Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-06241

Loomis Sayles Funds II

(Exact name of Registrant as specified in charter)

888 Boylston Street, Suite 800 Boston, Massachusetts 02199-8197

(Address of principal executive offices) (Zip code)

Russell L. Kane, Esq.

Natixis Distribution, L.P.

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617)449-2822

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Table of Contents

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 is as follows:

Table of Contents

Annual Report

December 31, 2018

Loomis Sayles High Income Fund

Loomis Sayles Investment Grade Bond Fund

| Portfolio Review | 1 | |||

| Portfolio of Investments | 12 | |||

| Financial Statements | 39 | |||

| Notes to Financial Statements | 52 | |||

IMPORTANT NOTICE TO SHAREHOLDERS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you wish to continue receiving paper copies of your shareholder reports after January 1, 2021, you can inform the Fund at any time by calling 1-800-225-5478. If you hold your account with a financial intermediary and you wish to continue receiving paper copies after January 1, 2021, you should call your financial intermediary directly. Paper copies are provided free of charge, and your election to receive reports in paper will apply to all funds held with the Natixis Funds complex. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You currently may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically at www.icsdelivery.com/natixisfunds.

Table of Contents

LOOMIS SAYLES HIGH INCOME FUND

| Managers | Symbols | |

| Matthew J. Eagan, CFA® | Class A NEFHX | |

| Elaine M. Stokes | Class C NEHCX | |

| Brian P. Kennedy | Class N LSHNX | |

| Todd P. Vandam, CFA® | Class Y NEHYX | |

| Loomis, Sayles & Company, L.P. | ||

Investment Goal

The Fund seeks high current income plus the opportunity for capital appreciation to produce a high total return.

Market Conditions

The broad market environment experienced a significant shift in the final three months of the year. While the markets had previously been riding a wave of optimism stemming from robust economic growth and rising corporate earnings, market sentiment turned sharply lower in the fourth quarter. Concerns about US trade policy and weaker economic conditions overseas sparked a downturn in global equities and other asset classes seen as having higher risk. US core personal consumption expenditures (PCE) inflation ticked below 2% in the fourth quarter, which marked a decrease from its mid-year high. While the US Federal Reserve (Fed) raised rates by a quarter point at its December meeting, slowing growth and commentary from Fed officials fueled expectations that the cycle of rate increases was nearing its conclusion.

US Treasuries performed well and finished as one of the few major asset categories to post a positive return. Government bonds were aided by weaker economic data and a “flight to quality” that benefited lower-risk investments. Long-term issues, which are less sensitive to Fed policy than shorter-term bonds, delivered the strongest returns.

Investment grade corporates underperformed Treasuries but strongly outpaced high yield issues. Although yield spreads over government bonds increased, higher-rated securities benefited from their above-average credit quality and greater sensitivity to the direction of Treasury yields.

High yield bonds performed poorly and lagged investment-grade issues by a sizable margin. A large portion of the selloff occurred in December amid the downturn in equities and the broader weakness in higher-risk assets. High yield was pressured by the combination of slower growth, falling oil prices and the evaporation of investors’ risk appetites.

Performance Results1

For the three months ended December 31, 2018, Class Y shares of the Loomis Sayles High Income Fund returned -4.49%. The Fund held up better than its benchmark, the Bloomberg Barclays U.S. Corporate High Yield Bond Index, which returned -4.53%.

| 1 | Effective November 1, 2018, the Board of Trustees approved a change in the fiscal year-end of the Fund from September 30 to December 31. The Fund performance provided in this section reflects the three-month fiscal period ended December 31, 2018. |

1 |

Table of Contents

Explanation of Fund Performance

An overweight allocation to emerging market credit added to relative performance. High yield corporate credit positively impacted relative return as well aided both by our longer duration positioning versus the benchmark and selected names within the energy space.Non-US-dollar securities, specifically those denominated in Argentine peso, helped performance during the period. Exposure to securitized assets including asset-backed securities andnon-agency commercial mortgage-backed securities also contributed positively to relative return.

Convertible securities acted as a constraint on relative performance largely due to holdings in selected energy, consumernon-cyclical and communications names. An allocation to equities reduced the fund’s overall performance, led by a position in Whiting Petroleum.

Outlook

Driven by market volatility, Fed policy and a fragile geopolitical environment, our outlook is evolving. While the US economy has experienced positive growth and strong employment, business uncertainty is rising and the pace of growth is slowing at the periphery. Recent growth and strong employment have generated some wage pressures, but inflation still appears contained and the dramatic move in oil should remove some inflationary pressures. Fed policy has been under pressure and the move lower in interest rates has been dramatic. Markets are appearing to price in no further rate hikes, but instead, the possibility of a rate cut. We believe market volatility and lower growth expectations may cause the Fed to pause; we expect one more rate hike (at most) in 2019.

Despite the volatility, we do believe the US economy is strong and we are not in “the cycle is turning” camp. We believe a fair amount of slowing growth is due to the inventory cycle and see the potential for some pickup in growth in the second half. Given the move down in US interest rates, we remain cautious about taking on more interest rate risk at present levels. However, our forward-looking view is that rates will be lower for this cycle. Geopolitical and political risks are rising, and outcomes from trade negotiations, actual Fed policy and developments abroad could have meaningful impacts on forward yield curve moves.

As we enter 2019, our strategy is to maintain a higher quality bias within credit markets as a whole, given the aging of the credit cycle.1 We continue to favor sectors that are exhibiting credit improvement, such as banking, and those with defensive characteristics, such as telecommunications and cable. We see more opportunity with the recent selloff in oil and have been selectively adding. We are limiting our exposure to industries with more challenging business trends, such as retail and home construction.

We believe opportunities in the US high yield market have increased and long-term value in certain areas is more attractive: Spreads have widened over 200 basis points in the past three months to more than 500 basis points, while market yield hovers at or above 8%. Historically, this is a material move. The fundamentals appear healthy and new issuance has declined dramatically, helping give support to the market. We still do not anticipate a large increase in defaults and the maturity wall remains pushed out until 2022. However, growth concerns warrant some increase in default risk.

| 2

Table of Contents

LOOMIS SAYLES HIGH INCOME FUND

In both investment grade and high yield markets, liquidity has been choppy. We remain very focused on liquidity conditions and have been actively buying into select opportunities.

A key risk to our outlook is the health of the global economy and markets outside of the United States, particularly Europe and parts of Asia, which have already experienced slowing growth. China is likely the most important economy to watch, given its large contribution to global growth. A negative outcome from trade policy discussions has the potential to significantly weaken risk appetite and accelerate an economic slowdown. Conversely, an agreement on trade could lead to a meaningful market recovery. As we enter the new year, we continue to favor an allocation to selected higher quality US investment grade and below investment grade bonds with an emphasis on solid fundamentals, attractive yield and liquidity.

| 1 | A credit cycle is a cyclical pattern that follows credit availability and corporate health. |

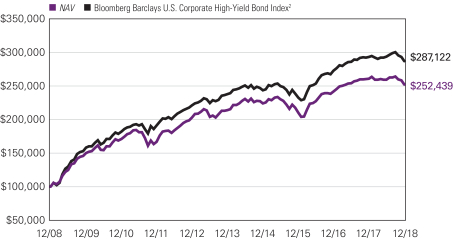

Hypothetical Growth of $100,000 Investment in Class Y Shares3

December 31, 2008 through December 31, 2018

3 |

Table of Contents

Average Annual Total Returns — December 31, 20183

3 Months

| 1 Year

| 5 Years

| 10 Years

| Life of

| Expense Ratios4 | |||||||||||||||||||||||

| Gross | Net | |||||||||||||||||||||||||||

| Class Y (Inception 2/29/08) | ||||||||||||||||||||||||||||

| NAV | -4.49 | % | -3.21 | % | 3.31 | % | 9.70 | % | — | % | 0.90 | % | 0.80 | % | ||||||||||||||

| Class A (Inception 2/22/84) | ||||||||||||||||||||||||||||

| NAV | -4.54 | -3.45 | 3.04 | 9.43 | — | 1.15 | 1.05 | |||||||||||||||||||||

| With 4.25% Maximum Sales Charge | -8.63 | -7.51 | 2.12 | 8.96 | — | |||||||||||||||||||||||

| Class C (Inception 3/2/98) | ||||||||||||||||||||||||||||

| NAV | -4.95 | -4.41 | 2.25 | 8.59 | — | 1.90 | 1.80 | |||||||||||||||||||||

| With CDSC1 | -5.89 | -5.33 | 2.25 | 8.59 | — | |||||||||||||||||||||||

| Class N (Inception 11/30/16) | ||||||||||||||||||||||||||||

| NAV | -4.47 | -3.15 | — | — | 2.91 | 31.73 | 0.75 | |||||||||||||||||||||

| Comparative Performance | ||||||||||||||||||||||||||||

| Bloomberg Barclays U.S. Corporate High-Yield Bond Index2 | -4.53 | -2.08 | 3.83 | 11.12 | 3.40 | |||||||||||||||||||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 2 | The Bloomberg Barclays U.S. Corporate High-Yield Bond Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB /BB or below, excluding emerging market debt. The Bloomberg Barclays U.S. Corporate High-Yield Bond Index was created in 1986, with history backfilled to July 1, 1983, and rolls up into the Bloomberg Barclays U.S. Universal and Global High-Yield Indices. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense caps set to expire on 1/31/19. When a Fund’s expenses are below the cap, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense caps. |

| 4

Table of Contents

LOOMIS SAYLES INVESTMENT GRADE BOND FUND

| Managers | Symbols | |||

| Matthew J. Eagan, CFA® | Class A | LIGRX | ||

| Brian P. Kennedy | Class C | LGBCX | ||

| Elaine M. Stokes | Class N | LGBNX | ||

| Loomis, Sayles & Company, L.P. | Class Y | LSIIX | ||

| Admin Class | LIGAX | |||

Investment Goal

The Fund seeks high total investment return through a combination of current income and capital appreciation.

