Noranda Inc.

BCE Place, 181 Bay Street, Suite 200

Toronto, Ontario M5J 2T3

TO THE SHAREHOLDERS:

TAKE NOTICE that the Eighty-First Annual Meeting of the holders of Common Shares of NORANDA INC. will be held at the Design Exchange, Trading Floor, 234 Bay Street, Toronto, Ontario on Monday, April 26, 2004 at 2:30 p.m. (local time) for the following purposes:

(i) to receive reports and financial statements;

(ii) to elect directors;

(iii) to appoint auditors and authorize the directors to fix the remuneration of the auditors; and

(iv) to transact such other business as may properly come before the Meeting or any adjournment thereof.

A copy of the reports and the financial statements to be placed before the Meeting accompanies this Notice of Meeting.

Shareholders who are unable to attend the Meeting in person are requested to date, sign and return the enclosed form of proxy in the return envelope provided.

DATED March 4, 2004.

| | | By Order of the Board of Directors, |

|

|

(Signed) STEPHEN K. YOUNG

Secretary |

MANAGEMENT INFORMATION CIRCULAR

VOTING INFORMATION

SOLICITATION OF PROXIES

This Management Information Circular ("Circular") is furnished in connection with the solicitation by the management of Noranda Inc. (the "Corporation" or "Noranda") of proxies to be used at the Annual Meeting of the holders of common shares in the capital of Noranda ("Common Shares") referred to in the accompanying Notice of Meeting (the "Notice") to be held at the time and place and for the purposes set forth in such Notice (the "Meeting"). The solicitation will be made primarily by mail, but proxies may also be solicited personally or by telephone by employees of the Corporation at nominal cost. The cost of solicitation will be borne by the Corporation. The information contained herein is given as at March 4, 2004, unless otherwise indicated.

APPOINTMENT OF PROXIES

The persons named in the enclosed form of proxy are officers of the Corporation.Each shareholder has the right to appoint a person other than the persons named in the enclosed form of proxy, who need not be a shareholder of the Corporation, to represent such shareholder at the Meeting or any adjournment thereof. Such right may be exercised by inserting such person's name in the blank space provided in the form of proxy and striking out the other names or by completing another proper form of proxy. The completed form of proxy must be deposited with CIBC Mellon Trust Company, by mail in the return envelope provided or addressed to CIBC Mellon Trust Company, Attention: Proxy Department, 200 Queens Quay East, Unit 6, Toronto, Ontario M5A 4K9 or by facsimile at (416) 368-2502, or with the Secretary of the Corporation, not later than the close of business on Friday, April 23, 2004 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjourned Meeting.

NON-REGISTERED HOLDERS

In this Circular and the enclosed form of proxy and Notice, all references to shareholders are to registered holders of Common Shares. Only registered holders of Common Shares, or the persons they appoint as their proxies, are permitted to vote at the Meeting. However, in many cases, Common Shares beneficially owned by a holder (a "Non-Registered Holder") are registered either:

(i) in the name of an intermediary (an "Intermediary") that the Non-Registered Holder deals with in respect of the shares, such as, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or

(ii) in the name of a clearing agency (such as The Canadian Depository for Securities Limited) of which the Intermediary is a participant.

In accordance with the requirements of National Instrument 54-101 — Communication with Beneficial Owners of Securities of a Reporting Issuer, the Corporation has distributed copies of the accompanying Notice, this Circular, the enclosed form of proxy and the Corporation's 2003 Annual Report (which includes management's discussion and analysis of financial condition and results of operations and consolidated financial statements for the fiscal year ended December 31, 2003) (collectively, the "Meeting Materials") to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

(i) be given a proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) and is restricted as to the number of shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. This form of proxy neednot be signed by the Non-Registered Holder. In this case, the Non-Registered Holder who wishes to submit a proxy should otherwise properly complete the form of proxy and deposit it with CIBC Mellon Trust Company, by mail addressed to CIBC Mellon Trust Company, Attention: Proxy Department, 200 Queens Quay East, Unit 6, Toronto, Ontario M5A 4K9 or by facsimile at (416) 368-2502, or with the Secretary of the Corporation, as described above; or

(ii) more typically, be given a voting instruction form which must be completed and signed by the Non-Registered Holder in accordance with the directions on the voting instruction form (which may in some cases permit the completion of the voting instruction form by telephone, the internet or facsimile).

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the shares they beneficially own. Should a Non-Registered Holder who receives either a proxy or a voting instruction form wish to attend and vote at the Meetingin person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the proxy and insert the Non-Registered Holder's (or such other person's) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form.

In any case, Non-Registered Holders should carefully follow the instructions of their Intermediaries and their service companies.

REVOCATION OF PROXIES

A shareholder who has given a proxy has the power to revoke it as to any matter on which a vote shall not already have been cast pursuant to the authority conferred by such proxy and may do so: (1) by delivering another properly executed proxy bearing a later date and depositing it as aforesaid, including within the prescribed time limits noted above; (2) by depositing an instrument in writing revoking the proxy executed by the shareholder or by the shareholder's attorney authorized in writing (i) at the registered office of the Corporation (BCE Place, 181 Bay Street, Suite 200, Toronto, Ontario M5J 2T3) at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or (ii) with the Chairman of the Meeting, prior to its commencement, on the day of the Meeting or any adjournment thereof; (3) by attending the Meeting in person and so requesting; or (4) in any other manner permitted by law.

A Non-Registered Holder may revoke a voting instruction form or a waiver of the right to receive Meeting Materials and to vote given to an Intermediary at any time by written notice to the Intermediary, except that an Intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive Meeting Materials and to vote that is not received by the Intermediary at least seven days prior to the Meeting.

VOTING OF SHARES REPRESENTED BY MANAGEMENT PROXIES

The persons named in the enclosed form of proxy will vote or withhold from voting the shares in respect of which they are appointed proxy on any ballot that may be called for in accordance with the instructions of the shareholder as indicated on the proxy and, if the shareholder specifies a choice with respect to any matter to be

2

acted upon, the shares will be voted for or against or withheld from voting accordingly.In the absence of such direction, such shares will be

(i) voted for the election as directors of the Corporation of the persons listed under the heading "Election of Directors" below;

(ii) voted for the appointment of Ernst & Young LLP as auditors of the Corporation and to authorize the directors to fix its remuneration; and

(iii) voted in accordance with management's recommendations with respect to amendments or variations to the matters set out in the Notice or any other matters which may properly come before the Meeting.

The enclosed form of proxy confers discretionary authority upon the persons named therein in respect of amendments or variations to matters identified in the Notice and in respect of other matters that may properly come before the Meeting. At the date of this Circular, the management of the Corporation knows of no such amendments, variations or other matters to come before the Meeting.

VOTING SHARES

As of March 4, 2004, 296,041,178 Common Shares were outstanding. Each holder of Common Shares is entitled to one vote on all matters to come before the Meeting or any adjournment thereof for each Common Share registered in the shareholder's name in the list of holders of Common Shares prepared as of March 15, 2004 (the "Record Date") unless a person has transferred shares after the Record Date and the new holder of such shares establishes proper ownership thereof and in writing requests the Secretary of the Corporation by April 16, 2004 to be included in the list of holders of Common Shares entitled to vote. For a description of the procedures to be followed by Non-Registered Holders to direct the voting of shares beneficially owned, see "Non-Registered Holders" above.

PRINCIPAL HOLDERS OF THE CORPORATION'S VOTING SHARES

The management of the Corporation understands that Brascan Corporation ("Brascan") and associated companies own 122,597,952 Common Shares (or approximately 41.4% of the outstanding Common Shares) and Convertible Debentures convertible into 2,722,323 Common Shares.

Brascan is a public corporation listed on the Toronto and New York stock exchanges. Brascan's major shareholder is Partners Limited ("Partners") who, together with its shareholders, collectively own, directly or indirectly, exercise control or direction over, or have options and warrants to acquire, approximately 30 million Class A Limited Voting Shares of Brascan, representing approximately 17% of the outstanding Class A Limited Voting Shares of Brascan on a fully diluted basis, and 85,120 Class B Limited Voting Shares of Brascan, representing all of the outstanding Class B Limited Voting Shares of Brascan. Messrs. Cockwell, Balogh, Flatt, Harding, Kerr, Myhal and Pannell, presently Noranda directors and nominees referenced below, are shareholders of Partners.

