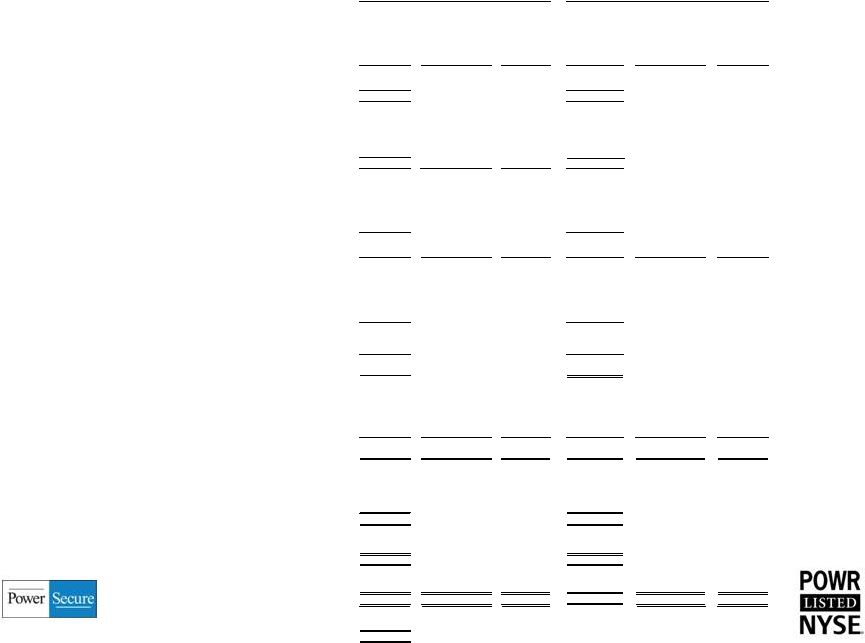

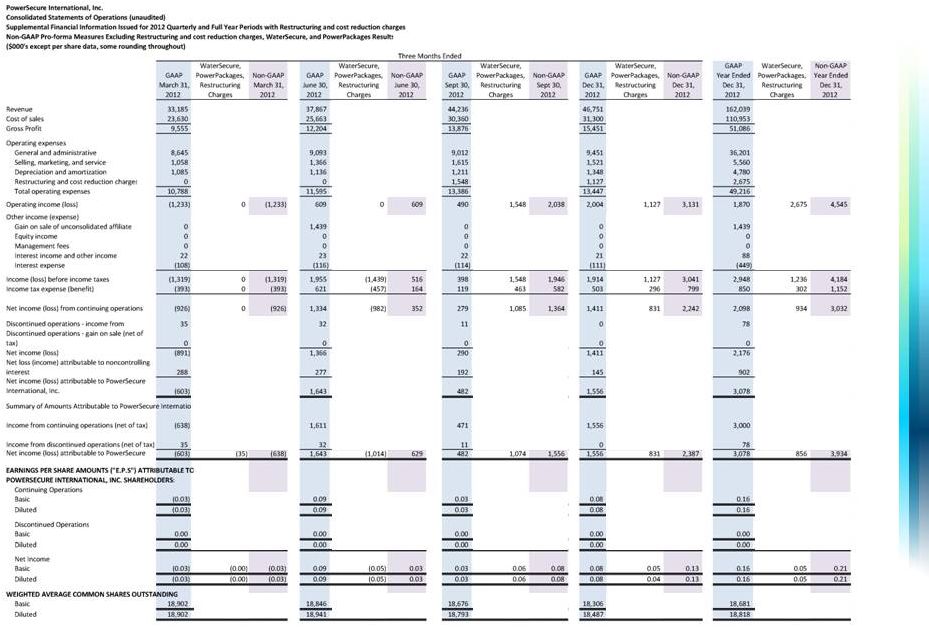

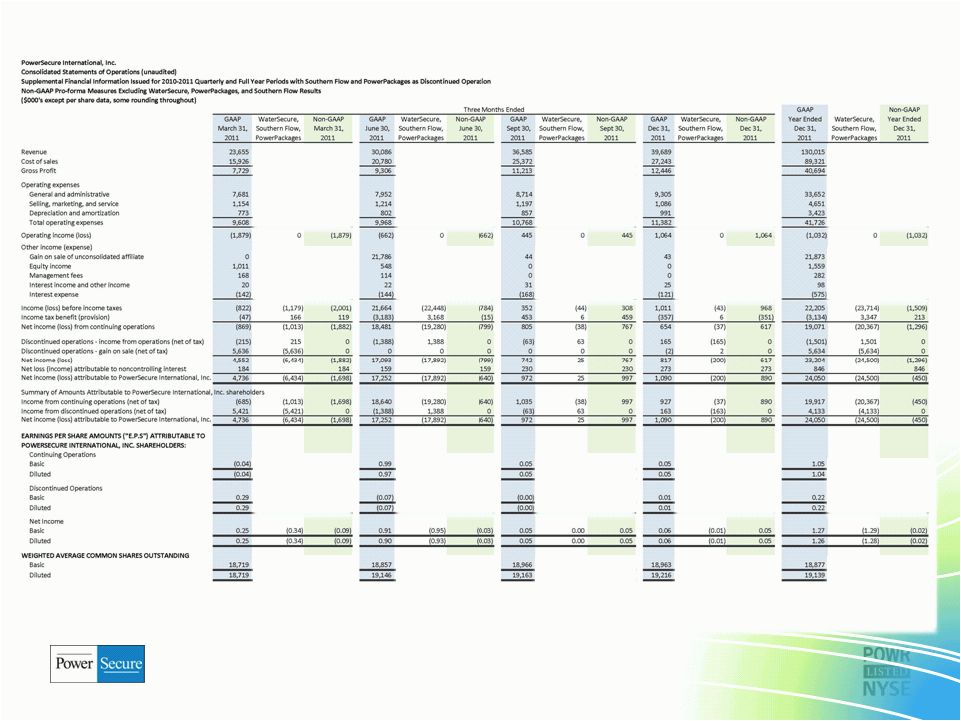

27 | © 2013 PowerSecure. All rights reserved. PowerSecure International, Inc. Non-GAAP Pro forma Measures ($000's except per share data, some rounding throughout) Three Months Ended June 30, 2013 Three Months Ended June 30, 2012 As Reported 2Q13 Acquisition Expenses for Solais, ESCO, PowerLine, IES, and PowerSecure Solar Transactions Pro forma 2Q13 As Reported 2Q12 WaterSecure, PowerPackages, and Acquisition Expenses for PowerSecure Solar Pro forma 2Q12 Revenue 70,187 37,867 Cost of sales 50,304 25,663 Gross Profit 19,883 12,204 Operating expenses General and administrative 12,511 9,093 Selling, marketing, and service 2,105 1,366 Depreciation and amortization 1,809 1,136 Restructuring and cost reduction charges 0 0 Total operating expenses 16,425 11,595 Operating income (loss) 3,458 452 3,910 609 74 683 Other income (expense) Gain on sale of unconsolidated affiliate 0 1,439 Interest income and other income 19 23 Interest expense (130) (116) Income (loss) before income taxes 3,347 452 3,799 1,955 (1,365) 