0000874766us-gaap:GroupPoliciesMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2012Memberhig:LongtermDisabilityMember2014-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

For the fiscal year ended December 31, 2020

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

For the transition period from to

Commission file number 001-13958

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3317783 | |||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

One Hartford Plaza, Hartford, Connecticut 06155

(Address of principal executive offices) (Zip Code)

(860) 547-5000

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12 (b) OF THE ACT:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, par value $0.01 per share | HIG | The New York Stock Exchange | ||||||

| 6.10% Notes due October 1, 2041 | HIG 41 | The New York Stock Exchange | ||||||

| 7.875% Fixed-to-Floating Rate Junior Subordinated Debentures due 2042 | HGH | The New York Stock Exchange | ||||||

| Depositary Shares, Each Representing a 1/1,000th Interest in a Share of 6.000% Non-Cumulative Preferred Stock, Series G, par value $0.01 per share | HIG PR G | The New York Stock Exchange | ||||||

SECURITIES REGISTERED PURSUANT TO SECTION 12 (g) OF THE ACT:

None

| Indicate by check mark: | |||||||||||||||||

| • | if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes | ☑ | No | |||||||||||||

| • | if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. | Yes | No | ☑ | |||||||||||||

| • | whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes | ☑ | No | |||||||||||||

| • | whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | Yes | ☑ | No | |||||||||||||

| • | whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | ||||||||||||||||

| Large accelerated filer | ☑ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

| • whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | ☑ | ||||||||||

The aggregate market value of the shares of Common Stock held by non-affiliates of the registrant as of June 30, 2020 was approximately $14 billion, based on the closing price of $38.55 per share of the Common Stock on the New York Stock Exchange on June 30, 2020.

As of February 18, 2021, there were outstanding 357,514,315 shares of Common Stock, $0.01 par value per share, of the registrant.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement for its 2021 annual meeting of stockholders are incorporated by reference in Part III of this Form 10-K.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020

TABLE OF CONTENTS

| Item | Description | Page | ||||||

| 1 | ||||||||

| 1A. | ||||||||

| 1B. | UNRESOLVED STAFF COMMENTS | None | ||||||

| 2 | ||||||||

| 3 | ||||||||

| 4 | MINE SAFETY DISCLOSURES | Not Applicable | ||||||

| 5 | ||||||||

| 6 | SELECTED FINANCIAL DATA | [a] | ||||||

| 7 | ||||||||

| 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | [b] | ||||||

| 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | [c] | ||||||

| 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | None | ||||||

| 9A. | ||||||||

| 9B. | OTHER INFORMATION | None | ||||||

| 10 | ||||||||

| 11 | EXECUTIVE COMPENSATION | [d] | ||||||

| 12 | ||||||||

| 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | [e] | ||||||

| 14 | PRINCIPAL ACCOUNTING FEES AND SERVICES | [f] | ||||||

| 15 | ||||||||

| 16 | FORM 10-K SUMMARY | Not Applicable | ||||||

[a] The information formerly required by Item 301 regarding material trend disclosure will be set forth in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations and is incorporated herein by reference.

[b] The information required by this item is set forth in the Enterprise Risk Management section of Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations and is incorporated herein by reference.

[c] See Index to Consolidated Financial Statements and Schedules elsewhere herein.

[d] The information called for by Item 11 will be set forth in the Proxy Statement under the subcaptions "Compensation Discussion and Analysis", "Executive Compensation", "Director Compensation", "Report of the Compensation and Management Development Committee", and "Compensation and Management Development Committee Interlocks and Insider Participation" and is incorporated herein by reference.

[e] Any information called for by Item 13 will be set forth in the Proxy Statement under the caption and subcaption "Board and Governance Matters" and "Director Independence" and is incorporated herein by reference.

[f] The information called for by Item 14 will be set forth in the Proxy Statement under the caption "Audit Matters" and is incorporated herein by reference.

3

Forward-looking Statements

Certain of the statements contained herein are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “projects,” and similar references to future periods.

Forward-looking statements are based on management's current expectations and assumptions regarding future economic, competitive, legislative and other developments and their potential effect upon The Hartford Financial Services Group, Inc. and its subsidiaries (collectively, the "Company" or "The Hartford"). Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual results could differ materially from expectations, depending on the evolution of various factors, including the risks and uncertainties identified below, as well as factors described in such forward-looking statements; or in Part I, Item 1A, Risk Factors, in Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, and those identified from time to time in our other filings with the Securities and Exchange Commission.

•Risks relating to the pandemic caused by the spread of the novel strain of coronavirus, specifically identified as the Coronavirus Disease 2019 (“COVID-19”) including impacts to the Company's insurance and product-related, regulatory/legal, recessionary and other global economic, capital and liquidity and operational risks

•Risks Relating to Economic, Political and Global Market Conditions:

◦challenges related to the Company’s current operating environment, including global political, economic and market conditions, and the effect of financial market disruptions, economic downturns, changes in trade regulation including tariffs and other barriers or other potentially adverse macroeconomic developments on the demand for our products and returns in our investment portfolios;

◦market risks associated with our business, including changes in credit spreads, equity prices, interest rates, inflation rate, foreign currency exchange rates and market volatility;

◦the impact on our investment portfolio if our investment portfolio is concentrated in any particular segment of the economy;

◦the impacts of changing climate and weather patterns on our businesses, operations and investment portfolio including on claims, demand and pricing of our products, the availability and cost of reinsurance, our modeling data used to evaluate and manage risks of catastrophes and severe weather events, the value of our investment portfolios and credit risk with reinsurers and other counterparties;

◦the risks associated with the discontinuance of the London Inter-Bank Offered Rate ("LIBOR") on the securities we hold or may have issued, other financial instruments and any other assets and liabilities whose value is tied to LIBOR;

◦the impacts associated with the withdrawal of the United Kingdom (“U.K.”) from the European Union (“E.U.”) on our international operations in the U.K. and E.U.

•Insurance Industry and Product-Related Risks:

◦the possibility of unfavorable loss development, including with respect to long-tailed exposures;

◦the significant uncertainties that limit our ability to estimate the ultimate reserves necessary for asbestos and environmental claims;

◦the possibility of another pandemic, civil unrest, earthquake, or other natural or man-made disaster that may adversely affect our businesses;

◦weather and other natural physical events, including the intensity and frequency of storms, hail, wildfires, flooding, winter storms, hurricanes and tropical storms, as well as climate change and its potential impact on weather patterns;

◦the possible occurrence of terrorist attacks and the Company’s inability to contain its exposure as a result of, among other factors, the inability to exclude coverage for terrorist attacks from workers' compensation policies and limitations on reinsurance coverage from the federal government under applicable laws;

◦the Company’s ability to effectively price its property and casualty policies, including its ability to obtain regulatory consents to pricing actions or to non-renewal or withdrawal of certain product lines;

◦actions by competitors that may be larger or have greater financial resources than we do;

◦technological changes, including usage-based methods of determining premiums, advancements in automotive safety features, the development of autonomous vehicles, and platforms that facilitate ride sharing,

◦the Company's ability to market, distribute and provide insurance products and investment advisory services through current and future distribution channels and advisory firms;

◦the uncertain effects of emerging claim and coverage issues;

•Financial Strength, Credit and Counterparty Risks:

4

◦risks to our business, financial position, prospects and results associated with negative rating actions or downgrades in the Company’s financial strength and credit ratings or negative rating actions or downgrades relating to our investments;

◦capital requirements which are subject to many factors, including many that are outside the Company’s control, such as National Association of Insurance Commissioners ("NAIC") risk based capital formulas, rating agency capital models, Funds at Lloyd's and Solvency Capital Requirement, which can in turn affect our credit and financial strength ratings, cost of capital, regulatory compliance and other aspects of our business and results;

◦losses due to nonperformance or defaults by others, including credit risk with counterparties associated with investments, derivatives, premiums receivable, reinsurance recoverables and indemnifications provided by third parties in connection with previous dispositions;

◦the potential for losses due to our reinsurers' unwillingness or inability to meet their obligations under reinsurance contracts and the availability, pricing and adequacy of reinsurance to protect the Company against losses;

◦state and international regulatory limitations on the ability of the Company and certain of its subsidiaries to declare and pay dividends;

•Risks Relating to Estimates, Assumptions and Valuations:

◦risk associated with the use of analytical models in making decisions in key areas such as underwriting, pricing, capital management, reserving, investments, reinsurance and catastrophe risk management;

◦the potential for differing interpretations of the methodologies, estimations and assumptions that underlie the Company’s fair value estimates for its investments and the evaluation of intent-to-sell impairments and allowance for credit losses on available-for-sale securities and mortgage loans;

◦the potential for further impairments of our goodwill;

•Strategic and Operational Risks:

◦the Company’s ability to maintain the availability of its systems and safeguard the security of its data in the event of a disaster, cyber or other information security incident or other unanticipated event;

◦the potential for difficulties arising from outsourcing and similar third-party relationships;

◦the risks, challenges and uncertainties associated with capital management plans, expense reduction initiatives and other actions, which may include acquisitions, divestitures or restructurings;

◦risks associated with acquisitions and divestitures, including the challenges of integrating acquired companies or businesses, which may result in our inability to achieve the anticipated benefits and synergies and may result in unintended consequences;

◦difficulty in attracting and retaining talented and qualified personnel, including key employees, such as executives, managers and employees with strong technological, analytical and other specialized skills;

◦the Company’s ability to protect its intellectual property and defend against claims of infringement;

•Regulatory and Legal Risks:

◦the cost and other potential effects of increased federal, state and international regulatory and legislative developments, including those that could adversely impact the demand for the Company’s products, operating costs and required capital levels;

◦unfavorable judicial or legislative developments;

◦the impact of changes in federal, state or foreign tax laws;

◦regulatory requirements that could delay, deter or prevent a takeover attempt that stockholders might consider in their best interests; and

◦the impact of potential changes in accounting principles and related financial reporting requirements.

Any forward-looking statement made by the Company in this document speaks only as of the date of the filing of this Form 10-K. Factors or events that could cause the Company’s actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise.

5

Item 1. BUSINESS

(Dollar amounts in millions, except for per share data, unless otherwise stated)

GENERAL

The Hartford Financial Services Group, Inc. (together with its subsidiaries, “The Hartford”, the “Company”, “we”, or “our”) is a holding company for a group of subsidiaries that provide property and casualty ("P&C") insurance, group benefits insurance and services, and mutual funds and exchange-traded products to individual and business customers in the United States as well as in the United Kingdom, continental Europe and other international locations. The Hartford is headquartered in Connecticut and its oldest subsidiary, Hartford Fire Insurance Company, dates back to 1810. At December 31, 2020, total assets and total stockholders’ equity of The Hartford were $74.1 billion and $18.6 billion, respectively.

ORGANIZATION

The Hartford strives to maintain and enhance its position as a market leader within the financial services industry. The Company sells diverse and innovative products through multiple distribution channels to individuals and businesses and is considered a leading property and casualty and employee group benefits insurer. The Hartford Stag logo is one of the most recognized symbols in the financial services industry.

As a holding company, The Hartford Financial Services Group, Inc. is separate and distinct from its subsidiaries and has no significant business operations of its own. The holding company relies on the dividends from its insurance companies and other subsidiaries as the principal source of cash flow to meet its obligations, pay dividends and repurchase common stock. Information regarding the cash flow and liquidity needs of The Hartford Financial Services Group, Inc. may be found in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) — Capital Resources and Liquidity.

STRATEGIC PRIORITIES

The Hartford’s strategy focuses on realizing the full potential of our product capabilities and underwriting expertise, becoming an easier company to do business with, and attracting, retaining and developing the talent needed for long-term success. The Company endeavors to expand its insurance product offerings and distribution and capitalize on the strength of the Company's brand. The Company is also working to increase efficiencies through investments in technology.

In 2020, we were focused on increasing shareholder value through a number of initiatives and investments:

•Integrating the acquisition of The Navigators Group, Inc. (“Navigators Group”) successfully, and maximizing our combined potential by deepening our distribution relationships, capitalizing on a broader product portfolio and meeting a wider array of customer needs.

