Insider Trading Policy For purposes of this Policy, the term "Company" includes all legal entities, subsidiaries or affiliates of Sterling Infrastructure, Inc. The term "Sterling" refers only to Sterling Infrastructure, Inc., the common stock of which is publicly traded. Sterling’s Board of Directors (the “Board”) has adopted this Policy to promote compliance with federal, state and foreign securities laws that prohibit certain persons and the Company who are aware of material nonpublic information about a company from: (i) trading in securities of that company; or (ii) providing material nonpublic information to other persons who may trade on the basis of that information. It is the policy of the Company that no member of any board of directors, no officer and no employee of the Company shall violate federal or state securities laws when engaging in a transaction involving Sterling securities, and that the acquisition of Sterling securities shall be made for investment purposes, not with a view to short-term gains. It is also the policy of the Company that it will not engage in transactions in Sterling’s securities in violation of federal or state securities laws. Persons Subject To This Policy As an employee, consultant, contractor, officer or director of the Company, this Policy applies to you. Additionally, this Policy also applies to the Company. The same restrictions that apply to you also apply to members of your family who reside with you, anyone else who lives in your household, and any family members who do not live in your household, but whose transactions in Sterling’s securities are directed by you or are subject to your influence or control, such as parents or children who consult with you before they trade in Sterling’s securities (those persons are referred to as “related persons”). This Policy also applies to entities that you influence or control, including corporations, partnerships or trusts. Individual Responsibility Persons subject to this Policy have ethical and legal obligations to maintain the confidentiality of information about the Company and not to engage in transactions or illegal trading in Sterling securities while in possession of material nonpublic information. Persons subject to this Policy must avoid the appearance of improper trading. Each individual is responsible for making sure that he or she complies with this Policy, and that any of his or her related persons or any entities

he or she controls also comply with this Policy. In all cases, the responsibility for determining whether an individual is in possession of material nonpublic information rests with that individual, and any action on the part of the Company, or any officer, employee or director pursuant to this Policy (or otherwise), including pre-approval of a transaction, does not in any way constitute legal advice or insulate an individual from liability under applicable securities laws. You could be subject to severe legal penalties and disciplinary action by the Company for any conduct prohibited by this Policy or applicable securities laws, as described below in more detail under the heading “Policy Violations.” Transactions Covered Except as otherwise provided, this Policy applies to all transactions in Sterling’s securities, including common stock, options for common stock and any other securities Sterling may issue from time to time, including, but not limited to, preferred stock, warrants and convertible notes and debentures, as well as to derivative securities relating to Sterling’s stock, whether or not issued by Sterling, such as exchange-traded options. Transactions subject to this Policy include purchases, sales and gifts of Sterling’s securities. This Policy also applies to transactions that occur after you cease to be an employee, consultant, contractor, officer or director of the Company for as long as you are in possession of material nonpublic information. Statement Of Policy No person subject to this Policy who is aware of material nonpublic information may directly or indirectly: + Engage in transactions in Sterling’s securities, except as otherwise specified in this Policy (see “Transactions Excluded from this Policy” below); + Recommend that others engage in transactions in any of Sterling’s securities; + Disclose material nonpublic information to persons (a) within the Company whose jobs do not require them to have that information, or (b) outside of the Company, including family, friends, business associates, investors and consulting firms, unless any such disclosure is made in accordance with Sterling’s disclosure and external communications policies; or + Assist anyone engaged in the above activities.