Market Conditions

The broad market environment experienced a significant shift in the final three months of the year. While the markets had previously been riding a wave of optimism stemming from robust economic growth and rising corporate earnings, market sentiment turned sharply lower in the fourth quarter. Concerns about US trade policy and weaker economic conditions overseas sparked a downturn in global equities and other asset classes seen as having higher risk. US core personal consumption expenditures (PCE) inflation ticked below 2% in the fourth quarter, which marked a decrease from its mid-year high. While the US Federal Reserve (Fed) raised rates by a quarter point at its December meeting, slowing growth and commentary from Fed officials fueled expectations that the cycle of rate increases was nearing its conclusion.

US Treasuries performed well and finished as one of the few major asset categories to post a positive return. Government bonds were aided by weaker economic data and a “flight to quality” that benefited lower-risk investments. Long-term issues, which are less sensitive to Fed policy than shorter-term bonds, delivered the strongest returns.

Investment grade corporates underperformed Treasuries but strongly outpaced high yield issues. Although yield spreads over government bonds increased, higher-rated securities benefited from their above-average credit quality and greater sensitivity to the direction of Treasury yields.

High yield bonds performed poorly and lagged investment-grade issues by a sizable margin. A large portion of the selloff occurred in December amid the downturn in equities and the broader weakness in higher-risk assets. High yield was pressured by the combination of slower growth, falling oil prices and the evaporation of investors’ risk appetites.

Performance Results1 2

For the three months ended December 31, 2018, Class Y shares of the Loomis Sayles Investment Grade Bond Fund returned-0.59%. The Fund underperformed its benchmark, the Bloomberg Barclays U.S. Government/Credit Bond Index, which returned 1.46%.

| 1 | Effective November 1, 2018, the Board of Trustees approved a change in the fiscalyear-end of the Fund from September 30 to December 31. The Fund performance provided in this section reflects the three-month fiscal period ended December 31, 2018. |

5 |

Table of Contents

Explanation of Fund Performance

Exposure tonon-US-dollar-denominated issues had a negative impact on relative return, with Mexican peso holdings as the worst performers for the period. An allocation to high yield corporate credit also detracted from relative performance, largely due to selected finance companies, banking and energy names.

An underweight allocation versus the benchmark in US Treasuries was a laggard for relative return as well. Though security selection within investment grade corporate credit was modestly helpful, this was outweighed by our shorter-than-benchmark duration positioning in the space.

Outlook

Driven by market volatility, Fed policy and a fragile geopolitical environment, our outlook is evolving. While the US economy has experienced positive growth and strong employment, business uncertainty is rising and the pace of growth is slowing at the periphery. Recent growth and strong employment have generated some wage pressures, but inflation still appears contained and the dramatic move in oil should remove some inflationary pressures. Fed policy has been under pressure and the move lower in interest rates has been dramatic. Markets are appearing to price in no further rate hikes, but instead, the possibility of a rate cut. We believe market volatility and lower growth expectations may cause the Fed to pause; we expect one more rate hike (at most) in 2019.

Despite the volatility, we do believe the US economy is strong and we are not in “the cycle is turning” camp. We believe a fair amount of slowing growth is due to the inventory cycle and see the potential for some pickup in growth in the second half. Given the move down in US interest rates, we remain cautious about taking on more interest rate risk at present levels. However, our forward-looking view is that rates will be lower for this cycle. Geopolitical and political risks are rising, and outcomes from trade negotiations, actual Fed policy and developments abroad could have meaningful impacts on forward yield curve moves.

As we enter 2019, our strategy is to maintain a higher quality bias within credit markets as a whole, given the aging of the credit cycle.1 We continue to favor sectors that are exhibiting credit improvement, such as banking, and those with defensive characteristics, such as telecommunications and cable. We see more opportunity with the recent selloff in oil and have been selectively adding. We are limiting our exposure to industries with more challenging business trends, such as retail and home construction.

We believe opportunities in the US high yield market have increased and long-term value in certain areas is more attractive: Spreads have widened over 200 basis points in the past three months to more than 500 basis points, while market yield hovers at or above 8%. Historically, this is a material move. The fundamentals appear healthy and new issuance has declined dramatically, helping give support to the market. We still do not anticipate a large increase in defaults and the maturity wall remains pushed out until 2022. However, growth concerns warrant some increase in default risk.

In both investment grade and high yield markets, liquidity has been choppy. We remain very focused on liquidity conditions and have been actively buying into select opportunities.

| 6

Table of Contents

LOOMIS SAYLES INVESTMENT GRADE BOND FUND

A key risk to our outlook is the health of the global economy and markets outside of the United States, particularly Europe and parts of Asia, which have already experienced slowing growth. China is likely the most important economy to watch, given its large contribution to global growth. A negative outcome from trade policy discussions has the potential to significantly weaken risk appetite and accelerate an economic slowdown. Conversely, an agreement on trade could lead to a meaningful market recovery. As we enter the new year, we continue to favor an allocation to selected higher quality US investment grade and below investment grade bonds with an emphasis on solid fundamentals, attractive yield and liquidity.

| 1 | A credit cycle is a cyclical pattern that follows credit availability and corporate health. |

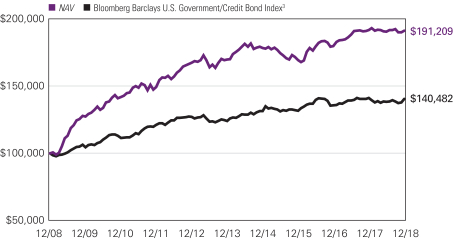

Hypothetical Growth of $100,000 Investment in Class Y Shares4

December 31, 2008 through December 31, 2018

7 |

Table of Contents

Average Annual Total Returns — December 31, 20184

3 Months

| 1 Year

| 5 Years

| 10 Years

| Life of

| Expense Ratios5 | |||||||||||||||||||||||

Gross | Net | |||||||||||||||||||||||||||

| Class Y (Inception 12/31/96) | ||||||||||||||||||||||||||||

| NAV | -0.59 | % | -0.32 | % | 2.41 | % | 6.69 | % | — | % | 0.57 | % | 0.53 | % | ||||||||||||||

| Class A (Inception 12/31/96) | ||||||||||||||||||||||||||||

| NAV | -0.66 | -0.64 | 2.15 | 6.42 | — | 0.82 | 0.78 | |||||||||||||||||||||

| With 4.25% Maximum Sales Charge | -4.90 | -4.86 | 1.27 | 5.96 | — | |||||||||||||||||||||||

| Class C (Inception 9/12/03) | ||||||||||||||||||||||||||||

| NAV | -0.86 | -1.37 | 1.39 | 5.63 | — | 1.57 | 1.53 | |||||||||||||||||||||

| With CDSC2 | -1.84 | -2.34 | 1.39 | 5.63 | — | |||||||||||||||||||||||

| Class N (Inception 2/1/13) | ||||||||||||||||||||||||||||

| NAV | -0.58 | -0.35 | 2.52 | — | 2.23 | 0.48 | 0.48 | |||||||||||||||||||||

| Admin Class (Inception 2/1/10)1 | ||||||||||||||||||||||||||||

| NAV | -0.63 | -0.72 | 1.94 | 6.15 | — | 1.03 | 1.03 | |||||||||||||||||||||

| Comparative Performance | ||||||||||||||||||||||||||||

| Bloomberg Barclays U.S. Government/Credit Bond Index3 | 1.46 | -0.42 | 2.53 | 3.46 | 1.89 | |||||||||||||||||||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Prior to the inception of Admin Class shares (2/1/10), performance is that of Class A shares, restated to reflect the higher net expenses of Admin Class shares. |

| 2 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 3 | The Bloomberg Barclays U.S. Government/Credit Bond Index is the non-securitized component of the U.S. Aggregate Index and was the first macro index launched by Barclays Capital. The U.S. Government/Credit Bond Index includes Treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year), government-related issues (i.e., agency, sovereign, supranational, and local authority debt), and corporates. The U.S. Government/Credit Bond Index was launched on January 1, 1979, with index history backfilled to 1973, and is a subset of the U.S. Aggregate Index. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense caps set to expire on 1/31/20. When a Fund’s expenses are below the cap, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense caps. |

| 8

Table of Contents

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis Affiliates”) and does not sponsor, endorse or participate in the provision of any Natixis Affiliates services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Natixis Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the Natixis Funds’ website at im.natixis.com; and on the Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the funds voted proxies relating to portfolio securities the most recent 12-month period ended June 30 is available from the Natixis Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The Natixis Funds file complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

9 |

Table of Contents

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions, and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectuses. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of Fund shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from July 1, 2018 through December 31, 2018. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table of each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| 10

