Exhibit 99.1

Form NI 43-101F1 Technical Report Minnesota, USA Zachary J. Black, Jennifer J. Brown, Nicholas Dempers, Thomas L. Drielick, Art S. Ibrado, Erin L. Patterson, Thomas J. Radue, Jeff S. Ubl and Herbert E. Welhener Prepared For:

NorthMet Project

Form NI 43-101F1 Technical Report

DATE AND SIGNATURES PAGE

This report is effective as of March 26, 2018. The Technical Report Contributors’ Professional Qualifications and certificates are attached as Appendix A. These certificates are considered the date and signature of this report in accordance with Form NI 43-101F1.

| M3-PN150164 26 March 2018 |

i

NorthMet Project

Form NI 43-101F1 Technical Report

Note: This Report contains “forward-looking statements”. Within the meaning of applicable Canadian securities legislation and Section 27A of the United States Securities Act of 1933 and Section 21E of the United States Securities Exchange Act of 1934, forward-looking statements are not, and cannot be, a guarantee of future results or events. Forward looking statements are based on, among other things, opinions, assumptions, estimates and analyses that are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking statement. All statements in this Report that address events or developments that PolyMet expects to occur in the future are forward-looking statements and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. These forward-looking statements include, but are not limited to, PolyMet’s objectives, strategies, intentions, expectations, production, costs, capital and exploration expenditures, including an estimated economics of future financial and operating performance and prospects for the possible expansion of the operation based on a PEA-level study and a ramp-up evaluation representing production growth and improved margins mine, life projections, recovery rate and concentrate grade projections, ability to obtain all necessary environmental and government approvals to completion and if undertaking an expansion case, ability to obtain at all, the viability and all information with respect to the ability to develop the Project to additional potential by mining additional resources beyond the permit design at a higher production rate. Prior to any decision to apply for permits to develop the project further, PolyMet would need to complete preliminary and definitive feasibility studies, as well as an analysis of the environmental impact and alternatives of any proposal. In addition, any future proposal would be subject to environmental review and permits, public notice and comment, and approval by appropriate federal and state Agencies. All forward-looking statements in this Report are qualified by this cautionary note.

The material factors or assumptions that PolyMet has identified and were applied by PolyMet in drawing the conclusions or making forecasts or projections set in the forward-looking statements include, but are not limited to:

| · | various economic assumptions, in particular, metal price estimates, set out in Section 22 of this Report and elsewhere; |

| · | certain operational assumptions set out in the Report, including mill recovery, operating scenarios; |

| · | construction schedules and timing issues; and |

| · | assumptions concerning timing and certainty regarding the environmental review and permitting process. |

The risks, uncertainties, contingencies and other factors that may cause actual results and events to differ materially from those expressed or implied by the forward-looking statement may include, but are not limited to, risks generally associated with the mining industry, such as: economic factors (including future commodity prices, currency fluctuations, inflation rates, energy prices and general cost escalation); uncertainties related to the development of the NorthMet Project; dependence on key personnel and employee relations; risks relating to political and social unrest or change, operational risk and hazards, including unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks; failure of plant, equipment, processes, transposition and other infrastructure to operate as anticipated; compliance with governmental and environmental regulations, including permitting requirements; etc., as well as other factors identified and as described in more detail under the heading “Risk Factors” in PolyMet’s most recent Annual Information Form, which may be viewed on www.sedar.com and sec.gov. The list is not exhaustive of the factors that may affect the forward-looking statements. There can be no assurance that such statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what benefits or liabilities PolyMet will derive therefrom. The forward-looking statements reflect the current expectations regarding future events and operating performance and speak only as of the date hereof and PolyMet does not assume any obligation to update the forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change other than as required by applicable law. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.

| M3-PN150164 26 March 2018 |

ii

NorthMet Project

Form NI 43-101F1 Technical Report

Cautionary Note to U.S. Investors – Information Concerning Preparation of Resource Estimates

This Report has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States Securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ materially from the definitions in the United States Securities and Exchange Commission’s (“SEC”) Industry Guide 7 under the United States Securities Act of 1933, as amended. Under SEC Industry Guide 7 standards, mineralization cannot be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally extracted at the time the reserve determination is made. As applied under SEC Industry Guide 7, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into SEC Industry Guide 7 reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained metal” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information concerning mineral deposits contained in this Report may not be comparable to similar information made by public U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

| M3-PN150164 26 March 2018 |

iii

NorthMet Project

Form NI 43-101F1 Technical Report

NORTHMET PROJECT

FORM NI 43-101F1 TECHNICAL REPORT

FORM NI 43-101F1 TECHNICAL REPORT

TABLE OF CONTENTS

SECTION | PAGE |

DATE AND SIGNATURES PAGE | I |

TABLE OF CONTENTS | IV |

LIST OF FIGURES AND ILLUSTRATIONS | XIII |

| LIST OF TABLES | XV |

1 | EXECUTIVE SUMMARY | 19 |

1.1 | Key Results | 19 |

| 1.1.1 | Project Phases | 19 |

| 1.1.2 | Key Results for Both Phases | 20 | ||

| 1.1.3 | Phase I Key Results at 32,000 STPD | 20 | ||

| 1.1.4 | Phase II Key Results at 32,000 STPD | 21 |

1.2 | Location AND Ownership | 21 |

1.3 | Geology And Mineralization | 21 |

1.4 | Status of Exploration | 21 |

1.5 | Mineral Reserve Statement | 22 |

1.6 | Mineral Resource Estimate | 22 |

1.7 | Mining And Processing | 23 |

1.8 | Environmental | 24 |

1.9 | Economics | 24 |

1.10 | Potential Expansion Opportunities – Basis of 59,000 STPD and 118,000 STPD Scenarios | 26 |

