | 42 |

| First M & F Corporation § | 700 | 24 |

| First Merchants § | 1,283 | 32 |

| First Midwest Bancorp | 2,056 | 72 |

| First of Long Island | 450 | 19 |

| First Republic Bank | 1,475 | 52 |

| First United | 800 | 16 |

| FirstBank Puerto Rico § | 2,200 | 88 |

| FirstMerit | 4,100 | 107 |

| FNB § | 1,836 | 36 |

| FNB Corp. of North Carolina § | 700 | 14 |

| Frontier Financial § | 1,800 | 45 |

| Fulton Financial § | 7,210 | 130 |

| German American Bancorp § | 1,589 | 22 |

| Glacier Bancorp | 2,015 | 53 |

| Gold Banc | 2,000 | 29 |

| Greater Bay Bancorp § | 2,406 | 63 |

| Greater Community Bancorp § | 1,050 | 17 |

| Hancock Holding | 1,500 | 52 |

| Harleysville National § | 1,841 | 43 |

| Hibernia, Class A | 7,000 | 232 |

| Hudson United Bancorp | 2,056 | 74 |

| IBERIABANK § | 600 | 37 |

| Independent Bank | 1,100 | 31 |

| Integra Bank § | 1,300 | 29 |

| Interchange Financial Services § | 1,800 | 33 |

| International Bancshares | 2,597 | 73 |

| Irwin Financial § | 1,500 | 33 |

| Main Street Banks § | 1,400 | 36 |

| MB Financial | 1,400 | 56 |

| Mercantile Bankshares | 3,500 | 180 |

| Mid-State Bancshares | 1,100 | 31 |

| Midsouth Bancorp § | 1,237 | 30 |

| Midwest Banc Holdings § | 1,400 | 27 |

| MidWestOne Financial | 1,000 | 19 |

| National Penn Bancshares § | 2,183 | 55 |

| NBT Bancorp | 2,080 | 49 |

| Northern States Financial | 700 | 19 |

| Northrim Bank | 900 | 21 |

| Old National Bancorp § | 3,322 | 71 |

| Omega Financial § | 1,000 | 31 |

| Oriental Financial Group § | 1,439 | 22 |

| Pacific Capital Bancorp | 2,488 | 92 |

| Park National § | 756 | 84 |

| Popular | 12,200 | 307 |

| PrivateBancorp § | 1,400 | 50 |

| Prosperity Bancshares | 1,500 | 43 |

| Provident Bankshares | 1,551 | 50 |

| Renasant § | 900 | 28 |

| Republic Bancorp | 3,955 | 59 |

| S&T Bancorp § | 1,300 | 47 |

| Sandy Spring Bancorp § | 1,100 | 39 |

| Santander Bancorp § | 1,875 | 47 |

| Signature Bank * | 1,200 | 29 |

| Sky Financial § | 4,714 | 133 |

| South Financial Group | 3,054 | 87 |

| Southwest Bancorp of Oklahoma | 1,300 | 27 |

| State Bancorp § | 1,126 | 25 |

| Sterling Bancshares | 2,850 | 44 |

| Sterling Financial § | 1,991 | 42 |

| Suffolk Bancorp § | 1,000 | 32 |

| Summit Bancshares § | 1,400 | 24 |

| Susquehanna Bancshares | 2,050 | 50 |

| SVB Financial Group *§ | 1,500 | 72 |

| SY Bancorp § | 1,100 | 25 |

| TCF Financial | 6,400 | 166 |

| TD Banknorth | 8,090 | 241 |

| Texas Capital Bancshares *§ | 1,800 | 36 |

| Texas Regional Bancshares, Class A | 2,491 | 76 |

| The Savannah Bancorp § | 925 | 28 |

| Trustco Bank § | 3,700 | 48 |

| Trustmark § | 2,300 | 67 |

| U.S.B. Holding Company § | 1,535 | 36 |

| UCBH Holdings § | 4,400 | 71 |

| UMB Financial | 756 | 43 |

| Umpqua Holdings Corporation § | 1,900 | 45 |

| Union Bankshares | 753 | 29 |

| UnionBancal | 6,700 | 448 |