590 Income tax expense (benefit) 1,305 176 1,481 621 (433) 188 Net income (loss) from continuing operations 2,042 276 2,318 1,334 (932) 402 Discontinued operations - income (loss) from operations (net of tax) 0 32 Discontinued operations - gain on sale (net of tax) 0 0 Net income (loss) 2,042 1,366 Net loss attributable to noncontrolling interest 57 277 Net income (loss) attributable to PowerSecure International, Inc. 2,099 1,643 Summary of Amounts Attributable to PowerSecure International, Inc. shareholders Income (loss) from continuing operations (net of tax) 2,099 276 2,375 1,611 (932) 679 Income (loss) from discontinued operations (net of tax) 0 0 0 32 (32) 0 Net income (loss) attributable to PowerSecure International, Inc. 2,099 276 2,375 1,643 (964) 679 EARNINGS PER SHARE AMOUNTS ("E.P.S") ATTRIBUTABLE TO POWERSECURE INTERNATIONAL, INC. SHAREHOLDERS: Continuing Operations Basic 0.11 0.09 Diluted 0.11 0.09 Discontinued Operations Basic 0.00 0.00 Diluted 0.00 0.00 Net Income Basic 0.11 0.01 0.12 0.09 (0.05) 0.04 Diluted 0.11 0.01 0.12 0.09 (0.05) 0.04 WEIGHTED AVERAGE COMMON SHARES OUTSTANDING Basic 19,024 Diluted 19,357 |