1.11 | Conclusions And Recommendations | 27 |

2 | INTRODUCTION | 28 |

2.1 | Purpose | 28 |

2.2 | Sources of Information | 28 |

2.3 | Terms of Reference | 29 |

2.4 | Units of Measure | 31 |

3 | RELIANCE ON OTHER EXPERTS | 32 |

4 | PROPERTY DESCRIPTION AND LOCATION | 33 |

4.1 | Project Location | 33 |

4.2 | Project Ownership | 34 |

4.3 | Mineral Tenure | 34 |

| M3-PN150164 26 March 2018 |

iv

NorthMet Project

Form NI 43-101F1 Technical Report

4.4 | Surface Rights | 35 |

4.5 | Royalties And Encumbrances | 35 |

4.6 | Environmental Liabilities | 35 |

4.7 | Permits | 36 |

4.8 | Social License | 36 |

4.9 | Significant Risk Factors | 36 |

| 4.9.1 | Permitting | 36 |

| 4.9.2 | Project Financing | 36 | ||

| 4.9.3 | Commodity Prices | 37 |

4.10 | Comments on Section 4 | 37 |

5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 38 |

5.1 | Accessibility | 38 |

5.2 | Climate | 38 |

5.3 | Local Resources and Infrastructure | 39 |

5.4 | Physiography | 39 |

5.5 | Sufficiency of Surface Rights | 39 |

6 | HISTORY | 40 |

6.1 | Ownership | 40 |

6.2 | Exploration and Sampling | 40 |

6.3 | Historical Mineral Resource and Reserve Estimates | 40 |

6.4 | Historical Production | 40 |

7 | GEOLOGICAL SETTING AND MINERALIZATION | 41 |

7.1 | Regional Geology | 41 |

| 7.1.1 | Felsic Series | 41 |

| 7.1.2 | Early Gabbro Series | 41 | ||

| 7.1.3 | Anorthositic Series | 41 | ||

| 7.1.4 | Layered Series | 41 |

7.2 | LOCAL AND PROPERTY GEOLOGY | 44 |

| 7.2.1 | Local Lithology | 45 |

| 7.2.2 | Unit Definitions and Descriptions | 47 |

8 | DEPOSIT TYPES | 51 |

9 | EXPLORATION | 52 |

9.1 | Geophysical Sounding | 52 |

9.2 | U.S. Steel Bulk Sampling | 52 |

| M3-PN150164 26 March 2018 |

v

NorthMet Project

Form NI 43-101F1 Technical Report

9.3 | Down-Hole Geophysical Testing | 53 |

10 | DRILLING | 54 |

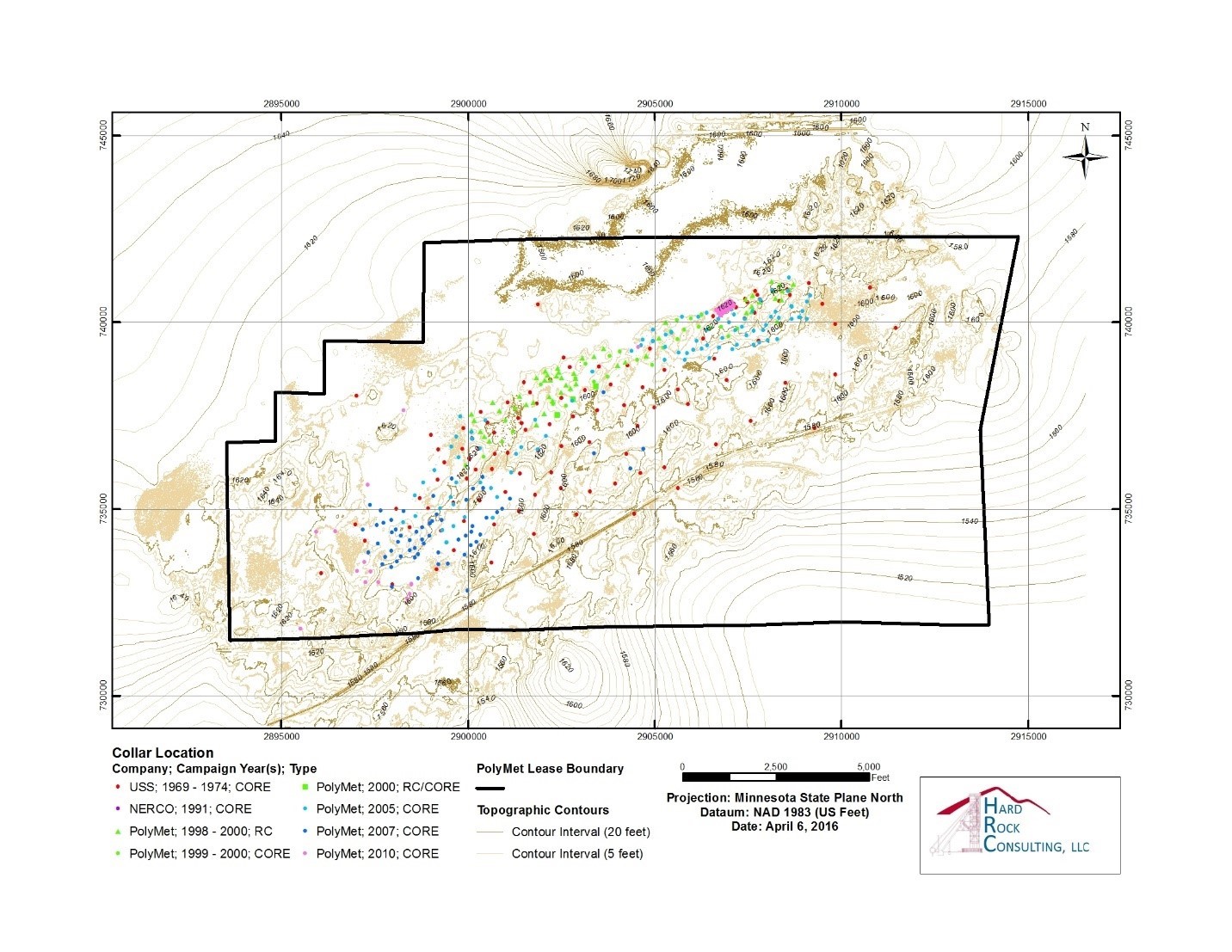

10.1 | Introduction | 54 |

10.2 | Historic Drilling | 56 |

| 10.2.1 | U.S. Steel Drilling, 1969 – 1974 | 56 |

| 10.2.2 | NERCO Drilling 1991 | 56 |

10.3 | PolyMet Drilling | 56 |

| 10.3.1 | PolyMet Drilling, 1999 – 2000, Reverse Circulation Holes | 56 | ||

| 10.3.2 | PolyMet Drilling, 1999-2000, Diamond Core Holes | 56 | ||

| 10.3.3 | PolyMet Drilling, 2005, Diamond Core Holes | 57 | ||

| 10.3.4 | PolyMet Drilling, 2007, Diamond Core Holes | 57 | ||

| 10.3.5 | PolyMet Drilling, 2010, Diamond Core Holes | 57 |

10.4 | Relevant Results And Interpretation | 58 |

11 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 59 |

11.1 | Historic Sample Preparation, Analysis and Security | 59 |

| 11.1.1 | U.S. Steel and NERCO | 59 | ||

| 11.1.2 | PolyMet Sample Preparation, Analysis and Security | 60 | ||

| 11.1.3 | Sample Preparation | 61 |

11.2 | Analytical History | 61 |

| 11.2.1 | Base Metals | 61 | ||

| 11.2.2 | Platinum Group Elements | 62 | ||

| 11.2.3 | Total Sulfur | 62 |

11.3 | Quality Assurance/Quality Control Procedures | 62 |

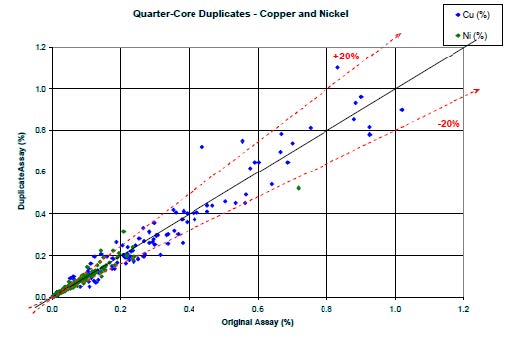

| 11.3.1 | Blanks | 63 | ||

| 11.3.2 | Standards | 64 | ||

| 11.3.3 | Duplicates | 66 |

11.4 | Data Entry Validation Controls | 69 |

11.5 | Core Storage And Sample Security | 69 |

11.6 | Opinion On Adequacy | 69 |

12 | DATA VERIFICATION | 70 |

12.1 | PolyMet Data Compilation And Verification 2004 | 70 |

12.2 | Database Audit | 70 |

12.3 | Certificates | 71 |

12.4 | Adequacy Of Data | 71 |

13 | MINERAL PROCESSING AND METALLURGICAL TESTING | 72 |

13.1 | Introduction | 72 |

13.2 | Comminution Circuit Test Work And Process Development | 74 |

| M3-PN150164 26 March 2018 |

vi

NorthMet Project

Form NI 43-101F1 Technical Report

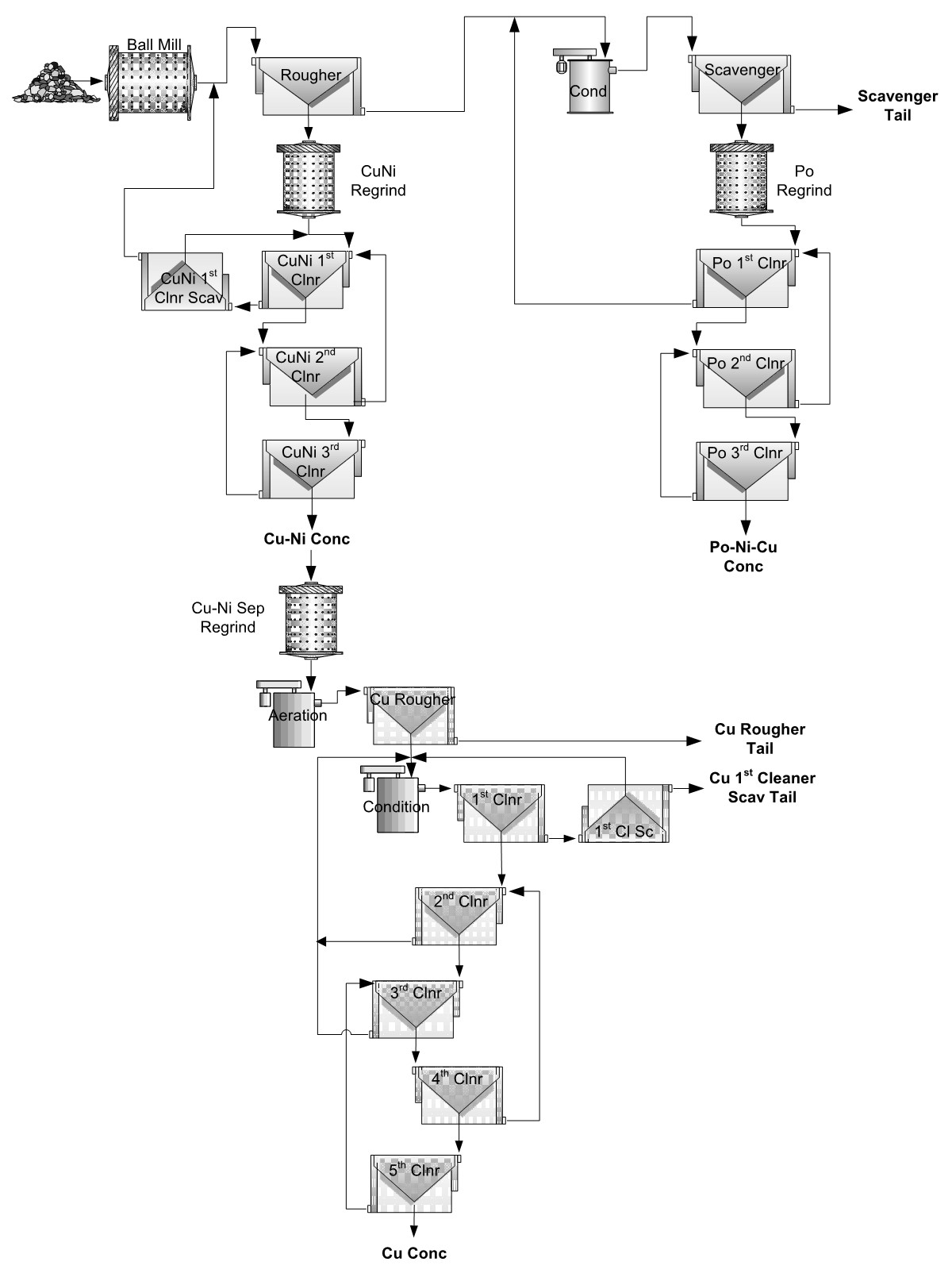

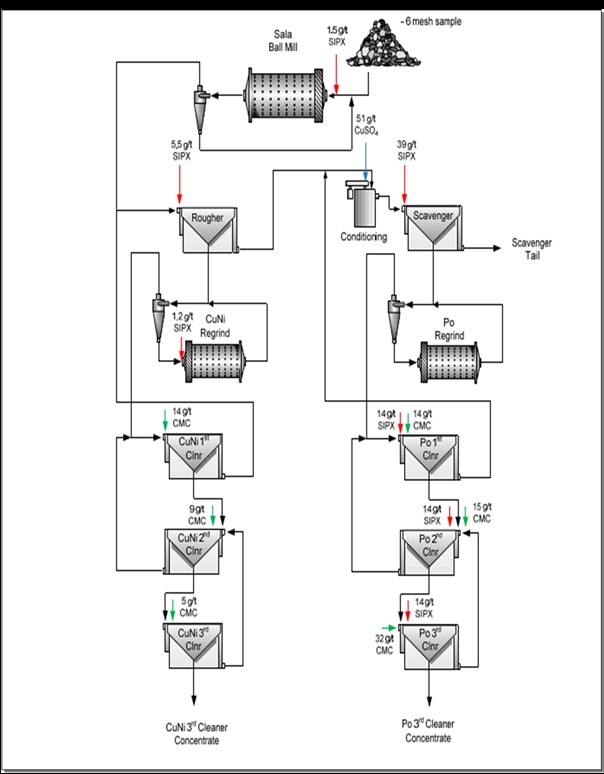

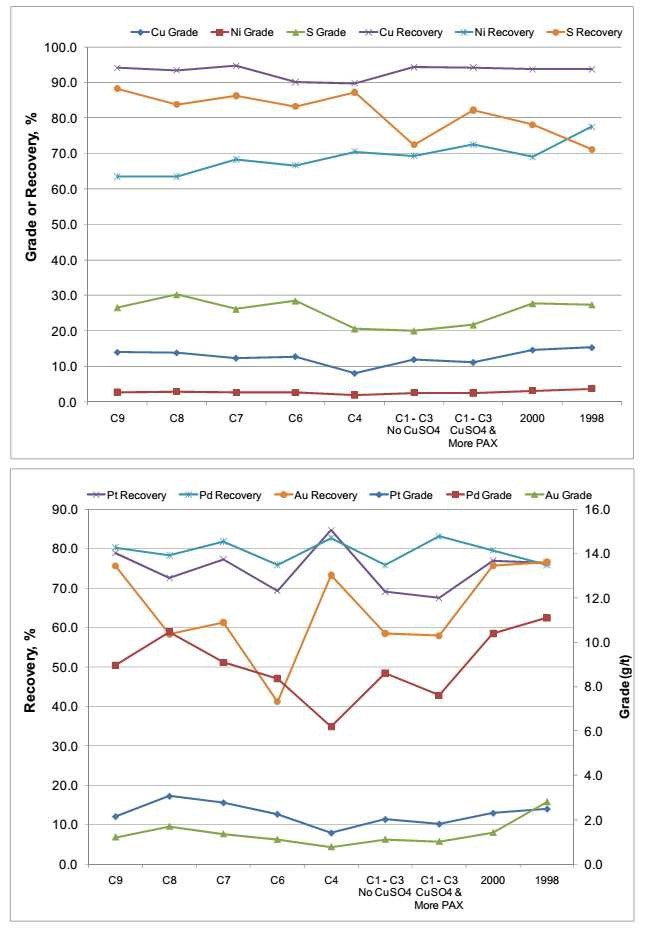

13.3 | Flotation Circuit Test Work And Process Development | 75 |

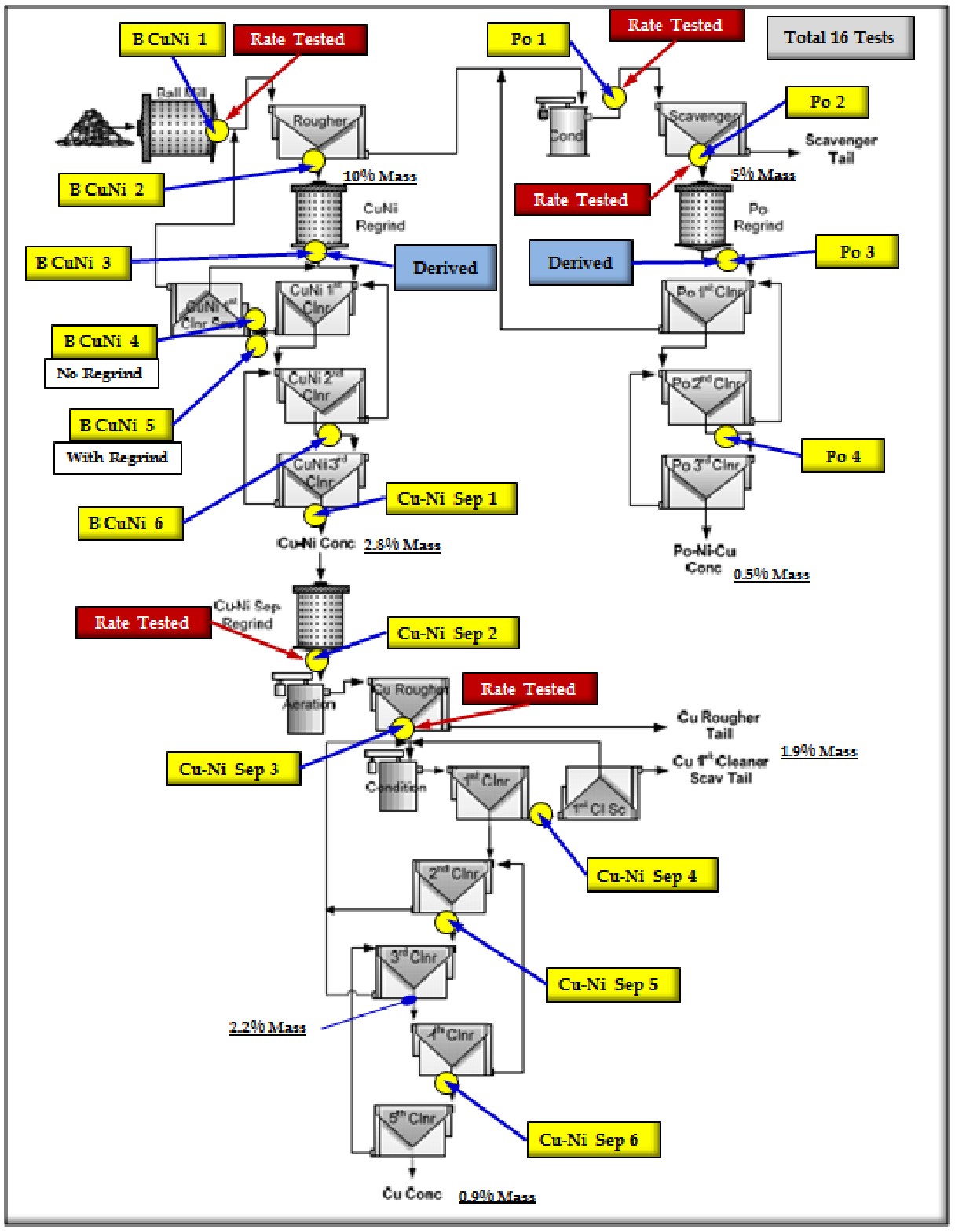

13.4 | Flotation Circuit Design | 80 |

| 13.4.1 | Flotation Circuit Simulation | 82 |

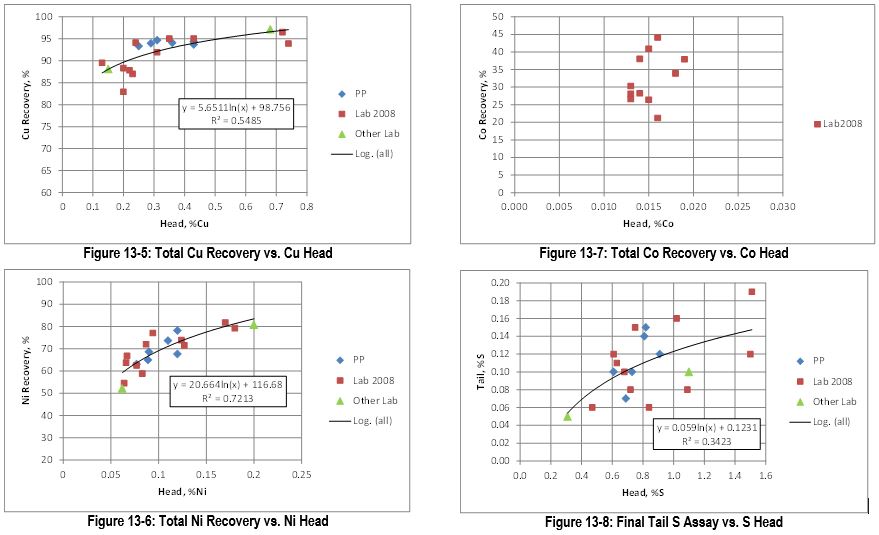

13.5 | Metallurgical Modelling For Recovery And Concentrate Quality | 84 |

| 13.5.1 | Cobalt | 85 |

13.6 | Hydrometallurgical Test Work | 89 |

| 13.6.1 | PLATSOL™ Leaching Pilot Plant Testing | 90 | ||

| 13.6.2 | Precipitation of PGMs by Copper Sulfide | 92 | ||

| 13.6.3 | Copper Concentrate Enrichment | 93 | ||

| 13.6.4 | Residual Copper Precipitation | 95 | ||

| 13.6.5 | Bulk Iron/Aluminum Removal | 96 | ||

| 13.6.6 | Mixed Hydroxide Precipitation (MHP) | 97 | ||

| 13.6.7 | Magnesium Removal | 98 |

14 | MINERAL RESOURCE ESTIMATES | 99 |

14.1 | Data | 99 |

14.2 | Block Model Physical Limits | 99 |

14.3 | Geological Models | 99 |

| 14.3.1 | Density | 101 |

14.4 | Exploratory Data Analysis | 101 |

| 14.4.1 | Sample Statistics | 101 | ||

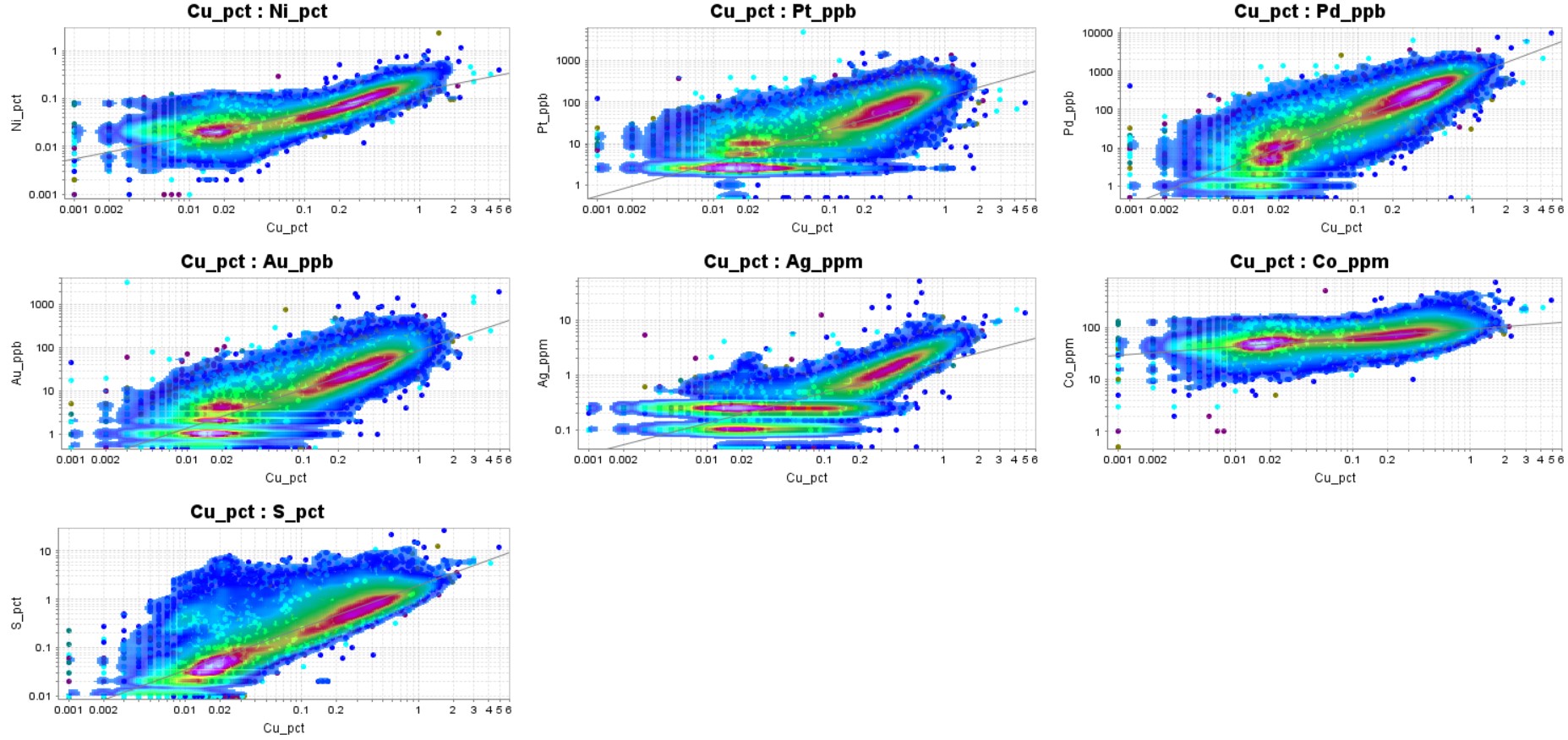

| 14.4.2 | Correlation Analysis | 104 | ||

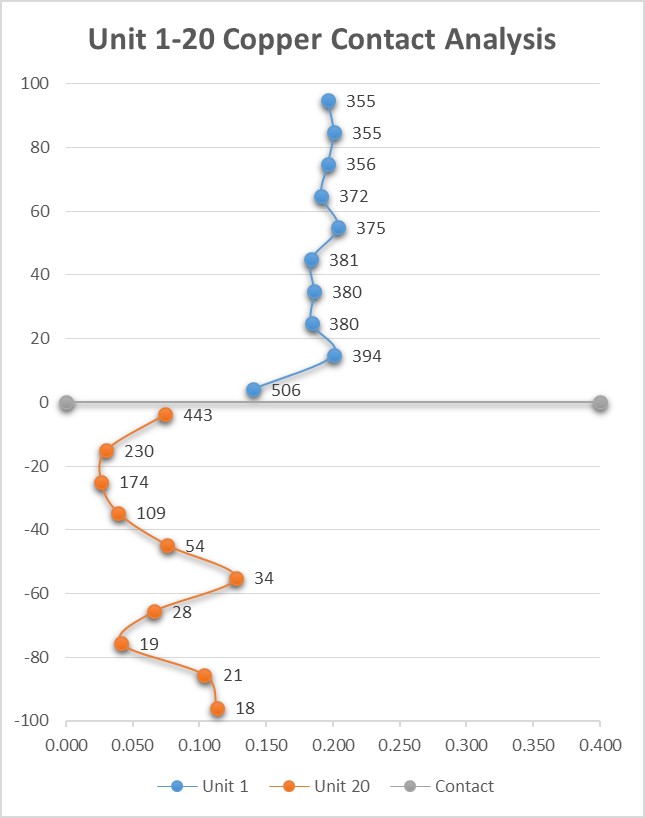

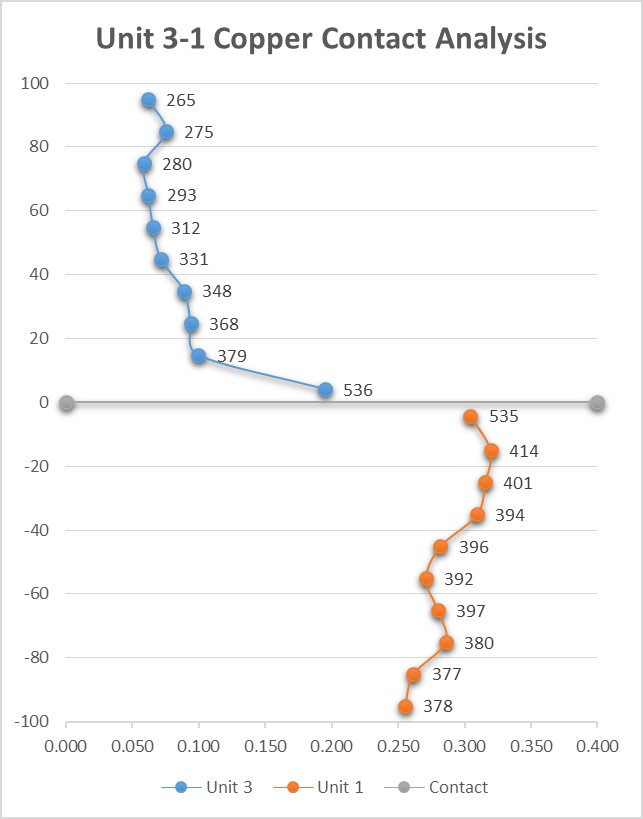

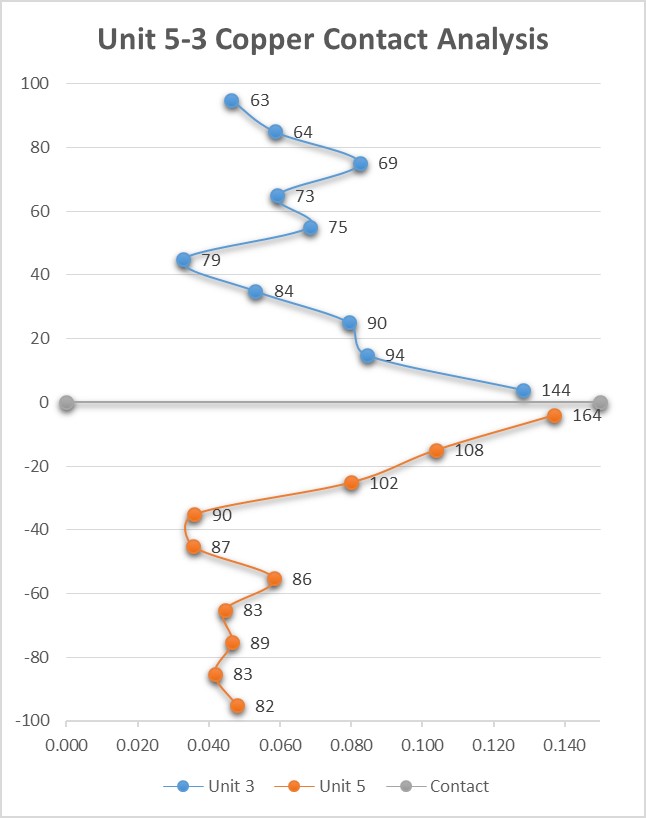

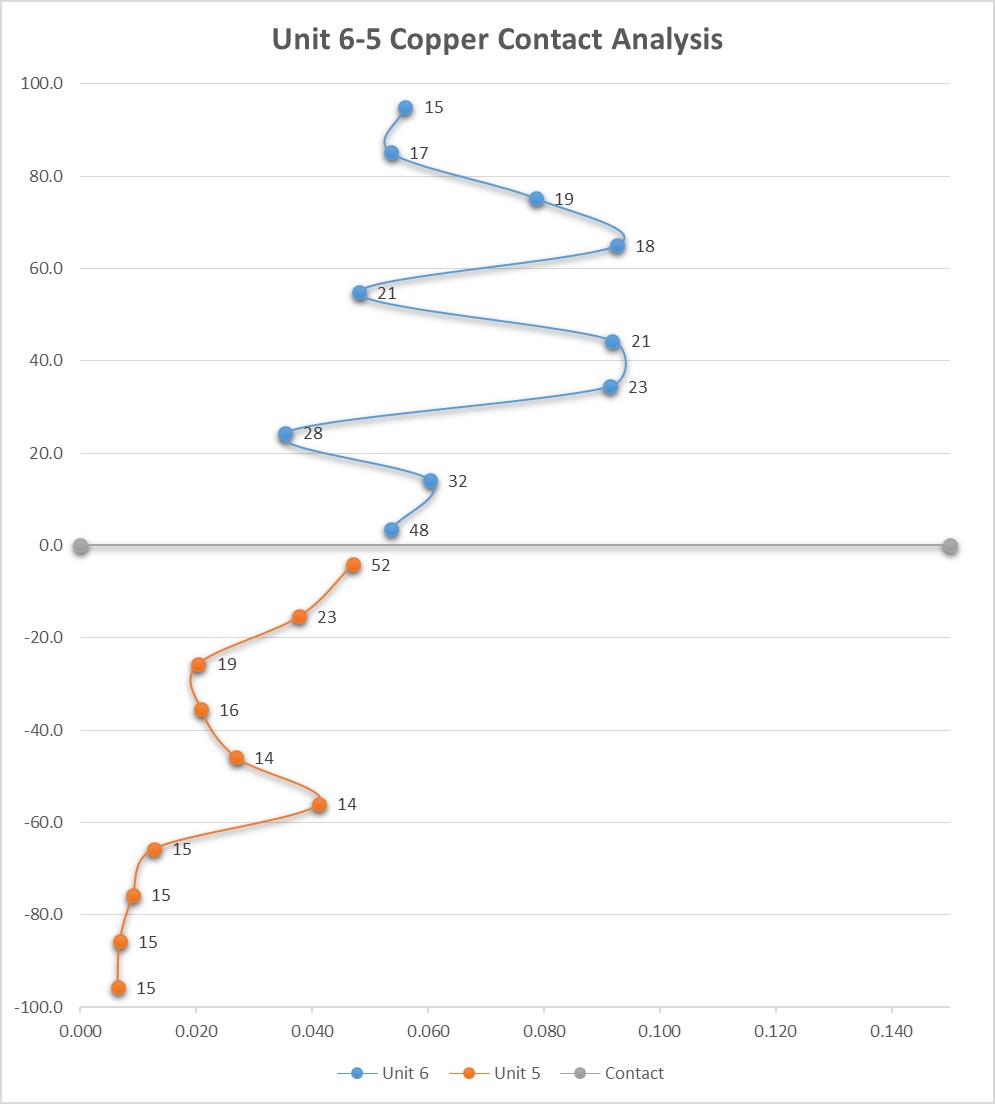

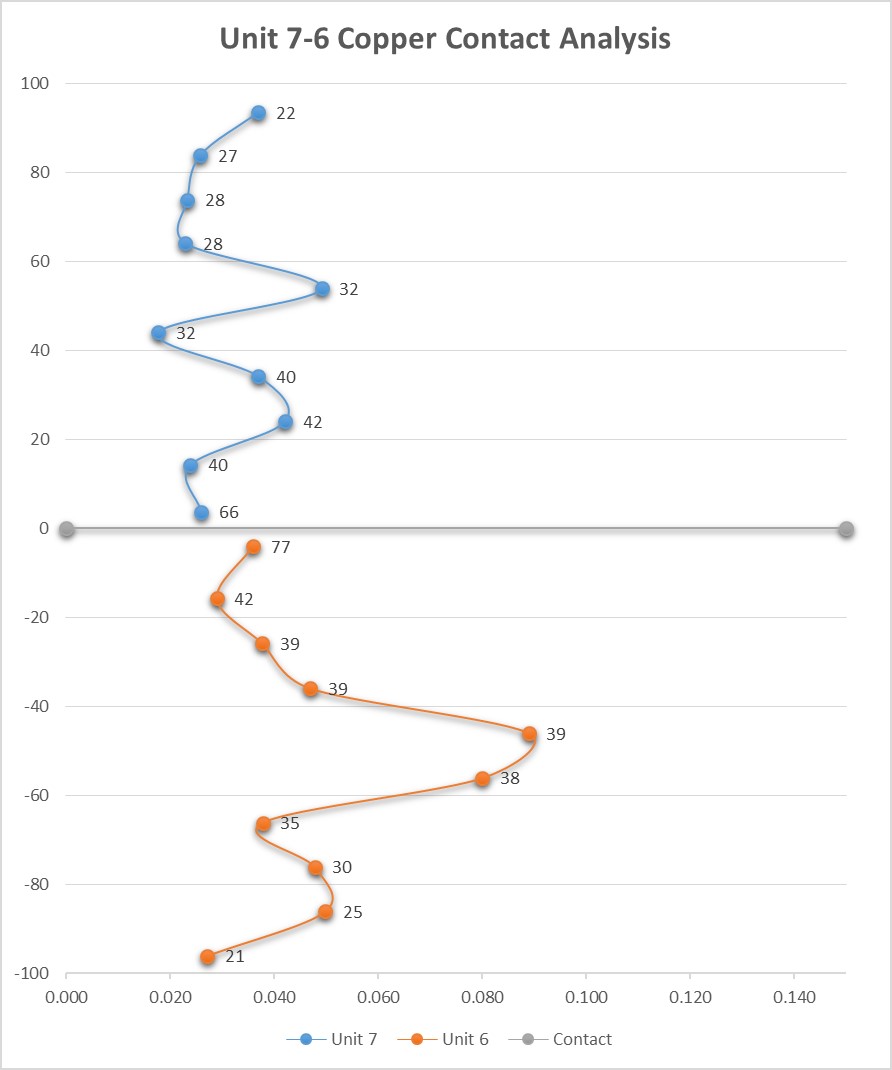

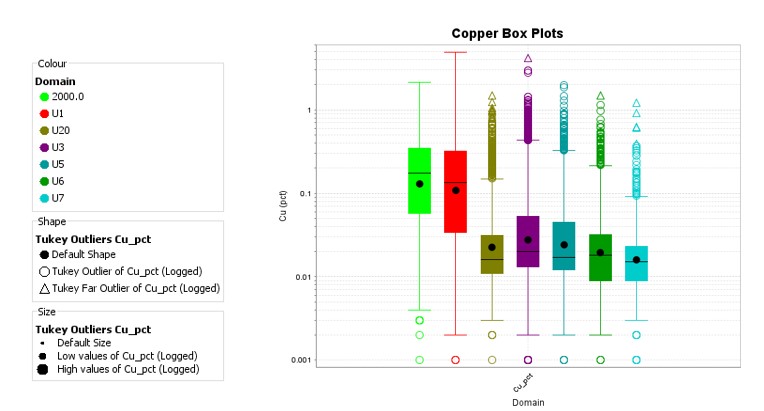

| 14.4.3 | Contact Plot Analysis | 106 |

14.5 | Estimation Methodology | 110 |

| 14.5.1 | Capping | 110 | ||

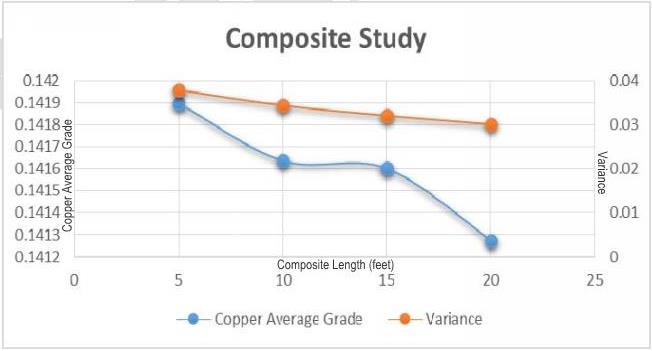

| 14.5.2 | Composite Study | 113 | ||

| 14.5.3 | Variograms | 116 | ||

| 14.5.4 | Estimation Strategy | 118 | ||

| 14.5.5 | Mineral Resource Classification | 119 | ||

| 14.5.6 | Model Validation | 120 |

14.6 | Mineral Resources | 127 |

| 14.6.1 | Net Smelter Return (NSR) and Cutoff | 127 | ||

| 14.6.2 | Test for Reasonable Prospect for Eventual Economic Extraction | 127 | ||