It makes no difference whether or not you relied upon or used material nonpublic information in deciding to transact; if you are aware of material nonpublic information about Sterling, the prohibition applies. You should avoid even the appearance of an improper transaction to preserve Sterling’s and you own reputation and to avoid investigations of your and Sterling’s conduct. Transactions that may seem necessary or justifiable for independent reasons (such as the need to raise money for an emergency expenditure), or small transactions, are not exceptions to this Policy. The securities laws do not recognize any mitigating circumstances. It is also the policy of the Company that it will not engage in transactions in Sterling’s securities in violation of federal securities laws. What is Material Nonpublic Information? "Nonpublic" information is information about a company that is not known generally by the investing public. In order for information to be considered public, it must be widely disseminated in a manner making it generally available to investors, including through the issuance of a press release or a filing with the Securities and Exchange Commission (“SEC”). "Material" information is information that might influence an investor in making the decision whether to trade the securities of a company. Generally, any information that could reasonably be expected to affect the market price of a security is likely to be considered material. Examples: typical examples of material nonpublic information are the receipt by a company of a major contract; the loss of a major customer; an unexpected decrease or increase in profits or losses; plans for major corporate transactions, such as a merger, an acquisition or the like; establishing a new stock repurchase program or changes with respect to such a program; changes in management; developments in significant legal proceedings; a significant cyber security incident; and unexpected (before market release) quarterly or annual financial results. This list is not exhaustive or exclusive and many other types of information may be considered material, depending on the circumstances. The probability of whether an event will or will not occur, along with the magnitude of the potential event, affects the determination of whether it is material. If you have any questions concerning the materiality of particular information, please contact the Company’s General Counsel. “Tipper” and “Tippee Liability. A person can be liable for a violation of the law if he or she (as a “tipper”) passes on material nonpublic information (a “tip”) to another person (a “tippee”) who uses or passes on that information to trade securities. The same liability applies to the person who is a recipient (tippee) of material nonpublic information from another person and uses the information to engage in trading of securities. Securities of a Customer, Supplier, etc. Persons subject to this Policy can also be found to violate the law and this Policy if such person engages in transactions involving securities of a publicly- traded customer, supplier or other entity doing business with the Company based on material nonpublic information about that customer, supplier or other entity gained through employment

or affiliation with the Company. Such companies include current or prospective customers or suppliers of the Company, companies with which the Company may be negotiating a major transaction and companies that may be a party to potential corporate transactions, such as an acquisition, investment or sale. Purchasing for Investment. Since all persons subject to this Policy may have access to material nonpublic information, it is not appropriate for them to be trading on short-term price fluctuations in Sterling securities. Generally, purchases of Sterling securities should be for a minimum of six months. Transactions Excluded from this Policy Stock Option Exercises. The purchase of Sterling stock under a stock option (an option exercise) if the exercise price is paid in cash or through an award recipient's use of shares delivered or withheld from the exercise to cover the cost of the option exercise or the satisfaction of tax withholding obligations is not subject to this Policy. However, this Policy does apply to any sale of the underlying stock or to a cashless option exercise through a broker (which entails the sale of a portion of the underlying stock on the market to cover the costs of exercise or the resulting taxes), or any other market sale for the purpose of generating cash to pay the exercise price. Restricted Stock Unit Awards. This Policy does not apply to the vesting of restricted stock or restricted stock units, or the exercise of a tax withholding right pursuant to which an award recipient elects to have Sterling withhold shares of stock to satisfy tax withholding obligations upon the vesting of any restricted stock or restricted stock unit. However, this Policy does apply to any sale of common stock received as a result of the vesting, including to satisfy tax liabilities. Employee Stock Purchase Plan. This Policy does not apply to purchases of Sterling securities in the employee stock purchase plan resulting from your periodic contribution of money to the plan pursuant to the election you made at the time of your enrollment in the plan. This Policy also does not apply to purchases of Sterling securities resulting from lump sum contributions to the plan (if permitted), provided that you elected to participate by lump sum payment at the beginning of the applicable enrollment period. This Policy does apply, however, to your sales of Sterling securities purchased pursuant to the plan. Transactions with Sterling. Any other purchase of Sterling securities from Sterling or sale of Sterling securities to Sterling are not subject to this Policy.