Table of Contents

| LOOMIS SAYLES HIGH INCOME FUND | BEGINNING ACCOUNT VALUE 7/1/2018 | ENDING ACCOUNT VALUE 12/31/2018 | EXPENSES PAID DURING PERIOD* 7/1/2018 – 12/31/2018 | |||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $970.70 | $5.22 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.91 | $5.35 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $967.00 | $8.92 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.13 | $9.15 | |||||||||

| Class N | ||||||||||||

| Actual | $1,000.00 | $974.50 | $3.73 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.43 | $3.82 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $971.90 | $3.98 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.17 | $4.08 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.05%, 1.80%, 0.75% and 0.80% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| LOOMIS SAYLES INVESTMENT GRADE BOND FUND | BEGINNING ACCOUNT VALUE 7/1/2018 | ENDING ACCOUNT VALUE 12/31/2018 | EXPENSES PAID DURING PERIOD* 7/1/2018 – 12/31/2018 | |||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $1,002.50 | $3.94 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.27 | $3.97 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $998.00 | $7.71 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.49 | $7.78 | |||||||||

| Class N | ||||||||||||

| Actual | $1,000.00 | $1,003.80 | $2.42 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.79 | $2.45 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $1,003.60 | $2.68 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.53 | $2.70 | |||||||||

| Admin Class | ||||||||||||

| Actual | $1,000.00 | $1,001.10 | $5.20 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.01 | $5.24 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 0.78%, 1.53%, 0.48%, 0.53% and 1.03% for Class A, C, N, Y and Admin Class, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

11 |

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund

| Principal Amount | Description | Value (†) | ||||||

| Bonds and Notes — 90.8% of Net Assets | ||||||||

| Non-Convertible Bonds — 80.9% | ||||||||

| ABS Home Equity — 1.2% |

| |||||||

| $ | 82,604 | Banc of America Alternative Loan Trust, Series2003-8, Class 1CB1, 5.500%, 10/25/2033 | $ | 84,287 | ||||

| 87,146 | Banc of America Funding Trust, Series2005-7, Class 3A1, 5.750%, 11/25/2035 | 91,858 | ||||||

| 61,178 | Banc of America Funding Trust, Series2007-4, Class 5A1, 5.500%, 11/25/2034 | 60,352 | ||||||

| 751 | Countrywide Home Loan Mortgage Pass Through Trust, Series 2005-HYB7, Class 2A, 4.383%, 11/20/2035(a)(b)(c) | 574 | ||||||

| 185,855 | DSLA Mortgage Loan Trust, Series2005-AR5, Class 2A1A,1-month LIBOR + 0.330%, 2.800%, 9/19/2045(d) | 151,084 | ||||||

| 305,000 | Freddie Mac Structured Agency Credit Risk Debt Notes, Series 2015-DNA1, Class M3,1-month LIBOR + 3.300%, 5.806%, 10/25/2027(d)(e) | 330,846 | ||||||

| 95,960 | �� | GMAC Mortgage Corp. Loan Trust, Series2005-AR4, Class 3A1, 4.268%, 7/19/2035(b) | 93,128 | |||||

| 150,000 | Home Partners of America Trust, Series2016-2, Class E, 1-month LIBOR + 3.780%, 6.235%, 10/17/2033, 144A(d) | 150,396 | ||||||

| 155,000 | Home Partners of America Trust, Series2016-2, Class F, 1-month LIBOR + 4.700%, 7.155%, 10/17/2033, 144A(d) | 155,000 | ||||||

| 214,901 | MASTR Adjustable Rate Mortgages Trust, Series2005-2, Class 3A1, 3.987%, 3/25/2035(b) | 209,792 | ||||||

| 223,825 | MASTR Adjustable Rate Mortgages Trust, Series2005-2, Class 4A1, 3.546%, 3/25/2035(b) | 202,249 | ||||||

| 100,000 | RCO Mortgage LLC, Series2017-1, Class A2, 5.125%, 8/25/2022, 144A(b) | 100,632 | ||||||

|

| |||||||

| 1,630,198 | ||||||||

|

| |||||||

| ABS Other — 0.3% |

| |||||||

| 186,325 | AIM Aviation Finance Ltd., Series2015-1A, Class B1, 5.072%, 2/15/2040, 144A(b) | 186,165 | ||||||

| 233,759 | Wave LLC, Series2017-1A, Class B, 5.682%, 11/15/2042, 144A | 242,651 | ||||||

|

| |||||||

| 428,816 | ||||||||

|

| |||||||

| Aerospace & Defense — 1.5% |

| |||||||

| 638,000 | Leonardo U.S. Holdings, Inc., 6.250%, 1/15/2040, 144A | 595,171 | ||||||

| 383,000 | Leonardo U.S. Holdings, Inc., 7.375%, 7/15/2039, 144A | 402,150 | ||||||

| 200,000 | TransDigm UK Holdings PLC, 6.875%, 5/15/2026, 144A | 190,500 | ||||||

| 845,000 | TransDigm, Inc., 6.500%, 7/15/2024 | 821,763 | ||||||

|

| |||||||

| 2,009,584 | ||||||||

|

| |||||||

| Airlines — 0.4% |

| |||||||

| 535,000 | Latam Finance Ltd., 6.875%, 4/11/2024, 144A | 526,846 | ||||||

| 23,236 | Virgin Australia Pass Through Certificates, Series2013-1B, 6.000%, 4/23/2022, 144A | 23,558 | ||||||

|

| |||||||

| 550,404 | ||||||||

|

| |||||||

See accompanying notes to financial statements.

| 12

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Automotive — 1.6% |

| |||||||

| $ | 195,000 | Allison Transmission, Inc., 5.000%, 10/01/2024, 144A | $ | 187,200 | ||||

| 285,000 | Dana Financing Luxembourg S.a.r.l., 5.750%, 4/15/2025, 144A | 265,762 | ||||||

| 465,000 | Delphi Technologies PLC, 5.000%, 10/01/2025, 144A | 390,600 | ||||||

| 115,000 | Goodyear Tire & Rubber Co. (The), 5.000%, 5/31/2026 | 103,500 | ||||||

| 880,000 | IHO Verwaltungs GmbH, 5.250% PIK, 4.500% Cash, 9/15/2023, 144A(f) | 805,200 | ||||||

| 420,000 | Midas Intermediate Holdco II LLC/Midas Intermediate Holdco II Finance, Inc., 7.875%, 10/01/2022, 144A | 382,200 | ||||||

|

| |||||||

| 2,134,462 | ||||||||

|

| |||||||

| Banking — 3.1% |

| |||||||

| 1,730,000 | Ally Financial, Inc., 4.625%, 3/30/2025 | 1,675,937 | ||||||

| 485,000 | Ally Financial, Inc., 5.750%, 11/20/2025 | 482,575 | ||||||

| 850,000 | Barclays PLC, 5.200%, 5/12/2026(e) | 814,795 | ||||||

| 425,000 | Deutsche Bank AG, (fixed rate to 12/01/2027, variable rate thereafter), 4.875%, 12/01/2032 | 330,455 | ||||||

| 470,000 | Intesa Sanpaolo SpA, 5.017%, 6/26/2024, 144A | 426,235 | ||||||

| 495,000 | Intesa Sanpaolo SpA, 5.710%, 1/15/2026, 144A | 453,755 | ||||||

|

| |||||||

| 4,183,752 | ||||||||

|

| |||||||

| Brokerage — 0.4% |

| |||||||

| 535,000 | Jefferies Finance LLC/JFINCo-Issuer Corp., 6.875%, 4/15/2022, 144A | 520,288 | ||||||

|

| |||||||

| Building Materials — 2.8% |

| |||||||

| 610,000 | Beacon Roofing Supply, Inc., 4.875%, 11/01/2025, 144A | 536,037 | ||||||

| 230,000 | Cemex SAB de CV, 5.700%, 1/11/2025, 144A | 220,515 | ||||||

| 350,000 | Cemex SAB de CV, 7.750%, 4/16/2026, 144A | 367,938 | ||||||

| 420,000 | James Hardie International Finance Ltd., 4.750%, 1/15/2025, 144A | 382,200 | ||||||

| 445,000 | James Hardie International Finance Ltd., 5.000%, 1/15/2028, 144A | 380,475 | ||||||

| 360,000 | Jeld-Wen, Inc., 4.625%, 12/15/2025, 144A | 315,000 | ||||||

| 160,000 | Jeld-Wen, Inc., 4.875%, 12/15/2027, 144A | 135,200 | ||||||

| 420,000 | Summit Materials LLC / Summit Materials Finance Corp., 6.125%, 7/15/2023 | 415,800 | ||||||

| 1,120,000 | U.S. Concrete, Inc., 6.375%, 6/01/2024 | 1,030,400 | ||||||

|

| |||||||

| 3,783,565 | ||||||||

|

| |||||||

| Cable Satellite — 6.9% |

| |||||||

| 795,000 | Altice Financing S.A., 6.625%, 2/15/2023, 144A | 763,200 | ||||||

| 475,000 | CCO Holdings LLC/CCO Holdings Capital Corp., 5.125%, 2/15/2023 | 463,125 | ||||||

| 625,000 | CCO Holdings LLC/CCO Holdings Capital Corp., 5.125%, 5/01/2023, 144A | 607,813 | ||||||

| 865,000 | CCO Holdings LLC/CCO Holdings Capital Corp., 5.750%, 2/15/2026, 144A | 847,700 | ||||||

| 1,360,000 | CSC Holdings LLC, 5.500%, 4/15/2027, 144A | 1,264,800 | ||||||

| 355,000 | Sirius XM Radio, Inc., 5.000%, 8/01/2027, 144A | 324,381 | ||||||

| 800,000 | Telenet Finance Luxembourg Notes S.a.r.l., 5.500%, 3/01/2028, 144A | 725,208 | ||||||

| 1,485,000 | Unitymedia GmbH, 6.125%, 1/15/2025, 144A | 1,492,276 | ||||||

| 265,000 | Virgin Media Finance PLC, 6.000%, 10/15/2024, 144A | 254,533 | ||||||

| 375,000 | Virgin Media Secured Finance PLC, 5.500%, 1/15/2025, 144A | 369,614 | ||||||

| 2,570,000 | Ziggo BV, 5.500%, 1/15/2027, 144A | 2,300,150 | ||||||

|

| |||||||

| 9,412,800 | ||||||||

|

| |||||||

See accompanying notes to financial statements.

