Searchable text section of graphics shown above

Forward-Looking Statements

This presentation contains forward-looking information about Inco and the combined company after completion of the purchase by Inco of all outstanding shares of Falconbridge, that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. Words such as “expect(s)”, “feel(s)”, “believe(s)”, “will”, “may”, “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services and projects; statements regarding business and financial prospects; financial multiples and accretion estimates; statements regarding anticipated financial or operating performance and cash flows; statements regarding expected synergies and cost savings, including the timing, from the proposed combination of the two companies; statements concerning possible divestitures; and statements regarding strategies, objectives, goals and targets. Such statements are subject to certain risks and uncertainties, many of which are difficult to predict and are generally beyond the control of Inco, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed and identified in public filings with the U.S. Securities and Exchange Commission (“SEC”) made by Inco and include, but are not limited to: the possibility that approvals or clearances required to be obtained by Inco and Falconbridge from regulatory and other agencies and bodies will not be obtained in a timely manner; the possibility that divestitures required by regulatory agencies may not be acceptable or may not be completed in a timely manner; the possibility that the anticipated benefits and synergies and cost savings from the acquisition or related divestitures cannot be fully realized; the possibility that the costs or difficulties related to the integration of Falconbridge’s operations with Inco will be greater than expected; the level of cash payments to shareholders of Falconbridge who exercise their statutory dissenters’ rights in connection with the expected eventual combination of the two companies; the possible delay in the completion of the steps required to be taken for the eventual combination of the two companies; business and economic conditions in the principal markets for the companies’ products, the supply, demand, and prices for metals to be produced, purchased intermediates and substitutes and competing products for the primary metals and other products produced by the companies, production and other anticipated and unanticipated costs and expenses and other risk factors relating to the metals and mining industry as detailed from time to time in Falconbridge’s and Inco’s reports filed with the SEC. The forward-looking statements included in this presentation represent Inco’s views as of the date hereof. While Inco anticipates that subsequent events and developments may cause Inco’s views to change, Inco specifically disclaims any obligation to update these forward-looking statements. These forward-looking statements should not be relied upon as representing Inco’s views as of any date subsequent to the date hereof. Readers are also urged to carefully review and consider the various disclosures in Inco’s various SEC filings, including, but not limited to, Inco’s Annual Report on Form 10-K for the year ended December 31, 2005 and Inco’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2006.

Important Legal Information

This presentation may be deemed to be solicitation material in respect of Inco’s proposed combination with Falconbridge. Inco filed with the SEC, on October 24, 2005, a registration statement on Form F-8 (containing an offer to purchase and a share exchange take-over bid circular) and amendments thereto, and will file further amendments thereto in connection with the proposed combination. Falconbridge has filed a Schedule 14D-9F in connection with Inco’s offer and has filed, and will file (if required), other documents regarding the proposed combination, in each case with the SEC.

INVESTORS AND SECURITYHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors and security holders may obtain copies of the registration statement and Inco’s and Falconbridge’s SEC filings free of charge at the SEC’s website (www.sec.gov). In addition, documents filed with the SEC by Inco may be obtained free of charge by contacting Inco’s media or investor relations departments.

Filings made by Inco and Falconbridge with Canadian securities regulatory authorities, including filings made in connection with the offer, are available at www.sedar.com

Sandra Scott

Director, Investor Relations, Inco

[LOGO]

Inco announces revised offer

for Falconbridge conference call and

webcast

News release

www.inco.com

www.falconbridge.com

Investor Relations

Inco: | | 416-361-7670 |

| | |

Falconbridge: | | 416-982-7337 |

Housekeeping items

Members of public on webcast on a live, listen only basis

News media on conference call will be invited to ask questions following questions from analysts and investors

“This presentation includes certain exploration results. These results and any related mineral reserve and mineral resource estimates, as may be included in Inco Limited’s Annual Report to Shareholders and Annual Report on Form 10-K for year ended December 31, 2005, utilize certain definitions, including “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “indicated” , “measured” and “inferred” mineral resource, in the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral Resources and Reserves Definitions and Guidelines adopted by the CIM Council. Nicholas Sheard, Vice President, Exploration, Olivier Tavchandjian, Principal Geologist, Mineral Reserves and Mineral Resources, and Lawrence Cochrane, Director, Mines Exploration, each is an employee of Inco and as a “qualified person” (as defined in National Instrument 43-101, “Standards of Disclosure for Mineral Projects”) has supervised the preparation of such estimates as of December 31, 2004 and 2005 and exploration results, and either directly or indirectly through employees of Inco reporting directly to him, has conducted a comprehensive review and confirmation of the application of the detailed procedures, systems and processes developed and implemented to verify such data. For details relating to key assumptions, parameters, and methods used to estimate our mineral reserves and resources, as well as a general discussion of relevant factors, reference is made to our 2005 Annual Report to Shareholders and Annual Report on Form 10-K”.

