QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.2

Notice of Annual and Special Meeting of Shareholders

May 11, 2011

Management Information Circular

March 30, 2011

Table of Contents

| | | |

Invitation to Shareholders | | (ii) |

Notice of Annual and Special Meeting | | (iii) |

NORTH AMERICAN PALLADIUM LTD. MANAGEMENT INFORMATION CIRCULAR | | 1 |

Voting Information | | 1 |

General Information | | 2 |

| | Exercise of Discretion by Proxies | | 2 |

| | Voting Securities and Principal Holders Thereof | | 3 |

Business of the Meeting | | 3 |

| | 1. Presentation of Financial Statements | | 3 |

| | 2. Election of Directors | | 3 |

| | 3. Appointment of Auditors | | 7 |

| | 4. Adoption of Shareholder Rights Plan | | 7 |

| | 5. Other Matters | | 9 |

Report on Executive Compensation | | 9 |

| | Role of the Governance, Nominating and Compensation Committee | | 9 |

| | Compensation Benchmarking Study | | 10 |

| | Compensation Discussion and Analysis | | 11 |

| | Performance Graph | | 13 |

| | Compensation of Named Executive Officers | | 14 |

| | Employment Contracts and Termination and Change of Control Entitlements | | 16 |

Board of Directors Compensation | | 18 |

| | Remuneration | | 18 |

| | Stock Ownership Guidelines | | 18 |

| | Compensation of Directors | | 19 |

Statement of Corporate Governance Practices | | 21 |

Other Information | | 24 |

| | Equity Compensation Plans | | 24 |

| | Restricted Share Unit Plan | | 28 |

| | Securities Authorized for Issuance under Equity Compensation Plans | | 28 |

| | Indebtedness of Directors and Executive Officers | | 29 |

| | Directors' and Officers' Liability Insurance | | 29 |

| | Interest of Certain Persons in Matters to be Acted Upon | | 29 |

| | Interest of Certain Persons in Material Transactions | | 29 |

| | Shareholder Proposals for the 2012 Annual Meeting | | 29 |

| | Additional Information | | 30 |

Directors' Approval | | 30 |

Schedule A — Resolution: Adoption of Rights Plan | | A-1 |

Appendix A — Description of Rights Plan | | A-2 |

Schedule B — Mandate of the Board of Directors | | B-1 |

i

INVITATION TO SHAREHOLDERS

March 30, 2011

Dear Shareholder,

On behalf of the board of directors, management and employees of North American Palladium ("NAP"), we invite you to attend the annual and special meeting of shareholders which will take place on Wednesday, May 11, 2011 at 10:00 a.m. (Toronto time) at the TSX Broadcast Centre, in Toronto, Ontario, Canada. The meeting is your opportunity to hear first-hand about our performance in 2010 and our plans to ensure NAP remains a valued investment, to meet with NAP's board of directors, senior management and fellow shareholders and to vote in person on the items of business.

We encourage you to read the attached management information circular as it describes who can vote, how to vote, and what the meeting will cover. It also provides information on each of our director nominees, outlines our compensation practices and provides information about corporate governance and the board of directors' role and responsibilities.

If you are unable to attend the meeting in person, we encourage you to vote your common shares by any of the means available to you, as described in the management information circular and proxy form.

Additional documentation and information concerning NAP is available on our website at www.nap.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Paper copies may also be requested free of charge from our Corporate Secretary.

Sincerely,

| | |

| |  |

André J. Douchane

Chairman of the Board | | William J. Biggar

President and Chief Executive Officer |

ii

NOTICE OF ANNUAL AND SPECIAL MEETING

NORTH AMERICAN PALLADIUM LTD.

200 Bay St., Suite 2350

Royal Bank Plaza, South Tower

Toronto, Ontario, Canada M5J 2J2

Notice is hereby given that the annual and special meeting of shareholders (the "Meeting") of North American Palladium Ltd. ("NAP" or the "Company") will be held at the TSX Broadcast Centre, The Exchange Tower, 130 King Street West, Toronto, Ontario, Canada on May 11, 2011, at 10:00 a.m. (Toronto time) for the following purposes:

- 1.

- To receive the audited consolidated financial statements of the Company for the year ended December 31, 2010 and the report of the auditors thereon;

- 2.

- To elect directors of the Company for the ensuing year;

- 3.

- To consider and, if thought fit, approve the appointment of KPMG LLP, Chartered Accountants, as auditors for the Company, and to authorize the directors of the Company to fix the auditors' remuneration;

- 4.

- To consider and, if thought fit, pass an ordinary resolution (the "Rights Plan Resolution") to ratify, confirm and approve the adoption of the shareholder rights plan of the Company approved by the board of directors on March 22, 2011, as set out in Schedule "A" to the Circular; and

- 5.

- To transact such further or other business as may properly come before the Meeting or any adjournment or adjournments thereof.

A copy of the management information circular and form of proxy with respect to matters to be dealt with at the Meeting are included herewith.

By resolution of the board of directors of the Company, shareholders of record at the close of business on March 22, 2011 will be entitled to notice of and to vote at the Meeting in person or by proxy.

DATED at Toronto, Ontario as of March 30, 2011.

| | |

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

| | | André J. Douchane

Chairman of the Board |

Shareholders unable to attend the Meeting in person are requested to complete, date, sign and return the enclosed form of proxy. All forms of proxy must be deposited with Computershare Investor Services Inc. no later than 5:00 p.m. (Toronto time) on May 9th, 2011 or, in the case of any adjournment or postponement of the meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed meeting.

iii

NORTH AMERICAN PALLADIUM LTD.

MANAGEMENT INFORMATION CIRCULAR

VOTING INFORMATION

Who is soliciting my proxy?

The management of NAP is soliciting your proxy for use at the annual and special meeting of shareholders of the Company.

What will I be voting on?

You will be voting on:

- •

- the election of directors;

- •

- the appointment of KPMG LLP, Chartered Accountants as the Company's auditors;

- •

- the adoption of the shareholder rights plan of the Company; and

- •

- any other business brought before the meeting if any other matter is put to a vote.

What else will happen at the meeting?

The financial statements for the year ended December 31, 2010 together with the auditors' report on these statements will be presented at the meeting.

How will these matters be decided at the meeting?

A majority of votes cast, by proxy or in person, will constitute approval of each of the matters specified in this Circular.

How many votes do I have?

You will have one vote for every common share of the Company you own at the close of business on March 22, 2011, the record date for the meeting.

How do I vote?

If you are eligible to vote and your common shares are registered in your name, you can vote your common shares in person at the meeting or by proxy, as explained below. If your common shares are registered in the name of an intermediary, such as a bank, trust company, securities broker or other financial institution, please see the instructions below under the heading "How can a non-registered shareholder vote?".

Voting by proxy

In addition to voting in person at the meeting, you may vote by mail by completing the form of proxy and returning it in the enclosed envelope to Computershare Investor Services Inc., Proxy Department, 9th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1.You may also appoint a person (who need not be a shareholder), other than one of the directors or officers named in the proxy, to represent you at the meeting by inserting the person's name in the blank space provided in the proxy and returning the proxy no later than 48 hours prior to the commencement of the meeting or any adjournment thereof. You may also vote by telephone or via the Internet. To vote by telephone, in Canada and the United States only, call the toll-free number listed on the proxy from a touch tone phone. When prompted, enter your Holder Account Number and Proxy Access Number listed on the proxy and follow the voting instructions. To vote via the Internet, go to the website specified on the proxy and enter your Holder Account Number and Proxy Access Number listed on the proxy and follow the voting instructions on the screen. If you vote by telephone or via the Internet, do not complete or return the form of proxy.

How will my proxy be voted?

On the form of proxy, you can indicate how you would like your proxyholder to vote your common shares for any matter put to a vote at the meeting and on any ballot, and your common shares will be voted accordingly.

If you do not indicate how you want your common shares to be voted, the persons named in the proxy intend to vote your common shares in the following manner:

- •

- for the election of management's nominees as directors;

- •

- for the appointment of KPMG LLP, Chartered Accountants, as the Company's auditors and for the authorization of the directors to fix the remuneration of the auditors;

- •

- for the adoption of the shareholder rights plan of the Company; and

- •

- for management's proposals generally.