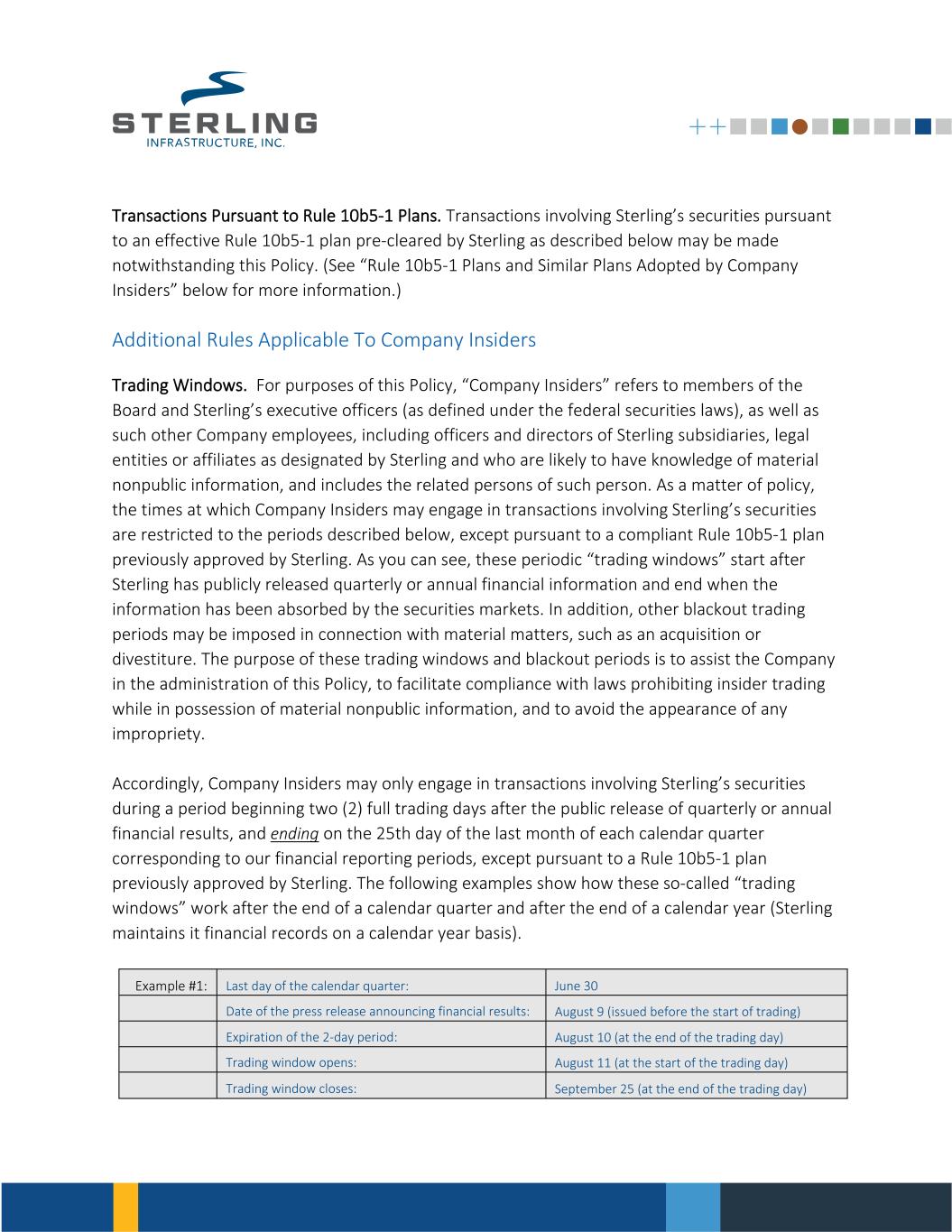

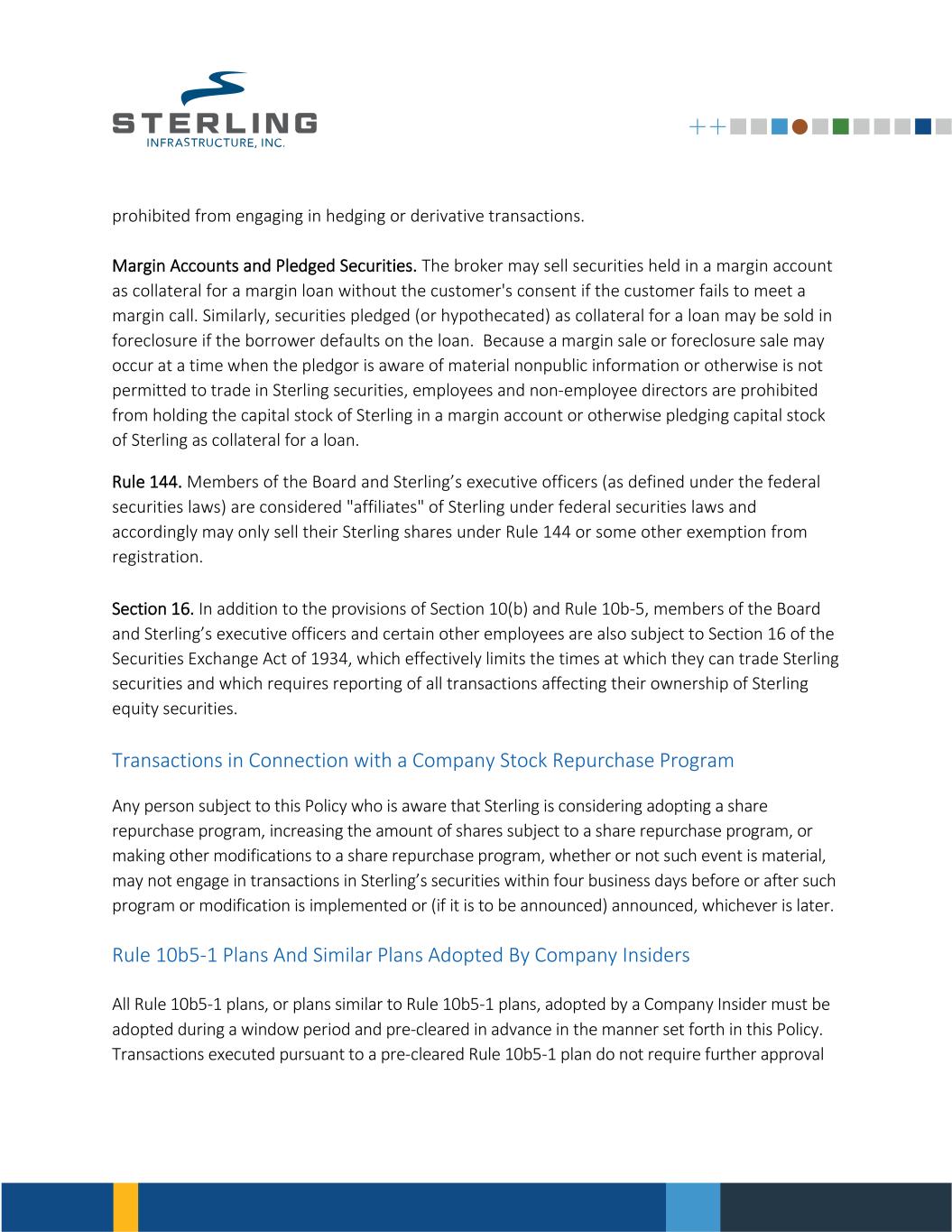

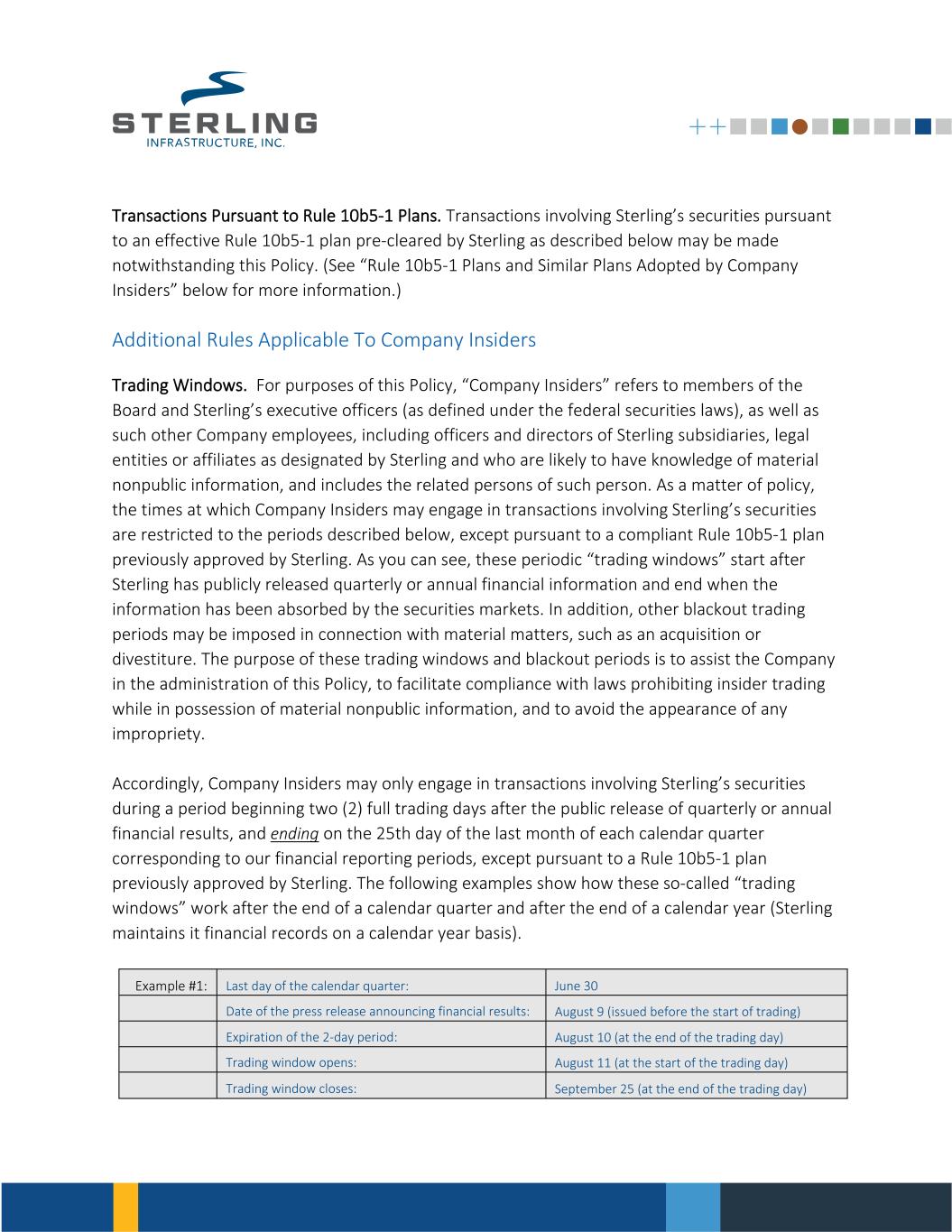

Transactions Pursuant to Rule 10b5-1 Plans. Transactions involving Sterling’s securities pursuant to an effective Rule 10b5-1 plan pre-cleared by Sterling as described below may be made notwithstanding this Policy. (See “Rule 10b5-1 Plans and Similar Plans Adopted by Company Insiders” below for more information.) Additional Rules Applicable To Company Insiders Trading Windows. For purposes of this Policy, “Company Insiders” refers to members of the Board and Sterling’s executive officers (as defined under the federal securities laws), as well as such other Company employees, including officers and directors of Sterling subsidiaries, legal entities or affiliates as designated by Sterling and who are likely to have knowledge of material nonpublic information, and includes the related persons of such person. As a matter of policy, the times at which Company Insiders may engage in transactions involving Sterling’s securities are restricted to the periods described below, except pursuant to a compliant Rule 10b5-1 plan previously approved by Sterling. As you can see, these periodic “trading windows” start after Sterling has publicly released quarterly or annual financial information and end when the information has been absorbed by the securities markets. In addition, other blackout trading periods may be imposed in connection with material matters, such as an acquisition or divestiture. The purpose of these trading windows and blackout periods is to assist the Company in the administration of this Policy, to facilitate compliance with laws prohibiting insider trading while in possession of material nonpublic information, and to avoid the appearance of any impropriety. Accordingly, Company Insiders may only engage in transactions involving Sterling’s securities during a period beginning two (2) full trading days after the public release of quarterly or annual financial results, and ending on the 25th day of