Dollar amounts in this presentation are expressed in United States currency unless otherwise stated

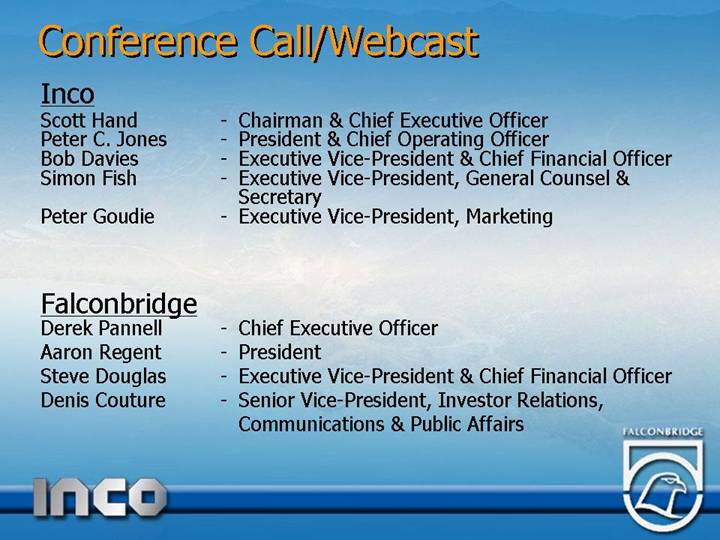

Conference Call/Webcast

Inco

Scott Hand | - | Chairman & Chief Executive Officer |

Peter C. Jones | - | President & Chief Operating Officer |

Bob Davies | - | Executive Vice-President & Chief Financial Officer |

Simon Fish | - | Executive Vice-President, General Counsel & Secretary |

Peter Goudie | - | Executive Vice-President, Marketing |

Falconbridge

Derek Pannell | - | Chief Executive Officer |

Aaron Regent | - | President |

Steve Douglas | - | Executive Vice-President & Chief Financial Officer |

Denis Couture | - | Senior Vice-President, Investor Relations, Communications & Public Affairs |

Scott Hand

Chairman and

Chief Executive Officer, Inco

Inco’s revised friendly takeover offer for Falconbridge

Transaction summary

| | October 11, 2005 | | May 13, 2006 |

| | | | |

Consideration assuming proration: | | Cdn$7.50 + 0.524 Inco share | | Cdn$12.50 + 0.524 Inco share |