What if I want to revoke my proxy?

You can revoke your proxy at any time prior to its use. You may revoke your proxy by requesting, or having your authorized attorney request, in writing to revoke your proxy. This request must be delivered to NAP's address (as listed in this Circular) before the last business day preceding the day of the meeting or to the Chairman of the meeting on the day of the meeting or any adjournment.

How are proxies solicited?

The solicitation of proxies will be made primarily by mail but proxies may also be solicited personally, by facsimile or by telephone by directors, officers or other employees of the Company for which no additional compensation will be paid. We have also retained Phoenix Advisory Partners to solicit proxies in Canada and the United States at a fee of approximately $25,000, plus out-of-pocket expenses. The cost of the solicitation will be paid by the Company.

How can a non-registered shareholder vote?

If your common shares are not registered in your name, they will be held by an intermediary such as a bank, trust company, securities broker or other financial institution. Each intermediary has its own procedures which should be carefully followed by non-registered shareholders to ensure that their common shares are voted at the meeting. If you are a non-registered shareholder, you should have received this Circular, together with a voting instruction form from your intermediary. To vote in person at the meeting, follow the instructions set out on the voting instruction form, appoint yourself a proxyholder and return the voting instruction form in the envelope provided.

GENERAL INFORMATION

This management information circular (this "Circular") is furnished in connection with the solicitation of proxies by the management of the Company to be used at the Annual and Special Meeting (the "Meeting") of the shareholders of the Company to be held at the time, place and for the purposes indicated in the enclosed Notice of Annual and Special Meeting of Shareholders (the "Notice") and any adjournment thereof.

Unless otherwise indicated, the information in this Circular is dated as of March 30, 2011 and all dollar or "$" figures in this Circular refer to Canadian dollars.

Exercise of Discretion by Proxies

The common shares of the Company (each a "Common Share") represented by the enclosed form of proxy will be voted or withheld from voting on any motion, by ballot or otherwise, in accordance with any indicated instructions.In the absence of such direction, such Common Shares will be voted FOR the resolutions referred to in the form of proxy.

If any amendment or variation to the matters identified in the Notice is proposed at the Meeting or any adjournment thereof, or if any other matters properly come before the Meeting or any adjournment thereof, the enclosed form of proxy confers discretionary authority to vote on such amendments or variations or such other matters according to the best judgment of the appointed proxyholder. At the time of printing this Circular,

2

management of the Company knows of no such amendments, variations or other matters to come before the Meeting other than the matters referred to in the Notice.

Voting Securities and Principal Holders Thereof

At the close of business on March 22, 2011 (the "Record Date"), 162,379,397 Common Shares were issued and outstanding. Each Common Share entitles its holder to one vote on each matter voted on at the Meeting.

At the close of business on March 22, 2011 (the "Record Date"), 8,760,000 Common Share purchase warrants ("Warrants") were issued and outstanding. The Warrants were issued in connection with the unit offering completed in April 2010. Each Warrant entitles its holder to purchase one Common Share at an exercise price of $6.50, subject to adjustment, at any time prior to 5:00 p.m. (Toronto time) on October 28, 2011. Warrant holders are not entitled to vote at the meeting.

On February 22, 2011, Kaiser-Francis Oil Company ("KFOC") reported that it held 19,292,524 Common Shares, representing approximately 11.9% of the issued and outstanding Common Shares. KFOC is a wholly owned subsidiary of GBK Corporation, a private company controlled by Mr. George B. Kaiser of Tulsa, Oklahoma and members of his family. To the knowledge of the directors and officers of the Company, no other person or company beneficially owns, directly or indirectly, or exercises control or direction over, voting securities of the Company carrying more than 10% of the voting rights attached to the voting securities of the Company.

BUSINESS OF THE MEETING

1. Presentation of Financial Statements

The audited consolidated financial statements of the Company for the financial year ended December 31, 2010 and the auditors' report thereon will be placed before the Meeting.

The audited consolidated financial statements of the Company for the fiscal year ended December 31, 2010 and the auditors' report thereon are also included in NAP's 2010 Annual Report, which is being mailed to the Company's registered and beneficial shareholders who requested it. Management will review NAP's consolidated financial results at the Meeting, and shareholders and proxyholders will be given an opportunity to discuss these results with management. The 2010 Annual Report is available on NAP's website at www.nap.com and on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com.

2. Election of Directors

It is proposed that the seven people listed below be nominated for election as directors of NAP to hold office until the next annual meeting or until their successors are elected or appointed, unless the director resigns or the office becomes vacant through death or any other reason in accordance with the by-laws of the Company. All of the proposed nominees are currently directors of NAP whose term of office expires at the Meeting unless re-elected; they have been directors since the dates indicated. The articles of the Company provide for a board of directors (the "Board") consisting of a minimum of one and a maximum of ten directors. The Board has set the number of directors at 7.

Management of the Company has been informed that, if elected, each of such nominees would be willing to serve as a director. However, in the event any such nominee is unable or unwilling to serve as a director, proxies will be voted in favour of the remaining nominees and for such other substitute nominee as the Board may designate.

Majority Voting Policy

As part of its ongoing review of corporate governance practices, on March 30, 2011, the Board of Directors adopted a policy providing that if any proposed nominee receives a greater number of votes "withheld" from his or her election than votes "for" such election, then such nominee is expected to offer to resign. The Governance, Nominating and Compensation Committee will review any such offer of resignation and make a recommendation to the Board. The Board will determine whether to accept the resignation and will announce

3

its decision within 90 days of the shareholders' meeting. If the Board rejects the offer, it will disclose the reasons why. If the Board accepts the offer, it may appoint a new director to fill the vacancy.

Management of the Company recommends that shareholders vote FOR the election of the individuals set forth in the table below as directors of the Company. Unless directed otherwise, the persons designated in the accompanying form of proxy intend to vote FOR the election of the proposed nominees.

The table below sets forth information regarding the proposed nominees for election as directors (all of whom have agreed to stand for election) together with their municipality of residence, year in which they joined the Board, their independence status, areas of expertise, principal occupation(s) during the five preceding years and Board Committee memberships, as well as other public, private and not-for-profit affiliations. Also set forth is the number of common shares, warrants and stock options held as of March 30, 2011.

| | |

| |

Director

| | Profile

|

|---|

| |

Steven R. Berlin, 66

Tulsa, Oklahoma, USA

Shares: 44,000

Warrants: 1,500

Options: 82,500 |

|

Mr. Berlin is a business consultant. Prior to 2006, he was Vice-President at KFOC, where he worked part-time for two years following four years of full-time work as Vice-President and Chief Financial Officer. Prior to joining KFOC, Mr. Berlin taught at the University of Tulsa for three years where he also served a year as acting associate Dean of the College of Business and acting Director of the School of Accounting. Before joining the University of Tulsa, Mr. Berlin spent 25 years with Citgo Petroleum Corporation, latterly as Senior VP Finance and Administration and Chief Financial Officer. Mr. Berlin is a Certified Public Accountant, has a bachelor's degree from Duquesne University, an MBA from the University of Wisconsin Madison and has completed the Executive Management Program at Stanford University.

Areas of Expertise: Finance, metals and mining, executive management, audit and accounting

NAP Board Details:

• Director since February 2001

• Committees: Audit Committee (Chair); Governance, Compensation and Nominating Committee

• Meets share ownership guidelines

• Independent

Other Public Company Boards: Orchids Paper Products |

| |

William J. Biggar, 58

Toronto, Ontario, Canada

Shares: 71,275

Warrants: 10,000

Options: 1,100,000 |

|

Mr. Biggar has been the President and Chief Executive Officer of NAP since October 1, 2008. He has significant expertise in the mining sector developed from his extensive experience in corporate finance, corporate development and mergers & acquisitions. He has served as Senior Vice President at Barrick Gold Corporation and The Horsham Corporation and has 10 years of experience in investment banking. Mr. Biggar has also held the position of Executive Vice President of Magna International as well as President and CEO of MI Developments. A Chartered Accountant, he holds Master of Business Administration and Bachelor of Commerce (with distinction) degrees from the University of Toronto.