Shareholders of Partners, in addition to receiving dividends from their investment in Partners, participate in an investment fund (the "Fund") that was formed and financed by Partners in 2001 to invest in securities other than those issued by Brascan and its affiliates. In March 2004 the Fund distributed $3.2 million of income to its shareholders. Mr. Kerr, Chairman, and Mr. Pannell, President and Chief Executive Officer, each received $209,500.

3

BUSINESS OF THE MEETING

ANNUAL FINANCIAL STATEMENTS

The Annual Financial Statements of the Corporation for the fiscal year ended December 31, 2003 are included in the 2003 Annual Report, which is being mailed to shareholders with this Circular. The Annual Report will be placed before the shareholders at the Meeting.

ELECTION OF DIRECTORS

The number of directors of the Corporation to be elected at the Meeting is 14. The persons named in the enclosed form of proxy intend, unless otherwise directed, to vote for the election of a Board of Directors of Noranda (the "Board") composed of the 14 nominees listed below to serve until the next annual meeting of the shareholders of the Corporation or until their successors are duly elected or appointed, unless any such person is not available to act as a director, in which event a substitute may be nominated. The nominees whose names are set forth below are currently directors of the Corporation. Management is not aware that any such persons will be unable or unwilling to serve as a director.

Those directors who are currently members of committees of the Board are indicated below.

|

|---|

|

|

Alex G. Balogh,Director since 1994;

Ontario, Canada

Corporate Director

Former Deputy Chairman of Noranda (1994-2003) and Chairman of Falconbridge Limited ("Falconbridge") (1994-2003). Directorships include Falconbridge, Strongco Inc., Great Lakes Power Inc., Sentient Global Resources Fund and Cambior Inc. |

|

Chair of Environment, Health & Safety Committee

(Direct and Indirect Ownership)

5,275 – Common Shares

8,424 – Common Shares(1)

1,625 – Deferred Share Units

Nil – Options |

|

|---|

|

|

André Bérard, O.C.,Director since 1990;

Québec, Canada

Chairman of the Board, National Bank of Canada(Banking)

Previously CEO of National Bank of Canada. Directorships include Banque Saradar France, BCE Inc., Vasogen Inc., Groupe BMTC Inc., Saputo Inc., Kruger Inc., BRED (Banque populaire), Société financière Bourgie Inc., Le Groupe Canam Manac Inc. and Transforce Income Fund. |

|

Member of Audit and Human Resources Committees

(Direct and Indirect Ownership)

1,250 – Common Shares

10,486 – Deferred Share Units

5,000 – Options |

|

|---|

|

|

Jack L. Cockwell,Director since 1981;

Ontario, Canada

Group Chairman, Brascan Corporation

(an asset management company with a focus on real estate and power generation)

Formerly Brascan's President and Chief Executive Officer for 12 years. Directorships include Brascan, Astral Media Inc. and the following publicly-traded affiliates of Brascan: Brookfield Properties Corporation, Falconbridge and Nexfor Inc. Chairman of the Board of Trustees of the Royal Ontario Museum and Director of the C.D. Howe Institute. |

|

Chair of Human Resources Committee

(Direct and Indirect Ownership)

48,000 – Common Shares

3,171,703 – Common Shares(1)

Nil – Deferred Share Units

Nil – Options |

|

|---|

|

|

The Hon. J. Trevor Eyton, O.C., Q.C.,Director since 1981;

Ontario, Canada

Member of the Senate of Canada

Directorships include Brascan, General Motors of Canada Ltd., Coca-Cola Enterprises Inc., IMAX Corp. and Nestlé Canada Inc. Governor of the Canadian Olympic Foundations of Junior Achievement Canada and Chair of the Canadian Sports Hall of Fame. |

|

Member of Environment, Health & Safety Committee

(Direct and Indirect Ownership)

2,500 – Common Shares

Nil – Deferred Share Units

Nil – Options |

|

|---|

| | | | | |

4

|

|

J. Bruce Flatt,Director since 2001;

Ontario, Canada

President and Chief Executive Officer, Brascan Corporation

President and Chief Executive Officer of Brascan and a director of Nexfor Inc. Formerly President and Chief Executive Officer of affiliate Brookfield Properties Corporation, during which time he helped develop one of the highest quality real estate companies in North America. |

|

Member of Human Resources Committee

(Direct and Indirect Ownership)

5,000 – Common Shares

2,251,525 – Common Shares(1)

Nil – Deferred Share Units

Nil – Options |

|

|---|

|

|

A.L. (Al) Flood, C.M., O.C.,Director since 1999;

Ontario, Canada

Retired Chairman and Chief Executive Officer,

Canadian Imperial Bank of Commerce (Banking)

Directorships include Canadian Imperial Bank of Commerce and Talisman Energy Inc. |

|

Chairman of Audit Committee and member of Human Resources Committee

(Direct and Indirect Ownership)

4,000 – Common Shares

11,123 – Deferred Share Units

Nil – Options |

|

|---|

|

|

Norman R. Gish,Director since 2001;

Alberta, Canada

President, Gish Consulting Inc.

(Pipeline, energy and international marketing advisory services)

Previously Chairman, President and Chief Executive Officer of Alliance Pipeline and Aux Sable Liquid Products Inc. Directorships include Superior Plus Inc., Railpower Technologies Corp., Energreen Canada Corp., Provident Energy Trust and Quadrise Canada Fuel Systems. |

|

Member of Audit and Governance Committees

(Direct and Indirect Ownership)

1,000 – Common Shares

2,816 – Deferred Share Units

Nil – Options |

|

|---|

|

|

Robert J. Harding, F.C.A.,Director since 1995;

Ontario, Canada

Chairman, Brascan Corporation

Directorships include Brascan and the following publicly-traded affiliates of Brascan: BPO Properties Corporation (Chairman), Falconbridge and Nexfor Inc. Mr. Harding is also a director of Burlington Resources Inc. Chairman of the Board of Governors of the University of Waterloo and a Trustee of the United Way of Greater Toronto. |

|

Member of Environment, Health & Safety, Governance and Human Resources Committees

(Direct and Indirect Ownership)

1,500 – Common Shares

321,095 – Common Shares(1)

Nil – Deferred Share Units

Nil – Options |

|

|---|

|

|

V. Maureen Kempston Darkes, O.C., O.O.,Director since 1998;

Florida, U.S.A.

GM Group Vice-President and President Latin America, Africa,

Mid-East Operations, General Motors Corporation

(International motor vehicle manufacturer).

Previously President and General Manager of General Motors of Canada Limited. Directorships include CN Rail and Thomson Corporation. |

|

Member of Governance Committee

(Direct and Indirect Ownership)

200 – Common Shares

8,607 – Deferred Share Units

Nil – Options |

|

|---|

|

|

David W. Kerr,Director since 1987;

Ontario, Canada.

Chairman of the Corporation and of Falconbridge Limited

Previously President and Chief Executive Officer of Noranda. Directorships include Brascan, Shell Canada Limited and Sustainable Development Technology Canada. Chairman of the International Council on Mining and Metals. |

|

(Direct and Indirect Ownership)

263,244 – Common Shares

1,219,800 – Common Shares(1)

17,473 – Deferred Share Units

704,800 – Options |

|

|---|

| | | | | |

5

|

|

James W. McCutcheon, Q.C.,Director since 1993;

Ontario, Canada.

Counsel, McCarthy Tétrault LLP(law firm)

Directorships include CAE Inc., Dominion of Canada General Insurance Company, Empire Life Insurance Company (Chairman 1991-1997) and Guardian Capital Group Limited. |

|

Member of Environment, Health & Safety and Governance Committees

(Direct and Indirect Ownership)

1,000 – Common Shares

1,625 – Deferred Share Units

Nil – Options |

|

|---|

|

|

The Hon. Frank J. McKenna, P.C., Q.C.,Director since 1998;

New Brunswick, Canada

Counsel, McInnes Cooper(law firm)

Former Premier of New Brunswick (1987-1997) and currently counsel with Atlantic Canada law firm McInnes Cooper. Directorships include Bank of Montreal and CanWest Communications Corp. |

|

Chair of Governance Committee and member of Audit Committee

(Direct and Indirect Ownership)

500 – Common Shares

7,822 – Deferred Share Units

Nil – Options |

|

|---|

|

|

George E. Myhal,Director since 1999;

Ontario, Canada

Chief Operating Officer, Brascan Corporation

Formerly President and Chief Executive Officer of Brascan Financial Corporation. Senior executive at Brascan and several of its affiliated companies since joining Hees International Bancorp Inc. as Managing Partner in 1981. |

|

(Direct and Indirect Ownership)

1,500 – Common Shares

1,411,904 – Common Shares(1)

Nil – Deferred Share Units

Nil – Options |

|

|---|

|

|

Derek G. Pannell,Director since 2002;

Ontario, Canada

President and Chief Executive Officer, Noranda Inc.