•Increasing the speed and ease of our interactions and business processes through data, digital technology and voice of customer, including expanded use of robotics and continued enhancements to underwriting and quoting platforms.

•Continuing investment in new products and business models such as Spectrum, our next-generation package offering for small businesses, which offers customers tailored coverage recommendations as well as the ability to customize their own coverage, including real-time quote pricing. We are

investing to maintain market leadership in small commercial as existing competitors and new entrants increase their focus on this business. Through a planned roll out of new automobile and homeowners insurance products for AARP members, we are investing in our Personal Lines segment to return that business to top line growth.

•Improving the employee experience by investing in our workforce and striving to attract, retain and develop the best talent in the industry, enhance our industry-leading position in diversity and inclusion, and sustain our ethical culture. We see the benefits of this commitment in our sustained top-decile employee engagement scores.

•Becoming more cost efficient and competitive along with enhancing the experience we provide to agents and customers through an operational transformation and cost reduction plan we commenced in July 2020 called Hartford Next. Relative to 2019, we expect to achieve a reduction in

6

annual insurance operating costs and other expenses of approximately $500 by 2022, reducing the P&C expense ratio by 2.0 to 2.5 points, the Group Benefits expense ratio by 1.5 to 2.0 points and the claims expense ratio by approximately 0.5 points.