Areas of Expertise: Metals and mining, executive management, finance

NAP Board Details:

• Director since October 2008

• Committees: Attends Committee meetings as an observer on invitation of the Committee chairperson

• Meets share ownership guidelines

• Not independent (member of management)

Other Public Company Boards: Silver Bear Resources Inc. and Primaris Retail REIT |

| |

4

| | |

| |

Director

| | Profile

|

|---|

| |

C. David A Comba, 67

Burlington, Ontario, Canada

Shares: 23,500

Warrants: 500

Options: 107,500 |

|

Mr. Comba, has over 40 years of experience as an exploration advocate and senior mining executive. As Chief Exploration Geologist of Falconbridge Limited in Sudbury, Ontario, he led the team that discovered the highgrade footwall component of the Thayer Lindsley mine. Mr. Comba was Vice-President, Exploration of Falconbridge Gold Corporation prior to its takeover by Kinross Gold Corporation. Following the takeover, he became President and Chief Executive Officer of a Kinross-controlled junior exploration company listed on the TSX. Mr. Comba was Director of Issues Management with the Prospectors and Developers Association of Canada from 1998 to 2005, during which time he led the successful lobby effort for the re-introduction of enhanced or "super" flow-through shares. Mr. Comba has Bachelor's and Masters' degrees in geology from Queen's University in Kingston, Ontario.

Areas of Expertise: Metals and mining, mineral geology

NAP Board Details:

• Director since March 2006

• Committees: Technical, Environment, Health and Safety Committee (Chair); Audit Committee

• Meets share ownership guidelines

• Independent

Other Public Company Boards: First Nickel Inc., Cogitore Resources Inc. and Regent Pacific Group Ltd. |

| |

André J. Douchane, 60

Toronto, Ontario, Canada

Shares: 15,500

Options: 191,000 |

|

Mr. Douchane is mining engineer with over 40 years of mining experience managing precious metals operations. Mr. Douchane is the President and Chief Executive Officer and director of Starfield Resources Inc., an exploration and development company operating in Nunavut, Canada. Mr. Douchane previously served as NAP's President and Chief Executive Officer, from April 2003 to January 2006, and has held senior management positions with several international publicly-traded precious metal mining companies including Vice President, Operations of Franco and Euro-Nevada (Newmont Mining Corporation).

Areas of Expertise: Metals and mining, mine engineering, executive management

NAP Board Details:

• Director since April 2003

• Committees: Technical, Environment, Health and Safety Committee; Governance, Compensation and Nominating Committee until Nov 18, 2010

• Meets share ownership guidelines

• Independent

Other Public Company Boards: Osisko Mining Corporation |

| |

Robert J. Quinn, 55

Houston, Texas, USA

Shares: 21,000

Warrants: 1,250

Options: 107,500 |

|

A founding partner of the Houston mining transactional law firm Quinn & Brooks LLP, Mr. Quinn has over 31 years of legal and management experience, including as Vice President and General Counsel for Battle Mountain Gold Company. He has extensive experience in M&A transactions, corporate governance, public disclosure, governmental affairs, environmental law and land management. Mr. Quinn has a Bachelor of Science degree in Economics from the University of Denver, a juris doctorate degree from the University of Denver College of Law and has completed two years of graduate work in mineral economics at the Colorado School of Mines.

Areas of Expertise: Metals and mining, law, mineral economics

NAP Board Details:

• Director since June 2006

• Committees: Technical, Environment, Health and Safety Committee; Audit Committee

• Meets share ownership guidelines

• Independent

Other Public Company Boards: Formation Metals Inc., Mercator Minerals Ltd. and Great Western Minerals Group Ltd. |

| |

5

| | |

| |

Director

| | Profile

|

|---|

| |

Greg J. Van Staveren, 50

Etobicoke, Ontario, Canada

Shares: 42,500

Options: 107,500 |

|

Mr. Van Staveren is the President of Strategic Financial Services, a private consulting company providing business advisory services. Mr. Van Staveren is also part-time Chief Financial Officer for Starfield Resources Inc. (SRU:TSX) and AIM Health Group Inc. (AHG:TSX). He was the Chief Financial Officer of MartinRea International Inc. (MRE:TSX) from 1998 to September 2001 and was previously a partner in the Mining Group at KPMG LLP. Mr. Van Staveren is a Chartered Accountant and a Certified Public Accountant and holds a Bachelor of Math (Honours) degree from the University of Waterloo.

Areas of Expertise: metals and mining, finance, audit and accounting

NAP Board Details:

• Director since February 2003

• Committees: Governance, Compensation and Nominating Committee (Chair); Audit Committee

• Meets share ownership guidelines

• Independent

Other Public Company Boards: QuadraFNX Mining Ltd. and MacMillian Minerals Inc. |

| |

William J. Weymark, 57

West Vancouver, British Columbia, Canada

Shares: 21,700

Options: 102,500 |

|

Mr. Weymark is President of Weymark Engineering Ltd., a Company providing consulting services to businesses in the private equity, construction and resource sector. He is also a director of the VGH & UBC Hospital Foundation Board, and several private companies. Mr. Weymark is active with the BC Lions as a Founder of their business association and a Member of the Industry Advisory Committee for the Norman B. Keevil Institute of Mining Engineering at the University of British Columbia. Until June 2007, Mr. Weymark was President and CEO of Vancouver Wharves/BCR Marine, a transportation firm located on the west coast of British Columbia. Prior to joining Vancouver Wharves in 1991, Mr. Weymark spent 14 years in the mining industry throughout western Canada working on the start-up and operation of several mines.

Areas of Expertise: Metals and mining, executive management

NAP Board Details:

• Director since January 2007

• Committees: Governance, Compensation and Nominating Committee; Technical, Environment, Health and Safety Committee

• Meets share ownership guidelines

• Independent |

| |

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Mr. Berlin was a director of Ozark Airlines, Inc., doing business as Great Plains Airlines, Inc., which filed a voluntary bankruptcy petition under Chapter 11 of the United StatesBankruptcy Code on January 23, 2003. Mr. Berlin resigned from the board of directors of Ozark Airlines on December 14, 2004. Ozark Airlines filed a motion to convert the bankruptcy to Chapter 7, which was granted on March 11, 2005.

Mr. Biggar was a director of Mosaic Group Limited from October 1995 to May 2002. In December 2002, Mosaic Group Limited filed for protection from its creditors under theCompanies' Creditor Arrangement Act (Canada). Mr. Biggar was also a director of Cabletel Ltd. from June 2001 to November 2003. In June 2004, Cabletel Ltd. filed a proposal under theBankruptcy and Insolvency Act (Canada).

Mr. Comba was a director of Black Pearl Minerals Consolidated Inc. from December 1998 to April 2004. In July 2002, the Ontario Securities Commission ("OSC") issued a cease trading order against Black Pearl for failing to meet its continuous disclosure obligations, which order was revoked on October 3, 2002. A second cease trading order was issued by the OSC on February 3, 2004 for failure to file financial statements, which order was revoked on February 18, 2004.

6

3. Appointment and Remuneration of Auditors

KPMG LLP, Chartered Accountants ("KPMG") have been the auditors of the Company since May 2004. It is proposed that KPMG be reappointed as the auditors of the Company to hold office until the next annual meeting of shareholders and that the Board be authorized to fix their remuneration.

Unless directed otherwise, the persons designated in the accompanying form of proxy intend to vote FOR the appointment of KPMG as auditors of the Company until the next annual meeting of shareholders and to authorize the Board to fix their remuneration. The appointment of auditors, to be effective, must be approved by a majority of the votes cast in person or represented by proxy at the Meeting.

4. Adoption of Shareholder Rights Plan

At the Meeting, shareholders will be asked to consider and, if thought advisable, approve the Rights Plan Resolution approving the adoption of the shareholder rights plan. The Board has determined that the shareholder rights plan is in the best interests of the Company and unanimously recommends that the shareholders vote for the approval of the Rights Plan Resolution.