Previously President and Chief Operating Officer of Noranda, Chief Executive Officer of Falconbridge, Vice-President of Compañía Minera Antamina in Peru, and in respect of the following Noranda business units: Senior Vice-President, Copper Group, President of Noranda Copper Smelting and Refining and President of Brunswick Mining and Smelting. |

|

(Direct and Indirect Ownership)

137,260 – Common Shares

16,228 – Common Shares(1)

Nil – Deferred Share Units

671,350 – Options |

|

|---|

- (1)

- Management understands that these shareholdings reflect the nominee's indirect proportionate interest in Common Shares held through Partners and Brascan (see "Principal Holders of the Corporation's Voting Shares").

Each of the proposed nominees was elected to his or her present term of office by the shareholders of the Corporation at a meeting in respect of which the Corporation circulated a management information circular.

APPOINTMENT OF AUDITORS

Unless the shareholder has specified in the enclosed form of proxy that the Common Shares represented by such proxy are to be withheld from voting in the appointment of auditors, on any ballot that may be called for in the appointment of auditors, the persons named in the form of proxy enclosed with the Notice intend to vote "For" the appointment of Ernst & Young LLP, Chartered Accountants, Toronto, as auditors of the Corporation to hold office until the next annual meeting of shareholders and authorizing the directors to fix the remuneration to be paid to the auditors.

6

PRINCIPAL ACCOUNTING FIRM FEES

Ernst & Young LLP and its respective affiliates (collectively "Ernst & Young") are the auditors of the Corporation and its reporting issuer subsidiary Novicourt Inc.

From time to time, Ernst & Young also provides advisory and other non-audit services to the Corporation and its subsidiaries. The Audit Committee of the Board has considered whether the provision of such non-audit services is compatible with maintaining Ernst & Young's independence and is satisfied that it is.

Aggregate fees billed to the Corporation and its reporting issuer subsidiaries for the fiscal years ended December 31, 2002 and 2003 by Ernst & Young are set forth in the following table:

| | Noranda

($)

2002/2003

| | Reporting Issuer

Subsidiaries

($)

2002/2003

| | Total

($)

2002/2003

|

|---|

|

| Audit fees | | 2,364,822/2,294,398 | | 23,000/35,292 | | 2,387,822/2,329,690 |

| Audit-related fees | | 280,632/166,255 | | — | | 280,632/166,255 |

| Tax fees | | 830,480/563,624 | | 15,118/22,926 | | 845,598/586,550 |

| All other fees | | —/3,111 | | —/— | | —/3,111 |

|

| Total | | 3,475,934/3,027,388 | | 38,118/58,218 | | 3,514,052/3,085,606 |

|

Fees for audit services include fees associated with the annual audit and fees associated with regulatory filings. Audit-related fees are for services provided by Ernst & Young that are reasonably related to its role as auditor, and consist principally of audits of employee benefit funds and advice on accounting standards and other specific transactions. Tax fees include tax compliance, tax advice and tax planning, including expatriate tax services. All other fees would principally include all other support and advisory services.

It is the Corporation's policy not to engage its auditors to provide services in connection with financial information systems design and implementation.

EXECUTIVE COMPENSATION

REPORT ON EXECUTIVE COMPENSATION

Members of the Human Resources Committee (the "HR Committee") are Jack L. Cockwell (Chairman), J. Bruce Flatt, A. L. (Al) Flood, André Bérard and Robert J. Harding. No member of the HR Committee is an officer or employee of the Corporation or any of its subsidiaries.

The HR Committee is responsible for recommending to the Board the compensation of the senior officers of Noranda and its wholly owned subsidiaries. The Board of Directors of each subsidiary of the Corporation which is itself a public company is responsible for the compensation of the senior officers employed by it.

Derek G. Pannell, the President and Chief Executive Officer (the "CEO") of the Corporation, makes recommendations to the HR Committee with respect to executive compensation philosophy and policy and with respect to the compensation paid to senior officers of the Corporation other than himself. Mr. Pannell is not present at HR Committee or Board meetings while his compensation is determined.

Through its total compensation program for executives, the Corporation aims to attract, retain and motivate top quality people at the executive level. Performance incentives that are tied directly to increases in shareholder value are essential components of the program.

With respect to general philosophy, the HR Committee believes that senior executive compensation should be driven primarily by performance relative to the established plans and strategy of the business. Information on the compensation practices of competitors is considered, but does not drive the philosophy or design of the Corporation's program. The HR Committee focuses on rewarding performance, and not on entitlement or excessive levels of employment security.

7

The Corporation's compensation policies are designed to motivate management to maximize the long-term value of the Corporation's assets and business operations and to provide an overall competitive compensation package with a high proportion weighted to variable compensation tied to the Corporation's performance for the most senior executives. In the case of the Corporation's CEO, this is achieved by maintaining a base salary and cash bonus award below the median base salary level in return for an opportunity to participate at a higher level in the growth in the value of the Common Shares.

Base Salaries

Base salaries for the Corporation's executives are reviewed annually to ensure that they reflect the contribution of each executive. The Corporation believes that base salaries should be based on the median level for comparable companies within the relevant industry, adjusted to reflect a higher weighting to variable compensation for the most senior executives.

Short-Term Incentives

The Annual Variable Compensation Plan (the "VCP") generates cash incentives based on corporate, business unit and individual performance. Target awards, expressed as a percentage of salary, have been established for each eligible position. Corporate and business unit performance is determined on the basis of the Corporation's return on net assets ("RONA"). All of the Named Executive Officers (defined below) participated in the Corporation's VCP in 2003, except Steven Douglas.

Long-Term Incentives

Long-term incentives are intended to reward management based on increases in the value of Common Shares. The purpose of these arrangements is to achieve a commonality of interest between shareholders and management and to motivate executives to improve the Corporation's long-term financial success, measured in terms of enhanced shareholder wealth over the long term.

The Corporation's long-term incentives consist of the following:

(a) Stock Option Plan (the "SOP"). Under this Plan the Corporation grants options to purchase Common Shares at a fixed price, being the closing price of the Common Shares on the Toronto Stock Exchange on the last trading day immediately preceding the date of the grant. Generally, for the Named Executive Officers, options are granted annually in the range of two to three times base salary (determined by multiplying the number of Common Shares under option by the exercise price). Under the SOP, the Board has the discretion to grant options having up to a 10-year term, and being subject to vesting provisions and any other conditions considered appropriate. All presently outstanding stock options have a 10-year term and contain vesting provisions as follows: 20% of the options will vest on the first anniversary following the date of grant; and a further 20% will vest on each of the four subsequent anniversary dates. Stock options granted in 2001 and 2002 also contained an accelerated vesting feature specifying that on the first day that the market price of the Common Shares is 20% greater than the exercise price of the option, the final tranche of unvested options outstanding on that date will immediately vest and be exercisable. Effective January 2003, all stock options granted no longer contain this accelerated vesting feature and it is not anticipated that future options will contain such feature. Effective June 28, 2002, the market growth option feature, which provided the participant with the ability to receive, at the participant's election and without payment to the Corporation, an amount reflecting the market appreciation of a Common Share from the date of the stock option grant, was discontinued. The maximum number of Common Shares issuable under the SOP is 13 million.

8

The following sets out information with respect to the SOP under which Common Shares are authorized for issuance as of the financial year ended December 31, 2003. The Corporation has no equity compensation plan which has not been approved by its security holders.

|

| Number of Common Shares to be issued upon exercise of outstanding options, warrants and rights | | | 9,583,889 | |

| Weighted-average exercise price of outstanding options | | $ | 16.35 | |

| Number of common shares remaining available for future issuance under the SOP | | | 1,007,348 | |

|

In connection with the stock options granted on or after February 10th, 2003, the Board established a policy requiring all Named Executive Officers to hold, for at least one year, the "net shares" of the Corporation received from the exercise of an option granted on or after February 10, 2003. For this purpose "net shares" means the number of Common Shares obtained through the exercise of such option, less the number of Common Shares required to be sold in order to make payment of (a) the exercise price of the option; and (b) any personal income taxes attributable to the gain on exercise of the option.