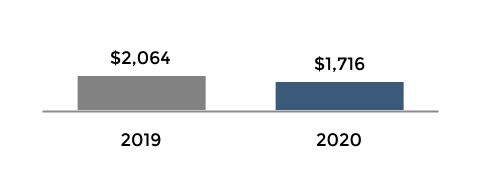

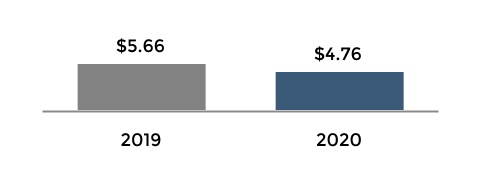

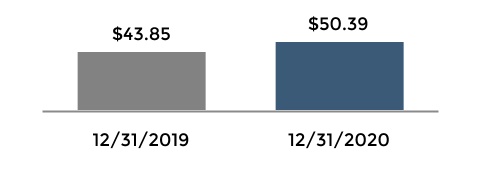

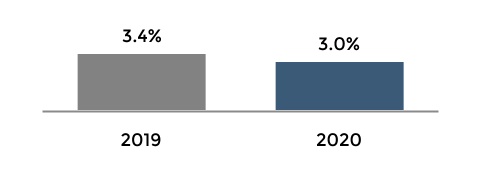

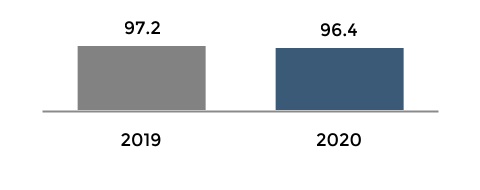

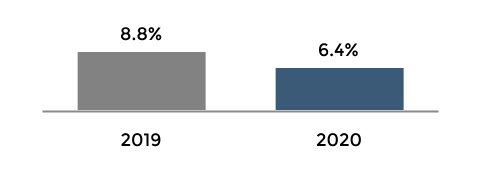

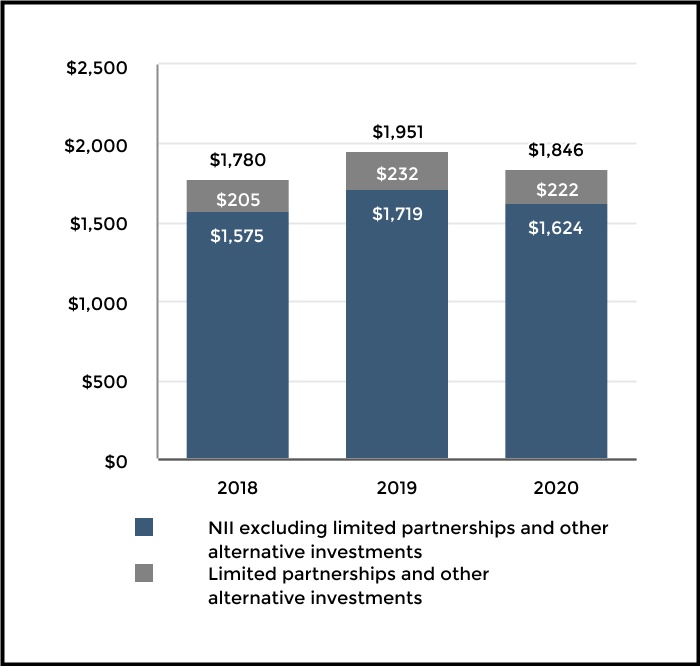

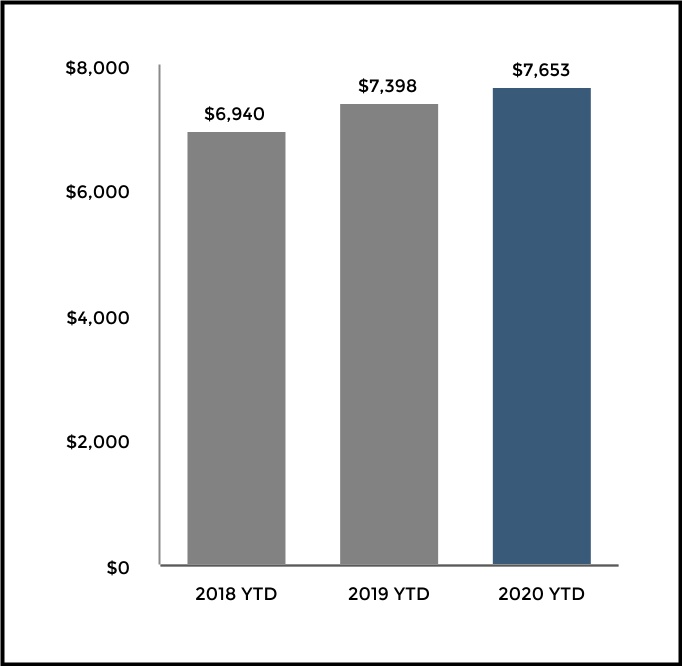

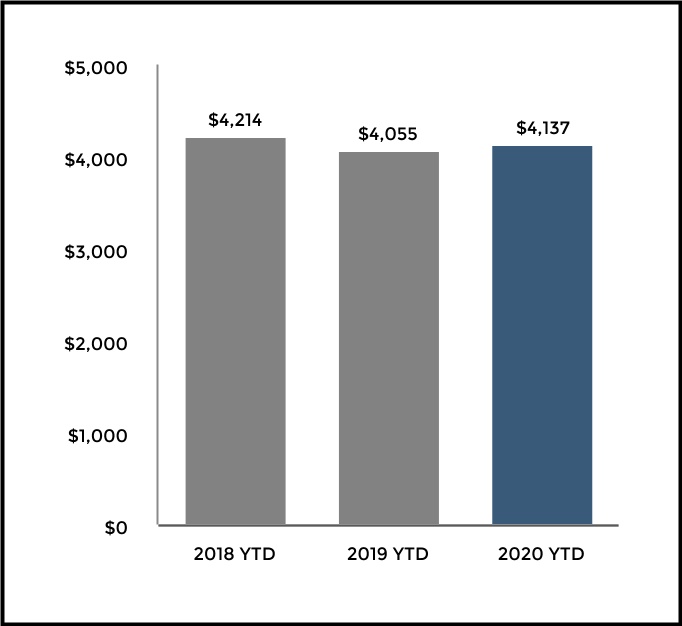

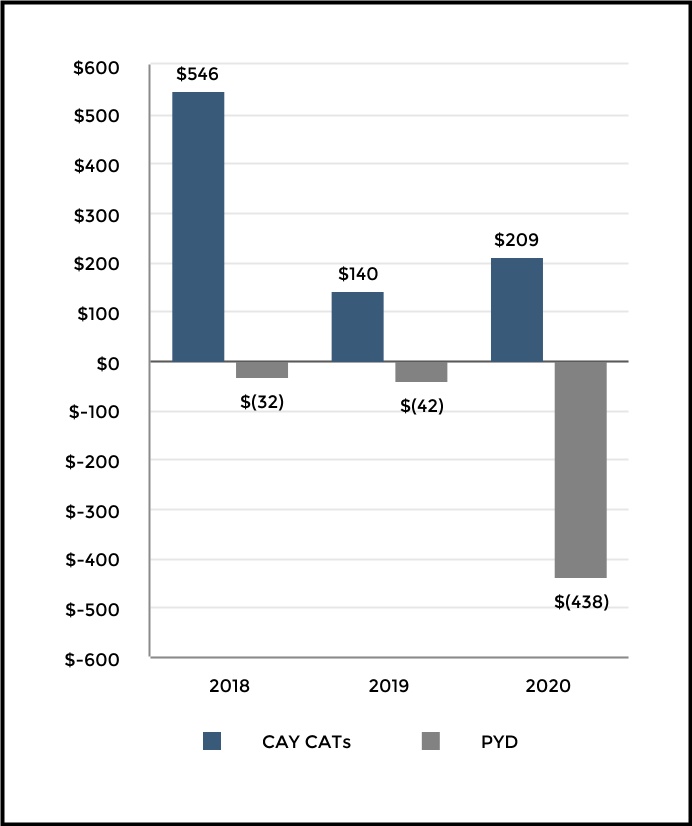

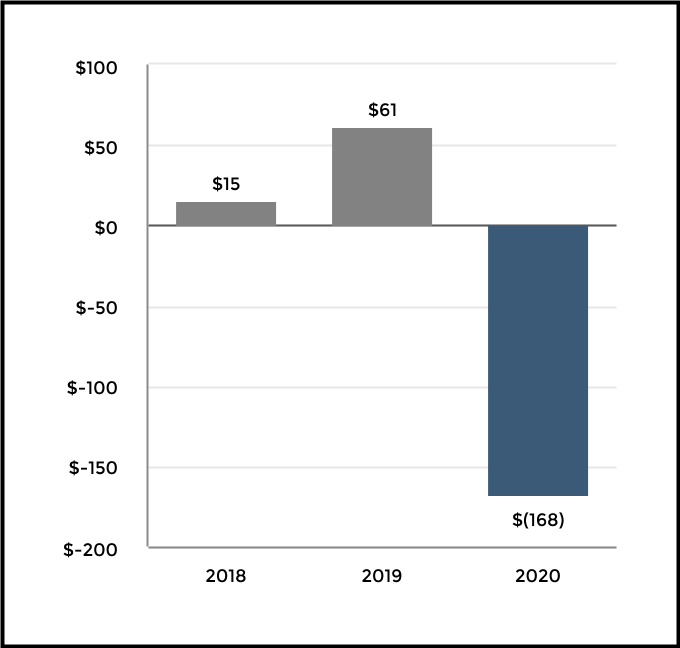

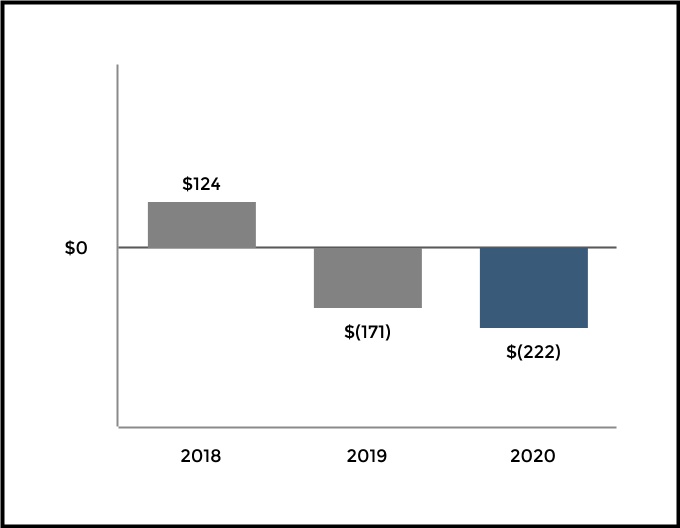

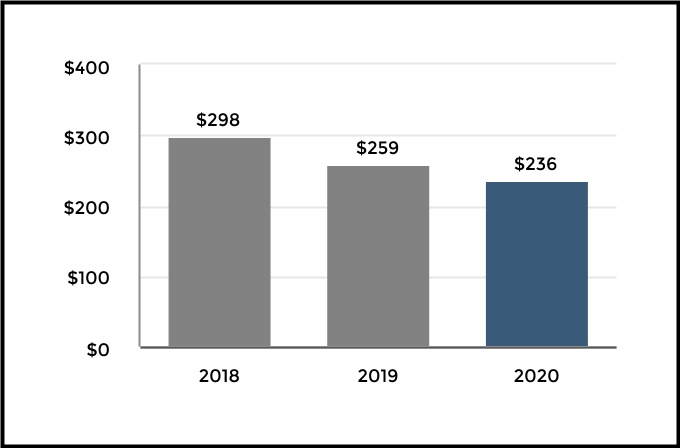

2020 Financial Results

Our 2020 financial results were affected by COVID-19 claims and the economic effects of the pandemic that reduced insured exposures in both P&C and Group Benefits, including $278 of direct COVID-19 claims in P&C and $230 of COVID impacts in Group Benefits, principally driven by $239 of excess mortality in the group life business. Apart from these impacts, financial results benefited from favorable non-COVID automobile claim frequency in Personal Lines, a reduction in prior accident year catastrophe reserves, and lower operating expenses. Full year 2020 net income available to common stockholders was $1.7 billion, or $4.76 per diluted share, and net income return on equity ("ROE") was 10%. Book value per diluted share rose 15%, to $50.39, primarily due to net income in excess of common stockholder dividends during 2020 and an increase in common stockholders' equity resulting from the impact of lower interest rates on net unrealized investment gains within AOCI. Total revenues were $20.5 billion, down 1% since 2019 as growth in Commercial Lines, primarily driven by a full year’s earned premium from the Navigators Group acquisition, was more than offset by a change from net realized capital gains in 2019 to net realized capital losses in 2020 as well as the effects of the pandemic, decreasing net investment income and decreasing new business and insured exposures across segments.

We are more than half way through the integration of the Navigators Group business and have significantly improved the profitability of the acquired book of business, through pricing increases and underwriting actions. The cross-sale of business between global specialty and middle & large commercial has been in-line with or better than the expectations we had at the time we acquired Navigators Group. In addition, with the pending sale of the continental Europe operations, the go-forward focus of our international business is principally in the Lloyd's of London ("Lloyd's") market and we expect to continue to improve performance of our Lloyd’s syndicate through pricing and other actions.

Our Group Benefits business has continued to benefit from favorable incidence trends in group disability and, as we emerge from the pandemic, remains well-poised to compete moving forward with a complete set of voluntary product offerings.

We will also continue to address business challenges, including the need to return our Personal Lines segment to top line growth and the continued rate pressure on workers’ compensation in response to continued favorable loss cost trends. In addition, the decline in reinvestment rates will continue to put pressure on investment yields and it remains to be seen whether the market will compensate with higher rate increases to increase underwriting profitability or will accept lower overall returns on equity.

2021 Priorities

As we enter 2021, our strategy remains consistent and we are focused on the following priorities:

•Commercial Lines

–Benefiting from a firm pricing environment in most property and liability lines while navigating continued pricing pressure in workers’ compensation by staying disciplined in our underwriting;

–Leveraging advanced analytics and technologies as well as our product breadth, including expanding cross-sale of global specialty products within small commercial and middle & large commercial;

–Continuing our journey to be a top-tier risk player in middle market;

–Navigating the impacts of broker consolidation and other trends in distribution; and

–Maintaining strong retention and improving new business in small commercial.

•Personal Lines

–Continuing to transform our products and regain competitive momentum through the rollout of our new automobile and homeowners products expected to begin in the first half of 2021; and

–Continuing to drive new business growth in AARP Direct through direct marketing initiatives designed to increase conversion rates.

•Group Benefits

– Continuing to grow revenues through strong sales and persistency which we expect will offset reduced premiums from lower employment due to the effects of COVID-19; and

–Completing implementation of our disability and leave management claims platform, The Hartford Ability Advantage, to enhance the overall customer experience and accommodate the Company’s leave management programs, including new state paid family and medical leave requirements.

•Capital Management

– Continuing to increase book value per share from net income in excess of shareholder dividends with strong profitability from all business lines;

–Returning capital to shareholders through share repurchases and dividends if not deployed for growth or investment opportunities. See Part II, Item 7, MD&A — Capital Resources and Liquidity section for discussion of share repurchase authorization for 2021 and 2022 announced in December 2020; and

–Continuing to ensure adequate capital to withstand adverse economic conditions, including the economic stress related to the COVID-19 pandemic.

Finally, beyond the achievement of business performance goals, The Hartford has long understood that making a sustainable and positive impact on society is an essential element of our ongoing success. Through financial contributions, volunteering and support for our company’s environmental initiatives, we are committed to demonstrating our character to customers and

7

neighbors. We have proactive positions on social, environmental and governance issues important to our sustainability, and our capacity to deliver long-term shareholder value. For more information on the Company’s sustainability initiatives, refer to our 2019 Sustainability Highlight Report available on the investor relations section of the Company’s website at https://ir.thehartford.com. For more information on retaining and attracting talent through our diversity and inclusion initiatives, refer to the Human Capital Resources section of Part 1, Item 1.

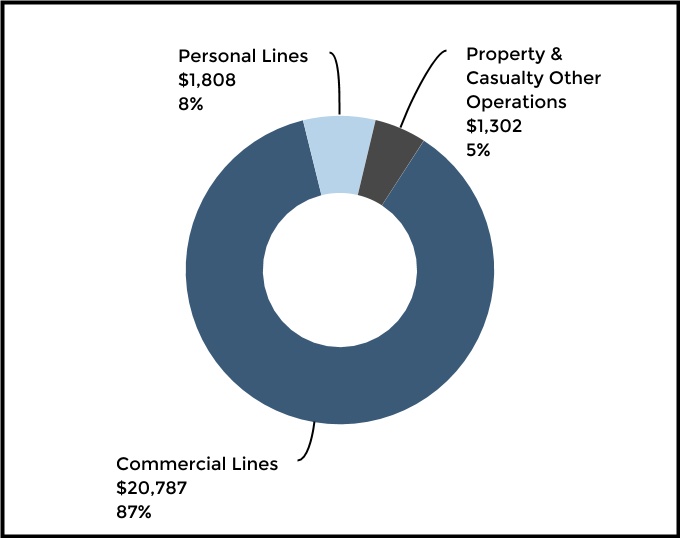

REPORTING SEGMENTS

The Hartford conducts business principally in five reporting segments including Commercial Lines, Personal Lines, Property & Casualty Other Operations, Group Benefits and Hartford Funds, as well as a Corporate category. The Company includes in the Corporate category discontinued operations related to the life and annuity business sold in May 2018, reserves for run-off structured settlement and terminal funding agreement liabilities, restructuring costs, capital raising activities (including equity financing, debt financing and related interest expense), transaction expenses incurred in connection with an acquisition, purchase accounting adjustments related to goodwill and other expenses not allocated to the reporting segments. Corporate also includes investment management fees and expenses related to managing third party business, including management of the invested assets of Talcott Resolution Life, Inc. and its subsidiaries ("Talcott Resolution"). Talcott Resolution is the holding company of the life and annuity business that we sold in May 2018. In addition, Corporate includes a 9.7% ownership interest in the legal entity that acquired the life and annuity business sold.

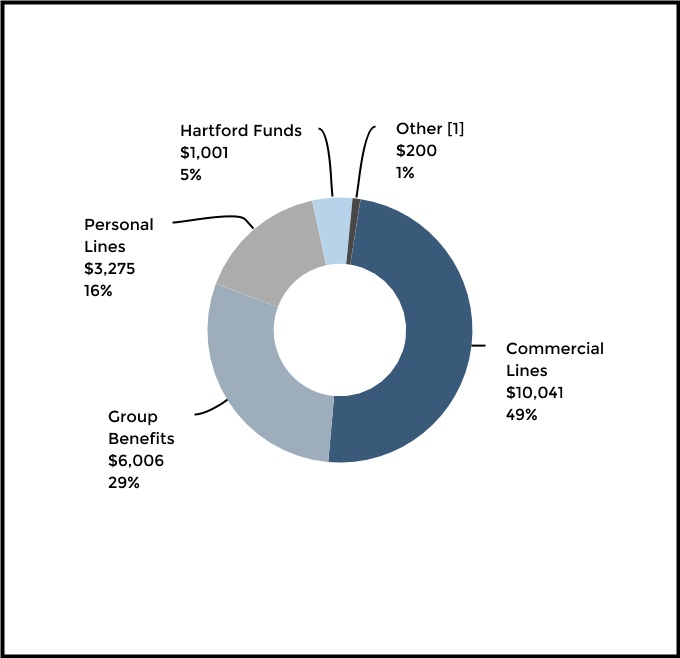

2020 Revenues of $20,523 by Segment

[1]Includes Revenue of $54 for Property & Casualty Other Operations and $146 for Corporate.

The following discussion describes the principal products and services, marketing and distribution, and competition of The Hartford's reporting segments. For further discussion of the reporting segments, including financial disclosures of revenues by product line, net income (loss), and assets for each reporting segment, see Note 4 - Segment Information of Notes to Consolidated Financial Statements.