| United Bankshares | 2,400 | 85 |

| United Community Banks § | 1,950 | 51 |

| Unizan Financial | 1,076 | 29 |

| Valley National Bancorp | 4,961 | 116 |

| WesBanco § | 1,300 | 39 |

| West Coast Bancorp § | 1,220 | 30 |

| WestAmerica | 1,546 | 82 |

| Westbank | 882 | 14 |

| Westcorp | 2,600 | 136 |

| Whitney Holding | 2,400 | 78 |

| Wilmington Trust | 2,800 | 101 |

| Wintrust Financial | 1,200 | 63 |

| | | 8,425 |

| Consumer Finance 0.6% | | |

| Advance America Cash Advance Centers § | 4,400 | 70 |

| Advanta, Class A | 1,466 | 38 |

| AmeriCredit * | 7,300 | 186 |

| Asta Funding § | 1,200 | 33 |

| Cash America Investments | 1,600 | 32 |

| CompuCredit *§ | 2,400 | 82 |

| First Cash * | 1,800 | 39 |

| First Marblehead *§ | 2,900 | 102 |

| Metris Companies *§ | 4,050 | 59 |

| Moneygram International | 3,900 | 75 |

| Nelnet, Class A * | 2,600 | 87 |

| QC Holdings *§ | 300 | 4 |

| Student Loan | 1,020 | 224 |

| WFS Financial | 1,800 | 91 |

| World Acceptance * | 1,500 | 45 |

| | | 1,167 |

| Diversified Financial Services 0.7% | | |

| Alliance Capital | 3,600 | 168 |

| California First National Bancorp § | 500 | 6 |

| CapitalSource *§ | 4,900 | 96 |

| Chicago Mercantile Exchange Holdings | 1,500 | 443 |

| Encore Capital *§ | 2,100 | 36 |

| eSpeed, Class A *§ | 2,200 | 20 |

| Financial Federal | 700 | 27 |

| Instinet Group * | 14,400 | 75 |

| International Securities Exchange *§ | 1,600 | 40 |

| Leucadia National § | 6,754 | 261 |

| Nasdaq Stock Market *§ | 3,500 | 66 |

| Transnational Financial Network * | 3,400 | 2 |

| | | 1,240�� |

| Insurance 6.9% | | |

| 21st Century Insurance Group | 3,400 | 50 |

| Alfa § | 3,700 | 54 |

| Allmerica Financial * | 2,300 | 85 |

| American Financial Group | 3,100 | 104 |

| American National Insurance | 1,050 | 120 |

| AmerUs Life § | 1,900 | 91 |

| Arch Capital Group * | 1,800 | 81 |

| Argonaut Group *§ | 1,900 | 44 |

| Arthur J. Gallagher § | 4,600 | 125 |

| Assurant | 5,900 | 213 |

| Baldwin & Lyons | 1,175 | 28 |

| BancInsurance *§ | 2,310 | 12 |

| Berkshire Hathaway, Class A * | 70 | 5,845 |

| Bristol West Holdings | 2,200 | 40 |

| Brown & Brown | 2,700 | 121 |

| Citizens § | 4,050 | 25 |

| Clark § | 1,300 | 19 |

| CNA Financial *§ | 11,500 | 327 |

| CNA Surety * | 2,400 | 36 |

| Commerce Group | 1,300 | 81 |

| Conseco * | 6,100 | 133 |

| Danielson *§ | 9,500 | 116 |

| Delphi Financial, Class A | 1,606 | 71 |

| Erie Indemnity, Class A § | 3,000 | 163 |

| FBL Financial Group, Class A § | 1,732 | 48 |

| Fidelity National Financial | 7,850 | 280 |

| Financial Industries Corporation *§ | 800 | 6 |

| First American Financial | 4,100 | 165 |

| FPIC Insurance Group *§ | 900 | 26 |

| Genworth Financial, Class A | 21,300 | 644 |

| Great American Financial Resources § | 3,000 | 59 |

| Harleysville Group | 1,800 | 38 |

| HCC Insurance Holdings | 2,500 | 95 |