(b) Management Deferred Share Unit Plan (the "MDSUP"). Under this Plan, senior officers designated by the HR Committee may, at their option, elect to receive all or a portion of their VCP award in the form of Deferred Share Units ("Units"). The VCP is converted to Units based on the closing price of the shares on the Toronto Stock Exchange on the last trading day immediately preceding the date of the award. The portion of the VCP award elected to be received in Units by the executive may, at the discretion of the HR Committee, be increased by a factor of up to two times for purposes of calculating the number of Units to be allocated under the MDSUP. Units are credited with dividend equivalents when dividends are paid on the Common Shares. The Units vest over a five-year period and participants are only allowed to redeem the Units upon cessation of employment through retirement, resignation, termination or death, after which time the Units will terminate unless redeemed by the last day of the first calendar year that commences after retirement, resignation, termination or death. The cash value of the Units when redeemed will be equivalent to the market value of an equivalent number of Common Shares at the time of cessation of employment with the Corporation. In connection with the 2003 VCP award, Mr. Kukielski elected to participate in the Noranda MDSUP for 50% of his annual award and in the Falconbridge management deferred share unit plan for the other 50%. Mr. Kukielski's award was increased by the Board by a factor of 1.5.

Prior to August 2002, the Corporation also had a Management Share Purchase Plan ("SPP") that was intended to advance the interests of the Corporation and its subsidiaries by encouraging and enabling the acquisition of a larger share interest in the Corporation by key executives of the Corporation and its subsidiaries. The maximum term of any loans granted thereunder was ten years and the maximum number of Common Shares issuable thereunder was 10 million. Loans outstanding under the SPP at the time it was discontinued will be repaid in accordance with their original terms.

Other Components

The other components of the total executive compensation program are the Pension Plans, the Benefits Plan, the Executive Perquisite Program and the Employee Share Savings Plan (the "ESSP").

Each element of the executive compensation program is intended to fulfill a different goal. The HR Committee places the greatest emphasis for the Named Executive Officers on the short-term and long-term incentive programs which are designed to link their interests with those of the Corporation's shareholders, and a lesser emphasis on pension, other benefits and perquisites.

9

Compensation of the Chief Executive Officer

Mr. Pannell was appointed President and Chief Executive Officer of Noranda effective June 1, 2002. In 2003 Mr. Pannell's annual salary was $425,000, consistent with the HR Committee's belief of maintaining base salary and incentive payments for the Chief Executive Officer below the median level of the marketplace in return for the opportunity to participate at a higher level in the growth in the value of the Corporation's shares.

Mr. Pannell participates in the Corporation's VCP at a target award percentage of 60% of base salary established by the HR Committee. The target award is based on attaining and exceeding established performance criteria, which include the following:

- •

- Enhance financial performance of the Corporation against specific short and longer term objectives;

- •

- Provide strong leadership and direction to the Corporation, its various global business units and subsidiary companies;

- •

- Create opportunities for profitable growth and value creation;

- •

- Continued strong commitment to environment, health and safety; and

- •

- Ensure that effective succession plans are developed, implemented and managed to provide continuity of key positions across the Corporation and its subsidiaries.

Mr. Pannell was awarded a payout under the Corporation's 2003 VCP of $360,000. The HR Committee's assessment of Mr. Pannell's performance included the following:

- •

- Financial position of the Corporation substantially improved;

- •

- Senior management team of the Corporation and its subsidiaries consolidated and strengthened; integration savings and synergies realized;

- •

- Project and capital expenditure approval disciplines consolidated and strengthened; Six Sigma (a program providing effective quality control and process improvement) further deployed throughout the Corporation and its subsidiaries globally;

- •

- Projects crucial to the future of the Corporation initiated and advanced; strategic partnerships developed and strengthened;

- •

- Continued high standards of corporate governance and responsible corporate performance;

- •

- Strong and effective leadership provided throughout the Corporation and its subsidiaries; and

- •

- People development, performance management and succession planning programs further enhanced.

In February 2004, Mr. Pannell was granted 10-year options under the SOP to purchase 70,000 Common Shares at an exercise price of $20.37 per share. In February 2003, Mr. Pannell was granted 10-year options under the SOP to purchase 130,000 Common Shares at an exercise price of $13.82 per share. Mr. Pannell also has loans under the Noranda Executive Loan program which was discontinued in 2002. These loans are secured by Common Shares and securities of Partners and its publicly-traded associated companies.

10

SUMMARY COMPENSATION OF NAMED EXECUTIVE OFFICERS

The following table sets forth all compensation paid or payable for services rendered during the financial years ended December 31, 2003, 2002 and 2001, in respect of the CEO and the four other most highly compensated individuals performing a policy-making function in respect of the Corporation, as well as Mr. Douglas who was appointed Executive Vice-President and Chief Financial Officer of the Corporation effective November 11, 2003 (collectively, the "Named Executive Officers").

| |

| | Annual Compensation

| | Long-Term

Compensation

| |

|

|

|---|

| |

| |

| |

| | Other

Annual

Compensation(5)

($)

| | Securities Under Options

Granted (1)

(#)

| |

| | Management

Deferred

Share Units

(#)

| | All Other

Compensation(6)

($)

|

|

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | VCP Award

($)

| | Shares or Units Subject to Resale Restrictions

($)

|

|

|---|

|

Derek Pannell

President & Chief Executive Officer | | 2003

2002

2001 | | 425,000

400,000

360,000 | | 360,000

150,000

30,000 | | 33,053

— | | 70,000

130,000

200,000 | | —

—

— | | —

—

— | | 8,622

6,457

1,765 | |

|

Steven Douglas(2)

Executive Vice-President & Chief Financial Officer | | 2003

2002

2001 | | 325,000

—

— | | —

—

— | | 86

—

— | | 45,000

150,000

— | | —

—

— | | —

—

— | | 1,250

—

— | |

|

Lars-Eric Johansson(3)

Executive Vice-President & Chief Financial Officer | | 2003

2002

2001 | | 310,000

289,000

267,333 | | 145,700

45,000

55,579 | | 33,175

30,975

— | | —

50,000

51,125

42,000 FL | | —

—

— | | —

—

— | | 664,939

7,416

2,079 | |

|

Fernando Porcile(4)

President, Copper South Business Unit | | 2003

2002

2001 | | US 288,979

US 275,000

— | | US 167,040

US 30,000

— | | 17,551

—

— | | 14,000

9,000

18,500

17,500

10,225

— |

FL

FL

| —

—

— | | —

—

— | | —

—

— | |

|

William Brooks

President & CEO

Noranda Aluminum, Inc. | | 2003

2002

2001 | | US 336,000

US 330,000

US 330,000 | | US 53,760

US 25,000

US 35,000 | | US 54,470

US 22,617

US 20,440 | | 28,000

37,500

55,000 | | —

—

— | | —

—

— | | US 6,000

US 5,500

US 5,100 | |

|

Peter Kukielski(7)

Executive Vice-President, Projects and Aluminum | | 2003

2002

2001 | | 310,417

270,000

88,269 | | 149,283

48,000

16,000 | | 31,377

—

—

— | | 22,000

14,000

118,000

42,500

38,000 |

FL

FL

| —

—

— | | 5,496

3,659

—

— |

FL

| 5,369

—

— | |

|

Notes:

(1) The options set out in the above table reflect options granted in February 2004 in respect of the 2003 fiscal period.

(2) Mr. Douglas was appointed Executive Vice-President and Chief Financial Officer of Noranda effective November 11, 2003. He was granted options to purchase 150,000 Common Shares at $18.00 in December 2003. Mr. Douglas participates in the Noranda Retirement Annuity Plan on a Defined Contribution basis. The Corporation contributed $1,250 on his behalf in 2003.

(3) Mr. Johansson was Executive Vice-President and Chief Financial Officer of Noranda from June 1, 2002 to November 11, 2003. He was formerly Senior Vice-President and Chief Financial Officer for Falconbridge. The amounts shown as salary and bonus for 2002 represent the aggregate amounts paid to Mr. Johansson by both Noranda and Falconbridge for 2002. The options shown for Mr. Johansson include options to purchase common shares of Falconbridge (indicated as "FL" above). After November 11,2003, Mr. Johansson has continued to act in an advisory capacity with his compensation unchanged, except that he no longer participates in the VCP or the SOP.