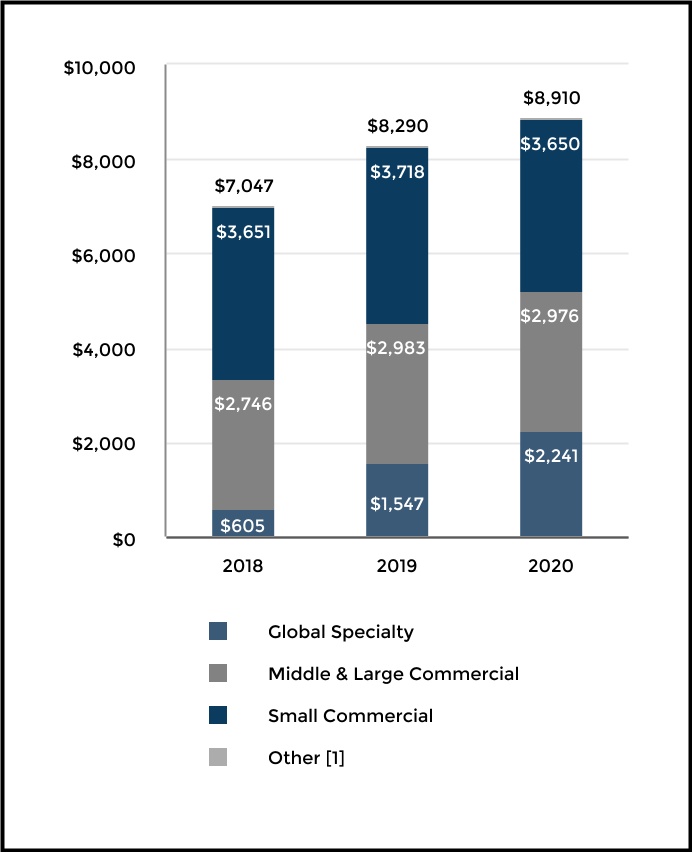

| COMMERCIAL LINES | ||

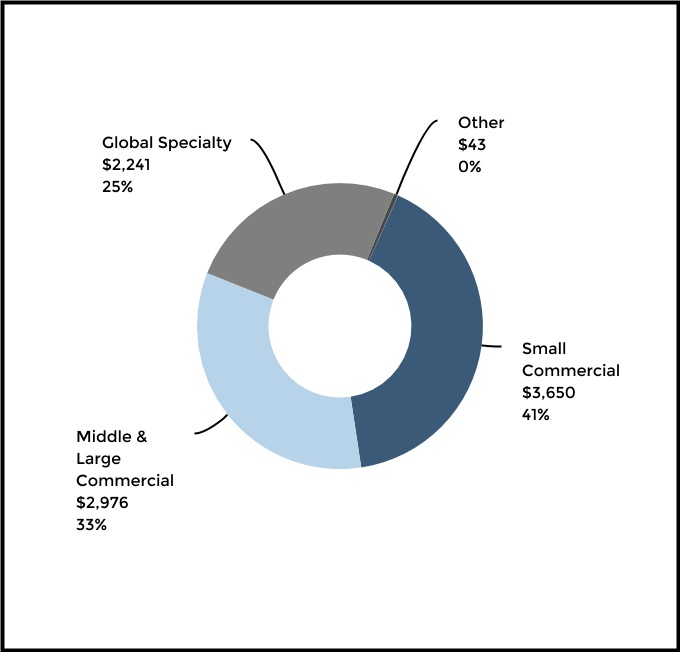

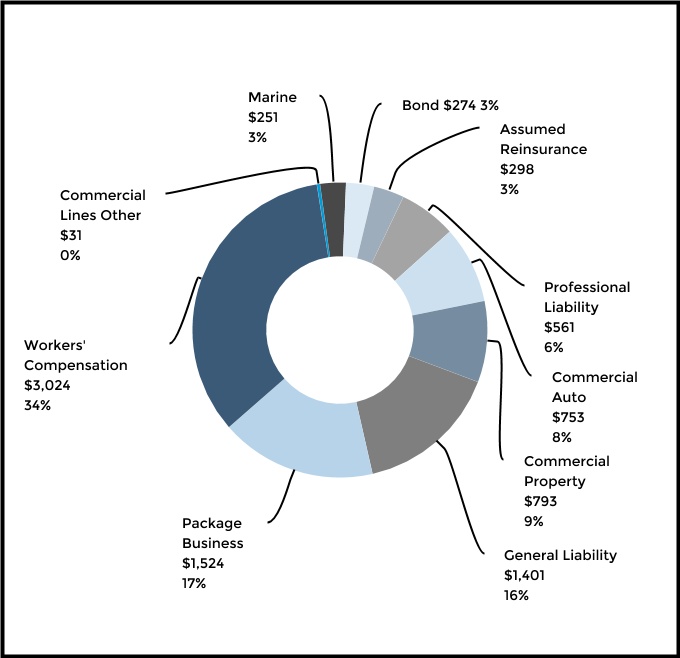

2020 Earned Premiums of $8,910 by Line of Business

2020 Earned Premiums of $8,910 by Product

8

Principal Products and Services

| Automobile | Covers damage to a business's fleet of vehicles due to collision or other perils (automobile physical damage). In addition to first party automobile physical damage, commercial automobile covers liability for bodily injuries and property damage suffered by third parties and losses caused by uninsured or under-insured motorists. | ||||

| Property | Covers the building a business owns or leases as well as its personal property, including tools and equipment, inventory, and furniture. A commercial property insurance policy covers losses resulting from fire, wind, hail, earthquake, theft and other covered perils, including coverage for assets such as accounts receivable and valuable papers and records. Commercial property may include specialized equipment insurance, which provides coverage for loss or damage resulting from the mechanical breakdown of boilers and machinery. | ||||

| General Liability | Covers a business in the event it is sued for causing harm to a person and/or damage to property. General liability insurance covers third-party claims arising from accidents occurring on the insured’s premises or arising out of their operations. General liability insurance may also cover losses arising from product liability and provides replacement of lost income due to an event that interrupts business operations. | ||||

| Marine | Encompasses various ocean and inland marine coverages including cargo, craft, hull, specie, transport and liability, among others. | ||||

| Package Business | Covers both property and general liability damages. | ||||

| Workers' Compensation | Covers employers for losses incurred due to employees sustaining an injury, illness or disability in connection with their work. Benefits paid under workers’ compensation policies may include reimbursement of medical care costs, replacement income, compensation for permanent injuries and benefits to survivors. Workers’ compensation is provided under both guaranteed cost policies (coverage for a fixed premium) and loss sensitive policies where premiums are adjustable based on the loss experience of the employer. | ||||

| Professional Liability | Covers liability arising from directors and officers acting in their official capacity and liability for errors and omissions committed by professionals and others. Coverage may also provide employment practices insurance relating to allegations of wrongful termination and discrimination. | ||||

| Bond | Encompasses fidelity and surety insurance, including commercial surety, contract surety and fidelity bonds. Commercial surety includes bonds that insure non-performance by contractors, license and permit bonds to help meet government-mandated requirements and probate and judicial bonds for fiduciaries and civil court proceedings. Contract surety bonds may include payment and performance bonds for contractors. Fidelity bonds may include ERISA bonds related to the handling of retirement plan assets and bonds protecting against employee theft or fraud. The Company also provides credit and political risk insurance offered to clients with global operations. | ||||

| Assumed Reinsurance | Includes assumed reinsurance of property, liability, surety, credit and political, agriculture, and marine risks throughout the world but principally in Europe and North America. | ||||

Through its three lines of business of small commercial, middle & large commercial, and global specialty, Commercial Lines offers its products and services to businesses in the United States ("U.S.") and internationally. Commercial Lines generally consists of products written for small businesses and middle market companies as well as national and multi-national accounts, largely distributed through retail agents and brokers, wholesale agents and global and specialty reinsurance brokers. The majority of Commercial Lines written premium is generated by small commercial and middle market, which provide coverage options and customized pricing based on the policyholder’s individual risk characteristics. Small commercial and middle market lines within middle & large commercial are generally referred to as standard commercial lines.

Small commercial provides coverages for small businesses, which the Company generally considers to be businesses with an annual payroll under $12, revenues under $25 and property values less than $20 per location. Within small commercial, both property and general liability coverages are offered under a single package policy, marketed under the Spectrum name. Small commercial also provides excess and surplus lines coverage to small businesses including umbrella, general liability, property and other coverages.

Middle & large commercial business provides insurance coverages to medium-sized and national accounts businesses, which are companies whose payroll, revenue and property values exceed the small business definition. In addition to offering standard commercial lines products, middle & large commercial

includes program business which provides tailored programs, primarily to customers with common risk characteristics. On national accounts, a significant portion of the business is written through large deductible programs. Other programs written within middle & large commercial are retrospectively-rated where the premiums are adjustable based on loss experience. Also within middle & large commercial, the Company writes captive programs business, which provides tailored programs to those seeking a loss sensitive solution where premiums are adjustable based on loss experience.

Global specialty provides a variety of customized insurance products, including property, liability, marine, professional liability, and bond. On May 23, 2019, the Company acquired Navigators Group, a global specialty insurer. The vast majority of the business written by our Navigators Group insurance subsidiaries is reported in the global specialty business unit. Revenues and earnings of the Navigators Group business are included in operating results of the Company's Commercial Lines segment since the acquisition date. For discussion of this transaction, see Note 2- Business Acquisitions of Notes to Consolidated Financial Statements.

Marketing and Distribution

Commercial Lines provides insurance products and services through the Company’s regional offices, branches and sales and policyholder service centers throughout the United States and overseas, principally in Europe. The products are marketed and

9

distributed using independent retail agents and brokers, wholesale agents and global and specialty reinsurance brokers. As the sole corporate member of Lloyd's Syndicate 1221 ("Lloyd's Syndicate"), the Company has the exclusive right to underwrite business up to an approved level of premium in the Lloyd’s market.

In the United States, the independent agent and broker distribution channel is consolidating and this trend is expected to continue. This will likely result in a larger proportion of written premium being concentrated among fewer agents and brokers. In addition, the Company offers insurance products to customers of payroll service providers through its relationships with major national payroll companies in the United States and to members of affinity organizations.

Competition

Small Commercial

In small commercial, The Hartford competes against large national carriers, regional carriers and direct writers. Competitors include stock companies, mutual companies and other underwriting organizations. The small commercial market remains highly competitive and fragmented as carriers seek to differentiate themselves through product expansion, price, enhanced service and leading technology. Larger carriers such as The Hartford continually advance their pricing sophistication and ease of doing business with agents and customers through the use of technology, analytics and other capabilities that improve the process of evaluating a risk, quoting new business and servicing customers. The Company also continuously enhances digital capabilities as customers and distributors demand more access and convenience, and expands product and underwriting capabilities to accommodate both larger accounts and a broader risk appetite. Existing competitors and new entrants, including start-up and non-traditional carriers, are actively looking to expand sales of business insurance products to small businesses through increasing their underwriting appetite, deepening their relationships with distribution partners, and through on-line and direct-to-consumer marketing.

Middle & Large Commercial

Middle & large commercial business is considered “high touch” and involves individual underwriting and pricing decisions. Competition in this market includes stock companies, mutual companies, alternative risk sharing groups and other underwriting organizations. The pricing of middle market and national accounts is prone to significant volatility over time due to changes in individual account characteristics and exposure, as well as legislative and macro-economic forces. National and regional carriers participate in the middle & large commercial insurance sector, resulting in a competitive environment where pricing and policy terms are critical to securing new business and retaining existing accounts. Within this competitive environment, The Hartford is working to deepen its product and underwriting capabilities, leverage its sales and underwriting talent and expand its use of data analytics to make risk selection and pricing decisions. In product development and related areas such as claims and risk engineering, the Company has extended its capabilities in industry verticals, such as energy, construction, technology and life sciences. Through business partners, the Company offers business insurance coverages to exporters and other U.S. companies with a physical presence overseas. The Hartford’s middle & large commercial business will leverage the

investments in product, underwriting, and technology to better match price to individual risk as the firm pursues responsible growth strategies to deliver target returns.

For specialty casualty businesses within middle & large commercial, pricing competition continues to be significant, particularly for the larger individual accounts. As a means to mitigate the cost of insurance on larger accounts, more insureds may opt for loss-sensitive products, including retrospectively rated contracts, in lieu of guaranteed cost policies. Under a retrospectively-rated contract, the ultimate premium collected from the insured is adjusted based on how incurred losses for the policy year develop over time, subject to a minimum and maximum premium.

Global Specialty

Global specialty competes against multi-national insurance and reinsurance companies, writing marine, property, excess casualty, professional liability, bond and assumed reinsurance. Global specialty also includes property coverages written through Maxum Specialty Insurance Group ("Maxum"). Due to adverse loss experience over the past couple of years, particularly in ocean marine, property, excess casualty and international professional liability lines, pricing has increased across the industry in response to those loss cost trends. Nonetheless, the market continues to be highly competitive.

In the bond business, favorable underwriting results in recent years has led to increased competition for market share.

Management and professional lines in both the U.S. and international continue to witness significant firming in price, terms and conditions. Private company market rates remain strong in reflecting the increased employment practices liability insurance ("EPLI") exposure.

Lloyd's Syndicate and London market business have been under financial stress in recent years due to a perceived lack of adequate premium pricing and an excessive focus on growth at the expense of underwriting discipline in those markets, combined with a significant increase in the level of catastrophe activity. As such, syndicates and London market carriers, including The Hartford, are taking pricing and underwriting actions to improve profitability. Lloyd's, which is regulated by the Financial Conduct Authority and Prudential Regulatory Authority in the U.K., has been implementing changes to improve performance of the syndicates including a more rigorous approach to the approval of syndicate business plans. Additionally Lloyd’s have also introduced recent changes which require that members limit the amount of tier 2 capital (e.g. letters of credit) that can be used to meet syndicate solvency capital requirements. For further discussion, see Part II, Item 7, MD&A - Capital Resources and Liquidity.