Background and Summary of the Rights Plan

The Company and Computershare Investor Services Inc. (the "Rights Agent") entered into an agreement (the "Rights Plan") dated as of March 22, 2011 to implement the Rights Plan. A summary of the key features of the Rights Plan is attached as Appendix "A" to this Circular. This summary is qualified in its entirety by reference to the complete text of the Rights Plan, which is available on SEDAR at www.sedar.com. The Rights Plan is also available to any shareholder on request from the Corporate Secretary. Shareholders wishing to receive a copy of the Rights Plan should contact the Company by telephone at (416) 360-7590 or by facsimile at (416) 360-7709, in both cases to the attention of the Corporate Secretary. All capitalized terms used in this section of this Circular and Appendix "A" and not otherwise defined in the Circular have the meanings set forth in the Rights Plan unless otherwise indicated.

Objectives of the Rights Plan

The Rights Plan is not being proposed by management in anticipation of any pending or threatened take-over bid, nor to deter take-over bids generally. The primary objectives of the Rights Plan are to seek to ensure that, in the context of a bid for control of the Company through an acquisition of Common Shares, all shareholders have an equal opportunity to participate in the bid and are given adequate time to assess the bid. The Rights Plan in no way prohibits a change of control of the Company in a transaction that is procedurally fair to shareholders. The rights of shareholders to seek a change in the Board or to influence or promote action of the Board in a particular manner will not be affected by the Rights Plan. The approval of the Rights Plan by the shareholders will not alter, diminish or reduce the fiduciary duties of the directors of the Company when faced with a potential change of control transaction or restrict the potential actions that might be taken by the directors in such circumstances.

The Company believes that the Rights Plan, as currently drafted, conforms to "new generation" rights plan guidelines set out by Institutional Investor Services Inc. ("ISS"). Among other things these new generation rights plans: (i) remove the board's discretion to take certain actions which normally would be considered to be in accordance with its fiduciary duties (e.g. to determine whether actions by shareholders constitute a change in control or to redeem the rights or waive the plan's application without a shareholder vote), (ii) permit partial bids, and (iii) contain restrictions on certain equity financings. Although the Board of Directors may not agree with all of the relevant ISS guidelines, it has nevertheless incorporated them in the Rights Plan in an attempt to avoid a negative recommendation by ISS.

In approving the Rights Plan, the Board considered a number of factors, including the following concerns arising from the existing securities law framework that applies to take-over bids in Canada:

- 1.

- Unequal Treatment. While existing Canadian securities legislation has established a number of procedural requirements for the conduct of take-over bids, which generally require that a take-over bid be made to all shareholders and that a bidder offer identical consideration to all shareholders, the take-over bid regime

7

includes exemptions to the formal bid requirements that could operate to allow control of an issuer to be acquired without the making of a formal take-over bid to all shareholders. Specifically, Canadian securities legislation allows a small group of securityholders to dispose of their securities pursuant to a private agreement at a premium to market price, which premium is not shared with other securityholders. In addition, a person may slowly accumulate securities through stock exchange acquisitions which may result, over time, in an acquisition of control without payment of fair value for control or a fair sharing of a control premium among all securityholders. It may also be possible to engage in transactions outside of Canada without regard to these protections. The Rights Plan addresses these concerns by applying to all acquisitions that would result in a person owning 20% or more of the Common Shares (subject to certain limited exceptions), thereby generally precluding a person from acquiring a control interest in the Company without making a Permitted Bid to all shareholders.

- 2.

- Time. Current legislation permits a take-over bid to expire in 35 days. The Board is of the view that this generally is not sufficient time to permit shareholders to consider a take-over bid and to make a reasoned and considered decision. The Rights Plan provides a mechanism for "Permitted Bids" whereby the minimum expiry period for a Take-over Bid must be 60 days after the date of the bid and the bid must remain open for a further period of ten Business Days after an offeror publicly announces that the Common Shares deposited or tendered and not withdrawn constitute more than 50% of the Common Shares outstanding held by Independent Shareholders. The Rights Plan is intended to provide shareholders with adequate time to properly evaluate any offer, and also to provide the Board with additional time to assess any offer and, if appropriate, to explore and develop alternatives for maximizing shareholder value. Those alternatives could include, among other things, identifying other potential bidders, conducting an orderly auction, or developing a restructuring or other alternative that could enhance shareholder value.

- 3.

- Pressure to Tender. A shareholder may feel pressured to tender to a bid that the shareholder considers to be inadequate out of a concern that failing to tender may result in the shareholder being left with illiquid or minority discounted securities in the Company. This is particularly so in the case of a partial bid for less than all securities of a class, where the bidder wishes to obtain a control position but does not wish to acquire all of the Common Shares. The Rights Plan provides a mechanism in the Permitted Bid provision that is intended to address this concern by requiring that a take-over bid remain open for acceptance for a further 10 Business Days following public announcement that more than 50% of the Common Shares held by Independent Shareholders have been deposited and not withdrawn. This mechanism is intended to lessen any undue pressure to tender that may be encountered by a shareholder, as the shareholder will have the ability to tender during a subsequent offering period after learning that a majority of the other shareholders of the Company have tendered to the offer.

General Impact of the Rights Plan

It is not the intention of the Board, in approving the Rights Plan, to secure the continuance of existing directors or management in office, nor to avoid a bid for control of the Company in a transaction that is procedurally fair. For example, through the Permitted Bid mechanism, described in more detail in the summary contained in Appendix "A" to this Circular, shareholders may tender to a bid that meets the Permitted Bid criteria without triggering the exercise of Rights under the Rights Plan, regardless of the value of the consideration being offered under the bid. The Rights Plan should not preclude any shareholder from utilizing the proxy mechanism under theCanada Business Corporations Act ("CBCA") and securities laws to promote a change in the management or direction of the Company, or the Board, and is designed to have no effect on the rights of holders of outstanding Common Shares to requisition a meeting in accordance with the provisions of the CBCA, or to enter into agreements with respect to voting their Common Shares. The definitions of "Acquiring Person" and "Beneficial Ownership" have been developed to minimize concerns that the Rights Plan may be inadvertently triggered or triggered as a result of an overly-broad aggregation of holdings of institutional shareholders and their clients. Persons who currently own more than 20% of the Common Shares are known as "Grandfathered Persons" under the Rights Plan. Such ownership will not trigger the exercise of rights under the Rights Plan unless such persons increase their ownership of Common Shares by more than one percent. To the knowledge of the Company, no person currently beneficially owns more than 20% of the Common Shares. The Rights Plan is not expected to interfere with the day-to-day operations of the Company. The issuance of the

8

Rights does not in any way alter the financial condition of the Company, impede its business plans or alter its financial statements. In summary, the Board believes that the dominant effect of the Rights Plan will be to ensure equal treatment of all shareholders in the context of an acquisition of control.

Approval

At the Meeting, shareholders will be asked to consider and, if thought advisable, ratify, confirm and approve the adoption of the Rights Plan. Pursuant to the terms of the Rights Plan and applicable stock exchange requirements, the number of votes required to pass the resolution in respect of the Rights Plan shall be not less than (i) a majority of the votes cast by shareholders, and (ii) a majority of votes cast by shareholders, without giving effect to any votes cast (a) by any Shareholder that, directly or indirectly, on its own or in concert with others, holds or exercises control over more than 20% of the outstanding Common Shares of the Corporation, if any; and (b) by the associates, affiliates and insiders of any referred to in (a) above, in each case present either in person or by proxy at the Meeting. As of the Record Date, based on publicly available information, to the knowledge of the Company, no shareholder, directly or indirectly, individually or in concert with any other person, beneficially owns, or exercises control or direction over, 20% or more of the outstanding Common Shares. A copy of the Rights Plan Resolution is set out in Schedule "A" of this Circular.

Unless directed otherwise, the persons designated in the accompanying form of proxy intend to vote FOR the adoption of the Rights Plan. In order for the resolution to pass, the resolution must be approved by a majority of the votes cast in person or represented by proxy at the Meeting.

5. Other Matters

Management is not aware of any other matters to come before the Meeting other than those set out in the attached Notice. If other matters come before the Meeting, it is the intention of the individuals named in the form of proxy to vote in accordance with their best judgment in such matters.

REPORT ON EXECUTIVE COMPENSATION

Role of the Governance, Nominating and Compensation Committee

In 2010, the Governance, Nominating and Compensation Committee was comprised of Messrs. Van Staveren (Chairman), Berlin, and Weymark. Mr. Douchane was also a member of the Committee in 2010 but he stepped down on November 18, 2010.