(4) Mr. Porcile was appointed President for the Copper South Business Unit effective April 1, 2002. Mr. Porcile's compensation is stated in US Dollars and he is paid in Chilean pesos, converted on a monthly basis. The options shown for Mr. Porcile include options to purchase common shares of Falconbridge (indicated as "FL" above).

(5) For all of the Named Executive Officers except Messrs. Porcile and Douglas, the amounts include an executive perquisite allowance, car benefit, life insurance premium and executive medical benefit. For Mr. Pannell, the amount also includes an imputed interest benefit from his SPP loan and the dollar value of the difference between the price paid for Common Shares with his SPP loan (at a 10% discount) and the average price of Common Shares on the Toronto Stock Exchange on the relevant date (see "Indebtedness of Directors and Senior Officers"). In the case of Mr. Brooks, the amounts approximate the above-market portion of interest credited in connection with a non-qualified deferred compensation plan in which he participates. The value of perquisites and other personal benefits for each Named Executive Officer does not exceed the lesser of $50,000 and 10% of the total of his annual salary and bonus, with the exception of Mr. Brooks. Mr. Porcile's amount includes legislatively required payments in Chile as well as life insurance premiums paid by the Corporation.

(6) In the case of Messrs. Pannell and Kukielski, the amounts include the Corporation's contributions under the ESSP. These individuals participated in the ESSP on the same basis as all other participating employees. Under the ESSP, employees can contribute up to 5% of their salary towards the purchase of Common Shares, with the Corporation contributing cash to the extent of 30% of eligible contributions towards the purchase of additional Common Shares. Mr. Johansson's amount includes the Corporation's contributions under the ESSP as well as gains realized through the exercise of Falconbridge stock options. In the case of Mr. Brooks, the amounts represent vested employer matching contributions under a defined contribution plan qualified under section 401(k) of the U.S. Internal Revenue Code maintained by the U.S. subsidiary, Noranda Aluminum, Inc.

(7) Mr. Kukielski elected to receive 50% of his 2003 VCP award in the form of Noranda Units and 50% of his 2003 VCP award in the form of Falconbridge deferred share units in lieu of receiving cash. The Noranda Units were granted in February 2004 at the price of $20.37 per Unit and the Falconbridge units were granted in February 2004 at the price of $30.60 per unit. Mr. Kukielski's 2001 base salary earnings are pro-rated reflecting his start date of September 1, 2001.

11

SHARE OPTIONS

Options to purchase Common Shares are granted each year at the discretion of the Board to officers of the Corporation pursuant to the SOP described above.

The following table sets forth individual grants of stock options since January 1, 2003 to the Named Executive Officers.

OPTION GRANTS SINCE JANUARY 1, 2003

Name

| | Securities Under

Options Granted (1)(2)

(#)

| | % of Total

Options

Granted to

Employees in

2004/2003

| | Exercise or

Base Price

($/Security)

| | Market Value

of Securities

Underlying Options

on the

Date of Grant

($/Security)

| | Grant/Expiration Date

|

|

|---|

|

| Derek Pannell | | 70,000

130,000 | | 8.13

9.14 | | $20.37

$13.82 | | $20.37

$13.82 | | February 10, 2004/February 9, 2014

February 10, 2003/February 9, 2013 | |

|

| Steven Douglas | | 45,000

150,000 | | 5.23

10.54 | | $20.37

$18.00 | | $20.37

$18.00 | | February 10, 2004/February 9, 2014

December 11, 2003/December 10, 2013 | |

|

| Lars-Eric Johansson | | —

50,000 | | —

3.51 | | —

$13.82 | | —

$13.82 | | —

February 10, 2003/February 9, 2013 | |

|

| Fernando Porcile | | 14,000

9,000 FL

18,500

17,500 FL | | 1.63

2.37

1.30

2.30 | | $20.37

$30.60

$13.82

$16.65 | | $20.37

$30.60

$13.82

$16.65 | | February 10, 2004/February 9, 2014

February 4, 2004/February 3, 2014

February 10, 2003/February 9, 2013

February 5, 2003/February 4, 2013 | |

|

| William Brooks | | 28,000

37,500 | | 3.25

2.64 | | $20.37

$13.82 | | $20.37

$13.82 | | February 10, 2004/February 9, 2014

February 10, 2003/February 9, 2013 | |

|

| Peter Kukielski | | 22,000

14,000 FL

75,000

25,000

25,000 FL

18,000

17,500 FL | | 2.56

3.68

5.27

1.76

3.29

1.27

2.30 | | $20.37

$30.60

$18.00

$12.67

$18.15

$13.82

$16.65 | | $20.37

$30.60

$18.00

$12.67

$18.15

$13.82

$16.65 | | February 10, 2004/February 9, 2014

February 4, 2004/February 3, 2014

December 11, 2003/December 10, 2013

August 1, 2003/July 31, 2013

July 21, 2003/July 20, 2013

February 10, 2003/February 9, 2013

February 5, 2003/February 4, 2013 | |

|

Notes:

(1) The options to purchase the specified number of Noranda and, in the case of Messrs. Kukielski and Porcile, Falconbridge common shares, vest as follows: 20% on the first anniversary following the date of grant and a further 20% on each of the four subsequent anniversary dates.

(2) Options to purchase common shares of Falconbridge indicated as "FL".

12

The following table sets forth details of each exercise of stock options during the financial year ended December 31, 2003 by the Named Executive Officers, and the financial year-end value of unexercised options on an aggregated basis.

AGGREGATED OPTION EXERCISES DURING THE PERIOD

COMMENCING JANUARY 1, 2003 AND ENDING MARCH 4, 2004 AND OPTION VALUES

AS AT MARCH 4, 2004

Name

| | Securities

Acquired

on Exercise

(#)

| | Aggregate

Value

Realized(1)

($)

| | Unexercised

Options at

March 4, 2004

(#)

Exercisable/

Unexercisable

| | Value of

Unexercised

in-the-money

Options at

March 4, 2004(2)

($)

Exercisable/

Unexercisable

|

|

|---|

|

| Derek Pannell | | — | | — | | 378,350/293,000 | | 2,335,686/1,707,920 | |

| Steven Douglas | | — | | — | | —/195,000 | | —/644,100 | |

| Lars-Eric Johansson(3) | | 93,600 FL

— | | 818,578 FL

— | | 20,225/80,900

57,200 FL/25,200 FL | | 141,139/564,555

897,596 FL/478,464 FL | |

| Fernando Porcile(3) | | — | | — | | 5,745/36,980

3,500 FL/23,000 FL | | 41,879/188,235

65,450 FL/304,550 FL | |

| William Brooks | | — | | — | | 187,800/91,850 | | 949,503/501,520 | |

| Peter Kukielski(3) | | — | | — | | 26,400/151,600

3,500 FL/53,000 FL | | 172,548/762,202

65,450 FL/758,300 FL | |

|

Notes:

(1) Determined on the basis of market value at date of exercise.

(2) An option is "in the money" at March 4, 2004 if the market price of the option on that date exceeds the exercise price of the option. The value of unexercised options at March 4, 2004 is equal to the difference between the market price of the options at March 4, 2004 and the exercise price of the options. The market price for Noranda is the closing price of $21.85 on March 4, 2004. The market price for Falconbridge is the closing price of $35.35 on March 4, 2004.

(3) Options to purchase common shares of Falconbridge indicated as "FL".

MANAGEMENT DEFERRED SHARE UNIT PLAN

Units may be granted each year at the discretion of the Board to senior executives in lieu of all or part of their annual VCP, pursuant to the MDSUP described above.

The following table sets forth the Units issued to Named Executive Officers in lieu of VCP since January 1, 2003. The Units allocated for 2003 were issued on February 11, 2004 and none of them have vested.

MANAGEMENT DEFERRED SHARE UNITS

ISSUED IN CONNECTION WITH THE FINANCIAL YEAR ENDED DECEMBER 31, 2003,

AND UNIT VALUES AS AT MARCH 4, 2004

| |

| |

| |

| |

| |

| |

Unexercised Units at

March 4, 2004(2)

|

|

|---|

| |

| |

| |

| |

| | Exercise or

Base Price

($/Security)(1)

| |

|

|---|

| |

| | Units Granted

for Year Ended December 31, 2003

| | % of Total Units

Granted

| | Units Vested

(#)

|

|---|

Name

| | Date Units Issued

| | (#)

| | ($)

|

|

|---|

|

| Peter Kukielski | | February 11, 2004

February 5, 2004 | | 5,496

3,659 FL | | 57%

25% | | —

— | | $20.37

$30.60 | | 5,496

3,659 | | 120,088

129,346 | |

|

Notes:

(1) Equal to the closing prices on the Toronto Stock Exchange (i.e., the market value of the class of security underlying the Unit) on February 10, 2004 and February 4, 2004 respectively, being the last trading days preceding the dates of the awards.