10

| PERSONAL LINES | ||

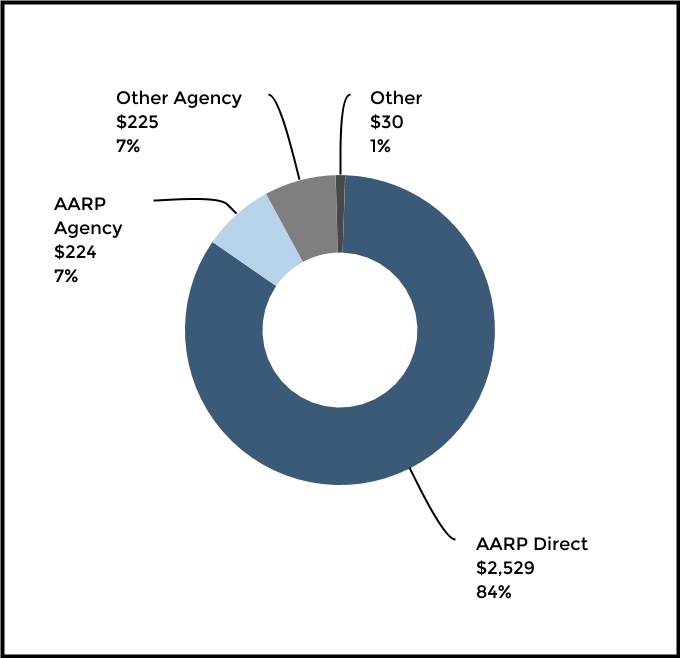

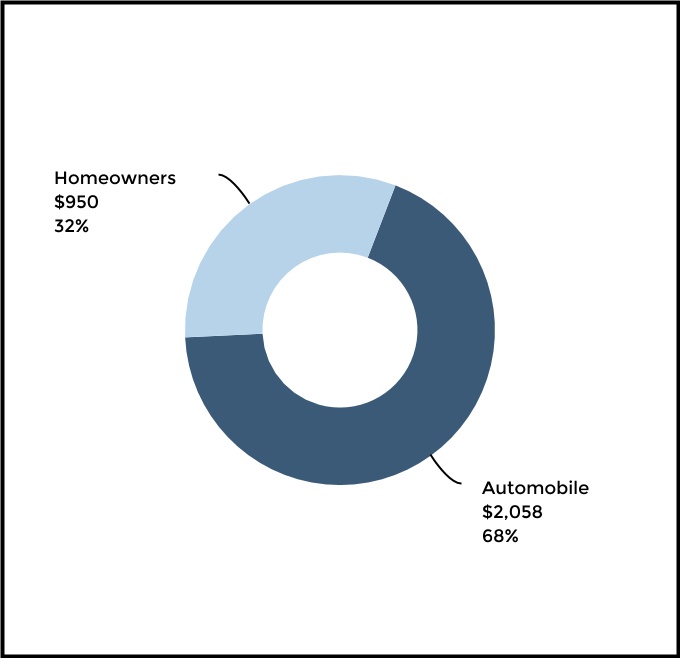

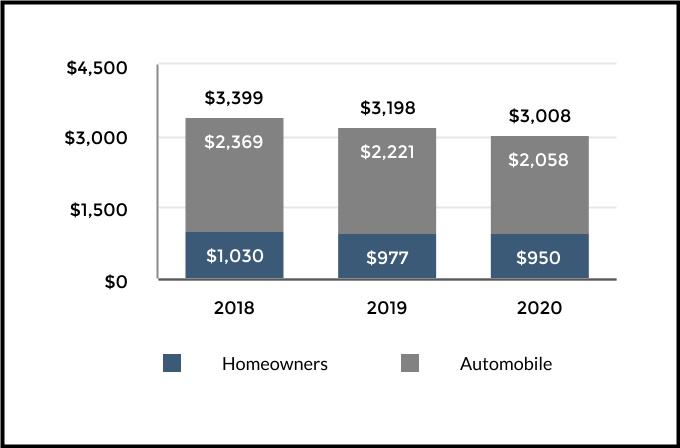

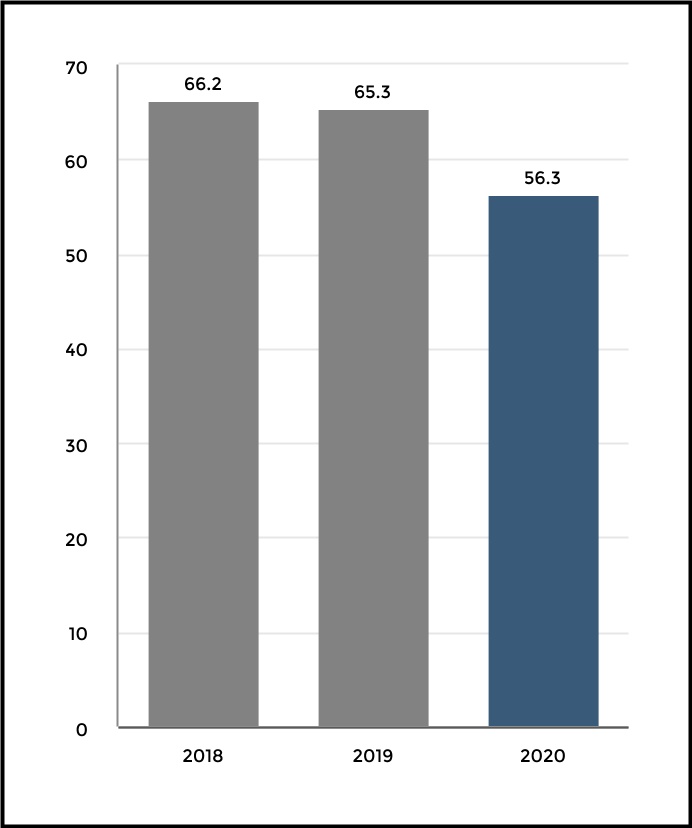

2020 Earned Premiums of $3,008 by Line of Business

2020 Earned Premiums of $3,008 by Product

Principal Products and Services

| Automobile | Covers damage to an individual insured’s own vehicle due to collision or other perils and is referred to as automobile physical damage. In addition to first party automobile physical damage, automobile insurance covers liability for bodily injuries and property damage suffered by third parties and losses caused by uninsured or underinsured motorists. Also, under no-fault laws, policies written in some states provide first party personal injury protection. Some of the Company’s personal automobile insurance policies also offer personal umbrella liability coverage for an additional premium. | ||||

| Homeowners | Insures against losses to residences and contents from fire, wind and other perils. Homeowners insurance includes owned dwellings, rental properties and coverage for tenants. The policies may provide other coverages, including loss related to recreation vehicles or watercraft, identity theft and personal items such as jewelry. | ||||

Personal Lines provides automobile, homeowners and personal umbrella coverages to individuals across the United States, mostly through a program designed exclusively for members of AARP (“AARP Program”). The Hartford's automobile and homeowners products provide coverage options and pricing tailored to a customer's individual risk. The Hartford has individual customer relationships with AARP Program policyholders and, as a group, they represent a significant portion of the total Personal Lines' business. Business sold to AARP members, either direct or through independent agents, amounted to earned premiums of $2.8 billion, $2.9 billion and $3.0 billion in 2020, 2019 and 2018, respectively.

The Company is in the process of transforming its automobile and homeowners products to regain competitive advantage with the state-by-state rollout of a new automobile product beginning in March of 2021 and the rollout of a new homeowners product beginning in the second quarter of 2021. Among other things, overall rate levels, price segmentation, rating factors and underwriting procedures are being updated. Personal Lines works with carrier partners to provide risk protection options for

AARP members with needs beyond the company’s current product offering.

Marketing and Distribution

Personal Lines reaches diverse customers through multiple distribution channels, including direct-to-consumer and independent agents. In direct-to-consumer, Personal Lines markets its products through a mix of media, including direct mail, digital marketing, television as well as digital and print advertising. Through the agency channel, Personal Lines provides products and services to customers through a network of independent agents in the standard personal lines market, primarily serving mature, preferred consumers. These independent agents are not employees of the Company.

Personal Lines has made significant investments in offering direct and agency-based customers the opportunity to interact with the company online, including via mobile devices. In addition, its technology platform for telephone sales centers enables sales representatives to provide an enhanced experience for direct-to-consumer customers, positioning the Company to offer unique

11

capabilities to AARP’s member base.

Most of Personal Lines' sales are associated with its exclusive licensing arrangement with AARP, with the current agreement in place through December 31, 2032, to market automobile, homeowners and personal umbrella coverages to AARP's approximately 37 million members, primarily direct but also through independent agents. This relationship with AARP, which has been in place since 1984, provides Personal Lines with an important competitive advantage given the increase in the population of those over age 50 and the strength of the AARP brand. In most states, new business automobile and home policies have been issued to AARP members with a lifetime continuation agreement endorsement, providing that the policies will be renewed as long as certain terms are met, such as timely payment of premium and maintaining a driver’s license in good standing. Beginning in 2021, Personal Lines will no longer offer the lifetime continuation agreement on new business home and automobile policies, subject to regulatory approval on a state-by-state basis. The endorsement will remain on renewal policies, provided they were originally written with the lifetime continuation agreement.

In addition to selling to AARP members, Personal Lines offers its automobile and homeowners products to non-AARP customers, primarily through the independent agent channel within select underwriting markets where we believe we have a competitive advantage. Personal Lines leverages its agency channel to target AARP members and other customer segments that value the advice of an independent agent and recognize the differentiated experience the Company provides. In particular, the Company has taken action to distinguish its brand and improve profitability in the independent agent channel with fewer and more highly partnered agents.

Competition

The personal lines automobile and homeowners insurance markets are highly competitive. Personal lines insurance is written by insurance companies of varying sizes that compete

principally on the basis of price, product, service, including claims handling, the insurer's ratings and brand recognition. Companies with strong ratings, recognized brands, direct sales capability and economies of scale will have a competitive advantage. In recent years, insurers have increased their advertising in the direct-to-consumer market, in an effort to gain new business and retain profitable business. The growth of direct-to-consumer sales, including through new entrants to the marketplace, continues to outpace sales in the agency distribution channel.

Insurers that distribute products principally through agency channels compete by offering commissions and additional incentives to attract new business. To distinguish themselves in the marketplace, top tier insurers are offering on-line and self-service capabilities that make it easier for agents and consumers to do business with the insurer. A large majority of agents have been using “comparative rater” tools that allow the agent to compare premium quotes among several insurance companies. The use of comparative rater tools increases price competition. Insurers that are able to capitalize on their brand and reputation, differentiate their products and deliver strong customer service are more likely to be successful in this market.

The use of data mining and predictive modeling is used by more and more carriers to target the most profitable business, and carriers have further segmented their pricing plans to expand market share in what they believe to be the most profitable segments. The Company continues to invest in capabilities to better utilize data and analytics, and thereby, refine and manage underwriting and pricing.

Also, new automobile technology advancements, including lane departure warnings, backup cameras, automatic braking and active collision alerts, are being deployed rapidly and are expected to improve driver safety and reduce the likelihood of vehicle collisions. However, these features include expensive parts, potentially increasing average claim severity.

| PROPERTY & CASUALTY OTHER OPERATIONS | ||

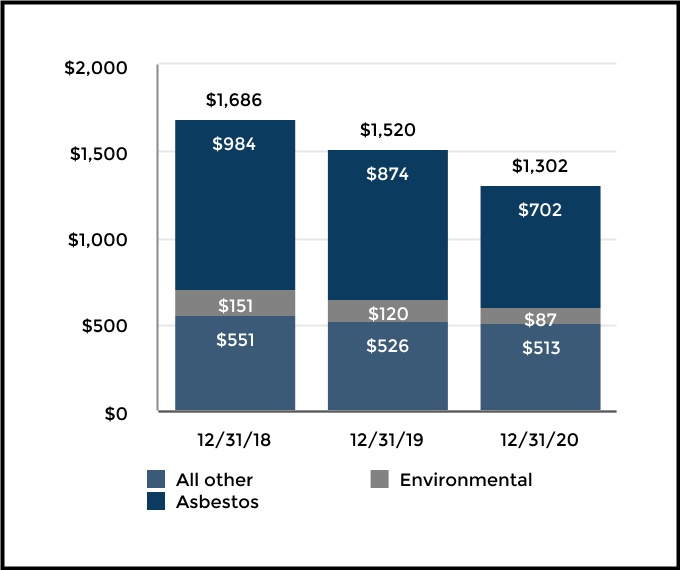

Property & Casualty Other Operations includes certain property and casualty operations, managed by the Company, that have discontinued writing new business and includes substantially all of the Company's pre-1986 asbestos and environmental ("A&E") exposures. For a discussion of coverages provided under policies

written with exposure to A&E prior to 1986, reported within the P&C Other Operations segment (“Run-off A&E”), run-off assumed reinsurance and all other non-A&E exposures, see Part II, Item 7, MD&A - Critical Accounting Estimates, Property & Casualty Insurance Product Reserves.