| | | | |

Aggregate: | | Cash: Cdn$2.87 billion | | Cash: Cdn$4.8 billion |

| | Stock: 200.7 million shares | | Stock: 200.7 million shares |

| | | | |

Ownership(1): | | Inco 54%/Falconbridge 46% | | Inco 53%/Falconbridge 47% |

| | | | |

Offer expiry: | | June 30, 2006 | | June 30, 2006 |

| | | | |

Break fee: | | US$320 million | | US$450 million |

(1) Fully-diluted basis

Inherent value of an Inco/Falconbridge combination

Great company: great operations, great assets, great growth properties

+

Focus on two of the best metals around – nickel and copper

+

Significant value creation in joining of operations in the Sudbury basin

=

Great near- and long-term value

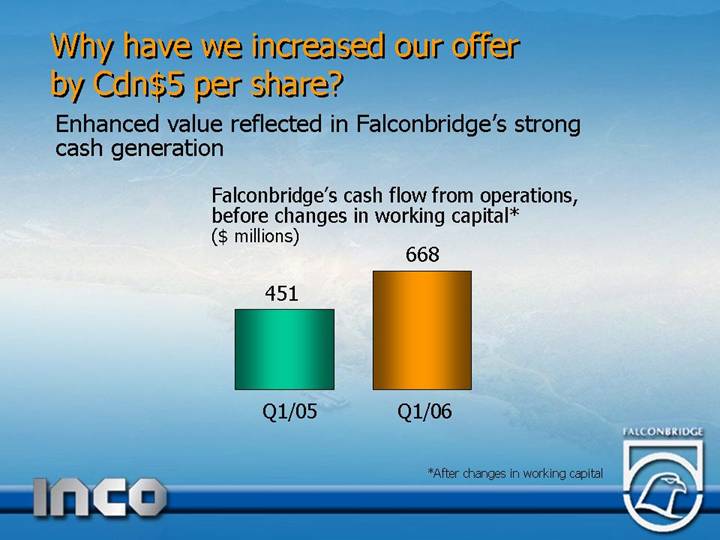

Why have we increased our offer by Cdn$5 per share?

Enhanced value reflected in Falconbridge’s strong cash generation

Falconbridge’s cash flow from operations,

before changes in working capital*

($ millions)

[CHART]

We expect to retain our investment grade credit rating

*After changes in working capital

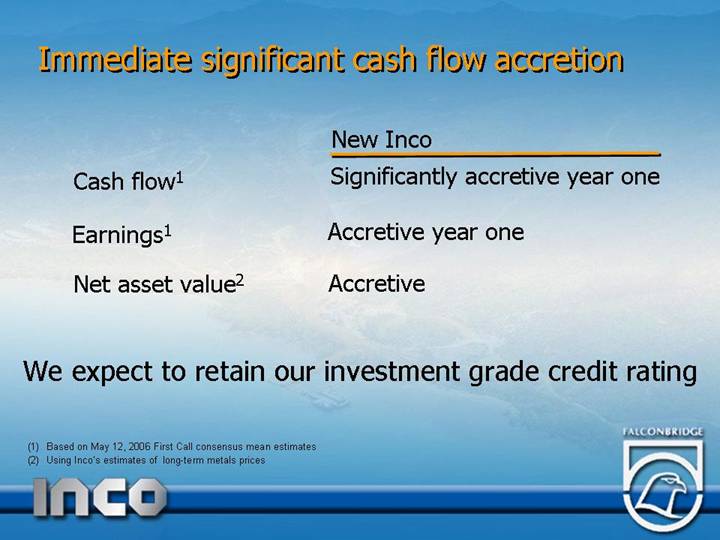

Immediate significant cash flow accretion

| | New Inco |

Cash flow(1) | | Significantly accretive year one |

| | |

Earnings(1) | | Accretive year one |

| | |

Net asset value(2) | | Accretive |

(1) Based on May 12, 2006 First Call consensus mean estimates

(2) Using Inco’s estimates of long-term metals prices

This is the right deal

with the right company

With higher metal prices…

Relative Commodity Price Performance

[CHART]

Source: Bloomberg. London Metal Exchange (LME) Prices.

…Falconbridge’s cash flow has soared

Cash flow from operations, before changes in working capital

($ millions)

[CHART]

Cash flow used to delever balance sheet by over $750 million since initial offer was made

Why acquisition of Falconbridge is the best and most value creating opportunity for Inco and our shareholders?

• Creating company with nickel leadership position and strong position in copper

• Both partners bring tremendous growth options

• Financial strength to achieve objectives

• Potential for multiple expansion

• Deliver value through unique synergies in Sudbury Basin

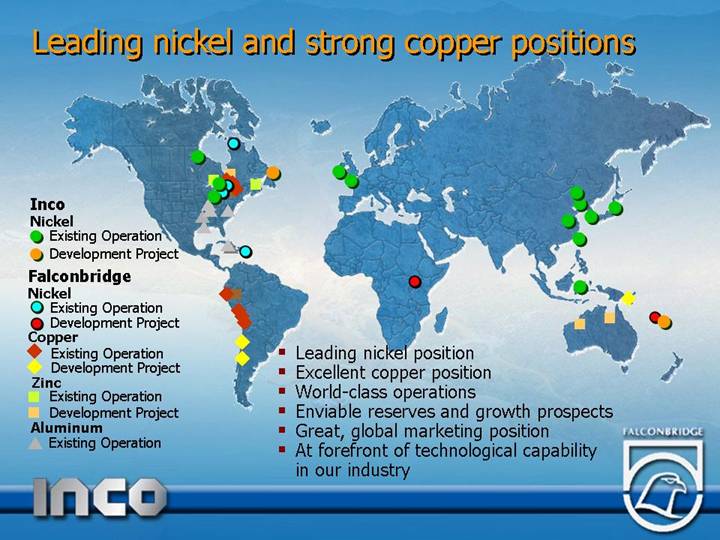

Leading nickel and strong copper positions

[CHART]