(2) Calculated at the closing price on the Toronto Stock Exchange for Noranda and Falconbridge Common Shares (i.e., the market value of the class of security underlying the Unit) on March 4, 2004, being $21.85 and $35.35, respectively.

13

PENSION AND RETIREMENT ARRANGEMENTS

Retirement Annuity Pension Plan for Canadian Salaried Employees

The Noranda Retirement Annuity Pension Plan ("RAP") for Canadian salaried employees provides comprehensive coverage on a defined benefit basis. The formula (1.75%) contains a partial offset for the Canada Pension Plan benefit and the survivor benefit is a lifetime pension with a guarantee period of five years. In order to provide a survivor benefit of 662/3% of the basic pension, the amount shown on the following table would have to be reduced.

In October 2001, the Board approved an amendment to the RAP to add a defined contribution option effective January 1, 2002. In 2002, the Named Executive Officers, with the exception of Messrs. Brooks, Johansson and Porcile, were given a one-time choice to either remain in the current defined benefit option or elect the new defined contribution option of this Plan.

Messrs. Pannell and Kukielski elected to continue participating in the defined benefit portion of the RAP for Canadian salaried employees. The following table shows the total annual retirement benefits payable under such retirement plan to participants at the specified remuneration levels and years of credited service categories assuming retirement at age 65, or at age 60 after completion of 20 years of service.

The amounts shown are payable for life and guaranteed for five years. The RAP formula contains a partial offset for the Canada Pension Plan benefit. The amounts shown are after adjustment for the estimated offset. The Corporation requires a pensioner to choose a joint and survivorship pension wherein the member's surviving spouse will be entitled to a pension of not less than 662/3% of the member's pension unless the spouse waives this condition. The conversion from the amounts shown in the table to this option is dependent on the age of the spouse at the member's retirement and on interest rates at that time.

Mr. Douglas participates in the RAP on a defined contribution basis.

PENSION PLAN TABLE (CANADIAN SALARIED EMPLOYEES)

| |

Retirement Benefits by Years of Credited Service ($)

|

|---|

Annual Remuneration

($)(1)

|

|---|

| | 5 yrs.

| | 10 yrs.

| | 15 yrs.

| | 20 yrs.

| | 25 yrs.

| | 30 yrs.

| | 35 yrs.

| | 40 yrs.

| | 45 yrs.

|

|

|---|

|

| 250,000 | | 21,200 | | 42,400 | | 63,600 | | 84,800 | | 106,000 | | 127,200 | | 148,400 | | 170,275 | | 192,150 | |

| 275,000 and above(2) | | 23,375 | | 46,775 | | 70,150 | | 93,550 | | 116,925 | | 140,325 | | 163,700 | | 187,775 | | 211,825 | |

|

Notes:

(1) Remuneration is calculated on the basis of the average of the best 60 months of basic pay prior to retirement. Effective January 1, 2002, remuneration includes basic pay and earnings paid from the VCP that are set from time to time by the Board.

(2) To limit the Corporation's retirement benefit liability, an annual remuneration level of $275,000 has been established as the maximum average remuneration eligible for pension calculations effective January 1, 2002.

For purposes of computing the total retirement benefit of the participating Named Executive Officers, estimated years of credited service at normal retirement age (65) are 43 years for Mr. Pannell and 20 years for Mr. Kukielski.

The accrued retirement income benefits of the Named Executive Officers in the RAP defined benefit option exceed maximum pension benefit limits as specified by Canada Customs and Revenue Agency. The excess benefits are payable directly by Noranda.

Mr. Pannell is entitled to a supplementary pension payable at normal retirement age on a joint and survivor basis of $155,000 reduced by the actuarial equivalent of the appreciation in value of Noranda share plan participations granted to him.

14

Retirement Plan for U.S. Salaried Employees

Mr. Brooks participates in the defined benefit retirement plan for U.S. salaried employees. The following table shows the total annual retirement benefits payable under such retirement plan to participants in the specified compensation and years of credited service categories assuming retirement at age 65. The U.S. Dollar amounts shown are payable for life and guaranteed for five years. The U.S. Pension Plan formula contains a partial offset for the U.S. Social Security benefit. The amounts shown are after adjustment for the estimated offset.

PENSION PLAN TABLE (U.S. SALARIED EMPLOYEES)

| | Retirement Benefits by Years of Credited Service ($)

|

|---|

Annual Remuneration

(US$)(1)

|

|---|

| | 15 yrs.

| | 20 yrs.

| | 25 yrs.

| | 30 yrs.

| | 35 yrs.

|

|

|---|

|

| 300,000 | | 76,500 | | 102,000 | | 127,500 | | 153,000 | | 178,500 | |

| 400,000 | | 102,800 | | 137,000 | | 171,300 | | 205,500 | | 239,800 | |

|

Note:

(1) Remuneration for the purposes of such pension plan includes base salary, bonus and profit sharing. Remuneration is calculated on the basis of the average of the five calendar years immediately preceding and including the year of termination.

For purposes of computing the total retirement benefit for Mr. Brooks, estimated years of credited service at normal retirement age (65) are 25 years.

Retirement Income Plan

Mr. Johansson participates in the Falconbridge Limited Retirement Income Plan ("RIP"), a defined benefit retirement plan for Canadian based salaried employees. Credited service for Mr. Johansson as at December 31, 2003 was 14.3 years.

The RIP provides comprehensive coverage on a defined benefit basis and it includes features such as partial protection against inflation, several retirement options including retirement after 30 years of service, a supplemental temporary pension until age 65, and survivor benefit of 662/3% of the basic pension.

Mr. Johansson has accrued retirement income benefits that exceed Canada Customs and Revenue Agency's maximum pension limits. The excess benefits are payable directly by the Corporation.

The following table sets forth the total annual retirement benefits payable under the RIP to participants in the specified compensation and years of service categories, assuming retirement at age 65.

| | Retirement Benefits by Years of Credited Service ($)

|

|---|

Remuneration

($)(1)

|

|---|

| | 15

| | 20

| | 25

| | 30

| | 35

| | 40

|

|

|---|

|

| 300,000 | | 67,500 | | 90,000 | | 112,500 | | 135,000 | | 157,500 | | 180,000 | |

| 400,000 | | 90,000 | | 120,000 | | 150,000 | | 180,000 | | 210,000 | | 240,000 | |

| 500,000 | | 112,500 | | 150,000 | | 187,500 | | 225,000 | | 262,500 | | 300,000 | |

|

Note:

(1) Remuneration for a year for the purposes of the RIP of an executive (including Mr. Johansson) includes base salary and the lesser of the actual amount of the annual incentive bonus program payment and the amount of the target bonus. The pension benefits are based on 1.5% per year of service.

Other

Mr. Porcile participates in the Chilean national pension scheme which requires Chilean national employees to make prescribed personal contributions into a strictly regulated personal retirement investment fund. Noranda does not make any supplementary contributions to Mr. Porcile's account. However, Noranda has agreed to pay Mr. Porcile the equivalent of his base salary, in effect at such time as his employment may be terminated, until he reaches the age of 65 unless he voluntarily resigns or his employment is terminated for just cause. In the event Mr. Porcile continues to work for the Corporation after he reaches the age of 65, Noranda will pay Mr. Porcile a severance amount of one month of base salary for each year and partial year worked from his initial start date as provided for by Chilean legislation, in the event his employment is terminated other than for just cause.

15

INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND SENIOR OFFICERS

As at December 31, 2003, the aggregate indebtedness (other than "routine indebtedness" under applicable Canadian securities laws) of all current and former officers, directors and employees of the Corporation or its subsidiaries to the Corporation or its subsidiaries entered into in connection with a purchase of securities was approximately $8.8 million. The largest aggregate amount of debt outstanding during the year ended December 31, 2003 was $9.8 million. This indebtedness represents loans made by the Corporation pursuant to the SPP as well as other loans ("Loans"), as described below.