13 |

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Chemicals — 1.6% |

| |||||||

| $ | 1,510,000 | Hercules LLC, 6.500%, 6/30/2029 | $ | 1,506,225 | ||||

| 420,000 | Hexion, Inc., 6.625%, 4/15/2020 | 334,950 | ||||||

| 70,000 | Hexion, Inc., 10.375%, 2/01/2022, 144A | 55,825 | ||||||

| 245,000 | SASOL Financing USA LLC, 5.875%, 3/27/2024 | 244,483 | ||||||

|

| |||||||

| 2,141,483 | ||||||||

|

| |||||||

| Construction Machinery — 1.0% |

| |||||||

| 615,000 | United Rentals North America, Inc., 4.625%, 10/15/2025 | 548,887 | ||||||

| 15,000 | United Rentals North America, Inc., 5.500%, 5/15/2027 | 13,913 | ||||||

| 800,000 | United Rentals North America, Inc., 5.750%, 11/15/2024 | 770,000 | ||||||

|

| |||||||

| 1,332,800 | ||||||||

|

| |||||||

| Consumer Cyclical Services — 0.2% |

| |||||||

| 350,000 | ServiceMaster Co. LLC (The), 7.450%, 8/15/2027 | 357,000 | ||||||

|

| |||||||

| Consumer Products — 0.5% |

| |||||||

| 790,000 | Coty, Inc., 6.500%, 4/15/2026, 144A | 679,400 | ||||||

|

| |||||||

| Electric — 1.7% |

| |||||||

| 125,000 | AES Corp. (The), 5.125%, 9/01/2027 | 120,000 | ||||||

| 479,000 | AES Corp. (The), 5.500%, 4/15/2025 | 476,533 | ||||||

| 150,000 | AES Corp. (The), 6.000%, 5/15/2026 | 152,250 | ||||||

| 1,502,000 | Enel SpA, (fixed rate to 9/24/2023, variable rate thereafter), 8.750%, 9/24/2073, 144A | 1,532,040 | ||||||

|

| |||||||

| 2,280,823 | ||||||||

|

| |||||||

| Environmental — 0.1% |

| |||||||

| 100,000 | GFL Environmental, Inc., 5.625%, 5/01/2022, 144A | 92,250 | ||||||

|

| |||||||

| Finance Companies — 4.6% |

| |||||||

| 120,000 | CIT Group, Inc., 4.125%, 3/09/2021 | 118,200 | ||||||

| 120,000 | iStar, Inc., 4.625%, 9/15/2020 | 117,000 | ||||||

| 395,000 | iStar, Inc., 5.250%, 9/15/2022 | 369,285 | ||||||

| 800,000 | iStar, Inc., 6.500%, 7/01/2021 | 792,000 | ||||||

| 720,000 | Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp., 5.250%, 10/01/2025, 144A | 642,600 | ||||||

| 255,000 | Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp., 5.875%, 8/01/2021, 144A | 254,363 | ||||||

| 820,000 | Navient Corp., 6.500%, 6/15/2022 | 764,650 | ||||||

| 315,000 | Provident Funding Associates LP/PFG Finance Corp., 6.375%, 6/15/2025, 144A | 283,500 | ||||||

| 1,305,000 | Quicken Loans, Inc., 5.250%, 1/15/2028, 144A | 1,154,925 | ||||||

| 710,000 | Quicken Loans, Inc., 5.750%, 5/01/2025, 144A | 663,850 | ||||||

| 185,000 | Springleaf Finance Corp., 6.875%, 3/15/2025 | 165,575 | ||||||

| 700,000 | Springleaf Finance Corp., 7.125%, 3/15/2026 | 624,750 | ||||||

| 405,000 | Unifin Financiera SAB de CV SOFOM ENR, 7.250%, 9/27/2023, 144A | 373,681 | ||||||

|

| |||||||

| 6,324,379 | ||||||||

|

| |||||||

| Financial Other — 0.8% |

| |||||||

| 180,000 | Icahn Enterprises LP/Icahn Enterprises Finance Corp., 5.875%, 2/01/2022 | 176,400 | ||||||

| 105,000 | Icahn Enterprises LP/Icahn Enterprises Finance Corp., 6.250%, 2/01/2022 | 103,688 | ||||||

See accompanying notes to financial statements.

| 14

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Financial Other — continued |

| |||||||

| $ | 465,000 | Nationstar Mortgage Holdings, Inc., 8.125%, 7/15/2023, 144A | $ | 453,375 | ||||

| 330,000 | Nationstar Mortgage Holdings, Inc., 9.125%, 7/15/2026, 144A | 320,925 | ||||||

|

| |||||||

| 1,054,388 | ||||||||

|

| |||||||

| Food & Beverage — 2.4% |

| |||||||

| 405,000 | BRF GmbH, 4.350%, 9/29/2026, 144A | 349,495 | ||||||

| 210,000 | BRF S.A., 4.750%, 5/22/2024, 144A | 192,937 | ||||||

| 520,000 | Cosan Luxembourg S.A., 7.000%, 1/20/2027, 144A | 524,098 | ||||||

| 330,000 | JBS USA LUX S.A./JBS USA Finance, Inc., 5.750%, 6/15/2025, 144A | 315,150 | ||||||

| 385,000 | Marfrig Holdings Europe BV, Class B, 8.000%, 6/08/2023, 144A | 385,385 | ||||||

| 280,000 | Pilgrim’s Pride Corp., 5.750%, 3/15/2025, 144A | 262,500 | ||||||

| 540,000 | Pilgrim’s Pride Corp., 5.875%, 9/30/2027, 144A | 490,050 | ||||||

| 830,000 | Post Holdings, Inc., 5.750%, 3/01/2027, 144A | 778,125 | ||||||

|

| |||||||

| 3,297,740 | ||||||||

|

| |||||||

| Gaming — 0.5% |

| |||||||

| 175,000 | Boyd Gaming Corp., 6.375%, 4/01/2026 | 169,313 | ||||||

| 210,000 | MGM Growth Properties Operating Partnership LP / MGP FinanceCo-Issuer, Inc., 4.500%, 1/15/2028 | 183,750 | ||||||

| 380,000 | MGM Resorts International, 7.750%, 3/15/2022 | 404,225 | ||||||

|

| |||||||

| 757,288 | ||||||||

|

| |||||||

| Government Owned – No Guarantee — 1.0% |

| |||||||

| 400,000 | Petrobras Global Finance BV, 5.625%, 5/20/2043 | 335,204 | ||||||

| 515,000 | Petrobras Global Finance BV, 5.750%, 2/01/2029 | 476,375 | ||||||

| 710,000 | YPF S.A., 6.950%, 7/21/2027, 144A | 578,650 | ||||||

|

| |||||||

| 1,390,229 | ||||||||

|

| |||||||

| Healthcare — 4.6% |

| |||||||

| 170,000 | HCA, Inc., 7.050%, 12/01/2027 | 177,225 | ||||||

| 655,000 | HCA, Inc., 7.500%, 12/15/2023 | 700,850 | ||||||

| 145,000 | HCA, Inc., 7.500%, 11/06/2033 | 152,250 | ||||||

| 590,000 | HCA, Inc., 7.690%, 6/15/2025 | 628,350 | ||||||

| 480,000 | HCA, Inc., 8.360%, 4/15/2024 | 528,000 | ||||||

| 820,000 | HCA, Inc., MTN, 7.580%, 9/15/2025 | 869,200 | ||||||

| 515,000 | HCA, Inc., MTN, 7.750%, 7/15/2036 | 534,313 | ||||||

| 275,000 | Hologic, Inc., 4.375%, 10/15/2025, 144A | 255,750 | ||||||

| 315,000 | Hologic, Inc., 4.625%, 2/01/2028, 144A | 283,500 | ||||||

| 200,000 | IQVIA, Inc., 5.000%, 10/15/2026, 144A | 191,000 | ||||||

| 800,000 | Polaris Intermediate Corp., 8.500% PIK, 8.500% Cash, 12/01/2022, 144A(f) | 729,696 | ||||||

| 390,000 | Tenet Healthcare Corp., 5.125%, 5/01/2025 | 363,675 | ||||||

| 830,000 | Tenet Healthcare Corp., 7.500%, 1/01/2022, 144A | 842,450 | ||||||

|

| |||||||

| 6,256,259 | ||||||||

|

| |||||||

| Home Construction — 1.8% |

| |||||||

| 1,200,000 | Corporacion GEO SAB de CV, 8.875%, 3/27/2022(a)(c)(g)(h) | 12 | ||||||

| 750,000 | K. Hovnanian Enterprises, Inc., 5.000%, 11/01/2021 | 600,000 | ||||||

| 800,000 | Lennar Corp., 4.750%, 5/30/2025 | 750,000 | ||||||

| 1,130,000 | PulteGroup, Inc., 5.500%, 3/01/2026 | 1,087,625 | ||||||

|

| |||||||

| 2,437,637 | ||||||||

|

| |||||||

See accompanying notes to financial statements.