• Leading nickel position

• Excellent copper position

• World-class operations

• Enviable reserves and growth prospects

• Great, global marketing position

• At forefront of technological capability in our industry

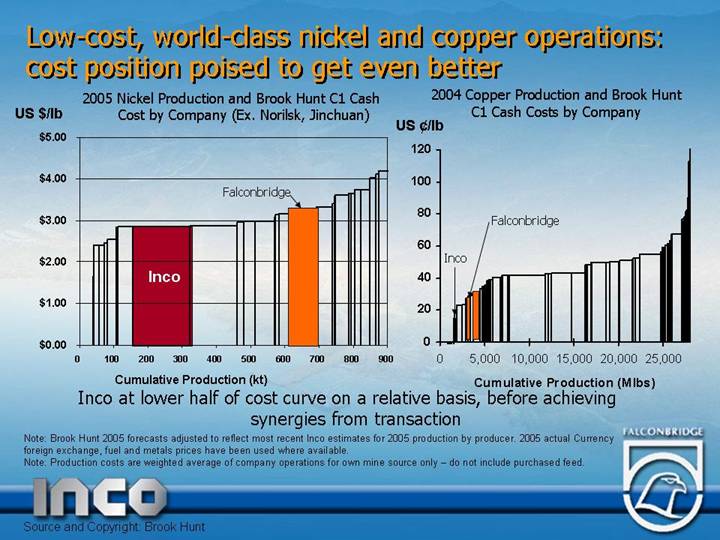

Low-cost, world-class nickel and copper operations: cost position poised to get even better

2005 Nickel Production and Brook Hunt C1 Cash

Cost by Company (Ex. Norilsk, Jinchuan) | | 2004 Copper Production and Brook Hunt

C1 Cash Costs by Company |

| | |

[CHART] | | [CHART] |

Inco at lower half of cost curve on a relative basis, before achieving synergies from transaction

Note: Brook Hunt 2005 forecasts adjusted to reflect most recent Inco estimates for 2005 production by producer. 2005 actual Currency foreign exchange, fuel and metals prices have been used where available.

Note: Production costs are weighted average of company operations for own mine source only – do not include purchased feed.

Inco is only major public company in metals industry with declining costs in absolute terms this year — despite $75 per barrel oil and Cdn$0.90

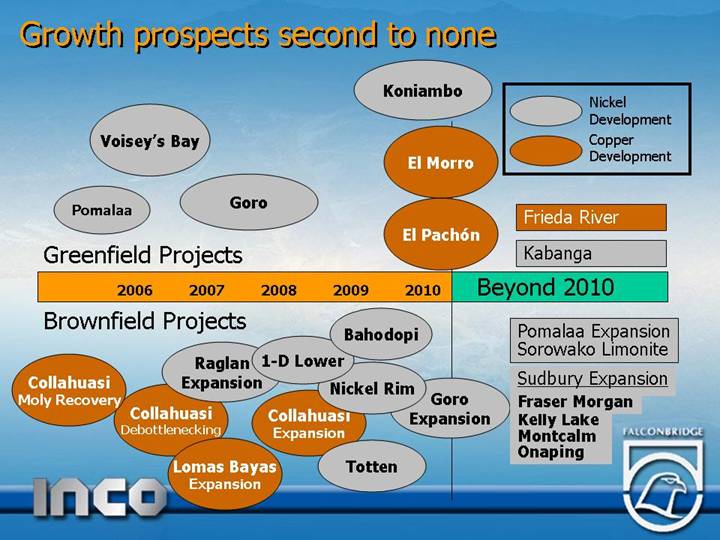

Growth prospects second to none

[CHART]

New Inco nickel production expected to climb by over 30% by 2009 from 2005 levels

[CHART]