One of the roles of the Committee is to undertake periodic, independent reviews of market conditions to ensure that the executive officers of the Company are paid competitively relative to other comparable participants in the industry. When deemed necessary, the Committee may call upon outside resources to assist with these reviews and to ensure that the comprehensive executive compensation packages available to executive officers are sufficient, without being excessive, to retain the existing compliment of executive officers and to recruit others into this group as an integral part of facilitating and sustaining the advancement of the Company's strategic objectives and its ongoing operations. Similarly, the Committee reviews and ensures that the directors' compensation packages are competitive in light of the time commitments required from directors relative to other comparable participants in the industry. Based on such reviews, the Committee makes recommendations to the Board with respect to changes to executive compensation and director compensation. For more information regarding this Committee, see "Corporate Governance — Governance, Nominating and Compensation Committee" in this Circular.

In assessing 2010 performance and determining appropriate compensation levels, the Governance, Nominating and Compensation Committee considered, among other things, the positive results of the scoping study for the Offset Zone, the discovery of new mineralized areas near the Lac des Iles mine, the completion of a $100,000,000 equity financing in April 2010, exploration success at the Sleeping Giant gold mine and the Flordin gold property, the acquisition of the Vezza gold project in the Abitibi region, the restart of palladium production at the Lac des Iles ("LDI") mine, development at the Roby and Offset Zones, the establishment of a $30 million operating line of credit, the addition of NAP to the S&P/TSX SmallCap Index in September 2010,

9

and the achievement of a two-year track record without a single injury at LDI that resulted in lost time when determining appropriate compensation levels.

Compensation Benchmarking Study

In 2010, Mercer (Canada) Limited ("Mercer") was retained as an advisor to the Committee to complete a market review of the current compensation levels of the individuals who served in the capacity of President and Chief Executive Officer, the Vice President, Finance and Chief Financial Officer and the other three most highly compensated executive officers of the Company who served in such capacities during the year ended December 31, 2010 and whose total salary and bonus, individually, exceeded $150,000 (collectively, the "Named Executive Officers" and each a "Named Executive Officer"), and the Company's non-executive directors relative to a comparator group of Canadian mining companies. Although Mercer provides advice to the Committee, the decisions reached by the Committee may reflect factors and considerations other than the information and findings provided by Mercer.

In selecting the comparator group, the Committee sought to select a comparator group comprised primarily of mid-tier TSX listed mining companies with a Canadian head office, a focus on palladium or gold production, less than 3 operating and/or near-term production mines, comparable revenue and a market capitalization of less than $2 billion. The 11 peer companies chosen for comparison were: Alamos Gold Inc., Aurizon Mines Ltd., Dundee Precious Metals Inc., Eastern Platinum Ltd., Gammon Gold Inc., Golden Star Resources Ltd., Great Basin Gold Ltd., Lake Shore Gold Corp., Jaguar Mining Inc., Northgate Minerals Corp. and Stillwater Mining Co (the "comparator group").

Review of Named Executive Officers Compensation

Mercer compared the Company's compensation for its executive officers against the comparator group and provided its findings in an executive compensation review dated December 1, 2010.

Mercer's report found that the annual base salaries of the Chief Executive Officer, Chief Financial Officer and Vice President & Chief Operating Officer were competitive relative to the median of the market based on functionally-matched positions of the Company's comparator group. Mercer could not identify functionally matched positions for the base salary of the Vice President, Corporate Development, General Counsel & Corporate Secretary or the Vice President, Operations but found base salaries, as well as the base salary of the Vice President, Exploration & Development, to be competitive relative to the average of the third, fourth and fifth highest total cash ranked Named Executive Officers of the Company's comparator group. In recommending salary adjustments for Named Executive Officers for 2011, the Committee favored a measure of internal equity over a tiered approach to the manner in which Vice Presidents were compensated. In particular, the responsibilities of certain vice presidents were viewed as being larger in scope than vice presidents in the comparator group.

The total cash compensation of the executive officers was found to be above the median of the Company's comparator group, with the exception of the Chief Financial Officer. The Chief Executive Officer was found to have a higher proportion of cash compensation relative to market. The Chief Financial Officer was found to have a lower proportion of equity and a higher proportion of base salary relative to market. The Chief Operating Officer was found to have a higher proportion of equity (which included 2010 sign-on grants) and a lower proportion of base salary relative to market. The Vice President, Exploration & Development was found to have a slightly higher proportion of equity relative to the market. The compensation mix of the Vice President, Corporate Development, General Counsel & Corporate Secretary, the Vice President, Operations and the Vice President, Exploration & Development was found to be in line with the average of the third, fourth and fifth highest total cash ranked Named Executive Officers of the Company's comparator group.

As a result, Mercer's report found that the Company's total direct compensation was positioned at or above the median of the comparator group. In light of the current robust state and competitive nature of the mining industry, the Committee is of the view that the Company should target pay above the median (i.e. at between 50% to 75%) in order to attract and retain qualified personnel.

10

Review of Director Compensation

Mercer compared the Company's compensation for its directors against compensation in the same comparator group used for the executive compensation review, and provided its findings and recommendations in a director compensation review report dated January 7, 2011.

Based on Mercer's findings, the total annual compensation (i.e. total cash and equity compensation) paid by the Company to non-executive directors was found to be competitive (i.e. at between 50% to 75%) with the total annual compensation paid to directors of the Company's comparator group. However, the equity compensation of the Company's directors was found to be in the bottom 25% of the comparator group while the annual cash retainers of the Company's directors was found to be at the top 25% of the comparator group.

Based on Mercer's findings, the Governance, Nominating and Compensation Committee recommended to the Board that cash compensation paid to non-executive directors be decreased for 2011 and that equity linked compensation, in the form of cash-settled RSUs, for directors be increased so as to be competitive at the median of the Company's comparator group. As a result, as of January 1, 2011, a minimum of 40% of directors' annual base retainer will be paid in the form of RSUs.

Compensation Discussion and Analysis

Objectives of Compensation Strategy

The primary focus of the Company's compensation strategy is to provide a comprehensive executive compensation package designed to attract and retain executive officers while taking into consideration the overall strategies and objectives of the Company. The compensation strategy also recognizes the importance of balancing the financial interests and objectives of executive officers and other members of senior management with the financial interests and objectives of shareholders.

The Governance, Nominating and Compensation Committee's compensation policy in respect of executive compensation emphasizes incentive compensation linked to business success and features three major measurement indicia: (1) the performance of the Company, (2) the performance of the employee, and (3) the compensation paid to employees with similar responsibilities and experience in comparable companies. The performance of the Company is evaluated by comparing its performance against its targeted performance for a given period and by ascertaining whether the Company met its objectives in respect of its business strategy. The performance of the employee is measured by evaluating his contribution to the performance of the Company in respect of corporate objectives as well as role specific objectives and leadership factors. The amount of bonuses paid to the Named Executive Officers for 2010 was based on each Named Executive Officer's performance against his STIP objectives. See "— Short Term (Annual Performance) Incentives" below. With respect to executive compensation, significant emphasis is placed on awarding a proper compensation mix, including cash remuneration in the form of competitive base salaries and annual bonuses and long-term incentives in the form of stock options and RSUs.

Elements of Compensation

The basic elements of the compensation for Named Executive Officers are: base salary, short-term incentives and long-term incentives.

- 1.

- Base Salary. On an individual basis, annual base salaries are reviewed for each Named Executive Officer and adjusted where it is deemed necessary. In order to ensure that base salaries are competitive relative to other similar positions within the mining industry in Canada, industry salary surveys are reviewed. Other considerations taken into account when examining base salaries include years of experience, the contribution which the Named Executive Officer can make and has made to the success of the Company, the level of responsibility and authority inherent in the Named Executive Officer's job, leadership qualities of the individual and the importance of maintaining internal equity within the Company.

- 2.