In response to changing guidelines in the United States on executive loans, the Board discontinued the granting of any further loans under the SPP in June of 2002. Under the SPP, loans were made to key employees of the Corporation and its subsidiaries for the purchase of Common Shares at a 10% discount from a prescribed formula for determining market price. Such Common Shares were pledged as collateral security for the repayment of the loans. SPP loans bear interest equal to the cash dividends paid on Common Shares and are repayable within a period of ten years. Unless otherwise approved by the Board, a participant is only permitted to repay each loan to the extent of 20% per year on a cumulative basis.

Each Loan is evidenced by a promissory note of the respective executive officer and the designated securities are pledged as collateral security for the payment of the note. The Loans bear interest, payable on a quarterly basis, at a rate equal to the prime rate of a Canadian chartered bank.

The following table sets forth the names of the directors and officers of the Corporation to whom loans have been made, together with the largest amount outstanding during the fiscal year ended December 31, 2003, and the amount outstanding as at February 27, 2004.

TABLE OF INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS

AND SENIOR OFFICERS UNDER SECURITIES PURCHASE PROGRAMS

Name and Principal Position

| | Involvement

of Issuer or

Subsidiary

| | Largest Amount

Outstanding during

Financial Year Ended

December 31, 2003

($)

| | Amount

Outstanding

as at

February 27, 2004(1)

($)

|

|

|---|

|

David Kerr(2)

Chairman | | SPP Loan | | 3,134,430 | | 2,634,353 | |

|

Derek Pannell(2)

President and CEO | | Loans(4)

SPP Loan | | 484,000

1,999,878 | | 484,000

1,999,878 | |

|

Lars-Eric Johansson

Executive Vice-President & CFO | | Loan(4) | | 250,000 | | 250,000 | |

|

Aaron Regent

Executive Vice-President & CFO(3) | | Loans(4) | | 3,468,353 | | 2,968,353 | |

|

Martin Schady

Senior Vice-President, Corporate Development | | SPP Loan | | 500,018 | | 500,018 | |

|

Notes:

(1) The security for such indebtedness comprises Common Shares and securities of Partners and its publicly traded associated companies.

(2) Messrs. Kerr and Pannell are currently, and are proposed nominees for election as directors of the Corporation.

(3) Mr. Regent was Noranda's Executive Vice-President and CFO until May 31, 2002. Effective June 1, 2002, he was appointed President and Chief Executive Officer of Falconbridge.

(4) These interest-bearing, secured loans were advanced by the Corporation to the relevant executive at the time of his appointment as a senior officer of the Corporation for the purposes of acquiring securities of Partners.

16

COMPENSATION OF DIRECTORS

Directors (other than directors who are employees of the Corporation) are compensated for their services as directors through an annual retainer fee payable quarterly. The annual retainer paid to each such director by the Corporation is $55,000. An additional annual retainer fee of $5,000 is paid to each of the Independent Board Leader and the Chair of the Audit Committee. This fee structure was implemented on May 1, 2003 and the annual retainer fee was paid to the directors on a prorated basis for the period May 1 to December 31, 2003.

Directors (other than directors who are employees of the Corporation) were formerly compensated for their services as directors through a combination of retainer fees and meeting attendance fees. The annual retainer paid to each such director by the Corporation was $15,000. In addition, such directors who were members of Board Committees received an annual retainer of $3,000 for each Committee membership. Each such director also received a fee of $2,000 for each meeting of the Board attended (other than the meeting held immediately following the annual meeting of shareholders) and a fee of $1,000 for each Committee meeting attended. Payments to the directors using this fee structure were paid on a prorated basis for the period January 1 to April 30, 2003.

The retainer fees otherwise payable by the Corporation to Messrs. Cockwell, Eyton, Flatt, Harding and Myhal during 2003 were paid to Brascan.

The Corporation maintains a deferred share unit plan for non-employee directors ("DSUPD") to enhance the Corporation's ability to attract and retain high quality individuals to serve as members of the Board and to promote a greater alignment of interests between non-employee members of the Board and the shareholders of the Corporation. Under the DSUPD, as amended in 2003, the annual director retainer fee for non-employee directors (the "Eligible Directors") is paid entirely in deferred share units, subject to the right of a director, at his or her option elected on a yearly basis, to receive (a) up to 50% of such fees in cash; or (b) up to 100% of such fees in cash if the director holds deferred share units and Common Shares with an aggregate cost or value of at least $275,000 (five times the annual retainer). Fees payable in the form of deferred share units are credited to an account maintained for the Eligible Director on the books of the Corporation as of the third business day following release of the Corporation's quarterly or annual results (the "Valuation Date"). The number of deferred share units (including fractions thereof) to be credited as of the Valuation Date is determined by dividing the amount of the fees to be deferred by the closing price of the Common Shares as reported on the Toronto Stock Exchange as of the Valuation Date. Deferred share units are credited with dividend equivalents when dividends are paid on the Corporation's Common Shares. An Eligible Director will receive a payment in cash or Common Shares on the fourth business day following the next release of the Corporation's quarterly results immediately following his or her termination of service on the Board.

The Board has determined as a matter of policy that non-management directors are not granted stock options under the SOP.

Directors are also reimbursed for travel and other out-of-pocket expenses incurred in attending Board and Board Committee meetings.

CHAIRMAN OF THE BOARD

Mr. Kerr, as Chairman of the Board of the Corporation, received compensation in respect of the year ended December 31, 2003 comprising a salary of $325,000, a VCP award of $150,000, an executive perquisite allowance, car benefit and executive medical benefit totaling $32,733, and a contribution of $4,886 towards the purchase of Common Shares under the ESSP. In addition, Mr. Kerr was granted 85,000 stock options at an exercise price of $13.82 on February 10, 2003 pursuant to the SOP and he was granted 8,900 Units under the MDSUP based on a price of $13.82 per Common Share on February 10, 2003 in respect of the financial year ended December 31, 2002.

17

PERFORMANCE GRAPH

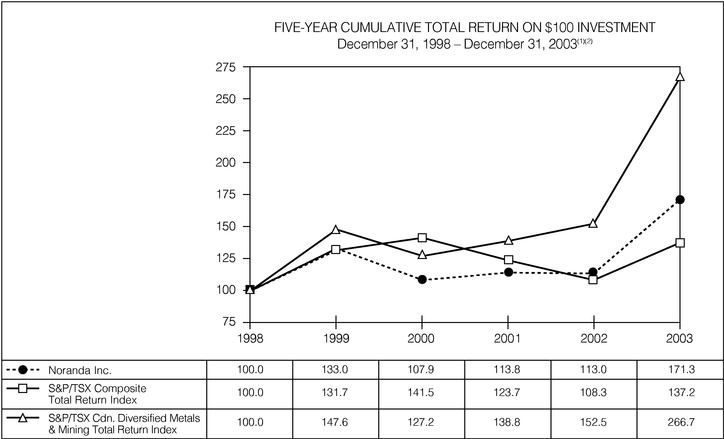

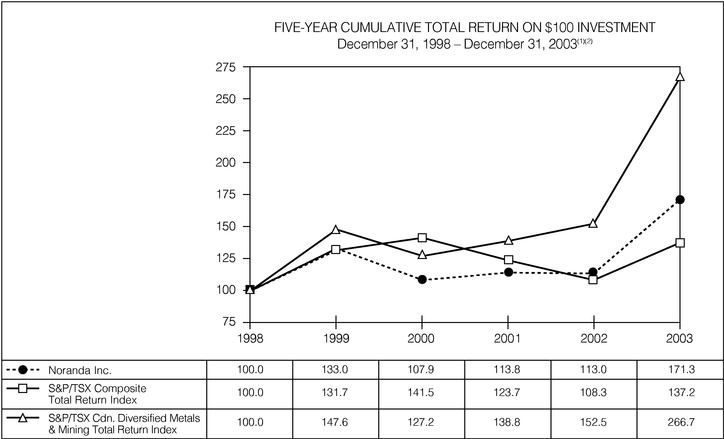

The following graph compares the yearly percentage change in the cumulative total shareholder return over the last five fiscal years on the Corporation's Common Shares with the cumulative total return of the S&P/TSX Composite Total Return Index and the S&P/TSX Canadian Diversified Metals and Mining Total Return Index:

Notes:

(1) Assumes dividends were re-invested on the ex-dividend date.