15 |

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Independent Energy — 11.6% |

| |||||||

| $ | 460,000 | Aker BP ASA, 5.875%, 3/31/2025, 144A | $ | 458,850 | ||||

| 202,000 | Ascent Resources Utica Holdings LLC/ARU Finance Corp., 10.000%, 4/01/2022, 144A | 206,606 | ||||||

| 685,000 | Baytex Energy Corp., 5.625%, 6/01/2024, 144A | 592,525 | ||||||

| 570,000 | Bruin E&P Partners LLC, 8.875%, 8/01/2023, 144A | 507,300 | ||||||

| 90,000 | California Resources Corp., 5.500%, 9/15/2021 | 64,646 | ||||||

| 41,000 | California Resources Corp., 6.000%, 11/15/2024 | 25,010 | ||||||

| 2,530,000 | California Resources Corp., 8.000%, 12/15/2022, 144A | 1,714,075 | ||||||

| 140,000 | Callon Petroleum Co., 6.125%, 10/01/2024 | 130,200 | ||||||

| 795,000 | CNX Resources Corp., 5.875%, 4/15/2022 | 763,200 | ||||||

| 635,000 | Denbury Resources, Inc., 7.500%, 2/15/2024, 144A | 511,175 | ||||||

| 205,000 | Denbury Resources, Inc., 9.250%, 3/31/2022, 144A | 189,112 | ||||||

| 690,000 | Eclipse Resources Corp., 8.875%, 7/15/2023 | 591,675 | ||||||

| 375,000 | Gulfport Energy Corp., 6.000%, 10/15/2024 | 331,875 | ||||||

| 595,000 | Gulfport Energy Corp., 6.375%, 5/15/2025 | 526,575 | ||||||

| 365,000 | Gulfport Energy Corp., 6.375%, 1/15/2026 | 315,725 | ||||||

| 622,000 | Halcon Resources Corp., 6.750%, 2/15/2025 | 454,060 | ||||||

| 605,000 | Matador Resources Co., 5.875%, 9/15/2026 | 556,600 | ||||||

| 1,250,000 | MEG Energy Corp., 6.500%, 1/15/2025, 144A | 1,268,750 | ||||||

| 585,000 | MEG Energy Corp., 7.000%, 3/31/2024, 144A | 558,675 | ||||||

| 185,000 | Newfield Exploration Co., 5.625%, 7/01/2024 | 187,313 | ||||||

| 592,000 | Oasis Petroleum, Inc., 6.875%, 3/15/2022 | 557,960 | ||||||

| 210,000 | PDC Energy, Inc., 5.750%, 5/15/2026 | 186,900 | ||||||

| 205,000 | PDC Energy, Inc., 6.125%, 9/15/2024 | 189,625 | ||||||

| 870,000 | Range Resources Corp., 4.875%, 5/15/2025 | 713,400 | ||||||

| 330,000 | Sanchez Energy Corp., 6.125%, 1/15/2023 | 59,400 | ||||||

| 755,000 | Sanchez Energy Corp., 7.250%, 2/15/2023, 144A | 615,325 | ||||||

| 685,000 | Seven Generations Energy Ltd., 5.375%, 9/30/2025, 144A | 613,075 | ||||||

| 175,000 | Seven Generations Energy Ltd., 6.875%, 6/30/2023, 144A | 172,375 | ||||||

| 920,000 | SM Energy Co., 5.000%, 1/15/2024 | 800,400 | ||||||

| 27,000 | SM Energy Co., 6.125%, 11/15/2022 | 25,515 | ||||||

| 45,000 | SM Energy Co., 6.625%, 1/15/2027 | 39,825 | ||||||

| 190,000 | SM Energy Co., 6.750%, 9/15/2026 | 170,050 | ||||||

| 264,000 | Southwestern Energy Co., 6.200%, 1/23/2025 | 235,950 | ||||||

| 405,000 | Whiting Petroleum Corp., 5.750%, 3/15/2021 | 384,750 | ||||||

| 50,000 | Whiting Petroleum Corp., 6.250%, 4/01/2023 | 45,565 | ||||||

| 1,215,000 | Whiting Petroleum Corp., 6.625%, 1/15/2026 | 1,041,862 | ||||||

|

| |||||||

| 15,805,924 | ||||||||

|

| |||||||

| Integrated Energy — 0.1% |

| |||||||

| 200,000 | Geopark Ltd., 6.500%, 9/21/2024, 144A | 185,758 | ||||||

|

| |||||||

| Life Insurance — 0.2% |

| |||||||

| 340,000 | CNO Financial Group, Inc., 5.250%, 5/30/2025 | 323,850 | ||||||

|

| |||||||

| Local Authorities — 0.3% |

| |||||||

| 325,000 | Provincia de Buenos Aires, 6.500%, 2/15/2023, 144A | 261,427 | ||||||

| 270,000 | Provincia de Buenos Aires, 7.875%, 6/15/2027, 144A | 194,402 | ||||||

|

| |||||||

| 455,829 | ||||||||

|

| |||||||

See accompanying notes to financial statements.

| 16

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Lodging — 0.9% |

| |||||||

| $ | 150,000 | Hilton Domestic Operating Co., Inc., 4.250%, 9/01/2024 | $ | 141,750 | ||||

| 755,000 | Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp., 4.625%, 4/01/2025 | 715,362 | ||||||

| 365,000 | Marriott Ownership Resorts, Inc., 6.500%, 9/15/2026, 144A | 352,225 | ||||||

|

| |||||||

| 1,209,337 | ||||||||

|

| |||||||

| Media Entertainment — 3.6% |

| |||||||

| 735,000 | AMC Networks, Inc., 4.750%, 8/01/2025 | 667,012 | ||||||

| 1,155,000 | Clear Channel Worldwide Holdings, Inc., Series B, 6.500%, 11/15/2022 | 1,155,000 | ||||||

| 1,305,000 | Clear Channel Worldwide Holdings, Inc., Series B, 7.625%, 3/15/2020 | 1,272,375 | ||||||

| 1,115,000 | iHeartCommunications, Inc., 9.000%, 12/15/2019(g) | 747,050 | ||||||

| 395,000 | Meredith Corp., 6.875%, 2/01/2026, 144A | 386,113 | ||||||

| 740,000 | Netflix, Inc., 4.875%, 4/15/2028 | 675,250 | ||||||

|

| |||||||

| 4,902,800 | ||||||||

|

| |||||||

| Metals & Mining — 2.1% |

| |||||||

| 190,000 | Commercial Metals Co., 4.875%, 5/15/2023 | 179,550 | ||||||

| 400,000 | First Quantum Minerals Ltd., 6.500%, 3/01/2024, 144A | 332,000 | ||||||

| 955,000 | First Quantum Minerals Ltd., 7.000%, 2/15/2021, 144A | 916,800 | ||||||

| 670,000 | First Quantum Minerals Ltd., 7.250%, 5/15/2022, 144A | 621,425 | ||||||

| 840,000 | FMG Resources (August 2006) Pty Ltd., 4.750%, 5/15/2022, 144A | 798,000 | ||||||

|

| |||||||

| 2,847,775 | ||||||||

|

| |||||||

| Midstream — 4.3% |

| |||||||

| 205,000 | EnLink Midstream Partners LP, 5.450%, 6/01/2047 | 165,789 | ||||||

| 360,000 | EnLink Midstream Partners LP, 5.600%, 4/01/2044 | 295,737 | ||||||

| 1,265,000 | Hess Infrastructure Partners LP/Hess Infrastructure Partners Finance Corp., 5.625%, 2/15/2026, 144A | 1,223,887 | ||||||

| 570,000 | NGL Energy Partners LP/NGL Energy Finance Corp., 5.125%, 7/15/2019 | 567,520 | ||||||

| 200,000 | NGL Energy Partners LP/NGL Energy Finance Corp., 6.125%, 3/01/2025 | 172,000 | ||||||

| 405,000 | NGL Energy Partners LP/NGL Energy Finance Corp., 7.500%, 11/01/2023 | 388,800 | ||||||

| 165,000 | NGPL PipeCo LLC, 4.375%, 8/15/2022, 144A | 160,463 | ||||||

| 700,000 | NGPL PipeCo LLC, 4.875%, 8/15/2027, 144A | 659,750 | ||||||

| 385,000 | SemGroup Corp./Rose Rock Finance Corp., 5.625%, 7/15/2022 | 362,863 | ||||||

| 935,000 | Summit Midstream Holdings LLC/Summit Midstream Finance Corp., 5.500%, 8/15/2022 | 888,250 | ||||||

| 95,000 | Targa Resources Partners LP/Targa Resources Partners Finance Corp., 4.250%, 11/15/2023 | 87,994 | ||||||

| 640,000 | Targa Resources Partners LP/Targa Resources Partners Finance Corp., 5.250%, 5/01/2023 | 627,200 | ||||||

| 305,000 | Transportadora de Gas del Sur S.A., 6.750%, 5/02/2025, 144A | 277,767 | ||||||

|

| |||||||

| 5,878,020 | ||||||||

|

| |||||||

| Non-Agency Commercial Mortgage-Backed Securities — 1.5% |

| |||||||

| 100,000 | CG-CCRE Commercial Mortgage Trust, Series2014-FL2, Class COL1, 1-month LIBOR + 3.500%, 5.955%, 11/15/2031, 144A(d)(h)(i) | 96,832 | ||||||

| 225,000 | CG-CCRE Commercial Mortgage Trust, Series2014-FL2, Class COL2, 1-month LIBOR + 4.500%, 6.955%, 11/15/2031, 144A(d)(h)(i) | 214,498 | ||||||

See accompanying notes to financial statements.