12

| GROUP BENEFITS | ||

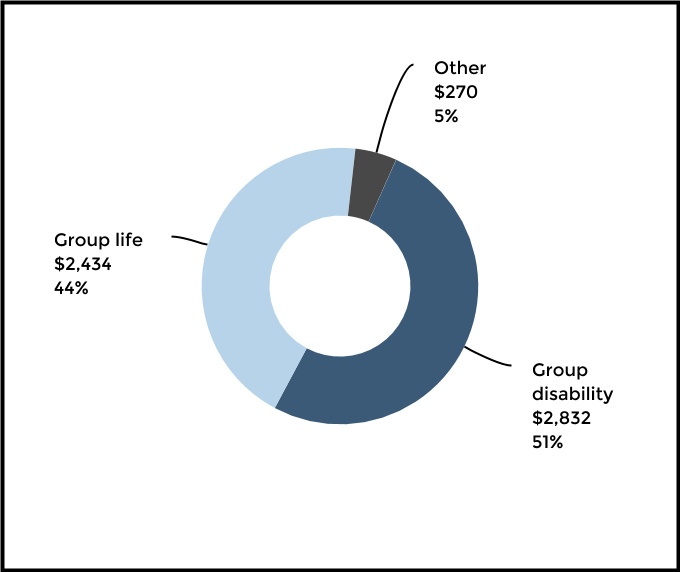

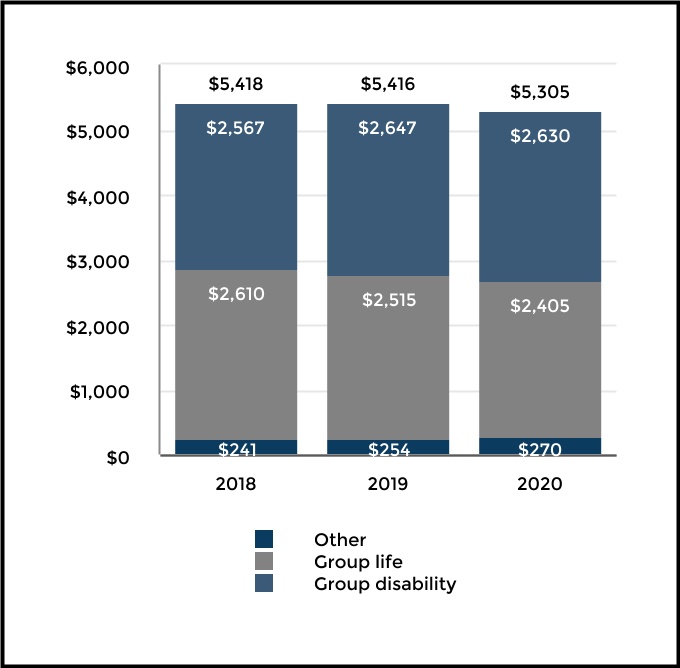

2020 Premiums and Fee Income of $5,536

Principal Products and Services

| Group Life | Typically is term life insurance provided in the form of yearly renewable term life insurance. Other life coverages in this category include accidental death and dismemberment and travel accident insurance. | ||||

| Group Disability | Typically comprised of short-term disability, long-term disability, and family leave coverage that pays a percentage of an employee’s salary for a period of time if they are ill or injured and cannot perform the duties of their job or absent from work to care for a family member. Short-term and long-term disability policies have elimination periods that must be satisfied prior to benefit payments. The Company also earns fee income from leave management services and the administration of underwriting, enrollment and claims processing for employer self-funded plans. | ||||

| Other Products | Includes other group coverages such as retiree health insurance, critical illness, accident, hospital indemnity and participant accident coverages. | ||||

Group insurance typically covers an entire group of people under a single contract, most typically the employees of a single employer or members of an association.

Group Benefits provides group life, disability and other group coverages to members of employer groups, associations and affinity groups through direct insurance policies and provides reinsurance to other insurance companies. In addition to employer paid coverages, the segment offers voluntary product coverages which are offered through employee payroll deductions. Group Benefits also offers disability underwriting, administration, and claims processing to self-funded employer plans. In addition, the segment offers a single-company leave management solution, which integrates work absence data from the insurer’s short-term and long-term group disability and workers’ compensation insurance business with its leave management administration services.

Group Benefits generally offers term insurance policies, allowing for the adjustment of rates or policy terms at renewal in order to minimize the adverse effect of market trends, loss costs, declining interest rates and other factors. Policies are typically sold with one, two or three-year rate guarantees depending upon the product and market segment.

Marketing and Distribution

The Group Benefits distribution network is managed through a regional sales office system to distribute its group insurance products and services through a variety of distribution outlets including brokers, consultants, third-party administrators and trade associations. Additionally, the segment has relationships with several private exchanges which offer its products to employer groups.

Competition

Group Benefits competes with numerous insurance companies and financial intermediaries marketing insurance products. In order to differentiate itself, Group Benefits uses its risk management expertise and economies of scale to derive a competitive advantage. Competitive factors include the extent of products offered, price, the quality of customer and claims handling services, and the Company's relationship with third-party distributors and private exchanges. Active price competition continues in the marketplace, resulting in multi-year rate guarantees being offered to customers. Top tier insurers in the marketplace also offer on-line and self-service capabilities to third party distributors and consumers. The relatively large size

13

and underwriting capacity of the Group Benefits business provides a competitive advantage over smaller competitors.

Group Benefits' acquisition of Aetna's U.S. group life and disability business further increased its market presence and competitive capabilities through the addition of industry-leading digital technology and an integrated absence management and claims platform.

Additionally, as employers continue to focus on reducing the cost of employee benefits, we expect more companies to offer voluntary products paid for by employees. Competitive factors affecting the sale of voluntary products include the breadth of products, product education, enrollment capabilities and overall customer service.

In addition to providing group disability, leave management and life insurance, we offer integrated claim, leave and benefits administration with The Hartford's Ability Advantage platform. We also offer voluntary products including critical illness, accident and hospital indemnity coverage to employees through our Employee Choice Benefits programs, and travel accident coverage for employers and other organizations. The Company's enhanced enrollment and marketing tools, such as My Tomorrow©, are providing additional opportunities to educate individual participants about supplementary benefits and deepen their knowledge about product selection.

| HARTFORD FUNDS | ||

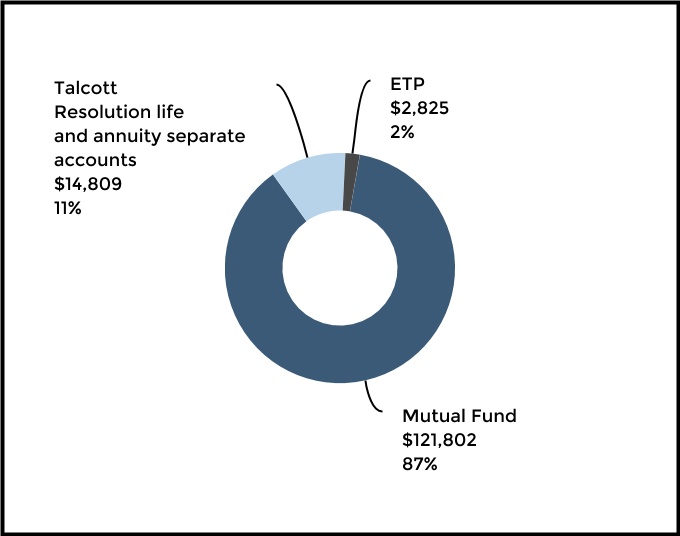

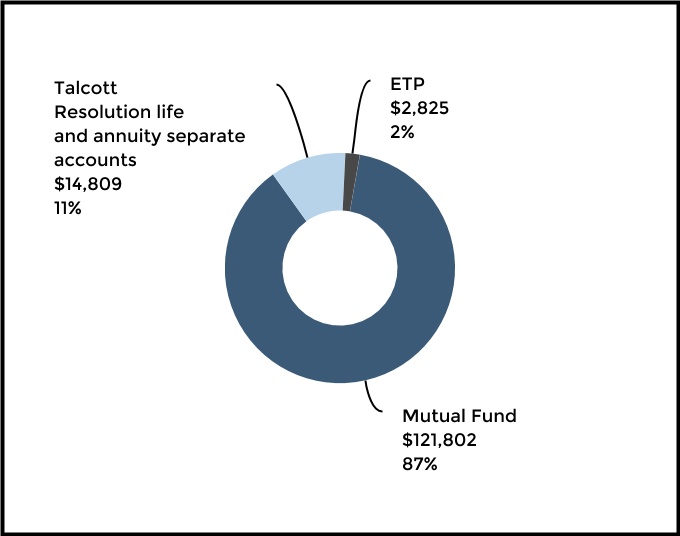

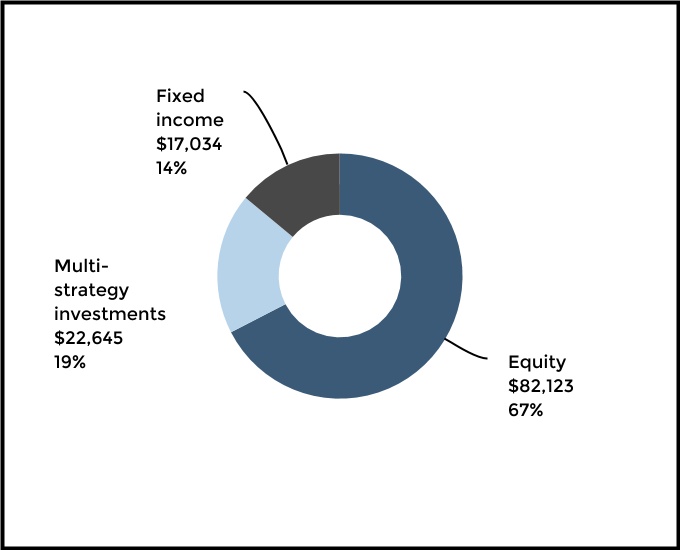

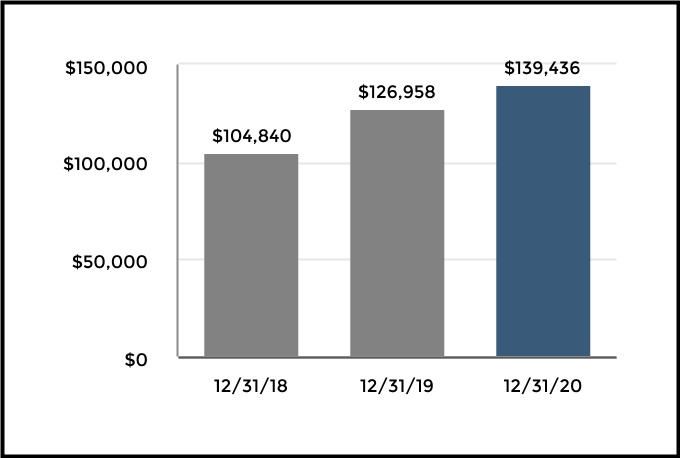

Hartford Funds Segment Assets Under Management ("AUM") of $139,436 as of December 31, 2020

Mutual Fund AUM as of December 31, 2020

Principal Products and Services

| Mutual Funds | Includes approximately 70 actively managed mutual funds across a variety of asset classes including domestic and international equity, fixed income, and multi-strategy investments, principally subadvised by two unaffiliated institutional asset management firms that have comprehensive global investment capabilities. | ||||

| ETP | Includes a suite of exchange-traded products (“ETP”) traded on the New York Stock Exchange that is comprised of multi-factor and actively managed fixed income exchange-traded funds ("ETF"). Multi-factor ETF’s are designed to track indices using both active and passive investment techniques that strive to improve performance relative to traditional capitalization weighted indices. | ||||

| Talcott Resolution life and annuity separate accounts | Relates to assets of the life and annuity business sold in May 2018 that are still managed by the Company's Hartford Funds segment. | ||||

The Hartford Funds segment provides investment management, administration, product distribution and related services to investors through a diverse set of investment products in domestic and international markets. Hartford Funds' comprehensive range of products and services assist clients in achieving their desired investment objectives. AUM are separated into three distinct categories referred to as mutual funds, ETP and Talcott Resolution life and annuity separate

accounts, which relate to the life and annuity business sold in May 2018. The Hartford Funds segment will continue to manage the mutual fund assets of Talcott Resolution, though these assets are expected to continue to decline over time.