the last month of each calendar quarter corresponding to our financial reporting periods, except pursuant to a Rule 10b5-1 plan previously approved by Sterling. The following examples show how these so-called “trading windows” work after the end of a calendar quarter and after the end of a calendar year (Sterling maintains it financial records on a calendar year basis). Example #1: Last day of the calendar quarter: June 30 Date of the press release announcing financial results: August 9 (issued before the start of trading) Expiration of the 2-day period: August 10 (at the end of the trading day) Trading window opens: August 11 (at the start of the trading day) Trading window closes: September 25 (at the end of the trading day)

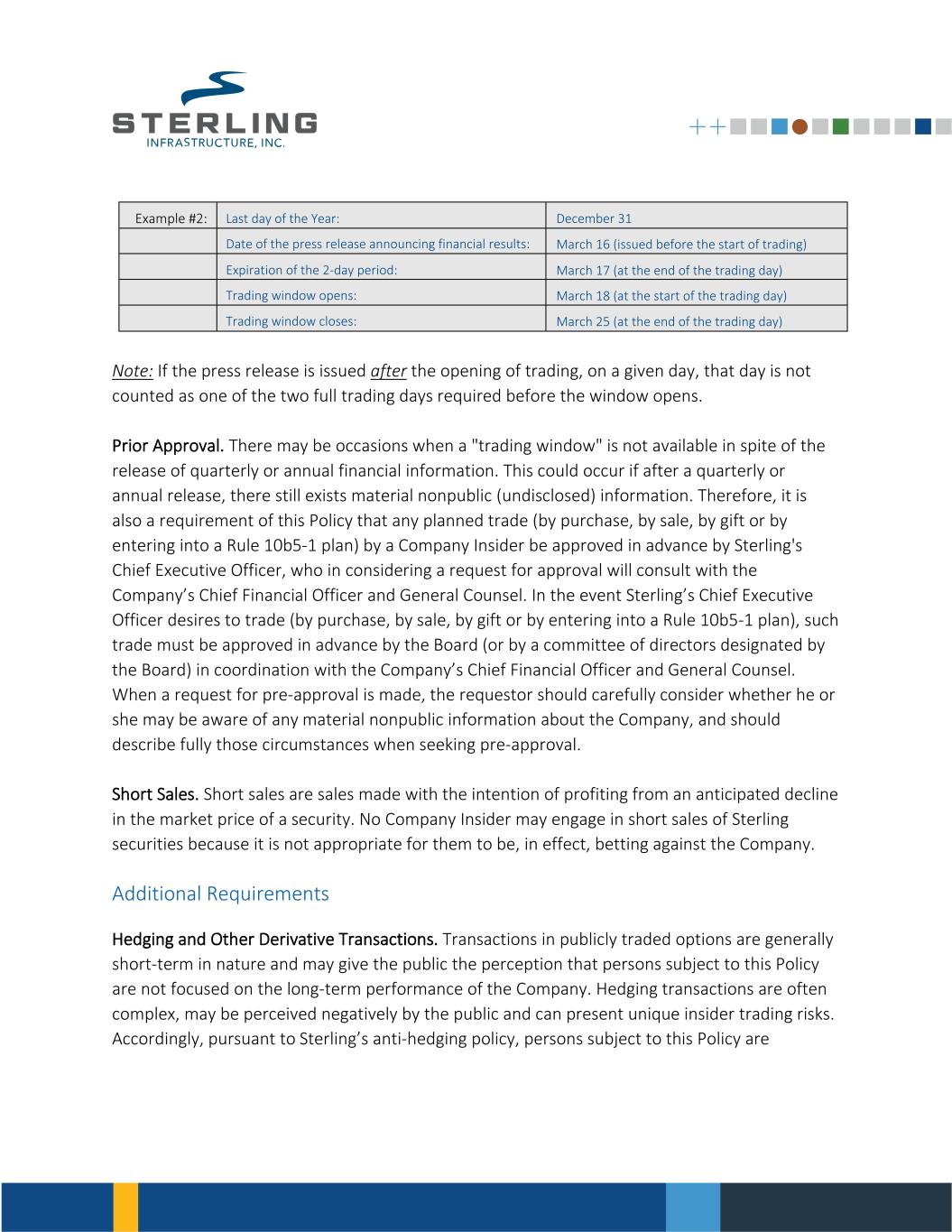

Example #2: Last day of the Year: December 31 Date of the press release announcing financial results: March 16 (issued before the start of trading) Expiration of the 2-day period: March 17 (at the end of the trading day) Trading window opens: March 18 (at the start of the trading day) Trading window closes: March 25 (at the end of the trading day) Note: If the press release is issued after the opening of trading, on a given day, that day is not counted as one of the two full trading days required before the window opens. Prior Approval. There may be occasions when a "trading window" is not available in spite of the release of quarterly or annual financial information. This could occur if after a quarterly or annual release, there still exists material nonpublic (undisclosed) information. Therefore, it is also a requirement of this Policy that any planned trade (by purchase, by sale, by gift or by entering into a Rule 10b5-1 plan) by a Company Insider be approved in advance by Sterling's Chief Executive Officer, who in considering a request for approval will consult with the Company’s Chief Financial Officer and General Counsel. In the event Sterling’s Chief Executive Officer desires to trade (by purchase, by sale, by gift or by entering into a Rule 10b5-1 plan), such