| 14.6.3 | Resource Statement | 128 |

15 | MINERAL RESERVE ESTIMATES | 129 |

15.1 | Calculation Parameters | 129 |

| 15.1.1 | Pit Slopes | 129 | ||

| 15.1.2 | Dilution and Mining Losses | 129 | ||

| 15.1.3 | Cutoff and NSR Calculation | 130 |

15.2 | Mineral Reserve Estimate | 132 |

| M3-PN150164 26 March 2018 |

vii

NorthMet Project

Form NI 43-101F1 Technical Report

15.3 | Factors that may Affect the Mineral Reserve Estimate | 132 |

16 | MINING METHODS | 133 |

16.1 | Open Pit Mine Plan | 133 |

16.2 | Resource Model Review | 135 |

16.3 | Definition Of Material Types | 135 |

| 16.3.1 | Ore Classification | 135 | ||

| 16.3.2 | Waste Rock Classification | 135 | ||

| 16.3.3 | Waste Rock Stockpile Liners | 136 | ||

| 16.3.4 | Overburden Classification | 136 |

16.4 | Geotechnical | 137 |

16.5 | Pit Design | 137 |

16.6 | Preproduction Development | 138 |

16.7 | Production Schedule | 138 |

| 16.7.1 | Yearly Production | 139 | ||

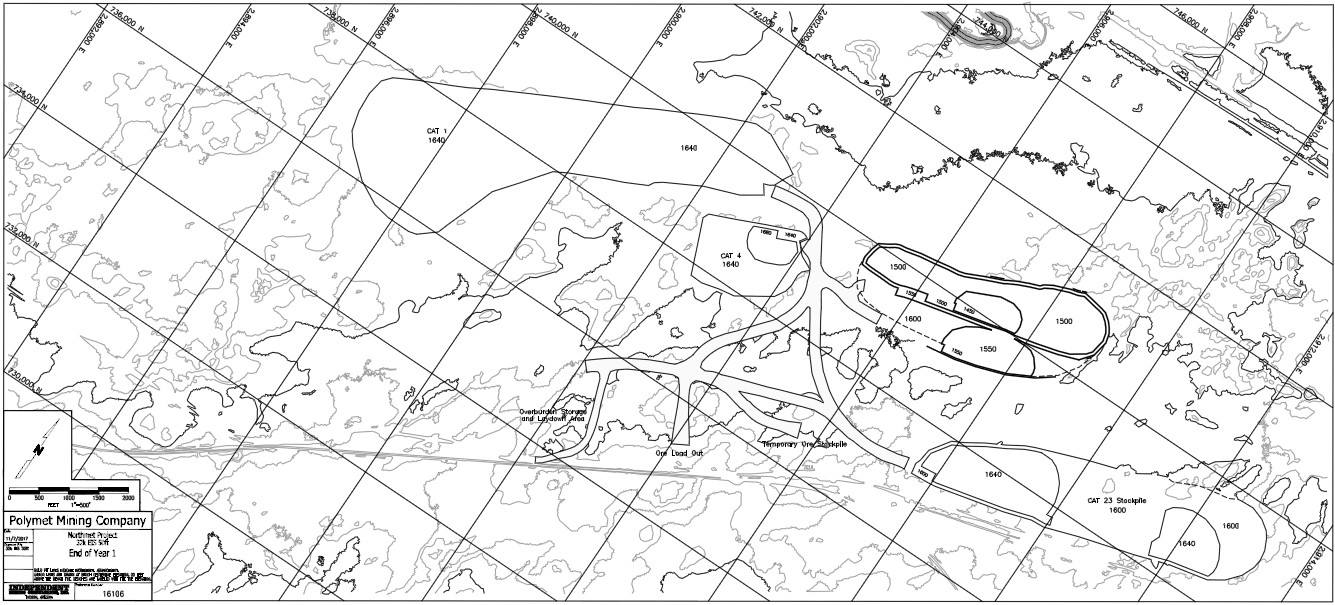

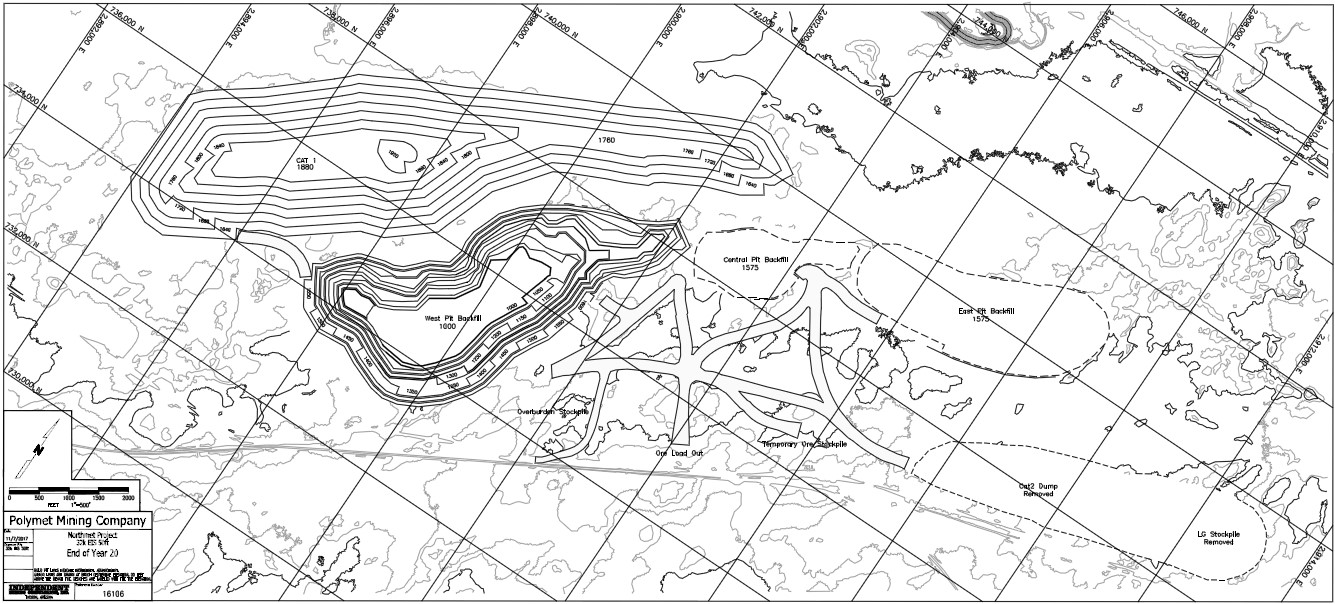

| 16.7.2 | Pit and Stockpile Progression Maps | 142 |

16.8 | Water Management System | 145 |

16.9 | Mining Equipment | 147 |

| 16.9.1 | Production Schedule Parameters | 147 | ||

| 16.9.2 | Drill Equipment and Blast Parameters | 148 | ||

| 16.9.3 | Loading Equipment Requirements | 149 | ||

| 16.9.4 | Hauling Equipment Requirements | 150 | ||

| 16.9.5 | Auxiliary Equipment Requirements | 150 |

16.10 | Railroad | 151 |

16.11 | Mine Personnel | 152 |

17 | RECOVERY METHODS | 155 |

17.1 | Plant Design | 155 |

| 17.1.1 | Introduction | 155 | ||

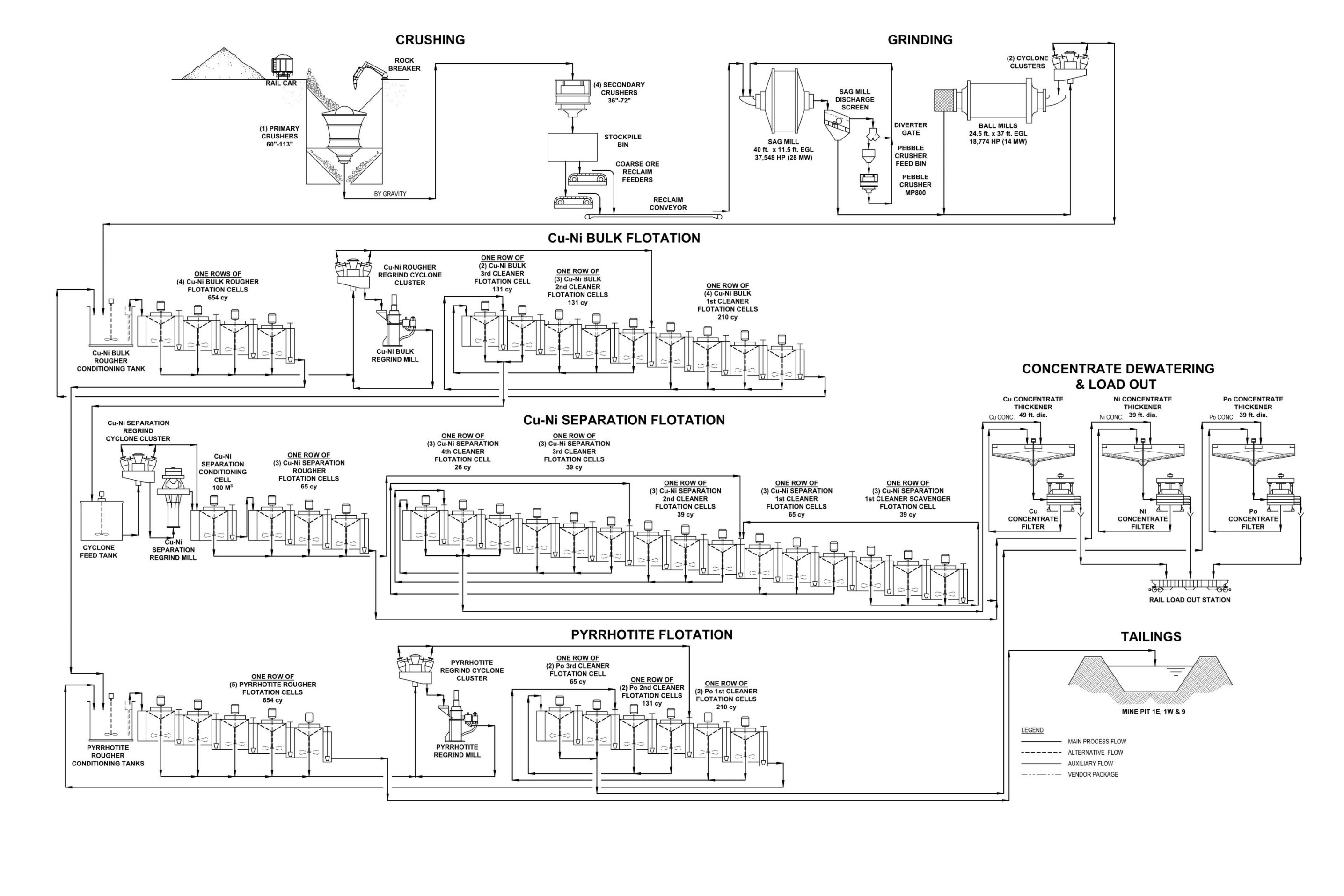

| 17.1.2 | Crushing and Material Handling | 156 | ||

| 17.1.3 | Flotation | 159 | ||

| 17.1.4 | Concentrate Handling | 161 | ||

| 17.1.5 | Reagent Services | 161 | ||

| 17.1.6 | Piping Systems | 162 | ||

| 17.1.7 | Air Systems | 163 | ||

| 17.1.8 | Plant Electrical Distribution | 164 | ||

| 17.1.9 | Plant Instrumentation | 164 |

17.2 | Process Plant Flowsheet Development | 164 |

| 17.2.1 | Primary and Secondary Crushing | 164 | ||

| 17.2.2 | Milling | 165 | ||

| 17.2.3 | Flotation | 168 | ||

| 17.2.4 | Tailings Disposal | 171 |

| M3-PN150164 26 March 2018 |

viii

NorthMet Project

Form NI 43-101F1 Technical Report

| 17.2.5 | Concentrate Thickening and Filtration | 172 | ||

| 17.2.6 | Concentrate Storage | 174 | ||

| 17.2.7 | Reagents | 174 | ||

| 17.2.8 | Air Services | 176 | ||

| 17.2.9 | Water Circuits | 176 | ||

| 17.2.10 | Sampling and Metal Accounting | 176 |

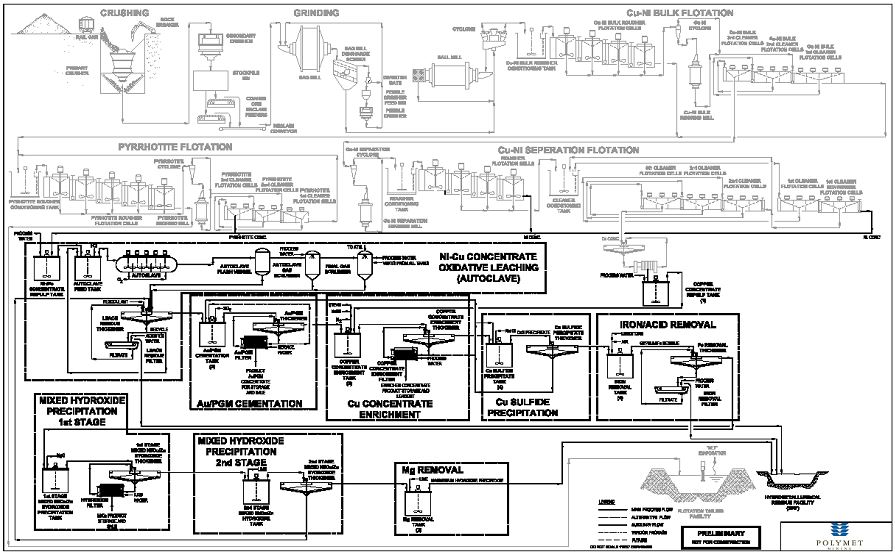

17.3 | HYDROMETALLURGICAL PROCESSING | 177 |

17.4 | PHASE II – OPTIONAL HYDROMETALLURGICAL PLANT | 177 |

| 17.4.1 | Autoclave | 180 | ||

| 17.4.2 | Gold and Platinum Group Metals Recovery | 180 | ||

| 17.4.3 | Concentrate Enrichment | 181 | ||

| 17.4.4 | Copper Sulfide Precipitation | 181 | ||

| 17.4.5 | Iron, Aluminum and Acid Removal | 181 | ||

| 17.4.6 | Mixed Hydroxide Precipitation Recovery | 182 | ||

| 17.4.7 | Magnesium Removal | 182 | ||

| 17.4.8 | Process Consumables | 182 | ||

| 17.4.9 | Hydrometallurgical Plant Water | 183 | ||

| 17.4.10 | Metal Recoveries | 183 |

17.5 | PLANT SITE AIR QUALITY MANAGEMENT | 183 |

| 17.5.1 | Hydrometallurgical Residue Management | 184 | ||

| 17.5.2 | Hydrometallurgical Residue Cell Design and Operations | 184 |

| 17.6 | WATER MANAGEMENT | 184 |

| 17.6.1 | Hydrometallurgical Plant | 184 |

18 | PROJECT INFRASTRUCTURE | 185 |

18.1 | PLANT AND ADMINISTRATIVE INFRASTRUCTURE | 185 |

| 18.1.1 | Asset Preservation | 185 | ||

| 18.1.2 | Plant Workshops | 185 | ||

| 18.1.3 | Plant Warehouses | 185 | ||

| 18.1.4 | Administration Offices | 186 | ||

| 18.1.5 | Site First Aid Station | 186 | ||

| 18.1.6 | Laboratory | 186 |

18.2 | Mine Infrastructure | 186 |

| 18.2.1 | Mine Workshops, Warehouses and Offices | 186 | ||

| 18.2.2 | Mine Site Service and Refueling Facility | 186 | ||

| 18.2.3 | Rail Loadout | 186 |

18.3 | Haul and Access Roads | 187 |

18.4 | Rail Facilities | 187 |

18.5 | Water Supply | 187 |

| 18.5.1 | Raw Water Supply | 187 | ||

| 18.5.2 | Potable Water Distribution | 187 | ||

| 18.5.3 | Fire Water Distribution | 187 | ||

| 18.5.4 | Sewage Collection and Treatment | 187 |

| M3-PN150164 26 March 2018 |

ix

NorthMet Project

Form NI 43-101F1 Technical Report

18.6 | Flotation Tailings Basin (FTB) | 187 |

18.7 | Waste Water Treatment | 188 |

| 18.7.1 | Mine Site Waste Water Collection and Distribution | 188 | ||

| 18.7.2 | Waste Water Treatment System | 188 |

18.8 | Power Supply | 189 |

| 18.8.1 | Plant Power Supply | 189 | ||

| 18.8.2 | Mine Site Power Supply | 189 | ||

| 18.8.3 | Emergency Power Plant | 189 |

18.9 | Natural Gas Supply | 190 |

18.10 | Accommodations | 190 |

19 | MARKET STUDIES AND CONTRACTS | 191 |

19.1 | Commodity Price Projections | 191 |

19.2 | Contracts | 191 |

20 | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 192 |

20.1 | Environmental Review and Permitting | 192 |

20.2 | Baseline Studies | 193 |

20.3 | Environmental Considerations | 193 |

| 20.3.1 | Waste Management | 194 | ||

| 20.3.2 | Water Management | 194 | ||

| 20.3.3 | Air Management | 195 | ||

| 20.3.4 | Land Management | 195 |

20.4 | Social Issues | 195 |

| 20.4.1 | Labor and Employment Support | 195 | ||

| 20.4.2 | Economic Impact | 195 | ||

| 20.4.3 | Treaties and Indigenous Groups | 196 |

20.5 | Closure Plan and Financial Assurance | 196 |

20.6 | Discussion on Permitting Risks to Mineral Resources and Mineral Reserves | 197 |

20.7 | Comments on Section 20 | 197 |

21 | CAPITAL AND OPERATING COSTS | 198 |

21.1 | Capital Cost Estimate | 198 |

| 21.1.1 | Basis of Phase I Capital Cost Estimate | 199 | ||

| 21.1.2 | Hydrometallurgical Plant Cost Estimate | 206 | ||

| 21.1.3 | Indirect Costs | 207 |

21.2 | Operating Cost Estimate | 210 |

| 21.2.1 | Mine Operating Cost | 210 | ||

| 21.2.2 | Process Plant and Assay Operating Cost Estimate Summary | 213 | ||

| 21.2.3 | Basis of Process Plant Operating Cost Estimate | 213 | ||

| 21.2.4 | Hydrometallurgical Plant (Phase II) Operating Cost Estimate Summary | 222 |