14

Marketing and Distribution

Our funds and ETPs are sold through national and regional broker-dealer organizations, independent financial advisers, defined contribution plans, financial consultants, bank trust groups and registered investment advisers. Our distribution team is organized to sell primarily in the United States. The investment products for Talcott Resolution are not actively distributed.

Competition

The investment management industry is mature and highly competitive. Firms are differentiated by investment performance,

range of products offered, brand recognition, financial strength, proprietary distribution channels, quality of service and level of fees charged relative to quality of investment products. The Hartford Funds segment competes with a large number of asset management firms and other financial institutions and differentiates itself through superior fund performance, product breadth, strong distribution and competitive fees. In recent years demand for lower cost passive investment strategies has outpaced demand for actively managed strategies and has taken market share from active managers.

| CORPORATE | ||

The Company includes in the Corporate category investment management fees and expenses related to managing third party business, including management of the invested assets of Talcott Resolution, reserves for run-off structured settlement and terminal funding agreement liabilities, restructuring costs, capital raising activities (including equity financing, debt financing and related interest expense), transaction expenses incurred in connection with an acquisition, purchase accounting adjustments related to goodwill and other expenses not allocated to the reporting segments.

Additionally, included in the Corporate category are discontinued operations from the Company's life and annuity business sold in May 2018 and a 9.7% ownership interest in the legal entity that acquired this business. The operating results of the life and annuity business are included in discontinued operations for all periods prior to the closing date.

RESERVES

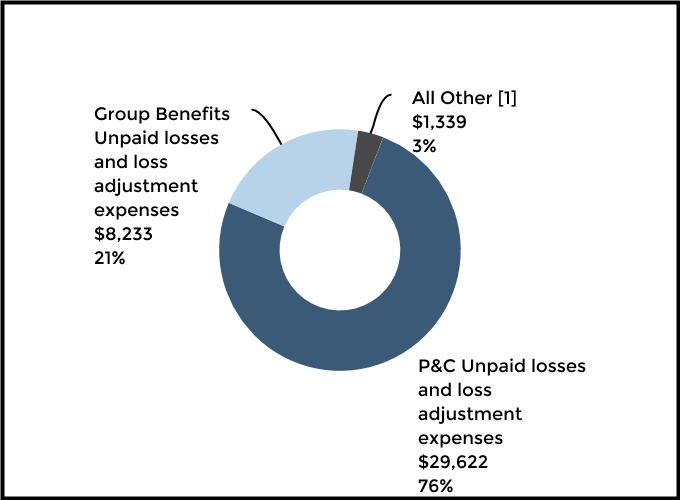

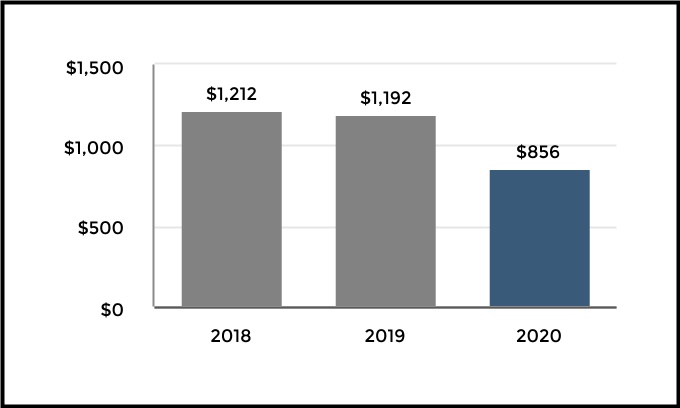

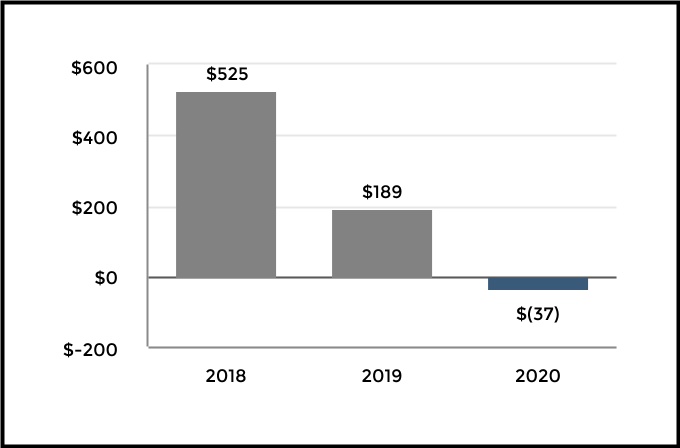

Total Reserves as of December 31, 2020 [1]

[1]Includes reserves for future policy benefits and other policyholder funds and benefits payable of $638 and $701, respectively, of which $420 and $415, respectively, relate to the Group Benefits segment with the remainder related to run-off structured settlement and terminal funding agreements within Corporate.

The reserve for unpaid losses and loss adjustment expenses includes a liability for unpaid losses, including those that have been incurred but not yet reported, as well as estimates of all expenses associated with processing and settling these insurance claims, including reserves related to both Property & Casualty and Group Benefits.

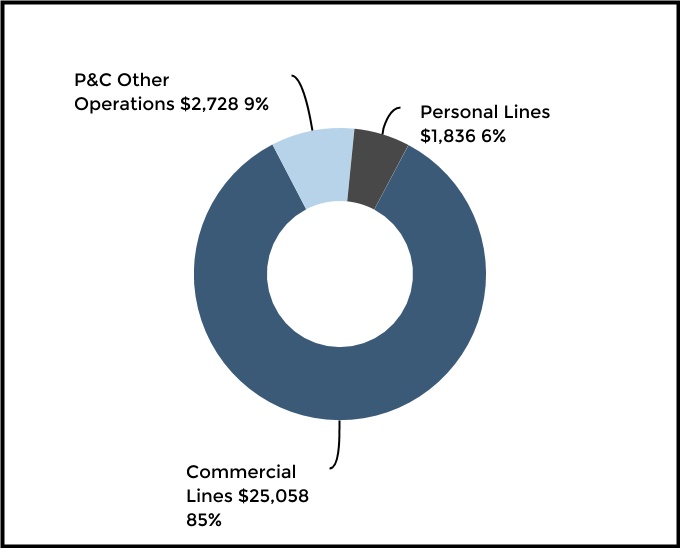

Total Property & Casualty Reserves as of December 31, 2020

Further discussion of The Hartford’s property and casualty insurance product reserves, including run-off asbestos and environmental claims reserves within P&C Other Operations, may be found in Part II, Item 7, MD&A — Critical Accounting Estimates — Property and Casualty Insurance Product Reserves. Additional discussion may be found in Notes to Consolidated Financial Statements, including in the Company’s accounting policies for insurance product reserves within Note 1 - Basis of Presentation and Significant Accounting Policies and in Note 12 - Reserve for Unpaid Losses and Loss Adjustment Expenses of Notes to Consolidated Financial Statements.

15

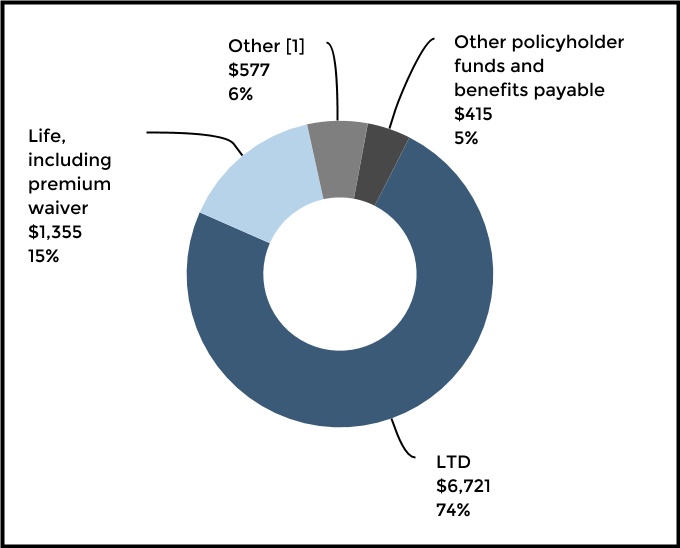

Total Group Benefits Reserves for Future Policy Benefits and Other Policyholder Funds and Benefits Payable as of December 31, 2020 [1]

[1]Includes short duration contract reserves of $121 of short-term disability and $36 of supplemental health as well as reserves for future policy benefits that includes $307 of paid up life reserves and policy reserves on life policies, $99 of reserves for conversions to individual life and $14 of other reserves.

Other policyholder funds and benefits payable represent deposits from policyholders where the company does not have insurance risk but is subject to investment risk. Reserves for future policy benefits represent life-contingent reserves for which the company is subject to insurance and investment risk.

Discussion of The Hartford's Group Benefits long-term disability reserves may be found in Part II, Item 7, MD&A — Critical Accounting Estimates — Group Benefits Long-term Disability ("LTD") Reserves, Net of Reinsurance. Additional discussion may be found in Note 12 - Reserve for Unpaid Losses and Loss Adjustment Expenses of Notes to Consolidated Financial Statements.

UNDERWRITING FOR P&C AND GROUP BENEFITS

The Company underwrites the risks it insures in order to manage exposure to loss through favorable risk selection and diversification. Risk modeling is used to manage, within specified limits, the aggregate exposure taken in each line of business and across the Company. For property and casualty business, aggregate exposure limits are set by geographic zone and peril. Products are priced according to the risk characteristics of the insured’s exposures. Rates charged for Personal Lines products are filed with the states in which we write business. Rates for Commercial Lines products are also filed with the states but the premium charged may be modified based on the insured’s relative risk profile and workers’ compensation policies may be subject to modification based on prior loss experience. Pricing for Group Benefits products, including long-term disability and life insurance, is also based on an underwriting of the risks and a

projection of estimated losses, including consideration of investment income.

Pricing adequacy depends on a number of factors, including the ability to obtain regulatory approval for rate changes, proper evaluation of underwriting risks, the ability to project future loss cost frequency and severity based on historical loss experience adjusted for known trends, the Company’s response to rate actions taken by competitors, its expense levels and expectations about regulatory and legal developments. The Company seeks to price its insurance policies such that insurance premiums and future net investment income earned on premiums received will cover underwriting expenses and the ultimate cost of paying claims reported on the policies and provide for a profit margin. For many of its insurance products, the Company is required to obtain approval for its premium rates from state insurance departments and the Lloyd's Syndicate's ability to write business is subject to Lloyd's approval for its premium capacity each year.

Geographic Distribution of Earned Premium (% of total)

| Location | Commercial Lines | Personal Lines | Group Benefits | Total | ||||||||||

| California | 7 | % | 2 | % | 3 | % | 12 | % | ||||||

| New York | 6 | % | 1 | % | 2 | % | 9 | % | ||||||

| Texas | 4 | % | 1 | % | 2 | % | 7 | % | ||||||

| Florida | 3 | % | 1 | % | 1 | % | 5 | % | ||||||

| All other [1] | 32 | % | 12 | % | 23 | % | 67 | % | ||||||

| Total | 52 | % | 17 | % | 31 | % | 100 | % | ||||||

[1] No other single state or country accounted for 5% or more of the Company's consolidated earned premium in 2020.

CLAIMS ADMINISTRATION FOR P&C AND GROUP BENEFITS

Claims administration includes the functions associated with the receipt of initial loss notices, claims adjudication and estimates, legal representation for insureds where appropriate, establishment of case reserves, payment of losses and notification to reinsurers. These activities are performed by approximately 6,600 claim professionals handling 50 states, Washington D.C and 2 international locations, organized to meet the specific claim service needs for our various product offerings. Our combined workers’ compensation and Group Benefits units enable us to leverage synergies for improved outcomes.