trade must be approved in advance by the Board (or by a committee of directors designated by the Board) in coordination with the Company’s Chief Financial Officer and General Counsel. When a request for pre-approval is made, the requestor should carefully consider whether he or she may be aware of any material nonpublic information about the Company, and should describe fully those circumstances when seeking pre-approval. Short Sales. Short sales are sales made with the intention of profiting from an anticipated decline in the market price of a security. No Company Insider may engage in short sales of Sterling securities because it is not appropriate for them to be, in effect, betting against the Company. Additional Requirements Hedging and Other Derivative Transactions. Transactions in publicly traded options are generally short-term in nature and may give the public the perception that persons subject to this Policy are not focused on the long-term performance of the Company. Hedging transactions are often complex, may be perceived negatively by the public and can present unique insider trading risks. Accordingly, pursuant to Sterling’s anti-hedging policy, persons subject to this Policy are

prohibited from engaging in hedging or derivative transactions. Margin Accounts and Pledged Securities. The broker may sell securities held in a margin account as collateral for a margin loan without the customer's consent if the customer fails to meet a margin call. Similarly, securities pledged (or hypothecated) as collateral for a loan may be sold in foreclosure if the borrower defaults on the loan. Because a margin sale or foreclosure sale may occur at a time when the pledgor is aware of material nonpublic information or otherwise is not permitted to trade in Sterling securities, employees and non-employee directors are prohibited from holding the capital stock of Sterling in a margin account or otherwise pledging capital stock of Sterling as collateral for a loan. Rule 144. Members of the Board and Sterling’s executive officers (as defined under the federal securities laws) are considered "affiliates" of Sterling under federal securities laws and accordingly may only sell their Sterling shares under Rule 144 or some other exemption from registration. Section 16. In addition to the provisions of Section 10(b) and Rule 10b-5, members of the Board and Sterling’s executive officers and certain other employees are also subject to Section 16 of the Securities Exchange Act of 1934, which effectively limits the times at which they can trade Sterling securities and which requires reporting of all transactions affecting their ownership of Sterling equity securities. Transactions in Connection with a Company Stock Repurchase Program Any person subject to this Policy who is aware that Sterling is considering adopting a share repurchase program, increasing the amount of shares subject to a share repurchase program, or making other modifications to a share repurchase program, whether or not such event is material, may not engage in transactions in Sterling’s securities within four business days before or after such program or modification is implemented or (if it is to be announced) announced, whichever is later. Rule 10b5-1 Plans And Similar Plans Adopted By Company Insiders All Rule 10b5-1 plans, or plans similar to Rule 10b5-1 plans, adopted by a Company Insider must be adopted during a window period and pre-cleared in advance in the manner set forth in this Policy. Transactions executed pursuant to a pre-cleared Rule 10b5-1 plan do not require further approval

and are not subject to the Company’s window period or black-out period, as Rule 10b5-1 provides an affirmative defense from insider trading liability under the federal securities laws for transactions made pursuant to the plan and in accordance with Rule 10b5-1. Any modification to a Rule 10b5-1 plan or similar plan of a Company Insider must also be cleared in advance in the manner set forth in this Policy. Any termination of such a plan must be reported promptly to the Company’s General Counsel. The