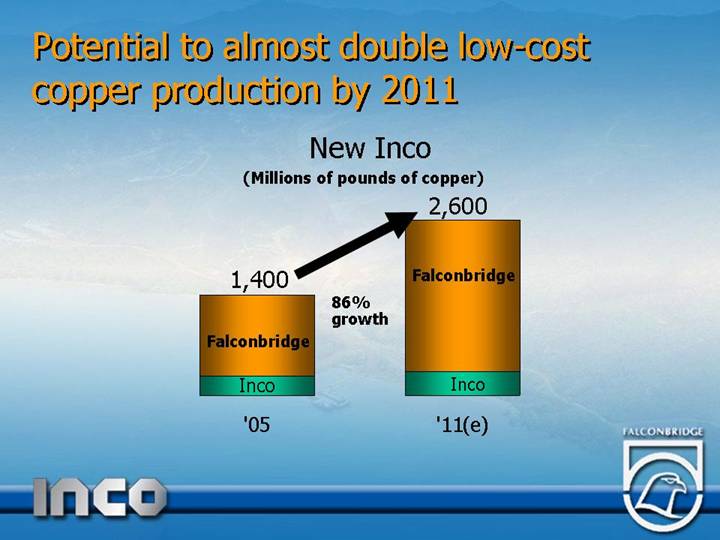

Potential to almost double low-cost copper production by 2011

New Inco

(Millions of pounds of copper)

[CHART]

Financial strength to achieve our objectives

Cash flow from operations,

before changes in working capital

($ millions)

[CHART]

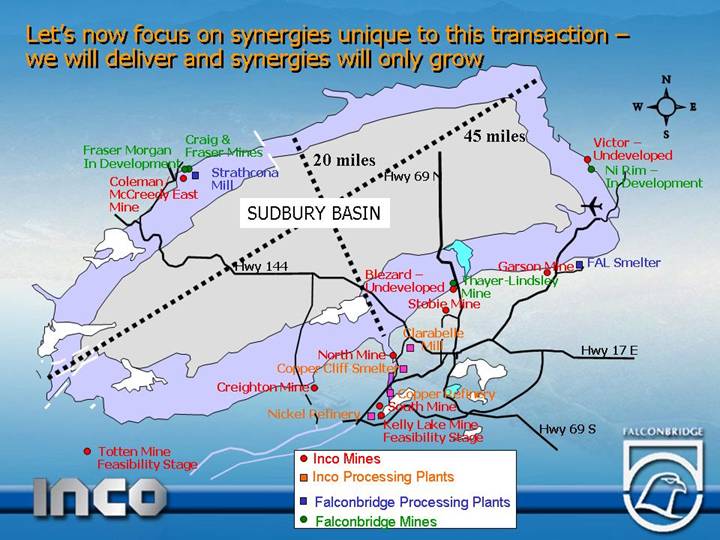

Let’s now focus on synergies unique to this transaction – we will deliver and synergies will only grow

[GRAPHIC]

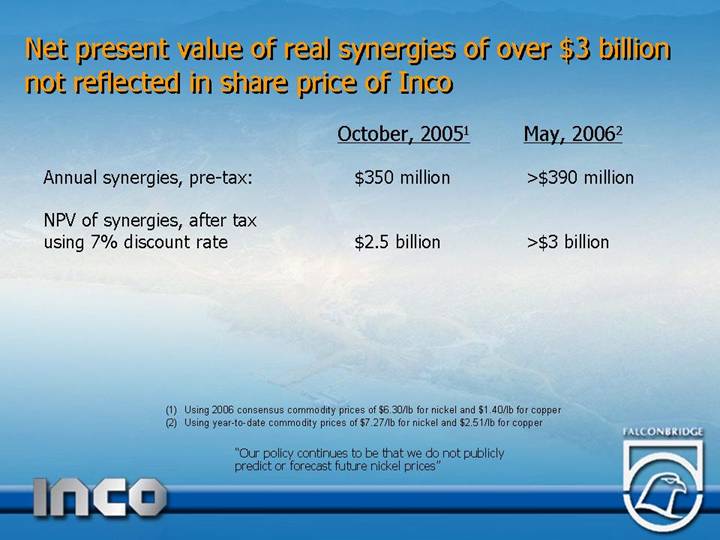

Net present value of real synergies of over $3 billion not reflected in share price of Inco

| | October, 2005(1) | | May, 2006(2) | |

Annual synergies, pre-tax: | | $ | 350 million | | >$390 million | |

| | | | | |

NPV of synergies, after tax using 7% discount rate | | $ | 2.5 billion | | >$3 billion | |

(1) Using 2006 consensus commodity prices of $6.30/lb for nickel and $1.40/lb for copper

(2) Using year-to-date commodity prices of $7.27/lb for nickel and $2.51/lb for copper