| M3-PN150164 26 March 2018 |

x

NorthMet Project

Form NI 43-101F1 Technical Report

| 21.2.5 | Basis of Hydrometallurgical Plant (Phase II) Operating Cost | 222 |

| 22 | ECONOMIC ANALYSIS | 224 |

| 22.1 | FEASIBILITY STUDY ECONOMIC ANALYSIS | 224 |

| 22.1.1 | Economic Assumptions | 225 | |

| 22.1.2 | Key Data and Economic Analysis | 225 | |

| 22.1.3 | Capital Costs | 228 | |

| 22.1.4 | Operating Plans and Costs | 228 | |

| 22.1.5 | Sustaining Capital | 228 |

| 22.2 | FINANCIAL MODEL | 229 |

| 23 | ADJACENT PROPERTIES | 231 |

| 24 | OTHER RELEVANT DATA AND INFORMATION | 232 |

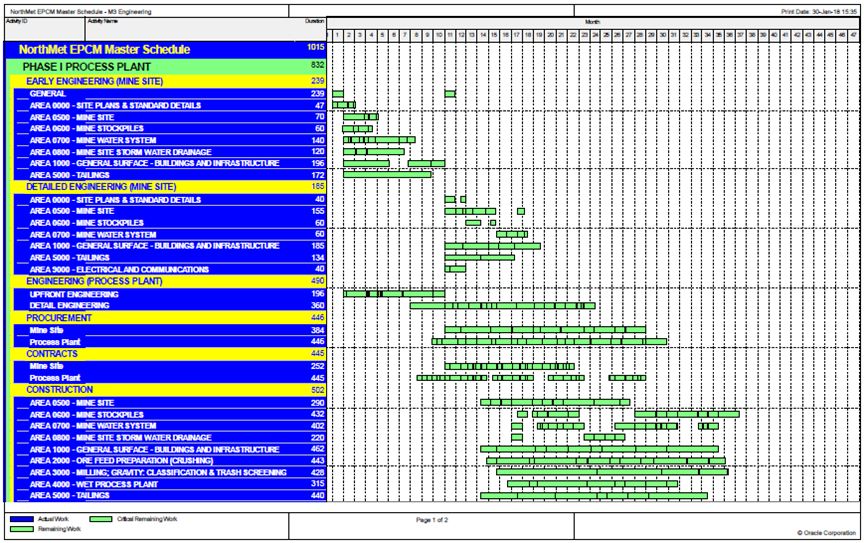

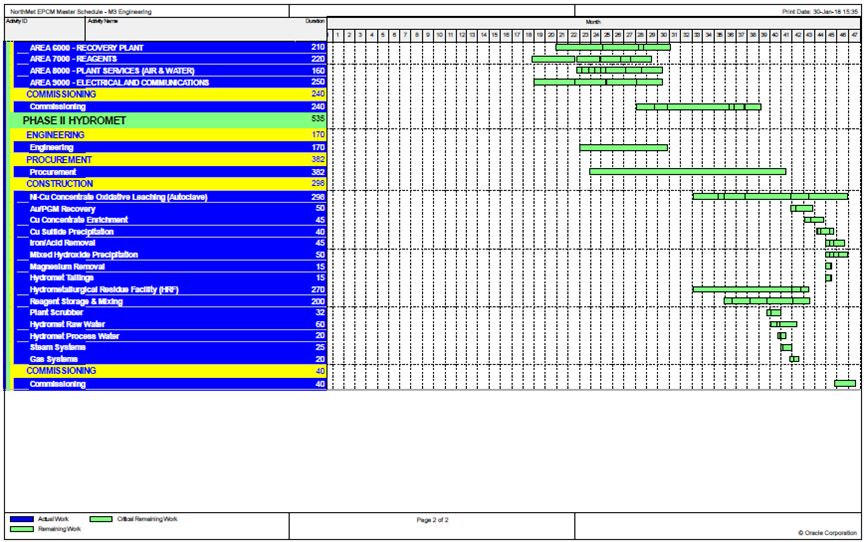

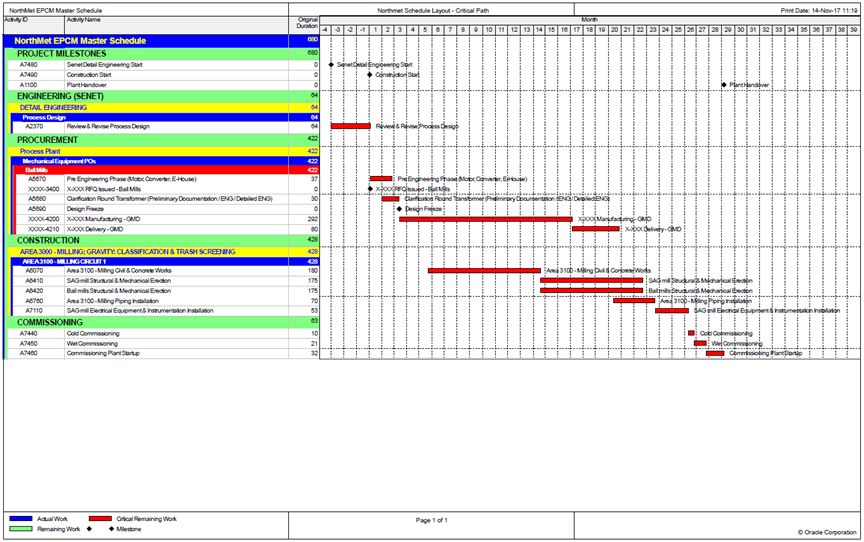

| 24.1 | PROJECT IMPLEMENTATION | 232 |

| 24.1.1 | Engineering | 232 | |

| 24.1.2 | Demolition | 234 | |

| 24.1.3 | Execution and Construction | 234 | |

| 24.1.4 | Ramp-up Evaluation | 235 |

| 24.2 | POTENTIAL OPPORTUNITIES | 239 |

| 24.2.1 | Summary | 239 | |

| 24.2.2 | Introduction | 239 | |

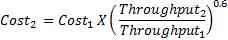

| 24.2.3 | Mill Throughput Tonnages | 240 | |

| 24.2.4 | Mine Site Modifications | 241 | |

| 24.2.5 | Plant Site Modifications | 242 | |

| 24.2.6 | Financial Outlook | 243 |

| 24.3 | ECONOMIC ANALYSIS | 244 |

| 25 | INTERPRETATION AND CONCLUSIONS | 249 |

| 25.1 | INTRODUCTION | 249 |

| 25.2 | INTERPRETATION | 249 |

| 25.2.1 | Surface Rights, Royalties, and Mineral Tenure | 249 | |

| 25.2.2 | Geology and Mineralization | 249 | |

| 25.2.3 | Exploration | 249 | |

| 25.2.4 | Drilling and Sampling | 249 | |

| 25.2.5 | Data Verification | 249 | |

| 25.2.6 | Metallurgy | 250 | |

| 25.2.7 | Mineral Resources | 250 | |

| 25.2.8 | Mineral Reserves | 250 | |

| 25.2.9 | Mine Plan and Schedule | 250 | |

| 25.2.10 | Metallurgical Recovery | 250 | |

| 25.2.11 | Infrastructure | 250 | |

| 25.2.12 | Market Studies and Contracts | 250 | |

| 25.2.13 | Environment, Permits, and Social and Community Impacts | 251 | |

| 25.2.14 | Capital and Operating Costs | 251 | |

| 25.2.15 | Economic Analysis | 251 |

| M3-PN150164 26 March 2018 |

xi

NorthMet Project

Form NI 43-101F1 Technical Report

| 25.3 | Conclusions | 251 |

| 25.4 | Risks | 251 |

| 25.5 | Opportunities | 254 |

| 26 | RECOMMENDATIONS | 256 |

| 27 | REFERENCES | 257 |

| APPENDIX A – PROFESSIONAL QUALIFICATIONS AND CERTIFICATES OF QUALIFIED PERSONS | 261 | |

| M3-PN150164 26 March 2018 |

xii

NorthMet Project

Form NI 43-101F1 Technical Report

LIST OF FIGURES AND ILLUSTRATIONS

| FIGURE | DESCRIPTION | PAGE |

| Figure 4-1: Property Layout Map | 33 | |

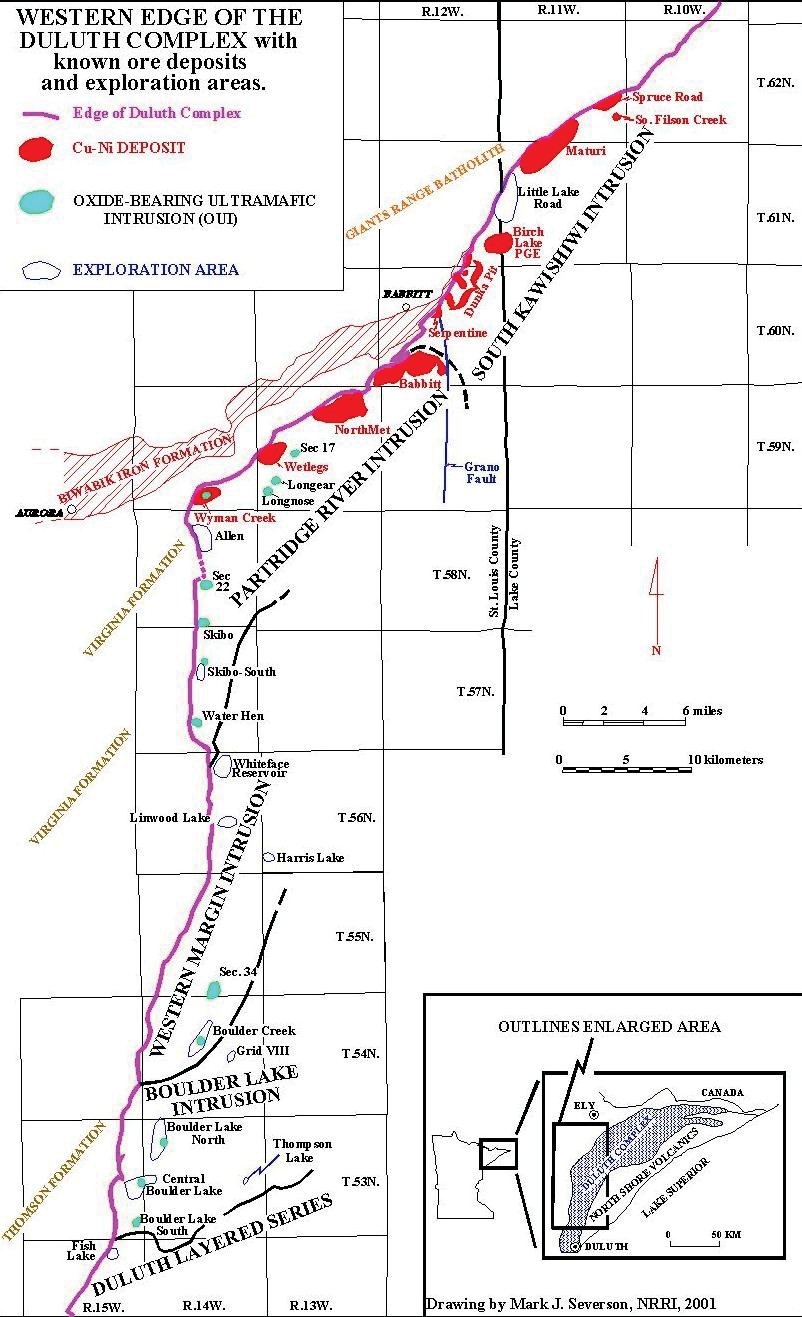

| Figure 7-1: Regional Geology | 42 | |

| Figure 7-2: Copper-Nickel Deposits in the Duluth Complex (after Severson) | 43 | |

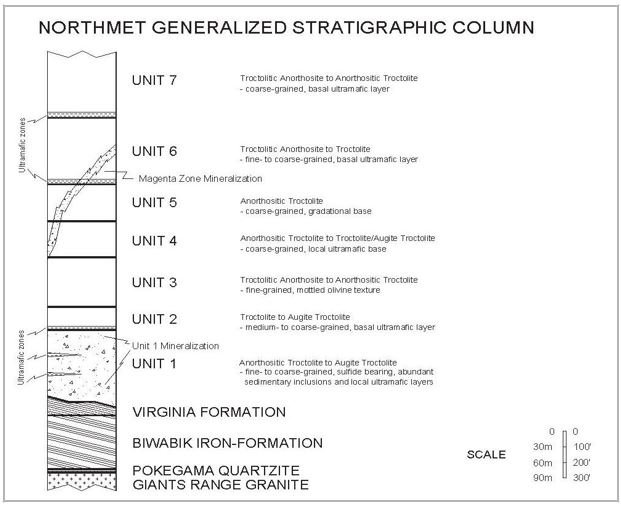

| Figure 7-3: NorthMet Stratigraphic Column (after Geerts, 1994) | 45 | |

| Figure 7-4: NorthMet Property Bedrock Geology | 46 | |

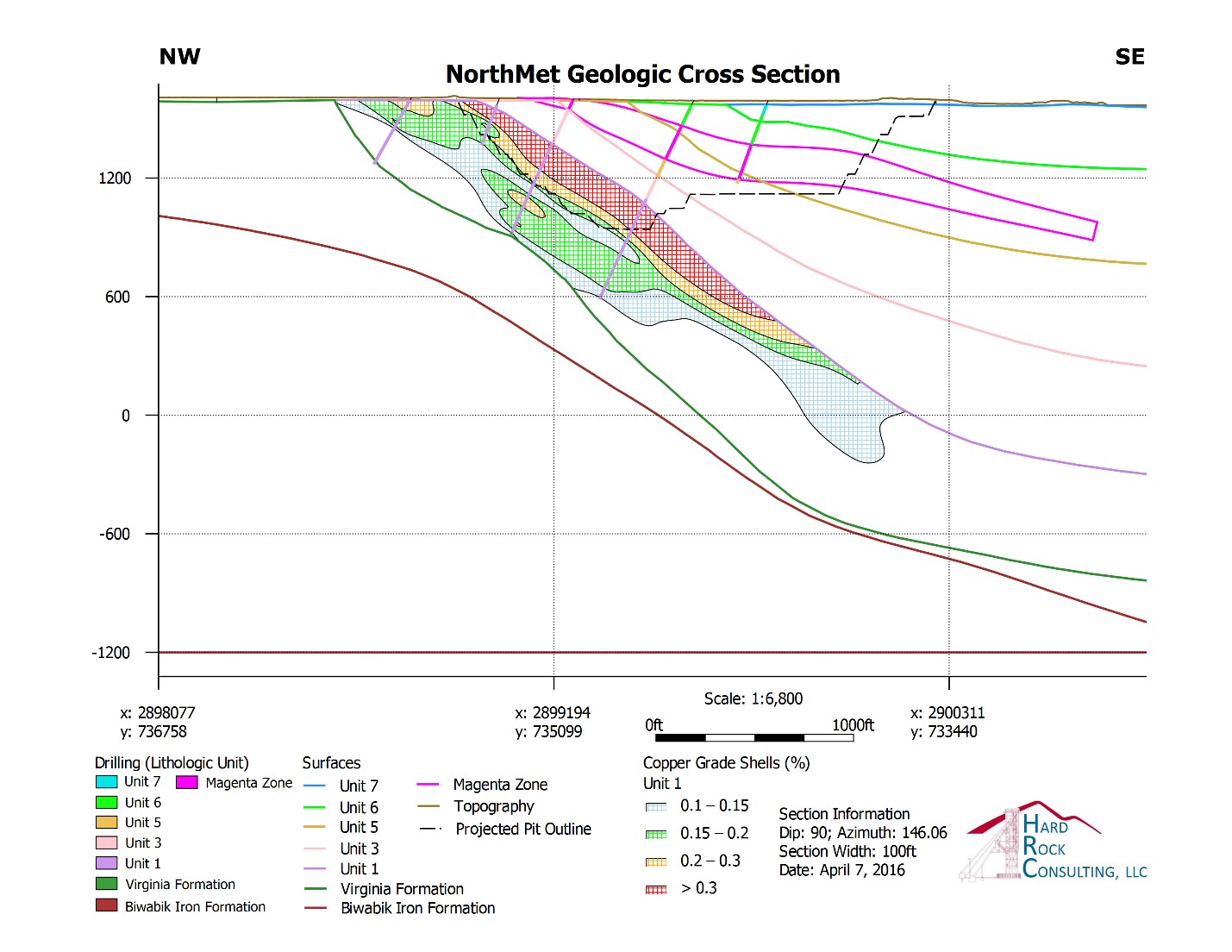

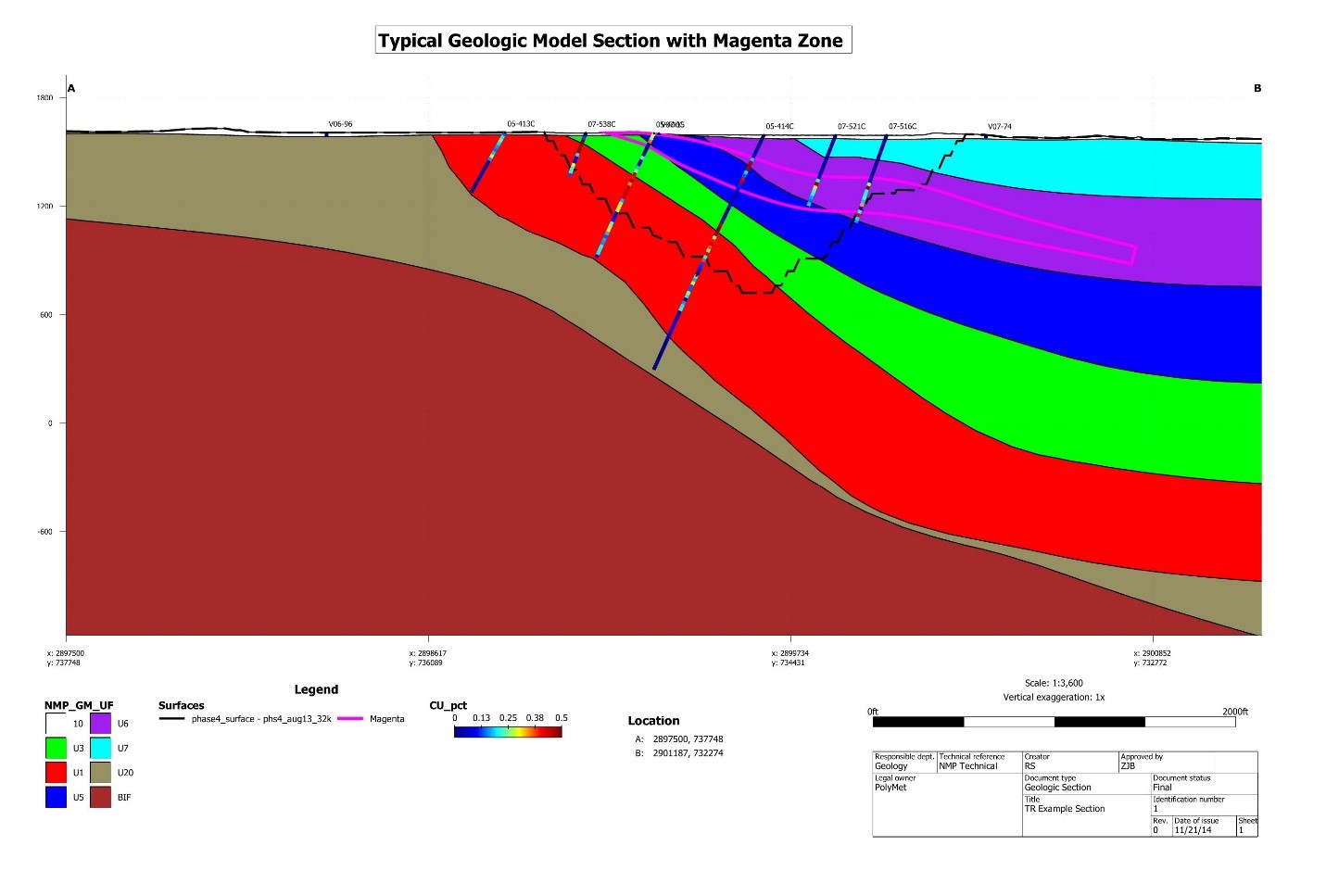

| Figure 7-5: NorthMet “Magenta Zone” in Cross Section | 50 | |

| Figure 10-1: Drill-hole Collar Location by Campaign | 55 | |

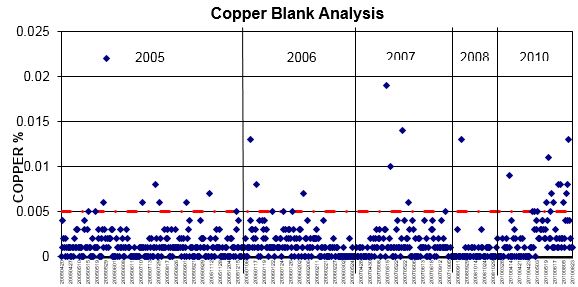

| Figure 11-1: Copper Blank Analysis | 64 | |

| Figure 11-2: Nickel Blank Analysis | 64 | |

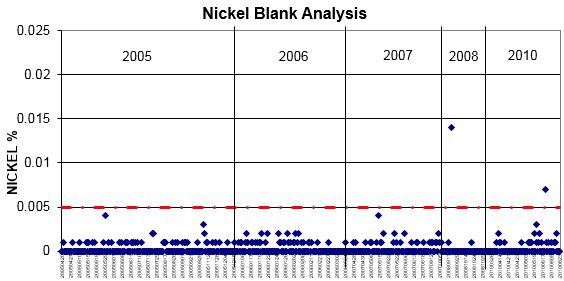

| Figure 11-3: Copper Results for Standard 4-1 | 65 | |

| Figure 11-4: Nickel Results for Standard 4-1 | 65 | |

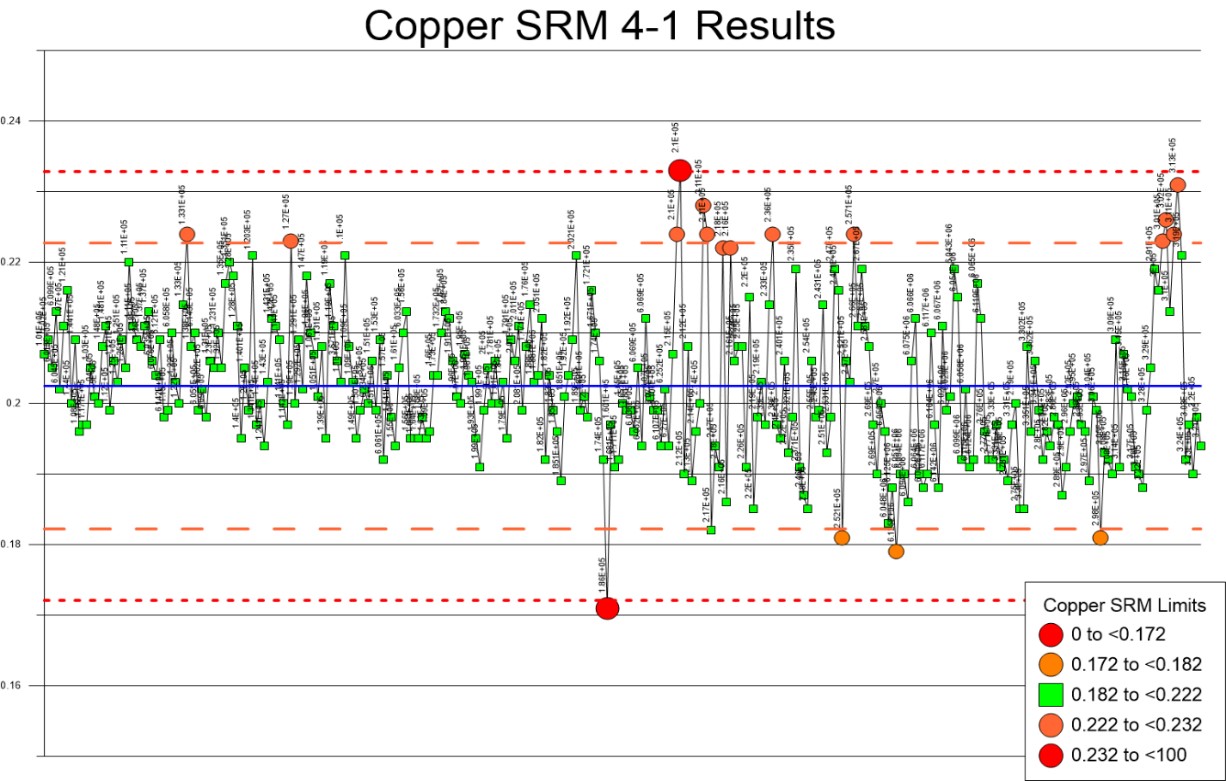

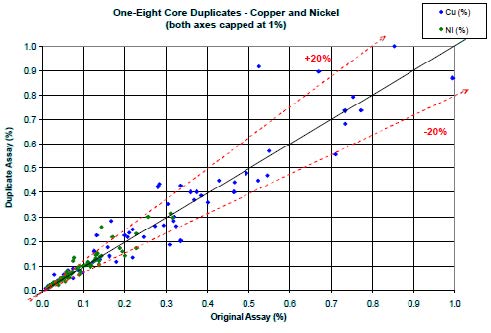

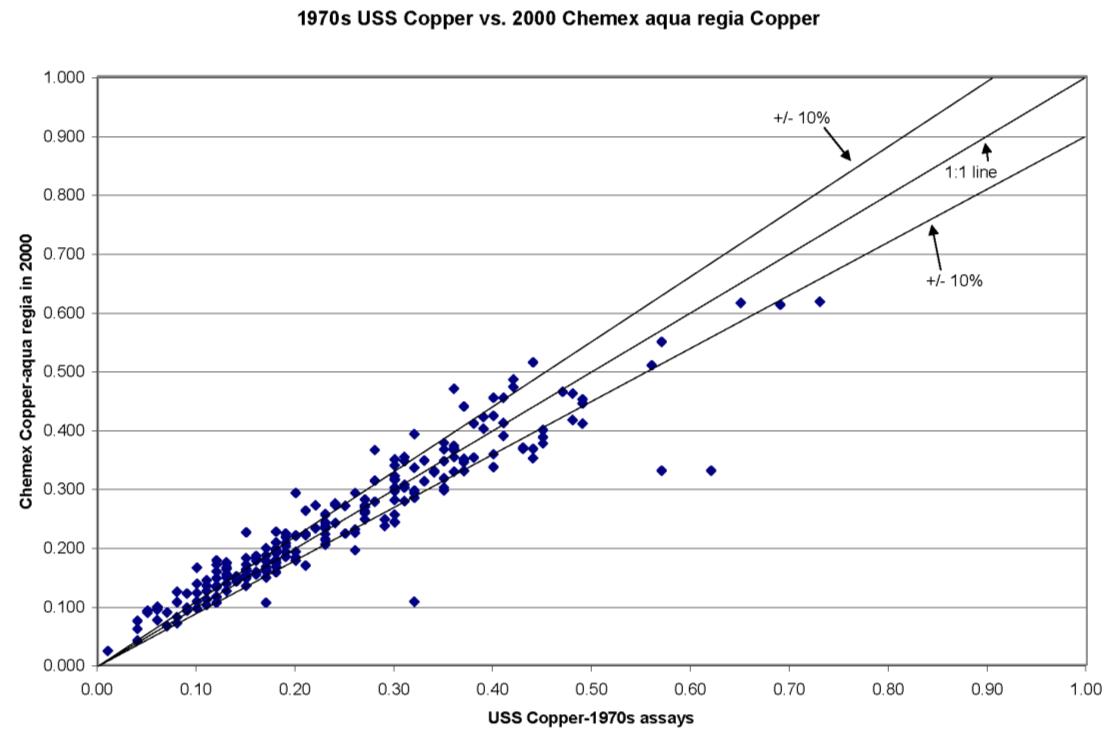

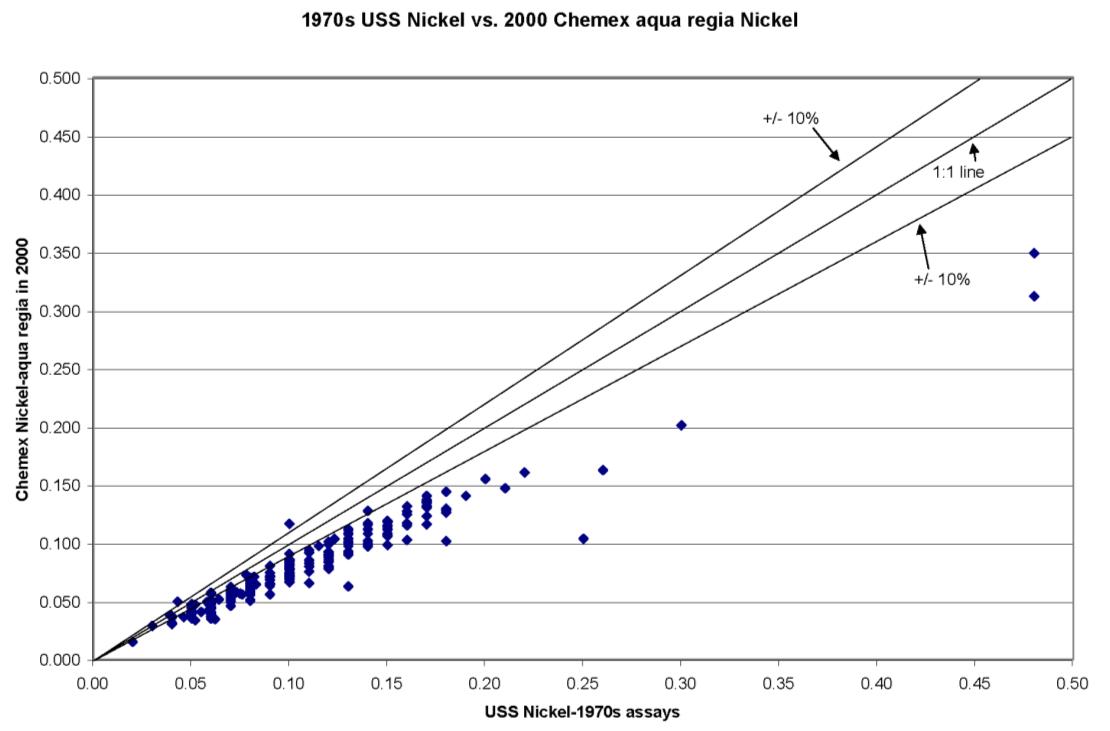

| Figure 11-5: Copper and Nickel ¼ Core Duplicate Analysis | 66 | |

| Figure 11-6: Copper and Nickel 1/8 Core Duplicate Analysis | 67 | |

| Figure 11-7: Copper Pulp Duplicate Analysis | 68 | |

| Figure 11-8: Nickel Pulp Duplicate Analysis | 68 | |

| Figure 13-1: NorthMet Process Block Flow | 73 | |

| Figure 13-2: Pilot Plant Flowsheet | 77 | |

| Figure 13-3: Comparative Recoveries between C9 Pilot Work and Previous Pilot Work | 78 | |