- Short Term (Annual Performance) Incentives. The Company has a short term incentive plan ("STIP") developed by the Governance, Nominating and Compensation Committee and approved by the Board, pursuant to which the Named Executive Officers are eligible for an annual bonus calculated as a percentage

11

of their annual base salary if certain performance criteria prescribed by the STIP are satisfied. The target bonus amounts for each of the Named Executive Officers in 2011 is: President & Chief Executive Officer, 100%; Vice President & Chief Operating Officer, 60%; Vice President, Finance & Chief Financial Officer, 50%; Vice President, Corporate Development, General Counsel & Corporate Secretary, 50%; and Vice President, Exploration & Development, 50%. In addition, Officers are eligible for an additional discretionary bonus for performance that the Board determines clearly exceeds expectations. See "Summary Compensation Table" in this Circular for actual bonus amounts paid to Named Executive Officers for 2010, as set out under the "Non-equity incentive plan compensation — Annual incentive plans" column of the table.

The 2010 STIP had two components and the relative weighting of each objective within these components varied for each Named Executive Officer. The two components of the 2010 STIP were: (i) corporate results (i.e. achievement of production and operating cost targets, health and safety targets, completion of scoping study, share price appreciation); and (ii) role specific and leadership factors (i.e. contribution to NAP market awareness, corporate development, promoting a safe work environment, development of corporate culture and ethical practices).

All but one of the corporate results were found to have been achieved in 2010: operating metrics at the Lac des Iles Mine were achieved, health and safety targets were achived, a positive scoping study was completed for the Offset Zone and the share price appreciated significantly in 2010. All of the operating targets for the Sleeping Giant mine were not achieved.

The role specific and leadership factors component of the 2010 STIP was determined based on objectives and relative weightings set by the Governance, Nominating and Compensation Committee for each of the Named Executive Officers. All of the role specific and leadership factors were generally achieved in 2010 (i.e. between 80% to 100% of target on an individual basis). In line with the corporate and individual results for 2010, Named Executive Officers received between 80% and 110% of their target bonus.

- 3.

- Long Term Incentives. Long-term incentives such as stock options and RSUs are a means of aligning the compensation of executive officers with the performance of the Company and the interests of shareholders. In determining whether to grant stock options or RSUs to an executive officer and in determining the number of stock options or RSUs granted, factors taken into consideration include the relative position of the individual officer, the contribution made by that officer during the review period, the number of stock options or RSUs previously granted and the resulting level of total compensation in relation to the executive's comparator group position. Executive officers may also participate in the Company's RRSP Plan (defined below), under which the Company makes matching contributions on behalf of the employee in, at the Company's discretion, cash, Common Shares issued from treasury, or a combination thereof. See also "Other Information — Equity Compensation Plans".

12

Performance Graph

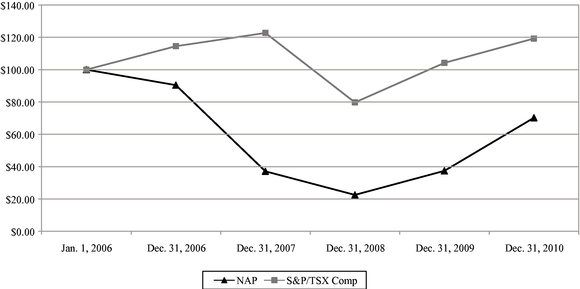

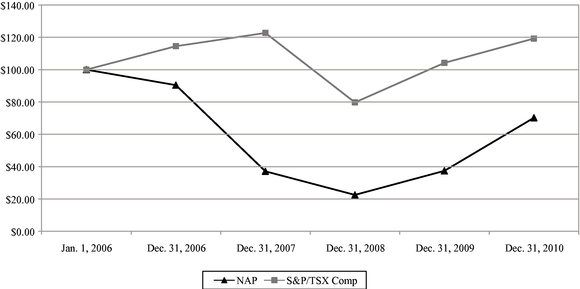

The following graph compares the total cumulative shareholder return for $100 invested in Common Shares on January 1, 2006 with the cumulative total return of S&P/TSX Composite Index for the five most recently completed financial years. The total cumulative shareholder return for $100 invested in Common Shares was $70.23 compared to $119.26 for the S&P/TSX Composite Index.

The S&P/TSX Composite Index is an index of the stock prices of the largest companies on the TSX as measured by market capitalization. The Company's stock price has outperformed the index over the past two years, having appreciated 66% in 2009 (versus 31% for the index) and 88% in 2010 (versus 14% for the index).

Compensation levels for the Named Executive Officers cannot and should not be directly compared to year over year relative share price performance. Global commodity prices, particularly the price of palladium is the single most significant factor affecting the Company's stock price and are beyond the control of the Company's management.

Over the past few years, the entire senior management team at the Company has been replaced. In order to attract and retain a new and highly qualified management team, the Governance, Nominating and Compensation Committee increased the total compensation mix to be positioned above the median of the Company's peer group of companies (see "Report on Executive Compensation — Compensation Benchmarking Study"). The Company's executive compensation package is designed to attract and retain top quality managers for the longer term to manage and grow the business through both adverse and favourable economic cycles.

13

Compensation of Named Executive Officers

The following table sets forth all annual and long term compensation for services in all capacities to the Company and its subsidiaries for each of the past three fiscal years ended December 31 in respect of the Named Executive Officers.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| | Non-equity incentive plan compensation | |

| |

| |

|---|

Name and

principal position | | Year | | Salary

($) | | Share-

based

awards(1)

($) | | Option-

based

awards(2)

($) | | Annual

incentive

plans(3)

($) | | Long-term

incentive

plans

($) | | All other

compensation(4)

($) | | Total

compensation

($) | |

|---|

William J. Biggar

President & Chief Executive Officer | | | 2010

2009

2008 | | | 500,000

500,000

125,000 |

(5) | | Nil

Nil

50,000 | | | 801,000

103,500

1,012,500 | | | 400,000

475,000

Nil | | Nil

Nil

Nil | | | 15,135

15,562

2,679 | | | 1,716,135

1,094,062

1,190,179 | |

Jeffrey A. Swinoga

Vice President, Finance & Chief Financial Officer | | | 2010

2009 | | | 270,000

121,673 |

(5) | | Nil

Nil | | | 333,750

437,750 | | | 90,000

40,000 | | Nil

Nil | | | 10,272

6,655 | | | 704,022

606,078 | |

Trent C. A. Mell

Vice President, Corporate Development, HR, General Counsel & Corporate Secretary | | | 2010

2009

2008 | | | 260,000

220,000

210,833 | | | Nil

Nil

120,000 | | | 333,750

310,500

Nil | | | 90,000

90,000

30,000 | | Nil

Nil

Nil | | | 9,665

9,337

7,110 | | | 693,415

629,837

367,943 | |

Michel F. Bouchard

Vice President, Exploration & Development | | | 2010

2009 | | | 260,000

141,541 |

(5) | | Nil

Nil | | | 333,750

51,750 | | | 115,000

45,000 | | Nil | | | 8,051

9,328 | | | 716,801

247,619 | |

Gregory R. Struble

Vice President & Chief Operating Officer | | | 2010 | | | 25,353 | ( 5) | | 300,000 | | | 934,500 | | | Nil | | Nil | | | 247 | | | 1,260,100 | |

- (1)

- The "Share-based awards" figures reflect the grant date fair value of RSUs granted under the Company's RSU Plan. Grant date fair value for each RSU is equivalent in value to the fair market value of the weighted average trading price per Common Share on the TSX for the five trading days immediately preceding the date of the grant, and adjusted to reflect changes in market value until the date of redemption.

- (2)

- The "Option-based awards" figures reflect the fair value of options granted for the year ended December 31, 2010 in accordance with the Company's Stock Option Plan on the grant date. The fair value of these options on their grant date are calculated by using the Black-Scholes option valuation model. The Black-Scholes option valuation is determined using the expected life of the stock option, expected volatility of the Common Share price, expected dividend yield, and risk-free interest rate. The Company assigns an exercise price equivalent to the value of one Common Share on the TSX on the date immediately preceding the date of the grant. The assumptions used in the valuation are based on an actual term of five years and a vesting period of three years. Section 3870 of the Handbook of the Canadian Institute of Chartered Accountants (CICA) requires recognition in the Company's financial statements of an expense for option awards using the fair value method of accounting. Under this method, the fair value of an award at the grant date is amortized over the applicable vesting period and recognized as a compensation expense.

- (3)

- The "Annual incentive plans" figures reflect the bonuses paid to each Named Executive Officer in January 2011 based on his performance against the 2010 STIP targets (see "Executive Compensation Discussion and Analysis — Structure of Compensation Strategy").