“Our policy continues to be that we do not publicly

predict or forecast future nickel prices”

Synergies to be realized by mid-2008,

assuming transaction closes in H2/06

A large percentage of the synergies

are unique to the combination of our

two companies

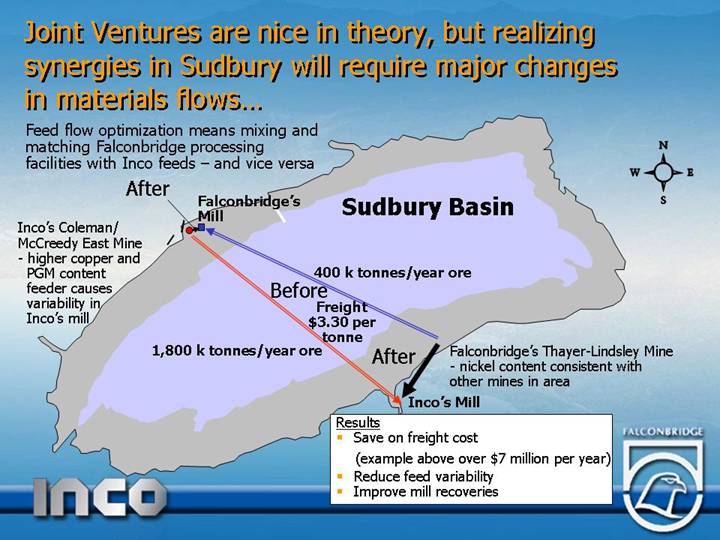

Joint Ventures are nice in theory, but realizing synergies in Sudbury will require major changes in materials flows…

Feed flow optimization means mixing and matching Falconbridge processing facilities with Inco feeds – and vice versa

Inco’s Coleman/

McCreedy East Mine

• higher copper and PGM content feeder causes variability in Inco’s mill

[GRAPHIC]

Falconbridge’s Thayer-Lindsley Mine

• nickel content consistent with other mines in area

Results

• Save on freight cost

(example above over $7 million per year)

• Reduce feed variability

• Improve mill recoveries

…and long-term commitments and investment, which is only possible through the combination of our two companies

[GRAPHIC]

• Reconfigure Clarabelle mill processing circuit to produce copper concentrate to feed Falconbridge’s Kidd Creek or Horne smelters

Benefits to new Inco:

• Increases nickel smelting capacity and nickel production while avoiding capital expenditures that would otherwise be required

• Reduces working capital

• Reduces freight charges

Seven months of working closely on how to maximize synergies give us even more confidence in what we will achieve together

Maximizing throughput – matching assets to processes and feeds

[GRAPHIC]

• Economics of Falconbridge’s Fraser Morgan Mine significantly improved due to proximity to and ability to share infrastructure with Inco’s Coleman/McCreedy East Mine

• Coleman/McCreedy East could avoid $15 million of capital by using Falconbridge’s ventilation system

A Joint Venture might be able to realize a small fraction of the synergies over much longer time period

[GRAPHIC]

We’re bringing together our processing facilities and mines to maximize synergies

We need and we have the backing of our people

• Steel Workers support our deal

• Tremendous support from all levels of governments in Canada

[GRAPHIC]

Our synergy numbers have considerable upside - do not include assets beyond Sudbury Basin

[GRAPHIC]

Inco

Nickel

• Existing Operation

• Development Project

Falconbridge

Nickel

• Existing Operation

• Development Project

Copper

• Existing Operation

• Development Project

Zinc

• Existing Operation

• Development Project

Aluminum

• Existing Operation

• Leading nickel position

• Excellent copper position

• World-class operations

• Enviable reserves and growth prospects

• Great, global marketing position

• At forefront of technological capabilityin our industry

Continuing to advance work with US Department of Justice and European Commission in connection with their reviews of transaction

Once we obtain remaining regulatory clearances, we can proceed to complete our offer for Falconbridge

Amended support agreement provides for a US$450 million break fee to Inco if acquisition is not completed for the reasons set forth in the original agreement