| Figure 13-4: General Block Flow – Rate Tested and Kinetic-Derived Process Streams from Report NM 1-2015 NorthMet Feb 2015 | 81 | |

| Figure 13-5: Total Cu Recovery vs. Cu Head | 86 | |

| Figure 13-6: Total Ni Recovery vs. Ni Head | 86 | |

| Figure 13-7: Total Co Recovery vs. Co Head | 86 | |

| Figure 13-8: Final Tail S Assay vs. S Head | 86 | |

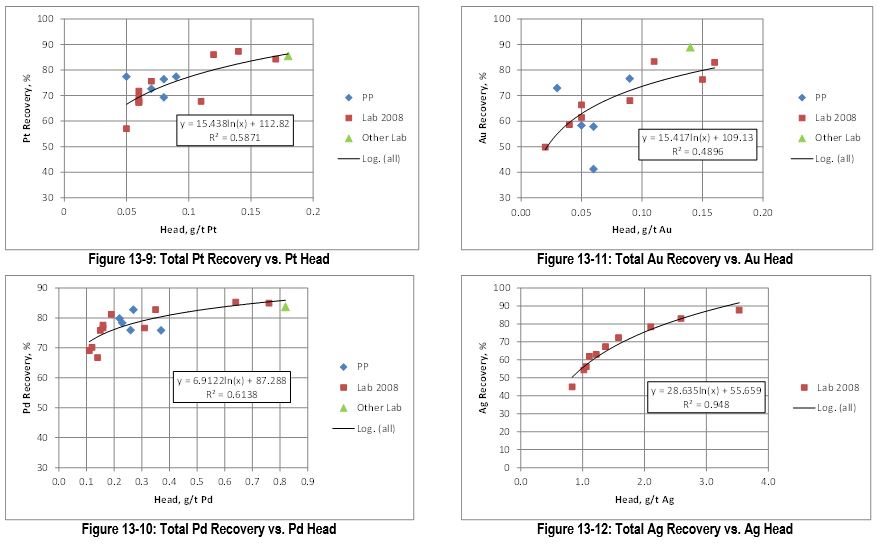

| Figure 13-9: Total Pt Recovery vs. Pt Head | 87 | |

| Figure 13-10: Total Pd Recovery vs. Pd Head | 87 | |

| Figure 13-11: Total Au Recovery vs. Au Head | 87 | |

| Figure 13-12: Total Ag Recovery vs. Ag Head | 87 | |

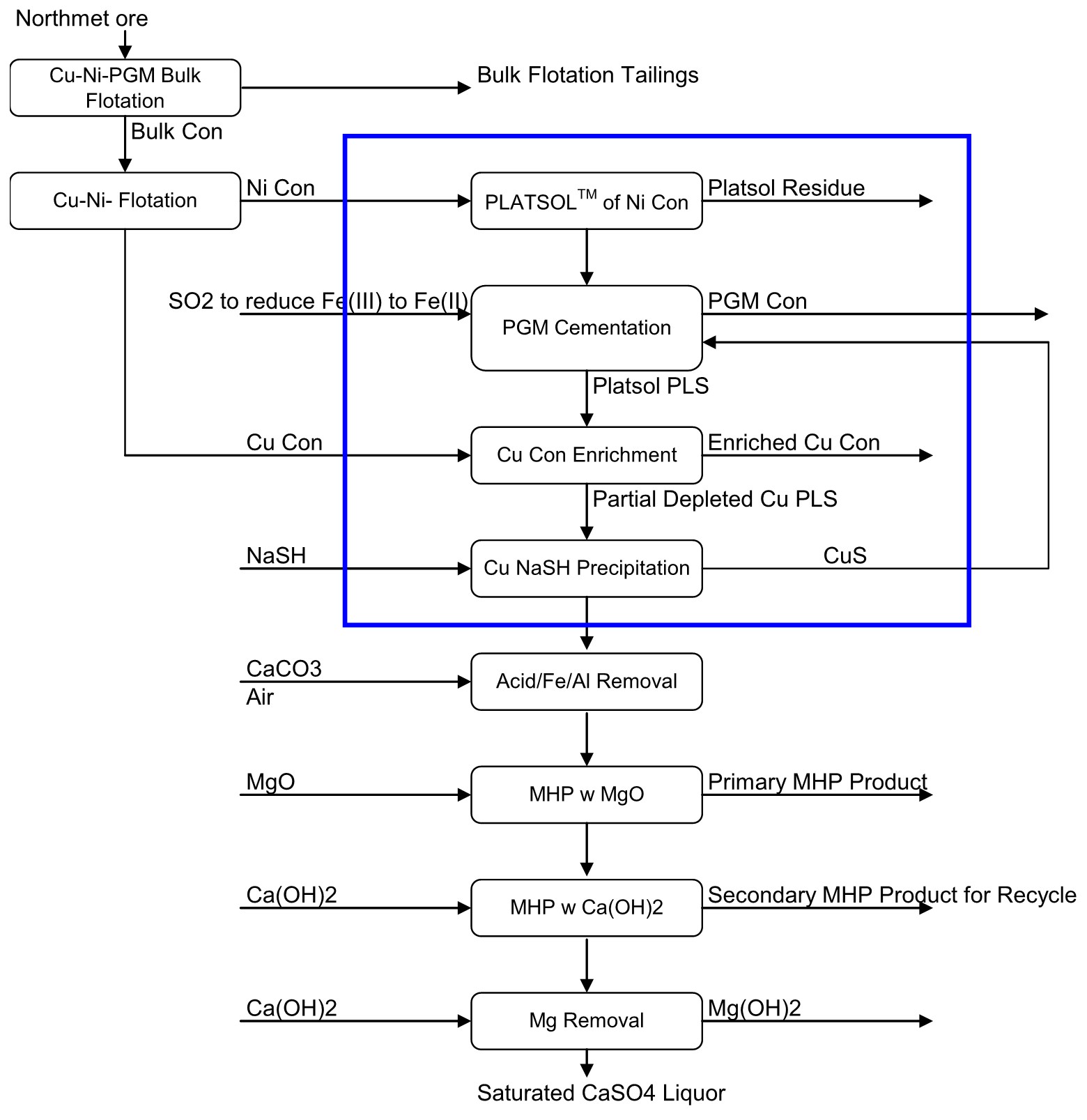

| Figure 13-13: Hydrometallurgical Pilot Plant Flowsheet | 89 | |

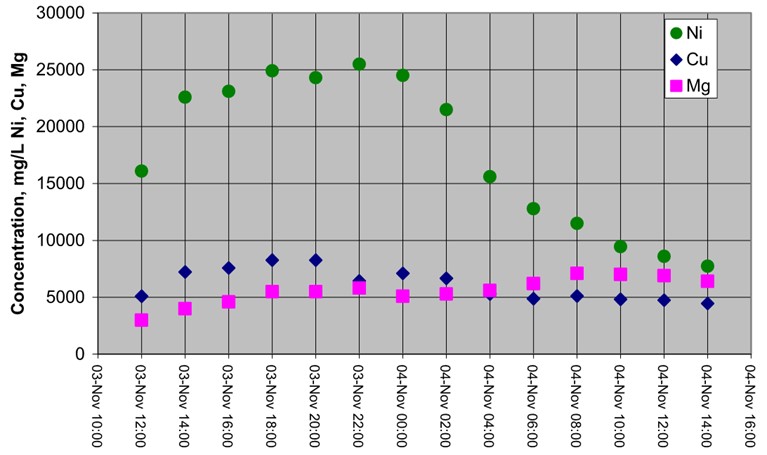

| Figure 13-14: ACD Liquor Ni, Cu, Mg PLS Trends | 91 | |

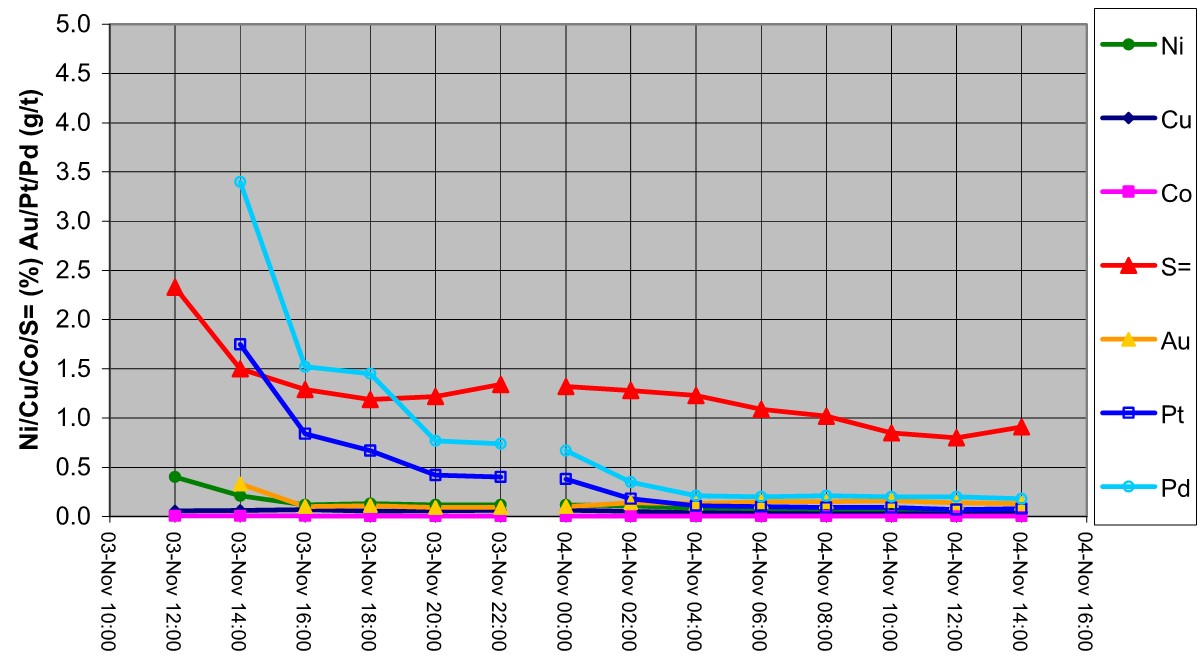

| Figure 13-15: ACD Residue Trends | 91 | |

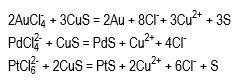

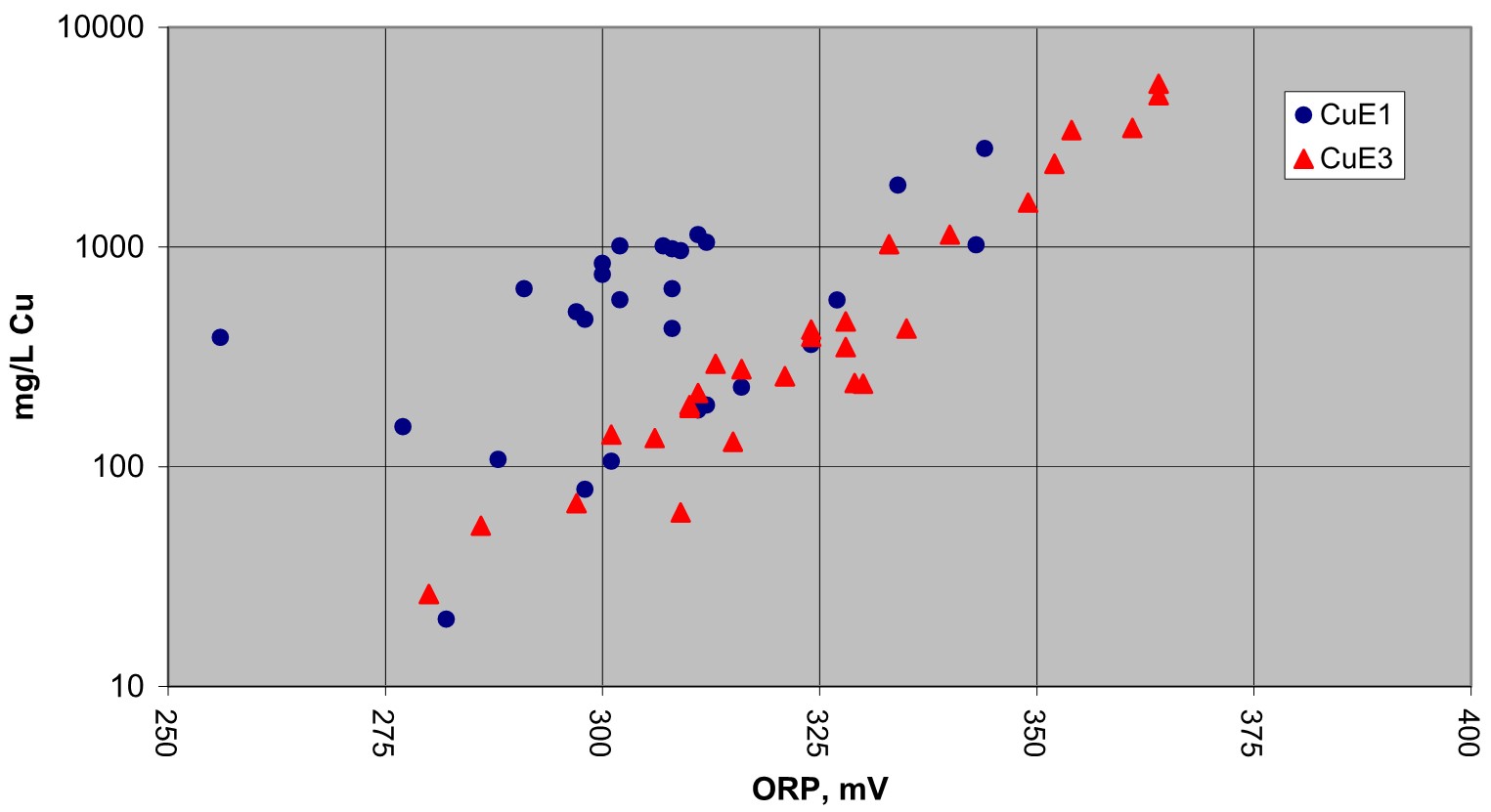

| Figure 13-16: Correlation between Cu and ORP Observed for Copper Enrichment Trials | 94 | |

| M3-PN150164 26 March 2018 |

xiii

NorthMet Project

Form NI 43-101F1 Technical Report

| Figure 13-17: Correlation Between ORP and Soluble Copper Concentration | 96 |

| Figure 14-1: Estimation Domains | 100 |

| Figure 14-2: Copper Correlation Plots | 105 |

| Figure 14-3: Contact Plot Virginia Formation and Unit 1 | 106 |

| Figure 14-4: Contact Plot Unit 1 and Unit 3 | 107 |

| Figure 14-5: Contact Plot Unit 3 and Unit 5 | 108 |

| Figure 14-6: Contact Plot Unit 5 and Unit 6 | 109 |

| Figure 14-7: Contact Plot Unit 6 and Unit 7 | 110 |

| Figure 14-8: Tukey Box Plots for Unit 1 | 112 |

| Figure 14-9: Copper Composite Study | 113 |

| Figure 14-10: North – South Section Looking East Displaying the Dynamic Search Ellipses | 119 |

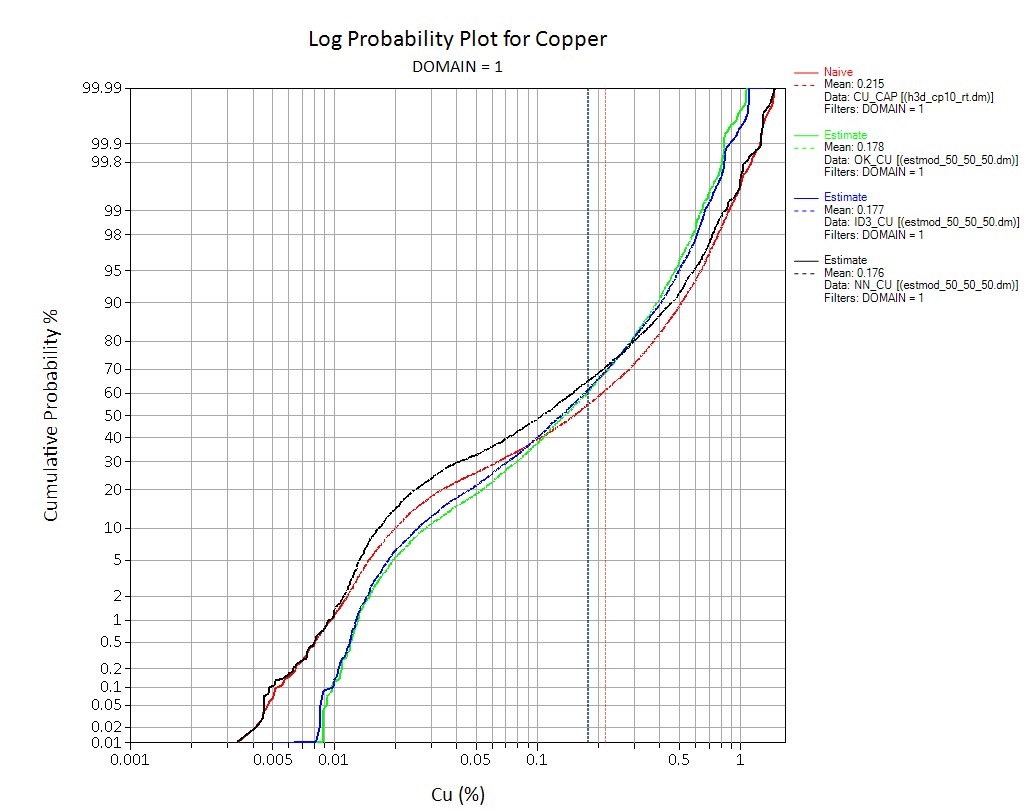

| Figure 14-11: Model Comparison Cumulative Frequency Plot (NN red, ID blue, Composites Black, OK Green) | 123 |