- (4)

- Consists of premiums paid for life insurance, RRSP contributions and fitness benefits for Named Executive Officers.

- (5)

- Compensation is not for a full year of service. Mr. Biggar joined the Company on October 1, 2008, Mr. Swinoga on July 20, 2009, Mr. Bouchard on May 26, 2009 and Mr. Struble on December 6, 2010. Mr. Struble's total compensation includes sign-on share and option based awards granted at the time he joined the Company.

14

Outstanding Share-based Awards and Option-based Awards

The following table sets forth the options to purchase securities of the Company and RSUs of the Company granted to Named Executive Officers outstanding as at December 31, 2010.

| | | | | | | | | | | | | | | | |

| | Option-based Awards(1) | |

| |

|

|---|

| | Share-based Awards(2) |

|---|

| | Number of

securities

underlying

unexercised

options

(#) | |

| |

| |

|

|---|

Name | | Option

exercise

price

($) | | Option

expiration date | | Value of

unexercised

in-the-money

options(3)

($) | | Number of

RSUs

that have

not vested

(#) | | Market or

payout value of

RSUs that have

not vested(4)

($) |

|---|

William J. Biggar | | | 300,000

50,000

750,000 | | | 6.24

3.22

2.20 | | | Dec. 7, 2015

Dec. 7, 2017

Sept. 30, 2016 | | | 195,000

183,500

3,517,500 | | Nil | | Nil |

Jeffrey A. Swinoga | | | 125,000

25,000

200,000 | | | 6.24

3.22

2.85 | | | Dec. 7, 2015

Dec. 7, 2017

July 19, 2017 | | | 81,250

91,750

808,000 | | Nil | | Nil |

Trent C. A. Mell | | | 125,000

150,000

10,000

30,000

30,000 | | | 6.24

3.22

5.22

6.47

10.18 | | | Dec. 7, 2015

Dec. 7, 2017

Jun. 9, 2016

May 21, 2016

Apr. 15, 2015 | | | 81,250

550,500

16,700

12,600

Nil | |

18,913 | |

130,311 |

Michel F. Bouchard | | | 125,000

25,000

165,000

330,000 |

(5)

(5) | | 6.24

3.22

1.32

3.03 | | | Dec. 7, 2015

Dec. 7, 2017

Jun. 17, 2013

Sept. 10, 2011 | | | 81,250

91,750

919,050

1,273,800 | | Nil | | Nil |

Gregory R. Struble | | | 350,000 | | | 6.24 | | | Dec. 7, 2018 | | | 227,500 | | 48,046 | | 331,037 |

- (1)

- Includes all options awarded to Named Executive Officers under the Stock Option Plan outstanding as at December 31, 2010.

- (2)

- Includes all RSUs awarded to Named Executive Officers under the RSU Plan outstanding as at December 31, 2010.

- (3)

- The "Value of unexercised in-the-money options" figures reflect the aggregate dollar amount of in-the-money unexercised options that are either vested or unvested held at the end of the year. The amount is calculated based on the difference between the price per Common Share at the close of business on the TSX on December 31, 2010, which was $6.89, and the exercise price of the option.

- (4)

- The "Market or payout value of share-based awards that have not vested" figures reflect the aggregate market value or payout value of RSUs that have not vested, based on the closing price of Common Shares on the TSX on December 31, 2010.

- (5)

- These options were granted to Mr. Bouchard while he was President and CEO of Cadiscor Resources. Upon completion of the Cadiscor acquisition by NAP, Mr. Bouchard's options were converted into NAP options at the approved exchange rate.

15

Incentive Plan Awards — Value Vested or Earned During 2010

For the year ended December 31, 2010, the following table sets forth for each Named Executive Officer the value that would have been realized if the options granted under the Stock Option Plan had been exercised on their vesting date, the value for RSUs had they been exercised on their vesting date and the value earned under non-equity incentives (i.e. STIP).

| | | | | | |

Name | | Option-based awards —

Value vested during the year(1)

($) | | Share-based awards (RSUs) —

Value vested during the year(2)

($) | | Non-equity incentive plan

compensation — Value earned

during the year(3)

($) |

|---|

William J. Biggar | | 564,000 | | Nil | | 400,000 |

Jeffrey A. Swinoga | | 48,420 | | Nil | | 90,000 |

Trent C. A. Mell | | 154,500 | | 87,000 | | 90,000 |

Michel F. Bouchard | | 25,753 | | Nil | | 115,000 |

Gregory R. Struble | | Nil | | Nil | | Nil |

- (1)

- Figures represent the value that would have been realized from all options vested during 2010, calculated based on the difference between the closing price of Common Shares on the TSX on the date of vesting and the exercise price of the option.

- (2)

- Figures represent the value realized for RSUs that vested during 2010, calculated based on the closing price of Common Shares on the TSX on the date of vesting.

- (3)

- Figures represent the bonuses paid to each Named Executive Officer in January, 2011 based on his performance against the 2010 STIP targets. See "Annual Incentive Plans" in Summary Compensation Table above.

Employment Contracts and Termination and Change of Control Entitlements

The Company entered into employment agreements with each of the Named Executive Officers. Generally, the employment agreements provide the position, term and duties of each Named Executive Officer. The agreements contain non-solicitation covenants in favour of the Company during the term of the Named Executive Officer's employment and for a period of one year thereafter. The employment agreements also provide that the Company shall pay each Named Executive Officer an annual base salary, the right to participate in all health, dental and other benefit plans of the Company, the right to participate in the Company's STIP and the right to receive stock options or RSUs upon approval from the Board. Pursuant to the STIP, the Named Executive Officers are eligible to receive a performance bonus in accordance with the Governance, Nominating and Compensation Committee's compensation policy. The amount of any such performance bonus and the related performance criteria are determined from time to time by the Governance, Nominating and Compensation Committee and are subject to approval by the Board. See "Executive Compensation and Analysis — Structure of Compensation Strategy — Short Term (Annual Performance) Incentives" in this Circular.

Pursuant to Mr. Biggar's employment agreement with the Company dated September 14, 2008 (effective October 1, 2008), as amended January 11, 2011, in the event that the Company terminates Mr. Biggar's employment without cause or Mr. Biggar terminates his employment for "Good Reason" (as defined in his employment agreement), Mr. Biggar shall receive (i) an amount equal to his base salary, plus an amount equal to the average of the annual bonus paid to him by the Company for each of the two calendar years immediately preceding the date of termination, for 24 months, (ii) an amount equal to the Company's cost for maintaining his benefits for 24 months, and (iii) his entitlements in accordance with the terms of his options. In the event that the Company terminates Mr. Biggar's employment following a change of control, the entitlements are based on a 30 month period instead of a 24 month period. In the event of a change of control, all unvested share and option-based awards held by Mr. Biggar at such time shall immediately vest and become exercisable.

Pursuant to the other Named Executive Officer employment agreements with the Company, in the event that the Company terminates their employment without cause or they terminate their employment for "Good Reason" (as defined in their employment agreements), they shall receive (i) an amount equal to base salary, plus an amount equal to the average of the annual bonus paid by the Company for each of the two calendar years immediately preceding the date of termination for 12 months, (ii) an amount equal to the Company's cost for

16

maintaining their benefits for 12 months, and (iii) entitlements in accordance with the terms of their options. In the event that the Company terminates a Named Executive Officer's employment following a change of control, entitlements are based on an 18 month period instead of a 12 month period. In the event of a change of control, all unvested share and option-based awards held at such time shall immediately vest and become exercisable.