17 |

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Non-Agency Commercial Mortgage-Backed Securities — continued |

| |||||||

| $ | 1,020,000 | Credit Suisse Mortgage Trust, Series2014-USA, Class E, 4.373%, 9/15/2037, 144A | $ | 912,767 | ||||

| 59,087 | GS Mortgage Securities Trust, Series 2007-GG10, Class AM, 5.780%, 8/10/2045(b) | 59,852 | ||||||

| 18,277 | JPMorgan Chase Commercial Mortgage Securities Trust, Series 2007-LDPX, Class AM, 5.464%, 1/15/2049(b) | 18,288 | ||||||

| 380,000 | Starwood Retail Property Trust, Series 2014-STAR, Class D, 1-month LIBOR + 3.250%, 5.705%, 11/15/2027, 144A(d)(h)(i) | 323,001 | ||||||

| 420,000 | Starwood Retail Property Trust, Series 2014-STAR, Class E, 1-month LIBOR + 4.150%, 6.605%, 11/15/2027, 144A(d) | 316,421 | ||||||

| 125,000 | WFRBS Commercial Mortgage Trust, Series2012-C7, Class E, 4.821%, 6/15/2045, 144A(b) | 104,073 | ||||||

|

| |||||||

| 2,045,732 | ||||||||

|

| |||||||

| Oil Field Services — 1.8% |

| |||||||

| 430,000 | Ensco PLC, 5.750%, 10/01/2044 | 240,318 | ||||||

| 490,000 | McDermott Technology Americas, Inc./McDermott Technology U.S., Inc., 10.625%, 5/01/2024, 144A | 413,437 | ||||||

| 160,000 | Noble Holding International Ltd., 5.250%, 3/15/2042 | 92,800 | ||||||

| 160,000 | Noble Holding International Ltd., 6.050%, 3/01/2041 | 98,400 | ||||||

| 420,000 | Noble Holding International Ltd., 7.750%, 1/15/2024 | 318,150 | ||||||

| 530,000 | Noble Holding International Ltd., 7.875%, 2/01/2026, 144A | 451,825 | ||||||

| 405,000 | Shelf Drilling Holdings Ltd., 8.250%, 2/15/2025, 144A | 346,275 | ||||||

| 175,000 | Transocean Guardian Ltd., 5.875%, 1/15/2024, 144A | 167,563 | ||||||

| 224,000 | Transocean Proteus Ltd., 6.250%, 12/01/2024, 144A | 214,480 | ||||||

| 175,000 | Transocean, Inc., 7.500%, 1/15/2026, 144A | 153,563 | ||||||

|

| |||||||

| 2,496,811 | ||||||||

|

| |||||||

| Packaging — 1.2% |

| |||||||

| 200,000 | ARD Finance S.A., 7.875% PIK, 7.125% Cash, 9/15/2023(f) | 179,500 | ||||||

| 395,000 | Ardagh Packaging Finance PLC/Ardagh MP Holdings USA, Inc., 4.625%, 5/15/2023, 144A | 377,225 | ||||||

| 1,165,000 | Ardagh Packaging Finance PLC/Ardagh MP Holdings USA, Inc., 7.250%, 5/15/2024, 144A | 1,162,087 | ||||||

|

| |||||||

| 1,718,812 | ||||||||

|

| |||||||

| Paper — 0.3% |

| |||||||

| 440,000 | Klabin Finance S.A., 4.875%, 9/19/2027, 144A | 399,300 | ||||||

|

| |||||||

| Pharmaceuticals — 2.0% |

| |||||||

| 265,000 | Bausch Health Cos., Inc., 5.500%, 3/01/2023, 144A | 242,475 | ||||||

| 66,000 | Bausch Health Cos., Inc., 5.625%, 12/01/2021, 144A | 65,010 | ||||||

| 1,350,000 | Bausch Health Cos., Inc., 5.875%, 5/15/2023, 144A | 1,248,750 | ||||||

| 280,000 | Catalent Pharma Solutions, Inc., 4.875%, 1/15/2026, 144A | 265,300 | ||||||

| 975,000 | Teva Pharmaceutical Finance Co. BV, 2.950%, 12/18/2022 | 862,251 | ||||||

|

| |||||||

| 2,683,786 | ||||||||

|

| |||||||

| Property & Casualty Insurance — 0.7% |

| |||||||

| 1,110,000 | Ardonagh Midco 3 PLC, 8.625%, 7/15/2023, 144A | 940,103 | ||||||

|

| |||||||

See accompanying notes to financial statements.

| 18

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Refining — 0.4% |

| |||||||

| $ | 635,000 | Parkland Fuel Corp., 6.000%, 4/01/2026, 144A | $ | 595,313 | ||||

|

| |||||||

| Restaurants — 0.6% |

| |||||||

| 890,000 | 1011778 B.C. ULC/New Red Finance, Inc., 5.000%, 10/15/2025, 144A | 818,800 | ||||||

|

| |||||||

| Retailers — 2.3% |

| |||||||

| 830,000 | Asbury Automotive Group, Inc., 6.000%, 12/15/2024 | 794,725 | ||||||

| 820,000 | Group 1 Automotive, Inc., 5.000%, 6/01/2022 | 776,950 | ||||||

| 505,000 | JC Penney Corp., Inc., 5.875%, 7/01/2023, 144A | 406,525 | ||||||

| 475,000 | L Brands, Inc., 6.750%, 7/01/2036 | 387,125 | ||||||

| 180,000 | L Brands, Inc., 6.875%, 11/01/2035 | 150,336 | ||||||

| 665,000 | Party City Holdings, Inc., 6.625%, 8/01/2026, 144A | 605,150 | ||||||

|

| |||||||

| 3,120,811 | ||||||||

|

| |||||||

| Supermarkets — 0.7% |

| |||||||

| 335,000 | Albertson’s Cos. LLC/Safeway, Inc./New Albertson’s, Inc./Albertson’s LLC, 5.750%, 3/15/2025 | 293,125 | ||||||

| 935,000 | New Albertsons LP, Series C, MTN, 6.625%, 6/01/2028 | 691,900 | ||||||

|

| |||||||

| 985,025 | ||||||||

|

| |||||||

| Technology — 2.7% |

| |||||||

| 416,000 | Blackboard, Inc., 9.750%, 10/15/2021, 144A | 282,880 | ||||||

| 170,000 | Camelot Finance S.A., 7.875%, 10/15/2024, 144A | 164,050 | ||||||

| 60,000 | CommScope Technologies LLC, 6.000%, 6/15/2025, 144A | 54,600 | ||||||

| 1,205,000 | Dell International LLC/EMC Corp., 6.020%, 6/15/2026, 144A | 1,210,449 | ||||||

| 420,000 | First Data Corp., 5.375%, 8/15/2023, 144A | 412,650 | ||||||

| 190,000 | Open Text Corp., 5.875%, 6/01/2026, 144A | 186,200 | ||||||

| 275,000 | Sabre GLBL, Inc., 5.250%, 11/15/2023, 144A | 271,562 | ||||||

| 435,000 | Veritas U.S., Inc./Veritas Bermuda Ltd., 10.500%, 2/01/2024, 144A | 284,925 | ||||||

| 900,000 | Western Digital Corp., 4.750%, 2/15/2026 | 780,750 | ||||||

|

| |||||||

| 3,648,066 | ||||||||

|

| |||||||

| Transportation Services — 0.2% |

| |||||||

| 275,000 | APL Ltd., 8.000%, 1/15/2024(h)(i) | 244,626 | ||||||

|

| |||||||

| Wireless — 3.1% |

| |||||||

| 865,000 | Nokia Oyj, 4.375%, 6/12/2027 | 804,450 | ||||||

| 786,000 | Sprint Capital Corp., 6.875%, 11/15/2028 | 742,770 | ||||||

| 650,000 | Sprint Corp., 7.250%, 9/15/2021 | 665,275 | ||||||

| 920,000 | Sprint Corp., 7.875%, 9/15/2023 | 944,150 | ||||||

| 315,000 | T-Mobile USA, Inc., 4.500%, 2/01/2026 | 289,012 | ||||||

| 895,000 | T-Mobile USA, Inc., 4.750%, 2/01/2028 | 809,975 | ||||||

|

| |||||||

| 4,255,632 | ||||||||

|

| |||||||

| Wirelines — 1.3% |

| |||||||

| 130,000 | Cincinnati Bell Telephone Co. LLC, 6.300%, 12/01/2028 | 107,479 | ||||||

| 1,060,000 | Frontier Communications Corp., 8.500%, 4/01/2026, 144A | 927,500 | ||||||

| 405,000 | Frontier Communications Corp., 9.000%, 8/15/2031 | 216,675 | ||||||

| 120,000 | Telecom Italia Capital S.A., 7.200%, 7/18/2036 | 114,600 | ||||||

See accompanying notes to financial statements.