Company is required to disclose in its quarterly and annual reports on Forms 10-Q and 10-K, respectively, filed with the SEC whether during its last fiscal quarter any director or officer subject to Section 16 adopted (which includes certain modifications) or terminated a Rule 10b5-1 plan or similar plan, and is also required to disclose specified information about the plan. Therefore, it is important that you promptly report to the Company’s General Counsel such adoptions, modifications and terminations as noted above. For additional information, please contact the Company’s General Counsel. Policy Violations Trading securities while aware of material nonpublic information, or the disclosure of material nonpublic information to others who then trade in the Company’s securities, is prohibited by the federal and state laws. Insider trading violations are pursued vigorously by the SEC, U.S. Attorneys and state enforcement authorities as well as the laws of foreign jurisdictions. Punishment for insider trading violations is severe, and could include significant fines and imprisonment. While the regulatory authorities concentrate their efforts on the individuals who trade, or who tip material nonpublic information to others who trade, the federal securities laws also impose potential liability on companies and other “controlling persons” if they fail to take reasonable steps to prevent insider trading by company personnel. In addition, an individual’s failure to comply with this Policy may subject the individual to Company-imposed sanctions, including dismissal for cause, whether or not the person’s failure to comply results in a violation of law. Needless to say, a violation of law, or even an SEC investigation that does not result in prosecution, can tarnish a person’s reputation and irreparably damage a career. IF YOU HAVE ANY QUESTIONS AS TO WHETHER A TRADE IN STERLING SECURITIES MAY BE A VIOLATION OF THIS POLICY OR OF FEDERAL SECURITIES LAWS, YOU SHOULD ASK STERLING'S CHIEF EXECUTIVE OFFICER OR IN HIS ABSENCE, ITS GENERAL COUNSEL.