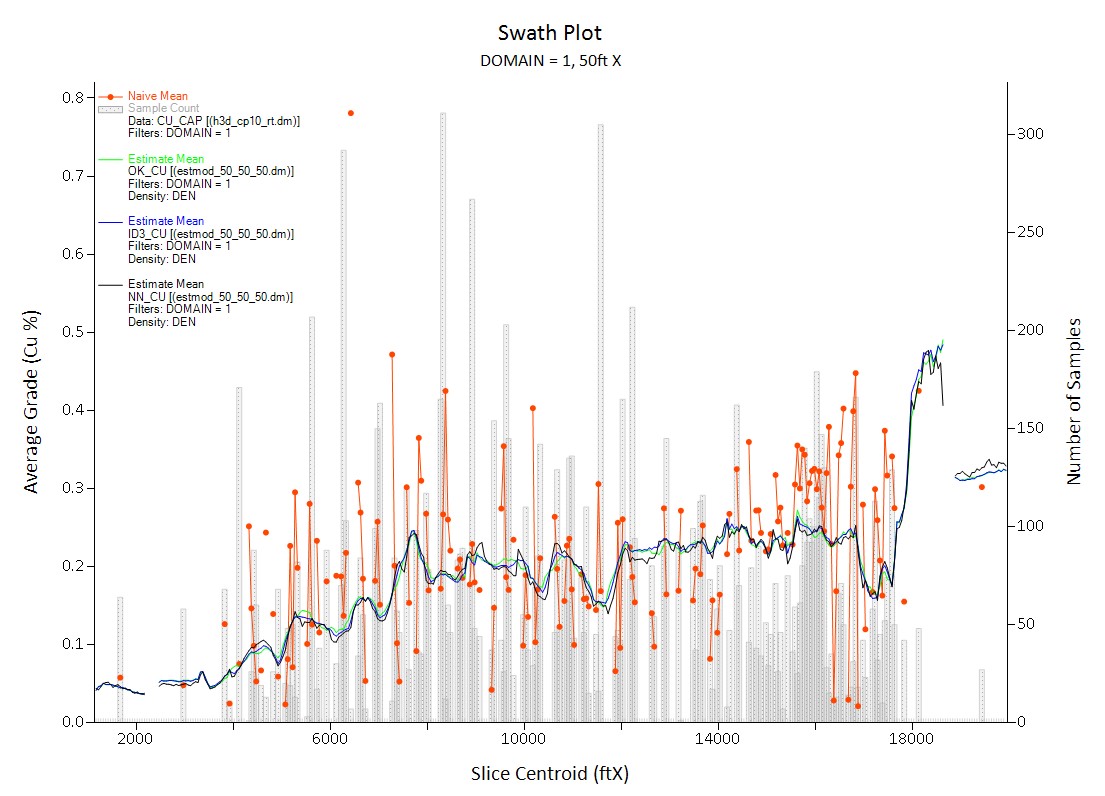

| Figure 14-12: Domain 1 Copper Swath Plot Along Rotated Easting | 124 |

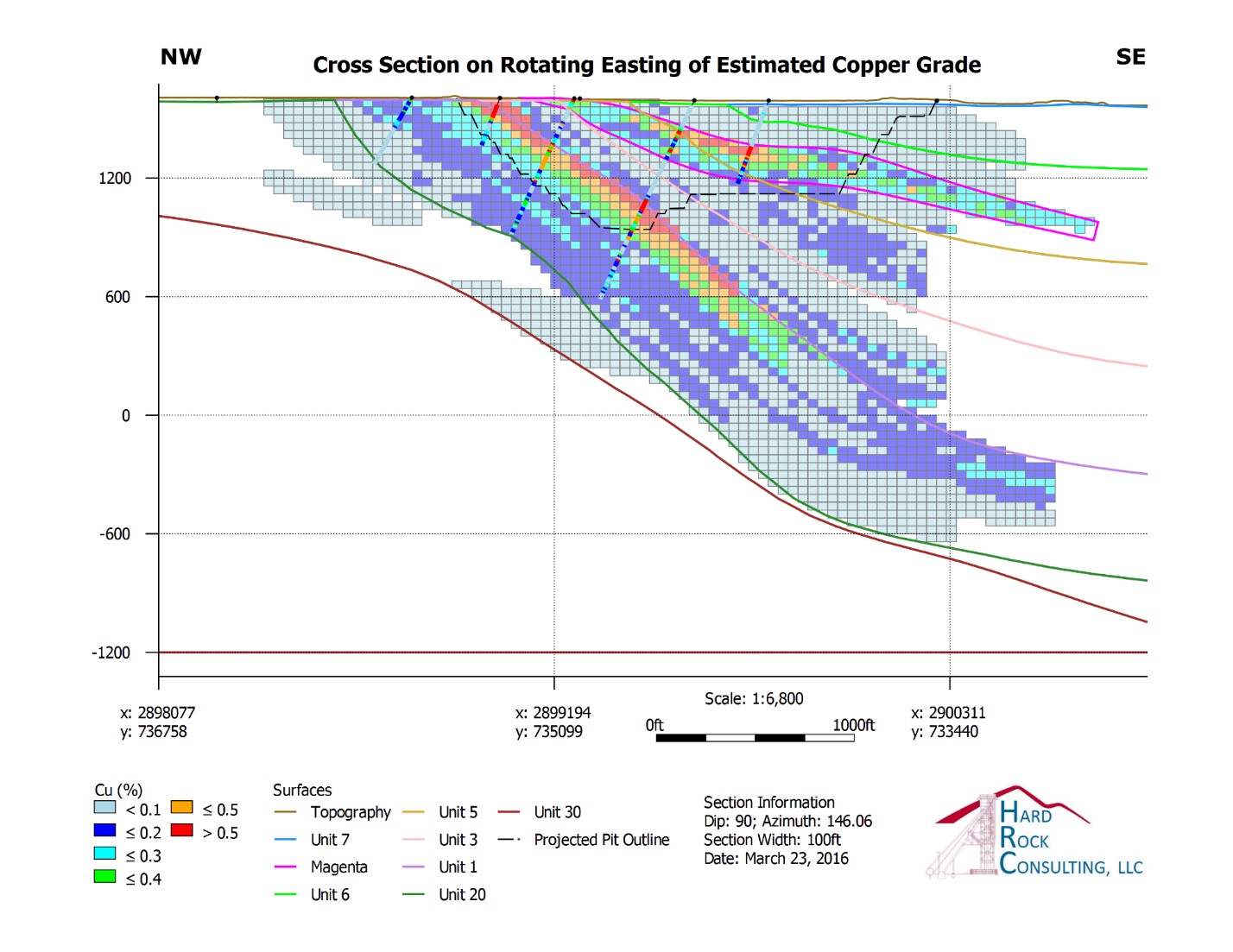

| Figure 14-13: Copper Cross Section Along Rotated Easting | 125 |

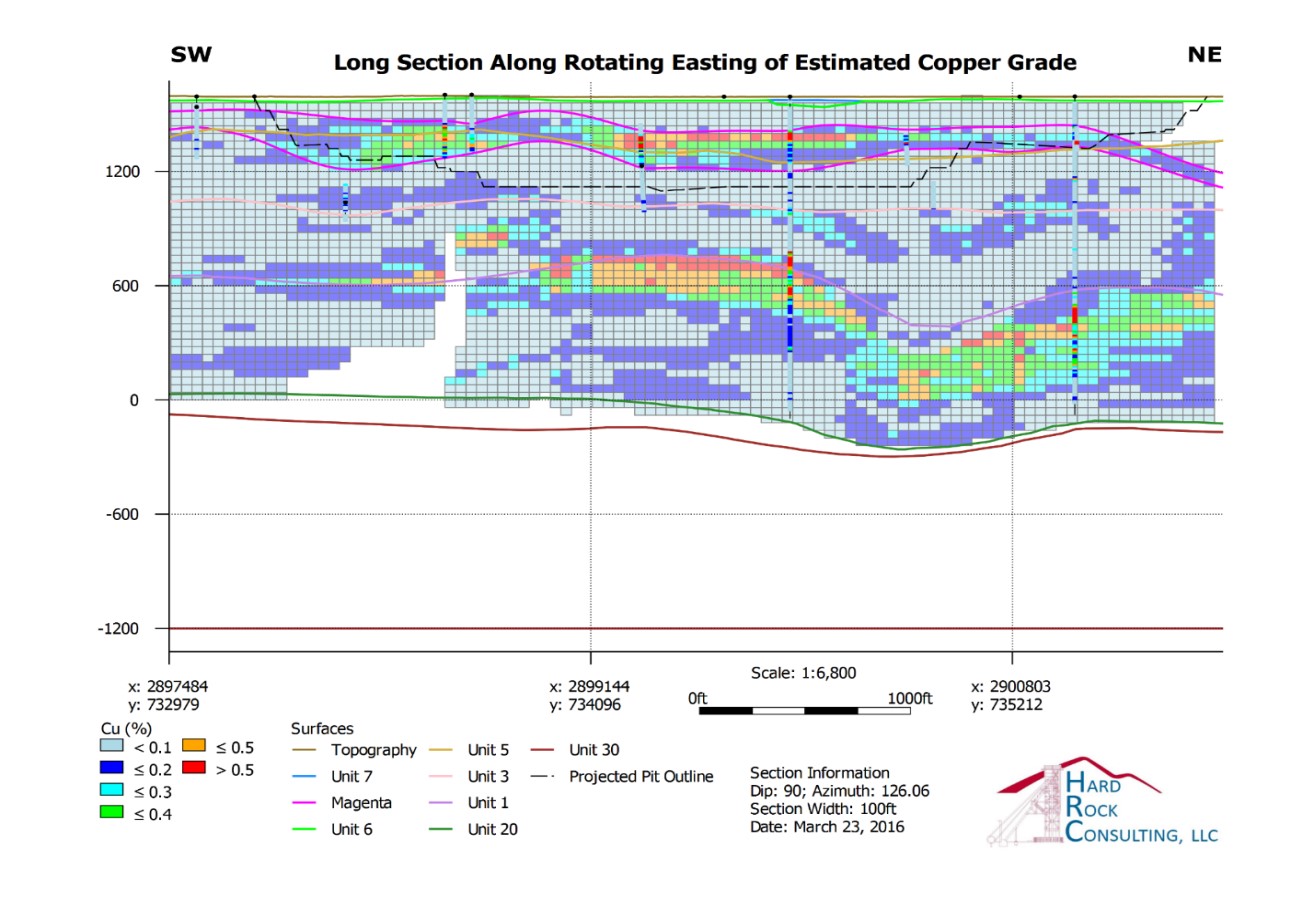

| Figure 14-14: Copper Long Section Along Rotated Northing | 126 |

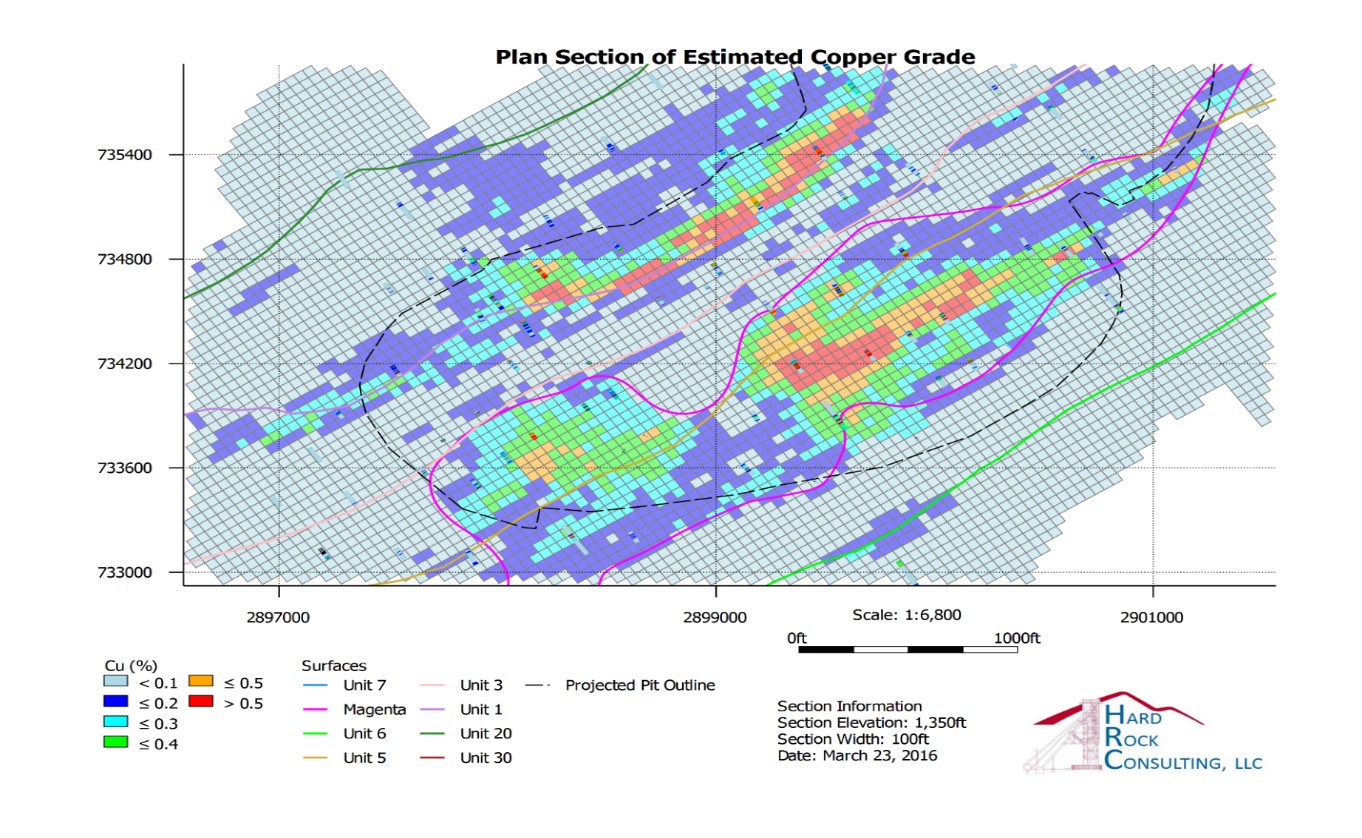

| Figure 14-15: Copper Plan Section | 126 |

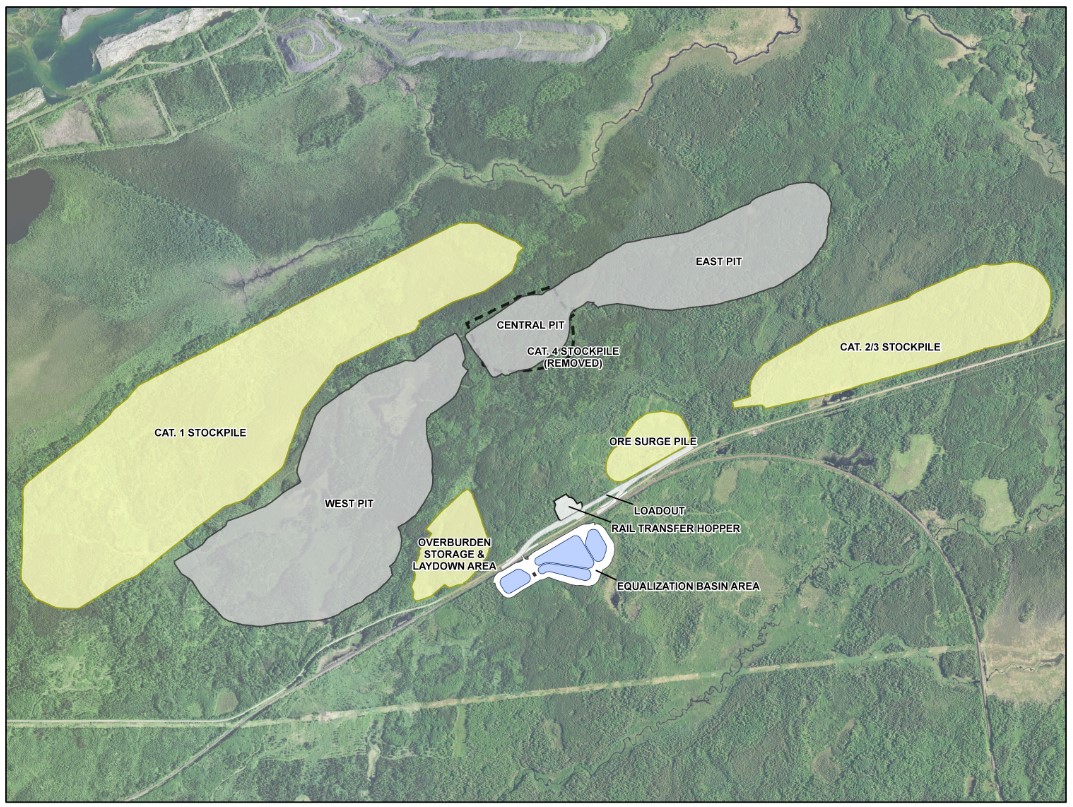

| Figure 16-1: Mine Site Layout | 134 |

| Figure 16-2: Pit Shell Map – End of Year 1 | 143 |

| Figure 16-3: Pit Shell Map – End of Year 20 | 144 |

| Figure 16-4: Process Plant Water Balance | 146 |

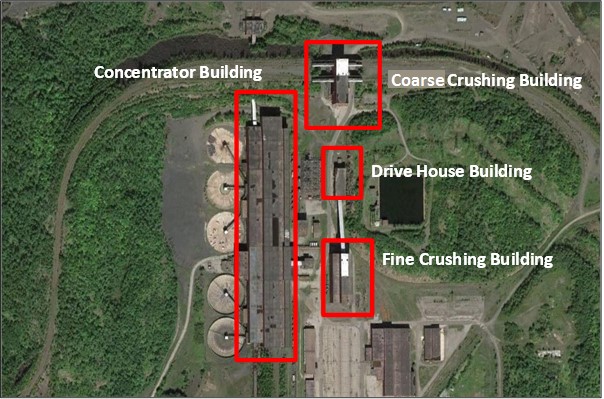

| Figure 17-1: Plant Aerial View | 156 |

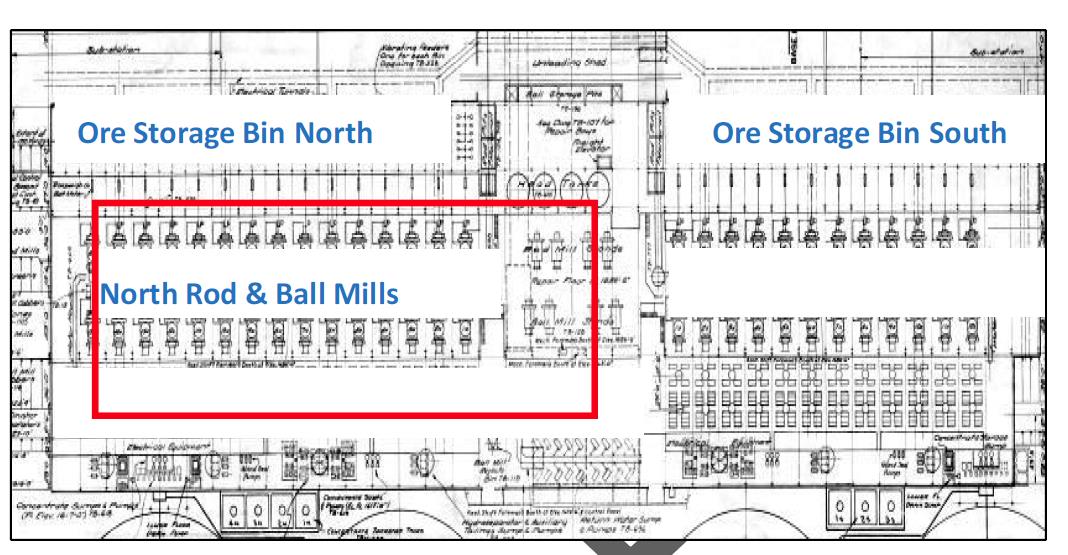

| Figure 17-2: Current Concentrator Arrangement | 158 |

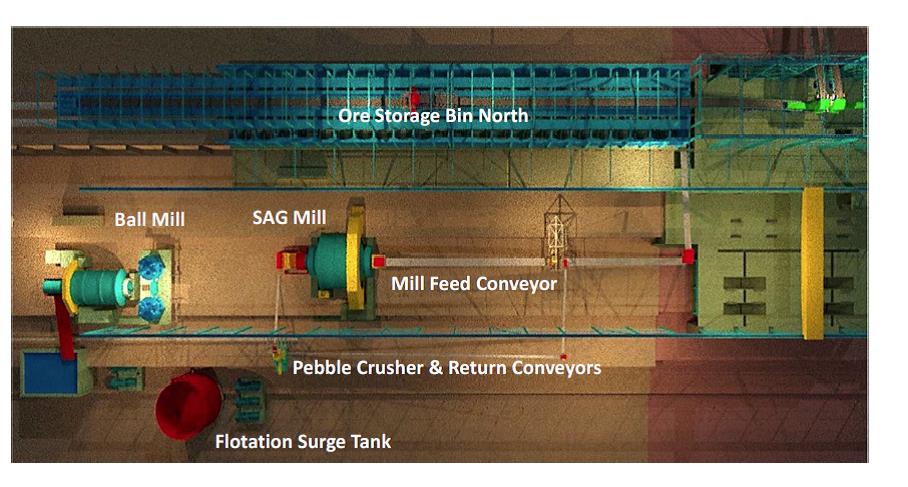

| Figure 17-3: Milling Circuit | 159 |

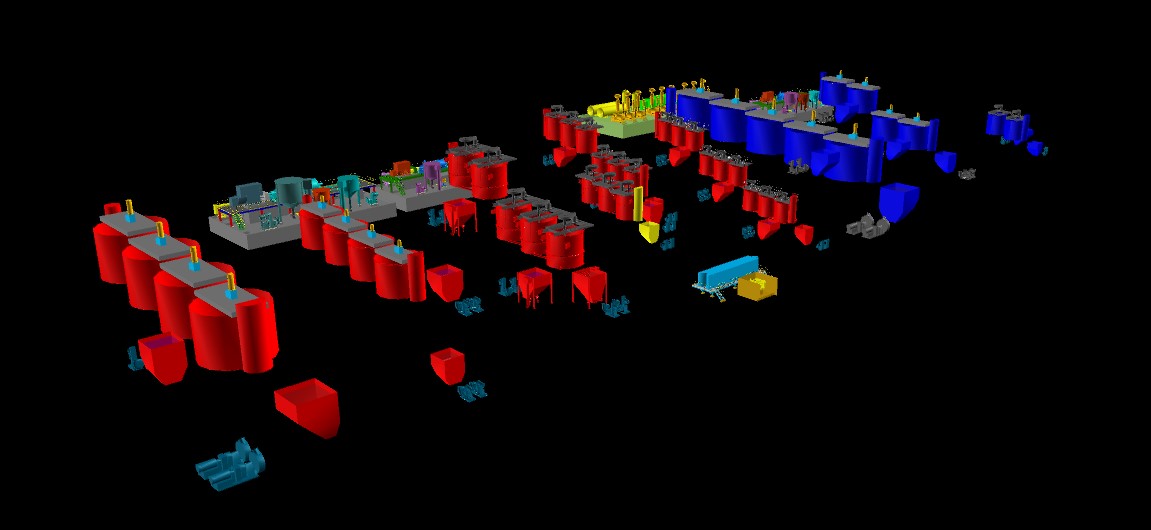

| Figure 17-4: Flotation Circuit | 160 |

| Figure 17-5: Overall Plant Process Flow Diagram | 167 |

| Figure 17-6: Phase I & II - Overall Plant Process Flow Diagram, Highlighting the Hydrometallurgical Plant Section | 179 |

| Figure 24-1: Project Execution Schedule Summary | 236 |

| Figure 24-2: Project Execution Schedule Summary Continued | 237 |

| Figure 24-3: Project Critical Path | 238 |

| M3-PN150164 26 March 2018 |

xiv

NorthMet Project

Form NI 43-101F1 Technical Report

LIST OF TABLES

| TABLE | DESCRIPTION | PAGE |

| Table 1-1: Mineral Reserve Statement – January 2018 | 22 | |

| Table 1-2: Summary Mineral Resource Statement for the NorthMet Project Inclusive of Mineral Reserves | 23 | |

| Table 1-3: Capital Expenditure & Operating Costs – Phase I and Phase I & II | 25 | |

| Table 1-4: Price Assumptions in the Financial Analysis | 25 | |

| Table 1-5: Financial Summary – 32,000 STPD | 26 | |

| Table 2-1: List of Qualified Persons | 28 | |

| Table 2-2: Units, Terms and Abbreviations | 29 | |

| Table 5-1: Current Iron Ore Mines on the Mesabi Iron Range | 38 | |

| Table 10-1: NorthMet Project Drill Hole Summary | 54 | |

| Table 10-2: Summary of Core Recoveries and RQD Measurements (includes all drilling through 2010) | 58 | |

| Table 11-1: Detection Limits of Elements | 62 | |

| Table 11-2: Detection Limits | 62 | |

| Table 11-3: Details of Sampling of U.S. Steel Core by PolyMet | 63 | |

| Table 12-1: Summary of the Analytical Data Used in the Estimation of Mineral Resources | 71 | |

| Table 13-1: Summary of Comminution Test Work Results | 74 | |

| Table 13-2: Summary of SMC Test Work Results Conducted by Hazen Research | 75 | |

| Table 13-3: Milling Circuit Design | 75 | |

| Table 13-4: Summary of Pilot Plant Test Work Results on Sample C9 | 77 | |

| Table 13-5: Projected Metallurgy of Cu-Ni Separation LCT of C9 Pilot Cleaner Concentrate | 79 | |

| Table 13-6: Summary of Laboratory Test Work Results on Sample C10 | 79 | |

| Table 13-7: Flotation Stage Design Parameters | 80 | |

| Table 13-8: Flotation Plant Simulation and Design Parameters | 82 | |

| Table 13-9: Summary of Flotation Circuit Simulation | 83 | |

| Table 13-10: NorthMet Tank Cell Sizing and Selection | 84 | |

| Table 13-11: Summary of C-9 and C-10 Metallurgy Compared to Model | 88 | |

| Table 13-12: Flotation Concentrate Head Assays Used in the Test Campaigns (C1 & C2) | 90 | |

| Table 13-13: Average Autoclave Feed Flowrates | 90 | |

| Table 13-14: Base Metal and PGM Recoveries | 92 | |

| Table 13-15: Summary of PGM Precipitation Operating Parameters | 92 | |

| Table 13-16: Comparison between PGM Precipitation Circuit Feed and Filtrate Concentrations | 93 | |

| Table 13-17: Operating Conditions and Feed Parameter for Copper Concentrate Enrichment | 94 | |

| M3-PN150164 26 March 2018 |

xv

NorthMet Project

Form NI 43-101F1 Technical Report

| Table 13-18: Head and Copper Enrichment Solids and Filtrate Composite Assays | 95 |

| Table 13-19: Soluble Copper Precipitation Parameters | 95 |

| Table 13-20: NaHS Product Filter Cake Assays | 96 |

| Table 13-21: Test Conditions, Target Ni Concentrations and Ni and Co Feed Concentrations for MHP Tests | 97 |

| Table 13-22: MHP Stage 1 Final Product Analysis and Distribution for Campaigns C1 & C2 | 97 |

| Table 13-23: Test Conditions for Bulk Magnesium Removal | 98 |

| Table 14-1: Specific Gravity Average per Unit (October 15 Dataset) | 101 |

| Table 14-2: Copper Sample Statistics | 101 |

| Table 14-3:Nickel Sample Statistics | 102 |

| Table 14-4: Platinum Sample Statistics | 102 |

| Table 14-5: Palladium Sample Statistics | 102 |

| Table 14-6: Gold Sample Statistics | 102 |

| Table 14-7: Silver Sample Statistics | 103 |

| Table 14-8:Cobalt Sample Statistics | 103 |

| Table 14-9: Sulfur Sample Statistics | 103 |

| Table 14-10: Spearman Rank Correlation Matrix | 104 |

| Table 14-11: Summary of Capped Values for Each Metal | 113 |

| Table 14-12: Copper Capped Composite Descriptive Statistics | 114 |

| Table 14-13: Nickel Capped Composite Descriptive Statistics | 114 |

| Table 14-14: Platinum Capped Composite Descriptive Statistics | 114 |

| Table 14-15: Palladium Capped Composite Descriptive Statistics | 114 |

| Table 14-16: Gold Capped Composite Descriptive Statistics | 115 |

| Table 14-17: Silver Capped Composite Descriptive Statistics | 115 |

| Table 14-18: Cobalt Capped Composite Descriptive Statistics | 115 |

| Table 14-19: Sulfur Capped Composite Descriptive Statistics | 115 |

| Table 14-20: Unit Variogram Parameters | 116 |

| Table 14-21: Units 20 and 3, 5, 6, and 7 Variogram Parameters | 117 |

| Table 14-22: Magenta Zone Variogram Parameters | 118 |

| Table 14-23: Search Volume Parameters for all Domains | 119 |

| Table 14-24: Mineral Resource Classification Criteria | 120 |

| Table 14-25: Copper Model Statistics | 120 |

| Table 14-26: Nickel Model Statistics | 120 |

| Table 14-27: Platinum Model Statistics | 121 |

| Table 14-28: Palladium Model Statistics | 121 |

| M3-PN150164 26 March 2018 |

xvi

NorthMet Project

Form NI 43-101F1 Technical Report

| Table 14-29: Gold Model Statistics | 121 |

| Table 14-30: Silver Model Statistics | 121 |

| Table 14-31: Cobalt Model Statistics | 122 |

| Table 14-32: Sulfur Model Statistics | 122 |

| Table 14-33: Resource Metal Prices and Estimated Recoveries | 127 |

| Table 14-34: Estimated Process Operating Costs | 127 |

| Table 14-35: Mineral Resource Statement for the NorthMet Project Inclusive of Mineral Reserves, Hard Rock Consulting, LLC, January 1, 2018 | 128 |