19 |

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Wirelines — continued |

| |||||||

| $ | 505,000 | Windstream Services LLC/Windstream Finance Corp., 10.500%, 6/30/2024, 144A | $ | 383,800 | ||||

|

| |||||||

| 1,750,054 | ||||||||

|

| |||||||

| TotalNon-Convertible Bonds (Identified Cost $118,115,267) | 110,367,709 | |||||||

|

| |||||||

| Convertible Bonds — 9.9% | ||||||||

| Automotive — 0.3% |

| |||||||

| 390,000 | Meritor, Inc., 3.250%, 10/15/2037 | 340,517 | ||||||

|

| |||||||

| Cable Satellite — 1.2% |

| |||||||

| 1,515,000 | DISH Network Corp., 2.375%, 3/15/2024 | 1,206,192 | ||||||

| 580,000 | DISH Network Corp., 3.375%, 8/15/2026 | 468,359 | ||||||

|

| |||||||

| 1,674,551 | ||||||||

|

| |||||||

| Consumer Cyclical Services — 0.5% |

| |||||||

| 755,000 | Macquarie Infrastructure Corp., 2.000%, 10/01/2023 | 653,300 | ||||||

|

| |||||||

| Diversified Operations — 0.1% |

| |||||||

| 160,000 | RWT Holdings, Inc., 5.625%, 11/15/2019 | 160,701 | ||||||

|

| |||||||

| Healthcare — 0.5% |

| |||||||

| 190,000 | Evolent Health, Inc., 2.000%, 12/01/2021 | 210,686 | ||||||

| 125,000 | Insulet Corp., 1.375%, 11/15/2024, 144A | 132,752 | ||||||

| 275,000 | Wright Medical Group, Inc., 1.625%, 6/15/2023, 144A | 280,044 | ||||||

|

| |||||||

| 623,482 | ||||||||

|

| |||||||

| Independent Energy — 1.1% |

| |||||||

| 840,000 | Chesapeake Energy Corp., 5.500%, 9/15/2026 | 676,084 | ||||||

| 825,000 | PDC Energy, Inc., 1.125%, 9/15/2021 | 731,156 | ||||||

| 170,000 | Whiting Petroleum Corp., 1.250%, 4/01/2020 | 160,721 | ||||||

|

| |||||||

| 1,567,961 | ||||||||

|

| |||||||

| Industrial Other — 0.2% |

| |||||||

| 340,000 | Tutor Perini Corp., 2.875%, 6/15/2021 | 312,953 | ||||||

|

| |||||||

| Leisure — 0.1% |

| |||||||

| 185,000 | Rovi Corp., 0.500%, 3/01/2020 | 173,458 | ||||||

|

| |||||||

| Midstream — 0.0% |

| |||||||

| 60,000 | SM Energy Co., 1.500%, 7/01/2021 | 55,771 | ||||||

|

| |||||||

| Oil Field Services — 0.5% |

| |||||||

| 860,000 | Nabors Industries, Inc., 0.750%, 1/15/2024 | 531,248 | ||||||

| 225,000 | Oil States International, Inc., 1.500%, 2/15/2023, 144A | 184,414 | ||||||

|

| |||||||

| 715,662 | ||||||||

|

| |||||||

| Pharmaceuticals — 2.6% |

| |||||||

| 1,530,000 | BioMarin Pharmaceutical, Inc., 0.599%, 8/01/2024 | 1,521,430 | ||||||

| 265,000 | Dermira, Inc., 3.000%, 5/15/2022 | 204,426 | ||||||

| 475,000 | Flexion Therapeutics, Inc., 3.375%, 5/01/2024 | 390,583 | ||||||

| 745,000 | Intercept Pharmaceuticals, Inc., 3.250%, 7/01/2023 | 686,425 | ||||||

| 660,000 | Ionis Pharmaceuticals, Inc., 1.000%, 11/15/2021 | 706,268 | ||||||

|

| |||||||

| 3,509,132 | ||||||||

|

| |||||||

See accompanying notes to financial statements.

| 20

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Railroads — 0.3% |

| |||||||

| $ | 385,000 | Greenbrier Cos., Inc. (The), 2.875%, 2/01/2024 | $ | 378,318 | ||||

|

| |||||||

| REITs – Diversified — 0.3% |

| |||||||

| 435,000 | iStar, Inc., 3.125%, 9/15/2022 | 391,952 | ||||||

|

| |||||||

| Technology — 2.0% |

| |||||||

| 570,000 | Avaya Holdings Corp., 2.250%, 6/15/2023, 144A | 486,295 | ||||||

| 865,000 | Finisar Corp., 0.500%, 12/15/2036 | 821,075 | ||||||

| 625,000 | Nuance Communications, Inc., 1.000%, 12/15/2035 | 537,406 | ||||||

| 315,000 | Nuance Communications, Inc., 1.250%, 4/01/2025 | 276,173 | ||||||

| 245,000 | Palo Alto Networks, Inc., 0.750%, 7/01/2023, 144A | 242,302 | ||||||

| 140,000 | Verint Systems, Inc., 1.500%, 6/01/2021 | 135,434 | ||||||

| 305,000 | Western Digital Corp., 1.500%, 2/01/2024, 144A | 247,173 | ||||||

|

| |||||||

| 2,745,858 | ||||||||

|

| |||||||

| Wirelines — 0.2% |

| |||||||

| 275,000 | GCI Liberty, Inc., 1.750%, 9/30/2046, 144A | 268,427 | ||||||

|

| |||||||

| Total Convertible Bonds (Identified Cost $14,909,751) | 13,572,043 | |||||||

|

| |||||||

| Total Bonds and Notes (Identified Cost $133,025,018) | 123,939,752 | |||||||

|

| |||||||

| Loan Participations — 0.3% | ||||||||

| ABS Other — 0.3% |

| |||||||

| 425,733 | Harbour Aircraft Investments Ltd., Series2017-1, Class C, 8.000%, 11/15/2037(a) (Identified Cost $424,760) | 425,679 | ||||||

|

| |||||||

| Senior Loans — 1.8% | ||||||||

| Retailers — 0.4% |

| |||||||

| 212,000 | J.C. Penney Corp., Inc., 2016 Term Loan B, 6/23/2023(j) | 180,200 | ||||||

| 461,941 | J.C. Penney Corp., Inc., 2016 Term Loan B,3-month LIBOR + 4.250%, 6.956%, 6/23/2023(d) | 392,650 | ||||||

|

| |||||||

| Total Retailers (Identified Cost $607,345) | 572,850 | |||||||

|

| |||||||

| Supermarkets — 0.6% |

| |||||||

| 422,927 | Albertsons LLC, USD 2017 Term Loan B5, 12/21/2022(j) | 405,244 | ||||||

| 429,000 | Albertsons LLC, Term Loan B7,1-month LIBOR + 3.000%, 5.522%, 11/17/2025(d) | 405,941 | ||||||

|

| |||||||

| 811,185 | ||||||||

|

| |||||||

| Transportation Services — 0.8% |

| |||||||

| 1,037,012 | Uber Technologies, 2018 Term Loan,1-month LIBOR + 4.000%, 6.387%, 4/04/2025(d) | 1,008,494 | ||||||

|

| |||||||

| Total Senior Loans (Identified Cost $2,479,828) | 2,392,529 | |||||||

|

| |||||||

See accompanying notes to financial statements.

21 |

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

Shares | Description | Value (†) | ||||||

| Preferred Stocks — 1.5% | ||||||||

| Food & Beverage — 1.1% |

| |||||||

| 14,765 | Bunge Ltd., 4.875% | $ | 1,433,853 | |||||

|

| |||||||

| Midstream — 0.4% |

| |||||||

| 988 | Chesapeake Energy Corp., 5.750% | 509,662 | ||||||

| 20 | Chesapeake Energy Corp., 5.750%, 144A | 10,317 | ||||||

| 137 | Chesapeake Energy Corp., 5.750%(a) | 58,567 | ||||||

|

| |||||||

| 578,546 | ||||||||

|

| |||||||

| Total Preferred Stocks (Identified Cost $2,234,677) | 2,012,399 | |||||||

|

| |||||||

| Other Investments — 0.6% | ||||||||

| Aircraft ABS — 0.6% |

| |||||||

| 100 | ECAF I Blocker Ltd.(a)(c)(h)(k) (Identified Cost $1,000,000) | 865,625 | ||||||

|

| |||||||

| Principal Amount | ||||||||

| Short-Term Investments — 20.6% | ||||||||

| $ | 28,093,324 | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/31/2018 at 1.500% to be repurchased at $28,095,666 on 1/02/2019 collateralized by $23,255,000 U.S. Treasury Bond, 4.375% due 5/15/2041 valued at $28,661,206 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $28,093,324) | 28,093,324 | |||||

|

| |||||||

| Total Investments — 115.6% (Identified Cost $167,257,607) | 157,729,308 | |||||||

| Other assets less liabilities — (15.6)% | (21,251,074 | ) | ||||||

|

| |||||||

| Net Assets — 100.0% | $ | 136,478,234 | ||||||

|

| |||||||

| (†) | See Note 2 of Notes to Financial Statements. | |||||||

| (a) | Level 3 security. Value has been determined using significant unobservable inputs. See Note 3 of Notes to Financial Statements. |

| ||||||

| (b) | Variable rate security. The interest rate adjusts periodically based on; (i) changes in current interest rates and/or prepayments on underlying pools of assets, if applicable, (ii) reference to a base lending rate plus or minus a margin, and/or (iii) reference to a base lending rate adjusted by a multiplier and/or subject to certain floors or caps. Rate as of December 31, 2018 is disclosed. |

| ||||||

| (c) | Fair valued by the Fund’s adviser. At December 31, 2018, the value of these securities amounted to $866,211 or 0.6% of net assets. See Note 2 of Notes to Financial Statements. |

| ||||||

| (d) | Variable rate security. Rate as of December 31, 2018 is disclosed. |

| ||||||

| (e) | Security (or a portion thereof) has been designated to cover the Fund’s obligations under open derivative contracts. |

| ||||||

| (f) | Payment-in-kind security for which the issuer has the option at each interest payment date of making interest payments in cash or additional principal. For the period ended December 31, 2018, interest payments were made in cash. |

| ||||||

See accompanying notes to financial statements.