Termination of Employment Without Cause / Resignation for Good Reason

The table below sets out the estimated incremental payments due to each Named Executive Officer upon a termination without cause or a resignation for Good Reason, assuming that it took place on December 31, 2010.

| | | | | | | | | | | | | | | | |

| | Base Salary | | Bonus | | Option-Based

Awards | | All Other

Compensation | | Total | |

|---|

William J. Biggar | | | 1,000,000 | | | 875,000 | | | Nil | | | 30,250 | | | 1,905,250 | |

Jeffrey A. Swinoga | | | 270,000 | | | 90,000 | | | Nil | | | 10,250 | | | 370,250 | |

Trent C. A. Mell | | | 260,000 | | | 90,000 | | | Nil | | | 9,650 | | | 359,650 | |

Michel F. Bouchard | | | 260,000 | | | 115,000 | | | Nil | | | 8,050 | | | 383,025 | |

Gregory R. Struble | | | 350,000 | | | 210,000 | | | Nil | | | 12,350 | | | 572,350 | |

Termination of Employment Upon a Change of Control

The table below sets out the estimated incremental payments due to each Named Executive Officer upon a change of control, assuming that it took place on December 31, 2010.

| | | | | | | | | | | | | | | | |

| | Base Salary | | Bonus | | Option-Based

Awards | | All Other

Compensation | | Total | |

|---|

William J. Biggar | | | 1,250,000 | | | 1,093,750 | | | 1,489,850 | | | 38,850 | | | 3,872,450 | |

Jeffrey A. Swinoga | | | 405,000 | | | 135,000 | | | 681,100 | | | 15,400 | | | 1,236,500 | |

Trent C. A. Mell | | | 390,000 | | | 135,000 | | | 458,000 | | | 14,500 | | | 997,500 | |

Michel F. Bouchard | | | 390,000 | | | 172,500 | | | 142,400 | | | 12,100 | | | 717,000 | |

Gregory R. Struble | | | 525,000 | | | 315,000 | | | 558,550 | | | 18,500 | | | 1,417,050 | |

17

BOARD OF DIRECTORS COMPENSATION

Remuneration

As an executive officer of the Company, Mr. Biggar is not compensated for his services as a director. The non-executive directors receive the following annual retainers and attendance fees for their services as directors:

| | | | | | | |

| | Fiscal year 2010 — Received(1) | | Fiscal year 2011 — Policy(2) | |

|---|

Director retainer (base) | | | $85,000 per year | | | $120,000 per year | |

Chairman (additional retainer) | | | $90,000 per year | | | $60,000 per year | |

Audit Committee chair (additional retainer) | | | $15,000 per year | | | $15,000 per year | |

Other Committee chair (additional retainer) | | | $7,500 per year | | | $7,500 per year | |

Meeting attendance fee | | | $1,000 per meeting | | | $1,000 per meeting | |

Audit Committee member (other than the chair) preparation fee | | | $1,000 per quarterly meeting to approve financial statements | | | $1,000 per quarterly meeting to approve financial statements | |

- (1)

- The practice of the Company had been to grant stock options to directors every 1-2 years. Although no stock options were issued to directors during the 2010 calendar year, directors received option-based awards valued at $155,310 in December 2009.

- (2)

- A minimum of 40% and a maximum of 60% of retainer must be paid in the form of cash settled RSUs. No other option or share-based awards are anticipated for 2011.

As of January 1, 2011, a minimum of 40% and a maximum of 60% of the annual retainer is paid in the form of RSUs, which will vest immediately and may be exercised as to one third on the date of the grant, one third on the first anniversary and one third on the second anniversary. Directors elect what additional percentage of the annual retainer above 40% (to a maximum of 60%) will be received as RSUs prior to December 31 of the previous year. The RSUs are priced at the volume weighted average price on the TSX for the 5 trading days preceding January 1 of the new calendar year.

All retainers are paidpro rata on a quarterly basis. Directors are also reimbursed for out-of-pocket expenses incurred in attending meetings and otherwise carrying out their duties as directors of NAP. Any director who is required to travel a total of more than four hours per round trip in order to attend a meeting or series of meetings is entitled to a travel fee of $1,000 as compensation for the travel time. If a director is called upon to dedicate a significant amount of time in the performance of duties above and beyond those described in the Board and Committee mandates, the Board may approve additional compensation for the director provided that: (i) the compensation amount is approved in advance of the work being completed; and (ii) such compensation does not impair the director's independence, as the term is defined in National Instrument 52-110 — Audit Committees ("NI 52-110") and under the rules of the NYSE Amex.

Stock Ownership Guidelines

The Board believes that the economic interests of directors should be aligned with those of shareholders. To achieve this, the Company's director compensation policy was revised for 2011 and now provides that directors are expected hold at least $150,000 in securities of NAP. The minimum holding requirement is calculated based on: (i) the actual price paid per Common Share acquired and (ii) the grant value of RSUs. For purposes of transitioning from the previous $75,000 securities requirement to the $150,000 requirement effective January 1, 2011, securities held as at January 1, 2011 are deemed to have been purchased at $6.79, being the "market price" (as defined in the TSX Company Manual) of the Common Shares on the TSX as of December 31, 2010. Unless they are expiring, directors may not exercise RSUs if, after the exercise of the RSUs, their ownership of NAP securities would be less than $150,000. As of the Record Date, all of the directors have satisfied the ownership guidelines.

18

Compensation of Directors

The following table sets forth all compensation provided to the Company's non-executive directors for the year ended December 31, 2010.

Director Compensation Table

| | | | | | | | | | | | | | |

| Name | | Fees earned

($) | | Share-based

awards(2)

($) | | Option-based

awards(3)

($) | | All other

compensation(1)

($) | | Total

($) | |

|---|

André J. Douchane | | $ | 193,000 | | Nil | | Nil | | $ | 1,000 | | $ | 194,000 | |

Steven R. Berlin | | $ | 123,000 | | Nil | | Nil | | $ | 3,000 | | $ | 126,000 | |

C. David A. Comba | | $ | 121,500 | | Nil | | Nil | | $ | 2,000 | | $ | 123,500 | |

Robert J. Quinn | | $ | 112,000 | | Nil | | Nil | | $ | 4,000 | | $ | 116,000 | |

Greg J. Van Staveren | | $ | 120,500 | | Nil | | Nil | | $ | 1,000 | | $ | 121,500 | |

William J. Weymark | | $ | 102,000 | | Nil | | Nil | | $ | 3,000 | | $ | 105,000 | |

- (1)

- Reflects compensation for travel time in excess of four hours to attend Board and Committee meetings.

Outstanding Share-based Awards and Option-based Awards

The following table provides information for all stock options and share-based awards granted to non-executive directors outstanding as at December 31, 2010:

| | | | | | | | | | | | | | | |

| | Option-based Awards | | Share-based Awards |

|---|

| Name | | Number of

securities

underlying

unexercised

options

(#) | | Option

exercise

price

($) | | Option

expiration

date | | Value of

unexercised

in-the-money

options(1)

($) | | Number

of RSUs

that have

not vested

(#) | | Market or

payout value

of RSUs

that have

not vested

($) |

|---|

André J. Douchane | | | 75,000

20,000

5,000

5,000

86,000 | | $

$

$

$

$ | 3.22

6.47

8.40

8.84

11.90 | | December 7, 2017

May 21, 2016

June 20, 2014

December 14, 2013

June 23, 2012 | | | 275,250

8,400

—

—

— | | Nil | | Nil |

Steven R. Berlin | | | 50,000

20,000

5,000

7,500 | | $

$

$

$ | 3.22

6.47

8.84

11.90 | | December 7, 2017

May 21, 2016

December 14, 2013

June 23, 2012 | | | 183,500

8,400

—

— | | Nil | | Nil |

C. David A. Comba | | | 75,000

20,000

5,000

7,500 | | $

$

$

$ | 3.22

6.47

8.40

8.40 | | December 7, 2017

May 21, 2016

June 20, 2014

June 20, 2014 | | | 275,250

8,400

—

— | | Nil | | Nil |

Robert J. Quinn | | | 75,000

20,000

5,000

7,500 | | $

$

$

$ | 3.22

6.47

8.40

8.40 | | December 7, 2017

May 21, 2016

June 20, 2014

June 20, 2014 | | | 275,250

8,400

—

— | | Nil | | Nil |

Greg J. Van Staveren | | | 75,000

20,000

5,000

7,500

7,500 | | $

$

$

$

$ | 3.22

6.47

8.40

11.90

4.75 | | December 7, 2017

May 21, 2016

June 20, 2014

June 23, 2012

February 27, 2011 | | | 275,250

8,400

—

—

16,050 | | Nil | | Nil |

William J. Weymark | | | 75,000

20,000

7,500 | | $

$

$ | 3.22

6.47

8.87 | | December 7, 2017

May 21, 2016

January 14, 2015 | | | 275,250

8,400

— | | Nil | | Nil |

- (1)