| Hilb Rogal and Hobbs § | 1,500 | 52 |

| Horace Mann Educators | 2,400 | 45 |

| Infinity Property & Casualty | 1,300 | 45 |

| Kansas City Life Insurance § | 800 | 38 |

| LandAmerica Financial Group | 800 | 48 |

| Markel *§ | 480 | 163 |

| Merchants Group | 600 | 15 |

| Mercury General | 2,600 | 142 |

| Midland | 1,200 | 42 |

| Nationwide Financial Services, Class A | 2,700 | 102 |

| Navigators Group * | 1,000 | 35 |

| Odyssey Re Holdings § | 3,000 | 74 |

| Ohio Casualty | 3,400 | 82 |

| Old Republic International | 7,525 | 190 |

| Philadelphia Consolidated * | 1,000 | 85 |

| Phoenix Companies § | 4,000 | 48 |

| PMA Capital, Class A *§ | 3,200 | 28 |

| Presidential Life § | 2,200 | 38 |

| ProAssurance * | 1,320 | 55 |

| Protective Life | 3,000 | 127 |

| Reinsurance Group of America | 2,850 | 133 |

| RLI | 1,100 | 49 |

| Selective Insurance | 1,300 | 64 |

| StanCorp Financial Group | 1,400 | 107 |

| Standard Management * | 1,400 | 3 |

| State Auto Financial | 1,800 | 56 |

| Stewart Information Services | 900 | 38 |

| Transatlantic Holdings § | 2,981 | 166 |

| U.S.I. Holdings * | 1,900 | 24 |

| UICI | 2,300 | 68 |

| United America Indemnity * | 1,512 | 26 |

| United Fire & Casualty | 1,400 | 62 |

| Unitrin | 3,100 | 152 |

| Universal American Financial * | 3,100 | 70 |

| Vesta Insurance § | 3,100 | 8 |

| W. R. Berkley | 5,712 | 204 |

| Wesco Financial | 330 | 119 |

| White Mountains Insurance Group § | 480 | 303 |

| Zenith National | 900 | 61 |

| | | 12,512 |

| Real Estate 6.9% | | |

| Agree Realty, REIT § | 800 | 24 |

| Alexanders, REIT *§ | 250 | 62 |

| Alexandria Real Estate, REIT | 800 | 59 |

| AMB Property, REIT | 4,000 | 174 |

| American Financial Realty, REIT | 5,100 | 78 |

| American Home Mortgage Holdings, REIT | 2,195 | 77 |

| American Mortgage Acceptance, REIT § | 1,500 | 23 |

| American Real Estate *§ | 2,300 | 67 |

| AmeriVest Properties, REIT | 3,000 | 13 |

| Amli Residential Properties, REIT § | 1,500 | 47 |

| Annaly Mortgage Management, REIT § | 5,400 | 97 |

| Anthracite Capital, REIT § | 3,400 | 40 |

| Arden Realty, REIT | 3,100 | 112 |

| Avalonbay Communities, REIT | 3,084 | 249 |

| Bedford Property Investors, REIT § | 1,300 | 30 |

| BioMed Realty Trust, REIT | 1,700 | 41 |

| BNP Residential Properties, REIT | 1,100 | 18 |

| Boston Properties, REIT | 4,900 | 343 |

| Brandywine Realty Trust, REIT | 2,400 | 74 |

| BRE Properties, REIT, Class A | 2,300 | 96 |

| Camden Property Trust, REIT | 2,300 | 124 |

| Capital Automotive, REIT | 1,700 | 65 |

| Capital Properties | | |

| Class A § | 1,200 | 28 |

| Class B * | 120 | 0 |

| CarrAmerica Realty, REIT | 2,400 | 87 |

| Catellus Development, REIT | 4,403 | 144 |

| CB Richard Ellis Group, Class A * | 3,500 | 154 |

| CBL & Associates Properties, REIT | 3,000 | 129 |

| Centerpoint Properties, REIT | 2,000 | 85 |