Claim payments for benefit, loss and loss adjustment expenses are the largest expenditure for the Company.

REINSURANCE

For discussion of reinsurance, see Part II, Item 7, MD&A — Enterprise Risk Management and Note 9 - Reinsurance of Notes to Consolidated Financial Statements.

16

INVESTMENT OPERATIONS

Hartford Investment Management Company (“HIMCO”) is an SEC registered investment advisor and manages the Company's investment operations. HIMCO provides customized investment strategies for The Hartford's investment portfolio, as well as for The Hartford's pension plan and institutional clients. In connection with the life and annuity business sold in May 2018, HIMCO entered into an agreement for an initial five year term to manage the invested assets of Talcott Resolution.

As of December 31, 2020 and 2019, the fair value of HIMCO’s total assets under management was approximately $106.1 billion and $98.0 billion, respectively, including $45.9 billion and $42.4 billion, respectively, that were held in HIMCO managed third party accounts and $4.6 billion and $4.1 billion, respectively, that support the Company's pension and other post-retirement benefit plans.

Management of The Hartford's Investment Portfolio

HIMCO manages the Company's investment portfolios to maximize economic value and generate the returns necessary to support The Hartford’s various product obligations, within internally established objectives, guidelines and risk tolerances. The portfolio objectives and guidelines are developed based upon the asset/liability profile, including duration, convexity and other characteristics within specified risk tolerances. The risk tolerances considered include, but are not limited to, asset sector, credit issuer allocation limits, and maximum portfolio limits for below investment grade holdings. The Company attempts to minimize adverse impacts to the portfolio and the Company’s results of operations from changes in economic conditions through asset diversification, asset allocation limits, asset/liability duration matching and the use of derivatives. For further discussion of HIMCO’s portfolio management approach, see Part II, Item 7, MD&A — Enterprise Risk Management.

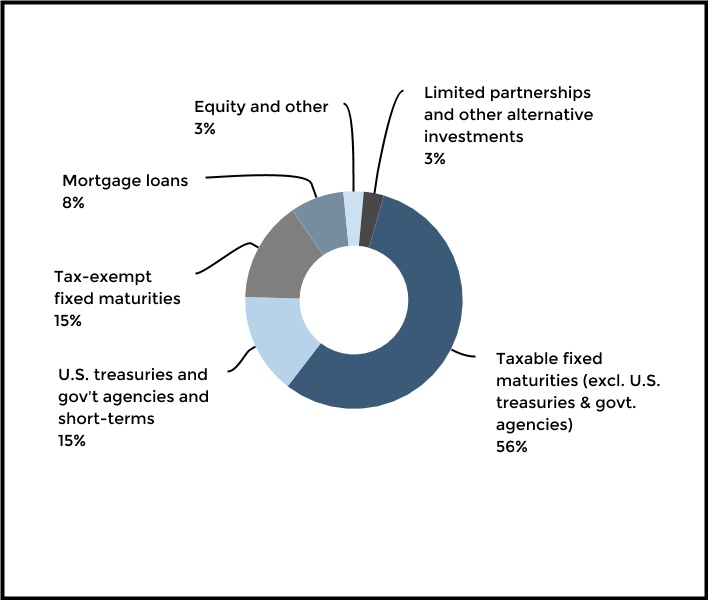

The Hartford's Investment Portfolio of $56.5 billion as of December 31, 2020

ENTERPRISE RISK MANAGEMENT

The Company has insurance, operational and financial risks. For discussion on how The Hartford manages these risks, see Part II, Item 7, MD&A - Enterprise Risk Management.

REGULATION

State and Foreign Insurance Laws

State insurance laws are intended to supervise and regulate insurers with the goal of protecting policyholders and ensuring the solvency of the insurers. As such, the insurance laws and regulations grant broad authority to state insurance departments (“Departments”) to oversee and regulate the business of insurance. The Departments monitor the financial stability of an insurer by requiring insurers to maintain certain solvency standards and minimum capital and surplus requirements; invested asset requirements; state deposits of securities; guaranty fund premiums; restrictions on the size of risks which may be insured under a single policy; and adequate reserves and other necessary provisions for unearned premiums, unpaid losses and loss adjustment expenses and other liabilities, both reported and unreported. In addition, the Departments perform periodic market and financial examinations of insurers and require insurers to file annual and other reports on the financial condition of the companies. Policyholder protection is also regulated by the Departments through licensing of insurers, sales employees, agents and brokers and others; approval of premium rates and policy forms; claims administration requirements; and maintenance of minimum rates for accumulation of surrender values.

17

Many states also have laws regulating insurance holding company systems. These laws require insurance companies, which are formed and chartered in the state ( “Domestic Insurers”), to register with the state department of insurance (referred to as their “domestic state or regulator”) and file information concerning the operations of companies within the holding company system that may materially affect the operations, management or financial condition of the insurers within the system. Insurance holding company regulations principally relate to (i) state insurance approval of the acquisition of Domestic Insurers, (ii) prior review or approval of certain transactions between the domestic insurer and its affiliates, and (iii) regulation of dividends made by the domestic insurer. All transactions within a holding company system affecting Domestic Insurers must be determined to be fair and equitable.

The NAIC, the organization that works to promote standardization of best practices and assists state insurance regulatory authorities and insurers, conducted the “Solvency Modernization Initiative” (the “Solvency Initiative”). The effort focused on reviewing the U.S. financial regulatory system and financial regulation affecting insurance companies including capital requirements, corporate governance and risk management, group supervision, statutory accounting and financial reporting and reinsurance. As a result of the Solvency Initiative, the NAIC adopted model regulations, adopted by the Company’s lead regulator of Connecticut, requiring insurers to file disclosures annually on their risk management and corporate governance practices under the Corporate Governance Annual Disclosure Model Act, Risk Management and Own Risk and Solvency Assessment Model Act ("ORSA") and Holding Company Act Enterprise Risk Report.

The extent of financial services regulation on business outside the United States varies significantly among the countries in which The Hartford operates. Foreign financial services providers in certain countries are faced with greater restrictions than domestic competitors domiciled in that particular jurisdiction. In addition, an insurance company underwriting risks through the Lloyd’s market utilizes a special vehicle (the Lloyd's Syndicate) and is required to comply with Lloyd’s capital requirements. Lloyd’s determines the amount of capital, known as Funds at Lloyd’s (“FAL”), that each Syndicate has to provide in order to support the amount and the level of risk (as determined by Lloyd’s) of the business which the Syndicate is expected to underwrite. Under Solvency II, insurers are required to hold a sufficient level of capital. Syndicates seeking to utilize letters of credit or other third party guarantees to meet Solvency II requirements must first obtain approval from the Prudential Regulation Authority.

Federal and State Securities and Financial Regulation Laws

The Company sells and distributes its mutual funds through a broker dealer subsidiary, and is subject to regulation promulgated and enforced by the Financial Industry Regulatory Authority, the SEC and/or, in some instances, state securities administrators. Other subsidiaries operate as investment advisers registered with the SEC under the Investment Advisers’ Act of 1940, as amended, and are registered as investment advisers under certain state laws, as applicable. Because federal and state laws and regulations are primarily intended to protect investors in

securities markets, they generally grant regulators broad rulemaking and enforcement authority. Some of these regulations include, among other things, regulations impacting sales methods, trading practices, suitability of investments, use and safekeeping of customers’ funds, corporate governance, capital, recordkeeping, and reporting requirements.

Failure to comply with federal and state laws and regulations may result in fines, the issuance of cease-and-desist orders or suspension, termination or limitation of the activities of our operations and/or our employees.

INTELLECTUAL PROPERTY

We rely on a combination of contractual rights and copyright, trademark, patent and trade secret laws to establish and protect our intellectual property.

We have a trademark portfolio that we consider important in the marketing of our products and services, including, among others, the trademarks of The Hartford name, the Stag Logo and the combination of these two trademarks. The duration of trademark registrations may be renewed indefinitely subject to country-specific use and registration requirements. We regard our trademarks as highly valuable assets in marketing our products and services and vigorously seek to protect them against infringement. In addition, we own a number of patents and patent applications relating to on-line quoting, insurance related processing, insurance telematics, proprietary interface platforms, and other matters, some of which may be important to our business operations. Patents are of varying duration depending on filing date, and will typically expire at the end of their natural term.

HUMAN CAPITAL RESOURCES

The Hartford has approximately 18,500 employees as of December 31, 2020.

Management, including the CEO and Chief Human Resources Officer ("CHRO"), establishes the hiring and compensation practices for our company. The Board is periodically updated on key employee engagement and employee relations measures, including our annual employee survey results. In addition, the Board’s Compensation and Management Development Committee (“Compensation Committee”) is responsible for approving compensation paid to senior leaders, and the oversight of succession planning, pay equity practices, and diversity and inclusion ("D&I") initiatives. Our Human Resources team, led by our CHRO, supports the Compensation Committee in the execution of its responsibilities. In addition to the day-to-day support and counseling they provide to our leaders, managers and employees, the Human Resources team also monitors key indicators to keep a pulse on trends across our employee population including employee engagement, employee relations matters, career mobility, talent acquisition, and retention.

18

Talent Attraction, Retention and Development

The Hartford prioritizes building a diverse workforce and an inclusive and equitable work environment where employees are respected, inspired to perform at their best, and are recognized for their contributions. We believe that the combination of a diverse workforce and an operating culture that actively embraces different experiences, perspectives and insights results in better decisions, outcomes and experiences for both our customers and employees. We persistently work to improve the employee experience in support of our continuing strategic objective to attract, retain and develop the best talent in the industry.

Our commitment to a robust talent pool starts at the top. The Board of Directors engages with the Compensation Committee annually to review executive level talent, consider key pipeline talent and conduct succession planning. In addition, our leadership team conducts a comprehensive annual Talent Review process across our organization each year.

In 2020, we achieved top decile employee engagement and performance enablement scores as measured by an independent third party survey through continued focus on leadership development, communications, talent management and diversity and inclusion.

To keep pace with the evolving expectations of employees and external candidates, we focus on a broad array of actions, including:

•Providing career growth and development opportunities by enhancing our talent management systems, including succession planning, executive recruitment, training, development and retention strategies; and

•Holding leaders accountable for their talent decisions and measuring progress with a Diversity Talent Mobility Scorecard, reviewed quarterly by the CEO and executive leadership team.

For entry-level roles in the organization, we recruit at colleges and universities, partner with both internal and external recruiters, and offer a range of training and development programs, including:

•The Hartford’s Leadership Development program which provides curriculum to enhance leadership skill sets for all – from first-time leaders through our executive ranks;

•The Hartford’s Apprenticeship Program which prepares students for careers in insurance; and

•Our HartCode Academy Developer Training Program which provides employees with IT application development skills, providing a pipeline of diverse IT talent from across the Company.

Pay and Benefits

Compensation and Pay Equity

We offer competitive pay and benefits to our employees, with a performance-based, variable compensation structure making up a larger share of the total compensation paid to executives and senior leaders in the organization. Variable compensation

includes an annual bonus plan and long-term incentive awards. Annual bonus payouts are informed by whether the Company achieves core earnings above or below a target level that is determined from the annual operating plan set at the beginning of each year and reviewed and approved by the Compensation Committee. Long-term incentive awards include restricted stock units, performance shares and, for the most senior executives, stock options. Additional information about The Hartford’s variable compensation programs is provided in the Company’s Proxy Statement.

To help ensure pay equity, we use an independent third party compensation specialist firm to conduct statistical pay equity analyses for our U.S. employees three times per year – before, during and after the annual compensation planning cycle. This analysis enables us to identify unexplained pay disparities, conduct additional research to determine reasons for these differences and take appropriate actions to address the shortfall if necessary.

The Compensation Committee is updated annually on our compensation equity processes and status.

The Hartford also engages in a number of additional practices to ensure pay fairness, including:

•Centralized compensation function ensuring consistent programs and practices across the enterprise;