| 22

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

| (g) | The issuer is in default with respect to interest and/or principal payments. Income is not being accrued. |

| ||||||

| (h) | Illiquid security. (Unaudited) |

| ||||||

| (i) | Securities classified as fair valued pursuant to the Fund’s pricing policies and procedures. At December 31, 2018, the value of these securities amounted to $878,957 or 0.6% of net assets. See Note 2 of Notes to Financial Statements. |

| ||||||

| (j) | Position is unsettled. Contract rate was not determined at December 31, 2018 and does not take effect until settlement date. Maturity date is not finalized until settlement date. |

| ||||||

| (k) | Securities subject to restriction on resale. At December 31, 2018, the restricted securities held by the Fund are as follows: |

| ||||||

| Acquisition Date | Acquisition Cost | Value | % of Net Assets | |||||||||||

| ECAF I Blocker Ltd. | December 20, 2016 | $ | 1,000,000 | $ | 865,625 | 0.6% | ||||||||

| 144A | All or a portion of these securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2018, the value of Rule 144A holdings amounted to $60,625,842 or 44.4% of net assets. |

| ||||||

| ABS | Asset-Backed Securities | |||||||

| LIBOR | London Interbank Offered Rate | |||||||

| MTN | Medium Term Note | |||||||

| PIK | Payment-in-Kind | |||||||

| REITs | Real Estate Investment Trusts | |||||||

| GBP | British Pound | |||||||

| ZAR | South African Rand | |||||||

At December 31, 2018, the Fund had the following open forward foreign currency contracts:

| Counterparty | Delivery Date | Currency Bought/ Sold (B/S) | Units of Currency | In Exchange for | Notional Value | Unrealized Appreciation (Depreciation) | ||||||||||||||||||||||

HSBC Bank USA | 2/04/2019 | GBP | B | 340,000 | $ | 447,077 | $ | 434,051 | $ | (13,026 | ) | |||||||||||||||||

HSBC Bank USA | 2/04/2019 | GBP | S | 340,000 | 436,304 | 434,051 | 2,253 | |||||||||||||||||||||

Bank of America N.A | 2/04/2019 | ZAR | B | 25,220,000 | 1,719,116 | 1,746,214 | 27,098 | |||||||||||||||||||||

Bank of America N.A | 2/04/2019 | ZAR | S | 25,220,000 | 1,685,795 | 1,746,214 | (60,419 | ) | ||||||||||||||||||||

|

| |||||||||||||||||||||||||||

Total |

| $ | (44,094 | ) | ||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||

See accompanying notes to financial statements.

23 |

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles High Income Fund – (continued)

Industry Summary at December 31, 2018

Independent Energy | 12.7 | % | ||

Cable Satellite | 8.1 | |||

Healthcare | 5.1 | |||

Midstream | 4.7 | |||

Technology | 4.7 | |||

Finance Companies | 4.6 | |||

Pharmaceuticals | 4.6 | |||

Media Entertainment | 3.6 | |||

Food & Beverage | 3.5 | |||

Wireless | 3.1 | |||

Banking | 3.1 | |||

Building Materials | 2.8 | |||

Retailers | 2.7 | |||

Oil Field Services | 2.3 | |||

Metals & Mining | 2.1 | |||

Other Investments, less than 2% each | 27.3 | |||

Short-Term Investments | 20.6 | |||

|

| |||

Total Investments | 115.6 | |||

Other assets less liabilities (including forward foreign currency contracts) | (15.6 | ) | ||

|

| |||

Net Assets | 100.0 | % | ||

|

|

See accompanying notes to financial statements.

| 24

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles Investment Grade Bond Fund

| Principal Amount (‡) | Description | Value (†) | ||||||

| Bonds and Notes — 83.3% of Net Assets | ||||||||

| Non-Convertible Bonds — 81.6% | ||||||||

| ABS Car Loan — 4.3% |

| |||||||

| $ | 20,902,000 | Ally Auto Receivables Trust, Series2017-3, Class A3, 1.740%, 9/15/2021 | $ | 20,706,221 | ||||

| 10,515,000 | AmeriCredit Automobile Receivables Trust, Series2018-3, Class D, 4.040%, 11/18/2024 | 10,645,240 | ||||||

| 6,317,885 | BMW Vehicle Owner Trust, Series2016-A, Class A3, 1.160%, 11/25/2020 | 6,276,831 | ||||||

| 3,650,000 | CarMax Auto Owner Trust, Series2018-3, Class D, 3.910%, 1/15/2025 | 3,660,478 | ||||||

| 22,010,000 | Credit Acceptance Auto Loan Trust, Series2018-2A, Class A, 3.470%, 5/17/2027, 144A | 21,968,885 | ||||||

| 6,555,000 | Drive Auto Receivables Trust, Series2018-5, Class D, 4.300%, 4/15/2026 | 6,639,626 | ||||||

| 3,122,000 | Ford Credit Auto Owner Trust, Series2017-B, Class A3, 1.690%, 11/15/2021 | 3,083,523 | ||||||

| 6,770,000 | Ford Credit Auto Owner Trust, Series2018-A, Class A3, 3.030%, 11/15/2022 | 6,773,149 | ||||||

| 6,697,430 | Honda Auto Receivables Owner Trust, Series2016-4, Class A3, 1.210%, 12/18/2020 | 6,637,116 | ||||||

| 2,103,000 | Honda Auto Receivables Owner Trust, Series2017-2, Class A3, 1.680%, 8/16/2021 | 2,081,255 | ||||||

| 28,000,000 | Honda Auto Receivables Owner Trust, Series2018-4, Class A3, 3.160%, 1/17/2023 | 28,133,025 | ||||||

| 25,503,002 | Nissan Auto Receivables Owner Trust, Series2016-C, Class A3, 1.180%, 1/15/2021 | 25,263,710 | ||||||

| 26,135,000 | Nissan Auto Receivables Owner Trust, Series2018-C, Class A3, 3.220%, 6/15/2023 | 26,323,091 | ||||||

| 12,632,000 | Toyota Auto Receivables Owner Trust, Series2017-B, Class A3, 1.760%, 7/15/2021 | 12,515,467 | ||||||

| 15,720,000 | Toyota Auto Receivables Owner Trust, Series2017-D, Class A3, 1.930%, 1/18/2022 | 15,500,980 | ||||||

| 27,000,000 | Toyota Auto Receivables Owner Trust, Series2018-A, Class A3, 2.350%, 5/16/2022(a) | 26,740,395 | ||||||

| 4,500,000 | Toyota Auto Receivables Owner Trust, Series2018-C, Class A2A, 2.770%, 8/16/2021 | 4,489,051 | ||||||

|

| |||||||

| 227,438,043 | ||||||||

|

| |||||||

| ABS Credit Card — 4.8% |

| |||||||

| 14,559,000 | American Express Credit Account Master Trust, Series2017-1, Class A, 1.930%, 9/15/2022 | 14,386,811 | ||||||

| 10,434,000 | American Express Credit Account Master Trust, Series2017-6, Class A, 2.040%, 5/15/2023 | 10,273,110 | ||||||

| 3,000,000 | American Express Credit Account Master Trust, Series2018-1, Class A, 2.670%, 10/17/2022 | 2,988,322 | ||||||

| 9,770,000 | BA Credit Card Trust, Series2017-A2, Class A2, 1.840%, 1/17/2023 | 9,595,101 | ||||||

| 28,630,000 | BA Credit Card Trust, Series2018-A2, Class A2, 3.000%, 9/15/2023(a) | 28,710,900 | ||||||

| 24,885,000 | Capital One Multi-Asset Execution Trust, Series2015-A2, Class A2, 2.080%, 3/15/2023 | 24,586,096 | ||||||

| 9,480,000 | Capital One Multi-Asset Execution Trust, Series2016-A3, Class A3, 1.340%, 4/15/2022 | 9,407,015 | ||||||

| 6,170,000 | Capital One Multi-Asset Execution Trust, Series2017-A4, Class A4, 1.990%, 7/17/2023 | 6,074,210 | ||||||

See accompanying notes to financial statements.

25 |

Table of Contents

Portfolio of Investments – as of December 31, 2018

Loomis Sayles Investment Grade Bond Fund – (continued)

| Principal Amount (‡) | Description | Value (†) | ||||||

| ABS Credit Card — continued |

| |||||||

| $ | 17,700,000 | Chase Issuance Trust, Series2012-A4, Class A4, 1.580%, 8/15/2021 | $ | 17,555,904 | ||||

| 7,915,000 | Chase Issuance Trust, Series2015-A4, Class A4, 1.840%, 4/15/2022 | 7,796,723 | ||||||

| 31,257,000 | Chase Issuance Trust, Sries2016-A5, Class A5, 1.270%, 7/15/2021 | 30,983,017 | ||||||

| 22,714,000 | Citibank Credit Card Issuance Trust, Series2014-A6, Class A6, 2.150%, 7/15/2021 | 22,620,471 | ||||||

| 13,575,000 | Citibank Credit Card Issuance Trust, Series2016-A1, Class A1, 1.750%, 11/19/2021 | 13,430,952 | ||||||

| 10,366,000 | Citibank Credit Card Issuance Trust, Series2017-A3, Class A3, 1.920%, 4/07/2022 | 10,233,786 | ||||||

| 13,235,000 | Citibank Credit Card Issuance Trust, Series2017-A8, Class A8, 1.860%, 8/08/2022 | 13,019,325 | ||||||

| 35,306,000 | Discover Card Execution Note Trust, Series2016-A4, Class A4, 1.390%, 3/15/2022 | 34,916,487 | ||||||

|

| |||||||

| 256,578,230 | ||||||||

|

| |||||||

| ABS Home Equity — 0.7% |

| |||||||

| 1,534,525 | Bayview Opportunity Master Fund Trust, Series2018-RN3, Class A1, 3.672%, 3/28/2033, 144A(b) | 1,533,133 | ||||||

| 3,147,076 | Bayview Opportunity Master Fund Trust, Series2018-RN8, Class A1, 4.066%, 9/28/2033, 144A(b) | 3,150,318 | ||||||