The acquisition will transform Inco

• Leading nickel company

• Large, low-cost copper company

• Very competitive cash costs

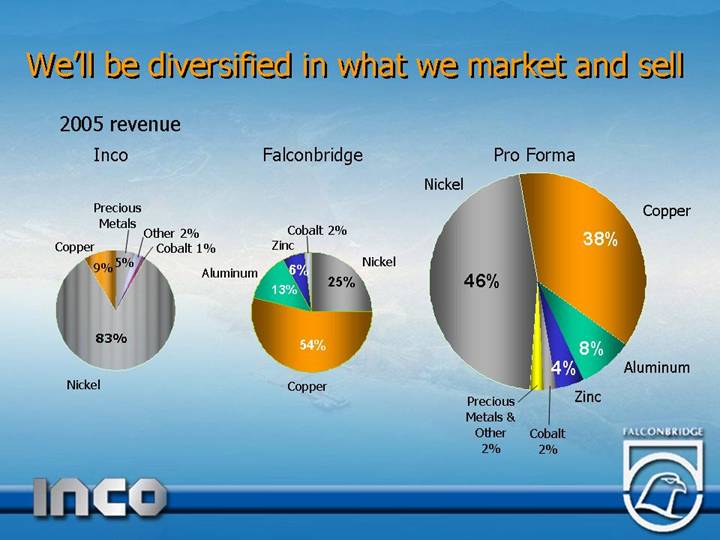

We’ll be diversified in what we market and sell

2005 revenue

Inco | | Falconbridge | | Pro Forma |

[CHART] | | [CHART] | | [CHART] |

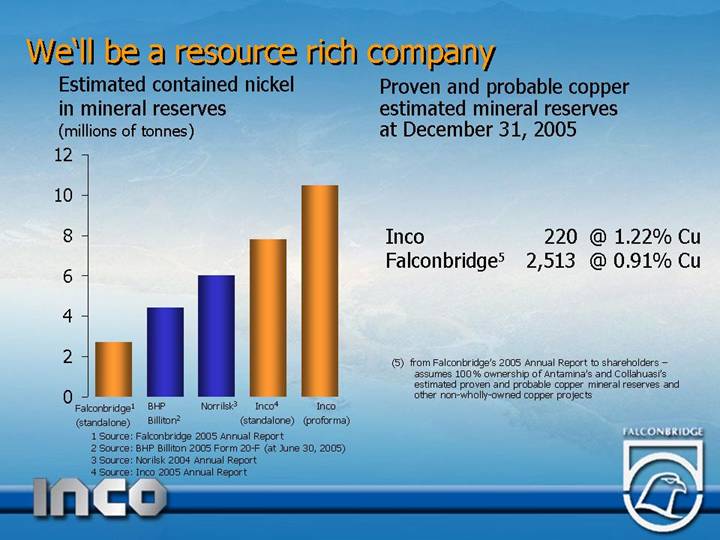

We’ll be a resource rich company

Estimated contained nickel in mineral reserves

(millions of tonnes)

[CHART]

(1) Source: Falconbridge 2005 Annual Report

(2) Source: BHP Billiton 2005 Form 20-F (at June 30, 2005)

(3) Source: Norilsk 2004 Annual Report

(4) Source: Inco 2005 Annual Report

Proven and probable copper estimated mineral reserves at December 31, 2005

Inco | | 220 | | @ 1.22 Cu | % |

Falconbridge(5) | | 2,513 | | @ 0.91 Cu | % |

(5) from Falconbridge’s 2005 Annual Report to shareholders – assumes 100% ownership of Antamina’s and Collahuasi’s estimated proven and probable copper mineral reserves and other non-wholly-owned copper projects