Source: TSX Market Data Services

(2) The TSE Mining and Metals Index, phased out by the Toronto Stock Exchange in 2003, was used as a comparison in the Corporation's previous management information circulars.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Board believes that effective corporate governance contributes to improved corporate performance and enhanced shareholder value. The Board is of the view that Noranda's corporate governance policies and practices, outlined below, are appropriate and consistent with the guidelines for corporate governance adopted by the Toronto Stock Exchange (the "Exchange Guidelines"). The Corporation's specific disclosure relative to these guidelines is set out in Schedule "A" to this Circular. The Board is also of the view that these policies and practices are consistent with the most recent rules of the New York Stock Exchange ("NYSE") respecting corporate governance listing standards, other than the requirement to have an internal audit function which the Corporation is in the process of implementing and expects to have in place by early 2005.

The Board will continue to critically assess the Corporation's governance practices to fulfill its commitment to ensure continued effective corporate governance.

18

BOARD OF DIRECTORS

Mandate

The mandate of the Board, as prescribed by corporate statute, is to manage or supervise the management of the business and affairs of the Corporation and to act with a view to the best interests of the Corporation.

In fulfilling its mandate, the Board, among other matters, is responsible for:

- •

- reviewing the Corporation's overall business strategies and its annual business plan

- •

- reviewing the principal risks of the Corporation's business to ensure that these risks are within acceptable limits and that appropriate systems are in place to manage these risks

- •

- reviewing major strategic initiatives to ensure that the Corporation's proposed actions accord with shareholders' objectives

- •

- appointing the CEO and reviewing succession planning

- •

- assessing management's performance against approved business plans and industry standards

- •

- reviewing and approving the reports issued to shareholders, including annual and interim financial statements

- •

- ensuring the effective operation of the Board

- •

- safeguarding shareholders' equity interests through the optimum utilisation of the Corporation's capital resources, including setting an appropriate dividend policy

Meetings

The Board meets quarterly to review, among other things, the performance of the Corporation on a consolidated basis and by business unit. Results are compared to and measured against a previously established plan and performance in prior years. At these meetings, the Board also receives activity reports of the CEO, and various other reports covering pertinent issues, enabling the directors to oversee the management of the business and affairs of the Corporation. The Corporation's strategies and their implementation are discussed frequently at Board meetings.

One meeting each year is held at a site or facility in conjunction with an organized review of the operations, at which the directors are able to increase their knowledge of the Corporation's businesses and gain exposure to key operating personnel.

The Board also conducts one meeting annually devoted to reviewing and assessing the Corporation's Business Plan for the ensuing year and its overall strategic objectives, priorities, opportunities and risks. Management develops this Plan and at this meeting, presents it for discussion, incorporates strategic input and obtains Board endorsement. This Plan establishes, among other things, a strategic backdrop for the consideration of capital allocation requests throughout the year, as well as benchmarks against which the Board measures the performance of management. At this meeting, management's views of key longer-term trends and global factors of significance are also considered.

Other meetings of the Board are called to deal with special matters as circumstances require.

In 2003, there were four regular meetings, one strategy meeting and six special meetings to review specific strategic initiatives. Four regular meetings and one strategy meeting are scheduled for 2004. Meeting frequency and agenda items may change depending upon the opportunities or risks faced by the Corporation.

Composition and Size

The Board is comprised of 14 directors, 5 of whom have been nominated by the Corporation's principal shareholder, Brascan (Messrs. Cockwell, Eyton, Flatt, Harding and Myhal), and 2 of whom have been drawn from past and current senior management (Messrs. Kerr and Pannell). The Board believes that this composition leads to a constructive exchange of views in board deliberations resulting in objective, well-balanced and informed discussion and decision making.

The Board has established criteria for the selection of directors, and the performance of the Board as a whole, in an effort to foster a diversity of viewpoints and to ensure a breadth of business and other relevant experience.

19

The Board considers that the following 12 of its 14 directors are "unrelated" within the meaning of the Exchange Guidelines and are independent directors under the NYSE standards: Alex G. Balogh, André Bérard, Jack L. Cockwell, V. Maureen Kempston Darkes, J. Trevor Eyton, J. Bruce Flatt, A.L. (Al) Flood, Norman R. Gish, Robert J. Harding, James W. McCutcheon, Frank J. McKenna and George E. Myhal. An "unrelated" director is a director who is independent of management and is free from any interest and any business or other relationship which could, or could reasonably be perceived to, materially interfere with the director's ability to act with a view to the best interests of the corporation, other than interests and relationships arising from shareholding. The Board, in making the determination that the 12 independent directors meet the Corporation's standards for independent directors, also applies additional criteria set out in the Independent Director Qualification Standards which form part of the Corporate Governance Guidelines adopted by the Board and posted on the Corporation's website. These criteria are considered together with the examining for each director of a range of types of relationships, as applicable, such as legal, accounting, consulting, commercial, banking, charitable and familial relationships from both the perspective of the individual director and that of any organization with which he or she is associated. The two related, non-independent directors of the Corporation are Messrs. Kerr and Pannell.

Prior to June 1, 2002, Mr. Kerr had served as Chairman and CEO of the Corporation. Effective June 1, 2002, Mr. Pannell assumed the roles of President and CEO and Mr. Kerr assumed the role of Chairman.

Independent Board Leader

Since September 1, 2001, Mr. McKenna, the Chairman of the Governance Committee, has served as "Independent Board Leader", in which role he is responsible for the following functions:

- •

- to chair an "in camera" session during each Board meeting without management present in order to give independent directors an opportunity to fully and frankly discuss issues and provide feedback, serving as a liaison amongst the directors and then between the Board and senior management

- •

- as described below, to meet privately, or ensure that the Chairman of the Board meets privately, with each director once a year to discuss, and to receive suggestions on how to enhance, Noranda's corporate governance practices, overall Board effectiveness and the contributions being made by individual directors

- •

- should a perceived need arise, to be accessible to all directors to discuss issues of Board independence; and to call a Governance Committee meeting should that be requested or warranted in the circumstances

Any employee of the Corporation who wishes to make a concern known to the non-management directors can be put in contact with Independent Board Leader through the facilities of the Ethics Hotline available under the Corporation's Code of Ethics.

Prior Approvals/Risk Management

In addition to those matters which must by law be approved by a company's board of directors, the Board has established a capital investment approval process, procedures and guidelines, with respect to significant capital appropriation requests. The Board annually reviews the planned capital investments of the Corporation. In addition, all capital appropriation requests by the Corporation or its wholly-owned operations that exceed $10 million require specific prior Board approval. Other significant matters such as any material acquisition or disposition of assets also require prior Board approval.

The Board has charged management with identifying Noranda's principal business risks and periodically reviewing with specified Committees and/or the full Board its efforts to address and effectively manage them. To specifically address and oversee risk assessment, as well as disclosure controls and procedures generally, management has revised the composition of its Disclosure Committee whose core members comprise the Senior Vice-President, General Counsel; the Vice-President, Investor Relations, Communications & Public Affairs; the Senior Vice-President, Procurement, Logistics, Transportation and Information Services; and the Corporate Secretary. In addition to its frequent sessions to discuss disclosure matters and monitor compliance with the

20

Corporation's Disclosure Policy, the Disclosure Committee meets at least quarterly to review and analyze the output of the Enterprise Risk Management Process of the Corporation, assessing it on a continuous basis for improvement opportunities. Pursuant to a risk management framework, presentations of risk issues are made by a member or members of the Disclosure Committee to the Governance Committee, the Audit Committee and the Board as a whole. In addition, risks relating to financial matters are regularly monitored by the Audit Committee and risks relating to environment, occupational health and safety matters are regularly monitored by the Environment, Health & Safety Committee. In connection with risk management, the Board has adopted treasury risk management policies covering specified significant market activities of the Corporation's Corporate Treasury and a commodity trading policy covering metal trading activities. Authorization levels and other parameters have been established, requiring prior Board approval for those transactions exceeding specified materiality thresholds considered by the Board to be appropriate. Other risk management tools include Noranda's Code of Ethics, Environment, Safety & Health Policy, Corporate Disclosure Policy, and the delivery of an annual Insurance Report to the Audit Committee.

Board Activities

A work plan and schedule of business unit presentations for the upcoming year are prepared for the Board and each Committee. These are continuously updated to include additional items requested by any Board or Committee member. Other special agenda items are added on an as-needed basis to reflect the state of the Corporation's affairs and in light of opportunities or risks which it faces.

Board and Committee Effectiveness