| Table 15-1: Mineral Reserve NSR Cutoff | 130 |

| Table 15-2: Mineral Reserve Metal Prices | 130 |

| Table 15-3: Plant Recovery to Concentrates of Reserve Blocks | 131 |

| Table 15-4: Summary of Concentrate Treatment Terms | 131 |

| Table 15-5: Mineral Reserve Statement – December 2017 | 132 |

| Table 16-1: Waste Rock Classification | 135 |

| Table 16-2: Pit Design Criteria | 138 |

| Table 16-3: Yearly Mine Production Schedule | 140 |

| Table 16-4: Yearly Mill Feed Schedule | 141 |

| Table 16-5: Mine Schedule Parameters | 147 |

| Table 16-6: Major Mine Equipment Mechanical Availability, Utilization and Fleet Size | 148 |

| Table 16-7: Drill Productivity | 148 |

| Table 16-8: Loading Equipment Productivity | 149 |

| Table 16-9: Truck Fleet Requirements | 150 |

| Table 16-10: Mine Operations and Maintenance Personnel | 153 |

| Table 16-11: Mine Operations and Maintenance Salary Personnel | 154 |

| Table 17-1: List of Major Equipment in the Hydrometallurgical Plant | 178 |

| Table 17-2: Materials Consumed by the Hydrometallurgical Plant Process | 182 |

| Table 17-3: Hydrometallurgical Plant Metal Recoveries | 183 |

| Table 20-1: Permits Under Application | 193 |

| Table 21-1: Phase I Direct Costs | 199 |

| Table 21-2: Summary of Mine Capital Cost ($USx1000) | 201 |

| Table 21-3: Mine Capital Cost by Year | 202 |

| Table 21-4: Phase II Direct Costs (Hydrometallurgical Plant) | 207 |

| Table 21-5: Direct and Indirect Costs (Phase I & II) | 209 |

| Table 21-6: Mine Operating Costs by Process | 210 |

| M3-PN150164 26 March 2018 |

xvii

NorthMet Project

Form NI 43-101F1 Technical Report

| Table 21-7: Mine Operating Costs Per Ton Moved ($000) by Cost Centers | 212 |

| Table 21-8: Phase I Operating Cost Estimate Summary | 213 |

| Table 21-9: Labor Schedule and Rates | 215 |

| Table 21-10: Summary of Electric Power Costs | 217 |

| Table 21-11: Process Equipment Power Draw Summary | 218 |

| Table 21-12: HVAC and Dust Collection Electric Power Summary | 219 |

| Table 21-13: Summary of Natural Gas Costs (Heating) | 219 |

| Table 21-14: HVAC Natural Gas Demand | 219 |

| Table 21-15: Process Plant Reagent and Consumable Consumption and Costs | 220 |

| Table 21-16: Maintenance, Parts and Supplies Factors | 221 |

| Table 21-17: Breakdown of Laboratory Assay Costs | 222 |

| Table 21-18: Phase II Operating Cost Estimate Summary | 222 |

| Table 22-1: LOM Operating Cost Highlights – Phase I and Phase I & II Combined | 225 |

| Table 22-2: 32,000 STPD Base Case (Phase I) Price and Operating Assumptions and Key Production Numbers | 226 |

| Table 22-3: Base Case (Phase I & II) Price and Operating Assumptions and Key Production Numbers | 226 |

| Table 22-4: Phase I Economic Projections on a Range of Metal Price Assumptions | 227 |

| Table 22-5: Phase I & II Economic Projections on a Range of Metal Price Assumptions | 227 |

| Table 22-6: Initial and Expansion Capital Summary | 228 |

| Table 22-7: Phase I and Phase I & II Operating Cost Summary | 228 |

| Table 22-8: Sustaining Capital Summary | 229 |

| Table 22-9: NorthMet Financial Model – 32,000 STPD with Hydrometallurgical Plant (Phase I and Phase II Combined | 230 |

| Table 24-1: A Comparison of the Mill Feed Tonnages between 59,000 and 118,000 STPD Throughputs | 240 |

| Table 24-2: Comparison of Cost Inputs to NSR Cutoff Grade for Various Throughputs (STPD) | 241 |

| Table 24-3: LOM Operating Highlights for 59,000 STPD & 118,000 STPD | 244 |

| Table 24-4: 59,000 STPD Economic Highlights | 245 |

| Table 24-5: 118,000 STPD Economic Highlights | 246 |

| Table 24-6: Metal Price Sensitivity Analysis for 59,000 STPD Phase I | 247 |

| Table 24-7: Metal Price Sensitivity Analysis for 59,000 STPD Phase I and II | 247 |

| Table 24-8: Metal Price Sensitivity Analysis for 118,000 STPD Phase I | 248 |

| Table 24-9: Metal Price Sensitivity Analysis for 118,000 STPD Phase I and II | 248 |

| Table 25-1: Project Risks Identified for the Feasibility Study | 252 |

| Table 25-2: Project Opportunities Identified for the Feasibility Study | 255 |

| M3-PN150164 26 March 2018 |

xviii

NorthMet Project

Form NI 43-101F1 Technical Report

| 1 | EXECUTIVE SUMMARY |

Poly Met Mining, Inc. (PolyMet US), a Minnesota company and a wholly owned subsidiary of PolyMet Mining Corp. (PolyMet), contracted M3 Engineering & Technology Corporation (M3) to complete an updated Technical Report (the “Study”), at a Feasibility Study level, for the NorthMet Copper and Nickel Project (the “Project” or “NorthMet”) located near Hoyt Lakes, Minnesota, US. PolyMet US also retained Independent Mining Consultants (IMC), Senet, (Pty) Ltd. (Senet), Hard Rock Consulting, LLC (HRC) and Barr Engineering Company (Barr) to contribute to this Study. The update is based on feasibility-study-level engineering as well as the Final Environmental Impact Statement (FEIS, Nov 2015) and recently released draft environmental permits (Jan 2018) for the development of a 32,000-short ton per day (STPD) 225 million short ton production schedule.

PolyMet US also requested that M3 investigate potential project economic valuations using scoping or preliminary economic assessment (PEA) level mine designs at higher throughputs (59,000 and 118,000 STPD). The estimates for these two scenarios are preliminary in nature and both scenarios include Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that the results for these two cases will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability and there is no certainty that Mineral Resources will become Mineral Reserves.

The purpose of the additional investigations is to quantify the potential viability of identified resources at higher throughputs that are not currently permitted for development. Development of those additional resources would require additional engineering, environmental review and permitting and would require changes in infrastructure that would require significant capital investment. The economic viability of these additional resources has not been demonstrated to date. These scenarios are only being presented in Section 1.10 and Section 24 of this report and, for clarity, they have not been included with the economic analysis presented in Section 22 of this report. In no way do these scenarios demonstrate economic viability.

Based on these results, M3 recommends that additional engineering and environmental studies be performed to further refine the costs, valuations and environmental requirements of the potential production scenarios which may have the opportunity to create additional value.

1.1 Key Results

1.1.1 Project Phases

This Study details the construction and operation of the Project in two distinct phases. These phases are:

| · | Phase I: Involves development of the NorthMet 225-million-ton orebody into an operating mine producing 32,000 STPD of ore over a 20-year life and rehabilitating an existing taconite processing plant, tailings storage facility and infrastructure (also referred to as the “Erie Plant”) located approximately eight miles to the west. Phase I would produce commercial grade copper and nickel concentrates for which Glencore AG (“Glencore”) currently holds offtake agreements payable at market terms. |

| · | Phase II: Involves construction and operation of a hydrometallurgical plant to treat nickel sulfide concentrates into upgraded nickel-cobalt hydroxide and recover additional copper and Platinum Group Metals (“PGM”). |

Execution of Phase II would be at the company’s discretion. However, both Phase I and Phase II are currently being permitted, having been included in the FEIS and draft permits.

For the purposes of this Study, all monetary values are in United States Dollars ($). All references to “ton” or “tons” in this Study refer to US short tons except as noted otherwise. Life of Mine (LOM capital and operating costs are reported in Table 1‑3. Metal pricing used for the financial analysis is shown in Table 1‑4. Key financial metrics and production figures are shown in Table 1‑5.

| M3-PN150164 26 March 2018 |

19

NorthMet Project

Form NI 43-101F1 Technical Report

| 1.1.2 | Key Results for Both Phases |

Both Phase I and Phase II were developed as Class 3 estimates as defined by AACE International (AACEI), which corresponds to estimates performed at a feasibility level. Key results common to both phases are as follows:

| · | Total proven and probable mineral reserves for the Project are estimated to be 254.669 million tons within the pit footprints evaluated in the FEIS and draft permits. Head grades for the reserve are shown in Table 1‑1. |

| · | Of the mineral reserve tonnage, 225 million tons (Proven and Probable) are included in the 32,000 STPD draft permit mine plan based on metal prices shown in Table 1‑4. For reference, the mill copper equivalent is 0.586%. |

| · | The mine plan at 32,000 STPD yields a mine life of approximately 20 years. |

| · | Measured and indicated resources total 649.3 million tons at a copper equivalent grade of 0.496%, inclusive of mineral reserves, and using the price assumptions reported in Table 14‑33. |

| · | Inferred resources are estimated at 508.9 million tons at a copper equivalent grade of 0.489% (See Table 1‑2). |

| · | Refurbishing the existing Erie Plant and associated infrastructure with a modern semi-autogenous grinding (SAG) mill and flotation plant is technically viable and will produce saleable copper and nickel concentrate products for the 32,000 STPD design used in this Study. PolyMet US plans to process 11.6 million tons of ore per year, or an average of 32,000 STPD, representing approximately one third of the historic capacity of the plant. |

| · | PolyMet US has secured offtake agreements at market terms for copper, nickel, cobalt and PGM products from Glencore. |

1.1.3 Phase I Key Results at 32,000 STPD

Under this phase, PolyMet US plans to refurbish the primary crushing circuit and replace the existing rod and ball mill circuits with a new modern semi autogenous grinding (SAG) mill, a new large ball mill and a new flotation circuit. Once upgraded, the Erie Plant will produce copper and nickel concentrates that will be transported by rail to third-party smelting facilities. For Phase I, the 32,000 STPD case for this Study shows:

| · | Initial Capital Cost Estimate (CAPEX) of $945 million, |

| · | After-tax Net Present Value at a 7% discount rate (NPV@7%) of $173.3 million, and |

| · | Internal Rate of Return (IRR) of 9.6%. |

Under Phase I, which only includes revenues based on concentrate sales, payable metals in the concentrate are estimated as 1,096 million lbs of copper, 133 million lbs of nickel, a combined 1.05 million oz of platinum, palladium and gold, 0.96 million oz of silver and 5.6 million lbs of cobalt. Palladium is the predominant PGM product, totalling 0.836 million oz.

Total life-of-mine (LOM) copper recovered in concentrates is expected to be 91.8%, with 63.5% recovery of nickel in concentrates under this phase.

| M3-PN150164 26 March 2018 |

20

NorthMet Project

Form NI 43-101F1 Technical Report

| 1.1.4 | Phase II Key Results at 32,000 STPD |

Phase II of the Project involves constructing a Hydrometallurgical Process that includes a 1,000 STPD autoclave to solubilize the nickel concentrates to produce a nickel-cobalt hydroxide and a precious metals precipitate. Copper precipitates from the process will be combined with the copper concentrate. Timing of Phase II will depend on the nickel concentrate market. For Phase II, the 32,000 STPD case for this Study shows improved economics as follows:

| · | Initial CAPEX of $1,204 million (inclusive of Phase I costs), |

| · | After-tax NPV@7% of $271 million, and |

| · | IRR of 10.3%. |

Under Phase II, payable metals in enriched copper concentrates and products from the hydrometallurgical plant are 1,155 million lbs of copper, 174 million lbs of nickel, 1.56 million combined oz of platinum, palladium and gold, 0.958 million oz of silver and 6.2 million lbs of cobalt. Palladium is the predominant PGM product, totalling 1.19 million oz.

| 1.2 | Location And Ownership |

The NorthMet Deposit is situated on a private mineral lease located in St Louis County in northeastern Minnesota, US, at approximately Latitude 47° 36’ north, Longitude 91° 58’ west, 90 road miles north of Duluth and 6.5 miles south of the town of Babbitt.

The NorthMet Project comprises two elements: The NorthMet Deposit and the nearby Erie Plant. PolyMet US leases the mineral rights to the NorthMet Deposit under a perpetually renewable lease and is acquiring the Erie Plant through contracts for deed with Cliffs Erie, L.L.C. (Cliffs Erie) a subsidiary of Cleveland Cliffs (Cliffs), which will be satisfied once the State of Minnesota issues the NorthMet permits to PolyMet US and assigns certain existing operating permits held by Cliffs Erie to PolyMet US or otherwise terminates those existing Cliffs Erie permits.

| 1.3 | Geology And Mineralization |

The NorthMet Deposit is one of twelve known copper-nickel-platinum group metal deposits along the northern margin of the Duluth Complex. The Duluth Complex is a large, composite, layered, mafic intrusion that was emplaced into comagmatic flood basalts along a portion of the Mesoproterozoic Midcontinent Rift System. The NorthMet deposit is hosted by the Partridge River Intrusion (PRI), which consists of troctolitic, anorthositic and minor gabbroic rock types that have been subdivided into seven igneous stratigraphic units. The ore-bearing units are primarily found in the basal unit of the Duluth Complex, which contains disseminated sulfides and minor massive sulfides hosted in troctolitic rocks. The Duluth Complex dips shallowly to the southeast in the western end of the deposit but steepens moving to the east.

The metals of interest at NorthMet are copper, nickel, cobalt, platinum, palladium, silver and gold. Minor amounts of rhodium, osmium, iridium and ruthenium are also present though these are considered to have no economic significance. The majority of the metals are concentrated in, or associated with, four sulfide minerals: chalcopyrite, cubanite, pentlandite, and pyrrhotite. Platinum, palladium and gold are found in bismuthides, tellurides, and alloys. In general, the metals have strong positive correlations with copper sulfide mineralization. Cobalt has a strong correlation with nickel. At the NorthMet Deposit, Duluth Complex rocks are overlain by up to 50 feet of overburden. Average overburden depth from all drill holes is 13 feet.

| 1.4 | Status of Exploration |

The NorthMet Deposit was formally discovered during drilling exploration carried out by U.S. Steel based on an anomaly identified during airborne survey work completed in 1966. Between 1969 and 1974, U.S. Steel drilled 112 holes for a total of 113,716 feet, producing 9,475 assay intervals, which are included in the Project database. U.S. Steel also collected three bulk surface samples for metallurgical testing from two discrete locations within the NorthMet Project area. In total, eight major exploration programs carried out at NorthMet (U.S. Steel, NERCO, and PolyMet US) have produced 436 boreholes, providing over 300,000 feet of stratigraphic control and extensive assay results.

| M3-PN150164 26 March 2018 |

21

NorthMet Project

Form NI 43-101F1 Technical Report

All exploration data have been collected in a drill-hole database used for geologic modeling, resource estimation, and mine planning. PolyMet US has verified and validated all drill-hole collar locations, down-hole surveys, lithologies, geotechnical properties, and assay data, organized all related records, and established procedures for ongoing database maintenance.

| 1.5 | Mineral Reserve Statement |

Proven and Probable Mineral Reserves of 255 million tons are reported within the final pit design used for the mine production schedule and shown in Table 1‑1. All inferred material was classified as waste and scheduled to the appropriate waste stockpile. The final mineral reserves are reported using a $7.98 NSR cut-off inside the pit design using the diluted grades. Both the mineral resource and mineral reserve estimates take into consideration metallurgical recoveries, concentrate grades, transportation costs, smelter treatment charges and royalties in determining NSR values. Table 1‑1 also shows the mineral reserves by classification category and grade. The Qualified Person responsible for the Mineral Reserve estimate is Herb Welhener, Vice President of IMC.

Table 1‑1: Mineral Reserve Statement – January 2018

| Class | Tonnage (x 1,000) | Grades (Diluted) | ||||||||||||||||||||||||||||||||||||||

| Copper | Nickel | Platinum | Palladium | Gold | Cobalt | Silver | NSR | Cu-Eq | ||||||||||||||||||||||||||||||||

| (%) | (%) | (ppb) | (ppb) | (ppb) | (ppm) | (ppm) | $/ton | (%) | ||||||||||||||||||||||||||||||||

| Proven | 121,849 | 0.308 | 0.087 | 82 | 282 | 41 | 74.81 | 1.11 | 19.87 | 0.612 | ||||||||||||||||||||||||||||||

| Probable | 132,820 | 0.281 | 0.081 | 78 | 256 | 37 | 74.06 | 1.02 | 18.02 | 0.559 | ||||||||||||||||||||||||||||||

| Total | 254,669 | 0.294 | 0.084 | 80 | 268 | 39 | 74.42 | 1.06 | 18.90 | 0.584 | ||||||||||||||||||||||||||||||

Notes: | |

(1) | Mineral reserve tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding |

(2) | All reserves are stated above a $7.98 NSR cutoff and bound within the final pit design. |

(3) | Tonnage and grade estimates are in Imperial units |

(4) | Total Tonnage within the pit is 628,499 ktons; average waste: ore ratio = 1.47 |

(5) | Copper Equivalent (CuEq) values are based on the metal prices in Table 15‑2 and total mill recoveries in Table 15‑3 and diluted mill feed. |

(6) | Copper Equivalent (CuEq) = ((Cu head grade x recovery x Cu Price) + (Ni head grade x recovery x Ni Price) + (Pt head grade x recovery x Pt Price) + (Pd head grade x recovery x Pd Price) + (Au head grade x recovery x Au Price) + (Co head grade x recovery x Co Price) (Ag head grade x recovery x Ag Price)) / (Cu recovery x Cu Price) |

(7) | NSR values include post property concentrate transportation, smelting and refining costs and payable metal calculations. |

| 1.6 | Mineral Resource Estimate |

Zachary J. Black, RM-SME, of Hard Rock Consulting, LLC (HRC) is a Qualified Person as defined by NI 43-101 for mineral resource estimation and classification. HRC estimated the mineral resource for the NorthMet Project from drill-hole data constrained by geologic boundaries using an Ordinary Kriging (“OK”) algorithm.

The NorthMet Deposit was divided into eight units for geological modeling: the Biwabik Iron Formation including banded iron formation, sedimentary marine rocks of the Virginia Formation that overlie the Biwabik Formation, and five distinct units within the Duluth Complex and overburden.

The Magenta Zone, a smaller mineralized zone that cuts through Units 3 through 7 but resides primarily within Units 5 and 6, was modeled from select intercepts provided by PolyMet US.

Grades that were estimated include copper, nickel, cobalt, platinum, palladium, gold, silver and total sulfur.

| M3-PN150164 26 March 2018 |

22

NorthMet Project

Form NI 43-101F1 Technical Report

HRC created a rotated three-dimensional (3D) block model in Datamine Studio 3® mining software. The block resource model was estimated using the lithologic boundaries of the Duluth Complex as the basis for an estimation domain. Units 1, 3, 5, 6, 7, the Magenta Zone, and Virginia Formation were all estimated using only samples that resided inside of the defined boundaries. Grades were estimated from 10-foot (ft) down-hole composites using Ordinary Kriging. Composites were coded according to their domain. Each metal was estimated using variogram parameters established by AGP Mining Consultants Inc. (AGP) in 2013, which were re-evaluated by HRC and deemed acceptable for use in the current mineral resource estimation.

The mineral resources reported herein are classified as Measured, Indicated and Inferred in accordance with standards defined by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “CIM Definition Standards – For Mineral Resources and Mineral Reserves,” prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council on May 10, 2014. Each individual mineral resource classification reflects an associated relative confidence of the grade estimates.

The mineral resources estimated for the NorthMet Project includes 649.3 million tons of Measured and Indicated resources and 508.9 million tons Inferred resources. The resource has been limited to the material that resides above the optimized pit shell. All mineralization below the optimized pit shell has been excluded from any resource classification and is not considered to be part of the mineral resource.

The mineral resource estimate for the NorthMet Project is summarized in Table 1‑2. This mineral resource estimate includes all drill data obtained as of January 31, 2016 and has been independently verified by HRC. The Measured and Indicated mineral resources are inclusive of the mineral reserves. Inferred mineral resources are, by definition, always additional to mineral reserves. Encouraging results have prompted recommendations for additional exploration drilling to better define the Inferred mineral resources (see Note 1 in Table 1‑2).

Table 1‑2: Summary Mineral Resource Statement for the NorthMet Project Inclusive of Mineral Reserves

| Class | Tonnage (Mt) | Grades (UnDiluted) | ||||||||||||||||||||||||||||||||||||||

| Copper | Nickel | Platinum | Palladium | Gold | Cobalt | Silver | NSR | Cu-EQ | ||||||||||||||||||||||||||||||||

| (%) | (%) | (ppb) | (ppb) | (ppb) | (ppm) | (ppm) | $/ton | (%) | ||||||||||||||||||||||||||||||||

| Measured | 237.2 | 0.270 | 0.080 | 69 | 241 | 35 | 72 | 0.97 | 19.67 | 0.541 | ||||||||||||||||||||||||||||||

| Indicated | 412.2 | 0.230 | 0.070 | 63 | 210 | 32 | 70 | 0.87 | 16.95 | 0.470 | ||||||||||||||||||||||||||||||

| M&I | 649.3 | 0.245 | 0.074 | 65 | 221 | 33 | 71 | 0.91 | 17.94 | 0.496 | ||||||||||||||||||||||||||||||

| Inferred | 508.9 | 0.240 | 0.070 | 72 | 234 | 37 | 66 | 0.93 | 17.66 | 0.489 | ||||||||||||||||||||||||||||||

Source: Hard Rock Consulting, LLC, January 2018

Notes:

| (1) | Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

| (2) | All resources are stated above a $7.35 NSR cut-off. Cut-off is based on estimated processing and G&A costs. Metal Prices and metallurgical recoveries used for the development of cut-off grade are presented in Table 14‑33. |

| (3) | Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding. |

| (4) | Cu-Eq (copper equivalent grade) is based on the mill recovery to concentrates and metal prices (Table 14‑33). |

| (5) | Copper Equivalent (Cu Eq) = ((Cu head grade x recovery x Cu Price)) + (Ni head grade x recovery x Ni Price) + (Pt head grade x recovery x Pt Price) + (Pd head grade x recovery x Pd Price) +(Au head grade x recovery x Au Price) + (Co head grade x recovery x Co Price) + (Ag head grade x recovery x Ag Price)) / (Cu recovery x Cu Price). |

| 1.7 | Mining And Processing |

The NorthMet Deposit will be mined from three pits: The East Pit, the Central Pit, and the West Pit. After mining in each pit is completed, waste from the West Pit will be backfilled into the East and Central Pits, along with waste rock from the temporary waste rock stockpiles.

| M3-PN150164 26 March 2018 |

23

NorthMet Project

Form NI 43-101F1 Technical Report

Run of Mine (ROM) ore will be loaded onto rail cars at the Mine Site and transported eight miles to the Erie Plant by private railroad.