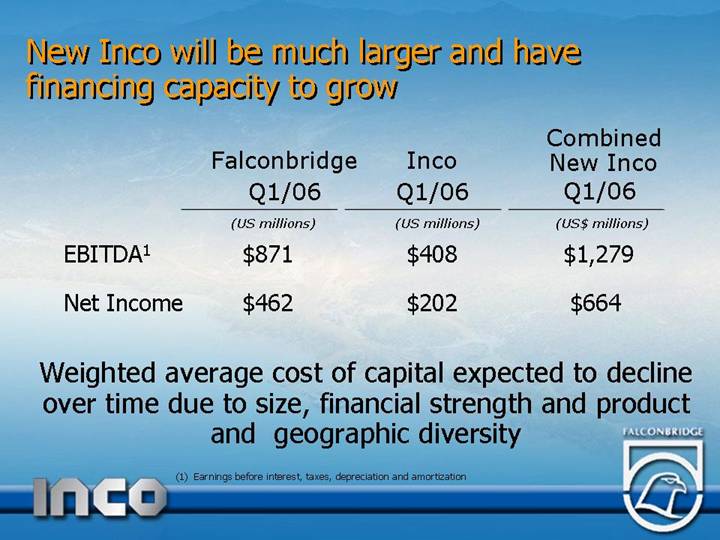

New Inco will be much larger and have financing capacity to grow

| | Falconbridge

Q1/06 | | Inco

Q1/06 | | Combined

New Inco

Q1/06 | |

| | (US millions) | | (US millions) | | (US$ millions) | |

| | | | | | | |

EBITDA(1) | | $ | 871 | | $ | 408 | | $ | 1,279 | |

Net Income | | $ | 462 | | $ | 202 | | $ | 664 | |

Weighted average cost of capital expected to decline over time due to size, financial strength and product and geographic diversity

(1) Earnings before interest, taxes, depreciation and amortization

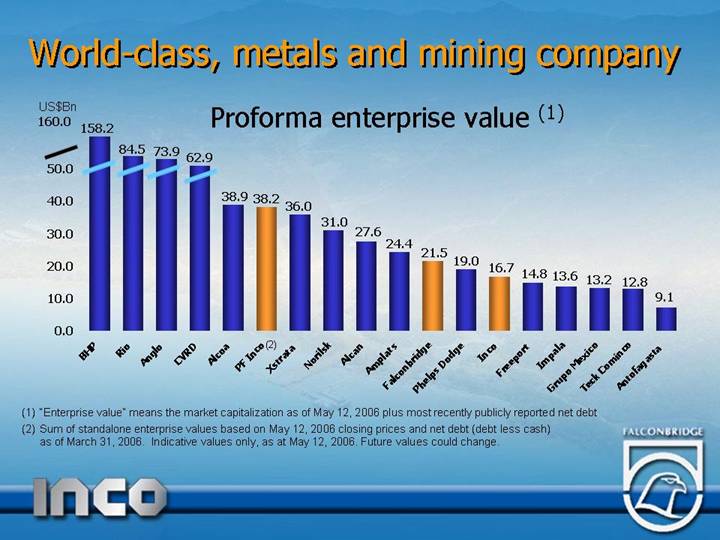

World-class, metals and mining company

Proforma enterprise value (1)

[CHART]

(1) “Enterprise value” means the market capitalization as of May 12, 2006 plus most recently publicly reported net debt

(2) Sum of standalone enterprise values based on May 12, 2006 closing prices and net debt (debt less cash) as of March 31, 2006. Indicative values only, as at May 12, 2006. Future values could change.

New Inco will be among top metals and mining companies on North American stock markets — multiple expansion should be in our future

Combined Q1/06 New Inco EBITDA of almost $1.3 billion

Strong, experienced management team and growth profile to attract the best people

Inco’s Board has and it will continue to evaluate all of its strategic alternatives that would serve our shareholders’

best interests — both short-term and long-term

Best strategic alternative for Inco and its shareholders is to acquire Falconbridge

Remain committed to working aggressively to complete the transaction

Inco/Falconbridge transaction structured to provide immediate and ongoing benefits for shareholders

• Strong operations

• Unique and significant synergies

• Best project pipeline

• Resource rich

• Terrific exploration portfolio

• Financially strong

Inco and Falconbridge together will deliver shareholder value that far exceeds ability of any other player to realize

Current Falconbridge Net Earnings Sensitivity

| | Prices | | Sensitivities | |

| | | | | | | | Impact on 2006 | |

| | Q1 | | Current | | Change in | | Annualized Net Earnings* | |

| | Realized | | Prices | | Realized Price | | Net Earnings | | EPS | |

| | Prices | | May 10 | | US$ /lb. | | US$ millions | | US$ | |

Copper | | $ | 2.29 | | $ | 3.73 | | $ | 0.05 | | $ | 37 | | $ | 0.10 | |

Nickel | | 6.84 | | 9.34 | | 0.50 | | 63 | | 0.17 | |

Zinc | | 1.07 | | 1.67 | | 0.05 | | 38 | | 0.10 | |

Aluminum | | 1.13 | | 1.39 | | 0.05 | | 19 | | 0.05 | |

Lead | | 0.63 | | 0.58 | | 0.05 | | 6 | | 0.02 | |

| | | | | | | | | | | | | | | | |

*holding other factors constant