The Erie Plant processed Taconite from 1957 to 2001, processing up to 100,000 tons per day.

PolyMet US plans to refurbish the plant and reuse the existing primary crusher, and replace the downstream mill circuit with a new 40’ diameter x 22.5’ Effective Grinding Length (EGL) SAG mill and one new 24’ diameter x 37’ ball mill.

Primary ground ore will be processed through a rougher flotation circuit to produce a bulk copper and nickel concentrate. The bulk concentrate will be reground and separated in cleaner flotation. The rougher tailing will be sent to the pyrrhotite flotation circuit so that PGM-rich iron sulfide can be captured as a pyrrhotite nickel concentrate.

Tailing from the flotation circuit will be disposed of in the existing tailings basin, which is partially filled with taconite tailings exclusively, but has more than sufficient capacity for the planned operations. The waste stream from the Hydrometallurgical Process Plant will be permanently stored in the Hydromet Residue Facility (HRF).

| 1.8 | Environmental |

Minnesota has stringent environmental standards and environmental review and permitting processes. The NorthMet environmental review process involved the Minnesota Department of Natural Resources (MDNR), the United States Army Corps of Engineers (USACE), and the United States Forest Service (USFS) as "Co-Lead Agencies." The United States Environmental Protection Agency (EPA) and tribal authorities served as cooperating agencies and the Minnesota Pollution Control Agency (MPCA) took part in the process as a permitting agency.

The most significant area of attention is water quality – the NorthMet Project is in the headwaters of the St Louis River, which flows into Lake Superior and is therefore governed by Great Lakes standards. It is important to note that NorthMet is south of the Laurentian Divide and in a separate watershed from the Boundary Waters Canoe Area Wilderness and Voyagers National Park located to the northeast.

Mineral and property tenure is secure. Permitting risks for the Project were reduced with the completion of a Final Environmental Impact Statement (FEIS) (Nov 2015) and Record of Decision (ROD) from the State of Minnesota (March 2016) indicating that the Project, as reviewed, can meet federal and state environmental standards. The State of Minnesota has also issued all major state environmental permits in draft form for public comment. See Section 20 for a listing of required permits.

The NorthMet Project is located within an established mining district of existing open pit iron ore mines that have been mined over the last 100 years. The Peter Mitchell pit of the Northshore operations of Cleveland Cliffs lies immediately north of the NorthMet Deposit. Major impacts from the Project are limited to tailings storage in a permitted Flotation Tailings Basin (FTB), hydromet residue facility, and waste rock stockpiles and mine pits in low-lying areas.

| 1.9 | Economics |

Phase I of the NorthMet Project involves development of the 225-million-ton orebody into an operating mine producing 32,000 tons per day of ore and rehabilitating an existing taconite processing plant, tailings storage facility and infrastructure located approximately eight miles to the west. Phase I would produce commercial grade copper and nickel concentrates for which Glencore currently holds offtake agreements payable at market terms. Phase II of the Project involves construction and operation of hydrometallurgical plant to process nickel sulfide concentrates into upgraded nickel-cobalt hydroxide and recover additional copper and PGMs. An estimate of Project capital expenditure and annual operating costs over the life of the mine for Phase I and the combined Phase I and Phase II are summarized in Table 1‑3.

| M3-PN150164 26 March 2018 |

24

NorthMet Project

Form NI 43-101F1 Technical Report

Table 1‑3: Capital Expenditure & Operating Costs – Phase I and Phase I & II

| Cost Category | UOM | Phase I | Phase I & II | ||||||

| Capital Costs | |||||||||

| Initial Project Capital | $M | 945 | 1,204 | ||||||

| LOM Sustaining Capital | $M | 221 | 221 | ||||||

| Operating Costs | LOM | ||||||||

| Mining & Delivery to Plant | $/t processed | 4.02 | 4.02 | ||||||

| Processing | $/t processed | 6.55 | 8.66 | ||||||

| G&A | $/t processed | 0.48 | 0.48 | ||||||

| Total | $/t processed | 11.05 | 13.16 | ||||||

To evaluate the economic potential of the capital investment, Phase I was structured to independently assess the overall economics both with and without Phase II (hydrometallurgical plant). The company compiled, with the aid of its financial partners, a commodity price forecast based on consensus estimates from an extensive list of financial and industry analysts. These prices are the basis for the financial analysis and are summarized in Table 1‑4.

Table 1‑4: Price Assumptions in the Financial Analysis

| Units | LOM | |

| Copper | US$/lb | 3.22 |

| Nickel | US$/lb | 7.95 |

| Cobalt | US$/lb | 20.68 |

| Platinum | US$/oz | 1,128 |

| Palladium | US$/oz | 973 |

| Gold | US$/oz | 1,308 |

| Silver | US$/oz | 18.92 |

The economic summary and financial analysis reflects processing 225 million tons of ore over a twenty-year mine life, at an average processing rate of 32,000 STPD. Key financial results for Phase I and combined Phase I and II are presented in Table 1‑5.

| M3-PN150164 26 March 2018 |

25

NorthMet Project

Form NI 43-101F1 Technical Report

Table 1‑5: Financial Summary – 32,000 STPD

| Phase I | Phase I & II | ||||||||||||

| Units | First 5 Yrs 1 | LOM | LOM 2 | ||||||||||

| Life of Mine | Yrs | 20 | 20 | ||||||||||

| Material Mined | Mt | 197 | 574 | 574 | |||||||||

| Ore Mined | Mt | 58 | 225 | 225 | |||||||||

| Waste: Ore Ratio | 2.4 | 1.6 | 1.6 | ||||||||||

| Ore Grade | |||||||||||||

| Copper | % | 0.343 | 0.295 | 0.295 | |||||||||

| Nickel | % | 0.092 | 0.085 | 0.085 | |||||||||

| Cobalt | ppm | 76 | 75 | 75 | |||||||||

| Palladium | ppm | 0.327 | 0.269 | 0.269 | |||||||||

| Platinum | ppm | 0.099 | 0.079 | 0.079 | |||||||||

| Gold | ppm | 0.048 | 0.039 | 0.039 | |||||||||

| Annual Payable Metal Produced | |||||||||||||

| Copper | mlb | 66.7 | 54.8 | 57.8 | |||||||||

| Nickel | mlb | 7.9 | 6.6 | 8.7 | |||||||||

| Cobalt | mlb | 0.33 | 0.28 | 0.31 | |||||||||

| Palladium | koz | 57.6 | 41.8 | 59.4 | |||||||||

| Platinum | koz | 12.4 | 8.5 | 14.3 | |||||||||

| Gold | koz | 3.4 | 2.2 | 4.3 | |||||||||

Copper Equivalent3 | mlb | 112.4 | 90.6 | 106.4 | |||||||||

| Cash Costs: by-product | $/lb Cu | 0.67 | 1.06 | 0.59 | |||||||||

| Cash Costs: Cu equivalent | $/lb CuEq | 1.71 | 1.91 | 1.79 | |||||||||

| Development Capital | $M | 945 | 945 | 1,204 | |||||||||

| Sustaining Capital | $M | 99 | 221 | 221 | |||||||||

| Annual Revenue | $M | 362 | 292 | 343 | |||||||||

| Annual EBITDA | $M | 170 | 118 | 152 | |||||||||

NPV7 (After Taxes) | $M | 173 | 271 | ||||||||||

| IRR (After Taxes) | % | 9.6 | 10.3 | ||||||||||

| Payback (after taxes, from first production) | Years | 7.3 | 7.5 | ||||||||||

1 Represents first five years at full concentrator production.

2 Phase II production is projected to commence in Year 3 of operations.

3 Cu Eq recovered payable metal, is based on prices shown in Table 1‑4, mill recovery assumptions shown in Table 15‑3 and Hydromet Phase II recoveries shown in Table 13‑14.

2 Phase II production is projected to commence in Year 3 of operations.

3 Cu Eq recovered payable metal, is based on prices shown in Table 1‑4, mill recovery assumptions shown in Table 15‑3 and Hydromet Phase II recoveries shown in Table 13‑14.

Financial returns for the Project are highly sensitive to changes in metal prices. A +/-10% change in prices results in a corresponding $265 million change in NPV@7% for Phase I. Inclusive of Phase II, the NPV@7% sensitivity is estimated to be +/-$300 million at an accuracy level of ±10%.

| 1.10 | Potential Expansion Opportunities – Basis of 59,000 STPD and 118,000 STPD Scenarios |

Metals prices for the financial analysis of both the 59,000 STPD and 118,000 STPD scenarios are based on prices shown in Table 1‑4. The 59,000 STPD and 118,000 STPD throughput values represent Class 5 estimates as defined by AACE International, corresponding to an Order of Magnitude, Scoping or Preliminary Economic Assessment. As such, further engineering, environmental studies and permitting would be required to prove the economic viability of these potential scenarios and to improve the economic uncertainties associated with these estimates. Further delineation drilling to move inferred resources into measured and indicated resources is also required in the 59,000 and 118,000 STPD cases. Overall, the expansion scenarios require significant capital investment.

| M3-PN150164 26 March 2018 |

26

NorthMet Project

Form NI 43-101F1 Technical Report

The results of this exercise were as follows:

| · | 59,000 STPD throughput |

| o | 293 million tons of mineralized material grading at 0.576% Cu-Eq, and |

| o | 14-year mine life. |

| · | 118,000 STPD throughput |

| o | 730 million tons of mineralized material grading at 0.533% Cu-Eq, and |

| o | 18-year mine life. |

See Section 24 of this report for further evaluation of these cases. Again, note that the estimates for these two scenarios are preliminary in nature and include Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There can be no certainty that the results for these two cases will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability and there is no certainty that Mineral Resources will become Mineral Reserves.

| 1.11 | Conclusions And Recommendations |

M3 offers the following recommendations:

| · | M3 recommends that PolyMet proceed with final design, construction and operation of the 32,000 STPD design that is discussed in this Technical Report, and |

| · | Review and update the scope of the Project design to reflect any changes resulting from the environmental review and permitting process. |

Recommendations for further work are presented below:

| · | Based on the initial results of the additional scoping level and PEA level estimates in Section 24 of this study M3 recommends that additional engineering and environmental studies be performed at a pre-feasibility study level to further refine the costs, valuations and environmental requirements for the potential 59,000 STPD and 118,000 STPD production scenarios. The estimated costs of these studies are expected to be $500,000. An estimated $2.5 million is required to move currently classified inferred material into measured and indicated categories. |

| M3-PN150164 26 March 2018 |

27

NorthMet Project

Form NI 43-101F1 Technical Report

| 2 | INTRODUCTION |

| 2.1 | Purpose |

This report has been prepared specifically for PolyMet by the Qualified Persons (QPs) listed in Table 2‑1 to provide ‘Expert Study’ on the NorthMet Project. The findings and conclusions are based on information available at the time of preparation and data supplied by other consultants as indicated.

This report has been prepared in accordance with the guidelines provided in Canadian National Instrument 43-101, Standards of Disclosure for Mineral Projects (NI 43-101) dated 24 June 2011 and updated on 10 May 2014. This Technical Report has been prepared to the level of a Feasibility Study. The effective date of this report is March 26, 2018.

| 2.2 | Sources of Information |

Table 2‑1 shows the list of Qualified Persons with their associated responsibilities.

Table 2‑1: List of Qualified Persons

| Name of Qualified Person | Certification | Company | Last Site Visit | Section Responsibilities |

Zachary J. Black | SME-RM | Hard Rock Consulting | 16 May 2017 | Sections 1.3, 1.4, 1.6, 7, 8, 9, 10, 11, 12, 14, 23, 25.2.2, 25.2.3, 25.2.4, 25.2.5 and 25.2.7. |

| Jennifer J. Brown | SME-RM | Hard Rock Consulting | N/A | Section 6. |

| Nicholas Dempers | Pr. Eng., SAIMM | Senet | 1 March 2018 | Section 13.1-13.5, 17.1, 17.2, 18.7, 18.9, 21, 21.2.2, 21.2.3, 24.2, 25.2.6 and 25.2.10. |

| Thomas L. Drielick | P.E. | M3 Engineering | N/A | Sections 1.9, 19, 21, 21.1, 21.2.4, 21.2.5, 22, 25.2.12, 25.2.14, and 25.2.15. |

| Art S. Ibrado | P.E. | M3 Engineering | N/A | Sections 13.6, 17.3, 17.4, 17.5.1, 17.6 and 25.2.6. |

| Erin L. Patterson | P.E. | M3 Engineering | 11 October 2017 | Sections 1.1, 1.2, 1.9, 1.10, 1.11, 2, 3, 4.1- 4.5, 4.7- 4.10, 5, 18.1-18.5, 18.8, 18.10, 24, 24.2 25.1- 25.2.1, 25.2.11, 25.3- 25.5, 26 and 27. |

| Thomas J. Radue | P.E. | Barr Engineering Co. | 11 October 2017 | Section 1.7, 1.8, 4.6, 16.3.3, 17.2.4, 17.5.2, 18.6, 20.1-20.6, 20.7, 21, 21.1, 25.2.13. |

| Jeff S. Ubl | P.E. | Barr Engineering Co. | N/A | 18.7 |

| Herbert E. Welhener | SME -RM | Independent Mining Consultants | 11 December 2000 | Sections 1.5, 15, 16, 21, 21.2.1, 24.2, 25.2.8, and 25.2.9. |

| M3-PN150164 26 March 2018 |

28

NorthMet Project

Form NI 43-101F1 Technical Report

| 2.3 | Terms of Reference |

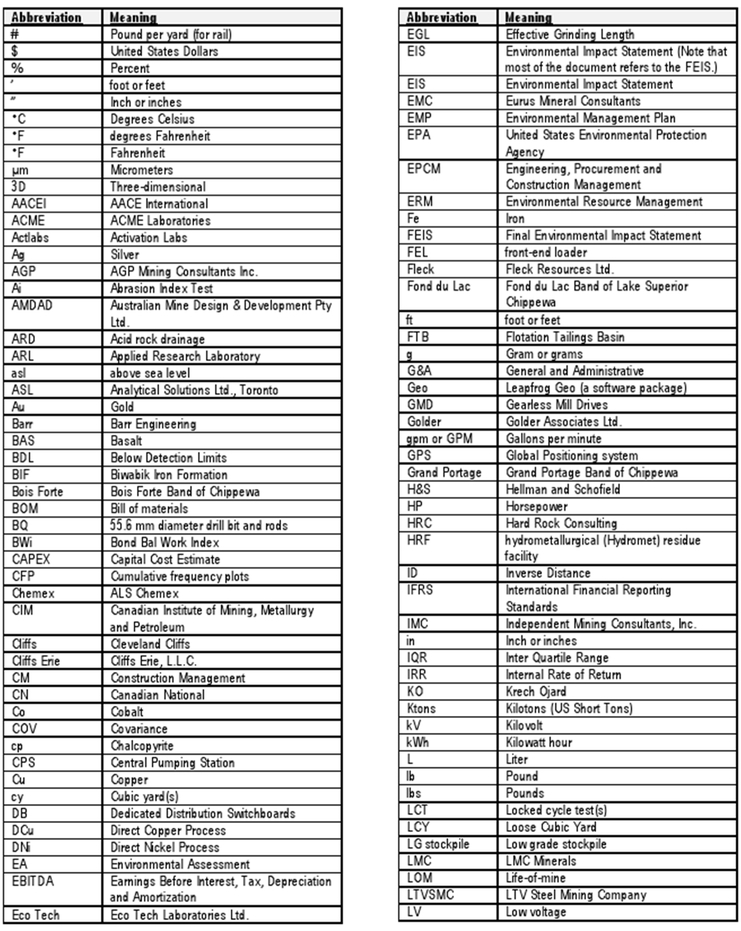

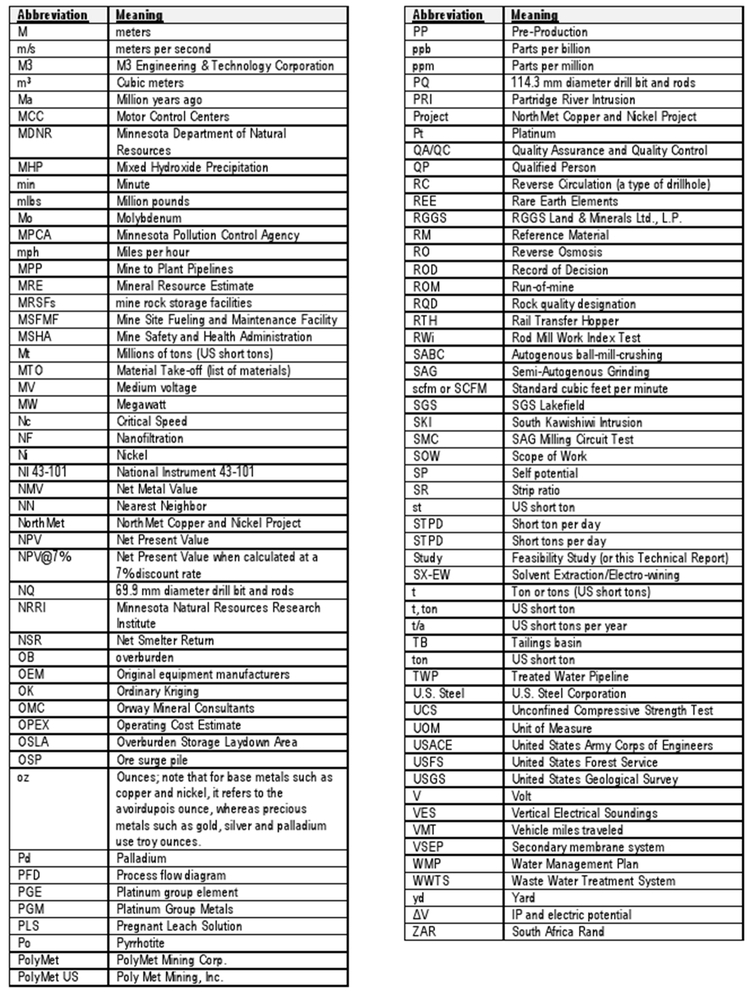

Table 2‑2: Units, Terms and Abbreviation

| M3-PN150164 26 March 2018 |

29

NorthMet Project

Form NI 43-101F1 Technical Report

| M3-PN150164 26 March 2018 |

30

NorthMet Project

Form NI 43-101F1 Technical Report

| 2.4 | Units of Measure |

This report uses U.S. Customary Units expressed in short tons (ton, t, 2,000 lbs), feet, and gallons consistent with U.S. Standards – unless stated otherwise. The monetary units are expressed in United States Dollars.

| M3-PN150164 26 March 2018 |

31

NorthMet Project

Form NI 43-101F1 Technical Report

| 3 | RELIANCE ON OTHER EXPERTS |

M3 relied upon contributions from a range of technical and engineering consultants as well as PolyMet. Data used in this report has been verified where possible and this report is based upon information believed to be accurate at the time of completion. M3 is not aware of any reason why the information provided by these contributors cannot be relied upon.

Owner’s environmental and permitting costs were supplied by PolyMet. In addition, PolyMet provided all Owner’s costs in the capital cost estimate. Owners Costs are defined in section 21.1.3.3

An independent verification of land title and tenure was not performed. M3 has not verified the legality of any underlying agreement(s) that may exist concerning the licenses or other agreement(s) between third parties. Likewise, PolyMet has provided data for land ownership, and claim ownership. All mineral and surface title work on the project and land exchange is managed by the law firm Hanft Fride, a Professional Association, out of Duluth, Minnesota, USA.

| M3-PN150164 26 March 2018 |

32

NorthMet Project

Form NI 43-101F1 Technical Report

| 4 | PROPERTY DESCRIPTION AND LOCATION |

| 4.1 | Project Location |

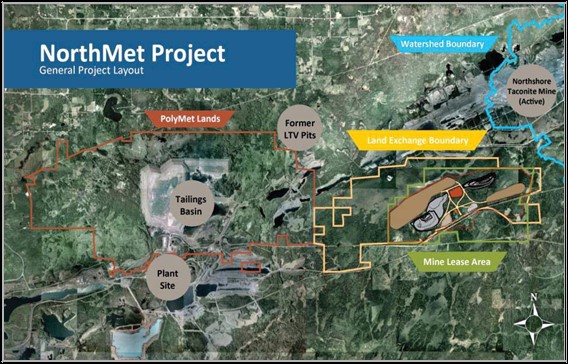

The NorthMet Project comprises two key elements: the NorthMet Deposit (or Mine Site) and the Erie Plant. The NorthMet Deposit is situated on mineral leases located in St. Louis County in northeastern Minnesota at Latitude 47° 36’ north, Longitude 91° 58’ west, about 70 miles north of the City of Duluth and 6.5 miles south of the town of Babbitt, as shown in Figure 4‑1. The Erie Plant is approximately eight miles west of the NorthMet Deposit.

The NorthMet Deposit site totals approximately 4,300 acres and the Erie Plant site, including the existing tailings basin, covers approximately 12,400 acres.

The NorthMet Project is located immediately south of the eastern end of the historic Mesabi Iron Range and is in proximity to a number of existing iron ore mines including the Peter Mitchell open pit mine located approximately two miles to the north of the NorthMet Deposit. NorthMet is one of several known mineral deposits that have been identified within the 30-mile length of the Duluth Complex, a well-known geological formation containing copper, nickel, cobalt, platinum group metals, silver, gold and titanium.

The NorthMet Deposit is connected to the Erie Plant by a transportation and utility corridor that is comprised of an existing private railroad that will primarily be used to transport ore, a segment of the existing private Dunka Road that will be upgraded to provide vehicle access, and new water pipelines and electrical power network for the NorthMet Mine Site.

Figure 4‑1: Property Layout Map

| M3-PN150164 26 March 2018 |

33

NorthMet Project

Form NI 43-101F1 Technical Report

| 4.2 | Project Ownership |

PolyMet Mining Corporation (PolyMet) owns 100% of Poly Met Mining, Inc. (PolyMet US), a Minnesota corporation. PolyMet US controls 100% of the NorthMet Project. As PolyMet is the owner of PolyMet US, for the sake of simplicity this Study will for the most part refer to both entities as PolyMet, except when specific differentiation is required for legal clarity. The mineral rights covering 4,282 acres or 6.5 square miles at the NorthMet orebody are held through two mineral leases:

| · | The U.S. Steel Lease dated January 4, 1989, subsequently amended and assigned, covers 4,162 acres originally leased from U.S. Steel Corporation (U.S. Steel), which subsequently sold the underlying mineral rights to RGGS Land & Minerals Ltd., L.P. (RGGS). PolyMet has extended the lease indefinitely by making $150,000 annual lease payments on each successive anniversary date. The lease payments are advance royalty payments and will be deducted from future production royalties payable to RGGS, which range from 3% to 5% based on the net smelter return, subject to minimum payments of $150,000 per annum. |

| · | On December 1, 2008, PolyMet entered into an agreement with LMC Minerals ("LMC") whereby PolyMet leases 120 acres that are encircled by the RGGS property. The initial term of the renewable lease is 20 years with minimum annual lease payments of $3,000 on each successive anniversary date until the earlier of NorthMet commencing commercial production or for the first four years, after which the minimum annual lease payment increases to $30,000. The initial term may be extended for up to four additional five-year periods on the same terms. The lease payments are advance royalty payments and will be deducted from future production royalties payable to LMC, which range from 3% to 5% based on the net smelter return, subject to a minimum payment of $30,000 per annum. |

The surface rights are held by the USFS and are currently subject to a land exchange initiative with PolyMet– see Section 4.4.

PolyMet US holds various rights of ownership and use, and other property rights that currently give it control of 100% of the Erie Plant, which covers approximately 12,400 acres, or 19.4 square miles, through contracts for deed with Cliffs Erie, L.L.C. (Cliffs Erie). Further details on the arrangements with Cliffs Erie can be found in Section 4.6.

| 4.3 | Mineral Tenure |